UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | Registration statement pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934 |

OR

| x | Annual report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the fiscal year endedDecember 31, 2004

OR

| ¨ | Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from to

Commission file number333-08176

|

| CLP Holdings Limited |

|

(Exact name of Registrant as specified in its charter) |

|

Not Applicable |

(Translation of Registrant’s name into English) |

|

| Hong Kong Special Administrative Region, China |

(Jurisdiction of incorporation or organization) |

|

147 Argyle Street, Kowloon, Hong Kong Special Administrative Region, China |

(Address of principal executive offices) |

Securities registered or to be registered pursuant to Section 12(b) of the Act

| | |

Title of each class

| | Name of each exchange on which registered

|

| None | | None |

| |

|

Securities registered or to be registered pursuant to Section 12(g) of the Act

|

Ordinary shares of HK$5.00 each |

(Title of Class) |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

|

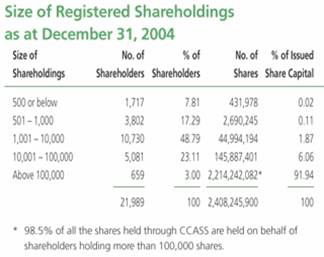

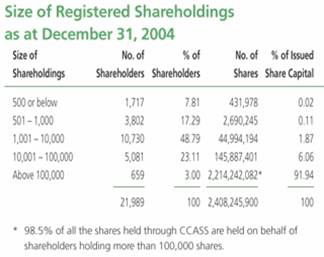

2,408,245,900 Ordinary Shares of par value HK$5 each

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes X No

Indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 X Item 18

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Section 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes No

TABLE OF CONTENTS

i

ii

iii

FORWARD LOOKING STATEMENTS IN THIS ANNUAL REPORT

MAY NOT BE ACCURATE

Our disclosure and analysis in this annual report contain or incorporate by reference some forward-looking statements. Our forward-looking statements contain information regarding, among other things, our financial condition, future expansion plans and business strategy. We have based these forward-looking statements on our current expectations and projections about future events. You can identify these statements by the fact that they do not relate strictly to historical or current facts. Although we believe that these expectations and projections are reasonable, such forward-looking statements are inherently subject to risks, uncertainties and assumptions about us, including, among other things:

| | • | | general economic and political conditions affecting Hong Kong; |

| | • | | possible disruptions in commercial activities caused by natural and human-induced disasters, including terrorist activity, that may impact the economy of Hong Kong; |

| | • | | natural disasters, such as earthquakes and droughts, which are beyond our control; |

| | • | | the introduction of new environmental regulations; |

| | • | | fluctuations in foreign currency exchange rates and the possible devaluation of the Hong Kong dollar; |

| | • | | additional disclosures we make in our previous and future Form 20-F annual reports and Form 6-K periodic reports to the U.S. Securities and Exchange Commission; and |

| | • | | those other risks identified in “Item 3. Key Information—D. Risk Factors” of this annual report. |

The words “anticipate,” “believe,” “estimate,” “expect,” “intend,” “plan” and similar expressions, as they relate to us, are intended to identify a number of these forward-looking statements. We undertake no obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise. In light of these risks, uncertainties and assumptions, the forward-looking events discussed in this annual report might not occur and our actual results could differ materially from those anticipated in these forward-looking statements.

4

PART I

| Item 1. | Identity of Directors, Senior Management and Advisers |

Not applicable.

| Item 2. | Offer Statistics and Expected Timetable |

Not applicable.

5

A. Selected Financial Data

Since January 6, 1998, we became the holding company of a group of companies, consisting of CLP Power Hong Kong Limited and various other companies under a scheme of arrangement, referred to as the Scheme of Arrangement in this annual report. Effective from September 30, 1999, our financial year end date has been changed from September 30 to December 31. The table below sets forth our selected financial data for the years ended December 31, 2000, 2001, 2002, 2003 and 2004. The selected balance sheet data as of December 31, 2003 and 2004 and the selected income statement information for the years ended December 31, 2002, 2003 and 2004 are derived from our audited consolidated financial statements included elsewhere in this annual report. The selected balance sheet data as of December 31, 2000, 2001 and 2002 and the selected income statement information for the years ended December 31, 2000 and 2001 are derived from our audited consolidated financial statements not included in this annual report. Our financial statements have been prepared in conformity with accounting principles generally accepted in Hong Kong, or Hong Kong GAAP. In addition, such data have been reconciled with accounting principles generally accepted in the United States of America, or U.S. GAAP, described in Note 34 (pages F-53 to F-61) to our financial statements set forth in “Item 17. Financial Statements” and presented in compliance with Item 17 of Form 20-F under the U.S. Securities Exchange Act of 1934, as amended.

The current Scheme of Control Agreement, referred to as the Scheme of Control in this annual report, that governs our Hong Kong electricity-related financial affairs was entered into in March 1992 with the Hong Kong Government and certain other parties and became effective on October 1, 1993 with a duration of 15 years. The following information should be read in conjunction with “Item 5. Operating and Financial Review and Prospects” and the financial statements and the related notes to those statements included in “Item 17. Financial Statements” in this annual report.

6

| | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31,

| |

| | | 2000

| | | 2001(1)

| | | 2002(1)

| | | 2003

| | | 2004

| | | 2004

| |

| | | HK$ | | | HK$ | | | HK$ | | | HK$ | | | HK$ | | | US$ | |

| | | (in millions, except for per share data) | |

Consolidated Income Statement Information: | | | | | | | | | | | | | | | | | | |

Hong Kong GAAP | | | | | | | | | | | | | | | | | | |

Turnover(2) | | 24,451 | | | 24,999 | | | 26,134 | | | 28,248 | | | 30,784 | | | 3,961 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Expenses | | | | | | | | | | | | | | | | | | |

Purchases of electricity | | 14,779 | | | 15,252 | | | 15,586 | | | 15,873 | | | 16,055 | | | 2,066 | |

Staff expenses | | 827 | | | 929 | | | 945 | | | 1,157 | | | 1,284 | | | 165 | |

Fuel and other operating costs | | 1,180 | | | 1,246 | | | 1,331 | | | 2,249 | | | 3,026 | | | 389 | |

Depreciation | | 1,474 | | | 1,624 | | | 1,749 | | | 2,357 | | | 2,529 | | | 325 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

| | | 18,260 | | | 19,051 | | | 19,611 | | | 21,636 | | | 22,894 | | | 2,945 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Property disposal gain | | – | | | – | | | 313 | | | – | | | 214 | | | 27 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Operating profit | | 6,191 | | | 5,948 | | | 6,836 | | | 6,612 | | | 8,104 | | | 1,043 | |

Finance costs | | (204 | ) | | (187 | ) | | (189 | ) | | (688 | ) | | (1,046 | ) | | (134 | ) |

Finance income | | 110 | | | 29 | | | 33 | | | 48 | | | 63 | | | 8 | |

Hok Un redevelopment profit(3) | | 1,357 | | | 1,752 | | | 282 | | | 291 | | | 187 | | | 24 | |

Share of profits less losses of | | | | | | | | | | | | | | | | | | |

jointly controlled entities | | 2,216 | | | 2,348 | | | 2,992 | | | 3,399 | | | 3,181 | | | 409 | |

associated companies | | 5 | | | 71 | | | 86 | | | 102 | | | 236 | | | 30 | |

Impairment loss on investment in associated company(4) | | (900 | ) | | – | | | – | | | – | | | – | | | – | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Profit before taxation | | 8,775 | | | 9,961 | | | 10,040 | | | 9,764 | | | 10,725 | | | 1,380 | |

Taxation | | (1,378 | ) | | (1,128 | ) | | (1,293 | ) | | (1,712 | ) | | (1,815 | ) | | (234 | ) |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Profit after taxation | | 7,397 | | | 8,833 | | | 8,747 | | | 8,052 | | | 8,910 | | | 1,146 | |

Transfers under Scheme of Control(5) | | (1,629 | ) | | (1,506 | ) | | (1,643 | ) | | (365 | ) | | (296 | ) | | (38 | ) |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Net earnings | | 5,768 | | | 7,327 | | | 7,104 | | | 7,687 | | | 8,614 | | | 1,108 | |

| | |

|

| |

|

| |

|

| |

|

| |

|

| |

|

|

Earnings per share of common stock(6) | | 2.31 | | | 2.95 | | | 2.95 | | | 3.19 | | | 3.58 | | | 0.46 | |

Dividends per share of common stock(6) | | 1.867 | (7) | | 2.100 | (7) | | 1.880 | (7) | | 1.980 | (7) | | 2.230 | (7) | | 0.287 | (7) |

