Investor Presentation May 2017 Exhibit 99.1

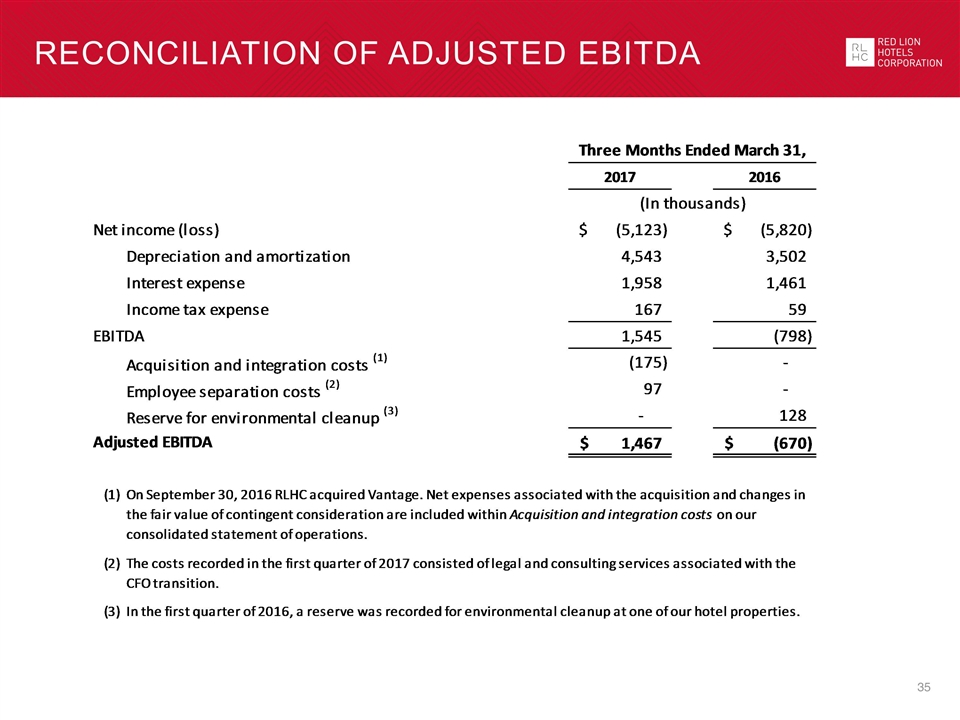

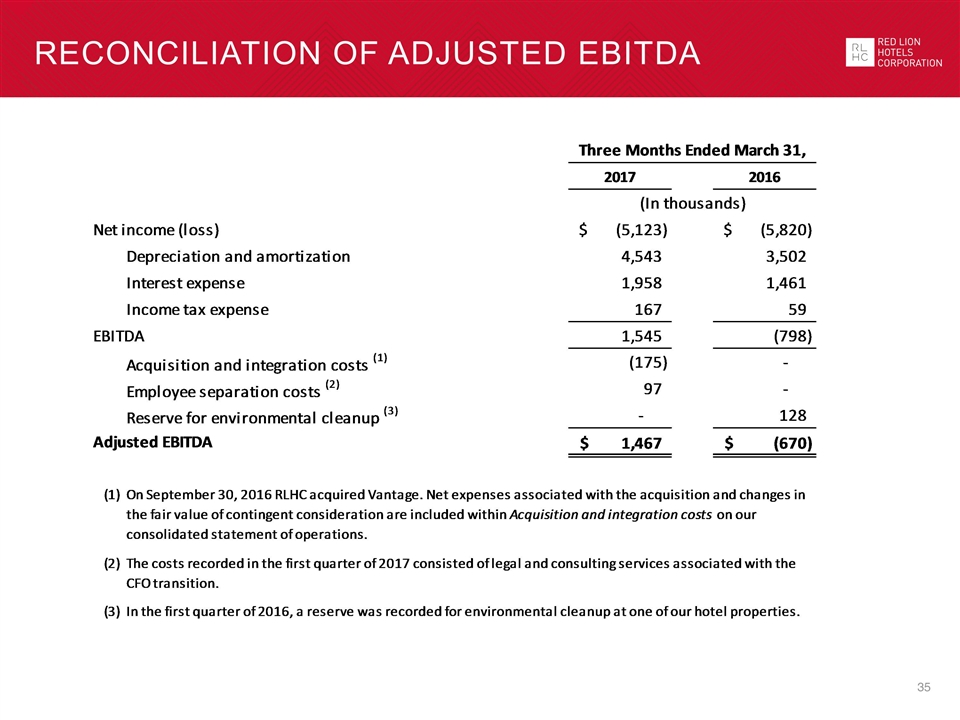

Disclaimer This presentation (the “Presentation”) is provided for information purposes only. Forward Looking Statements. Certain matters discussed throughout all of this presentation constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Generally, our use of words such as “expect,” “estimate,” “believe,” “anticipate,” “should,“ “will,” “forecast,” “plan,” project,” “assume” or similar words of futurity identify such forward-looking statements. These forward-looking statements are based on management’s current beliefs, assumption and expectations regarding future events, which in turn are based on information currently available to management. Such statements may relate to projections of the Company’s revenue, earnings and other financial and operational measures, Company debt levels, ability to repay outstanding indebtedness, payment of dividends, and future operations, among other matters. We caution you not to place undue reliance on any such forward-looking statements. Forward-looking statements do not guarantee future performance and involve known and unknown risks, uncertainties and other factors. Several factors could cause actual results, performance or achievements of the Company to differ materially from those expressed in or contemplated by the forward-looking statements. Such risks include, but are not limited to, changes to general, domestic and foreign economic conditions; operating risks common in the lodging and franchising industries; changes to the desirability of our brands as viewed by hotel operators and customers; changes to the terms or termination of our contracts with franchisees; our ability to keep pace with improvements in technology utilized for reservations systems and other operating systems; fluctuations in the supply and demand for hotels rooms; the outcome of litigation; and our ability to effectively manage our indebtedness. These and other risk factors are discussed in detail in the Risk Factors section of the Company’s Annual Report on Form 10-K for the year ended December 31, 2016, filed with the Securities and Exchange Commission on March 31, 2017. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. Non-GAAP Financial Measures. Management believes that non-GAAP financial measures may be useful in certain instances to provide additional meaningful comparisons between past, present and future operating results and as a means to evaluate the results of core, ongoing operations. Within this presentation, reference is made to adjusted earnings before interest, taxes, depreciation and amortization (EBITDA). See Appendix – “Reconciliation of Adjusted EBITDA” for a reconciliation of Adjusted EBITDA to net income (loss). EBITDA and Adjusted EBITDA are commonly used measures in our industry, and we believe they are a complement to reported operating results. EBITDA and Adjusted EBITDA are not intended to represent net income (loss) defined by generally accepted accounting principles in the United States (GAAP). In addition, other companies in our industry may calculate EBITDA and Adjusted EBITDA differently than we do or may not calculate them at all, limiting the usefulness of EBITDA and Adjusted EBITDA as comparative measures. While management believes that the non-GAAP measurements are useful supplemental information, such adjusted results are not intended to replace the Company’s GAAP financial results and should be read in conjunction with those GAAP results.

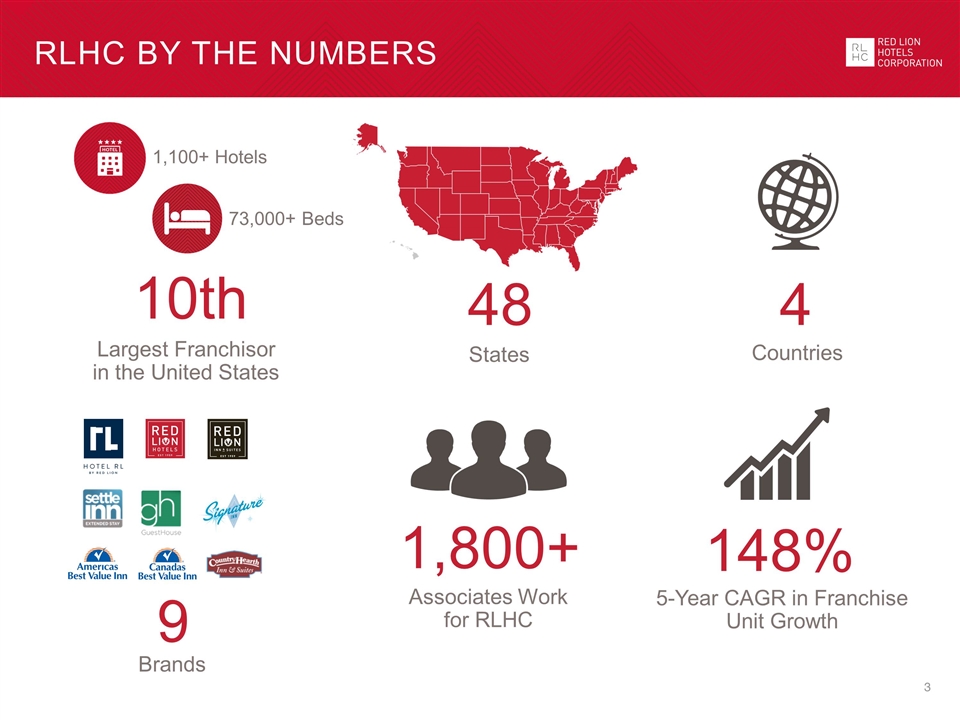

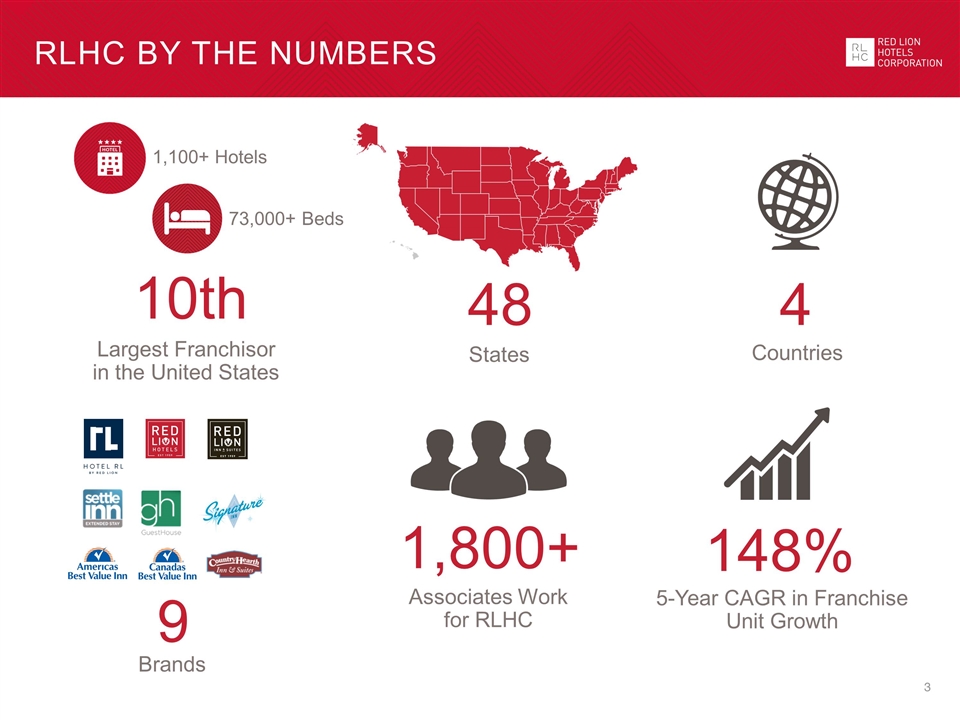

RLHC by the numbers Largest Franchisor in the United States States 10th 9 Brands 1,100+ Hotels 48 4 Countries 73,000+ Beds 148% 5-Year CAGR in Franchise Unit Growth Associates Work for RLHC 1,800+

