Pricing Supplement No. J158 To the Underlying Supplement dated June 24, 2010, Product Supplement No. JPM-III dated July 15, 2009, Prospectus Supplement dated March 25, 2009 and Prospectus dated March 25, 2009 | Filed Pursuant to Rule 424(b)(2) Registration Statement No. 333-158199-10 November 19, 2010 | |||

| Credit Suisse AG | ||||

Structured Investments | Credit Suisse $21,032,000 Notes due December 7, 2011 Linked to a Weighted Basket of Three Buffered Return Enhanced Components, Consisting of the Dow Jones EURO STOXX 50® Index, the FTSE™ 100 Index and the TOPIX® Index and Related Currencies | ||

General

| · | The notes are designed for investors who seek a return at maturity of two times the appreciation of a weighted basket of three buffered return enhanced components, consisting of the Dow Jones EURO STOXX 50® Index (“SX5E”), the FTSE™ 100 Index (“UKX”) and the TOPIX® Index (“TPX”), each of which is subject to a different maximum return, as described below, and is multiplied by the performance of its respective currency relative to the U.S. dollar. Investors should be willing to forgo interest and dividend payments and, if one or more of the Basket Components decline by more than 10%, be willing to lose some or all of their investment. Any payment at maturi ty is subject to our ability to pay our obligations as they become due. |

| · | Senior unsecured obligations of Credit Suisse AG, acting through its Nassau Branch, maturing December 7, 2011†. |

| · | Minimum purchase of $10,000. Minimum denominations of $1,000 and integral multiples in excess thereof. |

| · | The notes priced on November 19, 2010 (the “Pricing Date”) and are expected to settle on November 24, 2010. Delivery of the notes in book-entry form only will be made through The Depository Trust Company. |

Key Terms

| Issuer: | Credit Suisse AG, acting through its Nassau Branch | ||||||

| Basket: | A weighted basket consisting of three buffered return enhanced components (each a “Basket Component,” and together, the “Basket Components”). Each Basket Component includes an international index (each a “Component Underlying,” and together, the “Component Underlyings”) and the spot exchange rate of the related currency (each a “Component Currency,” and together, the “Component Currencies”) against the U.S. dollar, as set forth below. | ||||||

| Component Underlying | Component Weighting | Maximum Return | Initial Underlying Level | Component Currency | Initial Spot Rate | ||

| SX5E | 51.00% | 17.75% | 2845.75 | euro (EURUSD) | 1.36615 | ||

| UKX | 25.00% | 15.45% | 5732.83 | pound (GBPUSD) | 1.59520 | ||

| TPX | 24.00% | 15.40% | 869.52 | yen (JPYUSD) | 0.011982 | ||

| The maximum payment at maturity, based on the percentages set forth above, is $1,166.11 per $1,000 principal amount of notes. | |||||||

| Currency of the Issue: | United States dollars | ||||||

| Upside Leverage Factor: | 2 | ||||||

| Downside Leverage Factor: | 1.1111 | ||||||

| Buffer Amount: | 10% | ||||||

| Payment at Maturity: | The amount you will be entitled to receive at maturity is based on the Basket Return, which in turn is based on the performance of the Basket Components. At maturity, your payment per $1,000 principal amount of notes will be calculated as follows: $1,000 + ($1,000 x Basket Return) Any payment at maturity is subject to our ability to pay our obligations as they become due. | ||||||

| Basket Return: | The sum of the products of (a) the Component Return of each Basket Component and (b) the Component Weighting of such Basket Component. | ||||||

| Component Return: | With respect to each Basket Component, the Component Return will be calculated as follows: | ||||||

| (Underlying Return x Currency Return - 1) | Component Return | ||||||

is greater than or equal to zero | (Underlying Return x Currency Return - 1) x Upside Leverage Factor, subject to the Maximum Return | ||||||

| is greater than or equal to -10% but less than zero | zero | ||||||

| is less than -10% | ((Underlying Return x Currency Return - 1) + Buffer Amount) x Downside Leverage Factor | ||||||

| If one or more of the Basket Components decline by more than 10%, you may lose some and could lose all of your investment at maturity. | |||||||

| Underlying Return: | With respect to each Component Underlying, the performance of such Component Underlying from its Initial Underlying Level to its Final Underlying Level, calculated as follows: Final Underlying Level Initial Underlying Level | ||||||

| Initial Underlying Level: | With respect to each Component Underlying, as set forth in the table above. | ||||||

| Final Underlying Level: | With respect to each Component Underlying, the arithmetic average of the closing levels of such Component Underlying on each of the five Valuation Dates. | ||||||

| Currency Return: | For each Component Currency, the performance of such Component Currency from its Initial Spot Rate to its Final Spot Rate, calculated as follows: Final Spot Rate Initial Spot Rate | ||||||

| Spot Rate: | For each Component Currency, the official MID WM Reuters fixing at 4 pm London Time, expressed as the number of U.S. dollars per one unit of such Component Currency. | ||||||

| Initial Spot Rate: | For each Component Currency, as set forth in the table above. | ||||||

| Final Spot Rate: | For each Component Currency, the Spot Rate on the Final Valuation Date. | ||||||

Valuation Dates†: | November 28, 2011; November 29, 2011; November 30, 2011; December 1, 2011 and December 2, 2011 (each a “Valuation Date” and December 2, 2011, the “Final Valuation Date”) | ||||||

Maturity Date†: | December 7, 2011 | ||||||

| Listing: | The notes will not be listed on any securities exchange. | ||||||

| CUSIP: | 22546EJ21 | ||||||

† Each scheduled Valuation Date is subject to postponement in respect of each Component Underlying and each Component Currency if such date is not an underlying business day for such Component Underlying or such Component Currency or as a result of a market disruption event in respect of such Component Underlying or such Component Currency as described in the accompanying product supplement under “Description of the Notes—Market disruption events.” The Maturity Date is subject to postponement if the scheduled Maturity Date is not a business day or if the last scheduled Valuation Date is postponed because it is not an underlying business day for any Component Underlying or Component Currency or is postponed as a result of a market disruption ev ent in respect of any Component Underlying or Component Currency.

Investing in the notes involves a number of risks. See “Selected Risk Considerations” beginning on page 7 of this pricing supplement and “Risk Factors” beginning on page PS-3 of the accompanying product supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the notes or passed upon the accuracy or the adequacy of this pricing supplement or the accompanying underlying supplement, the product supplement, the prospectus supplement and the prospectus. Any representation to the contrary is a criminal offense.

| Price to Public(1) | Fees(2) | Proceeds to Issuer | |

| Per note | $1,000.00 | $10.00 | $990.00 |

| Total | $21,032,000.00 | $210,320.00 | $20,821,680.00 |

(1) Certain fiduciary accounts will pay a purchase price of $990.00 per note, and the placement agents with respect to sales made to such accounts will forgo any fees.