Dividends per share of common stock(6) (US$) | | 0.239 | (7) | | 0.269 | (7) | | 0.241 | (7) | | 0.255 | (7) | | 0.287 | (7) | | | |

U.S. GAAP: | | | | | | | | | | | | | | | | | | |

Net income | | 6,071 | | | 7,405 | | | 7,023 | | | 7,525 | | | 9,293 | | | 1,196 | |

| (1) | Comparative figures for 2001 and 2002 have been restated as a result of the initial adoption of Statement of Standard Accounting Practice (SSAP) No. 12 (Revised) “Income Taxes” in 2003. |

| (2) | Turnover represents sales of electricity based on either actual and accrued consumption derived from meter readings or the amount billed in accordance with the terms of the contractual agreements where applicable during the period, other electricity-related revenue, property income, and supply and maintenance services fees. |

| (3) | This represents our share of profit (Phase 3 in 2000 and Phases 4 & 5 in both 2001, 2002, 2003 and 2004) arising from Laguna Verde (the property development at Hok Un site in Hung Hom, Hong Kong), which is a joint venture undertaken with a subsidiary company of Cheung Kong (Holdings) Limited. |

| (4) | In 2000, we reviewed the carrying value of Electricity Generating Public Company Limited of Thailand, or EGCO, which included unamortized goodwill capitalized in accordance with our accounting policy. This review focused on the investment fundamentals and took into consideration a change in government policy on the privatization of the assets of Electricity Generating Authority of Thailand, as well as slower growth of electricity demand in Thailand. In reflecting the fair value of the investment, we wrote off HK$900 million of the unamortized goodwill of EGCO as an impairment loss. |

| (5) | Transfers under the Scheme of Control comprised (i) the difference between the permitted return and the Scheme of Control profit being transferred to or from the Scheme of Control development fund, or the Development Fund, (ii) the amount of deferral premium in relation to Units 7 and 8 of the Black Point Power Station charged to the special provision account, and (iii) a charge of 8% per annum on the sum of the average balances of the Development Fund and the special provision account, being credited to a rate reduction reserve to be applied as rebates to customers. See “Item 4. Information on the Company — B. Business Overview — Electricity Business in Hong Kong — Scheme of Control”. |

| (6) | Earnings and dividends per share for 2000 have been adjusted for the capitalization issue of one-for-five shares on April 23, 2001. |

| (7) | Excluding the special dividends, dividends per share would have been HK$1.417 (US$0.18) in 2000, HK$1.49 (US$0.19) in 2001, HK$1.65 (US$0.21) in 2002, HK$1.88 (US$0.24) in 2003 and HK$2.08 (US$0.26) in 2004. |

7

| | | | | | | | | | | | | | | |

| | | As of December 31,

| |

| | | 2000

| | 2001(1)

| | 2002(1)

| | 2003

| | | 2004

| | | 2004

| |

| | | HK$ | | HK$ | | HK$ | | HK$ | | | HK$ | | | US$ | |

| | | (in millions) | |

Consolidated Balance Sheet Information: | | | | | | | | | | | | | | | |

Hong Kong GAAP | | | | | | | | | | | | | | | |

Current assets | | 3,821 | | 1,704 | | 2,510 | | 5,451 | | | 6,383 | | | 821 | |

Fixed assets | | 30,692 | | 33,577 | | 36,550 | | 54,157 | | | 57,748 | | | 7,430 | |

Goodwill | | – | | – | | – | | (1,017 | ) | | (1,022 | ) | | (131 | ) |

Investments in | | | | | | | | | | | | | | | |

jointly controlled entities | | 12,155 | | 15,867 | | 18,982 | | 14,687 | | | 14,998 | | | 1,930 | |

associated companies | | 1,173 | | 1,216 | | 1,426 | | 1,593 | | | 1,640 | | | 211 | |

Other assets | | 1,837 | | 1,925 | | 1,425 | | 961 | | | 1,052 | | | 135 | |

| | |

| |

| |

| |

|

| |

|

| |

|

|

Total assets | | 49,678 | | 54,289 | | 60,893 | | 75,832 | | | 80,799 | | | 10,396 | |

| | |

| |

| |

| |

|

| |

|

| |

|

|

| | | | | | |

Current liabilities(2) | | 5,393 | | 7,356 | | 7,168 | | 8,905 | | | 9,678 | | | 1,245 | |

Minority interest | | – | | – | | – | | 393 | | | – | | | – | |

Term loans (long-term portion) | | 2,501 | | 4,068 | | 8,727 | | 17,602 | | | 17,596 | | | 2,264 | |

Deferred taxation | | 3,110 | | 3,279 | | 3,610 | | 4,614 | | | 5,084 | | | 654 | |

Other long-term liabilities | | 4,060 | | 4,354 | | 4,500 | | 4,077 | | | 4,242 | | | 546 | |

Shareholders’ funds | | 34,614 | | 35,232 | | 36,888 | | 40,241 | | | 44,199 | | | 5,687 | |

| | |

| |

| |

| |

|

| |

|

| |

|

|

Total liabilities and shareholders’ funds | | 49,678 | | 54,289 | | 60,893 | | 75,832 | | | 80,799 | | | 10,396 | |

| | |

| |

| |

| |

|

| |

|

| |

|

|

U.S. GAAP: | | | | | | | | | | | | | | | |

Shareholders’ equity | | 34,045 | | 34,615 | | 36,177 | | 39,397 | | | 44,052 | | | 5,668 | |

Number of shares in issue(3) (millions) | | 2,497.47 | | 2,421.49 | | 2,408.25 | | 2,408.25 | | | 2,408.25 | | | | |

| (1) | Comparative figures for 2001 and 2002 have been restated as a result of the initial adoption of SSAP No. 12 (Revised) “Income Taxes” in 2003. |

| (2) | Current liabilities include the current portion of term loans. |

| (3) | Number of shares in issue for 2000 has been adjusted for the capitalization issue of one-for-five shares on April 23, 2001. |

| | | | | | | | | | |

| | | Year Ended December 31,

|

| | | 2000

| | 2001

| | 2002

| | 2003

| | 2004

|

Other Information: | | | | | | | | | | |

Units of electricity sold by CLP Power Hong Kong | | | | | | | | | | |

Total (millions of kWh) | | 27,488 | | 28,531 | | 29,887 | | 31,043 | | 31,719 |

Local (Hong Kong) (millions of kWh) | | 26,307 | | 26,950 | | 27,712 | | 28,035 | | 28,632 |

Average local tariff(1) (HK¢ per kWh) | | 88.0 | | 88.0 | | 87.6 | | 87.5 | | 87.2 |

Group generating capacity (owned/operated)(2) | | | | | | | | | | |

Hong Kong (MW) | | 6,908 | | 6,908 | | 6,908 | | 6,908 | | 6,908 |

Chinese mainland (MW) | | 2,015 | | 2,743 | | 3,163 | | 3,163 | | 3,163 |

Other Asia-Pacific countries (MW) | | 1,048 | | 2,151 | | 2,675 | | 3,803 | | 4,088 |

| | |

| |

| |

| |

| |

|

| | | 9,971 | | 11,802 | | 12,746 | | 13,874 | | 14,159 |

| | |

| |

| |

| |

| |

|

Interest coverage(3) (times) | | 44 | | 44 | | 29 | | 12 | | 11 |

Total debt to total capitalization(4) (%) | | 6.9 | | 13.6 | | 20.1 | | 31.5 | | 29.8 |

Ratio of earnings to fixed charges(5) | | | | | | | | | | |

Hong Kong GAAP | | 21:1 | | 17:1 | | 27:1 | | 12:1 | | 10:1 |

U.S. GAAP | | 22:1 | | 17:1 | | 26:1 | | 12:1 | | 9:1 |

| (1) | Included special rebates which averaged 2.2 HK¢ per kWh for 2000, 2001, 2002 and 2003. |

| (2) | Group generating capacity (in MW) is incorporated on the following basis: (i) CAPCO on 100% capacity as stations are operated by us; (ii) PSDC on 100% as having the right to use and (iii) other stations on the proportion of our equity interests. |

| (3) | Interest coverage is calculated as profit before taxation and interest divided by interest charges. |

| (4) | Total debt to total capitalization is calculated as total debt divided by the sum of total debt and shareholders’ funds. |

| (5) | For the purpose of calculating ratio of earnings to fixed charges, earnings consist of (i) profit before taxation and fixed charges for us and our consolidated subsidiaries and (ii) distributed income received from investments accounted for under equity accounting method. Fixed charges consist of interest expense (including capitalized interest) and amortization of notes charges. |

8

Currency Translations and Exchange Rates

We publish our financial statements in Hong Kong dollars. For the convenience of the reader, we have translated Hong Kong dollar amounts into U.S. dollars in certain portions of this annual report at a rate of HK$7.7723 = US$1.00. This rate was the noon buying rate in New York City for cable transfers in foreign currencies, as certified for customs purposes by the Federal Reserve Bank of New York on December 31, 2004. The translation does not mean that Hong Kong dollars could actually be converted into U.S. dollars at that rate.

