QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to §240.14a-12 |

CLICK2LEARN, INC. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

April 23, 2003

To Our Stockholders:

You are cordially invited to attend the 2003 Annual Meeting of Stockholders (the "Meeting") of Click2learn, Inc. ("Click2learn") to be held at our headquarters, 110–110th Avenue NE, Bellevue, Washington, on Wednesday, May 28, 2003, at 10:00 a.m., Pacific Daylight Time. The matters expected to be acted upon at the Meeting include the following:

- •

- the election of three Class II directors; and

- •

- the ratification of KPMG LLP as our independent accountants and auditors for 2003.

Each of these proposals is described in detail in the accompanying Notice of Annual Meeting of Stockholders and Proxy Statement.

Please use this opportunity to take part in Click2learn's affairs by voting on the business to come before this Meeting. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE COMPLETE, DATE, SIGN AND PROMPTLY RETURN THE ENCLOSED PROXY IN THE ENCLOSED POSTAGE-PAID ENVELOPE PRIOR TO THE MEETING SO THAT YOUR SHARES WILL BE REPRESENTED AT THE MEETING. Returning the proxy does not deprive you of your right to attend the Meeting and to vote your shares in person. If you do plan to attend the Meeting in person, please mark the appropriate box on the enclosed proxy so that we can plan appropriately for the Meeting.

We hope to see you at the Meeting.

Sincerely,

Kevin M. Oakes

Chairman and Chief Executive Officer

CLICK2LEARN, INC.

110–110TH AVENUE NE

BELLEVUE, WASHINGTON 98004

NOTICE OF 2003 ANNUAL MEETING OF STOCKHOLDERS

To Our Stockholders:

NOTICE IS HEREBY GIVEN that the 2003 Annual Meeting of Stockholders (the "Meeting") of Click2learn, Inc. ("Click2learn") will be held at Click2learn's headquarters, 110–110th Avenue NE, Bellevue, Washington on Wednesday, May 28, 2003 at 10:00 a.m. Pacific Daylight Time.

At the Meeting, you will be asked to consider and vote upon the following matters:

- 1.

- The election of three Class II directors to serve until the Annual Meeting of Stockholders held in 2006 and until their successors have been elected and qualified or until their earlier resignation, death or removal. Click2learn's Board of Directors intends to present the following nominees for election as Class II directors:

| | Kevin M. Oakes

Ronald S. Posner

Jonathan Morgan |

- 2.

- A proposal to ratify the selection of KPMG LLP as Click2learn's independent accountants for 2003.

- 3.

- Such other business as may properly come before the Meeting or any adjournment thereof.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. Only stockholders of record at the close of business on April 4, 2003 are entitled to notice of and to vote at the Meeting or any adjournment thereof.

| | By Order of the Board of Directors |

|

|

|

Steven Esau

Secretary |

Bellevue, Washington

April 23, 2003 |

|

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE COMPLETE, DATE, SIGN AND PROMPTLY RETURN THE ACCOMPANYING PROXY IN THE ENCLOSED POSTAGE-PAID ENVELOPE SO THAT YOUR SHARES MAY BE REPRESENTED AT THE MEETING.

CLICK2LEARN, INC.

110–110TH AVENUE NE

BELLEVUE, WASHINGTON 98004

PROXY STATEMENT

April 23, 2003

The accompanying proxy is solicited on behalf of the Board of Directors of Click2learn, Inc., a Delaware corporation, for use at the 2003 Annual Meeting of Stockholders to be held at our headquarters, 110—110th Avenue NE, Bellevue, Washington 98004, on Wednesday, May 28, 2003 at 10:00 a.m., Pacific Daylight Time (the "Meeting"). This Proxy Statement and the accompanying form of proxy were first mailed to stockholders on or about April 23, 2003. An annual report for the year ended December 31, 2002 is enclosed with this Proxy Statement.

Record Date; Quorum

Only holders of record of our common stock at the close of business on April 4, 2003 (the "Record Date") are entitled to vote at the Meeting. A majority of the shares outstanding on the Record Date will constitute a quorum for the transaction of business at the Meeting.

Outstanding Shares

At the close of business on the Record Date, we had 24,937,164 shares of common stock outstanding and entitled to vote that were held of record by approximately 214 stockholders. We have been informed that as of the record date there were approximately 4,600 beneficial owners of our common stock.

Voting Rights; Required Vote

Holders of our common stock are entitled to one vote for each share held as of the Record Date. Shares of common stock may not be voted cumulatively. In the event that a broker, bank, custodian, nominee or other record holder of our common stock indicates on a proxy that it does not have discretionary authority to vote certain shares on a particular matter (a "broker non-vote"), then those shares will not be considered present and entitled to vote with respect to that matter, although they will be counted in determining whether or not a quorum is present at the Meeting.

The directors will be elected by a plurality of the votes of the shares of common stock present in person or represented by proxy at the Meeting and entitled to vote on the election of directors. Broker non-votes and abstentions will have no effect on the election of directors.

All votes will be tabulated by the inspector of elections appointed for the Meeting, who will separately tabulate affirmative votes, negative votes, abstentions and broker non-votes on each proposal.

Voting of Proxies

The proxy accompanying this Proxy Statement is solicited on behalf of our Board of Directors (the "Board") for use at the Meeting and any adjournment thereof. Stockholders are requested to complete, date and sign the accompanying proxy card and promptly return it in the enclosed envelope. All executed, returned proxies that are not revoked will be voted in accordance with the instructions contained therein. Returned signed proxies that give no instructions as to how they should be voted on a particular proposal at the Meeting will be counted as votes "for" such proposal (or, in the case of the election of directors, as a vote "for" election to the Board of all the nominees presented by the Board). So far as is known to the Board, no other matters are to be brought before the Meeting. However, as

to any business that may properly come before the Meeting, it is intended that proxies in the form enclosed will be voted in accordance with the judgment of the persons holding such proxies.

We will pay the expenses of soliciting proxies in the enclosed form. Following the original mailing of the proxies and other soliciting materials, we will request brokers, custodians, nominees and other record holders to forward copies of the proxy and other soliciting materials to persons for whom they hold shares of common stock and to request authority for the exercise of proxies. In such cases and upon the request of the record holders, we will reimburse such holders for their reasonable expenses. Proxies may also be solicited by our directors, officers and regular employees, without additional compensation, in person or by telephone.

Revocability of Proxies

Any person signing a proxy in the form accompanying this Proxy Statement has the power to revoke it prior to the Meeting or at the Meeting prior to the vote. A proxy may be revoked by:

- •

- written notice delivered to us stating that the proxy is revoked,

- •

- a subsequent proxy that is signed by the person who signed the earlier proxy is presented at the Meeting, or

- •

- attendance at the Meeting and voting in person.

Please note that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the Meeting, you must bring to the Meeting a letter from the broker, bank or other nominee confirming your beneficial ownership of the shares and that the broker, bank or other nominee is not voting your shares.

PROPOSAL NO. 1—ELECTION OF DIRECTORS

The size of the Board is fixed by resolution of the Board and currently stands at nine members. Our Certificate of Incorporation and Bylaws divide the Board into three classes. The members of each class of directors serve staggered three-year terms. Kevin M. Oakes, Ronald S. Posner and Jonathan Morgan are the Class II directors whose terms expire at this Annual Meeting of Stockholders. Jonathan Morgan was appointed to the Board on December 5, 2002 to fill the vacancy created by the resignation of Class II director Shelley Harrison. All three are standing for re-election to the Board. The Board, acting upon the recommendation of the Corporate Governance Committee, has nominated and recommends that Kevin M. Oakes, Ronald S. Posner and Jonathan Morgan be elected as Class II directors to hold office until the Annual Meeting of Stockholders to be held in the year 2006 or until their successors have been duly elected and qualified or until their earlier death, resignation or removal. Proxies may not be voted for a greater number of nominees than the three named in this proxy statement.

