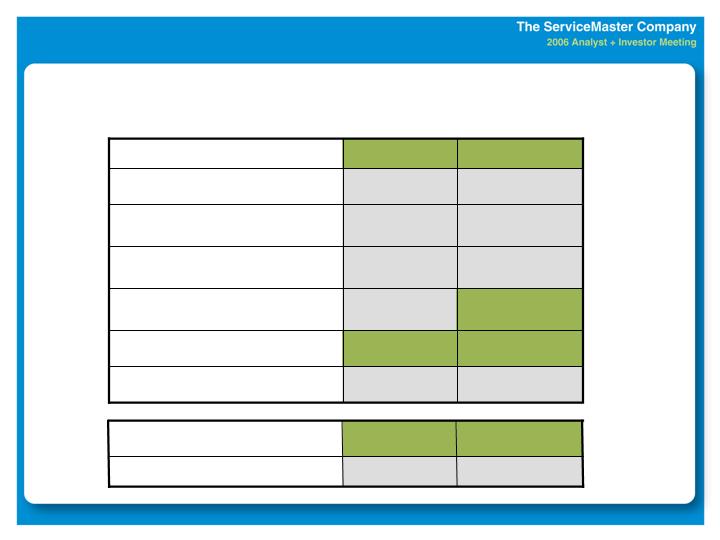

Growth Drivers

(all levered by PEGA, e - capabilities, QA)

Real Estate Sales

Maximize Realogy relationship

Accelerate core business growth

Focus on key segments /

services

Improve sales force productivity

Direct Marketing

Proven acquisition strategy

Consistent and predictable

Add internet lead engine,

and reach deeper into files

Improve telesales efficiency by

30% over 3 years

Retention Strategy

Rate continues to increase, slows

due to sales mix

Improve relationship contact and

timeliness

Build the capabilities for

web-driven channel

Continued service improvements

Service / Contractor Improvements

Capacity

Contractor network

Peak season service center

Proactively reach customers

during service experience

Modify compensation to reward

speed, quality and volume

Execute Realogy start up and expansion

Develop and Execute

Expanded Web Capabilities / Interactions

Quality Assurance Program

Roll Out “BPM” Sales

Roll Out “BPM” Service

Improve total customer experience -- at all touch points

Pre / post sell contact / communication

During all points of service experience

E dispatch confirmation

E follow up, e customer satisfaction / feedback process

Save process and problem resolution improvements

Reduce the hassles for customers, contractors, third parties and employees

Result:

Low double digit revenue growth

Operating margins improve 50-70 bps in ’07

Summary

David Crawford

President

American Home Shield

Ernie Mrozek

Vice Chairman

ServiceMaster

Compelling Business Model

High recurring revenue

Low volatility

Low risk from technology / offshore competition

Returns exceeding cost of capital

Exceptional cash flows

Strong, reliable dividend

Solid balance sheet - Investment Grade

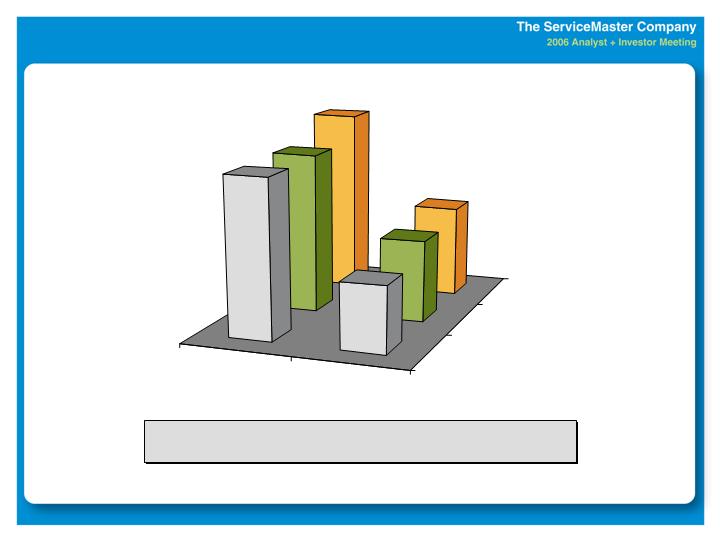

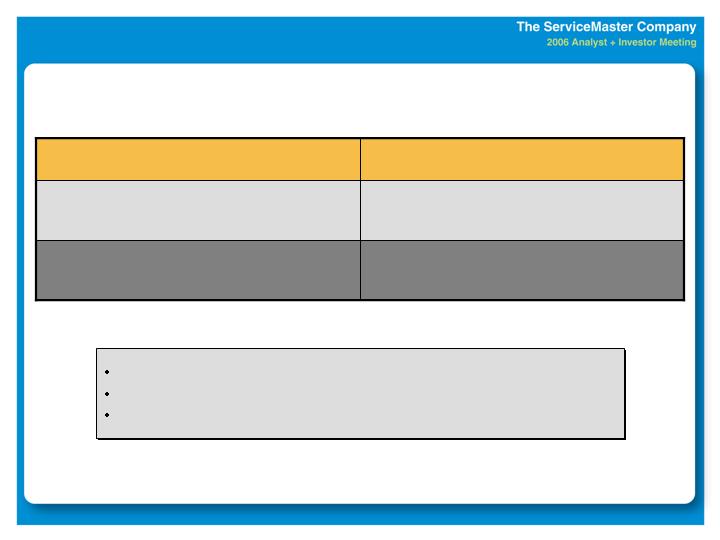

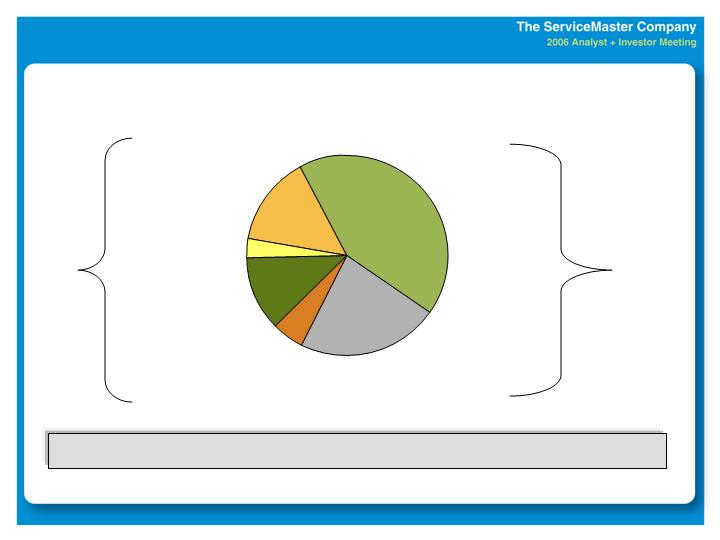

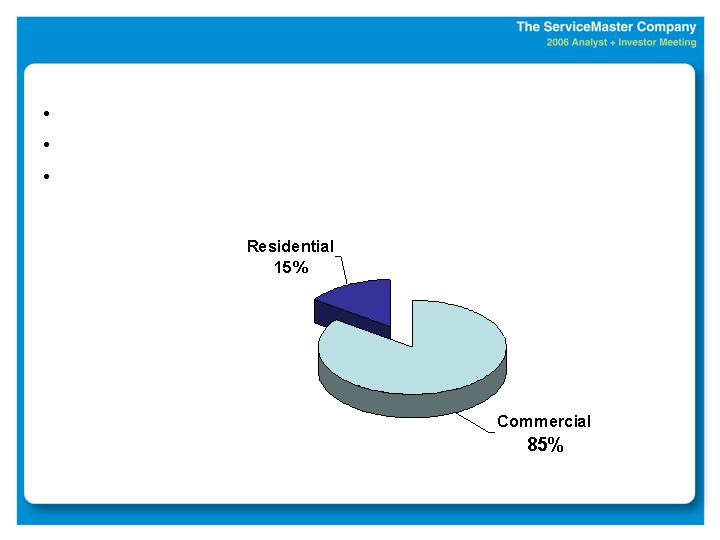

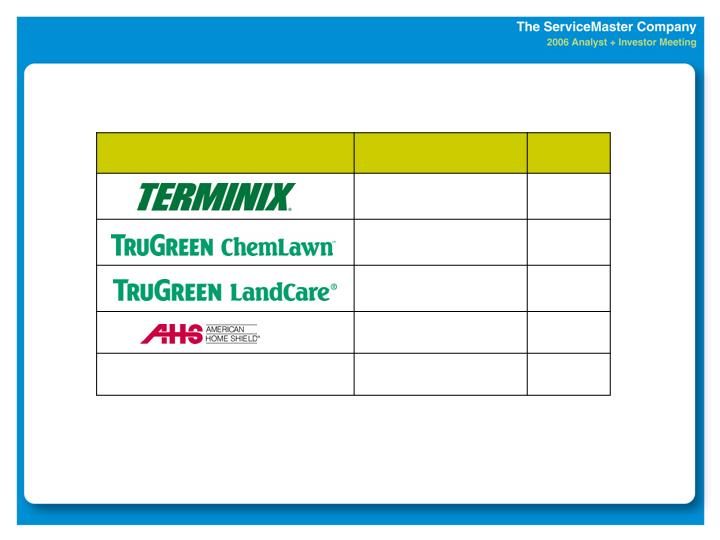

High Recurring Revenue

70%

62%

55%

77%

83%

70%

Total

62%

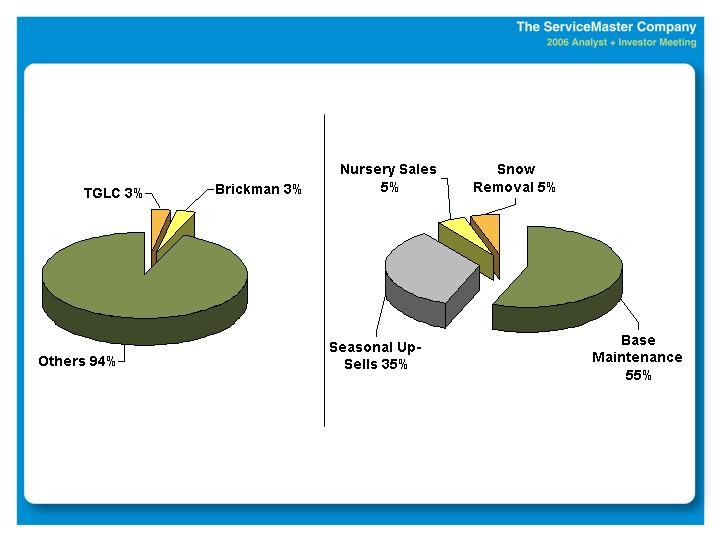

Residential Lawn, Shrub

and Tree Care

55%

77%

83%

Commercial Landscape

Maintenance

Home Warranty

Pest and Termite Control

Services

Brand

Percent

Recurring

