FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of August 2004

CLP Holdings Limited

(Registrant’s name in English)

147 Argyle Street

Kowloon, Hong Kong

(Address of Registrant’s principal executive office)

Indicate by check mark whether the Registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F X Form 40-F

Indicate by check mark whether the Registrant by furnishing this information contained in this Form is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes No X

If “Yes” is marked, indicate below the file number assigned to the Registrant in connection with Rule 12g3-2(b): 82-

Registrant hereby incorporates by reference in the report on Form 6-K the following Exhibit:

Exhibit

The Interim Report 2004 which was despatched to shareholders on 30 August 2004.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | |

| | | For and on behalf of |

| | | CLP HOLDINGS LIMITED |

| |

| By: | | / s / April Chan

|

| Name: | | April Chan |

| Title: | | Deputy Company Secretary |

Date:30 August 2004

Page 1

Performance Highlights

| | | | | | | | | |

| | | 6 months ended 30 June | | | Increase/ (Decrease) % | |

| | | 2004 | | | 2003 | | |

Per share | | | | | | | | | |

| | | |

Earnings per share, HK$ | | | | | | | | | |

Including Hok Un redevelopment profit | | 1.72 | | | 1.54 | | | 11.4 | |

Excluding Hok Un redevelopment profit | | 1.67 | | | 1.52 | | | 9.6 | |

| | | |

Dividends per share, HK$ | | | | | | | | | |

First interim | | 0.45 | | | 0.41 | | | | |

Second interim | | 0.45 | | | 0.41 | | | | |

| | |

|

| |

|

| | | |

Total interim dividends | | 0.90 | | | 0.82 | | | 9.8 | |

| | |

|

| |

|

| | | |

For the period | | | | | | | | | |

| | | |

Turnover, HK$M | | | | | | | | | |

Scheme of Control (SoC) revenue | | 11,870 | | | 11,333 | | | 4.7 | |

Total turnover | | 13,922 | | | 11,871 | | | 17.3 | |

| | | |

Earnings, HK$M | | | | | | | | | |

SoC earnings | | 3,337 | | | 3,045 | | | 9.6 | |

Non-SoC operating earnings | | 791 | | | 710 | | | 11.4 | |

Unallocated net finance costs | | (39 | ) | | (33 | ) | | | |

Unallocated Group expenses | | (75 | ) | | (59 | ) | | | |

| | |

|

| |

|

| | | |

Total operating earnings | | 4,014 | | | 3,663 | | | 9.6 | |

Hok Un redevelopment profit | | 124 | | | 51 | | | | |

| | |

|

| |

|

| | | |

Total earnings | | 4,138 | | | 3,714 | | | 11.4 | |

| | |

|

| |

|

| | | |

SoC capital expenditure, HK$M | | | | | | | | | |

CLP Power Hong Kong | | 2,313 | | | 2,295 | | | 0.8 | |

CAPCO | | 829 | | | 599 | | | 38.4 | |

| | | |

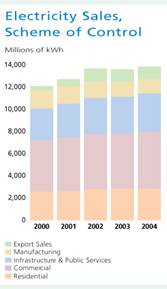

Electricity sales (SoC), millions of kWh | | | | | | | | | |

Residential | | 2,875 | | | 2,857 | | | 0.6 | |

Commercial | | 5,093 | | | 4,936 | | | 3.2 | |

Infrastructure & Public Services | | 3,497 | | | 3,340 | | | 4.7 | |

Manufacturing | | 1,333 | | | 1,348 | | | (1.1 | ) |

| | |

|

| |

|

| | | |

Total local sales | | 12,798 | | | 12,481 | | | 2.5 | |

Export sales | | 1,085 | | | 1,153 | | | (5.9 | ) |

| | |

|

| |

|

| | | |

Total electricity sales | | 13,883 | | | 13,634 | | | 1.8 | |

| | |

|

| |

|

| | | |

Interest cover1 , times | | 9 | | | 102 | | | | |

Page 2

| | | | | | |

As at the balance sheet date | | 30 June

2004 | | 31 December

2003 | | Increase

% |

| | | |

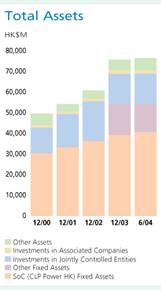

Total assets, HK$M | | 76,641 | | 75,832 | | 1.1 |

| | | |

Total borrowings, HK$M | | 19,637 | | 18,697 | | 5.0 |

| | | |

Shareholders’ funds, HK$M | | 41,403 | | 40,241 | | 2.9 |

| | | |

Total debt to total capital3, % | | 32.2 | | 31.5 | | |

| 1 | Interest cover = Profit before taxation and interest / (interest charges + capitalised interest) |

| 2 | Yallourn Energy and GPEC were reclassified from jointly controlled entities to subsidiaries of the Group in April and June 2003 respectively. For meaningful comparison, the 2003 figure has been calculated by including the Group’s share of interest charges of Yallourn Energy and GPEC during the period when they were jointly controlled entities. |

| 3 | Total debt to total capital = debt / (shareholders’ funds + debt + minority interest) |

Page 3

Chairman’s Statement

Dear Shareholders,

I am pleased to present our Interim Report for the half year ended 30 June 2004 and to record a satisfactory performance by the CLP Group over this period.

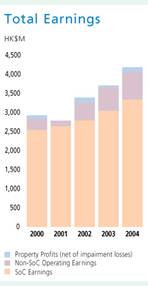

Financial Results for the six-month period

The operating earnings of CLP Holdings for the six months ended 30 June 2004 increased by 9.6% to HK$4,014 million, as compared with the corresponding period in 2003. It was encouraging to see that this growth in earnings came from both our Hong Kong electricity business (regulated by the Government of the Hong Kong Special Administrative Region under the Scheme of Control) and our non-Scheme of Control businesses, notably our investments in the electricity sector in the Asia-Pacific region.

Total earnings (which include Hok Un redevelopment profit) for this interim period were HK$4,138 million (HK$1.72 per share), an increase of 11.4%, compared to HK$3,714 million (HK$1.54 per share) in 2003.

Earnings from our electricity business in Hong Kong increased by 9.6% to HK$3,337 million, whilst operating earnings from non-Scheme of Control activities grew by 11.4% to HK$791 million, an increase of HK$81 million compared to the same period in 2003.

Hong Kong

The Hong Kong electricity business remained the main source of the Group’s earnings, contributing 81% of our operating earnings before deduction of unallocated expenses (2003: 81%). Overall, sales of electricity in Hong Kong in the first half of 2004 grew by 2.5% compared with the same period last year. Slow growth earlier in the period was attributable to temperatures being cooler than normal. However, the strength of underlying demand, and Hong Kong’s gradual economic recovery, was dramatically illustrated on 2 July 2004, when our local demand reached a historical peak of 6,329MW. This represented an increase of 7.7% from the previous maximum demand of 5,874MW in summer 2003.

In my Chairman’s Statement to our 2003 Annual Report, I commented on the likelihood that discussions with the Hong Kong Government on the future electricity regulatory regime would move forward during the course of this year. I also noted that any regulatory regime which is introduced after the expiry of the present Scheme of Control in 2008 should be on terms which ensure that the quality of electricity supply is maintained in Hong Kong and that the necessary investments continue to be made.

The sharp and significant growth in maximum electricity demand which has occurred in summer 2004 shows the importance of making the necessary investment in our electricity infrastructure in advance of demand. It also demonstrates that increases in demand can be steep and unexpected and that, even for a mature economy such as Hong Kong, it is unwise to assume that demand in growth will be slow and predictable, and to under-invest accordingly. The increase in maximum demand compared to 2003 was 455MW. To put this in context, this increase alone is equivalent to almost a quarter of the current generating capacity at our Black Point Power Station. On an overall basis, our reserve margin of generating capacity to meet local demand has now fallen from 40.7% to 30.6%.

Page 4

Increases in electricity demand bear not only upon our generating capacity, but also upon the adequacy and reliability of our transmission and distribution network in Hong Kong. The weather during the last week in June was continually hot and humid. Consequently some significant incremental load increases, up to 38% in some locations, were observed in a variety of residential areas, particularly over the evening periods. Such sharp increases present challenges to any electricity network, yet reliability and availability of electricity supplies were maintained at the customary high levels.

These figures illustrate the straightforward point that present demand can only be met by past investment. CLP’s policy of prudent and continuing investment, backed by certainty in the regulatory regime which enables those investments to be made and for reasonable returns to be earned by our investors, continues to provide the foundation for ensuring that Hong Kong has an electricity infrastructure which meets the needs of our community.

Chinese Mainland and Asia Pacific

The performance of the Group’s investments in the Mainland and the Asia-Pacific region is described in more detail later in this Interim Report.

I wish to note that these activities, whilst more volatile in nature than the Hong Kong Scheme of Control business, are now contributing sustainable and significant income to the Group. This indicates the progress that has been made in CLP’s policy of diversifying its investments, such that we no longer solely rely on the earnings from our Hong Kong electricity business.

The increase in Hong Kong’s domestic demand reflects economic trends that extend across much of the Asia region, including some of the countries where CLP has a presence and is ready to consider further investment. There is very considerable activity in new projects in the Chinese mainland, due to high demand growth, and opportunities for CLP to maintain its position in this market. Similarly, the economic growth in India, Thailand and Taiwan is increasing pressure for further private sector power projects to support the state utilities. Whilst sustainable economic growth creates the basis for expanding our business outside Hong Kong, we will approach all such opportunities cautiously to ensure that any new investment is supported by strong fundamentals of providing power at affordable and competitive prices, and delivering an acceptable return.

