FORM 6-K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of August 2007

CLP Holdings Limited

(Registrant’s name in English)

147 Argyle Street

Kowloon, Hong Kong

(Address of Registrant’s principal executive office)

Indicate by check mark whether the Registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F X Form 40-F

Indicate by check mark whether the Registrant by furnishing this information contained in this Form is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes No X

If “Yes” is marked, indicate below the file number assigned to the Registrant in connection with Rule 12g3-2(b): 82-

Registrant hereby incorporates by reference in the report on Form 6-K the following Exhibits:

Exhibits

| 1. | The 2007 Interim Report which was despatched to shareholders on 31 August 2007. |

| 2. | The letter to shareholders in relation to shareholders’ choice of language and means of receipt of CLP Holdings’ corporate communications which was despatched to shareholders on 31 August 2007. |

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | |

| | | For and on behalf of |

| | CLP HOLDINGS LIMITED |

| By: | | / s / April Chan |

| Name: | | April Chan |

| Title: | | Company Secretary |

Date: 5 September 2007

3

Exhibit 1

CLP’s vision is to be a leading investor-operator in the Asia-Pacific electric power sector.

|

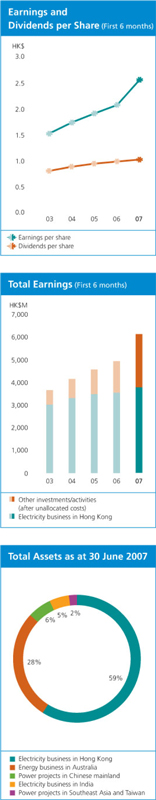

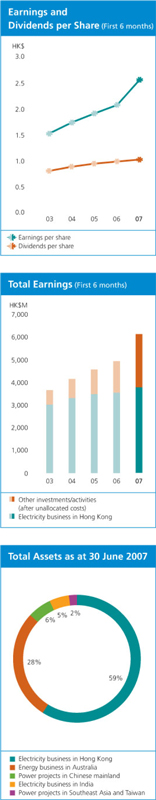

HIGHLIGHTS • Electricity sales in Hong Kong grew 1.6% to 13,509 GWh; total sales (which include sales to the Chinese mainland) rose 2.7% to 15,829 GWh. • Consolidated revenue rose 14.3% to HK$24,672 million; revenue from our electricity business in Hong Kong recorded a 2.2% growth to HK$14,307 million. • Earnings from our electricity business in Hong Kong increased by 5.1% to HK$3,756 million. • Earnings from other activities grew by 54.5% to HK$2,591 million, including a one-off gain of HK$1,030 million from the transfer of our interest in Ho-Ping to OneEnergy. • Total earnings up 23.2% to HK$6,130 million. • Second interim dividend of HK$0.52 per share. |

Page 1

Financial Highlights

| | | | | | | | | | | |

| | | 6 months ended 30 June | | | | Increase | |

| | 2007 | | | | 2006 | | | | % | |

Per share (in HK$) | | | | | | | | | | | |

Earnings per share | | 2.55 | | | | 2.07 | | | | 23.2 | |

| | | | | |

Dividends per share | | | | | | | | | | | |

First interim | | 0.52 | | | | 0.50 | | | | | |

Second interim | | 0.52 | | | | 0.50 | | | | | |

Total interim dividends | | 1.04 | | | | 1.00 | | | | 4.0 | |

For the period(in HK$ million) | | | | | | | | | | | |

Revenue | | | | | | | | | | | |

Electricity business in Hong Kong (HK) | | 14,307 | | | | 13,993 | | | | 2.2 | |

Energy business outside HK | | 10,262 | | | | 7,522 | | | | 36.4 | |

Others | | 103 | | | | 69 | | | | | |

Total | | 24,672 | | | | 21,584 | | | | 14.3 | |

| | | | | |

Earnings | | | | | | | | | | | |

Electricity business in HK | | 3,756 | | | | 3,573 | | | | 5.1 | |

Other investments/activities | | | | | | | | | | | |

Electricity sales to Chinese mainland from HK | | 61 | | | | 55 | | | | | |

Generating facilities in Chinese mainland serving HK1 | | 399 | | | | 347 | | | | | |

Other power projects in Chinese mainland | | 57 | | | | 152 | | | | | |

Energy business in Australia | | 599 | | | | 260 | | | | | |

Electricity business in India | | 175 | | | | 374 | | | | | |

Power projects in Southeast Asia and Taiwan | | 266 | | | | 165 | | | | | |

Other businesses | | 4 | | | | 33 | | | | | |

Other income | | 1,030 | | | | 291 | | | | | |

| | 2,591 | | | | 1,677 | | | | 54.5 | |

Unallocated net finance costs | | (54) | | | | (122) | | | | | |

Unallocated Group expenses | | (163) | | | | (153) | | | | | |

Total earnings | | 6,130 | | | | 4,975 | | | | 23.2 | |

| | | | | |

Interest cover2 (times) | | 9 | | | | 8 | | | | | |

| | 30 June

2007 | | | | 31 December

2006 | | | | Increase/

(Decrease)

% |

|

As at balance sheet date(in HK$ million) | | | | | | | | | | | |

Total assets, including leased assets | | 137,247 | | | | 131,091 | | | | 4.7 | |

Total borrowings | | 29,934 | | | | 30,278 | | | | (1.1 | ) |

Obligations under finance leases | | 22,060 | | | | 22,810 | | | | (3.3 | ) |

Shareholders’ funds | | 60,492 | | | | 55,838 | | | | 8.3 | |

Total debt to total capital3 (%) | | 33.1 | | | | 35.1 | | | | | |

Notes:

| 1 | This represents earnings contribution from our investments in Guangdong Nuclear Power Joint Venture Company, Limited and Hong Kong Pumped Storage Development Company, Limited, whose generating facilities serve Hong Kong. |

| 2 | Interest cover = Profit before income tax and interest/(interest charges + capitalised interest). |

| 3 | Total debt to total capital = Debt/(shareholders’ funds + debt + minority interests). Total debt excludes obligations under finance leases. |

Page 2

Page 3

Chairman’s Statement

Dear Shareholders,

I am pleased to present our Interim Report for the six months to 30 June 2007.

Financial Results for the Six-Month Period

The CLP Group’s total earnings for the six months ended 30 June 2007 increased by 23.2% to HK$6,130 million, as compared with the corresponding period in 2006.

All our investments in the energy sector, whether from our electricity business in Hong Kong or our interests in the Chinese mainland, Australia, India and elsewhere in the Asia-Pacific region contributed to the Group’s earnings during the first half of the year. Whilst earnings from our investments in the Mainland and India fell slightly, there was an increase in the contribution made by the Hong Kong electricity business, which continues to provide the major share of the Group’s earnings, and from our TRUenergy gas and electricity businesses in Australia. Further details of the financial and operational performance of the Group, and of the principal business streams within the Group, are set out later in this Interim Report.

CLP and Our Shareholders

We pay particular regard to the views expressed by our shareholders on the conduct of CLP’s affairs. For example, the CLP Shareholders’ Visit Programme, which has been running since 2003 has seen over 8,000 shareholders visiting our facilities in Hong Kong and exchanging views with Directors and representatives of senior management.

Our Annual General Meeting (AGM) has always been a most important date in CLP’s calendar. As Chairman, I regard my attendance at the AGM not as a duty, but as a valuable opportunity to meet our shareholders, listen to their opinions and reinforce their confidence in the manner in which, I, my fellow Directors and Management are discharging our responsibilities towards them.

Nearly 700 shareholders attended this year’s AGM – the highest attendance we have ever had, and amongst the highest attendance by shareholders at the General Meeting of any Hong Kong listed company. During the questions and answers session at the AGM, shareholders raised three questions – relating to CLP’s environmental performance, our customer service and the performance of our investment in Australia. In my statement for this year’s Interim Report, I wish to discuss each of these issues further, as they are amongst the issues to which the Board gives particular attention.

Environment

We are determined to manage responsibly the environmental dimension of our business. In this regard, we are continuing to make significant progress on three fronts.

Page 4

First, we are playing a full part in the collective effort that is required to improve air quality in Hong Kong. Our track record in reducing the emissions from our power stations has been excellent – total emissions last year were actually lower than those in 1990, despite an increase in electricity demand of over 80%. Nonetheless, Hong Kong’s overall air quality has deteriorated over that period. In significant measure, this is due to emissions generated in Guangdong. However, since we share a common airshed in the Pearl River Delta, the Hong Kong Government must play a leading role in promoting the regional action that will be necessary for this problem to be tackled successfully over the medium to longer term – and CLP must support Government’s efforts. In addition to the ongoing operational measures we take to reduce emissions from our power generating activities in Hong Kong, such as the increased use of ultra-low sulphur coal at Castle Peak Power Station, we have two important initiatives in hand which will lead to further improvements in our environmental performance, namely,

| | · | | our project to construct a liquefied natural gas (LNG) receiving terminal in Hong Kong and secure long-term LNG supplies such that, by early next decade we are able to replace the depleting gas resources in the South China Sea that are currently supplying Black Point Power Station; and |

| | · | | the retrofit of additional emissions reduction facilities at Castle Peak Power Station, notably the installation of flue gas desulphurisation (FGD). On completion of this project, we expect to see significant reductions in the emissions of NOx and SO2 from Castle Peak. |

Compared to air quality issues in Hong Kong, climate change is an issue which needs to be addressed on a Group-wide basis. Through our existing climate change framework, we are already ensuring that the greenhouse gas emissions associated with any particular project or investment are carefully evaluated in any pre-investment decision. We need to go further and to revisit and reinforce our climate strategy to ensure that it remains the best answer we can give to the dilemma of responding to the growing demand from the people of our region for accessible and affordable electricity, whilst meeting that demand in a sustainable way. I expect that one of the central elements of our strategy will be a commitment to large-scale reductions in the carbon intensity of our electricity generation portfolio between now and the middle of this century. Whilst it is urgent that governments, energy companies and consumers start now to address the threat of serious climate change, the solutions will require a large-scale collective effort and take many years, indeed decades, to be effectively implemented.