(2) J.P. Morgan Securities Inc., which we refer to as JPMSI, and JPMorgan Chase Bank, N.A. will act as placement agents for the notes. The placement agents will forego fees for sales to fiduciary accounts. The total fees represent the amount that the placement agents received from sales to accounts other than such fiduciary accounts.

The notes are not deposit liabilities and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency of the United States, Switzerland or any other jurisdiction.

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities Offered | Maximum Aggregate Offering Price | Amount of Registration Fee |

| Notes | $21,032,000.00 | $1,499.58 |

JPMorgan

Placement Agent

November 19, 2010

Additional Terms Specific to the Notes

You should read this pricing supplement together with the underlying supplement dated June 24, 2010, the product supplement dated July 15, 2009, the prospectus supplement dated March 25, 2009 and the prospectus dated March 25, 2009, relating to our Medium-Term Notes of which these notes are a part. You may access these documents on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

| • | Underlying supplement dated June 24, 2010: |

| • | Product supplement No. JPM-III dated July 15, 2009: |

| • | Prospectus supplement dated March 25, 2009: |

| • | Prospectus dated March 25, 2009: |

Our Central Index Key, or CIK, on the SEC website is 1053092. As used in this pricing supplement, the ‘‘Company,’’ ‘‘we,’’ ‘‘us,’’ or ‘‘our’’ refers to Credit Suisse.

This pricing supplement, together with the documents listed above, contain the terms of the notes and supersede all other prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. You should carefully consider, among other things, the matters set forth in “Selected Risk Considerations” in this pricing supplement and “Risk Factors” in the accompanying product supplement, as the notes involve risks not associated with conventional debt securities. You should consult your investment, legal, tax, accounting and other advisors before deciding to invest in the notes.

1

What is the Payment at Maturity on the Notes Under Various Hypothetical Performance Scenarios for the Basket?

The following examples illustrate the payment at maturity for a $1,000 principal amount note under various hypothetical performance scenarios for the Basket Components, reflecting the Maximum Return for each Basket Component set forth on the cover page of this pricing supplement. The Underlying Returns, Currency Returns and Component Returns set forth below are expressed as percentages. The hypothetical payment at maturity calculations set forth below are for illustrative purposes only. The actual payment at maturity applicable to a purchaser of the notes will be based on the arithmetic average of the closing levels for each Component Underlying and Component Currency on the Valuation Dates. You should consider carefully whether the notes are suitable to your investment goals. Any payment at maturity is subject to our ability to pay our obligations as they become due. The numbers appearing in the following scenarios have been rounded for ease of analysis.

Scenario 1

| Component Underlying | Dow Jones EURO STOXX 50 Index | FTSE 100 Index | TOPIX Index |

| Component Currency | euro | pound | yen |

| Component Weighting | 51.00% | 25.00% | 24.00% |

| Maximum Return | 17.75% | 15.45% | 15.40% |

| Underlying Return | 110.00% | 110.00% | 110.00% |

| Currency Return | 100.00% | 100.00% | 100.00% |

| Underlying Return x Currency Return - 1 | 10.00% | 10.00% | 10.00% |

| Component Return | 17.75% | 15.45% | 15.40% |

| Basket Return | (51.00% x 17.75%) + (25.00% x 15.45%) + (24.00% x 15.40%) = 16.611% | ||

| Payment at Maturity | $1,166.11 | ||

In Scenario 1, the Underlying Return for each Component Underlying is 110.00%, indicating that each Component Underlying has appreciated by 10.00% from its Initial Underlying Level to its Final Underlying Level, and the Currency Return for each Component Currency is 100%, indicating that the Initial Spot Rate is the same as the Final Spot Rate for each Component Currency.

Because the product of the Underlying Return and the Currency Return minus one for each Basket Component is greater than zero, the Component Return for each Basket Component is calculated as follows:

Component Return = (Underlying Return x Currency Return - 1) x Upside Leverage Factor,

subject to the Maximum Return

Therefore the Component Returns are 17.75% for the SX5E/euro Basket Component and 15.45% for the UKX/pound and TPX/yen Basket Components, and the Basket Return and Payment at Maturity are calculated as follows:

| Basket Return = | (SX5E Weighting x SX5E Component Return) + (UKX Weighting x UKX Component Return) + (TPX Weighting x TPX Component Return) | |

| = | (51.00% x 17.75%) + (25.00% x 15.45%) + (24.00% x 15.40%) | |

| = | 16.611% | |

| Payment at Maturity = | $1,000 + ($1,000 x Basket Return) | |

| = | $1,000 + ($1,000 x 16.611%) | |

| = | $1,166.11 |

2

Scenario 2

| Component Underlying | Dow Jones EURO STOXX 50 Index | FTSE 100 Index | TOPIX Index |

| Component Currency | euro | pound | yen |

| Component Weighting | 51.00% | 25.00% | 24.00% |

| Maximum Return | 17.75% | 15.45% | 15.40% |

| Underlying Return | 100.00% | 100.00% | 100.00% |

| Currency Return | 110.00% | 105.00% | 105.00% |

| Underlying Return x Currency Return - 1 | 10.00% | 5.00% | 5.00% |

| Component Return | 17.75% | 10.00% | 10.00% |

| Basket Return | (51.00% x 17.75%) + (25.00% x 10.00%) + (24.00% x 10.00%) = 13.9525% | ||

| Payment at Maturity | $1,139.53 | ||

In Scenario 2, the Underlying Return for each Component Underlying is 100%, indicating that the Initial Underlying Level is the same as the Final Underlying Level for each Component Underlying. The Currency Return is 110% for the euro and 105% for each of the pound and the yen, indicating that each of the euro, the pound and the yen has strengthened against the U.S. dollar such that the Final Spot Rate for each such Component Currency has appreciated from its Initial Spot Rate by 10%, 5% and 5%, respectively.

Because the product of the Underlying Return and the Currency Return minus one for each Basket Component is greater than zero, the Component Return for each Basket Component is calculated as follows:

Component Return = (Underlying Return x Currency Return - 1) x Upside Leverage Factor,

subject to the Maximum Return

Therefore the Component Returns are 17.75%, 10.00% and 10.00% for the SX5E/euro, UKX/pound and TPX/yen Basket Components, respectively, and the Basket Return and Payment at Maturity are calculated as follows:

| Basket Return = | (SX5E Weighting x SX5E Component Return) + (UKX Weighting x UKX Component Return) + (TPX Weighting x TPX Component Return) | |

| = | (51.00% x 17.75%) + (25.00% x 10.00%) + (24.00% x 10.00%) | |

| = | 13.9525% | |

| Payment at Maturity = | $1,000 + ($1,000 x Basket Return) | |

| = | $1,000 + ($1,000 x 13.9525%) | |

| = | $1,139.53 |

Scenario 3

| Component Underlying | Dow Jones EURO STOXX 50 Index | FTSE 100 Index | TOPIX Index |

| Component Currency | euro | pound | yen |

| Component Weighting | 51.00% | 25.00% | 24.00% |

| Maximum Return | 17.75% | 15.45% | 15.40% |

| Underlying Return | 110.00% | 110.00% | 110.00% |

| Currency Return | 110.00% | 110.00% | 110.00% |

| Underlying Return x Currency Return - 1 | 21.00% | 21.00% | 21.00% |

| Component Return | 17.75% | 15.45% | 15.40% |

| Basket Return | (51.00% x 17.75%) + (25.00% x 15.45%) + (24.00% x 15.40%) = 16.611% | ||

| Payment at Maturity | $1,166.11 | ||

In Scenario 3, the Underlying Return for each Component Underlying is 110%, indicating that each Component Underlying has appreciated by 10% from its Initial Underlying Level to its Final Underlying Level, and the Currency Return for each Component Currency is 110%, indicating that each Component Currency has strengthened against the U.S. dollar such that the Final Spot Rate for each Component Currency has appreciated from its Initial Spot Rate by 10%.

Because the product of the Underlying Return and the Currency Return minus one for each Basket Component is greater than zero, the Component Return for each Basket Component is calculated as follows:

Component Return = (Underlying Return x Currency Return - 1) x Upside Leverage Factor,

subject to the Maximum Return

3

Therefore the Component Return for each Basket Component is equal to the applicable Maximum Return, or 17.75%, 15.45% and 15.40% for the SX5E/euro Basket Component, the UKX/pound Basket Component and the TPX/yen Basket Component, respectively. The Basket Return and Payment at Maturity are calculated as follows:

| Basket Return = | (SX5E Weighting x SX5E Component Return) + (UKX Weighting x UKX Component Return) + (TPX Weighting x TPX Component Return) | |

| = | (51.00% x 17.75%) + (25.00% x 15.45%) + (24.00% x 15.40%) | |

| = | 16.611% | |

| Payment at Maturity = | $1,000 + ($1,000 x Basket Return) | |

| = | $1,000 + ($1,000 x 16.611%) | |

| = | $1,166.11 |

Scenario 4

| Component Underlying | Dow Jones EURO STOXX 50 Index | FTSE 100 Index | TOPIX Index |

| Component Currency | euro | pound | yen |

| Component Weighting | 51.00% | 25.00% | 24.00% |

| Maximum Return | 17.75% | 15.45% | 15.40% |

| Underlying Return | 110.00% | 90.00% | 90.00% |

| Currency Return | 110.00% | 90.00% | 90.00% |

| Underlying Return x Currency Return - 1 | 21.00% | -19.00% | -19.00% |

| Component Return | 17.75% | -9.99% | -9.99% |

| Basket Return | (51.00% x 17.75%) + (25.00% x -9.99%) + (24.00% x -9.99%) = 4.157% | ||

| Payment at Maturity | $1,041.57 | ||

In Scenario 4, the Underlying Return is 110% for the SX5E and 90% for each of the UKX and TPX, indicating that the SX5E has appreciated by 10%, the UKX has declined by 10% and the TPX has declined by 10%, each from its Initial Underlying Level to its Final Underlying Level. The Currency Return is 110% for the euro and 90% for each of the pound and the yen, indicating that the euro has strengthened against the U.S. dollar such that the Final Spot Rate for the euro has appreciated from its Initial Spot Rate by 10% while the pound and the yen have weakened against the U.S. dollar such that the Final Spot Rate for each such Component Currency has declined from its Initial Spot Rate by 10%.

Because the product of the Underlying Return and the Currency Return minus one for the SX5E/euro Basket Component is greater than zero, the Component Return for such Basket Component is calculated as follows:

Component Return = (Underlying Return x Currency Return - 1) x Upside Leverage Factor,

subject to the Maximum Return

For the UKX/pound Basket Component and the TPX/yen Basket Component, the product of the Underlying Return and the Currency Return minus one is less than -10% so the Component Return for each such Basket Component is calculated as follows:

Component Return = ((Underlying Return x Currency Return - 1) + Buffer Amount)

x Downside Leverage Factor

Therefore the Component Returns are 17.75%, -9.99% and -9.99% for the SX5E/euro, UKX/pound and TPX/yen Basket Components, respectively, and the Basket Return and Payment at Maturity are calculated as follows:

| Basket Return = | (SX5E Weighting x SX5E Component Return) + (UKX Weighting x UKX Component Return) + (TPX Weighting x TPX Component Return) | |

| = | (51.00% x 17.75%) + (25.00% x -9.99%) + (24.00% x -9.99%) | |

| = | 4.157% | |

| Payment at Maturity = | $1,000 + ($1,000 x Basket Return) | |

| = | $1,000 + ($1,000 x 4.157%) | |

| = | $1,041.57 |

4

Scenario 5

| Component Underlying | Dow Jones EURO STOXX 50 Index | FTSE 100 Index | TOPIX Index |

| Component Currency | euro | pound | yen |

| Component Weighting | 51.00% | 25.00% | 24.00% |

| Maximum Return | 17.75% | 15.45% | 15.40% |

| Underlying Return | 95.00% | 95.00% | 95.00% |

| Currency Return | 95.00% | 95.00% | 95.00% |

| Underlying Return x Currency Return - 1 | -9.75% | -9.75% | -9.75% |

| Component Return | 0.00% | 0.00% | 0.00% |

| Basket Return | (51.00% x 0.00%) + (25.00% x 0.00%) + (24.00% x 0.00%) = 0.00% | ||

| Payment at Maturity | $1,000.00 | ||

In Scenario 5, the Underlying Return for each Component Underlying is 95%, indicating that each Component Underlying has declined by 5% from its Initial Underlying Level to its Final Underlying Level, and the Currency Return for each Component Currency is 95%, indicating that each Component Currency has weakened against the U.S. dollar such that the Final Spot Rate for each Component Currency has declined from its Initial Spot Rate by 5%.

