FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of August 2003

CLP Holdings Limited

(Registrant’s name in English)

147 Argyle Street

Kowloon, Hong Kong

(Address of Registrant’s principal executive office)

Indicate by check mark whether the Registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark whether the Registrant by furnishing this information contained in this Form is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

If “Yes” is marked, indicate below the file number assigned to the Registrant in connection with Rule 12g3-2(b): 82-_________

Registrant hereby incorporates by reference in the report on Form 6-K the following Exhibit:

Exhibit

The Interim Report 2003 (January — June) which was despatched to shareholders on 29 August 2003.

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | |

| | | | | CLP HOLDINGS LIMITED |

| |

| | | | | |

| |

| | | By: | | / s / April Chan

|

| | | Name: | | April Chan |

| | | Title: | | Deputy Company Secretary |

| |

| Date: 2 September 2003 | | | | |

3

Exhibit

| | | |

| | | CONTENTS |

| | | |

| | | |

| 1 | | Performance Highlights |

| | | |

| 5 | | Chairman’s Statement |

| | | |

| 7 | | Management’s Discussion and Analysis |

| | | |

| 19 | | Condensed Consolidated Profit and Loss Account |

| | | |

| 20 | | Condensed Consolidated Balance Sheet |

| | | |

| 21 | | Condensed Statement of Changes in Equity |

| | | |

| 22 | | Condensed Consolidated Cash Flow Statement |

| | | |

| 23 | | Notes to the Condensed Interim Accounts |

| | | |

| 41 | | Scheme of Control Statement |

| | | |

| 42 | | Independent Review Report |

| | | |

| 43 | | Disclosure of Interests |

| | | |

| 43 | | - Interests of Directors and Chief Executive Officer |

| | | |

| 45 | | - Interests of Substantial Shareholders |

| | | |

| 46 | | - Interests of Any Other Persons |

| | | |

| 47 | | Corporate Governance |

| | | |

| 47 | | Purchase, Sale or Redemption of the Company’s Listed Shares |

| | | |

| 48 | | Information for our Investors |

Page 1

Performance Highlights

| | | | | | | | | | | | | | |

| | | | | | | | | | | | Increase/ | |

| | | | 6 months ended 30 June | | | (Decrease) | |

| | | |

| | |

| |

| | | | 2003 | | | 2002 | | | (%) | |

| | | | | | | | | | | | |

| Earnings per share, HK$ | | | | | | | | | | | | |

| | Including Hok Un redevelopment profit | | | 1.54 | | | | 1.42 | | | | 8.2 | |

| | Excluding Hok Un redevelopment profit | | | 1.52 | | | | 1.37 | | | | 11.1 | |

| | | | | | | | | | | | | |

| Dividends per share, HK$ | | | 0.82 | | | | 0.76 | | | | 7.9 | |

Dividend, HK$M | | | 1,974 | | | | 1,830 | | | | 7.9 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | |

| Turnover, HK$M | | | 11,871 | | | | 11,804 | | | | 0.6 | |

| | | | | | | | | | | | | |

| Earnings, HK$M | | | | | | | | | | | | |

| | Scheme of Control earnings | | | 3,045 | | | | 2,829 | | | | 7.6 | |

| | Non-Scheme of Control operating earnings | | | 710 | | | | 568 | | | | 25.0 | |

| | Unallocated net finance costs | | | (33 | ) | | | (41 | ) | | | | |

| | Unallocated Group expenses | | | (59 | ) | | | (59 | ) | | | | |

| | |

| |

| | | | |

| | Total operating earnings | | | 3,663 | | | | 3,297 | | | | 11.1 | |

| | Hok Un redevelopment profit | | | 51 | | | | 134 | | | | | |

| | |

| |

| | | | |

| | Total earnings | | | 3,714 | | | | 3,431 | | | | 8.2 | |

| | |

| |

| | | | |

Interest cover1 | | 14.5 times | | | 30.5 times

| | | | | |

| Capital expenditure, HK$M | | | | | | | | | | | | |

| | Scheme of Control business | | | 2,295 | | | | 1,857 | | | | | |

| | Associated Hong Kong generating companies | | | 606 | | | | 288 | | | | | |

| | Non-Scheme of Control business | | | 97 | | | | 9 | | | | | |

| | | | | | | | | | | | | |

| Sales analysis (Scheme of Control), millions of kWh | | | | | | | | | | | | |

| | Commercial | | | 4,936 | | | | 4,984 | | | | (1.0 | ) |

| | Manufacturing | | | 1,348 | | | | 1,459 | | | | (7.6 | ) |

| | Residential | | | 2,857 | | | | 2,791 | | | | 2.4 | |

| | Infrastructure and Public Services | | | 3,340 | | | | 3,265 | | | | 2.3 | |

| | |

| |

| | | | |

| | Local | | | 12,481 | | | | 12,499 | | | | (0.1 | ) |

| | Chinese mainland | | | 1,153 | | | | 1,197 | | | | (3.7 | ) |

| | |

| |

| | | | |

| | Total electricity sales | | | 13,634 | | | | 13,696 | | | | (0.5 | ) |

| | |

| |

| | | | |

Page 2

| | | | | | | | | | | | | | | |

As at the balance sheet date | | | | | | | | | | | |

| | | | | 30 June | | | 31 December | | | Increase/ | |

| | | 2003 | | | 2002 | | | (Decrease) | |

| | |

| | |

| | |

| |

| Fixed assets, HK$M | | | | | | | | | | | | |

| | Scheme of Control business | | | 37,604 | | | | 36,273 | | | | 1,331 | |

| | Non-Scheme of Control business | | | 13,689 | | | | 277 | | | | 13,412 | |

| | |

| | |

| | |

| |

| | | | 51,293 | | | | 36,550 | | | | 14,743 | |

| | |

| | |

| | |

| |

| | | | | | | | | | | | | |

| Shareholders’ funds per share, HK$ | | | 15.79 | | | | 15.32 | | | | | |

| | | | | | | | | | | | | |

| Total shareholders’ funds, HK$M | | | 38,020 | | | | 36,888 | | | | 1,132 | |

| Total indebtedness, HK$M | | | | | | | | | | | | |

| | Scheme of Control business | | | 6,565 | | | | 6,742 | | | | (177 | ) |

| | Non-Scheme of Control business | | | | | | | | | | | | |

| | | - Yallourn Energy & GPEC | | | 7,458 | | | | — | | | | 7,458 | |

| | | - Other projects | | | 4,554 | | | | 2,555 | | | | 1,999 | |

| | |

| | |

| | |

| |

| | | | 18,577 | | | | 9,297 | | | | 9,280 | |

| | |

| | |

| | |

| |

| | | | | | | | | | | | | |

Total debt to total capital2, % | | | 32.8 | | | | 20.1 | | | | | |

| 1 | | Interest cover = Profit before taxation and interest / (interest charges + capitalised interest) |

| |

| 2 | | Total debt to total capital = debt / (shareholders’ funds + debt) |

Page 3

Page 4

Page 5

Chairman’s Statement

I am pleased to present our Interim Report for the half year ended 30 June 2003 and to record a satisfactory performance by the CLP Group over that period.

Financial Results for the Six-month Period

During the first half of 2003, CLP completed the acquisition of Powergen’s remaining interests in Yallourn Energy Pty Limited, Australia (Yallourn Energy) and Gujarat Paguthan Energy Corporation Private Limited, India (GPEC), which had previously been held through an 80:20 joint venture between CLP and Powergen. CLP now holds 92% and 100% of Yallourn Energy and GPEC respectively. As a result, these two major businesses are, for the first time, consolidated in CLP Holdings’ Report and Accounts.

The operating earnings of CLP Holdings for the six months ended 30 June 2003 increased by 11.1% to HK$3,663 million as compared with earnings for the corresponding period in 2002. Satisfactory growth was achieved from both the Scheme of Control and the non-Scheme of Control businesses. Total earnings, which include Hok Un redevelopment profit for this interim period, were HK$3,714 million (HK$1.54 per share), an increase of 8.2%, compared to HK$3,431 million (HK$1.42 per share) in 2002.

Earnings from the Scheme of Control electricity business in Hong Kong increased by 7.6% to HK$3,045 million. CLP Power’s capital expenditure on the transmission and distribution networks and other facilities totalled HK$2,295 million (2002: HK$1,857 million), whilst capital expenditure by associated Hong Kong generating companies was HK$606 million (2002: HK$288 million).

Operating earnings from non-Scheme of Control activities grew from HK$568 million to HK$710 million, an increase of 25% compared to the same period in 2002. This was mainly due to strong earnings contribution from power projects in the Chinese mainland and incorporation of a full six months profits from Ho-Ping Power Station in Taiwan which was commissioned in 2002.

Directors today declared the second interim dividend of HK$0.41 per share (2002: HK$0.38 per share) which will be payable on 15 September 2003 to shareholders registered as at 1 September 2003. The Register of Shareholders will be closed on 2 September 2003.

Business Performance

Our major businesses in Hong Kong, the Chinese mainland and the Asia-Pacific region (outside the Mainland) performed satisfactorily during the first six months of 2003. The Scheme of Control electricity business in Hong Kong remained the main source of revenue, contributing 81% of our operating earnings (2002: 83%), while the non-Scheme of Control businesses generated 19% (2002: 17%).

Sales of electricity in Hong Kong in the first half of 2003 decreased slightly by 0.1% compared with the same period last year. Despite the 3.9% growth in the first quarter, our electricity sales were adversely affected by the cooler weather and the outbreak of severe acute respiratory syndrome (SARS) during the second quarter. However, local sales are now improving. On 15 July 2003, our local and system demand reached historical peaks of 5,874MW and 7,646MW respectively.

Page 6

Earnings from our electricity business in the Chinese mainland recorded strong growth. This is mainly attributable to the earnings from our joint venture power projects in Shandong, Beijing, Tianjin and Hebei.

