Exhibit 4.25

[FACE OF NOTE]

UNLESS THIS NOTE IS PRESENTED BY AN AUTHORIZED REPRESENTATIVE OF THE DEPOSITORY TRUST COMPANY, A NEW YORK CORPORATION (“DTC” OR THE “DEPOSITARY”), TO THE COMPANY OR ITS AGENT FOR REGISTRATION OF TRANSFER, EXCHANGE, OR PAYMENT, AND ANY NOTE ISSUED IS REGISTERED IN THE NAME OF CEDE & CO. OR IN SUCH OTHER NAME AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC (AND ANY PAYMENT IS MADE TO CEDE & CO. OR TO SUCH OTHER ENTITY AS IS REQUESTED BY AN AUTHORIZED REPRESENTATIVE OF DTC), ANY TRANSFER, PLEDGE, OR OTHER USE HEREOF FOR VALUE OR OTHERWISE BY OR TO ANY PERSON IS WRONGFUL INASMUCH AS THE REGISTERED OWNER HEREOF, CEDE & CO., HAS AN INTEREST HEREIN.

UNLESS AND UNTIL IT IS EXCHANGED IN WHOLE OR IN PART FOR SECURITIES IN DEFINITIVE REGISTERED FORM, THIS SECURITY MAY NOT BE TRANSFERRED EXCEPT AS A WHOLE BY THE DEPOSITARY TO A NOMINEE OF THE DEPOSITARY OR BY A NOMINEE OF THE DEPOSITARY TO THE DEPOSITARY OR ANOTHER NOMINEE OF THE DEPOSITARY OR BY THE DEPOSITARY OR ANY SUCH NOMINEE TO A SUCCESSOR DEPOSITARY OR A NOMINEE OF SUCH SUCCESSOR

DEPOSITARY.

| REGISTERED | | PRINCIPAL AMOUNT: $ | |

| NO. FLR- | | CUSIP: | |

| | | ISIN: | |

CREDIT SUISSE AG[, acting through its

____________ Branch]

SENIOR MEDIUM-TERM NOTE

(FLOATING RATE)

Branch:

Form of Note: Book-Entry Note

Original Issue Date (Settlement Date):

| Specified Currency: | ¨ U.S. dollars | ¨ Other: |

| | |

| Authorized Denominations | ¨ U.S. $2,000 and integral multiples of U.S. $1,000 in excess thereof

¨ Other: |

Maturity Date:

Interest Payment Date(s):

| Interest Rate Basis or Bases: | |

| | |

| ¨ Prime Rate | ¨ Commercial Paper Rate |

| ¨ LIBOR | ¨ Federal Funds Rate |

| ¨ SOFR | ¨ Federal Funds Open Rate |

| | ¨ Treasury Rate |

| | Index Currency: |

| | Index Maturity: |

| ¨ Other | |

| Spread (plus or minus): | Spread Multiplier:__% |

| | |

| Initial Interest Rate: | |

| Interest Category | |

| | |

| ¨ Regular Floating Rate Note | |

¨ Floating Rate/Fixed Rate Note

Fixed Rate Commencement Date:

Fixed Interest Rate: | |

¨ Inverse Floating Rate Note:

Fixed Interest Rate: | |

¨ Original Issue Discount Note

Issue Price: | |

| | |

| Initial Interest Reset Date: | Interest Reset Date(s): Each Interest Payment Date. |

| | |

| Interest Reset Period: ___ months | |

| | |

| Day Count: | ¨ 30/360 | ¨ Actual/Actual |

| | ¨ Actual/360 | ¨ Other: |

| | |

| Maximum Interest Rate: ____% | Minimum Interest Rate: ____% |

| Manner of Determining Principal Amount Payable at Maturity Date: |

| Manner of Determining Interest Payable at Interest Payment Date: |

| Dual Currency Note: | ¨ Yes | ¨ No |

| Optional Payment Currency: |

| |

| Optional Election Date: |

| | | | |

| Amortizing Note: | ¨ Yes | ¨ No |

| Original Issue Discount Note: | ¨ Yes | ¨ No |

| Optional Redemption: | ¨ Yes | ¨ No |

| Initial Redemption Date: | | |

| Initial Redemption Percentage:__% | | |

| Annual Redemption Percentage Reduction: | |

| Optional Repayment: | ¨ Yes | ¨ No |

| Optional Repayment Date(s): | | |

| Optional Extension of Maturity: | ¨ Yes | ¨ No |

| Addendum Attached: | ¨ Yes | ¨ No |

Other Provisions:

Credit Suisse AG, a corporation established under the laws of, and duly licensed as a bank in, Switzerland (together with its successors and assigns, the “Company”), [acting through its ____________ Branch,] for value received, hereby promises to pay to Cede & Co., or registered assignees, the Principal Amount as specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith or as shall be set forth in the Schedule of Exchanges of Senior Medium-Term Notes (Floating Rate) attached hereto) on the Maturity Date specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) (except to the extent redeemed or repaid prior to the Maturity Date) and to pay interest thereon from the Original Issue Date specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) at a rate per annum equal to the Initial Interest Rate specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) until the first Interest Reset Date next succeeding the Original Issue Date specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith), and thereafter at a rate per annum determined in accordance with the provisions specified on the reverse hereof until the Principal hereof is paid or duly made available for payment (except as provided below). The Company will pay interest in arrears on each Interest Payment Date as specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) commencing with the first Interest Payment Date next succeeding the Original Issue Date specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith), and on the Maturity Date (or any Redemption Date or Repayment Date) (these and certain other capitalized terms used herein are defined on the reverse of this Note); provided, however, that if the Original Issue Date occurs between a Record Date, as defined below, and the next succeeding Interest Payment Date, interest payments will commence on the second Interest Payment Date succeeding the Original Issue Date and will be payable to the registered holder of this Note (the “Holder” and, collectively, the “Holders”) on the Record Date with respect to such second Interest Payment Date; and provided, further, that (i) if an Interest Payment Date (other than the Maturity Date, but including any Redemption Date or Repayment Date) would fall on a day that is not a Business Day, such Interest Payment Date (or Redemption Date or Repayment Date) shall be the following day that is a Business Day, and interest shall accrue and be payable with respect to such payment for the period from the originally-scheduled Interest Payment Date (or Redemption Date or Repayment Date) to such following Business Day, except that if the Interest Rate Basis specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) is LIBOR or SOFR and such next Business Day falls in the next calendar month, the Interest Payment Date (or Redemption Date or Repayment Date) shall be the immediately preceding day that is a Business Day and interest shall accrue to such preceding Business Day, and (ii) if the Maturity Date falls on a day that is not a Business Day, the required payment of Principal, premium, if any, and interest shall be made on the next succeeding Business Day with the same force and effect as if made on the date such payment was due, and interest shall not accrue and be payable with respect to such payment for the period from and after the Maturity Date to the date of such payment on the next succeeding Business Day.

Payment of the Principal of this Note, any premium and the interest due on the Maturity Date (or any Redemption Date or Repayment Date) will be made in immediately available funds upon surrender of this Note at the office or agency of such paying agent as the Company may determine and maintained for that purpose in the Borough of Manhattan, The City of New York (a “Paying Agent”), or at the office or agency of such other Paying Agent as the Company may determine.

Notwithstanding the foregoing, if an Addendum is attached hereto or “Other Provisions” apply to this Note as specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith), this Note shall be subject to the terms set forth in such Addendum or such “Other Provisions.”