The continued development of renewable energy projects is the third of the major environmental components of our business and will also form part of our climate change strategy going forward. Shareholders will be familiar with the commitment we made in 2004 to aim for a target of 5% of the Group’s generating capacity being derived from renewable sources by 2010. At the time this commitment was made, our renewable energy capacity of 53 equity megawatts represented only about 0.5% of our generating portfolio. We have made excellent progress towards this target. By way of example, in July we entered into an agreement to take a 100% interest in a 100.8MW wind farm at Samana in Gujarat, India – the largest wind project, in equity megawatt terms, that the Group has yet procured. The percentage of renewable energy within our portfolio now stands at 4.4%, corresponding to 440 equity megawatts. I am confident that we will meet our 5% target well in advance of 2010. If so, I expect that we will set new challenges for ourselves in terms of further renewable energy development.

Page 5

Customer Service

Achieving and maintaining high levels of customer service is essential to the success of our energy businesses in Australia and Hong Kong.

In Australia, TRUenergy is operating in an extremely competitive retail environment, with a customer churn rate (i.e. the percentage of customers in the market who change their energy supplier within a given year) in Victoria currently at a level of 29% - one of the highest in any energy market in the world. In such a market, TRUenergy’s ability to compete effectively depends not only on tariff levels, but also on the quality of service we offer to our customers. With its continued focus on Customer First, including a business commitment to revert to any customer within 24 hours, TRUenergy has been successful in maintaining its leadership position as measured by the low level of official complaints to the Ombudsman, while improving service levels, particularly in South Australia.

In Hong Kong, the position is different, insofar as over the course of the past century, CLP has become the sole electricity retailer to the people and businesses of Kowloon and the New Territories, representing over 80% of Hong Kong’s total population. In such circumstances, the drive for excellence in customer service comes not from the external discipline of market forces, but from the self-discipline that arises from recognition of our duty to provide our community with an electricity supply which is world-class in all respects, be it in terms of tariff levels, reliability, environmental performance or customer service.

During the past months, we have continued to improve our customer service, such as through revamping the CLP website, setting up a customer service centre at Po Lam MTR Station, which is the first one along the MTR network, as well as opening the first Business Centre for our small and medium-sized enterprise customers. Our efforts in this regard have been recognised, both by our customers and by industry peers, such as through the Regional Contact Centre Association Annual Awards and the Hong Kong Association for Customer Service Excellence Awards.

As the negotiations on the new electricity regulatory framework, to replace the existing Scheme of Control (SoC) on its expiry in September 2008, move forward during the remainder of the year, continued excellence in customer service remains one of the clearest indicators of the merits of the existing SoC and how a fair, stable and durable regulatory regime safeguards not only the interests of CLP shareholders, but those of the customers we serve.

Australia

Some of our shareholders have expressed concern about the performance of our energy business in Australia and, indeed, this was the focus of one of the questions raised at the AGM. In response to that question, our Chief Executive Officer, Andrew Brandler, explained the steps being taken by Management to improve the financial performance of this business, including swapping Torrens Island Power Station with AGL’s Hallett Power Station, in order to balance the generating portfolio more closely with our retail load, and outsourcing our information technology support in order to reduce operating cost. These and other measures have contributed to an improved earnings contribution from TRUenergy in the six months to 30 June 2007, compared with the corresponding period last year.

Page 6

Our efforts in this regard will continue. The Australian energy industry is entering a phase of consolidation – a process which we think is positive for the market and, in turn, positive for TRUenergy. As this process unfolds, we shall be alert to the opportunities to exploit the qualities and strengths of TRUenergy within that market, whilst maintaining a strong focus on sustainability and the development of renewable energy sources.

During the opening months of 2007, CLP’s management and staff have responded well to the challenges and opportunities present in the evolving and dynamic Asian power sector. I look forward to reporting to you at the end of the year on the ongoing success of these efforts and the completion of another year in which the Board, management and staff have discharged our duty of delivering value to our shareholders.

/ s / The Hon. Sir Michael Kadoorie

The Hon. Sir Michael Kadoorie

Hong Kong, 16 August 2007

Page 7

Business Overview

CLP follows a clear, consistent and focused strategy to realise our vision of being a leading investor-operator in the Asia-Pacific electricity power sector. We aim continuously to develop a portfolio of electricity businesses in Hong Kong, Australia, the Chinese mainland, India and elsewhere in the Asia-Pacific region. An outline of our investments as at 30 June 2007 is set out below:

Hong Kong

| | | | |

Investments | | Equity

Interest | | Description |

CLP Power Hong Kong Limited (CLP Power Hong Kong)(1) | | 100% | | CLP Power Hong Kong owns and operates the transmission and distribution system, covering a supply area of approximately 1,000 sq. km and which includes: · 554 km of 400kV lines · 1,299 km of 132kV lines · 120 km of 33kV lines · 11,078 km of 11kV lines · 55,808 MVA transformers · 204 primary substations in operation · 12,697 secondary substations in operation |

Castle Peak Power Company Limited (CAPCO)(1), 6,908 megawatts (MW) of installed generating capacity | | 40% | | CAPCO owns and CLP Power Hong Kong operates: Black Point Power Station (2,500MW) · One of the world’s largest gas-fired power stations (with distillate as back-up) comprising eight combined-cycle turbines of 312.5MW each Castle Peak Power Station (4,108MW) · Comprising four coal-fired units of 350MW each and another four units of 677MW each · Two of the 677MW units are capable of burning gas as backup fuel. All units can burn oil as a backup fuel Penny’s Bay Power Station (300MW) · Three diesel oil-fired units of 100MW each |

| | | | | | |

| | Note (1): | | CLP Power Hong Kong purchases its power from CAPCO and Guangdong Daya Bay Nuclear Power Station. These sources of power, together with CLP’s right to use 50% of the capacity of Phase 1 of the Guangzhou Pumped Storage Power Station, amount to a total installed capacity of 8,888MW. | | |

Page 8

Southeast Asia and Taiwan

| | | | |

Investments Gross/Equity MW | | Equity

Interest | | Description |

OneEnergy Limited (OneEnergy) 8,342/728MW(2) | | 50% | | A 50:50 strategic joint venture with Mitsubishi Corporation of Japan, which currently owns: (a) a 22.4% interest inElectricity Generating Public Company Limited (EGCO) in Thailand. EGCO owns: · REGCO and KEGCO gas-fired combined-cycle power stations in Thailand (2,056MW) which it also operates · a 50% interest in the operating 1,434MW BLCP coal-fired project in Thailand · a 50% interest in the 1,468MW Kaeng Khoi 2 combined-cycle gas turbine project in Thailand, 734MW in operation and 734MW under construction · a 25% interest in the 1,070MW Nam Theun 2 hydro project in Laos, under construction · 369MW out of a total of 994MW in a portfolio of small power projects operating in Thailand and the Philippines (b) a 40% interest inHo-Ping Power Company (HPC) in Taiwan. HPC owns the 1,320MW coal-fired Ho-Ping power station located on the north-eastern coast of Taiwan. Operation started in 2002 and is by a separate joint venture, with the same shareholdings as HPC, but with CLP management leadership |

| | | | |

| | Note (2): | | The 728 equity MW attributed to CLP, through its 50% equity interest in OneEnergy, takes into account that OneEnergy indirectly holds varying equity interests in the generating assets included in the 8,342 gross MW. |

Page 9

Australia

| | | | |

Investments Gross/Equity MW | | Equity

Interest | | Description |

TRUenergy 4,126/4,126MW | | 100% | | TRUenergy is an integrated generation and retail electricity and gas business in Victoria, South Australia, New South Wales, Queensland, Tasmania and the Australian Capital Territory, comprising: · 1,480MW coal-firedYallourn Power Station and brown coal mine in Victoria · 1,280MW gas-firedTorrens Island Power Station (TIPS) in South Australia (in July 2007, TIPS was swapped with Hallett Power Station, a 180MW gas-fired plant in South Australia) · Ecogen long-term hedge agreement that allows TRUenergy to purchase up to 966MW gas-fired capacity · 400MW gas-firedTallawarra projectin New South Wales, currently under construction · 12 PetajouleIona Gas Storage facility in Victoria · Various long-term gas supply contracts · a 33.33% interest in the SEAGas pipeline between Victoria and South Australia · 1.2 million business and residential electricity and gas customer accounts, predominantly in Victoria and South Australia |