Revenue Growth 2004-2005

* Returns based on ROI including Goodwill

Terminix

LandCare

LawnCare

Franchises

American Home

Shield

Cost of Capital = 9%

0%

Bulk of Portfolio Returns

Exceeding Cost of Capital

InStar

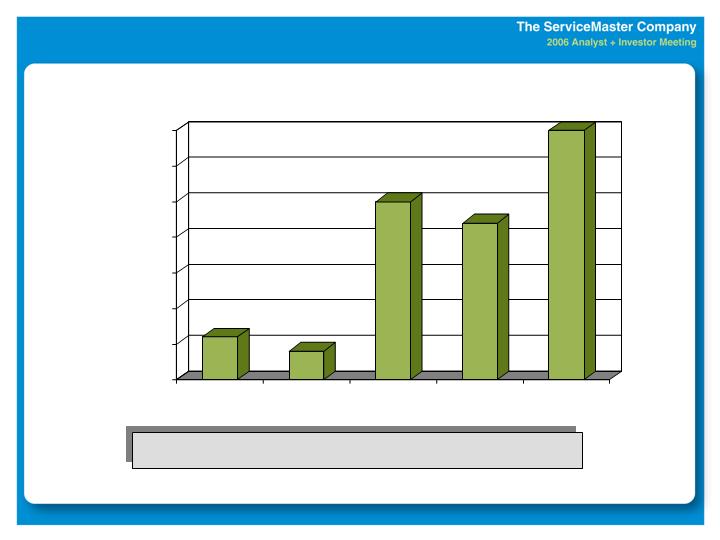

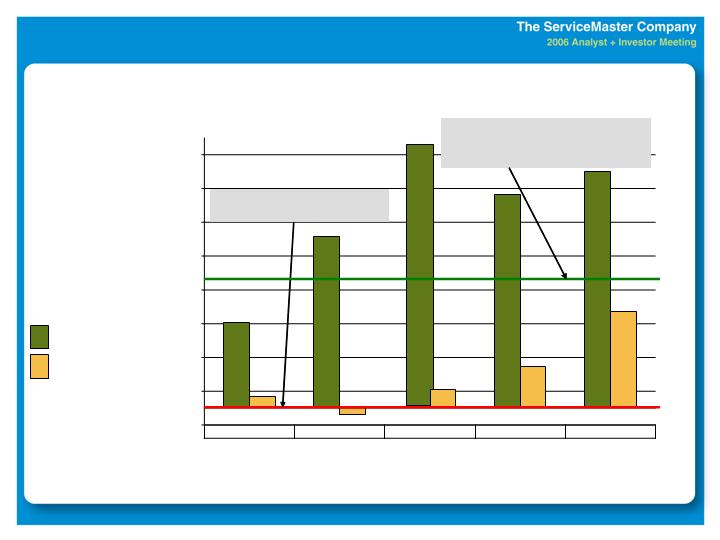

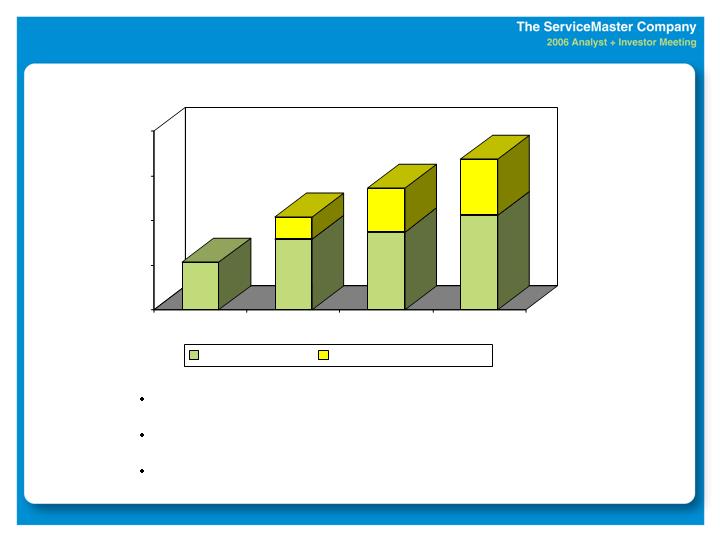

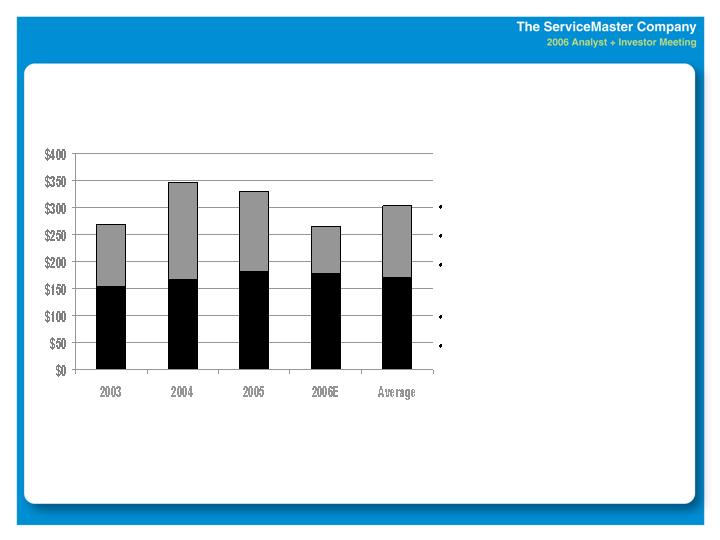

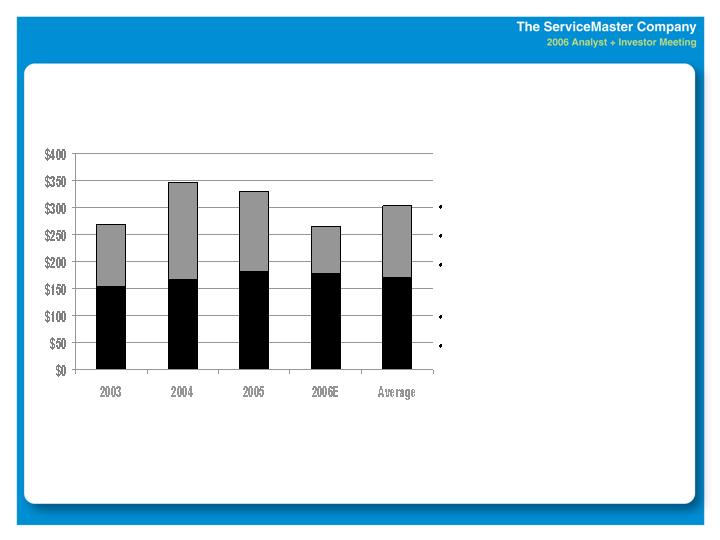

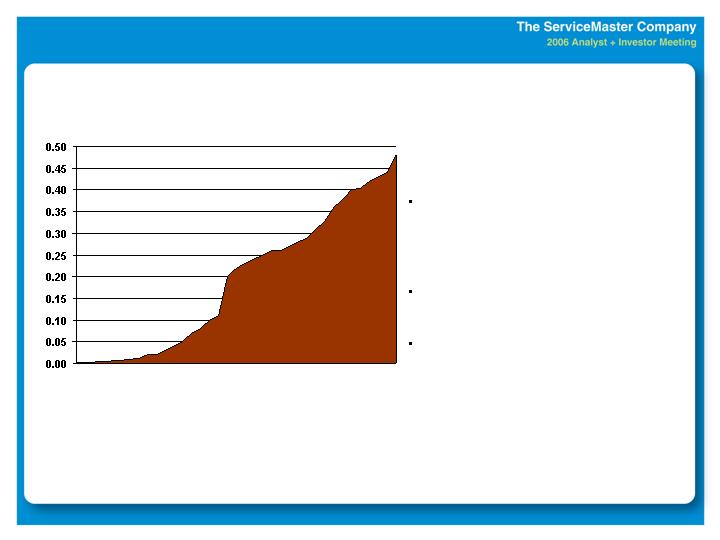

Exceptional Cash Flows

Consistently Exceed Net Income*

* Comparable basis, excluding unusual items

Cash From Operations

Net Income

$ millions

Cash Flow From Operations

Multiple 1.7X 2.1X 1.8X 1.5X 1.8X

* Comparable basis, excluding unusual items

$ millions

Cash Flow From Operations

Multiple 1.7X 2.1X 1.8X 1.5X 1.8X

Fundamentals

Low fixed asset requirements

Significant prepayments

Quick accounts receivable

turnover