The following tables show the noon buying rates expressed in Hong Kong dollars per U.S. dollar for the periods indicated below.

| | | | |

Year Ended

| | Average

Rate(1)

| | At Period

End

|

| | | (HK$ per US$1.00) |

| | |

December 31, 2000 | | 7.7936 | | 7.7999 |

December 31, 2001 | | 7.7996 | | 7.7980 |

December 31, 2002 | | 7.7996 | | 7.7988 |

December 31, 2003 | | 7.7864 | | 7.7640 |

December 31, 2004 | | 7.7899 | | 7.7723 |

| | | | |

(1) These figures each represent the average of the noon buying rates on the last day of each month during the period. |

| | | | | | |

Month

| | High

| | Low

| | At Period

End

|

| | | (HK$ per US$1.00) |

| | | |

December 2004 | | 7.7821 | | 7.7698 | | 7.7723 |

January 2005 | | 7.7994 | | 7.7775 | | 7.7993 |

February 2005 | | 7.7999 | | 7.7984 | | 7.7992 |

March 2005 | | 7.7998 | | 7.7987 | | 7.7990 |

April 2005 | | 7.7995 | | 7.7946 | | 7.7946 |

May 2005 | | 7.7995 | | 7.7767 | | 7.7788 |

June 2005 (through June 10, 2005) | | 7.7842 | | 7.7781 | | 7.7781 |

9

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

10

D. Risk Factors

Our business and operations are subject to various risks, many of which are beyond our control. If any of the risks described below actually occurs, our business, financial condition or results of operations could be seriously harmed.

Changes in Hong Kong’s political situation may affect the manner in which our business is conducted, as well as business confidence and economic conditions in Hong Kong, which could adversely affect our results of operations.

From July 1, 1997, Hong Kong ceased to be a Crown Colony of the United Kingdom and became a Special Administrative Region of the People’s Republic of China, or China in accordance with the Sino-British Joint Declaration signed in Beijing in December 1984. The basic policies of China regarding Hong Kong are embodied in the Basic Law of the Hong Kong Special Administrative Region enacted by the National People’s Congress of China, or the Basic Law. The Basic Law provides that Hong Kong will have a high degree of legislative, legal and economic autonomy. We cannot assure you that China will not exercise direct influence over the political and economic affairs of Hong Kong, or that such influence will not affect business confidence and economic conditions in Hong Kong.

In Hong Kong, the administration of policies have always been the concern of the general public and business community, and some have led to large scale demonstration. The resignation of some Senior Government Officials, demand for early universal suffrage, delay of launching the Link Real Estate Investment Trust and the recent resignation of the Chief Executive created different levels of political uncertainties. There can be no assurance that future changes in the political situation of Hong Kong will not affect the economic climate in Hong Kong, which in turn could materially and adversely affect our results of operations.

We generate revenues primarily from the provision of electricity to Hong Kong residential, commercial, infrastructure and public services and manufacturing sectors within Hong Kong. Any material adverse developments in Hong Kong’s economy could impact our electricity revenue, reduce the growth in the electricity demand in Hong Kong, further defer our capital expenditures and adversely affect our business and results of operations.

Most of our revenues are derived from our business activities in Hong Kong, which are directly affected by the performance of Hong Kong’s economy. The economy of Hong Kong has in recent years experienced a decline from the high rates of growth experienced in the 1960s, 1970s and 1980s as businesses in Hong Kong have increasingly relocated manufacturing operations to the Chinese mainland and other regions, where labor and other fixed costs are generally lower. This has resulted, and is expected to continue to result, in a decline in electricity sales by us to the manufacturing sector and consequently, reduced growth in our sales of electricity in Hong Kong.

11

Hong Kong has experienced some years of economic difficulties since the Asian financial crisis. However, the economy largely recovered throughout 2004. Although Hong Kong is expected to maintain a solid economic growth in 2005, it is vulnerable to external factors because of its highly externally oriented economic structure. Persistent high oil prices, an upward interest rate cycle and continuous macroeconomic adjustment measures in China could impact the Hong Kong economy. More directly, outbreak of epidemics such as avian flu in the surrounding regions could take a toll on the regional economy. This could in turn slow the growth in electricity demand in Hong Kong, which might result in our further deferral of capital expenditures and limit our revenue growth. Furthermore, exceptional and major changes to social or economic circumstances in Hong Kong could also adversely affect our local electricity business in terms of volume of sales and, notwithstanding the Scheme of Control, tariff implementation.

Most of our revenues are derived from the operations of our subsidiary, CLP Power Hong Kong Limited, or CLP Power Hong Kong, and our affiliated company, Castle Peak Power Company Limited, or CAPCO. The electricity-related operations and financial affairs of CLP Power Hong Kong and CAPCO are governed by the current Scheme of Control which is effective until September 30, 2008. Any unfavorable modifications to the Scheme of Control by the Hong Kong Government following its expiry in 2008 may have an adverse effect on our financial performance.

Most of our revenues are derived from the operations of our subsidiary, CLP Power Hong Kong, and our affiliated company, CAPCO. The Scheme of Control governs the financial affairs of CLP Power Hong Kong and CAPCO insofar as such affairs relate to CLP Power Hong Kong’s and CAPCO’s core electricity-related operations in Hong Kong. The current Scheme of Control is effective until September 30, 2008. On January 31, 2005, the Hong Kong Government launched a process of public consultation on post-2008 electricity market arrangements. Recently, some companies have also expressed interest in electricity generation and electricity supply business in Hong Kong, but they have not disclosed any detailed plan to the public at the moment. Should there be any modification to the Scheme of Control by the Hong Kong Government following its expiration in 2008 in a manner which would be unfavorable to CLP Power Hong Kong and CAPCO, our financial condition could be seriously affected.

Our business outside Hong Kong may be adversely affected by factors beyond our control.

We have invested in power projects located in Australia, India, Taiwan, Thailand and the Chinese mainland. Apart from the power projects of our subsidiaries, Yallourn Energy Pty Limited and CLP Australia Energy Holdings located in Australia and Gujarat Paguthan Energy Corporation Private Limited located in India, other projects are in the form of jointly controlled entities where we share the control over these entities with our joint venture partners, or as an associated company where we can only exercise certain significant influence in its management. As we do not have unilateral control over these ventures, their operations may not follow the same policies and standards that are adopted by our subsidiaries.

12

In addition, the success and profitability of our investment activities depend largely on the following factors, which are beyond our control:

| | • | | performance of a particular foreign economy; |

| | • | | political and social stability; |

| | • | | unexpected changes in environmental and other regulatory requirements; |

| | • | | foreign exchange control; |

| | • | | tariffs adjustments and substantial increases in fuel and transportation costs which cannot be passed on to our customers for political or other reasons; |

| | • | | stability of interest and exchange rates; and |

Any unfavorable changes in the above factors will adversely affect the profitability of our investments and our operating results.

We have long-term commitments denominated in U.S. dollars and other foreign currencies for our operations and business expansion. A devaluation of the Hong Kong dollar may increase costs associated with our operations and business expansion, and materially and adversely affect our financial condition and results of operations.

Although the Hong Kong dollar has been officially linked to the U.S. dollar at the rate of approximately HK$7.80 to US$1.00 since October 17, 1983, we cannot assure you that this or any linked exchange rate will be maintained by the Hong Kong Government in the future. While most of our revenues are denominated in Hong Kong dollars and we have hedged a material portion of our foreign currency exposures through the use of derivative instruments, any devaluation of the Hong Kong dollar in the longer term beyond the available and practicable hedging time span would increase the Hong Kong dollar cost of our future expenditures denominated in U.S. dollars or other foreign currencies, which could materially and adversely affect our financial condition and results of operations.

Accidents and natural disasters could prevent the operation of our power generating and distribution facilities and prevent us from generating electricity-related revenues or reduce our operating flexibility.

Our power generating and distribution operations may be affected from time to time by equipment failures and natural disasters, such as typhoons or floods. Natural disasters could interrupt our power generating, transmission and distribution services leading to decreased revenues, increased maintenance and higher engineering costs. Accidents could interrupt our power generating, transmission and distribution services, subject us to increased liabilities or bring about pressure for greater regulation of our services. Although we have acquired insurance that is consistent with industry practice against such risks, our insurance is subject to market-wide exclusion, limitation and commercial availability.

13

Our power generating and distribution operations may be adversely affected by environmental regulations.

