Exhibit 99.2

GETTY COPPER INC.

MANAGEMENT DISCUSSION & ANALYSIS

DECEMBER 31, 2009

The following discussion and analysis of the results of operations and financial position of the Company for the year ending December 31, 2009 should be read in conjunction with the December 31, 2009 financial statements and the related notes which have been prepared in accordance with or reconciled to Canadian Generally Accepted Accounting Principles. All dollar amounts in this Management Discussion and Analysis (“MD&A”) are stated in Canadian dollars. The effective date of this report is date of filing 2010.

Forward Looking Statements

Except for historical information, this MD&A may contain forward-looking statements. These statements involve known risks, uncertainties and other factors that may cause the Company’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievement expressed or implied by these forward looking statements. The reader is cautioned not to place undue reliance on this forward-looking information.

Overall Performance

The Company is engaged in the acquisition and exploration of natural resource properties. Since 1993, the Company has been focussing on exploration, when funds permit, on parts of its approximately 200 km2mineral properties in Highland Valley, British Columbia. These properties adjoin the large porphyry copper mining and milling operations of Highland Valley Copper.

The Company retained West Coast Environmental and Engineering (WCE) of Ventura and Nevada City, California, to prepare a Preliminary Feasibility Study (“PFS”) which was filed on SEDAR on July 22, 2009. On Nov 30 2009 the Company’s securities were made subject to a cease trade order in British Columbia issued by the BC Securities Commission pending resolution of the BCSC’s technical staff’s comments on the PFS.”) The PFS is presently being amended to respond to their comments. Some of the information contained in the MD &A respecting the Getty South and Getty North properties which is the subject of the PFS, are at this time likely to be subject to change or clarification.The Company is optimistic that its responses to the staff comments and amendments to the PFS will see the cease trade order lifted in due course.

The focus of the PFS is evaluating the potential viability of a cathode copper and molybdenum process plant. The PFS summarizes and integrates a large number of previous technical reports. The PFS posits that the oxide and sulphide resources of the Getty North Deposit could potentially be open-pit mined in conjunction with the Getty South oxide and sulphide resources.

As the Getty North NI 43-101 compliant resource has been updated with molybdenum values, the PFS states that the processing plan is proposed to be altered to effectively accommodate the molybdenum resource. To facilitate effective recovery of the molybdenum resource, the option of dump and heap leaching of oxide ores has now been replaced by a flotation tailings leach system. This methodology is anticipated to allow maximum potential utilization of the updated Getty resources, and is analogous to other recent and successfully operating global hydrometallurgical production facilities. In particular, the hydrometallurgical process plant posited for the Getty Project could allow treatment of much lower grade combined bulk copper and molybdenum concentrates, which could be a significant advantage over current molybdenum concentrate production and roasting practices. However, at the time of filing there can be no certainty that the PFS, once all amendments have been made, will conti nue to indicate that the quality of the present resources can be upgraded to the status of reserves, or that the planned processes will be able to produce cathode copper material as proposed. The PFS description for producing copper concentrates and cathode copper may not be economically achievable even though the testing and planning to date indicate that the copper cathode could potentially be produced using the planned processes.

GETTY COPPER INC.

MANAGEMENT DISCUSSION & ANALYSIS

DECEMBER 31, 2009

The Company primarily has been exploring the Getty North and Getty South deposits. These deposits have copper mineral resource estimates that were received by the Company in August and June of 2007 respectively. In addition, the Getty North deposit has both copper and molybdenum mineral resource estimates that were received by the Company in February 2008. These 2007 and 2008 technical reports meet the requirements of the CIM classifications referenced in National Instrument 43-101.

The 2007 Getty South technical report discloses an Inferred Resource of 28.16 million tonnes, having a grade of 0.47% copper at a cut off grade of 0.2% copper.

