Annual Per-Participant Limits on Awards. The Restated Plan limits the size of awards that may be granted during any one calendar year to any participant.

Performance-Based Awards. The Restated Plan permits the grant of performance-based stock awards that vest or are earned only upon the attainment of specified performance goals.

Minimum Restriction Period for All Awards. The Restated Plan requires all awards to be subject to a minimum restriction period of 12 months from the date of grant, except in the case of death, disability, retirement, termination of employment, a change of control, another event as determined by the Committee or 5% of the aggregate share reserve.

No Transfers for Value. Participants are not permitted to transfer awards for value under the Restated Plan.

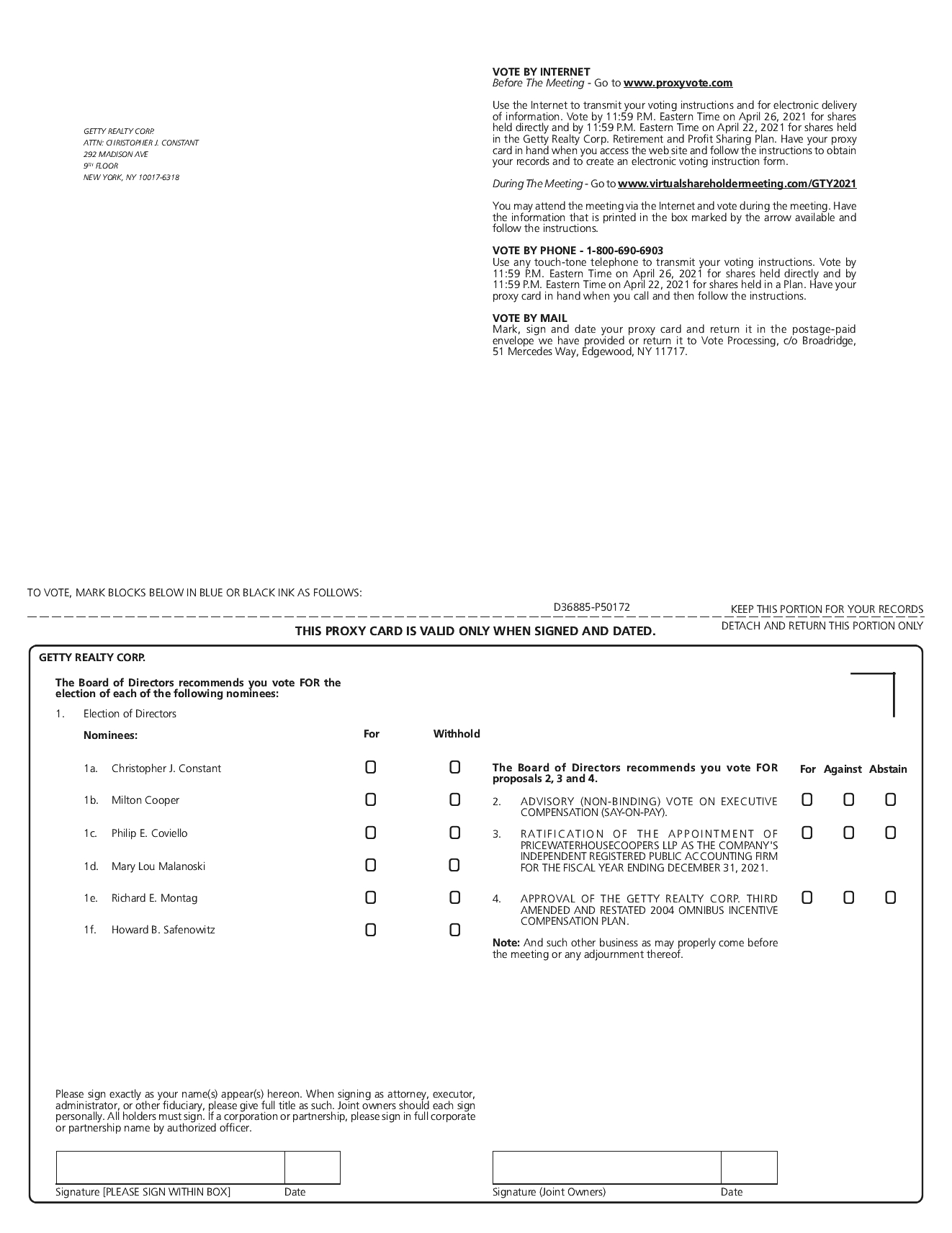

Overview of the Restated Plan

The following summary describes the material features of the Restated Plan. The summary is qualified by reference to the full text of the Restated Plan, which is annexed to this Proxy Statement as Appendix A.

Administration

Generally, the Restated Plan will be administered by the Compensation Committee; provided however, that the full Board of Directors, acting by a majority of its members in office, will conduct the general administration of the Restated Plan with respect to awards granted to independent directors. The Compensation Committee will have the authority to administer the Restated Plan, including the power to determine eligibility, the types and sizes of awards, the price and timing of awards, terms of vesting, the acceleration or waiver of any vesting restriction and the timing and manner of settling vested awards. In its absolute discretion, the Board of Directors may at any time and from time to time exercise any and all rights and duties of the Compensation Committee under the Restated Plan, except with respect to matters which under SEC Rule 16b-3 or any regulations or rules issued thereunder, are required to be determined in the sole discretion of the Compensation Committee.

Eligibility

The individuals eligible to participate in the Restated Plan will include all (approximately 30) employees of the Company and its subsidiaries, as determined by the Compensation Committee, and all members of the Board of Directors, comprised of up to seven persons.

Limitation on Awards and Shares Available

If approved, an aggregate of 4,000,000 shares of our common stock (which includes the 2,500,000 share increase request) will be available for grant pursuant to the Restated Plan, as measured from the date of inception of the plan in May 2004. As of March 2, 2021, approximately 302,341 shares of common stock of the current share reserve of 1,500,000 shares remain available for grant, subject to adjustments for changes in our capitalization (as more fully described below) and restoration of shares resulting from award forfeitures and the like.

The shares of common stock covered by the Restated Plan will be authorized but unissued shares. As of March 2, 2021, the fair market value of a share of our common stock, determined by the last reported sale price per share of the common stock on such date as quoted on the New York Stock Exchange, was $28.38. If any right to acquire shares of common stock under any award under the Restated Plan expires, is forfeited or is canceled, or is settled in whole or in part for cash as permitted by the Restated Plan, the number of shares subject to such canceled, forfeited or expired award, and the number of shares with respect to which an award was settled in cash, again may be awarded under the Restated Plan.

The Restated Plan has limitations on the size of awards that may be granted during any one calendar year to any one participant. Specifically, subject to adjustments for changes in our capitalization, the maximum number of shares of common stock that may be made subject to awards granted under the Restated Plan during a calendar year to any one participant is, in the aggregate, 150,000 shares, and solely with respect to cash performance awards and dividend equivalent awards granted to such participants, the maximum dollar amount that may be earned thereunder for any calendar year by any one participant is $2,500,000.

In the event that the Administrator determines that any dividend or other distribution (whether in the form of cash, common stock, other securities or other property), recapitalization, reclassification, stock split, reverse stock