Profit from our electricity business in the Asia-Pacific region was slightly lower than the same period last year, due to additional provision being made for higher tax requirement and on certain receivables, and development costs incurred for various projects.

Whilst more volatile than the Hong Kong Scheme of Control business, our activities in the Chinese mainland and the Asia-Pacific region are reaching the position to contribute meaningful income to the Group. This indicates that useful progress has been made in diversifying our business beyond the Hong Kong electricity business. We will continue to explore opportunities for greenfield developments and for acquisitions that increase shareholder value and take forward our development strategy in target markets.

The operational/financial performances and outlook for our businesses are reviewed in the “Management’s Discussion and Analysis” section of this Interim Report.

Challenges after the SARS Outbreak

The SARS outbreak has been a major challenge for Hong Kong and, indeed, in other places where CLP carries on business, notably the Chinese mainland and Taiwan. The situation has improved, recovery is taking place, and we do not believe that the longer-term effects on our business will be material.

In Hong Kong, where the majority of our business is based, the dramatic decline in the activities of some industries, especially the tourism and restaurant sectors, has had a negative effect on the economy. As a result, we have joined forces with the business community to help stimulate the economic recovery of Hong Kong. This was done, most notably, through a special, one-off rebate package, amounting to HK$460 million in total, to all our customers in Hong Kong that we announced in May 2003. We have also supported and participated in a number of activities which aimed to draw the Hong Kong community together in the fight against SARS.

I would like to take this opportunity to thank all our employees for their continued dedication and application, during the SARS outbreak, in maintaining electricity supply to all our customers, both in Hong Kong and elsewhere in the region, and in ensuring that the Group’s affairs continued to be conducted effectively and without disruption.

The Hon. Michael D. Kadoorie

Hong Kong, 4 August 2003

Page 7

Management’s Discussion and Analysis

This section describes CLP’s major activities in Hong Kong, the Chinese mainland and elsewhere in the Asia-Pacific region, as well as the Group’s financial results, funding and obligations during the first half of 2003.

BUSINESS OVERVIEW

The CLP Group includes a vertically integrated electricity generation, transmission and distribution business in Hong Kong. The Group also invests in energy businesses in the Chinese mainland and the Asia-Pacific region and continues to explore selective opportunities in electricity-related businesses, which make use of existing assets, expertise and relationships. An outline of these activities is set out below:

Page 8

| | | | | | | | | | | |

| | | | | CLP Group's Investments |

| | | | |

|

| | | | | 30.6.2003 | | 31.12.2002 |

|

| Business Description | | Assets | | HK$M | | % | | HK$M | | % |

| Electricity Business in Hong Kong |

| |

l Electricity supplier since 1903

l Owner and operator of a vertically integrated electricity supply business, comprising: o Generation: 6,283 megawatts (MW) of installed generating capacity; o Transmission: over 11,000 kilometres of transmission and distribution lines; and o Distribution: 2.1 million customer accounts (about 80% of Hong Kong’s total population)

l 8.5% of electricity sales up to 30 June 2003 was for distribution to customers in Guangdong Province | | l 40% each of Black Point Power Station (2,500MW, when completed), Castle Peak Power Station (4,108MW) and Penny’s Bay Power Station (300MW)

l 100% of Transmission and Distribution System | | 42,884 | | 64 | | 42,395 | | 72 |

| | | | | | | | | | |

| Electricity Business in the Chinese Mainland and Asia-Pacific Region |

| |

| Chinese Mainland | | | | 5,992 | | 9 | | 6,337 | | 11 |

| |

l Developer and investor in power projects since 1985

l Largest external investor in the Mainland electricity industry

l Interests in generating assets in the Chinese mainland (3,163 equity MW) | | l 49% of CLP Guohua Power Company Limited, Beijing, Tianjin and Hebei (2,100MW)

l 49% of CLP Guohua Shenmu Power Company Limited, Shaanxi (200MW)

l 29.4% of Shandong Zhonghua Power Company, Shandong (3,000MW)

l 70% of Guizhou CLP Power Company Limited, Guizhou (600MW)

l 25% of Guangdong Nuclear Power Joint Venture Company, Limited, Guangdong (1,968MW)

l 49% of Hong Kong Pumped Storage Development Company, Limited, Guangdong (1,200MW)

l 41.5% of Huaiji Power Project, Guangdong (98MW) |

|

| |

| Asia-Pacific Region | | | | 16,285 | | 25 | | 8,030 | | 14 |

| |

l Developer, operator and investor in power projects since 1994

l Building a balanced portfolio of interests in generating assets in Australia, India, Taiwan and Thailand (3,729 equity MW) | | l 100% of Gujarat Paguthan Energy Corporation Private Limited, India (655MW)

l 92% of Yallourn Energy Pty Limited, Australia (1,450MW)

l 40% of Ho-Ping Power Company, Taiwan (1,320MW)

l 22.4% of Electricity Generating Public Company Limited, Thailand (2,207MW)

l 50% of BLCP Power Limited, Thailand (1,434MW) |

| |

| Electricity-Related Business |

| |

l Developer of electricity-related activities which use CLP’s existing assets and skills | | l Property redevelopment, engineering services, telecommunications, information technology and research and development | | 1,442 | | 2 | | 1,621 | | 3 |

Page 9

OPERATIONAL PERFORMANCE AND OUTLOOK

Electricity Business in Hong Kong

Total sales, including sales to the Chinese mainland, decreased by 0.5% in comparison with the same period last year.

Despite a very challenging economic environment in the first half of 2003, electricity sales to customers in Hong Kong decreased by only 0.1% compared to the same period in 2002. The decline was mainly due to a reduction of sales by 1% to the Commercial sector as a result of the cooler weather and the outbreak of the severe acute respiratory syndrome (SARS) in the second quarter. The most affected segments within this sector were tourism related services, retail, restaurants and transportation. Sales to the Manufacturing sector also recorded a 7.6% decrease, due to Hong Kong’s continuing transformation from a manufacturing to a services-based economy. Electricity sales to the Residential sector increased by 2.4%, in line with the increase in the number of customers. Sales to the Infrastructure and Public Services sector (formerly described as Government and Others sector) recorded sales growth of 2.3%, which was supported by continuing investment in Hong Kong’s infrastructure.

Our local and system demand reached historical peaks of 5,874MW and 7,646MW respectively in July.

The Infrastructure and Public Services sector has registered the largest growth among all our customer sectors during recent years. It is expected that demand from this sector will remain steady in the near future. For the Residential and Commercial sectors, future increase in demand will remain moderate. In particular, the Commercial sector still needs time to recover fully from the effect of SARS. Government and business initiatives to promote tourism should have a positive effect on the Commercial sector in the second half of the year. It is expected that demand for electricity in the Manufacturing sector will continue to weaken.

Sales to the Chinese mainland totalled 1,153GWh. Shekou’s demand grew by 14% in the first six months of the year. However, Guangdong Guang-Dian Power Grid Group Company Limited reduced its electricity purchase from CLP during the period.

In May 2003, CLP announced a special, one-off rebate package, amounting to HK$460 million in total, to be provided to all CLP’s customers in Hong Kong, as a move to support the local economy during the SARS outbreak. The Company was able to bring forward this rebate from the normal year-end cycle due to its excellent performance in managing costs. The rebate package resulted in about 95% of CLP’s customers receiving a full half-month electricity rebate.

To enhance supply quality and reliability, as well as to provide for demand created by new towns and infrastructure development projects in our supply area, CLP invested HK$2,295 million in the transmission and distribution networks as well as in customer services and other supporting facilities during the period.

Our unwavering commitment to a high standard of safety and health in the workplace continues to be recognised by the community. In June 2003, CLP received a total of eight awards in the Hong Kong Occupational Safety & Health Award 2003, jointly organised by the Hong Kong Occupational Safety & Health Council and the Labour Department.

Page 10

CLP attaches great importance to environmental protection. Over the years, CLP has successfully implemented initiatives such as the marketing of ash as combustion by-products, reduction of energy wastage, control of industrial and chemical wastes, energy saving in power stations, and energy efficiency advice to customers. Recently, initiatives have been extended from the operational environment to the office environment — “green office” programmes. CLP has been awarded four Gold Wastewi$e Logos and the Certificate of Merit from the Hong Kong Eco-Business Award in recognition of its efforts in this respect.

The current Scheme of Control Agreement, which regulates our Hong Kong electricity business, will expire in 2008. CLP is devoting considerable management resources to a thorough understanding of the implications of different regulatory systems for our Hong Kong electricity business. Working closely with all stakeholders, CLP aims to develop an outcome which will balance the legitimate interests of the Company, shareholders, employees and the community we serve. CLP and the Government have commenced discussions on the 2003 Scheme of Control Interim Review. We do not expect any major changes to the Scheme of Control Agreement arising from this regular five-yearly review process.

Electricity Business in the Chinese Mainland and Asia-Pacific Region

The Group continues to grow its business through diversification and through investment in the electricity sector in selected markets outside Hong Kong. Significant strides towards this goal have been made in recent years through our subsidiaries, CLP Power International and CLP Power China. In order to improve organisational effectiveness, optimise resource allocation, and enhance synergies, the operations of these two subsidiaries have been integrated into a single business unit, CLP Power Asia, with effect from 1 July 2003.

Chinese Mainland

CLP has a long history of successful investment in the Chinese mainland, dating back to the 1980’s. Currently the largest foreign power investor in the Mainland, investment in the Chinese mainland continues to be an integral part of our business strategy.

The four power stations, operated by CLP Guohua Power Company Limited (CLP Guohua), namely, Beijing Yire (2 x 200MW), Panshan (2 x 500MW) and Sanhe (2 x 350MW) and Shenmu II (2 x 100MW), have been operating satisfactorily and achieved higher than budget electricity sales in the first six months. Approved tariffs for all the four power stations have been implemented. CLP Guohua accomplished a new milestone in the area of environmental protection with all four stations achieving full accreditation of ISO14001.

