UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| ¨ | Annual report pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934. |

For the fiscal year ending March 31, 2011

OR

| ¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. |

For the transition period from ________ to ________.

Commission file number 000-52954

Tongli Pharmaceuticals (USA), Inc.

(Exact name of registrant as specified in its charter)

| Delaware | | 84-1090791 |

| (State or other jurisdiction | | (IRS Employer |

| of incorporation or organization) | | Identification number) |

| | | |

| 14 Wall Street, 20th Floor | | |

| New York, NY | | 10005 |

| (Address of Principal Executive Offices) | | (Zip Code) |

212-842-8837

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

None

(Title of Class)

Name of each exchange on which registered

None

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, $.001 par value per share

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x.

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨.

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See definition of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ¨ | Accelerated filer ¨ |

Non-accelerated filer ¨ | Smaller reporting company x. |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the voting and non-voting common stock, other than shares held by persons who may be deemed affiliates of the registrant, computed by reference to the closing sales price for the registrant’s Common Stock on September 30, 2010, as reported on the OTC Bulletin Board, was approximately $3,372,049.

As of June 27, 2011, there were 11,791,789 outstanding shares of common stock of the registrant, par value $.001 per share.

DOCUMENTS INCORPORATED BY REFERENCE

None

TABLE OF CONTENTS

| | | Page |

| | | |

| Cautionary Note On Forward Looking Statements | -i- |

| | | |

| Part I | | |

| | | |

| Item 1. | Business | 1 |

| Item 1A. | Risk Factors | 11 |

| Item 1B. | Unresolved Staff Comments | |

| Item 2. | Description of Properties | 25 |

| Item 3. | Legal Proceedings | 25 |

| Item 4. | (Removed and Reserved) | 25 |

| | | |

| Part II | | |

| | | |

| Item 5. | Market For Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities | 26 |

| Item 6. | Selected Financial Data | 27 |

| Item 7. | Management’s Discussion and Analysis or Plan of Operation | 27 |

| Item 7A. | Quantitative and Qualitative Disclosures About Market Risk | 37 |

| Item 8. | Financial Statements and Supplementary Data | 37 |

| Item 9. | Changes In and Disagreements With Accountants On Accounting and Financial Disclosure | 37 |

| Item 9A. | Controls and Procedures | 37 |

| Item 9B. | Other Information | 39 |

| | | |

| Part III | | |

| | | |

| Item 10. | Directors, Executive Officers, Promoters and Control Persons; Compliance With Section 16(A) of the Exchange Act | 40 |

| Item 11. | Executive Compensation. | 43 |

| Item 12. | Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters | 45 |

| Item 13. | Certain Relationships and Related Party Transactions | 46 |

| Item 14. | Principal Accountant Fees and Services | 47 |

| | | |

| Part IV | | |

| | | |

| Item 15. | Exhibits | 48 |

| Index to Financial Statements | F-1 |

Unless otherwise provided in this Annual Report on Form 10-K, references to “Tongli,” “we,” “us,” “our” and similar terminology refer to Tongli Pharmaceuticals (USA), Inc. and its subsidiaries.

CAUTIONARY NOTE ON FORWARD LOOKING STATEMENTS

In addition to historical information, this Annual Report on Form 10-K contains forward looking statements which are subject to certain risks and uncertainties that could cause actual results to differ materially from those reflected in such forward-looking statements. Factors that might cause such a difference include, but are not limited to, those discussed in the sections entitled “Business”, “Risk Factors”, and “Management’s Discussion and Analysis or Plan of Operation.” Readers are cautioned not to place undue reliance on these forward-looking statements, which reflect management’s opinions only as of the date thereof. We undertake no obligation to revise or publicly release the results of any revision of these forward-looking statements. Readers should carefully review the risk factors described in this Report and in other documents that we file from time to time with the Securities and Exchange Commission.

In some cases, you can identify forward-looking statements by terminology such as “may,” “will,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “projects,” “potential,” “proposed,” “intended,” or “continue” or the negative of these terms or other comparable terminology. You should read statements that contain these words carefully, because they discuss our expectations about our future operating results or our future financial condition or state other “forward-looking” information. There may be events in the future that we are not able to accurately predict or control. You should be aware that the occurrence of any of the events described in our risk factors and other disclosures included in this Report could substantially harm our business, results of operations and financial condition, and that upon the occurrence of any of these events, the trading price of our securities could decline. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, growth rates, and levels of activity, performance or achievements. Factors that may cause actual results, our performance or achievements, or industry results, to differ materially from those contemplated by such forward-looking statements include without limitation:

| | · | obtain sufficient working capital to support our business plans; |

| | · | maintain or protect our intellectual property; |

| | · | maintain our proprietary technology; |

| | · | expand our product offerings and maintain the quality of our products; |

| | · | manage our expanding operations and continue to fill customers’ orders on time; |

| | · | maintain adequate control of our expenses allowing us to realize anticipated revenue growth; |

| | · | the impact of government regulation in China and elsewhere; |

| | · | implement our product development, marketing, sales and acquisition strategies and adapt and modify them as needed; |

| | · | integrate any future acquisitions; |

| | · | our implementation of required financial, accounting and disclosure controls and procedures and related corporate governance policies; and |

| | · | anticipate and adapt to changing conditions in the Chinese herbal medicines industry resulting from changes in government regulations, mergers and acquisitions involving our competitors, technological developments and other significant competitive and market dynamics. |

Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results. The following discussion should be read in conjunction with our financial statements and the related notes that appear elsewhere in this report.

We cannot give any guarantee that these plans, intentions or expectations will be achieved. All forward-looking statements involve risks and uncertainties, and actual results may differ materially from those discussed in the forward-looking statements as a result of various factors, including those factors listed above and described in the “Risk Factors” section of this Report.

PART I

Item 1. Business

Organization and Business Description

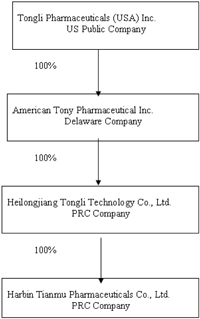

Tongli Pharmaceuticals (USA), Inc., through its indirectly wholly-owned subsidiary, Harbin Tianmu Pharmaceuticals Co., Ltd. (“HTP” or “Tianmu Pharmaceuticals”), develops, produces and sells a wide variety of pharmaceuticals and healthcare products in the People’s Republic of China (“PRC” or “China”) that are based on traditional Chinese medicine, or TCM. We were formerly known as American Tony Pharmaceutical, Inc. (“American Tony”), which was a holding company incorporated in the state of Delaware on November 17, 2006 and had no significant operations since its inception. The name change became effective on October 30, 2008 and was done to better represent the origin and ongoing business of our company.

On August 12, 2008, American Tony completed a reverse merger with Aim Smart Corporation (“Aim Smart”), a dormant public shell, which was originally incorporated on April 27, 1988 in the State of Colorado under the name “Gatwick, Ltd” for the purpose of seeking out and completing a merger or acquisition with one or more companies or businesses, and was reorganized as a Delaware corporation in September 2007. The acquisition was effected by the merger of American Tony into a wholly-owned subsidiary of Aim Smart.