Page 10

| | | | |

Investments Gross/Equity MW | | Equity

Interest | | Description |

Roaring 40s Renewable Energy Pty Ltd (Roaring 40s) 552/184MW(3) | | 50% | | Roaring 40s is a 50:50 joint venture partnership with Hydro Tasmania and owns: · 100% of the 65MW Woolnorth Bluff Point wind farm in Tasmania · 100% of the 75MW Woolnorth Studland Bay wind farm project in Tasmania · a 50% interest in the 66MW Cathedral Rocks wind farm in South Australia · a 49% interest in the 49MW Datang Shuangliao wind farm project in Jilin Province ( ), China ), China · a 49% interest in the 49MW Guohua Rongcheng wind farm project in Shandong Province ( ), China ), China · a 49% interest in three 50MW Guohua wind farm projects in Hekou ( ) and Lijin ( ) and Lijin ( ) of Dongying City ) of Dongying City ( ), and Zhanhua ( ), and Zhanhua ( ) of Binzhou City ( ) of Binzhou City ( ) in Shandong Province, China ) in Shandong Province, China · a 49% interest in the 50MW Datang Datong wind farm project in Jilin Province, China · 100% of the 50MW Khandke wind farm in Maharashtra, India |

| | | | |

| | Note (3): | | The 184 equity MW attributed to CLP, through its 50% equity interest in Roaring 40s, takes into account varying equity interests held by Roaring 40s in the generating assets included in the 552 gross MW. |

| | |

| | India | | |

| | | | |

Investments Gross/Equity MW | | Equity

Interest | | Description |

Gujarat Paguthan Energy Corporation Private Limited (GPEC) 655/655MW | | 100% | | GPEC owns and operates a 655MW gas-fired combined-cycle power station in Gujarat, India. |

Page 11

Chinese Mainland

| | | | |

Investments Gross/Equity MW | | Equity

Interest | | Description |

Guangdong Nuclear Power Joint Venture Company, Limited (GNPJVC) 1,968/492MW | | 25% | | GNPJVC constructed and operates Guangdong Daya Bay Nuclear Power Station (GNPS) at Daya Bay ( ). GNPS is equipped with two 984MW Pressurised Water Reactors for which the majority of the equipment was imported from France and the United Kingdom. 70% of electricity generated is supplied to Hong Kong, with the remaining 30% sold to Guangdong Province ( ). GNPS is equipped with two 984MW Pressurised Water Reactors for which the majority of the equipment was imported from France and the United Kingdom. 70% of electricity generated is supplied to Hong Kong, with the remaining 30% sold to Guangdong Province ( ) ) |

Hong Kong Pumped Storage Development Company, Limited (PSDC) 1,200/600MW | | 49% | | PSDC has the right to use half of the 1,200MW pumped storage capacity of Phase 1 of the Guangzhou Pumped Storage Power Station until 2034 |

CLP Guohua Power Company Limited (CLP Guohua) 2,100/703MW(4) | | 49% | | CLP Guohua holds interests in three coal-fired power stations: · 100% in Beijing Yire Power Station in Beijing ( ) (400MW) ) (400MW) · 65% in Panshan Power Station in Tianjin ( ) (1,000MW) ) (1,000MW) · 55% in Sanhe Power Station in Hebei Province ( ) (700MW) ) (700MW) |

CLP Guohua Shenmu Power Company Limited (Shenmu) 200/98MW | | 49% | | Shenmu Power Station, in Shaanxi Province ( ), which has two 100MW coal-fired units ), which has two 100MW coal-fired units |

Guizhou CLP Power Company Limited (Guizhou CLP Power) 600/420MW | | 70% | | Guizhou CLP Power owns and operates two 300MW coal-fired generating units in Anshun ( ) which supply the Guizhou ( ) which supply the Guizhou ( ) power grid and, indirectly, Guangdong Province ) power grid and, indirectly, Guangdong Province |

Shandong Zhonghua Power Company, Ltd. (SZPC) 3,000/882MW | | 29.4% | | SZPC owns four coal-fired power stations, Shiheng I and II (totalling 1,200MW), Liaocheng (1,200MW) and Heze II (600MW), in Shandong Province |

CLP Guangxi Fangchenggang Power Company Limited (Fangchenggang) 1,200/840MW | | 70% | | Construction of a new power station with two 600MW coal-fired units at Fangchenggang ( ), Guangxi ( ), Guangxi ( ) is in progress. The first unit is scheduled for commissioning by the third quarter of 2007 ) is in progress. The first unit is scheduled for commissioning by the third quarter of 2007 |

Page 12

| | | | |

Investments Gross/Equity MW | | Equity

Interest | | Description |

Huaiji Hydropower Stations (Huaiji) 99/84MW | | 84.9% | | Eight small hydro power stations in Huaiji County ( ), Guangdong Province are in operation, with one under construction, amounting to a total of 99MW ), Guangdong Province are in operation, with one under construction, amounting to a total of 99MW |

HNEEP-CLP Changdao Wind Power Co., Ltd. (Changdao Wind Power) 27/12MW | | 45% | | Changdao wind farm, with a generating capacity of 27MW, is connected to the Shandong provincial grid to serve Yantai City ( ) ) |

HNNE-CLP Weihai Wind Power Company Limited (Weihai Wind Power) 69/31MW | | 45% | | Weihai wind farm is located in Shandong Province and has a capacity of 20MW for Phase I and 49MW for Phase II respectively. Phase I achieved commercial operation on 1 April 2007 and Phase II is scheduled for commissioning by end of 2007. The power will serve local electricity needs |

Huaneng Shantou Wind Power Company Limited (Nanao II Wind Power) 45/11MW | | 25% | | Nanao II wind power project of 45MW is located on Nanao Island off Shantou ( ), Guangdong Province. This wind farm is targeted for commissioning in the last quarter of 2007 and will serve Shantou City ), Guangdong Province. This wind farm is targeted for commissioning in the last quarter of 2007 and will serve Shantou City |

CLP Huanyu (Shandong) Biomass Heat and Power Company Limited (Boxing Biomass) Equivalent of 14/11MW | | 79% | | A biomass combined heat and power project, with 1x75 tons/hour straw-fired boiler + 6MW generator, with 79% held by CLP. It is located in Boxing County ( ), Binzhou City, Shandong Province and is scheduled for commissioning by second quarter 2008 ), Binzhou City, Shandong Province and is scheduled for commissioning by second quarter 2008 |

| | |

| Note (4): | | The 703 equity MW attributed to CLP, through its 49% equity interest in CLP Guohua, takes into account that CLP Guohua holds varying equity interests in the generating assets included in the 2,100 gross MW. |

Page 13

Operational Performance

This section describes CLP’s operational performance in Hong Kong, Australia, the Chinese mainland, India and Southeast Asia and Taiwan over the first six months of 2007 and the outlook for these activities.

Electricity Business in Hong Kong

The Hong Kong economy continued to experience strong and broad-based growth in the first half of 2007. During this period, electricity sales to local customers grew by 1.6% to 13,509 GWh compared to the corresponding period last year.

Due to the warmer weather this year, sales increased to all sectors, except the manufacturing sector. In the commercial sector, sales growth was supported by upbeat consumer sentiment and inbound tourism. For the infrastructure and public services sector, the moderate sales growth was largely attributable to increased consumption in the container terminals, new terminal at the Hong Kong International Airport and telecommunication facilities. Sales to the manufacturing sector continued to decline, due to a drop in sales to the paper, electronic and textile trade industries.

A breakdown of the local sales growth by sector during the period is as follows:

| | | | |

| | | Increase/ (Decrease) | | As Percentage of Total Local Sales |

Residential | | 2.7 % | | 23.3 % |

Commercial | | 2.2 % | | 41.8 % |

Infrastructure & Public Services | | 3.1 % | | 26.2 % |

Manufacturing | | (8.1)% | | 8.7 % |

Sales to the Chinese mainland recorded year-on-year growth of 9.7%, as Guangdong continues to have a supply shortfall, mainly attributable to high consumption growth and delays in the construction of generation facilities and transmission networks.

Total unit sales, including both local sales and sales to the Chinese mainland grew by 2.7% to 15,829 GWh over the same period last year.

As a result of CLP’s efforts in improving productivity and keeping operating costs to a minimum, customers are benefiting through an average net tariff that is the lowest in Hong Kong. During 2006, we announced that tariff would be frozen in 2007. We have respected this commitment. There has now been no increase in tariff since 1998.

To enhance supply quality and reliability, as well as to meet the demand created by new towns and infrastructure development projects in our supply area, CLP incurred HK$1.9 billion of capital expenditure in the transmission and distribution networks during the period. Major projects included Castle Peak Cable Tunnel establishment, addition of Black Point third 400/132kV transformer, redevelopment of Junk Bay Road Substation and installation of 400kV tower line arresters. CLP also invested HK$0.5 billion in generation, customer services and other supporting facilities.

Page 14

CLP has been in active discussions with Government on the post-2008 arrangements for over a year. We have maintained a frank and constructive dialogue with Government based on the views set out in our response to the Government’s second consultation paper, namely that Hong Kong needs a fair, stable and long-term regulatory regime which balances the interests of all stakeholders.

