UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

December 04, 2008

Commission File Number 001-15244

CREDIT SUISSE GROUP AG

(Translation of registrant’s name into English)

Paradeplatz 8, P.O. Box 1, CH-8070 Zurich, Switzerland

(Address of principal executive office)

Commission File Number 001-33434

CREDIT SUISSE

(Translation of registrant’s name into English)

Paradeplatz 8, P.O. Box 1, CH-8070 Zurich, Switzerland

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F | Form 40-F |

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes | No |

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-.

Accelerated implementation of

strategic plan

Zurich

December 4, 2008

Slide 1

Cautionary statement

Cautionary statement regarding forward-looking and non-GAAP information

This presentation contains forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking statements involve inherent risks

and uncertainties, and we might not be able to achieve the predictions, forecasts,

projections and other outcomes we describe or imply in forward-looking statements.

A number of important factors could cause results to differ materially from the plans,

objectives, expectations, estimates and intentions we express in these forward-looking

statements, including those we identify in "Risk Factors" in our Annual Report on Form 20-

F for the fiscal year ended December 31, 2007 filed with the US Securities and Exchange

Commission, and in other public filings and press releases. We do not intend to update

these forward-looking statements except as may be required by applicable laws.

This presentation contains non-GAAP financial information. Information needed to reconcile

such non-GAAP financial information to the most directly comparable measures under

GAAP can be found in Credit Suisse Group's third quarter report 2008.

Slide 2

Accelerated implementation of strategic plan

Positions Credit Suisse strongly with reduced risk,

lower costs and strong capital to enable us to weather the continuing market

challenges, capture opportunities, and prosper when markets improve

CHF 2 billion cost reduction, including a headcount reduction

of 5,300, or 11%, and an additional reduction of 1,400 contractors

Accelerated repositioning of the Investment Banking business

portfolio with a reduction in risk, volatility and costs

Continued commitment to integrated business model;

growth of Private Banking globally and Swiss businesses

Slide 3

Continue to invest in the growth of Private Banking globally

Continue to invest judiciously in the growth of Private Banking business globally

and the Swiss businesses

Build on progress made to date

Strengthened international presence by hiring 370 relationship managers in

Wealth Management as of the end-November; exceeding the target of 330 for

the year

Opened 18 new locations and entered 4 new markets since January 2007

Bank-wide efficiency measures also targeted at improving efficiency in

Private Banking, positioning the business for further growth in 2009

Slide 4

Repositioning the Investment Bank

Weaker macroeconomic trends leading to

volatile markets

More conservative behavior from market

participants leading to lower financial leverage

and reduced demand for complex products

Reduce volatility and improve capital

efficiency

Focus on client and flow-based businesses

(e.g. building on strength in algorithmic

trading, cash equities, prime services, rates,

FX and high grade credit)