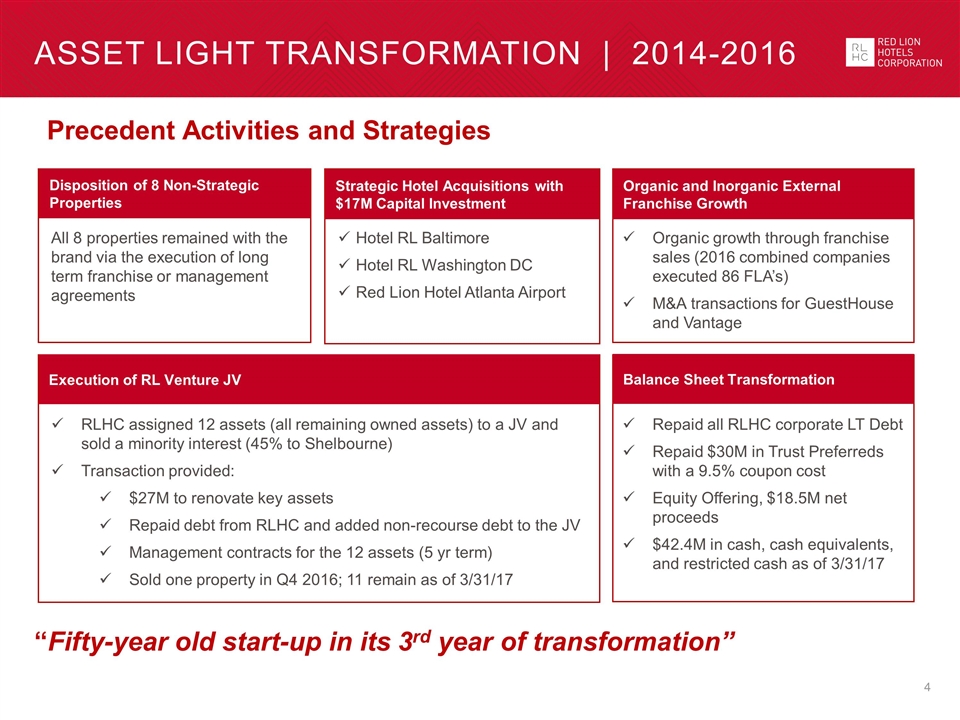

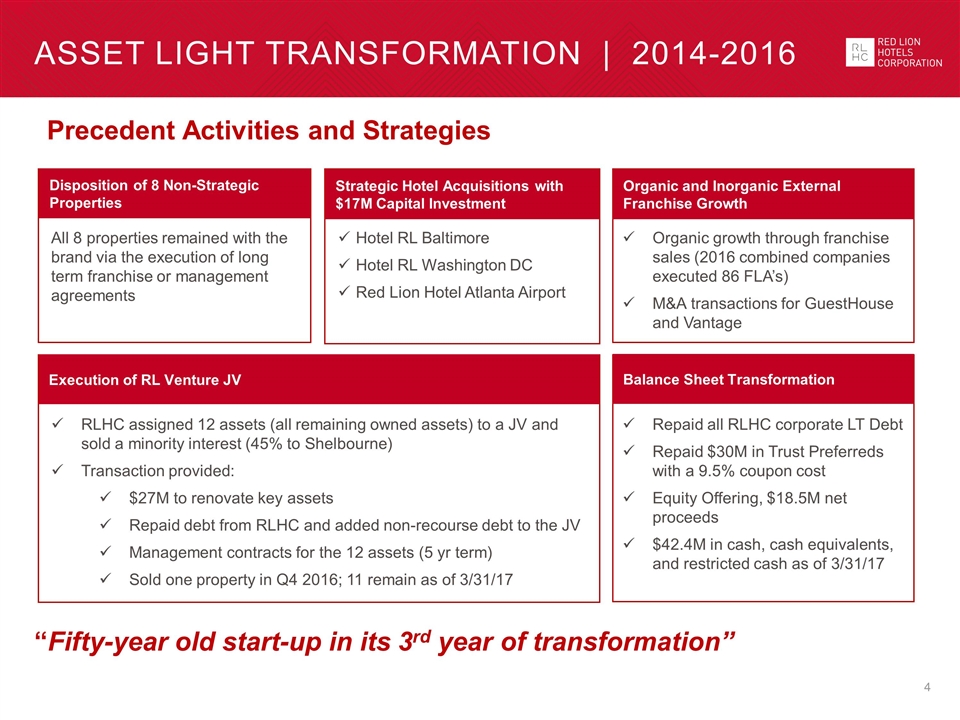

Asset Light Transformation | 2014-2016 Precedent Activities and Strategies All 8 properties remained with the brand via the execution of long term franchise or management agreements RLHC assigned 12 assets (all remaining owned assets) to a JV and sold a minority interest (45% to Shelbourne) Transaction provided: $27M to renovate key assets Repaid debt from RLHC and added non-recourse debt to the JV Management contracts for the 12 assets (5 yr term) Sold one property in Q4 2016; 11 remain as of 3/31/17 Hotel RL Baltimore Hotel RL Washington DC Red Lion Hotel Atlanta Airport Organic growth through franchise sales (2016 combined companies executed 86 FLA’s) M&A transactions for GuestHouse and Vantage Repaid all RLHC corporate LT Debt Repaid $30M in Trust Preferreds with a 9.5% coupon cost Equity Offering, $18.5M net proceeds $42.4M in cash, cash equivalents, and restricted cash as of 3/31/17 “Fifty-year old start-up in its 3rd year of transformation” Disposition of 8 Non-Strategic Properties Strategic Hotel Acquisitions with $17M Capital Investment Organic and Inorganic External Franchise Growth Balance Sheet Transformation Execution of RL Venture JV

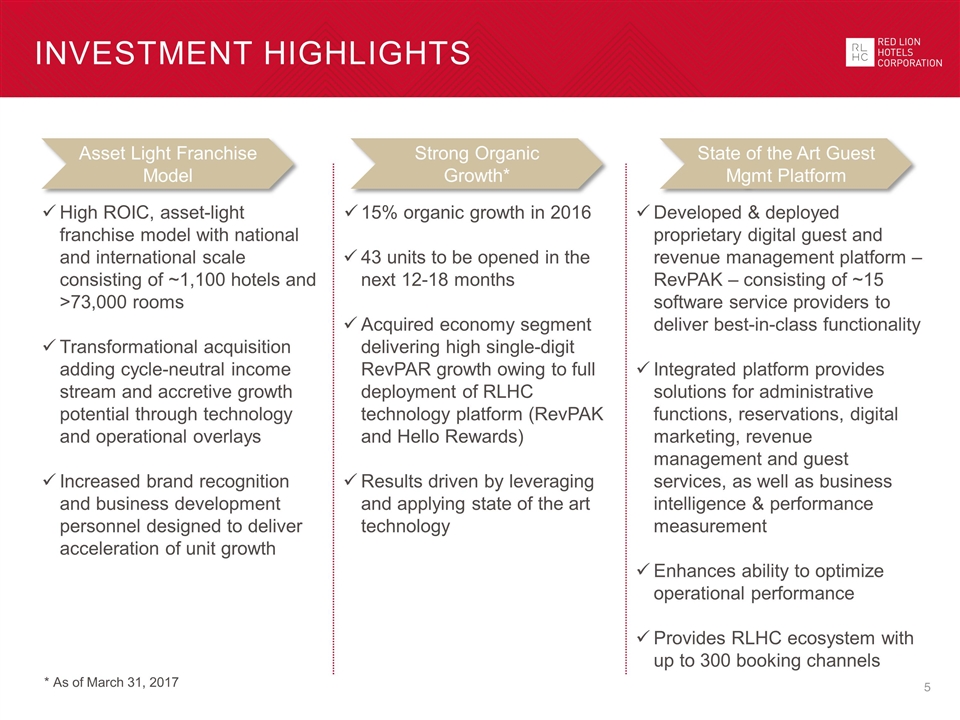

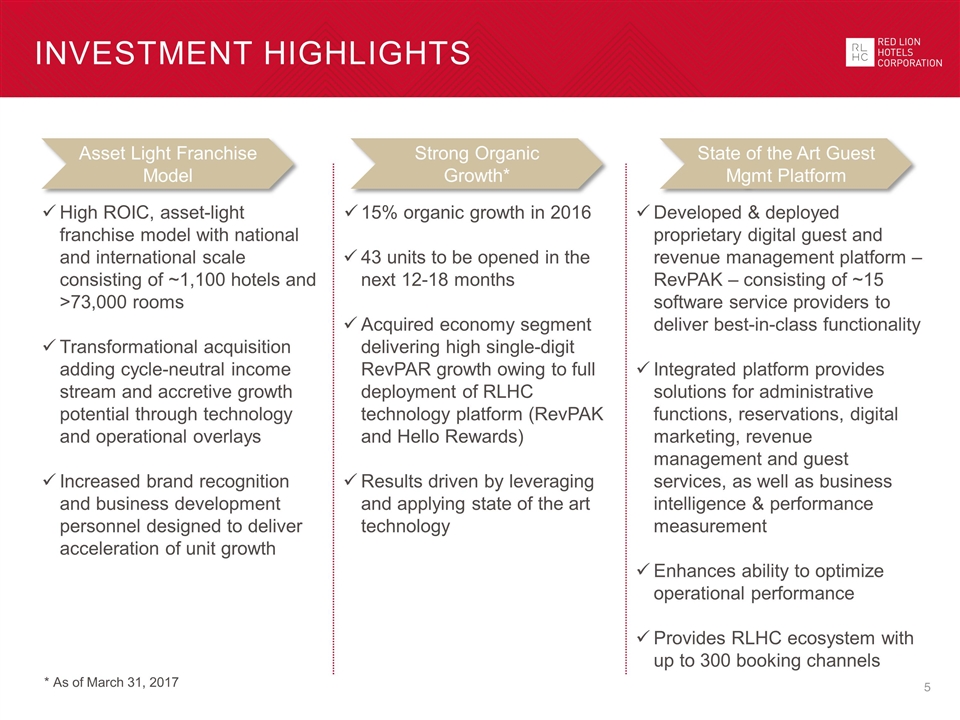

Investment Highlights * Data as of March 31, 2017 High ROIC, asset-light franchise model with national and international scale consisting of ~1,100 hotels and >73,000 rooms Transformational acquisition adding cycle-neutral income stream and accretive growth potential through technology and operational overlays Increased brand recognition and business development personnel designed to deliver acceleration of unit growth 15% organic growth in 2016 43 units to be opened in the next 12-18 months Acquired economy segment delivering high single-digit RevPAR growth owing to full deployment of RLHC technology platform (RevPAK and Hello Rewards) Results driven by leveraging and applying state of the art technology Developed & deployed proprietary digital guest and revenue management platform – RevPAK – consisting of ~15 software service providers to deliver best-in-class functionality Integrated platform provides solutions for administrative functions, reservations, digital marketing, revenue management and guest services, as well as business intelligence & performance measurement Enhances ability to optimize operational performance Provides RLHC ecosystem with up to 300 booking channels Asset Light Franchise Model Strong Organic Growth* State of the Art Guest Mgmt Platform * As of March 31, 2017

