November 18, 2022

VIA KITEWORKS SECURE FILE TRANSFER

Cara Lubit

Robert Klein

Division of Corporation Finance

Office of Finance

United States Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

| Re: | Credit Suisse AG

Form 20-F for the Fiscal Year Ended December 31, 2021

Filed March 10, 2022

File No. 001-33434 |

Dear Ms. Lubit and Mr. Klein:

Credit Suisse AG (the “Bank” or “Credit Suisse”) is writing in response to the letter from the staff (the “Staff”) of the United States Securities and Exchange Commission (the “Commission”) dated October 20, 2022, containing the Staff’s comments with respect to the Bank’s annual report on Form 20-F for the fiscal year ended December 31, 2021, filed with the Commission on March 10, 2022 (the “2021 Form 20-F”). As discussed between Ms. Lubit of the Staff and Sebastian Sperber of Cleary Gottlieb Steen & Hamilton LLP, our counsel, on October 24, 2022, the Bank very much appreciates the Staff’s accommodation to file its response via EDGAR on or before November 18, 2022, as opposed to submitting it by the originally requested deadline.

For ease of reference, the Bank has repeated the Staff’s comments in italicized text prior to its responses. Defined terms in our responses that are not defined below are defined in the 2021 Form 20-F. Please note that in the version of this letter filed via EDGAR confidential information has been omitted and delivered separately to the Staff and the redactions are denoted in the EDGAR-filed version by bracketed asterisks (“[***]”).

Form 20-F for the Fiscal Year Ended December 31, 2021

Notes to the consolidated financial statements

Note 1 - Summary of significant accounting policies

Revisions of prior period financial statements, page 466

Ms. Cara Lubit and Mr. Robert Klein

Securities and Exchange Commission

November 18, 2022

Page 2

| 1. | We note your response to prior comment 3 relating to the reclassification and other changes to the consolidated statements of cash flows and the related SAB 99 materiality analysis provided for the errors identified. Your response notes that you conducted a detailed review of reporting processes supporting the consolidated cash flow statements in the second half of 2021. Explain in more detail the factors driving this review. In addition, your response notes that the review was part of a series of self-identified enhancements to the accounting control environment in recent years. Please tell us whether you conducted detailed reviews of the reporting processes supporting the other consolidated financial statements, and, if so, when those reviews were conducted. |

Response to Comment 1

We acknowledge the Staff’s comment in relation to our response to prior comment 3 in the letter dated August 12, 2022, relating to the reclassification and other changes to the consolidated statements of cash flows and related SAB 99 materiality analysis. Our responses below refer to and supplement the response provided to prior comment 3.

Management continuously reviews its control environment and enhances its processes to self-identify improvements to the accounting control environment. A primary example is the accounting Quality Assurance Review (“QAR”), which is a business-as-usual activity and focuses on a specific accounting topic and documenting and reviewing the way such a topic is addressed across relevant entities and systems within the Bank to ensure appropriate treatment in our consolidated financial statements and footnote disclosures. In addition, we also consider identified control deficiencies and whether those are reflective of potential areas for process and control improvements. This included our review work on the consolidated statement of cash flows, which followed from an earlier matter relating to the intra-table classification within the Loans footnote disclosure.

In the second quarter of 2020, we identified a mapping error in our Loans footnote disclosure. As a result of this matter, a significant deficiency (“Loans footnote deficiency”) was identified and reported to the Board of Directors (“BoD”) Audit Committee.

As part of the continuous reviews that we perform over our control environment and informed by the remediation of the Loans footnote deficiency, management carried out a review of disclosure table extracts that were dependent on manual processes and/or on the receipt of non-balance sheet or income statement data elements. Using a risk-based approach, management reviewed the data inputs into selected footnote disclosures and confirmed the accounting treatment. The risk-based approach considered various factors including the complexity of the relevant accounting standards, extent of automation in the underlying production processes, criticality of the data inputs, and history of errors and/or control deficiencies relating to the disclosure. While the consolidated statement of cash flows is a primary financial statement, it requires recategorization of certain income statement line items, and is not fully automated, and was therefore included in the review.

Ms. Cara Lubit and Mr. Robert Klein

Securities and Exchange Commission

November 18, 2022

Page 3

The review was completed in the second quarter of 2022, following the analysis of forty-seven disclosure tables and thirty-seven critical data inputs impacting disclosure tables. Critical data inputs refer to trade or position attributes such as maturity date or product name.

| 2. | Your response to comment 3 indicates that control deficiencies were identified where inappropriate mapping rules were used and that the automated rules relating to the sharebased compensation and cash flow hedges were remediated prior to the filing of the 2021 Form 20-F. Please address the items below. |

| • | Clarify whether these control deficiencies were determined to be a significant deficiency. |

| • | Your response indicates that the remediation of the rules relating to the nonfunctional currency gains and losses is expected to be completed in 2022. Please clarify whether the same control deficiency (deficiencies) was (were) identified related to the non-functional currency gains and losses and/or whether there were additional control deficiencies related to this error. |

| • | As part of your response, explain each of the control deficiencies in more detail, as well as how you concluded that they did not rise to the level of a material weakness given the nature of the control deficiencies (at least several mapping rule errors) and the fact that they led to quantitative errors exceeding 10% of the respective line items for several periods. |

Response to Comment 2

We acknowledge the Staff’s comment 2 relating to our response to prior comment 3 in the letter dated August 12, 2022, that a control deficiency was identified where inappropriate mapping rules were used and that the automated rules relating to the share-based compensation and cash flow hedges were remediated prior to the filing of the 2021 Form 20-F (“Mapping rules deficiency”). We also acknowledge the Staff’s comment relating to the distinct control deficiency relating to non-functional currency gains and losses (“Nonfunctional currency gains and losses deficiency”) and/or whether there were additional control deficiencies related to this error. Both topics were reported to the BoD Audit Committee in the context of the corrections to the consolidated statements of cash flows, the results of the reviews that we perform on our control environment, and the reporting of select control deficiencies that do not rise to the level of a significant deficiency. At the request of the BoD Audit Committee, and for transparency on the control environment, management reports on a recurring basis to those charged with governance at the Bank (i.e., the BoD Audit Committee) on various internal control topics, which include the reporting of required matters (e.g., material weaknesses (if applicable), significant deficiencies, etc.) and other items that relate to the annual and/or quarterly financial reporting or are topical in nature (e.g., prior period financial reporting corrections, select control deficiencies that do not rise to the level of a significant deficiency, process and control recommendations, etc.).

