UNITED STATES SECURITIES AND EXCHANGE COMMISSION

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 001-15244

(Translation of registrant’s name into English)

Paradeplatz 8, 8001 Zurich, Switzerland (Address of principal executive office)

Commission File Number 001-33434

(Translation of registrant’s name into English)

Paradeplatz 8, 8001 Zurich, Switzerland (Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F  Form 40-F

Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

This report includes the media release and the slides for the presentation to investors in connection with the 2Q20 results and strategic update.

Media Release Zurich, July 30, 2020 | |

Second quarter 2020 financial results

Highest first-half net income of CHF 2.5 billion in a decade1

| - | 2Q20 pre-tax income of CHF 1.6 billion, up 19% year on year; net income attributable to shareholders of CHF 1.2 billion, up 24% year on year; net revenues of CHF 6.2 billion, up 11% year on year |

| - | 2Q20 Return on Tangible Equity (RoTE) of 11.0% |

| - | 1H20 pre-tax income of CHF 2.8 billion, up 16% year on year; net income attributable to shareholders of CHF 2.5 billion, up 47% year on year; net revenues of CHF 12 billion, up 9% year on year |

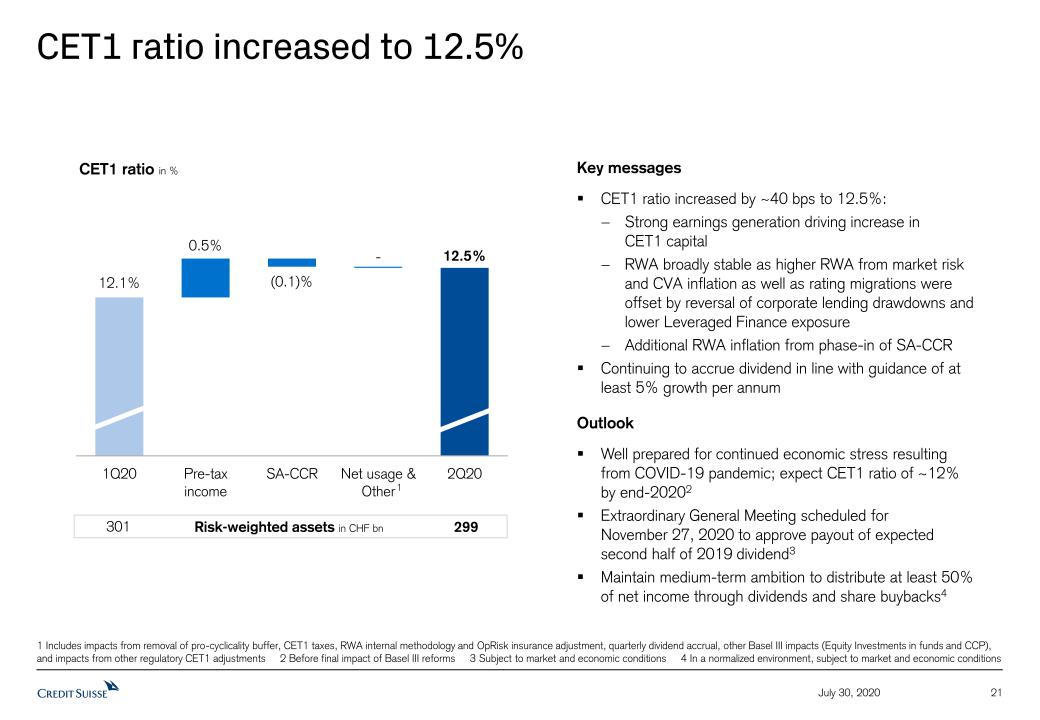

| - | CET1 ratio of 12.5% in 2Q20, up from 12.1% at the end of 1Q20, and Tier 1 leverage ratio of 6.2%2 in 2Q20, up from 5.8% at the end of 1Q20 |

| - | Total Assets under Management (AuM) were CHF 1.4 trillion at the end of 2Q20 |

| - | Net New Assets (NNA) were CHF 9.8 billion for 2Q20, up compared to CHF 5.8 billion in 1Q20; NNA were CHF 15.6 billion for 1H20 |

Urs Rohner, Chairman of the Board of Directors of Credit Suisse Group AG, said: “Thanks to our proven strategy, solid capital position and an agile and well-executed crisis response, Credit Suisse has been able to effectively address the challenges of the COVID-19 pandemic from a position of strength and deliver a very good 1H20 result. In light of the strong 1H20 performance, the Board of Directors expects to distribute the second half of the full dividend amount of CHF 0.2776 gross per share as originally proposed to shareholders for the financial year 2019, subject to approval by shareholders at an Extraordinary General Meeting (EGM) to be held on November 27, 2020, and subject to market and economic conditions.” Thomas Gottstein, Chief Executive Officer of Credit Suisse Group AG, commented: “In a continued volatile market environment, we delivered a strong performance. Despite persistent challenges caused by COVID-19, our employees again showed outstanding commitment and dedication. With an RoTE of 11.0% for the second quarter and 12.0% for the first six months 2020, we delivered on our pre-COVID-19 ambition to achieve an RoTE of approximately 10% for 2020, confirming the resilience of our integrated business model as a leading wealth manager with strong global investment banking capabilities. Amid the turbulent market environment, we were also able to improve our CET1 ratio in the second quarter to 12.5%. Having achieved strong results in the first half of the year, we would like to take this opportunity to reaffirm our strategy and to announce several structural changes, which we will implement going forward. The changes should allow us to extract significant potential to improve effectiveness and efficiency, navigate the current environment with the necessary far-sightedness, and to unlock additional growth potential in the future to the benefit of our clients.” |

Media Release Zurich, July 30, 2020 | |

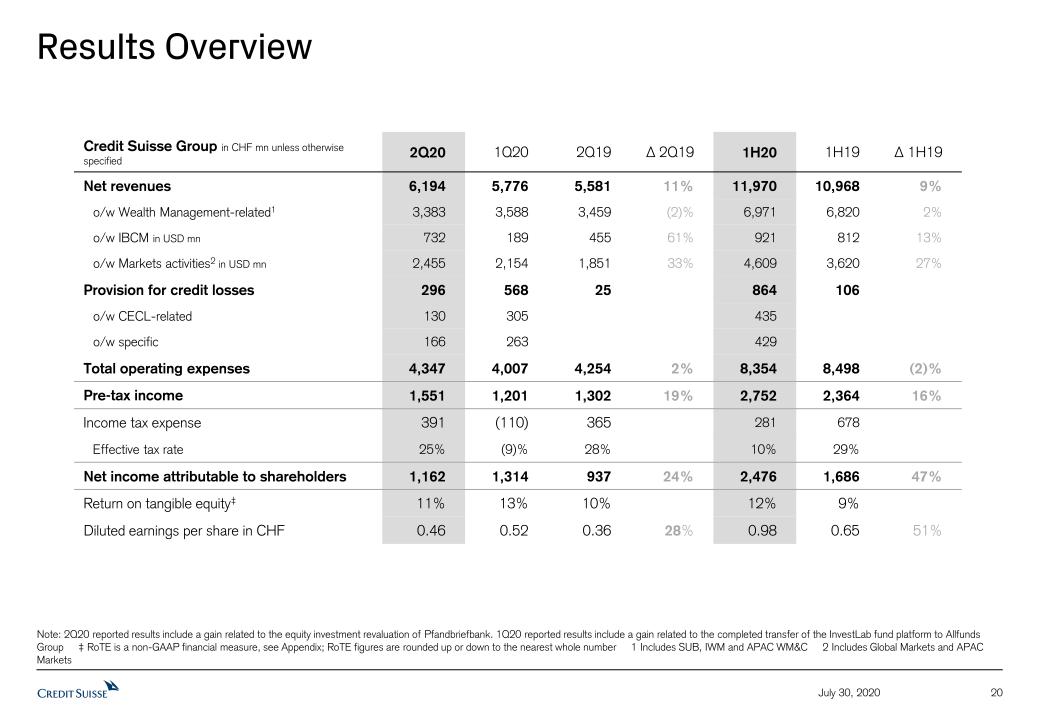

Credit Suisse Group (in CHF million) | 2Q20 | 1Q20 | 2Q19 | ∆2Q19 | | 1H20 | 1H19 | ∆1H19 |

| Net revenues | 6,194 | 5,776 | 5,581 | 11% | 11,970 | 10,968 | 9% |

| Provision for credit losses | 296 | 568 | 25 | - | 864 | 106 | - |

| Total operating expenses | 4,347 | 4,007 | 4,254 | 2% | 8,354 | 8,498 | (2)% |

| Pre-tax income | 1,551 | 1,201 | 1,302 | 19% | 2,752 | 2,364 | 16% |

| Net income attributable to shareholders | 1,162 | 1,314 | 937 | 24% | 2,476 | 1,686 | 47% |

