QuickLinks -- Click here to rapidly navigate through this documentSCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrantý |

| Filed by a Party other than the Registranto |

Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Pursuant to Rule 14a-12

|

Versicor Inc. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| ý | | No fee required |

| o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

��

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11: (Set forth the amount on which the filing fee is calculated and state how it was determined.)

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

| o | | Fee paid previously with preliminary materials. |

| o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | (1) | | Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

| | Versicor Inc.

34790 Ardentech Court

Fremont, California 94555 |

NOTICE OF ANNUAL MEETING

Dear Stockholder:

On June 14, 2002, Versicor Inc. will hold its 2002 Annual Meeting of Stockholders at the corporate headquarters of Versicor. The meeting will begin at 1:00 p.m.

Only stockholders who owned stock at the close of business on April 15, 2002 can vote at this meeting or any adjournments that may take place. At the meeting, we will:

- 1.

- Elect one Director to the Board of Directors;

- 2.

- Ratify the appointment of PricewaterhouseCoopers LLP as independent accountants for 2002; and

- 3.

- Attend to any other business properly presented at the meeting.

Your Board of Directors recommends that you vote in favor of the two proposals outlined in this proxy statement.

At the meeting, we will also report on our 2001 business results and other matters of interest to stockholders.

The approximate date of mailing for this proxy statement and card(s) is May 10, 2002.

|

|

|

| | | By Order of the Board of Directors, |

|

|

George F. Horner, III

President and Chief Executive Officer

April 26, 2002 |

| QUESTIONS AND ANSWERS | | 2 |

| PROPOSALS YOU MAY VOTE ON | | 5 |

| 1. Election of Directors | | 5 |

| 2. Ratification of the Appointment of PricewaterhouseCoopers LLP as Independent Accountants | | 5 |

| THE BOARD OF DIRECTORS | | 6 |

| Nominee for Director | | 6 |

| Continuing Directors | | 6 |

| Statement on Corporate Governance | | 7 |

| Report of the Audit Committee | | 8 |

| Report of the Compensation Committee | | 9 |

| EXECUTIVE COMPENSATION | | 11 |

| Compensation of Directors | | 11 |

| Compensation of Executives | | 11 |

| Security Ownership of Certain Beneficial Owners and Management | | 11 |

| Summary Compensation Table | | 13 |

| Option Grant Table | | 14 |

| Aggregated Option Exercises and Year-End Option Values | | 15 |

| Related Party Transactions | | 15 |

| Change of Control Agreements | | 16 |

| Compensation Committee Interlocks and Insider Participation | | 16 |

| Performance Graph | | 17 |

| OTHER MATTERS | | 18 |

| Section 16(a) Beneficial Ownership Reporting Compliance | | 18 |

| Exhibits to Annual Report on Form 10-K | | 18 |

1

QUESTIONS AND ANSWERS

| 1. | | Q: | | What may I vote on by proxy? |

| | | A: | | (1) The election of the nominee to serve on the Board of Directors; and |

| | | | | (2) The ratification of the appointment of PricewaterhouseCoopers LLP as independent accountants for 2002. |

2. |

|

Q: |

|

How does the Board recommend I vote on the proposal? |

| | | A: | | The Board recommends a vote FOR the nominee and FOR the ratification of PricewaterhouseCoopers LLP as independent accountants for 2002. |

3. |

|

Q: |

|

Who is entitled to vote? |

| | | A: | | Stockholders as of the close of business on April 15, 2002 (the record date) are entitled to vote at the Annual Meeting. |

4. |

|

Q: |

|

How do I vote? |

| | | A: | | Complete, sign and date each proxy card you receive and return it in the prepaid envelope. You have the right to revoke your proxy at any time before the meeting by:

(1) notifying the Secretary of Versicor in writing;

(2) voting in person; OR

(3) returning a later-dated proxy card. |

5. |

|

Q: |

|

Who will count the votes? |

| | | A: | | Representatives of American Stock Transfer & Trust Company will count the votes and act as the inspector of election. |

6. |

|

Q: |

|

Is my vote confidential? |

| | | A: | | Proxy cards, ballots and voting tabulations that identify individual stockholders are mailed or returned directly to American Stock Transfer & Trust Company and are handled in a manner that protects your voting privacy. Your vote will not be disclosed except:

(1) as needed to permit American Stock Transfer & Trust Company to tabulate and certify the vote;

(2) as required by law; OR

(3) in limited circumstances such as a proxy contest in opposition to the Board. Additionally, all comments written on the proxy card or elsewhere will be forwarded to management, but your identity will be kept confidential unless you ask that your name be disclosed. |

7. |

|

Q: |

|

What shares are included on the proxy card(s)? |

| | | A: | | The shares on your proxy card(s) represent ALL of your shares. If you do not return your proxy card(s), your shares will not be voted. |

8. |

|

Q: |

|

What does it mean if I get more than one proxy card? |

| | | A: | | If your shares are registered differently and are in more than one account, you will receive more than one proxy card. Sign and return all proxy cards to ensure that all your shares are voted. We encourage you to have all accounts registered in the same name and address (whenever possible). You can accomplish this by contacting our transfer agent, American Stock Transfer & Trust Company. |

9. |

|

Q: |

|

How many shares can vote? |

| | | A: | | As of April 15, 2002 (the record date), 26,291,654 shares of common stock, our only voting securities, were issued and outstanding. Every stockholder of common stock is entitled to one vote for each share held. |

2

10. |

|

Q: |

|

What is a "quorum"? |

| | | A: | | Stockholders holding a majority of the outstanding shares entitled to vote on a matter constitute a "quorum." The stockholders may be present or represented by proxy. For the purposes of determining a quorum, shares held by brokers or nominees will be treated as present even if the broker or nominee does not have discretionary power to vote on a particular matter or if instructions were never received from the beneficial owner. These shares are called "broker non-votes." Abstentions will be counted as present for quorum purposes and for the purpose of determining the outcome of any matter submitted to the stockholders for a vote. However, abstentions do not constitute a vote "for" or "against" any matter and will be disregarded in the calculation of a plurality. |

