The information in this preliminary pricing supplement is not complete and may be changed. This preliminary pricing supplement is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted. Subject to completion dated February 1, 2011. | ||

Preliminary Pricing Supplement No. ETN-4 To the Prospectus Supplement dated March 25, 2009 and Prospectus dated March 25, 2009 | Filed Pursuant to Rule 424(b)(2) Registration Statement No. 333-158199-10 February 1, 2011 | |

|  $250,000,000* Exchange Traded Notes due February 14, 2031 Linked on a Leveraged Basis to the Credit Suisse Merger Arbitrage Liquid Index (Net) (“ETNs”) | |

General

| • | The ETNs are designed for investors who seek leveraged exposure to the performance of the Credit Suisse Merger Arbitrage Liquid Index (Net) (the “index”). Investors should be willing to forgo interest payments and, if the index declines, be willing to lose up to 100% of their investment. Any payment on the ETNs is subject to our ability to pay our obligations as they become due. |

| • | The ETNs are designed to reflect a leveraged exposure to the performance of the index on a monthly basis, but their returns over longer periods of time can, and most likely will, differ significantly from two times the return on a direct investment in the index. The ETNs are very sensitive to changes in the performance of the index, and returns on the ETNs may be negatively impacted in complex ways by volatility of the index on a monthly basis. Accordingly, the ETNs should be purchased only by knowledgeable investors who understand the potential consequences of investing in the index and of seeking monthly compounding leveraged investment results. Investors should actively and frequently monitor their investments in the ETNs. |

| • | The ETNs are senior medium-term notes of Credit Suisse AG, acting through its Nassau Branch, maturing February 14, 2031. |

| • | The denomination and stated principal amount of each ETN is $20.00. Any ETNs issued in the future may be issued at a price that is higher or lower than the stated principal amount, based on the indicative value of the ETNs at that time. |

| • | The initial issuance of ETNs is expected to price on or about February 10, 2011 (the “inception date”) and is expected to settle on or about February 16, 2011 (the “initial settlement date”). Delivery of the ETNs in book-entry form only will be made through The Depository Trust Company (“DTC”). |

Key Terms

| Issuer: | Credit Suisse AG (“Credit Suisse”), acting through its Nassau Branch |

| CUSIP/ISIN: | 22542D753/US22542D7536. |

| Index: | The return on the ETNs will be based on the performance of the index during the term of the ETNs. The index is reported on Bloomberg under ticker symbol “CSLABMN <Index>”. The index uses a quantitative methodology to track a dynamic basket of securities held as long or short positions (the “index components”) and cash weighted in accordance with certain rules to include publicly announced merger and acquisition transactions that meet certain qualifying conditions. It is designed to capture the spread, if any, between the price at which the stock of a target company trades after a proposed acquisition of such target company is announced and the price that the acquiring company has proposed to pay for the stock of such target company. ;The spread between these two prices typically exists due to the uncertainty that the announced merger or acquisition will close and, if it closes, that such merger or acquisition will be at the initially proposed economic terms. For more information on the index, see “The Index” in this pricing supplement. |

| Payment at Maturity: | If your ETNs have not previously been repurchased by Credit Suisse, at maturity you will receive a cash payment equal to the closing value of your ETNs on the final valuation date.† Any payment on the ETNs is subject to our ability to pay our obligations as they become due. |

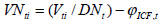

| Closing Value: | The closing value of the ETNs on any trading day equals the quotient obtained by dividing the product of the leverage factor and the closing level of the index on such trading day by the ETN divisor as of such trading day, minus the sum of (i) the accrued fee amount as of such trading day, (ii) the leverage amount as of such trading day and (iii) the leverage charge for such trading day. |

| Leverage Factor: | 2.0 |

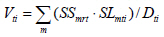

| ETN Divisor: | The ETN divisor resets on the first calendar day of each calendar month. For the calendar month that includes the inception date, the ETN divisor equals , which is equal to the closing level of the index on the inception date, divided by $20, which is the stated principal amount per ETN. For any subsequent calendar month, the ETN divisor equals the closing level of the index on the last calendar day of the previous calendar month (or, if such last calendar day is not a trading day, the level of the index at 5:00 p.m., New York City time, on that day as determined by Credit Suisse International (the “calculation agent”) divided by the closin g value of the ETNs on such last calendar day of the previous calendar month (or, if such last calendar day is not a trading day, the indicative value of the ETNs at 5:00 p.m., New York City time, on that day). |

Investing in the ETNs involves a number of risks. See “Risk Factors” beginning on page PS-12 of this pricing supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities or passed upon the accuracy or the adequacy of this pricing supplement or the accompanying prospectus supplement and the prospectus. Any representation to the contrary is a criminal offense.

* The agent for this offering, CSSU, is our affiliate. We intend to sell $ in principal amount of the ETNs on the initial settlement date through CSSU and through one or more dealers purchasing as principal through CSSU for $20.00 each, which is the stated principal amount. Additional ETNs may be offered and sold from time to time through CSSU and one or more dealers at a price that is higher or lower than the stated principal amount, based on the indicative value of the ETNs at that time. We will receive proceeds equal to 100% of the offering price of the ETNs issued and sold after the initial settlement date. Delivery of the ETNs in book-entry form only will be made through The Depository Trust Company (“DTC& #8221;).

CSSU is expected to charge normal commissions for the purchase of the ETNs. In exchange for providing certain services relating to the distribution of the ETNs, CSSU, a member of the Financial Industry Regulatory Authority (“FINRA”), may receive all or a portion of the investor fee. In addition, CSSU may charge investors a fee of up to $0.03 per ETN that is repurchased at the investor’s option. Please see “Supplemental Plan of Distribution (Conflicts of Interest)” in this pricing supplement for more information.

The securities are not deposit liabilities and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency of the United States, Switzerland or any other jurisdiction.

Credit Suisse

February , 2011

(cover continued on next page)

(continued from previous page)

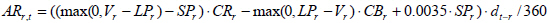

| Accrued Fee Amount: | As of any day (the “calculation day”), the accrued fee amount is equal to the sum, for each calendar day from and including the first calendar day in the calendar month that includes the calculation day to and including the calculation day, of: ETN Closing Value t-1 x Annual Investor Fee x 1/365 where ETN Closing Value t-1 means the closing value of the ETNs on the previous calendar day (or, if such previous calendar day is not a trading day, the indicative value of the ETNs at 5:00 p.m., New York City time, on that day) and annual investor fee means 0.55% per annum. |

| Leverage Amount: | The leverage amount resets on the first calendar day of each calendar month. For the calendar month that includes the inception date, the leverage amount equals $20.00, which is the stated principal amount per ETN. For any subsequent calendar month, the leverage amount equals the closing value of each ETN at 5:00 p.m., New York City time, on the last calendar day of the previous calendar month (or, if such last calendar day is not a trading day, the indicative value of each ETN at 5:00 p.m., New York City time, on that day). |

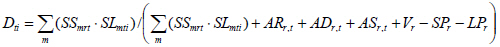

| Leverage Charge: | As of any day (the “leverage charge calculation day”), the leverage charge is equal to the sum, for each calendar day from and including the first calendar day in the calendar month that includes the leverage charge calculation day to and including the leverage charge calculation day, of: Leverage Amount x (USD 1M Libort-1 + 0.95%) x 1/ 360 where USD 1M Libort-1 is the rate on the immediately preceding business day for deposits of one month in U.S. dollars as displayed on Bloomberg page “US0001M Index” (or, if such rate is not available, the rate determined by the calculation agent in a commercially reasonable manner). |

| Indicative Value: | The indicative value of the ETNs at any time equals the quotient obtained by dividing the product of the leverage factor and the level of the index at such time (based on the most recent reported value of the index at such time or, if the day on which such time occurs is not a trading day, as determined by the calculation agent) by the ETN divisor as of such day, minus the sum of (i) the accrued fee amount for the day on which such time occurs, (ii) the leverage amount as of the day on which such time occurs and (iii) the leverage charge for the day on which such time occurs. |