Ms. Cara Lubit and Mr. Robert Klein

Securities and Exchange Commission

November 18, 2022

Page 4

In 2021, as a part of the review that we performed over the consolidated statement of cash flows (as referred to in our response to comment 1), we self-identified the Mapping rules deficiency, which relates to certain cash flow positions that had not been categorized in accordance with Generally Accepted Accounting Principles in the United States of America (“US GAAP”) due to inappropriate mapping rules. This deficiency was remediated and closed in 2021 prior to the filing of our 2021 Form 20-F. Notwithstanding the quantitative percentages of the corrections (as outlined in Exhibit A), the control deficiency was not material or significant, individually or in combination with other control deficiencies, for the reasons outlined below.

| • | The magnitude of the potential misstatement/error, in combination with qualitative considerations, was not material to a reader of our financial reporting. We considered several quantitative and qualitative factors: |

| o | The disclosures as reported on the consolidated statement of cash flows. |

| o | The management review (as referred to in our response to comment 1), which was compensating in nature and identified these items, over the process and reporting of the consolidated statement of cash flows. |

| o | The actual size and relevance of the items identified that resulted in the corrections to our financial reporting (as outlined in Exhibit A). |

| o | The impact of these corrections across the relevant periods. |

| o | The fact that it is not likely that further quantitative errors that are similar and significant in nature existed, given the findings from the process and reporting review over the consolidated statement of cash flows (as previously outlined). |

| o | The impact of these corrections to a reader of our financial reporting. |

| • | As outlined in Exhibit A, the largest of these corrections was in relation to Share-based compensation to reflect the relevant amounts relating to accruals and forfeiture events as an adjustment to reconcile Net income to Net cash provided by/(used in) operating activities, as opposed to Net cash provided by/(used in) financing activities. To understand and assess the impact of our Employee deferred compensation, a reader of our financial reporting will likely consider the Employee deferred compensation footnote disclosure, which was not impacted by this matter. An increase or decrease to the amounts reported within that footnote disclosure would be considered, by a reader of our financial reporting, independently of the intra-statement classification of these Share-based compensation related accruals and forfeiture events within our consolidated statement of cash flows. |

| • | The impact of this control deficiency was limited to the intra-statement presentation within the consolidated statement of cash flows. There was no impact to any other financial statement or any footnote disclosure. In the context of the “total mix” of information available to a reader of our financial reporting, and considering the factors outlined above, this control deficiency was not material or significant, individually or in combination with other control deficiencies. |

Ms. Cara Lubit and Mr. Robert Klein

Securities and Exchange Commission

November 18, 2022

Page 5

| • | As of December 31, 2021, the likelihood of a potential misstatement/error resulting from the Mapping rules deficiency was remote and the magnitude of the potential misstatement/error was limited, as we made the relevant corrections to our financial reporting in 2021, as deemed necessary, we remediated the associated mapping rules in the respective system, and we closed the control deficiency prior to our filing of the 2021 Form 20-F. |

In 2021, as a part of the review that we performed over our consolidated statement of cash flows (as referred to in our response to comment 1), we self-identified the Nonfunctional currency gains and losses deficiency, which relates to the computation and reporting of the cash flow effects of gains and losses on remeasurements within the consolidated statement of cash flows. Prior to the filing of the 2021 Form 20-F, we corrected our financial reporting (as outlined in Exhibit A), as deemed necessary, and identified a distinct control deficiency, which was not material or significant, individually or in combination with other control deficiencies. Notwithstanding the quantitative percentages of the corrections, the impact of these corrections (as outlined in Exhibit A) and the severity of the associated control deficiency was not material to a reader of our financial reporting for the reasons outlined below.

| • | The likelihood of a potential misstatement/error resulting from the Nonfunctional currency gains and losses deficiency was reasonably possible, as not all instruments are included within our computation of the cash flow effects of gains and losses resulting from the remeasurement of foreign currency-denominated monetary assets and liabilities (refer to our response to comment 3 for further detail). However, the magnitude of the potential misstatement/error, in combination with qualitative considerations, was not material to a reader of our financial reporting. We considered several quantitative and qualitative factors: |

| o | The disclosures as reported on the consolidated statement of cash flows. |

| o | The management review (as referred to in our response to comment 1), which was compensating in nature and identified these items, over the process and reporting of the consolidated statement of cash flows. |

| o | The actual size and relevance of the items identified that resulted in the corrections to our financial reporting (as outlined in Exhibit A). |

| o | The impact of these corrections across the relevant periods. |

| o | The potential impact of the relevant instruments not included in the computation of the cash flow effects of gains and losses resulting from the remeasurement of foreign currency-denominated monetary assets and liabilities (as referred to in our response to comment 3). |

| o | The fact that it is not likely that further quantitative errors that are similar and significant in nature existed, given the findings from the process and reporting review over the consolidated statement of cash flows (as previously outlined), and the process and control enhancements. |

