Registration No. 333-218604-02 Dated October 2, 2018 Securities Act of 1933, Rule 424(b)(2) |  |

UNDERLYING PERFORMANCE SUPPLEMENT TO THE UNDERLYING SUPPLEMENT DATED OCTOBER 2, 2018, PROSPECTUS SUPPLEMENT AND PROSPECTUS DATED JUNE 30, 2017

Credit Suisse AG

Medium-Term Notes

Underlying Performance Supplement for the Credit Suisse RavenPack AIS Balanced 5% ER Index

As part of our Medium-Term Notes program, Credit Suisse AG (“Credit Suisse”) from time to time may offer certain securities (the “securities”), linked to the performance of the Credit Suisse RavenPack AIS Balanced 5% ER Index, which we refer to as the “Index.” This prospectus supplement, which we refer to as an “underlying performance supplement,” supplements the underlying supplement dated October 2, 2018. The specific terms of each security offered will be described in the applicable pricing supplement and product supplement.

You should read this underlying performance supplement, the related underlying supplement, dated October 2, 2018, the prospectus and the related prospectus supplement, both dated June 30, 2017, the applicable product supplement and pricing supplement, and any applicable free writing prospectus (each, an “offering document”) carefully before you invest. If the terms described in the applicable pricing supplement are different or inconsistent with those described herein (or with those described in the underlying supplement, the prospectus, the prospectus supplement, any applicable product supplement or any applicable free writing prospectus), the terms described in the applicable pricing supplement will control.

Please refer to the “Selected Risk Considerations” section beginning on page 6 of this underlying performance supplement, the “Selected Risk Considerations” section in the underlying supplement, the “Risk Factors” section in the accompanying product supplement and the “Selected Risk Considerations” section in the applicable pricing supplement for risks related to an investment in the securities, as applicable.

The securities will not be listed on any exchange.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the securities or determined if this underlying performance supplement or any other offering document to which it relates is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this underlying performance supplement is October 2, 2018.

Credit Suisse

The Credit Suisse RavenPack AIS Balanced 5% ER Index Performance Summary

| TABLE OF CONTENTS | PAGE |

| Credit Suisse RavenPack AIS Balanced 5% ER Index | 1 |

| Component Indices | 2 |

| Limitations of Back-Tested Index Performance Information | 2 |

| Back-Tested and Actual Historical Performance of the Index | 2 |

| Overview of the Equity Index | 3 |

| Index Asset Allocation and Realized Volatility Target | 5 |

| Index Characteristics | 5 |

| Selected Risk Considerations | 6 |

Additional Information

You should read this underlying performance supplement together with the underlying supplement dated October 2, 2018 and the prospectus supplement and prospectus dated June 30, 2017, which you may access on the SEC website at www.sec.gov (or if such address has changed, by reviewing our filings for the relevant date on the SEC website).

| • | Underlying Supplement dated October 2, 2018: |

https://www.sec.gov/Archives/edgar/data/1053092/000095010318011482/dp96276_424b2-rpus.htm

| • | Prospectus Supplement and Prospectus dated June 30, 2017: http://www.sec.gov/Archives/edgar/data/1053092/000104746917004364/a2232566z424b2.htm |

The Securities

We are responsible for the information contained and incorporated by reference in this underlying performance supplement. As of the date of this underlying performance supplement, we have not authorized anyone to provide you with different information, and we take no responsibility for any other information others may give you. We are not making an offer of any securities in any state where the offer is not permitted. You should not assume that the information in this document or other offering documents is accurate as of any date other than the date on the front of this document.

We are offering securities for sale in those jurisdictions in the United States where it is lawful to make such offers. The distribution of the offering documents and the offering of securities in some jurisdictions may be restricted by law. If you possess the offering documents, you should find out about and observe these restrictions. The offering documents are not an offer to sell the securities and are not soliciting an offer to buy the securities in any jurisdiction where the offer or sale is not permitted or where the person making the offer or sale is not qualified to do so or to any person to whom such offer or sale is not permitted. We refer you to the “Underwriting (Conflicts of Interest)” section of the applicable product supplement and the “Supplemental Plan of Distribution (Conflicts of Interest)” section of the applicable pricing supplement for additional information. If the terms described in the applicable pricing supplement are different or inconsistent with those described herein, the terms described in the applicable pricing supplement will control.