| Closing Level: | The closing level of the index on any trading day will be the closing level reported on the Bloomberg page “CSLABMN <Index>” or any successor page on Bloomberg or any successor service, as applicable, as determined by the calculation agent, provided that in the event a valuation date is not a component business day for any index component or a market disruption event exists on a valuation date, the calculation agent will determine the closing level of the index for such valuation date according to the methodology described below in “Specific Terms of the ETNs—Market Disruption Events.” |

| Additional Fees Applicable to the ETNs: | In addition to the ETN divisor, which represents accumulated fees applicable to the ETNs, the accrued fee amount and the leverage charge, the index is subject to an annual index calculation fee of 0.5%, as described herein. Because the index calculation fee, the ETN divisor, the accrued fee amount and the leverage charge reduce the amount of your return at maturity or upon repurchase by Credit Suisse, the level of the index (before taking into account the index calculation fee) must increase by an amount sufficient, taking into account the leverage factor, to offset the index calculation fee, the ETN divisor and the accrued fee amount applicable to your ETNs (and the fee of up to $0.03 per ETN repurchased at your option as described herein) in order for you to receive at least the principal amount of your investment at maturity or upon repurchase. If the level of the index decreases or does not increase sufficiently, you will receive less, and possibly significantly less, than the principal amount of your investment at maturity or upon repurchase by Credit Suisse. |

| Secondary Market: | We intend to list the ETNs on NYSE Arca under the ticker symbol “CSMB”. If an active secondary market in the ETNs develops, we expect that investors will purchase and sell the ETNs primarily in this secondary market. We have no obligation to maintain any listing on NYSE Arca or any other exchange. |

Repurchase of the ETNs at Your Option: | Subject to the requirements described below, you may offer the applicable minimum repurchase amount or more of your ETNs to Credit Suisse for repurchase on any business day during the term of the ETNs until February 3, 2031. The minimum repurchase amount will be equal to $1,000,000 stated principal amount of ETNs (50,000 ETNs). The trading day immediately succeeding the date you offer your ETNs for repurchase will be the valuation date applicable to such repurchase. If you elect to offer your ETNs for repurchase, and the requirements for acceptance by Credit Suisse are met, you will receive a cash payment in an amount equal to the “daily repurchase value”, which is the closing value of the ETNs on the applicable valuation date.† Credit Suisse Securities (USA) LLC (“CSSU”) may charge investors an additional fee of up to $0.03 for each ETN that is repurchased at the investor’s option. |

Repurchase of the ETNs at Our Option: | We will have the right to repurchase the ETNs in whole but not in part on any business day during the term of the ETNs. Upon any such repurchase, you will receive a cash payment in an amount equal to the daily repurchase value.† |

| Repurchase of the ETNs upon Automatic Early Termination Event: | If the closing value of the ETNs on any trading day is equal to or less than 25% of the leverage amount on such trading day (an “automatic early termination event”), as determined by the calculation agent, we will repurchase all of the outstanding ETNs. Upon any such repurchase, you will receive a cash payment in an amount equal to the daily repurchase value. The trading day immediately following the trading day on which the automatic early termination event occurs will be the valuation date applicable to such repurchase.† |

† If a valuation date is not a component business day for any index component or if a market disruption event exists on a valuation date, your payment at maturity or upon repurchase will be delayed as described herein.

(cover continued on next page)

(continued from previous page)

| Repurchase Mechanics: | Repurchase at Your Option: To offer your ETNs for repurchase, you and your broker must deliver an irrevocable offer for repurchase to Credit Suisse and follow the procedures set forth under “Specific Terms of the ETNs—Repurchase Procedures.” If your irrevocable offer for repurchase is received after 4:00 p.m., New York City time, on a business day, you will be deemed to have made your offer for repurchase on the following business day. If you otherwise fail to comply with these procedures, your offer will be deemed ineffective and Credit Suisse will not be obligated to repurchase your ETNs. Unless the scheduled repurchase date is postponed because the valuation date is not a component business day for any index component or due to a market disruption eve nt, the final day on which Credit Suisse will repurchase your ETNs will be February 7, 2031. As such, you must offer your ETNs for repurchase no later than February 3, 2031. CSSU may charge a fee of up to $0.03 per ETN which is repurchased at your option. |

Repurchase at Our Option: If we exercise our right to repurchase the ETNs, we will deliver an irrevocable call notice to DTC (the holder of the global note). The trading day immediately succeeding the date the irrevocable call notice was delivered to DTC shall be the valuation date applicable to such repurchase, subject to postponement because such valuation date is not a component business day for any index component or due to the occurrence of a market disruption event. The last day on which we can deliver a repurchase notice is February 3, 2031. | |

Repurchase upon Automatic Early Termination Event: If an automatic early termination event occurs, we will deliver notice of the automatic early termination of the ETNs to DTC on the date of such automatic early termination event. The trading day immediately following the trading day on which the automatic early termination event occurs shall be the valuation date applicable to such repurchase, subject to postponement because such valuation date is not a component business day for any index component or due to the occurrence of a market disruption event. | |

| Valuation Date: | Any valuation date for a repurchase of your ETNs and February 10, 2031, which we refer to as the “final valuation date.” If a valuation date is not a component business day for any index component or if a market disruption event exists on a valuation date, the determination of the closing level of the index for such valuation date, including the final valuation date, will be postponed as provided herein. |

| Repurchase Date: | A repurchase date is the third business day following a valuation date. Unless the scheduled repurchase date is postponed because such valuation date is not a component business day for any index component or due to a market disruption event as described herein, the final day on which Credit Suisse will repurchase your ETNs will be February 7, 2031. As such, you must offer your ETNs for repurchase no later than February 3, 2031. |

| Trading Day: | A trading day is a day on which (i) the level of the index is calculated and published and (ii) trading is generally conducted on the NYSE Arca. |

| Component Business Day: | A component business day is, for each index component, a day on which trading is generally conducted on the primary securities exchange on which such index component is traded and any exchange on which futures or options contracts relating to such index component are traded. |

| Business Day: | A business day is a Monday, Tuesday, Wednesday, Thursday or Friday that is not a day on which banking institutions in New York City or London, England generally are authorized or obligated by law, regulation or executive order to close. |

| Calculation Agent: | Credit Suisse International |

TABLE OF CONTENTS

| Summary | PS-1 |

| Risk Factors | PS-12 |

| The Index | PS-20 |

| Description of The ETNs | PS-29 |

| Specific Terms of The ETNs | PS-31 |

| Clearance and Settlement | PS-37 |

| Supplemental Use of Proceeds and Hedging | PS-37 |

| Certain U.S. Federal Income Tax Considerations | PS-38 |

| Supplemental Plan of Distribution (Conflicts of Interest) | PS-42 |

| Benefit Plan Investor Considerations | PS-42 |

| Legal Matters | PS-43 |

| Annex A | A-1 |

| Annex B | B-1 |

You should read this pricing supplement together with the accompanying prospectus supplement dated March 25, 2009 and the prospectus dated March 25, 2009, relating to our Medium-Term Notes of which these ETNs are a part. You may access these documents on the SEC website at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

| • | Prospectus supplement dated March 25, 2009: |

| • | Prospectus dated March 25, 2009: |

Our Central Index Key, or CIK, on the SEC website is 1053092.

This pricing supplement, together with the documents listed above, contains the terms of the ETNs and supersedes all other prior or contemporaneous oral statements as well as any other written materials including preliminary or indicative pricing terms, fact sheets, correspondence, trade ideas, structures for implementation, sample structures, brochures or other educational materials of ours. You should carefully consider, among other things, the matters set forth in “Risk Factors” in this pricing supplement and the accompanying prospectus supplement and prospectus, as the ETNs involve risks not associated with conventional debt securities. You should consult your investment, legal, tax, accounting and other advisers before deciding to invest in the ETNs. You should rely only on the information contained in this document or i n any documents to which we have referred you. We have not authorized anyone to provide you with information that is different. This document may only be used where it is legal to sell these ETNs. The information in this document may only be accurate on the date of this document.

The distribution of this pricing supplement and the accompanying prospectus supplement and prospectus and the offering of the ETNs in some jurisdictions may be restricted by law. If you possess this pricing supplement, you should find out about and observe these restrictions.