Shares represented by the accompanying proxy will be voted "for" the election of the nominees recommended by the Board unless the proxy is marked in such a manner as to withhold authority so to vote. If any nominee for any reason is unable to serve, the proxies may be voted for such substitute nominee as the proxy holder may determine. We are not aware of any nominee who is unable or unwilling to serve as a director. Directors will be elected by a plurality of the votes of the shares present in person or represented by proxy and entitled to vote in the election of directors at the Meeting with a quorum being present.

THE BOARD RECOMMENDS A VOTEFOR THE ELECTION

OF EACH OF THE NOMINEES NAMED ABOVE.

2

Nominees and Directors

In addition to the Class II directors standing for re-election at the Meeting, the Board also includes three Class III directors (Bert Kolde, Edward Harris and Vijay Vashee), whose terms expire upon the election and qualification of directors at the Annual Meeting of Stockholders to be held in 2004 and two Class I directors (Sally Narodick and John W. Coné), whose terms expire upon the election and qualification of directors at the annual meeting of stockholders to be held in 2005. There is currently a vacancy for a Class I director resulting from the resignation of Jonathan Klein in 2002. The Corporate Governance Committee continues to seek qualified candidates who can add significant value to the Board to fill this vacancy.

The following table sets forth the nominees for directors recommended to be elected at the Meeting and each director whose term of office will extend beyond or expire at the Meeting, the year such nominee or director was first elected or appointed as a director, the principal positions held by the nominees and each director with Click2learn, the year each nominee's or director's term will expire, the class of each nominee and each director, and certain additional biographical information regarding the nominees and continuing directors:

Name of Nominee or Director

| | Age

| | Position with Click2learn

| | Director Since

| | Class

| | Term Expires

|

|---|

| Nominees: | | | | | | | | | | |

| Kevin M. Oakes | | 39 | | Chairman, Chief Executive Officer and President | | 1997 | | II | | 2003 |

| Ronald S. Posner(1) | | 60 | | Director | | 1998 | | II | | 2003 |

| Jonathan Morgan(1) | | 49 | | Director | | 2002 | | II | | 2003 |

Continuing Directors: |

|

|

|

|

|

|

|

|

|

|

| Bert Kolde(2) | | 48 | | Director | | 1984 | | III | | 2004 |

| Edward Harris(2) | | 46 | | Director | | 2001 | | III | | 2004 |

| Vijay Vashee(1) | | 51 | | Director | | 2001 | | III | | 2004 |

| Sally Narodick(3) | | 57 | | Lead Director | | 1999 | | I | | 2005 |

| John W. Coné(1)(2)(3) | | 52 | | Director | | 2002 | | I | | 2005 |

- (1)

- Member of the Audit Committee

- (2)

- Member of the Compensation Committee

- (3)

- Member of the Corporate Governance Committee

Mr. Oakes has served as a director since September 1997. Mr. Oakes has served as Chief Executive Officer since January 2000 and as Chairman of the Board since May 2001. Mr. Oakes has served as President since he joined Click2learn in September 1997. Prior to that time, Mr. Oakes was the President of each of Oakes Interactive, a custom content development company, Acorn Associates, an e-Learning consulting firm and TopShelf Multimedia, a reseller of e-Learning titles (the "Oakes Companies") which he founded in March 1993, January 1996 and March 1997, respectively, and each of which Click2learn acquired in September 1997. Prior to forming the Oakes Companies, Mr. Oakes held positions at The Minnesota Mutual Life Insurance Company and Fidelity Investments. Mr. Oakes also serves on the Board of Directors of the American Society of Training & Development (ASTD) and Development Dimensions International (DDI), a privately-held HR training firm.

Mr. Posner has served as a director since September 1998. Mr. Posner is Chairman of NetCatalyst, a high technology mergers and acquisitions firm, and a founding general partner of PS Capital LLC, an angel venture capital firm. Mr. Posner has over 25 years experience in the technology industry, having held CEO positions with a number of high technology companies, including Peter Norton Computing, a PC utilities software company. He has been an active investor and advisor to a number of Internet

3

companies including PrizeCentral.com (now called Flipside.com and part of Vivendi-Universal Net Group), tunes.com (now part of Universal Music Group), Spinner.com (now part of AOL Time Warner), STV.com (now part of Sonic Foundry), Match.com (now part of TicketMaster City Search, Inc.), and Novatel Wireless.

Mr. Morgan has served as a director since December 2002. He is interim Chief Executive Officer of First Virtual Communications, Inc, a web-based meeting and collaboration company. Mr. Morgan was a director of CUseeMe Networks when it was acquired by First Virtual Communications in June 2001 and he continues to serve as a director of First Virtual Communications. From 1993 to 2001, Mr. Morgan was a Managing Director at Prudential Securities and a Managing Director at Prudential Volpe Technology Group, a division of Prudential Securities. Mr. Morgan is currently a Managing Director at Rostrevor Partners, LLC, a strategic consulting services company, which provides services to early stage growth companies.

Mr. Kolde has served as a director since December 1984. Mr. Kolde is Chief Operating Officer at Digeo, Inc., an interactive media company, and has served as Vice Chairman of the Seattle Seahawks and Portland Trail Blazers. Mr. Kolde served as Executive Vice President of Click2learn from December 1984 until April 1993, and thereafter as President until November 1994. Prior to joining Click2learn, Mr. Kolde was the Vice President of Management Reporting of Seafirst Corporation.

Mr. Harris has served as a director since May 2001. Mr. Harris is currently an independent financial consultant. Previously, Mr. Harris was a Senior Investment Analyst for Vulcan Ventures Inc. from December 1998 to December 2002. Prior to that Mr. Harris served as Chief Financial Officer for three early stage companies: Claircom Communications Group, L.P., an affiliate of McCaw Cellular Incorporated, and provider of wireless communications services; Starwave Incorporated, an Internet company; and Mirror Software, Inc., a provider of medical imaging software. From 1985 to 1992, Mr. Harris was an investment banker, for Salomon Brothers Inc from 1985 to 1990, and for Sumishin Capital from 1990 to 1992. Mr. Harris is a director of Edison Schools, Inc., First Virtual Communications, Inc. and RCN Corporation.

Mr. Vashee has served as a director since July 2001. From 1982 to the present, Mr. Vashee served in various positions at Microsoft, including as General Manager for Microsoft Project from December 1992 to June 1998 and as General Manager for Power Point from January 1993 to January 1997. Mr. Vashee previously served as a board member of IntelliPrep Technologies, Incorporated ("IntelliPrep") prior to its acquisition by Click2learn in May 2001.

Ms. Narodick has served as Lead Director since December 2002 and as a director since May 1999. Ms. Narodick is currently an independent consultant in the e-Learning industry. From September 2000 to March 2001, she worked with Click2learn's management team advising on mergers and acquisitions, in addition to working with other non-competitive e-Learning companies. From October 1998 to September 2000, she was President and CEO of Apex Learning Inc., which provides e-Learning courses to high school students. Prior to that, she was Chairman and CEO of Edmark Corporation, a publicly held educational software company, from 1989 until Edmark was sold to IBM in December 1996. From December 1996 through October 1998, she was an educational technology consultant working primarily for the Consumer Software Division of IBM. Ms. Narodick is a director of Penford Corporation, a publicly held complex carbohydrate company, Solutia, Inc., a publicly held specialty chemical company, and Puget Energy, a publicly held gas and electric utility.

Mr. Coné has served as a director since May 2002. He currently is a consultant and author in the field of organization learning. From July 1995 until his retirement in August 2001 he served as Vice President of Learning & Development for Dell Computer. Prior to Dell, he served as Chief Learning Officer and Vice President of Human Resources for Sequent Computer Systems Inc. a computer hardware and software company, from June 1991 to June 1995. Prior to Sequent, he served as Director of Corporate Educational Services for Motorola from February 1988 to May 1991, where he was a

4

founder and creator of Motorola University in 1990. In 2002, Mr. Coné served as the Chairman of the American Society of Training and Development and on the Board of Storied Learning, a privately-held e-Learning content company.