Because the product of the Underlying Return and the Currency Return minus one for each Basket Component is less than zero but greater than or equal to -10%, the Component Return for each Basket Component is equal to zero and the Basket Return and Payment at Maturity are calculated as follows:

| Basket Return = | (SX5E Weighting x SX5E Component Return) + (UKX Weighting x UKX Component Return) + (TPX Weighting x TPX Component Return) | |

| = | (51.00% x 0.00%) + (25.00% x 0.00%) + (24.00% x 0.00%) | |

| = | 0.00% | |

| Payment at Maturity = | $1,000 + ($1,000 x Basket Return) | |

| = | $1,000 + ($1,000 x 0.00%) | |

| = | $1,000.00 |

Scenario 6

| Component Underlying | Dow Jones EURO STOXX 50 Index | FTSE 100 Index | TOPIX Index |

| Component Currency | euro | pound | yen |

| Component Weighting | 51.00% | 25.00% | 24.00% |

| Maximum Return | 17.75% | 15.45% | 15.40% |

| Underlying Return | 80.00% | 70.00% | 90.00% |

| Currency Return | 90.00% | 90.00% | 95.00% |

| Underlying Return x Currency Return - 1 | -28.00% | -37.00% | -14.50% |

| Component Return | -20.00% | -30.00% | -5.00% |

| Basket Return | (51.00% x -20.00%) + (25.00% x -30.00%) + (24.00% x -5.00%) = -18.90% | ||

| Payment at Maturity | $811.00 | ||

In Scenario 6, the Underlying Return is 80% for the SX5E, 70% for the UKX and 90% for the TPX, indicating that the SX5E has declined by 20%, the UKX has declined by 30% and the TPX has declined by 10%, each from its Initial Underlying Level to its Final Underlying Level. The Currency Return is 90% for each of the euro and the pound and 95% for the yen, indicating that the euro and the pound have weakened against the U.S. dollar such that the Final Spot Rate for each such Component Currency has declined from its Initial Spot Rate by 10% while the yen has also weakened against the U.S. dollar such that its Final Spot Rate has declined from its Initial Spot Rate by 5%.

Because the product of the Underlying Return and the Currency Return minus one for each Basket Component is less than -10%, the Component Return for each Basket Component is calculated as follows:

Component Return = ((Underlying Return x Currency Return - 1) + Buffer Amount)

x Downside Leverage Factor

5

Therefore the Component Returns are -20.00%, -30.00% and -5.00% for the SX5E/euro, UKX/pound and TPX/yen Basket Components, respectively, and the Basket Return and Payment at Maturity are calculated as follows:

| Basket Return = | (SX5E Weighting x SX5E Component Return) + (UKX Weighting x UKX Component Return) + (TPX Weighting x TPX Component Return) | |

| = | (51.00% x -20.00%) + (25.00% x -30.00%) + (24.00% x -5.00%) | |

| = | -18.90% | |

| Payment at Maturity = | $1,000 + ($1,000 x Basket Return) | |

| = | $1,000 + ($1,000 x -18.90%) | |

| = | $811.00 |

Selected Purchase Considerations

| · | APPRECIATION POTENTIAL – The notes provide the opportunity to enhance returns by multiplying the product of the Underlying Return and the Currency Return for each Basket Component by two, up to the Maximum Return of 17.75% for the SX5E/euro Basket Component, 15.45% for the UKX/pound Basket Component and 15.40% for the TPX/yen Basket Component. Accordingly, the maximum amount payable at maturity is $1,166.11 for every $1,000 principal amount of notes. Because the notes are our senior unsecured obligations, payment of any amount at maturity is subject to our ability to pay our obligations as they become due. |

| · | LIMITED PROTECTION AGAINST LOSS – Payment at maturity of the principal amount of the notes is protected against a decline of up to 10% in the value of each Basket Component. If the product of the Underlying Return and the Currency Return minus one for any Basket Component is less than -10%, for every 1% that such amount is less than -10%, the Component Return for such Basket Component will be reduced by 1.1111%. |

| · | DIVERSIFICATION AMONG THE BASKET COMPONENTS – The return on the notes is linked to a weighted basket consisting of three buffered return enhanced Basket Components. Each Basket Component is linked to an international index, each of which we refer to as a Component Underlying, and the spot exchange rate of a related currency, each of which we refer to as a Component Currency, against the U.S. dollar. The Component Underlyings are the SX5E, the UKX and the TPX. The SX5E consists of 50 component stocks of market sector leaders from within the Eurozone. Because the Basket Component linked to the SX5E makes up 51.00% of the weighted basket, we expect that generally the market value of your notes and your payment at maturity will depend significantly on the performance of the SX5E and its related currenc y, the euro. The UKX measures the composite price performance of stocks of the largest 100 companies (determined on the basis of market capitalization) traded on the London Stock Exchange. The TPX consists of all common stocks listed on the First Section of the Tokyo Stock Exchange that have an accumulative length of listing of at least six months. The TPX is a weighted index, the component stocks of which are reviewed and selected every six months, with the market price of each component stock multiplied by the number of shares listed. The notes are in no way sponsored, endorsed, sold or promoted by the sponsors of Component Underlyings and such sponsors will have no liability with respect to the notes. For additional information about each Component Underlying, see the information set forth under “The Reference Indices—The Dow Jones Indices—The EURO STOXX 50® Index,” “The Reference Indices̵ 2;The FTSE Indices—The FTSE™ 100 Index” and “The Reference Indices—The Tokyo Stock Price Index” in the accompanying underlying supplement. |

| · | CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS – Please refer to “Certain United States Federal Income Tax Considerations” in this pricing supplement for a discussion of certain United States federal income tax considerations for making an investment in the notes. |

6

Selected Risk Considerations

An investment in the notes involves significant risks. Investing in the notes is not equivalent to investing directly in the Component Currencies, the Component Underlyings or any of the stocks comprising the Component Underlyings. These risks are explained in more detail in the “Risk Factors” section of the accompanying product supplement.

| · | YOUR INVESTMENT IN THE NOTES MAY RESULT IN A LOSS – The notes do not guarantee any return of your investment. The return on the notes at maturity is linked to the performance of the Basket Components as reflected by the Basket Return. The Basket Return will be determined based on the Component Returns which in turn depend on the performance of the Component Underlyings and the Component Currencies. If the product of any Component Underlying and the corresponding Component Currency minus one is less than -10%, your investment will be fully exposed on a leveraged basis to the decline in the value of such Basket Component. In particular, if any Component Underlying declines in value from its Initial Underlying Level to its Final Underlying Level, your returns could be adversely affected. Similarly, if the U.S. dollar appreciates in value against any of the euro, pound or yen such that the Final Spot Rate of one or more of the Component Currencies is less than the Initial Spot Rate for such Component Currency, your returns could be adversely affected and you could lose the entire amount of your investment. |

| · | THE NOTES ARE SUBJECT TO THE CREDIT RISK OF CREDIT SUISSE – Although the return on the notes will be based on the performance of the Basket Components, the payment of any amount due on the notes is subject to the credit risk of Credit Suisse. Investors are dependant on our ability to pay all amounts due on the notes, and therefore investors are subject to our credit risk. In addition, any decline in our credit ratings, any adverse changes in the market’s view of our creditworthiness or any increase in our credit spreads is likely to adversely affect the value of the notes prior to maturity. |

| · | YOUR MAXIMUM GAIN ON THE NOTES IS LIMITED – The Component Return for each Basket Component will not exceed the Maximum Return of 17.75%, 15.45% and 15.40% for the SX5E/euro Basket component, the UKX/pound Basket component and the TPX/yen Basket Component, respectively, regardless of the appreciation, which may be significant, in the Component Underlying or the Component Currency comprising such Basket Component. Accordingly, your payment at maturity will not exceed $1,166.11 for each $1,000 principal amount of notes. Any payment at maturity is subject to our ability to pay our obligations as they become due. |

| · | CHANGES IN THE VALUES OF THE COMPONENT UNDERLYINGS AND THE EXCHANGE RATES OF THE COMPONENT CURRENCIES MAY OFFSET EACH OTHER – Price movements in the Component Underlyings and movements in the exchange rates of the Component Currencies may not correlate with each other. At a time when the value of one or more of the Component Underlyings increases and/or one or more of the Component Currencies appreciates against the U.S. dollar, the value of the other Component Underlyings may not increase as much or may decline and/or one or more of the Component Currencies may not appreciate as much or may weaken against the U.S. dollar. Therefore, in calculating the Basket Return, increases in the value of one or more of the Component Underlyings and/or inc reases in the value of one or more of the Component Currencies against the U.S. dollar may be moderated, or more than offset, by lesser increases or declines in the value of the other Component Underlyings and/or the value of the other Component Currencies against the U.S. dollar. |