Under the terms of the merger agreement, the former American Tony stockholders exchanged their shares for Aim Smart shares so that, upon the closing of the merger, the former American Tony stockholders owned 96.7% of the outstanding shares of Aim Smart. America Tony acquired its controlling interest in Aim Smart for a cost of $525,000. This interest was acquired solely to effectuate the reverse merger and was paid for with $276,000 of its own funds and a $249,000 loan from our Chairman, Mingli Yao. Aim Smart changed its name to American Tony upon the closing of the reverse merger.

Tianmu Pharmaceuticals was formed under laws of the PRC on November 26, 1999. In February 2007, American Tony acquired Tianmu Pharmaceuticals through a recapitalization transaction which was accomplished through the exchange of shares with Heilongjiang Tongli Technology Co., Ltd. (“TT” or “Tongli Technology”), a wholly-owned subsidiary of American Tony formed in 2007 in the PRC. TT owns 100% of Tianmu Pharmaceuticals and doesn’t have any other operations since its inception.

Our corporate structure as of the date of this Report is as follows:

Industry Background

Overview of Traditional Chinese Medicine

In China, Traditional Chinese Medicine is not an alternative form of therapy but is used in the state-run hospitals alongside modern medicine. For its practitioners and advocates, TCM is a complete medical system that is used to treat disease in all its forms. TCM is also believed to promote long term wellness and vigor. Many modern-day drugs have been developed from herbal sources. These include drugs designed to treat asthma and hay fever such as ephedrine; hepatitis remedies from fruits and licorice roots and a number of anticancer agents from trees and shrubs.

The roots of TCM date back thousands of years and include a number of therapeutic approaches. These include herbal medications, acupuncture, dietary manipulation, massage and others. Very early works of Chinese medical literature date back as much as 2,500 years while other classics appeared approximately 2,000 years ago during the Han Dynasty. Medicine in China continued to develop throughout the Middle Ages when emperors commissioned the creation of various scholarly works that compiled and documented hundreds of medicines derived from herbs, animal sources and minerals. In addition, these works described their therapeutic uses. In the 1950s, TCM was further modernized and reformed by the PRC government.

The emphasis on wellness and the avoidance of disease is considered by some to be a key distinction between TCM and western medical practice which has been seen as more heavily oriented toward the treatment of disease and less toward prevention. While TCM has remained a substantial part of medical treatment in China and throughout East Asia, recent decades have seen increasing acceptance throughout the United States, Europe and elsewhere. This growth is, in part, driven by increasingly educated and empowered consumers of medical care who seek organic, natural and alternative approaches to western medical treatments and prescription drugs. Medical doctors are also accelerating the process of acceptance, as doctors trained in the western tradition in Europe, the United States and elsewhere are integrating TCM and alternative treatments in their everyday practice. Additionally, a growing number of physicians specifically trained in TCM, acupuncture and other modalities are opening offices in communities in the U.S. and around the world.

We believe that the sales of TCM in China reflect the central and still growing role these therapies play in medical care in that nation. According to Helmut Kaiser Consultancy, in 2005, total sales revenue for Chinese herbal medicine manufactured in China was $13.6 billion which accounted for 25.8% of all medicine manufactured in China. This segment had total profit of $1.76 billion which accounted for 29% of the total profit of the Chinese drug industry. In 2006, there were approximately 1,400 Chinese herbal medicine manufacturers with an annual growth rate of 15%, much higher than the comparable period GDP growth. According to IMS Health, a market intelligence firm, the Chinese pharmaceutical market is predicted to grow to more than $50 billion by the end of 2011, which would make China the world’s third-largest pharmaceutical market.

Overview of the Chinese Market

The People’s Republic of China is undergoing the world’s most important and powerful economic transformation. This transformation includes the confluence of its ancient culture with modern trends in business, technology and finance. As a result, Chinese operating companies are capitalizing on unmatched growth opportunities in this evolving and growing marketplace. Although average income is approximately one-tenth that of developed western nations, business growth and market reform-driven policies have given the country’s 1.3 billion citizens more purchasing power than ever.

According to a report published in Newsweek, total consumer spending in China reached $1.7 trillion in 2007, compared with $12 trillion in the U.S. In its China Consumer Survey published in January 2010, Credit Suisse found that household income in China of the bottom 20% of those surveyed rose by 50% since 2004, while the top 10% had grown 255% to around RMB34,000 per month. Credit Suisse expects China’s share of global consumption to increase from 5.2% at US$1.72 trillion in 2009 to 23.1% at US$15.94 trillion in 2020, overtaking the U.S. as the largest consumer market in the world. Further, research on Chinese consumers by management consulting firm McKinsey classifies two million households out of a population of 1.3 billion as “wealthy,” based on fairly modest annual earnings of more than $30,000. An enormous middle class is rising, however, numbering some 70 million urban households, but these still earn $5,000-$10,000 a year. China’s National Bureau of Statistics, based on a random survey of 65,000 urban households in China, found that the average (annual) disposable income of urban residents in the first half of 2009 was U.S. $1,300, an increase of 9.8% compared to the same period last year. When price factors are deducted, this is equivalent to a real increase of 11.2%. The average consumption expenditure amount of urban residents in the first half of 2009 was U.S.$876, an increase of 8.9% compared to the same period last year. When price factors are deducted, this is equal to a real increase of 10.3%.

TCM Industry Drivers

We believe that demographic, governmental and related factors in the China will be favorable to growth and expansion of our business.

Growing Prosperity of the Chinese People. The increased spending power of China’s population continues to be reflected in the increased consumption of health products and medical services between 2007 and 2011. According to Euromonitor data, spending by Chinese people on these goods and services will increase from $100 billion in 2007 to $160 billion in 2011.

Population and Aging

| | · | The total population of China was 1.32 billion at the end of 2007, according to official government estimates. |

| | · | Due to improved healthcare, the elderly population of China is growing. |

| | · | The health/medical costs associated with care for elderly in China are approximately five (5x) times that of younger people. |

| | · | China had 170 million elderly people in 2007 but will have an expected 230 million elderly by 2015 according to “Consumer Lifestyles in China: Consumer Trends, China’s Grey Population,” by Euromonitor, 2009. |

| | · | The proportion of the China’s population aged 65 and over will rise from just 10% of the overall population in 1995 to 22% by 2030, according to the World Bank. |

| | · | From 1995 to 2030 it is estimated that the ratio of working-age people to pensioners will decrease from 9.7:1 to 4.2:1. China’s national estimates vary slightly from World Bank figures, but still show in increase in the proportion of the population over 65 years from 7% in 2000 to 9.4% in 2007, according to China Country Profile 2009, The Economist Intelligence Unit Ltd. |

Government Policies in Health Care and TCM. In April of 2009 the PRC government implemented a new national medical and health plan. Among other features, this new plan extended national medical insurance coverage to China’s rural areas, where the bulk of the population resides. This expanded coverage will eventually encompass virtually all of China’s 1.3 billion citizens, greatly expanding the market for TCM pharmaceuticals, as well as other health care products and services. This has led to massive potential for increased sales growth for Tongli and other providers of TCM pharmaceutical products.

According to Espicom Business Intelligence, in the next three years, the PRC government’s health care investment will rise to $125 billion, compared with $96 billion for 2008. Direct health care subsidies of urban and rural residents will amount to $57 billion. China’s health care investment is expected to witness a growth of 19.7% and the overall growth rate will reach more than 25%.