The 2007 Getty North technical report discloses indicated and inferred copper resources of oxide and sulphide zones at cut off grades of 0.2% and 0.3% copper. At a cut off grade of 0.2% copper, the Indicated Resource calculated was 32.106 million tonnes at a grade of 0.454% copper, and an Inferred Resource of 8.250 million tonnes at a grade of 0.355% copper. At a cut off grade of 0.3% copper, the Indicated Resource calculated was 30.730 million tonnes at a grade of 0.462% copper, and the Inferred Resource calculated was 3.983 million tonnes at a grade of 0.452% copper. The 2008 Getty North technical report discloses the same indicated and inferred copper resources as the 2007 technical report. In addition to the copper resources, the 2008 Getty North technical report discloses indicated molybdenum resources based on a cut-off grade of 0.2% copper. At a cut off grade of 0.2% copper, the molybdenum Indicated Resource calculated was 32.10 million tonnes at a grade of 0.015% molybd enum. The Preliminary Feasibility Study has been updated and disclosed copper molybdenum resources, for both Getty North and Getty South, see table 1.1 under Additional Disclosure of this Management Discussion & Analysis.

The Company’s other identified potential mineral zones, known as North Valley; Glossie; Getty West, Northwest, Southwest, and Central; are all in the early stage of exploration and there is insufficient data to establish whether any resources may exist. The Company continues to seek additional properties worthy of exploration and development.

The price of copper has rebounded strongly from the slump in 2009 as a result of worldwide economic conditions, There is no way to predict future metal prices and therefore current prices may not reflect future prices and this may have a bearing on the time frame that would be required to place any mineral deposit that may be located on the property into commercial production. The Company continues its efforts to move the properties into the development stage to take advantage of the current demand for copper.

Result of Operations

Due to reduced commodity prices and a lack of working capital, nominal exploration work was carried out by the Company between 1998 and 2003. Consequently at the years ended December 31, 2001 to December 31, 2003 the financial statements were adjusted to reflect a provision for impairment of mineral properties.

The Company’s working capital decreased to ($3,534) for the year ending December 31, 2009 from $358,634 at December 31, 2008, the decrease of $362,168 is a result general and administration expenses as well as the recognition of an indemnity payable to a director (see note 7 of the financial statements). The Company has no source of revenue other than funds raised through the issuance of stock, through private placement.

The Company’s total assets decreased during the year ending December 31, 2009 to $4,888,733 a decrease of $347,794 from December 31, 2008, due to funds being used to pay administrative expenses. The Company’s liabilities increased by $575,938. The increase in liabilities is a result of a settlement in principle with one of the directors to indemnify him for approximately 88 % of his legal expenses which were incurred during 2004 to 2007 in the research and prosecution of legal actions related to lawsuits involving the Company. These lawsuits were in connection with a 2002 mineral property interest sale agreement and the actions of certain former directors. The settlement is premised on the fact that the director’s legal actions were of benefit to the Company in the conduct of its own litigation in connection with the same matters. The settlement provides that the director will receive $650,000 by way of a secured promissory note for $600,000 payable January 2, 20 12 and bearing interest at 6% effective April 18, 2009, plus $50,000 cash upon execution of a definitive agreement. The indemnity is expensed to legal fees which is included in the professional fees in the statement of operations of the financial statements. Exploration expenditures on the property are deferred, thus increasing the balance sheet value of the mineral rights. The Company has no significant source of working capital other than funds raised through private placement, exercising of warrants and Incentive Stock Options.

GETTY COPPER INC.

MANAGEMENT DISCUSSION & ANALYSIS

DECEMBER 31, 2009

The loss from operations for the year ending December 31, 2009 increased by $787,246 over the loss reported at December 31, 2008. General and administrative expenditures for the year ending December 31, 2009 increased to $1,083,970 compared to $298,967 at December 31, 2008. The comparative increase of $785,003 in administrative expenses between the year ending December 31, 2009 and 2008 can be attributed to an increase in legal fees, which includes $ 650,000 indemnity plus interest to a director, as described in the paragraph above. The predominant administration expense being the legal costs associated with the lawsuits outlined under Additional Disclosure. The Company recognized $160,238 in stock option compensation during the year ending December 31, 2009 and $90,867 at December 31, 2008. Professional fees for the year ending December 31, 2009 $771,049 (2008 - $80,424) which include $734,107 (2008 - $41,554) for legal fees of which $650,000 related to the indemnity, $36,942 (2008 - $38,870) in accounting and audit fees.

