QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on August 30, 2001

Registration No. 333-49858

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

POST-EFFECTIVE

AMENDMENT NO. 1

to

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ABGENIX, INC.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 2836 | 94-3248826 |

(State or Other Jurisdiction of

Incorporation or Organization) | (Primary Standard Industrial

Classification Code Number) | (I.R.S. Employer

Identification No.) |

6701 Kaiser Drive

Fremont, CA 94555

(510) 608-6500

(Address, Including Zip Code, and Telephone Number, Including Area Code,

of Registrant's Principal Executive Offices)

R. Scott Greer

Chief Executive Officer

Abgenix, Inc.

6701 Kaiser Drive

Fremont, CA 94555

(510) 608-6500

Susan L. Thorner

Vice President, General Counsel and Secretary

Abgenix, Inc.

6701 Kaiser Drive

Fremont, CA 94555

(510) 608-6500

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

With a copy to:

William H. Hinman, Esq.

Simpson Thacher & Bartlett

3330 Hillview Avenue

Palo Alto, CA 94304

(650) 251-5000

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If the securities being registered on this form are being offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. /x/

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / /

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. / /

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

1,418,705 Shares

Common Stock

The holders of our common stock who are identified as selling shareholders in this prospectus may offer and sell from time to time up to 1,418,705 shares of our common stock by using this prospectus. We and one of our shareholders sold 4,050,000 shares of our common stock to the selling shareholders in a private placement transaction on November 6, 2000.

The offering price for our common stock may be the market price for our common stock prevailing at the time of sale, a price related to the prevailing market price, a negotiated price or such other price as the selling shareholders determine from time to time. We will not receive any of the proceeds from the sales of the shares.

Our common stock is traded on the Nasdaq National Market under the ticker symbol "ABGX." On August 27, 2001, the closing sale price of our common stock, as reported by Nasdaq, was $30.08 per share.

An investment in our common stock involves a high degree of risk. See "Risk Factors" beginning on page 1 of this prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus is August 30, 2001.

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information different from that contained in this prospectus. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our common stock.

TABLE OF CONTENTS

| RISK FACTORS | | 1 |

| CERTAIN INFORMATION | | 17 |

| USE OF PROCEEDS | | 17 |

| PRICE RANGE OF COMMON STOCK | | 18 |

| DIVIDEND POLICY | | 18 |

| SELECTED CONSOLIDATED FINANCIAL DATA | | 19 |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | | 20 |

| BUSINESS | | 33 |

| MANAGEMENT | | 61 |

| CERTAIN TRANSACTIONS | | 75 |

| DESCRIPTION OF CAPITAL STOCK | | 76 |

| SHARES ELIGIBLE FOR FUTURE SALE | | 79 |

| PRINCIPAL SHAREHOLDERS | | 79 |

| SELLING SHAREHOLDERS | | 81 |

| PLAN OF DISTRIBUTION | | 82 |

| WHERE YOU CAN FIND MORE INFORMATION | | 83 |

| LEGAL MATTERS | | 83 |

| EXPERTS | | 83 |

| INDEX TO CONSOLIDATED FINANCIAL STATEMENTS | | F-1 |

Abgenix and the Abgenix logo are trademarks of Abgenix. XenoMouse® is a registered trademark of Xenotech, Inc., a wholly-owned subsidiary of Abgenix. XenoMax™ is a trademark of Abgenix. SLAM™ is a trademark of Abgenix Biopharma, Inc. registered in Canada. This prospectus also contains trademarks of third parties.

FORWARD-LOOKING STATEMENTS

This prospectus includes forward-looking statements based largely on our current expectations and projections about future events and financial trends affecting the financial condition of our business. The words "believe," "may," "will," "estimate," "continue," "anticipate," "intend," "expect" and similar expressions identify these forward-looking statements. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described below under the caption "Risk Factors." In light of these risks and uncertainties, the forward-looking events and circumstances discussed in this prospectus may not occur and actual results could differ materially from those anticipated in the forward-looking statements. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

RISK FACTORS

Investing in our common stock involves a high degree of risk. In addition to the other information in this prospectus, you should carefully consider the risks described below before purchasing our common stock. If any of the following risks actually occurs, our business could be materially harmed, and our financial condition and results of operations could be materially harmed. As a result, the trading price of our common stock could decline, and you might lose all or part of your investment.

Risks Related to the Development and Commercialization of our Products

Our XenoMouse and XenoMax technologies may not produce safe, efficacious or commercially viable products.

Our XenoMouse and XenoMax technologies are new approaches to the generation of antibody therapeutic products. We have not commercialized any antibody products based on our technologies. Moreover, we are not aware of any commercialized, fully human antibody therapeutic products that have been generated from any technologies similar to ours. Our antibody product candidates are still at an early stage of development. Clinical trials have begun with respect to only four fully human antibody product candidates generated by XenoMouse technology. We cannot be certain that either XenoMouse technology or XenoMax technology will generate antibodies against every antigen to which they are exposed in an efficient and timely manner, if at all. Furthermore, XenoMouse technology and XenoMax technology may not result in any meaningful benefits to our current or potential customers or in product candidates that are safe and efficacious for patients. If our technologies fail to generate antibody product candidates that lead to the successful development and commercialization of products, our business, financial condition and results of operations will be materially harmed.

Successful development of our products is uncertain.

Our development of current and future product candidates, either alone or in conjunction with collaborators, is subject to the risks of failure inherent in the development of new pharmaceutical products and products based on new technologies. These risks include:

- •

- delays in product development, clinical testing or manufacturing;

- •

- unplanned expenditures in product development, clinical testing or manufacturing;

- •

- failure in clinical trials or failure to receive regulatory approvals;

- •

- emergence of superior or equivalent products;

- •

- inability to manufacture on our own, or through others, product candidates on a commercial scale;

- •

- inability to market products due to third-party proprietary rights;

- •

- election by our customers not to pursue product development;

- •

- failure by our customers to develop products successfully; and

- •

- failure to achieve market acceptance.

Because of these risks, our research and development efforts and those of our customers and collaborators may not result in any commercially viable products. If a significant portion of these development efforts is not successfully completed, required regulatory approvals are not obtained or any approved products are not commercially successful, our business, financial condition and results of operations will be materially harmed.

1

Clinical trials for our product candidates will be expensive and their outcome is uncertain.

Conducting clinical trials is a lengthy, time-consuming and expensive process. Before obtaining regulatory approvals for the commercial sale of any products, we must demonstrate through pre-clinical testing and clinical trials that our product candidates are safe and effective for use in humans. We will incur substantial expense for, and devote a significant amount of time to, pre-clinical testing and clinical trials.

Historically, the results from pre-clinical testing and early clinical trials have often not been predictive of results obtained in later clinical trials. A number of new drugs and biologics have shown promising results in clinical trials, but subsequently failed to establish sufficient safety and efficacy data to obtain necessary regulatory approvals. Data obtained from pre-clinical and clinical activities are susceptible to varying interpretations, which may delay, limit or prevent regulatory approval. In addition, regulatory delays or rejections may be encountered as a result of many factors, including changes in regulatory policy during the period of product development.

As of June 30, 2001 three of our proprietary product candidates, ABX-CBL, ABX-IL8 and ABX-EGF, were in clinical trials. Patient follow-up for these clinical trials has been limited. To date, data obtained from these clinical trials has been insufficient to demonstrate safety and efficacy under applicable Federal Drug Administration, or FDA, guidelines. As a result, this data will not support an application for regulatory approval without further clinical trials. Clinical trials conducted by us or by third parties on our behalf may not demonstrate sufficient safety and efficacy to obtain the requisite regulatory approvals for ABX-CBL, ABX-IL8, ABX-EGF or any other potential product candidates. Regulatory authorities may not permit us to undertake any additional clinical trials for our product candidates.

In addition, our other product candidates are in pre-clinical development, but we have not submitted investigational new drug applications nor begun clinical trials for these product candidates. Our pre-clinical or clinical development efforts may not be successfully completed, we may not file further investigational new drug applications and clinical trials may not commence as planned.

