- EVOL Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Symbolic Logic (EVOL) DEF 14ADefinitive proxy

Filed: 7 Apr 06, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o | ||

Check the appropriate box: | ||

o | Preliminary Proxy Statement | |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

ý | Definitive Proxy Statement | |

o | Definitive Additional Materials | |

o | Soliciting Material Pursuant to §240.14a-12 | |

EVOLVING SYSTEMS, INC. | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

(1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. | ||||

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 1, 2006

To the Stockholders of Evolving Systems, Inc.:

You are invited to attend the annual meeting of the stockholders of Evolving Systems, Inc. which will be held at 9:00 a.m. local time at the Summerfield Suites, 9280 East Costilla Avenue, Englewood, Colorado 80112, on June 1, 2006.

At the meeting, you will be asked to act on the following matters:

1. the election of two directors to serve for a term of three years;

2. the ratification of the selection of KPMG LLP as our independent registered public accounting firm to audit the consolidated financial statements of Evolving Systems for its fiscal year ending December 31, 2006; and

3. such other business as may properly come before the meeting or any adjournment or postponement of the meeting.

The Proxy Statement accompanying this Notice describes these items more fully.

Only holders of record of shares of Evolving Systems' common stock and its Series B Convertible Preferred Stock at the close of business on April 4, 2006 are entitled to vote at the meeting or any postponements or adjournments of the meeting.

YOUR VOTE IS IMPORTANT. PLEASE READ THE PROXY STATEMENT AND THE VOTING INSTRUCTIONS ON THE PROXY CARD AND THEN VOTE EITHER BY MAIL BY COMPLETING THE PROXY CARD AND RETURNING IT OR BY INTERNET OR TELEPHONE BY FOLLOWING THE VOTING INSTRUCTIONS PRINTED ON THE PROXY CARD SENT TO YOU.

Voting by the Internet or telephone is fast, convenient and your vote is immediately confirmed and tabulated. By using the Internet or telephone you help Evolving Systems reduce postage and proxy tabulation costs.

Please do not return the enclosed paper ballot if you are voting over the Internet or by telephone

| VOTE BY INTERNET | VOTE BY TELEPHONE | |

|---|---|---|

| http://www.voteproxy.com 24 hours a day/7 days a week | 1-800-776-9437 (toll free) 24 hours a day/7 days a week | |

Use the Internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. eastern time on May 31, 2006. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. | Use any touch-tone telephone to transmit your voting instructions up until 11:59 p.m. eastern time on May 31, 2006. Have your proxy card in hand when you call and then follow the instructions. |

Your cooperation is appreciated, since a majority of the stock outstanding must be represented, either in person or by proxy, to constitute a quorum for the conduct of business.

| By order of the Board of Directors, | ||

| ||

| Anita T. Moseley Secretary | ||

| Englewood, Colorado April 7, 2006 |

9777 Pyramid Court, Suite 100

Englewood, Colorado 80112

PROXY STATEMENT

FOR ANNUAL MEETING OF STOCKHOLDERS

June 1, 2006

This proxy statement contains information related to the annual meeting of stockholders of Evolving Systems, Inc. which will be held at 9:00 a.m. local time at the Summerfield Suites, 9280 East Costilla Avenue, Englewood, Colorado 80112, on June 1, 2006, and any postponements or adjournments thereof. Evolving Systems first mailed these proxy materials to stockholders on or about April 12, 2006. In this proxy statement, "Company," "Evolving Systems," "we," "us," and "our" each refer to Evolving Systems, Inc. and its subsidiaries.

What is the purpose of the Annual Meeting?

At the Annual Meeting, stockholders will act upon the matters listed in the Notice of Annual Meeting and any other matters that properly come before the meeting. In addition, the management team will report on the performance of Evolving Systems during 2005 and respond to questions from stockholders.

Who can vote at the Annual Meeting?

All stockholders of record at the close of business on April 4, 2006, or the "record date," are entitled to vote at the Annual Meeting and any postponements or adjournments of the meeting. Those stockholders who do not expect to attend the annual meeting are encouraged to complete their enclosed ballots and return them by mail, phone or the Internet as described below.

What are the voting rights of the holders of the common stock?

Holders of our common stock will vote on all matters to be acted upon at the Annual Meeting. Each outstanding share of common stock will be entitled to one vote on each matter to be voted upon at the Annual Meeting. Management encourages all stockholders to vote their shares.

What are the voting rights of the holders of the Series B Convertible Preferred Stock?

The holders of the Series B Convertible Preferred Stock are entitled to vote on any matters presented to our stockholders together with the holders of common stock. While each share of Series B Convertible Preferred Stock converts into three shares of the Company's common stock, each such share of Series B Convertible Preferred Stock is only entitled to 2.26 votes in order to comply with certain voting rights rules promulgated by The Nasdaq Stock Market, Inc. ("Nasdaq") relating to the fact that the Series B Convertible Preferred Stock was issued at a discount to market on the date of issuance. As of the record date, the holders of the Series B Convertible Preferred stock were entitled to an aggregate of 2,184,665 votes on all matters presented to the holders of common stock based on their ownership of the Series B Convertible Preferred Stock. The Series B Convertible Preferred Stock is voluntarily convertible into our common stock at anytime at the option of each holder, at which time each such share of common stock will be entitled to one vote per share.

Who can attend the Annual Meeting?

All stockholders as of the record date, or their duly appointed proxies, may attend the Annual Meeting. Each stockholder may be asked to present valid picture identification, such as a driver's license or passport. If you hold your shares through a broker or other nominee, you must bring a copy of a brokerage statement reflecting your stock ownership as of the record date. Everyone must check in at the registration desk at the meeting.

How do I vote if my shares are held in my name?

Stockholders who own shares of common stock registered directly in their name as determined by our stock records maintained by American Stock Transfer & Trust Company, the Company's transfer agent, may vote their shares in any of the following ways:

Each stockholder planning to vote by telephone or the Internet should have his, her or its proxy card handy as the unique control numbers printed on the proxy card will be required in order to vote by either of such means.

To vote by mail, simply mark, sign and date your proxy card and return it in the postage-paid envelope provided. Please return your proxy card promptly to ensure your vote will be counted in the final tabulation.

How do I vote if my shares are held in a brokerage account?

A number of brokerage firms and banks are participating in separate programs that offer telephone and/or Internet voting options. Such programs are different from the programs provided for shares registered directly in the name of the stockholder. If your shares of common stock are held in an account at a brokerage firm or bank participating in any such program, you may vote those shares by telephone and/or via the Internet in accordance with instructions set forth on the voting form provided to you by the brokerage firm or bank that holds your stock. If you want to vote in person at the Annual Meeting and you hold Evolving Systems common stock in street name, you must obtain a legal proxy from your broker and bring it to the Annual Meeting, together with proper identification and a copy of a brokerage statement for admittance to the meeting.

Please note that if you cast your vote by either mailing a signed proxy card, by telephone or via the Internet, you are authorizing the individuals listed on the proxy card to vote your shares in accordance with your instructions.

Is my vote confidential?

Yes. Proxy cards, ballots and voting tabulations that identify stockholders are kept confidential except in certain circumstances where it is important to protect the interests of Evolving Systems and its stockholders.

What if I do not indicate my preference on the proxy card?

If you do not indicate how you would like your shares to be voted for a particular proposal, your shares will be voted (i) FOR the election of the nominated slate of directors; and (ii) FOR the ratification of the selection of KPMG LLP as our independent registered public accounting firm to

2

audit the consolidated financial statements of Evolving Systems for its fiscal year ending December 31, 2006. As to other matters as may properly come before the meeting (or any adjournments or postponements thereof), the proxy holders will vote as recommended by the Board of Directors. If no such recommendation is made, the proxy holders will be authorized to vote upon such matters in their own discretion.

Can I change my vote after I return my proxy card?