| o | The impact of these corrections to a reader of our financial reporting. |

Ms. Cara Lubit and Mr. Robert Klein

Securities and Exchange Commission

November 18, 2022

Page 6

| • | A reader of our financial reporting may consider whether we are attracting or losing customers. An indicator of this is the Loan and Customer deposit balances as reflected in our consolidated balance sheet and the associated footnote disclosures. An increase or decrease to these balance sheet amounts would be considered, by a reader of our financial reporting, independently of the remeasurement cash flow effects (gains and losses resulting from the remeasurement of foreign currency-denominated monetary assets and liabilities) as reported on our consolidated statement of cash flows. The impact of these remeasurements is not material in relation to the balance sheet amounts of Loans or Customer deposits and these remeasurements do not indicate whether we are attracting or losing customers. |

| • | As noted above, to understand and assess our Loans or Customer deposits, and the results of our business activities for these balances, a reader of our financial reporting will primarily consider the disclosures in our consolidated balance sheet and the associated footnote disclosures. The affected intra-statement disclosure line items within the consolidated statement of cash flows are likely not to be of the same importance to a reader of our financial reporting to understand and assess our Loans or Customer deposits, or to understand and assess the associated business activities of Credit Suisse. |

| • | The affected intra-statement disclosure lines within the consolidated statement of cash flows typically have notable variability year-over-year, which emphasizes that there is substantial likelihood that these line items have limited usefulness to a reader of our financial reporting in the context of the “total mix” of information available. |

| • | The impact of this control deficiency was limited to the intra-statement presentation within the consolidated statement of cash flows. There was no impact to any other financial statement or any footnote disclosure. |

| • | As Credit Suisse is a regulated banking institution, a reader of our financial reporting will also likely be considering the liquidity metrics and disclosures in our Liquidity and funding management section of our Form 20-F to understand and assess our liquidity. |

Prior to our filing of the 2021 Form 20-F, management considered the severity of the Mapping rules deficiency and the Nonfunctional currency gains and losses deficiency, individually and in combination with other control deficiencies, as applicable. Based on quantitative and qualitative considerations, neither deficiency was deemed to be material or significant, individually or in combination with other control deficiencies. However, management did report these matters to the BoD Audit Committee to provide transparency on the control environment as previously outlined.

[***]

| 3. | In addition to the comments above, please explain in more detail the nature of the nonfunctional currency gains and losses error, in which you only recorded the gains and losses on a subsection of re-measured assets as a reconciling item between net income and net cash provided by / (used in) operating activities, and why you believe this change was appropriate. By way of example only, your response indicates that after observing a range of practices, you decided to extend the existing processes to include a broader selection of instruments; however, given that there are a range of practices, it is unclear how you concluded that this was the appropriate approach. It is also unclear why this change would only include additional instruments, rather than all instruments. As part of your response, tell us the types of instruments this new practice does not apply to and why, and the presentation used for the remaining instruments. |

Ms. Cara Lubit and Mr. Robert Klein

Securities and Exchange Commission

November 18, 2022

Page 7

Response to Comment 3

We acknowledge the Staff’s comment 3 on the appropriateness of recording gains and losses on only a subsection of re-measured assets as a reconciling item between net income and net cash provided by / (used in) operating activities.

US GAAP (as discussed in ASC 830) requires reporting entities to remeasure their foreign currency denominated monetary assets and liabilities into the reporting entity’s functional currency. Such remeasurement of foreign currency denominated assets and liabilities results in gains / losses that are included in the net income of the reporting entity.

ASC 230-10-45-28 allows the cash flows related to operating activities to be presented in one of two ways, the direct method, or the indirect method. Management has elected to present its cash flows from operating activities using the indirect method. Further, as discussed in ASC 230-10-45-25 and ASC 230-10-45-28, when the indirect method is used, a reporting entity provides a reconciliation of net income to cash flows from net operating activities. Such a reconciliation removes the effects of all non-cash transactions recorded in the net income of the reporting entity, which includes the gains / losses on remeasurement of foreign currency denominated assets and liabilities, to arrive at the pure cash flows from net operating activities.

We additionally acknowledge the Staff’s comment 3 on our conclusion to include a selection of instruments, and the appropriateness of the presentation thereof.

In 2021, as noted in our response to comment 1 above, management performed a review of the consolidated statement of cash flows, and this included an assessment of the reporting of the cash flow effects of gains and losses resulting from the remeasurement of foreign currency-denominated monetary assets and liabilities. Management considered the materiality of foreign currency exposures for the relevant monetary assets and liabilities within the legal entities that could significantly impact the total net cash provided by/(used in) operating activities, investing activities, and/or financing activities. Prior to the filing of our 2021 Form 20-F, we extended the coverage of instruments from long-term debt to also include net loans and customer deposits. We considered the potential impact of the relevant instruments not included, and that the exclusion of these instruments is appropriate and would not materially impact a reader of our financial reporting, as noted below.

Ms. Cara Lubit and Mr. Robert Klein

Securities and Exchange Commission

November 18, 2022

Page 8

The instruments within ‘Operating activities’ that this new practice does not apply to include: ‘Trading assets and liabilities’, ‘Other assets’, and ‘Other liabilities.’ The impact of not including these instruments is not material to a reader of our financial reporting as it would not impact the total net cash provided by/(used in) operating activities, as the cash flow effects of gains and losses on remeasurements are reported in the ‘Trading assets and liabilities, net’ disclosure line item.

The instruments within ‘Investing activities’ that this new practice does not apply to include: ‘Securities purchased under resale agreements and securities borrowing transactions’, ‘Investment securities’ and ‘Other investments.’ The instruments within ‘Financing activities’ that this new practice does not apply to include: ‘Short-term borrowings’ and ‘Securities sold under repurchased agreements and securities lending transactions.’ Further, this new practice does not apply to ‘Cash and due from banks.’ The impact of not including these instruments is not material to a reader of our financial reporting as the cash flow effects of gains and losses on remeasurements for these instruments is not material for the comparative periods (2021, 2020, and 2019) that we reported in our 2021 Form 20-F.