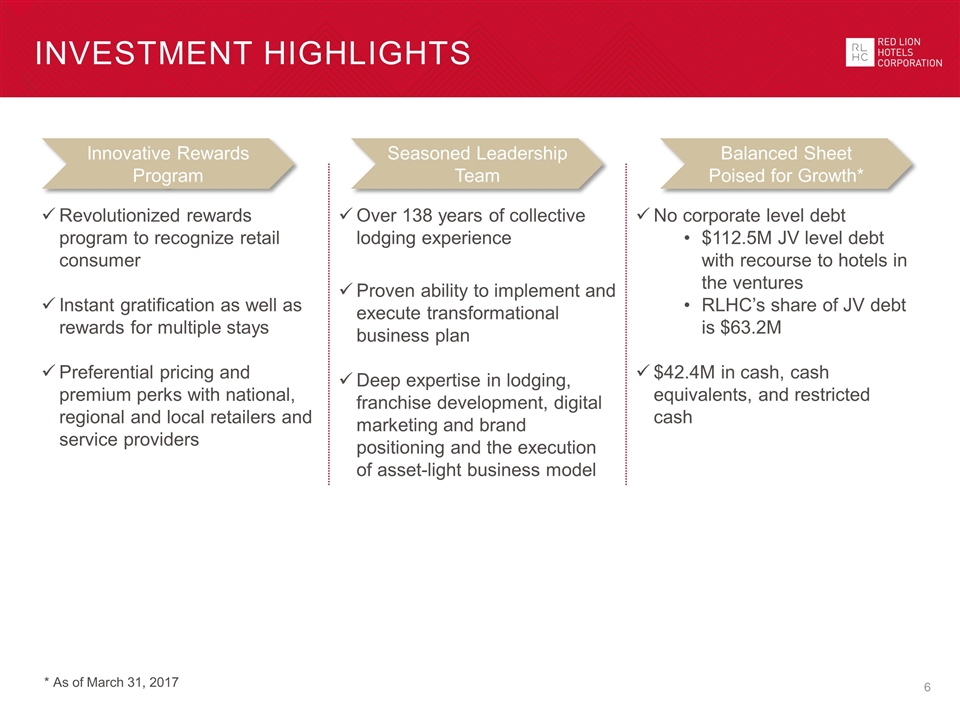

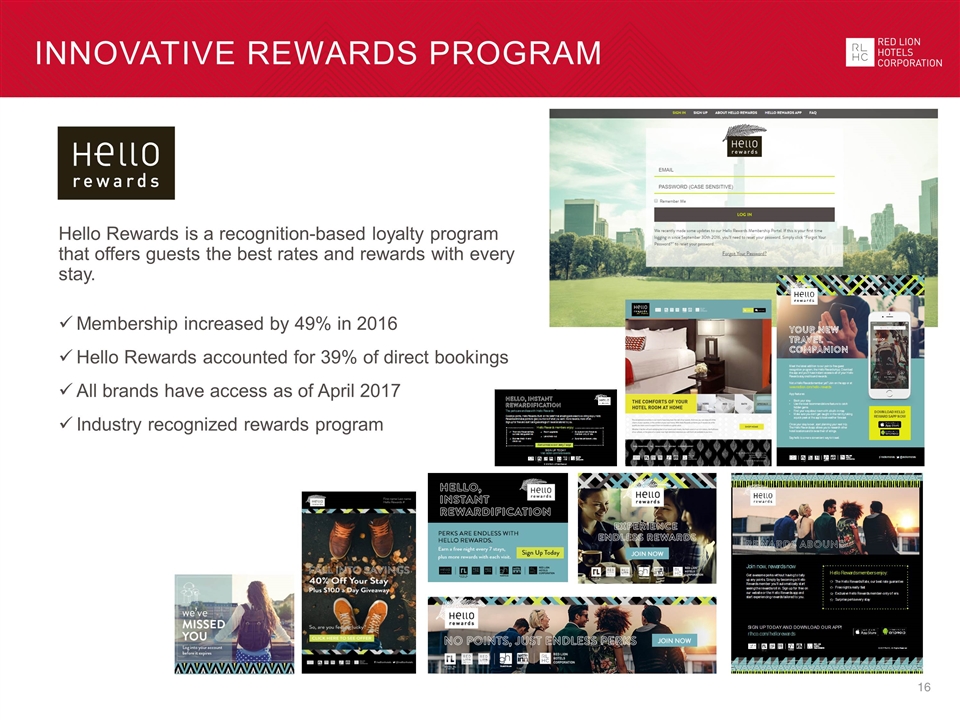

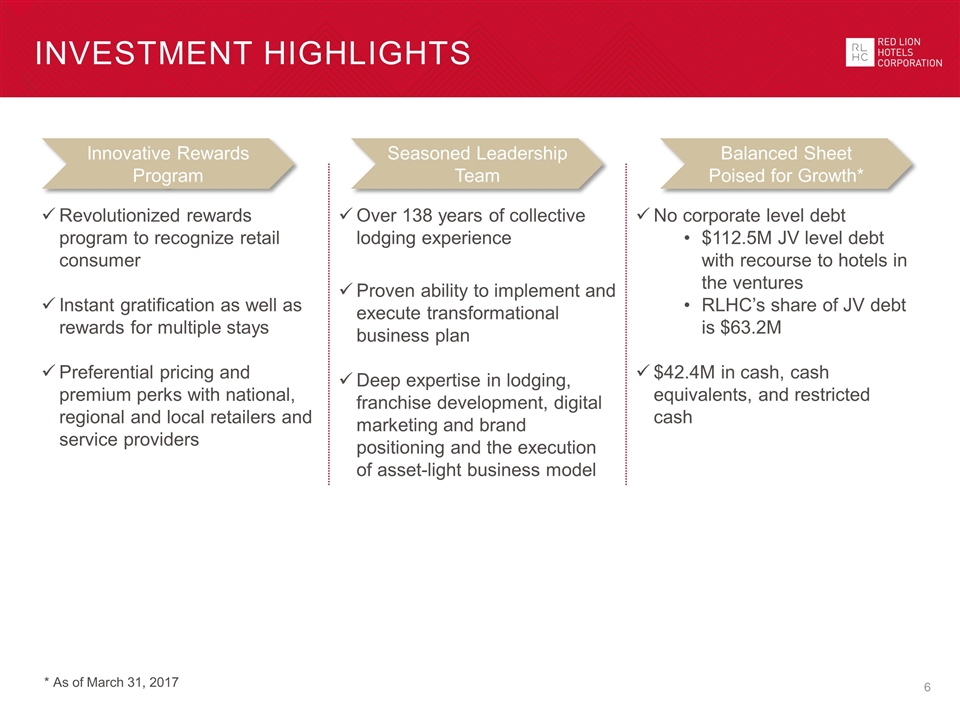

Investment Highlights * Data as of March 31, 2017 Innovative Rewards Program Seasoned Leadership Team Balanced Sheet Poised for Growth* Revolutionized rewards program to recognize retail consumer Instant gratification as well as rewards for multiple stays Preferential pricing and premium perks with national, regional and local retailers and service providers Over 138 years of collective lodging experience Proven ability to implement and execute transformational business plan Deep expertise in lodging, franchise development, digital marketing and brand positioning and the execution of asset-light business model No corporate level debt $112.5M JV level debt with recourse to hotels in the ventures RLHC’s share of JV debt is $63.2M $42.4M in cash, cash equivalents, and restricted cash * As of March 31, 2017

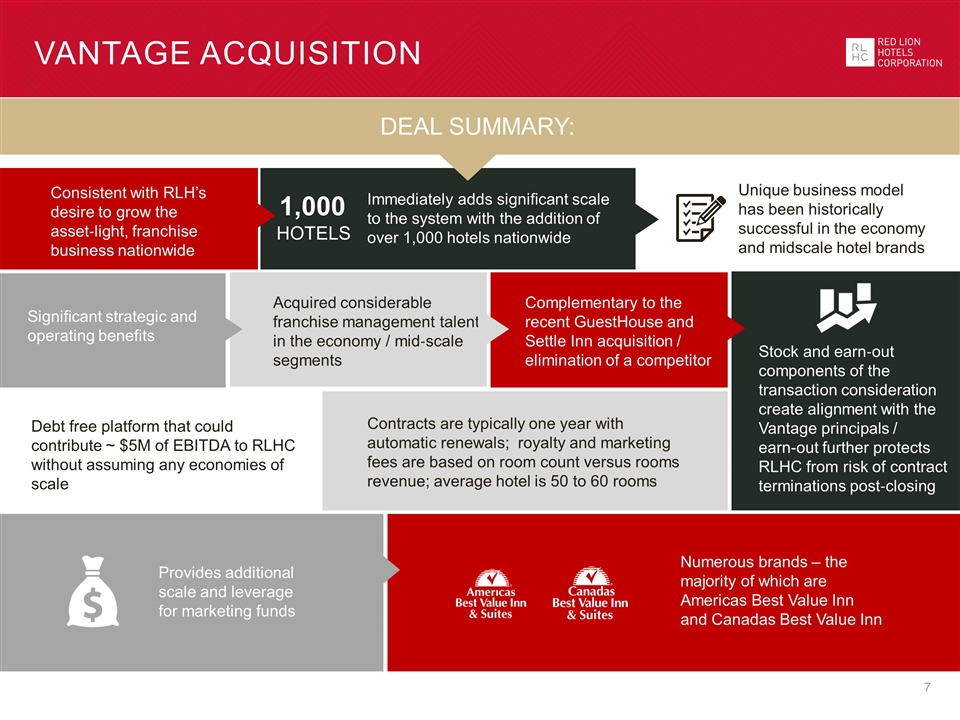

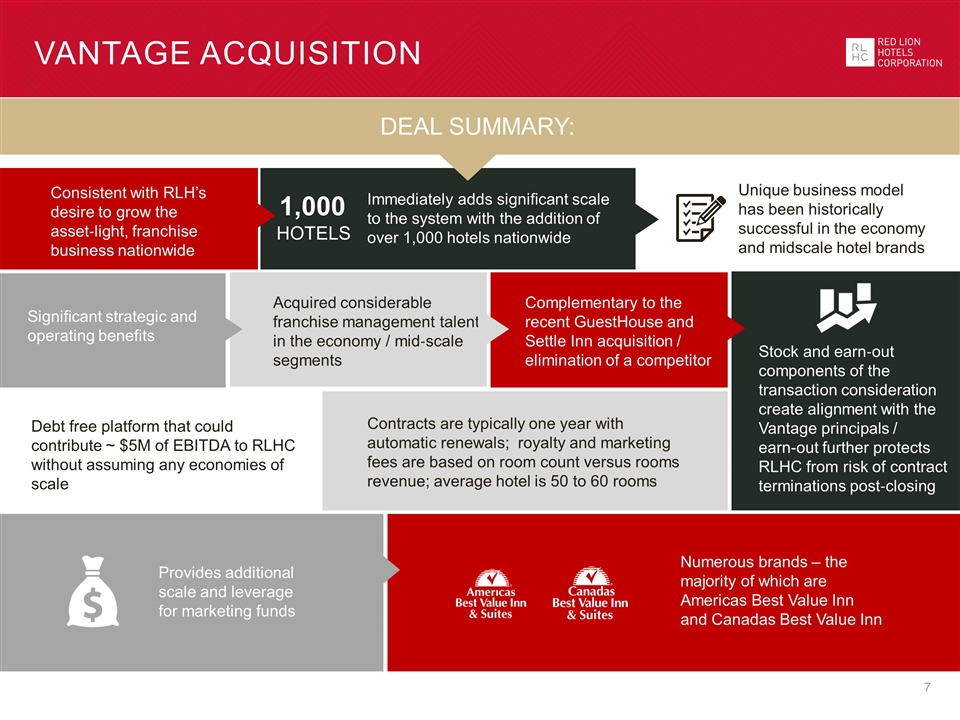

Vantage Acquisition DEAL SUMMARY: Consistent with RLH’s desire to grow the asset‐light, franchise business nationwide Immediately adds significant scale to the system with the addition of over 1,000 hotels nationwide Unique business model has been historically successful in the economy and midscale hotel brands Significant strategic and operating benefits Acquired considerable franchise management talent in the economy / mid‐scale segments Complementary to the recent GuestHouse and Settle Inn acquisition / elimination of a competitor Stock and earn‐out components of the transaction consideration create alignment with the Vantage principals / earn-out further protects RLHC from risk of contract terminations post‐closing Debt free platform that could contribute ~ $5M of EBITDA to RLHC without assuming any economies of scale Contracts are typically one year with automatic renewals; royalty and marketing fees are based on room count versus rooms revenue; average hotel is 50 to 60 rooms Provides additional scale and leverage for marketing funds Numerous brands – the majority of which are Americas Best Value Inn and Canadas Best Value Inn 1,000 HOTELS

FRANCHISE OF CHOICE

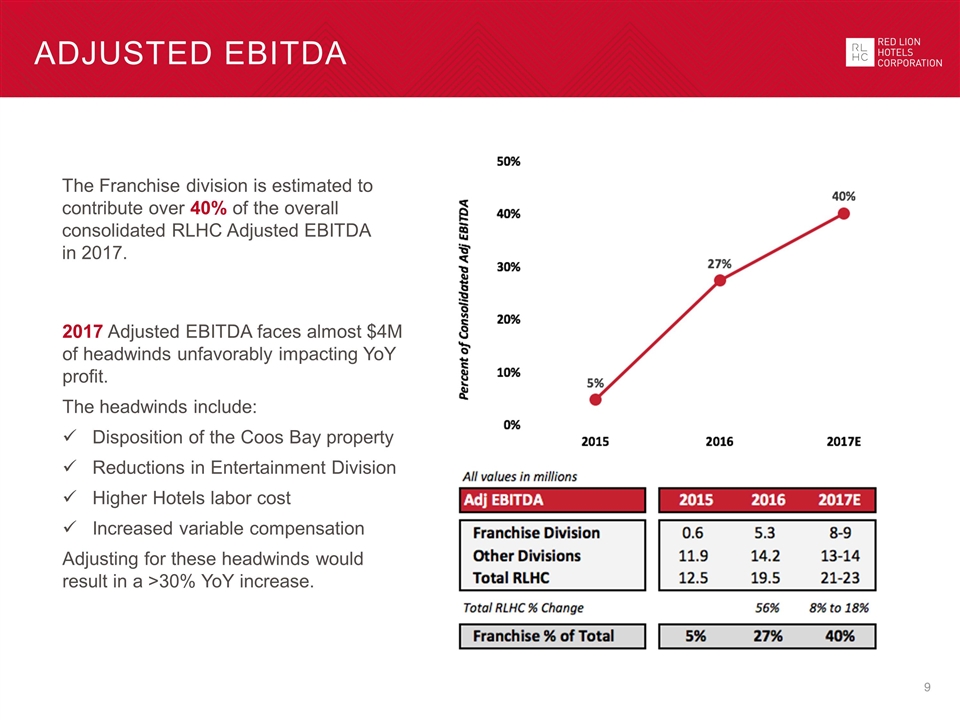

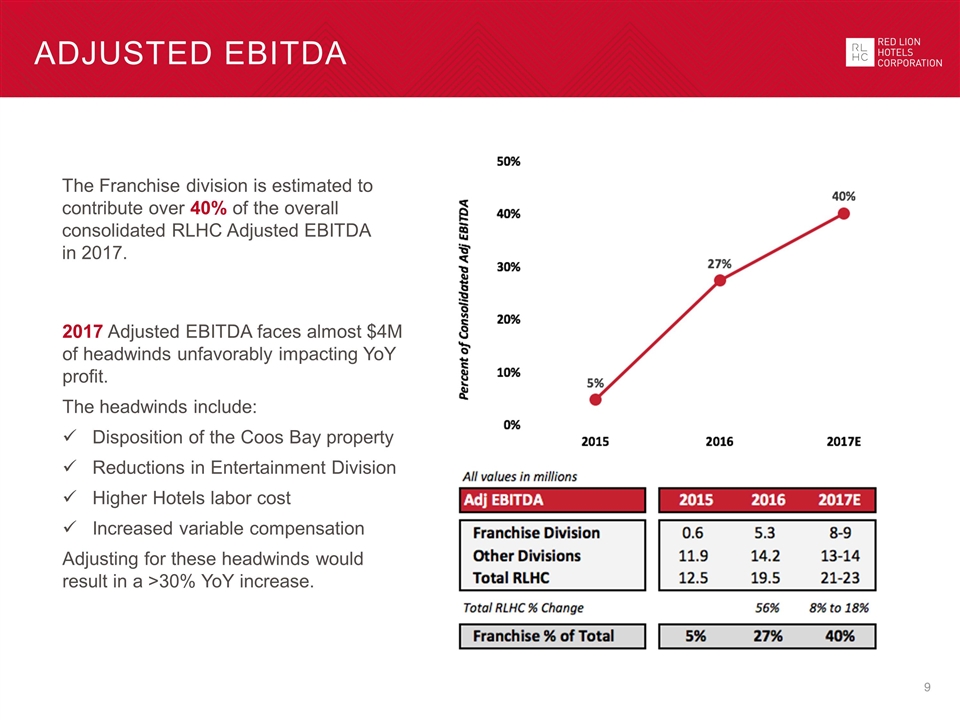

Adjusted EBITDA 2017 Adjusted EBITDA faces almost $4M of headwinds unfavorably impacting YoY profit. The headwinds include: Disposition of the Coos Bay property Reductions in Entertainment Division Higher Hotels labor cost Increased variable compensation Adjusting for these headwinds would result in a >30% YoY increase. The Franchise division is estimated to contribute over 40% of the overall consolidated RLHC Adjusted EBITDA in 2017.