Our power generating and distribution operations in Hong Kong, as well as in the Chinese mainland and other Asia-Pacific countries, are subject to a number of laws and regulations relating to environmental protection and safety. The operations may, in particular, be affected by mitigation measures such as those required under the Kyoto Protocol addressing the rising concerns over greenhouse gas emission and global climate change. Although we believe we are in compliance in all material respects with existing environmental laws and regulations, it is possible that additional costs may be incurred or operations of some of our power assets may be affected as a result of new interpretation or revision of existing laws and regulations, enactment of new or more stringent requirements, or the evolution in mitigation measures for global environmental issues. As some risks of environmental costs and liabilities are inherent in our operations, we cannot assure you that material costs and liabilities will not be incurred in the future in this regard.

Technological advances in the electricity industry may create competitive pressure on our operations, which may adversely affect our financial condition and results of operations.

Development of alternative generating, delivering, storage and application technologies may not only affect the ways we supply our electricity to customers, but also create more competition in the electricity industry. For instance, distributed generation technologies such as fuel cells and microturbines, together with other waste heat conversion technologies, are being experimented to provide combined heat and power to electricity customers at a high level of fuel efficiency. Such technological developments may negatively affect our competitive strength, and in turn our business. New technologies take time and require heavy investment to develop and realize commercial operation. Although we have dedicated resources to monitor technological developments that are of potential relevance to our business, we cannot assure you that our efforts can clear all risks and uncertainties that may be caused by technological advances worldwide.

Our business may be harmed, and our financial condition and results of operations may be adversely affected, by changes in general economic and business conditions resulting from terrorist activities, political unrest and military actions that take place outside Hong Kong.

We are exposed to the risks of political unrest, war, acts of terrorism and other instability, which could result in increased volatility in or damage to the global markets and the Hong Kong economy, cause disruption to our business or the business of our customers, and may in turn adversely affect our business and results of operations.

14

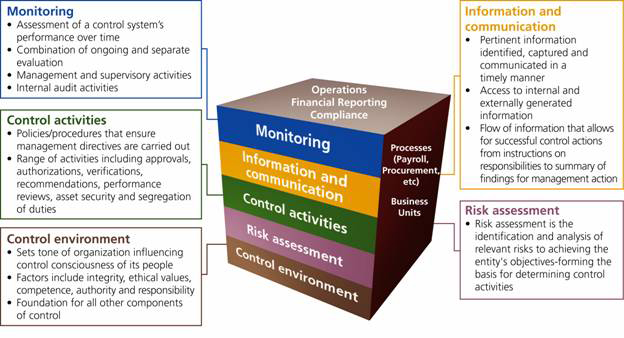

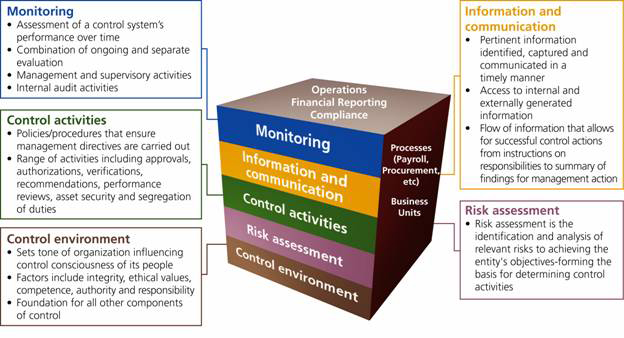

Investor confidence and the market price of our securities may be adversely impacted if we or our independent registered public accountant is unable to attest to the adequacy of the internal control over financial reporting of our company as of December 31, 2006, as required by Section 404 of the Sarbanes-Oxley Act of 2002.

The SEC, as directed by Section 404 of the Sarbanes-Oxley Act of 2002, adopted rules requiring public companies to include in their Annual Report on Form 10-K or Form 20-F, as the case may be, a report of management on the company’s internal controls over financial reporting that contains an assessment by management of the effectiveness of the company’s internal control over financial reporting. In addition, the company’s independent registered public accountant must attest to and report on management’s assessment of the effectiveness of the company’s internal control over financial reporting. These requirements will first apply to our Annual Report on Form 20-F for the fiscal year ending December 31, 2006. Our management may not conclude that our internal control over financial reporting is effective. Moreover, even if our management does conclude that our internal control over financial reporting is effective, if our independent registered public accountant is not satisfied with our internal control, the level at which our control is documented, designed, operated or reviewed, or if the independent registered public accountant interprets the requirements, rules or regulations differently from us, then he/she may decline to attest to our management’s assessment or may issue a report that is qualified.

In preparation for our compliance with these assessment and attestation requirements, we are in the process of carrying out a review of the design, documentation and operating effectiveness of our internal control over financial reporting. In the course of this readiness project, some deficiencies in our internal control came to light, none of these are considered material. We are working to rectify these deficiencies and we anticipate that all of them will be rectified by December 31, 2006.

However, because of its inherent limitations, internal control over financial reporting may not prevent or detect all misstatements which may occur. Furthermore, current evaluations of internal controls may in the future become inaccurate due to changes in conditions, or deterioration in compliance with policies or procedures. To the extent that any material weakness in our internal control over financial reporting is discovered in the future and not rectified by the time our first assessment and attestation under Section 404 of the Sarbanes-Oxley Act of 2002 must be made, or our management or our independent registered public accountant are unable to attest to the adequacy of our controls, we could suffer an adverse reaction in the financial marketplace due to a loss of investor confidence in the reliability of our financial statements, which could negatively impact the market price of our securities.

15

| Item 4. | Information on the Company |

A. History and Development of the Company

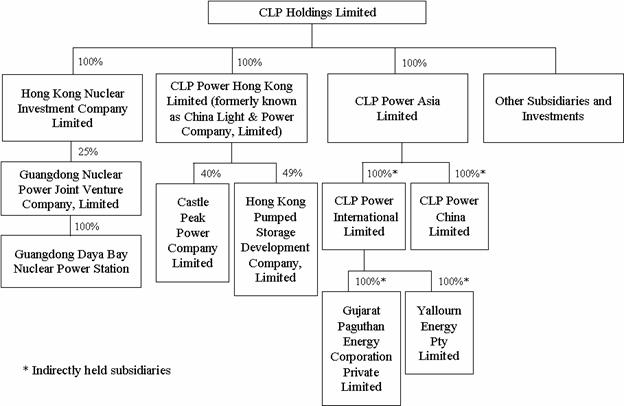

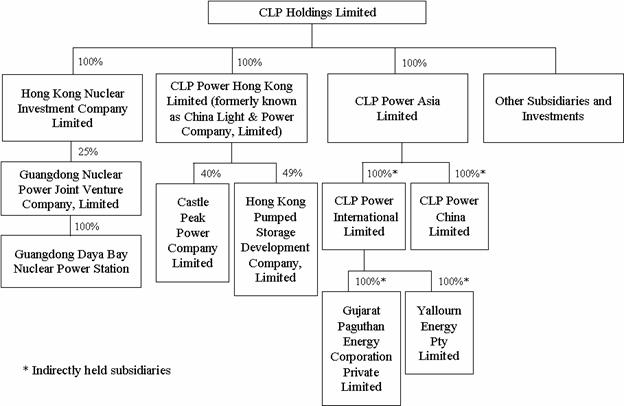

Our legal and commercial name is CLP Holdings Limited. We were incorporated on October 24, 1997 in the Hong Kong Special Administrative Region, China. Under a Scheme of Arrangement with effect from January 6, 1998, we reorganized the companies in our business group and became the holding company of a group of companies, consisting of CLP Power Hong Kong Limited, or CLP Power Hong Kong, (formerly known as China Light & Power Company, Limited, which was the listed and holding company of the CLP Group before reorganization) and other companies. We are a company limited by shares and incorporated under the Hong Kong Companies Ordinance. We refer to our company and our consolidated subsidiaries as the CLP Group, or our Group, in this annual report. Effective July 1, 2003, a new wholly owned subsidiary, CLP Power Asia Limited was formed to be the immediate holding company of CLP Power China Limited and CLP Power International Limited. Our aim is to strengthen management, make best use of our core industry experience across our complete portfolio and to achieve better efficiency in support functions that were previously duplicated in the two subsidiaries.

We continue to work hard to make the most productive and effective use of our people, infrastructure and systems in Hong Kong. Our record in tariff management and supply reliability is a clear measure of our performance in this respect, as is our productivity which, in terms of electricity output per employee, has increased by 127% over the past 10 years. In 2004 we announced that tariffs would be frozen in 2005. There has now been no tariff increase since 1998 which has been a period of deflation in Hong Kong. During that period there have been six tariff rebates, totaling HK$3 billion (US$0.4 billion) from our Scheme of Control reserves accounts. See Note 11 to our financial statements set forth in “Item 17. Financial Statements” in this annual report. This is the equivalent of up to a 3.7% tariff reduction in the respective years.