11. |

|

Q: |

|

What is required to approve each proposal? |

| | | A: | | A quorum must have been established in order to consider any matter. To elect a director, the candidate who receives the most votes will become a director of Versicor. To ratify the appointment of accountants, a majority of the shares represented at the meeting, either in person or by proxy, must be voted in favor of the accountants. |

|

|

|

|

Any shares that are considered broker non-votes with respect to a particular matter will be treated as not present and not entitled to vote with respect to that matter, even though the same shares may be considered present for quorum purposes and may be entitled to vote on other matters. |

12. |

|

Q: |

|

How will voting on any other business be conducted? |

| | | A: | | Although we do not know of any business to be considered at the 2002 Annual Meeting other than the proposals described in this proxy statement, if any other business is presented at the Annual Meeting, your signed proxy card will give authority to each of George F. Horner, III, our President, Chief Executive Officer and Chairman, and Dov A. Goldstein, M.D., our Vice President, Finance and Chief Financial Officer, to vote on such matters on your behalf at their discretion. |

13. |

|

Q: |

|

When are the stockholder proposals for the 2002 Annual Meeting due? |

| | | A: | | All stockholder proposals to be considered for inclusion in next year's proxy statement must be submitted in writing to Dov A. Goldstein, M.D., Vice President, Finance and Chief Financial Officer, Versicor Inc., 34790 Ardentech Court, Fremont, California 94555 by December 26, 2002. Any proposal received after this date will be considered untimely. Each proposal must comply with applicable law and our Bylaws. A stockholder proposal (other than in respect of a nominee for election to the Board of Directors) to be presented at the next annual meeting of stockholders but not submitted for inclusion in the proxy statement will be considered untimely under the SEC's proxy rules if received before March 16, 2003 or after April 15, 2003. |

14. |

|

Q: |

|

Can a stockholder nominate someone to be a director of Versicor? |

| | | A: | | Yes. Nominations for the Board of Directors may be made at an annual meeting or a special meeting called for the election of directors by any stockholder entitled to vote for the election of directors at the meeting who complies with the nomination provisions of our Bylaws. In order for a nomination to be considered for inclusion in next year's proxy statement, it must be submitted in writing to Dov A. Goldstein, M.D., Vice President, Finance and Chief Financial Officer, Versicor Inc., 34790 Ardentech Court, Fremont, California 94555 by December 26, 2002. In order for a nomination not submitted for inclusion in next year's proxy statement to be considered timely, notice of the nomination must be provided to us no earlier than March 16, 2003 and no later than April 15, 2003. |

3

15. |

|

Q: |

|

How much did this proxy solicitation cost? |

| | | A: | | We hired American Stock Transfer & Trust Company to assist in the distribution of proxy materials and solicitation of votes for part of the normal monthly fee of approximately $1,200 plus estimated out-of-pocket expenses of approximately $2,500. We also reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to stockholders. |

4

PROPOSALS YOU MAY VOTE ON

| 1. | | Election of Director |

|

|

We currently have seven directors on our Board. The directors are divided into three classes with two directors in each of Classes I and II and three directors in Class III.(1) The terms of the two directors in Class II expire this year. These directors are James H. Cavanaugh, Ph.D. and Richard J. White, Ph.D. Dr. Cavanaugh has been nominated by the Board to stand for re-election. The newly-elected director will serve a three-year term. |

|

|

Detailed information on Dr. Cavanaugh, along with information on the other continuing directors, is provided at pages 6 and 7. We do not expect that the nominee will become unavailable to stand for election, but should this happen, the Board will designate a substitute. Proxies voting for the original nominee will be cast for the substitute. |

|

|

YOUR BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR JAMES H. CAVANAUGH, PH.D. |

2. |

|

Ratification of the Appointment of PricewaterhouseCoopers LLP as Independent Accountants |

|

|

The Audit Committee of the Board of Directors has recommended, and the Board has approved, the appointment of PricewaterhouseCoopers LLP as our independent accountants for 2002. PricewaterhouseCoopers has served as our independent accountants since 1996. They have unrestricted access to the Audit Committee to discuss audit findings and other financial matters. Representatives of PricewaterhouseCoopers will attend the Annual Meeting to answer appropriate questions. They may also make a statement if they so desire. |

|

|

Audit services provided by PricewaterhouseCoopers during 2001 included an audit of our financial statements and consultation on various tax and accounting matters. For more information, see the Report of the Audit Committee beginning on page 8. |

|

|

YOUR BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR THE RATIFICATION OF PRICEWATERHOUSECOOPERS' APPOINTMENT AS OUR INDEPENDENT ACCOUNTANTS FOR 2002. |

- (1)

- Prior to Lori F. Rafield, Ph.D.'s resignation from our Board on April 3, 2002, we had three Class II Directors.

5

THE BOARD OF DIRECTORS

Nominee for Director

The following table sets forth certain information regarding the nominee for election to the Board of Directors for a three-year term.