Board of Directors Meetings and Committees

Board of Directors. During 2002 the Board met five times, including telephone conference meetings, and acted by unanimous written consent four times. No directors attended fewer than 75% of the aggregate number of meetings of the Board (held during the part of 2002 for which he or she was a director) and the number of meetings held by all committees of the Board on which such director served (during the part of 2002 that such director served) except Ronald S. Posner, who attended seven of the ten meetings of the full Board and the Audit Committee during 2002. Standing committees of the Board include the Audit Committee, the Compensation Committee and the Corporate Governance Committee.

In 2002 the Board established the position of Lead Director on the recommendation of the Corporate Governance Committee and appointed Sally Narodick as Lead Director. The Lead Director may not be a member of Click2earn's management and is responsible for (1) assisting in planning the Board calendar and setting the agenda for Board meetings, (2) communicating with other non-management directors with respect to any issues or concerns they have with Click2learn or its management, (3) chairing executive sessions of the non-management directors and reporting to the CEO with respect to such executive sessions, (4) working with the Compensation Committee to develop a process to review the performance of the CEO on an annual basis and (5) delivering the annual review of the CEO.

Audit Committee. Mr. Posner, Mr. Vashee, Mr. Coné and Mr. Morgan are the current members of the Audit Committee, with Mr. Posner serving as the chair. Each member of the Audit Committee is independent in accordance with the National Association of Securities Dealers current listing standards. The Audit Committee's current charter was adopted on January 23, 2003 and is attached as Appendix 1 to this Proxy Statement. The Audit Committee's primary function is to assist the Board in its oversight of (1) the integrity of our financial statements, (2) our independent auditor's qualifications and independence, (3) the performance of our independent auditors and (4) compliance with the code of ethics for senior financial officers. The Audit Committee met five times during 2002. The Report of the Audit Committee is at page 19 of this Proxy Statement.

Compensation Committee. Mr. Kolde, Mr. Harris and Mr. Coné are the current members of the Compensation Committee with Mr. Kolde serving as the chair. They are each "non-employee directors" as defined in Rule 16b-3 promulgated under the Securities Exchange Act of 1934, as amended, and "outside directors" as defined pursuant to Section 162(m) of the Internal Revenue Code of 1986, as amended. The Compensation Committee carries out the responsibilities of the Board relating to (1) compensation of our executive officers, (2) reviewing the performance of the Chief Executive Officer and (3) administration of the our equity incentive plans, and makes recommendations to the Board regarding such matters. During 2002 the Compensation Committee met once and acted by written consent 26 times. The Compensation Committee Report on Executive Compensation is at page 11 of this Proxy Statement.

Compensation Committee Interlocks and Insider Participation. Mr. Kolde and Mr. Harris served on the Compensation Committee during the last completed fiscal year (Mr. Coné was appointed to the Compensation Committee in January 2003). Neither Mr. Kolde nor Mr. Harris was an officer or employee of Click2learn or any of our subsidiaries during the fiscal year, although Mr. Kolde was an officer from December 1984 until November 1994. Neither Mr. Harris nor Mr. Kolde engaged in any transaction or had any relationship with us other than as a director. During our last completed fiscal year none of our executive officers served as a director or member of the compensation committee of

5

any entity, any of whose executive officers served as a member of our Board or Compensation Committee.

Corporate Governance Committee. The Corporate Governance Committee was established on October 15, 2002. Ms. Narodick and Mr. Coné are the current members of the Corporate Governance Committee, with Ms. Narodick serving as the chair. The Corporate Governance Committee's primary responsibilities are to (1) develop, update as necessary and recommend to the Board corporate governance principles and policies, (2) monitor compliance with such principles and policies, (3) identify individuals qualified to become members of the Board, and (4) approve and recommend to the Board director candidates. The Corporate Governance Committee met two times during 2002.

As part of its responsibility to approve and recommend director candidates, the Corporate Governance Committee will consider potential nominees recommended by security holders. To recommend a potential nominee, a security holder must submit the following information to Click2learn's Secretary at it headquarters in Bellevue, Washington: (1) the name, number of shares held and contact information for each of the nominating security holder and the potential nominee, (2) a consent to serve as a director of Click2learn signed by the potential nominee, and (3) a full professional resume for the potential nominee including all employment, board and board committee memberships held for past 5 years, and a description of any relationships to any current officer, director or 10% shareholder of Click2learn. Upon receipt of all of the foregoing, the Secretary will forward the potential nominee to the Corporate Governance Committee for evaluation. In conducting its evaluation, the Corporate Governance Committee may make a decision based on the documents submitted to the Secretary or may request such additional information or conduct such other due diligence as it determines in its sole discretion. The decision whether or not to approve or recommend a potential nominee shall be made by the Corporate Governance Committee in its sole discretion. The Corporate Governance Committee is not obligated to notify a potential nominee or the security holder recommending such potential nominee if it decides not approve and recommend such potential nominee to the Board as a director candidate.

Director Compensation

We do not pay directors any cash fees for their service on the Board or any committee, but we reimburse all reasonable out-of-pocket expenses incurred in connection with their attendance at Board and committee meetings.

Board members who are not our employees or employees of a parent, subsidiary or affiliate of ours are eligible to participate in the 1998 Directors Stock Option Plan (the "Directors Plan"). Option grants under the Directors Plan are automatic and non-discretionary, and the exercise price per share of such options is the fair market value of a share of common stock on the date of grant. Non-employee directors receive annual grants of 15,000 options on either June 11 (if such director was serving on the Board when the Directors Plan first became effective) or on the date he or she first became a director and each anniversary thereof, if the director has served continuously as a member of the Board since the date of the initial grant.

The term of these options is ten years, but they will terminate seven months following the date such director ceases to be a member of the Board or a consultant or twelve months if the termination is due to death or disability. All options granted under the Directors Plan will vest as to 2.78% of the shares each month after the date of grant for so long as the recipient continues as a director or a consultant. Additionally, immediately prior to our dissolution or liquidation or a change in control transaction, all options granted pursuant to the Directors Plan will accelerate and will be exercisable for a period of up to six months following the transaction, after which any unexercised options will expire.

In addition, on October 15, 2002, the Board approved a one-time grant of additional options to non-employee directors based on a formula of one additional option for every two options currently

6

held under the Directors Plan with exercise prices in excess of $2.00. The additional options were granted on October 29, 2002 pursuant to our 1998 Equity Incentive Plan (the "Incentive Plan") and have an exercise price of $0.80, which was the fair market value on the grant date as determined under the Incentive Plan. Because these options were granted under the Incentive Plan rather than the Directors Plan (which does not permit discretionary grants), these options differ in several respects from those granted under the Directors Plan. These options have a term of ten years and vest as to 50% of the shares subject to the option on each of the first and second anniversaries of the grant. The additional options terminate three months following the date such director ceases to be a member of the Board or a consultant or twelve months if the termination is due to death or disability. The additional options do not automatically vest on a change in control transaction, but are subject to assumption in accordance with the Incentive Plan.

PROPOSAL NO. 2—RATIFICATION OF SELECTION OF INDEPENDENT ACCOUNTANTS

The Audit Committee has selected KPMG LLP as our independent accountants to perform the audit of our financial statements for 2003 and the stockholders are being asked to ratify such selection. KPMG LLP have been our independent accountants since 1997. Representatives of KPMG LLP will be present at the Meeting, will have the opportunity to make a statement at the Meeting if they desire to do so, and will be available to respond to appropriate questions.

Selection of our independent accountants is not required to be submitted to a vote of the stockholders for ratification. However, the Board is submitting this matter to the stockholders as a matter of good corporate practice. If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether to retain KPMG LLP, and may decide to retain that firm or another without re-submitting the matter to a vote of the stockholders. Even if the appointment is ratified, the Audit Committee may, in its discretion, appoint different independent accountants at any time during the year if it determines that such a change would be in the best interests of Click2learn and our stockholders.