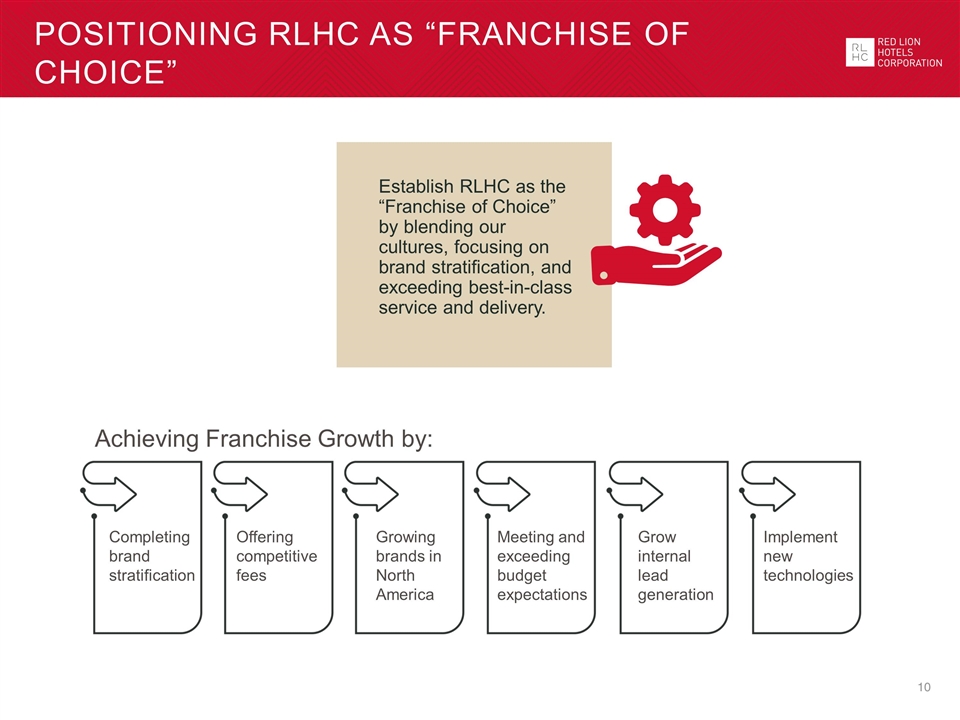

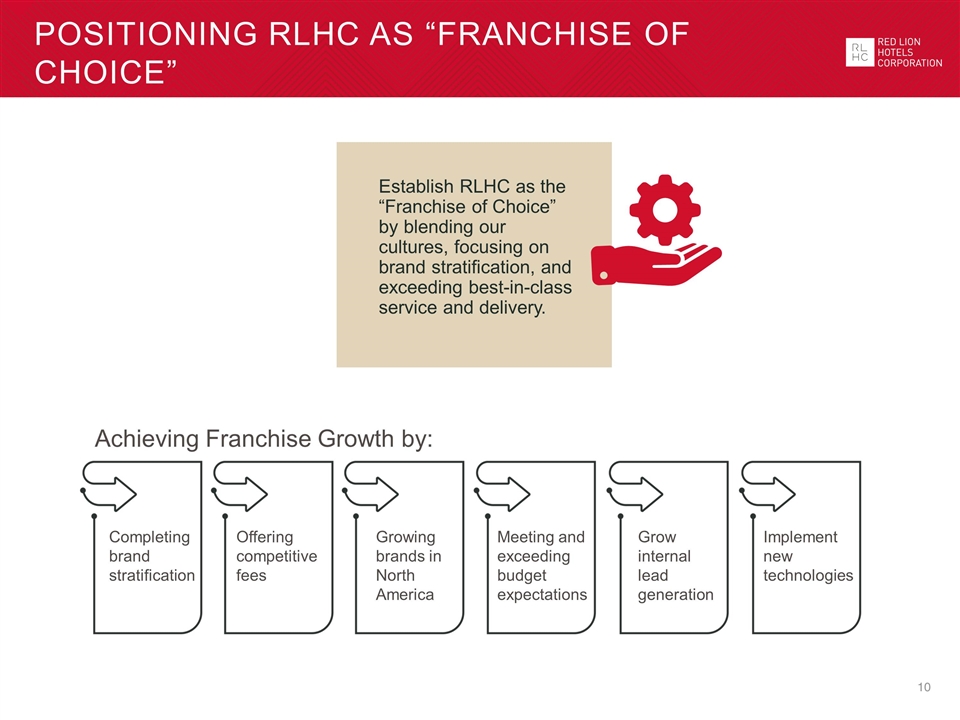

Positioning RLHC as “Franchise of Choice” Establish RLHC as the “Franchise of Choice” by blending our cultures, focusing on brand stratification, and exceeding best-in-class service and delivery. Achieving Franchise Growth by: Completing brand stratification Offering competitive fees Growing brands in North America Meeting and exceeding budget expectations Grow internal lead generation Implement new technologies

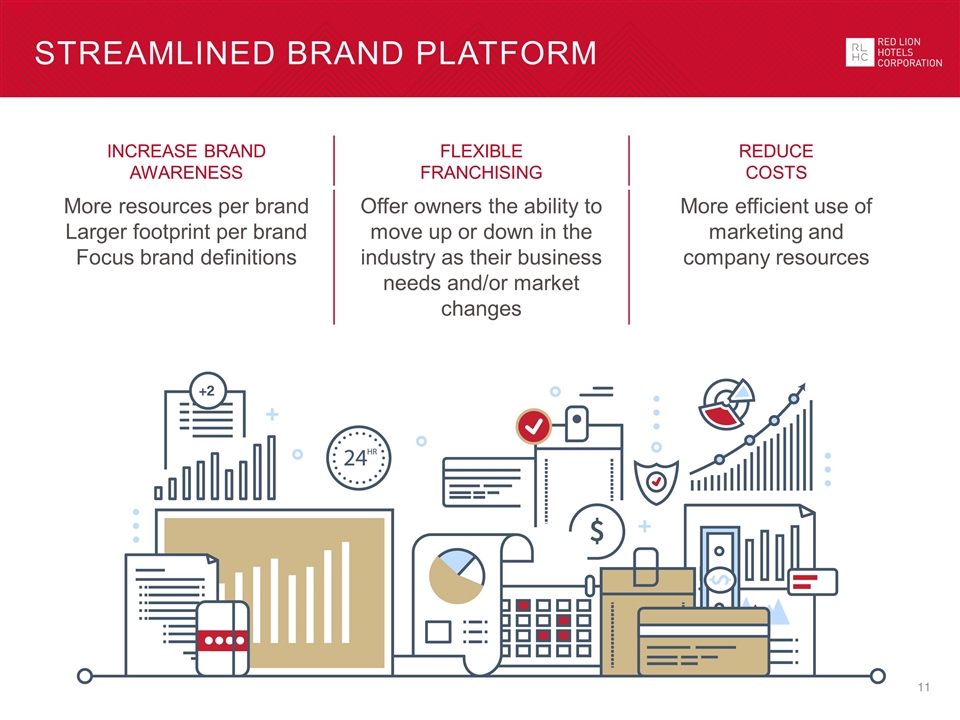

INCREASE BRAND AWARENESS FLEXIBLE FRANCHISING REDUCE COSTS More resources per brand Larger footprint per brand Focus brand definitions Offer owners the ability to move up or down in the industry as their business needs and/or market changes More efficient use of marketing and company resources Streamlined Brand Platform

Upscale offering Centrally located in destination, adventure and university cities Flat fee (Introductory offer) Midscale offering with or without a restaurant Primary and secondary markets Variable fee (% of GRR) Midscale Extended Stay Flat fee Affordable Boutique offering Older hotels in markets that could support RevPAR lift Flat fee Upper Economy offering Flat fee Economy offering Strong national presence with numerous opportunities for repositioning Flat fee Lower Economy offering National brand with few brand restrictions Flat fee Brand Stratification plan – 9 flags LUXURY ECONOMY

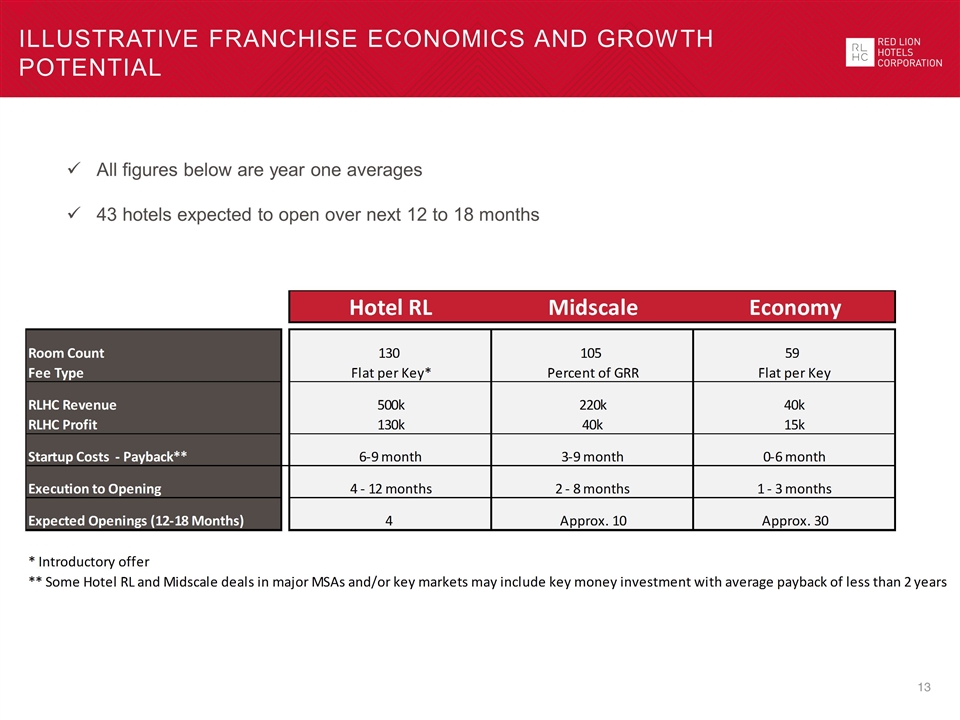

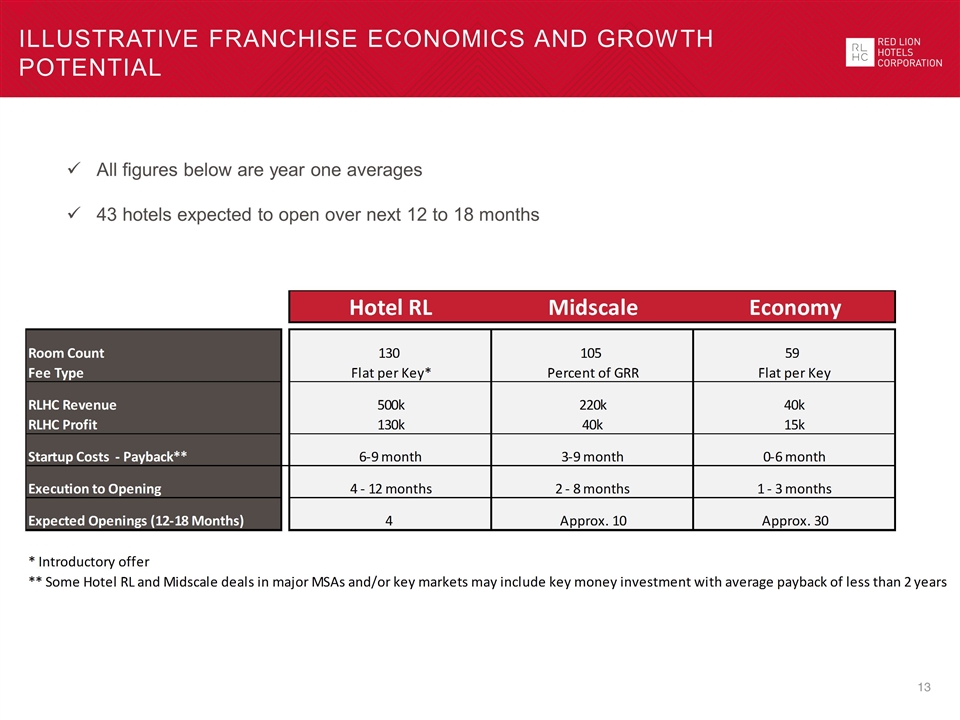

Illustrative franchise Economics and growth potential All figures below are year one averages 43 hotels expected to open over next 12 to 18 months