Government Support of Traditional Chinese Medicine. Among its public health initiatives, the Chinese government officially supports use of TCM to enhance wellness and to treat chronic and acute diseases. The government has also commenced a program to evaluate TCM and herbal-based pharmaceuticals for coverage and reimbursement under national medical insurance. In 2002, TCM was declared a “national strategic industry” in the government’s “Development Outline of Traditional Chinese Medicine Modernization (2002 – 2010).”

Decreased Competition. According to the Information Office of the State Council of the PRC, prior to 2009, there were approximately 6,000 Chinese pharmaceutical manufacturers. That number is being significantly reduced through both marketplace attrition and direct government involvement, decreasing competition and increasing potential sales opportunities for the surviving companies. Other companies are expected to fail through lack of size and innovative and aggressive management. According to a 2009 report published by KMPG, of the approximately 4,500 pharmaceutical companies in China, the majority are small players with limited local market reach, and rapid consolidation between medium and large players in the sector is anticipated since the Chinese government has been encouraging industry consolidation with an effort to improve the Good Manufacturing Practice (GMP) standard, enforce GMP certification and to better control the pricing of drugs.

Our Products

Our Chinese operating subsidiary has been developing, manufacturing and distributing pharmaceuticals and health care products that incorporate elements of Chinese traditional medicine with elements of western medicine since 1999. Tianmu Pharmaceuticals currently offers drugs and health care products in several distinct categories, including:

| | · | Antihyperlipidemics. These tablets, based on principles of Chinese traditional medicine, are used to reduce cholesterol levels and soften blood vessels in order to improve circulation. Our antihyperlipidemics are offered as an affordable alternative to the statins commonly used for this purpose in western medicine. For the year ended March 31, 2011, sales of Antihyperlipidemics accounted for approximately 23.8% of our total sales revenue during the year. |

| | · | Panax and Radix Polygoni Capsule. We began to market this new product in October 2010. This product is designed to reinforce the liver and kidney, replenish Qi (life energy) and blood, with major application on Qi and blood infirmity, beard and hair early whiteness, neurastheria, morbid forgetfulness and insomnia, lack of appetite and fatigue. For the year ended March 31, 2011, sales of Panax and Radix Polygoni Capsule accounted for approximately 26.9% of our total sales revenue during the year. |

| | · | Yuxiang Anti-Bacterial Mouthwash. Comprised of a mixture of medicinal ingredients that counter disease and odor in the oral cavity and throat, Yuxiang Mouthwash is designed to purge bad breath caused by gum disease, abnormal sleep, nervousness, food, alcohol and smoking. We package Yuxiang Mouthwash in bottles that are small enough to be carried conveniently, and we target customers who are travelling or away from home. Our primary points of distribution for Yuxiang Mouthwash are restaurants and transport carriers such us trains. For the year ended March 31, 2011, sales of Yufang Anti-Bacterial Mouthwash accounted for approximately 17.7% of our total sales revenue during the year. |

| | · | Calcium Gluconate Oral Liquid. This is a calcium supplement used for the prevention and treatment of diseases caused by calcium deficiency, such as osteoporosis, bone hypoplasis, and rickets. The liquid is particularly recommended for women during menopause or lactation. We believe that our product has a competitive advantage over other similar products provided by our competitors, because we have obtained a pharmaceutical license for this product, which is considerably more authoritative than the health license under which most of our competitors market their calcium supplements. For the year ended March 31, 2011, sales of Calcium Gluconate Oral Liquid accounted for approximately 18.2% of our total sales revenue during the year. |

| | · | Yan Li Xiao Capsules. This product is designed to detoxify the body, clear heat, relieve inflammatory symptoms and can be used to treat acute tonsillitis, bacillary dysentery, acute and chronic bronchitis, acute gastroenteritis, acute mastitis and other infectious diseases. However, the contract with Harbin Sanmu Pharmaceuticals (from whom we acquired the rights to this product) was terminated in July 2010 and therefore we have not sold this product since that time. For the year ended March 31, 2011, sales of Yan Li Xiao Capsule accounted for approximately 7.7% of our total sales revenue during the year. We believe we will be able to replace sale from this product with sales of our newer products, including most notably Panax and Radix Polygoni Capsule. |

| | · | Fuke Zhidai Tablets. This product is used to treat abnormal leucorrhea which caused by chronic cervicitis, endometritis and endocolpitis. For the year ended March 31, 2011, sales of Fuke Zhidai Tablets accounted for approximately 5.9 % of our total sales revenue during the year. |

We have obtained Drug Register License and Drug Production Certificate for each of the products listed above from China State Food & Drug Administration (“SFDA”). For further information, please refer to “Government Regulation” below.

Lanhai Agreement

In September 2008, we entered into a Patent Assignment Agreement (the “Lanhai Agreement”) with Harbin Lanhai Biochemical Company Limited (“Lanhai”) under which we agreed to acquire a patent related to a product called Lanhai Spirulina Calcium Tablet. Pursuant to the Lanhai Agreement, Lanhai agreed to provide us with the product formula as well as the technical support and assistance necessary for us to obtain SFDA approval for the product. Under the Lanhai Agreement, we made an aggregate payment of RMB7,030,000 (approximately $1.03 million) in October 2008, representing the entire purchase price for the subject patent. We are not obligated to make any subsequent payment. The patent application was accepted by the State Intellectual Property Office of China (“SIPO”) on March 14, 2008 and, if granted, the patent will expire on March 13, 2028 pursuant to PRC patent laws. The term of the Lanhai Agreement (meaning the term under which Lanhai is to provide support and assistance to us) is from November 1, 2008 to October 30, 2013. Title to this patent will not be assigned to us until the patent assignment is properly recorded with SIPO. The recording of this assignment is yet to be confirmed by SIPO. Based on ASC 805-50-30 “Initial Measurement of Acquisition of Assets Rather Than a Business” and ASC350-30 “General Intangibles Other Than Goodwill”, the payment of RMB7,030,000 for acquiring the patent was recorded as an asset at cost. The payment was originally recorded as a deposit which would be recorded as an intangible asset once we obtain the title to this patent, which asset will be subsequently amortized over the life of the patent. During 2010, we reached an unwritten mutual understanding with Lanhai that if we cannot obtain title to the patent before the end of the contract period (i.e., October 30, 2013), the entire payment will be refunded to us. Although we believe this understanding to be binding on the parties, it was not explicitly stipulated in the Lanhai Agreement or otherwise memorialized.

Subsequently, on June 17, 2011, we entered into a Termination Agreement with Lanhai pursuant to which the Lanhai Agreement was terminated. The parties agreed that, because the patent assignment recording process took too long, we shall return the Lanhai Spirulina Calcium Tablet product and related intellectual property to Lanhai. Pursuant to the Termination Agreement, Lanhai agreed to refund the total purchase price of RMB7,030,000 in three installments. The first installment of RMB2,000,000 shall be refunded prior to June 30, 2011, the second installment of RMB2,000,000 shall be refunded prior to July 30, 2011 and the last installment of RMB3,030,000 shall be refunded prior to August 30, 2011. The Termination Agreement also provides that we are entitled to initiate litigation against Lanhai if Lanhai fails to fully refund the total purchase price before August 30, 2011. In June 2011, Lanhai refunded the first installment of RMB 2,000,000

Sanmu Agreement

In August 2009, we signed a contract with a third party Harbin Sanmu Pharmaceuticals to purchase the exclusive rights to manufacture and sell a new product named Yan Li Xiao Capsule nationwide for the next seven years. We paid Harbin Sanmu Pharmaceuticals RMB 1,200,000 (approximate to USD 0.18 million) for this new product namely Yan Li Xiao Capsule in October 2009 and started to manufacture and distribute it in late 2009. However, in July 2010, Harbin Sanmu Pharmaceuticals decided to withdraw the exclusive sales right and the cooperative relationship between us and Harbin Sanmu Pharmaceuticals was terminated. Accordingly, management has written off the intangible asset related to this exclusive sales right.