Selected Quarterly Information:

| | | |

| | Dec. 31, 2009 | Dec. 31, 2008 | December 31, 2007 |

| Loss for the quarter | ($165,245) | ($115,159) | ($181,725) |

| Loss for the year ending | ($1,083,970) | ($296,724) | ($2,217,003) |

| Loss per share: | ($0. 01) | ($0.004) | ($0.04) |

| Assets | $4,888,733 | $5,236,527 | $4,898,678 |

Summary of Quarterly Results

| | | | | | | | |

| | Dec. 31 2009 | Sept. 30 2009 | June 30 2009 | March 31 2009 | Dec. 31 2008 | Sept. 30 2008 | June 30 2008 | March 31 2008 |

| Revenue | - | - | - | - | 2,243 | $2,243 | - | - |

| Loss before Other items | 1,083,970 | 918,725 | 787,106 | 41,455 | 296,724 | $181,565 | $125,300 | 77,585 |

| Net loss | 1,083,970 | 918,725 | 787,106 | 41,455 | 296,724 | $181,565 | $125,300 | 77,585 |

| Loss per share | $0.013 | $0.01 | $0.01 | $0.0007 | $0.004 | $0.002 | $0.002 | $0.001 |

| Loss per share diluted | $0.012 | $0.001 | $0.009 | $0.0006 | $0.004 | $0.002 | $0.002 | $0.001 |

GETTY COPPER INC.

MANAGEMENT DISCUSSION & ANALYSIS

DECEMBER 31, 2009

During the year ending December 31, 2009, the Company incurred $66,355 in deferred costs as follows:

| | | | | | | | | | | | | |

| | | Getty Northwest | | Getty Central | | Getty North | | Getty South

50% interest | | Getty Southwest | | Total Exploration & Development | |

| Pre-feasibility study | | - | | - | | 11,966 | | 11,966 | | - | | 23,932 | |

| Assay | | - | | - | | - | | 25 | | - | | 25 | |

| Geology | | - | | - | | 1,241 | | 1,241 | | - | | 2,482 | |

| Other | | 7,323 | | 47 | | 11,944 | | 19,812 | | 790 | | 39,916 | |

| Total exploration & development costs | $ | 7,323 | $ | 47 | $ | 25,151 | $ | 33,044 | $ | 790 | $ | 66,355 | |

During the year ending December 31, 2008, the Company spent $365,131 on deferred costs as follows:

| | | | | | | | | | | | | |

| | | Getty Northwest | | Getty Central | | Getty North | | Getty South

50% interest | | Getty Southwest | | Total Exploration & Development | |

| Assay | $ | - | $ | - | $ | - | $ | 548 | $ | - | $ | 548 | |

| Pre-feasibility study | | - | | - | | 134,090 | | 132,056 | | - | | 266,146 | |

| Geology | | - | | - | | 11,221 | | 31,244 | | - | | 42,465 | |

| Other | | 4,832 | | 35 | | 22,026 | | 28,509 | | 570 | | 55,972 | |

| Total exploration & development costs | $ | 4,832 | $ | 35 | $ | 167,337 | $ | 192,357 | $ | 570 | $ | 365,131 | |

Liquidity

The Company has no mineral producing properties at this time and receives no revenues from production. All of the Company’s properties are exploration projects, and there is no assurance that a commercially viable ore deposit exists in any such properties until further exploration work and a comprehensive evaluation based upon unit cost, grade, tonnage, recoveries, and other factors conclude economic feasibility.

Effective August 14, 2009, 2,675,000 options were cancelled and 3,325,000 options were issued at $0.10, expiring August 14, 2014. The cancelled options are not eligible for re-issue for 90 days. As of April 15, 2010, there are no share purchase warrants outstanding and if all the issued incentive stock options were exercised the number of shares outstanding would become 84,217,537.

