UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

UNDER THE SECURITIES EXCHANGE ACT OF 1934

February 13, 2020

Commission File Number 001-15244

CREDIT SUISSE GROUP AG

(Translation of registrant’s name into English)

Paradeplatz 8, 8001 Zurich, Switzerland

(Address of principal executive office)

(Address of principal executive office)

Commission File Number 001-33434

CREDIT SUISSE AG

(Translation of registrant’s name into English)

Paradeplatz 8, 8001 Zurich, Switzerland

(Address of principal executive office)

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or

Form 40-F.

Form 40-F.

Form 20-F  Form 40-F

Form 40-F

Form 40-F

Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

This report includes the media release and the slides for the presentation to investors in connection with the 4Q19 and full year 2019 results.

Media Release Zurich, February 13, 2020 |  |

Full year and fourth quarter 2019 financial results

Strong growth in profitability, net income and returns in 2019

Full year 2019 highlights:

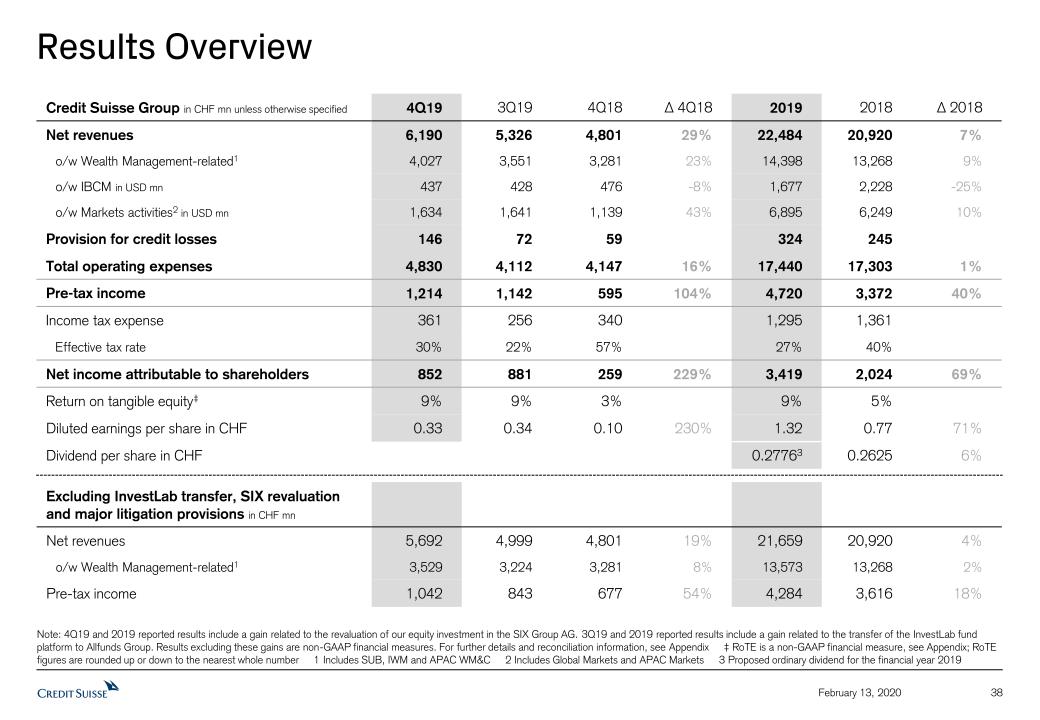

| ■ | Group pre-tax income of CHF 4.7 billion compared to CHF 3.4 billion in 2018, up 40%. This includes certain significant items, notably the gains from the revaluation of our equity investment in SIX Group AG (SIX) and from the transfer of the InvestLab funds platform to Allfunds Group*, which were partially offset by major litigation provisions*; excluding these items, pre-tax income would have been CHF 4.3 billion, up 18%, driven by higher revenues, which would have been up 4% |

| ■ | Adjusted1 pre-tax income of CHF 5.0 billion compared to CHF 4.2 billion in 2018, up 18% |

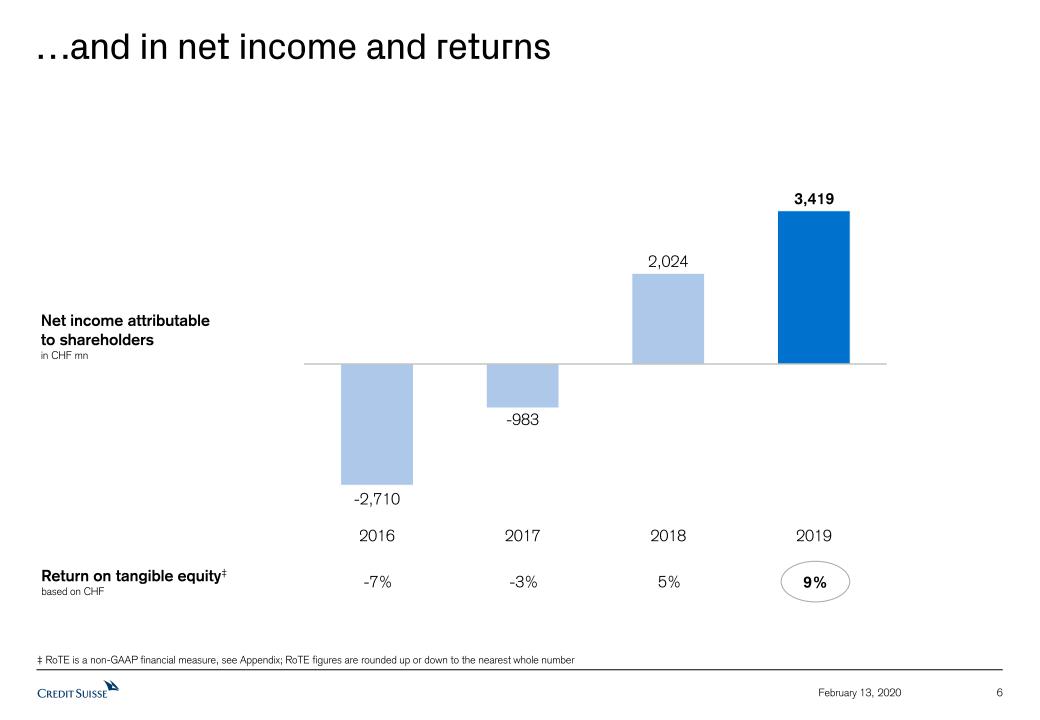

| ■ | Net income of CHF 3.4 billion compared to CHF 2.0 billion in 2018, up 69% |

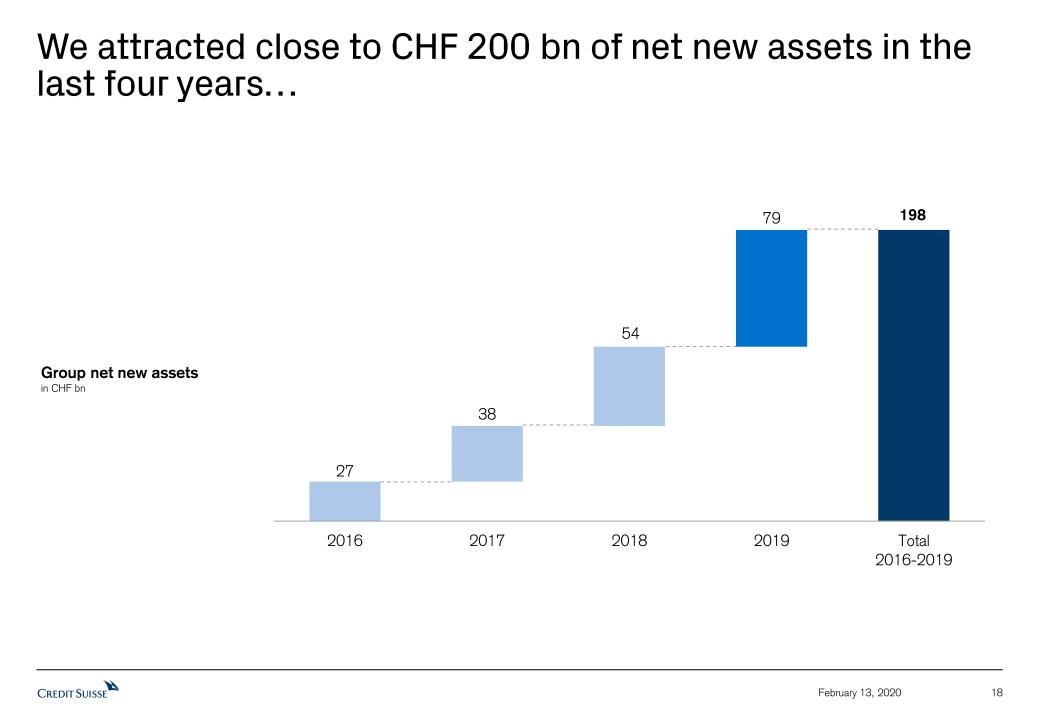

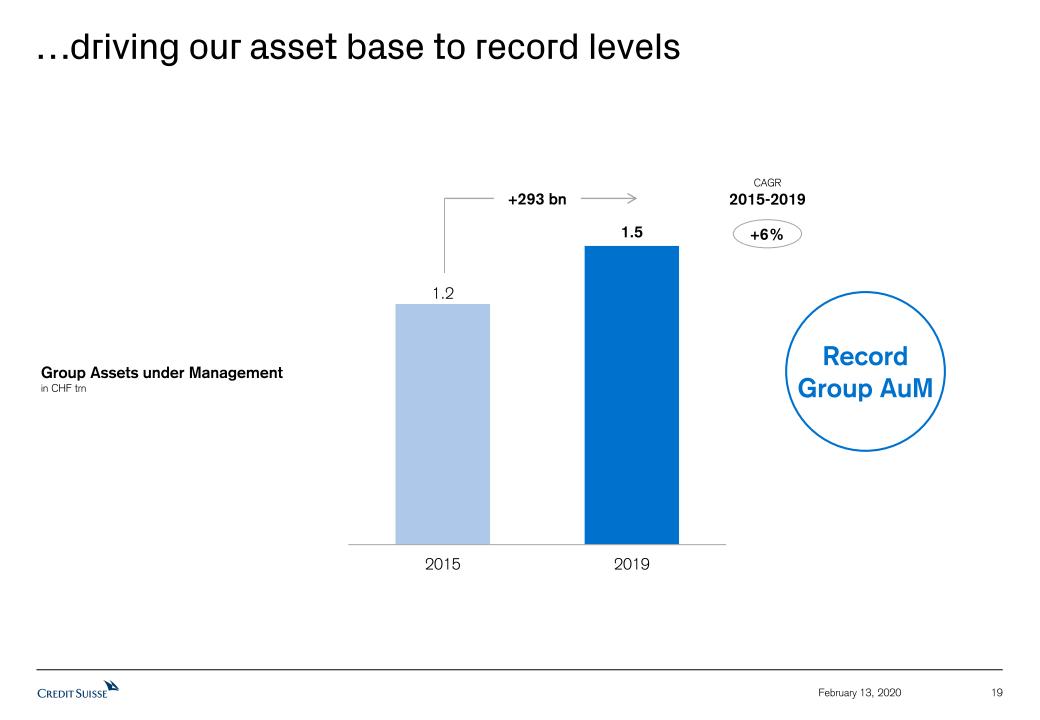

| ■ | Attracted Group Net New Assets (NNA) of CHF 79.3 billion, a record level since 2013, driving our asset base to the record level of CHF 1.5 trillion Assets under Management (AuM); total net asset inflows since 2016 of CHF 198 billion |

| ■ | Wealth Management-related revenues of CHF 14.4 billion compared to CHF 13.3 billion in 2018, up 9%; excluding the InvestLab transfer and SIX revaluation gains*, Wealth Management-related revenues would have remained resilient, up 2%, in spite of headwinds created by negative interest rates |

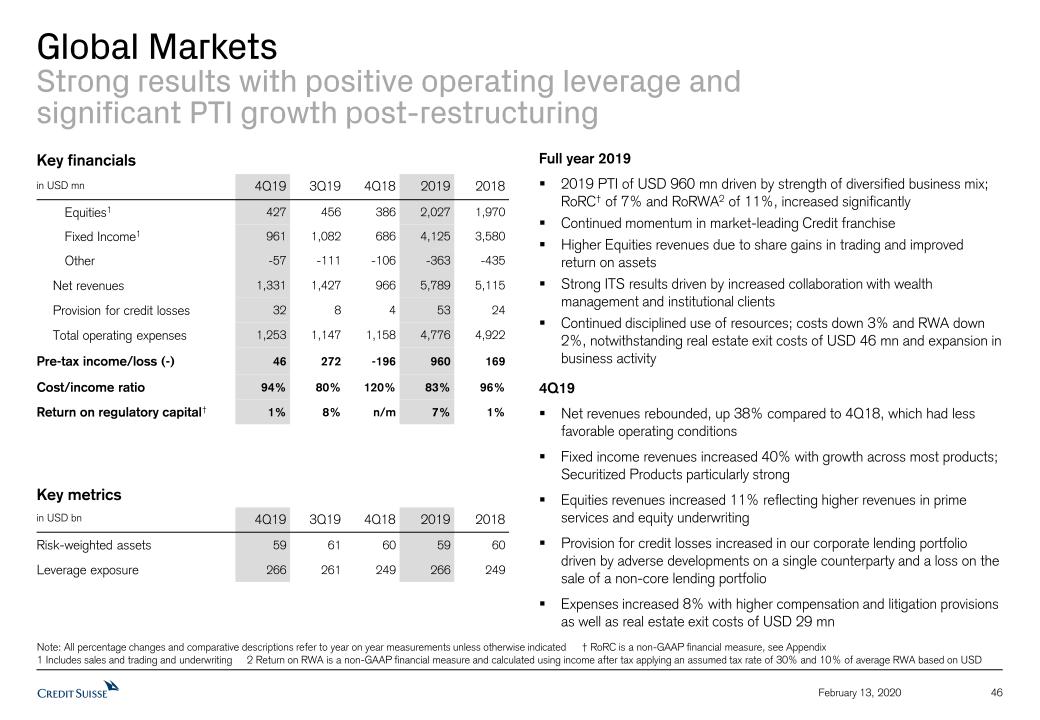

| ■ | Global Markets pre-tax income of USD 960 million compared to USD 169 million in 2018 |

| ■ | Adjusted operating cost base was CHF 16.9 billion2, an increase of 3% compared to 2018, achieving another year of positive operating leverage as revenues increased 4%, excluding the InvestLab transfer and SIX revaluation gains* |

| ■ | Including major litigation provisions*, total operating expenses were CHF 17.4 billion compared to CHF 17.3 billion in 2018, up 1% |

| ■ | Return on Tangible Equity (RoTE) of 9%, up from 5% in 2018, demonstrating strong progress towards our 2020 ambition of ~10% |

| ■ | Diluted earnings per share of CHF 1.32 compared to CHF 0.77 per share in 2018 |

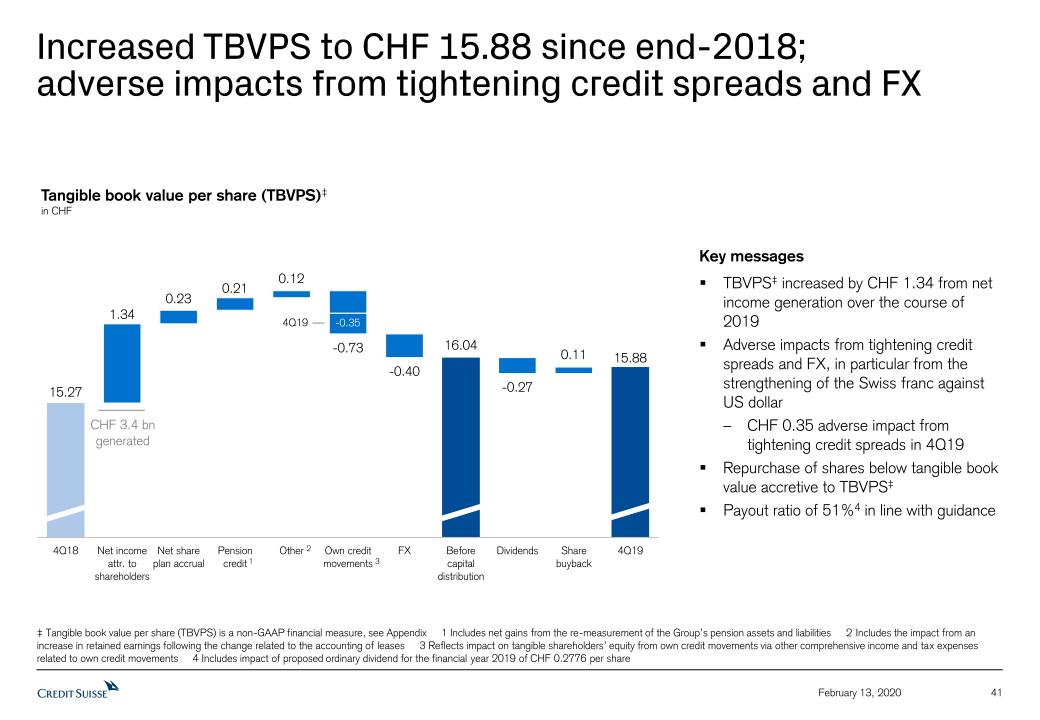

| ■ | Tangible book value per share (TBVPS) of CHF 15.88 at year-end 2019, compared to CHF 15.27 at year-end 2018 |

| ■ | Strengthened capital position: CET1 ratio of 12.7%, up from 12.6% at year-end 2018; Tier 1 leverage ratio of 5.5%, up from 5.2% at year-end 2018 |