Interest on this Note will accrue from the most recent Interest Payment Date to which interest has been paid or duly provided for or, if no interest has been paid or duly provided for, from the Original Issue Date, until the Principal hereof has been paid or duly made available for payment (except as provided herein). The interest so payable, and punctually paid or duly provided for, on any Interest Payment Date, will, subject to certain exceptions described herein, be paid to the person in whose name this Note (or one or more predecessor Notes) is registered at the close of business on the corresponding record date (the “Record Date”), which for this tranche of the Notes shall be, for so long as the Notes of this tranche are in the form of one or more Registered Global Securities, three Business Days prior to the relevant Interest Payment Date and, in the event that any Notes of this tranche are not represented by one or more Registered Global Securities, the fifteenth day (whether or not a Business Day) prior to the relevant Interest Payment Date; provided, however, that interest payable on the Maturity Date (or any Redemption Date or Repayment Date) will be payable to the person to whom the Principal hereof shall be payable.

If the Specified Currency specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) is other than U.S. dollars, any payment on this Note on an Interest Payment Date or the Maturity Date (or any Redemption Date or Repayment Date) will be made in U.S. dollars, as provided below, unless the Holder hereof elects by written request (which request shall also include appropriate wire transfer instructions) to the Paying Agent at its corporate trust office in The City of New York received on or prior to the Record Date relating to an Interest Payment Date or at least 10 days prior to the Maturity Date (or any Redemption Date or Repayment Date), as the case may be, to receive such payment in such Specified Currency except as provided on the reverse hereof; provided, that any U.S. dollar amount to be received by a Holder of this Note will be based on the highest bid quotation in The City of New York received by the Exchange Rate Agent appointed by the Company and specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) (the “Exchange Rate Agent”), at approximately 11:00 a.m., New York City time, on the second Business Day preceding the applicable payment date from three recognized foreign exchange dealers (one of which may be the Exchange Rate Agent) for the purchase by the quoting dealer of such Specified Currency for U.S. dollars for settlement on such payment date in the aggregate amount of such Specified Currency payable to all Holders of Notes having the same terms as this Note (including Original Issue Date) scheduled to receive U.S. dollar payment and at which the applicable dealer commits to execute a contract; provided, further, that if such bid quotations are not available, such payments shall be made in such Specified Currency. All currency exchange costs will be borne by the Holder of this Note by deductions from such payments. The Holder hereof may elect to receive payment in such Specified Currency for all such payments and need not file a separate election for each such payment, and such election shall remain in effect until revoked by written notice to the Paying Agent at its corporate trust office in The City of New York received on a date prior to the Record Date for the relevant Interest Payment Date or at least 10 calendar days prior to the Maturity Date (or any Redemption Date or Repayment Date), as the case may be; provided, that such election is irrevocable as to the next succeeding payment to which it relates; if such election is made as to full payment on this Note, such election may thereafter be revoked so long as the Paying Agent is notified of the revocation within the time period set forth above.

If the Specified Currency specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) is U.S. dollars, payment of the Principal of and premium, if any, and interest on this Note will be made in such coin or currency of the United States as at the time of payment is legal tender for payment of public and private debts; provided, however, that payments of interest, other than interest due at maturity (or any Redemption Date or Repayment Date) will be made by U.S. dollar check mailed to the address of the person entitled thereto as such address shall appear in the Note register.

A Holder of U.S. $5,000,000 (or, if the Specified Currency specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) is other than U.S. dollars, the equivalent thereof in the Specified Currency) or more in aggregate principal amount of Notes having the same Interest Payment Date will be entitled to receive payments of interest, other than interest due at maturity (or any Redemption Date or Repayment Date), by wire transfer of immediately available funds to an account within the United States maintained by the Holder of this Note if appropriate wire transfer instructions in writing have been received by the Paying Agent not less than 10 days prior to the applicable Interest Payment Date; provided, however, that, unless alternative arrangements are made, any such payments to be made in a Specified Currency other than U.S. dollars shall be made to an account at a bank outside the United States.

Reference is hereby made to the further provisions of this Note set forth on the reverse hereof, which further provisions shall for all purposes have the same effect as if set forth at this place.

Unless the certificate of authentication hereon has been executed by the Trustee, as defined on the reverse hereof, by manual signature, this Note shall not be entitled to any benefit under the Indenture, as defined on the reverse hereof, or be valid or obligatory for any purpose.

IN WITNESS WHEREOF, the Company[, acting through its ____________ Branch,] has caused this Note to be duly executed.

| | | CREDIT SUISSE AG[, acting through its

____________ Branch] |

| | | |

CERTIFICATE OF AUTHENTICATION

This is one of the Securities of the series designated therein referred to in the within-mentioned Indenture.

Dated:

THE BANK OF NEW YORK MELLON, as Trustee

[REVERSE OF NOTE]

CREDIT SUISSE AG[, acting through its

____________ Branch]

SENIOR MEDIUM-TERM NOTE

(FLOATING RATE)

This Note is one of a duly authorized issue of Senior Medium-Term Notes (the “Notes”) of the Company[, acting through its ____________ Branch]. The Notes are issuable under a senior indenture, dated as of March 29, 2007, as supplemented by a second supplemental indenture, dated as of March 25, 2009 (collectively, the “Indenture”), in each case between the Company and The Bank of New York Mellon (formerly known as The Bank of New York), as trustee (the “Trustee”), to which Indenture and all indentures supplemental thereto reference is hereby made for a statement of the respective rights, limitations of rights, duties and immunities of the Company, the Trustee and Holders of the Notes and the terms upon which the Notes are to be authenticated and delivered. The Bank of New York Mellon (formerly known as The Bank of New York) has been appointed Calculation Agent (the “Calculation Agent,” which term includes any successor calculation agent) with respect to the Notes, and The Bank of New York Mellon (formerly known as The Bank of New York) at its corporate trust office in The City of New York has been appointed the Registrar and Paying Agent with respect to the Notes. The terms of individual Notes may vary with respect to interest rates, interest rate formulas, issue dates, maturity dates, or otherwise, all as provided in the Indenture. To the extent not inconsistent herewith, the terms of the Indenture are hereby incorporated by reference herein.

This Note will not be subject to any sinking fund and, unless otherwise provided on the face hereof (or in the pricing supplement attached hereto or delivered herewith) in accordance with the provisions of the following two paragraphs, will not be redeemable or subject to repayment at the option of the Holder hereof prior to maturity.

This Note shall be subject to redemption at the option of the Company on any date on or after the Initial Redemption Date, if any, specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith), in whole or from time to time in part in increments of U.S. $2,000 and integral multiples of U.S. $1,000 in excess thereof or the minimum Authorized Denomination (provided that any remaining principal amount hereof shall be at least U.S. $2,000 or such minimum Authorized Denomination), at the Redemption Price (as defined below), together with unpaid interest accrued thereon to the date fixed for redemption (each, a “Redemption Date”), on notice given no more than 60 nor less than 30 calendar days prior to the Redemption Date and in accordance with the provisions of the Indenture. The “Redemption Price” shall initially be the Initial Redemption Percentage specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) multiplied by the unpaid principal amount of this Note to be redeemed. The Initial Redemption Percentage shall decline at each anniversary of the Initial Redemption Date by the Annual Redemption Percentage Reduction, if any, specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) until the Redemption Price is 100% of unpaid principal amount to be redeemed. In the event of redemption of this Note in part only, a new Note of like tenor for the unredeemed portion hereof and otherwise having the same terms as this Note shall be issued in the name of the Holder hereof upon the presentation and surrender hereof.