In this pricing supplement and the accompanying prospectus supplement and prospectus, unless otherwise specified or the context otherwise requires, references to “Credit Suisse”, the “Company”, “we”, “us” and “our” are to Credit Suisse AG, acting through its Nassau Branch, and references to “dollars” and “$” are to United States dollars.

i

SUMMARY

The following is a summary of terms of the ETNs, as well as a discussion of risks and other considerations you should take into account when deciding whether to invest in the ETNs. References to the “prospectus” mean our accompanying prospectus, dated March 25, 2009 and references to the “prospectus supplement” mean our accompanying prospectus supplement, dated March 25, 2009.

We may, without providing you notice or obtaining your consent, create and issue ETNs in addition to those offered by this pricing supplement having the same terms and conditions as the ETNs. We may consolidate the additional ETNs to form a single class with the outstanding ETNs.

What are the ETNs and how do they work?

The ETNs are medium-term notes of Credit Suisse AG (“Credit Suisse”), the return on which is linked on a leveraged basis to the performance of the Credit Suisse Merger Arbitrage Liquid Index (Net) (the “index”).

We will not pay you interest during the term of the ETNs. The ETNs do not have a minimum redemption or repurchase amount and are fully exposed to any decline in the index. Depreciation of the index will reduce your payment at maturity, and you could lose your entire investment.

The ETNs are designed to reflect a leveraged exposure to the performance of the index on a monthly basis, but their returns over longer periods of time can, and most likely will, differ significantly from two times the return on a direct investment in the index. The ETNs are very sensitive to changes in the performance of the index, and returns on the ETNs may be negatively impacted in complex ways by volatility of the index on a monthly basis. Accordingly, the ETNs should be purchased only by knowledgeable investors who understand the potential consequences of investing in the index and of seeking monthly compounding leveraged investment results. Investors should actively and frequently monitor their investments in the ETNs.

For a description of how the payment at maturity and upon repurchase, respectively, are calculated, please refer to the “Specific Terms of the ETNs—Payment at Maturity” and “—Payment upon Repurchase” sections herein.

The denomination and stated principal amount of each ETN is $20. Any ETNs issued in the future may be issued at a price higher or lower than the stated principal amount, based on the indicative value of the ETNs at that time. You will not have the right to receive physical certificates evidencing your ownership except under limited circumstances. Instead, we will issue the ETNs in the form of a global certificate, which will be held by DTC or its nominee. Direct and indirect participants in DTC will record beneficial ownership of the ETNs by individual investors. Accountholders in the Euroclear or Clearstream Banking clearance systems may hold beneficial interests in the ETNs through the accounts those systems maintain with DTC. You should refer to the section “Description of Notes—Book-Entry, Delivery and Form” in the accompanying prospectus supplement and the section “Description of Debt Securities—Book-Entry System” in the accompanying prospectus.

What is the index and who publishes the level of the index?

The index was created by Credit Suisse Alternative Capital, Inc., as index sponsor (the “index sponsor”) and uses a quantitative methodology to track a dynamic basket of securities held as long or short positions (the “index components”) and cash weighted in accordance with certain rules to include publicly announced merger and acquisition transactions that meet certain qualifying conditions. It is designed to capture the spread, if any, between the price at which the stock of a target company trades after a proposed acquisition of such target company is announced and the price that the acquiring company has proposed to pay for the stock of such target company. The spread betwe en these two prices typically exists due to the uncertainty that the announced merger or acquisition will close and, if it closes, that such merger or acquisition will be at the initially proposed economic terms.

The index was established on December 31, 2009 with an initial value of 1,000. The index components selected for inclusion in calculating the index, as well as their respective weightings, are determined on each rebalancing date (as defined below in “The Index—Weighting and Rebalancing”). NYSE Arca, Inc., or another party designated by the index committee, will act as the calculation agent for the index (the “index calculation agent”) and will be responsible for the calculation of

PS-1

the level of the index, using the data and methodologies described herein and as determined by the index committee. The Bloomberg ticker symbol for the index is “CSLABMN <Index>”.

For more information, please refer to “The Index” in this pricing supplement.

How will payment at maturity or payment at repurchase be determined for the ETNs?

Unless your ETNs have been previously repurchased by us, either at your election or at ours, the ETNs will mature on February 14, 2031. Further details on the conditions and the procedures applicable to any such repurchase are set forth in this pricing supplement.

Payment at maturity

If your ETNs have not been previously repurchased by Credit Suisse, at maturity you will receive a cash payment in an amount equal to the closing value of your ETNs on the final valuation date.

The closing value of the ETNs on any trading day equals the quotient obtained by dividing the product of the leverage factor and the closing level of the index on such trading day by the ETN divisor as of such trading day, minus the sum of (i) the accrued fee amount as of such trading day, (ii) the leverage amount as of such trading day and (iii) the leverage charge for such trading day.

The leverage factor equals 2.0.

The ETN divisor resets on the first calendar day of each calendar month. For the calendar month that includes the inception date, the ETN divisor equals , which is equal to the closing level of the index on the inception date, divided by $20, which is the stated principal amount per ETN. For any subsequent calendar month, the ETN divisor equals the closing level of the index on the last calendar day of the previous calendar month (or, if such last calendar day is not a trading day, the level of the index at 5:00 p.m., New York City time, on that day as determined by the calculation agent) divided by the closing value of the ETNs on such last calendar day of the previous calendar month (or, if such last calendar day is not a trading day, the indicative value of the ETNs at 5:00 p.m., New York City time, on that day).

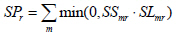

As of any day (the “calculation day”), the accrued fee amount is equal to the sum, for each calendar day from and including the first calendar day in the calendar month that includes the calculation day to and including the calculation day, of:

ETN Closing Valuet-1 x Annual Investor Fee x 1/365

where ETN Closing Valuet-1 means the closing value of the ETNs on the previous calendar day (or, if such previous calendar day is not a trading day, the indicative value of the ETNs at 5:00 p.m., New York City time, on that day) and annual investor fee means 0.55% per annum.

The leverage amount resets on the first calendar day of each calendar month. For the calendar month that includes the inception date, the leverage amount equals $20.00, which is the stated principal amount per ETN. For any subsequent calendar month, the leverage amount equals the closing value of each ETN at 5:00 p.m., New York City time, on the last calendar day of the previous calendar month (or, if such last calendar day is not a trading day, the indicative value of each ETN at 5:00 p.m., New York City time, on that day).

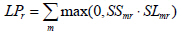

As of any day (the “leverage charge calculation day”), the leverage charge is equal to the sum, for each calendar day from and including the first calendar day in the calendar month that includes the leverage charge calculation day to and including the leverage charge calculation day, of:

Leverage Amount x (USD 1M Libort-1 + 0.95%) x 1/360 |

PS-2

where USD 1M Libort-1 is the rate on the immediately preceding business day for deposits of one month in U.S. dollars as displayed on Bloomberg page “US0001M Index” (or, if such rate is not available, the rate determined by the calculation agent in a commercially reasonable manner).

The indicative value of the ETNs at any time equals the quotient obtained by dividing the product of the leverage factor and the level of the index at such time (based on the most recent reported value of the index at such time or, if the day on which such time occurs is not a trading day, as determined by the calculation agent) by the ETN divisor as of such day, minus the sum of (i) the accrued fee amount as of the day on which such time occurs, (ii) the leverage amount as of the day on which such time occurs and (iii) the leverage charge for the day on which such time occurs.

The closing level of the index on any trading day will be the closing level reported on the Bloomberg page “CSLABMN <Index>” or any successor page on Bloomberg or any successor service, as applicable, as determined by the calculation agent, provided that in the event a valuation date is not a component business day for any index component or a market disruption event exists on a valuation date, the calculation agent will determine the closing level of the index for such valuation date according to the methodology described below in “Specific Terms of the ETNs—Market Disruption Events.”

Any payment you will be entitled to receive is subject to our ability to pay our obligations as they become due.

For a further description of how your payment at maturity will be calculated, see “—How Does the calculation agent Calculate the Payment on the ETNs?—Hypothetical Examples” below and “Specific Terms of the ETNs” in this pricing supplement.

| Payment Upon Repurchase |

We have the right to repurchase the ETNs in whole but not in part on any business day during the term of the ETNs. To repurchase the ETNs, we will deliver an irrevocable call notice to The Depository Trust Company (“DTC”). The trading day immediately succeeding the date the irrevocable call notice was delivered to DTC shall be the valuation date applicable to such repurchase.