For our electricity business in the Chinese mainland and other Asia-Pacific countries, in 2004, we have secured a 2x600MW coal-fired greenfield project at Fangchenggang in Guangxi Province, in which we will hold a 70% interest. The project was approved by the National Development and Reform Commission of China in March 2005. Establishment of Enterprises with Foreign Investment in the Chinese mainland was also approved by the Ministry of Commerce in May 2005. The joint venture company, CLP Guangxi Fangchenggang Power Company Limited, was then formed. As part of our continuous commitment to develop renewable energy projects, in December 2004, we established a joint venture with Huaneng New Energy Industrial Co. Ltd., to own and operate a 27MW wind farm in Changdao, Shandong Province, in which we own a 45% interest.

In March 2004, we completed the acquisition of the remaining 8% interest in Yallourn Energy from Deutsche Asset Management (Australia) Limited. Following completion, we now own 100% of Yallourn Energy.

16

The further pursuit of investment opportunities outside Hong Kong will depend on those opportunities meeting our criteria in terms of price, earnings and risk profile. Our policy of diversification will be selective, prudent and incremental. Details of our investments are described in “–– B. Business Overview” below.

Our registered address is 147 Argyle Street, Kowloon, Hong Kong Special Administrative Region, China. Our telephone and facsimile numbers are (852) 2678-8111 and (852) 2760-4448 respectively. Our website address iswww.clpgroup.com. Our authorized representative in the United States with respect to our American Depositary Receipt programme is Puglisi & Associates at 850 Library Avenue, suite 204, Newark, Delaware 19711. Their telephone and facsimile numbers are (302) 738-6680 and (302) 738-7210 respectively.

17

B. Business Overview

We follow a clear and consistent strategy to realize our vision of being a leading investor-operator in the Asia-Pacific electricity power sector.

The key elements of our strategy are to:

| | • | | continuously enhance our core Hong Kong electricity business; and |

| | • | | develop our portfolio of electricity businesses in the Chinese mainland and the Asia-Pacific region. |

The objective of our electricity business in Hong Kong is to provide reliable electricity supply and high quality services at competitive prices to our customers. The current Scheme of Control Agreement took effect on October 1, 1993 and will expire on September 30, 2008. The Agreement provides that, during the three years prior to that date, we and the Hong Kong Government will institute discussions regarding revision and extension of the Scheme of Control with a view to agreeing mutually acceptable terms and conditions. On January 31, 2005, the Hong Kong Government launched a process of public consultation on the future regulation of Hong Kong’s electricity industry. The first phase of the consultation, which solicited the public’s views on options for the future development of Hong Kong’s electricity market after 2008, was completed in April 2005, whilst the second phase will consult the public on the Hong Kong Government’s proposals for the post-2008 regulatory framework. There is a great deal at stake for us and our shareholders in the outcome of the Hong Kong Government’s review of the future regulatory regime. There is also a great deal at stake for Hong Kong as a whole – the continued provision of a quality electricity supply at reasonable cost is essential for our community’s social and economic well-being.

The performance of our investments in the electricity industry outside Hong Kong is improving and we will continue our focus on managing our existing joint ventures to further improve the quality and returns from these businesses. We continue to seek opportunities in other countries outside Hong Kong which meet our investment criteria in terms of price, earnings and risk profile. Our major challenges in the electricity industry outside Hong Kong come largely from political, economic and regulatory uncertainty. We will continue to manage these risks to achieve satisfactory returns on investment and meet safety, health and environmental objectives.

18

Electricity Business in Hong Kong

Through CLP Power Hong Kong, a wholly owned subsidiary, we are engaged in the electricity generation, transmission and distribution business in Hong Kong. We are one of the only two electricity providers in Hong Kong. Pursuant to several contracts described below in “— Power Purchase from CAPCO” and “— Non-CAPCO Power Purchases/Storage Facilities”, we purchase the electricity from CAPCO, our affiliated company incorporated in Hong Kong and from Guangdong Daya Bay Nuclear Power Station, located in Guangdong Province, China. These sources of power, together with CLP Power Hong Kong’s right to use 50% of the capacity of Phase 1 of the Guangzhou Pumped Storage Power Station, amount to a total installed capacity of 8,263 megawatts, or MW. We supply electricity to Kowloon, the New Territories and a number of outlying islands, including Lantau Island and Cheung Chau, which are collectively referred to as our supply area in this annual report. Our supply area extends to approximately 1,000 square kilometers and covers a population of approximately 5.5 million, equivalent to over 2.2 million customers. We supply approximately 73% of the electricity consumed in Hong Kong.

Since 1963, our electricity generation and supply business in Hong Kong has been regulated by the Hong Kong Government pursuant to a series of Scheme of Control Agreements. The current Scheme of Control, a contract between CLP Power Hong Kong, CAPCO, ExxonMobil Energy Limited (formerly known as Exxon Energy Limited) which is referred to as ExxonMobil in this annual report, and the Hong Kong Government, regulates CLP Power Hong Kong’s and CAPCO’s financial affairs for electricity related operations in Hong Kong. The Scheme of Control provides that we are obligated to meet electricity demand at the lowest reasonable cost. In return, the Hong Kong Government recognizes that we are entitled to receive a reasonable return on our investment. The 15-year term of the current Scheme of Control will expire on September 30, 2008 and cannot be amended prior to such date without the mutual agreement of the parties. See “— Scheme of Control” below.

19

CLP Power Hong Kong

China Light & Power Company, Limited (China Light) was incorporated in 1901 in Hong Kong to supply electricity to Guangzhou (formerly known as Canton) in the Chinese mainland and Kowloon. In 1903, China Light established its first power station in Kowloon. In 1918, a new company, The China Light & Power Company (1918), Limited was formed to take over the operations of China Light. Its company name was changed to China Light & Power Company, Limited in 1935 (which changed to the present name of CLP Power Hong Kong Limited in 1999). In 1964, we entered into a joint venture arrangement with ExxonMobil International Holdings Inc. (formerly known as Esso Eastern Inc.), a wholly owned subsidiary of Exxon Mobil Corporation (formerly known as Exxon Corporation), to help finance the substantial capital commitments required to build power stations needed in connection with the anticipated rapid economic expansion in Hong Kong in the 1960s and 1970s. The generating company, CAPCO, was formed under this joint venture arrangement, and was jointly owned by CLP Power Hong Kong (40%) and ExxonMobil Energy Limited (“ExxonMobil”) (an indirect subsidiary of ExxonMobil International Holdings Inc., and was formerly known as Exxon Energy Limited) (60%). Concurrently with the establishment of the joint venture arrangement, CLP Power Hong Kong, and ExxonMobil International Holdings Inc. negotiated a regulatory framework with the Hong Kong Government formally known as the “Scheme of Control”.

Relationship With CAPCO

General

We purchase a significant part of our electricity demand from CAPCO. We work closely with ExxonMobil, which owns 60% of CAPCO, in the financing, construction and management of CAPCO’s generating facilities. The affairs of CAPCO are managed by an eleven-member board of directors, of which six representatives are nominated by ExxonMobil and five representatives are nominated by us. While we act as the operator of CAPCO’s generating facilities, there are a number of key areas requiring the consent of both shareholders, including financing.

The joint venture relationship between us and ExxonMobil is governed by an agreement initially signed in 1964 and subsequently amended and supplemented by several contracts which, collectively, are referred to as the Basic Agreement in this annual report. The Basic Agreement provides, amongst other matters, that no facility expansion can be carried out independently by CAPCO without the approval of us and ExxonMobil. ExxonMobil also has an option to participate in any future generating capacity expansion undertaken by CAPCO to provide for CLP Power Hong Kong’s requirements for electricity. However, if ExxonMobil declines to participate in any such further expansion, their right to participate in succeeding expansions of generating capacity is deemed to be waived.

CAPCO’s balance sheets as of December 31, 2003 and 2004 and statements of income, cash flows and changes in equity for the years ended December 31, 2002, 2003 and 2004, audited by PricewaterhouseCoopers, Independent Registered Public Accounting Firm, are included in “Item 17. Financial Statements” in this annual report.

20

Electricity Purchases

Under the Basic Agreement, we purchase the total electricity output of CAPCO. We also pay all of CAPCO’s operating expenses, including fuel cost, depreciation, interest expenses, current and deferred taxes, as well as CAPCO’s share of the return permitted under the Scheme of Control. See “— Scheme of Control — Net and Permitted Returns” below.