This Note shall be subject to repayment by the Company at the option of the Holder hereof on the Optional Repayment Date(s), if any, specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith), in whole or in part in increments of U.S. $2,000 and integral multiples of U.S. $1,000 in excess thereof or the minimum Authorized Denomination (provided that any remaining principal amount hereof shall be at least U.S. $2,000 or such minimum Authorized Denomination), at a repayment price equal to 100% of the unpaid principal amount to be repaid, together with unpaid interest accrued thereon to the date fixed for repayment (each, a “Repayment Date”). For this Note to be repaid, this Note must be received, together with the form hereon entitled “Option to Elect Repayment” duly completed, by the Trustee at its corporate trust office not more than 60 nor less than 30 calendar days prior to the Repayment Date. Exercise of such repayment option by the Holder hereof will be irrevocable. In the event of repayment of this Note in part only, a new Note of like tenor for the unrepaid portion hereof and otherwise having the same terms as this Note shall be issued in the name of the Holder hereof upon the presentation and surrender hereof.

The interest rate borne by this Note will be determined as follows:

(i) Unless the Interest Category of this Note is specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) as a “Floating Rate/Fixed Rate Note” or an “Inverse Floating Rate Note,” this Note shall be designated as a “Regular Floating Rate Note” and, except as set forth below or on the face hereof (or in the pricing supplement attached hereto or delivered herewith), shall bear interest at the rate determined by reference to the applicable Interest Rate Basis or Bases (a) plus or minus the Spread, if any, and/or (b) multiplied by the Spread Multiplier, if any, in each case as specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith). Commencing on the Initial Interest Reset Date, the rate at which interest on this Note shall be payable shall be reset as of each Interest Reset Date specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith); provided, however, that the interest rate in effect for the period, if any, from the Original Issue Date to the Initial Interest Reset Date shall be the Initial Interest Rate.

(ii) If the Interest Category of this Note is specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) as a “Floating Rate/Fixed Rate Note,” then, except as set forth below or on the face hereof (or in the pricing supplement attached hereto or delivered herewith), this Note shall initially bear interest at the rate determined by reference to the applicable Interest Rate Basis or Bases (a) plus or minus the Spread, if any, and/or (b) multiplied by the Spread Multiplier, if any. Commencing on the Initial Interest Reset Date, the Rate at which interest on this Note shall be payable shall be reset as of each Interest Reset Date; provided, however, that (y) the interest rate in effect for the period, if any, from the Original Issue Date to the Initial Interest Reset Date shall be the Initial Interest Rate and (z) the interest rate in effect for the period commencing on the Fixed Rate Commencement Date specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) to the Maturity Date shall be the Fixed Interest Rate specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) or, if no such Fixed Interest Rate is specified and this Note is still outstanding on the Fixed Rate Commencement Date, the interest rate in effect hereon on the day immediately preceding the Fixed Rate Commencement Date.

(iii) If the Interest Category of this Note is specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) as an “Inverse Floating Rate Note,” then, except as set forth below or on the face hereof (or in the pricing supplement attached hereto or delivered herewith), this Note shall bear interest at the Fixed Interest Rate minus the rate determined by reference to the applicable Interest Rate Basis or Bases (a) plus or minus the Spread, if any, and/or (b) multiplied by the Spread Multiplier, if any; provided, however, that, unless otherwise specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith), the interest rate hereon shall not be less than zero. Commencing on the Initial Interest Reset Date, the rate at which interest on this Note shall be payable shall be reset as of each Interest Reset Date; provided, however, that the interest rate in effect for the period, if any, from the Original Issue Date to the Initial Interest Reset Date shall be the Initial Interest Rate.

Unless otherwise specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith), the rate with respect to each Interest Rate Basis will be determined in accordance with the applicable provisions below. Except as set forth above or on the face hereof (or in the pricing supplement attached hereto or delivered herewith), the interest rate in effect on each day shall be (i) if such day is an Interest Reset Date, the interest rate determined as of the Interest Determination Date (as defined below) immediately preceding such Interest Reset Date or (ii) if such day is not an Interest Reset Date, the interest rate determined as of the Interest Determination Date immediately preceding the most recent Interest Reset Date.

If any Interest Reset Date would otherwise be a day that is not a Business Day, such Interest Reset Date shall be postponed to the next succeeding Business Day, except that if LIBOR or SOFR is an applicable Interest Rate Basis and such Business Day falls in the next succeeding calendar month, such Interest Reset Date shall be the immediately preceding Business Day.

The “Interest Determination Date” pertaining to an Interest Reset Date for Notes bearing interest calculated by reference to the Commercial Paper Rate, Federal Funds Rate, Federal Funds Open Rate and Prime Rate will be the second Business Day preceding such Interest Reset Date. The Interest Determination Date pertaining to an Interest Reset Date for Notes bearing interest calculated by reference to LIBOR will be the second London Business Day preceding such Interest Reset Date. The Interest Determination Date pertaining to an Interest Reset Period for Notes bearing interest calculated by reference to SOFR will be the second U.S. Government Securities Business Day (as defined below) prior to the Interest Payment Date on which that Interest Reset Period ends; provided, however, in the case of any Interest Reset Period during which any Notes become due and payable on a date other than an Interest Payment Date, in respect of such Notes that become due and payable only, the Interest Determination Date for such Interest Reset Period will be the second U.S. Government Securities Business Day prior to such date on which such Notes become due and payable. The Interest Determination Date pertaining to an Interest Reset Date for Notes bearing interest calculated by reference to the Treasury Rate shall be the day of the week in which such Interest Reset Date falls on which Treasury bills normally would be auctioned; provided, however, that if as a result of a legal holiday an auction is held on the Friday of the week preceding such Interest Reset Date, the related Interest Determination Date shall be such preceding Friday; and provided, further, that if an auction shall fall on any Interest Reset Date, then the Interest Reset Date shall instead be the first Business Day following the date of such auction.

The “Calculation Date” pertaining to any Interest Determination Date will be the earlier of (i) the tenth calendar day after such Interest Determination Date or if such day is not a Business Day, the next succeeding Business Day or (ii) the Business Day preceding the applicable Interest Payment Date or Maturity Date, as the case may be.

Determination of Commercial Paper Rate. If the Interest Rate Basis specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) is the Commercial Paper Rate, the Commercial Paper Rate with respect to this Note shall be determined on each Interest Determination Date and shall be the Money Market Yield (as defined herein) of the rate on such date for commercial paper having the Index Maturity specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith), as such rate shall be published in H.15(519) under the heading “Commercial Paper—Nonfinancial,” or if not so published prior to 3:00 p.m., New York City time, on the Calculation Date pertaining to such Interest Determination Date, the Commercial Paper Rate shall be the Money Market Yield of the rate on such Interest Determination Date for commercial paper of the Index Maturity specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) as published in H.15 Daily Update under the heading “Commercial Paper—Non-financial” (with an Index Maturity of one month, two months or three months being deemed to be equivalent to an Index Maturity of 30, 60 or 90 days, respectively). If by 3:00 p.m., New York City time, on such Calculation Date, such rate is not yet available in either H.15(519) or H.15 Daily Update, the Calculation Agent will calculate the Commercial Paper Rate, which will be the Money Market Yield corresponding to the arithmetic mean of the offered rates as of approximately 11:00 a.m., New York City time, on such Interest Determination Date for commercial paper of the Index Maturity specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith), placed for a non-financial issuer whose bond rating is “AA” or the equivalent, from a nationally recognized rating agency as quoted by three leading dealers of commercial paper in The City of New York selected and identified by the Company; provided, however, that if the dealers selected as aforesaid by the Company are not quoting as mentioned in this sentence, the rate of interest in effect for the applicable period will be the same as the Commercial Paper Rate for the immediately preceding Interest Reset Period (or, if there was no such Interest Reset Period, the rate of interest payable hereon shall be the Initial Interest Rate).