In the offering documents, unless otherwise specified or the context otherwise requires, references to “we,” “us” and “our” are to Credit Suisse and its consolidated subsidiaries, and references to “dollars” and “$” are to U.S. dollars.

| ||

Credit Suisse RavenPack AIS Balanced 5% ER Index |  |

Index Description

| • | The Index’s portfolio is exposed to three “Component Indices” |

| • | The Index’s portfolio includes (i) equity exposure consisting of the excess return version of the Credit Suisse RavenPack Artificial Intelligence Sentiment Index (the “Credit Suisse RavenPack AIS Index,” and such excess return version, the “Equity Index”), (ii) fixed income exposure consisting of the Credit Suisse 10-Year U.S. Treasury Note Futures Index (the “10Y Fixed Income Index”) and the Credit Suisse 2-Year U.S. Treasury Note Futures Index (the “2Y Fixed Income Index,” and together with the 10Y Fixed Income Index, the “Fixed Income Indices”) and (iii) non-remunerating cash |

| • | Designed to provide exposure to a hypothetical “balanced” portfolio (consisting of the Equity Index and a momentum strategy-driven allocation of the Fixed Income Indices), while targeting a realized daily volatility of 5% |

| • | Allocation amongst the Equity Index and the Fixed Income Indices is based on: (1) historical realized volatility of the Credit Suisse RavenPack AIS Index and (2) performance of the 10Y Fixed Income Index, as measured by a “Risk Signal” |

| • | Index attempts to achieve a realized volatility target of 5% by varying its notional exposure to the portfolio of the Equity Index, the 10Y Fixed Income Index and the 2Y Fixed Income Index |

| • | Maximum notional exposure to the portfolio of 150% |

| • | 10Y Fixed Income Index tracks the performance of notional long investment in ten-year U.S. Treasury note futures contracts |

| • | 2Y Fixed Income Index tracks the performance of notional long investment in two-year U.S. Treasury note futures contracts |

Index Profile

| Name | Credit Suisse RavenPack AIS Balanced 5% ER Index (the “Index”) |

| Ticker | CSRPAISB |

| Launch Date | October 6, 2017 |

| Rebalancing | Daily |

| Realized Volatility Target | 5% Daily |

| Maximum Notional Exposure to Portfolio | 150% |

| Index Fee | 0.50% per annum |

| • | The Index Does Not Attempt to Achieve a Broad or “Balanced” Asset Class Diversification. “Balanced” is not meant to imply broad or balanced diversification across asset classes leading to risk mitigation. The Index does not attempt to achieve a broad asset class diversification, and in some instances may have only equity exposure. |

| • | The Index Has Limited History and May Perform in Unexpected Ways.The Index was launched on October 6, 2017. Because the Index is of recent origin with limited performance history, an investment linked to the Index may involve a greater risk than an investment linked to one or more indices with an established record of performance. |

| • | An index fee of 0.50% per annum is deducted in the calculation of the Index. The index fee will place a drag on the performance of the Index, offsetting any appreciation of its portfolio, exacerbating any depreciation of its portfolio and causing the level of the Index to decline steadily if the value of its portfolio remains relatively constant. The Index will not participate in any appreciation of its portfolio unless it is sufficiently great to offset the negative effects of the index fee, and then only to the extent that the favorable performance of its portfolio is greater than the index fee (and subject to the volatility-targeting feature). As a result of this deduction, the level of the Index may decline even if its portfolio appreciates. |

1

Component Indices

| Asset Class | Component Index | Ticker | Currency | Average Allocation* |

| 1 | Equities | Credit Suisse RavenPack Artificial Intelligence Sentiment Index (Excess return version) | CSRPAIS | USD | 39% | |

| 2 | Bond Futures | Credit Suisse 10-Year U.S. Treasury Note Futures Index | CSRFTYUE | USD | 51% | |

| 3 | Bond Futures | Credit Suisse 2-Year U.S. Treasury Note Futures Index | CSRFTUUE | USD | 6% | |

| 4 | Non-remunerating Cash | N/A | N/A | USD | 4% |

| * | Reflects average daily exposure of the Index from September 2, 2005 to September 28, 2018. Past performance of the Index is no guide to future performance. The average allocation shown above is based on both back-tested and actual historical Index performance information. For more information on the limitations of back-tested Index performance information, see “Limitations of Back-Tested Index Performance Information” below. |