At your election you may, subject to certain restrictions, offer your ETNs for repurchase by Credit Suisse on any business day during the term of the ETNs, beginning on February 10, 2011 (for an anticipated February 11, 2011 valuation date and a repurchase date of February 16, 2011) through February 3, 2031 (for an anticipated February 4, 2031 valuation date and a repurchase date of February 7, 2031), provided that you offer at least the applicable minimum repurchase amount (which will be $1,000,000 stated principal amount of ETNs (50,000 ETNs)) for repurchase and follow the procedures as described below. Credit Suisse Securities (USA) LLC (“CSSU”) will act as our agent in connection with any repurchases at your option and may charge investors an additional fee of up to $0.03 for each ETN repurchased.

If the closing value of the ETNs on any trading day is equal to or less than 25% of the leverage amount on such trading day (an “automatic early termination event”), as determined by the calculation agent, we will repurchase all of the outstanding ETNs. Upon any such repurchase, you will receive a cash payment in an amount equal to the daily repurchase value. The trading day immediately following the trading day on which the automatic early termination event occurs will be the valuation date applicable to such repurchase.

If you choose to offer your ETNs for repurchase or they are repurchased at our option or upon the occurrence of an automatic early termination event, you will receive a cash payment on the repurchase date in an amount equal to the “daily repurchase value”, which is the closing value of the ETNs on the applicable valuation date.

A repurchase date is the third business day following a valuation date. Unless your scheduled repurchase date is postponed because the valuation date is not a component business day for any index component or due to a market disruption event, the final day on which Credit Suisse will repurchase your ETNs will be February 7, 2031. As such, you must offer your ETNs for repurchase no later than February 3, 2031. The daily repurchase feature is intended to induce arbitrageurs to counteract any trading of the ETNs at a premium or discount to their indicative value, although there can be no assurance that arbitrageurs will employ the repurchase feature in this manner.

Any payment you will be entitled to receive is subject to our ability to pay our obligations as they become due.

PS-3

For a further description of how your payment upon repurchase will be calculated, see “—How Does the calculation agent Calculate the Payment on the ETNs?—Hypothetical Examples” below and “Specific Terms of the ETNs” in this pricing supplement.

General

If a market disruption event exists on any valuation date (including the final valuation date) or if such valuation date is not a component business day for any index component, calculation agent, will postpone the determination of the closing level of the index for such valuation date for up to six scheduled trading days, and the calculation agent will determine the closing level of the index for such valuation date according to the methodology described under “Specific Terms of the ETNs—Market Disruption Events” below. A “scheduled trading day” is any day that, but for the occurrence of a market disruption event, would have otherwise been a trading day. If the determination of the closing level of the index for the final valuation date is postponed, t he maturity date will also be postponed by an equal number of business days up to six business days. In addition, postponement of the determination of the closing level of the index for a valuation date relating to a repurchase of ETNs will have the effect of postponing the corresponding repurchase date by an equal number of business days. Any such postponement or determinations by the calculation agent may adversely affect your return on the ETNs. In addition, no interest or other payment will be payable as a result of such postponement. For more information on market disruption events and their effect on the calculation of the payment you will receive at maturity or upon repurchase, see “Specific Terms of the ETNs—Market Disruption Events” and “—Payment at Maturity” and “—Payment Upon Repurchase” in this pricing supplement.

In addition to the ETN divisor, which represents accumulated fees applicable to the ETNs, the accrued fee amount and the leverage charge, the index is subject to an annual index calculation fee of 0.5%, as described herein. Because the index calculation fee, the ETN divisor, the accrued fee amount and the leverage charge reduce the amount of your return at maturity or upon repurchase by Credit Suisse, the level of the index (before taking into account the index calculation fee) must increase by an amount sufficient, taking into account the leverage factor, to offset the index calculation fee, the ETN divisor, the accrued fee amount and the leverage charge applicable to your ETNs (and the fee of up to $0.03 per ETN repurchased at your option, if you elect to have us purchase your ETNs) in order for you to receive at least the p rincipal amount of your investment at maturity or upon repurchase. If the level of the index decreases or does not increase sufficiently, you will receive less, and possibly significantly less, than the principal amount of your investment at maturity or upon repurchase by Credit Suisse.

Will you receive interest on the ETNs?

No. We will not make any periodic payments of interest or any other payments on the ETNs during the term of the ETNs. Unless the ETNs are repurchased by Credit Suisse, you will not receive any payments on the ETNs prior to maturity of the ETNs.

How do you sell your ETNs?

We intend to list the ETNs on NYSE Arca. If an active secondary market in the ETNs develops, we expect that investors will purchase and sell the ETNs primarily in this secondary market. In addition, Credit Suisse may repurchase your ETNs as described herein.

How do you offer your ETNs for repurchase by Credit Suisse?

If you wish to offer your ETNs to Credit Suisse for repurchase, you and your broker must follow the following procedures:

| • | Your broker must deliver a completed irrevocable Offer for Repurchase, a form of which is attached as Annex A to this pricing supplement, to Credit Suisse. If your irrevocable offer for repurchase is received after 4:00 p.m., New York City time, on a business day, you will be deemed to have made your offer for repurchase on the following business day. One portion of the Offer for Repurchase must be completed by you as beneficial owner of the ETNs and the other portion must be completed by your broker. You must offer at least the applicable minimum repurchase amount (which will be $1,000,000 stated principal amount of ETNs (50,000 ETNs)) for repurchase. Credit Suisse must acknowledge receipt from your broker in order for your offer to be effective. |

PS-4

| • | Your broker must book a delivery vs. payment trade with respect to your ETNs on the applicable valuation date at a price equal to the applicable daily repurchase value, facing Credit Suisse. |

| • | Your broker must cause your DTC custodian to deliver the trade as booked for settlement via DTC at or prior to 10:00 a.m., New York City time, on the applicable repurchase date (the third business day following the valuation date). |

Different brokers and DTC participants may have different deadlines for accepting instructions from their customers. Accordingly, you should consult the brokerage firm or other DTC participant through which you own your interest in the ETNs in respect of such deadlines. Any repurchase instructions that we receive in accordance with the procedures described above will be irrevocable.

What are some of the risks of the ETNs?

An investment in the ETNs involves risks. Some of these risks are summarized here, but we urge you to read the more detailed explanation of risks in “Risk Factors” in this pricing supplement.

| • | Uncertain principal repayment—You may receive less than the principal amount of your ETNs at maturity or upon repurchase. If the level of the index decreases, or does not increase by an amount sufficient, taking into account the leverage factor, to offset the index calculation fee, the ETN divisor, the accrued fee amount and the leverage charge applicable to your ETNs, you will receive less, and possibly significantly less, than your original investment in the ETNs. |

| • | Long holding period risk—The ETNs are designed to reflect a leveraged exposure to the performance of the index on a monthly basis, but their returns over longer periods of time can, and most likely will, differ significantly from two times the return on a direct investment in the index. The ETNs are very sensitive to changes in the performance of the index, and returns on the ETNs may be negatively impacted in complex ways by volatility of the index on a monthly basis. Accordingly, the ETNs should be purchased only by knowledgeable investors who understand the potential consequences of investing in the index and of seeking monthly compounding leveraged investment results. Investors should actively and frequently monitor their investments in the ETNs. |

| • | No interest payments—You will not receive any periodic interest payments on the ETNs. |

| • | A trading market for the ETNs may not develop—Although we intend to list the ETNs on NYSE Arca, a trading market for your ETNs may not develop. We are not required to maintain any listing of the ETNs on NYSE Arca or any other exchange. |

| • | Credit risk of the issuer—Any payments you are entitled to receive on your ETNs are subject to the ability of Credit Suisse to pay its obligations as they come due. |

| • | Requirements on repurchases by Credit Suisse—You must offer at least the applicable minimum repurchase amount to Credit Suisse and satisfy the other requirements described herein for your offer for repurchase to be considered. |

| • | Your offer for repurchase is irrevocable—You will not be able to rescind your offer for repurchase after it is received by Credit Suisse, so you will be exposed to market risk in the event market conditions change after Credit Suisse receives your offer. |

| • | Uncertain tax treatment—No ruling is being requested from the Internal Revenue Service (“IRS”) with respect to the tax consequences of the ETNs. There is no direct authority dealing with securities such as the ETNs, and there can be no assurance that the IRS will accept, or that a court will uphold, the tax treatment described in this pricing supplement. In addition, you should note that the IRS and the U.S. Treasury Department have announced a review of the tax treatment of prepaid forward contracts. Accordingly, no assurance can be given that future tax legislation, regulations or other guidance may not change the tax treatment of the ETNs. Potential investors should consult their tax advisors regarding the U.S. federal income tax consequences of an investment in the ETNs, including po ssible alternative treatments. |

| • | Optional repurchase feature— We have the right to repurchase the ETNs in whole but not in part on any business day during the term of the ETNs. If your ETNs are repurchased by us, you will receive a cash payment in an amount equal to the daily repurchase value, which is the closing value of the ETNs on the applicable valuation date. |