Tonghua Agreement

On March 21, 2010, we entered into a New Drug Assignment Agreement (the “Tonghua Agreement”) with Tonghua Yisheng Pharmaceuticals Company Limited (“Tonghua”) pursuant to which we agreed to purchase a new drug candidate, called Nafarelin, from Tonghua for an aggregate purchase price of RMB33,000,000 (approximately $4.85 million). The total purchase price is payable in three installments: 33% of the total purchase price was paid upon execution of the Tonghua Agreement in March 2010; another 33% shall be paid upon conclusion of third clinical trial for the product in China; and the balance shall be paid upon conclusion of the transfer. Nafarelin is a proposed treatment for endometriosis and prostate cancer. At a minimum, completion of the third phase clinical trail is a pre-condition to receipt of the New Drug Approval Certificate from the SFDA. The SFDA new drug approval procedure is separate and distinct from the patent prosecution procedure. To date, neither Tonghua nor we have applied or intend to apply for patent protection for Nafarelin or the formula or process related to Nafarelin. Once we are granted with the New Drug Approval Certificate for Nafarelin, according to pharmaceutical laws of PRC, we shall enjoy 4 years of exclusive protection. As described below, we regard such protection period as the appropriate amortization period. The patent protection is irrelevant for purposes of amortization in determining the life of the drug as we will not apply for patent protection for Nafarelin. We shall not be responsible for conducting or paying for any clinical trial and/or research and development in connection with the new drug application for Nafarelin. Pursuant to the Tonghua Agreement, Tonghua shall continue the research, development and clinical trial work for Nafarelin until the SFDA grants the New Drug Approval Certificate and the product is ready to be marketed. Tonghua is listed as the applicant for the SFDA new drug approval process for this product. Once SFDA approval is obtained, we will be able to consummate the assignment and enjoy the protection afforded by the New Drug Approval Certificate. In addition, our ability to commercialize this new product also requires assistance and cooperation from Tonghua, which Tonghua is obligated to provide to us under the Tonghua Agreement. The Tonghua Agreement also provides that we and Tonghua will compensate each other for all losses incurred by the other party if the purchase is not concluded due to reasons attributable to the offending party.

Under PRC law, the SFDA’s New Drug Approval Certificate grants certain exclusive protections to approved new drugs, meaning that the subject formula may not be manufactured by other parties in China. The exclusive protection periods for the new drugs vary from 4 to 12 years depending on the category of the new drug. Because we shall be the beneficiary of the exclusive protection during the applicable period (the so-called “new drug approval period”), upon consummation of the transaction contemplated by the Tonghua Agreement, we will regard the protection period as the appropriate amortization period. Based on ASC 85-50-30 “Initial Measurement on Acquisition of Assets Rather Than a Business” and ASC350-30 “General Intangibles Other Than Goodwill”, the total payment pursuant to the Tonghua Agreement will be recorded as an intangible asset once we obtain the SFDA New Drug Approval Certificate and will be amortized over the term of the new drug protection period.

Based on an unwritten mutual understanding between us and Tonghua, any payments we made to Tonghua under the Tonghua Agreement will be refunded if SFDA approval is not obtained for Nafarelin. Such mutual understanding, although we believed to be binding, was not explicitly stipulated in the Tonghua Agreement or otherwise memorialized. We paid the first installment upon execution of the Tonghua Agreement. The second installment payment was made in February 2011, when Tonghua in good faith believed the Phase 3 clinical trial was finished. However, the SFDA later challenged the Phase 3 clinical trial results citing that the Phase 2 clinical trial was too old to be relied upon and therefore needed to be redone. As such, the first and second installments under the Tonghua Agreement was accounted as a deposit and the remaining two installment payments will be also accounted as deposits until the New Drug Approval Certificate is obtained, at which point the total payment will be recorded as intangible asset and amortized over the term of the new drug protection period. We believe the installments should be accounted for as deposits because of the alternative economic benefits the drug may bring to us.

Manufacturing

Our manufacturing and warehouse facilities are located in the Limin Pharmaceutical Technology Park in the City of Harbin. Our entire site was constructed in compliance with Chinese State Drug Administration GMP (Good Manufacturing Practices) standards at a total construction cost of 50 million RMB (approximately $7.3 million), with a goal of achieving world class standards. In recognition of our accomplishment, our manufacturing facility has received the National Drug GMP (Good Manufacturing Practices) Certificate, which is required by laws in order to carry on pharmaceutical manufacturing in the PRC. We have also received certificates from the International Organization for Standardization: specifically, ISO9001:2000 International Quality Management System Certificate and ISO14001 Environmental Management System Certificate.

At the present time, our manufacturing facility has the capacity to produce an annual output of products with a sales value over 100 million RMB (approximately $14,650,000). We believe that our current capacity is adequate for at least the next two years. In the meantime, we have budgeted $5 million for capital investment to expand our capacity, and we will need to raise capital or obtain other funding to finance such expansion.

Marketing

We currently market exclusively within the PRC. Our distribution network is comprised of our own direct sales personnel as well as a network of authorized distribution agents. Currently our sales network includes:

| | · | 15 regional distribution agents; |

| | · | over 200 city and county level distribution agents; and |

| | · | four national distributors, each of whom has the exclusive right to market one or more of our products if certain designated sales targets are achieved. For example, we have given Jilin Province Wan Min Medical Ltd. the exclusive right to market our Calcium Gluconate Oral Solution and our Clindamycin Hydrochloride Capsule nationwide through March 2011 if it purchases certain designated minimum quantities of each product. |

We have entered into agreements with four distributors to provide agreed upon amounts of products at pre-agreed price. In the event a distributor does not purchase a fixed percentage of the agreed upon amounts for three consecutive months, we may terminate the agreement. In addition to that, one agreement provides, among other things, that the distributor can become the exclusive distributor for a geographical area if certain sales targets are met.

We also market online through the “China Flagship Medicine Net”, a consortium website that offers subscribers medical information services and an online purchasing platform.

Major Customers

During the year ended March 31, 2011, approximately 25.36% of sales were generated from three major distributors with the largest distributor representing 9.25% of our sales. In addition, our four major products (Antihyperlipidemics, Yuxiang Anti-Bacterial Mouthwash, Calcium Gluconate Oral Liquid and Panax and Radix Polygoni Capsule represented approximately 86.6% of the total sales for the year ended March 31, 2011.