7

| · | THE NOTES ARE SUBJECT TO CURRENCY EXCHANGE RISK – Foreign currency exchange rates vary over time, and may vary considerably during the term of the notes. If the U.S. dollar strengthens against any of the Component Currencies during the term of the notes, your return will be adversely affected. The relative values of the U.S. dollar and each of the Component Currencies are at any moment a result of the supply and demand for such currencies. Changes in foreign currency exchange rates result over time from the interaction of many factors directly or indirectly affecting economic and political conditions in the country or countries in which such currency is used, and economic and political developments in other relevant countries. Of particular importance to currency exchange risk are: |

| · | existing and expected rates of inflation; |

| · | existing and expected interest rate levels; |

| · | the balance of payments in the United States, the European Union and Japan and between each country and its major trading partners; and |

| · | the extent of governmental surplus or deficit in the United States, the European Union and Japan. |

All of these factors are, in turn, sensitive to the monetary, fiscal and trade policies pursued by the United States, the European Union and Japan and those of other countries important to international trade and finance.

| · | CERTAIN BUILT-IN COSTS ARE LIKELY TO ADVERSELY AFFECT THE VALUE OF THE NOTES PRIOR TO MATURITY – While the payment at maturity described in this pricing supplement is based on the full principal amount of your notes, the original issue price of the notes includes the agent’s commission and the cost of hedging our obligations under the notes through one or more of our affiliates. As a result, the price, if any, at which Credit Suisse (or its affiliates), will be willing to purchase notes from you in secondary market transactions, if at all, will likely be lower than the original issue price, and any sale prior to the Maturity Date could result in a substantial loss to you. The notes are not designed to be short-term trading instruments. Accordingly, you should be able and willing to hold your notes to maturity. |

| · | NO VOTING RIGHTS OR DIVIDEND PAYMENTS – As a holder of the notes, you will not have voting rights or rights to receive cash dividends or other distributions or other rights with respect to the stocks that comprise the Basket Components. |

| · | NO INTEREST PAYMENTS – As a holder of the notes, you will not receive interest payments. |

| · | RISKS ASSOCIATED WITH INVESTMENTS IN SECURITIES INDEXED TO THE VALUE OF FOREIGN EQUITY SECURITIES – Investments in securities indexed to the value of foreign equity securities involve risks associated with the securities markets in those countries, including the risk of volatility in those markets, governmental intervention in those markets and cross-shareholdings in companies in certain countries. Foreign companies are subject to accounting, auditing and financial reporting standards and requirements different from those applicable to U.S. reporting companies. |

| · | LACK OF LIQUIDITY – The notes will not be listed on any securities exchange. Credit Suisse (or its affiliates) intends to offer to purchase the notes in the secondary market but is not required to do so. Even if there is a secondary market, it may not provide enough liquidity to allow you to trade or sell the notes when you wish to do so. Because other dealers are not likely to make a secondary market for the notes, the price at which you may be able to trade your notes is likely to depend on the price, if any, at which Credit Suisse (or its affiliates) is willing to buy the notes. If you have to sell your notes prior to maturity, you may not be able to do so or you may have to sell them at a substantial loss. |

| · | POTENTIAL CONFLICTS – We and our affiliates play a variety of roles in connection with the issuance of the notes, including acting as calculation agent and hedging our obligations under the notes. In performing these duties, the economic interests of the calculation agent and other affiliates of ours are potentially adverse to your interests as an investor in the notes. |

8

| · | MANY ECONOMIC AND MARKET FACTORS WILL AFFECT THE VALUE OF THE NOTES – In addition to the levels of the Component Underlyings and the exchange rates of the Component Currencies with respect to the U.S. dollar on any day, the value of the notes will be affected by a number of economic and market factors that may either offset or magnify each other, including: |

| · | the expected volatility of the Component Underlyings; |

| · | the time to maturity of the notes; |

| · | the dividend rates on the stocks comprising the Component Underlyings; |

| · | interest and yield rates in the market generally; |

| · | the exchange rate and volatility of the exchanges rates between the U.S. dollar, the euro, the British pound sterling and the Japanese yen; |

| · | geopolitical conditions and a variety of economic, financial, political, regulatory or judicial events that affect the stocks comprising the Component Underlyings or markets generally and which may affect the levels of the Component Underlyings; and |

| · | our creditworthiness, including actual or anticipated downgrades in our credit ratings. |

Some or all of these factors may influence the price that you will receive if you choose to sell your notes prior to maturity. The impact of any of the factors set forth above may enhance or offset some or all of any change resulting from another factor or factors.

Use of Proceeds and Hedging

We intend to use the proceeds of this offering for our general corporate purposes, which may include the refinancing of existing debt outside Switzerland. Some or all of the proceeds we receive from the sale of the notes may be used in connection with hedging our obligations under the notes through one or more of our affiliates. Such hedging or trading activities on or prior to the Pricing Date and during the term of the notes (including on the Valuation Dates) could adversely affect the value of the Basket Components and, as a result, could decrease the amount you may receive on the notes at maturity. For further information, please refer to “Use of Proceeds and Hedging” in the accompanying product supplement.