Name

| | Age

| | Principal Occupation/

Position Held with Versicor

| | Director Since

|

|---|

| James H. Cavanaugh, Ph.D. | | 65 | | General Partner of Healthcare Ventures | | 1999 |

James H. Cavanaugh, Ph.D. Dr. Cavanaugh has served as a member of our Board of Directors since 1999 and currently serves on our Audit Committee. Since 1989, he has served as President and General Partner of Healthcare Ventures based in Princeton, New Jersey. Prior to joining Healthcare Ventures, Dr. Cavanaugh was President of SmithKline and French Laboratories-U.S., the domestic pharmaceutical division of SmithKline Beecham Corporation, as well as President of Allergan International. Dr. Cavanaugh served as Staff Assistant to President Nixon for Health Affairs and then as Deputy Director, Domestic Council. Under President Ford, he was Deputy Assistant to the President for Domestic Affairs and then, Deputy Chief of the White House Staff. Dr. Cavanaugh currently serves on the Board of Trustees of the National Committee for Quality Health Care, the National Center for Genome Resources and a Trustee Emeritus of the California College of Medicine. He is a member of the board of directors of Diversa Corporation, MedImmune, Inc. and 3-Dimensional Pharmaceuticals, Inc., and is non-executive Chairman of Shire Pharmaceuticals Group PLC. He is a past Director of the Pharmaceutical Research and Manufacturers Association.

Continuing Directors

The following table sets forth certain information about the directors whose terms do not expire this year.

Name

| | Age

| | Principal Occupation/

Position Held with Versicor

| | Director Since

|

|---|

| David V. Milligan, Ph.D. | | 61 | | Chairman of the Board | | 1997 |

George F. Horner, III |

|

57 |

|

President and Chief Executive Officer |

|

1996 |

Christopher T. Walsh, Ph.D. |

|

58 |

|

Professor, Harvard Medical School |

|

1998 |

Mark Leschly |

|

33 |

|

Managing Director of Rho Management Company, Inc. |

|

1997 |

Timothy J. Barberich |

|

54 |

|

Chairman and Chief Executive Officer of Sepracor Inc. |

|

1995 |

David V. Milligan, Ph.D. Dr. Milligan has served as Chairman of our Board of Directors and has been a member of our scientific advisory board since 1997. From 1979 to 1996, he served in several executive positions at Abbott Laboratories, most recently as Senior Vice President and Chief Scientific Officer from 1994 to 1996. Dr. Milligan is chairman of the board of directors of Caliper Technologies Inc. and serves as a member of the board of directors of ICOS Corporation, Collabra Pharma, Diametrics Medical, Maxia Pharmaceuticals and Reliant Pharmaceuticals. He also serves on the University of California, Berkeley and Princeton University Chemistry Department Advisory Boards. In addition, Dr. Milligan is a Vice President with Bay City Capital, a San Francisco-based venture bank.

George F. Horner, III. Mr. Horner has served as President and Chief Executive Officer and a member of our Board of Directors since 1996. Prior to joining us, Mr. Horner was Corporate Vice

6

President of Ligand Pharmaceuticals from 1993 to 1995. He also served in a number of executive positions during his 17 years at Abbott Laboratories from 1976 to 1993, including President, Canada; Regional Director, Latin America; General Manager, Mexico; General Manager, Southern Africa Region; and Regional Manager, Southeast Asia. From 1967 to 1976, Mr. Horner served in a number of sales and product management positions at E.R. Squibb, Inc.

Christopher T. Walsh, Ph.D. Dr. Walsh has served as a member of our Board of Directors since 1998 and currently serves on our Audit Committee. Since 1991, he has served as the Hamilton Kuhn Professor of Biological Chemistry and Molecular Pharmacology at the Harvard Medical School. He was the President of the Dana-Farber Cancer Institute from 1992 to 1995. From 1987 to 1995, he served as the Chairman of the Department of Biological Chemistry and Molecular Pharmacology at the Harvard Medical School. Dr. Walsh is a member of the scientific advisory boards for Caliper Technologies Inc., Dyax, Epix Medical, KOSAN Biosciences and Millennium Pharmaceuticals. He is a member of the board of directors of Transform Pharmaceuticals and KOSAN Biosciences. He has also held various positions at Massachusetts Institute of Technology, including the Chairman, Chemistry Department and has served on the editorial boards of various scientific publications.

Mark Leschly. Mr. Leschly has served as a member of our Board of Directors since 1997 and he currently serves on our Compensation Committee. Since 1999 he has served as a managing director of Rho Management Company, Inc., a New York based international investment management firm. From 1994 to 1999, Mr. Leschly was a general partner at Healthcare Ventures. Prior to joining Healthcare Ventures, he worked at McKinsey & Company. He is a member of the board of directors of a number of private companies, including Confer, Delsys, Diversa, Medical Present Value, Memory Pharmaceuticals, more.com, NitroMed and Personal Health Technology. He is also a member of the advisory board of the Harvard AIDS Institute.

Timothy J. Barberich. Mr. Barberich has served as a member of our Board of Directors since May 1995 and currently serves on our Compensation Committee. Since 1984, he has served as the Chief Executive Officer and Chairman of the Board of Directors of Sepracor Inc. From 1984 to 1999, Mr. Barberich also served as President of Sepracor. Prior to founding Sepracor in 1984, Mr. Barberich spent 10 years at Millipore Corporation where he held a variety of marketing, sales and general management positions. Mr. Barberich is also a director of two publicly traded Sepracor spin-off companies, HemaSure Inc. and BioSphere Medical Inc.

Statement on Corporate Governance

The Board held six meetings during 2001, and all of the directors except Timothy J. Barberich attended at least 75% of the total number of Board meetings and committee meetings of which they were members.

The Board has established two standing committees to more fully address certain areas of importance to us. The two committees of the Board are (i) the Audit Committee, and (ii) the Compensation Committee. The Board does not have a nominating committee at this time.

Prior to Lori F. Rafield Ph.D.'s resignation from the Board of Directors on April 3, 2002, each of the Audit and Compensation Committees was composed of three outside directors. The committees are currently composed of:

Name

| | Audit

| | Compensation

|

|---|

| Timothy J. Barberich | | | | X |

| Mark Leschly | | | | X |

| James H. Cavanaugh, Ph.D. | | X | | |

| Christopher T. Walsh, Ph.D. | | X | | |

7

Audit Committee: The Audit Committee examines accounting processes and reporting systems, assesses the adequacy of internal controls and risk management, reviews and approves our financial disclosures, and communicates with our independent accountants. The Audit Committee met five times during 2001.