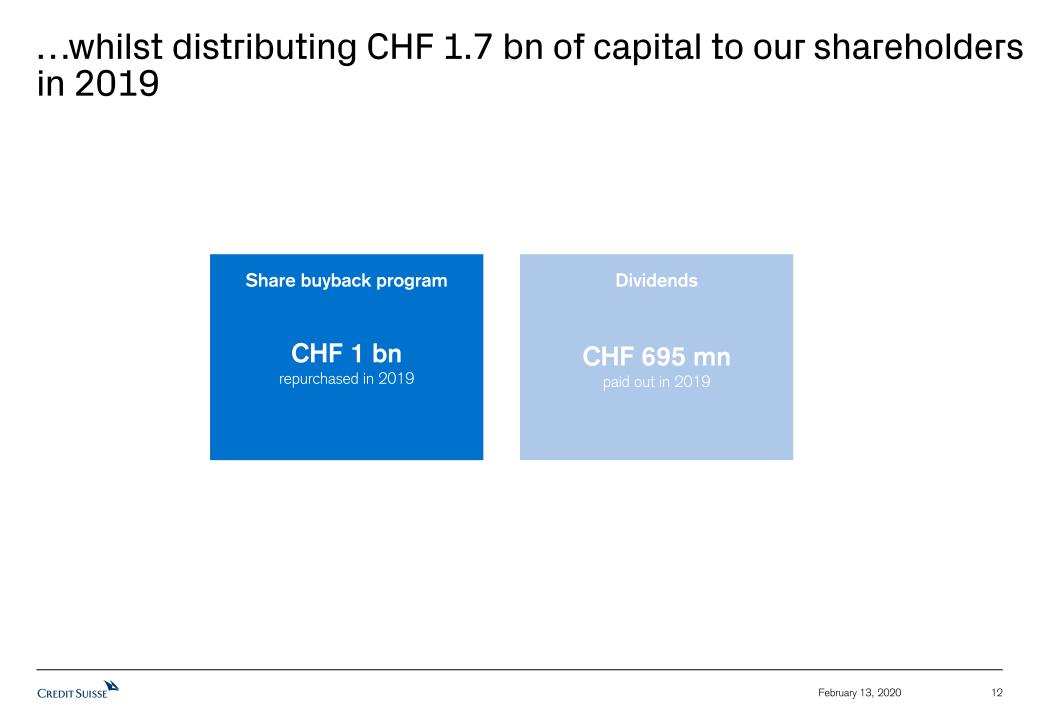

| ■ | Distributed CHF 1.7 billion of capital to our shareholders, including the successful completion of our 2019 share buyback program, delivering a buyback of shares of CHF 1 billion by the end of 2019; for 2020, commenced a similar buyback program and expect to buy back at least CHF 1 billion of shares, subject to market and economic conditions |

| ■ | The Board of Directors will propose to shareholders at the Annual General Meeting on April 30, 2020 a cash distribution of CHF 0.2776 per share, in line with our intention to increase the ordinary dividend per share by at least 5% per annum |

Page 1

Media Release Zurich, February 13, 2020 |  |

Fourth quarter 2019 highlights:

| ■ | 13th consecutive quarter of year on year pre-tax income growth, with reported pre-tax income of CHF 1.2 billion compared to CHF 595 million in 4Q18, up 104%; excluding the gains from the SIX equity investment revaluation and major litigation provisions*, pre-tax income would have been CHF 1.0 billion, up 54%, driven by higher revenues, which would have been up 19% |

| ■ | Adjusted1 pre-tax income of CHF 1.5 billion compared to CHF 846 million in 4Q18, up 72% |

| ■ | Wealth Management-related revenues of CHF 4.0 billion compared to CHF 3.3 billion in 4Q18, up 23%; excluding the InvestLab transfer and SIX revaluation gains*, Wealth Management-related revenues would have been up 8% |

| ■ | Global Markets revenues of USD 1.3 billion compared to USD 966 million in 4Q18, up 38% |

| ■ | CET1 ratio of 12.7%, compared to 12.4% at the end of the previous quarter; Tier 1 leverage ratio of 5.5% stable compared to the end of the previous quarter |

| ■ | RoTE of 9%; up from 3% at 4Q18 |

Tidjane Thiam, outgoing Chief Executive Officer of Credit Suisse Group, commented:

“When I joined Credit Suisse in 2015, we initiated a deep, three year-long restructuring programme, with the intention of creating sustainable shareholder value. The aim was to grow our unique wealth management franchise, taking advantage of a secular growth in Global Wealth. Since 2015, we estimate that Global Wealth has grown by CHF 110.5 trillion or 44%3. We decided to put a particular emphasis on our UHNW clients, where we could fully leverage our investment banking capabilities and offer institutional quality services to entrepreneur clients.

In parallel, we needed to make the bank more resilient in challenging times by reducing risks, cutting fixed costs and strengthening our capital base. We needed to significantly reduce the scale of our markets activities and exited a number of activities with unattractive risk return characteristics in order to right-size our more market dependent activities. We also dealt resolutely with our largest legacy issues, reaching a settlement with the US Department of Justice in 2017 and winding down our restructuring unit, the Strategic Resolution Unit (SRU), set up in 2016, on schedule at the end of 2018. We also wanted Credit Suisse to be increasingly recognized as a key player in sustainable development and impact investing. We set up an Impact Advisory and Finance (IAF) team that is delivering on that vision.

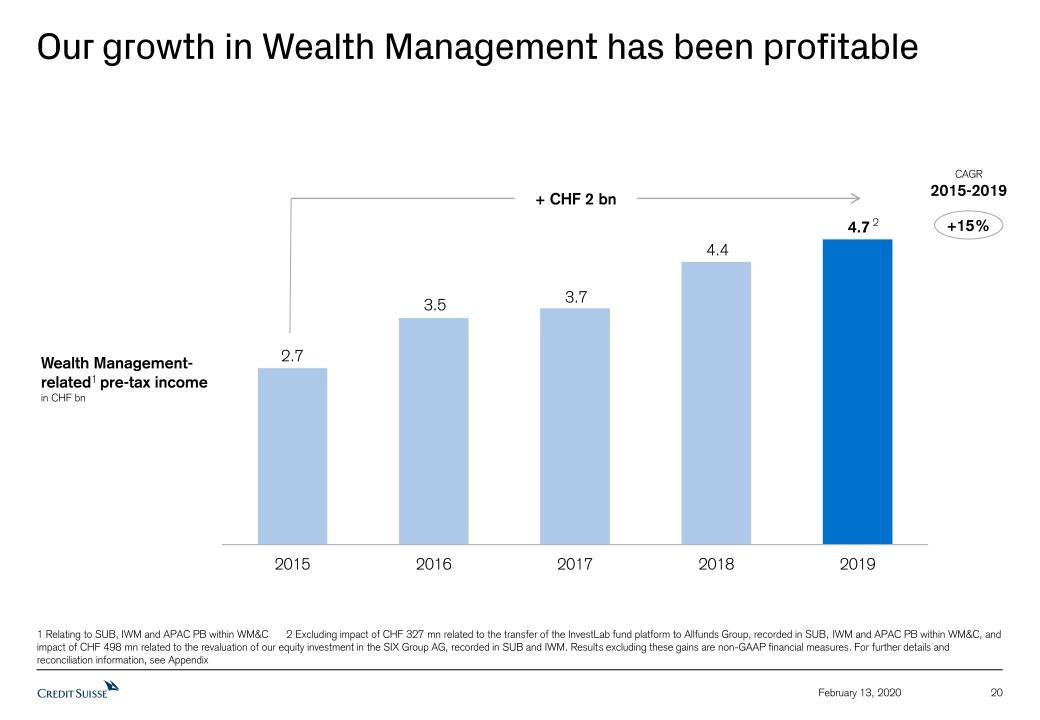

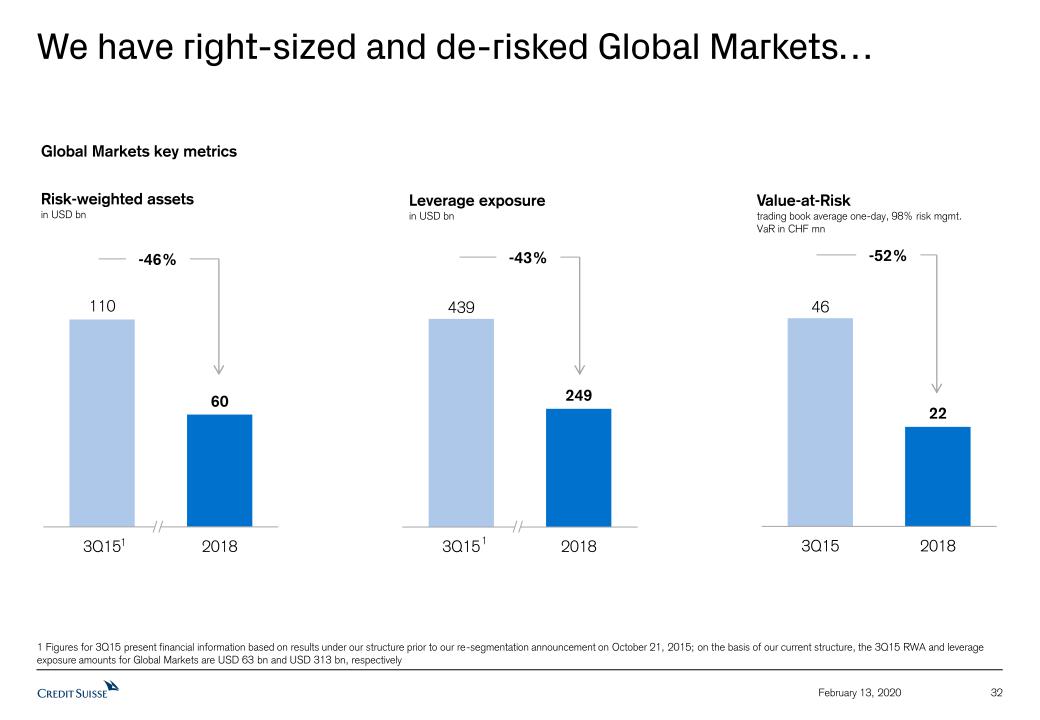

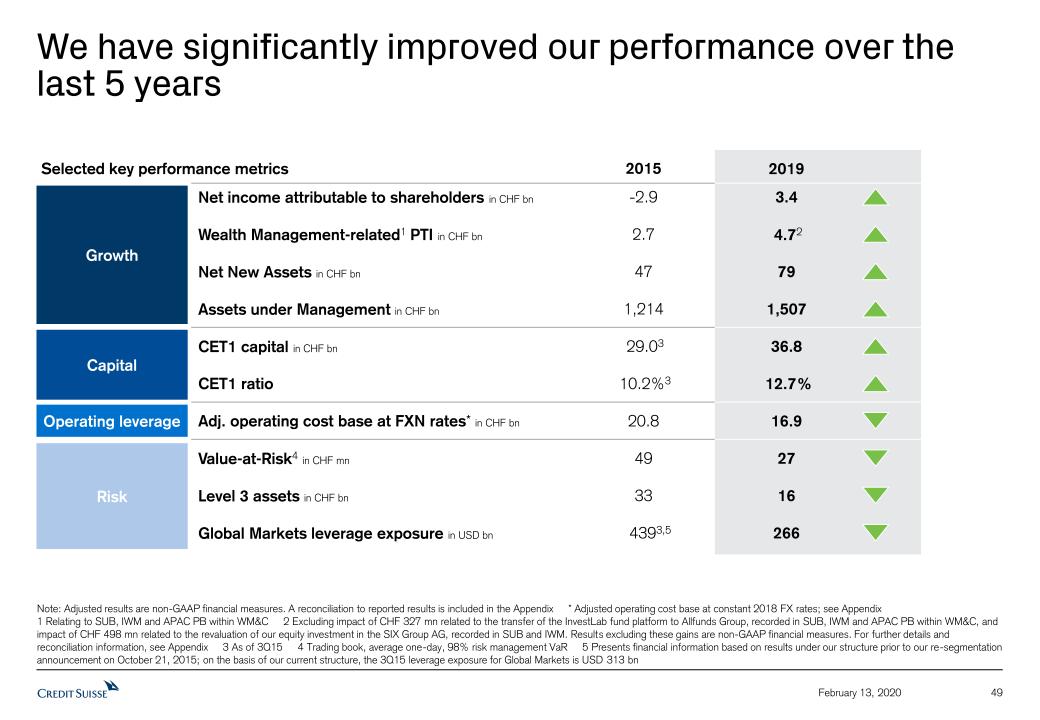

Our objective was to become a bank generating profitable, compliant, quality growth. From 2016 to 2019, we grew our Wealth Management businesses and attracted net new assets of CHF 121 billion, and our Wealth Management-related4 pre-tax income grew at a double-digit rate (+15%) for four successive years, going from CHF 2.7 billion in 2015 to CHF 4.7 billion in 2019, excluding the InvestLab transfer and SIX revaluation gains*. Whilst delivering this growth, we managed to reduce our risks by more than 40%5 and used the SRU to reduce the size of our Global Markets RWAs by more than 45%6. The restructuring was successful and our performance in 2019, the first full year post restructuring, illustrates how much the bank has changed since 2015.

Page 2

Media Release Zurich, February 13, 2020 |  |

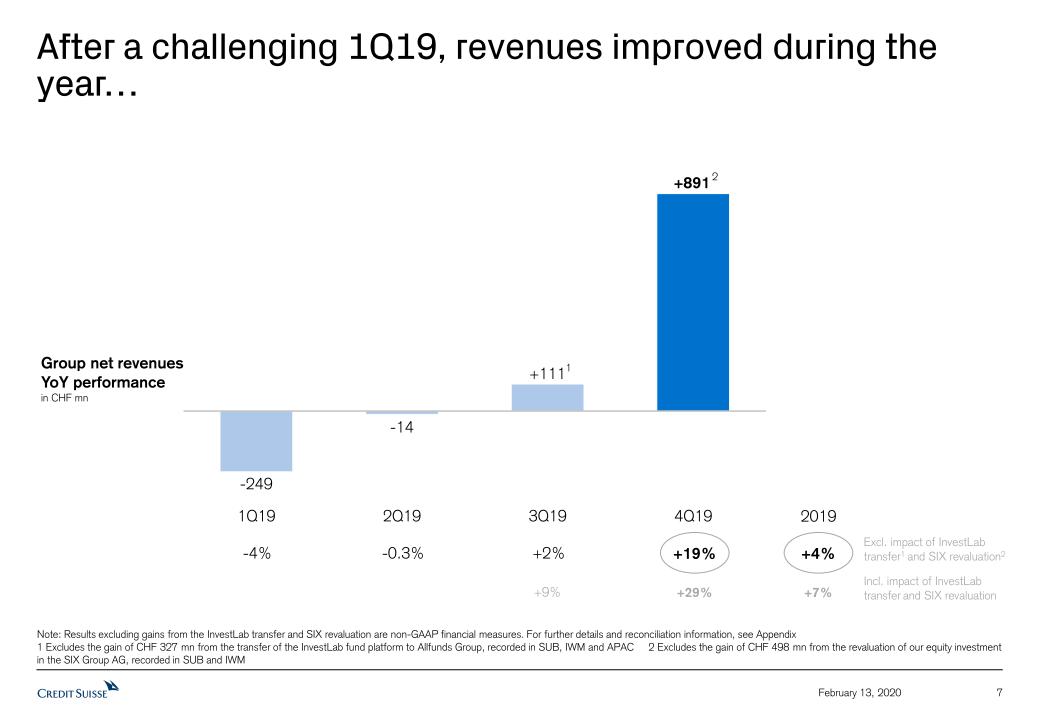

We began 2019 in a challenging market environment, with muted client activity in the first quarter. As the environment became more constructive in the second and third quarters, we were able to progressively improve revenue momentum and flexed our cost base accordingly to capture growth opportunities, finishing the year with a strong fourth quarter. Throughout the year we have continued to create positive operating leverage, with the fourth quarter being our 13th consecutive quarter of year on year profit growth, a significant achievement for us.