Completion of clinical trials may take several years or more. The length of time generally varies substantially according to the type, complexity, novelty and intended use of the product candidate. Our commencement and rate of completion of clinical trials may be delayed by many factors, including:

- •

- inability to manufacture sufficient quantities of materials for use in clinical trials;

- •

- slower than expected rate of patient recruitment;

- •

- inability to adequately follow patients after treatment;

- •

- unforeseen safety issues;

- •

- lack of efficacy during the clinical trials; or

- •

- government or regulatory delays.

We have limited experience in conducting and managing clinical trials. We rely on third parties, including our customers, to assist us in managing and monitoring clinical trials. Our reliance on these third parties may result in delays in completing, or in failure to complete, these trials if the third parties fail to perform under our agreements with them.

Our product candidates may fail to demonstrate safety and efficacy in clinical trials. This failure may delay development of other product candidates and hinder our ability to conduct related pre-clinical testing and clinical trials. As a result of these failures, we may also be unable to obtain additional financing. Any delays in, or termination of, our clinical trials could materially harm our business, financial condition and results of operations.

2

We currently rely on a sole source third-party manufacturer.

We currently rely, and will continue to rely for at least the next five years, on a single contract manufacturer, Lonza Biologics (Lonza), to produce ABX-CBL, ABX-IL8 and ABX-EGF under good manufacturing practice regulations, for use in our clinical trials. In December 2000, we entered into a manufacturing supply agreement with Lonza, under which Lonza will make available exclusively to us, for a period of five years, a cell culture production suite, with associated purification capacity, within Lonza's facility. As a result of this agreement, we expect to gain access to production capacity and scheduling flexibility similar to owning the production capability, while Lonza retains responsibility for staffing and operating the facility. The term of the agreement is five years with an option to extend the term. The dedicated cell culture production suite is being refurbished and is expected to be operational and available to us in the third or fourth quarter of 2001. In July 2001, we entered into an agreement giving us the right to enter into exclusive negotiations with Lonza for an additional manufacturing supply agreement under which Lonza will make available to us, for a period of up to five years, extendable for an additional two years, one third of a cell culture production suite for large-scale manufacturing of products. The exclusive negotiation period will expire on December 31, 2001, subject to a limited further extension. We currently anticipate that construction of the facility will be completed in the fourth quarter of 2004.

Lonza has a limited number of facilities in which our product candidates can be produced and has limited experience in manufacturing ABX-CBL, ABX-IL8 and ABX-EGF in quantities sufficient for conducting clinical trials or for commercialization. We currently rely on Lonza to produce our product candidates under good manufacturing practice regulations, which meet acceptable standards for our clinical trials.

Third-party manufacturers may encounter difficulties in scaling up production, including problems involving production yields, quality control and assurance, shortage of qualified personnel, compliance with FDA regulations, production costs, and development of advanced manufacturing techniques and process controls. Our third-party manufacturer may not perform as agreed or may not remain in the contract manufacturing business for the time required by us to successfully produce and market our product candidates. If our third-party manufacturer fails to deliver the required quantities of our product candidates for clinical use on a timely basis and at commercially reasonable prices, and we fail to find a replacement manufacturer or develop our own manufacturing capabilities, our business, financial condition and results of operations will be materially harmed.

Our own ability to manufacture is uncertain.

We are building our own manufacturing facility for the manufacture of products for clinical trials and early commercial launch, in compliance with FDA good manufacturing practices. In May 2000, we signed a long-term lease for a building to contain this manufacturing facility. Construction has started and this facility is expected to be operational by year-end 2002. The costs of the facility, including design, leasehold improvements and equipment, will approximate $140 million. Construction of this facility may take longer than expected, and the planned and actual construction costs of building and qualifying the facility for regulatory compliance may be higher than expected. The process of manufacturing antibody products is complex. We have no experience in the clinical or commercial scale manufacturing of ABX-CBL, ABX-IL8 and ABX-EGF, or any other antibody products. Such antibody products will also need to be manufactured in a facility and by a process that comply with FDA and other regulations. It may take a substantial period of time to begin producing antibodies in compliance with such regulations. Our manufacturing operations will be subject to ongoing, periodic unannounced inspection by the FDA and state agencies to ensure compliance with good manufacturing practices. If we are unable to establish and maintain a manufacturing facility within our planned time and cost parameters, the development and sales of our products and our financial performance may be materially harmed.

3

We also may encounter problems with the following:

- •

- production yields;

- •

- quality control and assurance;

- •

- shortages of qualified personnel;

- •

- on-going compliance with FDA regulations;

- •

- production costs; and

- •

- development of advanced manufacturing techniques and process controls.

We continually evaluate our options for commercial production of our antibody products, which include use of third-party manufacturers, establishing our own commercial scale manufacturing facility or entering into a manufacturing joint venture relationship with a third party. We are aware of only a limited number of companies on a worldwide basis who operate manufacturing facilities in which our product candidates can be manufactured under good manufacturing practice regulations, a requirement for all pharmaceutical products. It would take a substantial period of time for a contract manufacturing facility that has not been producing antibodies to begin producing antibodies under good manufacturing practice regulations. We may not be able to contract with any of these companies on acceptable terms, if at all.

In addition, we and any third-party manufacturer will be required to register with the FDA and other regulatory authorities any manufacturing facilities in which our antibody products are manufactured. The facilities will then be subject to inspections confirming compliance with FDA good manufacturing practice or other regulations. If we or any of our third-party manufacturers fail to maintain regulatory compliance, our business, financial condition and results of operations will be materially harmed.

We will need to find third parties to license and develop many of our product candidates.

Our strategy for the development and commercialization of antibody therapeutic products depends, in large part, upon the formation of collaboration agreements with third parties. Potential third parties include pharmaceutical and biotechnology companies, academic institutions and other entities. We must enter into these agreements to successfully develop and commercialize product candidates. These agreements are necessary in order for us to:

- •

- access proprietary antigens for which we can generate fully human antibody products;

- •

- fund our research and development activities;

- •

- fund pre-clinical development, clinical trials and manufacturing;

- •

- seek and obtain regulatory approvals; and

- •

- successfully commercialize existing and future product candidates.

Only a limited number of fully human antibody product candidates have been generated pursuant to our collaboration agreements, and only four antibody product candidates generated with XenoMouse technology have entered clinical testing. These product candidates may not result in commercially successful products. Current or future collaboration agreements may not be successful. If we fail to maintain our existing collaboration agreements or to enter into additional agreements, our business, financial condition and results of operations could be materially harmed.

Our dependence on licensing and other agreements with third parties subjects us to a number of risks. These agreements may not be on terms that prove favorable to us, and collaborators typically are afforded significant discretion in electing whether to pursue any of the planned activities. Licensing and

4

other contractual agreements may require us to relinquish our rights to certain of our technologies, products or marketing territories. We cannot control the amount or timing of resources our collaborators may devote to the product candidates, and collaborators may not perform their obligations as expected. Additionally, business combinations or significant changes in a collaborator's business strategy may adversely affect a collaborator's willingness or ability to complete its obligations under the arrangement. Even if we fulfill our obligations under an agreement, typically our collaborators can terminate the agreement at any time following proper written notice. If any of our collaborators were to terminate or breach our agreement, or otherwise fail to complete its obligations in a timely manner, our business, financial condition and results of operations may be materially harmed. If we are not able to establish further collaboration agreements or any or all of our existing agreements are terminated, we may be required to seek new collaborators or to undertake product development and commercialization at our own expense. Such an undertaking may:

- •

- limit the number of product candidates that we will be able to develop and commercialize;

- •

- reduce the likelihood of successful product introduction;

- •

- significantly increase our capital requirements; and

- •

- place additional strain on our management's time.