Limitations of Back-Tested Index Performance Information

It is important to understand that back-tested index performance information is subject to significant limitations, in addition to the fact that past performance is never a guarantee of future performance. In particular:

| • | Credit Suisse International, the “Index Sponsor,” developed the rules of the Index with the benefit of hindsight—that is, with the benefit of being able to evaluate how the index rules would have caused the Index to perform had it existed during the back-tested period. The fact that the Index generally appreciated over a given back-tested period may not therefore be an accurate or reliable indication of any fundamental aspect of the Index methodology. |

| • | The back-tested performance of the Index might look different if it covered a different historical period. The market conditions that existed during the historical period covered by the back-tested Index performance information are not necessarily representative of the market conditions that will exist in the future. |

| • | Because the Component Indices were not published during the entire period for which the Index Sponsor has prepared back-tested Index performance information, the back-tested Index levels have been calculated by the Index Sponsor based in part on back-tested levels of the Component Indices that were prepared by the Index Sponsor. |

It is impossible to predict whether the Index will rise or fall. The actual future performance of the Index may bear no relation to the historical or back-tested levels of the Index.

Back-Tested and Actual Historical Performance of the Index

| Full Period | Index | SPXT5UE |

| Ann. Return | 6.0% | 3.4% | |

| Ann. Volatility | 5.0% | 5.1% | |

| Max Drawdown | -6.3% | -12.3% | |

| Sharpe Ratio | 1.20 | 0.67 | |

| Return / Drawdown | 0.97 | 0.28 | |

| Best Month | 3.97% (Jan 2018) | 4.10% (Jan 2018) | |

| Worst Month | -4.45% (Aug 2015) | -3.74% (Aug 2015) | |

| Average Month | 0.51% | 0.29% |

Source: Credit Suisse, Bloomberg, RavenPack, S&PDJI. The Index was launched on October 6, 2017. Back-tested data is shown from September 2, 2005 to October 6, 2017. Historical data shown from October 6, 2017 to September 28, 2018.

2

Past performance of the Index is no guide to future performance. Performance is shown net of 0.50% per annum index fee embedded in the Index. Using back-tested methodology, Credit Suisse International, the “Index Calculation Agent,” has computed the closing level of the Index since September 2, 2005, with a hypothetical initial level of 100. Back-tested performance results have inherent limitations. For more information on the limitations of back-tested Index performance information, see “Limitations of Back-Tested Index Performance Information” above.

“SPXT5UE” is the S&P 500 Daily Risk Control 5% USD Excess Return Index. SPXT5UE was launched on September 10, 2009. Back-tested data for SPXT5UE is shown from September 2, 2005 to September 10, 2009. Historical data for SPXT5UE is shown from September 10, 2009 to September 28, 2018. Back-tested performance results have inherent limitations. For more information on the limitations of back-tested Index performance information, see “Limitations of Back-Tested Index Performance Information” above.

The relationship between the performance of the Index and the performance of SPXT5UE shown in the graph above is not an indication of how the performance of the Index may compare to the performance of SPXT5UE in the future. There is no guarantee that the Index will outperform SPXT5UE. By including performance information for SPXT5UE, no suggestion is made that SPXT5UE is the only alternative index to which the back-tested performance of the Index should be compared. You should independently evaluate an investment linked to the Index as compared to other investments available to you. In particular, you should note that, like the Index, SPXT5UE is an “excess return” index, which reflects the performance of a hypothetical investment made with borrowed funds and thus bears a hypothetical interest cost. The performance of excess return indices is less than the performance that could be achieved by a fully funded direct investment (i.e., an investment not made with borrowed funds).

As used in the table above, “Ann. Return” means the annualized return of the Index.

As used in the table above, “Ann. Volatility” means the annualized volatility of the Index.

“Max Drawdown” means the greatest decline in the level of the Index from September 2005 to September 2018 as measured from the highest level of the Index to the lowest level of the Index, expressed as a percentage.

As used in the table above, “Sharpe Ratio” means the annualized return divided by the annualized volatility.

As used in the table above, “Return / Drawdown” the annualized return of the Index divided by the Max Drawdown.

As used in the table above, “Best Month” means the highest monthly Index return from October 2005 to September 2018.

As used in the table above, “Worst Month” means the lowest monthly Index return from October 2005 to September 2018.