Economic and environmental regulation of the power sector is now consolidated under the new Environment Bureau. We are hopeful that this will facilitate the formulation of coherent policies and regulations for the energy sector, balancing environmental and economic considerations. We remain confident that the outcome of discussions with Government will reflect a shared determination to ensure that Hong Kong continues to enjoy a world-class electricity supply, which is built on the achievements already made under the SoC and will serve the long-term interests of our community.

Following Government’s approval of the Castle Peak ‘B’ emissions reduction project and the issue of an environmental permit by the Environmental Protection Department in 2006, good progress has been made with a number of key milestones achieved in the first half of 2007. This project is one of the strategic environmental initiatives CLP undertakes in support of the 2010 emissions objectives of the HKSAR.

This emissions reduction project comprises a FGD for reducing sulphur dioxide emissions and a Boiler Island/Selective Catalytic Reduction facility for reducing nitrogen oxide emissions. The project has significant permitting/approval requirements with about 100 permits/approvals needed. Some have been obtained and applications for others are underway. Retrofit work is much more challenging than a green-field project as large new facilities have to be fitted into an existing operating plant within a congested site. To support the retrofit work, additional relocation, civil foundation, material handling berth and plant customisation works are required. The project is in the procurement and design phases, together with the mobilisation of labour to enable the commencement on site of the relocation and civil foundation work soon. We also have to ensure reliable electricity supply during the summer months when demand is the highest, limiting the installation to be done on a unit-by-unit basis during the winter months. We are committed to overcoming the technical and operational challenges of this demanding project and to meeting the tight schedule of phased completion starting 2009.

CAPCO received the environmental permit to construct and operate an LNG receiving terminal on South Soko Island in April 2007, following the approval of the over 3,000-page Environmental Impact Assessment (EIA) report by the Director of the Environmental Protection. This marked an important milestone in advancing the LNG receiving terminal project, concluding four years of extensive work including site selection, engineering, environmental assessment, and gas supply discussions. We are proceeding with other crucial aspects of the project including the land acquisition. Negotiations with gas suppliers are making good progress, although rising fuel prices, coupled with growing demand for natural gas worldwide is putting pressure on the availability of gas resources and on gas prices.

CLP aims to offer the most user-friendly services to our two million customers in Hong Kong. Our Customer Interaction Centre and Customer Service Centres (CSCs) remain our most interactive and convenient service channels. Our newly revamped CLP website (www.clpgroup.com) provides round-the-clock online services for customers anywhere and at any time. As well as a selection of services including applications for electricity supply, deposit refund and bill payment, our CLP website also provides online access for customers to receive electricity bills by email and to monitor their accounts’ billing and payment records.

Page 15

In order to reach out to our customers better, and to provide higher quality customer services via the CSCs, the first CSC along the MTR network with longer operating hours was opened in April at the Po Lam MTR Station. For our small and medium-sized enterprise customers, the first Business Centre located in Sham Shui Po started its operation since June. In this new face-to-face contact channel, customers are able to enjoy one-stop-shop services on supply connection and electricity end-use applications.

Our major plans and activities in the second half of 2007 will include:

| · | | completion of the SoC negotiations with Government; |

| · | | progress permit applications, award of the remaining major contracts and the deployment of significant contract labour on the Castle Peak ‘B’ emissions reduction project; and |

| · | | further progress on the LNG project, including land acquisition for locating the LNG receiving terminal and concluding preliminary purchasing agreements for delivery of LNG to the terminal. |

Energy Business in Australia

The asset swap of TIPS and the Hallett Power Station, announced with AGL Energy Limited in January 2007, was successfully completed in July. The process of integrating the 180MW gas-fired Hallett Power Station within the TRUenergy group is largely complete. Combined with our existing generation, the Hallett Power Station, which is a peaking generator, will enable the TRUenergy portfolio to meet the supply needs of our existing customers.

In April 2007, we announced that TRUenergy had entered into an agreement with IBM Australia for the management and transformation of its information technology services and back-office functions. The agreement with IBM is for 10 years and includes the implementation of new retail systems by IBM that will offer customers improved product offerings and provide TRUenergy greater efficiencies and an enhanced ability to compete in the competitive Australian retail market. Transition activities are progressing well. The knowledge transfer process that will ensure IBM is able to undertake the functions is well underway. Transition is scheduled for completion by the end of the year and the new retail platform is scheduled to be implemented in late 2008.

The impact of the extended drought across Australia has seen some hydro and thermal generation capacity taken off-line, resulting in high wholesale prices both in the spot and forward contract markets. Given its natural long generation capacity position, TRUenergy is selling forward contracts as opportunities arise to capitalise on the high wholesale prices. The outlook for wholesale prices remains high in the medium term, due to a tightening of the supply/demand balance and reservoirs requiring year-on-year above average rainfall to return to full operation.

Climate change remains a major issue within Australia. In July 2007, TRUenergy successfully launched its Climate Change Strategy which included commitments to significantly reduce greenhouse emissions through concerted action with customers and governments. Further details about TRUenergy’s Climate Change Strategy are set out on page 21 of this Report.

TRUenergy’s retail business remains successful, preserving current market share in a competitive environment, particularly in Victoria where annualised customer churn has reached 29%. An envisaged mass market retail entry into Queensland to coincide with the commencement of full retail contestability from 1 July 2007 was held back owing to increased wholesale prices. TRUenergy will be continuing with a limited business customer market entry. Customer profitability will be monitored closely, and changes as appropriate will be made to the approach.

Page 16

The development of the 400MW combined-cycle gas-fired power station at Tallawarra in New South Wales is proceeding well. As at 30 June 2007, the overall plant was 62% complete and remains scheduled to start operation in late 2008. An application is pending for development consent to add two further generation units at Tallawarra. Planning consent for the rezoning of the surrounding land is progressing well, with the local Council recently approving the Environmental Study.

In the second half of 2007, TRUenergy will continue to focus on:

| · | | the implementation of the TRUenergy Climate Change Strategy; |

| · | | maintaining existing retail customers in core markets; and |

| · | | maximising the value of assets by improving efficiency and cost savings. |

Chinese Mainland

The 2 x 600MW coal-fired Fangchenggang project in Guangxi has progressed well to a tight construction schedule. The project remains within budget and at a substantially lower cost than an equivalent international project. The first unit is largely complete, ahead of schedule, but the final stages of commissioning may be affected as we wait for the 500kV grid connection to be completed by third parties. The second unit is targeted for completion early next year. This project is a significant step for CLP’s China business, since it is the first time we have taken direct responsibility, as the majority shareholder, for engineering, equipment procurement and construction in this market.

The Fangchenggang station will use imported coal and a long term contract has been signed with an Indonesian supplier. The first delivery has been received and unloaded at the marine terminal constructed as part of the project.

We have not yet been able to obtain approval from National Development and Reform Commission (NDRC) for the 3 x 110MW Jiangbian hydro project in Sichuan Province, but we hope to complete the approval process early in the second half of 2007. In the meantime, preparatory works are underway on site, with construction of road diversions and access tunnels to the main areas of construction. This project will produce renewable energy from the natural hydro resources in the mountainous areas of Sichuan, but is particularly challenging because of the extensive rock tunnelling required and the extremely remote location. We have already experienced serious rock and mud slides during intense rainfall.

The upgrade of the FGD facility at Anshun II Power Station has progressed smoothly. Major construction work including high voltage distribution board installation, the civil works for equipment foundation, electrical and control panels installation, maintenance and refurbishment of equipment and construction of the new scrubber have been completed. We target to commission the project by the fourth quarter of 2007.

The CLP Guohua joint venture has been successful in acquiring an additional 15% equity interest, valued at RMB480 million, in the Panshan Power Station. The sale and purchase agreement for the transaction was signed in June 2007. Following the acquisition, CLP Guohua now owns 65% of the Panshan Power Station. As the next step of the expansion of the CLP Guohua joint venture, we are working closely with the joint venture partner in a transaction which, if successfully implemented, will considerably increase CLP’s equity megawatts in the joint venture, despite some reduction below our current 49% shareholding level.

Page 17

GNPS, in which CLP holds a 25% stake, operated at a high capacity factor during the first half of the year, except for the period during which Unit 2 was shut down for a planned refueling outage. Unit 2 set a new record of 509 days of continuous operation prior to the outage. The station was awarded first places in Industrial Safety, Radiation Protection and Housekeeping in the 2006 Safety Challenge Competition, which included all the nuclear power stations in France, sister plants to GNPS.

In the second half of 2007, the focus of our activities in the Chinese mainland will be to:

| · | | extract greater value from existing assets by pushing for higher tariffs, sourcing alternative coal supplies and reducing operating and maintenance costs; |

| · | | manage the Fangchenggang project on budget and on schedule; |

| · | | secure NDRC approval for the Jiangbian hydro project and make progress in the pursuit of other renewable energy opportunities; |

| · | | work on the expansion of the CLP Guohua joint venture; and |

| · | | promote environmental improvement at power stations. |

India

In India, GPEC has continued to operate at high levels of reliability and availability. There have been no new disputes on billing with the off-taker, Gujarat Urja Vikas Nigam Limited (GUVNL), and payments have been made on time and in full so far this year. However, as mentioned in our 2006 Annual Report, an order was passed by the Gujarat Electricity Regulatory Commission (GERC) in August 2006 raising the possibility that incentives payable to GPEC could be paid on the basis of actual dispatch of electricity, rather than station availability, as provided for in the Power Purchase Agreement (PPA). The matter is still under discussion with both GUVNL and GERC. Petition has been filed by GPEC with the GERC seeking to restore the commercial entitlements of GPEC under the PPA.