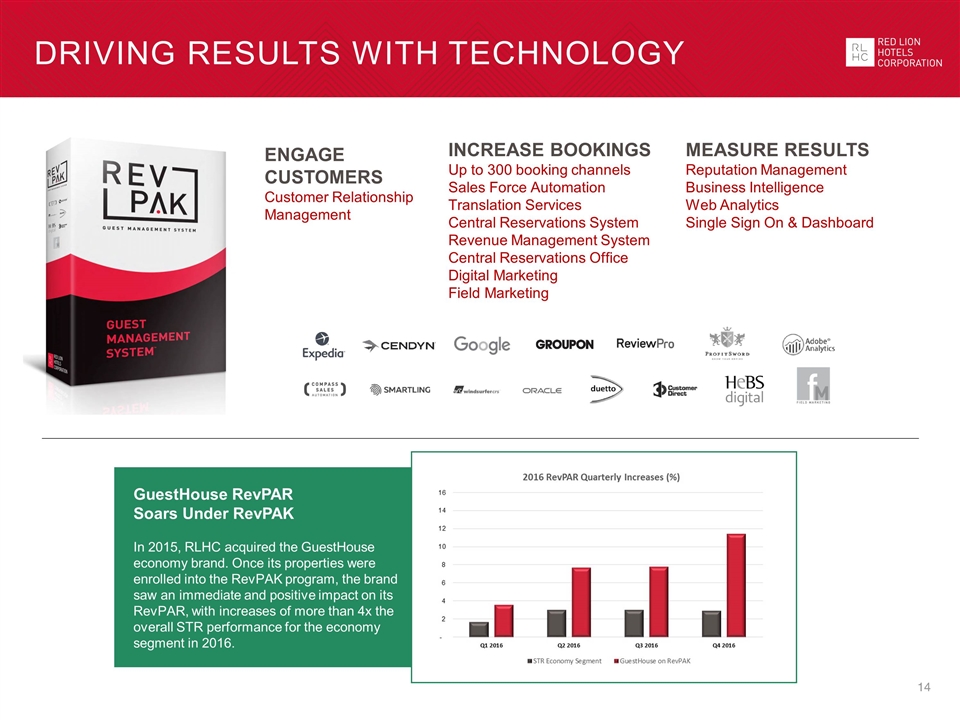

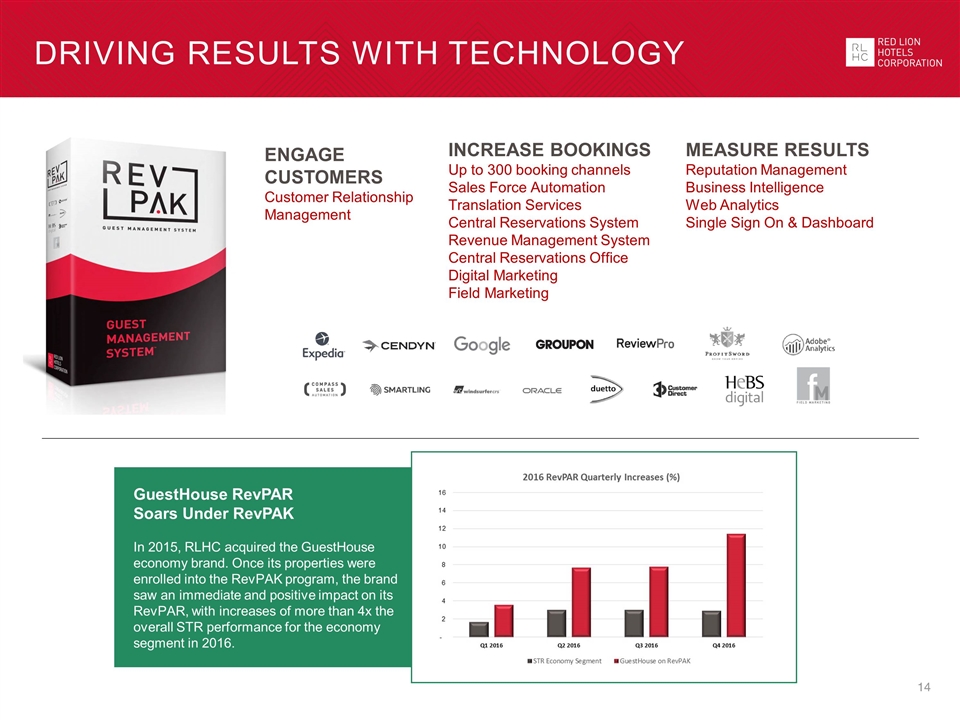

Driving Results with Technology INCREASE BOOKINGS Up to 300 booking channels Sales Force Automation Translation Services Central Reservations System Revenue Management System Central Reservations Office Digital Marketing Field Marketing ENGAGE CUSTOMERS Customer Relationship Management MEASURE RESULTS Reputation Management Business Intelligence Web Analytics Single Sign On & Dashboard GuestHouse RevPAR Soars Under RevPAK In 2015, RLHC acquired the GuestHouse economy brand. Once its properties were enrolled into the RevPAK program, the brand saw an immediate and positive impact on its RevPAR, with increases of more than 4x the overall STR performance for the economy segment in 2016.

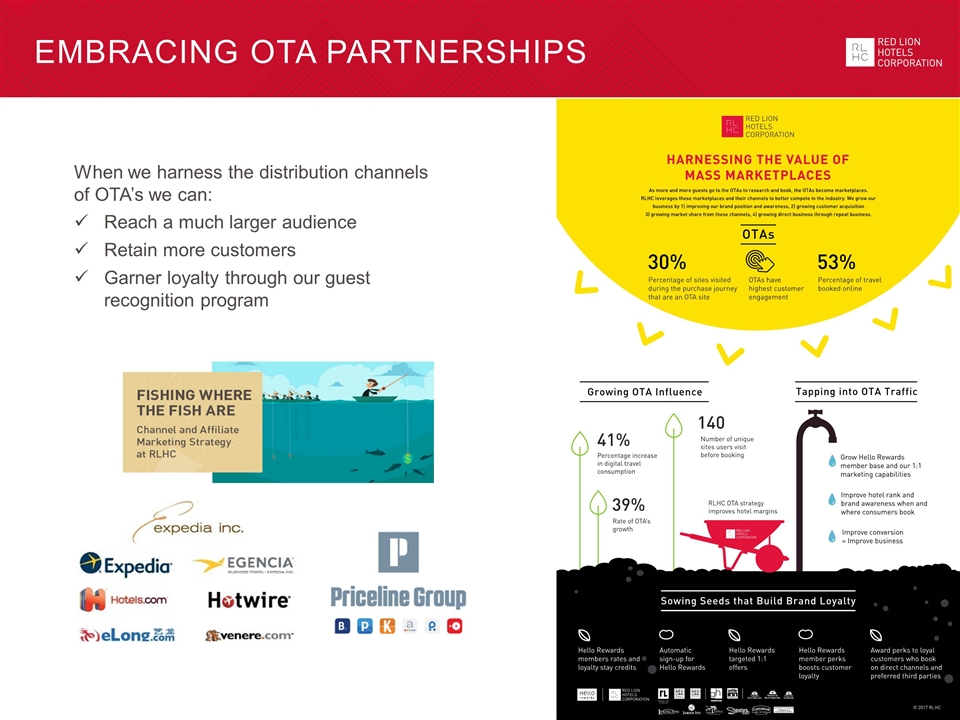

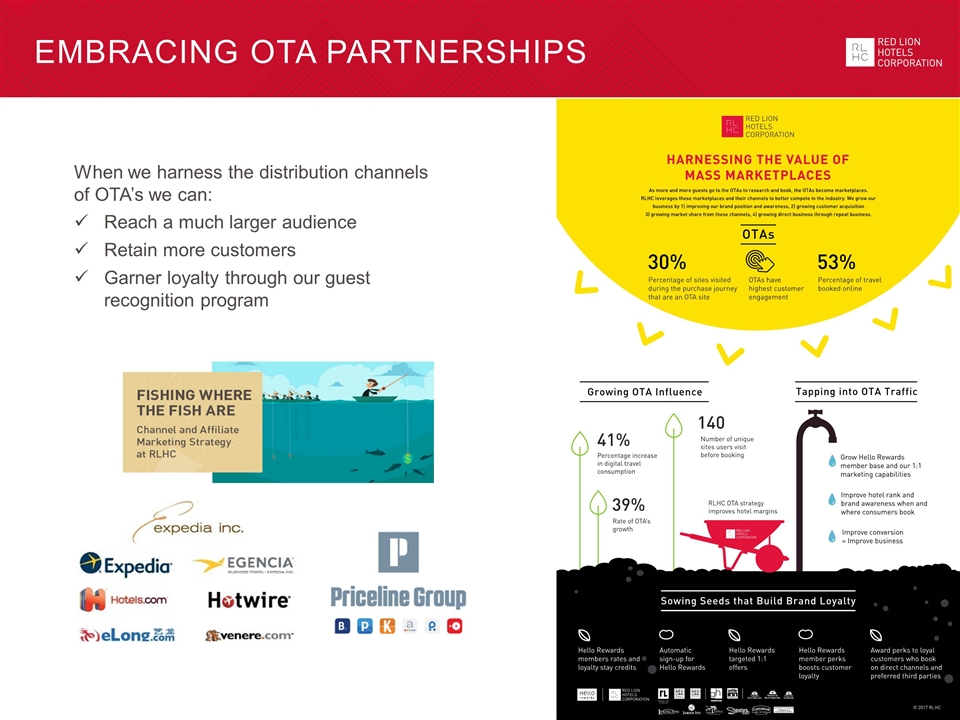

Embracing OTA Partnerships When we harness the distribution channels of OTA’s we can: Reach a much larger audience Retain more customers Garner loyalty through our guest recognition program

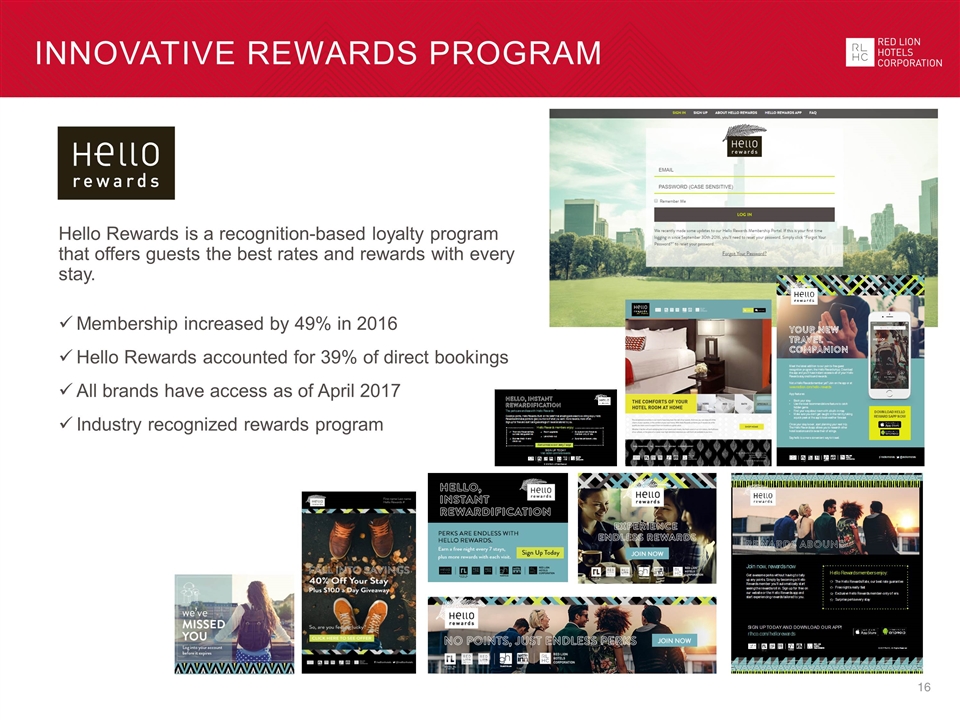

Hello Rewards is a recognition-based loyalty program that offers guests the best rates and rewards with every stay. Membership increased by 49% in 2016 Hello Rewards accounted for 39% of direct bookings All brands have access as of April 2017 Industry recognized rewards program Innovative rewards program