The 3,000MW joint venture in Shandong Province continues to make good progress. Unit 1 of Heze II (2 x 300MW) entered into commercial operation in February 2003, and Unit 2 completed performance and environmental tests. Unit 1 of Liaocheng (2 x 600MW) is targeted to commence performance tests in the third quarter, while initial firing of Unit 2 was achieved in April 2003. Shiheng I and II (4 x 300MW) have been operating satisfactorily.

Construction of the 2 x 300MW coal-fired Anshun II Power Station of Guizhou CLP Power Company Limited (Guizhou CLP Power) in Guizhou Province is ahead of schedule and within budget. Full commercial operation is anticipated in 2004. The station is one of the projects designated by the State Development and Reform Commission to provide electricity to Guangdong.

Page 11

The Guangdong Daya Bay Nuclear Power Station operated smoothly with high level of safety and reliability in the first six months. The Station participated in and was awarded first place in Industrial Safety and Radiation Protection in the annual Reactor Safety Challenge Competition for 2002 organised by sister plants in France. It was also the first power station to attain ISO14001 accreditation in the electric power industry in the Chinese mainland.

Progress continues in the Huaiji joint venture, a hydroelectric project in Guangdong Province. The Chiangdiao Power Station was successfully commissioned, bringing the aggregate generating capacity of the joint venture to 82MW. The collection of electricity charges from the offtaker remains slow and requires intense monitoring. The Huaiji Project is an example of CLP’s initiatives to support renewable energy development. CLP has also commenced feasibility studies for the development of a 100MW wind power station on Hailing Island, Yangjiang in Guangdong Province and a 100MW wind farm on Nanao Island off the Guangdong coast.

Following the approval of power sector reform and the restructuring of the State Power Corporation, the future direction of the power industry in the Chinese Mainland is becoming clearer. The promotion of the Mainland power sector, including the continued introduction of modern management methods, together with increasing electricity demand resulting from China’s strong economic growth, presents opportunities for further development of our electricity business in the Mainland. Building on our long-standing presence and experience in the Mainland electricity industry, we are well positioned to take advantage of such opportunities.

Asia-Pacific Region

CLP has a significant presence in Australia, India, Taiwan and Thailand. With the completion of the acquisition of the remaining interests of Powergen UK plc (Powergen) in the joint venture companies relating to BLCP Power Limited (BLCP) (10%), Yallourn Energy (18.4%) and GPEC (20%) in January, April and June 2003 respectively, CLP now owns 100% of GPEC, 92% of Yallourn Energy and 50% of BLCP. As a consequence, GPEC and Yallourn Energy are now consolidated into the Group’s accounts as subsidiary companies.

GPEC’s 655 MW combined cycle power station has continued to operate well on the new supply of natural gas. It has achieved a high level of availability and has followed dispatch instructions from the Gujarat Electricity Board (GEB). In our Annual Report 2002, we noted GEB’s difficulties in making timely payments to GPEC. We have since entered discussions with GEB on the power purchase agreement to secure a more stable and sustainable billing environment. These discussions are making progress and we hope that the position will improve this year.

Longer-term business prospects in India depend on the Government’s ability to address the financial position of the State Electricity Boards and structural issues in the electricity supply industry. The Electricity Act that came into effect in June is a significant step in that direction.

In Australia, recently commissioned new generation capacity in Queensland has depressed pool prices in the National Electricity Market. However, Yallourn Energy’s revenue is substantially protected from short-term pool price fluctuations by its forward contract position, and business performance to date has been in line with expectations. Major capital projects to upgrade the power station control and instrumentation systems and to develop new areas of the captive coal mine are progressing well.

Page 12

Performance of the 2 x 660 MW coal-fired units at Ho-Ping in Taiwan, which entered commercial operation last year, has been satisfactory and met the guaranteed generation required under the power purchase agreement with the offtaker, Taipower. Since full commissioning of the two units, management effort has been directed towards risk mitigation, rectification of start-up technical problems, and continuous training of operation and maintenance staff.

As noted in our Annual Report 2002, CLP has been reviewing the strategic rationale of its shareholding in YTL Power International Berhad (YTL Power) in the absence of any movement towards privatization of the Malaysian power industry. Agreement has now been reached on the disposal of our 5% shareholding in YTL Power to its parent, YTL Corporation.

BLCP, which is developing a 1,434 MW coal-fired project at Map Ta Phut, Thailand, has reached the final stages of the financing arrangements for the project. Reclamation of the project site is near completion and construction of a 2 x 717MW coal-fired power station will commence in the third quarter of 2003. Upon commencement of commercial operation of the two units, which is expected to occur in 2006 and 2007 respectively, all power generated is to be supplied to the Electricity Generating Authority of Thailand under a 25-year power purchase agreement.

CLP is concentrating on building meaningful and sustainable businesses in those countries in which we already have an established presence.

Electricity-Related Business

The Group’s overriding focus is on the electricity business. However, where appropriate, CLP makes use of its existing assets and skills to explore opportunities to develop electricity-related activities in Hong Kong and the Chinese mainland.

In this respect, CLP’s major project is the residential redevelopment of the former power station site at Hok Un, Kowloon, named Laguna Verde. This 50:50 joint venture project, between CLP and a wholly-owned subsidiary of Cheung Kong (Holdings) Limited, comprises 4,735 flats, 1,692 parking spaces and 270,000 sq. ft. of commercial space. Over 90% of the residential units in the redevelopment had been sold by the end of June 2003.

CLP maintained steady momentum in its engineering service businesses, with a number of contracts secured in railway projects, power engineering, lighting projects, energy services, facility maintenance and customer installation services. Major customers tend to focus on their core businesses and outsource the maintenance services. CLP has made use of these opportunities to provide total engineering solutions to hotels, hospitals and other institutions to reduce energy spending.

CLP continues to own and operate “ChinaLink”, which provides cross-border communications services to Hong Kong corporations operating in the Chinese mainland. PowerCom Network Hong Kong Limited, our joint venture with Cheung Kong Enterprises Limited, has made good progress in the roll-out of broadband services to Hong Kong customers using powerline telecommunications technology.

As a result of a strategic review on our 40% investment in Precision Marketing Inc. (PMI), a market research company which provides CLP with access to database management skills and technology, CLP sold all our shareholding in PMI in June 2003. The skill transfer from PMI to CLP has been substantially completed.

Page 13

CLP Research Institute is sponsoring a new research project on the co-combustion of bamboo scaffolding and wood debris with coal. The research team at the Hong Kong University of Science and Technology will study the effects of these materials on emissions of particulates into the air.

OUR PEOPLE

With the addition of 359 employees of Yallourn Energy and GPEC, as a result of these companies being consolidated into the Group, we had a total of 4,694 employees (2002: 4,205) on 30 June 2003. Of these, 3,895 (2002: 3,747) were employed by our Scheme of Control business in Hong Kong. Total remuneration for the six months ended 30 June 2003 was HK$1,117 million (2002: HK$1,049 million), including retirement benefit costs of HK$85 million.

During the recent SARS outbreak in Hong Kong and in some Chinese cities, every effort was made to ensure all employees in these locations were given appropriate protection against possible infection. In addition to providing face masks for employees, we put in place special arrangements such as an in-house education campaign, including information on personal hygiene, restricting business travel and allowing at-risk workers (for example pregnant employees) more flexible working arrangements. An internal website on SARS was launched in mid-March, shortly after the start of the outbreak, to ensure that employees were receiving accurate and reliable information so as to guard against the spread of the virus.

FINANCIAL PERFORMANCE

Consolidated Financial Results

The financial results for the six-month period to 30 June 2003, which are unaudited but have been reviewed by the auditors, incorporate two significant changes from the corresponding period in 2002 and from the financial year ended 31 December 2002:

| l | | The consolidation of Yallourn Energy and GPEC into these interim results as a result of their reclassification as subsidiaries of CLP Holdings following the acquisition of Powergen’s remaining shares in these two companies in the first half of 2003. |

| |

| l | | The adoption of Hong Kong Statement of Standard Accounting Practice (SSAP) No. 12 (Revised) “Income Taxes”, which became effective from 1 January 2003. |

Page 14

Earnings Attributable to Shareholders

The contribution of each major activity to the Group earnings is analysed as follows:

| | | | | | | | | | | | | | | | | | | | | | |

|

| 6 months ended 30 June | | 2003 | | | 2002 | | | | Increase/ |

| |

| |

| | | (Decrease) |

| | | HK$M | | | HK$M | | | HK$M | | | HK$M | | | % | |

| |

| Scheme of Control earnings | | | | | | | 3,045 | | | | | | | | 2,829 | | | | 7.6 | |

| Non-Scheme of Control operating earnings | | | | | | | | | | | | | | | | | | | | |

| | Income from power projects outside Hong Kong | | | 706 | | | | | | | | 618 | | | | | | | | | |

| | Sales to the Chinese mainland | | | 30 | | | | | | | | 35 | | | | | | | | | |

| | Other businesses | | | (26 | ) | | | 710 | | | | (85 | ) | | | 568 | | | | 25.0 | |

| | |

| | | | | |

| | | | | | | | |

| Unallocated net finance costs | | | | | | | (33 | ) | | | | | | | (41 | ) | | | | |

| Unallocated Group expenses | | | | | | | (59 | ) | | | | | | | (59 | ) | | | | |

| | | | | | |

| | | | | |

| | | | |

| | | | | | | | 3,663 | | | | | | | | 3,297 | | | | 11.1 | |

| Hok Un redevelopment profit | | | | | | | 51 | | | | | | | | 134 | | | | | |

| | | | | | |

| | | | | |

| | | | |

| Group earnings attributable to shareholders | | | | | | | 3,714 | | | | | | | | 3,431 | | | | 8.2 | |

| | | | | | |

| | | | | |

| | | | |

| Earnings per share, HK$ | | | | | | | 1.54 | | | | | | | | 1.42 | | | | 8.2 | |

| Earnings per share excluding Hok Un redevelopment profit, HK$ | | | | | | | 1.52 | | | | | | | | 1.37 | | | | 11.1 | |

| | | | | | | | | | | | | 6 months ended 30 June | | | | |

| | | | | | | | | | | | 2003 | | | 2002 | | | % | |

EBITDA1, HK$M | | | | | | | | | | | | |

| | Including Hok Un redevelopment profit | | | | | | | | | | | 6,150 | | | | 5,364 | | | | 14.6 | |

| | Excluding Hok Un redevelopment profit | | | | | | | | | | | 6,087 | | | | 5,201 | | | | 17.0 | |

| 1 | | EBITDA = earnings before interest (including interest on borrowed capital and development fund, and a charge based on non-shareholders’ investments financing net fixed assets under the Scheme of Control), taxation borne by the shareholders, depreciation and amortisation. |

During the six-month period to 30 June 2003, the Scheme of Control (SoC) electricity unit sales to local customers dropped by 0.1% while total unit sales, which included sales to the Chinese Mainland, decreased by 0.5% as compared to same period last year. Turnover registered a 0.6% increase due to consolidation of revenue from Yallourn Energy and GPEC.