| Return on tangible equity (%) | 11.0 | 13.1 | 9.7 | - | 12.0 | 8.7 | - |

| |

| CET1 capital | 37,346 | 36,332 | 36,394 | 3% | | 37,346 | 36,394 | 3% |

| CET1 ratio (%) | 12.5 | 12.1 | 12.5 | - | 12.5 | 12.5 | - |

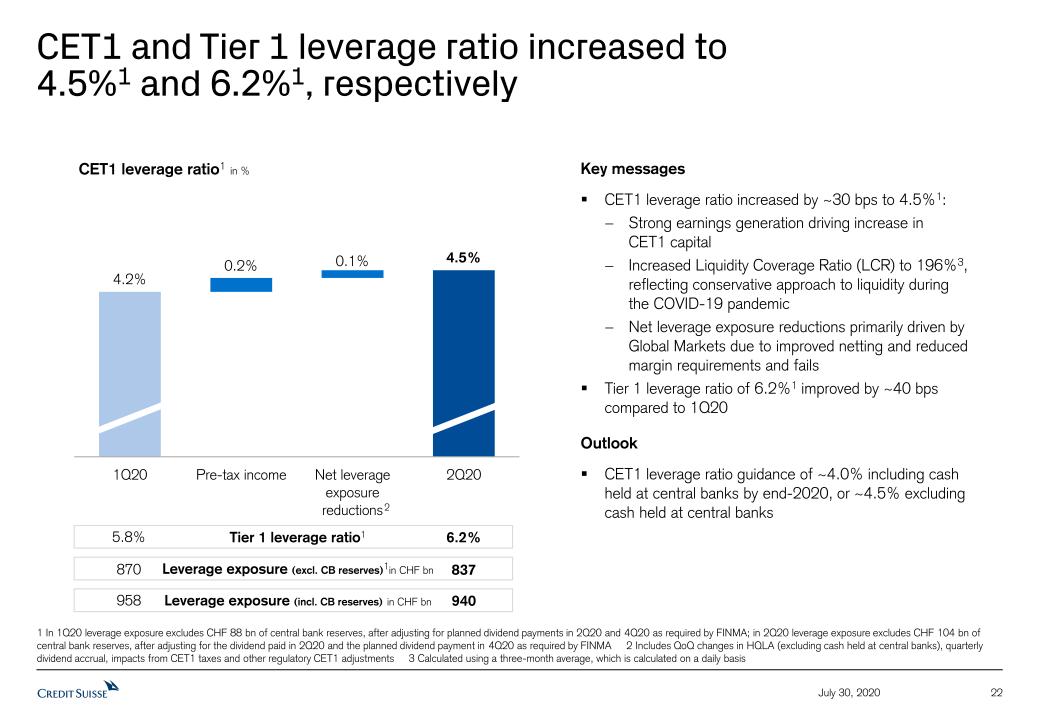

CET1 leverage ratio (%)3 | 4.5 | 4.2 | 4.1 | - | 4.5 | 4.1 | - |

Tier 1 leverage ratio (%)2 | 6.2 | 5.8 | 5.3 | - | 6.2 | 5.3 | - |

SUMMARY

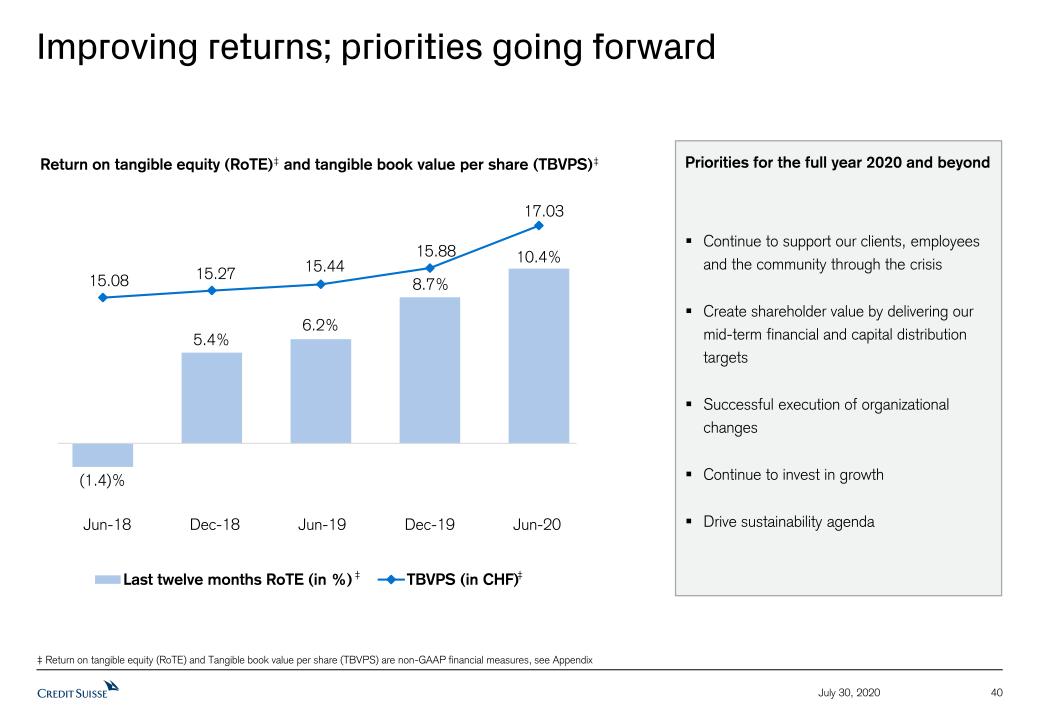

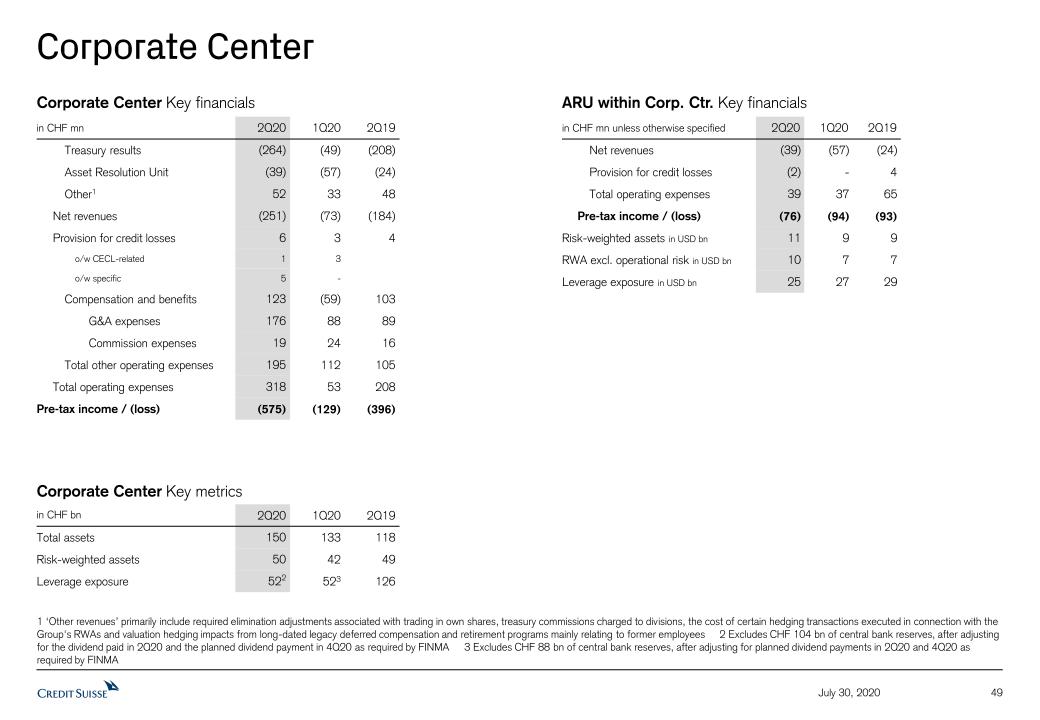

As in the previous quarter, 2Q20 results were heavily influenced by the COVID-19 pandemic. Despite the resulting challenges and continued geopolitical difficulties, profitability significantly increased compared to 2Q19. Pre-tax income of CHF 1.6 billion was up 19% year on year, while net income attributable to shareholders increased by 24% year on year to CHF 1.2 billion, the highest second quarter in a decade. In 1H20, pre-tax income was CHF 2.8 billion, up 16% year on year, and net income attributable to shareholders was CHF 2.5 billion, up 47%, again the highest first six months result in a decade. We delivered positive operating leverage for the 15th consecutive quarter, with higher net revenues of CHF 6.2 billion, up 11% year on year, more than offsetting slightly higher total operating expenses of CHF 4.3 billion, up 2% year on year. 1H20 net revenues were CHF 12.0 billion, up 9% year on year, and total operating expenses were CHF 8.4 billion, down 2%. Our RoTE for 2Q20 was 11.0%, for 1H20 it was 12.0% and over the last twelve months it was 10.4%, all in excess of our pre-COVID-19 ambition of approximately 10% for 2020.

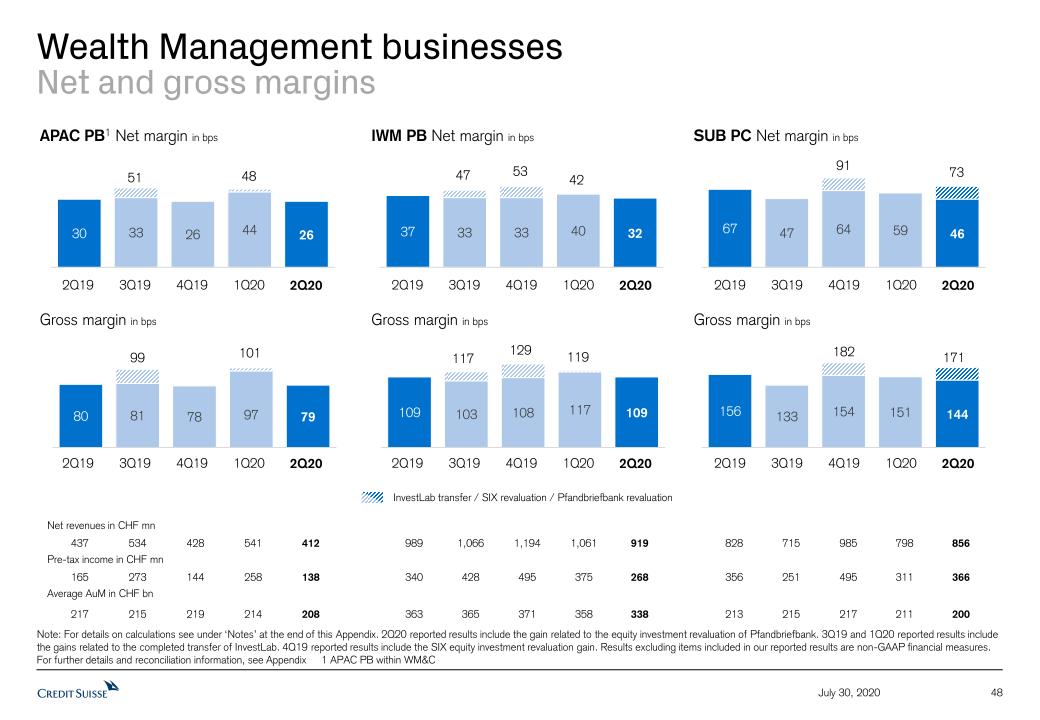

Our Private Banking businesses4 delivered a solid performance in 2Q20, with slightly lower net revenues, down 3% year on year, mainly reflecting stable transaction-based revenues, as well as lower recurring revenues, down 11%, and slightly lower net interest income, down 3%. For 1H20, net revenues were up 4% year on year. On an FX-adjusted basis, net revenues would have been stable in 2Q205 and up 8% in 1H206, year on year.