FUTURE GROWTH OPPORTUNITY

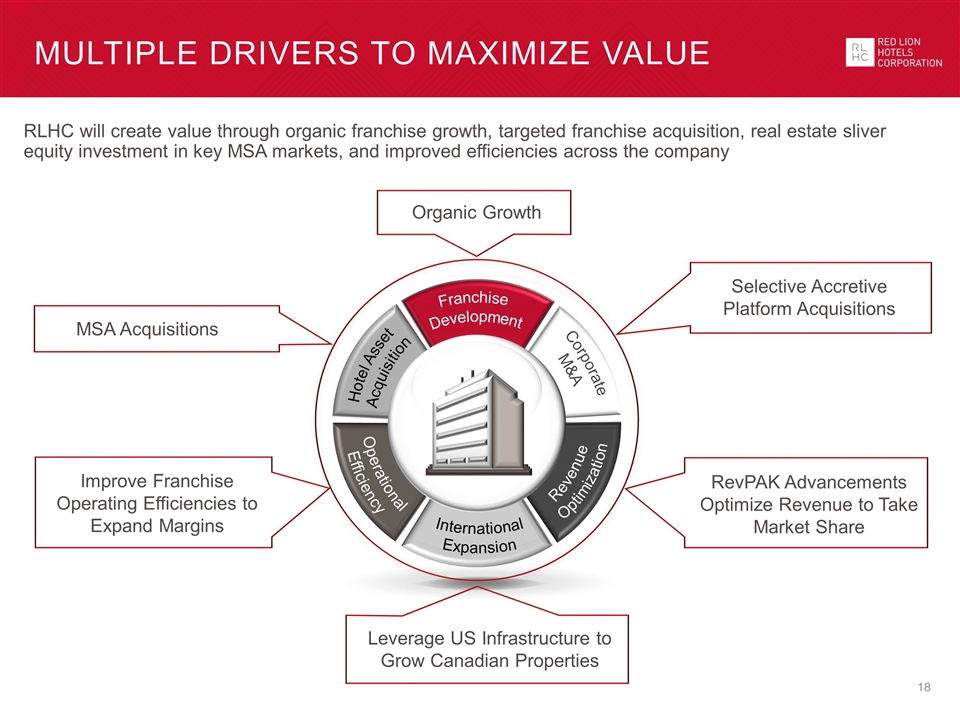

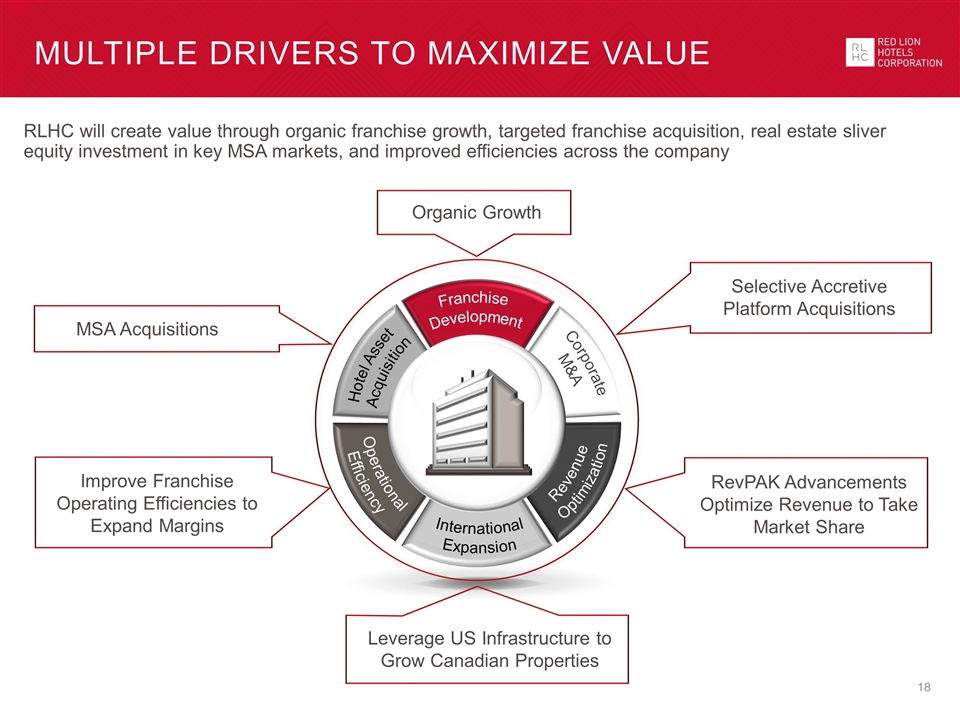

RLHC will create value through organic franchise growth, targeted franchise acquisition, real estate sliver equity investment in key MSA markets, and improved efficiencies across the company Multiple Drivers to Maximize value Hotel Asset Acquisition Franchise Development Corporate M&A Revenue Optimization Operational Efficiency International Expansion Organic Growth MSA Acquisitions Improve Franchise Operating Efficiencies to Expand Margins Leverage US Infrastructure to Grow Canadian Properties Selective Accretive Platform Acquisitions RevPAK Advancements Optimize Revenue to Take Market Share

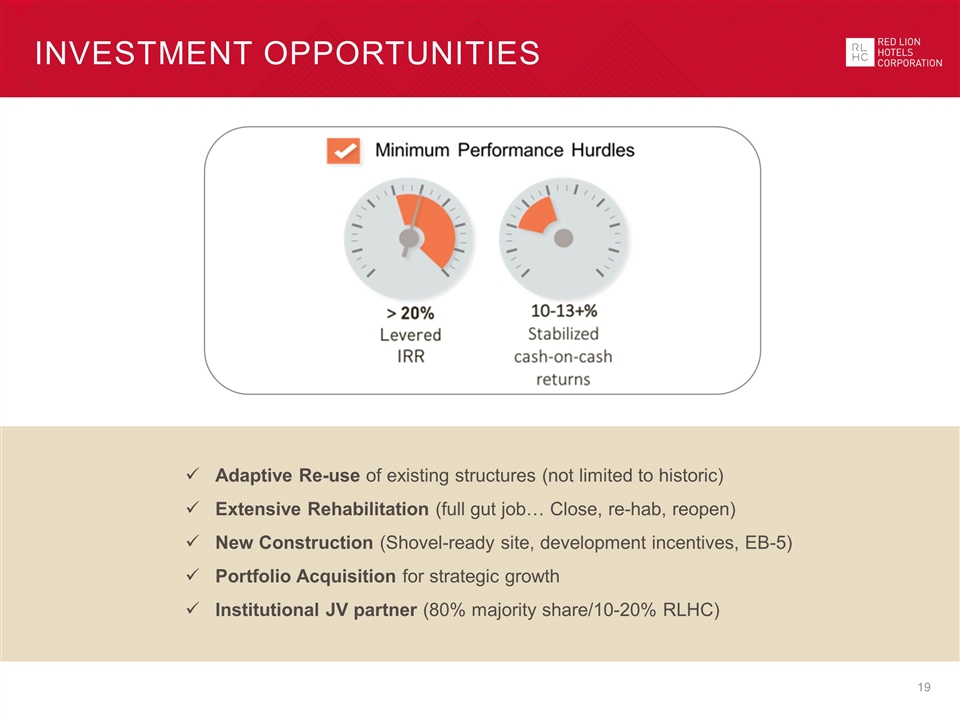

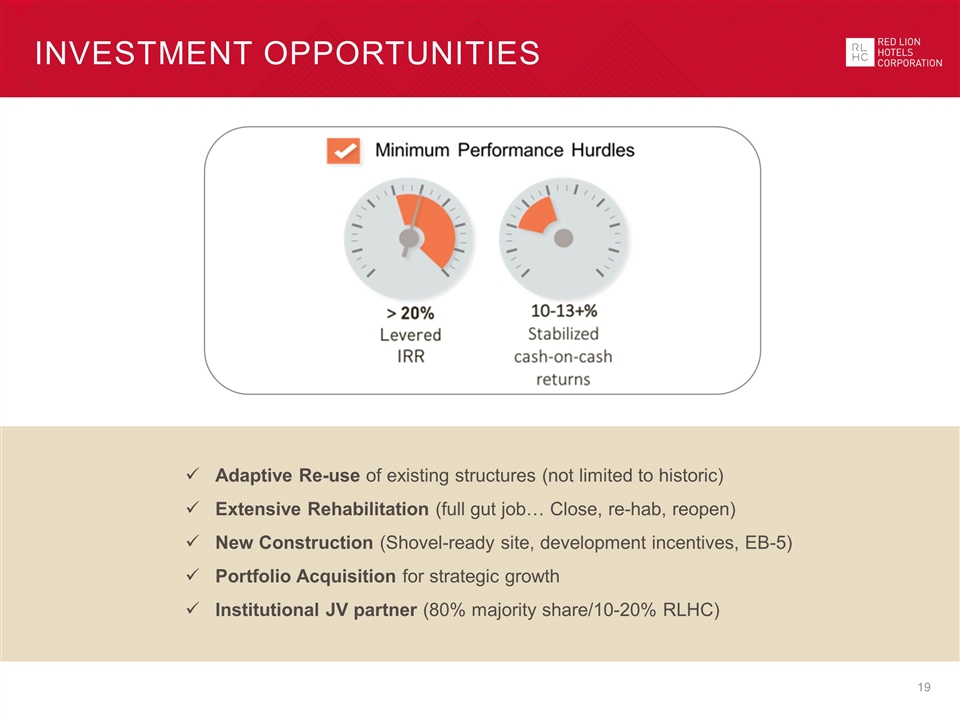

Investment Opportunities Adaptive Re-use of existing structures (not limited to historic) Extensive Rehabilitation (full gut job… Close, re-hab, reopen) New Construction (Shovel-ready site, development incentives, EB-5) Portfolio Acquisition for strategic growth Institutional JV partner (80% majority share/10-20% RLHC)

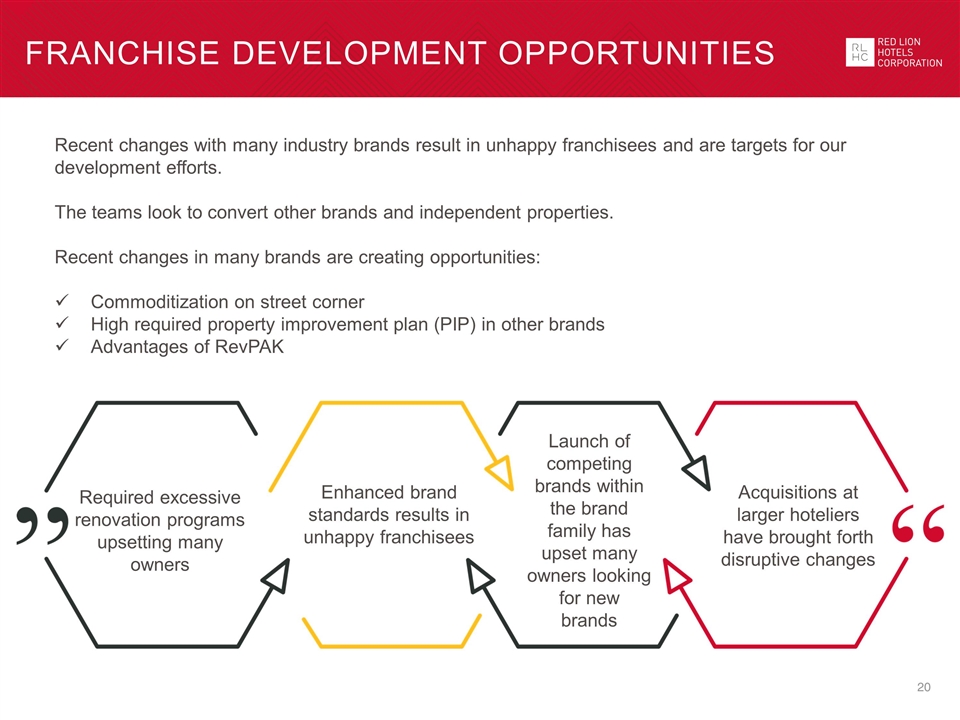

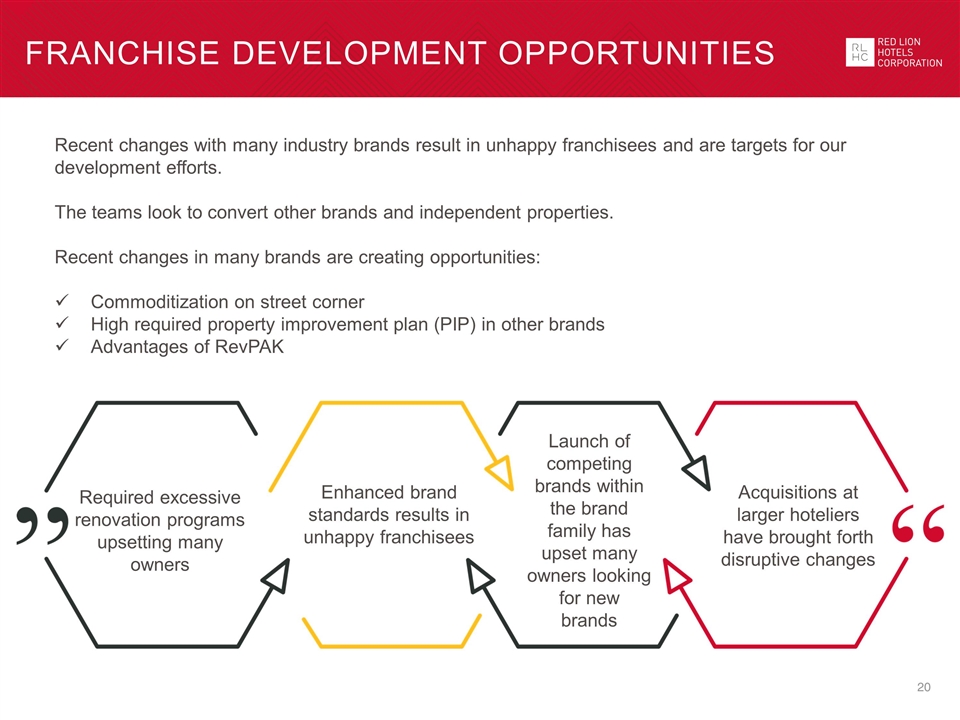

Franchise Development Opportunities Recent changes with many industry brands result in unhappy franchisees and are targets for our development efforts. The teams look to convert other brands and independent properties. Recent changes in many brands are creating opportunities: Commoditization on street corner High required property improvement plan (PIP) in other brands Advantages of RevPAK Required excessive renovation programs upsetting many owners Enhanced brand standards results in unhappy franchisees Launch of competing brands within the brand family has upset many owners looking for new brands Acquisitions at larger hoteliers have brought forth disruptive changes