The operating earnings were HK$3,663 million, which was HK$366 million higher than the corresponding period last year, representing an increase of 11.1%. Total earnings, which include Hok Un redevelopment profit increased by 8.2% to HK$3,714 million.

SoC earnings increased by 7.6% to HK$3,045 million as a combined effect of lower interest borne by shareholders and investments in fixed assets to meet new customer demand and to improve quality of services. The non-SoC operating earnings increased by HK$142 million. The increase in non-SoC operating earnings was mainly due to full six months operation of Ho-Ping Power Station, and improved performance from CLP Guohua and Yallourn Energy.

Earnings per share increased by 8.2%, the same as the increase in total group earnings. Excluding the Hok Un redevelopment profit, earnings per share increased by 11.1%.

Page 15

Significant Investments

Fixed assets of the Group of HK$36,550 million at 31 December 2002 mainly consisted of investment in the transmission and distribution network for the core Hong Kong electricity business. With the consolidation of Yallourn Energy and GPEC, electricity generation and related fixed assets amounting to HK$13,438 million are included into the balance of the fixed assets at 30 June 2003. During the six months, the Group also invested HK$2,392 million (2002: HK$1,866 million), of which HK$2,295 million (2002: HK$1,857 million) was made by CLP Power, in various fixed assets. As a result, after deducting depreciation and disposal, the Group’s fixed assets increased to HK$51,293 million, an increase of 40.3% compared to 31 December 2002. Capital expenditure by associated Hong Kong generating companies for the six months was HK$606 million (2002: HK$288 million).

The Group’s investments in each geographical segment are shown below:

| | | | | | | | | | | | | | | | | | | |

|

| | | | 30 June 2003 | | | 31 December 2002 | |

| | | |

| | |

| |

| | | | HK$M | | | % | | | HK$M | | | % | |

| Electricity Business | | | | | | | | | | | | | | | | |

| | Hong Kong | | | 42,884 | | | | 64 | | | | 42,395 | | | | 72 | |

| | Chinese mainland | | | 5,992 | | | | 9 | | | | 6,337 | | | | 11 | |

| | Asia-Pacific region | | | 16,285 | | | | 25 | | | | 8,030 | | | | 14 | |

| | |

| | |

| | |

| | |

| |

| | | | 65,161 | | | | 98 | | | | 56,762 | | | | 97 | |

| Property and other businesses | | | 1,442 | | | | 2 | | | | 1,621 | | | | 3 | |

| | |

| | |

| | |

| | |

| |

| | | | 66,603 | | | | 100 | | | | 58,383 | | | | 100 | |

| | |

| | |

| | |

| | |

| |

|

Liquidity and Capital Resources

As at 30 June 2003, the Group had liquid funds of HK$572 million. About 80% of these liquid funds were denominated in foreign currency mainly held by subsidiaries in Australia and India. The remainder was in Hong Kong dollars.

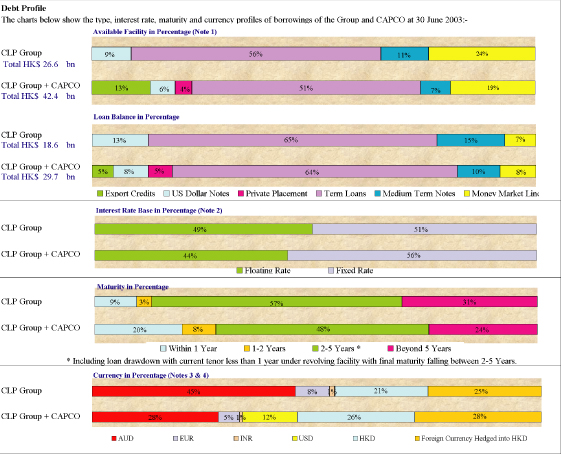

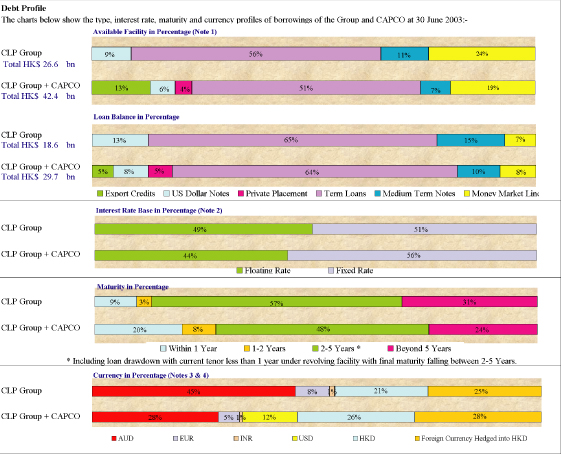

Financing facilities totalling HK$26.6 billion were available to the Group, including HK$9 billion for Yallourn Energy and GPEC. Out of the facilities available, HK$18.6 billion had been drawn down, out of which HK$7.5 billion were incurred by Yallourn Energy and GPEC. Financing facilities totalling HK$15.8 billion were available to CAPCO of which HK$11.1 billion were drawn down.

Total debt to total capital of the Group at 30 June 2003 was 32.8% and interest cover was 14.5 times. The increase in gearing ratio is due to the consolidation of the debts of Yallourn Energy and GPEC, which are without recourse to CLP Holdings.

Page 16

| | | | | | | |

| Notes: | | | | (1) | | For the Medium Term Note Programme, only the amount (HK$2,840 million) of the Notes issued was included in the total amount of Available Facility. |

| | | | | (2) | | 75% of Yallourn Energy and GPEC’s combined loans are at fixed rates. With the consolidation of these two subsidiaries, the percentage of fixed rate loans in the CLP Group is 51%, compared to 35% if Yallourn Energy and GPEC were not consolidated. |

| | | | | (3) | | The Australian dollar loans were mainly incurred by Yallourn Energy to refinance its project debts in 2001 and by CLP Holdings to hedge against currency exposure of the Group’s investment in Yallourn Energy. |

| | | | | (4) | | The loans in Euros and Indian Rupees were drawn by GPEC. |

Financing

The business expansion of the Group, in particular, the capital expenditure programmes of CLP Power and CAPCO, are funded by bank loans, issuance of debt securities and cash flow from operations.

The Group adopts a prudent approach to all our financial arrangements, while at the same time aiming to achieve cost efficient funding. In June 2003, CLP Power issued HK$500 million 4.45% fixed rate notes due 2013, through its wholly-owned subsidiary, CLP Power Hong Kong Financing Limited. The issue was made under the Medium Term Note Programme set up by CLP Power Hong Kong Financing Limited in 2002. Under the Programme, notes in an aggregate amount of up to US$1.5 billion may be issued and will be unconditionally and irrevocably guaranteed by CLP Power. As at 30 June 2003, about HK$2,840 million notes have been issued under the Programme.

Page 17

Credit Rating

The Group’s financial strength is reflected in its ratings assigned by Standard & Poor’s (S&P) and Moody’s. The current credit ratings of CLP Holdings and CLP Power are set out below:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | CLP Holdings | | | CLP Power | | | HKSAR | |

| | | | | | | | | | Government | |

| | | | S&P | | | Moody’s | | | S&P | | | Moody’s | | | S&P | | | Moody’s | |

| | | |

| |

| |

|

Long-term Rating | | | | | | | | | | | | | | | | | | | | | | | | |

| | Foreign currency | | | A+ | | | | A3 | | | | A+ | | | | A3 | | | | A+ | | | | A3 | |

| | Outlook | | Stable | | Positive | | Stable | | Positive | | Stable | | Positive |

| | Local currency | | | A+ | | | Aa2 | | | A+ | | | Aa1 | | AA- | | Aa3 |

| | Outlook | | Stable | | Stable | | Stable | | Stable | | Negative | | Stable |

Short-term Rating | | | | | | | | | | | | | | | | | | | | | | | | |

| | Foreign currency | | | A-1 | | | | P-1 | | | | A-1 | | | | P-1 | | | | A-1 | | | | P-1 | |

| | Local currency | | | A-1 | | | | — | | | | A-1 | | | | — | | | | A-1+ | | | | — | |

These credit ratings are supported by the strong cash flow generating ability and prudent financial structure of the Group. Our premier credit ratings can facilitate and enhance our position in various local and overseas business activities, including fund raising, investment and new business opportunities of the Group.