Cuts in origination cost base and risk limits

for complex credit and structured products

Reduction in risk capital usage, including exit

from certain proprietary and principal trading

activities and aligning lending with customer

franchises

Investment Banking will remain a valuable

contributor to the integrated bank with lower

volatility and attractive risk returns

Challenging market environment…

Credit Suisse strategic response

Investor preference for strong counterparties

Increased demand for exchange-based

products – structural growth in electronic

trading across products

Positive outlook for Rates and FX given fiscal

and macro trends

Fewer competitors and better pricing

…but some positive trends for Credit Suisse

Slide 5

2.0

3.7

2.0

0.5

16.4

0.4

9.4

11.5

14.4

10.9

15.7

12.4

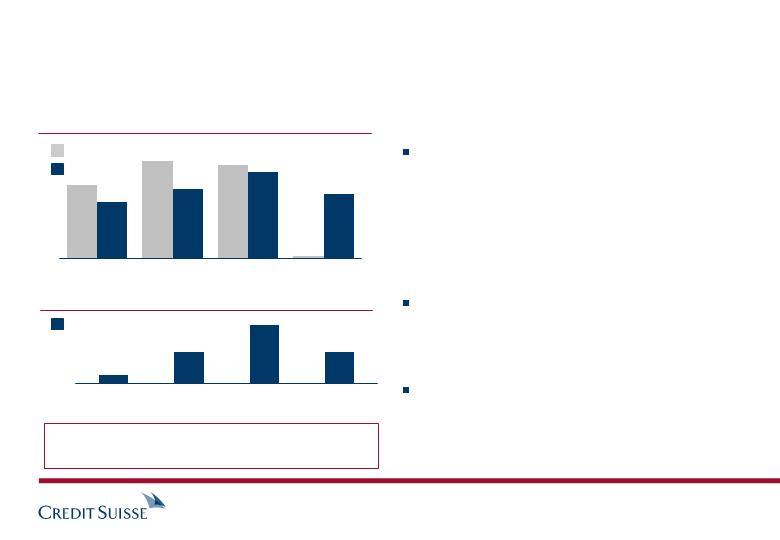

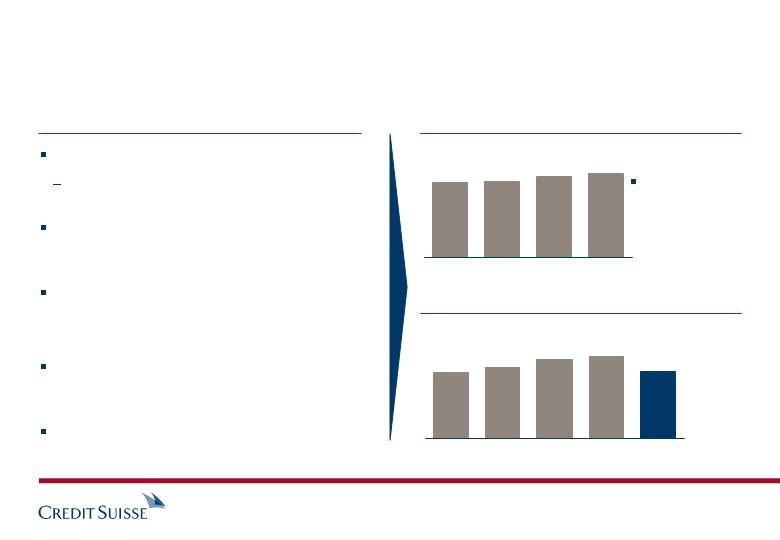

Repositioning the Investment Bank:

Robust earnings and returns over the cycle with lower volatility

Investment Banking revenue (USD bn)

2005

2006

2007

YTD Nov

2008

Investment Banking pre-tax income (USD bn)