Total Investment Banking7 net revenues in 2Q20 were up 38% year on year, on a US dollar basis, benefitting from a diversified portfolio, with IBCM net revenues up 61% and Markets activities8 net revenues up 33% year on year. For 1H20, total Investment Banking7 net revenues were up 25% year on year, on a US dollar basis.

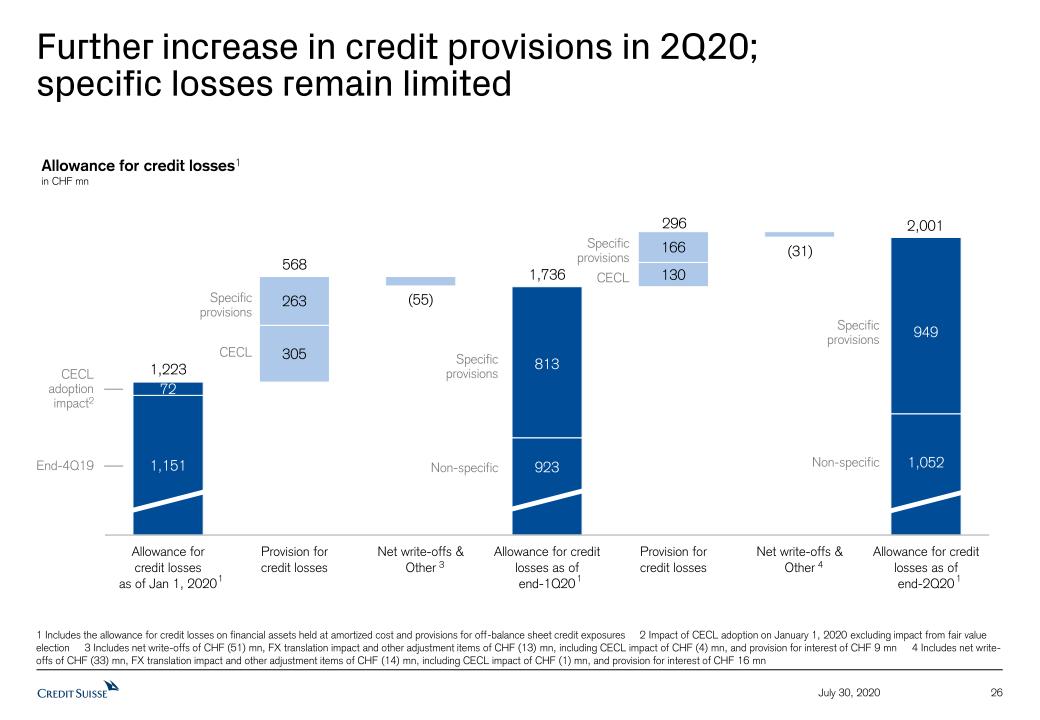

To reflect the challenging economic environment, we recorded CHF 296 million additional provision for credit losses in 2Q20, of which CHF 130 million were related to the recently implemented CECL methodology under US GAAP. In 1H20, we absorbed provision for credit losses of CHF 864 million, of which CHF 435 million were CECL-related. Our 1H20 provision for credit losses was 12 times higher than the average of the last ten years of first six months credit provisions, demonstrating both the degree

Media Release Zurich, July 30, 2020 | |

of challenges in the current environment but also the resilience of our integrated business model given the strong profitability.

We recorded NNA of CHF 9.8 billion across our businesses in 2Q20, with CHF 5.9 billion in IWM, CHF 4.5 billion in APAC and flat NNA in SUB. Our AuM were stable in 2Q20, compared to 1Q20, at CHF 1.4 trillion, with favorable market movements significantly offsetting negative foreign exchange-related effects. Total NNA for 1H20 were CHF 15.6 billion, with CHF 0.6 billion in SUB, CHF 9.7 billion in IWM and CHF 7.5 billion in APAC. Pure Private Banking4 NNA were CHF 4.7 billion in 2Q20 and CHF 7.2 billion for the first half 2020.

Our capital position at the end of 2Q20 remained strong, with a CET1 ratio of 12.5% compared to 12.1% at the end of 1Q20, as a result of our resilient and diversified business model as well as organic capital generation. Our Tier 1 leverage ratio was 6.2% at the end of 2Q20, up from 5.8% at the end of 1Q20, driven by higher Tier 1 capital and lower leverage exposure2.

Following our successful restructuring and repositioning years and the strong 2Q20 results, Credit Suisse reaffirms its strategy as a leading wealth manager with strong global investment banking capabilities. We intend to launch a series of structural improvements and investment initiatives, delivering additional financial benefits for our shareholders for the coming years. The strategic update was announced separately this morning.

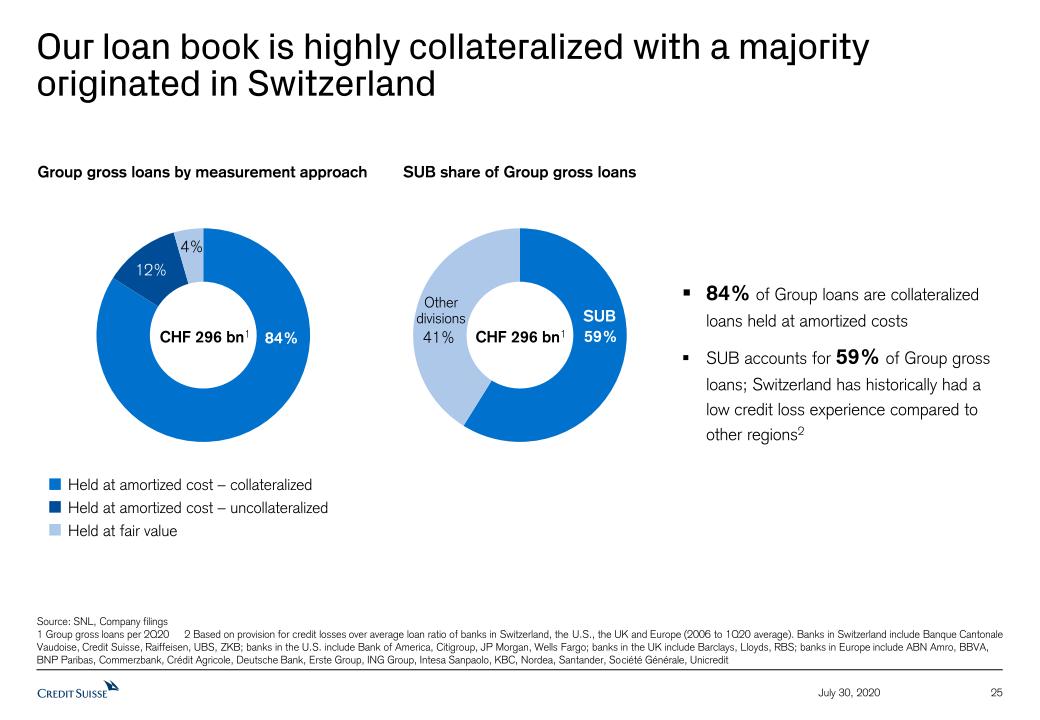

OUTLOOK Our strong 2Q20 and first half results have confirmed the strength and resilience of our integrated business model, delivering double-digit return on tangible equity. While the scale of the adverse economic impact of the COVID--19 crisis and path to recovery is still difficult to assess, the US GAAP CECL approach to provisioning should generally lead to earlier recognition of potential credit losses. Moreover, a substantial proportion of our overall loan book is collateralized and our profitable and resilient operations in our Swiss home market have historically experienced low credit losses. While US dollar interest rate headwinds are likely to persist, we expect a more stable net interest income performance from our Swiss Franc-denominated business. In recent months, capital markets have worked effectively to allow for refinancing of corporates around the world and we expect this trend to continue. Although elevated activity levels have subsided in our trading and transaction-based businesses, we expect volatility to persist and present opportunities to support our clients. We are accelerating the pace of change to make our organization even more effective in how we serve our clients and generate efficiencies for further growth investments and for our continued digitalization efforts across all of our divisions. We believe we are well prepared for further potential risks from COVID-19 as well as increased geopolitical uncertainties and can maintain a resilient financial performance and robust capital position through this challenging period. |

Media Release Zurich, July 30, 2020 | |

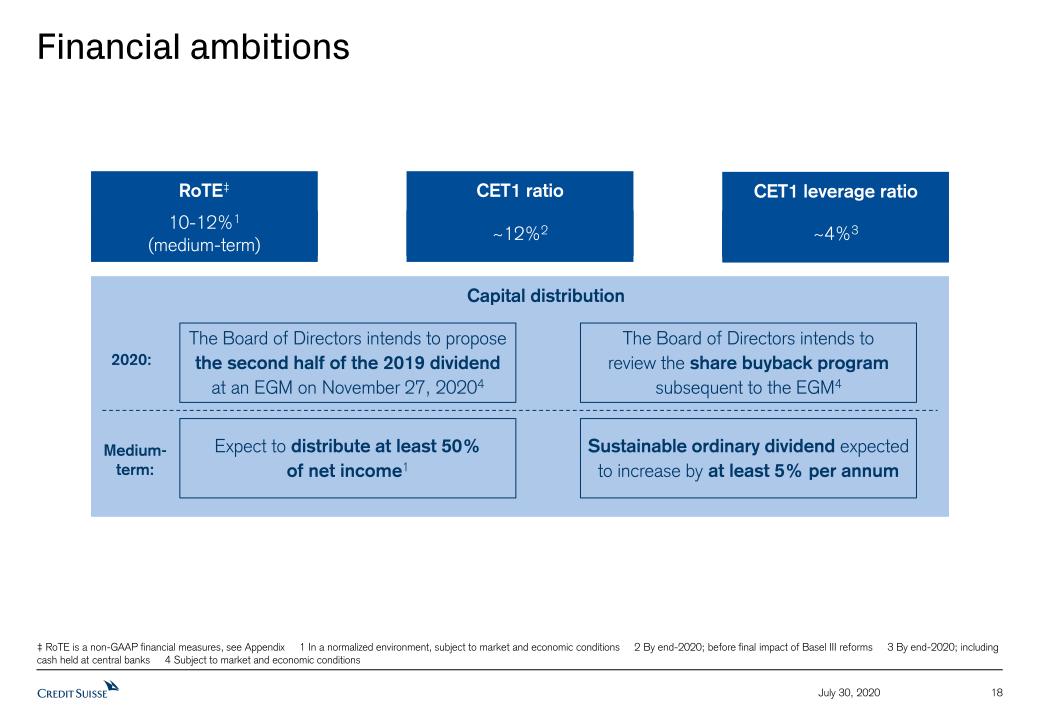

CAPITAL DISTRIBUTION

In light of the strong 1H20 performance, we expect to distribute the full dividend amount of CHF 0.2776 gross per share as originally proposed to shareholders for the financial year 2019. To this end, the Board of Directors intends to propose a second dividend distribution equal to the first distribution of CHF 0.1388 gross per share for approval by shareholders at an EGM to be held on November 27, 2020, subject to market and economic conditions and according to the Ordinance of the Swiss Federal Council regarding measures on combatting the coronavirus.