Risk Management

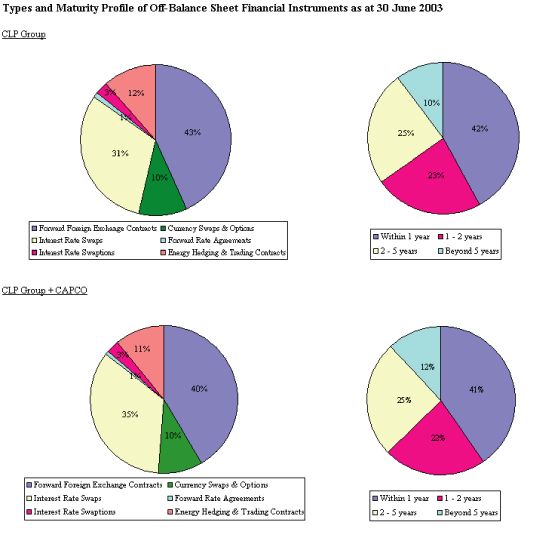

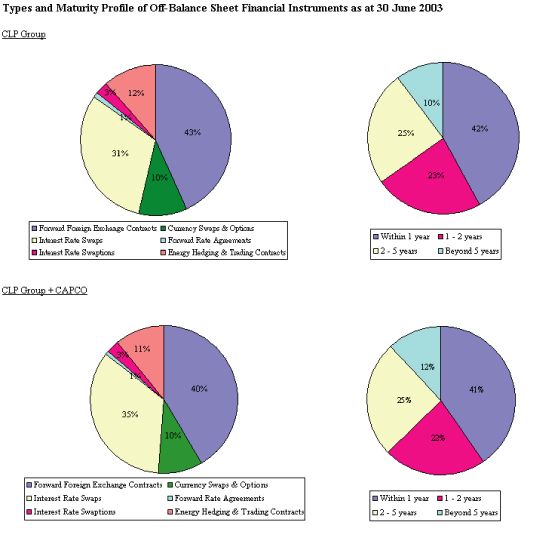

The Group uses different derivative instruments to manage its exposure to foreign currency, interest rate risks and the price risk associated with the sales and purchases of electricity in Australia, with an objective to minimise the impact of exchange rate, interest rate and electricity price fluctuations on earnings, reserves and tariff charges to customers. All transactions are made with counterparties with acceptable credit quality and a limit is assigned to each counterparty for monitoring the credit exposure. Other than certain energy trading activities engaged by Yallourn Energy, all derivative instruments are employed solely for hedging purposes.

Interest Rate Risks

The Group mainly utilises interest rate swaps to manage its interest rate risks. Our Australian subsidiary, Yallourn Energy, also employs forward rate agreements and interest rate swaptions to adjust the interest rate mix within pre-determined parameters. All these forward rate agreements and interest rate swaption contracts will mature within one year.

Foreign Currency Risks

The Group’s foreign currency exposures mainly arise from the loan repayment/interest payment obligations, purchases of goods and services, fuel-related payments and overseas investment activities. Apart from using forward foreign exchange contracts, currency swaps and options to manage our currency exposure, the Group also adopts an approach of financing its investments by borrowings of matching currency where appropriate to mitigate the currency risk.

Page 18

Electricity Sales and Purchases Risks

In Australia, Yallourn Energy uses hedging contracts to manage its exposure to price fluctuations in the electricity market. It also engages in limited energy trading activities.

Off-Balance Sheet Financial Instruments

As at 30 June 2003, the Group had gross outstanding derivative instruments amounting to HK$46.7 billion (HK$49 billion for the Group and CAPCO combined), out of which HK$0.4 billion were energy trading contracts. The breakdown by types and maturity profile of the Group and CAPCO’s derivative instruments are shown in the charts below:

The fair value of the Group’s outstanding derivative instruments at 30 June 2003 was HK$137.2 million (HK$41.1 million for the Group and CAPCO combined), which represents the net proceeds we would receive if these contracts were closed out at 30 June 2003. Out of the total fair value, HK$0.6 million was related to energy trading activities engaged by Yallourn Energy.

The Group has no significant operating lease commitments or sale and leaseback arrangements.

Page 19

Condensed Consolidated Profit And Loss Account

| | | | | | | | | | | | | | |

| | | | | | | | (Unaudited) |

| | | | | | | | 6 months ended 30 June |

| | | | Note | | | 2003 | | | 2002 | |

| | | | | | | HK$M | | | HK$M | |

| | | | | | | | | | (Restated) | |

| |

TURNOVER | | | 2,4 | | | | 11,871 | | | | 11,804 | |

| | | | | | | |

| | |

|

| Expenses | | | | | | | | | | | | |

| | Purchases of electricity | | | 3 | | | | 7,112 | | | | 7,093 | |

| | Staff expenses | | | 4 | | | | 525 | | | | 480 | |

| | Fuel and other net operating costs | | | 4 | | | | 643 | | | | 499 | |

| | Depreciation | | | 4 | | | | 1,005 | | | | 842 | |

| | | | | | | |

| | |

|

| | | | | | | | 9,285 | | | | 8,914 | |

| | | | | | | |

| | |

|

| |

| Operating profit | | | 2,5 | | | | 2,586 | | | | 2,890 | |

| Finance costs | | | 6 | | | | (223 | ) | | | (88 | ) |

| Finance income | | | 6 | | | | 35 | | | | 11 | |

| Hok Un redevelopment profit | | | | | | | 63 | | | | 163 | |

| Share of profits less losses of jointly controlled entities | | | | | | | 1,711 | | | | 1,495 | |

| Share of profits less losses of associated companies | | | | | | | 53 | | | | 84 | |

| | | | | | | |

| | |

|

| |

| Profit before taxation | | | | | | | 4,225 | | | | 4,555 | |

| Taxation | | | 7 | | | | (728 | ) | | | (684 | ) |

| | | | | | | |

| | |

|

| Profit after taxation | | | | | | | 3,497 | | | | 3,871 | |

| | | | | | | |

| | |

|

| |

| Transfers under Scheme of Control from/(to) | | | 23 | | | | | | | | | |

| | Development Fund | | | | | | | 263 | | | | (336 | ) |

| | Special provision account | | | | | | | 102 | | | | 54 | |

| | Rate reduction reserve | | | | | | | (148 | ) | | | (158 | ) |

| | | | | | | |

| | |

|

| | | | | | | | 217 | | | | (440 | ) |

| | | | | | | |

| | |

|

EARNINGS | | | | | | | | | | | | |

| | Scheme of Control earnings | | | | | | | 3,045 | | | | 2,829 | |

| | Non-Scheme of Control operating earnings | | | 8 | | | | 710 | | | | 568 | |

| | Unallocated net finance costs | | | | | | | (33 | ) | | | (41 | ) |

| | Unallocated Group expenses | | | | | | | (59 | ) | | | (59 | ) |

| | | | | | | |

| | |

|

| | Total operating earnings | | | | | | | 3,663 | | | | 3,297 | |

| | Hok Un redevelopment profit | | | | | | | 51 | | | | 134 | |

| | Total earnings | | | | | | | 3,714 | | | | 3,431 | |

| | | | | | | |

| | |

|

| |

DIVIDENDS | | | 9 | | | | | | | | | |

| | First interim paid | | | | | | | 987 | | | | 915 | |

| | Second interim | | | | | | | 987 | | | | 915 | |

| | | | | | | |

| | |

|

| | | | | | | | 1,974 | | | | 1,830 | |

| | | | | | | |

| | |

|

| |

| Earnings per share | | | 10 | | | HK$1.54 | | | HK$1.42 |

| Earnings per share excluding Hok Un redevelopment profit | | | 10 | | | HK$1.52 | | | HK$1.37 |

| | | |

| Note: | | The comparative figures for the 6 months ended 30 June 2002 have been restated as a result of the adoption of SSAP No. 12 (Revised) “Income Taxes” as explained in Note 1(A) to the Condensed Interim Accounts. |

Page 20

Condensed Consolidated Balance Sheet

| | | | | | | | | | | | | | |

| | | | | | | | 30 June | | | 31 December | |

| | | | | | | | 2003 | | | 2002 | |

| | | | | | | | (Unaudited) | | | (Restated) | |

| | | | Note | | | HK$M | | | HK$M | |

CAPITAL EMPLOYED | | | | | | | | | | | | |

| |

| Fixed assets | | | 11 | | | | 51,293 | | | | 36,550 | |

| Goodwill | | | 12 | | | | (768 | ) | | | — | |

| Investments in jointly controlled entities | | | 13 | | | | 13,693 | | | | 18,982 | |

| Investments in associated companies | | | 14 | | | | 1,487 | | | | 1,426 | |

| Investment securities | | | 15 | | | | 26 | | | | 287 | |

| Deferred tax assets | | | 16(A) | | | | 872 | | | | — | |

| Employee retirement benefit plan assets | | | 17 | | | | — | | | | 1,138 | |

| | | | | | | |

| | |

|

| | | | | | | | 66,603 | | | | 58,383 | |

| | | | | | | |

| | |

|

| Current assets | | | | | | | | | | | | |

| | Deposits, bank balances and cash | | | 18 | | | | 572 | | | | 516 | |

| | Other investments | | | 19 | | | | 659 | | | | 671 | |

| | Inventories — stores and fuel | | | | | | | 211 | | | | 67 | |

| | Trade and other receivables | | | 20 | | | | 4,870 | | | | 1,256 | |

| | | | | | | | 6,312 | | | | 2,510 | |

| Current liabilities | | | | | | | | | | | | |

| | Customers’ deposits | | | | | | | (2,762 | ) | | | (2,684 | ) |

| | Short-term loans and current portion of long-term loans and borrowings | | | 22 | | | | (1,759 | ) | | | (570 | ) |