THE BOARD RECOMMENDS A VOTEFOR THE RATIFICATION

OF THE SELECTION OF KPMG LLP.

7

EXECUTIVE OFFICERS OF CLICK2LEARN

The following table sets forth certain information regarding the executive officers of Click2learn as of the Record Date:

Name

| | Age

| | Position

|

|---|

| Kevin M. Oakes | | 39 | | Chairman, Chief Executive Officer and President |

| John D. Atherly | | 44 | | Chief Financial Officer |

| Sudheer Koneru | | 34 | | Chief Operating Officer |

| Srinivasan Chandrasekar | | 34 | | Executive Vice President, Products and Strategy |

| Gary Millrood | | 44 | | Senior Vice President, North American Sales |

| Steven Esau | | 40 | | Senior Vice President, General Counsel and Secretary |

| Rick Collins | | 44 | | Vice President, Business Development |

Mr. Oakes has served as a director since September 1997. Mr. Oakes has served as Chief Executive Officer since January 2000 and as Chairman of the Board since May 2001. Mr. Oakes has served as President since he joined Click2learn in September 1997. Prior to that time, Mr. Oakes was the President of each of Oakes Interactive, a custom content development company, Acorn Associates, an e-Learning consulting firm and TopShelf Multimedia, a reseller of e-Learning titles (the "Oakes Companies") which he founded in March 1993, January 1996 and March 1997, respectively, and each of which Click2learn acquired in September 1997. Prior to forming the Oakes Companies, Mr. Oakes held positions at The Minnesota Mutual Life Insurance Company and Fidelity Investments. Mr. Oakes also serves on the Board of Directors of the American Society of Training & Development (ASTD) and Development Dimensions International (DDI), a privately-held HR training firm.

Mr. Atherly has served as Chief Financial Officer since February 1995, and prior to that as Director of Finance and Operations, Treasurer and Secretary from February 1993. Mr. Atherly held various other positions since he joined Click2learn in June 1990, including Controller from February 1991 until February 1993. Prior to joining Click2learn, Mr. Atherly was a Finance and Operations Manager at MicroDisk Services, a software manufacturing services company.

Mr. Koneru has served as Chief Operating Officer since January 2003, as Executive Vice President, Customer Services from January 2002 until January 2003 and as Executive Vice President, Products and Strategy from May 2001 until January 2002. Prior to joining Click2learn, he co-founded IntelliPrep, an enterprise learning software company, in 2000 and served as IntelliPrep's Chief Executive Officer until IntelliPrep was acquired by Click2learn in May 2001. Prior to IntelliPrep, Mr. Koneru served in various positions at Microsoft Corporation since 1992, most recently as Director/Product Unit Manager for the consumer Windows division from 1998 to 2000.

Mr. Chandrasekar has served as Executive Vice President, Products and Strategy since January 2003 and as Senior Vice President, Technology from May 2001 until January 2003. Mr. Chandrasekar was a co-founder of IntelliPrep and served as its Chief Technology Officer from March 2000 until IntelliPrep was acquired by Click2learn in May 2001. From 1993 to March 2000, he served in various positions at Microsoft in both managerial and technical leadership, including as head of Microsoft's Metadirectory product development group from September 1999 to March 2000.

Mr. Millrood has served as Senior Vice President, North American Sales since December 2002. From December 2001 to December 2002 he was Executive Vice President of Corporate Development at Playback Media. From November 2000 until November 2001 he was CEO and President of iGeneration, a developer of training performance technology and services for the IT marketplace. Prior to iGeneration, he was a founder and Executive Vice President of Business Development, Sales and Marketing for Hungry Minds, a provider of e-Learning solutions, from May of 1999 until its acquisition by IDG Books in October 2000. Prior to that, he was Vice President of Business Development and

8

Sales for the ZD Studios division of Ziff-Davis, a provider of marketing and training solutions, from April 1996 until April 1999.

Mr. Esau has served as General Counsel since October 1995, as Vice President and Secretary of Click2learn since January 1997 and as Senior Vice President since February 2002. Prior to that time, Mr. Esau served as Director of Legal Affairs from February 1995 until October 1995 and as counsel since joining Click2learn in February 1994. From 1988 until February 1994, he was in private law practice, first with Stoel Rives LLP in Seattle and then with his own law firm, where he focused on advising software and technology startup companies.

Mr. Collins has served as Vice President, Business Development since May 2001 after serving as Senior Director, Business Development since August 1999. From September 1998 to August 1999, Mr. Collins served as Vice President of Media at Crisp Publications, Inc., a publisher of educational content. Prior to that, he served as Business Manager at Crisp Publications from September 1995 to September 1998.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information known to us with respect to the beneficial ownership of our common stock as of the Record Date, by (1) each person who is known to us to own beneficially more than 5% of our common stock, (2) each director and nominee, (3) each of our Chief Executive Officer and four most highly compensated executive officers, other than the Chief Executive Officer, who were serving as executive officers at the end of 2002 (collectively, the "Named Executive Officers") and (4) all directors and executive officers as a group. Unless otherwise indicated in the notes to the table, the persons and entities named in the table have sole voting and sole investment power with respect to all shares beneficially owned, subject to community property laws where applicable.

Name of Beneficial Owner

| | Number of Shares Beneficially Owned

| | Percentage of Common Stock Beneficially Owned(1)

| |

|---|

| Paul G. Allen(2) | | 6,928,216 | | 27.36 | % |

| WM Advisors Inc.(3) | | 3,256,436 | | 13.06 | |

| Kevin M. Oakes(4) | | 808,123 | | 3.21 | |

| Sudheer Koneru(5) | | 489,900 | | 1.96 | |

| Srinivasan Chandrasekar(6) | | 322,678 | | 1.29 | |

| John D. Atherly(7) | | 184,457 | | * | |

| Bert Kolde(8) | | 103,749 | | * | |

| Ronald S. Posner(9) | | 61,250 | | * | |

| Sally Narodick(10) | | 47,915 | | * | |

| Vijay Vashee(11) | | 39,901 | | * | |

| Edward Harris(12) | | 18,000 | | * | |

| Lee Maxey(13) | | 5,222 | | * | |

| John Cone(14) | | 5,000 | | * | |

| Jonathan Morgan(15) | | 2,083 | | * | |

| All officers, directors and nominees as a group (15 persons)(16) | | 2,286,542 | | 9.06 | |

- *

- Less than 1% of outstanding common stock

- (1)

- Percentage ownership is based on 24,937,164 shares outstanding as of the Record Date. Shares of common stock subject to options or warrants currently exercisable or exercisable within 60 days of the Record Date are deemed outstanding for the purpose of computing the percentage ownership of the person holding such options or warrants but are not deemed outstanding for computing the

9

percentage ownership of any other person. The addresses for each holder of more than 5% of our common stock are as follows:

Paul G. Allen

505 Union Station

505 Fifth Avenue South, Suite 900

Seattle, Washington 98104 | WM Advisors Inc.

1201 Third Avenue

22nd Floor

Seattle, Washington 98101 |

- (2)

- Includes 616,120 shares held of record by Vulcan Ventures, Inc. and 387,096 shares issuable upon exercise of a warrant issued to Vulcan Ventures, Inc. Mr. Allen is the sole shareholder of Vulcan Ventures, Inc. and may be deemed to have shared voting and investment power with respect to such shares. Mr. Allen is the founder of Click2learn.

- (3)

- Based on publicly available information filed with the SEC on Form 13G dated March 31, 2003.

- (4)

- Includes 243,707 shares subject to stock options exercisable within 60 days of the Record Date.

- (5)

- Includes 45,846 shares subject to stock options exercisable within 60 days of the Record Date and 169,981 shares held of record by his spouse.

- (6)

- Includes 48,569 shares subject to stock options exercisable within 60 days of the Record Date and 73,448 shares held of record by his spouse.