Research and Development

We currently have limited resources to devote to and limited capabilities to conduct the development of new products, and as such research and development activities are not presently material to our business. We, like other TCM manufacturers, enjoy relatively low research and development expenses as most TCM medicines are based on standardized formula. In 2008, SFDA promulgated a notice of registration of Chinese traditional medicine providing that TCM composed of classic prescriptions shall be exempted from pharmacological and toxicological tests and studies. The notice defined classic prescription and classic TCM formulas as those herbal remedies recorded in ancient Chinese medicine books from Qing Dynasty or earlier which are currently widely used. According to such notice, the production and manufacturing of TCM products are subject to non-clinical safety studies only and exempted from pharmacological and toxicological tests and studies. Thus, TCM products are entitled to obtain faster SFDA approval. As such, we enjoy relatively low research and development expenses because most of our products are based on classic TCM formulas that are covered by this notice.

We have decreased research and development expenses incurred in the fiscal year ended March 31, 2011 because our current products are still under normal product cycle and our patents have provided us sufficient capabilities to meet our current production and marketing demand, accordingly, we cut off our investment in our own research and development activities. In addition, we have switched our research and development strategy to acquiring new products with significant market potential from third parties instead of relying on our own efforts which we believe will be more efficient.

Raw Materials

We have developed purchasing relationships with a considerable number of suppliers, and have multiple sources for most of the raw materials that we require. Our business would not be significantly affected by the loss of any one supplier.

A considerable portion of the raw materials that we require are volatile herbs, which have a brief shelf life. This situation imposes a risk on our suppliers, who will often grow the herbs to order in order to insure an immediate market for their herbs. The situation also necessitates that we assure ourselves that our raw material requirements are available precisely when needed. To satisfy these conditions, it is our practice to make substantial cash advances to our suppliers in order to lock-in our raw material requirements. As of March 31, 2011, we have no advances to suppliers.

Competition

According to the Information Office of the State Council of the PRC, prior to 2009, there were approximately 6,000 Chinese pharmaceutical manufacturers. That number is being significantly reduced through both marketplace attrition and direct government involvement, decreasing competition and increasing potential sales opportunities for the surviving companies. Other companies are expected to fail through lack of size and innovative and aggressive management. According to a 2009 report published by KMPG, of the approximately 4,500 pharmaceutical companies in China, the majority are small players with limited local market reach, and rapid consolidation between medium and large players in the sector is anticipated since the Chinese government has been encouraging industry consolidation with an effort to improve the Good Manufacturing Practice (GMP) standard, enforce GMP certification and to better control the pricing of drugs. The market continues to attract new entrants because the per capita medicine consumption in China is still low, compared to developed countries, and that shows promise for substantial growth.

We compete with other companies, many of whom are developing, or can be expected to develop, products similar to ours. Some of our competitors are better established than we are, have better brand recognition of products that compete with ours, and have more financial, technical, marketing and other resources than we presently possess and a larger customer base. These competitors may be able to respond more quickly to new or changing opportunities and customer requirements and may be able to undertake more extensive promotional activities, offer more attractive terms to customers or adopt more aggressive pricing policies. We cannot assure you that we will be able to compete effectively with current or future competitors or that the competitive pressures we face will not harm our business.

We intend to establish a significant market share by advertising the demonstrated efficacy of Tianmu Pharmaceutical’s products. We have extensively tested our products and can cite studies that demonstrate the efficacy of many of them. This contrasts with a large portion of the over-the-counter pharmaceutical market in China, which is characterized by unproven products.

Growth Strategies

In our fiscal year ended at March 31, 2011, we continued the execution of our product channel expansion strategy that resulted in increased market penetration of our products and expanded revenue growth. Management plans to continue the emphasis on expanded and enhanced marketing and sales in our 2012 fiscal year and beyond. Part of this strategy involves increasing and improving our marketing and sales activities to enhance the market leadership of our key leading products and to increase the sales of other products by expanding our sales force, solidifying our distribution network and expanding our market segment coverage, and increasing our marketing and promotional activities.

Management also plans to pursue strategic acquisitions of new products with significant market potential as part of our growth strategy in 2012 and beyond. We plan to selectively pursue strategic acquisition opportunities to further consolidate our resources and expand our market coverage. We believe that such an initiative will provide efficient means to broaden our product lines, increase our market coverage and complement our research and development capabilities.

Management believes that our emphasis on further commercializing and broadening our product lines, enhanced sales and marketing efforts has the potential to yield significant increases in revenue in 2012 and beyond.

Government Regulation

The pharmaceutical industry in China, including the TCM sector, is highly regulated. The primary regulatory authority is the SFDA, including its provincial and local branches. As a developer, producer and distributor of medicinal products, we are subject to regulation and oversight by the SFDA and its provincial and local branches. The Law of the PRC on the Administration of Pharmaceuticals provides the basic legal framework for the administration of the production and sale of pharmaceuticals in China and covers the manufacturing, distributing, packaging, pricing and advertising of pharmaceutical products. Its implementing regulations set forth detailed rules with respect to the administration of pharmaceuticals in China. We are also subject to other PRC laws and regulations that are applicable to business operators, manufacturers and distributors in general.

Under the SFDA guidelines for licensing of pharmaceutical products, all pharmaceutical manufacturers must obtain and maintain Good Manufacturing Practices (“GMP”) Certificate.

Because our manufacturing facility has obtained the National GMP Certificate, we are authorized to produce products in four modes: tablets, capsules, granules, and oral suspensions. In addition to that, in order to market our products as pharmaceuticals, we are required to obtain Drug Register License and Drug Production Certificate specific to each product from the provincial branch of China SFDA. The process of application for such licenses is rigorous, requiring considerable testing. On average, it costs us approximately 1 million RMB (approximately $150,000) to get the approval for each product by the SFDA. To date we have obtained Drug Register License and Drug Production Certificate for the our products listed under “Our Products” above.

The more readily available license is for “health care products”, which are governed by the Heilongjiang Province Public Health Bureau. Tianmu Pharmaceuticals has registered its Yuxiang Anti-Bacterial Mouthwash with this Bureau.

Currently we have not developed a market in U.S. so we believe we are not subject to any of regulations by the U.S. Food and Drug Administration.

Our manufacturing and warehouse facilities are located in the Limin Pharmaceutical Technology Park in the City of Harbin. We believe that the industrial zone where we have located our manufacturing facilities is equipped with all necessary equipment that will enable us to comply with the applicable national, provincial and local environmental laws related to our operation. We maintain all the permits and licenses required by the PRC environment regulations through Limin Pharmaceutical Technology Park, to whom we pay certain amount of management fees every year.

Intellectual Property

We have one registered trademark for the Chinese character of “Tianmu” approved by the China Trademark Office covering drug capsule, medicinal capsule and active pharmaceutical ingredients. This registered trademark relates to our drug products. The trademark registration will expire in August 2012 and we plan to renew the registration for another ten-year period.

We have one design patent registered in China that covers the method of applying blue polyethylene packaging to the bottles of our Calcium Gluconate Oral Solution. This design patent relates to our healthcare products and will expire on May 10, 2015.

We purchased a patent related to a healthcare product named Lanhai Spirulina Calcium Tablet from Harbin Lanhai Biochemical Company Limited in September 2008. This patent will expire in August 2027. Subsequently, on June 17, 2011, we entered into a Termination Agreement with Lanhai pursuant to which the Lanhai Agreement was terminated. The parties agreed that, because the patent assignment recording process took too long, we shall return the Lanhai Spirulina Calcium Tablet product and related intellectual property to Lanhai.