This Interim Report explains not only our financial and operational performance, but also the broader environmental and social aspects of our activities. Your Board and I remain committed to the careful stewardship of your Company’s affairs and to overseeing a performance in the second half of this year, and beyond, which builds upon the good results achieved in the first half of 2004.

|

/s/ The Hon. Michael D. Kadoorie |

|

| The Hon. Michael D. Kadoorie |

Hong Kong, 4 August 2004 |

Page 5

Management’s Discussion and Analysis

This section describes CLP’s major activities in Hong Kong, the Chinese mainland and elsewhere in the Asia-Pacific region, as well as the Group’s financial results, funding and obligations during the first half of 2004.

Business Overview

CLP follows a clear, consistent and focused strategy to realise our vision of being a leading investor-operator in the Asia-Pacific electricity power sector. We aim continuously to enhance our core Hong Kong electricity business and to develop a portfolio of electricity businesses in the Chinese mainland and the Asia-Pacific region. An outline of our investments is set out below:

Hong Kong

| | | | | | |

| Investments | | Equity Interest | | Description |

| | |

CLP Power Hong Kong Limited (CLP Power Hong Kong) | | 100% | | CLP Power Hong Kong owns and operates the transmission and distribution system, covering a supply area of approximately 1,000 sq. km, which includes: |

| | | | | • • • • • • • | | 552 km of 400kV lines; 1,124 km of 132kV lines; 417 km of 33kV lines; 9,863 km of 11kV lines; 54,697 MVA transformers; 205 primary substations in operation; and 12,077 secondary substations in operation. |

| | |

| Castle Peak Power Company Limited (CAPCO), 6,283 megawatts (MW) of installed generating capacity | | 40% | | CAPCO owns: Black Point Power Station (2,500MW, when completed) |

| | | | • | | Gas-fired power station (with distillate as back-up) comprising eight combined cycle turbines of 312.5MW each. |

| | | | • | | Six units in operation, plus two final units to be commissioned in 2005 and 2006 respectively. |

| | |

| | | | | Castle Peak Power Station (4,108MW) |

| | | | | • | | Commissioned between 1982 and 1990. |

| | | | | • | | One of the world’s largest coal-fired power station complexes, comprising eight units ranging from 350MW to 677MW. |

| | | | | • | | Two of the 677MW units are capable of burning gas and oil as alternative fuels. |

| | |

| | | | | Penny’s Bay Power Station (300MW) |

| | | | | • | | Three diesel oil-fired units of 100MW each, commissioned in 1992. |

Page 6

| Note: | CLP Power Hong Kong operates CAPCO’s power stations and purchases its power from CAPCO and Guangdong Daya Bay Nuclear Power Station. These sources of power, together with CLP’s right to use 50% of the capacity of Phase 1 of the Guangzhou Pumped Storage Power Station, amount to a total installed capacity of 8,263MW. |

| | | | |

Chinese

Mainland | | | | |

Investments (Gross/

Equity MW) | | Equity Interest | | Description |

| | |

CLP Guohua Power Company Limited (CLP Guohua) 2,100/630MW | | 49% | | CLP Guohua holds interests in three coal-fired power stations, namely Beijing Yire in Beijing, Panshan in Tianjin, and Sanhe in Hebei, with a combined installed capacity of 2,100MW. |

| | |

Shandong Zhonghua Power Company, Ltd. (SZPC) 3,000/882MW | | 29.4% | | SZPC owns four coal-fired power stations, Shiheng I and II (totalling 1,200MW), Liaocheng (1,200MW) and Heze II (600MW). |

| | |

CLP Guohua Shenmu Power Company Limited (Shenmu) 200/98MW | | 49% | | Shenmu II Power Station, in Shaanxi, has two 100MW coal-fired units. It is managed as part of CLP Guohua. |

| | |

Guizhou CLP Power Company Limited (Guizhou CLP Power) 600/420MW | | 70% | | Guizhou CLP Power develops, constructs and operates two 300MW coal-fired generating units to supply the Guizhou power grid and, through it, to supply Guangdong Province. |

| | |

Guangdong Nuclear Power Joint Venture Company, Limited (GNPJVC) 1,968/492MW | | 25% | | GNPJVC was established in 1985 to construct and operate Guangdong Daya Bay Nuclear Power Station (GNPS) at Daya Bay. GNPS is equipped with two 984MW Pressurised Water Reactors. The majority of the GNPS equipment was imported from France and the United Kingdom. The two units at GNPS commenced commercial operation in 1994. 70% of electricity generated is supplied to Hong Kong, with the remaining 30% sold to Guangdong. |

| | |

Hong Kong Pumped Storage Development Company, Limited (PSDC) 1,200/600MW | | 49% | | CLP has the right to use half of the 1,200MW pumped storage capacity of Phase I of the Guangzhou Pumped Storage Power Station until 2034. |

| | |

Huaiji Power Project (Huaiji) 98/41MW | | 41.5% | | Eight small hydro power stations are in operation, with one under construction, amounting to a total of 98MW. |

Page 7

Asia-Pacific Region

| | | | |

Investments (Gross/

Equity MW) | | Equity Interest | | Description |

| | |

Gujarat Paguthan Energy Corporation Private Limited (GPEC), India 655MW | | 100% | | GPEC operates a 655MW gas-fired combined cycle power station in Gujarat, India. |

| | |

Ho-Ping Power Company (Ho-Ping), Taiwan 1,320/528MW | | 40% | | Ho-Ping owns a 1,320MW coal-fired power station at Ho-Ping, Taiwan, which started operations in 2002. |

| | |

Electricity Generating Public Company Limited (EGCO), Thailand 3,014/541MW | | 22.4% | | EGCO operates two gas-fired combined cycle power stations in Thailand (2,056MW). It has also invested in a number of small power projects in Thailand and the Philippines, totalling 958MW. |

| | |

BLCP Power Limited (BLCP), Thailand 1,434/717MW | | 50% | | BLCP is the developer of a 1,434MW coal-fired power station now under construction at Map Ta Phut, Thailand. |

| | |

Yallourn Energy Pty Limited (Yallourn Energy), Australia 1,480MW | | 100% | | Yallourn Energy owns and operates a 1,480MW coal-fired plant and a dedicated coal mine in Victoria, Australia. |

Operational Performance and Outlook

Electricity Business in Hong Kong

During the first six months of 2004 the Hong Kong economy continued to improve, with GDP growth of 6.8% in the first quarter compared to the corresponding period in 2003. However, local electricity sales increased at a slower pace than GDP, recording growth of 2.5%. Such sales were affected by the weather, which on average was cooler during the first six months of the year, compared to 2003.

Sales to the Residential Sector increased slightly, whereas sales to the Commercial Sector grew noticeably, reflecting the economic recovery. The Infrastructure & Public Services Sector had stronger growth, attributable in part to increased investment in Hong Kong’s railway infrastructure. The decline of sales to the Manufacturing Sector slowed down as a result of robust export performance.

A breakdown of the local unit sales growth by sector during the period is as follows:

| | | | | |

| | | Increase/(Decrease) % | | | Total Local Sales in % |

| | |

Residential | | 0.6 | | | 22.5 |

Commercial | | 3.2 | | | 39.8 |

Infrastructure & Public Services | | 4.7 | | | 27.3 |

Manufacturing | | (1.1 | ) | | 10.4 |

Page 8

With respect to sales to the Chinese mainland, demand from Shekou remained strong but sales to the Guangdong Guang-Dian Power Grid Group Company Limited (GPG) dropped approximately 12.6%. Overall sales to the Mainland decreased by 5.9% in comparison to the same period in 2003 as the then sales contract with GPG approached completion. With the renewal of the sales contract in late June 2004, sales to GPG are expected to return to a high level during the rest of the year.

Total unit sales, including both local sales and sales to the Chinese mainland, rose 1.8% over the same period in 2003.

Tariffs to our local customers remained unchanged. The HK$500 million rebate to our customers, announced in December 2003, was implemented in March when the rebates began to be credited to customer accounts.

To enhance supply quality and reliability, as well as to provide for demand created by new towns and infrastructure development projects in our supply area, CLP continued to invest in the transmission and distribution networks during the period. Major projects included Hung Hom Bay Bulk Substation, Yuen Long to Fanling 300MVA 132kV circuit and the establishment of San Shek Wan Substation.

Pursuant to the Scheme of Control Agreement with the Government of the Hong Kong Special Administrative Region (HKSAR), the current Financial Plan will expire in December 2004. The 2005 Financial Plan, setting out CLP’s projected sales, capital and operating expenditure and tariff levels for the period from January 2005 to September 2008, was submitted to the HKSAR Government in June and is now under review.

To enhance customer service quality, we have introduced new value added services in response to increasing customer demand. The new services include “Home Advisory Services”, “Electrical Appliances Consultancy Services”, “Registered Electrical Contractors Referral Services” as well as expanded product sales to all market segments and extended operation hours of certain customer centres. Customer traffic (meaning the number of walk-in customers requesting service) in the first three months increased 22% compared with the same period last year.