- (7)

- Includes 174,492 shares subject to stock options exercisable within 60 days of the Record Date.

- (8)

- Represents shares subject to stock options exercisable within 60 days of the Record Date.

- (9)

- Includes 41,250 shares subject to stock options exercisable within 60 days of the Record Date and 20,000 shares held of record by PS Capital LLC. Mr. Posner is a principal of PS Capital LLC and may be deemed to have shared voting and investment power with respect to such shares. Mr. Posner disclaims beneficial ownership of shares held by PS Capital LLC except to the extent of his pecuniary interest therein.

- (10)

- Represents shares subject to stock options exercisable within 60 days of the Record Date.

- (11)

- Includes 13,332 shares subject to stock options exercisable within 60 days of the Record Date.

- (12)

- Includes 15,000 shares subject to stock options exercisable within 60 days of the Record Date.

- (13)

- Mr. Maxey's employment terminated in January 2003 and although he is a Named Executive Officer he was not an executive officer as of the Record Date.

- (14)

- Represents shares subject to stock options exercisable within 60 days of the Record Date.

- (15)

- Represents shares subject to stock options exercisable within 60 days of the Record Date.

- (16)

- Represents the shares described in the table other than shares held by Mr. Maxey, plus an additional 203,486 shares beneficially owned by three other executive officers, of which 199,322 are shares subject to stock options exercisable within 60 days of the Record Date.

10

REPORT ON EXECUTIVE COMPENSATION

This report of the Compensation Committee is required by the SEC and shall not be deemed to be incorporated by reference by any general statement incorporating this Proxy Statement into any filing under the Securities Act of 1933, as amended (the "Securities Act"), or under the Securities Exchange Act of 1934, as amended (the "Exchange Act") except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed soliciting material or filed under such acts.

Final decisions regarding executive compensation and stock option grants to executives and employees are made by the Compensation Committee of the Board. The Compensation Committee is currently composed of three non-employee directors, but during all of 2002 was composed of two non-employee directors. John Coné joined the Compensation Committee in January 2003 and was not involved with decisions relating to 2002 compensation.

General Compensation Policy

The Compensation Committee acts on behalf of the Board to establish the general compensation policy for executive officers of Click2learn. Executive compensation generally consists of base salary, bonus or revenue-based incentive compensation (for executives with direct revenue generating responsibility), stock options and participation in benefit plans generally available to Click2learn employees. The Compensation Committee reviews the general executive bonus plan and individual incentive compensation plans for certain executive officers who do not participate in the general executive bonus plan at or about the beginning of each year. The Compensation Committee also administers Click2learn's incentive and equity plans, including the Incentive Plan, the Directors Plan, the 1999 Employee Stock Purchase Plan (the "Purchase Plan"), and the IntelliPrep 2000 Equity Incentive Plan (which was assumed by Click2learn but under which new options cannot be granted). The Compensation Committee also designates the persons eligible to participate in Click2learn's Change of Control Executive Severance Plan.

The Compensation Committee's general philosophy in compensating executive officers, including the Chief Executive Officer, is to relate compensation to corporate performance. Long-term equity incentives for executive officers are accomplished through grants of stock options under the Incentive Plan. Stock options generally have value for the executive only if the price of Click2learn's stock increases above the fair market value on the grant date and the executive remains employed by Click2learn for the period required for the shares to vest. In addition, the executive bonus plan or individual incentive compensation plans have accounted for a significant portion of the target compensation for executive officers. Bonuses have been tied to the achievement of corporate performance targets set by the Board, while executives with revenue generating responsibility have incentive compensation plans tied to the revenue for which they are responsible.

The base salaries and stock option grants of the executive officers are determined in part by the Compensation Committee informally reviewing data on prevailing compensation practices in similar technology companies and evaluating such information in connection with Click2learn's corporate goals and budget. With respect to the base salaries and revenue-based incentive compensation plans of executive officers other than the CEO, the Compensation Committee generally follows the recommendations of the CEO. In addition to their base salaries, Click2learn's executive officers, including the CEO, are each eligible to participate in the Incentive Plan and the Purchase Plan.

In preparing the stock price performance graph included with this Proxy Statement, Click2learn used the Nasdaq Computer Index as its published line of business index. However, the compensation practices of most of the companies in the Nasdaq Computer Index are not reviewed by the Compensation Committee when setting executive salaries because such companies generally are not competitive with Click2learn for executive talent.

11

Executive Compensation

Base Compensation. In 2002 the base salary level for each executive officer other than the CEO was based primarily on the recommendations of the CEO. The CEO's base compensation was paid in accordance with his Employment Agreement originally approved by the Compensation Committee in 2000, which expired in 2002, and a new Employment Agreement approved by the Compensation Committee in March 2002. During the second half of 2002 each of Click2learn's executives voluntarily accepted a reduction in base salary of 10 to 20% as part of Click2learn's overall expense reduction efforts. Salaries were restored to their prior levels as of January 1, 2003. The Compensation Committee does not anticipate that executive compensation will be increased over 2002 levels (without taking into account voluntary reductions) during 2003.

Incentive Compensation. Under the 2002 executive bonus plan, bonus payments were tied to corporate financial performance goals established by the Board. During 2002 these goals were not met and Click2learn did not pay cash bonuses to its executive officers. There is currently no executive bonus plan in place for 2003. In light of Click2learn's ongoing efforts to reduce expenses, the Compensation Committee does not anticipate that an executive bonus plan will be adopted for 2003, although the Compensation Committee may approve individual bonuses to certain executives on a case by case basis. Certain executives with revenue generating responsibility do not participate in the executive bonus plan, but have incentive compensation plans tied to the revenue for which they are responsible. These revenue-based incentive plans will remain in effect during 2003.

Stock Options. Stock options are granted to executive officers as incentives to become employees or to aid in the retention of executive officers and to align their interests with those of the stockholders. Stock options typically have been granted to executive officers when the executive first joins Click2learn, in connection with a significant change in responsibilities and to reward continued performance. The Compensation Committee may, however, grant additional stock options to executives for other reasons. The number of shares subject to each stock option granted is within the discretion of the Compensation Committee and is based on anticipated future contribution and ability to impact corporate and/or business unit results, past performance or consistency within the executive's peer group. In the discretion of the Compensation Committee, executive officers may also be granted stock options under the Incentive Plan to provide a greater incentive to continue their employment with Click2learn and to strive to increase the value of Click2learn's common stock. In October 2002 each of the executives, including the CEO, was granted additional stock options based on a formula of one additional option for every two options currently held under the Incentive Plan with exercise prices in excess of $2.00. These options become exercisable as to 50% of the total number of shares on each of the first and second anniversaries of the grant date have an exercise price per share of $0.80, which was the fair market value of a share of Click2learn's common stock on the grant date.

Company Performance and CEO Compensation. Mr. Oakes' compensation during 2002 was fixed by an Employment Agreement originally approved by the Compensation Committee in January 2000, which expired during the year, and a new Employment Agreement that was approved in March 2002. In determining Mr. Oakes' base salary under the new Employment Agreement, the Compensation Committee considered Mr. Oakes' performance in moving Click2learn from primarily a service business to an enterprise software company, revenue growth related to Click2learn's Aspen Enterprise Productivity Suite and progress toward generating positive cash flow and profitable operations. The new Employment Agreement did not change Mr. Oakes' compensation from that in effect under the prior Employment Agreement. Mr. Oakes' current Employment Agreement is described in more detail on page 16 of this Proxy Statement. Mr. Oakes' potential for bonus compensation in 2002 was based on achievement of corporate financial goals related to revenue and profitability. Mr. Oakes did not receive bonus compensation in 2002. He received a grant of 191,125 stock options as part of the October 2002 grants to executives.