The Board of Directors intends to review our 2020 share buyback program subsequent to the EGM, subject to market and economic conditions. In 1Q20, prior to the suspension of the program, we bought back 28.5 million shares for a total of CHF 325 million under the current program.

In the medium term, in a normalized environment, we expect to distribute at least 50% of our net income to our shareholders, subject to market and economic conditions. We continue to intend to sustainably increase our ordinary dividend by at least 5% per annum. To that end, we have been accruing for the 2020 dividend accordingly.

Media Release Zurich, July 30, 2020 | |

DETAILED DIVISIONAL SUMMARIES

Swiss Universal Bank (SUB)

SUB (in CHF million) | 2Q20 | 1Q20 | 2Q19 | ∆2Q19 | | 1H20 | 1H19 | ∆1H19 |

| Net revenues | 1,504 | 1,509 | 1,476 | 2% | 3,013 | 2,855 | 6% |

| Provision for credit losses | 30 | 124 | 10 | - | 154 | 39 | - |

| Total operating expenses | 787 | 796 | 812 | (3)% | 1,583 | 1,612 | (2)% |

| Pre-tax income | 687 | 589 | 654 | 5% | 1,276 | 1,204 | 6% |

| Cost/income ratio (%) | 52 | 53 | 55 | - | 53 | 56 | - |

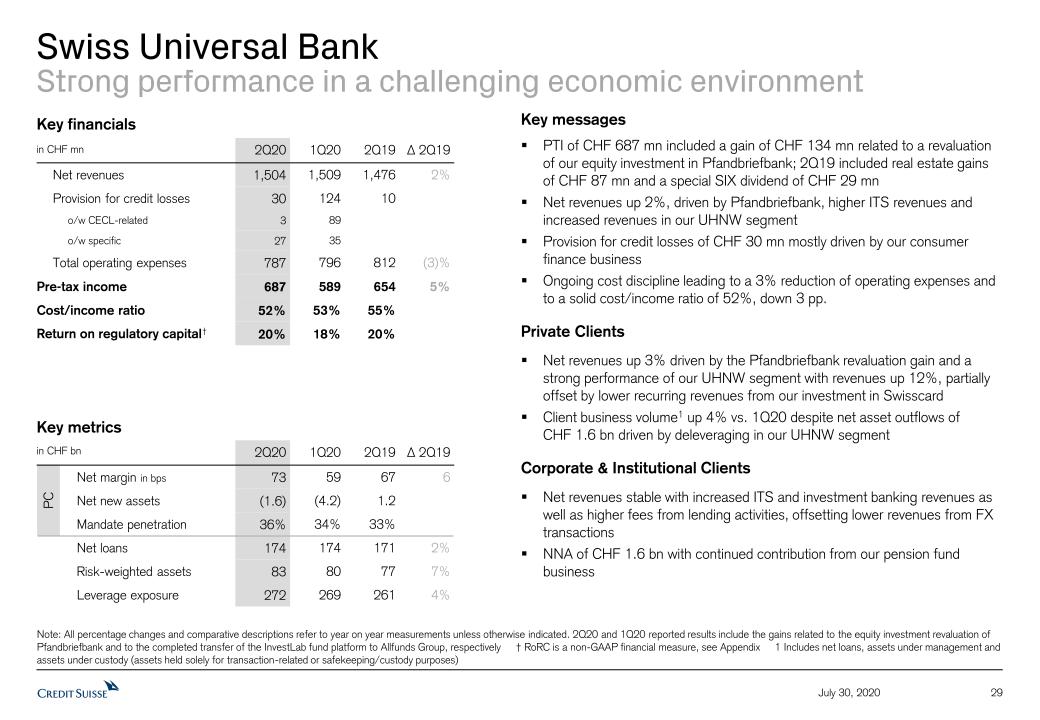

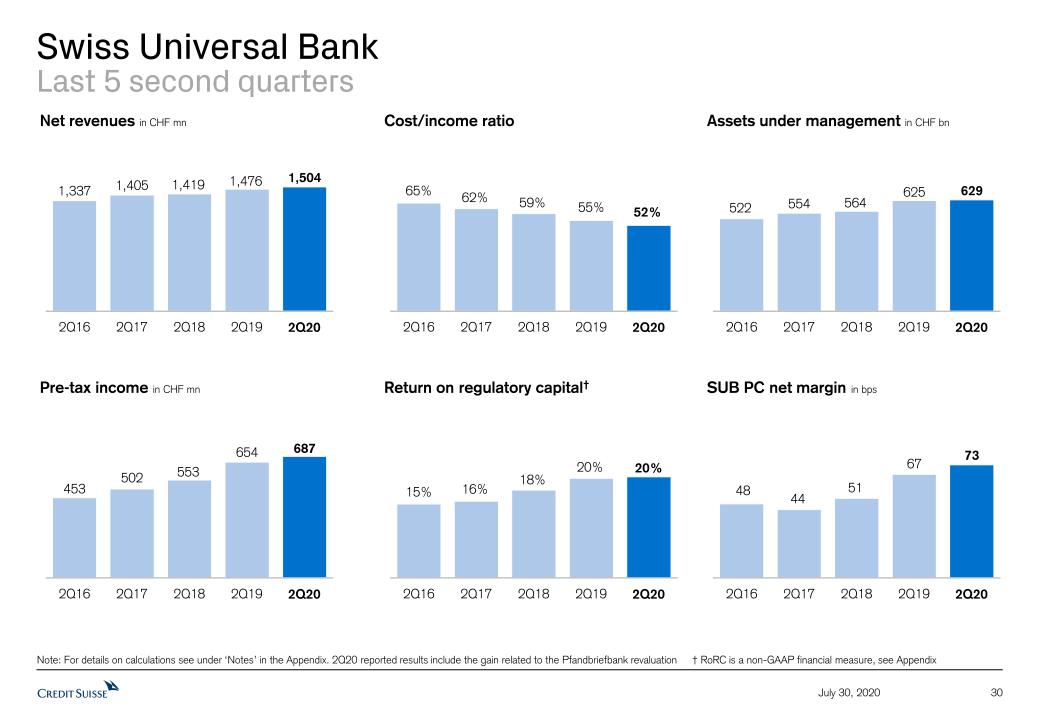

In a challenging economic environment, SUB recorded a strong pre-tax income of CHF 687 million in 2Q20, up 5% year on year. Net revenues increased by 2% year on year to CHF 1.5 billion, including a gain from the revaluation of our equity investment in Pfandbriefbank9; during 2Q19, revenues reflected real estate gains and a special SIX dividend10. Higher revenues from our collaboration with Global Markets (GM) and International Wealth Management (IWM) – International Trading Solutions (ITS), as well as increased revenues in our ultra-high-net-worth client segment further contributed to our revenues. Total operating expenses were down 3% year on year in 2Q20; our ongoing cost discipline helped fund continued investments in digitalization and selected hires. As a result, the cost/income ratio in 2Q20 was 52%. Provision for credit losses of CHF 30 million was mostly driven by Private Clients, primarily related to our consumer finance business.

Private Clients generated pre-tax income of CHF 366 million in 2Q20, up 3% year on year. Net revenues of CHF 856 million increased by 3% year on year, driven by the Pfandbriefbank revaluation gain9 and increased revenues in our ultra-high-net-worth client segment. This was partially offset by lower recurring revenues, primarily relating to our investment in Swisscard; additionally, 2Q19 net revenues included real estate gains11. AuM increased by 4% to CHF 202 billion compared to 1Q20, mainly due to favorable market developments. Net asset outflows of CHF 1.6 billion were partially driven by deleveraging in our ultra-high-net-worth client segment.

Corporate & Institutional Clients reported pre-tax income of CHF 321 million, up 8% year on year. Net revenues were stable year on year, with higher revenues from ITS and our Swiss investment banking business as well as higher fees from lending activities, which helped to offset decreased revenues from our foreign exchange business. AuM of CHF 427 billion increased by 5% compared to 1Q20. NNA in 2Q20 were CHF 1.6 billion, reflecting positive momentum in our pension fund business.