Our efforts and commitment in quality management were recognised in the Hong Kong Management Association’s (HKMA) 2004 Quality Awards, when CLP Power Hong Kong was named as the Overall Winner.

In line with our commitment to responsible corporate citizenship, CLP partnered with St. James’ Settlement to launch a “Fulfil A Wish” campaign from February to March. The programme aimed at encouraging the community to reduce wastage and reuse electrical appliances. A total of 2,421 electrical appliances were donated by customers and more than 800 less privileged families benefited from the campaign by receiving appliances. We are also pleased that CLP’s volunteers team marks its 10th anniversary this year. The team is currently made up of 600 staff members serving the community in their own time and is one of the largest corporate volunteer teams in Hong Kong.

Page 9

The current Scheme of Control Agreement, which regulates our Hong Kong electricity business, will expire in 2008. The HKSAR Government has previously indicated that later this year there will be a public consultation on the way forward for the electricity sector. Given the importance of electricity in our daily lives, CLP will be engaging all stakeholders – customers, shareholders, employees, and other members of the Hong Kong community – to promote a better understanding of the industry and a more informed and balanced discussion of the complex issues involved.

Electricity Business in the Chinese Mainland

The 3,000MW joint venture in Shandong Province continued to make good progress. Both units at Liaocheng (2 x 600MW) have now been taken over for commercial operation. New tariffs have been approved for Liaocheng as well as Heze II stations. A new lending consortium comprising entirely Mainland banks refinanced both the RMB and US$ loans. Although there were a number of charges associated with the refinancing, the result was to increase the loan tenors at a lower effective borrowing rate.

Last year we signed a letter of intent to undertake a feasibility study on a 2 x 600MW greenfield project at Fangchenggang in Guangxi, in which CLP may take a 70% interest. We have continued to work with our joint venture partner, Guangxi Water & Power Engineering (Group) Co. Ltd., a subsidiary of the Guangxi Electric Power Co. Ltd., on this project, including the regulatory approvals necessary to allow it to proceed.

Unit 1 of the 2 x 300MW Anshun II Power Station was taken over for commercial operation in March 2004, with Unit 2 envisaged for takeover in November 2004. An increased tariff, which took into account recent coal price increases, was approved in July 2004.

The Guangdong Daya Bay Nuclear Power Station continued to operate well, with good safety and environmental performance. In May, whilst Unit 2 was on a scheduled outage, an incident resulting in a bent fuel assembly, which had no safety or environmental impact, led to the outage being extended by approximately 2 months, with the Unit returning to service on 24 July.

During the first half of 2004, increased demand for electricity in the Mainland led to pressure on domestic coal supplies. Although generation at the power stations in which CLP holds an interest was occasionally constrained by coal supply difficulties, there was no significant adverse effect on production.

Electricity Business in the Asia-Pacific Region

CLP has a significant presence in Australia, India, Taiwan and Thailand. Our focus is on optimising the performance of our existing assets and, where market conditions and investment opportunities permit, continuing to build meaningful and sustainable businesses in those countries.

Page 10

The acquisition of the remaining 8% shareholding in Yallourn Energy in Australia was completed in March 2004. CLP now owns 100% of Yallourn Energy. During the first half of the year our Yallourn Energy power station performed largely in line with budget. The Morwell River Diversion project, which will secure access to a long-term coal reserve, and the upgrade of the station’s instrumentation and control systems remain on schedule and within budget. Good progress has been made towards a new enterprise bargaining agreement to replace the present three-year agreement which ends in September 2004.

High reliability and safety levels were maintained at our wholly-owned power station, GPEC, in India. An amended power purchase agreement (PPA) with the offtaker, Gujarat Electricity Board, was entered into at the end of 2003. To date, the implementation of the PPA has proceeded satisfactorily with significant improvement in the monthly collections of payments to GPEC, as compared to previous years.

The Ho-Ping power station in Taiwan was commissioned in 2002. Plant performance during the six-month period to 30 June 2004 was characterised by continuing improvement in reliability, as remaining technical issues were steadily resolved. The recent surge in coal prices and sea freight costs did have an operational and financial impact and has required ongoing and close attention from management. In July 2004 we completed a partial refinancing of the project in order to reduce interest costs.

In Thailand, a key task has been to take forward the construction of the BLCP project which is managed by CLP. Progress has been satisfactory and to a schedule which would see the two generating units entering service in 2006/07. The lender base for this project was widened by the participation of the Asian Development Bank and the Japan Bank for International Cooperation.

Electricity-Related Business

Property Business

CLP redevelops sites in Hong Kong which are no longer required for electricity purposes.

Our major project is the residential redevelopment of the former power station site at Hok Un, Kowloon. This 50/50 joint venture project, known as Laguna Verde, led by CLP and a wholly-owned subsidiary of Cheung Kong (Holdings) Limited, comprises 4,735 flats, 1,692 parking spaces and 270,000 sq. ft. of commercial space. About 99% of the residential units in the redevelopment had been sold by the end of June 2004.

Public Lighting and Engineering Services

CLP offers contracting and consultancy services in power engineering, building services, telecommunications, road lighting, energy services and facility management for customers in Hong Kong and neighbouring areas. Our energy services include energy audit, fuel switching and power quality improvement. Power engineering, building services and telecommunications services are normally provided through infrastructure projects. Road lighting and facility management services are provided under maintenance contracts.

Page 11

Telecommunications

CLP had previously held a 19% stake in PowerCom Network Hong Kong Limited (PowerCom), a joint venture with Cheung Kong Enterprises Limited (CKE) to provide broadband services to Hong Kong customers using powerline telecommunications technology. In line with our strategic focus on our electricity business, we participated in a sale of PowerCom by CKE to Vanda Systems & Communications Holdings Limited (renamed as Hutchison Global Communications Holdings Limited (HGCH)) in January 2004 in exchange for the issue of shares in HGCH. We subsequently placed 37.7% of those shares in March 2004 and sold the remaining shares in July 2004.

Human Resources

On 30 June 2004, the Group employed 4,678 staff (2003: 4,694), of whom 3,897 (2003: 3,895) were employed in the electricity business in Hong Kong and 359 (2003 : 359) by Yallourn Energy and GPEC. Total remuneration for the six months ended 30 June 2004 was HK$1,246 million (2003: HK$1,117 million), including retirement benefit costs of HK$99 million.

During the first half of 2004, we have undertaken a number of key human resources initiatives.

In addition to the internal identification of talent, we maintain programmes that support the introduction of new talent into the CLP Group. As part of this, four new entrants into the CLP Executive Programme (CEP) will join us later this year.

We have also continued the CLP Internship Programme (CIP) which encourages students to join CLP for a summer or a 12 month secondment. The CIP has an excellent reputation with local universities and 51 students are participating in this year’s programme.

On 1 July 2004 we completed the implementation of a new performance-based remuneration system for CLP’s Hong Kong workforce, which had been started in 2001. All permanent staff now have an appropriate percentage of their pay related to individual and company performance, and the 13th month bonus has been completely phased out.

Safety

Safety is of utmost importance across the CLP Group. During the first half of 2004, good performance continued in our wholly-owned subsidiaries in Australia and India. However, the safety performance of our Hong Kong business did not meet our standards. As previously reported in our Annual Report, there were two fatal accidents in February and March. These led to the loss of life of an employee of a CLP contractor at Black Point Power Station and a CLP employee working on an overhead line tower near Tseung Kwan O. In addition, an incident in June at Black Point Power Station injured 3 CLP employees, two of them seriously. This level of safety performance is unacceptable. Each accident is subject to investigation by panels comprising representatives of senior management. In addition to implementing the specific recommendations of the panels, a range of initiatives are being implemented to reinforce our safety culture. We are looking to significant improvement during the second half of 2004.

Page 12

Environment

A new Boiler Optimisation System, which makes use of Neural Network Technology (Artificial Intelligence), has been installed on a 677MW generating unit at the Castle Peak Power Station. Results show a reduction in Nitrogen Oxide emission and improvement in Boiler Efficiency. We plan to apply this system to other generating units.

CLP is assessing the application of wind energy in Hong Kong through a commercial grade wind turbine demonstration project. In June 2004, we engaged expert consultants to carry out the site selection, wind measurement and environmental studies necessary for bringing this project forward. This project should enable a better understanding of the potential role of renewable energy in Hong Kong.

In March 2004, CLP set new targets to improve our environmental performance, particularly with respect to emissions of sulphur dioxide (SO2). Among these is our commitment to incorporate SO2 emissions reduction capabilities at all new greenfield coal-fired projects in which we have a controlling interest. At the same time, we stated our intent to pursue, in conjunction with the HKSAR Government, the possibility of retrofitting flue gas desulphurisation (FGD) units at our Castle Peak Power Station in Hong Kong.

CLP recognises its responsibility towards future generations, and contributes regularly to educational activities for school children. This year, we are working with overseas science curriculum experts, Hong Kong teachers, and a US Fulbright Scholar to develop a bilingual curriculum on sustainable energy. Government advisors help us ensure that the curriculum will meet educational needs in Hong Kong. Dozens of local science teachers have indicated their interest in participating in the pilot test of the set of teaching material in Autumn 2004.