All of our employees are bound by our company policy of non-disclosure our proprietary information, although we have no written confidentiality agreements with individual employee.

Employees

We currently have approximately 142 employees, all of whom are employed on a full-time basis. 18 employees are in executive management and human resource and administration, 15 in sales, 6 in accounting, 8 in technical and 95 in manufacturing.

Executive Offices in China

Our executive offices in China are located at 1 Beijing Road, Limin Development Zone, Harbin, China. We maintain a website at www.tmyy.com.cn. Information contained on or accessed through our website is not intended to constitute and shall not be deemed to constitute part of this Report.

Item 1A. Risk Factors

Our business, operations and financial condition are subject to various risks. Some of these risks are described below and you should take these risks into account in making a decision to invest in our common stock. If any of the following risks actually occurs, we may not be able to conduct our business as currently planned and our financial condition and operating results could be seriously harmed. In that case, the market price of our common stock could decline and you could lose all or part of your investment in our common stock.

Risks Related to Our Business

We may need additional financing, which may not be available on satisfactory terms or at all.

The revenues from the production and sale may not be adequate to support our expansion plans or our business generally. We may need substantial additional funds to build new production facilities, acquire new products, obtain regulatory approvals, market our products, and file, prosecute, defend and enforce our intellectual property rights.

At present we have no commitment from any source for those funds. We cannot determine, therefore, the terms on which we will be able to raise the necessary funds. To the extent we raise additional capital by issuing equity securities, our stockholders may experience dilution. To the extent that we raise additional capital by issuing debt securities, we may incur substantial interest obligations, may be required to pledge assets as security for the debt and may be constrained by restrictive financial and/or operational covenants. Debt financing would also be superior to our stockholders’ interest in bankruptcy or liquidation.

There are no assurances that future funding will be available to us on favorable terms or at all. If additional funding is not obtained, we will need to reduce, defer or cancel development programs, planned initiatives or overhead expenditures, to the extent necessary. The failure to fund our capital requirements would have a material adverse effect on our business, financial condition and results of operations.

We have been heavily dependent on key products.

Our four major products (Antihyperlipidemics, Yuxiang Anti-Bacterial Mouthwash, Calcium Gluconate Oral Liquid and Panax and Radix Polygoni Capsule) represented approximately 86.6% of the total sales for the year ended March 31, 2011. We expect that a significant portion of our future revenue will continue to be derived from sales of these four products. If any of these four products were to become subject to a problem such as loss of patent protection, unexpected side effects, regulatory proceedings, publicity adversely affecting user confidence or pressure from competing products, or if a new, more effective treatment should be introduced, the impact on our revenues could be significant.

We face competition in the pharmaceutical market in the PRC and such competition could cause our sales revenue and profits to decline.

According to SFDA in China, there were approximately 5,071 pharmaceutical manufacturing companies in the PRC as of the end of June 2004, of which approximately 3,237 manufacturers obtained certificates of Good Manufacturing Practices Certification (“GMP”). After GMP certification became a mandatory requirement on July 1, 2004, approximately 1,834 pharmaceutical manufacturers were forced to cease production. Only the 3,237 pharmaceutical manufacturers with GMP certifications may continue their manufacturing operations. As of the end of 2006, there were 4,682 enterprises manufacturing medicines and formulation in China. The certificates, permits, and licenses required for pharmaceutical operation in the PRC create a potentially significant barrier for new competitors seeking entrance into the market. Despite these obstacles, we face competitors that will attempt to create, or are already marketing, products in the PRC that are similar to ours. Many of our current and potential competitors have significantly longer operating histories and significantly greater managerial, financial, marketing, technical and other competitive resources, as well as greater name recognition, than we do. These competitors may be able to respond more quickly to new or changing opportunities and customer requirements and may be able to undertake more extensive promotional activities, offer more attractive terms to customers or adopt more aggressive pricing policies. We cannot assure you that we will be able to compete effectively with current or future competitors or that the competitive pressures we face will not harm our business.

Our business and growth will suffer if we are unable to hire and retain key personnel that are in high demand.

Our future success depends on our ability to attract and retain highly skilled chemists, pharmaceutical engineers, technical, and marketingl, especially qualified personnel for our operations in China. Qualified individuals are in high demand in China, and there are insufficient experienced personnel to fill the demand. Therefore we may not be able to successfully attract or retain the personnel we need to succeed.

Our business development would be hindered if we lost the services of some key personnel. Yao Mingli is the Chief Executive Officer of our company and of its operating subsidiary, Tianmu Pharmaceuticals. Mr. Yao is responsible for strategizing not only our business plan but also the means of financing it. If Mr. Yao were to leave Tianmu Pharmaceuticals or become unable to fulfill his responsibilities, our business would be imperiled. At the very least, there would be a delay in the development of Tianmu Pharmaceuticals until a suitable replacement for Mr. Yao could be retained.

Our results of operations are dependent on continually developing or acquiring new and advanced products, technologies and processes, and failure to do so may cause us to lose our competitiveness in the pharmaceutical industry and may cause our profits to decline.

To remain competitive in the pharmaceutical industry, it is important to continually develop new and advanced products, technologies and processes. There is no assurance that our competitors’ new products, technologies and processes will not render our company’s existing products obsolete or non-competitive. Our company’s competitiveness in the pharmaceutical market therefore relies upon our ability to enhance our current products, introduce new products, and develop and implement new technologies and processes. Our company’s failure to technologically evolve and/or develop new or enhanced products may cause us to lose our competitiveness in the pharmaceutical industry and may cause our profits to decline. It is likely that our efforts to grow our products lines will be focused on acquisitions of such products from third parties. There are many risks attendant to the acquisition of assets or companies, including availability, pricing, competition and, if acquisitions are consummate, integration. If we are unable to so acquire and integrate new products, our revenue and profitability may suffer.

The commercial success of our products depends upon the degree of market acceptance among the medical community and failure to attain market acceptance among the medical community may have an adverse impact on our operations and profitability.

The commercial performance of our products depends upon the degree of market acceptance among the medical community, such as hospitals and physicians. Even if our products are approved by SFDA, and even if our products are authorized to be eligible for reimbursement under Chinese national medical insurance programs, there is no assurance that physicians will prescribe or recommend our products to patients. Furthermore, a product’s prevalence and use at hospitals may be contingent upon our relationship with the medical community. The acceptance of our products among the medical community may depend upon several factors, including but not limited to, the product’s acceptance by physicians and patients as a safe and effective treatment, cost effectiveness, potential advantages over alternative treatments, and the prevalence and severity of side effects. Failure to attain market acceptance among the medical community may have an adverse impact on our operations and profitability.

We may not be able to obtain the regulatory approvals or clearances that are necessary to commercialize our products.

The PRC and other countries impose significant statutory and regulatory obligations upon the manufacture and sale of pharmaceutical products. Each regulatory authority typically has a lengthy approval process in which it examines pre-clinical and clinical data and the facilities in which the product is manufactured. Regulatory submissions must meet complex criteria to demonstrate the safety and efficacy of the ultimate products. Addressing these criteria requires considerable data collection, verification and analysis. We may spend time and money preparing regulatory submissions or applications without assurances as to whether they will be approved on a timely basis or at all.