12

Compliance with Section 162(m) of the Internal Revenue Code of 1986. Click2learn intends to comply with the requirements of Section 162(m) of the Internal Revenue Code. Click2learn does not expect cash compensation for any executive officer during 2003 to be in excess of $1,000,000 or consequently to be affected by the requirements of Section 162(m).

| | THE COMPENSATION COMMITTEE

Bert Kolde, Chairman

Edward Harris

John Coné |

13

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table sets forth certain summary information concerning the compensation awarded to, earned by, or paid for services rendered to Click2learn in all capacities the three fiscal years ended December 31, 2002 by the Named Executive Officers.

| |

| |

| |

| | Long Term Compensation Awards

|

|---|

| |

| | Annual Compensation

|

|---|

Name and Principal Position

| |

| | Securities Underlying Options(#)

|

|---|

| | Year

| | Salary($)

| | Bonus($)

|

|---|

Kevin M. Oakes

President and Chief Executive Officer | | 2002

2001

2000 | | $

| 228,846

245,192

244,615 | |

$ | —

—

85,058 |

(1) | 191,125

225,000

100,000 |

Sudheer Koneru(2)

Chief Operating Officer |

|

2002

2001 |

|

$

|

176,558

72,500 |

|

|

—

— |

|

63,750

52,363 |

John D. Atherly

Chief Financial Officer |

|

2002

2001

2000 |

|

$

|

163,894

171,635

159,538 |

|

$ |

—

—

43,904 |

(1) |

82,500

70,000

— |

Lee Maxey(3)

Chief Learning Officer |

|

2002

2001

2000 |

|

$

|

142,788

8,654

62,493 |

|

$

|

25,000

—

16,497 |

(1) |

40,000

80,000

— |

Srinivasan Chandrasekar(2)

Executive Vice President, Products and Strategy |

|

2002

2001 |

|

$

|

139,327

55,769 |

|

|

—

— |

|

32,500

99,259 |

- (1)

- Includes certain bonus or incentive compensation/commissions earned in the fourth quarter of 1999 but not paid until 2000 as well as bonus or incentive compensation/commissions earned and paid in 2000.

- (2)

- Mr. Koneru and Mr. Chandrasekar joined Click2learn in May 2001 in connection with the acquisition of IntelliPrep.

- (3)

- Mr. Maxey left Click2learn in August 2000 and rejoined Click2learn in December 2001 as Chief Learning Officer. Mr. Maxey's employment as Chief Learning officer terminated in January 2003. 2002 bonus payment reflects non-refundable advance against commission payments.

14

Option and SAR Grants in Fiscal 2002

The following table sets forth certain information regarding stock options granted to each of the Named Executive Officers during the year ended December 31, 2002. No stock appreciation rights were granted in the year ended December 31, 2002.

| | Individual Grants(1)

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(4)

|

|---|

| | Number of Securities Underlying Options Granted(#)

| | % of Total Options Granted to Employees in Fiscal Year(2)

| |

| |

|

|---|

Name

| | Exercise or Base Price Per Share ($/Sh)(3)

| | Expiration Date

|

|---|

| | 5%($)

| | 10%($)

|

|---|

| Kevin M. Oakes | | 191,125 | | 7.61 | % | $ | 0.80 | | 10/29/12 | | $ | 96,158 | | $ | 243,683 |

Sudheer Koneru |

|

40,000

23,750 |

|

1.59

0.95 |

|

|

2.85

0.80 |

|

2/15/12

10/29/12 |

|

|

71,694

11,949 |

|

|

181,687

30,281 |

John D. Atherly |

|

82,500 |

|

3.28 |

|

|

0.80 |

|

10/29/12 |

|

|

41,507 |

|

|

105,187 |

Lee Maxey |

|

40,000 |

|

1.59 |

|

|

0.80 |

|

4/1/03 |

|

|

20,125 |

|

|

51,000 |

Srinivasan Chandrasekar |

|

32,500 |

|

1.29 |

|

|

0.80 |

|

10/29/12 |

|

|

16,351 |

|

|

41,437 |

- (1)

- Options were granted under the Incentive Plan. The options with an exercise price of $2.85 become exercisable with respect to 25% of the shares covered by the option on the first anniversary of the date of grant and with respect to an additional 2.083% of the total number of shares each month thereafter. The options with an exercise price of $0.80 become exercisable with respect to 50% of the shares covered by the option on each of the first and second anniversary of the date of grant. The Incentive Plan provides that upon a change in control transaction or sale of substantially all of Click2learn's assets, the options may be assumed, converted or replaced by substantially equivalent awards and that if the acquiring entity fails to do, the options become fully exercisable immediately prior to such transaction. However, under the Change in Control Severance Plan adopted in 2002, vesting is accelerated if the Named Executive Officer is terminated without cause or terminates with good reason (as defined in the Change of Control Plan) within 12 months following a change of control transaction. Mr. Oakes employment agreement contains certain additional terms related to the vesting of his options upon a change of control transaction. All options have a term of ten years.

- (2)

- We granted options to purchase an aggregate of 2,512,221 shares of common stock to all employees during 2002.

- (3)

- Options were granted at an exercise price equal to the fair market value of our common stock as determined by its closing price on the Nasdaq National Market on the date of grant, to the nearest whole cent.

- (4)

- Potential realizable value is based on the assumption that common stock appreciates at the annual rate shown (compounded annually) from the date of grant until the expiration of the ten-year term. These numbers are calculated based on SEC requirements and do not reflect our projection or estimate of future stock price growth.

- (5)

- Mr. Maxey's employment terminated in January 2003 and his options expired three months following his termination date.

15

Option Exercises and Fiscal Year End Option Values

The following table sets forth for each of the Named Executive Officers the number of exercisable and unexercisable options held at December 31, 2002. No Named Executive Officer held in-the-money options at December 31, 2002 and none of the Named Executive Officers exercised options in 2002.

| | Number of Securities Underlying Unexercised Options at 12/31/02(1)

|

|---|

Name

|

|---|

| | Exercisable(#)

| | Unexercisable(#)

|

|---|

| Kevin M. Oakes | | 209,854 | | 363,521 |

John D. Atherly |

|

167,200 |

|

131,875 |

Sudheer Koneru |

|

25,768 |

|

90,345 |

Lee Maxey |

|

20,000 |

|

100,000 |

Srinivasan Chandrasekar |

|

37,176 |

|

94,583 |

- (1)

- Options shown were granted under both the Incentive Plan and the 1995 Combined Incentive and Non-qualified Stock Option Plan. All options have a term of ten years.

Employment Agreements

On March 20, 2002, we entered into a two-year Employment Agreement with Mr. Oakes. Pursuant to this agreement, Mr. Oakes will receive an annual salary of $250,000, have a target bonus of 40% of his annual salary, and be eligible to receive a maximum bonus of 100% of his annual salary. If Mr. Oakes is terminated without cause (including termination resulting from a merger, change in control or acquisition of Click2learn or substantially all of its assets) prior to the end of the agreement term, Mr. Oakes will be entitled to receive severance pay equal to his salary for the greater of the remaining term of the Employment Agreement or six months. In the event of certain transactions that result in a change in control of Click2learn or the sale of substantially all of its assets, all of Mr. Oakes unvested options will accelerate and become exercisable immediately prior to the closing of such a transaction.

Termination of Employment and Change in Control Arrangements

On July 16, 2002 the Board adopted the Change of Control Executive Severance Plan (the "Change of Control Plan") which provides benefits to each of the Named Executive Officers and certain other executives if they are terminated in connection with a change in control of Click2learn. These benefits become available to a Named Executive Officer who is terminated without cause or who terminates his employment with good reason prior to or within 12 months following a change in control transaction. In the event of such a termination, the vesting of any stock options held by the Named Executive Officer would be accelerated and the Named Executive Officer would be entitled to severance pay based on his length of continuous employment with Click2learn and/or the acquiring company as follows:

Length of Employment

| | Severance Period

|

|---|

| Less than 2 years | | 3 months |

| 2 - 4 years | | 6 months |

| 4 - 6 years | | 9 months |

| 6 or more years | | 12 months |

Such severance is payable either on regular payroll dates over the severance term or in a lump sum at the option of the acquiring company. If a Named Executive Officer is also entitled to severance

16

payments on a change in control pursuant to his employment agreement or because a severance plan is made available to employees generally, such benefits will not be cumulative, but the Named Executive Officer will be entitled to receive the greater of the amounts due under the Change of Control Plan or under the employment agreement or generally available severance plan.