Media Release Zurich, July 30, 2020 | |

International Wealth Management (IWM)

IWM (in CHF million) | 2Q20 | 1Q20 | 2Q19 | ∆2Q19 | | 1H20 | 1H19 | ∆1H19 |

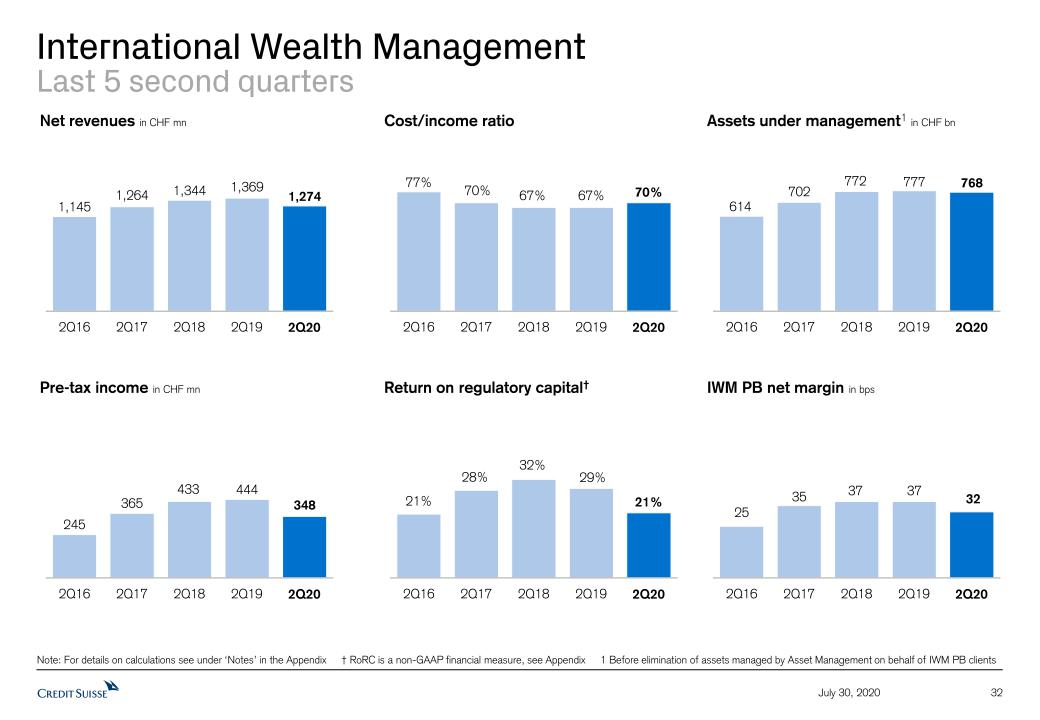

| Net revenues | 1,274 | 1,502 | 1,369 | (7)% | 2,776 | 2,786 | - |

| Provision for credit losses | 35 | 39 | 9 | - | 74 | 19 | - |

| Total operating expenses | 891 | 926 | 916 | (3)% | 1,817 | 1,800 | 1% |

| Pre-tax income | 348 | 537 | 444 | (22)% | 885 | 967 | (8)% |

| Cost/income ratio (%) | 70 | 62 | 67 | - | 66 | 65 | - |

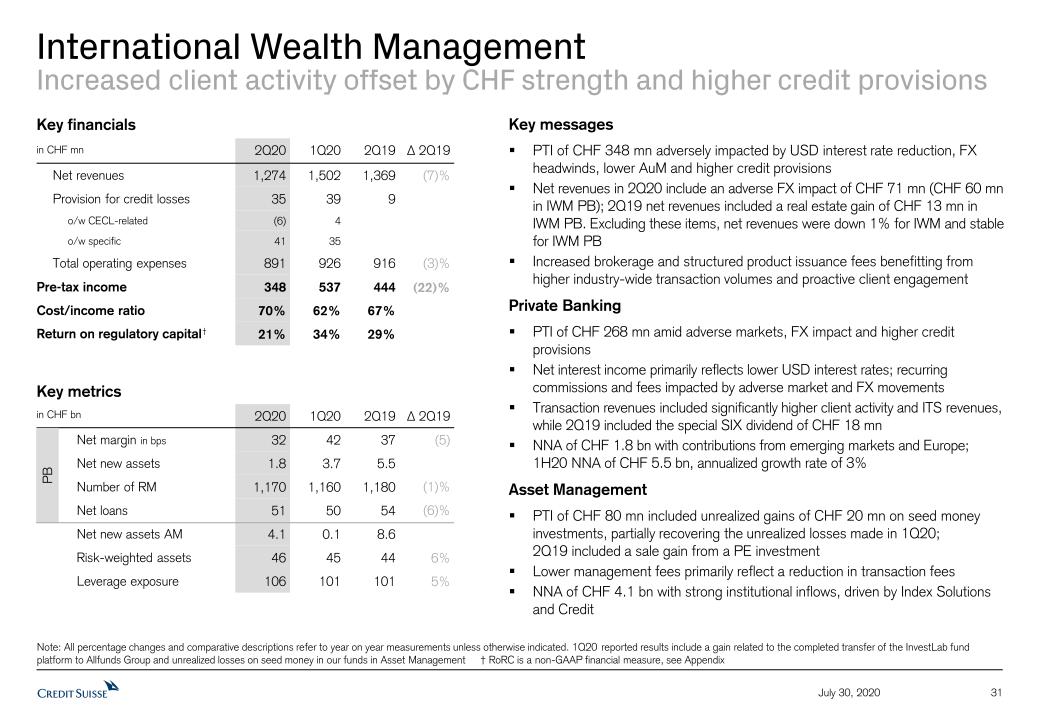

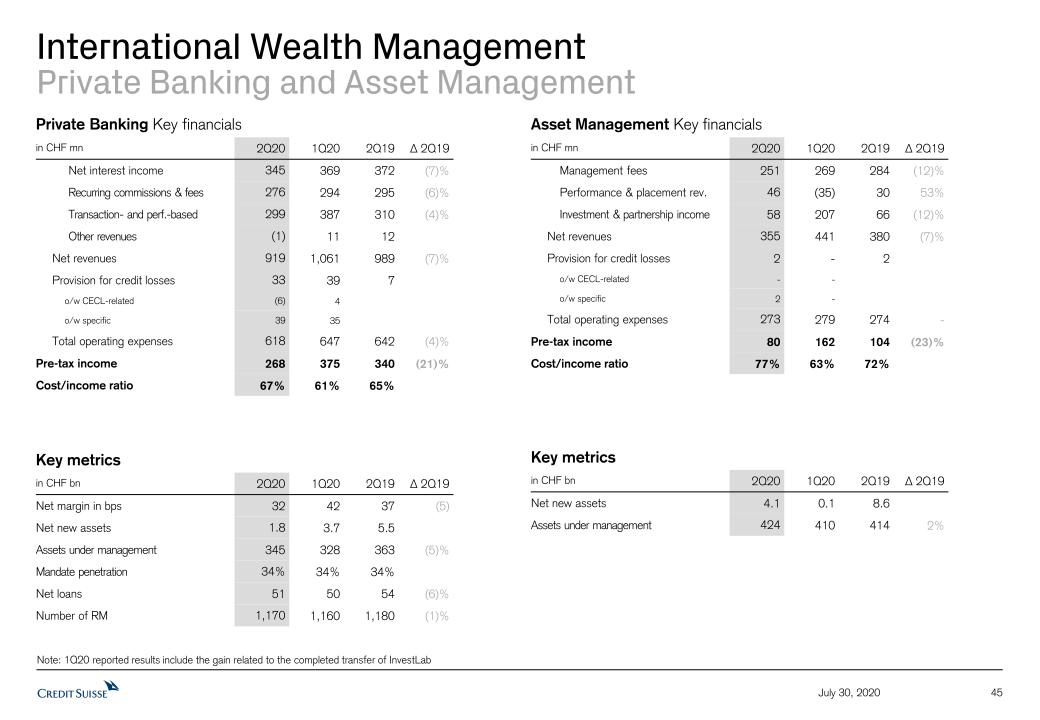

IWM’s results in 2Q20 continued to be supported by higher levels of client activity, which was offset by certain adverse market impacts and higher credit provisions. Pre-tax income in 2Q20 decreased 22% year on year to CHF 348 million, with net revenues down 7% and higher credit provisions, partially offset by lower operating expenses, down 3% year on year. IWM recorded a return on regulatory capital of 21% and solid NNA of CHF 5.9 billion for 2Q20.

Private Banking recorded pre-tax income of CHF 268 million in 2Q20, down 21% year on year, affected by higher credit provisions and lower net revenues of CHF 919 million in 2Q20, down 7% year on year. Net revenues benefitted from higher client activity, which was more than offset by lower net interest income and recurring commissions and fees. Within transaction- and performance-based revenues, significantly higher brokerage and structured product issuance fees benefited from higher industry-wide transaction volumes and proactive client engagement. Net interest income in part reflected the impact of further reductions in US dollar interest rates. Recurring commissions and fees declined in line with AuM, which were negatively impacted by FX movements. NNA stood at CHF 1.8 billion with solid contributions from emerging markets and Europe, bringing the half year 2020 total to CHF 5.5 billion at an annualized growth rate of 3%.

Asset Management’s pre-tax income in 2Q20 decreased 23% year on year to CHF 80 million, with a 7% decline in net revenues and stable operating expenses. Lower revenues mainly reflect decreased management fees, primarily due to a reduction in real estate-related transaction fees. Performance and placement revenues and investment and partnership income in 2Q20 included unrealized gains of CHF 20 million on seed money investments, partially recovering unrealized losses in 1Q20. NNA of CHF 4.1 billion in 2Q20, reflecting strong institutional inflows, driven by Index Solutions and Credit.