Yes. Even after you have submitted your proxy, you may change your vote at any time before the proxy is exercised by filing with the Secretary of Evolving Systems either a notice of revocation or a duly executed proxy bearing a later date. The powers of the proxy holders will be suspended if you attend the Annual Meeting in person and request to recast your vote. Attendance at the Annual Meeting will not, by itself, revoke a previously granted proxy.

What are the recommendations of the Board of Directors?

The Board recommends stockholders vote FOR all proposals. Unless you instruct otherwise on your proxy card, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board of Directors. Specifically, the Board's recommendations are set forth below. In summary, the Board recommends a vote:

The proxy holders will vote as recommended by the Board of Directors with respect to any other matter that properly comes before the Annual Meeting, including any postponements or adjournments thereof. If the Board of Directors on any such matter gives no recommendation, the proxy holders will vote in their own discretion.

What are the quorum requirements and how are abstentions and broker non-votes treated?

Outstanding Shares and Quorum. As of the record date, Evolving Systems had 16,188,236 shares of its common stock outstanding and 966,666 shares of Series B Convertible Preferred Stock, convertible into 2,899,998 shares of our common stock. The presence at the meeting of a majority of the outstanding shares, in person or by proxy relating to any matter to be acted upon at the meeting, is necessary to constitute a quorum for the meeting. Each outstanding share of common stock is entitled to one vote on all matters and each share of Series B Convertible Preferred Stock is entitled to 2.26 votes on all matters, for a total of 18,372,901 possible eligible votes for the proposals set forth herein.

Abstentions. If you return a proxy card that indicates an abstention from voting on all matters, the shares represented will be counted as present for the purpose of determining a quorum, but they will not be voted on any matter. Consequently, if you abstain from voting on the proposal to elect directors (Proposal No. 1), your abstention will have no effect on the outcome of the vote with respect to this proposal. If you abstain from voting on the proposal to ratify the appointment of KPMG LLP as our independent registered public accounting firm (Proposal No. 2), your abstention will have the same effect as a vote against this proposal.

Broker Non-Votes. Under the rules that govern brokers who have record ownership of shares that are held in "street name" for their clients, who are the beneficial owners of the shares, brokers have discretion to vote these shares on routine matters but not on non-routine matters. A "broker non-vote" occurs when a broker expressly instructs on a proxy card that it is not voting on a matter, whether routine or non-routine. Broker non-votes are counted for the purpose of determining the presence or

3

absence of a quorum, but are not counted for determining the number of votes cast for or against a proposal. Your broker will have discretionary authority to vote your shares on the proposal to elect directors (Proposal No. 1) and the proposal to ratify the appointment of KPMG LLP as our independent registered public accounting firm (Proposal No. 2), which are routine matters.

Election of Directors. The election of directors is a routine matter for brokers that hold their clients' shares in "street name." If a quorum is present and voting, the two nominees receiving the highest number of votes will be elected to the board of directors. Abstentions and broker non-votes will not be counted in the election of directors.

Ratification of KPMG LLP as Evolving Systems' Independent Registered Public Accounting Firm. The ratification of KPMG LLP as Evolving Systems' independent registered public accounting firm is a routine matter for brokers that hold their clients' shares in "street name." The affirmative vote of a majority of the shares of our common stock and our Series B Convertible Preferred Stock, voting together as a single class, present or represented and voting at the annual meeting will be required to ratify the appointment of KPMG as our independent registered public accounting firm. Abstentions will have the effect of a vote against this proposal and broker non-votes will have no effect on the outcome of the vote with respect to this proposal.

Do I have dissenters' rights with respect to any of the proposed matters?

Under Delaware law, stockholders are not entitled to dissenters' rights of appraisal with respect to any of the proposals.

What is the deadline for submitting a stockholder proposal?

The deadline for submitting a stockholder proposal for inclusion in Evolving Systems' proxy statement and form of proxy for our 2007 annual meeting of stockholders provided under Rule 14a-8 of the Securities and Exchange Commission is December 7, 2006. A stockholder proposal or nomination for director for consideration at the 2007 annual meeting but not included in the proxy statement and proxy must be received by the Secretary of Evolving Systems no earlier than March 3, 2007 and no later than April 2, 2007. The submission of a stockholder proposal does not guarantee that it will be presented at the annual meeting. Stockholders interested in submitting a proposal are advised to contact knowledgeable legal counsel with regard to the detailed requirements of applicable federal securities laws and Evolving Systems' bylaws, as applicable.

Delivery of this Proxy Statement

The Securities and Exchange Commission has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements with respect to two or more security holders sharing the same address by delivering a single proxy statement addressed to those security holders. This process, which is commonly referred to as "householding," potentially means extra convenience for security holders and cost savings for companies.

This year, a number of brokers with account holders who are Evolving Systems stockholders will be "householding" our proxy materials. A single proxy statement will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker or us that they will be "householding" communications to your address, "householding" will continue until you are notified otherwise or until you revoke your consent. If, at any time, you no longer wish to participate in "householding" and would prefer to receive a separate proxy statement, please notify your broker, direct your written request to Evolving Systems, Inc., Anita T. Moseley, Secretary, 9777 Pyramid Court, Suite 100, Englewood, Colorado 80112, or contact Anita T. Moseley at 303-802-1000.

4

Stockholders who currently receive multiple copies of the proxy statement at their address and would like to request "householding" of their communications should contact their broker.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our certificate of incorporation and bylaws provide that the Board of Directors is divided into three (3) classes, each class consisting, as nearly as possible, of one-third of the total number of directors, with each class having a three-year term. Vacancies on the Board may be filled only by persons elected by a majority of the remaining directors. A director elected by the Board to fill a vacancy (including a vacancy created by an increase in the Board of Directors) will serve for the remainder of the full term of the class of directors in which the vacancy occurred and until the director's successor is elected and qualified.

The Board of Directors presently consists of five (5) members. Except for Mr. Gartside who is currently an executive officer of the Company, and Mr. Hallenbeck, who was an executive officer of the Company until September 2, 2005, the Directors are independent under Nasdaq's current listing standards.

There are two Directors, George A. Hallenbeck and David J. Nicol, whose terms of office expire in 2006. The Board has nominated Mr. Hallenbeck and Mr. Nicol for re-election. There are currently two (2) vacancies on the Board which will remain following this election. The Board may fill these vacancies pursuant to the Company's bylaws. Proxies cannot be voted for a greater number of persons than the number of nominees named. If elected at the Annual Meeting, each of the nominees would serve until the 2009 annual meeting and until his successor is elected and has qualified, or until such director's earlier death, resignation or removal.

Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote at the meeting. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the nominees named below. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as management may propose. The persons nominated for election have agreed to serve if elected, and management has no reason to believe that the nominees will be unable to serve.

Set forth below is biographical information for the persons nominated and each person whose term of office as a director will continue after the Annual Meeting. Ages are as of April 4, 2006, the record date.

Vote Required and Recommendation of Board of Directors

The election of directors is a routine matter for brokers that hold their clients' shares in "street name." If a quorum is present and voting, the two nominees receiving the highest number of votes will be elected to the board of directors. Abstentions and broker non-votes will not be counted in the election of directors.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" EACH NAMED NOMINEE.

5

Nominees for Election for a Three Year Term Expiring at the 2009 Annual Meeting

George A. Hallenbeck

George A. Hallenbeck, 64, currently serves as Chairman of the Board. Mr. Hallenbeck was a founder of the Company in June 1985 and has served as Chairman and a member of the Board of Directors since that time. Mr. Hallenbeck served as the Company's Chief Executive Officer from June 1985 until December 1996; he resumed the position as Chief Executive Officer in October 1998 until December 2003. In January 2004, Mr. Hallenbeck resigned as Chief Executive Officer and became the Company's Chief Technology Officer, a position he held until September 2, 2005. Mr. Hallenbeck received a B.A. from the University of Colorado.