For the instruments noted above that are not included within this new practice, the cash flow effects of gains and losses resulting from the remeasurement of monetary assets and liabilities continue to form part of the related cash flow line for that asset or liability.

[***]

| 4. | We note your SAB 99 materiality analysis and the quantitative data provided in Exhibit A as part of your response to comment 3. We also note that you acknowledge in your response that the statement of cash flows errors exceed 5% of the impacted line items, but based on qualitative factors, you do not consider the changes to the comparative periods to be material to users of the financial statements. Please address the items below. |

| • | Your materiality analysis briefly addresses the qualitative factors enumerated in SAB 99, but SAB 99 also states “this is not an exhaustive list of the circumstances that may affect the materiality of a quantitatively small misstatement.” Tell us whether you considered other qualitative factors in concluding that the errors were not material, including any quantitative or qualitative metrics or disclosures related to liquidity and cash flows. |

| • | Your materiality analysis quantifies the impact of the statement of cash flow errors on the years ended December 31, 2020 and 2019. Please tell us how far you believe the errors go back and whether you quantified the impact on periods prior to December 31, 2019. Additionally, please clarify whether you evaluated the impact of the errors on your quarterly consolidated statements of cash flows filed on Forms 6-K, and, if so, provide the results of that analysis. |

Ms. Cara Lubit and Mr. Robert Klein

Securities and Exchange Commission

November 18, 2022

Page 9

| • | Your response addresses the quantitative impact of the errors on an aggregate basis but does not address the quantitative impact on an individual basis. Provide us with an analysis that quantifies the individual impact for all of the cash flow error adjustments described in your response for all applicable periods. |

Response to Comment 4

We acknowledge the Staff’s comment 4 on management’s consideration of qualitative factors in concluding that the errors were not material. As stated in our prior response, we considered a list of qualitative factors that are the most likely to be impactful for a reader of our financial reporting, based on our understanding of the industry and our experience of questions from shareholders, analysts, regulators, and auditors.

Other relevant considerations include the impact to footnote disclosures and segment reporting, earnings per share, compliance with loan covenants, management compensation, market price, and/or investor reactions, and these considerations do not lead us to a different conclusion.

We additionally acknowledge the Staff’s comment 4 on periods impacted by the errors and whether impacts for all such periods were quantified, and whether management evaluated the impact of errors on the quarterly consolidated statements of cash flows filed on Forms 6-K.

Management considers that the presentation errors have impacted periods since the implementation of the consolidated statement of cash flows in its current form, i.e., for a number of years. The impacts of the identified errors were quantified for the prior periods that would be relevant for publication as comparative periods in the consolidated statements of cash flows. We did not quantify the impact for periods prior to 2019 as the reported balances on the consolidated statement of cash flows are not cumulative, and the balances prior to 2019 were not reported in our 2021 Form 20-F, or our quarterly reports on Form 6-K that were filed in 2021. The periods that we quantified the impact for are listed below. These were the relevant periods for a reader of our financial reporting in 2021:

| • | 12 months ending December 31, 2019 |

| • | 12 months ending December 31, 2020 |

| • | 6 months ending June 30, 2021 |

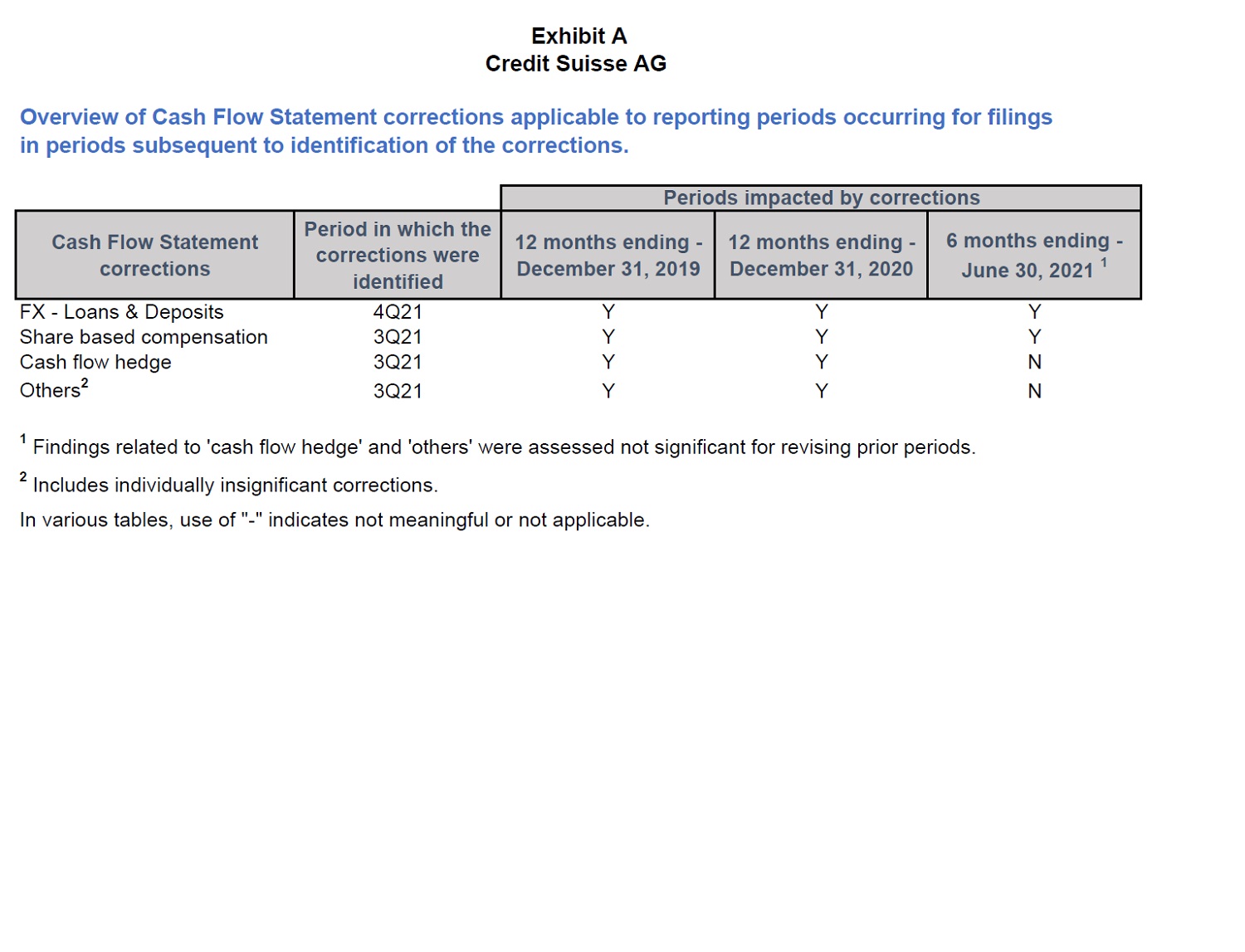

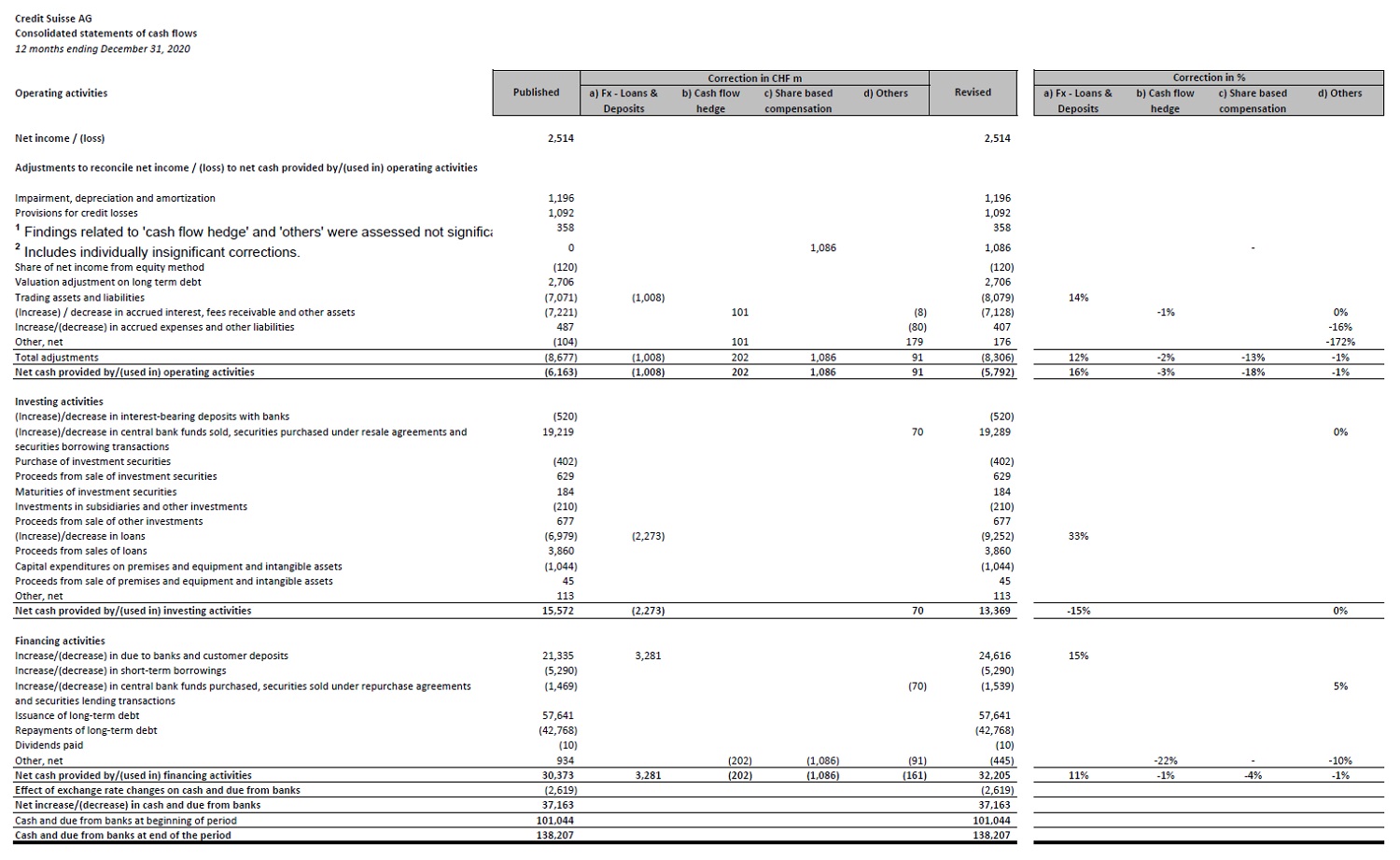

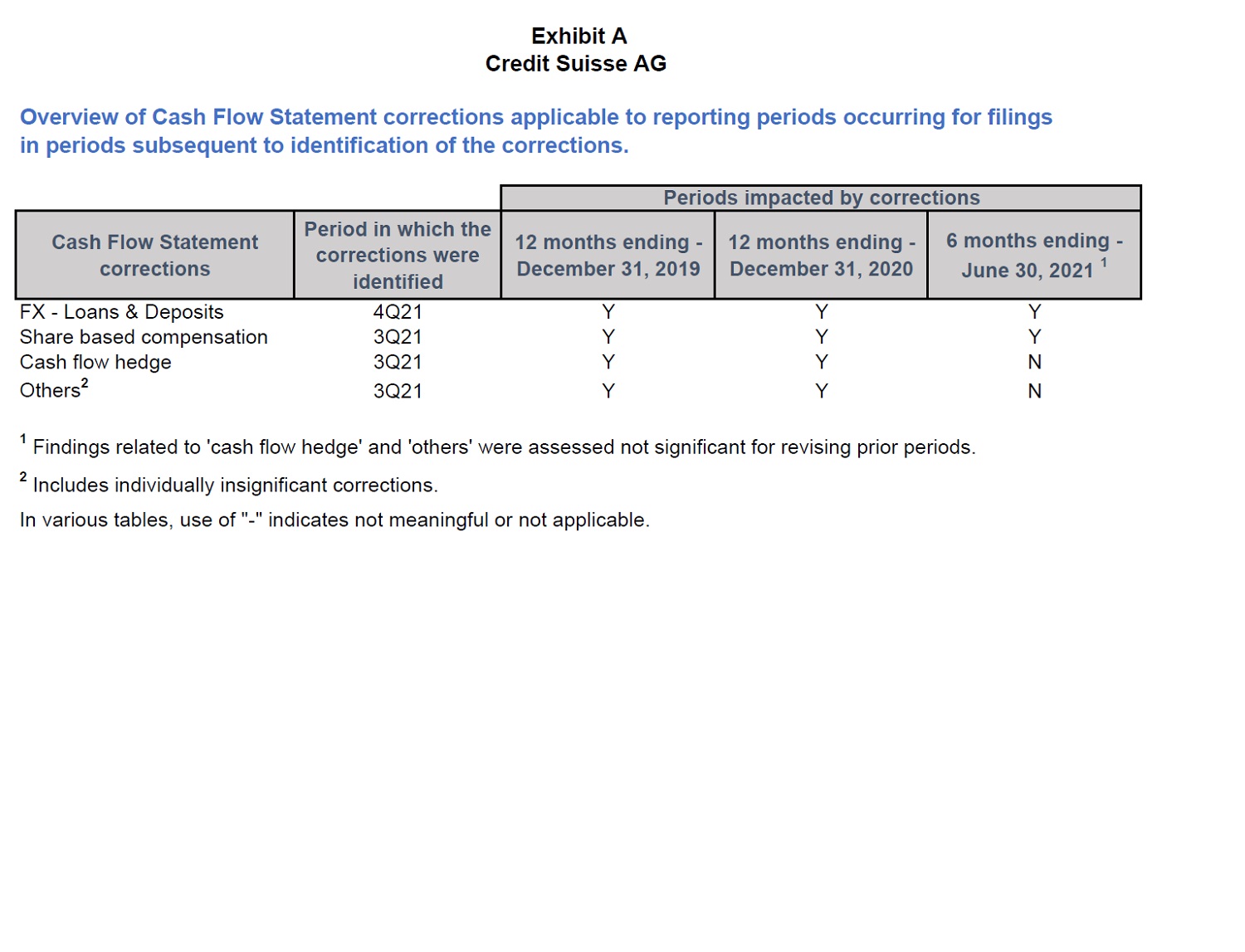

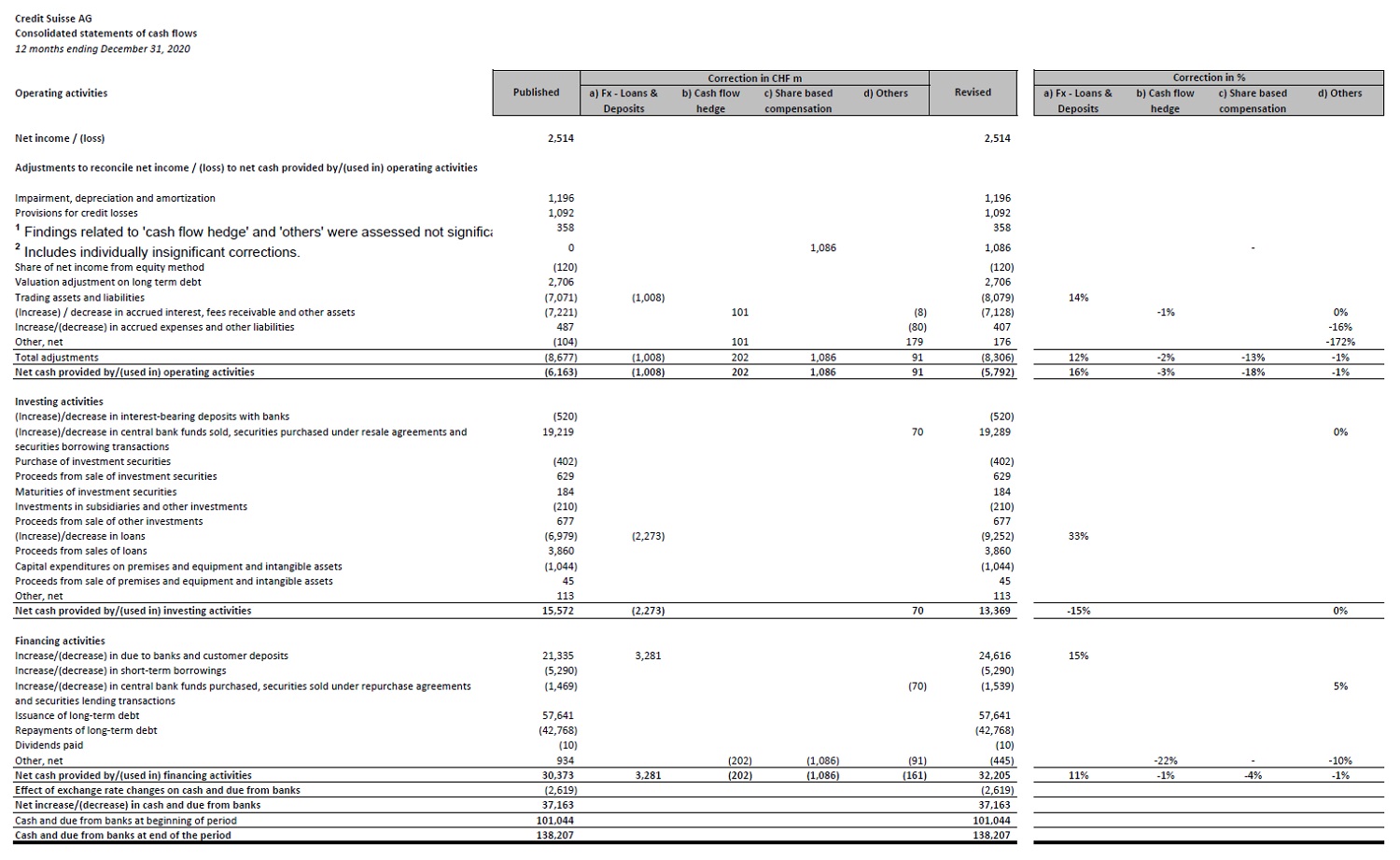

We additionally acknowledge the Staff’s comment 4 seeking analysis that quantifies the individual impact for all the cash flow adjustments described in our response to prior comment 3, for all applicable periods. Please refer to Exhibit A, for the quantification of each error, by each comparative period impacted by these errors.

* * * * *

Ms. Cara Lubit and Mr. Robert Klein

Securities and Exchange Commission

November 18, 2022

Page 10

The Bank acknowledges that it is responsible for the adequacy and accuracy of the disclosure in its filings with the Commission, that Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filings, and that it may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States.

The Bank hopes that its responses adequately address each of the Staff’s comments. If the Staff has any questions concerning this letter or requires further information, please do not hesitate to contact Robert Arbuthnott, Head of Group Finance and Chief Accounting Officer, in Zurich at 011-41-44-332-6261, Todd Runyan, Group Accountant, in Zurich at 011-41-44-334-8063, Christopher Harris, Head of External Reporting, in Zurich at 011-41-44-333-8395, or me in Zurich at 011-41-44-333-1780.

| | Very truly yours, |

| | |

| | CREDIT SUISSE AG |

| | |

| | |

| | /s/ Dixit Joshi |

| | |

| | Dixit Joshi |

| | Chief Financial Officer |

Chairman of the Audit Committee

Credit Suisse AG

Sebastian R. Sperber, Esq.

Cleary Gottlieb Steen & Hamilton LLP