Page 13

Shareholder Value

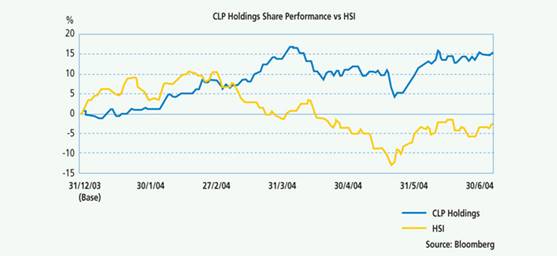

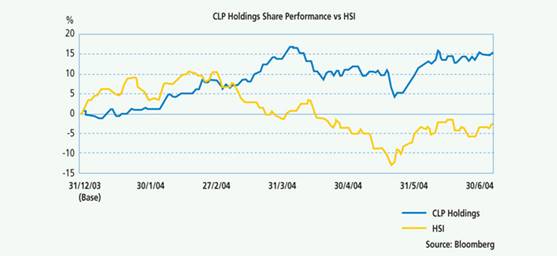

During the first half of 2004 CLP’s share price rose 15.4%, whereas the Hang Seng Index (HSI) decreased by 2.3%.

The final dividend of HK$0.65 per share and special final dividend of HK$0.10 per share for 2003 were paid to Shareholders on 23 April 2004. The first interim dividend for 2004 of HK$0.45 per share was paid on 23 June 2004 and the second interim dividend of HK$0.45 per share will be paid on 15 September 2004.

Financial Performance

Consolidated Financial Results

Turnover

During the six-month period to 30 June 2004, our turnover registered a 17.3% increase to HK$13,922 million (2003: HK$11,871 million). This resulted from higher revenue from the Scheme of Control (SoC) electricity business in Hong Kong, as well as incorporation of the full six-month turnover of Yallourn Energy and GPEC which became subsidiaries of the Group in April and June 2003 respectively.

Under the SoC business, electricity unit sales to local customers increased by 2.5% while total unit sales, which include sales to the Chinese mainland, increased by 1.8%, compared to the same period last year. As there was no tariff increase in 2004, the increase in SoC revenue by 4.7% to HK$11,870 million (2003: HK$11,333 million) was mainly due to fuel clause adjustment as a result of higher composite fuel price for the period.

Turnover of Yallourn Energy and GPEC amounted to HK$1,958 million (2003: HK$470 million).

Page 14

Group Earnings

Total operating earnings were HK$4,014 million, which was HK$351 million higher than the corresponding period last year, representing an increase of 9.6%. Total earnings, which include Hok Un redevelopment profit, increased by 11.4% to HK$4,138 million.

The SoC business continues to provide stable earnings growth, with earnings increasing by 9.6% to HK$3,337 million. This resulted from the combined effect of on-going investments in fixed assets to meet new customer demand and to improve quality of services and lower interest borne by shareholders.

Non-SoC operating earnings rose 11.4% to HK$791 million, reflecting improved contribution from our investments in the Asia-Pacific region. Earnings from power projects in the Chinese mainland decreased from HK$516 million to HK$423 million primarily due to a one-off swap breakage cost and the write-off of unamortised financing cost associated with the refinancing of the Shandong project loans. Our electricity business in the Asia-Pacific region achieved an earnings growth of 112.6% to HK$404 million. Contribution mainly came from GPEC with improved collection of receivables. The effect of increased coal prices and low coal reserve was not significant in the first six months, but may intensify in the second half of the year.

Earnings per share increased by 11.4% when compared to the corresponding period in 2003. Excluding the Hok Un redevelopment profit, earnings per share increased by 9.6%.

The contribution of each major activity to the Group earnings is analysed as follows:

| | | | | | | | | | | | | | |

| | | 6 months ended 30 June | | | |

| | | 2004 | | | 2003 | | | Increase |

| | | HK$M | | | HK$M | | | HK$M | | | HK$M | | | % |

| | | | | |

SoC earnings | | | | | 3,337 | | | | | | 3,045 | | | 9.6 |

Non-SoC operating earnings | | | | | | | | | | | | | | |

Sales to Chinese mainland | | 30 | | | | | | 30 | | | | | | |

Power projects in Chinese mainland | | 423 | | | | | | 516 | | | | | | |

Power projects in Asia-Pacific region | | 404 | | | | | | 190 | | | | | | |

Other businesses | | (66 | ) | | | | | (26 | ) | | | | | |

| | |

|

| | | | |

|

| | | | | |

| | | | | | 791 | | | | | | 710 | | | 11.4 |

Unallocated net finance costs | | | | | (39 | ) | | | | | (33 | ) | | |

Unallocated Group expenses | | | | | (75 | ) | | | | | (59 | ) | | |

| | | | | |

|

| | | | |

|

| | |

Total operating earnings | | | | | 4,014 | | | | | | 3,663 | | | 9.6 |

Hok Un redevelopment profit | | | | | 124 | | | | | | 51 | | | |

| | | | | |

|

| | | | |

|

| | |

Group earnings attributable to shareholders | | | | | 4,138 | | | | | | 3,714 | | | 11.4 |

| | | | | |

|

| | | | |

|

| | |

Weighted average number of shares in issue, million shares | | | | | 2,408.25 | | | | | | 2,408.25 | | | |

| | | | | |

Earnings per share, HK$ | | | | | | | | | | | | | | |

Including Hok Un redevelopment profit | | | | | 1.72 | | | | | | 1.54 | | | 11.4 |

Excluding Hok Un redevelopment profit | | | | | 1.67 | | | | | | 1.52 | | | 9.6 |

Page 15

Significant Investments

In March 2004, we completed the acquisition of the remaining 8% interest in Yallourn Energy managed by Deutsche Asset Management (Australia) Limited for a consideration of HK$376 million. Yallourn Energy has now become a wholly-owned subsidiary of the Group. In respect of our investment in Anshun II, we made the final share capital contribution of RMB286 million (approximately HK$269 million) in April 2004.

Fixed assets of the Group amounted to HK$54,569 million as at 30 June 2004, comprising mainly the investments in the transmission and distribution network for the core Hong Kong electricity business of HK$40,567 million (December 2003: HK$39,258 million) and in the generating facilities of Yallourn Energy and GPEC of HK$13,830 million (December 2003: HK$14,687 million). During the six-month period, we invested HK$2,637 million (2003: HK$2,392 million), of which HK$2,313 million (2003: HK$2,295 million) was made by CLP Power Hong Kong, in various fixed assets. Capital expenditure by CAPCO for the six months was HK$829 million (2003: HK$599 million).

Our total assets, which comprise primarily fixed assets and investments in jointly controlled entities and associated companies, analysed by principal activities, are as follows:

| | | | | | | | |

| | | 30 June 2004 | | 31 December 2003 |

| | | HK$M | | % | | HK$M | | % |

Electricity Business | | | | | | | | |

Hong Kong | | 48,994 | | 64 | | 46,718 | | 62 |

Asia-Pacific region | | 20,163 | | 26 | | 21,254 | | 28 |

Chinese mainland | | 6,643 | | 9 | | 6,416 | | 8 |

| | |

| |

| |

| |

|

| | | 75,800 | | 99 | | 74,388 | | 98 |

Property and other businesses | | 841 | | 1 | | 1,444 | | 2 |

| | |

| |

| |

| |

|

| | | 76,641 | | 100 | | 75,832 | | 100 |

| | |

| |

| |

| |

|

Capital expenditure contracted but not provided for in the accounts as at 30 June 2004 amounted to HK$2,771 million (December 2003: HK$2,984 million). These contracted amounts are primarily for enhancing our transmission and distribution systems in Hong Kong. The recent hot and humid weather in Hong Kong in late June and early July has triggered significant increases in demand for electricity. On the generation side, the local demand recorded a historical peak of 6,329MW, an increase of 7.7% from last year, whilst load increases of up to 38% were observed in some parts of our supply area. These sharp increases illustrate the importance of making the necessary investment in our electricity infrastructure in advance of demand in order to maintain and enhance supply reliability.

Owing primarily to continued high capital expenditure requirements and a slightly lower than expected revenue so far this year, Yallourn Energy forecasts that, in order to meet the debt service cover ratios as stipulated in the relevant loan agreements, further contingent equity support of about A$40 million may need to be provided in the second half of 2004.

Pursuant to the Equity Contribution Agreement and its amendment agreement relating to the BLCP power project, we are required to make further equity contributions of US$148 million by 2007.

Page 16

Liquidity and Capital Resources

As at 30 June 2004, we had liquid funds of HK$1,265 million (December 2003: HK$787 million), of which 92% (December 2003: 64%) were denominated in foreign currency mainly held by GPEC and Yallourn Energy. The remainder was in Hong Kong dollars.

Financing facilities totalling HK$26.3 billion were available to the Group, including HK$7.4 billion for Yallourn Energy and GPEC. Of the available facilities, HK$19.6 billion had been drawn down, of which HK$7.2 billion was by Yallourn Energy and GPEC. Facilities totalling HK$11.0 billion were available to CAPCO, of which HK$10.2 billion had been drawn down. The debts of Yallourn Energy and GPEC are without recourse to CLP Holdings. Of these borrowings, HK$5,746 million and HK$539 million as at 30 June 2004 are secured by fixed and floating charges over the assets of Yallourn Energy and GPEC respectively.

Our total debt to total capital as at 30 June 2004 was 32.2% and interest cover was 9 times.

Financing

Our business expansion, in particular, capital expenditure programmes by CLP Power Hong Kong and CAPCO for our Hong Kong electricity business, is funded by bank loans, debt securities and cash flow from operations.