Existing or future collaborators may pursue alternative technologies, including those of our competitors. Disputes may arise with respect to the ownership of rights to any technology or products developed with any current or future collaborator. Lengthy negotiations with potential new collaborators or disagreements between us and our collaborators may lead to delays or termination in the research, development or commercialization of product candidates or result in time-consuming and expensive litigation or arbitration. If any of our collaborators pursue alternative technologies or fail to develop or commercialize successfully any product candidate to which they have obtained rights from us, our business, financial condition and results of operations may be materially harmed.

We do not have marketing and sales experience.

We do not have marketing, sales or distribution experience or capability. For certain products, we may establish an internal marketing and sales force. We intend to enter into arrangements with third parties to market and sell most of our products. We may not be able to enter into marketing and sales arrangements with others on acceptable terms, if at all. To the extent that we enter into marketing and sales arrangements with other companies, our revenues, if any, will depend on the efforts of others. These efforts may not be successful. If we are unable to enter into third-party arrangements, then we must develop a marketing and sales force, which may need to be substantial in size, in order to achieve commercial success for any product candidate approved by the FDA. We may not successfully develop marketing and sales capabilities or have sufficient resources to do so. If we do develop such capabilities, we will compete with other companies that have experienced and well-funded marketing and sales operations. If we fail to establish successful marketing and sales capabilities or fail to enter into successful marketing arrangements with third parties, our business, financial condition and results of operations will be materially harmed.

We are subject to extensive government regulation and we may not be able to obtain regulatory approvals.

Our product candidates under development are subject to extensive and rigorous domestic government regulation. The FDA regulates, among other things, the development, testing, manufacture, safety, efficacy, record-keeping, labeling, storage, approval, advertising, promotion, sale and distribution of biopharmaceutical products. If our products are marketed abroad, they also are subject to extensive regulation by foreign governments. None of our product candidates has been approved for sale in the United States or any foreign market. The regulatory review and approval process, which includes

5

pre-clinical studies and clinical trials of each product candidate, is lengthy, expensive and uncertain. Securing FDA approval requires the submission of extensive pre-clinical and clinical data and supporting information to the FDA for each indication to establish the product candidates' safety and efficacy. The approval process takes many years, requires the expenditure of substantial resources, involves post-marketing surveillance, and may involve ongoing requirements for post-marketing studies. Regulatory requirements are subject to frequent change. Delays in obtaining regulatory approvals may:

- •

- adversely affect the successful commercialization of any drugs that we or our customers develop;

- •

- impose costly procedures on us or our customers;

- •

- diminish any competitive advantages that we or our customers may attain; and

- •

- adversely affect our receipt of revenues or royalties.

Certain material changes to an approved product such as manufacturing changes or additional labeling claims are subject to further FDA review and approval. Any required approvals, once obtained, may be withdrawn. Compliance with other regulatory requirements may not be maintained. Further, if we fail to comply with applicable FDA and other regulatory requirements at any stage during the regulatory process, we or our third-party manufacturers may be subject to sanctions, including:

- •

- delays;

- •

- warning letters;

- •

- fines;

- •

- product recalls or seizures;

- •

- injunctions;

- •

- refusal of the FDA to review pending market approval applications or supplements to approval applications;

- •

- total or partial suspension of production;

- •

- civil penalties;

- •

- withdrawals of previously approved marketing applications; and

- •

- criminal prosecutions.

We expect to rely on our customers to file investigational new drug applications and generally direct the regulatory approval process for many of our products. Our customers may not be able to conduct clinical testing or obtain necessary approvals from the FDA or other regulatory authorities for any product candidates. If we fail to obtain required governmental approvals, our customers will experience delays in or be precluded from marketing products developed through our research. In addition, the commercial use of our products will be precluded. Delays and limitations may materially harm our business, financial condition and results of operations.

We and our third-party manufacturers also are required to comply with the applicable FDA current good manufacturing practice regulations. Good manufacturing practice regulations include requirements relating to quality control and quality assurance as well as the corresponding maintenance of records and documentation. Manufacturing facilities are subject to inspection by the FDA. These facilities must be approved before we can use them in commercial manufacturing of our products. We or our third-party manufacturers may not be able to comply with the applicable good manufacturing practice requirements and other FDA regulatory requirements. If we or our third-party manufacturers fail to comply, our business, financial condition and results of operations will be materially harmed.

6

Market acceptance of our products is uncertain.

Our product candidates may not gain market acceptance among physicians, patients, healthcare payors and the medical community. We may not achieve market acceptance even if clinical trials demonstrate safety and efficacy, and the necessary regulatory and reimbursement approvals are obtained. The degree of market acceptance of any product candidates that we develop will depend on a number of factors, including:

- •

- establishment and demonstration of clinical efficacy and safety;

- •

- cost-effectiveness of our product candidates;

- •

- their potential advantage over alternative treatment methods;

- •

- reimbursement policies of government and third-party payors; and

- •

- marketing and distribution support for our product candidates, including the efforts of our collaborators where they have marketing and distribution responsibilities.

Physicians will not recommend therapies using our products until such time as clinical data or other factors demonstrate the safety and efficacy of such procedures as compared to conventional drug and other treatments. Even if the clinical safety and efficacy of therapies using our antibody products is established, physicians may elect not to recommend the therapies for any number of other reasons, including whether the mode of administration of our antibody products is effective for certain indications. For example, antibody products are typically administered by infusion or injection, which requires substantial cost and inconvenience to patients. Our product candidates, if successfully developed, will compete with a number of drugs and therapies manufactured and marketed by major pharmaceutical and other biotechnology companies. Our products may also compete with new products currently under development by others. Physicians, patients, third-party payors and the medical community may not accept and utilize any product candidates that we or our customers develop. If our products do not achieve significant market acceptance, our business, financial condition and results of operations will be materially harmed.

Risks Related to our Finances

We are an early stage company.

You must evaluate us in light of the uncertainties and complexities present in an early stage biopharmaceutical company. Our product candidates are in early stages of development. We will require significant additional investment in research and development, pre-clinical testing and clinical trials, and regulatory and sales and marketing activities to commercialize current and future product candidates. Our product candidates, if successfully developed, may not generate sufficient or sustainable revenues to enable us to be profitable.

We have a history of losses.

We have incurred net losses in each of the last five years of operation, including net losses of $7.1 million in 1996, $35.9 million in 1997, $16.8 million in 1998, $20.5 million in 1999, $8.8 million in 2000 and $22.4 million in the six months ended June 30, 2001. As of June 30, 2001, our accumulated deficit was $121.0 million. Our losses to date have resulted principally from:

- •

- research and development costs relating to the development of our XenoMouse technology and antibody product candidates;

- •

- costs associated with certain agreements with Japan Tobacco and certain 1997 settlement and cross-licensing agreements with GenPharm International, Inc.;

7

- •

- in-process research and development costs and amortization of intangible assets associated with our acquisitions of Abgenix Biopharma Inc. (formerly known as ImmGenics Pharmaceuticals, Inc.), IntraImmune Therapies, Inc. and Xenotech;

- •

- general and administrative costs relating to our operations.

We expect to incur additional losses for the foreseeable future as a result of increases in our research and development costs, including costs associated with conducting pre-clinical development and clinical trials, and charges related to purchases of technology or other assets. We intend to invest significantly in our products prior to entering into licensing agreements. This will increase our need for capital and will result in losses for several years. We expect that the amount of operating losses will fluctuate significantly from quarter to quarter as a result of increases or decreases in our research and development efforts, the execution or termination of licensing and contractual agreements, and the initiation, success or failure of clinical trials.

Our future profitability is uncertain.

Prior to June 1996, our business was owned by Cell Genesys, Inc. and operated as a business unit of Cell Genesys. Since that time, we have funded our research and development activities primarily from private placements and public offerings of our securities and from revenues generated by our licensing and contractual agreements.