For the full year 2019, we delivered net income of CHF 3.4 billion compared to CHF 2.0 billion in 2018, up 69%, driven by positive revenue performance and steady cost management. Before the impact of major litigation provisions, which were mostly related to legacy matters, and excluding the gains from SIX and InvestLab*, i.e. on a basis more reflective of our underlying business, PTI would have been CHF 4.3 billion, up 18% year on year, reflecting the continued success of our strategy in a tough environment.

With a Return on Tangible Equity of 9%, we demonstrated strong progress towards our 2020 ambition of ~10% that we presented at the Investor Day in December 2019.

Finally, we distributed CHF 1.7 billion of capital to our shareholders, including a buyback of shares of CHF 1 billion by the end of 2019, as well as a dividend of CHF 695 million.

I am proud of what Credit Suisse has achieved during my tenure. We have turned Credit Suisse around, and our 2019 results show we can be sustainably profitable. I will be an enthusiastic supporter of my colleagues, as they continue to build momentum in the business. I want to extend my heartfelt thanks to our clients, who are our raison d’être, our staff with their unmatched dedication, to our investors and to all our stakeholders, more broadly, for their support in my work. I will be forever grateful.

I welcome Thomas Gottstein in his new role. I have a lot of respect for his qualities as a business leader but also as a person and I know he will take Credit Suisse to the next level.”

Thomas Gottstein, Chief Executive Officer Designate of Credit Suisse Group, commented:

“With our strong capital base, as well as our clear strategy as a leading wealth manager with strong investment banking capabilities, I am convinced that Credit Suisse is well positioned to continue to deliver performance for all our stakeholders, including clients, shareholders and employees. Our business strategy is expected to remain unchanged, and under my leadership we will adhere to the course set by the Board of Directors and the Executive Board in 2015, and that was reconfirmed and renewed in 2019 post the restructuring period.

In 2020, we aim to continue to grow by offering bespoke solutions to our clients, fully leveraging our wealth management and investment banking capabilities. Our regionalized approach allows us to stay close to our clients whilst capturing global synergies, where relevant. We are firmly committed to deliver against the ambitions set out at the 2019 Investor Day in London: we aim to achieve a Return on Tangible Equity of ~10%, and we will demonstrate continued discipline on costs to drive positive operating leverage. We aim to return capital to shareholders through a share buyback program, expecting to buy back at least CHF 1 billion, market and economic conditions permitting, and by sustainably increasing our ordinary dividend per share by at least 5% per year.

I want to thank Tidjane Thiam for his support and partnership, and I look forward to devoting my full energy to this treasured bank, its clients and shareholders.”

Page 3

Media Release Zurich, February 13, 2020 |  |

Outlook

We have started the year strongly across all of our divisions, and as a result, are cautiously optimistic about the prospects for the year ahead. In spite of various geopolitical headwinds and uncertainties such as the impact of the coronavirus, we continue to believe the underlying fundamentals of the global economy remain intact. We will continue to execute with discipline to maintain our strong momentum in 2020 and intend to grow revenues in our Wealth Management-related businesses, increase profitability in our markets businesses, maintain cost discipline and continue to optimize our operating model.

Key metrics

| In CHF millions | 2019 | 2018 | 4Q19 | 4Q18 | Δ 2018 | Δ 4Q18 | |

| Net revenues | 22,484 | 20,920 | 6,190 | 4,801 | 7% | 29% | |

| Of which Wealth Management-related | 14,398 | 13,268 | 4,027 | 3,281 | 9% | 23% | |

| Of which IBCM (USD) | 1,677 | 2,228 | 437 | 476 | -25% | -8% | |

Of which Markets activities (USD)7 | 6,895 | 6,249 | 1,634 | 1,139 | 10% | 43% | |

| Total operating expenses | 17,440 | 17,303 | 4,830 | 4,147 | 1% | 16% | |

| Pre-tax income | 4,720 | 3,372 | 1,214 | 595 | 40% | 104% | |

| Net income attributable to shareholders | 3,419 | 2,024 | 852 | 259 | 69% | 229% | |

| Return on Tangible Equity | 9% | 5% | 9% | 3% | 4pp | 6pp |

Key metrics excluding the InvestLab transfer and SIX revaluation gains as well as major litigation provisions*:

| In CHF millions | 2019 | 2018 | 4Q19 | 4Q18 | Δ 2018 | Δ 4Q18 | |

| Net revenues | 21,659 | 20,920 | 5,692 | 4,801 | 4% | 19% | |

| Pre-tax income | 4,284 | 3,616 | 1,042 | 677 | 18% | 54% |

Page 4

Media Release Zurich, February 13, 2020 |  |

Changes to the Board of Directors

As previously announced on February 3, 2020, the Board of Directors is proposing Richard Meddings for election as a new non-executive member of the Board of Directors at the Annual General Meeting on April 30, 2020. Alexander Gut will not stand for re-election at the Annual General Meeting. All other members of the Board of Directors will stand for re-election for a further term of office of one year.

Urs Rohner, Chairman of the Board of Directors of Credit Suisse Group, said: “Alexander Gut decided not to stand for re-election at the upcoming Annual General Meeting in order to be able to focus more on his company, Gut Corporate Finance AG. Alexander Gut was first elected to the Board of Directors of Credit Suisse Group in 2016. The Board benefitted greatly from his extensive expertise in audit and finance, and his important contributions as a member of the Audit Committee as well as the Innovation and Technology Committee were of great value to our Group. We thank Alex for his extraordinary commitment and excellent collaboration, and wish him all the best for his future endeavors.”

Dividend

The Board of Directors will propose to the shareholders at the Annual General Meeting on April 30, 2020 a cash distribution of CHF 0.2776 per share for the financial year 2019. This is in line with our intention to increase the ordinary dividend per share by at least 5% per annum. 50% of the distribution will be paid out of capital contribution reserves, free of Swiss withholding tax and not be subject to income tax for Swiss resident individuals, and 50% will be paid out of retained earnings, net of 35% Swiss withholding tax.

Page 5

Media Release Zurich, February 13, 2020 |  |

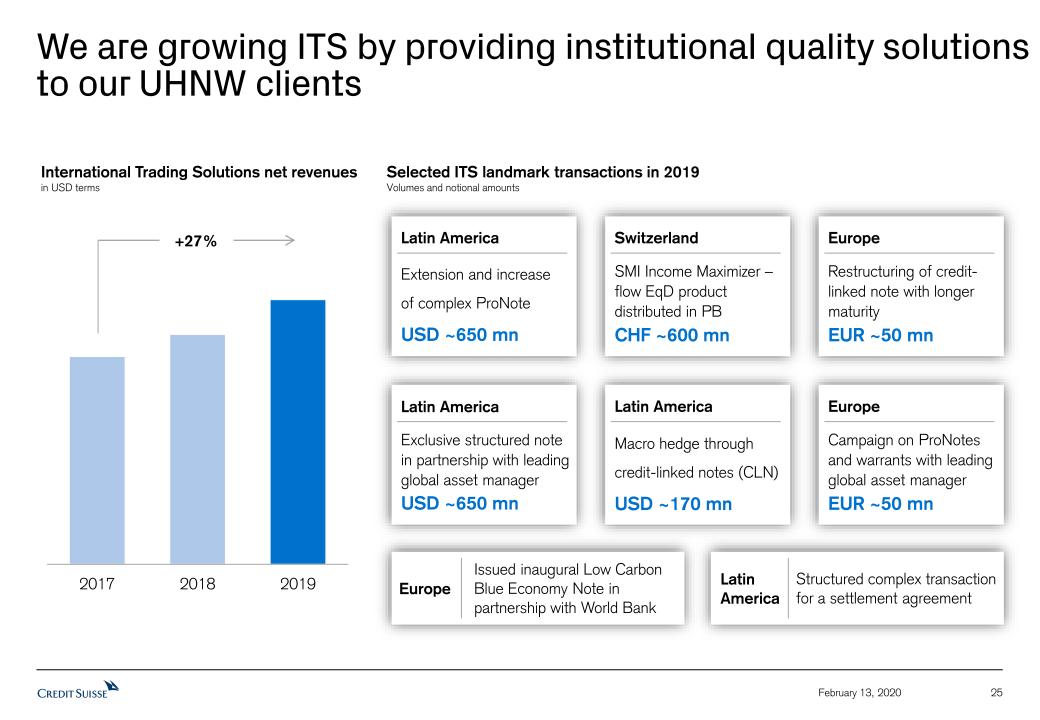

Detailed divisional summaries

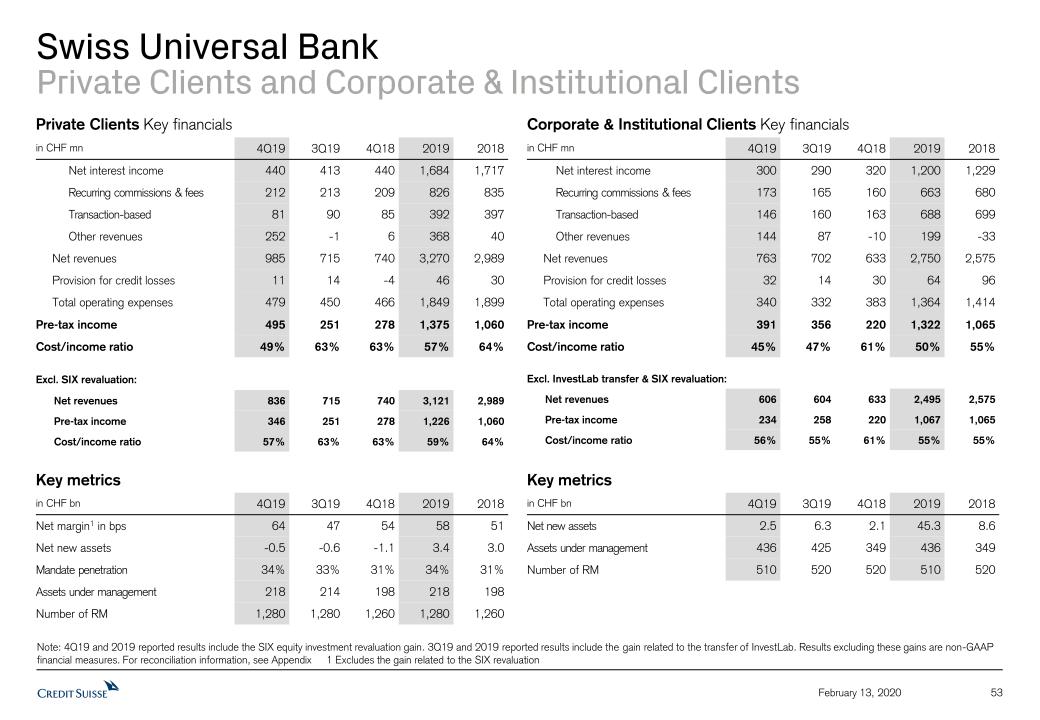

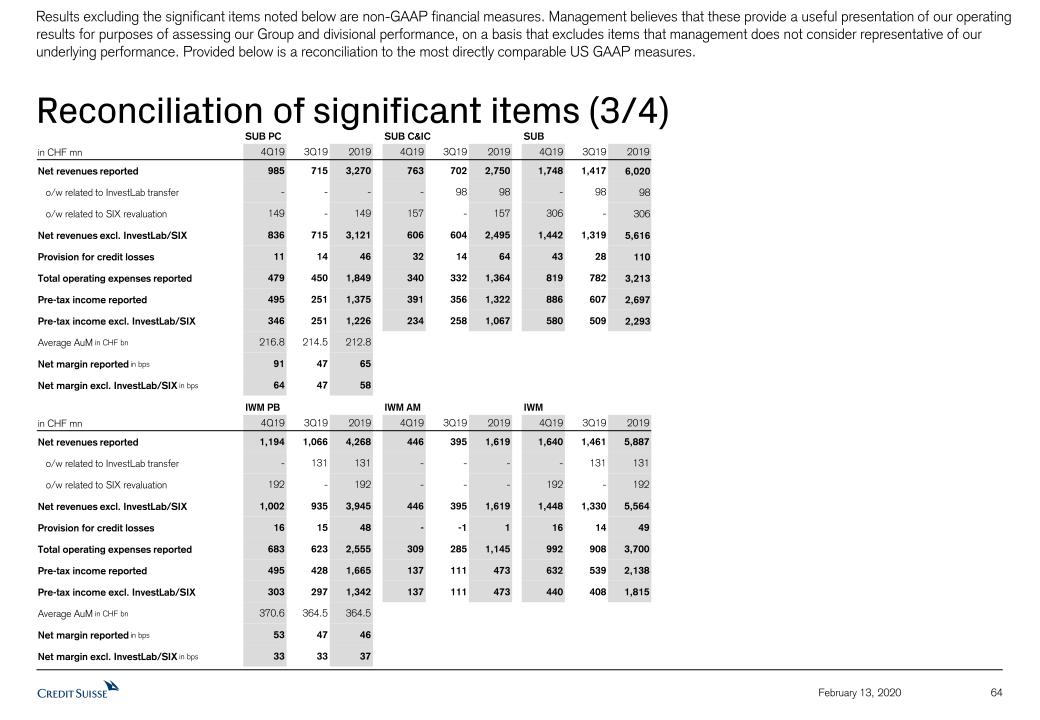

Swiss Universal Bank (SUB) had a strong full year 2019 with pre-tax income of CHF 2.7 billion, up 27% year on year. Excluding the InvestLab transfer and SIX revaluation gains*, pre-tax income would have been CHF 2.3 billion, up 8% year on year. Net revenues were up 8% year on year. Excluding the InvestLab transfer and SIX revaluation gains*, net revenues would have risen 1% year on year, driven by real estate gains as part of our ongoing sale and leaseback program and also reflecting higher revenues from our collaboration with Global Markets (GM) and International Wealth Management (IWM) – International Trading Solutions (ITS). However, net interest income and recurring commissions and fees were down slightly and transaction-based revenues were broadly flat, year on year.

While the negative interest rate environment remains challenging, increased client activity and higher recurring commissions and fees in the fourth quarter of 2019 had a positive effect on our revenues, supported by a strong rebound in net interest income versus the third quarter of 2019, and driven by initiated deposit pricing measures. Our continued disciplined approach on costs enabled us to further decrease total operating expenses by 3% in 2019, while we continued to invest in select strategic hires, digitalization and marketing. In 2019, SUB’s cost/income ratio was 53%; excluding the InvestLab transfer and SIX revaluation gains*, the cost/income ratio would have been 57%. AuM reached a new record level of CHF 654 billion, up 20% since the end of 2018, reflecting strong NNA supported by the positive market environment.

Private Clients generated pre-tax income of CHF 1.4 billion, up 30% year on year, for 2019. Excluding the gain from the SIX equity investment revaluation*, pre-tax income would have been CHF 1.2 billion in 2019, up 16% year on year. This increase was driven by lower costs, gains from real estate sales allocated to the Private Clients segment and implemented pricing measures due to the sustained negative interest rate environment. AuM increased by 10% year on year, with NNA of CHF 3.4 billion added in 2019. This represents strong contributions from our UHNW and HNW businesses and demonstrates the strength of our franchise.

Corporate & Institutional Clients reported pre-tax income of CHF 1.3 billion, up 24% year on year, in 2019. Excluding the InvestLab transfer and SIX revaluation gains*, pre-tax income would have been CHF 1.1 billion for 2019, stable year on year. Net revenues were up 7%, however, excluding the InvestLab transfer and SIX revaluation gains*, they would have been down 3%, year on year. This is related to continued pressure on net interest income and lower investment banking revenues in Switzerland. C&IC gathered record NNA of CHF 45.3 billion in 2019, reflecting continued strong contributions from our pension funds business.