Report of the Audit Committee

The Audit Committee of the Board has furnished the following report on our internal accounting controls and its independent accountants. This report will not be deemed to be incorporated by reference by any general statement incorporating this proxy statement into any of our filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent we specifically incorporate this information by reference therein and will not be deemed soliciting material or deemed filed under those Acts.

The members of the Audit Committee have been appointed by the Board of Directors. The Audit Committee is governed by a charter which was adopted at the December 9, 1997 meeting of the Board of Directors. The Audit Committee is comprised of two directors who meet the independence and experience requirements of the Nasdaq National Market.(1)

- (1)

- Prior to Lori F. Rafield, Ph.D.'s resignation from the Board on April 3, 2002, the Audit Committee was comprised of three directors who met the independence and experience requirements of the Nasdaq National Market. In accordance with the procedures set forth in our Charter, the Board intends to appoint another director to the Audit Committee who meets such requirements in the near future.

Duties of the Audit Committee include: (i) overseeing our internal accounting and operational controls as well as its financial and regulatory reporting; (ii) selecting our independent accountants and assessing their performance on an ongoing basis; (iii) reviewing our financial statements and audit findings, and taking any action considered appropriate by the Audit Committee and the Board of Directors; (iv) performing other oversight functions as requested by the Board of Directors; and (v) reporting activities performed to the Board of Directors.

Management is responsible for our internal controls. Our independent accountants are responsible for performing an independent audit of our financial statements in accordance with generally accepted auditing standards and for issuing a report thereon. The Audit Committee has general oversight responsibility with respect to our financial reporting, and reviews the results and scope of the audit and other services provided by our independent accountants.

In this context, the Audit Committee has reviewed our audited financial statements and discussed such statements with management and our independent accountants. Management represented to the Audit Committee that our financial statements were prepared in accordance with U.S. generally accepted accounting principles, and the Audit Committee has reviewed and discussed the financial statements with management and our independent accountants. The Audit Committee discussed with the independent accountants matters required to be discussed by Statement on Auditing Standards No. 61, as amended (Communication with Audit Committees). The Audit Committee has considered whether the provision of services other than audit services is compatible with maintaining PricewaterhouseCoopers LLP's independence.

Our independent accountants also provided to the Audit Committee the written disclosures required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees), and the Audit Committee discussed with the independent accountants their independence.

8

Based on the review and discussions noted above, the Audit Committee recommended to the Board that our audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2001, and be filed with the U.S. Securities and Exchange Commission.

Fees related to services performed by PricewaterhouseCoopers LLP in 2001 are as follows:

| Audit and Review Fees(1) | | $ | 100,000 |

| Financial Information Systems Design and Implementation Fees | | | 0 |

| All Other Fees(2) | | | 40,500 |

| | |

|

| Total | | $ | 140,500 |

| | |

|

- (1)

- Includes fees for the audit of our annual financial statements for fiscal 2001 and the reviews of the financial statements included in our quarterly reports on Form 10-Q, of which an aggregate amount of $45,000 had been billed through December 31, 2001.

- (2)

- Includes consultation on various tax, accounting and other matters.

Submitted by the Audit Committee of the Board of Directors:

Compensation Committee: The Compensation Committee reviews the compensation paid to executive officers and makes recommendations regarding changes in salary and yearly bonuses awarded to employees. This committee also administers the 1995 Stock Option Plan, the 1997 Equity Incentive Plan, the 2000 Employee Stock Purchase Plan and the 2001 Stock Option Plan, including determining the stock option grants for employees, consultants, directors and other individuals. The Compensation Committee met twice in 2001.

Report of the Compensation Committee

The Compensation Committee of the Board has furnished the following report on employee compensation. This report will not be deemed to be incorporated by reference by any general statement incorporating this proxy statement into any of our filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent we specifically incorporate this information by reference therein and will not be deemed soliciting material or deemed filed under those Acts.

The Compensation Committee of the Board is composed entirely of independent outside directors. The Compensation Committee is responsible for our general compensation policies and administers our various compensation plans, including our stock option plans and annual salary and bonus plans.

Each year, the Compensation Committee reviews the compensation of our Chief Executive Officer and the other senior executive officers to assure that compensation is appropriately tied to performance and that salary and potential bonus compensation levels are appropriate. To focus and facilitate such review, the Compensation Committee developed the following compensation philosophy for us:

- •

- executive compensation should be at or above the 50th percentile of pharmaceutical industry market levels to allow us to attract and retain talented management;

- •

- annual variable compensation should reward the executives for achieving specific results which should lead to increased stockholder value;

- •

- the majority of variable compensation should be directly related to sustained increases in stockholder value;

9

- •

- supplemental benefits and perquisites that reward executives without regard to performance should be minimal; and

- •

- all of our employees should be encouraged to think like stockholders.

The compensation of our Chief Executive Officer and of our other senior executive officers is comprised of three primary components: salary, bonus and stock options.

Salary is fixed at a competitive level to attract and retain qualified candidates.Bonuses are tied specifically to our performance and/or individual contributions.Stock options are awarded in amounts we believe necessary to provide incentives for future performance, taking into account individual performance and length of service with us. This mix of compensation elements places a significant portion of compensation at risk and emphasizes performance.