We adopt a prudent approach to all our financial arrangements, while at the same time aiming to achieve cost efficient funding. In January 2004, CLP Power Hong Kong issued HK$500 million 4.93% fixed rate notes due 2014 through the Medium Term Note (MTN) Programme set up by its wholly-owned subsidiary CLP Power Hong Kong Financing Limited. Under the MTN Programme, notes in an aggregate amount of up to US$1.5 billion may be issued and will be unconditionally and irrevocably guaranteed by CLP Power Hong Kong. As at 30 June 2004, about HK$3,840 million notes have been issued under the MTN Programme.

Page 17

Debt Profile

The charts below show the type, interest rate, maturity and currency profiles of borrowings of the Group and CAPCO at 30 June 2004

Notes:

| (1) | For the Medium Term Note Programme, only the amount (HK$3,840 million) of the Notes issued as at 30 June 2004 was included in the total amount of Available Facility. |

| (2) | 77% of Yallourn Energy and GPEC’s combined loans are at fixed or swapped to fixed rates. With the consolidation of these two subsidiaries, the percentage of fixed rate loans in CLP Group is 53%, compared to 39% if borrowings of Yallourn Energy and GPEC were not included. |

| (3) | The Australian dollar loans were mainly incurred by Yallourn Energy to refinance its project debts in 2001 and by CLP Holdings to hedge against currency exposure of the Group’s investment in Yallourn Energy. |

| (4) | The loans in Euros and Indian Rupees were drawn by GPEC. |

Credit Rating

There has been no change in credit ratings of CLP Holdings and CLP Power Hong Kong since the upgrade of both companies’ foreign currency ratings from A3 to A1 by Moody’s in October 2003. These credit ratings are supported by the strong cash flow generating ability and prudent financial structure of the Group. Our premier credit ratings can facilitate and enhance our position in local and overseas business activities, including fund raising, investment and new business opportunities of the Group.

Page 18

The current credit ratings of CLP Holdings and CLP Power Hong Kong are set out below:

| | | | | | | | | | | | |

| | | CLP Holdings | | CLP Power Hong Kong | | Hong Kong

Government |

| | | S&P | | Moody’s | | S&P | | Moody’s | | S&P | | Moody’s |

| | | | | | |

Long-term Rating | | | | | | | | | | | | |

| | | | | | |

Foreign currency | | A+ | | A1 | | A+ | | A1 | | A+ | | A1 |

Outlook | | Stable | | Stable | | Stable | | Stable | | Stable | | Stable |

| | | | | | |

Local currency | | A+ | | Aa2 | | A+ | | Aa1 | | AA- | | Aa3 |

Outlook | | Stable | | Stable | | Stable | | Stable | | Stable | | Stable |

| | | | | | |

Short-term Rating | | | | | | | | | | | | |

Foreign currency | | A-1 | | P-1 | | A-1 | | P-1 | | A-1 | | P-1 |

Local currency | | A-1 | | — | | A-1 | | — | | A-1+ | | — |

Risk Management

The Group uses different derivative instruments to manage its exposure to foreign currency, interest rate risks, and price risks associated with the sales and purchases of electricity in Australia, with an objective to minimise the impact of exchange rate, interest rate and electricity price fluctuations on earnings, reserves and tariff charges to customers. All transactions are made with counter-parties with acceptable credit quality and a limit is assigned to each counter-party for monitoring the credit exposure. Other than certain limited electricity trading activities engaged by Yallourn Energy, all derivative instruments are employed solely for hedging purposes.

Foreign Currency Risks

The Group’s foreign currency exposures mainly arise from the loan repayment/interest payment obligations, purchases of goods and services, fuel-related payments and overseas investment activities. During the period, CLP Power Hong Kong continued to take advantage of market opportunity to arrange further US dollar forward purchases to hedge its US dollar exposure. Apart from using forward foreign exchange contracts, currency swaps and options to manage the currency exposure, we also adopt an approach of financing our investments by borrowings of matching currency, where appropriate, to mitigate the currency risk.

Interest Rate Risks

The Group utilises interest rate swaps to manage its interest rate risk within a preferred interest rate mix. We closely monitor the market conditions and review our preferred interest rate mix periodically to ensure an appropriate interest rate mix is adopted and that the Group’s interest rate exposure is minimised.

Electricity Sales and Purchases Risks

Yallourn Energy’s revenue is predominantly derived from the sale of electricity into the Australia’s National Electricity Market (NEM). Electricity energy contracts, including forward electricity pricing contracts, swaps and options contracts, are entered into to help reduce the impact of the volatility of NEM pool prices on earnings. Yallourn Energy also engages in limited energy trading activities in accordance with the approved policy. We have strengthened controls and procedures within Yallourn Energy to ensure trading and marketing activities are conducted within a clear and appropriate framework.

Page 19

Off-Balance Sheet Financial Instruments

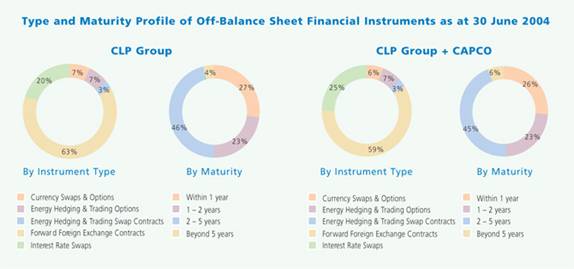

As at 30 June 2004, we had gross outstanding derivative instruments amounting to HK$71.1 billion (HK$75.5 billion for the Group and CAPCO combined), out of which HK$0.2 billion were energy trading contracts. A breakdown by type and maturity profile of the Group’s derivative instruments are shown in the charts below:

The fair value of the Group’s outstanding derivative instruments as at 30 June 2004 was at deficit of HK$281 million (HK$376 million deficit for the Group and CAPCO combined), which represents the net amount we would pay if these contracts were closed out on 30 June 2004. The deficit was largely caused by the weakening in the forward market for the US dollar against HK dollar. The fair market value of Yallourn Energy’s energy trading activities was at surplus of HK$0.8 million.

Contingent Liabilities

GPEC has obtained payment for some of its receivables from Gujarat Electricity Board (GEB) through bill discounting with recourse. There is no recourse to the Group beyond GPEC from these arrangements and to date there has been no incident where recourse to GPEC has been necessary. The potential effect if these financing arrangements are not settled by GEB as at 30 June 2004 was HK$597 million.

In respect of the Shandong joint venture, our contingent obligations in relation to the undertakings given to the project finance lenders effectively lapsed upon refinancing and arrangements are being made to obtain formal release from the lenders.

Page 20

Condensed Consolidated Profit and Loss Account

| | | | | | | | |

| | | | | (Unaudited) 6 months ended 30 June | |

| | | Note | | 2004

HK$M | | | 2003

HK$M | |

Turnover | | 3 | | 13,922 | | | 11,871 | |

| | | | |

|

| |

|

|

| | | | | | | | | |

Expenses | | | | | | | | |

Purchases of electricity | | 25(A) | | 7,630 | | | 7,112 | |

Staff expenses | | | | 648 | | | 525 | |

Fuel and other net operating costs | | | | 1,470 | | | 643 | |

Depreciation | | | | 1,242 | | | 1,005 | |

| | | | |

|

| |

|

|

| | | | | 10,990 | | | 9,285 | |

| | | | |

|

| |

|

|

| | | | |

|

| |

|

|

Operating profit | | 3, 4 | | 2,932 | | | 2,586 | |

Finance costs | | 5 | | (483 | ) | | (223 | ) |

Finance income | | 5 | | 23 | | | 35 | |

Hok Un redevelopment profit | | | | 147 | | | 63 | |

Share of profits less losses of jointly controlled entities | | 6 | | 1,587 | | | 1,711 | |

Share of profits less losses of associated companies | | 6 | | 143 | | | 53 | |

| | | | |

|

| |

|

|

| | | | | | | | | |

Profit before taxation | | | | 4,349 | | | 4,225 | |

Taxation | | 7 | | (792 | ) | | (728 | ) |

| | | | |

|

| |

|

|

| | | | | | | | | |

Profit after taxation | | | | 3,557 | | | 3,497 | |

Transfers under Scheme of Control (SoC) | | 8 | | 581 | | | 217 | |

| | | | |

|

| |

|

|

Earnings | | | | | | | | |

| | | | | | | | | |

SoC earnings (page 40) | | | | 3,337 | | | 3,045 | |

Non-SoC operating earnings | | 9 | | 791 | | | 710 | |

Unallocated net finance costs | | | | (39 | ) | | (33 | ) |

Unallocated Group expenses | | | | (75 | ) | | (59 | ) |

| | | | |

|

| |

|

|

Total operating earnings | | | | 4,014 | | | 3,663 | |

Hok Un redevelopment profit | | | | 124 | | | 51 | |

| | | | | | | | | |

Total earnings | | | | 4,138 | | | 3,714 | |

| | | | |

|

| |

|

|

| | | | | | | | | |

Dividends | | 10 | | | | | | |

First interim paid | | | | 1,084 | | | 987 | |

Second interim | | | | 1,084 | | | 987 | |

| | | | |

|

| |

|

|

| | | | | 2,168 | | | 1,974 | |

| | | | |

|

| |

|

|

| | | | | | | | | |

Earnings per share | | 11 | | | | | | |

Including Hok Un redevelopment profit | | | | HK$1.72 | | | HK$1.54 | |

Excluding Hok Un redevelopment profit | | | | HK$1.67 | | | HK$1.52 | |

Page 21

Condensed Consolidated Balance Sheet

| | | | | | | | |

| | | | | (Unaudited)