David J. Nicol

David J. Nicol, 60, became a member of the Board of Directors in March 2004. Since December 2005 he has served as Executive Vice President and Chief Financial Officer for Solutionary, an IT security services provider. From 2001 to the end of 2003, Mr. Nicol served as Sr. Vice President of Product Management and Development for VeriSign Communications Services. VeriSign provides signaling, intelligent network services and related e-commerce solutions to all service provider segments of the communications industry. Prior to VeriSign's acquisition of Illuminet, Inc. in 2001, Mr. Nicol held the same position at Illuminet since 1999. In those capacities, Mr. Nicol was responsible for product management, product development, application support, and business development for network services, IN services, clearinghouse services, CALEA compliance services and wireless services. Prior to 1999, Mr. Nicol held the positions of Vice President of Business Development for ITN, Chief Operating Officer for International Micronet Systems, Inc., and Chief Operating Officer and Partner for iLAN, Inc. From 1984 to 1990, Mr. Nicol held various officer positions with Sprint Corporation, lastly serving as Corporate Vice President of Planning. Mr. Nicol holds a B.Sc. from Ohio State University, an M.A. from Case Institute of Technology and a Ph.D. from Case Western Reserve University.

Directors Continuing in Office Until the 2007 Annual Meeting

Stephen K. Gartside, Jr.

Stephen K. Gartside, Jr., 40, became a member of the Board of Directors in January 2004, when he was also named as President and Chief Executive Officer of the Company. Mr. Gartside joined the Company in August 2001 as Vice President of Marketing and Corporate Business Development. He was promoted to the position of Executive Vice President of Sales and Operations in January 2003. Before joining the Company, from July 1998 through October 2000, Mr. Gartside served as Senior Vice President of Corporate Development of TeraBeam Corporation, a technology development and service provider that deploys Metropolitan Area Networks using Gigabit Ethernet, IP and Free Space Optics. Prior to TeraBeam, Mr. Gartside was the Regional Director, Communications Division, for Stratus Computers, where he had responsibility for sales of platform, OSS and Network Element solutions to carriers in the Western United States. Mr. Gartside has also held a number of sales, marketing and sales management positions, with NCR and AT&T Global Information Solutions. In his eleven-year career with NCR and AT&T GIS, his focus was on selling solutions for the communications industry. Mr. Gartside holds a B.B.A. in Marketing from the University of Texas and has pursued M.B.A. studies at the University of St. Thomas.

Philip M. Neches

Dr. Neches, 54, became a member of the Board of Directors in August 2005, when he was appointed by the Board of Directors of the Company to fill a vacancy on the Board. He is currently the Chairman of Foundation Ventures LLC, a New York City based investment bank serving information

6

technology and life science companies. Since September 1996, Dr. Neches has acted as an independent consultant, advisor and board member for a number of public and private information technology companies. Prior to 1996, Dr. Neches served as Vice President and Group Technology Officer, Multimedia Products and Services Group, AT&T Corporation (1994-1996) and Senior Vice President and Chief Scientist at NCR Corporation (1989-1994). Dr. Neches founded Teradata Corporation in July 1979, where he served as Vice President and Chief Scientist (1979-1988). Teradata pioneered the application of parallel processing to commercial applications with hardware and software products that implement the world's largest relational databases. Dr. Neches currently serves on the Board of Trustees of the California Institute of Technology, sits on its Alumni Relations, Audit, Business & Finance, Development, JPL, and Executive Committees, and chairs the Technology Transfer Committee and the Visiting Committee for the Division of Engineering and Applied Science. Dr. Neches received his formal training at the California Institute of Technology, where he holds a B.S. (1973), M.S. (1977), and Ph.D. (1973) in Computer Science.

Directors Continuing Until the 2008 Annual Meeting

Steve B. Warnecke

Steve B. Warnecke, 49, joined the Company's Board of Directors in March 2003. He is currently the Chief Financial Officer of The Children's Hospital Foundation, a Colorado not-for-profit foundation, Chief Executive Officer of Children's Partners Foundation and serves on the Board of Directors of the Cystic Fibrosis Foundation and Boppy, Inc., a private company that sells baby products. In 1983, Mr. Warnecke founded and he remains President of Children's Business Partners, Inc., a venture capital company with majority ownership in Giggling Gardens, Inc. and Sixty-Five Roses Ranch, Inc. In addition, from August 2001 through January 2002, Mr. Warnecke served as Senior Vice President—Strategic Planning for First Data Corp.'s Western Union subsidiary. From August 1999 through June 2001 Mr. Warnecke served as Chief Financial Officer for Denver based Frontier Airlines. Mr. Warnecke holds a B.B.A. from the University of Iowa and passed the C.P.A. exam in 1979.

INFORMATION REGARDING THE BOARD AND ITS COMMITTEES

Meetings and Committees of the Board of Directors

Our business, property and affairs are managed under the direction of our Board of Directors and its committees. Members of our Board are kept informed of our business through discussions with our Chief Executive Officer and other officers and employees, by reviewing materials provided to them, by visiting our offices and by participating in meetings of the Board and its committees.

During the Company's last fiscal year, ended December 31, 2005, the Board of Directors met 7 times; executive sessions of the Board (meetings of independent directors) were held 4 times; and the Board acted by unanimous consent 6 times. Each director attended at least 75% of all Board meetings in fiscal year 2005 held after becoming a director.

The Board has an Audit Committee, a Compensation Committee and a Governance and Nominating Committee. Below is a table that provides membership and meeting information for each

7

of the Board committees. In fiscal year 2005, each committee member attended at least 75% of the meetings of each applicable committee held after becoming a member of that committee.

| Name | Audit | Compensation | Governance & Nominating | ||||

|---|---|---|---|---|---|---|---|

| Mr. Gartside | |||||||

| Mr. Hallenbeck | X | X | |||||

| Mr. Neches | X | X | X | * | |||

| Mr. Nicol | X | X | * | ||||

| Mr. Warnecke | X | * | X | ||||

| Total meetings in fiscal year 2005 | 6 | 3 | 4 |

Below is a description of each committee of the Board of Directors. Each of the committees has authority to engage legal counsel or other experts or consultants as it deems appropriate to carry out its responsibilities. The Board of Directors has determined that, other than Mr. Hallenbeck, each member of each committee meets the independence requirements under the Nasdaq's current listing standards and each member is free of any relationship that would interfere with his individual exercise of independent judgment.

The Audit Committee. The Audit Committee assists the Board of Directors in its oversight of the integrity of the Company's accounting, auditing, and reporting practices. The Audit Committee meets with our independent registered public accounting firm at least annually to review the results of the annual audit and discuss the financial statements. The Committee also meets with our independent registered public accounting firm quarterly to discuss the results of the accountants' quarterly reviews as well as quarterly results and quarterly earnings releases; recommends to the Board the registered public accounting firm to be retained; and receives and considers the accountants' comments as to internal controls and procedures in connection with audit and financial controls. The Audit Committee reviews all financial reports prior to filing with the Securities and Exchange Commission (SEC). The specific responsibilities in carrying out the Audit Committee's oversight role are set forth in the Audit Committee's Charter, a copy of which is posted on the Company's website,www.evolving.com, under "Company—Corporate Governance." The Audit Committee consists of Messrs. Neches, Nicol and Warnecke, all of whom are independent directors as required under Exchange Act Section 10A(m)(3) and Nasdaq listing standards. The Board of Directors has determined that Mr. Warnecke is an "audit committee financial expert" as defined by the rules of the Securities and Exchange Commission. For more information concerning the Audit Committee see the "Report of the Audit Committee" contained in this Proxy Statement.

The Compensation Committee. The primary responsibilities of the Compensation Committee are to review and recommend to the Board the compensation of the Chief Executive Officer and our other executive officers, to review and recommend an incentive compensation plan, approve grants of stock options to employees and consultants under our stock option plan and otherwise determine compensation levels and perform such other functions regarding compensation as the Board may delegate. The Compensation Committee consists of Messrs. Neches, Nicol and Hallenbeck. Messrs. Neches and Nicol are independent under current Nasdaq listing standards for purposes of serving on this committee. Mr. Hallenbeck is not considered independent under Nasdaq listing standards because he served as an executive officer of the Company until September 2, 2005. The Board, however, determined that because Mr. Hallenbeck was a founder of the Company and has significant knowledge of the Company's business and the communications industry, Mr. Hallenbeck could provide a valuable contribution to the Compensation Committee. In accordance with Nasdaq listing standards, Mr. Hallenbeck may not serve more than two years on the Compensation Committee.