Sales to the Chinese Mainland

Only spare generating capacity of CAPCO not used to serve customers in Hong Kong may be used for sales to the Chinese mainland. Pursuant to a separate agreement among CLP Power Hong Kong, CAPCO and the Hong Kong Government, 80% of the profit from our sales to the Chinese mainland is credited to a Scheme of Control development fund, which is referred to as the Development Fund in this annual report. The remaining 20% of the profit from such sales is shared between CLP Power Hong Kong and CAPCO for the account of our respective shareholders. See “— Sales to the Chinese Mainland” below.

CAPCO Financing

We and ExxonMobil have provided most of our funding to CAPCO in the form of interest-free shareholders’ advances. As at December 31, 2004, CAPCO’s paid-in-capital amounted to HK$50 million (US$6.4 million), while shareholders’ advances amounted to HK$15.2 billion (US$2.0 billion). Pursuant to a deed of subordination, shareholders’ advances are subordinated to certain debt financing of CAPCO and may be repaid to the extent that CAPCO’s ratio of borrowed moneys to shareholders’ funds (representing the sum of the issued share capital, deferred taxation, retained profits, proposed dividend, shareholders’ advances (excluding unrealized foreign exchange differences) and special advances) is not higher than 1.5:1. Borrowed moneys means moneys lent to CAPCO excluding fuel stock loans, obligations arising from swaps and currency exchange transactions, and unrealized foreign exchange differences. As at December 31, 2004 the borrowed moneys of CAPCO amounted to approximately HK$9.3 billion (US$1.2 billion), while shareholders’ funds totaled approximately HK$18.5 billion (US$2.4 billion), giving a ratio of 0.50:1, which is lower than the ratio of 0.54:1 as at December 31, 2003. The lower ratio reflects the combined effect of increased shareholders’ funds and reduced borrowed moneys.

If CAPCO requires additional financing, we and ExxonMobil may at our discretion provide such financing in proportion to our respective participations and, if either declines, the other has the right, but not the obligation, to provide all or any part of the required financing. In addition, if so requested by CAPCO, we are obliged to provide financing in the form of special advances, provided that the cumulative amount of such special advances does not exceed the balance of the Development Fund. CAPCO also has the ability to raise funds through borrowings and/or to reduce its dividend payments to us and ExxonMobil to finance its activities.

21

Scheme of Control

Overview

The electricity-related operations and financial affairs of CLP Power Hong Kong and CAPCO (including its predecessors) have been governed since October 1, 1963 by a series of Scheme of Control Agreements entered into with the Hong Kong Government. The current Scheme of Control became effective on October 1, 1993 and is for a term of 15 years until September 30, 2008.

The Scheme of Control contains provisions covering the obligations of the parties to the Scheme of Control, the tariff setting mechanism, calculation of the permitted and net return of CLP Power Hong Kong and CAPCO and the procedures for government monitoring. Our sales of electricity to the Chinese mainland are governed by a separate contract with the Hong Kong Government.

In accordance with the Scheme of Control, we are obliged to contribute to the development of Hong Kong by providing sufficient facilities to meet the demand for electricity at the lowest reasonable cost. In return, we, CAPCO and any future companies formed by us, alone or together with ExxonMobil or others, these companies being collectively referred to as the SoC Companies, are entitled to receive tariff revenue sufficient for a reasonable return on our investments. Costs are forecast by means of a financial review process described below and the rate of return is determined by means of a formula established by the Scheme of Control. See “— Tariffs” below.

The Scheme of Control provides for government monitoring of the SoC Companies’ financial affairs and operating performance through financial reviews and auditing reviews as described below.

The Hong Kong Government reviews the SoC Companies’ major capital expenditure and tariff rates. A financial review is conducted whenever a major system expansion is proposed, the period of the existing review is about to expire, or when adjustments in excess of 14% of the previously approved tariff rates for that particular year are proposed.

The results of a financial review, including basic tariff rates, are subject to the approval of the Executive Council of Hong Kong. Once the financial review has been approved by the Executive Council of Hong Kong, the basic tariff rates cannot be unilaterally reduced by the Hong Kong Government. However, if a financial review is not completed prior to the expiry of the previous approved financial review, we and CAPCO may increase the basic tariff rates by up to 7% above the level approved by the previous financial review.

22

Subsequent to the approval of a financial review, we and CAPCO may increase the basic tariff rates by up to 7% above the level approved in the financial review for a particular year. A further increase of 7% is permitted with the approval of the Executive Council of Hong Kong without a further financial review. If we and CAPCO have requested an increase in basic tariff rates requiring governmental approval or if we and CAPCO have requested revisions to the current financial review and an agreement has not yet been reached with the Hong Kong Government concerning such increase or revisions, we and CAPCO still have the right to increase the approved basic tariff rates up to 7% on an interim basis. Our financial plan for the period 2005 to 2008 which outlined our projected capital investments and tariff rates is currently being reviewed by the Hong Kong Government. See “D. Property, Plants and Equipment — Capital Investment Programme” below. A tariff review is conducted in October of each year to agree on the implementation of tariff adjustments for the next year.

An auditing review is conducted jointly each year by the SoC Companies and the Hong Kong Government. The auditing review is to provide information to the Hong Kong Government in connection with its monitoring of the SoC Companies’ activities under the Scheme of Control. The auditing review contains an analysis of the prior-year actual results and current-year projections of sales, capital and operating expenditures and other financial and operating data.

An interim review is conducted every five years during the 15-year term of the current Scheme of Control. During an interim review, the Hong Kong Government and the SoC Companies can request modifications to the Scheme of Control, subject to mutual agreement. The second five-year interim review of the current Scheme of Control took place in 2003. Changes to the Scheme of Control made as a result of that interim review included lengthening of depreciation periods for certain assets, providing for depreciation of land, the introduction of an upper limit to the Development Fund (which is now set at 12.5% of annual total revenues from sales of electricity to Hong Kong customers) and enhancements to the disclosure of capital and operating expenditure. The other key terms of the Scheme of Control remain unchanged.

23

Tariffs

We design the net tariff we charge to cover CLP Power Hong Kong’s and other SoC Companies’ operating costs and permitted return. See “— Tariff Rates” below. The net tariff consists of three components: (i) the basic tariff rate, (ii) a fuel clause recovery rebate or charge, and (iii) the Scheme of Control rebate.

We calculate our annual projected basic tariff rates by taking into account the SoC Companies’ permitted return and the annual forecasts of (a), (b), (c) and (d) below, using the formula “(a+b-c)/d”:

| | (a) | operating costs, which include, among other things, the standard cost of fuel; generation, transmission, distribution and administration expenses; depreciation; interest expenses; and tax; |

| | (b) | allowed net return, referred to as net return in this annual report, which is derived by subtracting from the Scheme of Control permitted return, referred to as permitted return in this annual report (i) interest up to a maximum of 8% per annum on borrowings to finance fixed assets; (ii) a charge of 8% per annum on the average balance of the sums of the Development Fund and the special provision account; (iii) an excess capacity adjustment of 13.5% on the average excess capacity expenditure less an allowed interest charge of up to 8% per annum on the average excess capacity expenditure after the Black Point Power Station Units 7 and 8 are commissioned; and (iv) interest up to a maximum of 8% per annum on the increase in average balance of the customers’ deposits in excess of the balance as at September 30, 1998. The permitted return is the sum of 13.5% of the SoC Companies’ average net fixed assets and 1.5% on the average net fixed assets financed by shareholders’ investments and acquired after September 30, 1978; |

| | (c) | revenue from sales to the Chinese mainland less 20% of the incremental profit before tax (this 20% of incremental profit from the sales to the Chinese mainland is shared between CLP Power Hong Kong (40%) and CAPCO (60%)); and |

| | (d) | local (i.e. excluding the Chinese mainland) unit sales in terms of kWh as determined by the load forecast. |

Under the Scheme of Control, all of our expenses relating to power purchases from Guangdong Daya Bay Nuclear Power Station (See “— Non-CAPCO Power Purchases/Storage Facilities —Guangdong Daya Bay Nuclear Power Station” below) and all payments to Hong Kong Pumped Storage Development Company, Limited (See “— Non-CAPCO Power Purchases/Storage Facilities —Guangzhou Pumped Storage Power Station” below) are included in the operating costs described in (a) above.