We expect that substantially all of our revenues for the foreseeable future will result from payments under licensing and other contractual arrangements and from interest income. To date, payments under licensing and other agreements have been in the form of option fees, reimbursement for research and development expenses, license fees and milestone payments. Payments under our existing and any future customer agreements will be subject to significant fluctuation in both timing and amount. Our revenues may not be indicative of our future performance or of our ability to continue to achieve such milestones. Our revenues and results of operations for any period may also not be comparable to the revenues or results of operations for any other period. We may not be able to:

- •

- enter into further licensing and other agreements;

- •

- successfully complete pre-clinical development or clinical trials;

- •

- obtain required regulatory approvals;

- •

- successfully develop, manufacture and market product candidates; or

- •

- generate additional revenues or profitability.

If we fail to achieve any of the above goals, our business, financial condition and results of operations will be materially harmed.

We may require additional financing.

We will continue to expend substantial resources for the expansion of research and development, including costs associated with conducting pre-clinical development and clinical trials. We will be required to expend substantial funds in the course of completing required additional development, pre-clinical testing and clinical trials of and regulatory approval for product candidates. Our future liquidity and capital requirements will depend on many factors, including:

- •

- the scope and results of pre-clinical development and clinical trials;

- •

- the retention of existing and establishment of further licensing and other agreements, if any;

- •

- continued scientific progress in our research and development programs;

8

- •

- the size and complexity of these programs;

- •

- the cost of establishing manufacturing capabilities and conducting commercialization activities and arrangements;

- •

- the time and expense involved in seeking regulatory approvals;

- •

- competing technological and market developments;

- •

- the time and expense of filing and prosecuting patent applications and enforcing patent claims;

- •

- our investment in, or acquisition of, other companies;

- •

- the amount of product in-licensing in which we engage; and

- •

- other factors not within our control.

We believe that our current cash balances, cash equivalents, marketable securities, and the cash generated from our licensing and contractual agreements will be sufficient to meet our operating and capital requirements for at least one year. We may choose to obtain additional financing from time to time. We may choose to raise additional funds through public or private financing, licensing and contractual agreements or other arrangements. We cannot be sure that any additional funding, if needed, will be available on terms favorable to us. Furthermore, any additional equity financing may be dilutive to our shareholders, and debt financing, if available, may involve restrictive covenants. We may also choose to obtain funding through licensing and other contractual agreements. Such agreements may require us to relinquish our rights to certain of our technologies, products or marketing territories. Our failure to raise capital when needed would harm our business, financial condition and results of operations.

Risks Related to Our Intellectual Property

Our patent position is uncertain and our success depends on our proprietary rights.

Our success depends in part on our ability to:

- •

- obtain patents;

- •

- protect trade secrets;

- •

- operate without infringing the proprietary rights of others; and

- •

- prevent others from infringing our proprietary rights.

We will be able to protect our proprietary rights from unauthorized use by third parties only to the extent that our proprietary rights are covered by valid and enforceable patents or are effectively maintained as trade secrets. We own six issued patents in the United States, one granted patent in Europe, and three granted patents in Japan, and we have several pending patent applications in the United States and abroad, each of which relates to XenoMouse technology and products generated by it. Our wholly owned subsidiary, Xenotech, owns two issued U.S. patents, one Australian patent, and several pending U.S. and foreign patent applications related to methods of treatment of bone disease in cancer patients. Our wholly owned subsidiary, Abgenix Biopharma, owns one issued U.S. patent and has one pending patent application in Canada and Europe relating to the Selected Lymphocyte Antibody Method, or SLAM, technology. Our wholly owned subsidiary, IntraImmune Therapies, is licensed under patents and pending applications in the United States and in Europe related to intrabody technology. In addition, we have seven issued U.S. patents and several pending patent applications in the United States and abroad that are jointly owned with Japan Tobacco relating to antibody technology or genetic manipulation. We attempt to protect our proprietary position by filing U.S. and foreign patent applications related to our proprietary technology, inventions and

9

improvements that are important to the development of our business. However, the patent position of biopharmaceutical companies involves complex legal and factual questions, and, therefore, enforceability cannot be predicted with certainty. Patents, if issued, may be challenged, invalidated or circumvented. Thus, any patents that we own or license from third parties may not provide any protection against competitors. Our pending patent applications, those we may file in the future, or those we may license from third parties, may not result in patents being issued. Also, patent rights may not provide us with adequate proprietary protection or competitive advantages against competitors with similar technologies. The laws of certain foreign countries do not protect our intellectual property rights to the same extent as do the laws of the United States.

In addition to patents, we rely on trade secrets and proprietary know-how. We seek protection, in part, through confidentiality and proprietary information agreements. These agreements may not provide meaningful protection or adequate remedies for our technology in the event of unauthorized use or disclosure of confidential and proprietary information, and, in addition, the parties may breach such agreements. Also, our trade secrets may otherwise become known to, or be independently developed by, our competitors. Furthermore, others may independently develop similar technologies or duplicate any technology that we have developed.

We may face challenges from third parties regarding the validity of our patents and proprietary rights.

Research has been conducted for many years in the antibody and transgenic animal fields. This has resulted in a substantial number of issued patents and an even larger number of pending patent applications. The publication of discoveries in the scientific or patent literature frequently occurs substantially later than the date on which the underlying discoveries were made. Our commercial success depends significantly on our ability to operate without infringing the patents and other proprietary rights of third parties. Our technologies may unintentionally infringe the patents or violate other proprietary rights of third parties. In the event of such infringement or violation, we and our customers may be prevented from pursuing product development or commercialization. Such a result could materially harm our business, financial condition and results of operations.

In March 1997, we entered into a cross-license and settlement agreement with GenPharm International, Inc. to avoid protracted litigation. Under the cross-license, we licensed on a non-exclusive basis certain patents, patent applications, third-party licenses and inventions pertaining to the development and use of certain transgenic rodents, including mice, that produce fully human antibodies that are integral to our products and business. Our business, financial condition and results of operations could be materially harmed if any of the parties breaches the cross-license agreement.

We have one granted European patent relating to XenoMouse technology that is currently undergoing opposition proceedings within the European Patent Office and the outcome of this opposition is uncertain.

GlaxoSmithKline, plc, or Glaxo, has a family of patents relating to certain methods for generating monoclonal antibodies that Glaxo is asserting against Genentech, Inc. in litigation that was commenced in 1999. On May 4, 2001, Genentech announced that a jury had determined that Genentech had not infringed Glaxo's patents and that all of the patent claims asserted against Genentech are invalid. We understand that Glaxo has filed a notice of appeal with the Court of Appeals for the Federal Circuit. If any of the claims of these patents are finally determined in the litigation to be valid, and if we were to use manufacturing processes covered by the patents to make our products, we may then need to obtain a license should one be available. Should a license be denied or unavailable on commercially reasonable terms, commercialization of one or more of our products could be impeded in any territories in which these claims were in force.

Genentech, Inc. owns a U.S. patent that issued in June 1998 relating to inhibiting the growth of tumor cells that involves an anti-EGF receptor antibody in combination with a cytotoxic factor.

10

ImClone Systems, Inc. owns or is licensed under a U.S. patent that issued in April 2001, relating to inhibiting the growth of tumor cells that involves an anti-EGF receptor antibody in combination with an anti-neoplastic agent. We believe there are strong arguments that all claims of both the Genentech patent and the ImClone patent are invalid. We are continuing to analyze the scope of these patents. We believe that currently all of the Company's activities relating to anti-EGFr monoclonal antibodies are within the exemption provided by the U.S. patent laws for uses reasonably related to obtaining FDA approval of a drug. Based on our product development plans, we do not expect the scope of our activities in this regard to change in the future prior to filing an application for a biologic license with the FDA. If the claims of either the Genentech patent or the ImClone patent are judicially determined to cover our activities with ABX-EGF and are held valid, we may be required to obtain a license to Genentech's or ImClone's patent, as the case may be, to label and sell ABX-EGF for some or all such combination indications. Should a license be denied or unavailable on commercially reasonable terms, our commercialization of ABX-EGF could be impeded in the United States.