8

The specific responsibilities and functions of the Compensation Committee are set forth in the Compensation Committee Charter, which is updated as necessary to reflect changes in regulatory requirements and evolving practice. The Compensation Committee Charter is posted on our website,www.evolving.com, under "Company—Corporate Governance." For more information concerning the Compensation Committee see the "Report of the Compensation Committee" contained in this Proxy Statement.

Governance and Nominating Committee. The primary responsibilities of the Governance and Nominating Committee (the "Nominating Committee") are to monitor corporate governance matters, to determine the slate of Director nominees for election to the Company's Board of Directors and to identify and recommend candidates to fill vacancies occurring on the Board of Directors.

In filling vacancies that occur on the Board, and nominating candidates for election, the Nominating Committee takes into account certain minimum qualifications and qualities that the Committee believes are necessary for one or more of the Company's directors to possess. These qualifications and qualities are as follows:

Candidates for the Board should have some, but not necessarily all, of the above-described criteria. The Committee will also consider factors relating to the current composition of the Board, including, but not limited to, the diversity of the Board.

The process used by the Nominating Committee for identifying and evaluating nominees for directors is as follows:

9

at Board and committee meetings and his or her participation in, and preparation for, such meetings. In the event the Committee determines that it is in the Company's best interest to nominate an existing Board member whose term is expiring for re-election, the Committee will adopt a formal recommendation for consideration and adoption by the full Board of Directors, which, if adopted by the Board of Directors, will be contained in the Proxy Statement.

The specific responsibilities and functions of the Nominating Committee are set forth in the Nominating Committee Charter. The Committee's charter is posted on our webstire,www.evolving.com, under "Company—Corporate Governance." The current members of the Nominating Committee are Messrs. Hallenbeck, Neches and Warnecke. Mr. Neches and Mr. Warnecke are independent under current Nasdaq listing standards. Mr. Hallenbeck is not considered independent under Nasdaq listing standards because he served as an executive officer of the Company until September 2, 2005. The Board, however, determined that because Mr. Hallenbeck was a founder of the Company and has significant knowledge of the Company's business and the communications industry, Mr. Hallenbeck could provide a valuable contribution to the Nominating Committee. In accordance with Nasdaq listing standards, Mr. Hallenbeck may not serve more than two years on the Nominating Committee.

Statement on Corporate Governance

We regularly monitor developments in the area of corporate governance by reviewing federal laws affecting corporate governance, such as the Sarbanes-Oxley Act of 2002, as well as rules adopted by the SEC and Nasdaq. In response to those developments, we review our processes and procedures and implement corporate governance practices which we believe are in the best interest of the Company and its stockholders. Among other things, we have established a Disclosure Committee, comprised of executives and senior managers who are actively involved in the disclosure process, to specify, coordinate and oversee the review procedures that we use each quarter, including at fiscal year end, to prepare our periodic SEC reports.

The Board has approved a set of corporate governance guidelines to promote the functioning of the Board and its Committees and to set forth a common set of expectations as to how the Board should perform its functions. Our Corporate Governance Guidelines are posted on the Company's website under "Company—Corporate Governance." The Board also evaluates its performance annually.

10

The Board has also approved a Code of Business Conduct and a Code of Ethics for Finance Employees (collectively, the "Code of Conduct"), posted on our website,www.evolving.com, under "Company—Corporate Governance." We require all employees and Directors to adhere to the Code of Conduct in discharging their Company-related activities. Employees and Directors are required to report any conduct that they believe in good faith to be an actual or apparent violation of the Code of Conduct. We have also established a confidential hotline to answer employees' ethics questions and report ethical concerns. In accordance with the requirements of the Sarbanes-Oxley Act of 2002, the Audit Committee has established procedures to receive, retain and treat complaints we receive regarding accounting, internal accounting controls of auditing matters, and to allow for the confidential, anonymous submission by our employees of concerns regarding accounting or auditing matters.

Information Regarding Stockholder Communication with the Board of Directors; Attendance of Board Members at the Annual Meeting

Stockholders may contact an individual director, the Board as a group, or a specified Board committee or group, including the non-employee directors as a group, at the following address: Corporate Secretary, Evolving Systems, Inc., 9777 Pyramid Ct., Suite 100, Englewood, CO 80112 Attn: Board of Directors. Our Secretary will process communications before forwarding them to the addressee. Directors generally will not be forwarded stockholder communications that are primarily commercial in nature, relate to improper or irrelevant topics, or request general information about the Company.

We encourage, but do not require, Board members to attend our Annual Meeting of Stockholders. At the 2005 Annual Stockholders' Meeting, there were two (2) members of the Board present.

Director Compensation Overview

Mr. Gartside does not receive additional compensation for serving as a Director, except that he, like all Directors, is reimbursed for expenses incurred in attending Board and committee meetings. The annual compensation for non-employee members of the Board of Directors and the committees of the Board is as follows:

| | Annual retainer (payable in quarterly increments) | Cash compensation per in person meeting | Cash compensation per telephone meeting (lasting more than 1/2 hour) | Annual cash compensation for Committee membership | Additional annual cash compensation for Chairperson | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Board of Directors | $ | 10,000 | $ | 1,500 | $ | 500 | $ | 4,000 | |||||||

| Audit Committee | $ | 2,000 | $ | 4,000 | |||||||||||

| Compensation Committee | $ | 1,500 | $ | 1,500 | |||||||||||

| Governance & Nominating Committee | $ | 1,500 | $ | 1,500 | |||||||||||

In addition, non-employee Directors have historically been granted an initial stock option grant for 30,000 common shares upon joining the Board. These shares were granted at a strike price equal to the closing price for our stock on the date of the grant, and vest one-third on the one year anniversary date of the date of the grant, with the balance vesting quarterly over the remaining two years of the grant. Beginning in April 2004 through May 2005, following the annual stockholders' meeting, non-employee Board members received additional annual option grants for 10,000 common shares, vesting quarterly over a one year period.

Our stock option plan expired by its own terms on January 18, 2006. On December 28, 2005, the Board granted stock options for 40,000 common shares to each of the non-employee Directors. These grants were made in lieu of increasing the Board's cash compensation and in anticipation of the

11

expiration of our stock option plan. Options representing one-third of each grant were vested immediately upon grant, with the balance vesting in 8 quarterly installments, beginning March 28, 2007.

Also on December 12, 2005, the Board of Directors accelerated the vesting of all unvested and "out-of-the-money" stock options that had an exercise price equal to or greater than $4.64 per share. The acceleration of vesting will allow the Company to avoid recognizing future compensation expense associated with the accelerated options upon the January 1, 2006 adoption of Statement of Financial Standards No. 123R, "Share-Based Payment (FAS 123R)." FAS 123R sets forth accounting requirements for "share-based" compensation and requires companies to recognize in their income statements the grant-date fair value of stock options and other equity-based compensation.

Based upon attendance at meetings, and performance of committee chairman duties during 2005, the non-employee Board members received the following cash compensation and stock options:

| Name of non-employee Director | Cash compensation for Board services performed in 2005 | Number of shares of common stock underlying options granted in 2005 | |||

|---|---|---|---|---|---|

| George A. Hallenbeck | $ | 2,679 | 40,000 | ||

| Philip M. Neches | $ | 2,739 | 70,000 | ||

| David J. Nicol | $ | 26,125 | 50,000 | ||

| Steve B. Warnecke | $ | 29,000 | 50,000 | ||

PROPOSAL NO. 2

RATIFICATION OF SELECTION OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Directors has selected KPMG LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2006, and has further directed that management submit the selection of the independent registered public accounting firm for ratification by the stockholders at the Annual Meeting. Representatives of KPMG LLP are expected to be present at the Annual Meeting, will have an opportunity to make a statement if they so desire, and will be available to respond to appropriate questions from stockholders present at the meeting.