As used in the table above, “Average Month” means the arithmetic average of the monthly Index returns from October 2005 to September 2018.

Overview of the Equity Index

The Index’s portfolio includes equity exposure consisting of the Equity Index. The Equity Index is an excess return version of the Credit Suisse RavenPack AIS Index, reflecting the performance of the Credit Suisse RavenPack AIS Index less a deemed borrowing cost calculated based on 3-month USD LIBOR.

The title “artificial intelligence” does not imply any form of actual intelligence, learning or comprehension. For more information, see “Selected Risk Considerations” in the underlying supplement.

Index Objective

| • | The Equity Index provides exposure to a hypothetical portfolio of at least four sectors of the S&P 500® Index with the most positive Sentiment Scores in proportion to market capitalization and inversely proportional to realized volatility. |

RavenPack

| • | RavenPack has developed an algorithm, licensed by CSI for use by the Equity Index, that is designed to assign scores to news items that discuss companies (the “RPNA Algorithm”). |

| • | While the RPNA Algorithm assigns many different types of scores to news items, the Equity Index uses three of these scores that are on a scale from 0 – 100 that are designed to reflect the “relevance,” “novelty” and “sentiment” of the news items in relation to the companies discussed in such news item. |

Index Methodology

| • | Sentiment Score Calculation: The Equity Index selects the most relevant and most novel news items with significant positive or negative sentiment in relation to earnings or revenues of the companies in a particular sector and |

3

calculates a “Sentiment Score” for such sector based on the Event Scores of the selected news items.

| • | Index Selection:The four S&P Sector TR Indices that are deemed to have the most positive Sentiment Score relating to earnings and revenue as of the last trading day of the immediately preceding calendar quarter are selected for hypothetical long exposure. |

| • | Weighting: The Equity Index applies quarterly index weights to each selected S&P Sector TR Index, which are (i) directly proportional to the market capitalization of such S&P Sector TR Index and (ii) inversely proportional to an estimate of the realized volatility of such S&P Sector TR Index. |

|

Back-Tested and Actual Sector Selection Frequency of the Equity Index

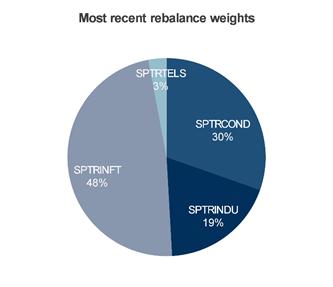

The below table shows the frequency with which the Equity Index allocated exposure to each S&P Sector TR Index from September 2, 2005 to September 28, 2018. Because the Equity Index was launched on September 29, 2017, the accompanying table is based in part on back-tested Index performance information. The Equity Index is designed to maintain exposure to a hypothetical portfolio of at least four S&P Sector TR Indices. The frequency with which the Equity Index allocated exposure to each S&P Sector TR Index is no indication of what the Equity Index will do in the future. Even if the Equity Index allocates exposure to each S&P Sector TR Index at a frequency comparable to the below, the relevant S&P Sector TR Indices may perform poorly and the level of the Equity Index may decline as a result. The pie chart below shows the most recent rebalance weights, as of September 5, 2018, of the Equity Index amongst S&P Sectors TR Indices. For more information on the limitations of back-tested Index performance information, see “Limitations of Back-Tested Index Performance Information” above.

S&P Sector TR Index | Ticker | Average Selection Frequency*** |  |

| S&P 500 Consumer Discretionary Sector TR Index* | SPTRCOND* | 12.3% | |

| S&P 500 Consumer Staples Sector TR Index | SPTRCONS | 9.9% | |

| S&P 500 Energy Sector TR Index | SPTRENRS | 9.0% | |

| S&P 500 Financials Sector TR Index | SPTRFINL | 5.2% | |

| S&P 500 Health Care Sector TR Index | SPTRHLTH | 13.2% | |

| S&P 500 Industrials Sector TR Index | SPTRINDU | 10.4% | |

| S&P 500 Information Technology Sector TR Index* | SPTRINFT* | 12.7% | |

| S&P 500 Materials Sector TR Index | SPTRMATR | 7.5% | |

| S&P 500 Real Estate (Sector) Index Total Return** | SPTRRLST** | 0.5% | |

| S&P 500 Communication Services Sector TR Index* | SPTRTELS* | 15.6% | |

| S&P 500 Utilities Sector TR Index | SPTRUTIL | 3.8% |

Source: Bloomberg, RavenPack, Credit Suisse, Standard and Poor’s.