Outlook

The Company continues its efforts to advance the status its mineral properties. Although the PFS has accorded probable reserve status to a portion of the known resources, it is uncertain whether the Company will determine that it has economically recoverable reserves and whether it will be able to obtain the necessary financing to complete the exploration and commercial development of the mineral properties, the Company believes that it may be able to economically develop the mineral properties. The ability to raise funds to develop its properties may be challenging in light of current metal prices and market conditions for financing junior exploration companies. However, Canadian generally accepted accounting principles require that development costs related to mineral properties be written down for impairment unless there is persuasive evidence that impairment has not occurred. During the year ending December 31, 2009, funding was available to continue the exploration of the mineral properties, so future exploration development costs will not be written off until such time as the Company determines if it has economical recoverable resources or until exploration and development ceases and/or the mineral claims are abandoned.

GETTY COPPER INC.

MANAGEMENT DISCUSSION & ANALYSIS

DECEMBER 31, 2009

The Company advises that the previous litigation it was involved in no longer impacts the levels of performance or achievements

The Company’s management remains committed to the advancement of the Company’s Highland Valley mineral claims, subject to a positive feasibility study, production permitting and financing.

Related Party Transactions

Except as disclosed in this report there were no related party transactions. During the year ending December 31, 2009, Cinnamon Jang Willoughby, a professional accounting firm to which director and CFO Donald Willoughby is associated, billed the Company $17,083 (2008- $17,976) in accounting fees related to tax filings, quarterly report review and other professional accounting related matters, For the year ending December 31, 2009, the Company paid $6,000 office rent to Deborah Resources Ltd. and $30,000 management fees to Freeway Properties Inc., and both companies are controlled by the Managing Director,John Lepinski. During the year ending December 31, 2009, the Company paid Mr. Lepinski,$50,000 as part of the indemnity settlement and agreed to pay an additional $600,000 plus interest at 6% per annum from April 18, 2009 (See note 7 of the December 31, 2009 Financial Statements. The Company paid $35,917 (2008- $32,380) to Allihies Engineering Inc. for technical service s, which is a company held by director and president Corby Anderson.

Outstanding share data

As of April 15, 2010, there were 80,892,537 common shares outstanding.

Changes in accounting policyAccounting changes:

Effective October 1, 2007, the Company implemented the new CICA accounting section 1506 (Accounting Changes). Under these new recommendations, voluntary changes in accounting policy are permitted only when they result in the financial statements providing reliable and more relevant information. This section requires changes in accounting policy to be applied retrospectively unless doing so is impracticable, requires prior period errors to be corrected retrospectively and requires enhanced disclosures about the effects of changes in accounting policies, estimates and errors on the financial statements. These recommendations also require the disclosure of new primary sources of generally accepted accounting principles that have been issued but not yet effective.

The impact that the adoption of this section will have on the Company’s financial statements will depend on the nature of future accounting changes and the required additional disclosure on recent accounting pronouncements.

Financial instruments:

Effective October 1, 2007, the Company implemented the new CICA accounting sections: 3862 (Financial Instruments – Disclosure), 3863 (Financial Instruments – Presentation), which replaced section 3861 Financial Instruments – Disclosures and Presentation.

These new standards revise and enhance the disclosure requirements, and carry forward, substantially unchanged, the presentation requirements. Sections 3862 and 3863 emphasize the significance of financial instruments for the entity’s financial position and performance, the nature and extent of the risks arising from financial instruments, how these risks are managed. The Company has included these required disclosures in Note 13 to the financial statements.

GETTY COPPER INC.

MANAGEMENT DISCUSSION & ANALYSIS

DECEMBER 31, 2009

Capital disclosures:

Effective October 1, 2007, the Company implemented the new CICA accounting section 1535 (Capital Disclosures). Section 1535 specifies the disclosure of (i) an entity’s objectives, policies, and processes for managing capital; (ii) quantitative data about what the entity regards as capital; (iii) whether the entity has complied with any capital requirements; and (iv) if it has not complied, the consequences of such non-compliance. The Company has included these disclosures in note 12 to the financial statements.