Minimal inventories

Recurring deferred tax benefit

Exceptional Cash Flows

Consistently Exceed Net Income*

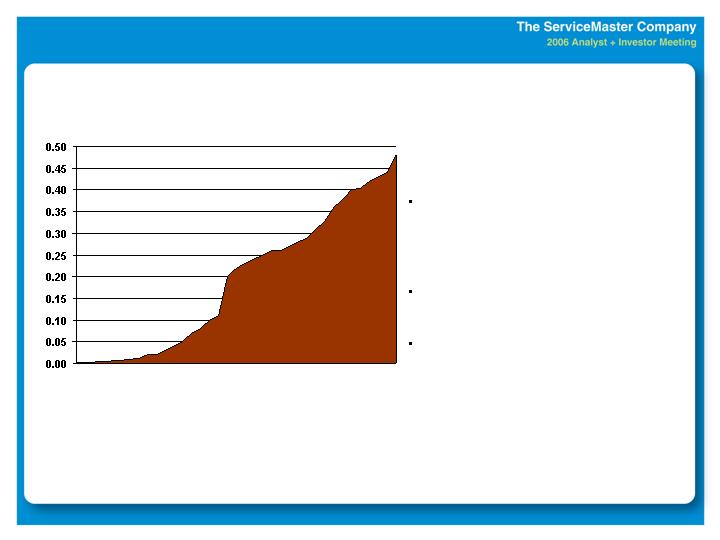

* Assumes 2007 – 2012 Estimate of $53 million and 300 million Diluted Shares Outstanding

Annual

Average

$ millions

Significant Annual Cash Tax Benefit of

$.18* per share; Not Included In EPS

Exceptional Cash Flows

Dividend Growth

Recently increased rate of growth based

on strong cash flow profile

Share Repurchase

$86 million completed through

September 30th

2006 combined yield exceeds 6.4%

1970 - 2006

4.0% Dividend Yield*

36 consecutive

years of

increase

*Based on $.48 dividend and $12.10 stock price

Strong History of Cash Returns to Shareholders

Balanced Approach to

Deployment of Free Cash Flows

2004 – 2006E

$196

$65

Free Cash Flow

(137)

(46)

Capital Expenditures

(72)

(130)

$313

Average

(215)

Share Repurchase

(390)