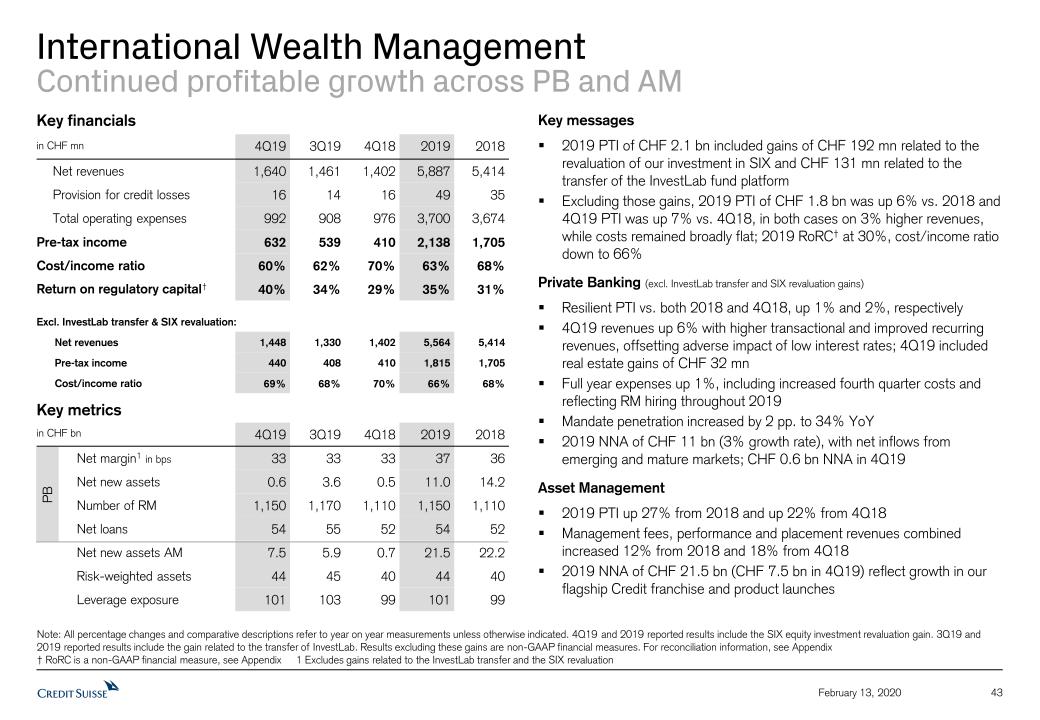

International Wealth Management (IWM) continued its growth momentum in 2019 as pre-tax income increased 25% year on year, to CHF 2.1 billion, reflecting a 9% increase in net revenues and stable operating expenses. Excluding the InvestLab transfer and SIX revaluation gains*, pre-tax income for 2019 would have been up 6% at CHF 1.8 billion and net revenues would have been up 3%. In the fourth quarter of 2019, pre-tax income was CHF 632 million, up 54% year on year. Excluding the gain from the SIX equity investment revaluation*, pre-tax income for the quarter would have increased by 7% year on year, while net revenues would have increased 3%. Operating expenses were slightly higher.

Page 6

Media Release Zurich, February 13, 2020 |  |

In Private Banking, pre-tax income for 2019 was CHF 1.7 billion, up 25% year on year; excluding the InvestLab transfer and SIX revaluation gains*, pre-tax income would have been stable at CHF 1.3 billion. Private Banking’s net revenues were up 10% year on year for 2019; the business also had a strong fourth quarter with net revenues up 27% year on year. Excluding the InvestLab transfer and SIX revaluation gains*, revenues in 2019 would have been up 1% year on year. For the fourth quarter, excluding the gain from the SIX equity investment revaluation*, revenues would have increased 6% year on year; driven by 11% higher transaction- and performance-based revenues, reflecting continued proactive engagement with our clients, and 6% higher recurring commissions and fees, primarily reflecting higher volumes for mandates and investment products. These positive trends, in the fourth quarter, more than offset a 4% reduction in net interest income as the adverse environment with low interest rates persisted. Operating expenses for 2019 were stable compared to 2018, including stable discretionary compensation expenses. Operating expenses in the fourth quarter were up 9% year on year reflecting higher discretionary compensation expenses compared to a low level in the fourth quarter 2018 and higher litigation provisions. NNA in 2019 were CHF 11 billion, representing a growth rate of 3%, with positive contributions from emerging markets and Western Europe. During the year, NNA improved from a slow start in the first quarter and amounted to CHF 0.6 billion in the fourth quarter.

In Asset Management, pre-tax income in 2019 grew by 27% to CHF 473 million, reflecting an increase of 6% in net revenues and stable operating expenses, year on year. Combined, management fees and performance and placement revenues increased 12% compared to 2018, and, in the fourth quarter of 2019, were up 18% year on year. The recurring fee margin was resilient in 2019 at 30 bps, down 1 bps. This offset a negative performance in our investment and partnership income, which was down year on year for 2019 and the fourth quarter. Pre-tax income for the quarter was CHF 137 million, up 22% year on year. NNA for the year were strong at CHF 21.5 billion, representing a growth rate of 6%, with significant growth in our flagship Credit franchise as well as new product launches.

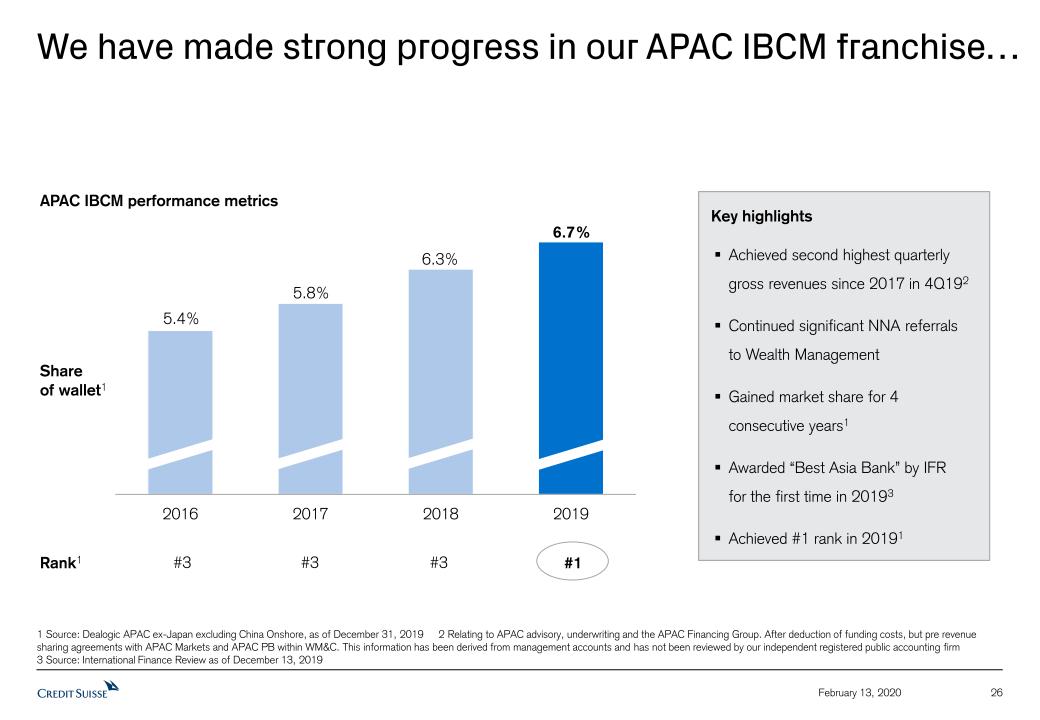

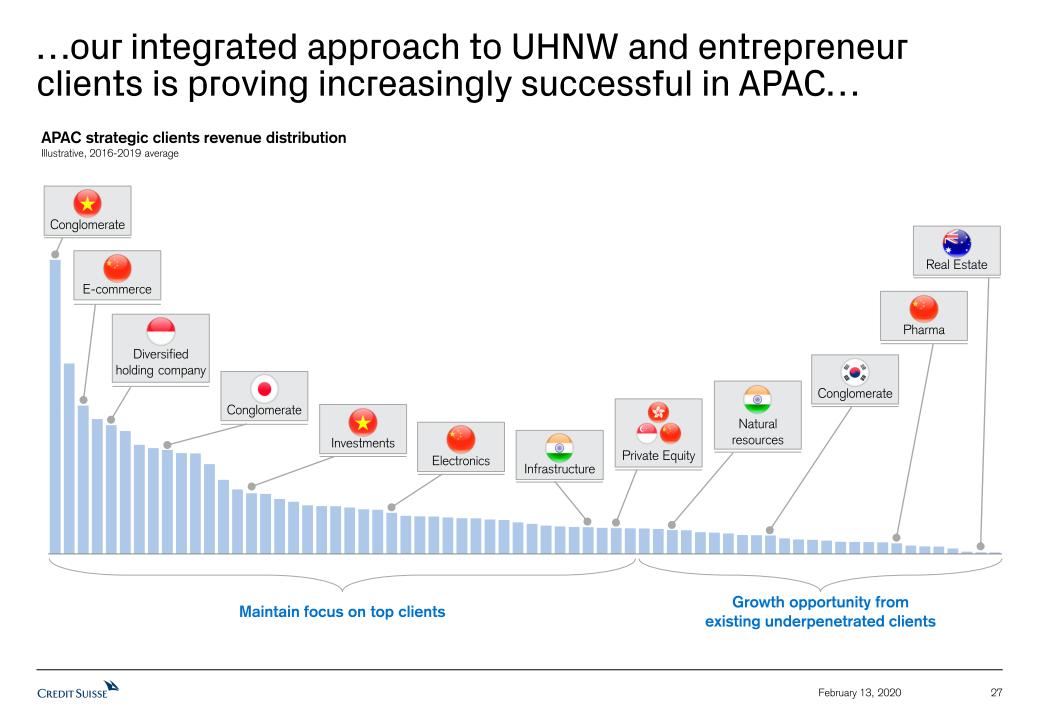

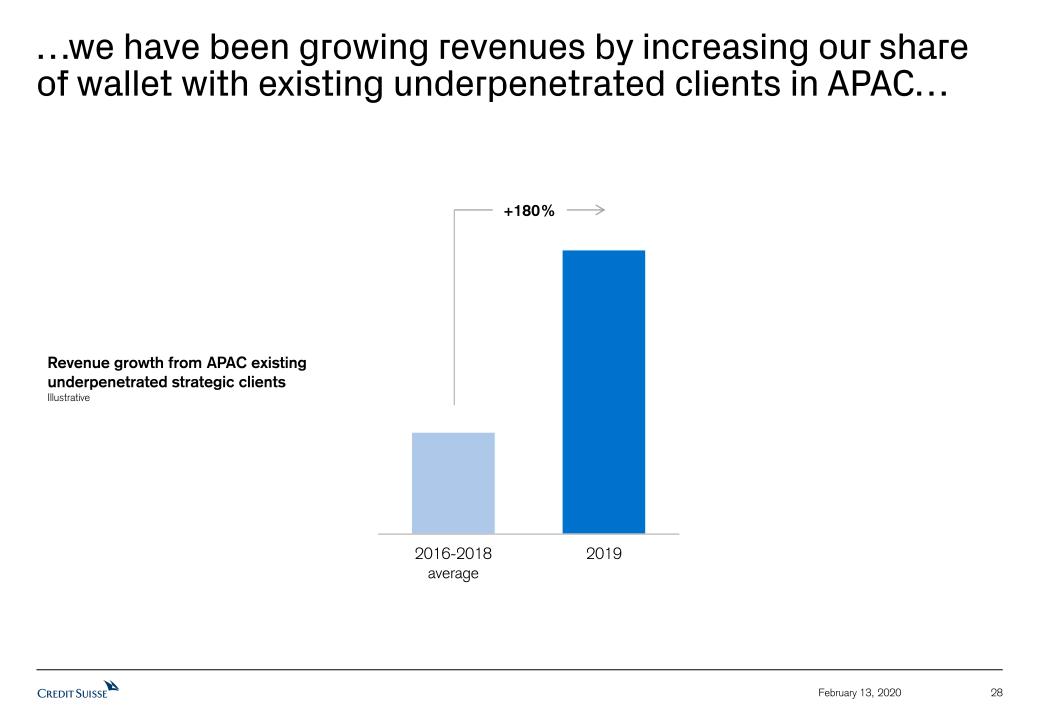

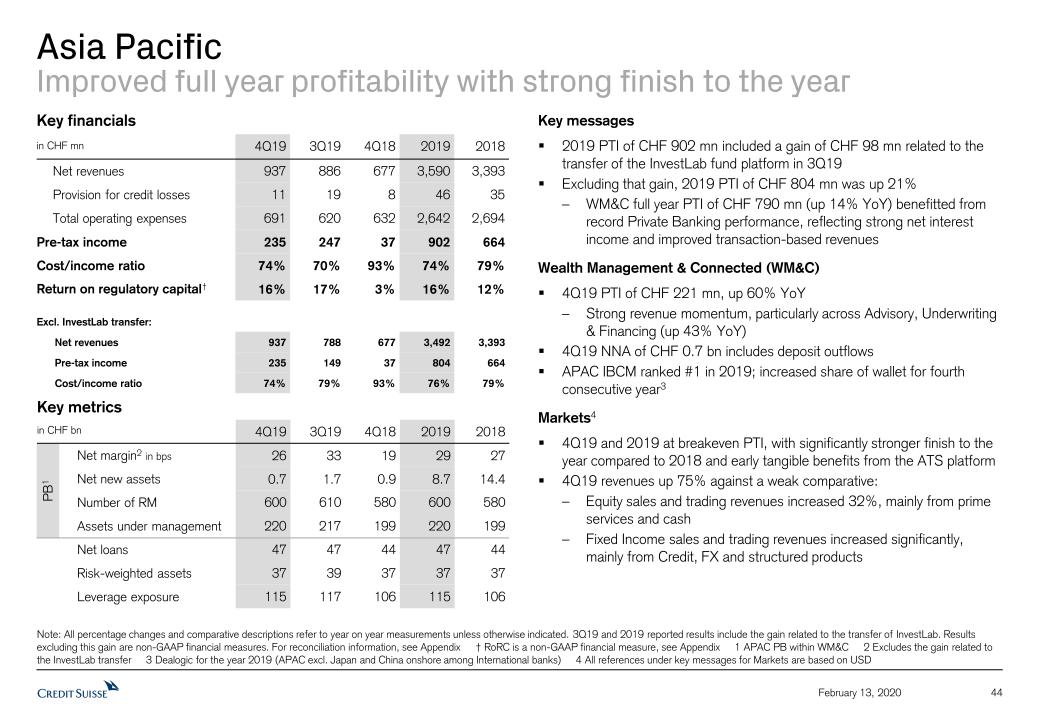

Asia Pacific (APAC) pre-tax income for 2019 was CHF 902 million, up 36% year on year. Excluding the gain from the InvestLab transfer*, pre-tax income would have been CHF 804 million, up 21% year on year. Pre-tax income in 2019 was driven by positive operating leverage, with revenues up 6% and operating expenses down 2%, year on year. Excluding the gain from the InvestLab transfer*, revenues would have been up 3% year on year. This result was supported by a record fourth quarter, with pre-tax income of CHF 235 million, due to year on year revenue growth across Wealth Management & Connected (WM&C) and Markets businesses. APAC delivered a return on regulatory capital of 16% for 2019.

WM&C reported pre-tax income of CHF 888 million for 2019, up 29% year on year, with return on regulatory capital of 23%. Excluding the gain from the InvestLab transfer*, pre-tax income would have been CHF 790 million for the period, up 14% year on year. We delivered record Private Banking revenues in 2019, with higher net interest income and transaction-based revenues; recurring commission and fees revenues were stable year on year. For 2019, we achieved record AuM of CHF 220 billion and generated NNA of CHF 8.7 billion. In 2019, advisory, underwriting and financing revenues grew 2% year on year, and were up 43% year on year for the fourth quarter, reflecting higher financing revenues and higher equity underwriting revenues and fees from M&A transactions in the fourth quarter of 2019. APAC advisory, underwriting and financing was ranked number 1 in terms of share of wallet8.

Page 7

Media Release Zurich, February 13, 2020 |  |

Markets reported pre-tax income of USD 14 million in 2019, an improvement from the pre-tax loss of USD 24 million in 2018. Net revenues were down 2% for the year, with lower equity sales and trading activities in continued challenging market conditions, partially offset by higher fixed income sales and trading revenues mainly reflecting strong performances in credit, structured and foreign exchange products. Operating expenses for 2019 were down 4% year on year to the lowest reported level since 2015. For the fourth quarter, net revenues were up 75% year on year to USD 303 million, supported by growth in the majority of our client activities across fixed income and equity sales and trading.