Future accounting changes:

International Financial Reporting Standards (“AFRS”):

In 2006, the Canadian Accounting Standards Board (“AcSB”) published a new strategic plan that will significantly affect financial reporting requirements for Canadian companies. The AcSB strategic plan outlines the convergence of Canadian GAAP with IFRS over an expected five year transitional period. In February 2008 the AcSB announced that 2011 is the changeover date for publicly-listed companies to use IFRS, replacing Canadian GAAP. The changeover date is for interim and annual financial statements relating to fiscal years beginning on or after October 1, 2011. The transition date of January 1, 2011 will require the restatement for comparative purposes of amounts reported by the Company for the year ended December 31, 2010. While the Company has begun assessing the adoption of IFRS for 2011, the financial reporting impact of the transition to IFRS cannot be reasonably estimated at this time.

Additional Disclosure

On April 25, 2006, the Company initiated a lawsuit in the Supreme Court of British Columbia against the law firm of Blake Cassels & Graydon LLP. The lawsuit claims inter alia, damages for breach of duty owed to the Company. As of April 15, 2010, this action remains unresolved.

West Coast Environmental and Engineering (WCE) has completed the independent, National Instrument 43-101 compliant preliminary feasibility study (PFS) in June 2009 covering the Getty North and Getty South claims (together the “Getty Project”). This PFS has been filed on www.SEDAR.com as a technical report. WCE is a consulting and engineering firm comprised of independent, qualified technical personnel with multiple disciplines who are professionally registered and certified. The Getty Project is located in the Highland Valley near Logan Lake, British Columbia, in the Kamloops Mining Division of British Columbia, Canada. The Highland Valley area is a well known mining district that has historically produced copper and molybdenum, since 1962. Production of these metals as well as by-product gold is carried out today by Teck's Highland Valley Copper mine located in the immediate vicinity of the Getty Project.

The purpose of the PFS was to provide estimates of copper and molybdenum resources and probable reserves in accordance with Canadian Institute of Mining and Metallurgy standards within the Getty North and South deposits, prepare preliminary mining and processing plans, and perform an economic analysis to determine the feasibility of the project on a 100% project basis (meaning the PFS includes 100% of the Getty South claims although it is only 50% owned by Getty and 50% owned by Robak Industries Ltd., a private company owned by John Lepinski, a director of Getty).

A summary of the updated copper and molybdenum Indicated and Inferred Mineral Resource estimates determined independently by WCE in the PFS for both the Getty North and Getty South deposits are provided below in Table 1-1. These resources were modeled by Mr. Ed Switzer using MineSight software and were reviewed by the NI 43 101 Technical Report signatory QP's Mr. Craig Parkinson, Mr. Todd Fayram and Mr. Paul Gann. As seen, a total of 86.561 million tonnes of Indicated Resources at an average copper grade of 0.400 % Cu has been determined by WCE. An additional 22.097 million tonnes of Inferred Resources at a copper grade of 0.352 % Cu has been determined by WCE. The inferred resources cannot be and were not used in the PFS calculations.

GETTY COPPER INC.

MANAGEMENT DISCUSSION & ANALYSIS

DECEMBER 31, 2009

Table 1-1 Summary of Getty Indicated and Inferred Mineral Resource Estimates.

| | | |

| Deposit | Indicated Resources(millions of tonnes) | Grade |

| | | Cu% | Mo% |

| North | 49.691 | 0.397 | 0.005 |

| South | 36.870 | 0.405 | No Data |

| Total | 86.561 | 0.400 | --- |

| Deposit | Inferred Resources(millions of tonnes) | Grade |

| | | Cu% | Mo% |

| North | 8.089 | 0.419 | 0.005 |

| South | 14.008 | 0.314 | No Data |

| Total | 22.097 | 0.352 | --- |

The key assumptions and parameters used in the Getty Project mineral resource and reserve estimates are as follows:

Specific gravity for: Getty North = 2.6 Getty South = 2.76;

Pit Slope = 52 degrees overall; Overall Stripping Ratio = 2.6 Waste to Ore

The strip ratio is 2.3::1 in the south, 2.8::1 in the north.