“Money Market Yield” shall be the yield (expressed as a percentage) calculated in accordance with the following formula:

Money Market Yield = D x 360 x 100

360 - (D x M)

where “D” refers to the applicable per annum rate for commercial paper quoted on a bank discount basis and expressed as a decimal and “M” refers to the actual number of days in the interest period for which interest is being calculated.

Determination of Federal Funds Rate. If the Interest Rate Basis specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) is the Federal Funds Rate, the Federal Funds Rate with respect to this Note shall be determined on each Interest Determination Date and shall be the rate applicable to such date for Federal Funds opposite the caption “Federal funds (effective),” as displayed on Reuters on page 118 (or any page which may replace such page on such service) under the heading “EFFECT” on the Business Day immediately following such Interest Determination Date, or, if such rate is not so published by 3:00 p.m., New York City time, on the Business Day immediately following such Interest Determination Date, the Federal Funds Rate will be the rate applicable to such Interest Determination Date as published in H.15 Daily Update (or such other recognized electronic source used for the purpose of displaying such rate) under the heading “Federal Funds (effective).” If such rate is not published in H.15 Daily Update (or such other recognized electronic source used for the purpose of displaying such rate) by 4:15 p.m., New York City time, on the Business Day immediately following such Interest Determination Date, the Calculation Agent will calculate the Federal Funds Rate for such Interest Determination Date, which will be the arithmetic mean of the rates for the last transaction in overnight U.S. dollar Federal Funds as of 9:00 a.m., New York City time, on such Interest Determination Date arranged by three leading brokers in Federal Funds transactions in The City of New York selected and identified by the Company; provided, however, that if the brokers selected as aforesaid by the Company are not quoting as mentioned in this sentence, the Federal Funds Rate applicable to such Interest Determination Date will be the same as the Federal Funds Rate in effect for the immediately preceding Interest Reset Period (or, if there was no such Interest Reset Period, the rate of interest payable hereon shall be the Initial Interest Rate).

Determination of the Federal Funds Open Rate. If the Interest Rate Basis specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) is the Federal Funds Open Rate, the Federal Funds Open Rate with respect to this Note shall be determined on each Interest Determination Date and shall be the rate for such day for federal funds transactions among members of the Federal Reserve System arranged by federal funds brokers on such day, as published under the heading “Federal Funds” opposite the caption “Open” as such rate is displayed on Reuters (or any successor service) on page 5 (or any page which may replace such page on such service) (“Reuters Page 5”). In the event that on any Interest Determination Date no reported rate appears on Reuters Page 5 by 3:00 p.m., New York City time, the rate for the Interest Determination Date will be the rate for that day displayed on FFPREBON Index page on Bloomberg, which is the Fed Funds Opening Rate as reported by Prebon Yamane (or any successor) on Bloomberg. In the event that on any Interest Determination Date no reported rate appears on Reuters Page 5 or the FFPREBON Index page on Bloomberg or another recognized electronic source by 3:00 p.m., New York City time, the interest rate applicable to the next Interest Reset Period will be the arithmetic mean of the rates for the last transaction in overnight U.S. dollar Federal Funds prior to 9:00 a.m., New York City time, on such Interest Determination Date arranged by three leading brokers (which may include any underwriters, agents or their affiliates) of Federal Funds transactions in New York City selected and identified by the Company; provided, however, that if the brokers selected by the Company are not quoting as set forth above, the Federal Funds Open Rate with respect to such Interest Determination Date will be the same as the Federal Funds Open Rate in effect for the immediately preceding Interest Reset Period (or, if there was no preceding Interest Reset Period, the rate of interest will be the Initial Interest Rate). Notwithstanding the foregoing, the Federal Funds open rate in effect for any day that is not a Business Day shall be the Federal Funds Open Rate in effect for the prior Business Day.

Determination of LIBOR. If the Interest Rate Basis specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) is LIBOR, LIBOR with respect to this Note shall be determined on each Interest Determination Date as follows:

(i) With respect to an Interest Determination Date relating to a LIBOR Note, LIBOR will be, the offered rate for deposits in the London interbank market in the Index Currency (as defined below) having the Index Maturity designated on the face hereof (or in the pricing supplement attached hereto or delivered herewith) commencing on the second London Business Day immediately following such Interest Determination Date that appears on the Designated LIBOR Page (as defined below) or a successor reporter of such rate selected by the Calculation Agent and acceptable to the Company as of 11:00 a.m., London time, on such Interest Determination Date. Subject to the provisions regarding the determination of a replacement reference rate (as defined below) described below, if no such rate appears as of such time on the Designated LIBOR Page, LIBOR in respect of such Interest Determination Date will be determined as if the parties had specified the rate described in clause (ii) below.

(ii) With respect to an Interest Determination Date relating to a LIBOR Note to which the last sentence of clause (i) above applies, the Calculation Agent will request the principal London offices of each of four major reference banks (which may include any underwriters, agents or their affiliates) in the London interbank market selected and identified by the Company to provide the Calculation Agent with its offered quotation for deposits in the Index Currency for the period of the Index Maturity designated on the face hereof (or in the pricing supplement attached hereto or delivered herewith) commencing on the second London Business Day immediately following such Interest Determination Date to prime banks in the London interbank market at approximately 11:00 a.m., London time, on such Interest Determination Date and in a principal amount that is representative for a single transaction in such Index Currency in such market at such time. If at least two such quotations are provided, LIBOR determined on such Interest Determination Date will be the arithmetic mean of such quotations. If fewer than two quotations are provided, LIBOR determined on such Interest Determination Date will be the arithmetic mean of the rates quoted at approximately 11:00 a.m. (or such other time specified in the pricing supplement attached hereto or delivered herewith), in the applicable Principal Financial Center (as defined below), on such Interest Determination Date for loans made in the Index Currency to leading European banks having the Index Maturity designated on the face hereof (or in the pricing supplement attached hereto or delivered herewith) commencing on the second London Business Day immediately following such Interest Determination Date and in a principal amount that is representative for a single transaction in such Index Currency in such market at such time by three major reference banks (which may include any underwriters, agents or their affiliates) in such Principal Financial Center selected and identified by the Company; provided, however, that if fewer than three reference banks so selected by the Company are quoting such rates as mentioned in this sentence, LIBOR with respect to such Interest Determination Date will be the same as LIBOR in effect for the immediately preceding Interest Reset Period (or, if there was no preceding Interest Reset Period, the rate of interest payable hereon will be the Initial Interest Rate).

Unless otherwise specified in the pricing supplement attached hereto or delivered herewith, the Company will appoint a replacement rate agent for the LIBOR Notes. The Company will notify the Holders of the LIBOR Notes of any such appointment. The Company may appoint its affiliate or any other person as replacement rate agent, so long as such affiliate or other person is a leading bank or financial institution that is experienced in the calculations or determinations to be made by the replacement rate agent. For the avoidance of doubt, in no event shall the Calculation Agent or the Trustee be appointed as replacement rate agent.

If the replacement rate agent determines at any time at or prior to 11:00 a.m., London time, on any Interest Determination Date that the rate appearing on the Designated LIBOR Page (or a successor reporter of such rate selected by the Calculation Agent and acceptable to the Company) for purposes of calculating LIBOR has been discontinued, then it will determine whether to use a substitute or successor rate for purposes of determining LIBOR on such Interest Determination Date and each Interest Determination Date thereafter that it has determined is most comparable to LIBOR had it not been discontinued. If the replacement rate agent determines to use a substitute or successor rate pursuant to the immediately preceding sentence, it will select such rate, provided that, if it determines there is an appropriate industry-accepted successor rate to LIBOR, the replacement rate agent will use such industry-accepted successor rate.