In 2000, the Japanese Patent Office granted a patent to Kirin Beer Kabushiki Kaisha, one of our competitors, relating to non-human transgenic mammals. Kirin has filed corresponding patent applications in Europe and Australia. Kirin may also have filed a corresponding patent application in the United States. Our licensee, Japan Tobacco, has filed opposition proceedings against the Kirin patent. We cannot predict the outcome of those opposition proceedings, which may take years to be resolved. We are analyzing the patent to determine its relevance to our business and if appropriate will analyze the scope and validity of its claims.

The biotechnology and pharmaceutical industries have been characterized by extensive litigation regarding patents and other intellectual property rights. The defense and prosecution of intellectual property suits, United States Patent and Trademark Office interference proceedings, and related legal and administrative proceedings in the United States and internationally involve complex legal and factual questions. As a result, such proceedings are costly and time-consuming to pursue and their outcome is uncertain. Litigation may be necessary to:

- •

- enforce patents that we own or license;

- •

- protect trade secrets or know-how that we own or license; or

- •

- determine the enforceability, scope and validity of the proprietary rights of others.

If we become involved in any litigation, interference or other administrative proceedings, we could incur substantial expense and the efforts of our technical and management personnel could be significantly diverted. An adverse determination may subject us to loss of our proprietary position or to significant liabilities, or require us to seek licenses that may not be available from third parties. We may be restricted or prevented from manufacturing and selling our products, if any, in the event of an adverse determination in a judicial or administrative proceeding or if we fail to obtain necessary licenses. Costs associated with these arrangements may be substantial and may include ongoing royalties. Furthermore, we may not be able to obtain the necessary licenses on satisfactory terms, if at all. These outcomes could materially harm our business, financial condition and results of operations.

Risks Related to Our Industry

We face intense competition and rapid technological change.

The biotechnology and pharmaceutical industries are highly competitive and subject to significant and rapid technological change. We are aware of several pharmaceutical and biotechnology companies that are actively engaged in research and development in areas related to antibody therapy. These companies have commenced clinical trials of antibody product candidates or have successfully commercialized antibody products. Many of these companies are addressing the same diseases and disease indications as us or our customers. Also, we compete with companies that offer antibody

11

generation services to companies that have antigens. These competitors have specific expertise or technology related to antibody development and introduce new or modified technologies from time to time. These companies include GenPharm International, Inc., a wholly-owned subsidiary of Medarex, Inc.; Medarex's joint venture partner, Kirin Brewing Co., Ltd.; Cambridge Antibody Technology Group plc; Protein Design Labs, Inc.; and MorphoSys AG.

Some of our competitors have received regulatory approval of or are developing or testing product candidates that may compete directly with our product candidates. For example, SangStat Medical Corp., Novartis, Pharmacia Corporation and Roche market organ transplant rejection products that may compete with ABX-CBL, which is in clinical trials. In addition, MedImmune, Inc. has a potential antibody product candidate in clinical trials for graft versus host disease that may compete with ABX-CBL. We are also aware that several companies, including Genentech, Inc., Biogen, Inc. and Immunex Corporation have potential product candidates for the treatment of psoriasis that may compete with ABX-IL8, which is in clinical trials. Furthermore, we are aware that ImClone Systems, Inc., AstraZeneca PLC, GlaxoSmithKline and a collaboration of OSI Pharmaceuticals, Inc., Genentech, Inc. and Roche have potential antibody and small molecule product candidates in clinical development that may compete with ABX-EGF, which is also in clinical trials.

Many of these companies and institutions, either alone or together with their customers, have substantially greater financial resources and larger research and development staffs than we do. In addition, many of these competitors, either alone or together with their customers, have significantly greater experience than we do in:

- •

- developing products;

- •

- undertaking pre-clinical testing and human clinical trials;

- •

- obtaining FDA and other regulatory approvals of products; and

- •

- manufacturing and marketing products.

Accordingly, our competitors may succeed in obtaining patent protection, receiving FDA approval or commercializing products before we do. If we commence commercial product sales, we will be competing against companies with greater marketing and manufacturing capabilities, areas in which we have limited or no experience.

We also face, and will continue to face, competition from academic institutions, government agencies and research institutions. There are numerous competitors working on products to treat each of the diseases for which we are seeking to develop therapeutic products. In addition, any product candidate that we successfully develop may compete with existing therapies that have long histories of safe and effective use. Competition may also arise from:

- •

- other drug development technologies and methods of preventing or reducing the incidence of disease;

- •

- new small molecules; or

- •

- other classes of therapeutic agents.

Developments by competitors may render our product candidates or technologies obsolete or non-competitive. We face and will continue to face intense competition from other companies for agreements with pharmaceutical and biotechnology companies for establishing relationships with academic and research institutions, and for licenses to proprietary technology. These competitors, either alone or with their customers, may succeed in developing technologies or products that are more effective than ours.

12

We face uncertainty over reimbursement and healthcare reform.

In both domestic and foreign markets, sales of our product candidates will depend in part upon the availability of reimbursement from third-party payors. Such third-party payors include government health administration authorities, managed care providers, private health insurers and other organizations. These third-party payors are increasingly challenging the price and examining the cost effectiveness of medical products and services. In addition, significant uncertainty exists as to the reimbursement status of newly approved healthcare products. We may need to conduct post-marketing studies in order to demonstrate the cost-effectiveness of our products. Such studies may require us to provide a significant amount of resources. Our product candidates may not be considered cost-effective. Adequate third-party reimbursement may not be available to enable us to maintain price levels sufficient to realize an appropriate return on our investment in product development. Domestic and foreign governments continue to propose and pass legislation designed to reduce the cost of healthcare. Accordingly, legislation and regulations affecting the pricing of pharmaceuticals may change before our proposed products are approved for marketing. Adoption of such legislation could further limit reimbursement for pharmaceuticals. If the government and third-party payors fail to provide adequate coverage and reimbursement rates for our product candidates, the market acceptance of our products may be adversely affected. If our products do not receive market acceptance, our business, financial condition and results of operations will be materially harmed.

Other Risks Related to Our Company

We acquired Abgenix Biopharma, a Vancouver-based biotechnology company, in November 2000. We may experience difficulty in the integration of this acquisition, or any future acquisition, with the operations of our business.

In November 2000, we acquired all of the voting stock of Abgenix Biopharma, a Canadian biotechnology company that develops and intends to commercialize antibody-based therapeutic and diagnostic products for the treatment and diagnosis of a variety of diseases, for an aggregate consideration of approximately $77.2 million.

We have a limited history of operating the business of our company and Abgenix Biopharma on a consolidated basis, and we have no prior experience operating a business outside of the United States. We may have difficulty integrating Abgenix Biopharma's research and development operations with our own. Difficulty managing the integration of Abgenix Biopharma could result from many factors, some of which are beyond our control, including the following:

- •

- the geographic distance between our Fremont, California headquarters and our acquired Vancouver, British Columbia subsidiary;

- •

- potential differences in research and development protocols between Abgenix Biopharma and ourselves; and

- •

- the potential loss of personnel from our acquired operations.

In the future, we may from time to time seek to expand our business through additional corporate acquisitions. Our acquisition of companies and businesses and expansion of operations, involve risks such as the following:

- •

- the potential inability to identify target companies best suited to our business plan;

- •

- the potential inability to successfully integrate acquired operations and businesses and to realize anticipated synergies, economies of scale or other expected value;

- •

- incurrence of expenses attendant to transactions that may or may not be consummated; and

13

- •

- difficulties in managing and coordinating operations at multiple venues, which, among other things, could divert our management's attention from other important business matters.

In addition, our acquisition of companies and businesses and expansion of operations, including the recent acquisition of Abgenix Biopharma, may result in dilutive issuances of equity securities, the incurrence of additional debt, large one-time write-offs and the creation of goodwill or other intangible assets that could result in amortization expense.

We depend on key personnel and must continue to attract and retain key employees and consultants.