Compensation of George F. Horner, III, President and Chief Executive Officer

Mr. Horner's salary and bonus for fiscal 2001 are consistent with the criteria described above and with the Compensation Committee's evaluation of his overall leadership and management of Versicor. Under Mr. Horner's strategic direction, we made significant progress in 2001. For our lead antifungal product candidate, anidulafungin, we initiated one Phase II clinical trial and two Phase III clinical trials during the year. For our lead antibiotic product candidate, dalbavancin, we completed Phase I clinical trials and initiated a Phase II clinical trial. Our research and development collaborations have also demonstrated continued success. Pharmacia Corporation initiated a Phase I clinical trial with a new product discovered as part of the collaboration between Pharmacia and us. We also achieved a further milestone from the Novartis collaboration to discover and develop new antibacterial agents. Mr. Horner's compensation for 2001 is set forth in the Summary Compensation Table beginning on page 13.

The Compensation Committee believes that our compensation policy as practiced to date by the Compensation Committee and the Board has been successful in attracting and retaining qualified employees and in tying compensation directly to corporate performance relative to corporate goals. Our compensation policy will evolve over time as we attempt to achieve the many short-term goals it faces while maintaining its focus on building long-term stockholder value through technological leadership and development and expansion of the market for our products.

No member of the Compensation Committee is a former or current officer or employee of ours, or is employed by a company whose board of directors includes a member of our management.

10

EXECUTIVE COMPENSATION

Compensation of Directors

Directors who are also our employees or officers do not receive any additional compensation for their service on the Board. We reimburse our non-employee directors for expenses incurred in connection with attending board and committee meetings, but we do not compensate them for their services as board or committee members. In the past, non-employee directors have been granted non-employee director options to purchase our common stock pursuant to the terms of our 1997 Equity Incentive Plan, and the Board continues to have discretion to grant options to new non-employee directors under either the 1997 Equity Incentive Plan or, following its adoption by our stockholders in September 2001, our 2001 Stock Option Plan. We anticipate that we will grant options from time to time under the 1997 Equity Incentive Plan and the 2001 Stock Option Plan to non-employee directors.

Compensation of Executives

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth as of April 15, 2002 the names, addresses, and holdings of those persons known to us to be beneficial owners of more than 5% of our common stock, the names and holdings of each director and each executive officer named in the Summary Compensation Table and the holdings of all executive officers and directors as a group.

Name and Address of Beneficial Owner

| | Number of Shares

Beneficially Owned and

Nature of Beneficial

Ownership(1)

| | Percent

Beneficially Owned(2)

|

|---|

Sepracor Inc.(3)

111 Locke Drive

Marlborough, MA 01752 | | 1,885,393 | | 7.2% |

Healthcare Ventures V, L.P.(4)

44 Nassau Street

Princeton, NJ 08542 |

|

1,588,737 |

|

6.0% |

Apax Europe IV GP Co. Limited

PO Box 431

13-15 Victoria Road

St. Peter Port, Guernsey

Channel Islands GYI 32D |

|

1,501,002 |

|

5.7% |

Apax Partners, Inc.

2100 Geng Road

Palo Alto, CA 94303 |

|

1,500,961 |

|

5.7% |

Deerfield Management Company(5)

780 Third Avenue

New York, NY 10017 |

|

1,312,500 |

|

5.0% |

George F. Horner, III(6) |

|

584,517 |

|

2.2% |

Timothy J. Henkel, M.D., Ph.D.(7) |

|

151,691 |

|

* |

Richard J. White, Ph.D(8) |

|

302,088 |

|

1.1% |

Dov A. Goldstein, M.D.(9) |

|

105,849 |

|

* |

11

Dinesh V. Patel, Ph.D(10) |

|

99,497 |

|

* |

David V. Milligan, Ph.D(11) |

|

123,437 |

|

* |

Timothy J. Barberich(12) |

|

1,902,269 |

|

7.2% |

James H. Cavanaugh, Ph.D(13) |

|

1,598,916 |

|

6.1% |

Mark Leschly |

|

2,653 |

|

* |

Christopher T. Walsh, Ph.D(14) |

|

110,644 |

|

* |

All directors and executive officers as a group (10 persons)(16) |

|

4,981,561 |

|

18.9% |

- *

- Holdings represent less than 1% of all shares outstanding.

- (1)

- Except as provided with respect to certain shares held in trust with the person's spouse and as otherwise provided under state community property laws, we believe that each of the stockholders named in this table has sole voting and investment power over the shares of common stock indicated.

- (2)

- Applicable percentages are based on 26,291,654 shares outstanding on April 15, 2002. All expressions of percentage assume that warrants and options exercisable within 60 days after April 15, 2002, if any, of the particular person or group in question, and no others, have been exercised. Except as otherwise noted, the address of each person listed is c/o Versicor Inc., 34790 Ardentech Court, Fremont, California 94555.

- (3)

- Includes 76,250 shares issuable upon exercise of warrants that expire on December 9, 2002. Timothy J. Barberich is chief executive officer and chairman of the board of directors of Sepracor Inc. Mr. Barberich disclaims beneficial ownership of these shares, except to the extent of his pecuniary interest in these shares.

- (4)

- Includes 145,868 shares issuable on the exercise of warrants. The warrant for 73,125 shares expires on December 9, 2002. The warrant for 72,743 shares expires on August 8, 2005. Healthcare Ventures LLC is general partner of Healthcare Ventures V, L.P. and James H. Cavanaugh, Ph.D. is president and a general partner of Healthcare Ventures LLC. Dr. Cavanaugh disclaims beneficial ownership of these shares, except to the extent of his pecuniary interest in these shares.

- (5)

- Includes 732,746 shares owned by Deerfield Partners, L.P., for whom Deerfield Management Company acts as the investment advisor, and 579,754 shares owned by Deerfield International Limited, for whom Deerfield Management Company also acts as the investment advisor.

- (6)

- Includes 567,017 shares underlying options that are exercisable within 60 days of April 15, 2002.

- (7)

- Includes 149,999 shares underlying options that are exercisable within 60 days of April 15, 2002.