Media Release Zurich, July 30, 2020 | |

Asia Pacific (APAC)

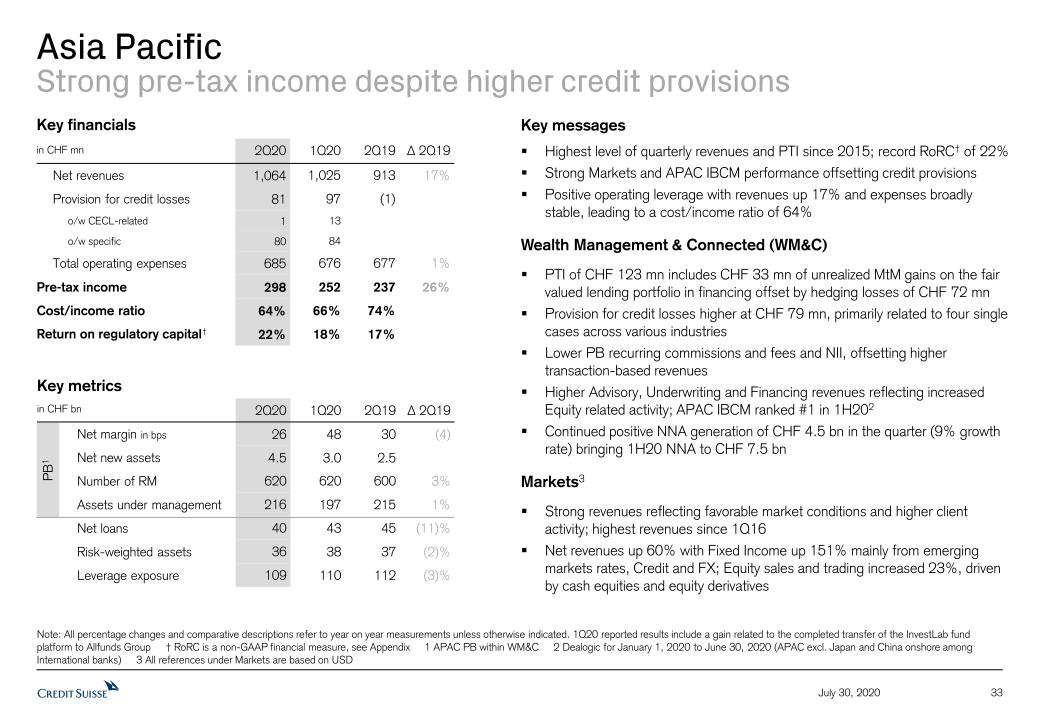

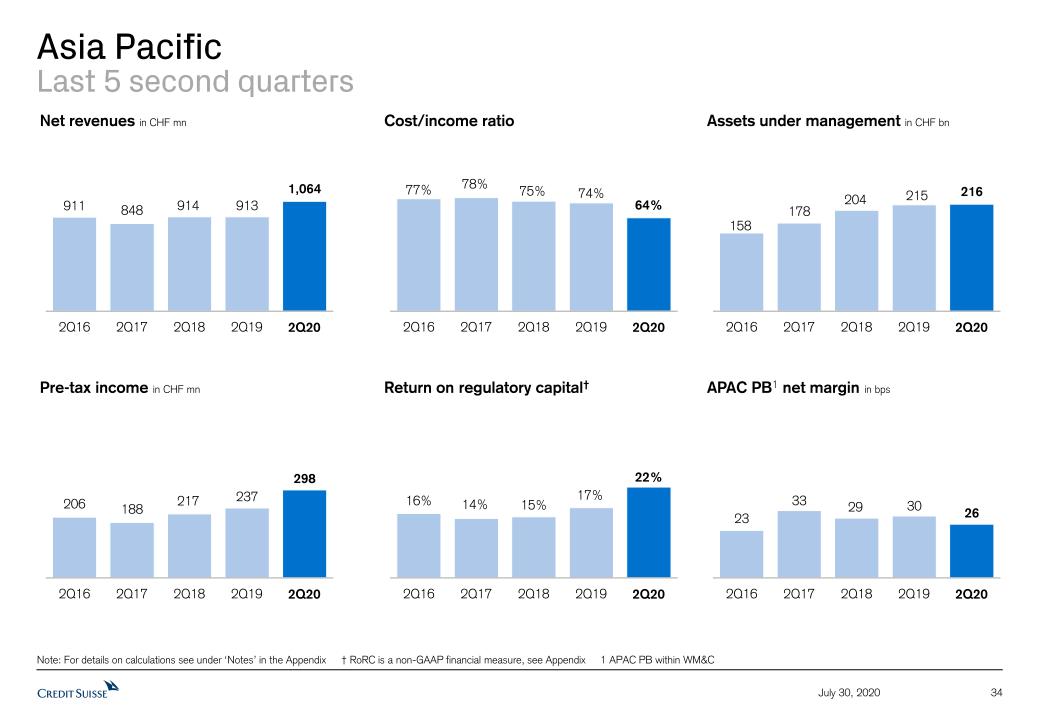

APAC (in CHF million) | 2Q20 | 1Q20 | 2Q19 | ∆2Q19 | | 1H20 | 1H19 | ∆1H19 |

| Net revenues | 1,064 | 1,025 | 913 | 17% | 2,089 | 1,767 | 18% |

| Provision for credit losses | 81 | 97 | (1) | - | 178 | 16 | - |

| Total operating expenses | 685 | 676 | 677 | 1% | 1,361 | 1,331 | 2% |

| Pre-tax income | 298 | 252 | 237 | 26% | 550 | 420 | 31% |

| Cost/income ratio (%) | 64 | 66 | 74 | – | 65 | 75 | - |

APAC delivered pre-tax income of CHF 298 million in 2Q20, a record since the formation of the division and up 26% year on year, with strong revenues of CHF 1.1 billion, up 17% year on year. These results were supported by higher performance in both our Markets business and our advisory, underwriting and financing business within Wealth Management & Connected (WM&C). Operating expenses for APAC in 2Q20 were stable year on year. APAC delivered a return on regulatory capital of 22% in 2Q20 and a cost/income ratio of 64%. In APAC, we recorded provision for credit losses of CHF 81 million.

WM&C reported pre-tax income of CHF 123 million in 2Q20, down 43% year on year and impacted by a provision for credit losses of CHF 79 million. Our Private Banking revenues were down 6% year on year, driven by lower recurring commissions and fees and lower net interest income. In 2Q20, we recorded AuM of CHF 216 billion and generated strong NNA of CHF 4.5 billion, supported by deposit inflows from Japan, Southeast Asia and Greater China. Advisory, underwriting and financing revenues for the quarter were up 9% year on year, reflecting higher equity-related activities. Unrealized mark-to-market gains on the fair valued lending portfolio in financing were offset by hedge losses. APAC advisory, underwriting and financing ranked as number 1 in terms of share of wallet in the first half of 202012, continuing our market leadership from 2019.

Markets delivered strong pre-tax income of USD 182 million in 2Q20, compared to pre-tax income of USD 21 million in 2Q19. Net revenues were up 60% year on year, supported by higher client activity across both equity and fixed income sales and trading. Equity sales and trading revenues were up 23% year on year, with a strong performance in equity derivatives and cash equities. Fixed income sales and trading revenues were up by 151% year on year, driven by emerging markets rates, credit and FX products.

Media Release Zurich, July 30, 2020 | |

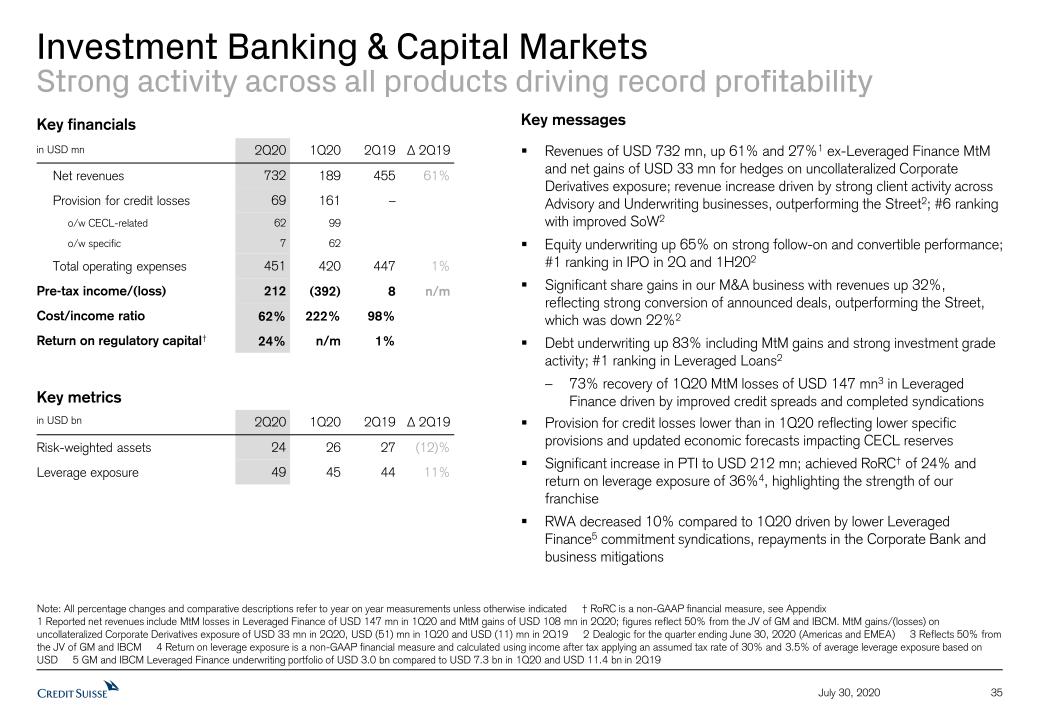

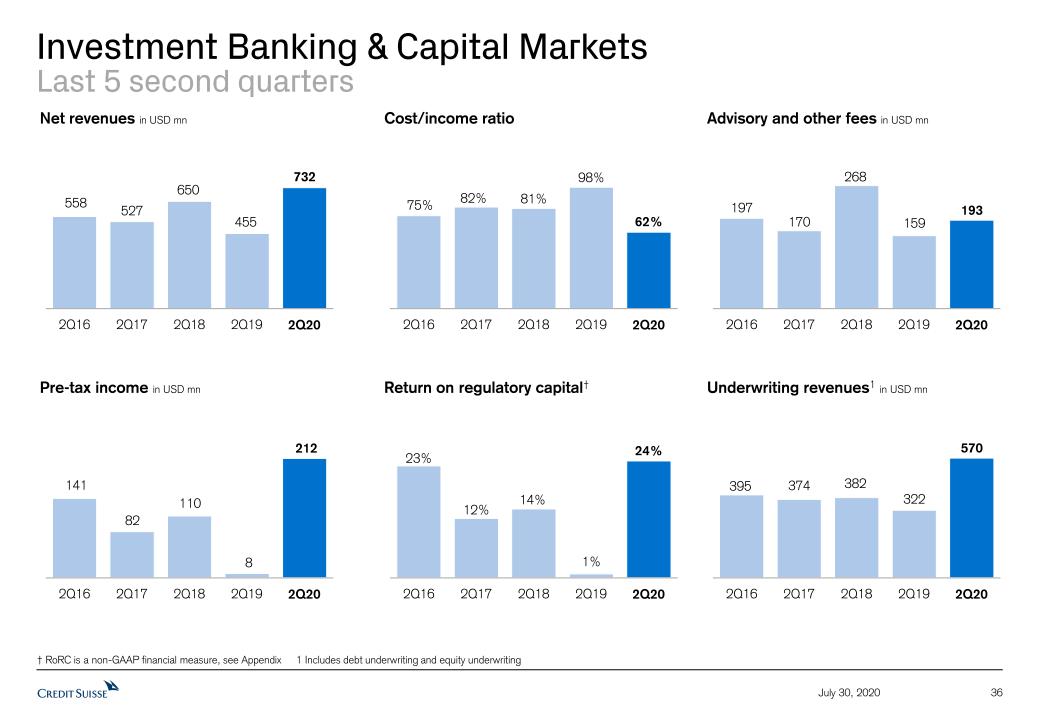

Investment Banking & Capital Markets (IBCM)