Investment Banking & Capital Markets (IBCM) reported a pre-tax loss of USD 161 million in 2019, including a pre-tax loss of USD 59 million in the fourth quarter of 2019. Net revenues of USD 1.7 billion for 2019 were down 25% year on year, reflecting fewer M&A completions as well as lower debt underwriting client activity. Street9 activity was lower in areas of historical strength for IBCM, notably in Leverage Finance and Financial Sponsors, amid challenging market conditions. Total operating expenses in 2019 were USD 1.8 billion, down 4% year on year, with lower variable compensation expenses, partially offset by real estate costs and severance costs.

Advisory revenues were down 31% year on year at USD 667 million for 2019, underperforming the Street9, reflecting lower revenues from completed M&A transactions. Revenues in the fourth quarter of 2019 decreased 30% year on year, compared to a decline in Street activity of 25% year on year9, against a strong comparable period in 2018, which represented the highest quarterly Street activity for M&A on record10.

Equity underwriting revenues were down 2% year on year at USD 315 million for 2019, in line with the Street9, mainly reflecting lower IPO issuance activity, partially offset by higher follow-on revenues. Revenues in the fourth quarter of 2019 increased significantly year on year, outperforming the Street9, driven by higher follow-on revenues and IPO issuance activity9.

Debt underwriting revenues were down 17% year on year at USD 794 million for 2019, underperforming the Street9, primarily driven by lower leveraged finance activity, in line with the Street9, and lower derivatives financing activity. Revenues in the fourth quarter of 2019 increased 5% year on year, less than the Street9, primarily driven by higher leveraged finance activity and derivatives financing activity, partially offset by lower investment grade underwriting revenues.

Our total global advisory and underwriting revenues11 for 2019 were USD 3.4 billion, down 15% year on year, underperforming the Street12. Global revenues in the fourth quarter were up 18% year on year, outperforming the Street12, reflecting strong performance in global equity and debt underwriting.

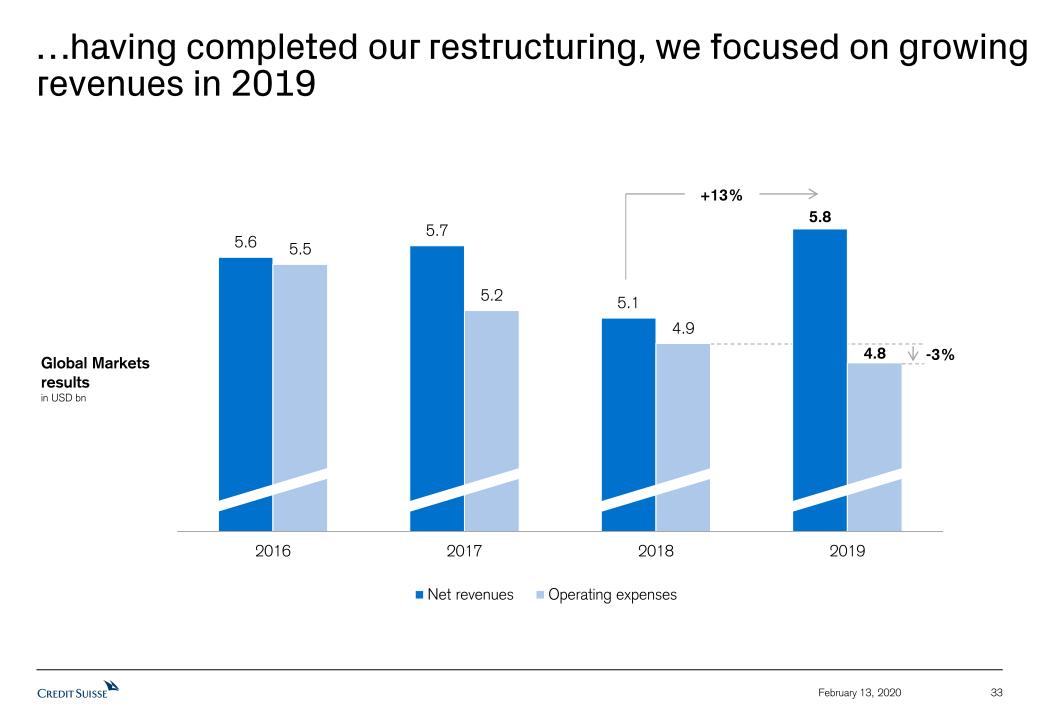

In 2019, Global Markets (GM) delivered strong results with positive operating leverage and pre-tax income of USD 960 million, up significantly year on year, resulting in a 7% return on regulatory capital. Net revenues of USD 5.8 billion increased by 13% compared to full year 2018, reflecting growth across our trading and financing businesses, partially offset by reduced debt and equity underwriting activity. Total operating expenses in 2019 declined 3% year on year, while risk-weighted assets decreased 2%. In the fourth quarter, GM recorded pre-tax income of USD 46 million and net revenues of USD 1.3 billion.

Page 8

Media Release Zurich, February 13, 2020 |  |

Fixed income sales and trading revenues of USD 3.5 billion increased 29% compared to 2018, driven by growth across our market-leading13 credit franchise and our financing and trading businesses in ITS. In the fourth quarter, fixed income sales and trading revenues of USD 820 million increased 73% compared to a subdued prior year, driven by broad based growth across businesses and improved market conditions.

Equities sales and trading revenues of USD 1.9 billion increased 7% compared to 2018, reflecting growth across prime services and equity derivatives, partially offset by lower cash equities results. In the fourth quarter, equity sales and trading revenues of USD 390 million increased 10% year on year, due to higher prime services and cash equities results, partially offset by lower equity derivatives revenues.

We continue to see strong momentum in our ITS business reflecting increased collaboration with IWM and SUB to serve our wealth management, institutional and corporate clients.

Underwriting revenues of USD 768 million decreased 29% year on year, reflecting lower industry-wide issuance activity across equity and debt. In the fourth quarter, underwriting revenues of USD 178 million decreased 27% year on year, reflecting lower debt underwriting results, partially offset by higher equity underwriting activity.

Page 9

Media Release Zurich, February 13, 2020 |  |

Impact Advisory and Finance (IAF)

2019 has been a productive year for IAF. The Department was involved with a number of notable global initiatives to further the use of both private and public capital markets solutions in addressing the social and environmental needs identified by the United Nations Sustainable Development Goals (UN SDGs).

The most notable activities in 2019 include:

| ■ | Credit Suisse issued the inaugural Credit Suisse green Yankee Certificates of Deposit of USD 200 million; |

| ■ | Credit Suisse Asset Management announced its intention to integrate Environmental, Social and Governance (ESG) factors into its investment process and is targeting to migrate CHF 100 billion of Credit Suisse assets under management to ESG by the end of 202014; |

| ■ | Credit Suisse partnered with the Climate Bonds Initiative to create a framework which would underpin a ‘sustainable transition bond’ market; |

| ■ | Credit Suisse significantly increased the number of green and sustainable debt financing transactions that it supported the execution of in 2019.15 |

Focusing on the fourth quarter of 2019, in November, Credit Suisse launched a Responsible Consumer Fund tracking the UN’s 12th SDG: “Responsible Consumption and Production”. The fund invests in listed companies across Sustainable Food, Urban Systems, Supply Chains and Sustainable Lifestyles, and addresses the topic across the whole value chain by targeting companies throughout the product lifecycle, ultimately providing investors with diversified sector risk.

In the same month, Credit Suisse partnered with the World Bank to focus on sustainable use of oceans and coastal areas. The World Bank issued a USD 28.6 million 5-year Sustainable Development Bond as part of ongoing efforts to raise awareness for the vital role fresh and saltwater resources play for communities and the environment. Credit Suisse acted as the sole manager of the transaction. The bond formed the collateral for Credit Suisse’s Low Carbon Blue Economy Note, which was placed with Credit Suisse’s private wealth management clients in Northern Europe.

Sustainability and Corporate Citizenship

As part of the Climate Risk Strategy, we have identified initial priority segments, which have a greater potential for adverse climate (and associated socio-economic) impacts: Oil & gas, thermal/metallurgical coal mining, utilities/power generation, ship finance and manufacturing (including cement, steel, chemicals and automotive). We are formulating specific client strategies for each and assessing the readiness and progress of our clients to transition to low-carbon and climate-resilient business activities. Credit Suisse announced at its Investor Day in December 2019 that it would no longer provide any form of financing specifically related to the development of new coal-fired power plants.

Over the course of 2019, the bank’s sustainability risk function reviewed approximately 800 transactions and client relationships for potential environmental and social risks and further engaged with some of the clients involved in these transactions as part of the assessment process.

Additionally, in the fourth quarter of 2019, Credit Suisse concluded a mediation procedure under the auspices of the Swiss National Contact Point of the OECD Guidelines for Multinational Enterprises, and as such has updated its sector-specific policies with strengthened wording regarding the rights of indigenous peoples.

Page 10

Media Release Zurich, February 13, 2020 |  |

The Corporate Citizenship department launched a new theme in 2019: Future Skills – a natural evolution of the bank’s longstanding commitment to education. Future Skills complements the programs in the Financial Inclusion and Education space the bank has been running for more than a decade and contributes to the bank’s efforts in closing the educational and employment gap for young people.

Contact details

Mark Smart, Investor Relations, Credit Suisse Tel: +41 44 333 71 49 Email: investor.relations@credit-suisse.com |

James Quinn, Corporate Communications, Credit Suisse Tel: +41 844 33 88 44 E-mail: media.relations@credit-suisse.com |

The Earnings Release and Presentation Slides for the full year and fourth quarter 2019 are available to download from 7:00 CET today at: https://www.credit-suisse.com/results |

Presentation of 4Q19 results – Thursday, February 13, 2020

| Event | Analyst Call | Media Call |

| Time | 08:15 Zurich 07:15 London 02:15 New York | 10:15 Zurich 09:15 London 04:15 New York |

| Language | English | English |

| Access | Switzerland: +41 44 580 48 67 Europe: +44 203 057 6528 US: +1 866 276 8933 Reference: Credit Suisse analyst call Conference ID: 2380499 Please dial in 10 minutes before the start of the call | Switzerland: +41 44 580 48 67 Europe: +44 203 057 6528 US: +1 866 276 8933 Reference: Credit Suisse media call Conference ID: 6249155 Please dial in 10 minutes before the start of the call |

| Q&A Session | Following the presentation, you will have the opportunity to ask the speakers questions | Following the presentation, you will have the opportunity to ask the speakers questions |

| Playback | Replay available approximately one hour after the event Switzerland: +41 44 580 40 26 Europe: +44 333 300 9785 US: +1 917 677 7532 Conference ID: 2380499 | Replay available approximately one hour after the event Switzerland: +41 44 580 40 26 Europe: +44 333 300 9785 US: +1 917 677 7532 Conference ID: 6249155 |

Page 11

Media Release Zurich, February 13, 2020 |  |

Footnotes

* 3Q19 and 2019 include CHF 327 million related to the transfer of the InvestLab fund platform to Allfunds Group, recorded in SUB C&IC (CHF 98 million), IWM PB (CHF 131 million) and APAC PB within WM&C (CHF 98 million); 4Q19 and 2019 include CHF 498 million related to the revaluation of our equity investment in the SIX Group AG, recorded in SUB PC (CHF 149 million), SUB C&IC (CHF 157 million) and IWM PB (CHF 192 million). 4Q19 and 2019 included major litigation provisions of CHF 326 million and CHF 389 million, respectively. 4Q18 and 2018 included major litigation provisions of CHF 82 million and CHF 244 million, respectively. Results excluding these gains are non-GAAP financial measures

1 Refers to adjusted results, which are non-GAAP financial measures. For a reconciliation of the adjusted results to the most directly comparable US GAAP measures, see the Appendix to this Media Release

2 Adjusted operating cost base at constant 2018 FX rates

3 Source: Credit Suisse Global Wealth Reports for 2015 and 2019

4 Relating to SUB, IWM and APAC Private Banking within WM&C

5 Group average one-day, 98% trading book risk management Value-at-Risk decreased 41% (from CHF 49 million in 2015 to CHF 29 million in 2018).

6 Risk-weighted assets decreased 46% (from USD 110 billion at the end of 3Q15 to USD 60 billion at the end of 2019); figures for 3Q15 present financial information based on results under our structure prior to our re-segmentation announcement on October 21, 2015; on the basis of our current structure, the 3Q15 RWA amount for Global Markets is USD 63 billion

7 Combined net revenues for Global Markets and APAC Markets.

8 Source: Dealogic for the period ending December 31, 2019 (APAC Int’l excluding Japan and excluding onshore China)

9 Source: Dealogic for the period ending December 31, 2019 (Americas and EMEA only)

10 Source: Dealogic for 1Q 1995 until the period ending December 31, 2019 (Americas and EMEA only)

11 Gross global revenues from advisory, debt and equity underwriting generated across all divisions

12 Source: Dealogic for the period ending December 31, 2019 (Global)

13 Ranked number 1 for Asset Finance for full year 2019, Source: Thomson Reuters as of December 31, 2019; Ranked number 3 for Leveraged Finance Capital Markets for full year 2019, Source: Dealogic as of December 31, 2019

14 Media release, ‘Credit Suisse Asset Management migrates ESG across its product range, targeting CHF 100 billion of ESG assets under management by the end of 2020’, September 27, 2019

15 Source: Bloomberg as of December 31, 2019

Abbreviations

APAC – Asia Pacific; AuM – assets under management; CHF – Swiss francs; CEO – Chief Executive Officer; CET1 – common equity tier 1; C&IC – Corporate & Institutional Clients; EMEA – Europe, Middle East and Africa; ESG – Environmental, Social and Governance; FINMA – Swiss Financial Market Supervisory Authority; GAAP – Generally accepted accounting principles; GM – Global Markets; IAF – Impact Advisory and Finance; IBCM – Investment Banking & Capital Markets; IPO – initial public offering; ITS – International Trading Solutions; IWM – International Wealth Management; M&A – mergers and acquisitions; NNA – net new assets; OECD – Organisation for Economic Co-operation and Development; PB – Private Banking; PC – Private Clients; PTI – pre-tax income; RoTE – Return on Tangible Equity; RWA – risk weighted assets; SDG – Sustainable Development Goals; SIX – SIX Group AG; SUB – Swiss Universal Bank; TBVPS – tangible book value per share; (U)HNW – (ultra-)high-net-worth; UN – United Nations; USD – US dollar; WM&C – Wealth Management & Connected

Important information

This document contains select information from the full 4Q19 Earnings Release and 4Q19 Results Presentation slides that Credit Suisse believes is of particular interest to media professionals. The complete 4Q19 Earnings Release and 4Q19 Results Presentation slides, which have been distributed simultaneously, contain more comprehensive information about our results and operations for the reporting quarter, as well as important information about our reporting methodology and some of the terms used in these documents. The complete 4Q19 Earnings Release and 4Q19 Results Presentation slides are not incorporated by reference into this document.

Credit Suisse has not finalized its 2019 Annual Report and Credit Suisse’s independent registered public accounting firm has not completed its audit of the consolidated financial statements for the period. Accordingly, the financial information contained in this document is subject to completion of year-end procedures, which may result in changes to that information.

We may not achieve all of the expected benefits of our strategic initiatives. Factors beyond our control, including but not limited to the market and economic conditions, changes in laws, rules or regulations and other challenges discussed in our public filings, could limit our ability to achieve some or all of the expected benefits of these initiatives.

In particular, the terms “Estimate”, “Illustrative”, “Ambition”, “Objective”, “Outlook” and “Goal” are not intended to be viewed as targets or projections, nor are they considered to be Key Performance Indicators. All such estimates, illustrations, ambitions, objectives, outlooks and goals are subject to a large number of inherent risks, assumptions and uncertainties, many of which are completely outside of our control. These risks, assumptions and uncertainties include, but are not limited to, general market conditions, market volatility, interest rate volatility and levels, global and regional economic conditions, political uncertainty,

Page 12

Media Release Zurich, February 13, 2020 |  |

changes in tax policies, regulatory changes, changes in levels of client activity as a result of any of the foregoing and other factors. Accordingly, this information should not be relied on for any purpose. We do not intend to update these estimates, illustrations, ambitions, objectives, outlooks or goals.

In preparing this document, management has made estimates and assumptions that affect the numbers presented. Actual results may differ. Annualized numbers do not take into account variations in operating results, seasonality and other factors and may not be indicative of actual, full-year results. Figures throughout this document may also be subject to rounding adjustments. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information. This information is subject to change at any time without notice and we do not intend to update this information.

Our ambitions often include metrics that are non-GAAP financial measures and are unaudited. A reconciliation of the ambitions to the nearest GAAP measures is unavailable without unreasonable efforts. Return on tangible equity is based on tangible shareholders' equity (also known as tangible book value), a non-GAAP financial measure, which is calculated by deducting goodwill and other intangible assets from total shareholders' equity as presented in our balance sheet, both of which are unavailable on a prospective basis. Such ambitions are calculated in a manner that is consistent with the accounting policies applied by us in preparing our financial statements.