- (8)

- Includes 6,252 shares owned by Dr. White's children and 182,599 shares underlying options that are exercisable within 60 days of April 15, 2002.

- (9)

- Includes 105,849 shares underlying options that are exercisable within 60 days of April 15, 2002.

- (10)

- Includes 68,031 shares underlying options that are exercisable within 60 days of April 15, 2002.

- (11)

- Includes 100,937 shares underlying options that are exercisable within 60 days of April 15, 2002.

12

- (12)

- Includes 10,688 shares underlying options that are exercisable within 60 days of April 15, 2002. Also includes 1,809,143 shares owned by Sepracor Inc. and 76,250 shares issuable upon the exercise of warrants by Sepracor Inc. The warrants expire on December 9, 2002. Mr. Barberich is chief executive officer and chairman of the board of directors of Sepracor Inc. As such, he may be deemed to have voting and dispositive power over the shares held by Sepracor Inc. However, Mr. Barberich disclaims beneficial ownership of these shares except to the extent of his pecuniary interest therein.

- (13)

- Includes 1,442,869 shares owned by HealthCare Ventures V, L.P. and 145,868 shares issuable upon the exercise of warrants by HealthCare Ventures V, L.P. The warrant for 73,125 shares expires on December 9, 2002. The warrant for 72,743 shares expires on August 8, 2005. Dr. Cavanaugh is president and a general partner of HealthCare Ventures, LLC. As such, he may be deemed to have voting and dispositive power over the shares held by HealthCare Ventures V, L.P. However, Dr. Cavanaugh disclaims beneficial ownership of these shares except to the extent of his pecuniary interest therein.

- (14)

- Includes 110,644 shares underlying options that are exercisable within 60 days of April 15, 2002.

- (15)

- Includes 1,296,285 shares issuable upon exercise of options granted to our directors and executive officers that are exercisable within 60 days of April 15, 2002.

Summary Compensation Table

The following table shows for the fiscal years ended December 31, 2001, 2000 and 1999, compensation awarded or paid to, or earned by, our Chief Executive Officer and our other four most highly compensated executive officers (the "named executive officers") at December 31, 2001.

Summary Compensation Table

| |

| | Annual Compensation

| | Long-Term

Compensation Awards

| |

| |

|---|

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | Other Annual

Compensation

($)(1)

| | Securities

Underlying Options

(#)(2)

| | All Other

Compensation($)

| |

|---|

George F. Horner, III,

President and Chief Executive Officer | | 2001

2000

1999 | | 271,249

271,300

249,615 | | 52,000

75,000

71,625 | | —

—

— | | —

—

457,956 | | —

—

— | |

Timothy J. Henkel, M.D., Ph.D.,

Executive Vice President

and Chief Medical Officer |

|

2001

2000

1999 |

|

263,230

—

— |

(3)

|

—

—

— |

|

—

—

— |

|

—

400,000

— |

|

154,597

—

— |

(4)

|

Richard J. White, Ph.D.,

Executive Vice President,

and Chief Scientific Officer |

|

2001

2000

1999 |

|

255,754

250,866

231,935 |

|

36,445

40,000

38,200 |

|

—

—

— |

|

—

—

125,000 |

|

40,000

146,667

2,355 |

(5)

(5)

|

Dov A. Goldstein, M.D.,

Vice President,

Finance and Chief

Financial Officer |

|

2001

2000

1999 |

|

208,039

96,323

— |

(6)

|

11,130

15,000

— |

|

—

—

— |

|

—

212,500

— |

|

—

—

— |

|

13

Dinesh V. Patel, Ph.D.,

Vice President,

Drug Discovery(7) |

|

2001

2000

1999 |

|

210,102

202,207

192,406 |

|

32,375

32,810

19,280 |

|

—

—

— |

|

—

—

52,173 |

|

—

—

6,078 |

|

- (1)

- The amounts included in this column for each of the named executive officers do not include the value of certain perquisites which in the aggregate did not exceed the lower of $50,000 or 10% of each named executive officer's aggregate fiscal 1999, 2000 or 2001 salary and bonus compensation.

- (2)

- Unless otherwise noted, represents shares of stock underlying options granted under (i) the Versicor Inc. 1997 Equity Incentive Plan Stock (the "1997 Plan"), as amended, or (ii) the Versicor Inc. 1995 Stock Option Plan (the "1995 Plan"). There were no individual grants of stock options in tandem with stock appreciation rights ("SAR's") or freestanding SAR's made during the years ended December 31, 1999, 2000 or 2001 to the named executive officers.

- (3)

- Based on annual salary of $295,000. Dr. Henkel was hired on February 1, 2001.

- (4)

- Dr. Henkel received a signing bonus of $154,959 on February 1, 2001.

- (5)

- Dr. White issued to us a non-interest bearing promissory note dated May 15, 1997. The promissory note was in the original principal amount of $200,000 and was due on May 15, 2002. We forgave the unpaid principal balance of the promissory note of $146,667 in 2000 and $40,000 in 2001.

- (6)

- Based on annual salary of $205,000. Dr. Goldstein was hired on July 6, 2000.

- (7)

- Dr. Patel issued to us a promissory note dated April 24, 1996. The promissory note was in the original principal amount of $100,000 and was secured by a deed of trust on Dr. Patel's residence. The promissory note was paid in full in July 2001.