Dividends

$938

Cash From Operations*

Cumulative

$ millions

Maintain strong balance sheet and investment grade status

* Comparable basis, excluding unusual items

$202

$.67/Share

$605

$2/Share

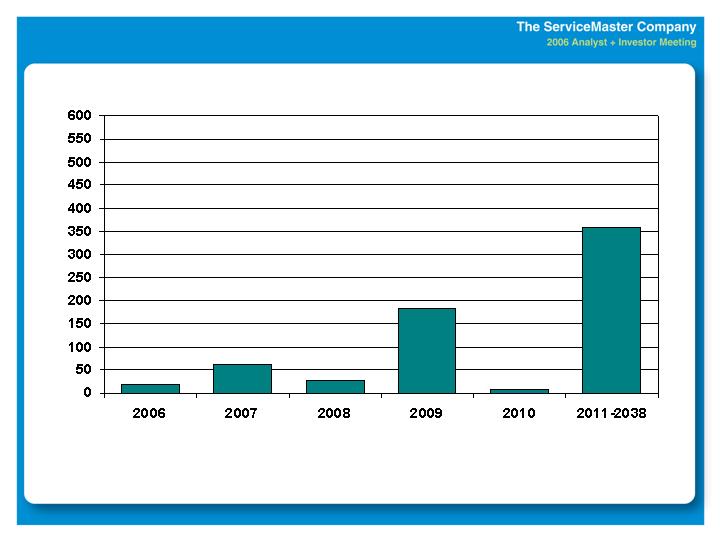

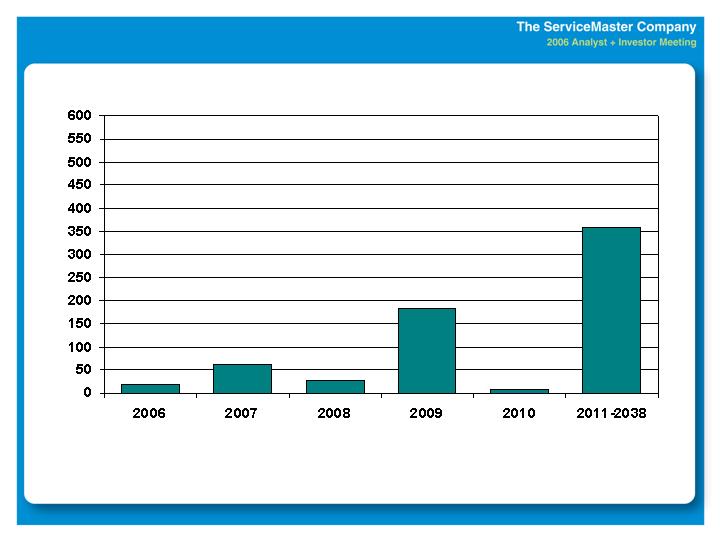

Investment Grade Debt

* Adjusted for $100 million cash proceeds from the ARS sale used to pay down debt on 10/03/06

$ millions

$773 Million in Total Debt (As of 9/30/06)*

Policy of maximum 35% floating rate debt

Mostly Fixed Rate, with Extended Maturities

Note: The income and EPS results on this schedule exclude the following non-comparable items:

2006 excludes restructuring costs of $12 million pretax, $7 million after-tax and $.02 per diluted share.

2004 excludes the resolution of the IRS audit resulting in a $149.7 million reduction in tax expense, $.49 per diluted share.

Historical Financial Summary

9%

8%

6%

% Chg

$0.61 to $0.63

178 to 184

$3,430 to $3,450

2006E

0% to 3%

(1%) to 2%

6%

% Chg

$0.61

10%

$0.56

EPS (see Note)

181

8%

167

Net Income (see Note)

$3,239

6%

$3,068

Revenue

2005

% Chg

2004

$ in millions

Income Statement

Organic growth weakened by unusual combination of events

TruGreen ChemLawn: Accelerated decline in telemarketing

Terminix: Very weak annual termite swarm

TruGreen LandCare: Timing delays in maintenance sales and less snow removal

AHS: Significant decline in home resale market

Rapid increases in fuel, health care and interest costs

Higher claims costs at AHS, due in part to new legislation

Investments in sales and retention initiatives

Key Factors Impacting 2006 Results

Despite unusually stiff headwinds, projected

earnings still consistent or slightly above 2005

Strong Growth Prospects

SPECIFIC INITIATIVES DRIVE RETURN TO ACCELERATED GROWTH

Accelerating gains in satisfaction and retention

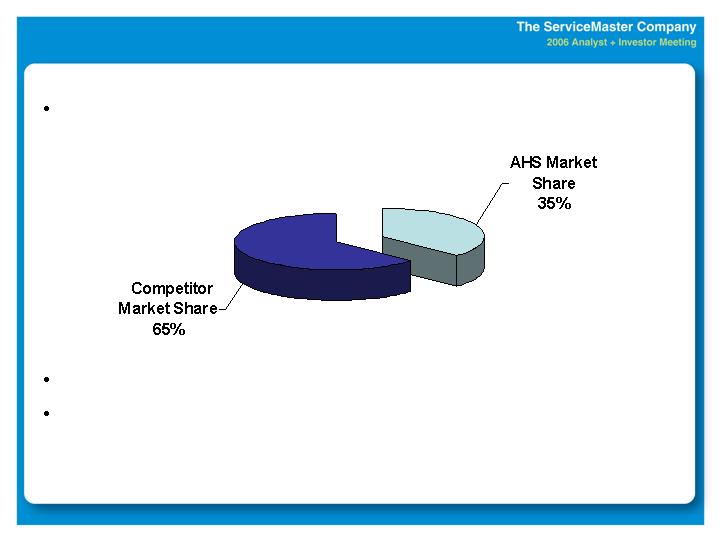

Expanding market share and category penetration

Innovative new offerings

New markets / increasing penetration

Expanding sales methods / channels

Improving employee selection, training and retention

Increasing operating leverage

Accelerating Gains

in Customer

Satisfaction and

Retention

Strategy: Enhance a CUSTOMER FIRST CULTURE by:

Delivering our services as promised, every time

Building loyalty and retention in everything we do

Tactics:

Employee selection and training

Customer communications and expectation setting

Getting it right the first time

LQAs and Progress Assessments

Problem resolution standards / follow up

Compensation plans and promotion qualifiers

Our Strategic Framework for Accelerating Growth

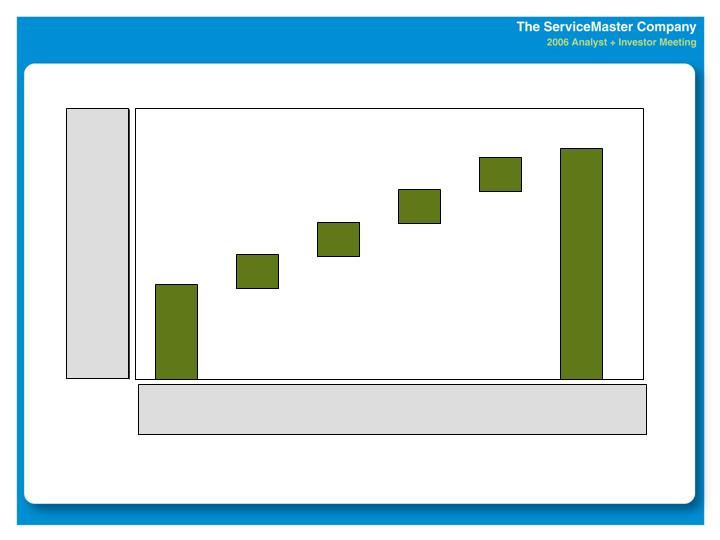

Continuing Gains in Retention

Have Significant Financial Impact

+ Improved Referrals

$45

$102

Total

3

7

American Home Shield

2

6

Terminix – Pest

5

10

Terminix – Termite

4

17

TruGreen LandCare

$31

$62

TruGreen ChemLawn

Operating

Income

Revenue

$ in millions

Annualized Impact in 2009

From Retention Gains

Strong Growth Prospects

Innovative Offerings

Termite Inspections

LQAs

Green Products

Expanding Market

Share and

Category

Penetration

Strong Growth Prospects

Innovative Offerings

Termite Inspections

LQAs

Green Products

New Markets / Increasing Penetration

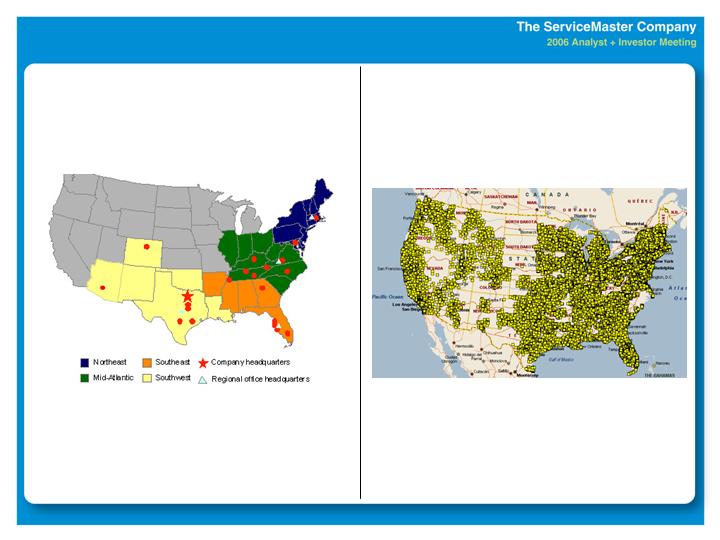

InStar: New markets and services

AHS Real Estate: New Realogy partnership

Terminix / TruGreen / Merry Maids:

Tuck-ins and new market acquisitions

Expanding Market

Share and

Category

Penetration

Strong Growth Prospects

Innovative Offerings

Termite Inspections

LQAs

Green Products

New Markets / Increasing Penetration

InStar: New markets and services

AHS Real Estate: new Realogy partnership

Terminix / TruGreen / Merry Maids:

Tuck-ins and new market acquisitions

Expanding Sales Methods / Channels

Direct mail

Neighborhood sales

Internet

Retail

Expanding Market

Share and

Category

Penetration

Strategies

LandCare margin improvement

Lawn / pest integration

Benefits of headquarters consolidation

Simplify service centers and functional processes

Improving

Operating

Leverage

Our Strategic Framework for Accelerating Growth

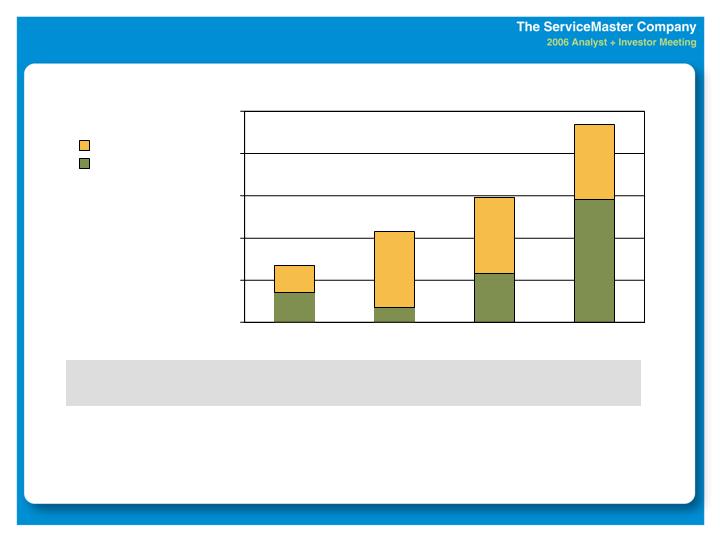

Strong Growth Prospects

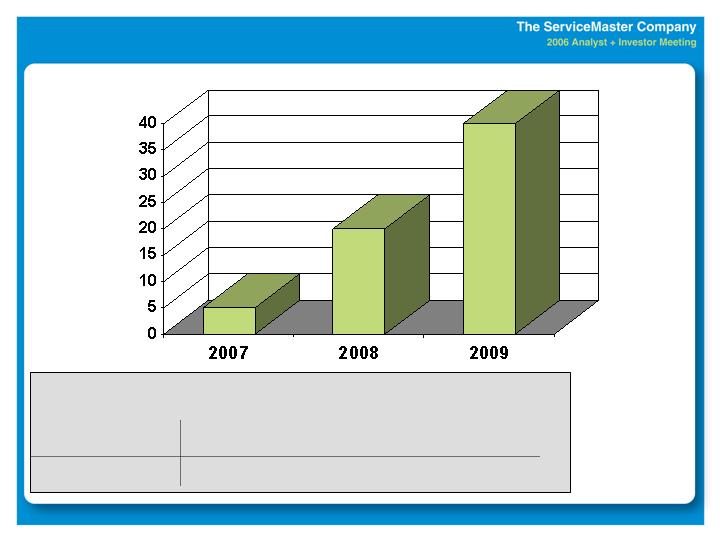

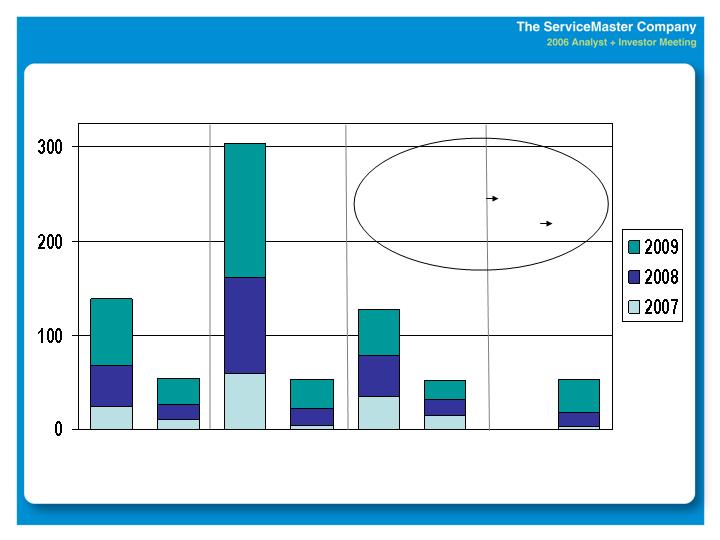

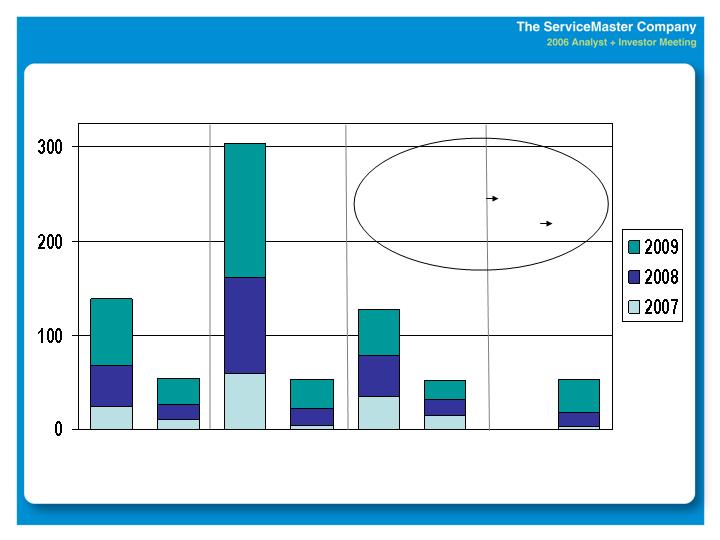

Meaningful Gains From Specific Initiatives

Improving Operating

Leverage

Expanding Sales

Methods / Channels

New Markets/ Innovative

Offerings

Improving

Retention

Rev OI Rev OI Rev OI Rev OI

Rev = Revenue OI = Operating Income

$ millions

Total Impact in 2007 – 2009:

Revenue - $120 $260m

Operating Income - $30 $110m

Cumulative

total in:

Strong Growth Prospects

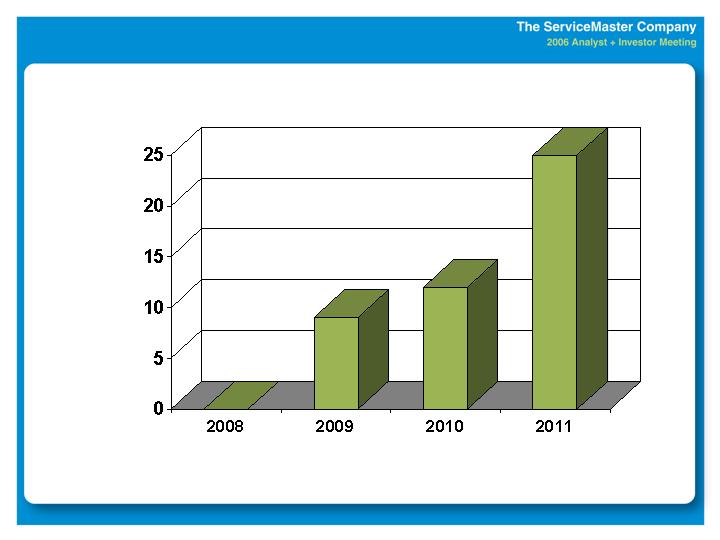

Business Unit Growth Targets: 2007 - 2009

50-100 bps per year

Mid-teen levels

InStar

Flat to 20 bps per year

Mid-single digit

TruGreen ChemLawn

Slightly declining margins due to

acquisitions

Mid-teen levels

ServiceMaster Clean / Merry Maids

50-70 bps in ’07; Maintain at ‘07 levels

Low-double digit

AHS

Flat in ’07; 50-100 bps per year

Mid to High-single digit

Terminix

100-200 bps per year

Low-single digit in ’07; Low-double digit

thereafter

TruGreen LandCare

Change in Operating

Margins

Revenue

(% Growth Rate)

Business

General

General economic growth of 2-3%

Home resale market stabilizes at 2006 levels

(-9% decrease in 2006; 4% increase in 2005)

Weather at multi-year historical averages

Key Factor Costs

Annual wage increases of 3%-3.5%

(3% - 4% in 2006 & 2005)

Growth in fuel costs of 9% in 2007 and 2% in 2008 & 2009

(20% - 25% in 2006 & 2005)

Annual inflationary increases in health care costs of 11%

(14% - 15% in 2006 & 2005)

Annual average LIBOR rate for 2007 that is 80 basis points higher than 2006, then

consistent rates in 2008 and 2009

(increase of 180 bp in 2006)