24

| | (ii) | Fuel Clause Recovery Rebate or Charge |

The standard cost of fuel is recovered through the basic tariff rates as an operating cost. The fuel clause recovery rebate or charge represents the difference between the actual cost of fuel (including natural gas, coal and oil) and the standard cost recovered through the basic tariff rate. The difference is charged or credited to a fuel clause recovery account maintained in our books. No approval from the Hong Kong Government is required to recover increases in the cost of fuel.

| | (iii) | Scheme of Control Rebate |

Any difference between our profit for Scheme of Control operations and our permitted return is required to be transferred to or from the Development Fund. The balance in the Development Fund represents a liability in our accounts. In addition, in relation to the deferral in constructing Units 7 and 8 of the Black Point Power Station, we and the Hong Kong Government agreed in 1999 that we set aside a total of HK$803 million from the Development Fund to a special provision account to pay for the additional costs incurred by the vendors for delayed delivery of the two generator units. See “D. Property, Plants and Equipment — Capital Investment Programme” below. We pay a charge of 8% per annum on the sum of the average balances of the Development Fund and the special provision account. The charge paid by us is credited to a rate reduction reserve and is applied as rebates to customers in the electricity bills.

Net and Permitted Returns

The Scheme of Control allows CLP Power Hong Kong and CAPCO a permitted return and net return as described above. The net return is divided between CLP Power Hong Kong and CAPCO in accordance with the Basic Agreement which provides that CAPCO will receive that proportion of the total net return represented by the net return CAPCO would receive if CAPCO were the only company under the Scheme of Control and the net return were calculated solely on the basis of CAPCO’s accounts. If the actual profit under the Scheme of Control, together with the amount available for transfer from the Development Fund, is less than the permitted return, CAPCO will not bear more than 20% of any such deficit. We believe that such limitation will not have a material effect on our business or financial condition in the foreseeable future.

Rate-Making Procedures

The revenue requirements of the SoC Companies, which are theoretically equal to the cost of supply of electricity, are computed in a financial model based on load forecast, projected operating expenses and return to shareholders. The overall cost of electricity supply is allocated to each class of customer based on consumption profiles, which are determined by load research. We use the cost of service to each class of customer to determine the revenue required and the unit rate. We then propose basic tariff rates to the Hong Kong Government for approval in accordance with the provisions of the Scheme of Control.

25

Power Generation

We do not directly own any generating facilities. Our sources of power supply comprise: (i) CAPCO’s power stations located at Castle Peak and Penny’s Bay and the six commissioned units at Black Point with a total installed capacity of 6,283MW; (ii) 70% share (approximate 1,380MW) of the output from Guangdong Daya Bay Nuclear Power Station under a 20-year contract beginning in 1994; and (iii) our right to use 50% (600MW) of the capacity of Phase I of Guangzhou Pumped Storage Power Station for a period of 40 years commencing in 1994. All of our sources of power supply provide us with a total installed capacity of 8,263MW.

Although we do not directly own any power generating facilities, we operate and maintain CAPCO’s power stations. In addition, we directly and through Hong Kong Nuclear Investment Company Limited, a wholly owned subsidiary, have seconded a number of staff to Guangzhou Pumped Storage Power Station and Guangdong Daya Bay Nuclear Power Station respectively to operate and maintain their power stations.

We met all demands for power during the year ended December 31, 2004 without any shortages. The amount of electricity supplied to the system for the year ended December 31, 2004 was 32,975 GWh, an increase of 2.1% over the year ended December 31, 2003. As at December 31, 2004, our system and local reserve margins were approximately 5% and 31% respectively.

26

The table below sets forth for the years ended December 31, 2003 and 2004, the amount of electricity purchased by us, as generated by CAPCO and other generating facilities, and the amount of power used or lost in connection with transmission and distribution:

| | | | | | |

| | | Year ended December 31,

| |

| | | 2003 | | | 2004 | |

| | |

| |

| | | (GWh) | |

CAPCO facilities: | | | | | | |

Castle Peak | | 15,961 | | | 13,802 | |

Black Point | | 7,728 | | | 11,304 | |

Gas turbines | | 1 | | | 3 | |

| | |

|

| |

|

|

| | | 23,690 | | | 25,109 | |

Auxiliary use(1) | | (1,358 | ) | | (1,300 | ) |

| | |

|

| |

|

|

Net CAPCO production | | 22,332 | | | 23,809 | |

| | |

Other power purchased: | | | | | | |

Nuclear | | 10,069 | | | 9,318 | |

Net transfer from/(to) | | | | | | |

Hongkong Electric | | (1 | ) | | – | |

Landfill gas generation | | 1 | | | 1 | |

| | |

|

| |

|

|

Total other power purchase | | 10,069 | | | 9,319 | |

| | |

Pumped Storage operation: | | | | | | |

Energy transferred | | 328 | | | 519 | |

Energy consumed for pumping | | (429 | ) | | (672 | ) |

| | |

|

| |

|

|

Net (loss) in pumped storage operation | | (101 | ) | | (153 | ) |

| | |

Total net generation | | 32,300 | | | 32,975 | |

| | |

|

| |

|

|

Transmission and distribution losses(2) | | 1,257 | | | 1,256 | |

| | |

|

| |

|

|

Note:

| (1) | Auxiliary use represents electricity consumed by generating units in the course of generation. |

| (2) | Losses including non-revenue items such as CLP Power Hong Kong’s office use and staff electricity allowances. |

The table below sets forth for the years ended December 31, 2003 and 2004, total capacity, total CAPCO capacity and peak load for power generated for our sale.

| | | | |

| | | Year Ended December 31,

|

| | | 2003 | | 2004 |

| | |

|

| | | (MW) |

| | |

Total CAPCO and Non-CAPCO capacity | | 8,263 | | 8,263 |

Total CAPCO capacity | | 6,283 | | 6,283 |

Peak load: | | | | |

Local (Hong Kong) | | 5,874 | | 6,329 |

System (Total) | | 7,646 | | 7,862 |

27

Power Purchase from CAPCO

Under the Basic Agreement, we have agreed to purchase, and CAPCO has agreed to sell, the total power produced by CAPCO. For the year ended December 31, 2004, we purchased approximately 72% of our power from CAPCO. CAPCO presently has three commissioned power stations with a combined installed capacity of 6,283MW as at December 31, 2004.

To ensure the reliability and security of power supply, CAPCO’s power generation system comprises a mix of different types of generating units, including gas-fired combined cycle units, coal-fired steam generators and gas turbines. The power stations at Black Point and Castle Peak provided almost all of CAPCO’s electricity supply to us during the year ended December 31, 2004.

Smaller capacity gas turbines are used as supplementary facilities to meet demand at peak periods and for emergency back-up because of their quick-start capability. CAPCO’s gas turbines have achieved 100% starting reliability, which is a key indicator of gas turbine performance.

CAPCO leases the properties on which all of its generating facilities are located from the Hong Kong Government. See “D. Property, Plants and Equipment” below. We are responsible for the overall management and control of construction at the site and operation of all of CAPCO’s generating facilities.

Black Point Power Station

Black Point Power Station commenced commercial operation in 1996 (Units 1 and 2) and is located at the western tip of the New Territories, approximately four kilometers north of the Castle Peak Power Station. It currently consists of six combined cycle units with a total capacity of 1,875MW. The commissioning of Units 7 and 8 is expected to occur in 2005 and 2006, respectively. See “D. Property, Plants and Equipment — Capital Investment Programme” below. Black Point Power Station, when completed, will be one of the largest combined cycle power plants in the world with an expected total capacity of 2,500MW.

Black Point Power Station is the first natural gas-fired plant in Hong Kong. The use of natural gas, a clean burning fuel which leaves no ash and emits negligible sulphur dioxide, allows the power station to operate with lower environmental impact and higher thermal efficiency. The current supply of natural gas comes from the Yacheng 13-1 field in the South China Sea. In view of the lengthy lead-time required for new gas projects and the possibility of increased promotion of gas-fired generation over time due to environmental considerations, we have commenced long-term planning of future arrangements for natural gas supply from other sources. As other South China gas reserves appear insufficient to supplement or replace Yacheng, the import of LNG through a Hong Kong LNG terminal is considered to be the most appropriate means for long-term supply. Terminal feasibility studies are underway with first deliveries targeted by 2011. This year, the project will enter Hong Kong’s statutory environmental impact assessment process.

28

Castle Peak Power Station

Castle Peak Power Station is one of the largest coal-fired power station complexes in the world, comprising eight coal-fired generating units with a total capacity of 4,108MW. Its first phase commenced operations in 1982. Its second phase, with four 677MW units, was completed in 1990. In April 1997, we and CAPCO agreed with the Hong Kong Government to decommission the gas turbines previously in operation at Tsing Yi and Castle Peak Power Stations and put such gas turbines into preservation. Castle Peak Power Station burns coal as its primary energy source, resulting in significantly lower electricity prices than burning oil. The coal-fired generating units achieved an overall availability of 87.81% for the year ended December 31, 2004, with a forced outage rate of 0.75%. We believe this rate corresponds to the highest world standards and reflects the high quality of the plant and its operation. The design of the Castle Peak Power Station also enables it to burn oil or natural gas as back-up fuel, should this be required.