Stockholder ratification of the selection of KPMG LLP as the Company's independent registered public accounting firm is not required by our bylaws or otherwise. However, the Board is submitting the selection of KPMG LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee and the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee and the Board in their discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if they determine that such a change would be in the best interests of the Company and its stockholders.

Required Vote and Recommendation of Board of Directors

The ratification of KPMG LLP as Evolving Systems' independent registered public accounting firm is a routine matter for brokers that hold their clients' shares in "street name." The affirmative vote of a majority of the shares of our common stock and our Series B Convertible Preferred Stock, voting together as a single class, present or represented and voting at the annual meeting will be required to ratify the appointment of KPMG as our independent registered public accounting firm. Abstentions will have the effect of a vote against this proposal and broker non-votes will have no effect on the outcome of the vote with respect to this proposal.

12

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "FOR" THE RATIFICATION OF KPMG LLP AS THE COMPANY'S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2006.

Information Regarding Change in Accountants

In 2004, our Audit Committee and our Board of Directors approved the decision to change our independent registered public accounting firm. The following information is provided with respect to such change:

(a) PricewaterhouseCoopers was dismissed by the Board of Directors on July 9, 2004. The Board appointed KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2004.

(b) The reports of PricewaterhouseCoopers on our consolidated financial statements as of and for the years ended December 31, 2003 and 2002 did not contain an adverse opinion or disclaimer or opinion, nor were the reports qualified or modified as to uncertainty, audit scope or accounting principle. During the fiscal years ending December 31, 2003 and December 31, 2002, and through July 9, 2004: (i) there were no disagreements with PricewaterhouseCoopers on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure which disagreements, if not resolved to PricewaterhouseCoopers' satisfaction, would have caused PricewaterhouseCoopers to make reference to the subject matter of the disagreement in connection with its reports on the Company's consolidated financial statements for such years and (ii) there were no reportable events as defined in Item 304(a)(1)(v) of Regulation S-K.

(c) The decision to change our independent registered public accounting firm was made by the Board of Directors upon recommendation of our Audit Committee.

(d) In connection with the Company's Form 8-K, filed with the SEC on July 15, 2004, we provided PricewaterhouseCoopers with a copy of the foregoing disclosures. PricewaterhouseCoopers furnished us with a letter addressed to the SEC stating that PricewaterhouseCoopers agreed with the above statements.

(e) During the fiscal years ended December 31, 2003 and December 31, 2002 and through July 9, 2004, we have not consulted with KPMG regarding either (i) the application of accounting principles to a specified transaction, either completed or proposed; or the type of audit opinion that might be rendered on the Company's financial statements, and neither a written report nor oral advice was provided that KPMG concluded was an important factor considered by the Company in reaching a decision as to the accounting, auditing or financial reporting issue; or (ii) any matter that was either the subject of a disagreement, as that term is defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions to Item 304 of Regulation S-K, or a reportable event, as that term is defined in Item 304(a)(1)(v) of Regulation S-K.

We have provided each of KPMG and PricewaterhouseCoopers with a copy of the foregoing disclosures prior to the filing of this Proxy Statement with the SEC.

TABLE OF EQUITY COMPENSATION PLANS

The following table contains summary information as of December 31, 2005 concerning the Company's Employee Stock Purchase Plan and Stock Option Plan. Both of the Plans have been

13

approved by the stockholders. See "Security Ownership of Certain Beneficial Owners and Management."

| | Number of shares to be issued upon exercise of outstanding options, warrants and rights | Weighted-average exercise price of outstanding options, warrants and rights | Number of shares remaining available for future issuance under equity compensation plan | |||||

|---|---|---|---|---|---|---|---|---|

| Stock Option Plan | 4,279,140 | $ | 3.49 | 1,216,866 | * | |||

| Employee Stock Purchase Plan | — | — | 436,125 | |||||

| Warrants | 0 | 0 | 0 | |||||

Note: As of the record date, the number of remaining shares available for issuance under the Employee Stock Purchase Plan was 394,633.

As of April 4, 2006, the executive officers of the Company are as follows:

| Name | Age | Position | ||

|---|---|---|---|---|

| Stephen K. Gartside, Jr. | 40 | Chief Executive Officer, President and Director | ||

| Thaddeus Dupper | 49 | Executive Vice President of Worldwide Sales & Marketing | ||

| Brian R. Ervine | 44 | Executive Vice President, Chief Financial & Administrative Officer, Treasurer and Assistant Secretary | ||

| Anita T. Moseley | 54 | Sr. Vice President, General Counsel and Secretary | ||

| Stuart Cochran | 36 | Vice President of Activation and Mediation |

See "Proposal 1—Election of Directors" for the biography of Mr. Gartside.

Thaddeus Dupper joined the Company in February 2004 as Vice President of Sales and Business Development. In January 2005 he was promoted to Executive Vice President of Worldwide Sales & Marketing. Before joining Evolving Systems, Mr. Dupper was Vice President of Sales and Marketing from October 2002 until February 2004 with Expand Beyond, a wireless software company. Prior to that, Mr. Dupper was Vice President of International Sales for Terabeam, a technology development and service provider that deploys Metropolitan Area Networks using Gigabit Ethernet, IP and Free Space Optics, from June 2000 until September 2003. In addition, he served as Senior Vice President of Valued- Added Products and Professional Services at Dun & Bradstreet, a global provider of company credit reports, from January 1998 until May of 2000. Mr. Dupper was an early member of the Teradata management team where he held a variety of sales and sales management positions from 1985 until 1997. Mr. Dupper began his career at Amdahl Corporation as a systems engineer from 1979 until 1985. Mr. Dupper received a Bachelor of Science degree in Computer Information Systems from Manhattan College.

Brian R. Ervine joined the Company in January 2002 as Senior Vice President of Finance, Chief Financial Officer, Treasurer and Assistant Secretary. In January 2005 he was promoted to the position of Executive Vice President, Chief Financial and Administrative Officer. He came to the Company from Brain Ranger, a content management software developer, where he was Chief Financial Officer and responsible for all financial and business planning activities and day-to-day operations from February 2001 to January 2002. Prior to Brain Ranger, Mr. Ervine was Executive Vice President, Chief Financial Officer and Treasurer for Convergent Communications, a provider of voice communication systems, and managed the finance and treasury operations from December 1999 to December 2000. He

14

joined Convergent Communications from Metapath Software International, a global provider of enterprise-wide wireless software and services, where he was Vice President of Finance and managed the worldwide financial operations in 9 countries from December 1995 to December 1999. Previous to then, Mr. Ervine was Vice President and Chief Financial Officer of PC ServiceSource, Inc., Assistant Controller for CompuCon Systems, Inc. and Senior Audit Manager at KPMG Peat Marwick, LLP. Mr. Ervine received a B.B.A. in Accounting from the University of Texas at Austin (1984) and is a Certified Public Accountant.

Anita T. Moseley joined the Company in May 1994 as corporate counsel of the Company and held that position until June 1997 when she assumed the positions of Vice President, General Counsel and Secretary of the Company. In June 2000 she was promoted to Senior Vice President. Between September 1991 and May 1994, she held corporate counsel positions with the Federal Deposit Insurance Corporation and the Resolution Trust Corporation. Prior to that time, Ms. Moseley was a partner in the Salt Lake City law firm of Prince, Yeates and Geldzahler. Ms. Moseley holds a B.A. from Syracuse University and a J.D. from the University of Utah.