If the replacement rate agent has determined a substitute or successor rate in accordance with the foregoing (such rate, the “replacement reference rate”), for purposes of determining the interest rate, (A) the replacement rate agent will determine (x) the method for obtaining the replacement reference rate (including any alternative method for determining the replacement reference rate if such substitute or successor rate is unavailable on the relevant Interest Determination Date), which method shall be consistent with industry-accepted practices for the replacement reference rate, and (y) any adjustment factor as may be necessary to make the replacement reference rate comparable to LIBOR had it not been discontinued, consistent with industry-accepted practices for the replacement reference rate, (B) references to LIBOR in any provision of the terms of the Notes will be deemed to be references to the replacement reference rate, including any alternative method for determining such rate and any adjustment factor as described in subclause (A) above, (C) if the replacement rate agent determines that changes to the definitions of Business Day, Day Count or Interest Determination Date, or any other technical changes to any other provision of the terms of the Notes are necessary in order to implement the replacement reference rate, such definitions will be amended to reflect such changes, and (D) the Company will give notice or will procure that notice is given as soon as practicable to the Calculation Agent, the Trustee and the Holders of the LIBOR Notes, specifying the replacement reference rate, as well as the details described in subclause (A) above and the amendments implemented as contemplated above. In no event shall the Calculation Agent be responsible for determining any substitute for LIBOR, or for making any adjustments to any alternative benchmark or spread thereon, the definitions of Business Day, Interest Determination Date or any other relevant methodology for calculating any such substitute or successor benchmark. In connection with the foregoing, the Calculation Agent will be entitled to conclusively rely on any determinations made by the Company or the replacement rate agent, if any, and will have no liability for such actions taken at the direction of the Company or the replacement rate agent, as applicable.

Any determination to be made by the replacement rate agent pursuant to this section, including any determination with respect to a rate or adjustment or of the occurrence or non-occurrence of an event, circumstance or date and any decision to take or refrain from taking any action or any selection, will be made in the sole discretion of the replacement rate agent acting in good faith and in a commercially reasonable manner, will be conclusive and binding absent willful misconduct, bad faith and manifest error, and, notwithstanding anything to the contrary in the pricing supplement attached hereto or delivered herewith or in the Indenture, will become effective without consent from any other party.

“Index Currency” means the currency (including currency units and composite currencies) specified as Index Currency on the face hereof (or in the pricing supplement attached hereto or delivered herewith) as the currency with respect to which LIBOR shall be calculated. If no such currency is specified as Index Currency on the face hereof (or in the pricing supplement attached hereto or delivered herewith), the Index Currency shall be U.S. dollars.

“Designated LIBOR Page” means the display on page LIBOR01 (or any other page specified in the pricing supplement attached hereto or delivered herewith) of Reuters (or any successor service) for the purpose of displaying the London interbank offered rates of major banks for the applicable index currency (or such other page as may replace that page on that service for the purpose of displaying such rates).

Unless provided otherwise in the pricing supplement attached hereto or delivered herewith, “Principal Financial Center” means the principal financial center of the country of the specified Index Currency, except that with respect to U.S. dollars and euro, the Principal Financial Center shall be The City of New York and Brussels, respectively.

Determination of Prime Rate. If the Interest Rate Basis specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) is the Prime Rate, the Prime Rate with respect to this Note shall be determined on each Interest Determination Date and shall be the rate set forth in H.15(519) for such date opposite the caption “Bank Prime Loan” or, if not published by 3:00 p.m., New York City time, on the Calculation Date, the rate on such Interest Determination Date as published in H.15 Daily Update under the caption “Bank Prime Loan.” If such rate is not yet published by 3:00 p.m., New York City time, on such Calculation Date, the Prime Rate for such Interest Determination Date will be the arithmetic mean of the rates of interest publicly announced by each bank named on the display designated as the “USPRIME 1” page on Reuters (or such other page as may replace the USPRIME 1 page on such service for the purpose of displaying prime rates or base lending rates of major U.S. banks) (the “Reuters Screen USPRIME 1 Page”) as such bank’s prime rate or base lending rate as in effect as of 11:00 a.m., New York City time, for such Interest Determination Date as quoted on the Reuters Screen USPRIME 1 Page on such Interest Determination Date, or, if fewer than four such rates appear on the Reuters Screen USPRIME 1 Page for such Interest Determination Date, the rate shall be the arithmetic mean of the prime rates quoted on the basis of the actual number of days in the year divided by 360 as of the close of business on such Interest Determination Date by at least two of the three major money center banks in The City of New York selected and identified by the Company from which quotations are requested. If fewer than two quotations are provided, the Calculation Agent will calculate the Prime Rate, which will be the arithmetic mean of the prime rates in The City of New York quoted by the appropriate number of substitute banks or trust companies organized and doing business under the laws of the United States, or any State thereof, in each case having total equity capital of at least U.S. $500 million and being subject to supervision or examination by Federal or State authority, selected and identified by the Company to quote prime rates.

Determination of SOFR. If the Interest Rate Basis specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) is SOFR, the interest rate for each Interest Reset Period for the Notes will be determined by reference to Compounded Daily SOFR, calculated in accordance with the formula set forth below by the Calculation Agent with respect to the Observation Period relating to such Interest Reset Period. Interest periods for the Notes will begin on and include each Interest Payment Date and end on but exclude the next succeeding Interest Payment Date, except that the initial interest period will begin on and include the issue date and end on but exclude the first Interest Payment Date. Each such period is an “Interest Reset Period.” The “Observation Period” in respect of each Interest Reset Period will be the period from, and including, the date two U.S. Government Securities Business Days prior to the first date in such Interest Reset Period to, but excluding, the date falling two U.S. Government Securities Business Days prior to the Interest Payment Date for such Interest Reset Period; provided, however, in the case of any Observation Period during which the Notes become due and payable on a date other than an Interest Payment Date, in respect of such Notes that become due and payable only, such Observation Period will end on (but exclude) the date falling two U.S. Government Securities Business Days prior to such earlier date, if any, on which such Notes become due and payable.

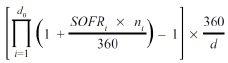

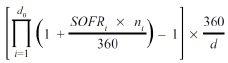

“Compounded Daily SOFR” means, with respect to any Interest Reset Period and the related Interest Determination Date, the rate of return of a daily compound interest investment (with the SOFR Reference Rate as the reference rate for the calculation of interest) as calculated by the Calculation Agent at 3:00 p.m., New York City time (the “Relevant Time”) on such Interest Determination Date in accordance with the following formula:

where:

“d” means the number of calendar days in the relevant Observation Period.

“do” means for any Observation Period, the number of U.S. Government Securities Business Days in the relevant Observation Period.

“i” is a series of whole numbers from one to do, each representing the relevant U.S. Government Securities Business Days in chronological order from (and including) the first U.S. Government Securities Business Day in the relevant Observation Period.

“ni” means for any U.S. Government Securities Business Day “i” in the relevant Observation Period, the number of calendar days from (and including) such U.S. Government Securities Business Day “i” up to, but excluding, the following U.S. Government Securities Business Day (“i+1”).

“SOFRi” means for any U.S. Government Securities Business Day “i” in the relevant Observation Period, SOFR in respect of that day “i”.