30 June | | | (Audited) 31 December | |

| | | |

| | | Note | | 2004 HK$M | | | 2003 HK$M | |

Capital employed | | | | | | | | |

Fixed assets | | 12 | | 54,569 | | | 54,157 | |

Goodwill | | 13 | | (958 | ) | | (1,017 | ) |

Investments in jointly controlled entities | | 14 | | 14,330 | | | 14,687 | |

Investments in associated companies | | 15 | | 1,523 | | | 1,593 | |

Investment securities | | | | 9 | | | 9 | |

Deferred tax assets | | | | 870 | | | 952 | |

| | | | |

|

| |

|

|

| | | | | 70,343 | | | 70,381 | |

| | | | |

|

| |

|

|

Current assets | | | | | | | | |

Bank balances, cash and other liquid funds | | 16 | | 1,265 | | | 787 | |

Other investments | | 17 | | 24 | | | 10 | |

Inventories – stores and fuel | | | | 243 | | | 230 | |

Trade and other receivables | | 18 | | 4,766 | | | 4,424 | |

| | | | | | | | | |

| | | | | 6,298 | | | 5,451 | |

| | | |

Current liabilities | | | | | | | | |

Customers’ deposits | | | | (2,993 | ) | | (2,878 | ) |

Short-term loans and current portion of long-term loans and other borrowings | | 20 | | (2,328 | ) | | (1,095 | ) |

Fuel clause account | | | | (748 | ) | | (874 | ) |

Taxation payable | | | | (274 | ) | | (64 | ) |

Trade and other payables | | 19 | | (3,341 | ) | | (3,994 | ) |

| | | | | | | | | |

| | | | | (9,684 | ) | | (8,905 | ) |

| | | | |

|

| |

|

|

Net current liabilities | | | | (3,386 | ) | | (3,454 | ) |

| | | | |

|

| |

|

|

| | | | |

|

| |

|

|

Total assets less current liabilities | | | | 66,957 | | | 66,927 | |

| | | | |

|

| |

|

|

Represented by | | | | | | | | |

Share capital | | 21 | | 12,041 | | | 12,041 | |

Share premium | | | | 1,164 | | | 1,164 | |

Reserves | | | | 27,114 | | | 25,230 | |

Proposed dividends | | | | 1,084 | | | 1,806 | |

| | | | |

|

| |

|

|

Shareholders’ funds | | | | 41,403 | | | 40,241 | |

Minority interest | | | | — | | | 393 | |

Long-term loans and other borrowings | | 20 | | 17,309 | | | 17,602 | |

Deferred tax liabilities | | | | 4,826 | | | 4,614 | |

SoC reserve accounts | | 8 | | 2,940 | | | 3,607 | |

Other non-current liabilities | | | | 479 | | | 470 | |

| | | | |

|

| |

|

|

| | | | | 66,957 | | | 66,927 | |

| | | | |

|

| |

|

|

| | | | |

/s/W. E. Mocatta | | /s/ Andrew Brandler | | /s/ Peter P. W. Tse |

| | |

W. E. Mocatta Vice Chairman | | Andrew Brandler

Group Managing Director &

Chief Executive Officer | | Peter P. W. Tse Group Executive Director & Chief Financial Officer |

Hong Kong, 4 August 2004

Page 22

Condensed Consolidated Statement of Changes in Equity

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Share

Capital

HK$M | | | | | Share

Premium

HK$M | | | | | Capital

Redemption

Reserve

HK$M | | | | | Other

Reserves

HK$M | | | | | | | Retained

Profits

HK$M | | | | | | | Total

HK$M | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance as at 1 January 2004 | | 12,041 | | | | | 1,164 | | | | | 2,482 | | | | | 387 | | | | | | | 24,167 | | | | | | | 40,241 | |

| | | | | | | | | | | | | |

Exchange differences arising on translation of: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

subsidiary companies | | — | | | | | — | | | | | — | | | | | (341 | ) | | | | | | — | | | | | | | (341 | ) |

jointly controlled entities | | — | | | | | — | | | | | — | | | | | 49 | | | | | | | — | | | | | | | 49 | |

associated company | | — | | | | | — | | | | | — | | | | | (49 | ) | | | | | | — | | | | | | | (49 | ) |

designated hedges | | — | | | | | — | | | | | — | | | | | 279 | (a) | | | | | | — | | | | | | | 279 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net losses not recognised in the profit and loss account | | — | | | | | — | | | | | — | | | | | (62 | ) | | | | | | — | | | | | | | (62 | ) |

Earnings for the period | | — | | | | | — | | | | | — | | | | | — | | | | | | | 4,138 | | | | | | | 4,138 | |

Dividends | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2003 finals | | — | | | | | — | | | | | — | | | | | — | | | | | | | (1,806 | ) | | | | | | (1,806 | ) |

2004 interim | | — | | | | | — | | | | | — | | | | | — | | | | | | | (1,084 | ) | | | | | | (1,084 | ) |

Share of other reserves of | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

jointly controlled entities | | — | | | | | — | | | | | — | | | | | 20 | | | | | | | (19 | ) | | | | | | 1 | |

associated company | | — | | | | | — | | | | | — | | | | | (25 | ) | | | | | | — | | | | | | | (25 | ) |

| | |

|

| | | |

|

| | | |

|

| | | |

|

| | | | | |

|

| | | | | |

|

|

Balance as at 30 June 2004 | | 12,041 | | | | | 1,164 | | | | | 2,482 | | | | | 320 | | | | | | | 25,396 | (b) | | | | | | 41,403 | |

| | |

|

| | | |

|

| | | |

|

| | | |

|

| | | | | |

|

| | | | | |

|

|

Company and subsidiary companies | | 12,041 | | | | | 1,164 | | | | | 2,482 | | | | | 238 | | | | | | | 21,943 | | | | | | | 37,868 | |

Jointly controlled entities | | — | | | | | — | | | | | — | | | | | 62 | | | | | | | 2,956 | | | | | | | 3,018 | |

Associated company | | — | | | | | — | | | | | — | | | | | 20 | | | | | | | 497 | | | | | | | 517 | |

| | |

|

| | | |

|

| | | |

|

| | | |

|

| | | | | |

|

| | | | | |

|

|

Balance as at 30 June 2004 | | 12,041 | | | | | 1,164 | | | | | 2,482 | | | | | 320 | | | | | | | 25,396 | | | | | | | 41,403 | |

| | |

|

| | | |

|

| | | |

|

| | | |

|

| | | | | |

|

| | | | | |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Balance as at 1 January 2003 | | 12,041 | | | | | 1,164 | | | | | 2,482 | | | | | (63 | ) | | | | | | 21,264 | | | | | | | 36,888 | |

| | | | | | | | | | | | | |

Exchange differences arising on translation of: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

subsidiary companies | | — | | | | | — | | | | | — | | | | | 621 | | | | | | | — | | | | | | | 621 | |

jointly controlled entities | | — | | | | | — | | | | | — | | | | | (96 | ) | | | | | | — | | | | | | | (96 | ) |

associated company | | — | | | | | — | | | | | — | | | | | 33 | | | | | | | — | | | | | | | 33 | |

designated hedges | | — | | | | | — | | | | | — | | | | | (383 | )(a) | | | | | | — | | | | | | | (383 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Net gains not recognised in the profit and loss account | | — | | | | | — | | | | | — | | | | | 175 | | | | | | | — | | | | | | | 175 | |

Earnings for the period | | — | | | | | — | | | | | — | | | | | — | | | | | | | 3,714 | | | | | | | 3,714 | |

Dividends | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

2002 finals | | — | | | | | — | | | | | — | | | | | — | | | | | | | (1,782 | ) | | | | | | (1,782 | ) |

2003 interim | | — | | | | | — | | | | | — | | | | | — | | | | | | | (987 | ) | | | | | | (987 | ) |

Share of other reserves of | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

jointly controlled entities | | — | | | | | — | | | | | — | | | | | 22 | | | | | | | (22 | ) | | | | | | — | |

associated company | | — | | | | | — | | | | | — | | | | | 12 | | | | | | | — | | | | | | | 12 | |

| | |

|

| | | |

|

| | | |

|

| | | |

|

| | | | | |

|

| | | | | |

|

|

Balance as at 30 June 2003 | | 12,041 | | | | | 1,164 | | | | | 2,482 | | | | | 146 | | | | | | | 22,187 | (c) | | | | | | 38,020 | |

| | |

|

| | | |

|

| | | |

|

| | | |

|

| | | | | |

|

| | | | | |

|

|

Company and subsidiary companies | | 12,041 | | | | | 1,164 | | | | | 2,482 | | | | | 107 | | | | | | | 18,388 | | | | | | | 34,182 | |

Jointly controlled entities | | — | | | | | — | | | | | — | | | | | 23 | | | | | | | 3,503 | | | | | | | 3,526 | |