We are highly dependent on the principal members of our scientific and management staff. For us to pursue product development, marketing and commercialization plans, we will need to hire additional qualified scientific personnel to perform research and development. We will also need to hire personnel with expertise in clinical testing, government regulation, manufacturing, marketing and finance. Attracting and retaining qualified personnel will be critical to our success. We may not be able to attract and retain personnel on acceptable terms given the competition for such personnel among biotechnology, pharmaceutical and healthcare companies, universities and non-profit research institutions. If we lose any of these persons, or are unable to attract and retain qualified personnel, our business, financial condition and results of operations may be materially harmed.

In addition, we rely on members of our Scientific Advisory Board and other consultants to assist us in formulating our research and development strategy. All of our consultants and the members of our Scientific Advisory Board are employed by other entities. They may have commitments to, or advisory or consulting agreements with, other entities that may limit their availability to us. If we lose the services of these advisors, the achievement of our development objectives may be impeded. Such impediments may materially harm our business, financial condition and results of operations.

We have implemented a stockholder rights plan and are subject to other anti-takeover provisions.

In June 1999, our board of directors adopted a stockholder rights plan, which was amended in November 1999. The stockholder rights plan and certain provisions of our amended and restated certificate of incorporation and amended and restated bylaws may have the effect of making it more difficult for a third party to acquire, or of discouraging a third party from attempting to acquire, control of us. This could limit the price that certain investors might be willing to pay in the future for our common stock. Certain provisions of our amended and restated certificate of incorporation and amended and restated bylaws allow us to:

- •

- issue preferred stock without any vote or further action by the stockholders;

- •

- eliminate the right of stockholders to act by written consent without a meeting;

- •

- specify procedures for director nominations by stockholders and submission of other proposals for consideration at stockholder meetings; and

- •

- eliminate cumulative voting in the election of directors.

We are subject to certain provisions of Delaware law which could also delay or make more difficult a merger, tender offer or proxy contest involving us. In particular, Section 203 of the Delaware General Corporation Law prohibits a Delaware corporation from engaging in any business combination with any interested stockholder for a period of three years unless certain conditions are met. The stockholder rights plan, the possible issuance of preferred stock, the procedures required for director nominations and stockholder proposals and Delaware law could have the effect of delaying, deferring or preventing a change in control of us, including, without limitation, discouraging a proxy contest or making more difficult the acquisition of a substantial block of our common stock. The provisions could also limit the price that investors might be willing to pay in the future for shares of our common stock.

14

We face product liability risks and may not be able to obtain adequate insurance.

The use of any of our product candidates in clinical trials, and the sale of any approved products, may expose us to liability claims resulting from such use or sale of our products. These claims might be made directly by consumers, healthcare providers or by pharmaceutical companies or others selling such products. We may experience financial losses in the future due to product liability claims. We have obtained limited product liability insurance coverage for our clinical trials, under which the coverage limits are $5.0 million per occurrence and $5.0 million in the aggregate. We intend to expand our insurance coverage to include the sale of commercial products if marketing approval is obtained for product candidates in development. We may not be able to maintain insurance coverage at a reasonable cost or in sufficient amounts to protect us against losses. If a successful product liability claim or series of claims is brought against us for uninsured liabilities or in excess of insured liabilities, our business, financial condition and results of operations may be materially harmed.

Our operations involve hazardous materials.

Our research and manufacturing activities involve the controlled use of hazardous materials. We cannot eliminate the risk of accidental contamination or injury from these materials. In the event of an accident or environmental discharge, we may be held liable for any resulting damages, which may exceed our financial resources and may materially harm our business, financial condition and results of operations.

We do not intend to pay cash dividends on our common stock.

We intend to retain any future earnings to finance the growth and development of our business and we do not plan to pay cash dividends on our common stock in the foreseeable future.

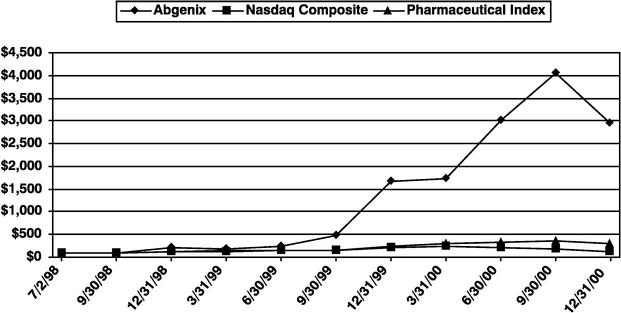

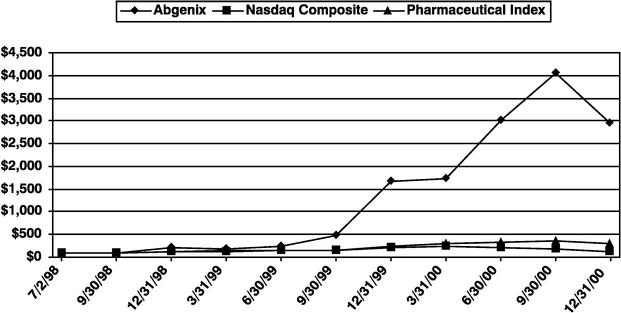

Our stock price is highly volatile.

The market price and trading volume of our common stock are volatile, and we expect such volatility to continue for the foreseeable future. For example, during the period between June 30, 2000 and June 30, 2001, our common stock closed as high as $93.1875 per share and as low as $16.75 per share. This may impact your decision to buy or sell our common stock. Factors affecting our stock price include:

- •

- our financial results;

- •

- fluctuations in our operating results;

- •

- announcements of technological innovations or new commercial therapeutic products by us or our competitors;

- •

- published reports by securities analysts;

- •

- progress with clinical trials;

- •

- government regulation;

- •

- changes in reimbursement policies;

- •

- developments in patent or other proprietary rights;

- •

- developments in our relationship with customers;

- •

- public concern as to the safety and efficacy of our products; and

- •

- general market conditions.

15

The state of California is currently experiencing a shortage of electrical energy that may cause certain of our operations to be suspended temporarily.

Substantially all of our operations in Fremont, California are run by electrical energy purchased from a local utility. We have not experienced energy shortages and do not anticipate any significant difficulties in the foreseeable future. We have limited back-up generating capacity. Extended shortages of energy could slow our research efforts and increase our operating costs.

16

CERTAIN INFORMATION

We were incorporated on June 24, 1996, and subsequently on July 15, 1996, were organized pursuant to a stock purchase and transfer agreement with Cell Genesys. Our business and operations were started in 1989 by Cell Genesys and prior to our organization were conducted within Cell Genesys. In 1991, Cell Genesys and JT Immunotech USA, Inc., the predecessor company to JT America and a medical subsidiary of Japan Tobacco, formed Xenotech, an equally owned joint venture, to develop genetically modified strains of mice known as XenoMouse animals or mice that can produce fully human monoclonal antibodies and to commercialize products generated from these mice. At the time of our organization, Cell Genesys assigned to us substantially all of its rights in Xenotech. On December 31, 1999, we became the sole owner of Xenotech by buying JT America's interest therein. As used in this prospectus, Japan Tobacco refers to either or both of Japan Tobacco or its wholly-owned subsidiary, JT America. Our principal executive offices are located at 6701 Kaiser Drive, Fremont, California 94555, and our telephone number is (510) 608-6500.

Unless otherwise indicated, the information in this prospectus is based on 86,156,183 shares outstanding on July 31, 2001 and:

- •

- excludes 12,656,057 shares of common stock issuable upon exercise of options outstanding as of July 31, 2001 under our various stock incentive plans; and

- •

- excludes 100,000 shares of common stock issuable pursuant to the terms of a license agreement.

USE OF PROCEEDS

We will not receive any proceeds from the sale of the shares of common stock offered by the selling shareholders pursuant to this prospectus.