Due to early depletion of the Lakshmi field, from which most gas for GPEC is sourced, securing long term gas supply remains a focus for CLP India. To mitigate the shortage of gas supply, CLP India is actively pursuing long term gas supply arrangements with major gas suppliers and has arranged spot purchases of gas, after having obtained the requisite approvals from the off-taker.

Paguthan, where GPEC is located, experienced unprecedented heavy rainfall of approximately 28 inches between the night of 30 June and the early morning of 2 July 2007. The station site at Paguthan and the neighbouring villages were flooded. GPEC was temporarily shut down for four days pursuant to instructions from the State Load Despatch Centre because of a drop in electricity demand during that period, and was restarted on 5 July 2007. We have provided emergency relief to our staff and their families, as well as neighbouring villages.

The outlook of CLP India continues to be strong, focussing on:

| · | | bidding for selected projects in generation (covering coal, gas and hydro), transmission and distribution; |

| · | | securing reliable gas supplies for phase II expansion of GPEC; |

| · | | completion of construction of a 100.8MW GPEC Samana Wind Project on schedule; and |

| · | | building a “Renewables” Portfolio with emphasis on investments in cogeneration plants, biomass based projects, land filled gas projects and wind energy projects. |

Page 18

Southeast Asia and Taiwan

In March, we completed the injection of our 40% interest in the Ho-Ping project into OneEnergy, our exclusive joint venture with Mitsubishi Corporation for Southeast Asia and Taiwan. We are currently discussing with Mitsubishi Corporation on the way forward regarding the potential injection of Mitsubishi Corporation’s 21% in the Ilijan project, following the completion of Mirant Corporation’s sale of its Philippine assets.

Both units of the 1,434MW coal-fired BLCP project in Thailand were completed ahead of schedule and within budget, and are now operating under the terms of the PPA with Electricity Generating Authority of Thailand. Operational performance so far has been excellent, with high levels of reliability and availability. We recognise that this is the early period of operation. Issues may still emerge which require to be resolved before we can be sure of long term stable production.

Unit 1 at Ho-Ping Power Station was restored to full output following the replacement of turbine blades that were damaged in an incident in 2005. The rebuild of the first of the Ho-Ping coal domes has started, using a design that is much stronger than the original model that failed during an intense typhoon. The rebuild of the other two domes will follow.

The major focus of OneEnergy’s regional activities in the second half of 2007 will be on:

| · | | further greenfield expansion efforts in Southeast Asia through OneEnergy, in particular with respect to upcoming solicitations for new generation capacity in Taiwan and Thailand; and |

| · | | evaluation of the potential opportunity to participate in upcoming privatisation bids for Singapore’s generation companies. |

Renewable Energy

We continued to make progress towards the Group target of increasing the capacity of renewable energy in our power generation portfolio to 5% by 2010. The 5% target is over and above our large hydro developments at Jiangbian (Sichuan Province, China) and Nam Theun 2 (Laos), which are also renewable. To date, our renewable energy generation capacity has increased to more than 440MW on equity basis, which is equivalent to approximately 4.4% of our total equity based generation capacity. Our renewables portfolio comprises interests in 14 wind farms, 11 small hydropower stations in the Chinese mainland province of Guangdong, and one biomass plant, of which several are currently under construction. The majority of these are greenfield projects, contributing directly to the expansion of total renewable generating capacity in the region.

The 27MW Changdao wind farm in Shandong, in which CLP has a 45% interest, received the China Electric Power Industry’s Best Quality Engineering Award 2007. A total of 35 power projects received this award in 2007 and only two of which were wind power projects.

The 20MW wind farm (Phase I) at Weihai, Shandong, achieved commercial operation on 1 April 2007. The Phase II project with 49MW at Weihai has finalised its turbine supply contract and started construction of turbine footings in July, aiming at commissioning by end of 2007. The feasibility study for developing Phase III of 50MW at Weihai has also started. Erection and commissioning of turbines is in good progress, with 47 out of 53 turbines installed, at the 45MW wind farm on Nanao Island, Guangdong.

Page 19

In Huaiji, the construction work of the main dam and penstock tunnel on the 16MW Xinwan hydropower project was completed and installation of water turbines has started. We are also pursuing acquisition opportunities for small hydropower stations in Guangdong. In mid July, we completed a transaction for two small hydropower stations of 6.2MW in Huaiji County.

The engineering, procurement and construction contract for the 14MW combined heat and power biomass project in Boxing, in which CLP owns 79%, has been executed. Construction work has started in July, with a view to commissioning in second quarter of 2008. We are also working on the feasibility studies for developing several other biomass projects in Shandong.

In Hong Kong, CLP completed the EIA of the wind turbine pilot demonstration in Hei Ling Chau, and received the environmental permit in early 2007. We continue with the feasibility study of an offshore wind farm in the eastern waters of Hong Kong in collaboration with a U.K. wind farm developer, Wind Prospect. The study is expected to be completed by 2008-9.

Our Roaring 40s joint venture has completed the commissioning of the 75MW wind farm at Woolnorth Studland Bay in Tasmania and the 49MW Datang Shuangliao wind farm in Jilin. Further to the registration of our wind farm at Nanao as a Clean Development Mechanism project (under the Kyoto Protocol) in August 2006, our Shuangliao wind farm also achieved the same status in April 2007. Erection of wind turbines in the 49MW Guohua Rongcheng wind farm in Shandong has been completed and commissioning tests started in July.

As an extension to its existing cooperation, Roaring 40s signed a joint venture agreement with Datang Jilin for the development of the 50MW Datong wind farm in Jilin. Construction work on the access road in Datong project has already started. In addition to the Rongcheng project, Roaring 40s signed an agreement with Guohua Energy in March to jointly develop three 50MW wind farms in Shandong. In India, the construction of the 50MW Khandke wind farm is making good progress. The first batch of 12 wind turbine units of 9.6MW in total of the Khandke wind farm was commissioned in June, with a view to full commissioning of a total of 50MW by the end of 2007.

In July 2007 CLP entered into an agreement with a major wind turbine manufacturer, Enercon (India) Limited to develop a greenfield 100.8MW wind farm at Samana in India’s north-western state of Gujarat. Construction of the new wind project, which will cost more than US$125 million, is planned to commence in November 2007 and is expected to be completed by January 2009. CLP has also executed a Warranty, Operations & Maintenance Agreement with Enercon for offering comprehensive operation and maintenance services upon commissioning of the wind turbines. The wind farm will involve the erection of more than 126 wind turbines, each of 800kW capacity.

Human Resources

On 30 June 2007, the Group employed 5,996 staff (2006: 6,251), of whom 3,850 were employed in the Hong Kong electricity and related business, 2,043 by our businesses in Australia, the Chinese mainland, India and Southeast Asia and Taiwan, as well as 103 by CLP Holdings. Total remuneration for the six months ended 30 June 2007 was HK$1,681 million (2006: HK$1,516 million), including retirement benefit costs which amounted to HK$114 million (2006: HK$123 million).

Page 20

“Caring for People” is one of our core values. We are committed to providing a safe, healthy and fulfilling work environment for our employees. During the first half of 2007, we have launched a number of initiatives to promote work/life balance and a family friendly working environment. These were well received by employees and widely recognised by the Hong Kong community:

| · | | We introduced paternity leave and marriage leave for all Hong Kong based employees with effect from 1 April 2007. Enhancements were also made to maternity leave, compassionate leave and annual leave. |

| · | | The Quality Work Life Programme in Hong Kong was strengthened with a number of new initiatives, including “Stairway to Health Fun Walk”, fitness/health (weight management) challenge and workplace stretching exercise. |

Other key human resources initiatives implemented during the first half of 2007 were:

| · | | The 2007 Group-wide Management Development & Succession Planning process has been initiated in all our businesses. The process is designed to enable senior management to assess succession strength, identify high potential staff, and plan for their development. |

| · | | The graduate engineer regional posting programme introduced in 2006 for Hong Kong based staff was extended to staff from GPEC. |

| · | | To enhance management communication, a CEO briefing was organised for senior managers of all the businesses across the whole Group. With the assistance of video conference technology, over 200 senior managers from Hong Kong, Australia and India simultaneously attended the CEO briefing in May. |

Safety

There were two disabling injuries in our Hong Kong electricity business during the first half of the year. Investigations were completed and measures have been taken to strengthen safety management.

Safety performance improved during the first half of 2007 in our businesses outside Hong Kong.

Investigations have been completed into the fatalities which occurred to contractors’ workers at Fangchenggang and Anshun during the last quarter of 2006 and on which we reported in our 2006 Annual Report. Immediate actions have been taken to improve supervision and the awareness of risks during construction. The fatality at Yallourn is subject to a statutory investigation, which is not yet complete.