PS-5

| • | Repurchase upon occurrence of automatic early termination event— If the closing value of the ETNs on any trading day is equal to or less than 25% of the leverage amount on such trading day (an “automatic early termination event”), as determined by the calculation agent, we will repurchase all of the outstanding ETNs. Upon any such repurchase, you will receive a cash payment in an amount equal to the daily repurchase value. The trading day immediately following the trading day on which the automatic early termination event occurs will be the valuation date applicable to such repurchase. |

Is this the right investment for you?

The ETNs may be a suitable investment for you if:

| • | You seek an investment with a return linked on a leveraged basis to the performance of the index. |

| • | You believe the level of the index will increase by an amount sufficient, taking into account the leverage factor, to offset the index calculation fee, the ETN divisor, the accrued fee amount and the leverage charge (and the fee of up to $0.03 per ETN repurchased at your option, if you elect to have us repurchase your ETNs), and to provide you with a satisfactory return on your investment during the term of the ETNs. |

| • | You are a knowledgeable investor who understands the potential consequences of investing in the index and of seeking monthly compounding leveraged investment results. |

| • | You are willing to actively and frequently monitor your investment in the ETNs. |

| • | You are willing to accept the risk of fluctuations in the level of the index. |

| • | You do not seek current income from this investment. |

The ETNs may not be a suitable investment for you if:

| • | You are not willing to be exposed to fluctuations in the level of the index. |

| • | You seek a guaranteed return of principal. |

| • | You seek an investment with a longer investment objective than one month. |

| • | You are not willing to actively and frequently monitor your investment in the ETNs |

| • | You believe the level of the index will decrease or will not increase by an amount sufficient, taking into account the leverage factor, to offset the index calculation fee, the ETN divisor, the accrued fee amount and the leverage charge during the term of the ETNs. |

| • | You prefer the lower risk and therefore accept the potentially lower returns of fixed income investments with comparable maturities and credit ratings. |

| • | You seek an investment with a longer duration than one month. |

| • | You seek current income from your investment. |

Does an investment in the ETNs entitle you to any ownership interests in the index components comprising the index?

No. An investment in the ETNs does not entitle you to any ownership interest or rights in the index components comprising the index. You will not have any voting rights with respect to any index component, receive dividend payments or other distributions or have any other interest or rights in any index component merely as a result of your ownership of the ETNs.

PS-6

Will the ETNs be distributed by affiliates of the Issuer?

Our affiliate, CSSU, a member of the Financial Industry Regulatory Authority (“FINRA”) will participate in the initial distribution of the ETNs on the initial settlement date and will likely participate in any future distribution of the ETNs. CSSU is expected to charge normal commissions for the purchase of any ETNs and may also receive all or a portion of the investor fee. Any offering in which CSSU participates will be conducted in compliance with the requirements of FINRA Rule 5121 regarding a FINRA member firm’s distribution of the securities of an affiliate and related conflicts of interest. In accordance with FINRA Rule 5121, CSSU may not make sales in offerings of the ETNs to any of its discretionary accounts without the prior written approval of t he customer. Please see the section entitled “Supplemental Plan of Distribution (Conflicts of Interest)” in this pricing supplement.

What is the U.S. Federal income tax treatment of an investment in the ETNs?

Please refer to “Certain U.S. Federal Income Tax Considerations” on page PS-38 for a discussion of certain U.S. federal income tax considerations for making an investment in the ETNs.

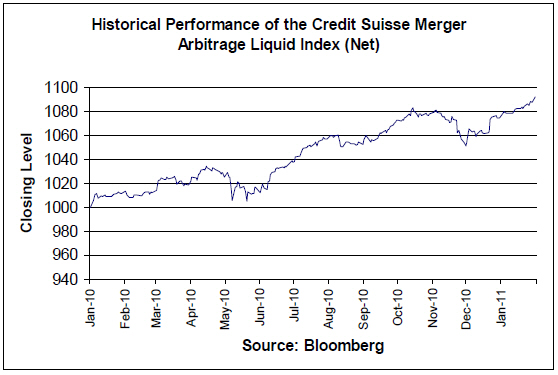

How has the index performed historically?

Hypothetical historical values of the index are provided in the section “The Index—Hypothetical Historical and Actual Historical Index Levels and Performance” in this pricing supplement. Past performance is based upon a certain set of data, estimates and assumption and is not necessarily indicative of how the index would have performed under a different set of parameters or how the index will perform in the future. In addition, the index rules were revised on September 1, 2010 as described in “The Index” below. The index performance prior to September 1, 2010 does not reflect the modification to the index rules that took place on that date.

How does the calculation agent calculate the payment on the ETNs?

Credit Suisse International, as calculation agent, will calculate payment at maturity or upon repurchase as the closing value of the ETNs on the applicable valuation date.

The closing value of the ETNs on any trading day equals the quotient obtained by dividing the product of the leverage factor and the closing level of the index on such trading day by the ETN divisor as of such trading day, minus the sum of (i) the accrued fee amount as of such trading day, (ii) the leverage amount as of such trading day and (iii) the leverage charge for such trading day.

The leverage factor equals 2.0.

The ETN divisor resets on the first calendar day of each calendar month. For the calendar month that includes the inception date, the ETN divisor equals , which is equal to the closing level of the index on the inception date, divided by $20, which is the stated principal amount per ETN. For any subsequent calendar month, the ETN divisor equals the closing level of the index on the last calendar day of the previous calendar month (or, if such last calendar day is not a trading day, the level of the index at 5:00 p.m., New York City time, on that day as determined by the calculation agent) divided by the closing value of the ETNs on such last calendar day of the previous calendar month (or, if such last calendar day is not a trading day, the indicative value of the ETNs at 5:00 p.m., New York City time, on that day).

As of any day (the “calculation day”), the accrued fee amount is equal to the sum, for each calendar day from and including the first calendar day in the calendar month that includes the calculation day to and including the calculation day, of:

ETN Closing Valuet-1 x Annual Investor Fee x 1/365

where ETN Closing Valuet-1 means the closing value of the ETNs on the previous calendar day (or, if such previous calendar day is not a trading day, the indicative value of the ETNs at 5:00 p.m., New York City time, on that day) and annual investor fee means 0.55% per annum.

PS-7

The leverage amount resets on the first calendar day of each calendar month. For the calendar month that includes the inception date, the leverage amount equals $20.00, which is the stated principal amount per ETN. For any subsequent calendar month, the leverage amount equals the closing value of each ETN at 5:00 p.m., New York City time, on the last calendar day of the previous calendar month (or, if such last calendar day is not a trading day, the indicative value of each ETN at 5:00 p.m., New York City time, on that day).

As of any day (the “leverage charge calculation day”), the leverage charge is equal to the sum, for each calendar day from and including the first calendar day in the calendar month that includes the leverage charge calculation day to and including the leverage charge calculation day, of:

Leverage Amount x (USD 1M Libort-1 + 0.95%) x 1/360

where USD 1M Libort-1 is the rate on the immediately preceding business day for deposits of one month in U.S. dollars as displayed on Bloomberg page “US0001M Index” (or, if such rate is not available, the rate determined by the calculation agent in a commercially reasonable manner).