17

PRICE RANGE OF COMMON STOCK

Our common stock began trading publicly on the Nasdaq National Market on July 2, 1998, under the symbol "ABGX." The following table lists quarterly information on the price range of our common stock based on the high and low reported closing prices for our common stock as reported on the Nasdaq National Market for the periods indicated below, as adjusted to reflect a two-for-one common stock split effective on April 6, 2000 and a two-for-one common stock split effective on July 7, 2000. These prices do not include retail markups, markdowns or commissions.

| | High

| | Low

|

|---|

| Fiscal 1999: | | | | | | |

| | First Quarter | | $ | 4.53 | | $ | 3.31 |

| | Second Quarter | | | 4.97 | | | 3.31 |

| | Third Quarter | | | 11.91 | | | 4.72 |

| | Fourth Quarter | | | 33.13 | | | 9.32 |

| Fiscal 2000: | | | | | | |

| | First Quarter | | $ | 99.75 | | $ | 29.03 |

| | Second Quarter | | | 69.02 | | | 32.31 |

| | Third Quarter | | | 85.81 | | | 50.13 |

| | Fourth Quarter | | | 93.19 | | | 46.81 |

| Fiscal 2001: | | | | | | |

| | First Quarter | | $ | 52.31 | | $ | 16.75 |

| | Second Quarter | | | 46.15 | | | 18.06 |

| | Third Quarter (through August 27, 2001) | | | 44.10 | | | 23.51 |

As of July 31, 2001, there were approximately 229 holders of record of our common stock. On August 27, 2001, the closing price on the Nasdaq National Market for our common stock was $30.08.

DIVIDEND POLICY

We have never declared or paid cash dividends on our common stock. We currently expect to retain our future earnings, if any, for use in the operation and expansion of our business and do not anticipate paying any cash dividends on our common stock in the foreseeable future.

18

SELECTED CONSOLIDATED FINANCIAL DATA

The consolidated statement of operations data for the years ended December 31, 1998, 1999 and 2000 and the consolidated balance sheet data as of December 31, 1999 and 2000 are derived from our audited consolidated financial statements. These financial statements are included elsewhere in this prospectus. The balance sheet data at December 31, 1996, 1997 and 1998, and the statement of operations data for the years ended December 31, 1996 and 1997, are derived from our audited financial statements. These financial statements are not included in this prospectus. The selected data as of June 30, 2001 and for each of the six-month periods ended June 30, 2000 and 2001 have been derived from our unaudited consolidated financial statements included in this prospectus, which reflect, in our management's judgment, all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the results of these periods. The results for the six-month period ended June 30, 2001 are not necessarily indicative of results for the full year.

You should read the following selected consolidated financial data in conjunction with our financial statements and notes that are included elsewhere in this prospectus and "Management's Discussion and Analysis of Financial Condition and Results of Operations."

| | Years Ended December 31,

| | Six Months Ended June 30,

| |

|---|

| | 2000

| | 1999

| | 1998

| | 1997

| | 1996

| | 2001

| | 2000

| |

|---|

| | (In thousands, except share and per share data)

| |

|---|

| Consolidated Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | | | |

| Revenues | | | | | | | | | | | | | | | | | | | | | | |

| Contract revenue | | $ | 26,601 | | $ | 12,285 | | $ | 2,498 | | $ | 611 | | $ | — | | $ | 12,530 | | $ | 5,443 | |

| Revenue under collaborative agreements from related parties | | | — | | | — | | | 1,344 | | | 1,343 | | | 4,719 | | | — | | | — | |

| Interest income | | | 32,848 | | | 3,045 | | | 961 | | | 307 | | | 203 | | | 17,971 | | | 13,122 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Total revenues | | | 59,449 | | | 15,330 | | | 4,803 | | | 2,261 | | | 4,922 | | | 30,501 | | | 18,565 | |

| Costs and expenses: | | | | | | | | | | | | | | | | | | | | | | |

| Research and development | | | 51,329 | | | 21,106 | | | 17,588 | | | 11,405 | | | 9,433 | | | 42,383 | | | 19,126 | |

| Amortization of intangible assets, related to research and development | | | 3,992 | | | — | | | — | | | — | | | — | | | 4,093 | | | 1,553 | |

| General and administrative | | | 7,667 | | | 5,164 | | | 3,405 | | | 3,525 | | | 2,565 | | | 6,200 | | | 3,390 | |

| In process research and development charge | | | 5,215 | | | — | | | — | | | — | | | — | | | — | | | — | |

| Charge for cross-license and settlement amount allocated from Cell Genesys | | | — | | | — | | | — | | | 11,250 | | | — | | | — | | | — | |

| Equity in (income) losses from the Xenotech joint venture | | | — | | | (546 | ) | | 107 | | | 11,250 | | | — | | | — | | | — | |

| Non-recurring termination fee | | | — | | | 8,667 | | | — | | | — | | | — | | | — | | | — | |

| Interest expense | | | 39 | | | 438 | | | 530 | | | 711 | | | 24 | | | 255 | | | 300 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Total costs and expenses | | | 68,242 | | | 34,829 | | | 21,630 | | | 38,141 | | | 12,022 | | | 52,931 | | | 24,369 | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Loss before income taxes | | | (8,793 | ) | | (19,499 | ) | | (16,827 | ) | | (35,880 | ) | | (7,100 | ) | | (22,430 | ) | | (5,804 | ) |

| Foreign income tax expense | | | — | | | 1,000 | | | — | | | — | | | — | | | — | | | — | |

| | |

| |

| |

| |

| |

| |

| |

| |

| Net loss | | $ | (8,793 | ) | $ | (20,499 | ) | $ | (16,827 | ) | $ | (35,880 | ) | $ | (7,100 | ) | $ | (22,430 | ) | $ | (5,804 | ) |

| | |

| |

| |

| |

| |

| |

| |

| |

| Net loss per share | | $ | (0.11 | ) | $ | (0.35 | ) | $ | (0.75 | ) | $ | (258.13 | ) | $ | (11,677.63 | ) | $ | (0.26 | ) | $ | (0.07 | ) |

| | |

| |

| |

| |

| |

| |

| |

| |

| Shares used in computing net loss per share | | | 80,076 | | | 58,148 | | | 22,412 | | | 139 | | | 0.61 | | | 85,805 | | | 77,522 | |

| | December 31,

| |

| |

|---|

| | June 30,

2001

| |

|---|

| | 2000

| | 1999

| | 1998

| | 1997

| | 1996

| |

|---|

| | (In thousands)

| |

|---|

| Consolidated Balance Sheet Data: | | | | | | | | | | | | | | | | | | | |

| Cash, cash equivalents, marketable securities and interest receivable | | $ | 702,676 | | $ | 58,012 | | $ | 16,744 | | $ | 15,321 | | $ | 10,172 | | $ | 581,430 | |

| Working capital | | | 621,480 | | | 56,113 | | | 13,101 | | | 6,637 | | | 5,564 | | | 572,642 | |

| Total assets | | | 936,800 | | | 148,541 | | | 24,220 | | | 22,084 | | | 14,357 | | | 869,101 | |

| Long term debt, less current portion | | | — | | | 421 | | | 2,180 | | | 3,979 | | | 1,757 | | | — | |

| Redeemable convertible stock | | | — | | | — | | | — | | | 31,189 | | | 10,150 | | | — | |

| Accumulated deficit | | | (98,593 | ) | | (89,800 | ) | | (69,301 | ) | | (52,474 | ) | | (16,594 | ) | | (121,022 | ) |

| Total stockholders' equity | | | 839,675 | | | 137,060 | | | 16,959 | | | (22,318 | ) | | (2,316 | ) | | 843,394 | |

19

MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

"Management's Discussion and Analysis of Financial Condition and Results of Operations" contains forward-looking statements based upon current expectations that involve risks and uncertainties. When used in this prospectus, the words "intend," "anticipate," "believe," "estimate," "plan" and "expect" and similar expressions as they relate to us are included to identify forward-looking statements. Our actual results and the timing of certain events could differ materially from those anticipated in these forward-looking statements as a result of certain factors, including those set forth under "Risk Factors" and elsewhere in this prospectus.