Apart from the investigations and consequent actions related to the fatalities in China and Australia, we have started a wide ranging review of safety across the Group portfolio outside Hong Kong. Whereas the underlying means of achieving safety are the same everywhere, and start with a determined and visible management commitment, we must recognise that we face a substantial challenge in some of our working environments, where prevailing norms fall well short of what we aim to achieve. Our objective is to achieve safe workplaces in all locations.

Page 21

We have engaged DuPont, who are recognised internationally as a leader in safety culture, to help with our safety initiatives. The aim is to develop a stronger corporate framework of safety practice across the CLP Group, whilst recognising that it is the management on the ground at our operational and construction sites who must retain the lead role. We believe there is much to be gained by bringing together management and safety professionals from different sites to exchange experience and participate fully in the development of the Group approach to safety. This process has been enhanced.

Environment

CLP continued to make progress in tackling climate change issues and air quality improvement projects.

Climate Change

As noted in the Chairman’s Statement, CLP is working on a revised Group-wide climate change strategy, intended to reinforce our response to this challenging issue.

In March 2007, we published our first Group-wide greenhouse gas inventory in our new on-line Sustainability Report. In June we also submitted our response to the Carbon Disclosure Project 5 (CDP5), an investor-led initiative to identify climate change impacts on publicly traded companies. Our full response will be available on our Group website, and will also be available together with CDP’s analysis on CDP website in September 2007.

At the subsidiary level, TRUenergy launched its Climate Change Strategy in July 2007, a blueprint for a transition towards a low-carbon future. TRUenergy is committed to taking immediate action to address climate change through efficiency improvements in its operations, as well as through increasing the uptake of renewable energy by customers.

Given a supportive policy framework, TRUenergy’s Climate Change Strategy commits it to:

| · | capping carbon intensity with reductions commencing by 2010; |

| · | cutting emissions intensity by one-third of 2007 levels (1.2 tonnes/MWh) by 2020; |

| · | reducing emissions by 35% by 2035 on a 1990 national electricity market baseline (proportional to market share); |

| · | reducing emissions by 60% by 2050 on a 1990 national electricity market baseline (proportional to market share); and |

| · | a commitment not to build any greenfield, traditional technology, coal-fired power stations. |

As TRUenergy continues to grow market share, it will also take responsibility for its increased proportion of emissions reductions across the National Electricity Market. Further details about TRUenergy’s Climate Change Strategy are available on CLP’s website.

Air Quality Improvement Projects

We have made progress in air quality improvement projects in Hong Kong and the Chinese mainland, which will contribute to significant emissions reduction.

In Hong Kong, FGD and NOx reduction facilities are major environmental mitigation projects at our Castle Peak Power Station. These facilities are necessary to meet the 2010 emission targets in Hong Kong and, as explained on page 14, these projects are well on track.

Page 22

Our LNG receiving terminal project in Hong Kong is an important project for us to increase the cleaner gas component of our fuel mix and necessary to meet the 2010 emissions targets. Further details about the progress of the LNG Project are set out on page 14 of this Report.

In the Chinese mainland, we have made progress in completing the construction of the new scrubber for both generating units at Anshun II, commenced installation of FGD which is scheduled to complete in 2007 at Sanhe Power Station, and completed construction of Selective Non Catalytic Reduction (SNCR) facility of Unit 2 in May 2007 at Yire Power Station. Yire is also scheduled to retrofit the low NOx burner and SNCR of Unit 1 in October 2007.

Our commitment to the responsible management of the environmental dimension of our business includes a commitment to report honestly and openly on our performance. CLP’s first online Sustainability Report was published in March 2007. It is also our first report compiled in line with the Global Reporting Initiative (GRI) G3 Guidelines, and received an A+ (highest) rating from GRI. We are pleased that the online report received via the internet more than 3,000 visits per month in April, May and June, and that our readers typically spent 15 to 20 minutes viewing our report. We look forward to additional feedback on the report from our stakeholders.

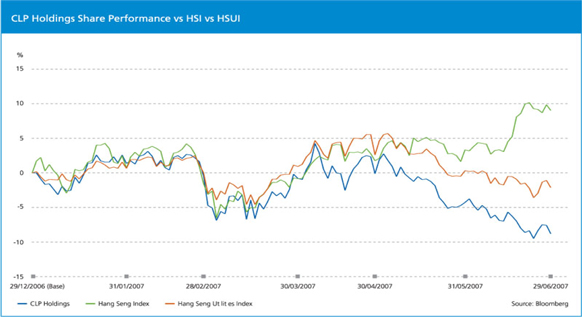

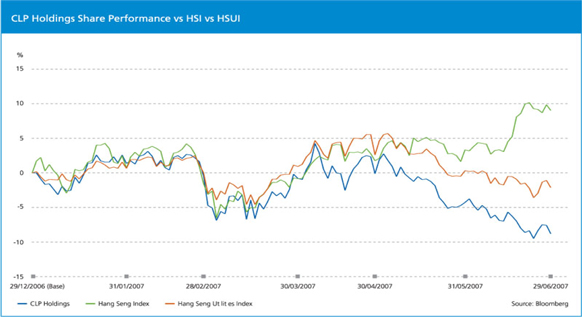

Shareholder Value

During the first half of 2007, CLP’s share price and the Hang Seng Utilities Index (HSUI) declined by 8.78% and 2.11% respectively, while the Hang Seng Index (HSI) rose by 9.06%.

The final dividends for 2006, comprising HK$0.89 per share by way of ordinary dividend and HK$0.02 per share as special dividend, were paid to shareholders on 25 April 2007. The first interim dividend for 2007 of HK$0.52 per share was paid on 15 June 2007 and the second interim dividend of HK$0.52 per share will be paid on 14 September 2007.

Page 23

Financial Performance

Key Financial Events

Our financial information must be viewed in its business context. In order to facilitate a more effective understanding of our financial performance, those key events which necessarily have significant financial impacts on the Group during the period under review are summarised below:

| · | | In March 2007, the Group’s entire 40% interest in Ho-Ping Power Company in Taiwan was injected into OneEnergy, thereby realising a gain of HK$1.0 billion. This transaction also completed the transfer of all our Southeast Asia and Taiwan investments into this strategic joint venture with Mitsubishi Corporation. |

| · | | In January 2007, TRUenergy entered into a power station swap agreement with AGL Energy Limited (AGL) to sell its Torrens Island Power Station (TIPS) in exchange for AGL’s Hallett Power Station plus cash of A$300 million (approximately HK$2.0 billion). The transaction was completed in July 2007. Although the gain on this asset swap will not be recognised until the second half of 2007 (upon completion), a credit of HK$365 million has been reflected in the current period’s results as write-back of the TIPS related deferred tax liabilities prior to the swap. |

Apart from the above events, the following also have a bearing on the understanding of our interim financial analysis:

| · | | Following our acquisition of the Australian Merchant Energy Business in May 2005, this is the first period where a full comparison with the corresponding prior period can be made. |

| · | | Owing to the downward trend of the US dollar (to which the Hong Kong dollar is pegged), the Australian dollar has surged 7.7% against the Hong Kong dollar since 2006 December year end, and 9.8% on average for the first six months as compared with the same period in 2006. These increases have caused an increase in the valuation of the Australian dollar denominated balances at TRUenergy when converted into Hong Kong dollar in the Group financial statements. |

Page 24

Group’s Financial Results

| | | | | | | |

| | | 6 months ended 30 June | | | |

| | 2007 | | 2006 | | Changes | |

| | | HK$M | | HK$M | | HK$M | |

| | | |

Revenue | | 24,672 | | 21,584 | | 3,088 | |

| | | |

Expenses | | 18,786 | | 15,442 | | 3,344 | |

| | | |

Other income | | 1,030 | | 291 | | 739 | |

| | | |

Income tax expense | | 31 | | 575 | | (544 | ) |

| | | |

Earnings attributable to shareholders | | 6,130 | | 4,975 | | 1,155 | |

| | |

| | | Revenue |

| | | Revenue grew 14.3% to HK$24.7 billion (2006: HK$21.6 billion). The main contributor to this increase is TRUenergy. The extended drought in Australia has driven the electricity pool price up significantly – sometimes over 100% increase in average pool prices were observed in some states we operate. This price spike coupled with the surge of the Australian dollar exchange rate have accounted for a HK$2.3 billion increase in revenue. In India, revenue was pushed up by rising fuel costs (as explained below), as part of the tariff is fuel cost linked. As expected, Hong Kong recorded a stable growth in revenue during the past six months. |

| | | | |

| | | Expenses |

| | | For the first six months of 2007, the Group’s expenses increased by HK$3.3 billion. This can be further analysed into: |

| | | · | | HK$2.3 billion increase in “Purchases of electricity, gas and distribution services”. The higher pool price in Australia is a doubled-edged sword. Whilst it drove up the sales revenue of our local retail business, the purchase cost from the national pool was inevitably driven up as well, which was magnified further by the appreciation of the Australian dollar. |

| | | |

| | | · | | HK$0.7 billion increase in “Fuel and other operating costs”. Shortage in long-term gas supplies in India forced more gas to be purchased on spot and resulted in higher fuel costs. Moreover, TRUenergy incurred certain set-up costs of HK$357 million as part of the IT and back-office outsourcing arrangement effected during the period. |