“SOFR Reference Rate” means, in respect of any U.S. Government Securities Business Day,

| (1) | a rate equal to SOFR for such U.S. Government Securities Business Day appearing on the New York Federal Reserve’s Website on or about the Relevant Time on the U.S. Government Securities Business Day immediately following such U.S. Government Securities Business Day; or |

| (2) | if SOFR in respect of such U.S. Government Securities Business Day does not appear as specified in paragraph (1), unless the Company or the Benchmark Replacement Agent, if any, determines that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to SOFR on or prior to the Relevant Time on the U.S. Government Securities Business Day immediately following such U.S. Government Securities Business Day, SOFR in respect of the last U.S. Government Securities Business Day for which such rate was published on the New York Federal Reserve’s Website; or |

| (3) | if SOFR in respect of such U.S. Government Securities Business Day does not appear as specified in paragraph (1) and the Company or the Benchmark Replacement Agent, if any, determines that a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to the then-current Benchmark on or prior to the Relevant Time on the U.S. Government Securities Business Day immediately following such U.S. Government Securities Business Day (or, if the then-current Benchmark is not SOFR, on or prior to the Alternative Relevant Time (as defined below) on the Relevant Date (as defined below)), then (subject to the subsequent operation of this clause (3)) from (and including) the U.S. Government Securities Business Day immediately following such U.S. Government Securities Business Day (or the Relevant Date, as applicable) (the “Affected Day”), “SOFR Reference Rate” shall mean, in respect of any U.S. Government Securities Business Day, the applicable Benchmark Replacement for such U.S. Government Securities Business Day appearing on, or obtained from, the Relevant Source (as defined below) at the Alternative Relevant Time on the Relevant Date. |

If the Benchmark Replacement is at any time required to be used pursuant to paragraph (3) above, then in connection with determining the Benchmark Replacement:

| (a) | the Company or the Benchmark Replacement Agent, as applicable, shall also determine the method for determining the rate described in clause (a) of paragraph (1), (2) or (3) of the definition of “Benchmark Replacement,” as applicable (including (i) the page, section or other part of a particular information service on or source from which such rate appears or is obtained (the “Relevant Source”), (ii) the time at which such rate appears on, or is obtained from, the Relevant Source (the “Alternative Relevant Time”), (iii) the day on which such rate will appear on, or is obtained from, the Relevant Source in respect of each U.S. Government Securities Business Day (the “Relevant Date”), and (iv) any alternative method for determining such rate if it is unavailable at the Alternative Relevant Time on the applicable Relevant Date), which method shall be consistent with industry-accepted practices for such rate; |

| (b) | from (and including) the Affected Day, references to the Relevant Time in the terms of the Notes shall be deemed to be references to the Alternative Relevant Time; |

| (c) | if the Company or the Benchmark Replacement Agent, as applicable, determines that (i) changes to the definitions of Business Day, Compounded Daily SOFR, Day Count, Interest Determination Date, Interest Payment Date, Interest Reset Period, Observation Period, SOFR Reference Rate or U.S. Government Securities Business Day or (ii) any other technical changes to any other provision of the terms of the Notes are necessary in order to implement the Benchmark Replacement (including any alternative method described in subclause (iv) of paragraph (a) above) as the Benchmark in a manner substantially consistent with market practices (or, if the Company or the Benchmark Replacement Agent, as the case may be, decides that adoption of any portion of such market practice is not administratively feasible or if the Company or the Benchmark Replacement Agent, as the case may be, determines that no market practice for use of the Benchmark Replacement exists, in such other manner as the Company or the Benchmark Replacement Agent, as the case may be, determines is reasonably necessary), such definitions or other provisions will be amended to reflect such changes, which amendments shall become effective without consent or approval of the Holders of the Notes or any other party; and |

| (d) | the Company will give notice or will procure that notice is given as soon as practicable to the Calculation Agent, Trustee and the Holders of the Notes, specifying the Benchmark Replacement, as well as the details described in paragraph (a) above and the amendments implemented as contemplated in paragraph (c) above. |

For purposes of the definition of SOFR Reference Rate:

“Benchmark” means SOFR, provided that if a Benchmark Transition Event and its related Benchmark Replacement Date have occurred with respect to SOFR or such other then-current Benchmark, then “Benchmark” means the applicable Benchmark Replacement.

“Benchmark Replacement” means, with respect to the then-current Benchmark, the first alternative set forth in the order presented below that can be determined by the Company or the Benchmark Replacement Agent, if any, as of the Benchmark Replacement Date with respect to the then-current Benchmark:

| (1) | the sum of: (a) the alternate rate of interest that has been selected or recommended by the Relevant Governmental Body as the replacement for the then-current Benchmark for the applicable Corresponding Tenor and (b) the Benchmark Replacement Adjustment; or |

| (2) | the sum of: (a) the ISDA Fallback Rate and (b) the Benchmark Replacement Adjustment; or |

| (3) | the sum of: (a) the alternate rate of interest that has been selected by the Company or the Benchmark Replacement Agent, if any, as the replacement for the then-current Benchmark for the applicable Corresponding Tenor, provided that, (i) if the Company or the Benchmark Replacement Agent, as the case may be, determine that there is an industry-accepted replacement rate of interest for the then-current Benchmark for U.S. dollar-denominated floating rate notes at such time, it shall select such industry-accepted rate, and (ii) otherwise, it shall select such rate of interest that it has determined is most comparable to the then-current Benchmark, and (b) the Benchmark Replacement Adjustment. |

“Benchmark Replacement Adjustment” means, with respect to any Benchmark Replacement, the first alternative set forth in the order below that can be determined by the Company or the Benchmark Replacement Agent, if any, as of the Benchmark Replacement Date with respect to the then-current Benchmark:

| (1) | the spread adjustment, or method for calculating or determining such spread adjustment, which may be a positive or negative value or zero, that has been selected or recommended by the Relevant Governmental Body for the applicable Unadjusted Benchmark Replacement; |

| (2) | if the applicable Unadjusted Benchmark Replacement is equivalent to the ISDA Fallback Rate, the ISDA Fallback Adjustment; |

| (3) | the spread adjustment, which may be a positive or negative value or zero, that has been selected by the Company or the Benchmark Replacement Agent, if any, to be applied to the applicable Unadjusted Benchmark Replacement in order to reduce or eliminate, to the extent reasonably practicable under the circumstances, any economic prejudice or benefit (as applicable) to Holders of the Notes as a result of the replacement of the then-current Benchmark with such Unadjusted Benchmark Replacement for purposes of determining the SOFR Reference Rate, which spread adjustment shall be consistent with any industry-accepted spread adjustment, or method for calculating or determining such spread adjustment, applied to such Unadjusted Benchmark Replacement where it has replaced the then-current Benchmark for U.S. dollar-denominated floating rate notes at such time. |

“Benchmark Replacement Agent” means any affiliate of the Company or such other person that has been appointed by the Company to make the calculations and determinations to be made by the Benchmark Replacement Agent described herein, so long as such affiliate or other person is a leading bank or other financial institution that is experienced in such calculations or determinations. The Company may elect, but is not required, to appoint a Benchmark Replacement Agent at any time. The Company will notify the Holders of the Notes of any such appointment. For the avoidance of doubt, in no event shall the Calculation Agent or Trustee be appointed as Benchmark Replacement Agent.

“Benchmark Replacement Date” means, with respect to the then-current Benchmark, the earliest to occur of the following events with respect thereto:

| (1) | in the case of clause (1) or (2) of the definition of “Benchmark Transition Event,” the later of (a) the date of the public statement or publication of information referenced therein and (b) the date on which the administrator of the Benchmark permanently or indefinitely ceases to provide the Benchmark; or |

| (2) | in the case of clause (3) of the definition of “Benchmark Transition Event,” the date of the public statement or publication of information referenced therein. |

For the avoidance of doubt, if the event giving rise to the Benchmark Replacement Date occurs on the same day as, but earlier than, the Relevant Time in respect of any determination, the Benchmark Replacement Date will be deemed to have occurred prior to the Relevant Time for such determination.