Option Grant Table

The following table sets forth the stock options granted to each of the executive officers named in the above Summary Compensation Table in fiscal year 2001 (and reflects the fact that none of the named executive officers received any stock option grants in fiscal year 2001):

2001 Option Grant Table

| |

| | Percent of

Total

Options

Granted

to Employees

in

Fiscal Year

2000

| |

| |

| | Potential Realizable

Value At Assumed

Annual Rates of Stock

Appreciation for

Option Term

|

|---|

| | Number of

Securities

Underlying

Options

Granted (#)

| |

| |

|

|---|

Name

| | Exercise

Price ($/sh)

| | Expiration

Date

|

|---|

| | 5%

| | 10%

|

|---|

| George F. Horner, III | | — | | — | | — | | — | | — | | — |

Timothy J. Henkel, M.D., Ph.D. |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

Richard J. White, Ph.D. |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

Dov A. Goldstein, M.D. |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

Dinesh V. Patel, Ph.D. |

|

— |

|

— |

|

— |

|

— |

|

— |

|

— |

14

Aggregated Option Exercises and Year-End Option Values

The following table shows information for the named executive officers concerning:

- •

- exercises of stock options during 2001; and

- •

- the amount and values of unexercised stock options as of December 31, 2001.

Aggregated Option Exercises and Year-End Option Values Table

| |

| |

| | Number of Securities

Underlying Options at

December 31, 2001 (#)

| | Value of Unexercised

In-the-Money Options at

December 31, 2001 ($)(2)

|

|---|

Name

| | Shares

Acquired on

Exercise (#)

| | Value

Realized

($)(1)

|

|---|

| | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

|---|

| George F. Horner, III | | — | | — | | 509,772 | | 228,978 | | 10,151,633 | | 4,549,793 |

Timothy J. Henkel, M.D., Ph.D. |

|

— |

|

— |

|

100,000 |

|

300,000 |

|

1,460,000 |

|

4,380,000 |

Richard J. White, Ph.D. |

|

17,000 |

|

263,840 |

|

158,382 |

|

75,391 |

|

3,154,721 |

|

1,499,050 |

Dov A. Goldstein, M.D. |

|

400 |

|

2,952 |

|

79,287 |

|

132,813 |

|

1,239,256 |

|

2,075,867 |

Dinesh V. Patel, Ph.D. |

|

— |

|

— |

|

58,905 |

|

30,776 |

|

1,173,905 |

|

611,894 |

- (1)

- Based on the closing price of our common stock on the date of exercise, minus the exercise price of the option.

- (2)

- Based on the closing price of our common stock on December 31, 2001 of $20.35 per share, minus the exercise price of "in-the-money" options.

Related Party Transactions

In March 1998, we entered into a written scientific agreement with Christopher T. Walsh, Ph.D., a member of our Board of Directors. Under this scientific agreement, Dr. Walsh agreed to provide consulting and advisory services to us. We agreed to pay Dr. Walsh an annual fee of $50,000 plus an annual laboratory gift of $50,000 in 1998 and $25,000 in 1999. This agreement expired by its terms in January 2001, but has continued through the mutual consent of Dr. Walsh and us.

In May 1997, we received a non-interest bearing promissory note from Richard J. White, Ph.D., our Executive Vice President and Chief Scientific Officer. The promissory note was in the original principal amount of $200,000 and was due on May 15, 2002. We forgave the unpaid principal balance of the promissory note of $146,667 in 2000 and $40,000 in 2001.

In January 1997, we entered a written consulting agreement with David V. Milligan, Ph.D., the Chairman of our Board of Directors. Under this consulting agreement, Dr. Milligan agreed to provide consulting and advisory services to us. We agreed to pay Dr. Milligan an annual fee of $100,000. The consulting agreement expired in December 1997, but has continued through the mutual consent of Dr. Milligan and us and, as a result, we have paid Dr. Milligan $100,000 per year since 1998.

In April 1996, we received an interest bearing promissory note from Dinesh Patel, Ph.D., our Vice President, Drug Discovery. The promissory note was in the original principal amount of $100,000 and was secured by a deed of trust on Dr. Patel's residence. The promissory note was paid in full in July 2001.

15

Change of Control Agreements

In July 2000, we entered employment agreements with Mr. Horner, Dr. White, Dr. Goldstein, and Dr. Patel. In December 2000, we entered an employment agreement with Dr. Henkel. The employment agreements terminate after three years from their respective commencement dates; however, each employment agreement contains an automatic renewal provision in which the employment agreement renews for three years on each third anniversary of the employment agreement unless we give notice to the named executive officer at least 60 days prior to the renewal date that the employment agreement will not be extended. The employment agreements provide for participation in all bonus, incentive, savings and retirement and benefit plans offered generally to our employees, among other terms and conditions.

If we terminate the named executive officer's employment other than for death, disability or cause, he will receive payments equal to two times the sum of his annual base salary then being paid or his highest annual base salary for the prior three years, depending on the particular agreement, plus the largest amount of bonuses received during any one calendar year. If a change in our control occurs and within two years after the change in our control we terminate the named executive officer's employment without cause or he resigns for good reason, then the named executive officer will receive payments equal to two times the sum of his annual base salary then being paid or his highest annual base salary for any one of the prior two years, depending on the particular agreement, plus the largest amount of bonuses received during any one calendar year.

Compensation Committee Interlocks and Insider Participation

Timothy J. Barberich, Mark Leschly and Lori F. Rafield, Ph.D. each served as members of the Compensation Committee during 2001. None of Messrs. Barberich or Leschly or Dr. Rafield is an officer or employee, or former officer or employee, of ours. Dr. Rafield resigned from the Board on April 3, 2002. No interlocking relationship exists between the members of the Board or the Compensation Committee and the board of directors or Compensation Committee of any other company, nor has any such interlocking relationship existed in the past.