IBCM (in USD million) | 2Q20 | 1Q20 | 2Q19 | ∆2Q19 | | 1H20 | 1H19 | ∆1H19 |

| Net revenues | 732 | 189 | 455 | 61% | 921 | 812 | 13% |

| Provision for credit losses | 69 | 161 | 0 | - | 230 | 8 | - |

| Total operating expenses | 451 | 420 | 447 | 1% | 871 | 890 | (2)% |

| Pre-tax income/loss | 212 | (392) | 8 | - | (180) | (86) | - |

| Cost/income ratio (%) | 62 | 222 | 98 | - | 95 | 110 | - |

IBCM reported net revenues of USD 732 million for 2Q20, up 61% year on year, driven by strong client activity across debt and equity underwriting and advisory, despite the global market disruption that continued throughout the quarter. We reported pre-tax income of USD 212 million, compared to pre-tax income of USD 8 million in 2Q19. Total operating expenses were slightly up year on year at USD 451 million. We recorded provision for credit losses of USD 69 million in 2Q20, reflecting the impact of macroeconomic factors under the recently implemented CECL methodology.

Advisory revenues were up 21% year on year at USD 193 million, reflecting strong conversions of announced deals, including the closings of several large deals during the quarter. Advisory revenues were up significantly compared to the Street13, which was down 22% year on year.

Equity underwriting revenues were up 65% year on year at USD 183 million, driven by strong follow-on and convertible performance. Equity underwriting revenues were in line with the Street’s performance, which was up 63% year on year13. Credit Suisse ranked number 1 in global IPOs for both the second quarter and the first half of 2020, a position which we last held in 200114.

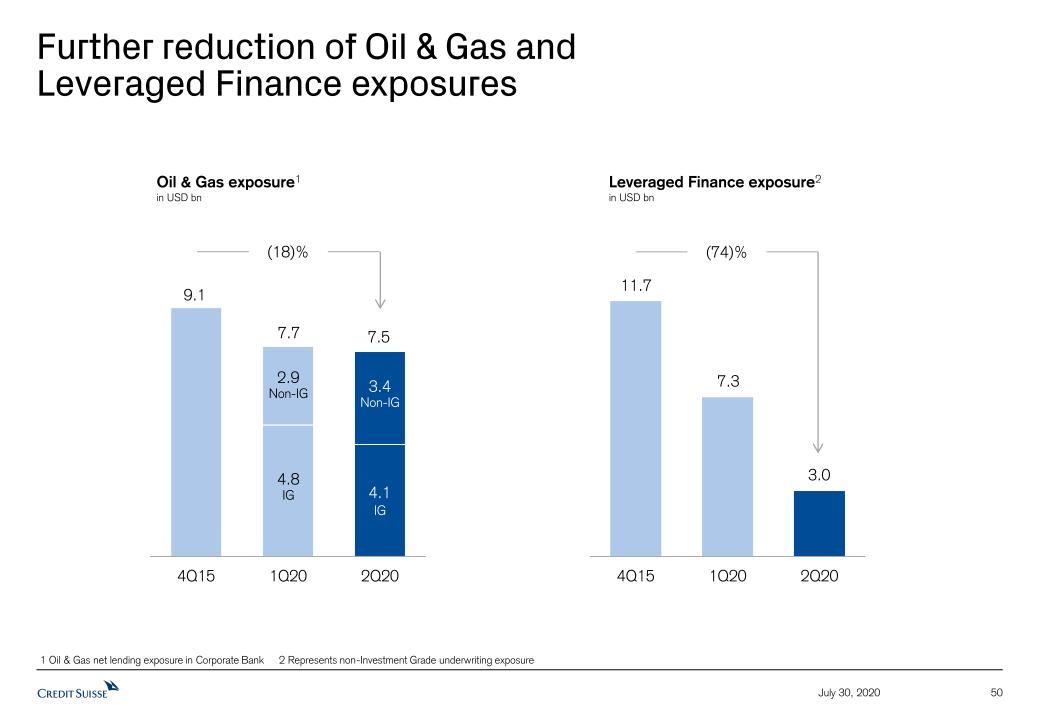

Debt underwriting revenues were up 83% year on year at USD 387 million, primarily driven by mark-to-market gains on leveraged finance underwriting commitments, strong revenues from investment grade debt issuance and net gains on hedges for our corporate derivatives portfolio. We reported a 73% recovery of our first quarter’s mark-to-market losses of USD 147 million in our leveraged finance underwriting portfolio, led by improved credit and large successful syndications.

In terms of strategic initiatives, IBCM recently formed an Environmental, Social and Governance (ESG) Advisory Group tasked with capturing future investment banking opportunities through the identification of new high-growth clients that are addressing global ESG challenges as well as advising existing clients on sustainable growth and finance opportunities.

Media Release Zurich, July 30, 2020 | |

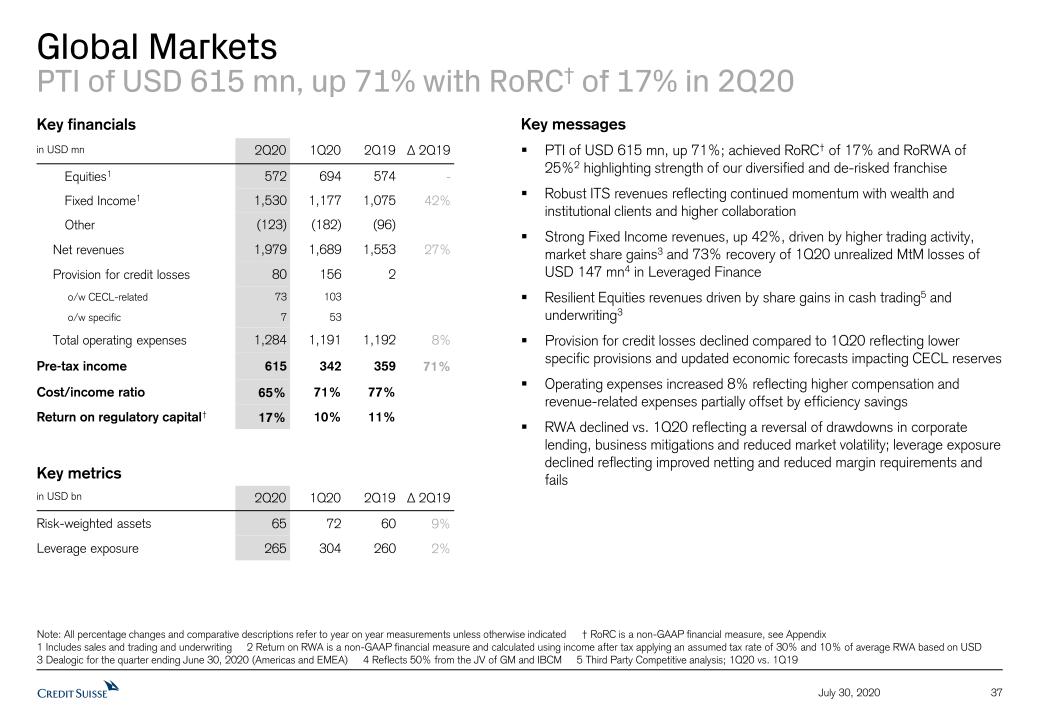

Global Markets (GM)

GM (in USD million) | 2Q20 | 1Q20 | 2Q19 | ∆2Q19 | | 1H20 | 1H19 | ∆1H19 |

| Net revenues | 1,979 | 1,689 | 1,553 | 27% | 3,668 | 3,031 | 21% |

| Provision for credit losses | 80 | 156 | 2 | - | 236 | 13 | - |

| Total operating expenses | 1,284 | 1,191 | 1,192 | 8% | 2,475 | 2,376 | 4% |

| Pre-tax income/loss | 615 | 342 | 359 | 71% | 957 | 642 | 49% |

| Cost/income ratio (%) | 65 | 71 | 77 | - | 68 | 78 | - |

GM achieved pre-tax income of USD 615 million, up 71% year on year, with a return on regulatory capital of 17%, in 2Q20. Our diversified client franchise delivered the best second quarter revenue performance since 2015, highlighting the strength of our de-risked business model. Net revenues of USD 2 billion in 2Q20 increased 27% year on year, driven by strong fixed income sales and trading results and increased underwriting activity as well as constructive market conditions. Total operating expenses in 2Q20 increased 8% year on year reflecting increased compensation and benefits and higher revenue related expenses, partially offset by continued efficiency savings. Additionally, we recorded provision for credit losses of USD 80 million, primarily reflecting the impact of macroeconomic factors under the recently implemented CECL methodology.

Fixed income15 revenues of USD 1.5 billion in 2Q20 increased 42% year on year, driven by higher trading and financing activity and market share gains16 across credit, macro and emerging markets products. In addition, results benefitted from a 73% recovery of unrealized mark-to-market losses of USD 147 million in leveraged finance incurred in 1Q20.

Equities17 revenues of USD 572 million in 2Q20 were stable year on year, with increasing market share in cash equities trading18 and underwriting 19.