EXHIBIT A

| Overview of Cash Flow Statement corrections applicable to reporting periods occurring for filings in periods subsequent to identification of the corrections.Cash Flow Statement correctionsPeriod in which the corrections were identified12 months ending - December 31, 201912 months ending - December 31, 20206 months ending - June 30, 2021 1FX - Loans & Deposits4Q21YYYShare based compensation3Q21YYY Cash flow hedge3Q21YYNOthers23Q21YYNIn various tables, use of "-" indicates not meaningful or not applicable.Exhibit A Credit Suisse AG Periods impacted by corrections1 Findings related to 'cash flow hedge' and 'others' were assessed not significant for revising prior periods.2 Includes individually insignificant corrections. |

| Credit Suisse AG Consolidated statements of cash flows 12 months ending December 31, 201 9 Operating activitiesa) Fx - Loans & Depositsb) Cash flow hedgec) Share based compensationd) Othersa) Fx - Loans & Depositsb) Cash flow hedgec) Share based compensationd) OthersNet income / (loss)3,0953,095Adjustments to reconcile net income / (loss) to net cash provided by/(used in) operating activities Impairment, depreciation and amortization1,1341,134Provisions for credit losses3243241 Findin g s related to 'cash flow hed g e' and 'others' were assessed not si g nific a 6166162 Includes individuall y insi g nificant corrections.01,0221,022-Share of net income from equity method(78)(78)Valuation adjustment on long term debt10,19310,193Trading assets and liabilities(27,700)(328)(28,028)1%(Increase) / decrease in accrued interest, fees receivable and other assets2,95679223,0573%1% Increase/(decrease) in accrued expenses and other liabilities(6,461)(41)(6,502)1% Other, net(2,497)20205(2,272)-8%Total