“Benchmark Transition Event” means, with respect to the then-current Benchmark, the occurrence of one or more of the following events with respect thereto:

| (1) | a public statement or publication of information by or on behalf of the administrator of the Benchmark announcing that such administrator has ceased or will cease to provide the Benchmark, permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark; |

| (2) | a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark, the central bank for the currency of the Benchmark, an insolvency official with jurisdiction over the administrator for the Benchmark, a resolution authority with jurisdiction over the administrator for the Benchmark or a court or an entity with similar insolvency or resolution authority over the administrator for the Benchmark, which states that the administrator of the Benchmark has ceased or will cease to provide the Benchmark permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide the Benchmark; or |

| (3) | a public statement or publication of information by the regulatory supervisor for the administrator of the Benchmark announcing that the Benchmark is no longer representative. |

“Corresponding Tenor” means, with respect to a Benchmark Replacement, a tenor (including overnight) having approximately the same length (disregarding any applicable business day convention) as the applicable tenor for the then-current Benchmark.

“ISDA Definitions” means the 2006 ISDA Definitions published by the International Swaps and Derivatives Association, Inc. or any successor thereto, as amended or supplemented from time to time, or any successor definitional booklet for interest rate derivatives published from time to time by the International Swaps and Derivatives Association, Inc.

“ISDA Fallback Adjustment” means, with respect to any ISDA Fallback Rate, the spread adjustment, which may be a positive or negative value or zero, that would be applied to such ISDA Fallback Rate in the case of derivatives transactions referencing the ISDA Definitions to be effective upon the occurrence of an index cessation event with respect to the then-current Benchmark for the applicable tenor.

“ISDA Fallback Rate” means, with respect to the then-current Benchmark, the rate that would apply for derivatives transactions referencing the ISDA Definitions to be effective upon the occurrence of an index cessation date with respect to the Benchmark for the applicable tenor excluding the applicable ISDA Fallback Adjustment.

“New York Federal Reserve’s Website” means the website of the Federal Reserve Bank of New York currently at http://www.newyorkfed.org, or any successor website of the Federal Reserve Bank of New York.

“Relevant Governmental Body” means the Board of Governors of the Federal Reserve System and/or the Federal Reserve Bank of New York, or a committee officially endorsed or convened by the Board of Governors of the Federal Reserve System and/or the Federal Reserve Bank of New York or any successor thereto.

“SOFR” means, in respect of any U.S. Government Securities Business Day, the daily secured overnight financing rate for such U.S. Government Securities Business Day as provided by the Federal Reserve Bank of New York, as the administrator of such rate (or any successor administrator of such rate).

“Unadjusted Benchmark Replacement” means the Benchmark Replacement excluding the Benchmark Replacement Adjustment.

“U.S. Government Securities Business Day” means any day, except for a Saturday, Sunday or a day on which the Securities Industry and Financial Markets Association or any successor organization recommends that the fixed income departments of its members be closed for the entire day for purposes of trading in U.S. government securities.

If the Company appoints a Benchmark Replacement Agent and such Benchmark Replacement Agent is unable to determine whether a Benchmark Transition Event has occurred or, following the occurrence of a Benchmark Transition Event, has not selected the Benchmark Replacement as of the related Benchmark Replacement Date, then, in such case, the Company shall make such determination or select the Benchmark Replacement, as the case may be. In no event shall the Calculation Agent be responsible for determining any substitute for SOFR or for making any adjustments to any alternative benchmark or spread thereon, the definitions of Business Day, Compounded Daily SOFR, Day Count, Interest Determination Date, Interest Payment Date, Interest Reset Period, Observation Period, SOFR Reference Rate or U.S. Government Securities Business Day or any other relevant methodology for calculating any such substitute or successor benchmark. In connection with the foregoing, the Calculation Agent will be entitled to conclusively rely on any determinations made by the Company or the Benchmark Replacement Agent, if any, and will have no liability for such actions taken at the direction of the Company or the Benchmark Replacement Agent, as applicable.

Any determination, decision or election that may be made by the Company or the Benchmark Replacement Agent pursuant to this section, including any determination with respect to a tenor, rate or adjustment or of the occurrence or non-occurrence of an event (including any determination that a Benchmark Transition Event and its related Benchmark Replacement have occurred with respect to the then-current Benchmark), circumstance or date and any decision to take or refrain from taking any action or any selection:

| • | will be conclusive and binding absent willful misconduct, bad faith and manifest error, |

| • | will be made in the sole discretion of the Company or the Benchmark Replacement Agent, as the case may be, acting in good faith and in a commercially reasonable manner; and |

| • | notwithstanding anything to the contrary in the pricing supplement attached hereto or delivered herewith or in the Indenture, will become effective without consent from any other party. |

Neither the Trustee nor the Calculation Agent will have any liability for any determination made by or on behalf of the Company or the Benchmark Replacement Agent in connection with a Benchmark Transition Event or a Benchmark Replacement.

Determination of Treasury Rates. If the Interest Rate Basis specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) is the Treasury Rate, the Treasury Rate with respect to this Note shall be determined on each Interest Determination Date and shall be the rate from the auction held on such Interest Determination Date (“Auction”) of direct obligations of the United States (“Treasury Bills”) having the Index Maturity specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) under the caption “INVESTMENT RATE” on the display on Reuters (or any successor service) on page USAUCTION10 (or any other page as may replace such page on such service) or page USAUCTION11 (or any other page as may replace such page on such service) or, if not so published by 3:00 p.m., New York City time, on the Calculation Date pertaining to such Interest Determination Date, the Bond Equivalent Yield (as defined below) of the rate for such Treasury Bills as published in H.15 Daily Update, or such other recognized electronic source used for the purpose of displaying such rate, under the caption “U.S. Government Securities/Treasury Bills/Auction High” or, if not so published by 3:00 p.m., New York City time, on the related Calculation Date, the Bond Equivalent Yield of the Auction rate of such Treasury Bills as announced by the U.S. Department of the Treasury. In the event that the Auction rate of Treasury Bills having the Index Maturity specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) is not so announced by the U.S. Department of the Treasury, or if no such Auction is held, then the Treasury Rate will be the Bond Equivalent Yield of the rate on such Interest Determination Date of Treasury Bills having the index maturity designated in the applicable pricing supplement as published in H.15(519) under the caption “U.S. Government Securities/Treasury Bills (Secondary Market)” or, if not published by 3:00 p.m., New York City time, on the related Calculation Date, the rate of such Interest Determination Date on such Treasury Bills as published in H.15 Daily Update, or such other recognized electronic source used for the purpose of displaying such rate, under the caption “U.S. Government Securities/Treasury Bills (Secondary Market).” In the event such rate is not published in H.15(519), H.15 Daily Update or another recognized electronic source by 3:00 p.m., New York City time, on such Calculation Date, the Calculation Agent will calculate the Treasury Rate, which will be a Bond Equivalent Yield of the arithmetic mean of the secondary market bid rates, as of approximately 3:30 p.m., New York City time, on such Interest Determination Date, of three leading primary U.S. government securities dealers (which may include Credit Suisse Securities (USA) LLC) selected and identified by the Company for the issue of Treasury Bills with a remaining maturity closest to the Index Maturity specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith); provided, however, that if the dealers selected as aforesaid by the Company are not quoting bid rates as mentioned in this sentence, the Treasury Rate with respect to the Interest Determination Date will be the same as the Treasury Rate for the immediately preceding Interest Reset Period (or, if there was no such Interest Reset Period, the rate of interest payable hereon shall be the Initial Interest Rate).