Key Common Assumptions in Plan

Strong Growth Prospects

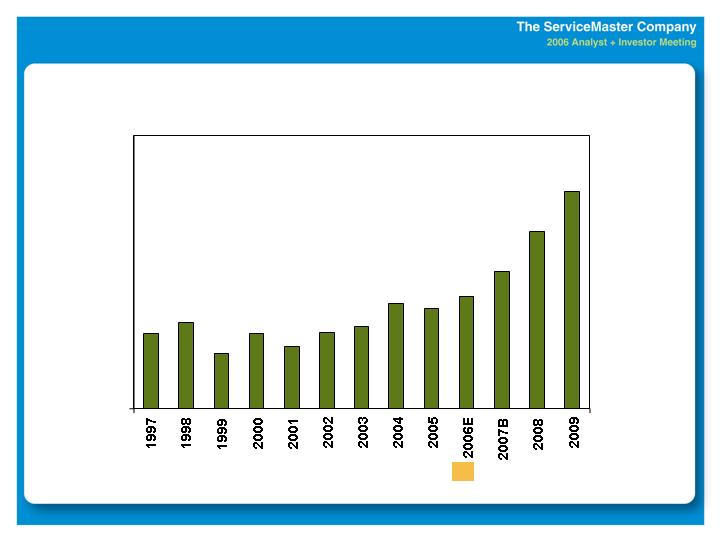

*Continuing operations; excludes unusual items.

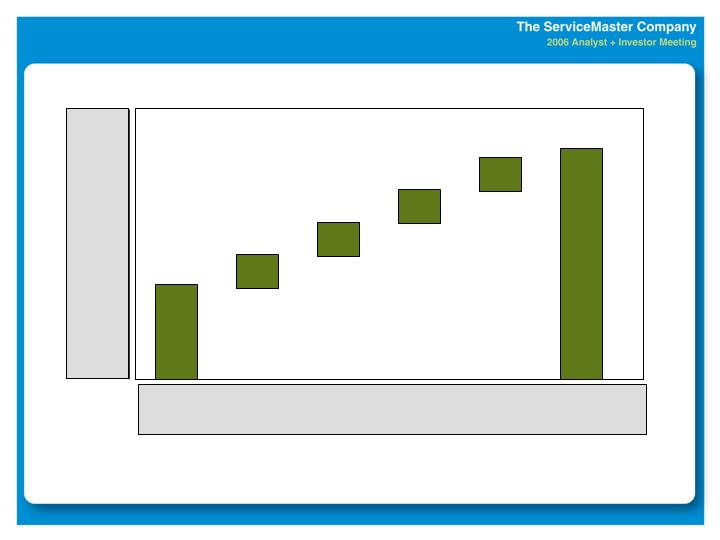

+13%

+8%

2008P

0%-3%

+6%

2006E

+10%

+7%

2007P

+10%

+6%

2004

+9%

+6%

2005

EPS*

Revenue

+16%

+9%

2009P

Growth Rates

SPECIFIC INITIATIVES SUPPORT ACCELERATING

AND SUSTAINABLE GROWTH

Ernie Mrozek

Vice Chairman

ServiceMaster

Pat Spainhour

Chairman and Chief Executive Officer

ServiceMaster

Question & Answer

Reconciliation of Non-GAAP Financial Measures

(Amounts in thousands, except per share data)

Within this investor presentation, ServiceMaster has provided certain non-GAAP (Generally Accepted Accounting Principles) measures. ServiceMaster does not intend for the information to be considered in isolation or as a substitute for the related GAAP measures. ServiceMaster believes that these non-GAAP measures provide an important perspective on the performance of ServiceMaster’s continuing operations.

A reconciliation of cash from operations on a comparable basis, before unusual items to its most directly comparable financial measure under GAAP for the years ended December 31 is as follows:

| 2006

Estimate

| | 2005

| | 2004

| | 2003

| |

|---|

| Reported cash from operations | | $ 259,200 | | $ 242,708 | | $ 370,057 | | $ 269,031 | |

| Resolution of income tax audits | | 5,000 | | 86,356 | | (25,000 | ) | — | |

|

| |

| |

| |

| |

| Cash from operations on a | |

| comparable basis, before | |

| unusual items | | $ 264,200 | | $ 329,064 | | $ 345,057 | | $ 269,031 | |

A reconciliation of income from continuing operations on a comparable basis, before unusual items to its most directly comparable financial measure under GAAP for the years ended December 31 is as follows:

| Range of 2006 Estimate

| |

|---|

| Low end

| | High end

| |

|---|

| Reported income from | | | | | | | | | |

| continuing operations | | $ 171,000 | | $ 0.59 | | $ 177,000 | | $ 0.61 | |

| Restructuring charges, net of tax | | 7,000 | | 0.02 | | 7,000 | | 0.02 | |

|

| |

| |

| |

| |

| Income from continuing | |

| operations on a comparable | |

| basis, before unusual items | | $ 178,000 | | $ 0.61 | | $ 184,000 | | $ 0.63 | |

| 2005

| | 2004

| |

|---|

| Reported income from | | | | | | | | | |

| continuing operations | | $ 180,561 | | $ 0.61 | | $ 316,623 | | $ 1.06 | |

| IRS tax agreement | | — | | — | | (149,722 | ) | (0.49 | ) |

|

| |

| |

| |

| |

| Income from continuing | |

| operations on a comparable | |

| basis, before unusual items | | $ 180,561 | | $ 0.61 | | $ 166,901 | | $ 0.56 | |

| 2003

| |

|---|

| Reported income from | | | | | |

| continuing operations | | $ (2,455 | ) | $ (0.01 | ) |

| Impairment charge, net of tax | | 156,200 | | 0.53 | |

|

| |

| |

| Income from continuing | |

| operations on a comparable | |

| basis, before unusual items | | $ 153,745 | | $ 0.51 | |

A reconciliation of total long-term debt adjusted for cash proceeds from the sale of ARS to its most directly comparable financial measure under GAAP is as follows:

| |

|---|

| Reported total long-term debt at September 30, 2006 | | $ 873,365 | |

| Cash proceeds from sale of ARS used to pay down | |

| debt on October 3, 2006 | | (100,000 | ) |

|

| |

| Adjusted total long-term debt | | $ 773,365 | |