adjustments(21,513)(328)991,022186(20,534)2%0%-5%-1%Net cash provided by/(used in) operating activities(18,418)(328)991,022186(17,439)2%-1%-6%-1%Investing activities(Increase)/decrease in interest-bearing deposits with banks411411(Increase)/decrease in central bank funds sold, securities purchased under resale agreements and securities borrowing transactions8,386 8,386 Purchase of investment securities(557)(557)Proceeds from sale of investment securities66Maturities of investment securities1,0071,007Investments in subsidiaries and other investments(284)(284)Proceeds from sale of other investments1,1331,133(Increase)/decrease in loans(17,309)(1,045)(18,354)6%Proceeds from sales of loans4,6124,612Capital expenditures on premises and equipment and intangible assets(1,133)(1,133)Proceeds from sale of premises and equipment and intangible assets3030Other, net537537Net cash provided by/(used in) investing activities(3,161)(1,045)(4,206)33%Financing activitiesIncrease/(decrease) in due to banks and customer deposits24,6841,37326,0576% Increase/(decrease) in short-term borrowings6,9116,911Increase/(decrease) in central bank funds purchased, securities sold under repurchase agreements and securities lending transactions3,4913,491Issuance of long-term debt34,91134,911Repayments of long-term debt(46,290)(46,290)Dividends paid(11)(11)Other, net208(99)(1,022)(186)(1,099)-48%--89%Net cash provided by/(used in) financing activitie s 23,9041,373(99)(1,022)(186)23,9706%0%-4%-1%Effect of exchange rate changes on cash and due from bank s (595)(595)Net increase/(decrease) in cash and due from banks1,7301,730Cash and due from banks at beginning of period99,31499,314Cash and due from banks at end of the period101,044101,044Correction in CHF mRevisedPublishedCorrection in % |