The Incentive Plan contains certain additional provisions relating to the acceleration of option vesting in the event of a change in control. These provisions are described on page 15 in note (1) to the table Options and SAR Grants in Fiscal 2002.

17

COMPANY STOCK PRICE PERFORMANCE

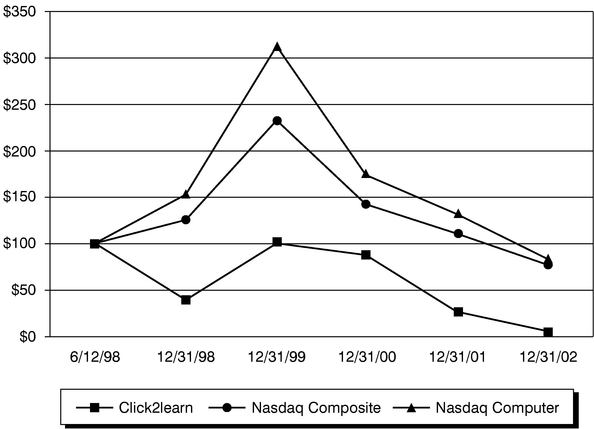

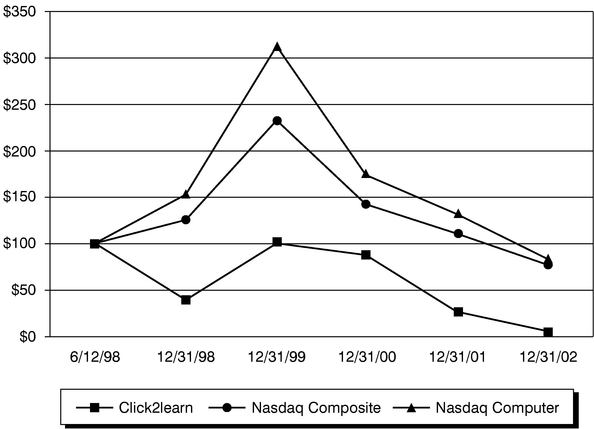

The stock price performance graph below is required by the SEC and shall not be deemed to be incorporated by reference by any general statement incorporating this Proxy Statement into any filing under the Securities Act or under the Exchange Act, except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed soliciting material or filed under such Acts.

The graph below compares the cumulative total stockholder return on (1) the common stock of Click2learn with (2) the Nasdaq Composite Index and (3) the Nasdaq Computer Index from June 12, 1998 (the effective date of Click2learn's registration statement with respect to the Click2learn initial public offering) to December 31, 2002 (assuming the investment of $100 in the Click2learn's common stock and in each of the other indices on the date of Click2learn's initial public offering, and reinvestment of all dividends).

The comparisons in the graph below are based on historical data and are not intended to forecast the possible future performance of Click2learn's common stock.

Prior to June 12, 1998 our common stock was not publicly traded. Comparative data is provided only for the period since that date. The stock price performance shown on the graph above is not necessarily indicative of future price performance. Information used in the graph was obtained from the Nasdaq National Market, a source believed to be reliable, but we are not responsible for any errors or omissions in such information.

18

REPORT OF THE AUDIT COMMITTEE

This report of the Audit Committee is required by the SEC and shall not be deemed to be incorporated by reference by any general statement incorporating this Proxy Statement by reference into any filing under the Securities Act, or under the Exchange Act except to the extent that we specifically incorporate this information by reference, and shall not otherwise be deemed soliciting material or filed under such acts.

The Audit Committee has reviewed and discussed Click2learn's audited financial statements included in the Annual Report on Form 10-K with management and KPMG LLP, Click2learn's independent auditors. The Audit Committee discussed with the independent auditors the matters required to be discussed by Statement on Auditing Standards No. 61. The Audit Committee also discussed with the independent auditors such auditors' independence from Click2learn and its management and has reviewed and discussed the written disclosures and letter from the independent auditors required by Independence Standards Board Standard No. 1. Based on the reviews and discussions described above, the Audit Committee recommended to the Board that Click2learn's audited financial statements be included in Click2learn's Annual Report on Form 10-K for the fiscal year ended December 31, 2002.

The aggregated fees billed for professional services rendered by KPMG LLP for the year ended December 31, 2002 are as follows:

| • | | Audit Fees (for the audit of our annual financial statements for the year ended December 31, 2002 and reviews of our quarterly financial statements) | | $151,000 |

• |

|

Financial Information Systems Design and Implementation Fees (for designing or implementing a hardware or software system that aggregates source data underlying our financial statements or generates information that is significant to the financial statements taken as a whole) |

|

None |

• |

|

All Other Fees (for all other services rendered during the year ended December 31, 2002, excluding the audit of our annual financial statements for the year ended December 31, 2002) |

|

$10,000 |

The Audit Committee has considered whether the provision of financial information and systems design and implementation services and other services is compatible with maintaining the independence of KPMG LLP. Less than fifty percent of the hours expended on KPMG's LLP's engagement to audit our financial statements for the year ended December 31, 2002 were attributed to work performed by persons other than the full-time, permanent employees of KPMG LLP.

| | THE AUDIT COMMITTEE

Ronald S. Posner, Chairman

John Coné

Jonathan Morgan

Vijay Vashee |

19

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Since January 1, 2002 there has not been, nor is there currently proposed, any transaction or series of similar transactions to which we or any of our subsidiaries was or is to be a party in which the amount involved exceeded or will exceed $60,000 and in which any director, executive officer, holder of more than 5% of our common stock or any member of the immediate family of any of the foregoing persons had or will have a direct or indirect material interest other than compensation agreements and other arrangements, which are described where required in "Executive Compensation."

STOCKHOLDER PROPOSALS

Proposals which stockholders wish to be considered for inclusion in the Proxy Statement and proxy card for the 2004 Annual Meeting of Stockholders must be received by the Secretary at our principal executive offices by December 23, 2003 and must comply with the requirements of Rule 14a-8 under the Exchange Act.

In addition, our Bylaws include advance notice provisions that require stockholders desiring to bring nominations or other business before an annual stockholders meeting to do so in accordance with the terms of the advance notice provisions. These advance notice provisions require that, among other things, stockholders give timely written notice to the Secretary regarding such nominations or other business. To be timely, a notice must be delivered to the Secretary at our principal executive offices no earlier than February 27, 2004 and no later than March 29, 2004 in order to be considered at the meeting, unless such meeting is held before April 28, 2004 or after July 27, 2004, in which case such proposals must be received by the Secretary at our principal executive offices no earlier than the close of business on the 90th day prior to meeting date and no later than the later of (i) the close of business on the 60th day prior to the meeting date or (ii) the close of business on the 10th day following the day we first make a public announcement of the meeting date.

Notwithstanding the foregoing, if the number of Class III directors to be elected at the meeting is increased and we make no public announcement before March 19, 2004 (or if such meeting is held before April 28, 2004 or after July 27, 2004, then before the 70th day prior to the meeting date) naming all of the nominees for Class III directors or specifying the increased number of Class III directors to be elected at the meeting, then proposals for nominees for any new positions created by the increase in the number of Class III directors (but not proposals for any other business) must be received by the Secretary at our principal executive offices no later than the close of business on the 10th following the day we first make a public announcement of increase in the number of Class III directors.

We reserve the right to reject, rule out of order, or take other appropriate action with respect to any proposal that does not comply with these and other applicable requirements. In addition, if we receive notice of a shareholder proposal after March 29, 2004, the persons named as proxies in the proxy statement for the 2004 annual meeting will have discretionary authority to vote such proposal at such annual meeting.