Recent results & outlook - 2017

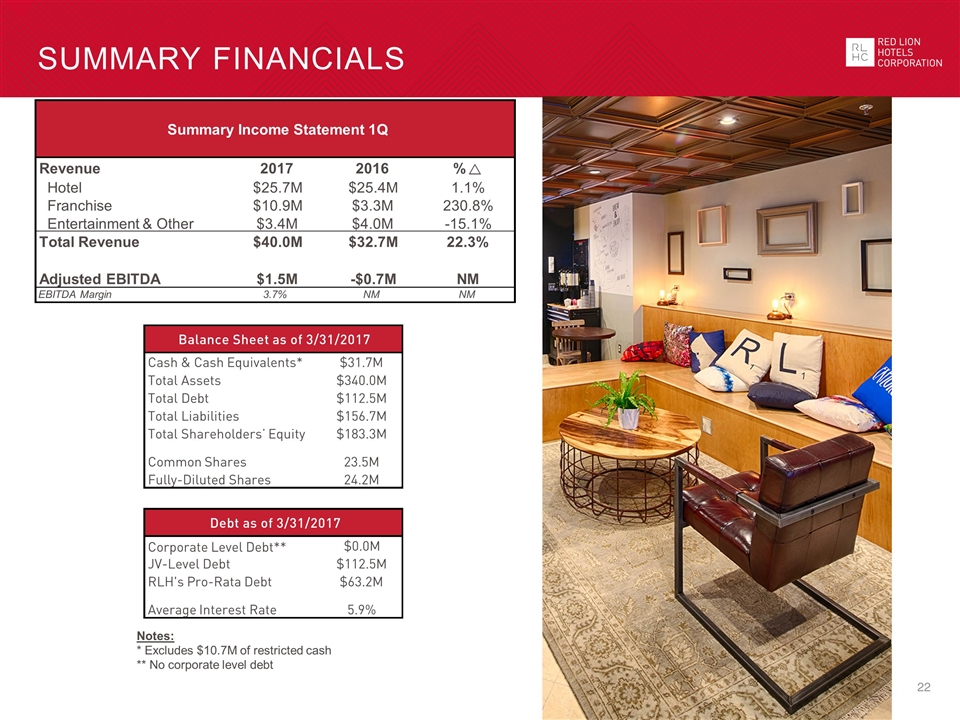

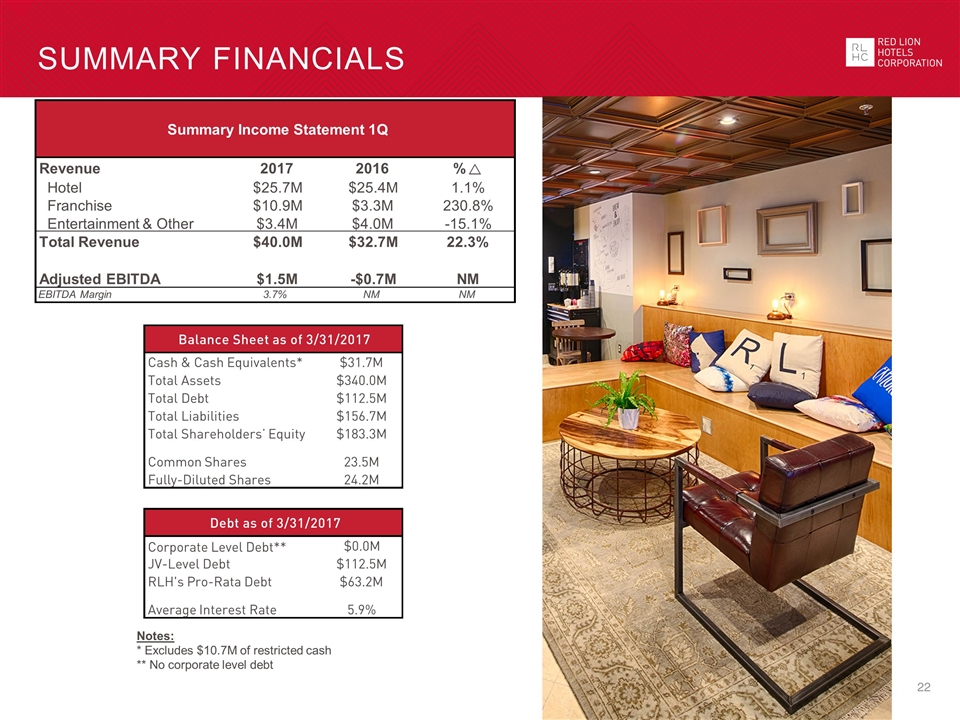

Summary Financials Notes: * Excludes $10.7M of restricted cash ** No corporate level debt Cash & Cash Equivalents* $31.7M Total Assets $340.0M Total Debt $112.5M Total Liabilities $156.7M Total Shareholders’ Equity $183.3M Common Shares 23.5M Fully-Diluted Shares 24.2M Corporate Level Debt** $0.0M JV-Level Debt $112.5M RLH's Pro-Rata Debt $63.2M Average Interest Rate 5.9% Balance Sheet as of 3/31/2017 Debt as of 3/31/2017 Revenue 2017 2016 % r Hotel $25.7M $25.4M 1.1% Franchise $10.9M $3.3M 230.8% Entertainment & Other $3.4M $4.0M -15.1% Total Revenue $40.0M $32.7M 22.3% Adjusted EBITDA $1.5M -$0.7M NM EBITDA Margin 3.7% NM NM Summary Income Statement 1Q

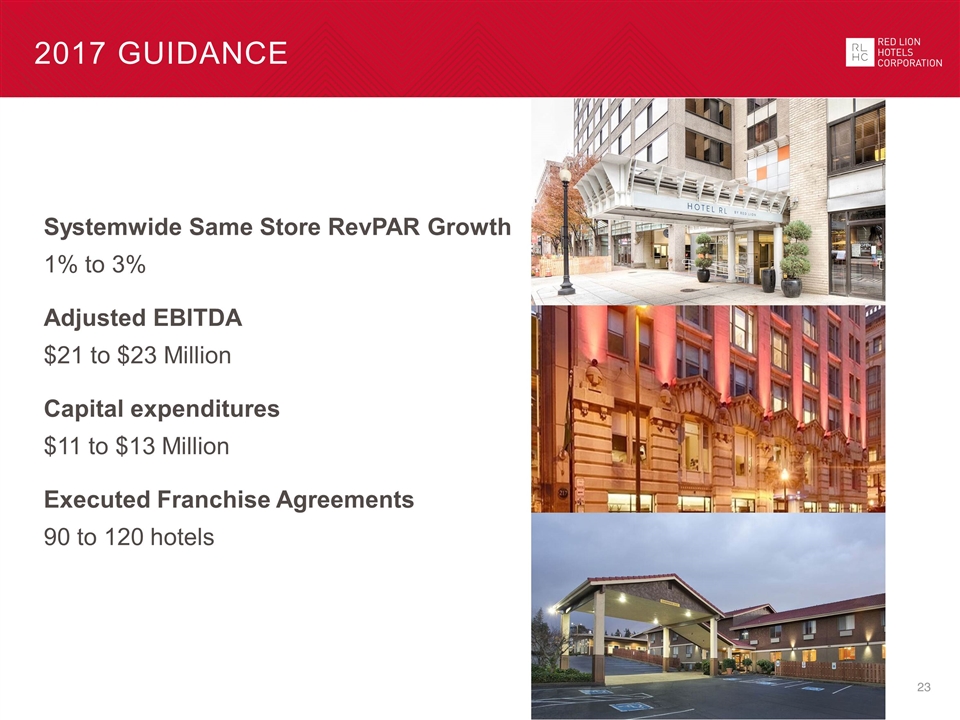

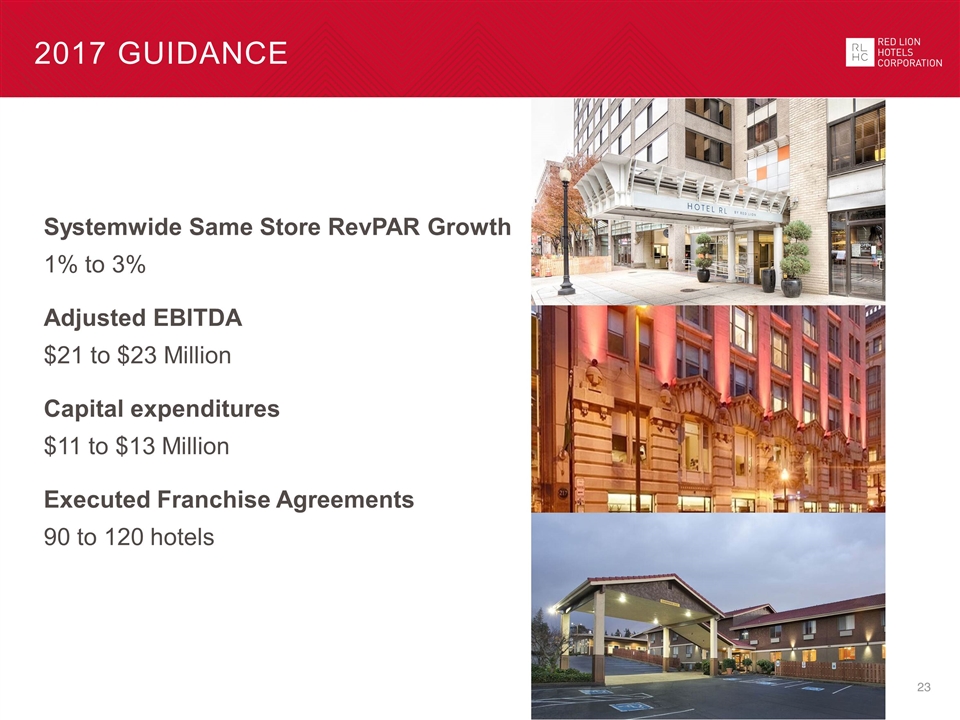

2017 Guidance Systemwide Same Store RevPAR Growth 1% to 3% Adjusted EBITDA $21 to $23 Million Capital expenditures $11 to $13 Million Executed Franchise Agreements 90 to 120 hotels

Strong Leadership Team Well-Respected Hospitality Veterans Driving Corporate Strategy Greg Mount, President & CEO 30+ Year Industry Veteran JV Real Estate Expert Proven Growth Strategist Roger Bloss, President, Global Development 40+ Years Hospitality Experience Executive positions with major hotel franchise companies Founded Vantage in 1996 Doug Ludwig , CFO & Treasurer 30+ Year Industry Veteran Former CFO of Four Seasons Experienced change agent in asset light business models Extensive global financing and capital raising experience Bill Linehan, EVP & Chief Marketing Officer 30+ Hotel Brand Positioning Digital Marketing Strategist Bernie Moyle, EVP & COO 18+ Years of commercial law Acquisition & Growth Specialist

Investment Highlights * Data as of March 31, 2017 Asset Light Franchise Model Strong Organic Growth State of the Art Guest Mgmt Platform Innovative Rewards Program Seasoned Leadership Team Balanced Sheet Poised for Growth