Our product candidates, some of which are currently in the early stages of development, will require significant additional development and pre-clinical and clinical testing prior to their commercialization. These steps and the process of obtaining required approvals and clearances can be costly and time-consuming. If our potential products are not successfully developed, cannot be proven to be safe and effective through clinical trials, or do not receive applicable regulatory approvals and clearances, or if there are delays in the process:

| | · | the commercialization of our products could be adversely affected; |

| | · | any competitive advantages of the products could be diminished; and |

| | · | revenues or collaborative milestones from the products could be reduced or delayed. |

Governmental and regulatory authorities may approve a product candidate for fewer indications or narrower circumstances than requested or may condition approval on the performance of post-marketing studies for a product candidate. Even if a product receives regulatory approval and clearance, it may later exhibit adverse side effects that limit or prevent its widespread use or that would force us to withdraw the product from the market.

Any marketed product and its manufacturer will continue to be subject to strict regulation after approval. Results of post-marketing programs may limit or expand the further marketing of products. Unforeseen problems with an approved product or any violation of regulations could result in restrictions on the product, including its withdrawal from the market and possible civil actions.

In manufacturing our products we will be required to comply with applicable good manufacturing practices regulations, which include requirements relating to quality control and quality assurance, as well as the maintenance of records and documentation. If we cannot comply with regulatory requirements, including applicable good manufacturing practice requirements, we may not be allowed to develop or market the product candidates. If we or our manufacturers fail to comply with applicable regulatory requirements at any stage during the regulatory process, we may be subject to sanctions, including fines, product recalls or seizures, injunctions, refusal of regulatory agencies to review pending market approval applications or supplements to approve applications, total or partial suspension of production, civil penalties, withdrawals of previously approved marketing applications and criminal prosecution.

Our current and future products may have inadvertent and/or harmful side effects which would expose us to the risks of litigation and a loss of revenue.

All medicines have certain side effects. Although all of our medicines sold on market have passed proper testing and are approved by SFDA, the products may still inadvertently adverse effects on the health of the consumers. If such side effect is identified after marketing and sale of the products, the products may be required to be withdrawn from the market, or have a change in labeling. If a product liability claim is brought against us, it may, regardless of merit or eventual outcome, result in damage to our reputation, breach of contracts with consumers, decreased demand for our products, costly litigation and loss of revenue.

Natural disasters, weather conditions and other environmental factors affect our raw material supply, and a reduction in the quality or quantity of our herb supplies may have material adverse consequences on our financial results.

Our business may be adversely affected by weather and environmental factors beyond our control, such as natural disasters and adverse weather conditions. The production of our products depends on the availability of raw materials, a significant portion of which are herbs. These herbs tend to be very sensitive crops, which can be readily damaged by harsh weather, by disease, and by pests. If our suppliers’ crops are destroyed by drought, flood, storm, blight, or the other woes of farming, we will not be able to meet the demands of our customers, which will have a material adverse effect on our business and financial condition and results.

If we lost control of our distribution network, our business would fail.

We depend on our distribution network for the success of our business. During the year ended March 31, 2011, approximately 25.36% of sales were generated from threemajor distributors. Competitors may seek to pull our distribution network away from us. In addition, if dominant members of our distribution network become dissatisfied with their relationship with Tianmu Pharmaceuticals, a concerted effort by the distribution network could force us to accept less favorable financial terms from the distribution network. Either of these possibilities, if realized, would have an adverse effect on our business.

We may not be able to adequately protect our intellectual property, which could cause us to be less competitive.

We regard our trademarks, trade secrets, patents and similar intellectual property as material to our success. We rely on trademark, patent and trade secret law, as well as confidentiality and license agreements with certain of our customers and others to protect our proprietary rights. We have received trademark and patent protection for certain of our products in the PRC. No assurance can be given that our patents and licenses will not be challenged, invalidated, infringed or circumvented, or that our intellectual property rights will provide competitive advantages to us. There can be no assurance that we will be able to obtain a license from a third-party technology that we may need to conduct our business or that such technology can be licensed at a reasonable cost.

If our products fail to receive regulatory approval or are severely limited in the products scope of use, then we may be unable to recoup our research and development expenditures and we may not be able to adequately sell such products.

Our products that are approved to be manufactured as of March 31, 2011include four medicines. The production of our pharmaceutical products is subject to the regulatory approval of the SFDA. The regulatory approval procedure for pharmaceuticals can be quite lengthy, costly, and uncertain. Depending upon the discretion of the SFDA, the approval process may be significantly delayed by additional clinical testing and require the expenditure of currently unavailable resources; in such an event, it may be necessary for us to abandon our application. Even where approval of the product is granted, it may contain significant limitations in the form of narrow indications, warnings, precautions, or contra-indications with respect to conditions of use. If approval of our product is denied, abandoned, or severely limited in terms of the scope of products use, it may result in the inability to recoup considerable research and development expenditures already incurred.

Our certificates, permits, and license are subject to governmental control and renewal, and the failure to obtain renewal would cause all or part of our operation to be suspended and have a material adverse effect on our financial condition.

We are subject to various PRC laws and regulations pertaining to the pharmaceutical industry. We have has attained certain certificates, permits, and licenses required for the operation of a pharmaceutical enterprise and the manufacturing of pharmaceutical products in the PRC. We obtained the Medicine Production Permit in 2003 and 2004, which are subject to annual checks by the SFDA. We also have GMP certificates which are subject to annual checks by the SFDA. The pharmaceutical production permits and GMP certificates are each valid for a term of five years and must be renewed before their expiration. During the renewal process, we will be re-evaluated by the appropriate governmental authorities and must comply with the prevailing standards and regulations, which may change from time to time. In the event that we are not able to renew the certificates, permits and licenses, all or part of our operations may be suspended by the government, which would have a material adverse effect on our financial condition. Furthermore, if escalating compliance costs associated with governmental standards and regulations restrict or prohibit any part of our operations, it may adversely affect our results of operations and profitability.

We may be subject to the People’s Republic of China’s price control of drugs which may limit our profitability and even cause us to stop manufacturing certain products.

The State Development and Reform Commission of the PRC (“SDRC”) and the price administration bureaus of the relevant provinces of the PRC in which the pharmaceutical products are manufactured are responsible for the retail price control over our pharmaceutical products. The SDRC sets the price ceilings for pharmaceutical products that are listed in an “Essential Drug List” (“EDL”) prescribed by the Chinese government. Products (other than under the new drug protection periods) are subject to such price controls. Previously, two of the ten products which we produced (Metformin Hydrochloride Tablets and Clindamycin Hydrochloride Capsules) were included in EDL. The new drug protection periods for both products have expired and thus these two products are under price control. We stopped production of these two products for the fiscal years ended March 31, 2011 or March 31, 2010 because there was no profit margin to support the production. There is no assurance as to whether the Chinese government will impose pricing control on products outside of the EDL. Where our products are subject to a price ceiling, we will need to adjust the product price to meet the requirement and to accommodate for the pricing of competitors in the competition for market shares. The price ceilings set by the SDRC may limit our profitability, and in some instances, such as where the price ceiling is below production costs, may cause us to stop manufacturing certain products which may adversely affect our results of operations.

Because we may not be able to obtain business insurance in the PRC, we may not be protected from risks that are customarily covered by insurance in the United States.