Stuart Cochran joined the Company as a non-executive Vice President of the Activation Market Unit in November 2004 when the Company acquired Tertio Telecoms Limited (now known as Evolving Systems Limited), a UK-based privately held supplier of activation and mediation software to communications service providers. In April 2005, he also assumed responsibility for the Company's Mediation Market Unit. In July 2005, he was appointed as an Executive Officer of the Company. Mr. Cochran joined Tertio Telecoms in August of 1994 and held a number of technical, pre-sales and product management positions until July 2000 when he was appointed Director of Product Strategy and Management, reporting to the company's chief executive officer and sitting on the management team. In January 2003, Mr.Cochran became the Director of Product Management, Development and Marketing, a position he held at the time of the Tertio Telecoms acquisition. Mr. Cochran has an MSc degree in Computing and Computer Modelling of Optoelectronic Devices and Systems and a BSc (Honours) degree in Theoretical Physics.

INFORMATION REGARDING BENEFICIAL OWNERSHIP OF PRINCIPAL STOCKHOLDERS, DIRECTORS, AND MANAGEMENT

The following table sets forth certain information regarding the ownership of the Company's common stock and preferred stock as of the record date by: (i) each director and nominee for director; (ii) each executive officer named in the Summary Compensation Table; (iii) all executive officers and directors of the Company as a group; and (iv) all those known by the Company to be beneficial owners of more than five percent (5%) of its common stock.

This table is based upon information supplied by officers, directors and principal stockholders and Schedules 13D and 13G filed with the Securities and Exchange Commission (the "SEC"). Unless otherwise indicated in the footnotes to this table and subject to community property laws where applicable, the Company believes that each of the stockholders named in this table has sole voting and

15

investment power with respect to the shares indicated as beneficially owned. Applicable percentages are based on shares outstanding on the record date, adjusted as required by rules promulgated by the SEC.

| | Shares of Common Stock Beneficially Owned(1) | Shares of Preferred Stock Beneficially Owned(1) | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Name and Address of Beneficial Owner | Number of Shares | Percentage Ownership | Number of Shares | Percentage Ownership | |||||

| George A. Hallenbeck(2) 6 Polo Club Drive Denver, CO 80206 | 1,518,834 | 8.0 | % | — | — | ||||

Stephen K. Gartside, Jr.(3) c/o Evolving Systems, Inc. 9777 Pyramid Court, Suite 100 Englewood, CO 80112 | 559,350 | 2.9 | % | — | — | ||||

Philip M. Neches(4) 60 Lenox Road Summit, NJ 07901 | 13,334 | * | — | — | |||||

David J. Nicol(5) 9871 West 83rd Street Overland Park, KS 66204 | 73,334 | * | — | — | |||||

Steve B. Warnecke(6) 1026 Anaconda Drive Castle Rock, CO 80108 | 169,139 | * | — | — | |||||

Disciplined Growth Investors, Inc.(7) 100 South 5th Street, Suite 2100 Minneapolis, MN 55402 | 1,021,175 | 5.3 | % | — | — | ||||

Advent International Corporation(8) 75 State Street Boston, MA 02109 | 1,324,131 | 6.9 | % | 441,377 | 46 | % | |||

Apax Europe IV GP Co. Limited(9) 13 - 15 Victoria Road St. Peter Port Guernsey Channel Islands GY1 3ZD | 1,385,274 | 7.3 | % | 461,758 | 48 | % | |||

Brian R. Ervine(10) c/o Evolving Systems, Inc. 9777 Pyramid Ct., Suite 100 Englewood, CO 80112 | 345,836 | 1.8 | % | — | — | ||||

Thaddeus Dupper(11) c/o Evolving Systems, Inc. 9777 Pyramid Ct., Suite 100 Englewood, CO 80112 | 257,819 | 1.4 | % | — | — | ||||

Anita T. Moseley(12) c/o Evolving Systems, Inc. 9777 Pyramid Ct., Suite 100 Englewood, CO 80112 | 401,891 | 2.1 | % | — | — | ||||

16

Stuart Cochran(13) c/o Evolving Systems Limited Riverside Buildings 108 Walcot Street Bath, UK BA1 5BG | 99,023 | * | — | — | |||||

All executive officers and directors as a group (9 persons)(14) | 3,438,560 | 18.0 | % | — | — |

17

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our directors and executive officers, and persons who own more than ten percent of a registered class of our equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock and other equity securities. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish us with copies of all Section 16(a) forms they file.

To our knowledge, based solely on a review of the copies of such reports furnished to us and written representations that no other reports were required, during the fiscal year ended December 31, 2005, all Section 16(a) filing requirements applicable to its officers, directors and greater than ten percent beneficial owners were complied with.

18

INFORMATION REGARDING EXECUTIVE OFFICER COMPENSATION

The following table and descriptive materials set forth information concerning compensation earned for services rendered to the Company for the fiscal years ended December 31, 2005, 2004 and 2003, by each person who served as our Chief Executive Officer during fiscal year 2005 and each of our other four (4) most highly compensated executive officers as of December 31, 2005 (collectively the "Named Executive Officers"):

| | Annual Compensation | Long-Term Compensation Securities Underlying Options (#) | | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name and Principal Position | Year | Salary ($) | Bonus ($) | Other Annual Compensation ($)(1) | All Other Compensation ($)(2) | ||||||||||||

| Stephen K. Gartside, Jr. President & Chief Executive Officer | 2005 2004 2003 | $ | 275,000 235,000 200,000 | $ | — 145,000 190,236 | (3) | $ | — 456,951 372,035 | 150,000 100,000 467,000 | $ | 10,575 10,475 2,944 | ||||||

Brian R. Ervine Executive Vice President, Chief Financial & Administrative Officer, Treasurer | 2005 2004 2003 | $ | 250,000 230,000 220,000 | $ | — 73,000 108,660 | $ | — 112,360 169,932 | 100,000 85,000 100,000 | $ | 10,881 10,781 3,622 | |||||||

Thaddeus Dupper Executive Vice President of Sales | 2005 2004 | $ | 225,000 152,308 | $ | 45,857 25,672 | (4) (5) | — — | 100,000 165,000 | $ | 9,732 76,405 | (6) | ||||||

Anita T. Moseley Sr. Vice President, General Counsel and Secretary | 2005 2004 2003 | $ | 230,000 220,000 210,000 | $ | — 70,000 100,230 | $ | 2,055 46,424 84,592 | 75,000 45,000 257,792 | $ | 11,448 11,348 4,102 | |||||||

Stuart Cochran(7) Vice President of Activation and Mediation Market Unit | 2005 2004 | (8) | $ | 198,706 34,669 | $ | 60,758 2,080 | — — | 75,000 75,000 | $ | 9,935 1,733 | |||||||

19

We have granted options to our Executive Officers under our Stock Option Plan. As of the record date, options to purchase a total of 4,254,819 shares were outstanding under the Stock Option Plan. Our Stock Option Plan expired on January 18, 2006, with 1,212,476 shares of stock remaining available for grant. These allocated shares of stock are now included in our total authorized but un-issued common stock.

On December 12, 2005, our Board of Directors accelerated the vesting of unvested and "out of the money" stock options that had an exercise price equal to or greater than $4.64 per share. The accelerating of vesting was effective for stock options outstanding as of December 12, 2005. As a result of the acceleration, approximately 603,000 stock options with a range of exercise prices between $4.64 and $14.15 per share and a weighted average exercise price of $6.17 became exercisable. Included in this number was approximately 341,000 stock options held by our Executive Officers and Directors with a weighted average exercise price of $7.12.