Proforma analysis of repositioned

Investment Bank demonstrates robust

revenues and earnings, and lower volatility

of this business model over the last

four years

Average margins and returns should be

higher through the cycle

Significantly lower risk capital usage in

Investment Bank resulting in a more

balanced capital allocation across

Credit Suisse

Proforma

As reported

2005

2006

2007

YTD Nov

2008

Proforma

Slide 6

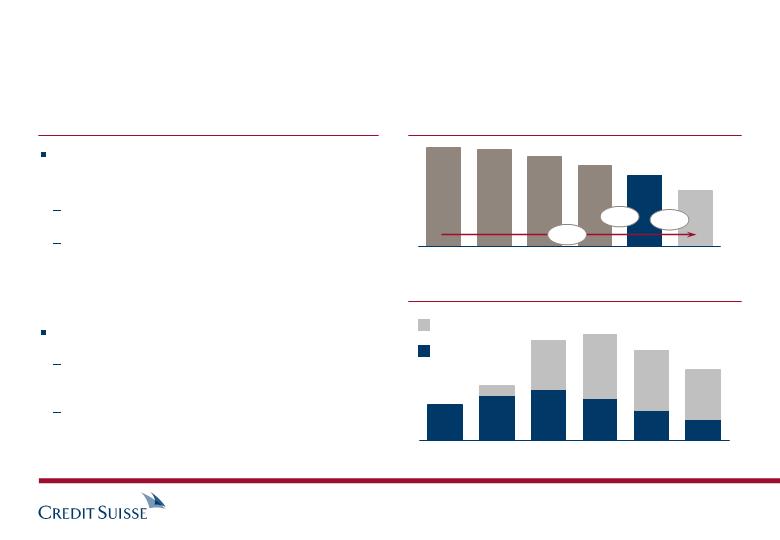

Proforma risk-weighted assets (USD bn)

99

129

161

135

89

72

52

35

78

63

236

230

214

193

170

135

Risk reduction in Investment Banking

On a consistent methodology basis, risk-

weighted assets (RWAs) expected to decline to

USD 170 bn at year-end 2008, and

USD 135 bn by year-end 2009

Underlying 1-day Value-at-Risk (VaR) declined

33% vs. 3Q08 average

(quarter-on-quarter)

55% vs. 2007 average

(year-on-year)

Investment Banking RWAs (period end in USD bn)

2007

1Q08

2Q08

3Q08

2009E

Continued risk reduction

2008E

Investment Banking average 1-Day VaR

2006

2007

1Q08

2Q08

3Q08

Nov 30

96

174

186

158

124

1) VaR on November 30, 2008

1)

Positioning

Dataset /

methodology effect

(Period end in USD m)

(43%)

(12%)

(21%)

Slide 7

Adjusting capacity

Reduction in headcount by 5,300, or 11%

plus an additional reduction of 1,400

contractors

CHF 2 billion cost reduction, representing 9%

of the bank’s 9M08 annualized cost base, most

of which is to be implemented by mid-2009

Includes additional reductions in compensation

and non-compensation expenses

Approx. 2/3 of total headcount reduction relates

to Investment Banking, including Shared

Services personnel

Year-end 2009 headcount target of 17,500 for

Investment Banking

Headcount Credit Suisse (period end)

Headcount Investment Banking (period end)

Efficiency improvements

2005

2006

3Q08

2009E

2005

2006

2007

3Q08

Nearly 50% of

headcount reduction

by year-end, with

remainder sche-

duled during 1H09

2007

17,300

18,700

21,300

17,500

20,600

44,600

44,900

50,300

48,100

Slide 8

4Q08 results update

Net loss of approximately CHF 3 bn as of end-November, reflecting the impact

of adverse market conditions in the quarter and costs associated with the risk

reduction program

Modest net profit for Credit Suisse in November

Good operating performance and solid asset inflows in Private Banking

Deposit base and funding remains strong

Strong capital position with tier 1 ratio around 13% expected at year-end 2008

Costs associated with the strategic measures of approx. CHF 900 m will be

taken in 4Q08 and are not reflected in the end-November net loss

Slide 9

Accelerated implementation of strategic plan

Positions Credit Suisse strongly with reduced risk,

lower costs and strong capital to enable us to weather the continuing market

challenges, capture opportunities, and prosper when markets improve

CHF 2 billion cost reduction, including a headcount reduction

of 5,300, or 11%, and an additional reduction of 1,400 contractors

Accelerated repositioning of the Investment Banking business

portfolio with a reduction in risk, volatility and costs

Continued commitment to integrated business model;

growth of Private Banking globally and Swiss businesses

Slide 10

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

| CREDIT SUISSE GROUP AG and CREDIT SUISSE |

|

| (Registrant) |

|

|

|

| By: | /s/ Urs Rohner |

|

| (Signature)* |

|

| General Counsel |

|

| Credit Suisse Group AG and Credit Suisse |

Date: December 04, 2008 |

|

|

|

| /s/ Charles Naylor |

|

| Head of Corporate Communications |

*Print the name and title under the signature of the signing officer. |

| Credit Suisse Group AG and Credit Suisse |