| | Fuel clause account | | | | | | | (479 | ) | | | (512 | ) |

| | Taxation payable | | | | | | | (317 | ) | | | (196 | ) |

| | Trade and other payables | | | 21 | | | | (3,809 | ) | | | (3,206 | ) |

| | | | | | | | (9,126 | ) | | | (7,168 | ) |

| | | | | | | |

| | |

|

| Net current liabilities | | | | | | | (2,814 | ) | | | (4,658 | ) |

| | | | | | | |

| | |

|

| | | | | | | |

| | |

|

| Total assets less current liabilities | | | | | | | 63,789 | | | | 53,725 | |

| | | | | | | |

| | |

|

REPRESENTED BY | | | | | | | | | | | | |

| |

| Share capital | | | | | | | 12,041 | | | | 12,041 | |

| Share premium | | | | | | | 1,164 | | | | 1,164 | |

| Reserves | | | | | | | 23,828 | | | | 21,901 | |

| Proposed dividend | | | | | | | 987 | | | | 1,782 | |

| | | | | | | |

| | |

|

| Shareholders’ funds | | | | | | | 38,020 | | | | 36,888 | |

| Long-term loans and other borrowings | | | 22 | | | | 16,818 | | | | 8,727 | |

| Other non-current liabilities | | | | | | | 392 | | | | — | |

| Deferred tax liabilities | | | 16(B) | | | | 4,348 | | | | 3,610 | |

| Scheme of Control reserve accounts | | | 23 | | | | 3,894 | | | | 4,500 | |

| Minority interest | | | | | | | 317 | | | | — | |

| | | | | | | |

| | |

|

| |

| | | | | | | | 63,789 | | | | 53,725 | |

| | | | | | | |

| | |

|

| | | | | |

| /s/ W.E. Mocatta | | /s/ Andrew Brandler | | /s/ Peter P.W. Tse |

| | | | | |

W.E. Mocatta

Vice Chairman

Hong Kong, 4 August 2003 | | Andrew Brandler

Group Managing Director | | Peter P.W. Tse

Executive Director &

Chief Financial Officer |

Page 21

Condensed Statement of Changes in Equity

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | Capital | | | | | | | | | | | | | |

| (Unaudited) | | Share | | | Share | | | Redemption | | | Other | | | Retained | | | | | |

| | | | Capital | | | Premium | | | Reserve | | | Reserves | | | Profit | | | Total | |

| | | | HK$M | | | HK$M | | | HK$M | | | HK$M | | | HK$M | | | HK$M | |

| |

| Balance at 1 January 2003, as previously reported | | | 12,041 | | | | 1,164 | | | | 2,482 | | | | (76 | ) | | | 21,176 | | | | 36,787 | |

| Tax adjustments (Note (a)) | | | — | | | | — | | | | — | | | | 13 | | | | 88 | | | | 101 | |

| | | |

| | |

| | |

| | |

| | |

| | |

|

| Balance at 1 January 2003, restated | | | 12,041 | | | | 1,164 | | | | 2,482 | | | | (63 | ) | | | 21,264 | | | | 36,888 | |

| |

| Exchange differences arising on translation of : | | | | | | | | | | | | | | | | | | | | | | | | |

| | subsidiaries | | | — | | | | — | | | | — | | | | 93 | | | | — | | | | 93 | |

| | jointly controlled entities | | | — | | | | — | | | | — | | | | 49 | | | | — | | | | 49 | |

| | associated companies | | | — | | | | — | | | | — | | | | 33 | | | | — | | | | 33 | |

| Net gains and losses not recognised in the profit and loss account | | | — | | | | — | | | | — | | | | 175 | | | | — | | | | 175 | |

| Earnings for the period | | | — | | | | — | | | | — | | | | — | | | | 3,714 | | | | 3,714 | |

| Dividends declared:2002 final | | | — | | | | — | | | | — | | | | — | | | | (1,782 | ) | | | (1,782 | ) |

| | | 2003 interim | | | — | | | | — | | | | — | | | | — | | | | (987 | ) | | | (987 | ) |

| Appropriation to non-distributable statutory reserve | | | — | | | | — | | | | — | | | | 22 | | | | (22 | ) | | | — | |

| Reserves of associated company | | | — | | | | — | | | | — | | | | 12 | | | | — | | | | 12 | |

| | | |

| | |

| | |

| | |

| | |

| | |

|

Balance at 30 June 2003 | | | 12,041 | | | | 1,164 | | | | 2,482 | | | | 146 | | | | 22,187 | | | | 38,020 | |

| | | |

| | |

| | |

| | |

| | |

| | |

|

| |

| Company and subsidiary companies | | | 12,041 | | | | 1,164 | | | | 2,482 | | | | 107 | | | | 18,388 | | | | 34,182 | |

| Jointly controlled entities | | | — | | | | — | | | | — | | | | 23 | | | | 3,503 | | | | 3,526 | |

| Associated companies | | | — | | | | — | | | | — | | | | 16 | | | | 296 | | | | 312 | |

| | | |

| | |

| | |

| | |

| | |

| | |

|

| | | | 12,041 | | | | 1,164 | | | | 2,482 | | | | 146 | | | | 22,187 | | | | 38,020 | |

| | | |

| | |

| | |

| | |

| | |

| | |

|

| |

| Balance at 1 January 2002, as previously reported | | | 12,107 | | | | 11,281 | | | | 2,416 | | | | (287 | ) | | | 9,651 | | | | 35,168 | |

| Tax adjustments (Note (a)) | | | — | | | | — | | | | — | | | | 1 | | | | 63 | | | | 64 | |

| | | |

| | |

| | |

| | |

| | |

| | |

|

| Balance at 1 January 2002, restated | | | 12,107 | | | | 11,281 | | | | 2,416 | | | | (286 | ) | | | 9,714 | | | | 35,232 | |

| |

| Exchange differences arising on translation of : | | | | | | | | | | | | | | | | | | | | | | | | |

| | jointly controlled entities | | | — | | | | — | | | | — | | | | 200 | | | | — | | | | 200 | |

| | associated company | | | — | | | | — | | | | — | | | | 81 | | | | — | | | | 81 | |

| Net gains and losses not recognised in the profit and loss account | | | — | | | | — | | | | — | | | | 281 | | | | — | | | | 281 | |

| Repurchase of ordinary shares | | | (66 | ) | | | — | | | | 66 | | | | — | | | | (397 | ) | | | (397 | ) |

| Transfer of share premium to retained profit | | | — | | | | (10,117 | ) | | | — | | | | — | | | | 10,117 | | | | — | |

| Earnings for the period, restated | | | — | | | | — | | | | — | | | | — | | | | 3,431 | | | | 3,431 | |

| Dividends declared: 2001 final | | | — | | | | — | | | | — | | | | — | | | | (2,528 | ) | | | (2,528 | ) |

| | | 2002 interim | | | — | | | | — | | | | — | | | | — | | | | (915 | ) | | | (915 | ) |

| Reserves of associated company | | | — | | | | — | | | | — | | | | 4 | | | | — | | | | 4 | |

| | | |

| | |

| | |

| | |

| | |

| | |

|

| | | | | | | | | | | | | | | | | | | Note (c) | | | | | |

| Balance at 30 June 2002 | | | 12,041 | | | | 1,164 | | | | 2,482 | | | | (1 | ) | | | 19,422 | | | | 35,108 | |

| | | |

| | |

| | |

| | |

| | |

| | |

|

| |

| Company and subsidiary companies | | | 12,041 | | | | 1,164 | | | | 2,482 | | | | (10 | ) | | | 15,709 | | | | 31,386 | |

| Jointly controlled entities | | | — | | | | — | | | | — | | | | 2 | | | | 3,461 | | | | 3,463 | |

| Associated companies | | | — | | | | — | | | | — | | | | 7 | | | | 252 | | | | 259 | |

| | | |

| | |

| | |

| | |

| | |

| | |

|

| | | | 12,041 | | | | 1,164 | | | | 2,482 | | | | (1 | ) | | | 19,422 | | | | 35,108 | |

| | | |

| | |

| | |

| | |

| | |

| | |

|

Notes:

| | (a) | | The profits tax adjustments are required for the adoption of SSAP No. 12 (Revised) “Income Taxes” (Note 1(A) to the Condensed Interim Accounts). The adjustments mainly relate to temporary differences in respect of property, plant and equipment, the revaluation of assets on acquisition, withholding taxation on retained earnings of overseas investments, and carried forward tax losses. |

| | (b) | | The proposed interim dividend at 30 June 2003 and balance of retained profits after the proposed interim dividend were HK$987 million and HK$21,200 million respectively. |

| | (c) | | The proposed interim dividend at 30 June 2002 and balance of retained profits after the proposed interim dividend were HK$915 million and HK$18,507 million respectively. |

| | | | |

Page 22

Condensed Consolidated Cash Flow Statement

| | | | | | | | | | | | | | | |

| | | | | | | | | 6 months ended 30 June |

| | | | | | | | | (Unaudited) |

| | | | | | | | | 2003 | | | 2002 | |

| | | | | Note | | | HK$M | | | HK$M | |

| |

OPERATING ACTIVITIES | | | | | | | | | | | | |

| | Cash generated from operations | | | 24(a) | | | | 2,800 | | | | 2,912 | |

| | Operating interest paid | | | | | | | (197 | ) | | | (49 | ) |

| | Interest received | | | | | | | 23 | | | | 11 | |

| | Profits tax paid | | | | | | | (203 | ) | | | (207 | ) |

| | | | | | | |

| | |

|

NET CASH INFLOW FROM OPERATING ACTIVITIES | | | | | | | 2,423 | | | | 2,667 | |

| | | | | | | |

| | |

|

INVESTING ACTIVITIES | | | | | | | | | | | | |

| | Capital expenditure | | | | | | | (2,524 | ) | | | (2,198 | ) |

| | Capitalised interest paid | | | | | | | (139 | ) | | | (86 | ) |

| | Proceeds from disposal of fixed assets | | | | | | | 3 | | | | 21 | |

| | Net cash outflow from acquisition of subsidiary undertakings | | | 24(b) | | | | (354 | ) | | | — | |

| | Investments in, loans and advances to, jointly controlled entities | | | | | | | (110 | ) | | | (2,272 | ) |