Page 25

| | | | |

| | | Other Income | | |

| | | Other income relates solely to the gain on the injection of Ho-Ping into OneEnergy, as opposed to the gain on the formation of OneEnergy in the first half of 2006. | | |

| | | | |

| | | Income Tax Expense | | |

| | | The significant drop in income tax expense is largely attributed to the write-back of the deferred tax liability of HK$365 million in contemplation of the TIPS asset swap in Australia. | | |

| | | | | |

| | | | | | | | | | | | | | | | |

Earnings Attributable to Shareholders | | |

The contribution of each major activity to the Group earnings is analysed as follows: | | |

| | | | | | |

| | | 6 months ended 30 June | | | | | | | | |

| | | 2007 | | | | 2006 | | | | Changes | | |

| | | HK$M | | HK$M | | | | HK$M | | HK$M | | | | HK$M | | |

| | | | | | | | | |

Electricity business in Hong Kong | | | | 3,756 | | | | | | 3,573 | | | | 183 | | |

Electricity sales to Chinese mainland from Hong Kong | | 61 | | | | | | 55 | | | | | | 6 | | |

Generating facilities in Chinese mainland serving Hong Kong | | 399 | | | | | | 347 | | | | | | 52 | | |

Other power projects in Chinese mainland | | 57 | | | | | | 152 | | | | | | (95) | | |

Energy business in Australia | | 599 | | | | | | 260 | | | | | | 339 | | |

Electricity business in India | | 175 | | | | | | 374 | | | | | | (199) | | |

Power projects in Southeast Asia and Taiwan | | 266 | | | | | | 165 | | | | | | 101 | | |

Other businesses | | 4 | | | | | | 33 | | | | | | (29) | | |

Other income | | 1,030 | | | | | | 291 | | | | | | 739 | | |

Earnings from other activities | | | | 2,591 | | | | | | 1,677 | | | | | | |

Unallocated net finance costs | | | | (54) | | | | | | (122) | | | | 68 | | |

Unallocated Group expenses | | | | (163) | | | | | | (153) | | | | (10) | | |

Earnings attributable to shareholders | | | | 6,130 | | | | | | 4,975 | | | | 1,155 | | |

| | | | | | | | | |

Earnings per share, HK$ | | | | 2.55 | | | | | | 2.07 | | | | 0.48 | | |

|

Note: Certain comparative figures have been reclassified to conform with the current year’s presentation, which reflects a more meaningful allocation of the corporate overheads between different operating regions. Earnings attributable to shareholders for the current six months increased by HK$1.1 billion to HK$6.1 billion, representing an increase of 23.2% over 2006. This includes the one-off gain on the Ho-Ping transfer of HK$1.0 billion. The SoC business in Hong Kong remains our prime earnings contributor and recorded a growth of HK$183 million. The lower units sold as well as the rising coal price eroded the earnings from our Chinese mainland power projects. |

Page 26

| | | | |

| | | | | |

| | | The overall Australian earnings increase is the composite result of the mark-to-market gain of HK$314 million on electricity trading contracts (due to the higher forward price) and the write-back of the TIPS related deferred tax provision of HK$365 million, partly offset by the HK$249 million (post tax) set-up costs in relation to the IT and back-office outsourcing. Earnings from India dropped to HK$175 million (2006: HK$374 million) in the absence of a doubtful debt write-back in the current period, and an additional tax provision was made due to an uplift in the tax rate. Contributions from power projects in Southeast Asia and Taiwan, conducted through our strategic joint venture OneEnergy, grew strongly as new generating units in Thailand were commissioned (BLCP and Kaeng Khoi 2 in late 2006 and May 2007 respectively). The increased earnings were also due to the higher availability in the current period of Ho-Ping power plant, which was under prolonged outage in 2006. | | |

Group’s Financial Position

| | | | | | | | | | | | | | | |

| | | | At 30 June | | | | At 31 December | | | | | | | |

| | | | 2007 | | | | 2006 | | | | Changes | | | |

| | | | HK$M | | | | HK$M | | | | HK$M | | | |

| | | | | | | | |

| | Total assets | | 137,247 | | | | 131,091 | | | | 6,156 | | | |

| | | | | | | |

| | Fixed assets | | 83,262 | | | | 83,418 | | | | (156 | ) | | |

| | | | | | | |

| | Goodwill and other intangible assets | | 7,915 | | | | 7,326 | | | | 589 | | | |

| | | | | | | |

| | Interests in jointly controlled entities | | 17,570 | | | | 19,173 | | | | (1,603 | ) | | |

| | | | | | | | | | | | | | | |

| | Assets held for sale | | 2,593 | | | | - | | | | 2,593 | | | |

| | | | | | | |

| | Liabilities relating to assets held for sale | | 249 | | | | - | | | | 249 | | | |

| | | | | | | |

| | Bank balances, cash and other liquid funds | | 2,340 | | | | 1,613 | | | | 727 | | | |

| | | | | | | |

| | Derivative financial instruments assets (current & non-current) | | 4,094 | | | | 1,556 | | | | 2,538 | | | |

| | | | | | | |

| | Derivative financial instruments liabilities (current & non-current) | | 4,448 | | | | 2,020 | | | | 2,428 | | | |

| | | | | | | | | | | | | | | |

| | | Bank loans and other borrowings (current & non-current) | | 29,934 | | | | 30,278 | | | | (344 | ) | | |

Page 27

| | |

Fixed Assets | | |

Fixed assets are the cornerstone of our strong asset base. In Hong Kong, we continue to invest – to improve and enhance our transmission and distribution network as well as to cater for new needs. In the past six months, additional capital expenditure amounted to about HK$2 billion. In Australia, construction at the new Tallawarra Power Station is in progress and HK$745 million capital costs were added during the period. On the other hand, HK$2.1 billion of fixed assets related to the TIPS asset swap were reclassified to “assets held for sale”. | | |

Capital expenditure commitments stood at HK$9.6 billion at 30 June 2007, mainly related to capital projects in Hong Kong and Australia. | | |

| | |

Goodwill and Other Intangible Assets | | |

As a major portion of the goodwill arose from the acquisition of the MEB in 2005, the appreciation of the Australian dollar has led to the increase during the period. | | |

| | |

Interests in Jointly Controlled Entities | | |

The decrease in the balance is mostly attributed to the injection of the Group’s 40% interest in Ho-Ping, a jointly controlled entity, into OneEnergy. This effectively diluted our interest by half. The balance is further reduced by CAPCO’s repayment of advances to CLP Power Hong Kong. | | |

| | |

Assets Held for Sale and Related Liabilities | | |

Assets of HK$2,593 million (mainly fixed assets) and liabilities of HK$249 million (mainly other non-current liabilities) relating to the TIPS asset swap were reclassified as held for sale in accordance with the accounting standard requirements. | | |

| | |

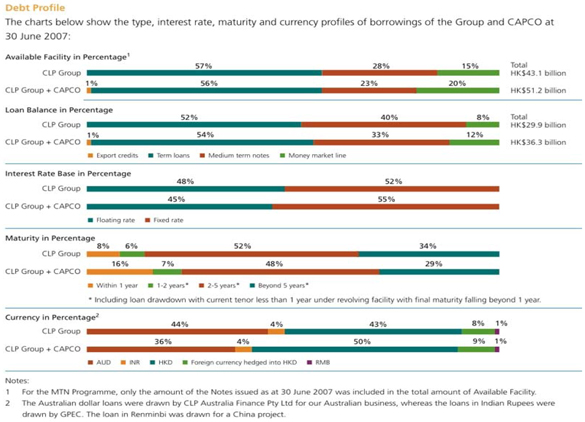

Liquidity and Capital Resources | | |

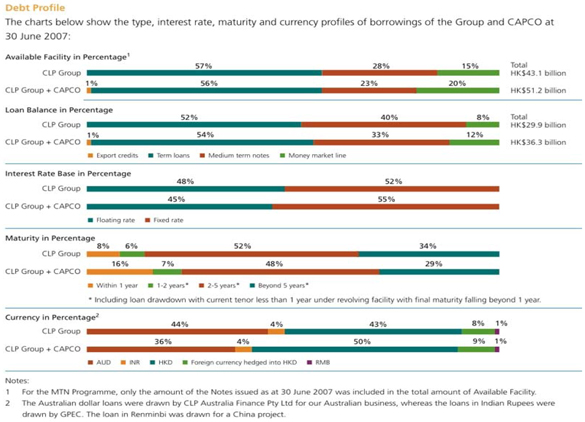

As at 30 June 2007, we had liquid funds of HK$2.3 billion (December 2006: HK$1.6 billion), of which 93% was denominated in foreign currency mainly held by overseas subsidiaries in India and Australia. The remainder was in Hong Kong dollars. We strive to maintain an appropriate mix of committed and uncommitted facilities and solicit our facilities from a pool of financial institutions with strong credit standing. As at 30 June 2007, financing facilities totalling HK$43.1 billion were available to the Group, including HK$17.6 billion for TRUenergy and GPEC. Of the facilities available, HK$29.9 billion had been drawn down, of which HK$14.4 billion relates to TRUenergy and GPEC. Facilities totalling HK$8.1 billion were available to CAPCO, of which HK$6.4 billion had been drawn down. The debts of overseas subsidiaries are without recourse to CLP Holdings. Of these borrowings, HK$731 million as at 30 June 2007 was secured by fixed and floating charges over the assets of GPEC and HK$336 million was secured by right of receipt of tariff, fixed assets and land use rights in Huaiji. | | |