Mining Cost = $1.60 CDN/average per tonne both ore and waste;

Processing Cost = $12.94 CDN/tonne ore;

General and Admin = $0.76 CDN/tonne ore;

Copper Price = $3.91CDN/lb ($ 3.29 US/lb) using a 36-Month Trailing Average;

Molybdenum Price (MoO3) = $34.87 CDN/lb using a 36-Month Trailing Average deescalated to $17.53 CDN/lb by year 7 of the project life;

Copper Recovery = 91%. Molybdenum Recovery = 50%. (These metallurgical recoveries are based on multiple test results and industrial operating data).

PFS includes 100% of the Getty South claims although it is only 50% owned by Getty

A summary of the updated copper and molybdenum Probable Mineral Reserve estimates determined independently by WCE in the PFS for both the Getty North and Getty South deposits are provided in Table 1-2. These resources were computer modeled by Mr. Ed Switzer and vetted by the NI 43 101 Technical Report signatory QP's Mr. Craig Parkinson, Mr. Todd Fayram and Mr. Paul Gann. As seen, a total of 86.561 million tonnes of Probable Mineral Reserves at a copper grade of 0.400 % Cu and a cutoff grade of 0.17% Cu has been determined by Mr. Switzer. Using the following: Mine Cost @ $1.60 CDN, Plant Cost $12.94 CDN, G&A $0.64 CDN, Copper Price $3.91 CDN per pound, Copper Recovery 91%.

Table 1-2 Summary of Getty Probable Mineral Reserve Estimates.

| | | |

| Deposit | Probable Reserves(millions of tonnes) | Grade |

| | | Cu% | Mo% |

| North | 49.691 | 0.397 | 0.005 |

| South | 36.870 | 0.405 | No Data |

| Total | 86.561 | 0.400 | --- |

GETTY COPPER INC.

MANAGEMENT DISCUSSION & ANALYSIS

DECEMBER 31, 2009

In addition, WCE recommends the further exploration with a view to expansion of both the Getty North and Getty South deposits. The Getty North property is comprised of 26 mineral claims located in south central British Columbia, Canada near latitude 50° 34' 15" North and longitude 121° 0' 3" West. To date diamond drilling on the Getty North property totals approximately 46,490 meters in 210 holes and percussion drilling totals approximately 5724 meters in 74 holes. In addition, 23 kilometers of induced polarization surveys, 23 kilometers of geochemical soil sampling surveys and detailed geological mapping has been conducted. The Getty North deposit is recommended by WCE to be developed laterally to the west, southwest and northeast of the deposit and also in the deeper sulphide zone. The deeper resources appear to occur within the continuous shoots that are amenable to open-pit mining followed by rubber tire underground mining methods. Additional drilling and sampling will likely increase the tonnage and grade estimates of the Getty North deposit as well as raise the resources to a higher category.

The Getty South property is currently 50% owned and 100% controlled by Getty Copper Inc. and 50% owned by Robak Industries Ltd., a related party. The parties operate the Getty South under a 2002 agreement which gives Getty discretion over spending and operations on the property. Getty carries Robak’s share of expenses with any carried amounts to be recovered by Getty in priority to Robak in the event of commercial production from Getty South. The Getty South property is comprised of 22 Crown granted mining claims, located in south central British Columbia, Canada on map sheet 921/056 near latitude 50° 32' 32" North and longitude 120° 59' 28". The Getty South property has been explored with almost 400 meters of surface trenching, approximately 20,353 meters of diamond drilling from surface and underground sites and 1,719 meters of underground workings. Most recently, an exploration program composed of 13 reconnaissance diamond drill holes and 15 surface trenches w ith a total length of 1,572 meters were completed in 1996 and 1997. The Getty South deposit is recommended by WCE to be further explored with particular attention given to the west, northeast and southeast areas to fill in gaps identified in the mine model that would potentially increase the probable reserves of the deposit. Like the Getty North deposit, the deeper resources appear to occur within continuous shoots that should be amenable to open-pit mining followed by rubber tire underground mining methods. Proper in-fill drilling, trenching and bulk sampling should be conducted to reclassify the resource at a potentially higher category. Additional deep-level-in-fill and exploratory drilling is also recommended to examine the vertical and lateral extent of copper mineralization in the underlying sulphide zone.