Return on tangible equity is based on tangible shareholders’ equity, a non-GAAP financial measure, which is calculated by deducting goodwill and other intangible assets from total shareholders’ equity as presented in our balance sheet. Return on tangible equity figures are rounded up or down to the nearest whole number. Tangible book value, a non-GAAP financial measure, is equal to tangible shareholders' equity. Tangible book value per share is a non-GAAP financial measure, which is calculated by dividing tangible shareholders' equity by total number of shares outstanding. Management believes that tangible shareholders' equity/tangible book value, return on tangible equity and tangible book value per share are meaningful as they are measures used and relied upon by industry analysts and investors to assess valuations and capital adequacy. For end-4Q19, tangible shareholders’ equity excluded goodwill of CHF 4,663 million and other intangible assets of CHF 291 million from total shareholders’ equity of CHF 43,644 million as presented in our balance sheet. For end-4Q18, tangible shareholders’ equity excluded goodwill of CHF 4,766 million and other intangible assets of CHF 219 million from total shareholders’ equity of CHF 43,922 million as presented in our balance sheet. Shares outstanding were 2,436.2 million at end-4Q19 and were 2,550.6 million at end-4Q18.

Regulatory capital is calculated as the worst of 10% of RWA and 3.5% of leverage exposure. Return on regulatory capital is calculated using income / (loss) after tax and assumes a tax rate of 30% and capital allocated based on the worst of 10% of average RWA and 3.5% of average leverage exposure. For the Markets business within the APAC division and for the Global Markets and Investment Banking & Capital Markets divisions, return on regulatory capital is based on US dollar denominated numbers. Adjusted return on regulatory capital is calculated using adjusted results, applying the same methodology to calculate return on regulatory capital.

Following the successful completion of our restructuring program in 2018, we updated our calculation approach for adjusted operating cost base at constant FX rates. Beginning in 1Q19, adjusted operating cost base includes adjustments for major litigation provisions, expenses related to real estate disposals and the termination of real estate contracts initiated prior to 2019 and business sales as well as for debit valuation adjustments (DVA) related volatility and FX, but not for restructuring expenses and certain accounting changes. Adjustments for FX apply unweighted 2018 currency exchange rates, i.e., a straight line average of monthly rates, consistently for the periods under review. Under the current presentation, adjusted operating cost base at constant FX rates for periods prior to 1Q19 still include adjustments for restructuring expenses and a goodwill impairment taken in 4Q15, but no longer include an adjustment for certain accounting changes. 2018 excludes restructuring expenses of CHF 626 million, major litigation provisions of CHF 244 million, expenses related to business sales of CHF 51 million and DVA of CHF 46 million. 2019 excludes major litigation provisions of CHF 389 million, expenses related to real estate disposals of CHF 108 million, DVA of 53 million and an FX adjustment of CHF 25 million.

Credit Suisse is subject to the Basel III framework, as implemented in Switzerland, as well as Swiss legislation and regulations for systemically important banks, which include capital, liquidity, leverage and large exposure requirements and rules for emergency plans designed to maintain systemically relevant functions in the event of threatened insolvency. Credit Suisse has adopted the Bank for International Settlements (BIS) leverage ratio framework, as issued by the Basel Committee on Banking Supervision (BCBS) and implemented in Switzerland by the Swiss Financial Market Supervisory Authority FINMA (FINMA).

Unless otherwise noted, all CET1 ratio, Tier-1 leverage ratio, risk-weighted assets and leverage exposure figures in this document are as of the end of the respective period.

Unless otherwise noted, leverage exposure is based on the BIS leverage ratio framework and consists of period-end balance sheet assets and prescribed regulatory adjustments. The tier 1 leverage ratio and CET1 leverage ratio are calculated as BIS tier 1 capital and CET1 capital, respectively, divided by period end leverage exposure. Swiss leverage ratios are measured on the same period-end basis as the leverage exposure for the BIS leverage ratio.

Page 13

Media Release Zurich, February 13, 2020 |  |

Generic references to profit and costs in this document refer to pre-tax income and operating expenses, respectively. References to net income refer to net income attributable to shareholders. References to Wealth Management mean SUB PC, IWM PB and APAC PB within WM&C or their combined results. References to Wealth Management-related mean SUB, IWM and APAC WM&C or their combined results. References to global advisory and underwriting include global revenues from advisory, debt and equity underwriting generated across all divisions.

Investors and others should note that we announce material information (including quarterly earnings releases and financial reports) to the investing public using press releases, SEC and Swiss ad hoc filings, our website and public conference calls and webcasts. We intend to also use our Twitter account @creditsuisse (https://twitter.com/creditsuisse) to excerpt key messages from our public disclosures, including earnings releases. We may retweet such messages through certain of our regional Twitter accounts, including @csschweiz (https://twitter.com/csschweiz) and @csapac (https://twitter.com/csapac). Investors and others should take care to consider such abbreviated messages in the context of the disclosures from which they are excerpted. The information we post on these Twitter accounts is not a part of this document.

Information referenced in this document, whether via website links or otherwise, is not incorporated into this document.

Certain material in this document has been prepared by Credit Suisse on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. Credit Suisse has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information.

In various tables, use of “–” indicates not meaningful or not applicable.

Page 14

| Key metrics | |||||||||||||||||

| in / end of | % change | in / end of | % change | ||||||||||||||

| 4Q19 | 3Q19 | 4Q18 | QoQ | YoY | 2019 | 2018 | YoY | ||||||||||

| Credit Suisse Group results (CHF million) | |||||||||||||||||

| Net revenues | 6,190 | 5,326 | 4,801 | 16 | 29 | 22,484 | 20,920 | 7 | |||||||||

| Provision for credit losses | 146 | 72 | 59 | 103 | 147 | 324 | 245 | 32 | |||||||||

| Compensation and benefits | 2,590 | 2,383 | 2,141 | 9 | 21 | 10,036 | 9,620 | 4 | |||||||||

| General and administrative expenses | 1,916 | 1,404 | 1,569 | 36 | 22 | 6,128 | 5,798 | 6 | |||||||||

| Commission expenses | 324 | 325 | 301 | 0 | 8 | 1,276 | 1,259 | 1 | |||||||||

| Restructuring expenses | – | – | 136 | – | – | – | 626 | – | |||||||||

| Total other operating expenses | 2,240 | 1,729 | 2,006 | 30 | 12 | 7,404 | 7,683 | (4) | |||||||||

| Total operating expenses | 4,830 | 4,112 | 4,147 | 17 | 16 | 17,440 | 17,303 | 1 | |||||||||

| Income before taxes | 1,214 | 1,142 | 595 | 6 | 104 | 4,720 | 3,372 | 40 | |||||||||

| Net income attributable to shareholders | 852 | 881 | 259 | (3) | 229 | 3,419 | 2,024 | 69 | |||||||||

| Statement of operations metrics (%) | |||||||||||||||||

| Return on regulatory capital | 10.6 | 10.0 | 5.4 | – | – | 10.5 | 7.4 | – | |||||||||

| Balance sheet statistics (CHF million) | |||||||||||||||||

| Total assets | 787,295 | 795,920 | 768,916 | (1) | 2 | 787,295 | 768,916 | 2 | |||||||||

| Risk-weighted assets | 290,463 | 302,121 | 284,582 | (4) | 2 | 290,463 | 284,582 | 2 | |||||||||

| Leverage exposure | 909,994 | 921,411 | 881,386 | (1) | 3 | 909,994 | 881,386 | 3 | |||||||||

| Assets under management and net new assets (CHF billion) | |||||||||||||||||

| Assets under management | 1,507.2 | 1,476.9 | 1,344.9 | 2.1 | 12.1 | 1,507.2 | 1,344.9 | 12.1 | |||||||||

| Net new assets | 9.9 | 11.9 | 0.2 | (16.8) | – | 79.3 | 53.7 | 47.7 | |||||||||

| Basel III regulatory capital and leverage statistics (%) | |||||||||||||||||

| CET1 ratio | 12.7 | 12.4 | 12.6 | – | – | 12.7 | 12.6 | – | |||||||||

| CET1 leverage ratio | 4.0 | 4.1 | 4.1 | – | – | 4.0 | 4.1 | – | |||||||||

| Tier 1 leverage ratio | 5.5 | 5.5 | 5.2 | – | – | 5.5 | 5.2 | – | |||||||||

A-1

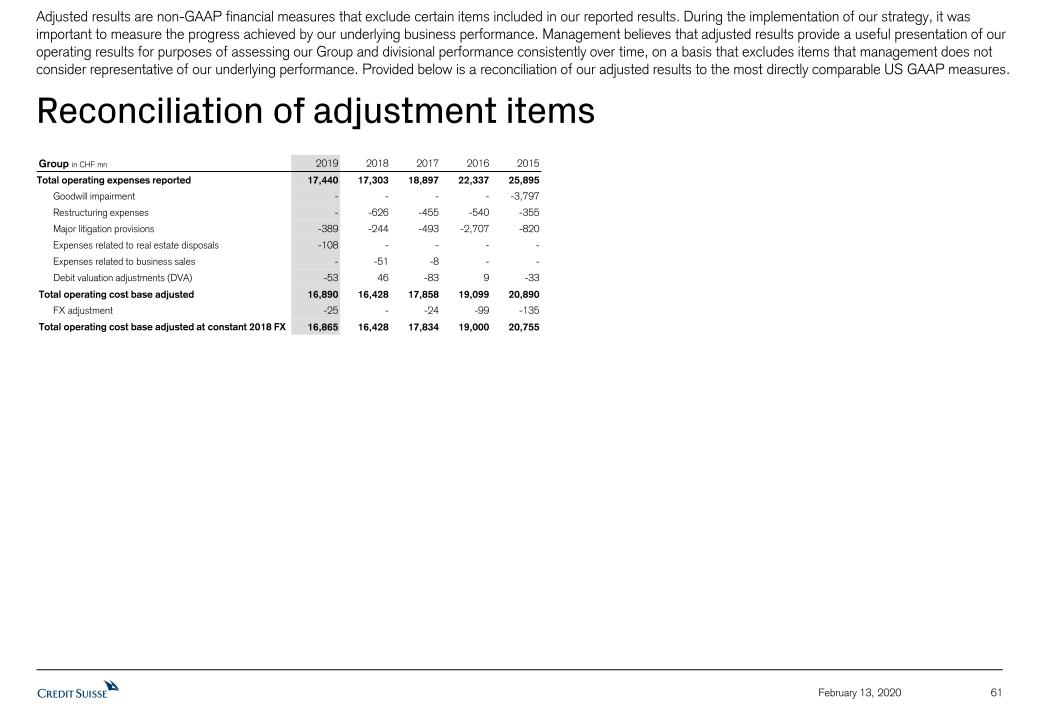

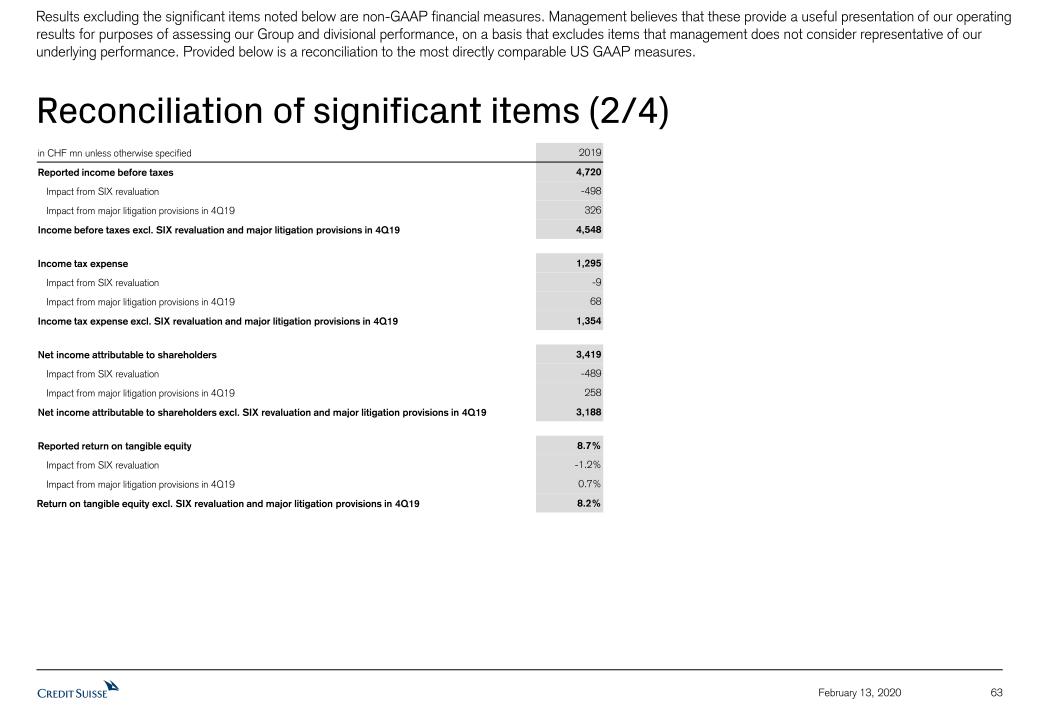

Adjusted results are non-GAAP financial measures that exclude certain items included in our reported results. During the implementation of our strategy, it was important to measure the progress achieved by our underlying business performance. Management believes that adjusted results provide a useful presentation of our operating results for purposes of assessing our Group and divisional performance consistently over time, on a basis that excludes items that management does not consider representative of our underlying performance. Provided below is a reconciliation of our adjusted results to the most directly comparable US GAAP measures.

| Credit Suisse – Reconciliation of adjusted results | |||||||||

| in | 4Q19 | 4Q18 | 2019 | 2018 | |||||

| Adjusted results (CHF million) | |||||||||

| Net revenues | 6,190 | 4,801 | 22,484 | 20,920 | |||||

| Real estate gains | (146) | (12) | (251) | (28) | |||||

| (Gains)/losses on business sales | 2 | (3) | 2 | (71) | |||||

| Adjusted net revenues | 6,046 | 4,786 | 22,235 | 20,821 | |||||

| Provision for credit losses | 146 | 59 | 324 | 245 | |||||

| Total operating expenses | 4,830 | 4,147 | 17,440 | 17,303 | |||||

| Restructuring expenses | – | (136) | – | (626) | |||||

| Major litigation provisions | (326) | (82) | (389) | (244) | |||||

| Expenses related to real estate disposals | (57) | – | (108) | – | |||||

| Expenses related to business sales | 0 | (48) | 0 | (51) | |||||

| Adjusted total operating expenses | 4,447 | 3,881 | 16,943 | 16,382 | |||||

| Income before taxes | 1,214 | 595 | 4,720 | 3,372 | |||||

| Total adjustments | 239 | 251 | 248 | 822 | |||||

| Adjusted income before taxes | 1,453 | 846 | 4,968 | 4,194 | |||||

A-2

| Swiss Universal Bank | |||||||||||||||||

| in / end of | % change | in / end of | % change | ||||||||||||||

| 4Q19 | 3Q19 | 4Q18 | QoQ | YoY | 2019 | 2018 | YoY | ||||||||||

| Results (CHF million) | |||||||||||||||||

| Net revenues | 1,748 | 1,417 | 1,373 | 23 | 27 | 6,020 | 5,564 | 8 | |||||||||

| of which Private Clients | 985 | 715 | 740 | 38 | 33 | 3,270 | 2,989 | 9 | |||||||||

| of which Corporate & Institutional Clients | 763 | 702 | 633 | 9 | 21 | 2,750 | 2,575 | 7 | |||||||||

| Provision for credit losses | 43 | 28 | 26 | 54 | 65 | 110 | 126 | (13) | |||||||||

| Total operating expenses | 819 | 782 | 849 | 5 | (4) | 3,213 | 3,313 | (3) | |||||||||

| Income before taxes | 886 | 607 | 498 | 46 | 78 | 2,697 | 2,125 | 27 | |||||||||

| of which Private Clients | 495 | 251 | 278 | 97 | 78 | 1,375 | 1,060 | 30 | |||||||||

| of which Corporate & Institutional Clients | 391 | 356 | 220 | 10 | 78 | 1,322 | 1,065 | 24 | |||||||||

| Metrics (%) | |||||||||||||||||

| Return on regulatory capital | 26.8 | 18.5 | 15.7 | – | – | 20.7 | 16.8 | – | |||||||||