The following tables show for the fiscal year ended December 31, 2005, certain information regarding options granted to, exercised by, and held at year-end by, the Named Executive Officers and Directors:

| | | | | | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(4) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Number of Securities Underlying Options Granted(1) | Percent of Total Options Granted to Employees in Fiscal Year(2) | | | |||||||||||

| Named Executive Officers | Exercise Price ($/Share)(3) | Expiration Date | |||||||||||||

| 5% | 10% | ||||||||||||||

| Stephen K. Gartside, Jr. | 150,000 | 11.5 | % | $ | 2.15 | 12/27/15 | $ | 525,319 | $ | 836,482 | |||||

| Brian R. Ervine | 100,000 | 7.6 | % | $ | 2.15 | 12/27/15 | $ | 350,212 | $ | 557,655 | |||||

| Thaddeus Dupper | 100,000 | 7.6 | % | $ | 2.15 | 12/27/15 | $ | 350,212 | $ | 557,655 | |||||

| Anita T. Moseley | 75,000 | 5.7 | % | $ | 2.15 | 12/27/15 | $ | 262,659 | $ | 418,241 | |||||

| Stuart Cochran | 75,000 | 5.7 | % | $ | 2.15 | 12/27/15 | $ | 262,659 | $ | 418,241 | |||||

Non-Executive Directors | |||||||||||||||

| George Hallenbeck | 40,000 | 3.1 | % | $ | 2.15 | 12/27/15 | $ | 140,085 | $ | 223,062 | |||||

| David J. Nicol | 10,000 40,000 | .8 3.1 | % % | $ | 1.95 2.15 | 5/15/15 12/27/15 | $ | 31,763 140,085 | $ | 50,578 223,062 | |||||

| Steve B. Warnecke | 10,000 40,000 | .8 3.1 | % % | $ | 1.95 2.15 | 5/15/15 12/27/15 | $ | 31,763 140,085 | $ | 50,578 223,062 | |||||

| Philip M. Neches | 30,000 40,000 | 2.3 3.1 | % % | $ | 1.99 2.15 | 8/18/15 12/27/15 | $ | 97,245 140,085 | $ | 154,846 223,062 | |||||

20

one-third on the one year anniversary date of the date of the grant, with the balance vesting quarterly over the remaining two years of the grant. Additional option grants generally vest quarterly.

OPTION EXERCISES IN LAST FISCAL YEAR AND FISCAL YEAR-END OPTION VALUES

| Officers | Shares Acquired on Exercise (#) | Value Realized ($)(1) | Number of Shares of Common Stock Underlying Unexercised Options at December 31, 2005 (#) Exercisable/Unexercisable(2) | Value of Unexercised In-the-Money Options at December 31, 2005 ($) Exercisable/Unexercisable(3) | |||||

|---|---|---|---|---|---|---|---|---|---|

| Stephen K. Gartside, Jr. | 0 | 0 | 427,063/257,937 | $39,315/$2,124 | |||||

| Brian R. Ervine | 0 | 0 | 310,812/117,188 | $197,438/$45,782 | |||||

| Thaddeus Dupper | 0 | 0 | 174,375/90,625 | 0/0 | |||||

| Anita T. Moseley | 1,500 | $ | 2,055 | 374,580/80,312 | $111,631/$2,124 | ||||

| Stuart Cochran | 0 | 0 | 93,750/56,250 | 0/0 | |||||

Non-Executive Directors | |||||||||

| George A. Hallenbeck | 0 | 0 | 774,446/26,666 | $306,000/0 | |||||

| Philip M. Neches | 0 | 0 | 13,334/56,666 | 0/$3,600 | |||||

| David J. Nicol | 0 | 0 | 58,334/31,666 | $800/$800 | |||||

| Steve B. Warnecke | 0 | 0 | 111,668/41,666 | $800/$800 | |||||

Compensation Agreements

Each of our Executive Officers has entered into Compensation Agreements with the Company. Each agreement provides for base salary and incentive compensation, and, in the case of the Executive Vice President of Worldwide Sales & Marketing, a commission amount. In 2005, incentive compensation was a percentage, ranging from 30% to 75%, of the Executive Officer's base salary, and

21

was paid only if we attained quarterly and annual revenue and net income and cash flow objectives established by the Board of Directors. No incentive compensation was paid to any of our Executive Officers in 2005, except that Mr. Cochran received a bonus as a result of Tertio Telecoms Limited's (now known as Evolving Systems Limited) achievement of financial goals and objective established by its Board of Directors prior to our acquisition of Tertio Telecoms. In addition, because we achieved some of our objectives in the fourth quarter of 2005, a portion of the incentive compensation relating to that quarter was paid during the first quarter of 2006.

For calendar year 2006, incentive compensation percentages will range from 40% to 75% of the Executive Officer's base salary and will be paid only if we attain quarterly and annual revenue and earnings before interest, taxes, depreciation and amortization (EBITDA) objectives established by the Board. There is the potential to earn up to 150% of the target percentage if we exceed quarterly or annual targets.

Each agreement generally provides that in the event we terminate the employment of the Executive Officer, other than for cause, death or disability, the Executive Officer will be paid severance pay. The amount of the severance pay varies from three (3) months of base salary to up to nine (9) months of base salary and incentive compensation, depending upon the Executive Officer's position and the circumstances surrounding the termination of employment. In exchange for severance, the Executive Officer will be required to execute a full release of the Company and agree not to compete with us nor to solicit our employees for the period of time during which severance is paid. The Compensation Agreements do not change the "at-will" nature of the U.S.-based Executive Officer's employment with the Company. Either the Company or the Executive Officer may terminate a U.S.-based Executive Officer's employment at any time. In the case of Mr. Cochran, he is employed under an employment contract, as is customary in the United Kingdom, which provides for three (3) months notice on termination.

Management Change in Control Agreements/Acceleration of Vesting on Options Granted to Board Members

Each of our Executive Officers has entered into a Management Change in Control Agreement with us. Each agreement generally provides that upon a Qualified Termination (as defined below), we will pay the Executive Officer all amounts earned or accrued through the applicable termination date, including, without limitation, the Executive Officer's base salary, a prorated portion of any earned incentive compensation, compensation for unused paid time off, reimbursement for reasonable and necessary expenses incurred by the Executive Officer on behalf of the Company during the period ending on the applicable termination date. We are also obligated to provide certain insurance benefits during the Executive Officer's applicable severance period. Moreover, we have agreed to pay the Executive Officer an amount equal to 100% of his or her annual base salary, plus 100% of the Executive Officer's annual incentive target, payable over a one year period. In addition, immediately upon the occurrence of a Change in Control (as defined below) or a Qualified Termination, 50% or 100%, respectively, of the Executive Officer's unvested stock options will vest. We have also agreed to reimburse the Executive Officer for any U.S. excise taxes payable as a result of the Executive Officer's receipt of these payments. A Qualified Termination will occur upon any of the following:

22

A Change in Control will occur upon:

Amendments to these agreements may be required in order to comply with the American Jobs Creation Act of 2004.

Each of the Company's non-employee Directors has been granted options which provide for acceleration of vesting of that number of options which would have vested over the 12 month period following the date on which a Change in Control occurs.

Notwithstanding anything to the contrary set forth in any of our previous or future filings with the SEC that might incorporate this Proxy Statement, in whole or in part, the following report of the Compensation Committee and the Stock Performance Graph which follows shall not be deemed to be "soliciting materials" or "filed" or incorporated by reference in our filings with the SEC, or subject to the liabilities of Section 18 of the Securities Exchange Act of 1934, except to the extent that we specifically incorporate it by reference into a document filed under the Securities Act of 1933 or the Securities Exchange Act of 1934.

REPORT OF THE COMPENSATION COMMITTEE

Membership and Role of the Compensation Committee

The Compensation Committee of the Board of Directors (the "Compensation Committee") is currently composed of three (3) directors appointed by the Board of Directors, two (2) of whom are independent under current Nasdaq listing standards. The Compensation Committee annually reviews and determines our executive compensation objectives and policies, administers our stock plans and grants stock options.

Executive Compensation Objectives and Practice

The executive compensation program is designed to:

Components of Executive Compensation

The compensation program for executive officers consists of the following three components: base salary; short-term incentive compensation through quarterly and annual bonuses; and long term incentive compensation, which has consisted of stock option grants.

23

Base Salary. It is our policy to set base salary levels competitively, but generally above-average, with selected corporations to which we compare our executive compensation. We select these corporations on the basis of a number of factors, such as their size, the nature of their businesses, the structure of their compensation programs and the availability of compensation information. Some of the corporations against which we compare our compensation are included in the indices used to compare the stockholder return in the Stock Performance Chart included in this Proxy Statement. When setting base salary levels, in a manner consistent with the objectives outlined above, the Compensation Committee considers competitive market conditions for executive compensation, our performance, the individual's breadth of knowledge, performance and levels of responsibility.