Page 28

|

Our total debt to total capital ratio as at 30 June 2007 was 33.1%. Interest cover for the six months ended 30 June 2007 was 9 times. |

| | | | |

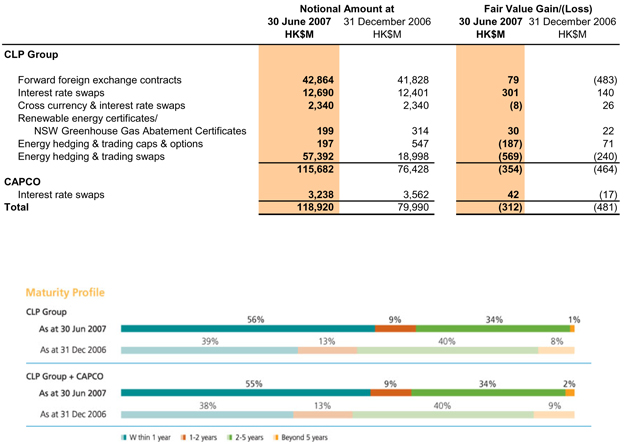

| | | Derivative Financial Instruments | | |

| | | |

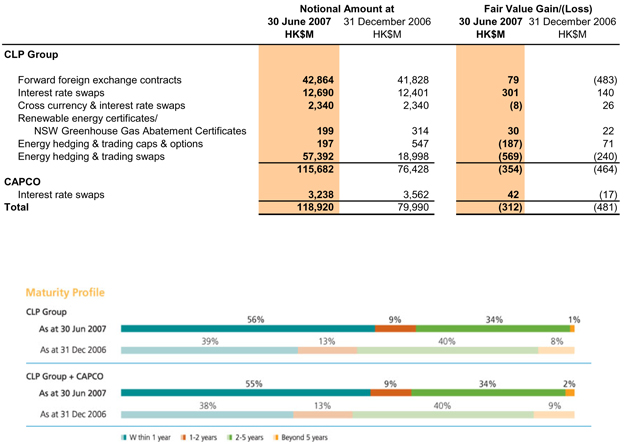

| | | As at 30 June 2007, the Group had gross outstanding derivative financial instruments amounting to HK$115.7 billion. The fair value of these derivative instruments was at a net deficit of HK$354 million, which represents the net amount we would pay if these contracts were closed out on 30 June 2007. However, changes in fair value of derivatives will have no impact on cash flow until settlement. The increase in the balance in gross terms is due to more contracts with larger notional amount, together with the Australian dollar exchange effect (for contracts held by TRUenergy). The breakdown by type and maturity profile of the derivative financial instruments are shown below:

| | |

Page 29

| | | | |

| | | Financing | | |

| | | The Group engaged in new financing activities in the first half of 2007 to support the expansion of our electricity business in Hong Kong. We continue to adopt a prudent approach to all our financing arrangements, while at the same time aiming to achieve cost effective funding. In January 2007, through its wholly-owned subsidiary CLP Power Hong Kong Financing Limited, CLP Power Hong Kong issued HK$1 billion fixed rate notes due in 2017 with coupon rate at 4.38%. This issue was made under the Medium Term Note (MTN) Programme set up by CLP Power Hong Kong Financing Limited in 2002. Under the MTN Programme, notes in an aggregate amount of up to US$1.5 billion may be issued and will be unconditionally and irrevocably guaranteed by CLP Power Hong Kong. As at 30 June 2007, notes with a nominal value of about HK$7.3 billion have been issued under the MTN Programme. In addition, a bank loan of HK$0.5 billion was drawn down at an attractive interest rate margin during the period.

| | |

Page 30

Credit Rating

The credit ratings of major companies within the Group as at 30 June 2007 are summarised below. All ratings remain at investment grade which can facilitate and enhance our position in local and overseas business activities, including fund raising, investment and new business opportunities.

| | | | | | | | | | | | | | |

| | | | | |

| | | CLP Holdings | | CLP Power Hong Kong | | TRUenergy

Holdings | | HKSAR Government |

| | | S&P | | Moody’s | | S&P | | Moody’s | | S&P1 | | S&P | | Moody’s2 |

| | | | | | | | |

Long-term Rating | | | | | | | | | | | | | | |

Foreign currency | | A | | A1 | | A+ | | Aa3 | | BBB+ | | AA | | Aa2 |

Outlook | | Stable | | Stable | | Stable | | Stable | | Stable | | Stable | | Stable |

Local currency | | A | | A1 | | A+ | | Aa3 | | BBB+ | | AA | | Aa2 |

Outlook | | Stable | | Stable | | Stable | | Stable | | Stable | | Stable | | Stable |

| | | | | | | | |

Short-term Rating | | | | | | | | | | | | | | |

Foreign currency | | A-1 | | P-1 | | A-1 | | P-1 | | - | | A-1+ | | P-1 |

Local currency | | A-1 | | - | | A-1 | | - | | - | | A-1+ | | - |

Notes:

1 Rating updated as at 4 July 2007

2 Rating updated as at 26 July 2007

| | | | |

| | | CLP Holdings | | |

| | | In April 2007, Moody’s re-affirmed the A1 credit rating of CLP Holdings. Moody’s explained in its report that the rating reflects the strong and predictable cash flows generated from the Scheme of Control (SoC) operations of CLP Power Hong Kong. Sound financial profiles of CLP Holdings and CLP Power Hong Kong could support a moderate reduction in the permitted rate of return under the SoC framework which CLP Power Hong Kong operates post 2008. However, a more severe reduction to the lower end of the proposed level could exert pressure on the ratings. Moody’s considered the ratings of CLP Power Hong Kong and CLP Holdings to be closely linked, and that a material deterioration in one could mean an increased rating pressure on the other. In July 2007, S&P re-affirmed the A credit rating of CLP Holdings. S&P cited in its report that if the SoC rate of return is significantly lowered, it could negatively affect the rating of the Group. In addition, if any aggressive international investment plan affects the Group’s business and financial strength, or if any investment is of low credit quality, the Group’s rating will also be under pressure. In May 2007, Fitch re-affirmed its self-initiated long-term issuer default rating of A+ to CLP Holdings, but revised the outlook on the ratings from stable to negative to reflect the regulatory uncertainty for CLP’s Hong Kong operations about the SoC Agreement post 2008. | | |

Page 31

| | | | |

| | | CLP Power Hong Kong | | |

| | | |

| | | In April 2007, Moody’s re-affirmed the Aa3 credit rating of CLP Power Hong Kong, which reflects the strong and highly predictable cash flow generated from its SoC operations. CLP Power Hong Kong’s strong access to bank and capital markets also supports its liquidity profile. In July 2007, S&P re-affirmed the A+ credit rating of CLP Power Hong Kong which reflects the strong market position and good financial performance under the current SoC agreement with the HKSAR Government. S&P cited in its report that the greatest threat to the rating over the short term is the expiration of the SoC Agreement at the end of 2008. If the rate of return is significantly lowered, it could negatively affect the rating on CLP Power Hong Kong. Moreover, any downward revision of the rating on CLP Holdings could also have negative consequences for CLP Power Hong Kong. In May 2007, Fitch re-affirmed its self-initiated long-term issuer default rating of A+ to CLP Power Hong Kong but revised the outlook on the ratings from stable to negative to reflect the regulatory uncertainty about the SoC Agreement post 2008. | | |

| | | | |

| | | TRUenergy Holdings | | |

| | | In July 2007, S&P lowered the long-term rating of TRUenergy Holdings, formerly CLP Australia Holdings Pty Ltd, to BBB+ from A-, citing operational underperformance at its main plant, Yallourn, its adverse effect on cash generation, and weakened financial metrics relative to expectations. The outlook is stable. This rating incorporates the positive effect of its 100% ownership by CLP Holdings and the expectation of its continued strong support in the medium term. Fitch has not altered the assigning of its self-initiated long-term issuer default rating of BBB+ with stable outlook. | | |

Risk Management

The Group’s investments and operations have resulted in exposure to foreign currency risks, interest rate risks, credit risks, as well as price risks associated with the sales and purchases of electricity in Australia. We actively manage such risks by using different derivative instruments with an objective to minimise the impact of exchange rate, interest rate and electricity price fluctuations on earnings, reserves and tariff charges to customers and monitor our risk exposures with the assistance of “Value-at-Risk” (VaR) methodology and stress testing technique. Other than certain energy trading activities engaged by our Australian business, all derivative instruments are employed solely for hedging purposes.

Various risk factors faced by the Group and the management of them have been set out in details on pages 63 to 69 of the 2006 Annual Report.

Page 32

Condensed Consolidated Income Statement - Unaudited