*In September 2018, S&P Dow Jones Indices and MSCI, Inc. updated the Global Industry Classification Sector structure, which resulted in an update to the sector representation in the S&P Sector TR Indices. Among other changes, the update broadened the Telecommunications Services sector and renamed it the Communication Services sector. The Communication Services sector includes companies selected from the Consumer Discretionary sector previously classified under the Media Industry Group and the Internet & Direct Marketing Retail sub-industry and select companies previously classified in the Information Technology sector.

**According to S&P Dow Jones Indices, effective Monday, September 19, 2016, Real Estate was moved out from under the Financials Sector and promoted to its own sector under code 60.

*** Due to rounding, the average selection frequency may not add up to100%.

4

Index Asset Allocation and Realized Volatility Target

| • | Asset Allocation: The Index allocates (i) all of its exposure to the Equity Index during potential “lower volatility” periods and (ii) part of its exposure to the Equity Index and the remainder of its exposure to one or both Fixed Income Indices during potential “higher volatility” periods. |

| o | When the historical realized volatility of the Credit Suisse RavenPack AIS Index is greater than 5% (signaling “more risky” markets), the Index reduces its exposure to the Equity Index and allocates part of its portfolio to the Fixed Income Indices |

| o | The greater the historical realized volatility of the Credit Suisse RavenPack AIS Index, the less of the portfolio is allocated to the Equity Index and the more of the portfolio is allocated to the Fixed Income Indices. |

| • | Risk Signal:Captures the presence of a downward trend in the performance of the 10Y Fixed Income Index. |

| o | If the Risk Signal is off, the Index will allocate all of the fixed income exposure, if applicable, to the 10Y Fixed Income Index. |

| o | The Risk Signal is turned on if the performance of the 10Y Fixed Income Index over the previous ten Index Calculation Days is lower than its historical moving average, indicating that the risk of future negative performance in ten-year U.S. Treasury note futures contracts is rising; in this scenario, the Index will allocate half of the fixed income exposure to the 10Y Fixed Income Index and the remaining half to the 2Y Fixed Income Index, which generally has a lower volatility than the 10Y Fixed Income Index. |

| • | Realized Volatility Target:Index attempts to achieve a realized volatility target of 5% by varying its notional exposure to the portfolio of indices. |

| o | The notional exposure to the portfolio on each Index Calculation Day will be set equal to the target volatility of 5% divided by the historical realized volatility of the portfolio calculated on such day, subject to a maximum notional exposure of 150%. |

| o | If the realized volatility of the portfolio is less than 3.33%, the Index will not achieve its target volatility of 5% even with 150% exposure to the portfolio. |

| o | An exposure of less than 100% would mean that the Index will participate in only a limited degree of the performance of the portfolio of Component Indices, and the difference between 100% and that exposure will be hypothetically allocated to non-remunerating cash and will accrue no interest or other return. |

Index Characteristics

| • | Objective:The Index is designed to provide exposure to a hypothetical “balanced” portfolio (consisting of the Equity Index and a momentum strategy-driven allocation of the Fixed Income Indices), while targeting a realized daily volatility of 5% |

| • | Exposure:The Index’s hypothetical portfolio may, under certain circumstances, include both: |

| – | equity exposure, in the form of large-cap U.S. equities included in the Equity Index; and |

| – | fixed income exposure, in the form of U.S. Treasury note futures contracts tracked by the Fixed Income Indices |

Realized Volatility Target: The Index’s exposure to the portfolio is adjusted on each Index Calculation Day in an attempt to maintain its realized volatility target of 5%

5

Selected Risk Considerations

The following describes significant risks relating to the Index. We urge you to read the following information about these risks, together with the other information in the offering documents before investing in any securities related to the Index. In particular, please review the “Selected Risk Considerations” section in the underlying supplement dated October 2, 2018 before investing in any securities related to the Index.