Appendix

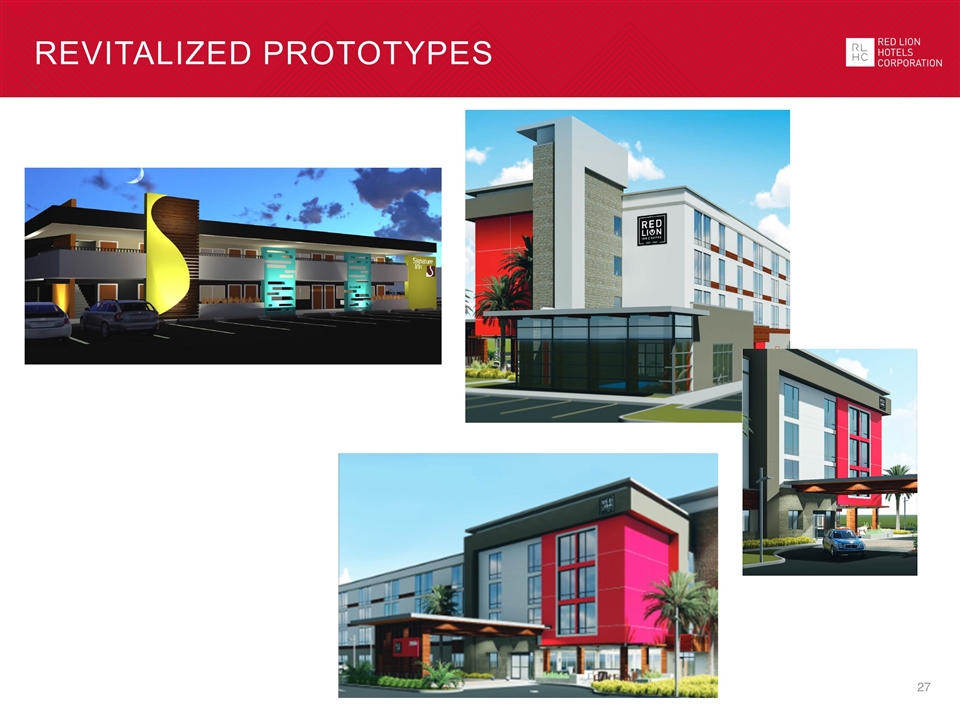

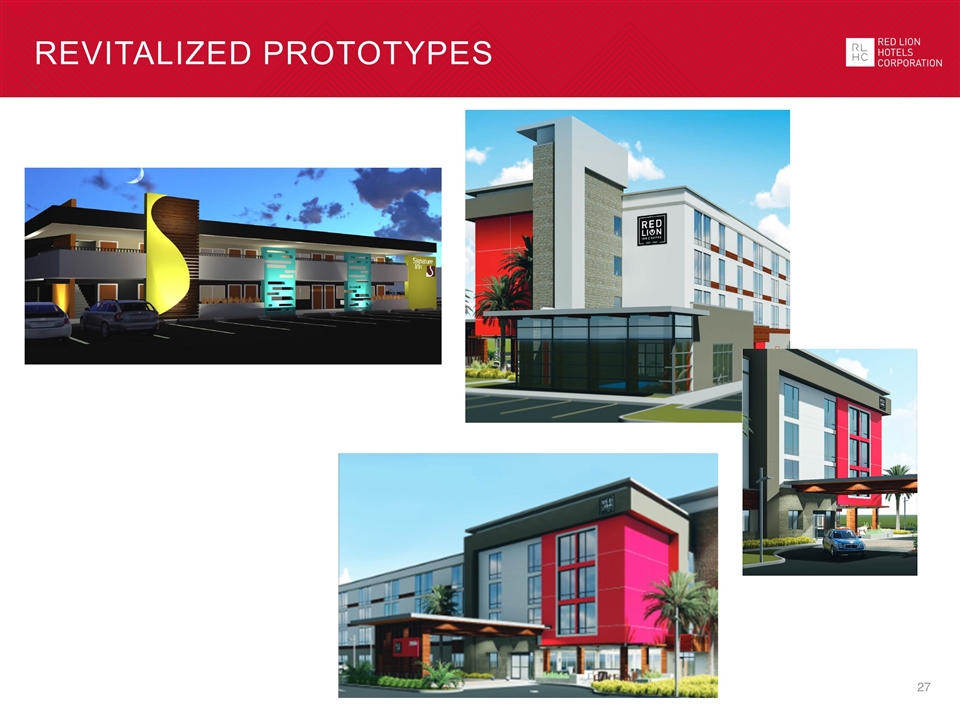

Revitalized Prototypes

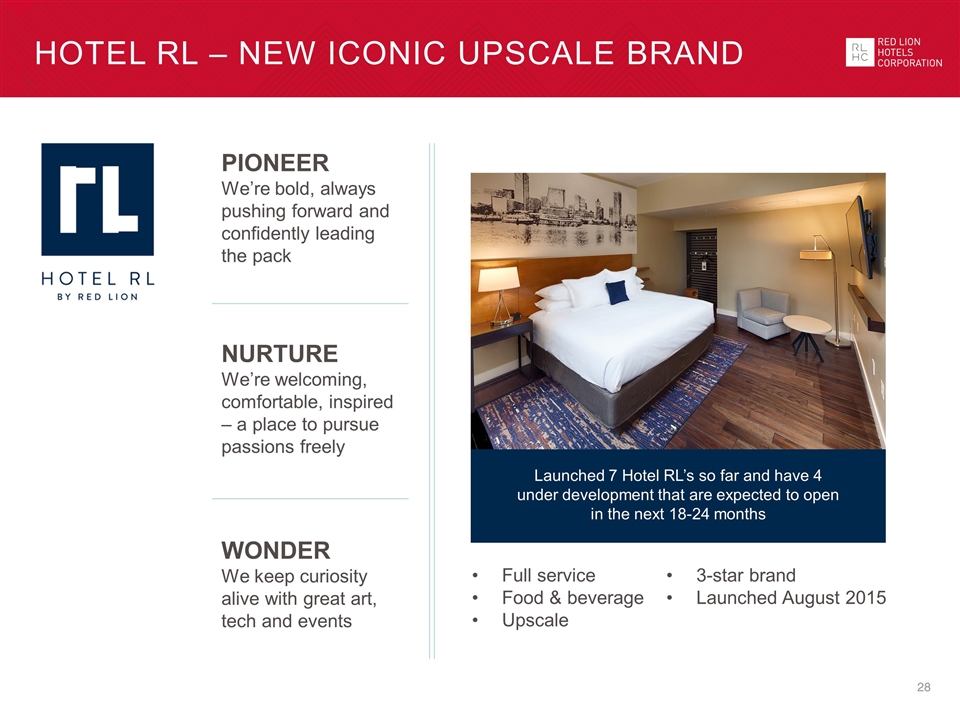

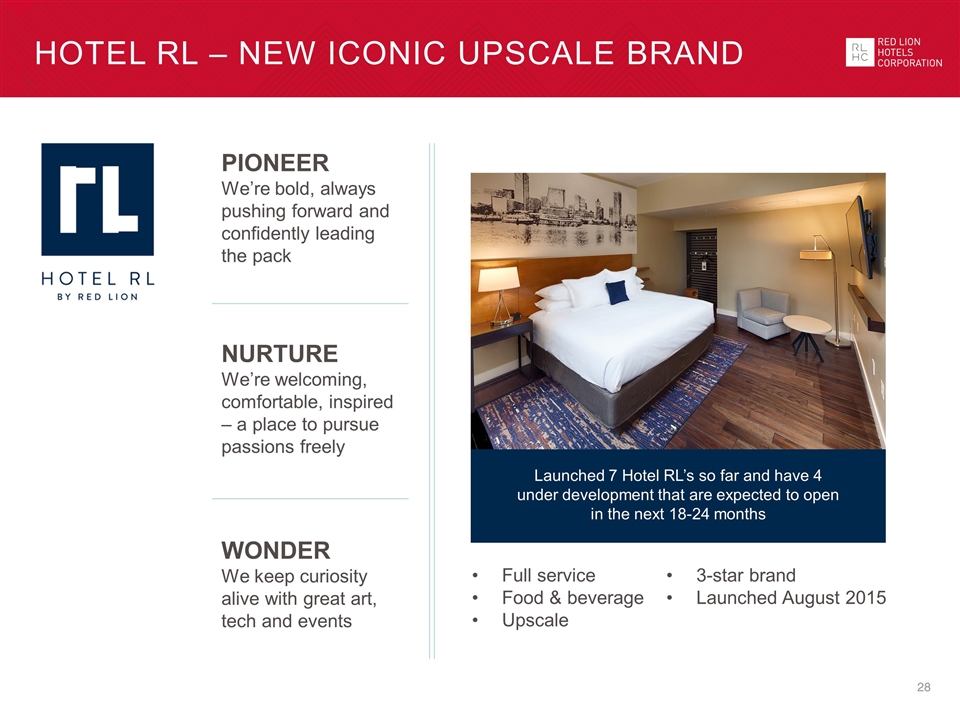

Full service Food & beverage Upscale PIONEER We’re bold, always pushing forward and confidently leading the pack NURTURE We’re welcoming, comfortable, inspired – a place to pursue passions freely WONDER We keep curiosity alive with great art, tech and events Conversion opportunities: Ideal repositioning in the top US markets for conversion from Crowne Plaza, DoubleTree, Wyndham, Radisson, Quality Inn and independent brands Hotel RL – New Iconic Upscale Brand Launched 7 Hotel RL’s so far and have 4 under development that are expected to open in the next 18-24 months 3-star brand Launched August 2015

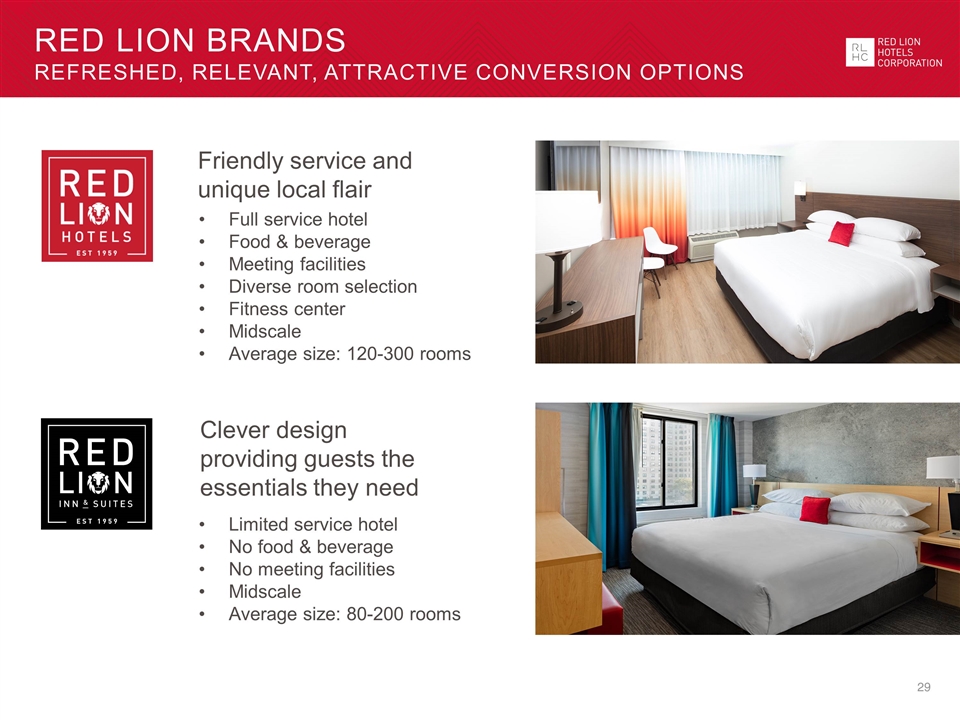

Friendly service and unique local flair Full service hotel Food & beverage Meeting facilities Diverse room selection Fitness center Midscale Average size: 120-300 rooms Red Lion Brands Refreshed, Relevant, Attractive Conversion Options Clever design providing guests the essentials they need Limited service hotel No food & beverage No meeting facilities Midscale Average size: 80-200 rooms

Settle Inn With big, comfy studio rooms, neighborly service and lots of space to relax and do your thing, we invite you to unpack, unwind and settle in. Midscale Select service Extended stay

GuestHouse Sit back, relax and enjoy a crisp, clean stay. We focus on getting all the comforts of home just right—spotless spaces, friendly faces, and service you can rely on—because when you stay here, you’re a guest in our house. Economy Select service Average size: 60-200 rooms

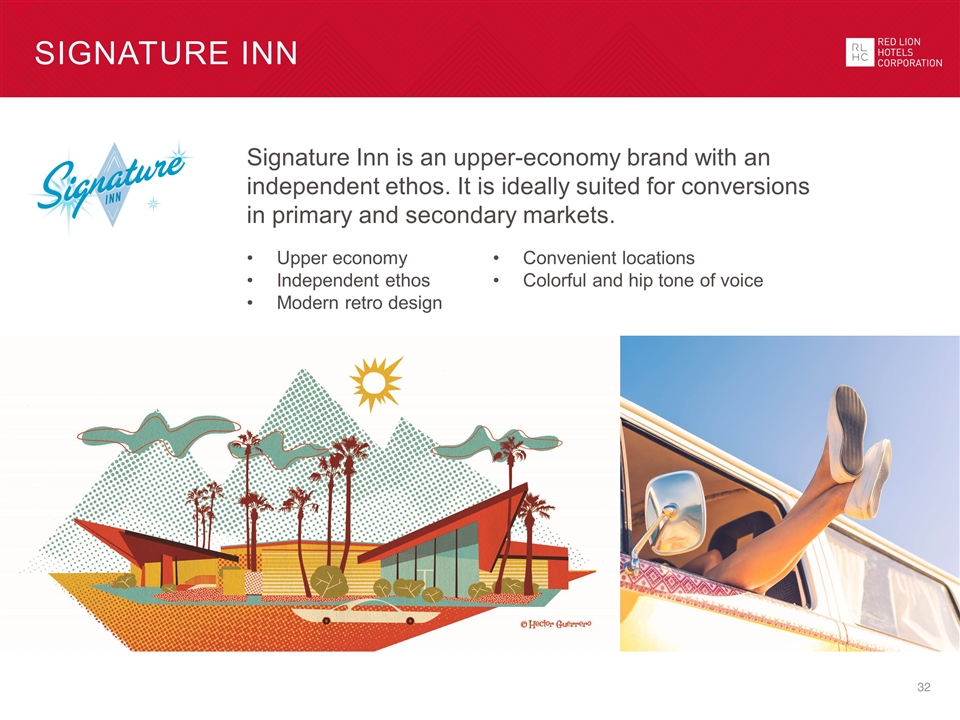

SIGNATURE INN Signature Inn is an upper-economy brand with an independent ethos. It is ideally suited for conversions in primary and secondary markets. Upper economy Independent ethos Modern retro design Convenient locations Colorful and hip tone of voice

Americas & Canadas best value inns Guests always leave with a sense of pride knowing they received the most for their money. It’s this value that makes us such an accessible option for solo travelers and families alike, and why we so strongly uphold our small business identity and the heritage from which it stems. Economy Focus on comfort essentials Best value Patriotism

COUNTRY HEARTH With a strong concentration on getting the essentials just right, our guests can expect an effortless hotel experience whether they are just coming in off the road or made a reservation in advance. Ideally suited for conversions in secondary and tertiary markets Lower economy Focus on comfort essentials Friendly and helpful staff Flexibility

RECONCILIATION OF adjusted ebitda