9

Historical Information

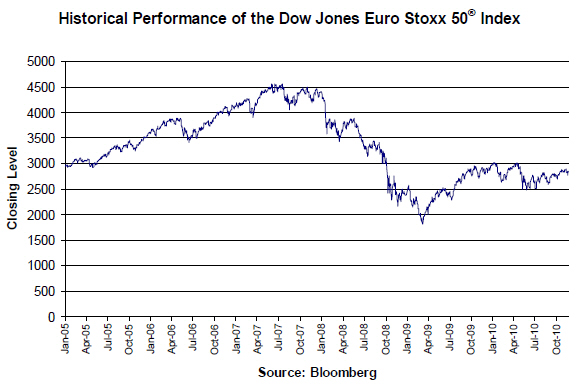

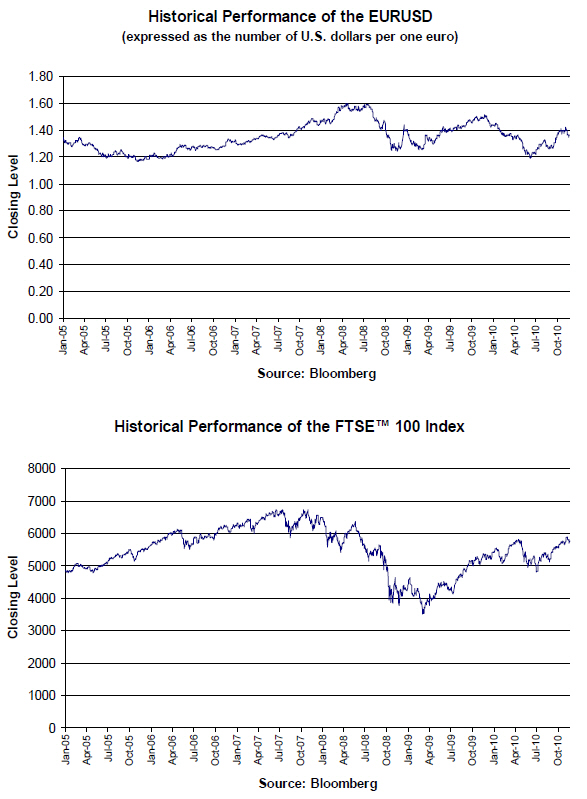

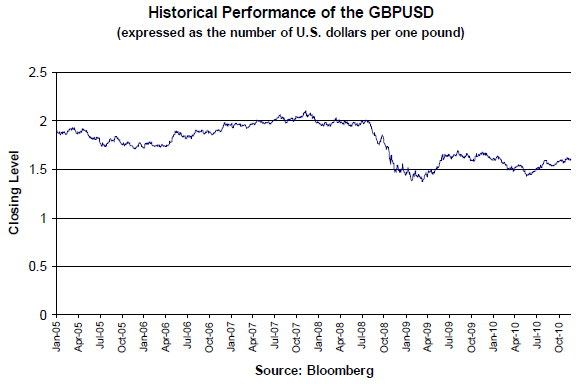

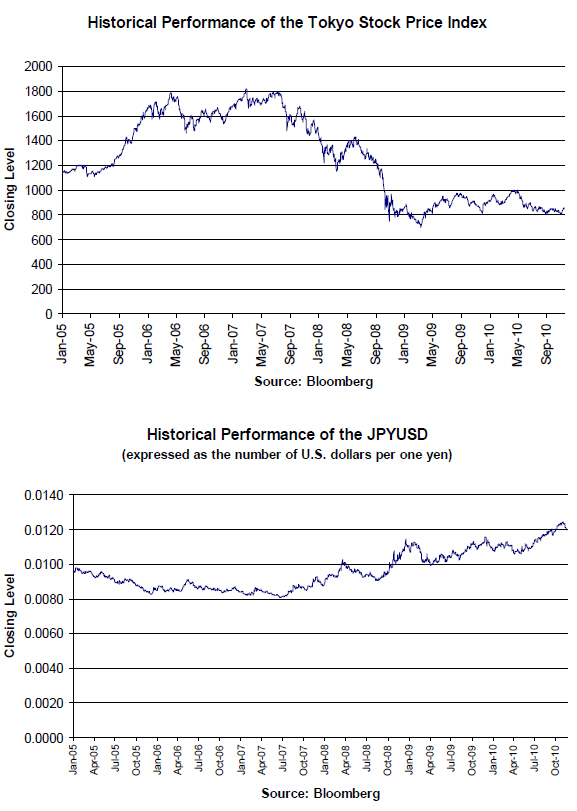

The following graphs set forth the historical performance of each Component Underlying from January 1, 2005 through November 19, 2010 and the historical performance of each Component Currency based on the exchange rates of such Component Currency with respect to the U.S. dollar (expressed as the number of U.S. dollars per one unit of such Component Currency) from January 1, 2005 through November 19, 2010. The closing level of the SX5E on November 19, 2010 was 2845.75. The closing level of the UKX on November 19, 2010 was 5732.83. The closing level of the TPX on November 19, 2010 was 869.52. The EURUSD exchange rate on November 19, 2010 was 1.36615. The GBPUSD exchange rate on November 19, 2010 was 1.59520. The JPYUSD exchange rate on November 19, 2010 was 0.011982. We obtained the closing levels of the Component Underlyings and the exchange rates of the Component Currencies below from Bloomberg, without independent verification. We make no representation or warranty as to the accuracy or completeness of the information obtained from Bloomberg.

The historical levels of the Component Underlyings and the historical exchange rates of the Component Currencies should not be taken as an indication of future performance, and no assurance can be given as to the closing levels of the Component Underlyings on any Valuation Dates or as to the exchange rates of the Component Currencies with respect to the U.S. dollar on the Final Valuation Date. We cannot give you assurance that the performance of the Component Underlyings or the Component Currencies will result in the return of any of your initial investment.

For further information on the SX5E, UKX and TPX, see “The Reference Indices—The Dow Jones Indices—The EURO STOXX 50® Index”, “The Reference Indices—The FTSE Indices—The FTSE™ 100 Index” and “The Reference Indices—The Tokyo Stock Price Index” in the accompanying underlying supplement.

10

11

12

13

Certain United States Federal Income Tax Considerations

The following discussion summarizes certain U.S. federal income tax consequences of owning and disposing of securities that may be relevant to holders of securities that acquire their securities from us as part of the original issuance of the securities. This discussion applies only to holders that hold their securities as capital assets within the meaning of the Internal Revenue Code of 1986, as amended (the “Code”). Further, this discussion does not address all of the U.S. federal income tax consequences that may be relevant to you in light of your individual circumstances or if you are subject to special rules, such as if you are:

| · | a financial institution, |

| · | a mutual fund, |

| · | a tax-exempt organization, |

| · | a grantor trust, |

| · | certain U.S. expatriates, |

| · | an insurance company, |

| · | a dealer or trader in securities or foreign currencies, |

| · | a person (including traders in securities) using a mark-to-market method of accounting, |

| · | a person who holds securities as a hedge or as part of a straddle with another position, constructive sale, conversion transaction or other integrated transaction, or |

| · | an entity that is treated as a partnership for U.S. federal income tax purposes. |

The discussion is based upon the Code, law, regulations, rulings and decisions, in each case, as available and in effect as of the date hereof, all of which are subject to change, possibly with retroactive effect. Tax consequences under state, local and foreign laws are not addressed herein. No ruling from the U.S. Internal Revenue Service (the “IRS”) has been or will be sought as to the U.S. federal income tax consequences of the ownership and disposition of securities, and the following discussion is not binding on the IRS.