Selected Risk Considerations Related to the Index

| • | The Index Does Not Attempt to Achieve a Broad or “Balanced” Asset Class Diversification. “Balanced” is not meant to imply broad or balanced diversification across asset classes leading to risk mitigation. The Index does not attempt to achieve a broad asset class diversification, and in some instances may have only equity exposure. |

| • | The Index Has Limited History and May Perform in Unexpected Ways. The Index was launched on October 6, 2017. Because the Index is of recent origin with limited performance history, an investment linked to the Index may involve a greater risk than an investment linked to one or more indices with an established record of performance. |

| • | An index fee of 0.50% per annum is deducted in the calculation of the Index.The index fee will place a drag on the performance of the Index, offsetting any appreciation of its portfolio, exacerbating any depreciation of its portfolio and causing the level of the Index to decline steadily if the value of its portfolio remains relatively constant. The Index will not participate in any appreciation of its portfolio unless it is sufficiently great to offset the negative effects of the index fee, and then only to the extent that the favorable performance of its portfolio is greater than the index fee (and subject to the volatility-targeting feature). As a result of this deduction, the level of the Index may decline even if its portfolio appreciates. |

| • | The Index May Fail to Maintain Its Volatility Target and May Experience Large Declines as a Result.Because this exposure adjustment is backward-looking based on realized volatility over a prior period, because past volatility may not be predictive of future volatility and because there is a time lag between when volatility occurs and when the Index rebalances its portfolio, there may be a time lag before a sudden increase in the volatility of the portfolio of Component Indices is sufficiently reflected in the exposure to the portfolio of Component Indices to result in a meaningful reduction in realized volatility. |

| • | The Volatility-Targeting Feature May Cause the Index to Perform Poorly in Temporary Market Crashes.The Index may not meaningfully reduce its exposure to the Index’s hypothetical portfolio until a crash has already occurred, and by the time the reduced exposure does take effect, the recovery may have already begun. |

| • | The Volatility-Targeting Feature Could Cause the Index to Significantly Underperform Its Portfolio in Rising Equity Markets.The Index will have less than 100% exposure to the Index’s hypothetical portfolio at any time when realized volatility of the Index’s hypothetical portfolio is greater than the Index’s volatility target of 5%. |

| • | The Index’s Volatility Target Is Arbitrary.Realized volatility is not the same as implied volatility, which is an estimation of future volatility and may better reflect market volatility expectation. |

| • | The Credit Suisse RavenPack AIS Balanced Index’s Decay Factors Are Arbitrary.The decay factors were chosen arbitrarily by Credit Suisse out of many decay factors that Credit Suisse could have selected, and may not be the optimal decay factors to use for the Index. |

| • | Calculating the Preliminary Weight of the Equity Index in the Index’s Portfolio Based on the Arithmetic Average of the Short-Term and Long-Term Realized Volatilities of the Credit Suisse RavenPack AIS Index Is Arbitrary. This averaging of short-term realized volatility and long-term realized volatility is arbitrary and may dampen or heighten the calculated realized volatility of the Equity Index compared to other methods of calculating volatility such as implied volatility, which is an estimation of future volatility and may better reflect market volatility expectation. |

| • | A Significant Portion of the Index May Be Hypothetically Allocated to Non-remunerating Cash, Which May Dampen Returns.At any time when the Index has less than 100% exposure to the Index’s hypothetical portfolio, a portion of the Index (corresponding to the difference between the exposure to the Index’s hypothetical portfolio and 100%) will be |

6

hypothetically allocated to non-remunerating cash and will not accrue any interest or other return.

| • | The Index Is Exposed to Risks Related to the Component Indices.The Index’s performance will be directly affected by the performance of the Component Indices and the risks related to the Component Indices. |

| • | The Index’s Allocation Methodology May Not Be Successful If the Equity Component and the Fixed Income Components Decline at the Same Time. If the equity component and the fixed income components tend to decline at the same time—in other words, if they prove to be positively correlated—the Index’s allocation methodology will not be successful, and the Index may experience significant declines. |

| • | The Index May Have Significant Exposure to the Fixed Income Indices, Which Have Limited Return Potential and Significant Downside Potential, Particularly in Times of Rising Interest Rates. The Fixed Income Indices offer only limited return potential, which in turn limits the return potential of the Credit Suisse RavenPack AIS Balanced Index. |

Selected Risk Considerations Related to the Credit Suisse RavenPack AIS Index

The Credit Suisse RavenPack AIS Index is a Component Index of the Credit Suisse RavenPack AIS Balanced Index.