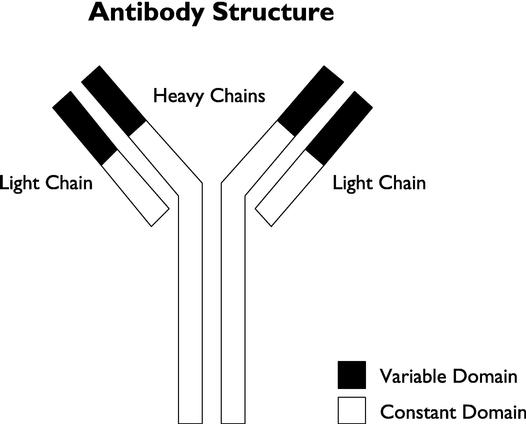

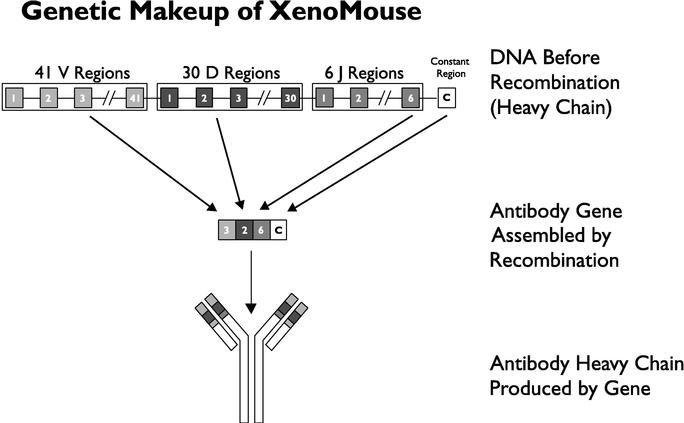

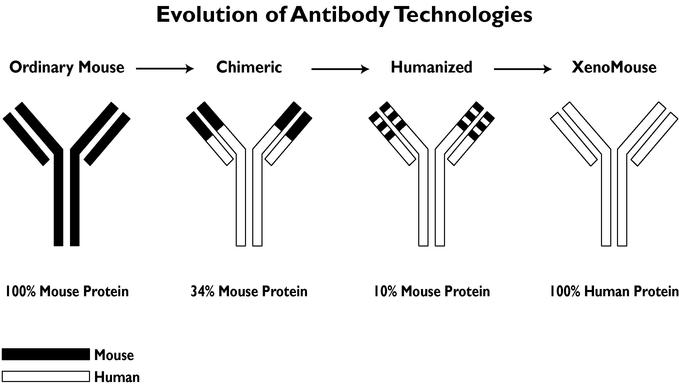

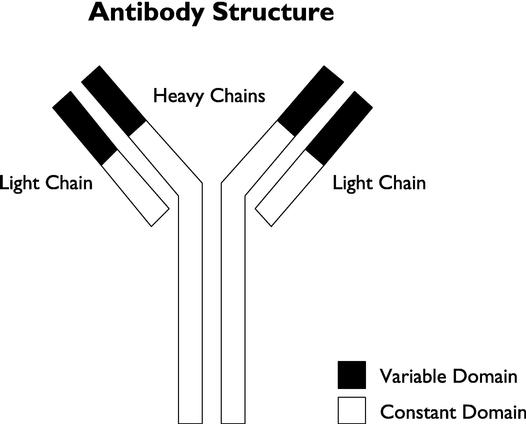

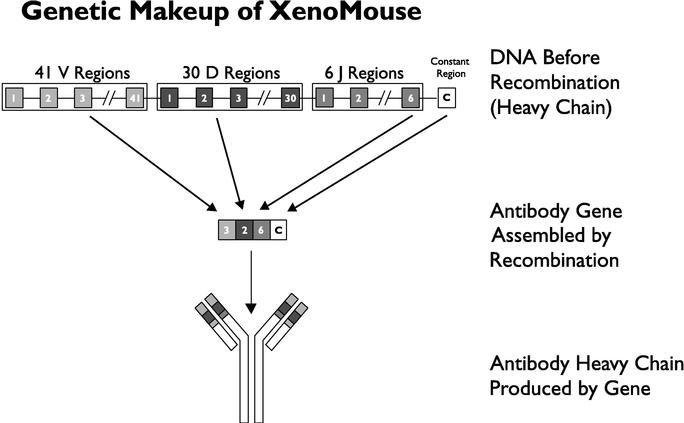

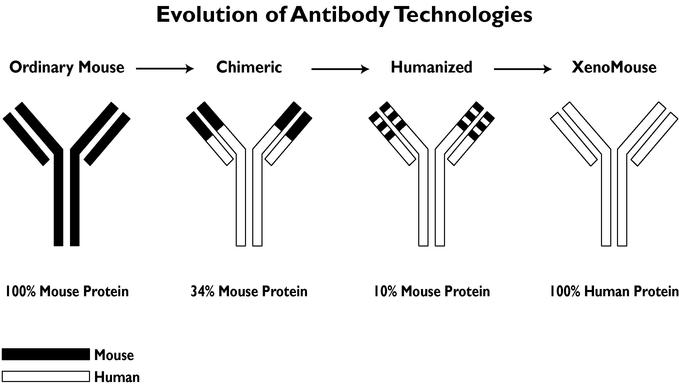

Overview

We are a biopharmaceutical company that develops and intends to commercialize antibody therapeutic products for the treatment of a variety of disease conditions, including transplant-related diseases, inflammatory and autoimmune disorders, cardiovascular disease, infectious diseases and cancer. We have proprietary technologies that facilitate rapid generation of highly specific, fully human antibody product candidates that bind to disease targets appropriate for antibody therapy. We developed our XenoMouse® technology, a technology utilizing genetically modified mice. We also own a technology that enables the rapid identification of antibodies with desired function and characteristics, referred to as SLAM™ technology. In our newly developed XenoMax™ technology, we use SLAM technology to select and isolate antibodies with particular function and characteristics from antibody-producing cells generated by XenoMouse animals. We believe XenoMax technology enhances our capabilities in product development and flexibility in manufacturing. We intend to use our technologies to build a large and diversified product portfolio that we expect to develop and commercialize through licensing arrangements with pharmaceutical companies and others, through joint development and through internal product development programs. We have entered into a variety of contractual arrangements with multiple pharmaceutical, biotechnology and genomics companies involving our XenoMouse technology. Two of our customers, Pfizer, Inc. and Amgen, Inc., have initiated clinical trials with fully human antibodies generated from XenoMouse animals. In addition, we have three proprietary antibody product candidates currently in clinical trials, two of which we have agreed to co-develop and commercialize with others.

As of August 27, 2001, we had entered into contracts covering numerous antigen targets with twenty-nine customers to use our XenoMouse technology or SLAM technology to produce and/or develop the resulting fully human antibody product candidates. Pursuant to these contracts, we and our customers intend to generate antibody product candidates for the treatment of cancer, inflammation, autoimmune diseases, transplant rejection, cardiovascular disease, growth factor modulation, neurological diseases and infectious diseases. We expect that substantially all of our revenues for the foreseeable future will result from payments under these and other contracts. The terms of these arrangements vary, but can generally be categorized as follows:

- •

- Antigen Target Sourcing Contracts—We have entered into several target sourcing contracts with genomics and biopharmaceutical companies that may enable us to generate a pipeline of proprietary fully human antibody product candidates. Typically, these contracts provide for Abgenix to make fully human antibodies to the antigen targets provided or identified by the contract counterparty. The contracts typically contain provisions that allow either Abgenix or the other contract party to evaluate and select particular antibodies from the pool of generated antibodies for further development and commercialization. The party selecting a product candidate for further development or commercialization will generally pay to the other party license fees, milestone payments and royalty payments on any eventual product sales, in exchange for rights to develop and commercialize the product.

20

- •