The indicative value of the ETNs at any time equals the quotient obtained by dividing the product of the leverage factor and the level of the index at such time (based on the most recent reported value of the index at such time or, if the day on which such time occurs is not a trading day, as determined by the calculation agent) by the ETN divisor as of such day, minus the sum of (i) the accrued fee amount as of the day on which such time occurs, (ii) the leverage amount as of the day on which such time occurs and (iii) the leverage charge for the day on which such time occurs.

The closing level of the index on any trading day will be the closing level reported on the Bloomberg page “CSLABMN <Index>” or any successor page on Bloomberg or any successor service, as applicable, as determined by the calculation agent, provided that in the event a valuation date is not a component business day for any index component or a market disruption event exists on a valuation date, the calculation agent will determine the closing level of the index for such valuation date according to the methodology described below in “Specific Terms of the ETNs—Market Disruption Events.”

Because the index calculation fee, the ETN divisor, the accrued fee amount and the leverage charge reduce the amount of your return at maturity or upon repurchase by Credit Suisse, the level of the index (before taking into account the index calculation fee) must increase by an amount sufficient, taking into account the leverage factor, to offset the index calculation fee, the ETN divisor, the accrued fee amount and the leverage charge applicable to your ETNs (and the fee of up to $0.03 per ETN repurchased at your option, if you elect to have us repurchase your ETNs) in order for you to receive at least the principal amount of your investment at maturity or upon repurchase of your ETNs by Credit Suisse. If the level of the index decre ases or does not increase sufficiently, taking into account the leverage factor, you will receive less, and possibly significantly less, than the principal amount of your investment at maturity or upon repurchase of your ETNs by Credit Suisse.

PS-8

HYPOTHETICAL EXAMPLES

The following examples show how the ETNs would perform in hypothetical circumstances, assuming an initial index level of 1,100 and reflecting the $20.00 stated principal amount of each ETN. These hypothetical examples are meant to illustrate the effect that different factors may have on the closing value. These factors include fees, compounding of returns and the volatility of the index. Many other factors may affect the value of your ETNs, and these figures are provided for purposes of illustration only. They should not be taken as an indication or prediction of future investment results and are intended merely to illustrate a few of the potential possible closing values for the ETNs. No single example can easily capture all the possible influences on the value of your ETNs. &# 160;The figures in these examples have been rounded for convenience.

The information in the tables reflects hypothetical rates of return on the ETNs assuming that they are purchased on the inception date at the closing value and disposed of on the maturity date. We have not considered repurchase of the ETNs at our option, at your option or upon the occurrence of an automatic early termination event for simplicity. Although your payment upon repurchase of the ETNs at your option would be based on the closing value of the ETNs on the valuation date applicable to such repurchase, your payment upon repurchase of the ETNs at your option would be subject to the fee of up to $0.03 per ETN repurchased at your option.

The examples below assume no Market Disruption Event occurs. Also, the hypothetical rates of return shown below do not take into account the effects of applicable taxes. Because of the U.S. tax treatment applicable to your ETN, tax liabilities could affect the after-tax rate of return on your ETNs to a comparatively greater extent than the after-tax return on the underlying index components.

Two of the most important factors that will affect the value of your ETNs are the directional change in the in the level of the index (either up or down) and the annualized monthly volatility of the index itself. The annualized monthly volatility of the index is a measure of the magnitude and frequency of month-to-month changes in the index closing level, and is equal to the standard deviation of the index’s monthly returns over twenty years, annualized by multiplying by the square root of 12. When we refer to “volatility in the monthly change in index closing levels” we mean that the annualized volatility of the monthly closing levels of the index over the relevant term. We therefore provide four examples below that reflect four different scenarios related to these two factors. 60;The hypothetical examples highlight the negative impact of higher annualized volatility of the index on the rate of return on your ETNs. In Example 1 we show increasing index closing levels with 4.58% annualized volatility in the monthly change in index closing levels over the relevant term. In example 2 we show increasing index closing levels with 28.26% annualized volatility in the monthly change in index closing levels over the relevant term. In example 3 we show decreasing index closing levels with 5.16% annualized volatility in the monthly change in index closing levels over the relevant term. In Example 4 we show decreasing index closing levels with 32.19% annualized volatility in the monthly change in index closing levels over the relevant term. Because the annual investor fee is calculated on a daily basis, its effect on the value of your ETNs is dependent upon the path the index takes rather than just the endpoint of the index. Each of these four examples is a random possibility generated by a computer among an infinite number of possible outcomes. Your return may be materially worse.

Any payment you will be entitled to receive is subject to our ability to pay our obligations as they become due.

For purposes of the calculation in this table, each year is assumed to have 360 days and USD 1M Libor is assumed to be constant at 0.25% per annum.

Example 1. This example assumes the index increases by 79.11% with 4.58% annualized volatility in the monthly change in index closing level over the relevant term.

| A | B | C | D | E |

| Year | Index Level | Closing Value | Annualized Index Return | Annualized ETN Return |

| 0 | 1,100.00 | 20.00 | n/a | n/a |

| 1 | 1,089.93 | 19.27 | -0.92% | -3.63% |

| 2 | 1,094.68 | 19.08 | 0.44% | -0.99% |

| 3 | 1,050.22 | 17.21 | -4.06% | -9.81% |

| 4 | 1,142.48 | 19.99 | 8.78% | 16.13% |

| 5 | 1,273.22 | 24.35 | 11.44% | 21.82% |

| 6 | 1,278.92 | 24.10 | 0.45% | -1.04% |

| 7 | 1,274.00 | 23.47 | -0.38% | -2.58% |

| 8 | 1,349.22 | 25.84 | 5.90% | 10.10% |

| 9 | 1,398.39 | 27.23 | 3.64% | 5.35% |

| 10 | 1,567.62 | 33.56 | 12.10% | 23.27% |

| 11 | 1,491.46 | 29.79 | -4.86% | -11.24% |

| 12 | 1,554.82 | 31.79 | 4.25% | 6.70% |

| 13 | 1,610.11 | 33.37 | 3.56% | 5.00% |

| 14 | 1,614.68 | 32.94 | 0.28% | -1.29% |

| 15 | 1,755.16 | 38.15 | 8.70% | 15.82% |

| 16 | 1,772.68 | 38.13 | 1.00% | -0.06% |

| 17 | 1,765.08 | 37.03 | -0.43% | -2.89% |

| 18 | 1,797.18 | 37.61 | 1.82% | 1.57% |

| 19 | 1,922.48 | 42.16 | 6.97% | 12.09% |

| 20 | 1,970.25 | 43.43 | 2.48% | 3.01% |

PS-9

Example 2. This example assumes the index increases by 79.11% with 28.26% annualized volatility in the monthly change in Index closing levels over the relevant term.

| A | B | C | D | E |

| Year | Index Level | Closing Value | Annualized Index Return | Annualized ETN Return |

| 0 | 1,100.00 | 20.00 | n/a | n/a |

| 1 | 934.14 | 13.04 | -15.08% | -34.80% |

| 2 | 1,028.00 | 14.68 | 10.05% | 12.61% |

| 3 | 750.31 | 6.88 | -27.01% | -53.12% |

| 4 | 565.89 | 3.60 | -24.58% | -47.77% |

| 5 | 735.19 | 5.13 | 29.92% | 42.67% |

| 6 | 948.20 | 7.74 | 28.97% | 50.81% |

| 7 | 1,080.29 | 9.64 | 13.93% | 24.64% |

| 8 | 1,296.80 | 12.33 | 20.04% | 27.87% |

| 9 | 1,050.69 | 7.26 | -18.98% | -41.09% |

| 10 | 1,196.32 | 8.84 | 13.86% | 21.78% |

| 11 | 1,186.39 | 7.80 | -0.83% | -11.76% |

| 12 | 1,014.04 | 5.40 | -14.53% | -30.82% |

| 13 | 960.15 | 4.56 | -5.31% | -15.47% |

| 14 | 550.94 | 1.31 | -42.62% | -71.21% |

| 15 | 882.22 | 2.96 | 60.13% | 125.55% |

| 16 | 968.41 | 3.29 | 9.77% | 11.12% |

| 17 | 1,354.44 | 6.06 | 39.86% | 84.16% |

| 18 | 1,776.13 | 9.19 | 31.13% | 51.58% |

| 19 | 2,266.37 | 13.86 | 27.60% | 50.81% |

| 20 | 1,970.25 | 9.42 | -13.07% | -32.07% |

Example 3. This example assumes the index decreases by 29.24% with 5.16% annualized volatility in the monthly change in Index closing levels over the relevant term.