The financial aspects and indicators for the Getty Project have been determined by using cash flow analysis to evaluate the capital and operating costs generated for the development, operation and closure for the estimated life of the Getty Project. A 12 month pre-production period is proposed to allow for capital outlay, pre-stripping and mine development. The Getty Project would have an estimated mine life of 17 years given the reserves independently determined by WCE in the PFS report. This assumes a nominal 15,000 tonnes of ore mined per day with an open-pit mining operation. The Getty ores would be treated with conventional crushing, grinding and flotation to produce bulk copper and molybdenum containing concentrates. The flotation tailings, which contain the oxide fraction of the copper ore, would then be treated by industrially proven, acidic vat leaching for copper recovery. The combined copper and molybdenum flotation concentrate will be pressure leached utilizing indu strially-proven, nitrogen species catalyzed (NSC) pressure oxidation. Conventional copper solvent extraction and electrowinning would be used to produce on site LME quality electrowon copper metal cathodes. The leached molybdenum would be recovered via hydrometallurgical processing to produce molybdenum trioxide on site. A sodium sulphate by product will also be produced and sold. In addition, the Getty hydrometallurgical plant has been sized with extra process capacity to accommodate the treatment of outside custom copper and molybdenum concentrates. Overall, the designed production capacity of the Getty Project metallurgical facilities is estimated to be 30,000 tonnes of copper metal cathode and 2,250 tonnes of molybdenum trioxide per annum. Further, based on the financial and technical outcomes of metallurgical process detailed in the WCE PFS, Getty Copper Inc. is no longer planning to use Innovat Limited's hydrometallurgical technology or pursue an exclusive agreement to do so.

GETTY COPPER INC.

MANAGEMENT DISCUSSION & ANALYSIS

DECEMBER 31, 2009

Revenues from on-site copper cathode and molybdenum trioxide production and sales are based on an overall metallurgical recovery of 91% Cu and 50% Mo over the life of the mine and using a three-year trailing average copper and molybdenum market price of $3.91 CDN ($ 3.29 USD) and $34.87 CDN per pound respectively. The three year average price structure utilized reflects the criteria commonly employed for United States Securities and Exchange Commission (SEC) reserve estimations, under Guideline 7. Under SEC guidelines all required production permits must be in hand before mineralization can be classified as reserves. In addition, over the life of the mine the molybdenum price is deescalated by WCE in the PFS to a final price of $17.53 CDN per pound.