“Bond Equivalent Yield” shall be the yield (expressed as a percentage) calculated in accordance with the following formula:

Bond Equivalent Yield = D x N x 100

360 - (D x M)

where “D” refers to the applicable per annum rate for Treasury Bills quoted on a bank discount basis, “N” refers to 365 or 366, as the case may be, and “M” refers to the actual number of days in the applicable Interest Reset Period.

Notwithstanding the foregoing, the interest rate hereon shall not be greater than the Maximum Interest Rate, if any, or less than the Minimum Interest Rate, if any, specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith). The Calculation Agent shall calculate the interest rate hereon in accordance with the foregoing on or before each Calculation Date. The interest rate on this Note will in no event be higher than the maximum rate permitted by New York law, as the same may be modified by United States Federal law of general application.

At the request of the Holder hereof, the Calculation Agent will provide to the Holder hereof the interest rate hereon then in effect (in the case of Notes bearing interest calculated by reference to SOFR, if determined) and, if determined, the interest rate that will become effective as of the next Interest Reset Date.

Interest payments on this Note will include interest accrued to but excluding the Interest Payment Dates or the Maturity Date (or any Redemption Date or Repayment Date), as the case may be. Accrued interest hereon shall be an amount calculated by multiplying the face amount hereof by an accrued interest factor. Such accrued interest factor shall be computed by adding the interest factor calculated for each day in the period for which interest is being paid. The interest factor for each such date shall be computed by dividing the interest rate applicable to such day by 360 if the Interest Rate Basis is Commercial Paper Rate, Federal Funds Rate, Federal Funds Open Rate, LIBOR, Prime Rate or SOFR, as specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith), or by the actual number of days in the year if the Interest Rate Basis is the Treasury Rate, as specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith). All percentages resulting from any calculation of the rate of interest on this Note will be rounded, if necessary, to the nearest one hundred-thousandth of a percentage point (.0000001), with five one-millionths of a percentage point rounded upward, and all dollar amounts used in or resulting from such calculation on this Note will be rounded to the nearest cent (with one-half cent rounded upward). The interest rate in effect on any Interest Reset Date will be the applicable rate as reset on such date. The interest rate applicable to any other day is the interest rate from the immediately preceding Interest Reset Date (or, if none, the Initial Interest Rate).

If this Note is specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) as an Original Issue Discount Note, the amount payable to the Holder of this Note in the event of redemption, repayment or acceleration of maturity will be equal to the sum of (i) the Issue Price specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) (increased by any accruals of the Discount, as defined below) and, in the event of any redemption of this Note (if applicable), multiplied by the Initial Redemption Percentage (as adjusted by the Annual Redemption Percentage Reduction, if applicable) and (ii) any unpaid interest on this Note accrued from the Original Issue Date to the Redemption Date, Repayment Date or date of acceleration of maturity, as the case may be. The difference between the Issue Price and 100% of the principal amount of this Note is referred to herein as the “Discount.”

For purposes of determining the amount of Discount that has accrued as of any Redemption Date, Repayment Date or date of acceleration of maturity of this Note, such Discount will be accrued so as to cause the yield on the Note to be constant (computed using the “Constant Yield” method in accordance with the rules under the Internal Revenue Code of 1986, as amended). The constant yield will be calculated using a 30-day month, 360-day year convention, a compounding period that, except for the Initial Period (as defined below), corresponds to the shortest period between Interest Payment Dates (with ratable accruals within a compounding period) and an assumption that the maturity of this Note will not be accelerated. If the period from the Original Issue Date to the initial Interest Payment Date (the “Initial Period”) is shorter than the compounding period for this Note, a proportionate amount of the yield for an entire compounding period will be accrued. If the Initial Period is longer than the compounding period, then such period will be divided into a regular compounding period and a short period, with the short period being treated as provided in the preceding sentence.

If this Note is specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) as an Indexed Note, the return on this Note will be linked to the performance of one or more underlyings or a basket of such underlyings. The Company will refer generally to each index, exchange-traded fund, equity security of an issuer, exchange rate, commodity, commodity futures contract or any other market measure or reference asset as an “underlying.”

If this Note is specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) as a Dual Currency Note, the Company may have a one time option, exercisable on the Option Election Date specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith), in whole, but not in part, with respect to all Dual Currency Notes issued on the same day and having the same terms, of making all payments of Principal, premium, if any, and interest after the exercise of such option, whether at maturity or otherwise (which payment would otherwise be made in the Specified Currency of such Notes), in an optional currency (the “Optional Payment Currency”) specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith).If this Note is specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) as an Amortizing Note, the Company will make payments combining Principal and interest in installments over the life of such Note. Payments with respect to Amortizing Notes will be applied first to the interest due and payable on the Notes and then to the reduction of the unpaid Principal of the Notes.

If this Note is specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) as a Renewable Note, this Note will mature on an Interest Payment Date set forth on the face hereof (or in the applicable pricing supplement attached hereto or delivered herewith), unless the maturity of all or a portion of the Principal amount of this Note is extended in accordance with the procedures set forth in the applicable pricing supplement.

If so specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith), the Maturity Date of this Note may be extended at the option of the Company for one or more periods up to but not beyond the date (the “Final Maturity Date”) set forth on the face hereof (or in the pricing supplement attached hereto or delivered herewith).

This Note is unsecured and ranks pari passu with all other unsecured and unsubordinated indebtedness of the Company.

This Note, and any Note or Notes issued upon transfer or exchange hereof, is issuable only in fully registered form, without coupons, and, if denominated in U.S. dollars, is issuable only in denominations of U.S. $2,000 or any integral multiple of U.S. $1,000 in excess thereof, provided that if a different Authorized Denomination is specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith), this Note shall be issuable only in such Authorized Denomination. If this Note is denominated in a Specified Currency other than U.S. dollars, then, unless a higher minimum denomination is required by applicable law, it is issuable only in the minimum Authorized Denomination specified on the face hereof (or in the pricing supplement attached hereto or delivered herewith) or any amount in excess thereof which is an integral multiple thereof.

In case an Event of Default (as defined in the Indenture) with respect to the Notes shall have occurred and be continuing, the Principal hereof and the interest accrued hereon, if any, may be declared, and upon such declaration shall become, due and payable, in the manner, with the effect and subject to the conditions provided in the Indenture.

The Indenture contains provisions that provide that the Company and the Trustee may amend or supplement the Indenture or the Notes without notice to or the consent of any Holder in order to (i) cure any ambiguity, defect or inconsistency in the Indenture or the Notes, provided that such amendments or supplements shall not materially and adversely affect the interests of the Holders; (ii) comply with the requirements of the Indenture if the Company consolidates with, merges with or into, or sells, conveys, transfers, leases or otherwise disposes of all or substantially all its property and assets (as an entirety or substantially as an entirety in one transaction or a series of transactions), to any person; (iii) comply with any requirements of the Securities and Exchange Commission in connection with the qualification of the Indenture under the Trust Indenture Act; (iv) evidence and provide for the acceptance of appointment under the Indenture with respect to the Notes by a successor Trustee; (v) provide for uncertificated or unregistered Notes and to make all appropriate changes for such purpose; (vi) provide for a guarantee from a third party on outstanding Notes that are issued under the Indenture; (vii) provide for the substitution of one or more of the Company’s branches as obligor of the Notes; or (viii) make any change that does not materially and adversely affect the rights of any Holder.