Associated companies | | — | | | | | — | | | | | — | | | | | 16 | | | | | | | 296 | | | | | | | 312 | |

| | |

|

| | | |

|

| | | |

|

| | | |

|

| | | | | |

|

| | | | | |

|

|

Balance as at 30 June 2003 | | 12,041 | | | | | 1,164 | | | | | 2,482 | | | | | 146 | | | | | | | 22,187 | | | | | | | 38,020 | |

| | |

|

| | | |

|

| | | |

|

| | | |

|

| | | | | |

|

| | | | | |

|

|

| (a) | Included a net gain of HK$150 million (2003: a net loss of HK$333 million) arising from designated hedges using foreign currency borrowings and a net gain of HK$129 million (2003: a net loss of HK$50 million) using forward contracts. |

| (b) | The proposed interim dividend as at 30 June 2004 and balance of retained profits after the proposed interim dividend were HK$1,084 million and HK$24,312 million respectively. |

| (c) | The proposed interim dividend as at 30 June 2003 and balance of retained profits after the proposed interim dividend were HK$987 million and HK$21,200 million respectively. |

Page 23

Condensed Consolidated Cash Flow Statement

| | | | | | | | | | | | | | |

| | | | | (Unaudited) 6 months ended 30 June | |

| | | | | 2004 | | | 2003 | |

| | | Note | | HK$M | | | HK$M | | | HK$M | | | HK$M | |

| | | | | |

Operating activities | | | | | | | | | | | | | | |

Net cash inflow from operations | | 22 | | 3,826 | | | | | | 3,046 | | | | |

Operating interest paid | | | | (405 | ) | | | | | (197 | ) | | | |

Interest received | | | | 19 | | | | | | 23 | | | | |

Profits tax paid | | | | (139 | ) | | | | | (203 | ) | | | |

| | | | |

|

| | | | |

|

| | | |

Net cash inflow from operating activities | | | | | | | 3,301 | | | | | | 2,669 | |

| | | | | |

Investing activities | | | | | | | | | | | | | | |

Capital expenditure | | | | (2,825 | ) | | | | | (2,524 | ) | | | |

Capitalised interest paid | | | | (150 | ) | | | | | (139 | ) | | | |

Proceeds from disposal of fixed assets | | | | 10 | | | | | | 3 | | | | |

Proceeds from disposal of other investments | | | | 31 | | | | | | — | | | | |

Net cash outflow for acquisition of subsidiaries | | | | (376 | ) | | | | | (354 | ) | | | |

Net cash inflow/(outflow) on settlement of forward contracts for investment hedging | | | | 86 | | | | | | (246 | ) | | | |

Investments in and advances to jointly controlled entities | | | | (220 | ) | | | | | (110 | ) | | | |

Purchase of investment securities | | | | — | | | | | | (438 | ) | | | |

Proceeds from realisation of employee retirement benefit plan assets | | | | — | | | | | | 1,155 | | | | |

Dividends received from investments | | | | | | | | | | | | | | |

- jointly controlled entities | | | | 1,416 | | | | | | 1,183 | | | | |

- associated company | | | | 30 | | | | | | 27 | | | | |

- other investments | | | | — | | | | | | 34 | | | | |

Profit received from Hok Un joint venture | | | | 439 | | | | | | 168 | | | | |

| | | | |

|

| | | | |

|

| | | |

Net cash outflow from investing activities | | | | | | | (1,559 | ) | | | | | (1,241 | ) |

| | | | | | | |

|

| | | | |

|

|

Net cash inflow before financing activities | | | | | | | 1,742 | | | | | | 1,428 | |

| | | | | |

Financing activities | | | | | | | | | | | | | | |

Proceeds from long-term borrowings | | | | 2,200 | | | | | | 1,500 | | | | |

Repayment of long-term borrowings | | | | (1,692 | ) | | | | | (855 | ) | | | |

Increase in short-term borrowings | | | | 1,127 | | | | | | 738 | | | | |

Dividends paid | | | | (2,890 | ) | | | | | (2,769 | ) | | | |

| | | | |

|

| | | | |

|

| | | |

Net cash outflow from financing activities | | | | | | | (1,255 | ) | | | | | (1,386 | ) |

| | | | | | | |

|

| | | | |

|

|

Increase in cash and cash equivalents | | | | | | | 487 | | | | | | 42 | |

Cash and cash equivalents at beginning of the period | | | | | | | 787 | | | | | | 516 | |

Effect of exchange rate changes | | | | | | | (9 | ) | | | | | 14 | |

| | | | | | | |

|

| | | | |

|

|

Cash and cash equivalents at end of the period | | | | | | | 1,265 | | | | | | 572 | |

| | | | | | | |

|

| | | | |

|

|

| | | | | |

Analysis of balances of cash and cash equivalents | | | | | | | | | | | | | | |

Short-term investments | | | | | | | 46 | | | | | | 11 | |

Deposits with banks | | | | | | | 742 | | | | | | 491 | |

Cash at banks and on hand | | | | | | | 477 | | | | | | 70 | |

| | | | | | | |

|

| | | | |

|

|

| | | | | | | | 1,265 | | | | | | 572 | |

| | | | | | | |

|

| | | | |

|

|

Page 24

Notes to the Condensed Interim Accounts

| 1. | Basis of Preparation and Accounting Policies |

The unaudited condensed consolidated interim accounts are prepared in accordance with the Statement of Standard Accounting Practice (SSAP) No. 25 “Interim Financial Reporting” issued by the Hong Kong Society of Accountants. The accounting policies used in the preparation of these condensed accounts are consistent with those set out in the 2003 Annual Report.

During the 2003 Scheme of Control (SoC) Interim Review, agreement was reached with the Hong Kong Government to extend the useful life of the following fixed assets employed for the SoC business:

| | | | |

| | | Original Life | | Revised Life |

| | |

Buildings | | 33 years | | 35 years |

Cable tunnels | | 33 years | | 100 years |

Switchgear and transformers | | 25 years | | 35 years |

Meters | | 10 years | | 15 years |

Leasehold land | | not depreciable | | unexpired terms

of the leases |

The net book value of the above assets as at 31 December 2003 are being written off uniformly over the remainder of their extended useful lives.

The net decrease in depreciation charge as a result of the above changes for the six months ended 30 June 2004 was approximately HK$110 million.

| 2. | Acquisition of Remaining Shareholding in Yallourn Energy |

In March 2004, the Group completed the acquisition of the remaining 8% interest in Yallourn Energy Pty Limited (Yallourn Energy) managed by Deutsche Asset Management (Australia) Limited. Following completion, the Group owns 100% of Yallourn Energy, the owner-operator of a 1,480MW coal-fired power station and a coal mine in Victoria, Australia.

The total cost of acquisition was HK$376 million. The fair value of the net assets acquired was HK$397 million, resulting in negative goodwill of HK$21 million to be amortised on a straight-line basis over the remaining plant life of 28 years.

Page 25

| 3. | Turnover and Segment Information |

An analysis of the Group’s turnover, contribution to operating profit and profit before financing and taxation for the period, by principal activities, is as follows:

| | | | | | | | | | | | |

| 6 months ended 30 June | | Turnover | | Operating

Profit/(Loss) (A) | | Profit/(Loss) Before Financing and Taxation (B) |

| | | 2004

HK$M | | 2003

HK$M | | 2004

HK$M | | 2003

HK$M | | 2004

HK$M | | 2003 HK$M |

SoC business | | 11,870 | | 11,333 | | 2,542 | | 2,609 | | 3,420 | | 3,436 |

Power projects outside Hong Kong | | 1,966 | | 470 | | 526 | | 47 | | 1,380 | | 995 |

Other businesses | | 86 | | 68 | | (61) | | (11) | | 84 | | 41 |

Unallocated Group expenses | | — | | — | | (75) | | (59) | | (75) | | (59) |

| | |

| |

| |

| |

| |

| |

|

| | | 13,922 | | 11,871 | | 2,932 | | 2,586 | | 4,809 | | 4,413 |

| | |

| |

| |

| |

| |

| |

|

| | (A) | Operating Profit/(Loss) is stated before taking into account the Group’s share of profits less losses of jointly controlled entities and associated companies. |

| | (B) | Profit/(Loss) Before Financing and Taxation is stated after taking into account the Group’s share of profits less losses of jointly controlled entities and associated companies. |

Page 26

| 3. | Turnover and Segment Information (continued) |

The Group operates, through its subsidiary companies, jointly controlled entities and associated companies, in three major geographical regions - Hong Kong, the Chinese mainland and the Asia-Pacific region. Information about the Group’s operations by geographical regions is as follows:

| | | | | | | | | | |

| 6 months ended 30 June 2004 | | Hong Kong

HK$M | | Chinese

Mainland

HK$M | | Asia-Pacific

Region HK$M | | Unallocated

Items HK$M | | Total

HK$M |

| | | | | |

Turnover | | 11,956 | | — | | 1,966 | | — | | 13,922 |

| | |

| |

| |

| |

| |

|

| | | | | |

Segment results | | 2,481 | | (98) | | 624 | | (75) | | 2,932 |

Hok Un redevelopment profit | | 147 | | — | | — | | — | | 147 |

Share of profits less losses of jointly controlled entities | | 878 | | 610(a) | | 99 | | — | | 1,587 |

Share of profits less losses of associated companies | | (2) | | — | | 145 | | — | | 143 |

| | |

| |

| |

| |

| |

|

Profit/(Loss) before financing and taxation | | 3,504 | | 512 | | 868 | | (75) | | 4,809 |