Our Annual Report on Form 10-K as filed with the Securities and Exchange Commission for the year ended December 31, 2002 is available without charge at www.click2learn.com/investor or by writing to or calling our headquarters. Requests should be directed to our Investor Relations Department at 110–110th Avenue NE, Bellevue, Washington 98004, or ir@click2learn.com.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16 of the Exchange Act requires directors and officers, and persons who own more than 10% of Click2learn's common stock, to file initial reports of ownership and reports of changes in ownership with the SEC and the Nasdaq National Market. Such persons are required by SEC regulation to furnish us with copies of all Section 16(a) forms they file. Based solely on our review of

20

the copies of such forms provided to us, we believe that WM Advisors Inc. did not file a Form 4 with respect to any transactions during the year nor a Form 5 for 2002, Ron Posner was late filing a Form 4 for an option to purchase 15,000 shares granted on September 3, 2002, and Sudheer Koneru filed an amended Form 5 after the due date.

OTHER BUSINESS

The Board does not presently intend to bring any other business before the Meeting, and, so far as is known to the Board, no matters are to be brought before the Meeting except as specified in the notice of the Meeting. As to any business that may properly come before the Meeting, however, it is intended that proxies, in the form enclosed, will be voted in respect thereof in accordance with the judgment of the persons voting such proxies.

WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE COMPLETE, DATE, SIGN AND PROMPTLY RETURN THE ACCOMPANYING PROXY IN THE ENCLOSED POSTAGE-PAID ENVELOPE SO THAT YOUR SHARES WILL BE REPRESENTED AT THE MEETING.

21

APPENDIX 1

CLICK2LEARN, INC.

AUDIT COMMITTEE CHARTER

Adopted By the Board of Directors on January 23, 2003

1. Purpose and Authority

The Audit Committee (the "Committee") shall assist the Board in its oversight of (1) the integrity of the Company's financial statements, (2) the independent auditor's qualifications and independence, (3) the performance of the Company's independent auditors, and (4) compliance with the Company's code of ethics for senior financial officers. The Committee shall have the ultimate authority and responsibility to select, evaluate and, where appropriate, replace the independent auditor. The Committee shall also have all authority necessary to fulfill the duties and responsibilities assigned to the Committee in this Charter or otherwise assigned to it by the Board.

As the Committee deems appropriate, it may retain independent counsel, accounting and other professionals to assist the Committee without seeking Board approval with respect to the selection, fees or terms of engagement of any such advisors, and the Company shall pay any such fees as directed by the Committee.

The Committee when appropriate may form and delegate authority to subcommittees and may delegate authority to one or more designated members of the Committee.

2. Composition

The Committee shall be composed of three or more directors, as determined by the Board, each of whom shall meet the independence requirements of the Nasdaq Stock Market and applicable law and regulations and be financially literate. At least one Committee member shall have employment experience in finance or accounting, requisite professional certification in accounting, or any other comparable experience or background which results in the individual's financial sophistication, including being or having been a chief executive officer, chief financial officer or other senior officer with financial oversight responsibilities, and whenever possible at least Committee member shall have through education and experience as a public accountant or auditor or a principal financial officer, comptroller or principal accounting officer or from performance of similar functions, sufficient financial expertise in accounting and auditing so as to be a "financial expert," in accordance with such regulations as may be applicable to the Company from time to time.

The members of the Committee shall be appointed by the Board. The Board may remove any member from the Committee at any time with or without cause.

3. Duties and Responsibilities

The Committee shall have the following duties and responsibilities, in addition to any duties and responsibilities assigned to the Committee from time to time by the Board.

Engagement of Independent Auditor

- •

- Select and retain the independent auditor; determine and approve compensation of the independent auditor; resolve disagreements between management and the independent auditor; oversee and evaluate the independent auditor and, where appropriate, replace the independent auditor, with the understanding that the independent auditor shall report directly to the Committee and shall be ultimately accountable to the Committee and to the Board, as representatives of the shareholders of the Company.

22

- •

- Pre-approve the retention of the independent auditor for all audit and such non-audit services as the independent auditor is permitted to provide the Company and approve the fees for such services. Pre-approval of audit and non-audit services shall not be delegated to management, but may be delegated to one or more independent members of the Committee so long as that member or members report their decisions to the Committee at all regularly scheduled meetings. In considering whether to pre-approve any non-audit services, the Committee or its delegees shall consider whether the provision of such services is compatible with maintaining the independence of the auditor.

- •

- Ensure that the Committee's approval of any non-audit services is publicly disclosed pursuant to applicable laws, rules and regulations.

Evaluate Independent Auditor's Qualifications, Performance and Independence

- •

- At least annually, evaluate the independent auditor's qualifications, performance and independence, including that of the lead partner.

- •

- At least annually, obtain and review the letter and written disclosures from the independent auditor consistent with Independence Standards Board Standard No. 1, including a formal written statement by the independent auditor delineating all relationships between the auditor and the Company; actively engage in a dialogue with the auditor with respect to that firm's independence and any disclosed relationships or services that may impact the objectivity and independence of the auditor; and take, or recommend that the Board take, appropriate action to oversee the independence of the outside auditor.

- •

- Discuss with the independent auditor the matters required to be discussed by Statement of Auditing Standards ("SAS") No. 61,Communications with Audit Committee, SAS No. 89,Audit Adjustments, and SAS No. 90,Audit Committee Communications, all as amended from time to time, together with any other matters as may be required for public disclosure or otherwise under applicable laws, rules and regulations.

- •

- Ensure that the independent auditor's lead partner and reviewing partner are replaced every five years. Consider, from time to time, whether a rotation of the independent auditing firm would be in the best interests of the Company and its shareholders.

- •

- Present the Committee's conclusions regarding the performance, qualifications and independence of the independent auditor to the full Board.

Review Financial Statements and Financial Disclosure

- •

- Meet with management and the independent auditor to review and discuss the annual audited financial statements and quarterly financial statements, including the Company's disclosures under "Management's Discussion and Analysis of Financial Condition and Results of Operations," and the report of the independent auditor thereon and to discuss any significant issues encountered in the course of the audit work, including any restrictions on the scope of activities, access to required information or the adequacy of internal controls.

- •

- Review with the independent auditor any audit problems or difficulties and management's response, including significant disagreements with management, adjustments noted by the independent auditor but not taken by management, communications between the audit team and the national office, and any management or internal control letters issued or proposed to be issued.

23

- •

- Determine (based on its review and discussion of the audited financial statements with management and the independent auditor, its discussions with the independent auditor regarding the matters required to be discussed by SAS 61, and its discussions regarding the auditor's independence), whether or on not to recommend to the Board that the audited financial statements be included in the Company's annual report on Form 10-K and report to the Board on such determination.

Periodic Assessment of Accounting Practices and Policies and Risk and Risk Management

- •

- Obtain and review timely reports from the independent auditor regarding (1) all critical accounting policies to be used, (2) all alternative treatments of financial information within GAAP that have been discussed with management, ramifications of the use of such alternative disclosures and treatments, and the treatment preferred by the independent auditor, and (3) other material written communications between the independent auditor and management, such as any management letter or schedule of unadjusted differences.

- •

- Review with management and the independent auditor the effect on the financial statements of the Company of regulatory and accounting initiatives, as well as off-balance sheet structures.

- •

- Review changes in promulgated accounting and auditing standards that may materially affect the Company's financial reporting practices.

- •

- Review any reports by management regarding the effectiveness of, or any deficiencies in, the design or operation of internal controls and any fraud, whether or not material, that involves management or other employees who have a significant role in the Company's internal controls. Review any report issued by the Company's independent auditor regarding management's assessment of the Company's internal controls.

Related-Party Transactions

- •

- Review and approve all related-party transactions, including transactions between the Company and its officers or directors or affiliates of officers or directors.

Review of Internal Controls and Procedures

- •