| A | B | C | D | E |

| Year | Index Level | Closing Value | Annualized Index Return | Annualized ETN Return |

| 0 | 1,100.00 | 20.00 | n/a | n/a |

| 1 | 1,081.36 | 18.95 | -1.69% | -5.23% |

| 2 | 954.62 | 14.43 | -11.72% | -23.85% |

| 3 | 915.36 | 13.02 | -4.11% | -9.82% |

| 4 | 964.99 | 14.19 | 5.42% | 9.02% |

| 5 | 934.90 | 13.03 | -3.12% | -8.16% |

| 6 | 888.57 | 11.51 | -4.96% | -11.70% |

| 7 | 855.58 | 10.46 | -3.71% | -9.10% |

| 8 | 881.04 | 10.88 | 2.98% | 4.03% |

| 9 | 862.98 | 10.23 | -2.05% | -5.97% |

| 10 | 807.07 | 8.77 | -6.48% | -14.25% |

| 11 | 777.38 | 7.98 | -3.68% | -9.02% |

| 12 | 790.00 | 8.09 | 1.62% | 1.36% |

| 13 | 857.67 | 9.35 | 8.57% | 15.60% |

| 14 | 790.40 | 7.78 | -7.84% | -16.84% |

| 15 | 801.30 | 7.83 | 1.38% | 0.59% |

| 16 | 790.52 | 7.46 | -1.35% | -4.61% |

| 17 | 803.72 | 7.56 | 1.67% | 1.34% |

| 18 | 829.12 | 7.89 | 3.16% | 4.29% |

| 19 | 793.55 | 7.08 | -4.29% | -10.21% |

| 20 | 778.37 | 6.68 | -1.91% | -5.69% |

PS-10

Example 4. This example assumes the index decreases by 29.24% with 32.19% annualized volatility in the monthly change in Index closing levels over the relevant term.

| A | B | C | D | E |

| Year | Index Level | Closing Value | Annualized Index Return | Annualized ETN Return |

| 0 | 1,100.00 | 20.00 | n/a | n/a |

| 1 | 1,379.65 | 26.82 | 25.42% | 34.09% |

| 2 | 2,441.73 | 77.79 | 76.98% | 190.09% |

| 3 | 1,411.59 | 23.13 | -42.19% | -70.27% |

| 4 | 679.09 | 4.33 | -51.89% | -81.29% |

| 5 | 729.32 | 4.32 | 7.40% | -0.06% |

| 6 | 776.22 | 4.33 | 6.43% | 0.04% |

| 7 | 1,123.24 | 7.76 | 44.71% | 79.49% |

| 8 | 1,022.20 | 5.55 | -8.99% | -28.49% |

| 9 | 1,508.70 | 10.26 | 47.59% | 84.86% |

| 10 | 1,419.26 | 8.27 | -5.93% | -19.43% |

| 11 | 1,915.27 | 13.29 | 34.95% | 60.72% |

| 12 | 3,434.55 | 38.10 | 79.32% | 186.64% |

| 13 | 2,630.88 | 20.58 | -23.40% | -45.98% |

| 14 | 3,065.18 | 25.99 | 16.51% | 26.30% |

| 15 | 2,642.49 | 17.20 | -13.79% | -33.83% |

| 16 | 2,280.66 | 11.46 | -13.69% | -33.40% |

| 17 | 2,169.07 | 9.65 | -4.89% | -15.75% |

| 18 | 2,285.12 | 9.50 | 5.35% | -1.53% |

| 19 | 1,476.03 | 3.36 | -35.41% | -64.68% |

| 20 | 778.37 | 0.79 | -47.27% | -76.43% |

PS-11

RISK FACTORS

The ETNs are senior unsecured debt obligations of Credit Suisse AG (“Credit Suisse”). The ETNs are Senior Medium-Term Notes as described in the accompanying prospectus supplement and prospectus and are riskier than ordinary unsecured debt securities. The return on the ETNs is linked on a leveraged basis to the performance of the index. Investing in the ETNs is not equivalent to investing directly in the securities tracked by the index (each, an “index component” and together the “index components”), the index itself or ETNs with an unleveraged return linked to the index. See “The Index” below for more information.

This section describes the most significant risks relating to an investment in the ETNs. We urge you to read the following information about these risks, together with the other information in this pricing supplement and the accompanying prospectus supplement and prospectus before investing in the ETNs.

The ETNs do not have a minimum redemption or repurchase amount and you may lose all or a significant portion of your investment in the ETNs

The ETNs do not have a minimum redemption or repurchase amount and you may receive less, and possibly significantly less, at maturity or upon repurchase than the amount you originally invested. Our cash payment on your ETNs at maturity or upon repurchase will be based primarily on any increase or decrease in the closing levels of the index, and will be reduced by the index calculation fee, the ETN divisor, the accrued fee amount and the leverage charge (and the fee of up to $0.03 per ETN repurchased at your option, if you elect to have us repurchase your ETNs). You may lose all or a significant amount of your investment in the ETNs if the level of the index decreases or does not increase sufficiently. Any payment you will be entitled to receive is subject to our ability to pay our obligations as they become due

The ETNs are subject to the credit risk of Credit Suisse

Although the return on the ETNs will be based on the performance of the index, the payment of any amount due on the ETNs, including any payment at maturity, is subject to the credit risk of Credit Suisse. Investors are dependant on Credit Suisse’s ability to pay all amounts due on the ETNs, and therefore investors are subject to our credit risk. In addition, any decline in our credit ratings, any adverse changes in the market’s view of our creditworthiness or any increase in our credit spreads is likely to adversely affect the market value of the ETNs prior to maturity.

The ETNs are not suitable for investors with longer-term investment objectives

The ETNs are designed to achieve their stated investment objective on a monthly basis, but their performance over longer periods of time can differ significantly from their stated monthly objective because the relationship between the level of the index and the closing value of the ETNs will begin to break down as the length of an investor’s holding period increases. The ETNs are not long term substitutes for long and/or short positions in the index components underlying the index.

Investors should carefully consider whether the ETNs are appropriate for their investment portfolio. As discussed above, because the ETNs are meant to provide leveraged exposure to changes in the monthly closing level of the index, their performance over months or years can differ significantly from the performance of the index during the same period of time. Therefore, it is possible that you will suffer significant losses even if the long-term performance of the index is positive. It is possible for the level of the index to increase over time while the market value of the ETNs declines over time. You should proceed with extreme caution in co nsidering an investment in the ETNs.

The ETNs seek to provide a leveraged return based on the performance of the index (as adjusted for costs and fees). The ETNs do not attempt to, and should not be expected to, provide returns that reflect leverage on the return of the index for periods longer than a single month. The ETNs rebalance their theoretical exposure on a monthly basis, increasing exposure in response to that month’s gains or reducing exposure in response to that month’s losses.

Monthly rebalancing will impair the performance of the ETNs if its index experiences volatility from month to month and such performance will be dependent on the path of monthly returns during the holder’s holding period. At higher ranges of volatility, there is a significant chance of a complete loss of the value of the ETNs even if the performance of the index is flat. The ETNs should be purchased only by knowledgeable investors who understand the potential consequences of investing in the index and of seeking monthly compounding leveraged investment results. The ETNs may not be appropriate for investors who intend to hold positions in an attempt to generate returns over longer periods of time.

PS-12

In addition, monthly rebalancing will result in leverage relative to the ETN closing value that may be greater or less than the stated leverage factor if the ETN closing value has changed since the beginning of the month in which you purchase ETNs.

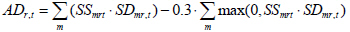

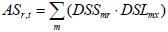

Your return at maturity or upon repurchase will be reduced by the fees and charges associated with the ETNs and the index

The value of the index used to calculate the payment at maturity or upon repurchase will be reduced by an accruing index calculation fee, established by the index committee, at 0.5% per annum. This fee is built into the calculation of the level of the index and, as a result, the closing level of the index will be less than it would be if such fee were not included.