Finance costs | | | | | | | | | | (483) |

Finance income | | | | | | | | | | 23 |

Taxation | | | | | | | | | | (792) |

| | | | | | | | | | |

|

Profit after taxation | | | | | | | | | | 3,557 |

Transfers under SoC | | | | | | | | | | 581 |

| | | | | | | | | | |

|

Earnings for the period | | | | | | | | | | 4,138 |

| | | | | | | | | | |

|

| | | | | |

| 6 months ended 30 June 2003 | | Hong Kong

HK$M | | Chinese

Mainland

HK$M | | Asia-Pacific

Region

HK$M | | Unallocated

Items HK$M | | Total HK$M |

| | | | | |

Turnover | | 11,401 | | — | | 470 | | — | | 11,871 |

| | |

| |

| |

| |

| |

|

| | | | | |

Segment results | | 2,598 | | (54) | | 101 | | (59) | | 2,586 |

Hok Un redevelopment profit | | 63 | | — | | — | | — | | 63 |

Share of profits less losses of jointly controlled entities | | 825 | | 661(a) | | 225 | | — | | 1,711 |

Share of profits less losses of associated companies | | (9) | | — | | 62 | | — | | 53 |

| | |

| |

| |

| |

| |

|

Profit/(Loss) before financing and taxation | | 3,477 | | 607 | | 388 | | (59) | | 4,413 |

Finance costs | | | | | | | | | | (223) |

Finance income | | | | | | | | | | 35 |

Taxation | | | | | | | | | | (728) |

| | | | | | | | | | |

|

Profit after taxation | | | | | | | | | | 3,497 |

Transfers under SoC | | | | | | | | | | 217 |

| | | | | | | | | | |

|

Earnings for the period | | | | | | | | | | 3,714 |

| | | | | | | | | | |

|

| | Note (a): | Out of the HK$610 million (2003: HK$661 million), HK$427 million (2003: HK$388 million) was attributed to investments in Guangdong Nuclear Power Joint Venture Company, Limited and Hong Kong Pumped Storage Development Company, Limited, whose generating facilities serve Hong Kong. |

Page 27

| | | | |

| | | 6 months ended 30 June |

| | | 2004 HK$M | | 2003 HK$M |

Operating profit is stated after charging/(crediting) the following: | | | | |

| | |

Charging | | | | |

Staff costs (A) | | | | |

Salaries and other costs | | 777 | | 687 |

Retirement benefits costs | | 69 | | 54 |

Loss on disposal of fixed assets | | 83 | | 44 |

Unrealised loss on other investments | | 33 | | 12 |

| | |

Crediting | | | | |

Other net exchange gains | | (10) | | (13) |

Net rental income from properties | | (7) | | (8) |

Gain on realisation of retirement benefit plan asset | | — | | (17) |

Amortisation of goodwill and negative goodwill | | (23) | | (6) |

| | (A) | Staff costs include amounts recharged to jointly controlled entities for services provided. |

| 5. | Finance Costs and Income |

| | | | |

| | | 6 months ended 30 June |

| | | 2004

HK$M | | 2003 HK$M |

Finance costs: | | | | |

Interest expenses on bank loans and overdrafts | | 373 | | 177 |

Interest expenses on other borrowings | | | | |

wholly repayable within five years | | 82 | | 82 |

not wholly repayable within five years | | 73 | | 46 |

Interest expenses on customers’ deposits and others | | 20 | | 13 |

Finance charges | | 14 | | 13 |

Exchange losses | | 62 | | 12 |

| | |

| |

|

| | | 624 | | 343 |

Less: amount capitalised | | (141) | | (120) |

| | |

| |

|

| | | 483 | | 223 |

| | |

| |

|

Finance income: | | | | |

Net interest income from investment securities | | — | | 20 |

Interest income on short-term investments and bank deposits | | 23 | | 15 |

| | |

| |

|

| | | 23 | | 35 |

| | |

| |

|

Page 28

| 6. | Share of Results of Affiliated Companies |

The share of profits less losses of jointly controlled entities and associated companies is determined based upon the management accounts of the respective affiliated companies, after making adjustments to conform with the Group’s significant accounting policies, for the periods ended 30 June.

| | | | | | |

| | | 6 months ended 30 June | |

| | | 2004 HK$M | | | 2003 HK$M | |

| | |

Taxation in the condensed consolidated profit and loss account represents: | | | | | | |

| | |

Company and subsidiary companies | | | | | | |

- Hong Kong | | | | | | |

current | | 333 | | | 247 | |

deferred | | 165 | | | 163 | |

- outside Hong Kong | | | | | | |

current | | 15 | | | 4 | |

deferred | | 59 | | | 20 | |

| | |

|

| |

|

|

| | | 572 | | | 434 | |

| | |

|

| |

|

|

Jointly controlled entities | | | | | | |

- Hong Kong | | | | | | |

current | | 144 | | | 143 | |

deferred | | (44 | ) | | (16 | ) |

- outside Hong Kong | | | | | | |

current | | 110 | | | 125 | |

deferred | | (17 | ) | | 30 | |

| | |

|

| |

|

|

| | | 193 | | | 282 | |

| | |

|

| |

|

|

Associated company | | | | | | |

- outside Hong Kong | | | | | | |

current | | 10 | | | 1 | |

deferred | | 17 | | | 11 | |

| | |

|

| |

|

|

| | | 27 | | | 12 | |

| | |

|

| |

|

|

| | |

|

| |

|

|

| | | 792 | | | 728 | |

| | |

|

| |

|

|

Hong Kong profits tax has been provided at the rate of 17.5% (2003: 17.5%) on the estimated assessable profits for the period. Taxation on profits assessable outside Hong Kong has been provided at the rates prevailing in the respective jurisdictions.

Page 29

| 8. | Transfers under Scheme of Control |

The financial operations of CLP Power Hong Kong are governed by the SoC Agreement. In accordance with the Agreement, transfers required under the SoC are shown below:

| | | | | | |

| | | 6 months ended 30 June | |

| | | 2004 | | | 2003 | |

| | | HK$M | | | HK$M | |

| | |

Transfers under SoC | | | | | | |

From Development Fund | | 597 | | | 263 | |

From special provision account | | 96 | | | 102 | |

To rate reduction reserve | | (112 | ) | | (148 | ) |

| | |

|

| |

|

|

| | | 581 | | | 217 | |

| | |

|

| |

|

|

The Development Fund, special provision account and rate reduction reserve of CLP Power Hong Kong are collectively referred to as SoC reserve accounts in the condensed consolidated balance sheet and the respective balances at the end of the period/year are:

| | | | |

| | | 30 June 2004 HK$M | | 31 December 2003 HK$M |

| | |

SoC reserve accounts | | | | |

Development Fund (A) | | 2,355 | | 2,960 |

Special provision account (B) | | 80 | | 176 |

Rate reduction reserve (C) | | 505 | | 471 |

| | |

| |

|

| | | 2,940 | | 3,607 |

| | |

| |

|

Page 30

| 8. | Transfers under Scheme of Control (continued) |

Movements in the SoC reserve accounts are as follows:

| | | | | | |

| | | 30 June

2004 HK$M | | | 31 December

2003 HK$M | |

| | |

(A) Development Fund | | | | | | |

At beginning of period/year | | 2,960 | | | 3,372 | |

Transfer (to)/from profit and loss account | | (597 | ) | | 572 | |

One-off rebates | | 8 | | | (308 | ) |

Business relief rebate | | (1 | ) | | (42 | ) |

Special rebate to customers | | (15 | ) | | (634 | ) |

| | |

|

| |

|

|

At end of period/year | | 2,355 | | | 2,960 | |

| | |

|

| |

|

|

(B) Special provision account | | | | | | |

At beginning of period/year | | 176 | | | 670 | |

Transfer to profit and loss account | | (96 | ) | | (494 | ) |

| | |

|

| |

|

|

At end of period/year | | 80 | | | 176 | |

| | |

|

| |

|

|

(C) Rate reduction reserve | | | | | | |

At beginning of period/year | | 471 | | | 458 | |

Transfer from profit and loss account | | 112 | | | 287 | |

One-off rebates | | 2 | | | (101 | ) |

Rebate to customers (note a) | | (80 | ) | | (173 | ) |

| | |

|

| |

|

|

At end of period/year | | 505 | | | 471 | |

| | |

|

| |

|

|

| | Note | (a): A rebate of HK¢0.6 per unit (2003: HK¢0.6 per unit) was made to customers during the period. |

Page 31

| 9. | Non-SoC Operating Earnings |

| | | | | | |

| | | 6 months ended 30 June | |

| | | 2004

HK$M | | | 2003 HK$M | |

| | | | | | | |

Income from power projects outside Hong Kong | | | | | | |

| | | | | | | |

Chinese mainland | | 423 | | | 516 | |

Asia-Pacific region | | 404 | | | 190 | |

| | | | | | | |

| | | 827 | | | 706 | |

Sales to Chinese mainland | | 30 | | | 30 | |

Other businesses | | (66 | ) | | (26 | ) |

| | |

|

| |

|

|

| | | 791 | | | 710 | |

| | |

|

| |

|

|

| | | | | | | | |

| | | 6 months ended 30 June |

| | | 2004 | | 2003 |

| | | HK$ per share | | HK$M | | HK$ per share | | HK$M |

| | | | |