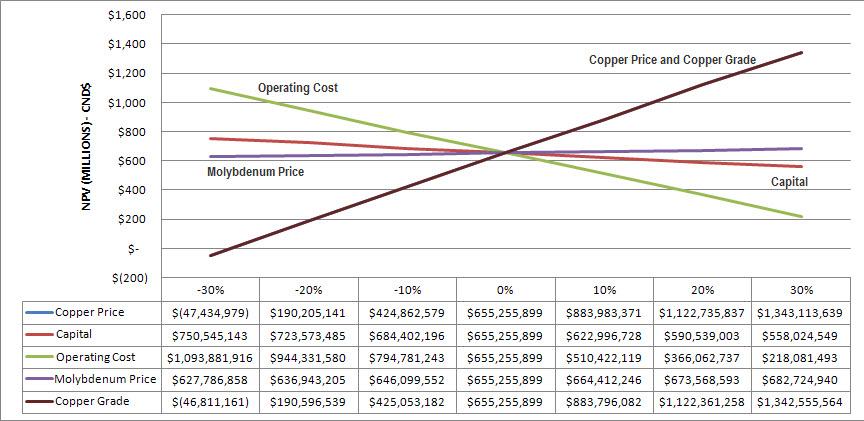

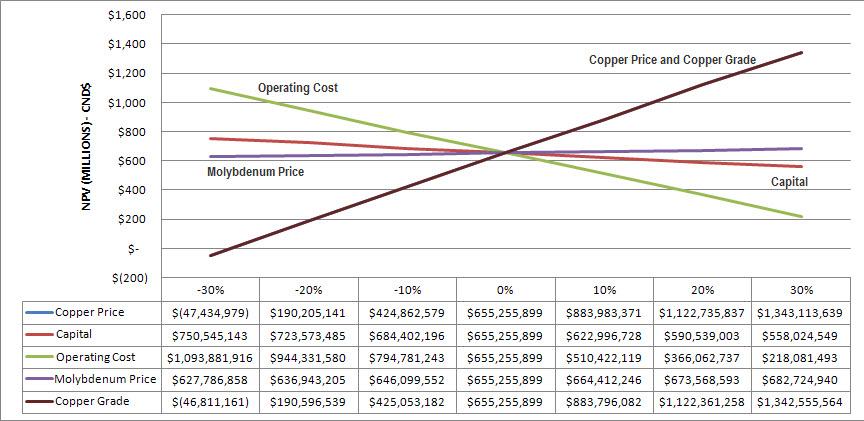

Overall cash operating costs for the Getty Project including mining, processing and support are estimated at $19.47 CDN per tonne of ore. The capital cost for the Getty Project is estimated at $428.2 million CDN with $18.98 million CDN in sustaining capital required over the life of the mine. Overall, WCE calculates the Getty Project has a pre tax Net Present Value (NPV) of $655.3 million CDN at a 0 % discount rate.(For comparison, at a discount rate of 2% the pre tax NPV is $ 493.6 million CDN and at a discount rate of 4 % the pre tax NPV is $ 368.4 million CDN). The estimated time to payback the capital expenditure is about 5.46 years at no imputed interest. The total net cash flow for the project is estimated at $655.3 million CDN while the Internal Rate of Return (IRR) is 16.44%. Further, a comprehensive economic sensitivity analysis was performed by WCE. The copper price (and of course, the copper grade) along with operating cost, were found to have the most impact on the project economics. At a drop of 20% in copper price the pre tax NPV is $ 190.2 million CDN while at a drop of 10% in the copper price the pre tax NPV is $ 424.9 million CDN. Correspondingly, a rise in copper price of 10% increases the pre tax NPV to $ 884.0 million CDN. As seen in Figure 1-1 below, the most important economic drivers are copper grade, copper price and operating cost. . These figures do not represent the Getty-only values as the 50% carried interest of Robak has not been separately accounted for.

Figure 1-1. Sensitivity Analysis Pre Tax NPV (0%).

As seen in Figure 1-1, the two most important economic drivers for the project NPV are operating cost and copper ore grade and price. It is anticipated by Getty with further immediate exploration and confirmatory drilling and analysis the total resource and reserve tonnage can be increased along with by product credits for recoverable molybdenum, silver and gold. The by product credits would serve to in effect increase the copper ore grade and price and greatly enhance the project NPV. As well, increasing the mining and processing at higher annual rates because of a larger confirmed resource and reserve will lower the operating costs by the concept of economies of scale and also impact the project impact in a very positive manner.

GETTY COPPER INC.

MANAGEMENT DISCUSSION & ANALYSIS

DECEMBER 31, 2009

The project is subject to a 1½% net smelter return royalty in favour of Robak Industries Ltd which was taken as a direct cost.

The project is subject to an environmental review by provincial and federal regulatory agencies and before any commercial production can be achieved a permit under theMines Actof British Columbia will need to be obtained. The report contemplates reclamation and closure costs of $8,680,000 CDN.

Net Revenue will be subject to federal income at the rate of 21.6% of net income with an allowance for mining royalties. Provincial Income tax is charged at the rate of 14.36% of net income less provincial mining tax of 13%. (Property taxes were included in the model)

Summary and Outlook

The Company is a British Columbia company engaged in the business of mineral exploration in the Highland Valley of British Columbia. The Company does not have any properties that are in production or that contain a proven reserve.

The Company’s main focus is to concentrate on seeking exploration funding or a joint venture partner to advance the status of the Getty North and Getty South deposits.

Additional Information

Additional information relating to the company, its activities and operations is available on SEDAR www.sedar.com.