| Cost/income ratio | 46.9 | 55.2 | 61.8 | – | – | 53.4 | 59.5 | – | |||||||||

| Private Clients | |||||||||||||||||

| Assets under management (CHF billion) | 217.6 | 214.2 | 198.0 | 1.6 | 9.9 | 217.6 | 198.0 | 9.9 | |||||||||

| Net new assets (CHF billion) | (0.5) | (0.6) | (1.1) | – | – | 3.4 | 3.0 | – | |||||||||

| Gross margin (annualized) (bp) | 182 | 133 | 144 | – | – | 154 | 144 | – | |||||||||

| Net margin (annualized) (bp) | 91 | 47 | 54 | – | – | 65 | 51 | – | |||||||||

| Corporate & Institutional Clients | |||||||||||||||||

| Assets under management (CHF billion) | 436.4 | 424.6 | 348.7 | 2.8 | 25.2 | 436.4 | 348.7 | 25.2 | |||||||||

| Net new assets (CHF billion) | 2.5 | 6.3 | 2.1 | – | – | 45.3 | 8.6 | – | |||||||||

| International Wealth Management | |||||||||||||||||

| in / end of | % change | in / end of | % change | ||||||||||||||

| 4Q19 | 3Q19 | 4Q18 | QoQ | YoY | 2019 | 2018 | YoY | ||||||||||

| Results (CHF million) | |||||||||||||||||

| Net revenues | 1,640 | 1,461 | 1,402 | 12 | 17 | 5,887 | 5,414 | 9 | |||||||||

| of which Private Banking | 1,194 | 1,066 | 942 | 12 | 27 | 4,268 | 3,890 | 10 | |||||||||

| of which Asset Management | 446 | 395 | 460 | 13 | (3) | 1,619 | 1,524 | 6 | |||||||||

| Provision for credit losses | 16 | 14 | 16 | 14 | 0 | 49 | 35 | 40 | |||||||||

| Total operating expenses | 992 | 908 | 976 | 9 | 2 | 3,700 | 3,674 | 1 | |||||||||

| Income before taxes | 632 | 539 | 410 | 17 | 54 | 2,138 | 1,705 | 25 | |||||||||

| of which Private Banking | 495 | 428 | 298 | 16 | 66 | 1,665 | 1,333 | 25 | |||||||||

| of which Asset Management | 137 | 111 | 112 | 23 | 22 | 473 | 372 | 27 | |||||||||

| Metrics (%) | |||||||||||||||||

| Return on regulatory capital | 40.1 | 34.3 | 28.9 | – | – | 34.9 | 30.7 | – | |||||||||

| Cost/income ratio | 60.5 | 62.1 | 69.6 | – | – | 62.9 | 67.9 | – | |||||||||

| Private Banking | |||||||||||||||||

| Assets under management (CHF billion) | 370.0 | 365.2 | 357.5 | 1.3 | 3.5 | 370.0 | 357.5 | 3.5 | |||||||||

| Net new assets (CHF billion) | 0.6 | 3.6 | 0.5 | – | – | 11.0 | 14.2 | – | |||||||||

| Gross margin (annualized) (bp) | 129 | 117 | 103 | – | – | 117 | 106 | – | |||||||||

| Net margin (annualized) (bp) | 53 | 47 | 33 | – | – | 46 | 36 | – | |||||||||

| Asset Management | |||||||||||||||||

| Assets under management (CHF billion) | 437.9 | 426.0 | 388.7 | 2.8 | 12.7 | 437.9 | 388.7 | 12.7 | |||||||||

| Net new assets (CHF billion) | 7.5 | 5.9 | 0.7 | – | – | 21.5 | 22.2 | – | |||||||||

A-3

| Asia Pacific | |||||||||||||||||

| in / end of | % change | in / end of | % change | ||||||||||||||

| 4Q19 | 3Q19 | 4Q18 | QoQ | YoY | 2019 | 2018 | YoY | ||||||||||

| Results (CHF million) | |||||||||||||||||

| Net revenues | 937 | 886 | 677 | 6 | 38 | 3,590 | 3,393 | 6 | |||||||||

| of which Wealth Management & Connected | 639 | 673 | 506 | (5) | 26 | 2,491 | 2,290 | 9 | |||||||||

| of which Markets | 298 | 213 | 171 | 40 | 74 | 1,099 | 1,103 | 0 | |||||||||

| Provision for credit losses | 11 | 19 | 8 | (42) | 38 | 46 | 35 | 31 | |||||||||

| Total operating expenses | 691 | 620 | 632 | 11 | 9 | 2,642 | 2,694 | (2) | |||||||||

| Income before taxes | 235 | 247 | 37 | (5) | – | 902 | 664 | 36 | |||||||||

| of which Wealth Management & Connected | 221 | 281 | 138 | (21) | 60 | 888 | 691 | 29 | |||||||||

| of which Markets | 14 | (34) | (101) | – | – | 14 | (27) | – | |||||||||

| Metrics (%) | |||||||||||||||||

| Return on regulatory capital | 16.2 | 17.2 | 2.7 | – | – | 16.1 | 12.0 | – | |||||||||

| Cost/income ratio | 73.7 | 70.0 | 93.4 | – | – | 73.6 | 79.4 | – | |||||||||

| Wealth Management & Connected – Private Banking | |||||||||||||||||

| Assets under management (CHF billion) | 220.0 | 217.1 | 199.3 | 1.3 | 10.4 | 220.0 | 199.3 | 10.4 | |||||||||

| Net new assets (CHF billion) | 0.7 | 1.7 | 0.9 | – | – | 8.7 | 14.4 | – | |||||||||

| Gross margin (annualized) (bp) | 78 | 99 | 70 | – | – | 84 | 80 | – | |||||||||

| Net margin (annualized) (bp) | 26 | 51 | 19 | – | – | 33 | 27 | – | |||||||||

A-4

| Global Markets | |||||||||||||||||

| in / end of | % change | in / end of | % change | ||||||||||||||

| 4Q19 | 3Q19 | 4Q18 | QoQ | YoY | 2019 | 2018 | YoY | ||||||||||

| Results (CHF million) | |||||||||||||||||

| Net revenues | 1,312 | 1,415 | 965 | (7) | 36 | 5,752 | 4,980 | 16 | |||||||||

| Provision for credit losses | 31 | 8 | 5 | 288 | – | 52 | 24 | 117 | |||||||||

| Total operating expenses | 1,233 | 1,138 | 1,153 | 8 | 7 | 4,744 | 4,802 | (1) | |||||||||

| Income/(loss) before taxes | 48 | 269 | (193) | (82) | – | 956 | 154 | – | |||||||||

| Metrics (%) | |||||||||||||||||

| Return on regulatory capital | 1.4 | 8.3 | (6.2) | – | – | 7.4 | 1.2 | – | |||||||||

| Cost/income ratio | 94.0 | 80.4 | 119.5 | – | – | 82.5 | 96.4 | – | |||||||||

| Investment Banking & Capital Markets | |||||||||||||||||

| in / end of | % change | in / end of | % change | ||||||||||||||

| 4Q19 | 3Q19 | 4Q18 | QoQ | YoY | 2019 | 2018 | YoY | ||||||||||

| Results (CHF million) | |||||||||||||||||

| Net revenues | 431 | 425 | 475 | 1 | (9) | 1,666 | 2,177 | (23) | |||||||||

| Provision for credit losses | 39 | 11 | 5 | 255 | – | 59 | 24 | 146 | |||||||||

| Total operating expenses | 452 | 429 | 365 | 5 | 24 | 1,769 | 1,809 | (2) | |||||||||

| Income/(loss) before taxes | (60) | (15) | 105 | 300 | – | (162) | 344 | – | |||||||||

| Metrics (%) | |||||||||||||||||

| Return on regulatory capital | (6.6) | (1.7) | 12.4 | – | – | (4.5) | 10.9 | – | |||||||||

| Cost/income ratio | 104.9 | 100.9 | 76.8 | – | – | 106.2 | 83.1 | – | |||||||||

| Global advisory and underwriting revenues | |||||||||||||||||

| in | % change | in | % change | ||||||||||||||

| 4Q19 | 3Q19 | 4Q18 | QoQ | YoY | 2019 | 2018 | YoY | ||||||||||

| Global advisory and underwriting revenues (USD million) | |||||||||||||||||

| Advisory and other fees | 234 | 203 | 308 | 15 | (24) | 816 | 1,163 | (30) | |||||||||

| Debt underwriting | 456 | 463 | 368 | (2) | 24 | 1,842 | 2,050 | (10) | |||||||||

| Equity underwriting | 205 | 175 | 85 | 17 | 141 | 771 | 830 | (7) | |||||||||

| Global advisory and underwriting revenues | 895 | 841 | 761 | 6 | 18 | 3,429 | 4,043 | (15) | |||||||||

A-5

Cautionary statement regarding forward-looking information

This document contains statements that constitute forward-looking statements. In addition, in the future we, and others on our behalf, may make statements that constitute forward-looking statements. Such forward-looking statements may include, without limitation, statements relating to the following:

■ our plans, targets or goals;

■ our future economic performance or prospects;

■ the potential effect on our future performance of certain contingencies; and

■ assumptions underlying any such statements.

Words such as “believes,” “anticipates,” “expects,” “intends” and “plans” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. We do not intend to update these forward-looking statements.

By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that predictions, forecasts, projections and other outcomes described or implied in forward-looking statements will not be achieved. We caution you that a number of important factors could cause results to differ materially from the plans, targets, goals, expectations, estimates and intentions expressed in such forward-looking statements. These factors include:

■ the ability to maintain sufficient liquidity and access capital markets;

■ market volatility and interest rate fluctuations and developments affecting interest rate levels;

■ the strength of the global economy in general and the strength of the economies of the countries in which we conduct our operations, in particular the risk of continued slow economic recovery or downturn in the EU, the US or other developed countries or in emerging markets in 2020 and beyond;

■ the direct and indirect impacts of deterioration or slow recovery in residential and commercial real estate markets;

■ adverse rating actions by credit rating agencies in respect of us, sovereign issuers, structured credit products or other credit-related exposures;

■ the ability to achieve our strategic goals, including those related to our targets and financial goals;

■ the ability of counterparties to meet their obligations to us;

■ the effects of, and changes in, fiscal, monetary, exchange rate, trade and tax policies, as well as currency fluctuations;

■ political and social developments, including war, civil unrest or terrorist activity;

■ the possibility of foreign exchange controls, expropriation, nationalization or confiscation of assets in countries in which we conduct our operations;

■ operational factors such as systems failure, human error, or the failure to implement procedures properly;

■ the risk of cyber attacks, information or security breaches or technology failures on our business or operations;

■ the adverse resolution of litigation, regulatory proceedings and other contingencies;

■ actions taken by regulators with respect to our business and practices and possible resulting changes to our business organization, practices and policies in countries in which we conduct our operations;

■ the effects of changes in laws, regulations or accounting or tax standards, policies or practices in countries in which we conduct our operations;

■ the potential effects of changes in our legal entity structure;

■ competition or changes in our competitive position in geographic and business areas in which we conduct our operations;

■ the ability to retain and recruit qualified personnel;

■ the ability to maintain our reputation and promote our brand;

■ the ability to increase market share and control expenses;

■ technological changes;

■ the timely development and acceptance of our new products and services and the perceived overall value of these products and services by users;

■ acquisitions, including the ability to integrate acquired businesses successfully, and divestitures, including the ability to sell non-core assets; and

■ other unforeseen or unexpected events and our success at managing these and the risks involved in the foregoing.

We caution you that the foregoing list of important factors is not exclusive. When evaluating forward-looking statements, you should carefully consider the foregoing factors and other uncertainties and events, including the information set forth in “Risk factors” in I– Information on the company in our Annual Report 2018.

A-6

Credit SuisseFourth Quarter andFull Year 2019 Results Tidjane Thiam, Chief Executive OfficerDavid Mathers, Chief Financial OfficerFebruary 13, 2020

Disclaimer (1/2) 2 February 13, 2020 Credit Suisse has not finalized its 2019 Annual Report and Credit Suisse’s independent registered public accounting firm has not completed its audit of the condensed consolidated financial statements for the period. Accordingly, the financial information contained in this presentation is subject to completion of year-end procedures, which may result in changes to that information.This material does not purport to contain all of the information that you may wish to consider. This material is not to be relied upon as such or used in substitution for the exercise of independent judgment. Cautionary statement regarding forward-looking statements This presentation contains forward-looking statements that involve inherent risks and uncertainties, and we might not be able to achieve the predictions, forecasts, projections and other outcomes we describe or imply in forward-looking statements. A number of important factors could cause results to differ materially from the plans, objectives, expectations, estimates and intentions we express in these forward-looking statements, including those we identify in "Risk factors” in our Annual Report on Form 20-F for the fiscal year ended December 31, 2018 and in the “Cautionary statement regarding forward-looking information" in our 4Q19 Earnings Release published on February 13, 2020 and filed with the US Securities and Exchange Commission, and in other public filings and press releases. We do not intend to update these forward-looking statements. In particular, the terms “Estimate”, “Illustrative”, “Ambition”, “Objective”, “Outlook” and “Goal” are not intended to be viewed as targets or projections, nor are they considered to be Key Performance Indicators. All such estimates, illustrations, ambitions, objectives, outlooks and goals are subject to a large number of inherent risks, assumptions and uncertainties, many of which are completely outside of our control. These risks, assumptions and uncertainties include, but are not limited to, general market conditions, market volatility, interest rate volatility and levels, global and regional economic conditions, political uncertainty, changes in tax policies, regulatory changes, changes in levels of client activity as a result of any of the foregoing and other factors. Accordingly, this information should not be relied on for any purpose. We do not intend to update these estimates, illustrations, ambitions, objectives, outlooks or goals. We may not achieve the benefits of our strategic initiativesWe may not achieve all of the expected benefits of our strategic initiatives. Factors beyond our control, including but not limited to the market and economic conditions, changes in laws, rules or regulations and other challenges discussed in our public filings, could limit our ability to achieve some or all of the expected benefits of these initiatives. Estimates and assumptionsIn preparing this presentation, management has made estimates and assumptions that affect the numbers presented. Actual results may differ. Annualized numbers do not take into account variations in operating results, seasonality and other factors and may not be indicative of actual, full-year results. Figures throughout this presentation may also be subject to rounding adjustments. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information. This information is subject to change at any time without notice and we do not intend to update this information.Statement regarding non-GAAP financial measuresThis presentation also contains non-GAAP financial measures, including adjusted results and results excluding certain significant items as well as return on regulatory capital, return on tangible equity and tangible book value per share (which are based on tangible shareholders’ equity). Information needed to reconcile such non-GAAP financial measures to the most directly comparable measures under US GAAP can be found in this presentation as well as in the 4Q19 Earnings Release, which are both available on our website at www.credit-suisse.com.Our estimates, ambitions, objectives and targets often include metrics that are non-GAAP financial measures and are unaudited. A reconciliation of the estimates, ambitions, objectives and targets to the nearest GAAP measures is unavailable without unreasonable efforts. Adjusted results exclude goodwill impairment, major litigation provisions, real estate gains and other revenues and expense items included in our reported results, all of which are unavailable on a prospective basis. Return on Tangible Equity is based on tangible shareholders' equity, a non-GAAP financial measure also known as tangible book value, which is calculated by deducting goodwill and other intangible assets from total shareholders' equity as presented in our balance sheet, both of which are unavailable on a prospective basis. Such estimates, ambitions, objectives and targets are calculated in a manner that is consistent with the accounting policies applied by us in preparing our financial statements.

Disclaimer (2/2) 3 February 13, 2020 Statement regarding capital, liquidity and leverageCredit Suisse is subject to the Basel III framework, as implemented in Switzerland, as well as Swiss legislation and regulations for systemically important banks (Swiss Requirements), which include capital, liquidity, leverage and large exposure requirements and rules for emergency plans designed to maintain systemically relevant functions in the event of threatened insolvency. Credit Suisse has adopted the Bank for International Settlements (BIS) leverage ratio framework, as issued by the Basel Committee on Banking Supervision (BCBS) and implemented in Switzerland by the Swiss Financial Market Supervisory Authority FINMA. References to phase-in and look-through included herein refer to Basel III capital requirements and Swiss Requirements. Phase-in reflects that, for the years 2014-2018, there was a five-year (20% per annum) phase-in of goodwill, other intangible assets and other capital deductions (e.g., certain deferred tax assets) and a phase-out of an adjustment for the accounting treatment of pension plans. For the years 2013-2022, there is a phase-out of certain capital instruments. Look-through assumes the full phase-in of goodwill and other intangible assets and other regulatory adjustments and the phase-out of certain capital instruments. Unless otherwise noted, leverage exposure is based on the BIS leverage ratio framework and consists of period-end balance sheet assets and prescribed regulatory adjustments. The look-through tier 1 leverage ratio and CET1 leverage ratio are calculated as look-through BIS tier 1 capital and CET1 capital, respectively, divided by period-end leverage exposure. Swiss leverage ratios are measured on the same period-end basis as the leverage exposure for the BIS leverage ratio. SourcesCertain material in this presentation has been prepared by Credit Suisse on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. Credit Suisse has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information.