| | Purchase of investment securities | | | | | | | (438 | ) | | | (14 | ) |

| | Realisation of employee retirement benefit plan assets | | | | | | | 1,155 | | | | — | |

| | Dividends received from investments | | | | | | | | | | | | |

| | | - jointly controlled entities | | | | | | | 1,183 | | | | 1,054 | |

| | | - associated company | | | | | | | 27 | | | | 27 | |

| | | - other investment | | | | | | | 34 | | | | 17 | |

| | Cash received from Hok Un joint venture | | | | | | | 168 | | | | 1,150 | |

| | | | | | | |

| | |

|

NET CASH OUTFLOW FROM INVESTING ACTIVITIES | | | | | | | (995 | ) | | | (2,301 | ) |

| | | | | | | |

| | |

|

| | | | | | | |

| | |

|

NET CASH INFLOW BEFORE FINANCING | | | | | | | 1,428 | | | | 366 | |

| | | | | | | |

| | |

|

FINANCING | | | | | | | | | | | | |

| | Proceeds from long-term borrowings | | | | | | | 1,500 | | | | 4,519 | |

| | Repayment of long-term borrowings | | | | | | | (855 | ) | | | (956 | ) |

| | Increase/(decrease) in short-term borrowings | | | | | | | 738 | | | | (60 | ) |

| | Repurchase of ordinary shares | | | | | | | — | | | | (397 | ) |

| | Dividends paid | | | | | | | (2,769 | ) | | | (3,443 | ) |

| | | | | | | |

| | |

|

NET CASH OUTFLOW FROM FINANCING | | | | | | | (1,386 | ) | | | (337 | ) |

| | | | | | | |

| | |

|

| | | | | | | |

| | |

|

| |

| Effect of exchange rate changes | | | | | | | 14 | | | | — | |

| | | | | | | |

| | |

|

| |

| Net increase in cash and cash equivalents | | | | | | | 56 | | | | 29 | |

| Cash and cash equivalents at beginning of the period | | | | | | | 516 | | | | 80 | |

| | | | | | | |

| | |

|

| |

CASH AND CASH EQUIVALENTS AT END OF THE PERIOD | | | | | | | 572 | | | | 109 | |

| | | | | | | |

| | |

|

| Analysis of cash and cash equivalents | | | | | | | | | | | | |

| | Trust fund for unclaimed dividends | | | | | | | 24 | | | | 23 | |

| | Trust fund for trade creditors | | | | | | | — | | | | 3 | |

| | Deposits, bank balances and cash | | | | | | | 548 | | | | 83 | |

| | | | | | | |

| | |

|

| | | | | | | | 572 | | | | 109 | |

| | | | | | | |

| | |

|

Page 23

Notes to the Condensed Interim Accounts

| 1. | | Basis of Preparation and Accounting Policies |

| | (A) | | The unaudited condensed interim accounts are prepared in accordance with Hong Kong Statement of Standard Accounting Practice (SSAP) No. 25 “Interim Financial Reporting” issued by the Hong Kong Society of Accountants. The accounting policies used in the preparation of the unaudited condensed interim accounts are consistent with those set out in the 2002 Annual Report except that the Group has changed its accounting policy for taxation following the adoption of SSAP No. 12 (Revised) “Income Taxes”, which became effective from 1 January 2003. The change to the Group’s accounting policies and the effect of adopting this new policy are set out below: |

| |

| | | | Deferred Taxation

Deferred taxation is provided in full, using the liability method, on temporary differences arising between the tax bases of assets and liabilities and their carrying amounts in the financial statements. Taxation rates enacted or substantially enacted by the balance sheet date are used to determine deferred taxation. |

| |

| | | | Deferred tax assets are recognised to the extent that it is probable that future taxable profit will be available against which the temporary differences can be utilised. |

| |

| | | | Deferred taxation is provided on temporary difference arising on investments in subsidiaries, associates and joint ventures, except where the timing of the reversal of the temporary difference can be controlled and it is probable that the temporary difference will not reverse in the foreseeable future. |

| |

| | | | Previously, the Group accounted for deferred tax in the SoC business on a full provision basis in respect of timing differences attributable to accelerated depreciation at the taxation rate in force in the year in which the difference arose. In the non-SoC businesses, deferred taxation was accounted for at the current taxation rate in respect of timing differences between profit as computed for taxation purposes and profit as stated in the accounts to the extent that a liability or an asset was expected to be payable or recoverable in the foreseeable future. |

| |

| | | | The adoption of the new SSAP No. 12 (Revised) represents a change in accounting policy which has been applied retrospectively so that the comparative figures presented have been restated to conform to the changed policy. |

| |

| | | | The main effects of the adoption of the new SSAP No. 12 (Revised) on the Group arise from revaluation of assets on acquisition, withholding taxation on retained earnings of overseas investments, and losses carried forward. |

| |

| | | | The deferred tax liabilities at 31 December 2002 have been reduced by HK$111 million (2001: HK$112 million) with corresponding adjustments to i) increase the share of net asset value of jointly controlled entities by HK$557 million (2001: HK$427 million), ii) reduce positive goodwill and create negative goodwill on jointly controlled entities by HK$56 million and HK$396 million, respectively, (2001: increase HK$9 million and create HK$369 million), iii) increase other payables by HK$115 million (2001: HK$115 million) and iv) increase retained earnings by HK$101 million (2001: HK$64 million). The impact of the SSAP No. 12 (Revised) on the profit and loss account for the period ended 30 June 2003 has been a reduction in reported net profit of HK$50 million. |

Page 24

| | (B) | | Pursuant to an agreement entered into with Powergen UK plc in November 2002 to acquire all of its remaining interests in BLCP Power Limited in Thailand (BLCP), Yallourn Energy Pty Limited in Australia (Yallourn Energy) and Gujarat Paguthan Energy Corporation Private Limited in India (GPEC), the acquisitions of these additional interests were completed on 10 January 2003, 16 April 2003 and 11 June 2003 respectively. After these acquisitions, the Group owns 50% of BLCP, 92% of Yallourn Energy and 100% of GPEC. BLCP remains as a jointly controlled entity. The Group gained control of Yallourn Energy and GPEC from the date when the additional interest acquisitions were completed. As a result, the description of some accounting policies of the Group has been expanded to reflect consolidation of Yallourn Energy and GPEC into the Group as shown below: |

| | i) | | Turnover |

| |

| | | | Turnover represents sale of electricity, other electricity-related revenue, property income, supply and maintenance services. Sale of electricity is based on either actual and accrued consumption derived from meters read or amount billed in accordance with the terms of the contractual agreements where applicable during the period. Other revenue is recognised when services are rendered or sales are completed. |

| |

| | ii) | | Fixed Assets and Depreciation |

| |

| | | | Depreciation of fixed assets are accounted according to the following range of useful lives: |

| | | | | | |

| Description | | | | Years | |

| | | |

| |

SoC fixed assets | | | | |

| | Buildings | | | 33 | |

| | Overhead line (132 kV and above) | | | 35 | |

| | Overhead line (below 132 kV) and cables | | | 30 | |

| | Generating plant, switchgear and transformer | | | 25 | |

| | Meters, system control equipment, furniture, tools, communication and office equipment | | | 10 | |

| | Computers and office automation equipment other than those forming part of the generating plant | | | 5 | |

| | Motor vehicles | | | 5 | |

| |

Non-SoC fixed assets | | | | |

| | Buildings | | | 30-32 | |

| | Generating plant, switchgear and transformers | | | 17-32 | |

| | Office equipment | | | 2-7 | |

| | Motor vehicles | | | 3-8 | |

| | Mining machine and equipment | | | 10-30 | |

| | Freehold land is not depreciated | | | | |

Page 25

| 2. | | Turnover and Segment Information |

| |

| | | An analysis of the Group’s turnover, contribution to operating profit and profits before financing and taxation for the period by principal activities is as follows: |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | Profit/(Loss) Before |

| | | | | | | | | | | Operating | | Financing and |

| 6 months ended 30 June | | Turnover | | Profit/(Loss) (A) | | Taxation (B) |

| | |

| |

| |

|

| | | 2003 | | | 2002 | | | 2003 | | | 2002 | | | 2003 | | | 2002 | |

| | | HK$M | | | HK$M | | | HK$M | | | HK$M | | | HK$M | | | HK$M | |

| |

| SoC business | | | 11,333 | | | | 11,692 | | | | 2,609 | | | | 3,118 | | | | 3,436 | | | | 3,901 | |

| Power projects outside Hong Kong | | | 470 | | | | — | | | | 47 | | | | (91 | ) | | | 995 | | | | 709 | |

| Other businesses | | | 68 | | | | 112 | | | | (11 | ) | | | (78 | ) | | | 41 | | | | 81 | |

| Unallocated Group expenses | | | — | | | | — | | | | (59 | ) | | | (59 | ) | | | (59 | ) | | | (59 | ) |

| | | |

| | |

| | |

| | |

| | |

| | |

|

| | | | 11,871 | | | | 11,804 | | | | 2,586 | | | | 2,890 | | | | 4,413 | | | | 4,632 | |

| | | |

| | |

| | |

| | |

| | |

| | |

|

| | (A): | | Operating Profit/(Loss) is stated before taking into account the Group’s share of the results of jointly controlled entities and associated companies. |

| |

| | (B): | | Profit/(Loss) Before Financing and Taxation is stated after taking into account the Group’s share of the results of jointly controlled entities and associated companies. |

| | | The Group operates, through its subsidiary companies, jointly controlled entities and associated companies, in three major geographical regions — Hong Kong, the Chinese mainland and the Asia-Pacific region. Information about the Group’s operations by geographical destination is as follows: |

| | | | | | | | | | | | | | | | | | | | | |

| 6 months ended | | | | | | Chinese | | | Asia-Pacific | | | Unallocated | | | | | |

| 30 June 2003 | | Hong Kong | | | Mainland | | | Region | | | Items | | | Total | |