The Castle Peak Power Station has achieved consistently high levels of compliance with air quality control standards. An energy saving programme has been in operation in each of the Black Point and Castle Peak Power Stations since 2000 to explore opportunities for auxiliary power reduction and resources conservation. As a consequence, energy savings of about 2.5% have been achieved as compared with the levels at the base year 1999.

Penny’s Bay Gas Turbine Power Station

The three 100MW gas turbines at Penny’s Bay Gas Turbine Power Station are utilized for peak load and emergency generation purposes. Total output by such units during the year ended December 31, 2004 was minimal.

Fuel

For the majority of the 1980’s, coal was our primary energy source. After the commissioning of the six natural gas-fired generating units at Black Point Power Station and the purchases from Guangdong Daya Bay Nuclear Power Station, we now operate with a diversified fuel mix of gas, coal and nuclear. Oil has been phased out as a fuel for base and intermediate power generation and is now used only for peak and standby generation. We believe diversification of energy sources will provide greater long-term security for customers and is beneficial to Hong Kong’s environment. For the year ended December 31, 2004, the fuel mix consisted of the following: natural gas (27%), coal (41%) and nuclear (32%). Our fuel costs are recovered through the basic tariff rates and the fuel clause recovery rebate or charge. See “— Scheme of Control — Tariffs” above.

Natural Gas

CAPCO purchases gas for the Black Point Power Station on a take-or-pay (if tendered) basis pursuant to a 20-year contract with BP China Exploration and Production Company (formerly Arco China Inc.), China National Offshore Oil Corporation (which transferred its interest to CNOOC China Limited (formerly known as Offshore Oil Limited) in 1999) and Kufpec (China) Inc. which commenced in January 1996. The base price under the contract was established when the contract was signed in December 1992. Changes in the contract price are determined annually by reference to certain market and economic indices.

29

Coal

For the year ended December 31, 2004, total coal consumption for the eight generating units of Castle Peak Power Station was approximately 5.9 million tones. Approximately 57% of CAPCO’s coal requirements are imported under long-term contracts from Indonesia. Prices are generally negotiated in line with market factors.

Nuclear

See “— Non-CAPCO Power Purchases/Storage Facilities — Guangdong Daya Bay Nuclear Power Station” below.

Non-CAPCO Power Purchases/Storage Facilities

Guangdong Daya Bay Nuclear Power Station

In addition to purchasing power from CAPCO, for the year ended December 31, 2004, we purchased approximately 9,318 GWh of power from Guangdong Daya Bay Nuclear Power Station located in Guangdong Province of the Chinese mainland, pursuant to power purchase agreements covering 70% of the output of Guangdong Daya Bay Nuclear Power Station. The agreements extend for 20 years from 1994 and contain a provision which permits us to continue to purchase 25% of the power generated by Guangdong Daya Bay Nuclear Power Station for an additional five years. Our wholly owned subsidiary, Hong Kong Nuclear Investment Company Limited, or HKNIC, owns a 25% equity interest in Guangdong Nuclear Power Joint Venture Company, Limited which owns Guangdong Daya Bay Nuclear Power Station. The other 75% equity interest is owned by Guangdong Nuclear Investment Company, Limited, a Chinese mainland enterprise. Guangdong Daya Bay Nuclear Power Station is one of the largest joint venture power projects in the Chinese mainland.

We are obliged to purchase HKNIC’s 25% equity share of Guangdong Daya Bay Nuclear Power Station’s total output and an additional 45% of such output from Guangdong Nuclear Investment Company, Limited. The price paid by us for electricity generated by Guangdong Daya Bay Nuclear Power Station throughout the terms of the power purchase agreements is determined by a formula based on Guangdong Daya Bay Nuclear Power Station’s operating costs and a profit calculated by reference to shareholders’ funds and the capacity factor for the year. We are allowed to treat all our payments for nuclear electricity generated by Guangdong Daya Bay Nuclear Power Station as part of our operating expenses permitted under the Scheme of Control. See “— Scheme of Control — Tariffs” above.

The design, construction, operation and maintenance of nuclear power plants involve significant safety measures because of the hazardous nature of radioactive materials. The use and disposal of nuclear fuels have the potential, albeit very low, to create substantial risks of liability arising from exposure to or release of radioactive materials. We believe that Guangdong Daya Bay Nuclear Power Station complies in all material respects with international safety standards. We also consider that HKNIC’s minority ownership interest and minor participation in Guangdong Daya Bay Nuclear Power Station limits its exposure to nuclear-related liabilities to the amount of its initial US$100 million investment and its share of undistributed retained profits in Guangdong Nuclear Power Joint Venture Company, Limited.

30

Guangdong Nuclear Investment Company, Limited, together with its parent company, also own Ling Ao Nuclear Power Station which was commissioned in 2002. Neither we, HKNIC nor CLP Power Hong Kong has any direct or indirect interest in Ling Ao Nuclear Power Station. The Ling Ao Nuclear Power Station is similar in design and situated very close to the Guangdong Daya Bay Nuclear Power Station. Guangdong Nuclear Power Joint Venture Company, Limited and Ling Ao Nuclear Power Company, Limited, as the direct owners of the Guangdong Daya Bay Nuclear Power Station and the Ling Ao Nuclear Power Station, respectively, have established a management company, Daya Bay Nuclear Power Operations and Management Company, Limited, or DNMC. DNMC is owned on a 50/50 basis and is responsible for the operation and maintenance of the two power stations.

The operating staff of the two nuclear power stations now perform their duties as employees of DNMC. The benefits of establishing DNMC include a pooling of resources, sharing of expertise and benefits of economy of scale. The documents for the establishment of DNMC are structured so as to ensure that neither Guangdong Nuclear Power Joint Venture Company, Limited nor HKNIC take on any additional risk or liability as a result of the establishment of DNMC or the operation of the Ling Ao Nuclear Power Station.

Guangzhou Pumped Storage Power Station

Hong Kong Pumped Storage Development Company, Limited, a joint venture company formed between CLP Power Hong Kong (49%) and ExxonMobil (51%), has the right to use 50% of the capacity of Phase 1 of the Guangzhou Pumped Storage Power Station for 40 years from 1994 pursuant to a capacity purchase contract. The Guangzhou Pumped Storage Power Station, owned by Guangdong Pumped Storage Company, Limited (formerly known as Guangzhou Pumped Storage Joint Venture Corporation), which in turn is owned by three Chinese government-owned entities, is located in Lu-Tien, Conghua County, which is about 90km north of Guangzhou. We are allowed to treat all payments to Hong Kong Pumped Storage Development Company, Limited for the pumped storage services provided as part of our operating expenses under the Scheme of Control. See “— Scheme of Control — Tariffs” above.

As electricity cannot be stored in large quantities, Guangzhou Pumped Storage Power Station indirectly stores electricity by way of pumping water to a high-level reservoir during periods of low demand such as at night. The water can then be released generating hydro-electric power at times of peak demand. Some energy is lost in this process, but the loss is more than offset by the savings from the reduction in use of high production cost plants during the day and the efficiency gains of running plants at a constant output level.

Interconnection with Hongkong Electric and Guangdong Grid

The interconnection of our systems with those of Hongkong Electric (the only other electricity supplier in Hong Kong) to the south and Guangdong Province to the north allows us to access other generating capacities to further enhance the reliability of our own supply system. See “— Power Systems — Security and Reliability” below. The interconnection with Guangdong Province allows us to sell our excess capacity to customers in the Chinese mainland. See “— Sales to the Chinese Mainland” below. We have an interconnection agreement with Hongkong Electric under which the two companies sell each other electricity to meet marginal demand when doing so is more economical than utilizing other sources. For the year ended December 31, 2004 about 430 MWh of power was sold to Hongkong Electric.

31

Power Systems

The Network

We transmit electricity to load centers through an advanced transmission network owned and operated by us. As at December 31, 2004, our transmission and distribution network comprised 11,955 kilometers of high voltage circuits, 202 primary substations and 12,215 secondary substations. Our system is interconnected with the transmission system of Hongkong Electric and the power system of neighboring Guangdong Province of the Chinese mainland.

Electricity generated from the steam turbine units at Castle Peak Power Station, the combined cycle units at Black Point Power Station, the nuclear units at Guangdong Daya Bay Nuclear Power Station and the pumped storage units at Guangzhou Pumped Storage Power Station is transmitted to the load centers via our 400kV transmission network. The 400kV network consists of two double-circuit 400kV transmission lines arranged in a ring encircling the New Territories together with cross-connection, and six 400kV underground cable circuits reaching into the densely populated Kowloon Peninsula. Continuity of supply is safeguarded even if one double-circuit power line is lost.