In addition to the index calculation fee, the ETN divisor, the accrued fee amount and the leverage charge reduce the amount of your return at maturity or upon repurchase by Credit Suisse, and therefore the level of the index (before taking into account the index calculation fee) must increase by an amount sufficient, taking into account the leverage factor, to offset the index calculation fee, the ETN divisor, the accrued fee amount and the leverage charge applicable to your ETNs (and the fee of up to $0.03 per ETN repurchased at your option, if you elect to have us repurchase your ETNs) in order for you to receive at least the principal amount of your investment at maturity or upon repurchase of your ETNs by Credit Suisse. If the level of the index decreases or does not increase sufficiently, taking into account the leverage factor, to offset the impact of these adjustments, you will receive less, and possibly significantly less, than the principal amount of your investment at maturity or upon repurchase of your ETNs by Credit Suisse.

You should regularly monitor your holdings of the ETNs to ensure that they remain consistent with your

investment strategies

The leverage amount varies monthly and the leverage charge varies daily. As such, the ETNs may be more volatile than a non-leveraged investment linked to the index. You should regularly monitor your holdings of the ETNs to ensure that they remain consistent with your investment strategies.

The formula used to determine the amount payable at maturity or upon repurchase, and the formula used to determine the level of the index, are very complex

The formula used to determine the payment on your ETNs at maturity or upon repurchase, and the formula used to determine the level of the index, are very complex. You should ensure that you understand the results that will be generated by the formulas in different scenarios.

A fee of up to $0.03 per ETN may be charged upon a repurchase at your option

CSSU will act as our agent in connection with any repurchases at your option and may charge a fee of up to $0.03 per ETN repurchased. The imposition of this fee will mean that you will not receive the full amount of the daily repurchase value upon a repurchase at your option.

You will not benefit from any increases in the closing levels of the index if such increases do not occur prior to the applicable valuation date

Increases in the closing levels of the index during the term of the ETNs but after the applicable valuation date (including the final valuation date) are not considered in the calculation of the payment due to you at maturity or upon repurchase of your ETNs. If the closing level of the index on the applicable valuation date (including the final valuation date) does not reflect an increase from the initial index level sufficient, taking into account the leverage factor, to offset the impact of the index calculation fee, the ETN divisor, the accrued fee amount and the leverage charge (and the fee of up to $0.03 per ETN repurchased at your option, if you elect to have us repurchase your ETNs) between the inception date and the applicable valuation date (including the final valuation date), we will pay you less, and possibly signi ficantly less, than the principal amount of your ETNs at maturity or upon repurchase by Credit Suisse. This will be true even if the level of the index as of a particular date or dates prior to the applicable valuation date (including the final valuation date) would have been high enough, taking into account the leverage factor, to offset the impact of such fees and charges. In addition, the intraday indicative value of the ETNs published under the symbol “CSMB” will be based on the intraday values of the index rather than its closing level. Because an intraday indicative value of the ETNs may vary significantly from the value of the ETNs determined based on a closing level of the index, the payment you receive at maturity or upon repurchase of the ETNs

PS-13

may vary significantly from the payment you would receive if such payment was determined based on the intraday indicative value of the ETNs.

There are restrictions on the minimum number of ETNs you may offer to Credit Suisse for repurchase

Credit Suisse will repurchase your ETNs at your election only if you are offering at least the applicable minimum repurchase amount for any single repurchase and you have followed the procedures for repurchase detailed herein. The minimum repurchase amount and the procedures involved in the offer of any repurchase represent substantial restrictions on your ability to cause Credit Suisse to repurchase your ETNs. If you own ETNs with an aggregate stated principal amount of less than the applicable minimum repurchase amount, you will not be able to cause Credit Suisse to repurchase your ETNs. If your irrevocable offer for repurchase is received after 4:00 p.m., New York City time, on a business day, you will be deemed to have made your offer for repurchase on the following business day. Also, unless the scheduled repurchase date is postpone d because the valuation date is not a component business day for any index component or due to a market disruption event, the final day on which Credit Suisse will repurchase your ETNs will be February 7, 2031. As such, you must offer your ETNs for repurchase no later than February 3, 2031. A repurchase date is the third business day following the applicable valuation date. See “Specific Terms of the ETNs—Repurchase Procedures” for more information. The daily repurchase feature is intended to induce arbitrageurs to counteract any trading of the ETNs at a premium or discount to their indicative value. There can be no assurance that arbitrageurs will employ the repurchase feature in this manner.

You will not know the daily repurchase value you will receive at the time an election is made to repurchase your ETNs.

You will not know the daily repurchase value you will receive at the time you elect to request that we repurchase your ETNs, that we elect to repurchase your ETNs or upon the occurrence of an automatic early termination event. You will not know the daily repurchase value until after the applicable valuation date, which shall be the trading day immediately following the business day on which either you deliver the repurchase offer to Credit Suisse or on which we deliver the relevant notice to DTC. We will pay you the daily repurchase value, if any, on the repurchase date, which is the third business day following the applicable valuation date. See “Specific Terms of the ETNs—Payment Upon Repurchase.” The determination of the closing level of the index for a valuation date, and the related repurchase date, will be postpon ed if such valuation date is not a component business day for any index component or if a market disruption event exists on such valuation date, as provided herein. See “—Market Disruption Events.” As a result, you will be exposed to market risk in the event the market fluctuates between the time either you deliver the repurchase offer to Credit Suisse or on which we deliver the relevant notice to DTC and the applicable valuation date.

Credit Suisse may repurchase your ETNs at its option at any time

We have the right to repurchase your ETNs in whole but not in part on any business day during the term of the ETNs. The amount you may receive upon a repurchase by Credit Suisse may be less than the amount you would receive on your investment at maturity or if you had elected to have Credit Suisse repurchase your ETNs at a time of your choosing. If Credit Suisse exercises its right to repurchase your ETNs, you will receive a cash payment in an amount equal to the daily repurchase value, which is the closing value of the ETNs on the applicable valuation date. Credit Suisse has no obligation to take your interests into account when deciding whether to call the ETNs.

Credit Suisse will repurchase your ETNs if an automatic early termination event occurs

If the closing value of the ETNs on any trading day is equal to or less than 25% of the leverage amount on such trading day (an “automatic early termination event”), as determined by the calculation agent, we will repurchase all of the outstanding ETNs. The amount you may receive upon a repurchase by Credit Suisse may be less than the amount you would receive on your investment at maturity or if you had elected to have Credit Suisse repurchase your ETNs at a time of your choosing and will likely be significantly less than the principal amount of your ETNs. Upon any such repurchase, you will receive a cash payment in an amount equal to the daily repurchase value, which is the closing value of the ETNs on the applicable valuation date. Credit Suisse has no contr ol over whether an automatic early termination event will occur.

The market value of the ETNs is expected to be influenced by many unpredictable factors

The market value of your ETNs is expected to fluctuate between the date you purchase them and the applicable valuation date. You may also sustain a significant loss if you sell the ETNs in the secondary market. Several factors, many of

PS-14

which are beyond our control, will influence the market value of the ETNs. We expect that generally the level of the index will affect the market value of the ETNs more than any other factor. Other factors that may influence the market value of the ETNs include:

| • | the time remaining to the maturity of the ETNs; |

| • | supply and demand for the ETNs, including inventory positions with any market maker (the supply and demand for the ETNs may be affected by the amount of ETNs we decide to issue and we are under no obligation to issue any ETNs); |

| • | economic, financial, political, regulatory or judicial events that affect the market for mergers and acquisitions, the level of the index or the values of the index components; |

| • | the exchange rate and the volatility of the exchange rate between the U.S. dollar and foreign currencies, to the extent that any of the index components are denominated in a currency other than the currency in which the index is denominated; |

| • | the prevailing rate of interest; and |

| • | the actual or perceived creditworthiness of Credit Suisse. |

These factors interrelate in complex ways, and the effect of one factor on the market value of your ETNs may offset or enhance the effect of another factor.

The ETNs may not be a suitable investment for you