You should consult your tax advisor as to the specific tax consequences to you of owning and disposing of securities, including the application of federal, state, local and foreign income and other tax laws based on your particular facts and circumstances.

IRS CIRCULAR 230 REQUIRES THAT WE INFORM YOU THAT ANY TAX STATEMENT HEREIN REGARDING ANY U.S. FEDERAL TAX IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED, BY ANY TAXPAYER FOR THE PURPOSE OF AVOIDING ANY PENALTIES. ANY SUCH STATEMENT HEREIN WAS WRITTEN TO SUPPORT THE MARKETING OR PROMOTION OF THE TRANSACTION(S) OR MATTER(S) TO WHICH THE STATEMENT RELATES. A PROSPECTIVE INVESTOR (INCLUDING A TAX-EXEMPT INVESTOR) IN THE SECURITIES SHOULD CONSULT ITS OWN TAX ADVISOR IN DETERMINING THE TAX CONSEQUENCES OF AN INVESTMENT IN THE SECURITIES, INCLUDING THE APPLICATION OF STATE, LOCAL OR OTHER TAX LAWS AND THE POSSIBLE EFFECTS OF CHANGES IN FEDERAL OR OTHER TAX LAWS.

Characterization of the Securities

There are no regulations, published rulings, or judicial decisions addressing the characterization for U.S. federal income tax purposes of securities with terms that are substantially the same as those of your securities. Thus, the characterization of the securities is not certain. Our special tax counsel, Orrick, Herrington & Sutcliffe LLP, has advised that the securities should be treated, for U.S. federal income tax purposes, as a prepaid forward contract, with respect to the Basket, that is eligible for open transaction treatment. In the absence of an administrative or judicial ruling to the contrary, we and, by acceptance of the securities, you agree to treat your securities for all tax purposes in accordance with such characterization. In light of the fact that we agree to treat the securities a s a prepaid forward contract, the balance of this discussion assumes that the securities will be so treated.

14

You should be aware that the characterization of the securities as described above is not certain, nor is it binding on the IRS or the courts. Thus, it is possible that the IRS would seek to characterize your securities in a manner that results in tax consequences to you that are different from those described above. For example, the IRS might assert that the securities constitute debt instruments that are “contingent payment debt instruments” that are subject to special tax rules under the applicable Treasury regulations governing the recognition of income over the term of your securities. If the securities were to be treated as contingent payment debt instruments (one of the requirements of which is that the instruments have a term of more than one year), you would be required to include in income on a n economic accrual basis over the term of the securities an amount of interest that is based upon the yield at which we would issue a non-contingent fixed-rate debt instrument with other terms and conditions similar to your securities, or the comparable yield. The characterization of securities as contingent payment debt instruments under these rules is likely to be adverse. However, if the securities had a term of one year or less, the rules for short-term debt obligations would apply rather than the rules for contingent payment debt instruments. Under Treasury regulations, a short-term debt obligation is treated as issued at a discount equal to the difference between all payments on the obligation and the obligation’s issue price. A cash method U.S. Holder that does not elect to accrue the discount in income currently should include the payments attributable to interest on the security as income upon receipt. Under these rules, any contingent pay ment would be taxable upon receipt by a cash basis taxpayer as ordinary interest income. You should consult your tax advisor regarding the possible tax consequences of characterization of the securities as contingent payment debt instruments or short-term debt obligations. It is also possible that the IRS would seek to characterize your securities as options, and thus as Code section 1256 contracts in the event that they are listed on a securities exchange. In such case, the securities would be marked-to-market at the end of the year and 40% of any gain or loss would be treated as short-term capital gain or loss, and the remaining 60% of any gain or loss would be treated as long-term capital gain or loss. We are not responsible for any adverse consequences that you may experience as a result of any alternative characterization of the securities for U.S. federal income tax or other tax purposes.

You should consult your tax advisor as to the tax consequences of such characterization and any possible alternative characterizations of your securities for U.S. federal income tax purposes.

U.S. Holders

For purposes of this discussion, the term “U.S. Holder,” for U.S. federal income tax purposes, means a beneficial owner of securities that is (1) a citizen or resident of the United States, (2) a corporation (or an entity treated as a corporation for U.S. federal income tax purposes) created or organized in or under the laws of the United States or any state thereof or the District of Columbia, (3) an estate, the income of which is subject to U.S. federal income taxation regardless of its source, or (4) a trust, if (a) a court within the United States is able to exercise primary supervision over the administration of such trust and one or more U.S. persons have the authority to control all substantial decisions of the trust or (b) such trust has in effect a valid election to be treated as a domestic trust for U.S. federal income tax pur poses. If a partnership (or an entity treated as a partnership for U.S. federal income tax purposes) holds securities, the U.S. federal income tax treatment of such partnership and a partner in such partnership will generally depend upon the status of the partner and the activities of the partnership. If you are a partnership, or a partner of a partnership, holding securities, you should consult your tax advisor regarding the tax consequences to you from the partnership’s purchase, ownership and disposition of the securities.

In accordance with the agreed-upon tax treatment described above, upon receipt of the redemption amount of the securities from us, a U.S. Holder will recognize gain or loss equal to the difference between the amount of cash received from us and the U.S. Holder’s tax basis in the security at that time. For securities with a term of more than one year, such gain or loss will be long-term capital gain or loss if the U.S. Holder has held the security for more than one year at maturity. For securities with a term of one year or less, such gain or loss will be short-term capital gain or loss.

Upon the sale or other taxable disposition of a security, a U.S. Holder generally will recognize capital gain or loss equal to the difference between the amount realized on the sale or other taxable disposition and the U.S. Holder’s tax basis in the security (generally its cost). For securities with a term of more than one year, such gain or loss will be long-term capital gain or loss if the U.S. Holder has held the security for more than one year at the time of disposition. For securities with a term of one year or less, such gain or loss will be short-term capital gain or loss.

15

Legislation Affecting Securities Held Through Foreign Accounts

Under the “Hiring Incentives to Restore Employment Act” (the “Act”), a 30% withholding tax is imposed on “withholdable payments” made to foreign financial institutions (and their more than 50% affiliates) unless the payee foreign financial institution agrees, among other things, to disclose the identity of any U.S. individual with an account at the institution (or the institution’s affiliates) and to annually report certain information about such account. “Withholdable payments” include payments of interest (including original issue discount), dividends, and other items of fixed or determinable annual or periodical gains, profits, and income (“FDAP”), in each case, from sources within the United States, as well as gross proceeds from the sale of any property of a type whic h can produce interest or dividends from sources within the United States. The Act also requires withholding agents making withholdable payments to certain foreign entities that do not disclose the name, address, and taxpayer identification number of any substantial U.S. owners (or certify that they do not have any substantial United States owners) to withhold tax at a rate of 30%. We will treat payments on the securities as withholdable payments for these purposes.