| Credit Suisse AG Consolidated statements of cash flows 12 months ending December 31, 202 0 Operating activitiesa) Fx - Loans & Depositsb) Cash flow hedgec) Share based compensationd) Othersa) Fx - Loans & Depositsb) Cash flow hedgec) Share based compensationd) OthersNet income / (loss)2,5142,514Adjustments to reconcile net income / (loss) to net cash provided by/(used in) operating activities Impairment, depreciation and amortization1,1961,196Provisions for credit losses1,0921,0921 Findin g s related to 'cash flow hed g e' and 'others' were assessed not si g nific a 3583582 Includes individuall y insi g nificant corrections.01,0861,086-Share of net income from equity method(120)(120)Valuation adjustment on long term debt2,7062,706Trading assets and liabilities(7,071)(1,008)(8,079)14%(Increase) / decrease in accrued interest, fees receivable and other assets(7,221)101(8)(7,128)-1%0% Increase/(decrease) in accrued expenses and other liabilities487(80)407-16% Other, net(104)101179176-172%Total adjustments(8,677)(1,008)2021,08691(8,306)12%-2%-13%-1%Net cash provided by/(used in) operating activities(6,163)(1,008)2021,08691(5,792)16%-3%-18%-1%Investing activities(Increase)/decrease in interest-bearing deposits with banks(520)(520)(Increase)/decrease in central bank funds sold, securities purchased under resale agreements and securities borrowing transactions19,2197019,2890%Purchase of investment securities(402)(402)Proceeds from sale of investment securities629629Maturities of investment securities184184Investments in subsidiaries and other investments(210)(210)Proceeds from sale of other investments677677(Increase)/decrease in loans(6,979)(2,273)(9,252)33%Proceeds from sales of loans3,8603,860Capital expenditures on premises and equipment and intangible assets(1,044)(1,044)Proceeds from sale of premises and equipment and intangible assets4545Other, net113113Net cash provided by/(used in) investing activities15,572(2,273)7013,369-15%0%Financing activitiesIncrease/(decrease) in due to banks and customer deposits21,3353,28124,61615% Increase/(decrease) in short-term borrowings(5,290)(5,290)Increase/(decrease) in central bank funds purchased, securities sold under repurchase agreements and securities lending transactions(1,469)(70)(1,539)5%Issuance of long-term debt57,64157,641Repayments of long-term debt(42,768)(42,768)Dividends paid(10)(10)Other, net934(202)(1,086)(91)(445)-22%--10%Net cash provided by/(used in) financing activitie s 30,3733,281(202)(1,086)(161)32,20511%-1%-4%-1%Effect of exchange rate changes on cash and due from bank s (2,619)(2,619)Net increase/(decrease) in cash and due from banks37,16337,163Cash and due from banks at beginning of period101,044101,044Cash and due from banks at end of the period138,207138,207Correction in CHF mPublishedRevisedCorrection in % |

| Credit Suisse AG Consolidated statements of cash flows 6 months ending June 30, 2021Operating activitiesa) Fx - Loans & Depositsb) Share based compensationa) Fx - Loans & Depositsb) Share based compensationNet income / (loss)99Adjustments to reconcile net income / (loss) to net cash provided by/(used in) operating activitiesImpairment, depreciation and amortization623623Provisions for credit losse s 4,3734,3731 Findin g s related to 'cash flow hed g e' and 'others' were assessed not si g nific a (322)(322)2 Includes individuall y insi g nificant corrections.0551551-Share of net income from equity method(72)(72)Valuation adjustment on long term debt2,0502,050 Trading assets and liabilitie s 20,5521,01721,5695%(Increase) / decrease in accrued interest, fees receivable and other asset s (517)(517)Increase/(decrease) in accrued expenses and other liabilitie s (5,441)(5,441)Other, net(234)(234)Total adjustments21,0121,01755122,5805%3%Net cash provided by/(used in) operating activities21,0211,01755122,5895%3%Investing activities(Increase)/decrease in interest-bearing deposits with bank s 99(Increase)/decrease in central bank funds sold, securities purchased under resale agreements and securities borrowing transactions(11,851)(11,851)Purchase of investment securitie s (213)(213)Proceeds from sale of investment securitie s 00Maturities of investment securitie s 2525Investments in subsidiaries and other investment s (288)(288)Proceeds from sale of other investment s 949949(Increase)/decrease in loan s (6,636)1,717(4,919)-26%Proceeds from sales of loan s 2,2162,216Capital expenditures on premises and equipment and intangible asset s (550)(550)Proceeds from sale of premises and equipment and intangible asset s 22Other, net5151Net cash provided by/(used in) investing activities(16,286)1,717(14,569)-11%Financing activitiesIncrease/(decrease) in due to banks and customer deposit s 3,411(2,734)677-80%Increase/(decrease) in short-term borrowing s 3,5833,583Increase/(decrease) in central bank funds purchased, securities sold under repurchase agreements and securities lending transaction s (3,932)(3,932)Issuance of long-term deb t 24,15524,155Repayments of long-term debt(27,321)(27,321)Dividends paid(11)(11)Other, net719(551)168-77%Net cash provided by/(used in) financing activities604(2,734)(551)(2,681)-453%-91% Effect of exchange rate changes on cash and due from banks1,8211,821 Net increase/(decrease) in cash and due from banks7,1607,160 Cash and due from banks at beginning of period138,207138,207 Cash and due from banks at end of the period145,367145,367PublishedRevisedCorrection in CHF mCorrection in % |