| • | The Credit Suisse RavenPack AIS Index Is Called “Artificial Intelligence” Only in the Limited Sense that It Is Based on a Static Algorithm. The RPNA Algorithm does not learn from news items it processes or adapt to its environment and, as a static algorithm, will continue to use the same mathematical rules to process news items, even as news develops over time |

| • | News Items Used to Calculate the Index May Be Incomplete, Biased or Inaccurate. Any news items used to calculate the Index and related sector weightings may contain misstatements, inaccuracies or omissions, which may be material to the performance of the relevant issuer. |

| • | RavenPack Exercised Discretion in Developing the RPNA Algorithm. The way the RPNA Algorithm processes news items reflects decisions RavenPack made about the RPNA Algorithm’s construction. |

| • | The Scoring and Classification of News Items May Be Materially Inaccurate. The scoring and classification of news items about individual companies (or their affiliates) by the RPNA Algorithm may not accurately reflect the impact such news items have on the performance of an S&P Sector TR Index as a whole, which may adversely affect the performance of the Credit Suisse RavenPack AIS Index, and therefore the value of your securities. |

| • | The Credit Suisse RavenPack AIS Index Is Calculated Based on Third-Party Data, Which May Become Unavailable. The RPNA Algorithm is owned and operated by RavenPack, which is not affiliated with Credit Suisse. |

| • | You Will Not Benefit from Any Updates to the RPNA Algorithm. Any improvements or refinements to the RPNA Algorithm that are published after Version 4.0 will not be reflected in the Index. |

| • | Use of RavenPack Data by Third Parties May Adversely Affect the Performance of the Credit Suisse RavenPack AIS Index.RavenPack sells rights to use RPNA Algorithm data to third parties, and Credit Suisse has no control over the actions of any such third parties. |

| • | Because of Arbitrary Methodological Rules, the Credit Suisse RavenPack AIS Index Excludes News Items that May Be Significant to the Performance of Companies in the S&P Sector TR Indices. Due to arbitrary methodological rules, the news items considered by the Credit Suisse RavenPack AIS Index may not include all news items that are relevant to the performance of companies in the S&P Sector TR Indices. |

General Risks Related to the Indices

The following risks relate to the Index and the Credit Suisse RavenPack AIS Index.

| • | Past Performance of the Indices Is No Guide to Future Performance and There Is No Assurance that the Strategies on Which the Indices are Based Will Be Successful. We cannot predict the future performance of the indices and there is no assurance that the strategy on which the indices are based will be successful in producing positive returns. |

7

| • | There Can Be No Assurance that the Performance of the Indices over Time Will Approximate the Return of the Relevant Strategy or Any Other Strategy.The composition of the indices at any time is determined by the allocation methodology, and is not actively managed by the Index Sponsor. There can be no assurance that the performance of the indices over time will approximate the return of the relevant strategy or any other strategy. |

| • | You Will Not Have Any Rights in Any Stocks or U.S. Treasury Note Futures Contracts Included in the Indices. The securities will be paid in cash, and you will have no right to receive any payment or delivery in respect of any stocks or U.S. Treasury note futures contracts. |

Owning the Securities Is Not the Same as Directly Owning the Stocks or U.S. Treasury Note Futures Contracts Included in the Indices. For example, as an investor in the securities, you will not have rights to receive dividends or other distributions or any other rights, including voting rights, with respect to any stocks included in any index.

| • | Suspension or Disruptions of Market Trading in Stocks or Futures Contracts May Adversely Affect the Value of the Securities.Stock markets and futures markets are subject to temporary distortions or other disruptions due to various factors, including the lack of liquidity in the markets, the participation of speculators, and government regulation and intervention. These circumstances could affect the level of the indices and the value of the securities. |

| • | We and Our Affiliates May Have Economic Interests Adverse to Those of the Holders of the Securities.Potential conflicts of interest may exist between our affiliates and you, including with respect to certain determinations and judgments that they must make in |

determining amounts due to you, either at maturity or upon early redemption of the securities or the composition or methodology of the indices.