| | | HK$M | | | HK$M | | | HK$M | | | HK$M | | | HK$M | |

| |

| Turnover | | | 10,922 | | | | 479 | | | | 470 | | | | — | | | | 11,871 | |

| | | |

| | |

| | |

| | |

| | |

|

| |

| Segment results | | | 2,575 | | | | (31 | ) | | | 101 | | | | (59 | ) | | | 2,586 | |

| Hok Un redevelopment profit | | | 63 | | | | — | | | | — | | | | — | | | | 63 | |

| Share of profits less losses of jointly controlled entities | | | 814 | | | | 672 | | | | 225 | | | | — | | | | 1,711 | |

| Share of profits less losses of associated companies | | | (9 | ) | | | — | | | | 62 | | | | — | | | | 53 | |

| | | |

| | |

| | |

| | |

| | |

|

| Profit/(Loss) before financing and taxation | | | 3,443 | | | | 641 | | | | 388 | | | | (59 | ) | | | 4,413 | |

| | | |

| | |

| | |

| | |

| | | | |

| Finance costs | | | | | | | | | | | | | | | | | | | (223 | ) |

| Finance income | | | | | | | | | | | | | | | | | | | 35 | |

| Taxation | | | | | | | | | | | | | | | | | | | (728 | ) |

| | | | | | | | | | | | | | | | | | | |

|

| Profit after taxation | | | | | | | | | | | | | | | | | | | 3,497 | |

| Transfers under SoC | | | | | | | | | | | | | | | | | | | 217 | |

| | | | | | | | | | | | | | | | | | | |

|

| Earnings for the period | | | | | | | | | | | | | | | | | | | 3,714 | |

| | | | | | | | | | | | | | | | | | | |

|

| |

| Amortisation of goodwill and cost of investment | | | 9 | | | | 17 | | | | 6 | | | | — | | | | 32 | |

| | | |

| | |

| | |

| | |

| | |

|

Page 26

| | | | | | | | | | | | | | | | | | | | | |

| 6 months ended | | | | | | Chinese | | | Asia-Pacific | | | Unallocated | | | | | |

| 30 June 2002 | | Hong Kong | | | Mainland | | | Region | | | Items | | | Total | |

| | | HK$M | | | HK$M | | | HK$M | | | HK$M | | | HK$M | |

| |

| Turnover | | | 11,285 | | | | 518 | | | | 1 | | | | — | | | | 11,804 | |

| | | |

| | |

| | |

| | |

| | |

|

| Segment results | | | 3,014 | | | | (26 | ) | | | (39 | ) | | | (59 | ) | | | 2,890 | |

| Hok Un redevelopment profit | | | 163 | | | | — | | | | — | | | | — | | | | 163 | |

| Share of profits less losses of jointly controlled entities | | | 764 | | | | 537 | | | | 194 | | | | — | | | | 1,495 | |

| Share of profit of associated company | | | — | | | | — | | | | 84 | | | | — | | | | 84 | |

| | | |

| | |

| | |

| | |

| | |

|

| Profit/(Loss) before financing and taxation | | | 3,941 | | | | 511 | | | | 239 | | | | (59 | ) | | | 4,632 | |

| | | |

| | |

| | |

| | |

| | | | |

| Finance costs | | | | | | | | | | | | | | | | | | | (88 | ) |

| Finance income | | | | | | | | | | | | | | | | | | | 11 | |

| Taxation | | | | | | | | | | | | | | | | | | | (684 | ) |

| | | | | | | | | | | | | | | | | | | |

|

| Profit after taxation | | | | | | | | | | | | | | | | | | | 3,871 | |

| Transfers under SoC | | | | | | | | | | | | | | | | | | | (440 | ) |

| | | | | | | | | | | | | | | | | | | |

|

| Earnings for the period | | | | | | | | | | | | | | | | | | | 3,431 | |

| | | | | | | | | | | | | | | | | | | |

|

| |

| Amortisation of goodwill and cost of investment | | | 2 | | | | 22 | | | | 2 | | | | — | | | | 26 | |

| | | |

| | |

| | |

| | |

| | |

|

| 3. | | Purchases of Electricity |

| |

| | | This represents the purchases of electricity for the Hong Kong SoC business. Further details are shown below: |

| | | | | | | | | |

| | | 6 months ended 30 June |

| | | 2003 | | | 2002 | |

| | | HK$M | | | HK$M | |

| |

| Purchases of electricity from CAPCO | | | 4,962 | | | | 5,105 | |

| Purchases of nuclear electricity | | | 2,029 | | | | 1,784 | |

| Pumped storage service fee | | | 121 | | | | 204 | |

| | | |

| | |

|

| | | | 7,112 | | | | 7,093 | |

| | | |

| | |

|

| 4. | | Yallourn Energy and GPEC |

| |

| | | The operating profit of existing operations and the post-acquisition operating profit of Yallourn Energy and GPEC are analysed as follows: |

| | | | | | | | | | | | | | |

| | | | 6 months ended 30 June 2003 |

| | | | Existing | | | Acquisitions | | | Total | |

| | | | HK$M | | | HK$M | | | HK$M | |

| |

TURNOVER | | | 11,401 | | | | 470 | | | | 11,871 | |

| |

| Expenses | | | | | | | | | | | | |

| | Purchases of electricity | | | (7,112 | ) | | | — | | | | (7,112 | ) |

| | Staff expenses | | | (501 | ) | | | (24 | ) | | | (525 | ) |

| | Fuel | | | — | | | | (71 | ) | | | (71 | ) |

| | Other net operating costs | | | (462 | ) | | | (110 | ) | | | (572 | ) |

| | Depreciation | | | (928 | ) | | | (77 | ) | | | (1,005 | ) |

| | | |

| | |

| | |

|

| Operating profit | | | 2,398 | | | | 188 | | | | 2,586 | |

| | | |

| | |

| | |

|

Page 27

| | | | | | | | | | |

| | | | 6 months ended 30 June |

| | | | 2003 | | | 2002 | |

| | | | HK$M | | | HK$M | |

| |

| Operating profit is stated after charging / (crediting) the following: | | | | | | | | |

| |

Charging | | | | | | | | |

| Staff costs (A) | | | | | | | | |

| | Salaries and other costs | | | 687 | | | | 610 | |

| | Retirement benefits costs | | | 54 | | | | 49 | |

| Loss on disposal of fixed assets | | | 44 | | | | 25 | |

| Impairment loss on other investments | | | 12 | | | | — | |

| Amortisation of positive goodwill and cost of investment | | | 42 | | | | 33 | |

| |

Crediting | | | | | | | | |

| Net rental income from properties | | | (8 | ) | | | (8 | ) |

| Capital gains on disposal of properties | | | — | | | | (5 | ) |

| Investment gain on realisation of retirement benefit plan asset | | | (17 | ) | | | — | |

| Exchange gain | | | (13 | ) | | | (20 | ) |

| Amortisation of negative goodwill | | | (10 | ) | | | (7 | ) |

| | (A) | | Staff costs include amounts recharged to jointly controlled entities for services provided. |

| 6. | | Finance Costs and Income |

| | | | | | | | | | |

| | | | 6 months ended 30 June |

| | | | 2003 | | | 2002 | |

| | | | HK$M | | | HK$M | |

| |

| Finance costs: | | | | | | | | |

| Interest on bank loans and overdrafts | | | 177 | | | | 55 | |

| Interest on other loans | | | | | | | | |

| | wholly repayable within five years | | | 82 | | | | 82 | |

| | not wholly repayable within five years | | | 46 | | | | 14 | |

| Interest on customers’ deposits and others | | | 13 | | | | 10 | |

| Finance charges | | | 13 | | | | 30 | |

| Exchange loss on foreign currency loan | | | 12 | | | | — | |

| | | |

| | |

|

| | | | 343 | | | | 191 | |

| Less amount capitalised within fixed assets | | | (120 | ) | | | (103 | ) |

| | | |

| | |

|

| | | | 223 | | | | 88 | |

| | | |

| | |

|

| |

| Finance income: | | | | | | | | |

| Net interest income from investment securities (Note (A)) | | | 20 | | | | 4 | |

| Interest income on bank deposits | | | 15 | | | | 7 | |

| | | |

| | |

|

| | | | 35 | | | | 11 | |

| | | |

| | |

|

| | Note (A) | | The net interest income relates to interest income of 100% (A$160 million) of the floating rate notes issued by Mezzco Pty Ltd. This is a wholly-owned subsidiary company of AusPower Holdings Pty Ltd., which is the immediate holding company of Yallourn Energy. This interest income relates to the period during which Yallourn Energy was accounted for as a jointly controlled entity. |

Page 28

| | | | | | | | | | | |

| | | | | 6 months ended 30 June |

| | | | | 2003 | | | 2002 | |

| | | | | HK$M | | | HK$M | |

| |

| Company and subsidiary companies | | | | | | | | |

| | - Hong Kong | | | | | | | | |

| | | current | | | 247 | | | | 512 | |

| | | deferred | | | 163 | | | | 105 | |

| | - outside Hong Kong | | | | | | | | |

| | | current | | | 4 | | | | — | |

| | | deferred | | | 20 | | | | — | |

| | | | | |

| | |

|

| | | | 434 | | | | 617 | |

| | | | | |

| | |

|

| |

| Share of jointly controlled entities | | | | | | | | |

| | - Hong Kong | | | | | | | | |

| | | current | | | 143 | | | | 130 | |

| | | deferred | | | (16 | ) | | | (159 | ) |

| | - outside Hong Kong | | | | | | | | |

| | | current | | | 125 | | | | 69 | |

| | | deferred | | | 30 | | | | 16 | |

| | | | | |

| | |

|

| | | | 282 | | | | 56 | |

| | | | | |

| | |

|

| |

| Share of associated companies | | | | | | | | |

| | - outside Hong Kong | | | | | | | | |

| | | current | | | 12 | | | | 11 | |

| | | | | |

| | |

|