16

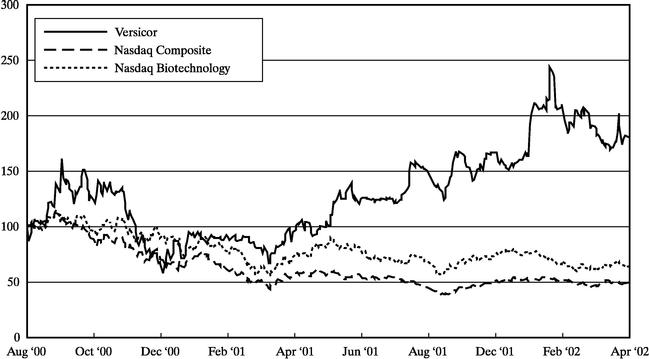

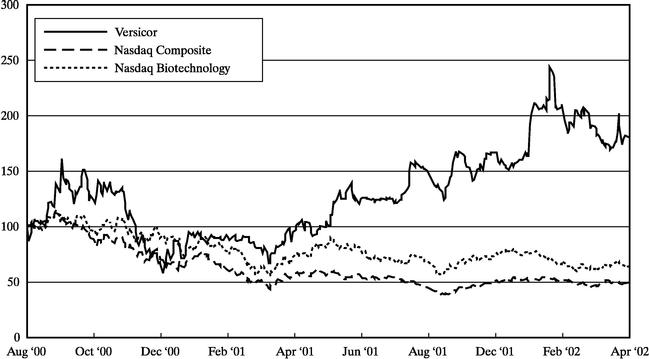

Performance Graph

The stock price performance depicted in the following graph is not necessarily indicative of future price performance. This graph will not be deemed to be incorporated by reference by any general statement incorporating this proxy statement into any of our filings under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent we specifically incorporate this information by reference, and shall not otherwise be deemed soliciting material or deemed filed under those Acts.

The following graph shows a comparison of total stockholder return for holders of our common stock from August 3, 2000, the date our common stock first traded on the Nasdaq National Market, through April 1, 2002 compared with the Nasdaq Composite Index and the Nasdaq Biotechnology Index. This graph is presented pursuant to SEC rules. We believe that while total stockholder return can be an important indicator of corporate performance, the stock prices of biopharmaceutical stocks like ours are subject to a number of market-related factors other than company performance, such as competitive announcements, drug discovery and commercialization, mergers and acquisitions in the industry, the general state of the economy, and the performance of other biopharmaceutical stocks.

17

OTHER MATTERS

Section 16(a) Beneficial Ownership Reporting Compliance

Based on a review of the forms filed, Dr. Goldstein filed one late report on Form 5 with respect to an exercise of a stock option. We believe that the other SEC filings of our officers, directors and 10% stockholders complied with the requirements of Section 16 of the Securities and Exchange Act during 2001.

Exhibits to Annual Report on Form 10-K

If any person who was a beneficial owner of our common stock on the record date for the 2002 Annual Meeting desires additional information, a copy of the exhibits to our Report on Form 10-K will be furnished upon written request. The request should identify the person requesting the exhibits as a stockholder of ours as of April 15, 2002 and should be directed to Dov A. Goldstein, M.D., Vice President, Finance and Chief Financial Officer, Versicor Inc., 34790 Ardentech Court, Fremont, California 94555

By Order of the Board of Directors, Fremont, California

April 26, 2002

18

YOUR VOTE IS IMPORTANT

PLEASE SIGN, DATE AND RETURN

YOUR PROXY CARD

IN THE ENVELOPE PROVIDED

AS SOON AS POSSIBLE

VERSICOR INC.

34790 Ardentech Court

Fremont, California 94555

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned hereby appoints George F. Horner, III and Dov A. Goldstein, M.D. as Proxies, each with the power to appoint his substitute, and hereby authorizes each of them to represent and to vote, as designated on the reverse side, all the shares of Common Stock of Versicor Inc. held of record by the undersigned on April 15, 2002, at the Annual Meeting of Stockholders to be held on June 14, 2002 and at any adjournment or postponement thereof.

(Continued on reverse side)

| ý | | Please mark your

vote as in this

example.

|

| | | FOR

the nominee

listed at right (except as indicated to the contrary below) | | WITHHOLD

AUTHORITY

for the nominee listed at right | | | | | | | | FOR | | AGAINST | | ABSTAIN |

1. Election of

Directors: | | o | | o

| | Nominee:

James H. Cavanaugh, Ph.D. | | 2. | | Ratify the appointment of PricewaterhouseCoopers LLP as independent accountants. | | o | | o | | o

|

|

|

|

|

|

|

|

|

3. |

|

In their discretion, the Proxies are authorized to vote upon such other business as may properly come before the Annual Meeting or any adjournment or postponment thereof. |

|

|

|

|

|

|

|

|

THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED STOCKHOLDER. IF NO DIRECTION IS GIVEN, THIS PROXY WILL BE VOTED FOR PROPOSALS 1 AND 2. |

|

|

|

|

|

|

|

|

All other proxies heretofore given by the undersigned to vote shares of stock of Versicor Inc., which the undersigned would be entitled to vote if personally present at the Annual Meeting or any adjournment or postponement thereof, are hereby expressly revoked. |

|

|

|

|

|

|

|

|

PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY USING THE ENCLOSED ENVELOPE. IF YOUR ADDRESS IS INCORRECTLY SHOWN, PLEASE PRINT CHANGES. |

| Signature | |

| | Signature | |

| | Date: | |

| , 2001

|

NOTE: |

|

Please date this Proxy and sign it exactly as your name or names appear above. When shares are held by joint tenants, both should sign. When signing as an attorney, executor, administrator, trustee or guardian, please give full title as such. If shares are held by a corporation, please sign in full corporate name by the President or other authorized officer. If shares are held by a partnership, please sign in partnership name by an authorized person.

|

QuickLinks

NOTICE OF ANNUAL MEETINGQUESTIONS AND ANSWERSPROPOSALS YOU MAY VOTE ONTHE BOARD OF DIRECTORSEXECUTIVE COMPENSATIONSummary Compensation TableOTHER MATTERS