| • | Adjustments to the Indices or to the Index Components Could Adversely Affect the Securities. The Index Sponsor can make methodological changes to the indices that could change the level of the indices at any time. Any action by the Index Sponsor could adversely affect the amount payable at maturity or repurchase and/or the market value of the securities. |

| • | You Will Have No Rights Against the Entities with Discretion over the Indices or the Index Components. As an owner of the securities, you will have no rights against the Index Sponsor or the Index Calculation Agent even though the amount you receive at maturity or upon repurchase of your securities by Credit Suisse will depend on the level of the indices. |

| • | Adjustments to the Indices Could Adversely Affect the Performance of the Indices. At any time, the Index Calculation Agent can make methodological changes that could change the present and past levels of the indices. Any action taken by the Index Calculation Agent could adversely affect performance of the indices. |

| • | The Indices Will Be Calculated Pursuant to a Set of Fixed Rules and Will Not Be Actively Managed. If the Indices Perform Poorly, the Index Sponsor Will Not Change the Rules in an Attempt to Improve Performance.Unlike a mutual fund, which could be actively managed by the fund manager in an attempt to maximize returns in changing market conditions, the index rules will remain unchanged, even if those rules might prove to be ill-suited to future market conditions. |

8

License Agreement with S&P

The Credit Suisse RavenPack Artificial Intelligence Sentiment Index (the “Strategy”) is the property of Credit Suisse International, which has contracted with S&P Opco, LLC (a subsidiary of S&P Dow Jones Indices LLC) to license the use of the S&P 500 Sector Indices in connection with the Strategy. The S&P 500 Sector Indices are the property of S&P Dow Jones Indices, its affiliates and/or their third-party licensors. S&P® is a registered trademark of Standard & Poor’s Financial Services LLC, and Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC. The Strategy is not sponsored by S&P Opco, LLC, S&P Dow Jones Indices LLC, their affiliates, including Standard & Poor’s Financial Services LLC, or their third-party licensors, including Dow Jones Trademark Holdings LLC (collectively, “S&P Dow Jones Indices”).

The securities based on the Strategy are not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices. S&P Dow Jones Indices does not make any representation or warranty, express or implied, to the owners of the securities or any member of the public regarding the advisability of investing in securities generally or in the securities particularly or the ability of the Strategy to track general market performance. S&P Dow Jones Indices’ only relationship to Credit Suisse International with respect to the Strategy is the licensing of the S&P 500 Sector Indices, certain trademarks, service marks and trade names of S&P Dow Jones Indices. S&P Dow Jones Indices is not responsible for and has not participated in the determination of the prices and amount of the securities or the timing of the issuance or sale of the securities or in the determination or calculation of the equation by which the securities may be converted into cash or other redemption mechanics. S&P Dow Jones Indices has no obligation or liability in connection with the administration, marketing or trading of the securities. S&P Dow Jones Indices LLC is not an investment advisor. Inclusion of a security within the Strategy or the S&P 500 Sector Indices is not a recommendation by S&P Dow Jones Indices to buy, sell, or hold such security, nor is it investment advice.

S&P DOW JONES INDICES DOES NOT GUARANTEE THE ADEQUACY, ACCURACY, TIMELINESS AND/OR THE COMPLETENESS OF THE STRATEGY, S&P 500 SECTOR INDEX OR ANY DATA RELATED THERETO OR ANY COMMUNICATION WITH RESPECT THERETO, INCLUDING ORAL, WRITTEN, OR ELECTRONIC COMMUNICATIONS. S&P DOW JONES INDICES SHALL NOT BE SUBJECT TO ANY DAMAGES OR LIABILITY FOR ANY ERRORS, OMISSIONS, OR DELAYS THEREIN. S&P DOW JONES INDICES MAKES NO EXPRESS OR IMPLIED WARRANTIES, AND EXPRESSLY DISCLAIMS ALL WARRANTIES, OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE OR AS TO RESULTS TO BE OBTAINED BY CREDIT SUISSE INTERNATIONAL, OWNERS OF THE SECURITIES, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE STRATEGY, S&P 500 SECTOR INDEX OR WITH RESPECT TO ANY DATA RELATED THERETO. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT WHATSOEVER SHALL S&P DOW JONES INDICES BE LIABLE FOR ANY INDIRECT, SPECIAL, INCIDENTAL, PUNITIVE, OR CONSEQUENTIAL DAMAGES, INCLUDING BUT NOT LIMITED TO, LOSS OF PROFITS, TRADING LOSSES, LOST TIME, OR GOODWILL, EVEN IF THEY HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, WHETHER IN CONTRACT, TORT, STRICT LIABILITY, OR OTHERWISE.

Copyright © 2018 Credit Suisse Group AG and/or its affiliates. All rights reserved.

9