For executive officers as a group, base salaries were increased by 2% to 25% for fiscal 2005 compared to fiscal 2004. The increases were due to individual performance and promotions, and the need to remain within the range of competitive salaries for comparable positions in comparable companies.

Quarterly and Annual Bonus. Our cash bonus program is designed to motivate executives to work effectively to achieve our financial performance goals and to reward them when those goals are achieved. Executives have the opportunity to earn quarterly and annual bonuses equal to a percentage of their base salary. In 2005, on an annual basis, these bonuses could have ranged from 30% of the executive's base salary to 75%, with the potential to receive up to 150% of the targeted bonus if certain "stretch" Company performance targets were attained. For fiscal 2005, these performance goals were revenue growth, attainment of certain net income targets and cash balance targets.

Long-Term Incentive Compensation. Historically, executive officers have been eligible for stock option grants and stock option grants were awarded in 2005. We believe that option grants give executives a significant, long-term interest in our success, help retain key executives in a competitive market, and align executive interests with stockholder interests and long-term performance of the Company.

In 1996 we adopted our Stock Option Plan in order to provide equity based performance incentives to our employees. Our Stock Option Plan expired in January 2006. The expired Stock Option Plan authorized us to award incentive stock options and nonqualified stock options to purchase common stock to employees, directors and consultants. The Compensation Committee believes that the Stock Option Plan assisted us in attracting, retaining and motivating officers and other employees. The grants were designed to align the interests of the optionees with those of the stockholders and provide each individual with a significant incentive to manage the Company from the perspective of an owner with an equity stake in the business. Moreover, the long-term vesting schedule (which was generally four years for employees and three years for non-employee Directors) encourages a long-term commitment to the Company by its executive officers and other optionees. The size of the option grant to each optionee was set at a level that the Compensation Committee deemed appropriate in order to create a meaningful opportunity for stock ownership based upon the individual's current position with the Company, but also takes into account the individual's potential for future responsibility and promotion over the option vesting period, and the individual's performance in recent periods. The Compensation Committee periodically reviewed the number of shares owned by, or subject to options held by, each executive officer, and additional awards are considered based upon past performance of the executive officer. The Board is evaluating adoption of a new equity compensation plan for the future. Under Nasdaq rules, adoption of a new equity compensation plan will require stockholder approval.

Corporate Performance and Chief Executive Officer Compensation

For the fiscal year ended December 31, 2005, Stephen K. Gartside, Jr., the Company's President and Chief Executive Officer received $275,000 in base salary and no incentive performance bonus.

24

Mr. Gartside's base salary was increased 17% over base salary for the 2004 fiscal year principally because the company became a global company as a result of the Tertio acquisition. Mr. Gartside's annual base salary is based largely on competitive salaries, which the Compensation Committee believes are generally commensurate with Mr. Gartside's salary. Mr. Gartside's compensation plan provides for incentive compensation, based upon achievement of corporate revenue and profit goals established by the Board of Directors. That incentive compensation, which in 2005 was 75% of base salary, with the potential for additional bonus if certain Company "stretch" performance objectives were met, reflects the Compensation Committee's desire to closely equate the Chief Executive Officer's incentive compensation with achievement of corporate objectives. In fiscal 2005, Mr. Gartside received a stock option grant for 150,000 shares of our common stock at a strike price of $2.15.

Limitation on Deduction of Compensation Paid to Certain Executive Officers

Section 162(m) of the Internal Revenue Code (the "Code") limits the Company to a deduction for federal income tax purposes of no more than $1 million of compensation paid to certain Named Executive Officers in a taxable year. Compensation above $1 million may be deducted if it is "performance-based compensation" within the meaning of the Code. The statute containing this law and the applicable proposed Treasury regulations offer a number of transitional exceptions to this deduction limit for pre-existing compensation plans, arrangements and binding contracts. As a result, the Compensation Committee believes that at the present time it is quite unlikely that the compensation paid to any Named Executive Officer in a taxable year which is subject to the deduction limit will exceed $1 million. Therefore, the Compensation Committee has not yet established a policy for determining which forms of incentive compensation awarded to its Named Executive Officers shall be designed to qualify as "performance-based compensation." The Compensation Committee intends to continue to evaluate the effects of the statute and any final Treasury regulations and to comply with Section 162(m) of the Code in the future to the extent consistent with the best interest of the Company.

Conclusion

The Compensation Committee believes that our compensation programs and the administration of those programs well serve the interest of the Company's stockholders. These programs allow us to attract, retain and motivate exceptional management and technical talent and to compensate executives and other employees in a manner that reflects their contributions to our short and long-term performance. We intend to continue to emphasize programs that we believe will positively affect stockholder value.

BY THE COMPENSATION COMMITTEE:

Philip M. Neches

David J. Nicol

George A. Hallenbeck

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Messrs. Neches, Nicol and Hallenbeck served as members of the Compensation Committee of the Board of Directors during fiscal 2005. Messrs. Neches and Hallenbeck became members of the Compensation Committee in November 2005. Mr. Nicol became a member of the Compensation Committee in March 2004. Mr. Hallenbeck was an executive officer of the Company until September 2, 2005. Neither of the other members of the Compensation Committee were, at any time during fiscal 2005, nor at any other time, officers or employees of the Company. No member of the Compensation Committee or executive officer of the Company has a relationship that would constitute an interlocking relationship with executive officers or directors of another entity.

25

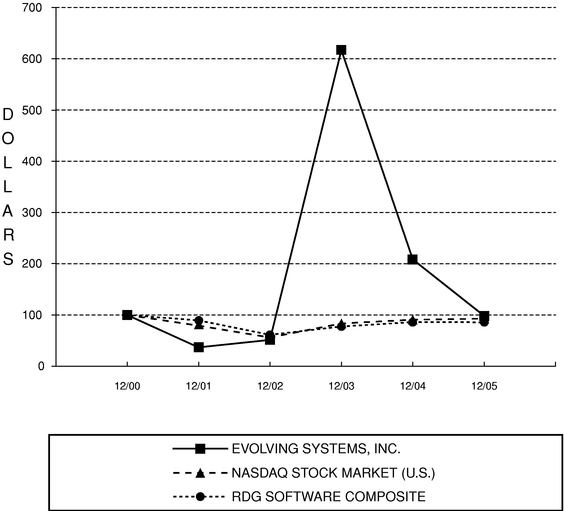

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG EVOLVING SYSTEMS, INC.

THE NASDAQ STOCK MARKET (U.S.) INDEX AND A PEER GROUP

Notwithstanding anything to the contrary set forth in any of our previous or future filings with the SEC that might incorporate this Proxy Statement, in whole or in part, the following report of the Audit Committee shall not be deemed to be "soliciting materials" or "filed" or incorporated by reference in our filings with the SEC, or subject to the liabilities of Section 18 of the Securities Exchange Act of 1934, except to the extent that we specifically incorporate it by reference into a document filed under the Securities Act of 1933 or the Securities Exchange Act of 1934.

The Audit Committee

As of the record date, the Audit Committee of the Board of Directors (the "Audit Committee") was composed of three (3) directors appointed by the Board of Directors. Each of the committee members, Mr. Neches, Mr. Nicol and Mr. Warnecke, satisfies the independence and financial management expertise requirements of Nasdaq's Audit Committee Policy and Mr. Warnecke has been

26

designated by the Board as the Audit Committee's "financial expert." For a description of Mr. Warnecke's relevant experience, please see his biographical information contained in Proposal 1 of this Proxy Statement.

On May 25, 2000, the Board of Directors adopted a charter for the Audit Committee (the "Charter"). An Amended and Restated Charter was adopted by the Board of Director on March 4, 2004 and a copy of the Amended and Restated Charter was included with our 2004 Proxy Statement. It can also be found our website,www.evolving.com, under "Company—Corporate Governance."