Business insurance is not readily available in the PRC. To the extent that we suffer a loss of a type which would normally be covered by insurance in the United States, such as product liability and general liability insurance, we would incur significant expenses in both defending any action and in paying any claims that result from a settlement or judgment. We have not obtained fire, casualty and theft insurance, and there is no insurance coverage for our raw materials, goods and merchandise, furniture and buildings in China. Any losses incurred by us will have to be borne by us without any assistance, and we may not have sufficient capital to cover material damage to, or the loss of, our production facility due to fire, severe weather, flood or other cause, and such damage or loss would have a material adverse effect on our financial condition, business and prospects.

We may be subject to product liability claims, for which we have no insurance.

We may produce products which inadvertently have an adverse pharmaceutical effect on the health of individuals. Existing laws and regulations in China do not require us to maintain third party liability insurance to cover product liability claims. However, if a product liability claim is brought against us, it may, regardless of merit or eventual outcome, result in damage to our reputation, breach of contracts with our customers, decreased demand for our products, costly litigations, product recalls, loss of revenue, and our inability to commercialize some products.

Our indemnification obligations could adversely affect our business, financial condition and results of operations.

Our governing documents require us to indemnify our current and former directors, officers, employees and agents against most actions of a civil, criminal, administrative or investigative nature. Generally, we are required to advance indemnification expenses prior to any final adjudication of an individual’s culpability. The expense of indemnifying our current and former directors, officers and employees and agents in their defense or related expenses as a result of any actions related to the internal investigation and financial restatement may be significant and in excess of any insurance coverage we may have. As such, there is a risk that our indemnification obligations could divert needed financial resources and may adversely affect our business, financial condition and results of operations.

A large portion of our common stock is controlled by a small number of stockholders and as a result, these stockholders are able to influence and ultimately control the outcome of stockholder votes on various matters.

Mr. Mingli Yao, our Chairman and CEO, together with his wife and daughter owns 2,698,333, or 23.4 % of our outstanding shares as of the date of this Form 10-K. As a result, these stockholders are able to influence and potentially control the outcome of stockholder votes on various matters, including the election of directors and other corporate transactions including business combinations. In addition, the occurrence of sales of a large number of shares of our common stock, or the perception that these sales could occur, may affect our stock price and could impair our ability to obtain capital through an offering of equity securities. Furthermore, the current ratios of ownership of our common stock reduce the public float and liquidity of our common stock which can in turn affect the market price of our common stock.

If we are unable to maintain appropriate internal financial reporting controls and procedures, it could cause us to fail to meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, and cause investors to lose confidence in our reported financial information.

Effective internal controls are necessary for us to provide reliable financial reports and effectively prevent fraud. As a public company, we have significant additional requirements for enhanced financial reporting and internal controls. We will be required to document and test our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, which requires annual management assessments of the effectiveness of our internal controls over financial reporting and a report by our independent registered public accounting firm addressing these assessments. The process of designing and implementing effective internal controls is a continuous effort that requires us to anticipate and react to changes in our business and the economic and regulatory environments and to expend significant resources to maintain a system of internal controls that is adequate to satisfy our reporting obligations as a public company.

We cannot assure you that we will not, in the future, identify areas requiring improvement in our internal control over financial reporting. We cannot assure you that the measures we will take to remediate any areas in need of improvement will be successful or that we will implement and maintain adequate controls over our financial processes and reporting in the future as we continue our growth. If we are unable to establish appropriate internal financial reporting controls and procedures, it could cause us to fail to comply with Sarbanes-Oxley and meet our reporting obligations, result in the restatement of our financial statements, harm our operating results, subject us to regulatory scrutiny and sanction, and cause investors to lose confidence in our reported financial information.

Moreover, because our business is in China, our management there lacks experience in Western accounting practices and related U.S. public company requirements. This lack of experience may result in the production of financial statements that are inaccurate or do not fully comply with U.S. generally accepted accounting principles. If inaccurate financial statements are prepared, we may later be required to restate them, which could cause great harm to our stock price and our company generally.

We have not yet fully developed independent corporate governance.

Although we have three director that is “independent” (as defined under Nasdaq Marketplace Rules), we have no audit, compensation, or nominating committees of our board of directors. we are inexperienced in formal U.S. corporate governance procedures. A lack of functioning independent controls over our corporate affairs may result in potential or actual conflicts of interest between our management and our stockholders. We presently have no policy to resolve such conflicts. The absence of such standards of corporate governance may leave our stockholders without protections against interested director or executive transactions, conflicts of interest and similar matters, which could negatively impact an investment in our company.

We incur increased costs as a result of being a public company.

As a public company, we incur significant legal, accounting and other expenses that we did not incur as a private company. In addition, the Sarbanes-Oxley Act of 2002, as well as new rules subsequently implemented by the SEC, have required changes in corporate governance practices of public companies. We expect these new rules and regulations to increase our legal, accounting and financial compliance costs and to make certain corporate activities more time-consuming and costly. In addition, we will incur additional costs associated with our public company reporting requirements. We are currently evaluating and monitoring developments with respect to these new rules, and we cannot predict or estimate the amount of additional costs we may incur or the timing of such costs.

Our directors and officers liability insurance may lapse or be invalid or may fail to cover any expenses and losses due to lawsuits related to financial reporting errors, and our indemnification obligations could adversely affect our business, financial condition and results of operations.

Our director and officer liability insurance may lapse or otherwise be unable to cover lawsuit expenses and losses related to financial reporting errors. Our bylaws require us to indemnify our current and former directors, officers, employees and agents against most actions of a civil, criminal, administrative or investigative nature. Generally, we are required to advance indemnification expenses prior to any final adjudication of an individual’s culpability. The expense of indemnifying our current and former directors, officers and employees and agents in their defense or related expenses as a result of any actions related to the internal investigation and financial restatement may be significant. Therefore, our indemnification obligations could result in the diversion of our financial resources and may adversely affect our business, financial condition and results of operations.

We are not likely to hold annual stockholder meetings in the next few years.

Management does not expect to hold annual meetings of stockholders in the next few years, due to the expense involved. The current members of the Board of Directors were appointed to that position by the previous directors. If other directors are added to the Board in the future, it is likely that the current directors will appoint them. As a result, our stockholders will have no effective means of exercising control over the operations of our company.

Potential environmental liability could have a material adverse effect on our operations and financial condition.

As a manufacturer, we are subject to various Chinese environmental laws and regulations on air emission, waste water discharge, solid wastes and noise. Although we believe that our operations are in substantial compliance with current environmental laws and regulations, we may not be able to comply with these regulations at all times as the Chinese environmental legal regime is evolving and becoming more stringent. Therefore, if the Chinese government imposes more stringent regulations in the future, we may have to incur additional and potentially substantial costs and expenses in order to comply with new regulations, which may negatively affect our results of operations. Further, no assurance can be given that all potential environmental liabilities have been identified or properly quantified or that any prior owner, operator, or tenant has not created an environmental condition unknown to us. If we fail to comply with any of the present or future environmental regulations in any material aspects, we may suffer from negative publicity and be subject to claims for damages that may require us to pay substantial fines or have our operations suspended or even be forced to cease operations.

Risks Associated With Doing Business In China

There are substantial risks associated with doing business in China, as set forth in the following risk factors.

The Chinese government exerts substantial influence over the manner in which we must conduct our business activities.