Earnings Review 4 February 13, 2020

We have delivered a strong performance in 2019 with a significant increase in profits… 5 February 13, 2020 Note: Results excluding gains from the InvestLab transfer and SIX revaluation and major litigation provisions are non-GAAP financial measures. For further details and reconciliation information, see Appendix1 Excludes major litigation provisions of CHF 244 mn 2 Impact of CHF 327 mn related to the transfer of the InvestLab fund platform to Allfunds Group, recorded in SUB, IWM and APAC, and impact of CHF 498 mn related to the revaluation of our equity investment in the SIX Group AG, recorded in SUB and IWM Reported PTIdevelopmentin CHF mn +18% 1

…and in net income and returns 6 Net income attributableto shareholdersin CHF mn February 13, 2020 Return on tangible equity‡based on CHF 9% -7% -3% 5% 3,419 ‡ RoTE is a non-GAAP financial measure, see Appendix; RoTE figures are rounded up or down to the nearest whole number

After a challenging 1Q19, revenues improved during the year… 7 February 13, 2020 Group net revenuesYoY performancein CHF mn Note: Results excluding gains from the InvestLab transfer and SIX revaluation are non-GAAP financial measures. For further details and reconciliation information, see Appendix1 Excludes the gain of CHF 327 mn from the transfer of the InvestLab fund platform to Allfunds Group, recorded in SUB, IWM and APAC 2 Excludes the gain of CHF 498 mn from the revaluation of our equity investment in the SIX Group AG, recorded in SUB and IWM -4% -0.3% +2% Incl. impact of InvestLabtransfer and SIX revaluation +29% +9% Excl. impact of InvestLabtransfer1 and SIX revaluation2 +19% 2 1 +7% +4% 2019

…and we flexed our costs accordingly… 8 February 13, 2020 Group operatingexpenses excl.major litigationYoY performancein CHF mn Note: Results excluding major litigation provisions are non-GAAP financial measures1 Excl. major litigation provisions of CHF 6 mn in 1Q19 and CHF 85 mn in 1Q18 2 Excl. major litigation provisions of CHF 29 mn in 2Q19 and CHF 55 mn in 2Q18 3 Excl. major litigation provisions of CHF 28 mn in 3Q19 and CHF 22 mn in 3Q18 4 Excl. major litigation provisions of CHF 326 mn in 4Q19 and CHF 82 mn in 4Q18 5 Excl. major litigation provisions of CHF 389 mn in 2019 and CHF 244 mn in 2018 Incl. impact of major litigation +16% Excl. impact of major litigation +11%4 -5%1 -4%2 -1%3 4 -1% -5% -6% +1% -0%5 2019

…continuing to create positive operating leverage 9 February 13, 2020 Group YoY performancein CHF terms Positiveoperating leverage Net revenues Operating expenses 1 Note: Results excluding gains from the InvestLab transfer and SIX revaluation and major litigation provisions are non-GAAP financial measures. For further details and reconciliation information, see Appendix1 Excludes impact of CHF 327 mn related to the transfer of the InvestLab fund platform to Allfunds Group, recorded in SUB, IWM and APAC 2 Excludes impact of CHF 498 mn related to the revaluation of our equity investment in the SIX Group AG, recorded in SUB and IWM 3 Excludes major litigation provisions of CHF 326 mn in 4Q19 and CHF 82 mn in 4Q18 2 -31% -32% 3

We have improved our CET1 ratio in 4Q19… 10 February 13, 2020 CET1 ratio +30 bps

…and continued to strengthen our capital position… 11 February 13, 2020 12.7% 11.5% 12.8% 12.6% CET1 capitalin CHF bn CET1 ratio +1.0 bn

…whilst distributing CHF 1.7 bn of capital to our shareholders in 2019 12 February 13, 2020 CHF 1 bnrepurchased in 2019 Share buyback program CHF 695 mnpaid out in 2019 Dividends

Highlights 13 February 13, 2020

14 February 13, 2020 We have a clear and consistent strategy A leading Wealth Manager… Following a balanced approach between Mature and Emerging Markets in Wealth Management… …with strong Investment Banking capabilities …focusing on UHNW and entrepreneur clients… …serving both our clients’ private wealth and business financial needs

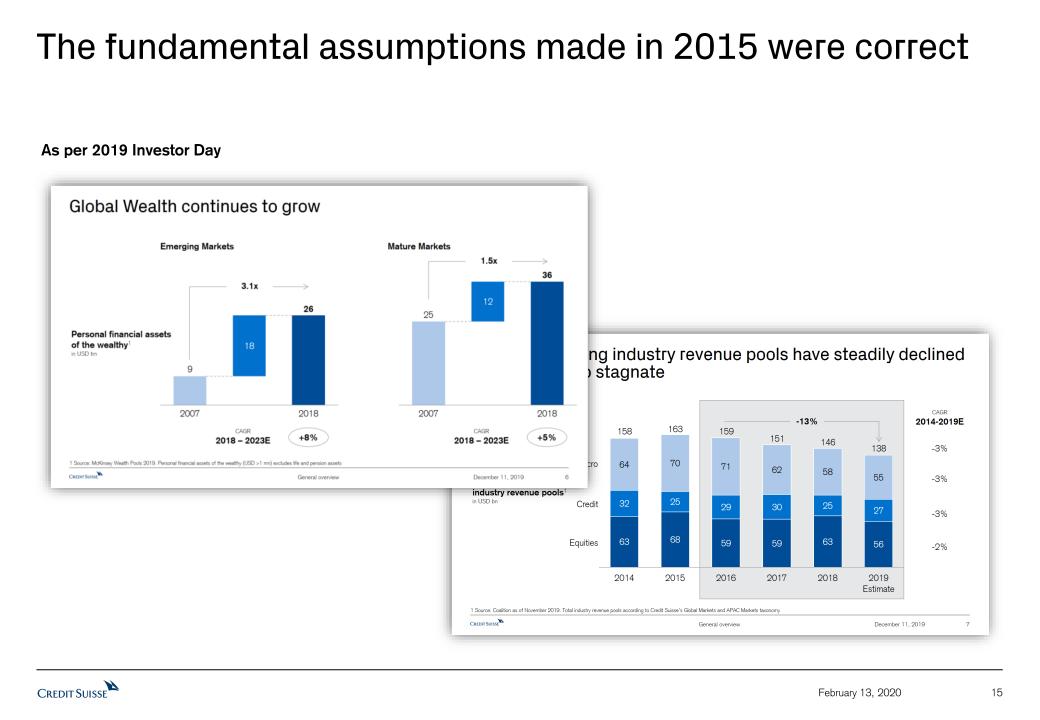

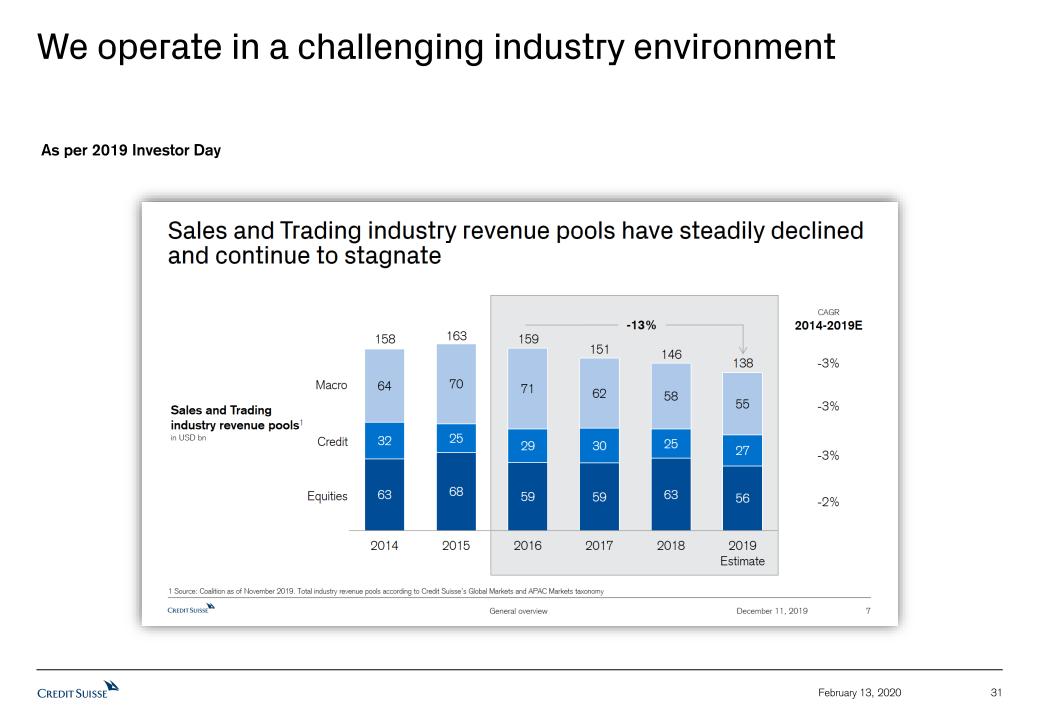

15 February 13, 2020 The fundamental assumptions made in 2015 were correct As per 2019 Investor Day

16 February 13, 2020 We put in place a new organisational structure in 2015 Private Banking & Wealth Management InvestmentBanking Previous structure Swiss Universal Bank International Wealth Management Asia Pacific Investment Banking & Capital Markets Global Markets Current structure

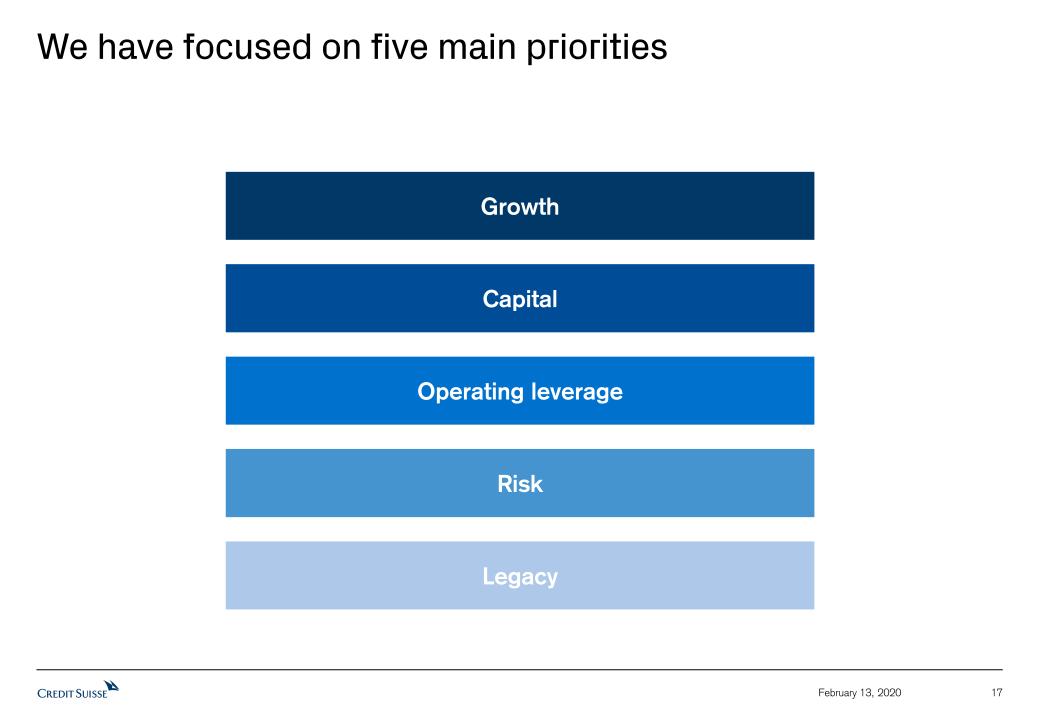

We have focused on five main priorities 17 February 13, 2020 Growth Capital Risk Legacy Operating leverage

We attracted close to CHF 200 bn of net new assets in the last four years… 18 February 13, 2020 Group net new assetsin CHF bn

…driving our asset base to record levels 19 +293 bn Group Assets under Managementin CHF trn February 13, 2020 +6% CAGR2015-2019 Record Group AuM

Our growth in Wealth Management has been profitable 20 February 13, 2020 1 Relating to SUB, IWM and APAC PB within WM&C 2 Excluding impact of CHF 327 mn related to the transfer of the InvestLab fund platform to Allfunds Group, recorded in SUB, IWM and APAC PB within WM&C, and impact of CHF 498 mn related to the revaluation of our equity investment in the SIX Group AG, recorded in SUB and IWM. Results excluding these gains are non-GAAP financial measures. For further details and reconciliation information, see Appendix Wealth Management-related1 pre-tax incomein CHF bn 2 +15% CAGR2015-2019 + CHF 2 bn

Our approach to Wealth Management – building on our understanding of our clients’ needs 21 February 13, 2020 Scalingasset base Compoundinggrowth instable andrecurring revenues Providing institutional qualitysolutions and capabilities Focusing onUHNW and entrepreneurs Beingtrusted advisoracross assets and liabilities Regionalised model aligned to client needs Prioritising compliantgrowth and riskmanagement Increasing RM productivity Growingsustainabilityplatform Offering distinctiveAsset Management capabilities

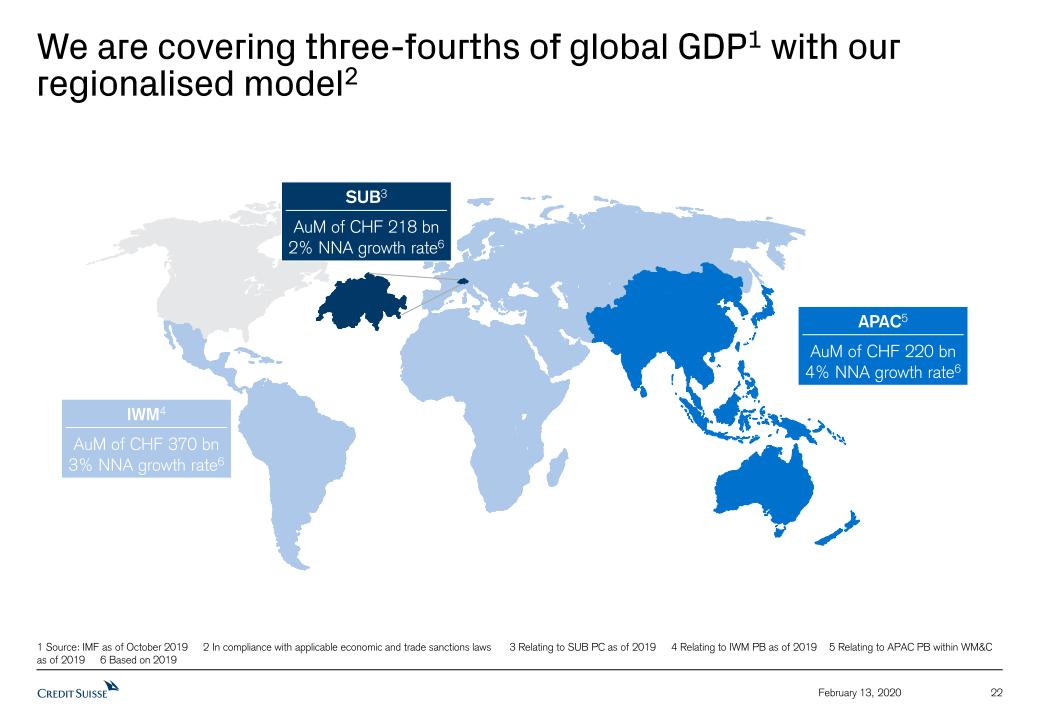

We are covering three-fourths of global GDP1 with our regionalised model2 22 February 13, 2020 1 Source: IMF as of October 2019 2 In compliance with applicable economic and trade sanctions laws 3 Relating to SUB PC as of 2019 4 Relating to IWM PB as of 2019 5 Relating to APAC PB within WM&C as of 2019 6 Based on 2019 IWM4AuM of CHF 370 bn3% NNA growth rate6 APAC5AuM of CHF 220 bn4% NNA growth rate6 SUB3AuM of CHF 218 bn2% NNA growth rate6