Withholding under the Act will apply to all withholdable payments without regard to whether the beneficial owner of the payment is a U.S. person, or would otherwise be entitled to an exemption from the imposition of withholding tax pursuant to an applicable tax treaty with the United States or pursuant to U.S. domestic law. Unless a foreign financial institution is the beneficial owner of a payment, it will be subject to refund or credit in accordance with the same procedures and limitations applicable to other taxes withheld on FDAP payments provided that the beneficial owner of the payment furnishes such information as the IRS determines is necessary to determine whether such beneficial owner is a United States owned foreign entity and the identity of any substantial United States owners of such entity. Generally, the Act 217;s withholding and reporting regime will apply to payments made after December 31, 2012. Thus, if you hold your securities through a foreign financial institution or foreign corporation or trust, a portion of any of your payments made after December 31, 2012 may be subject to 30% withholding.

Non-U.S. Holders Generally

In the case of a holder of the securities that is not a U.S. Holder and has no connection with the United States other than holding its securities (a “Non-U.S. Holder”), payments made with respect to the securities will not be subject to U.S. withholding tax, provided that such Non-U.S. Holder complies with applicable certification requirements. Any gain realized upon the sale or other disposition of the securities by a Non-U.S. Holder generally will not be subject to U.S. federal income tax unless (1) such gain is effectively connected with a U.S. trade or business of such Non-U.S. Holder or (2) in the case of an individual, such individual is present in the United States for 183 days or more in the taxable year of the sale or other disposition and certain other conditions are met. Non-U.S. Holders should consult their tax advisors regarding the possibility that any portion of the return with respect to the securities could be characterized as dividend income and be subject to U.S. withholding tax.

Non-U.S. Holders that are subject to U.S. federal income taxation on a net income basis with respect to their investment in the securities should refer to the discussion above relating to U.S. Holders.

Legislation Affecting Substitute Dividend and Dividend Equivalent Payments

The Act treats a “dividend equivalent” payment as a dividend from sources within the United States. Under the Act, unless reduced by an applicable tax treaty with the United States, such payments generally would be subject to U.S. withholding tax. A “dividend equivalent” payment is (i) a substitute dividend payment made pursuant to a securities lending or a sale-repurchase transaction that (directly or indirectly) is contingent upon, or determined by reference to, the payment of a dividend from sources within the United States, (ii) a payment made pursuant to a “specified notional principal contract” that (directly or indirectly) is contingent upon, or determined by reference to, the payment of a dividend from sources within the United States, and (iii) any other payment determined by the IR S to be substantially similar to a payment described in the preceding clauses (i) and (ii). In the case of payments made after March 18, 2012, a dividend equivalent payment includes a payment made pursuant to any notional principal contract unless otherwise exempted by the IRS. Where the securities reference an interest in a fixed basket of securities or an index, such fixed basket or index will be treated as a single security. Where the securities reference an interest in a basket of securities or an index that may provide for the payment of dividends from sources within the United States, absent guidance from the IRS, it is uncertain whether the IRS would determine that payments under the securities are substantially similar to a dividend. If the IRS determines that a payment is substantially similar to a dividend, it may be subject to U.S. withholding tax, unless reduced by an applicable tax treaty.

U.S. Federal Estate Tax Treatment of Non-U.S. Holders

The securities may be subject to U.S. federal estate tax if an individual Non-U.S. Holder holds the securities at the

16

time of his or her death. The gross estate of a Non-U.S. Holder domiciled outside the United States includes only property situated in the United States. Individual Non-U.S. Holders should consult their tax advisors regarding the U.S. federal estate tax consequences of holding the securities at death.

IRS Notice on Certain Financial Transactions

On December 7, 2007, the IRS and the Treasury Department issued Notice 2008-2, in which they stated they are considering issuing new regulations or other guidance on whether holders of an instrument such as the securities should be required to accrue income during the term of the instrument. The IRS and Treasury Department also requested taxpayer comments on (1) the appropriate method for accruing income or expense (e.g., a mark-to-market methodology or a method resembling the noncontingent bond method), (2) whether income and gain on such an instrument should be ordinary or capital, and (3) whether foreign holders should be subject to withholding tax on any deemed income accrual.

Accordingly, it is possible that regulations or other guidance may be issued that require holders of the securities to recognize income in respect of the securities prior to receipt of any payments thereunder or sale thereof. Any regulations or other guidance that may be issued could result in income and gain (either at maturity or upon sale) in respect of the securities being treated as ordinary income. It is also possible that a Non-U.S. Holder of the securities could be subject to U.S. withholding tax in respect of the securities under such regulations or other guidance. It is not possible to determine whether such regulations or other guidance will apply to your securities (possibly on a retroactive basis). You are urged to consult your tax advisor regarding Notice 2008-2 and its possible impact on you.

Information Reporting Regarding Specified Foreign Financial Assets

The Act requires individual U.S. Holders with an interest in any “specified foreign financial asset” to file a report with the IRS with information relating to the asset, including the maximum value thereof, for any taxable year in which the aggregate value of all such assets is greater than $50,000 (or such higher dollar amount as prescribed by Treasury regulations). Specified foreign financial assets include any depository or custodial account held at a foreign financial institution; any debt or equity interest in a foreign financial institution if such interest is not regularly traded on an established securities market; and, if not held at a financial institution, (i) any stock or security issued by a non-U.S. person, (ii) any financial instrument or contract held for investment where the issuer or counterparty is a non-U .S. person, and (iii) any interest in an entity which is a non-U.S. person. Depending on the aggregate value of your investment in specified foreign financial assets, you may be obligated to file an annual report under this provision. The requirement to file a report is effective for taxable years beginning after March 18, 2010. Penalties apply to any failure to file a required report. Additionally, in the event a U.S. Holder does not file the information report relating to disclosure of specified foreign financial assets, the statute of limitations on the assessment and collection of U.S. federal income taxes of such U.S. Holder for the related tax year may not close before such information is filed. You should consult your own tax advisor as to the possible application to you of this information reporting requirement and related statute of limitations tolling provision.

Backup Withholding and Information Reporting

A holder of the securities (whether a U.S. Holder or a Non-U.S. Holder) may be subject to information reporting requirements and to backup withholding with respect to certain amounts paid to such holder unless it provides a correct taxpayer identification number, complies with certain certification procedures establishing that it is not a U.S. Holder or establishes proof of another applicable exemption, and otherwise complies with applicable requirements of the backup withholding rules.

Supplemental Plan of Distribution

Under the terms of distribution agreements with JPMSI and JPMorgan Chase Bank, N.A., each dated as of June 18, 2008, JPMSI and JPMorgan Chase Bank, N.A. will act as placement agents for the notes. The placement agents will receive a fee from Credit Suisse or one of our affiliates that will not exceed $10 per $1,000 principal amount of notes and will forgo fees for sales to fiduciary accounts. For more information, please refer to “Underwriting” in the accompanying product supplement.

17

Credit Suisse