We continue to see strong momentum in our ITS business driven by increased collaboration with IWM and SUB to serve our wealth management, institutional and corporate clients.

Media Release Zurich, July 30, 2020 | |

ONGOING COMMITMENT TO SOCIETY AND SUSTAINABILITY

The safety of our employees, clients and communities remained the highest priority in 2Q20. During the pandemic, we have enabled 90% of our staff globally to work from home and we have offered free antibody testing to our employees. So far, more than 6,000 tests have been conducted in Switzerland, with a global roll-out now under preparation. We continued to offer paid family leave until schools reopened, and launched an initiative in July to explore new ways of working, with Switzerland being the first trial market of a broader study.

Credit Suisse continued to play a critical role in the bridging loan solution for Swiss companies that was introduced on March 25, 2020. Since the start of the Swiss SME support program and shortly before its official expiration, we granted around 16,500 COVID-19 bridging loans with a total volume of approximately CHF 3.2 billion as of today.

Credit Suisse’s global donation matching campaign, encouraging employee donations to charities, including those working to alleviate the impact of the COVID-19 pandemic and to support those affected by inequality, raised CHF 25 million, benefiting 1,400 charitable organizations. Also, in response to the challenges brought about by the COVID-19 pandemic, Credit Suisse offers ongoing support to its non-profit partner organizations by providing flexibility in how grants are spent, including providing some emergency funding to partners in the US and India. Additionally, where possible, employee volunteering assignments have been and are being shifted to virtual settings.

Our Impact Advisory and Finance (IAF) Department continued to drive key initiatives to further the bank’s sustainable and impact investing agenda in 2Q20. Over the quarter, Credit Suisse was involved in the issuance of over USD 5.5 billion of green bonds20. Furthermore, in May, Credit Suisse announced the successful pricing of its inaugural green bond, which raised EUR 500 million in proceeds to be allocated to eligible green projects or assets as defined by our Green Finance Framework.

In June, Credit Suisse Asset Management and IAF launched the Credit Suisse (Lux) Environmental Impact Equity Fund, which will invest in publicly traded, mostly small and mid-cap companies that provide products, services and technologies aimed at solving the most pressing environmental challenges such as climate change, pollution and natural resource depletion. Also in June, Credit Suisse became a member of the International Corporate Governance Network, an investor-led organization that promotes best standards of corporate governance and investor stewardship, globally. Additionally, Credit Suisse published its annual International Finance Corporation Operating Principles for Impact Management disclosure statement.

Finally, the bank sponsored the Asian Venture Philanthropy Network (virtual) conference in APAC, showcasing Credit Suisse’s contributions to collective impact, shared learning and capacity building in the region.

Media Release Zurich, July 30, 2020 | |

CONTACT DETAILS

Kinner Lakhani, Investor Relations, Credit Suisse Tel: +41 44 333 71 49 Email: investor.relations@credit-suisse.com |

James Quinn, Corporate Communications, Credit Suisse Tel: +41 844 33 88 44 E-mail: media.relations@credit-suisse.com |

The Financial Report and Presentation Slides for 2Q20 are available to download from 7:00 CEST today at: https://www.credit-suisse.com/results |

PRESENTATION OF 2Q20 RESULTS – THURSDAY, JULY 30, 2020

| Event | Analyst Call | Media Call |

| Time | 08:00 Zurich 07:00 London 02:00 New York | 10:30 Zurich 09:30 London 04:30 New York |

| Language | English | English |

| Access | Switzerland: +41 44 580 48 67 Europe: +44 203 057 6528 US: +1 866 276 8933 Reference: Credit Suisse Analysts and Investors Call Conference ID: 1847265 Please dial in 10 minutes before the start of the call Webcast link here. | Switzerland: +41 44 580 48 67 Europe: +44 203 057 6528 US: +1 866 276 8933 Reference: Credit Suisse Media Call Conference ID: 8985759 Please dial in 10 minutes before the start of the call Webcast link here. |

| Q&A Session | Following the presentation, you will have the opportunity to ask the speakers questions | Following the presentation, you will have the opportunity to ask the speakers questions |

| Playback | Replay available approximately one hour after the event Switzerland: +41 44 580 40 26 Europe: +44 333 300 9785 US: +1 917 677 7532 Conference ID: 1847265 | Replay available approximately one hour after the event Switzerland: +41 44 580 40 26 Europe: +44 333 300 9785 US: +1 917 677 7532 Conference ID: 8985759 |

Media Release Zurich, July 30, 2020 | |

Note: Our 2Q20 results include a gain of CHF 134 million related to the revaluation of our equity investment in Pfandbriefbank. Our 1Q20 and 3Q19 results include gains of CHF 268 million and CHF 327 million, respectively, related to the transfer of the InvestLab fund platform to Allfunds Group. Our 4Q19 results include a gain of CHF 498 million related to the revaluation of our equity investment in SIX Group AG.

Footnotes

1 Refers to net income attributable to shareholders

2 Including cash held at central banks, our Tier 1 leverage ratio would have been 5.5% for 2Q20 and 5.3% for 1Q20

3 Including cash held at central banks, our CET1 leverage ratio would have been 4.0% for 2Q20 and 3.8% for 1Q20

4 Includes Private Clients in SUB, Private Banking in IWM and APAC Private Banking within Wealth Management & Connected

5 Excludes CHF (85) million of negative FX impact in 2Q20; underlying revenue base at constant 1H19 average FX rates, applying a straight line average of monthly rates

6 Excludes CHF (165) million of negative FX impact in 1H20; underlying revenue base at constant 1H19 average FX rates, applying a straight line average of monthly rates

7 Includes Global Markets, APAC Markets and Investment Banking & Capital Markets

8 Includes Global Markets and APAC Markets

9 Gains from a Pfandbriefbank revaluation of CHF 134 million in Private Clients other revenues in 2Q20

10 Real estate gains of CHF 87 million in Private Clients other revenues and a special SIX dividend of CHF 29 million in transaction-based revenues in 2Q19

11 Real estate gains of CHF 87 million in other revenues in 2Q19

12 Source: Dealogic for the period ending June 30, 2020 (APAC excluding Japan and China onshore among International banks)

13 Source: Dealogic for the period ending June 30, 2020 (Americas and EMEA only)

14 Source: Dealogic for the period ending June 30, 2020 (Global)

15 Includes Fixed Income Sales and Trading and Underwriting revenues

16 Source: Dealogic as of June 30, 2020 (Americas and EMEA only) and Bloomberg as of June 30, 2020

17 Includes Equity Sales and Trading and Underwriting revenues

18 Source: Third Party competitive analysis 1Q20 vs. 1Q19

19 Source: Dealogic as June 30, 2020 (Americas and EMEA only)

20 Source: Bloomberg, April 1, 2020 – June 30, 2020, Americas and EMEA

Abbreviations

APAC – Asia Pacific; AuM – assets under management; BIS – Bank for International Settlements; CECL – US GAAP accounting standard for current expected credit losses; CET1 – common equity tier 1; CHF – Swiss francs; C&IC – Corporate & Institutional Clients; EGM – Extraordinary General Meeting; ESG – Environmental, Social and Governance; FINMA – Swiss Financial Market Supervisory Authority FINMA; FX – Foreign Exchange; GAAP – Generally accepted accounting principles; GM – Global Markets; IAF – Impact Advisory and Finance; IBCM – Investment Banking & Capital Markets; IPO – Initial Public Offering; ITS – International Trading Solutions; IWM – International Wealth Management; NNA – net new assets; PB – Private Banking; PC – Private Clients; RoTE – Return on Tangible Equity; RWA – risk weighted assets; SEC – U.S. Securities and Exchange Commission; SIX – Swiss Stock Exchange; SME – Small and Medium Enterprises; SUB – Swiss Universal Bank; USD – US dollar; WM&C – Wealth Management & Connected.

Important information

This document contains select information from the full 2Q20 Financial Report and 2Q20 Results Presentation slides that Credit Suisse believes is of particular interest to media professionals. The complete 2Q20 Financial Report and 2Q20 Results Presentation slides, which have been distributed simultaneously, contain more comprehensive information about our results and operations for the reporting quarter, as well as important information about our reporting methodology and some of the terms used in these documents. The complete 2Q20 Financial Report and 2Q20 Results Presentation slides are not incorporated by reference into this document.

We may not achieve all of the expected benefits of our strategic initiatives. Factors beyond our control, including but not limited to the market and economic conditions (including macroeconomic and other challenges and uncertainties, for example, resulting from the COVID-19 pandemic), changes in laws, rules or regulations and other challenges discussed in our public filings, could limit our ability to achieve some or all of the expected benefits of these initiatives.

In particular, the terms “Estimate”, “Illustrative”, “Ambition”, “Objective”, “Outlook” and “Goal” are not intended to be viewed as targets or projections, nor are they considered to be Key Performance Indicators. All such estimates, illustrations, ambitions, objectives, outlooks and goals are subject to a large number of inherent risks, assumptions and uncertainties, many of which are completely outside of our control. These risks, assumptions and uncertainties include, but are not limited to, general market conditions, market volatility, interest rate volatility and levels, global and regional economic conditions, challenges and uncertainties resulting from the COVID-19 pandemic, political uncertainty, changes in tax policies, regulatory changes, changes

Media Release Zurich, July 30, 2020 | |

in levels of client activity as a result of any of the foregoing and other factors. Accordingly, this information should not be relied on for any purpose. We do not intend to update these estimates, illustrations, ambitions, objectives, outlooks or goals.

In preparing this document, management has made estimates and assumptions that affect the numbers presented. Actual results may differ. Annualized numbers do not take into account variations in operating results, seasonality and other factors and may not be indicative of actual, full-year results. Figures throughout this document may also be subject to rounding adjustments. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information. This information is subject to change at any time without notice and we do not intend to update this information.

Our estimates, ambitions, objectives and targets often include metrics that are non-GAAP financial measures and are unaudited. A reconciliation of the estimates, ambitions, objectives and targets to the nearest GAAP measures is unavailable without unreasonable efforts. Return on tangible equity is based on tangible shareholders' equity (also known as tangible book value), a non-GAAP financial measure, which is calculated by deducting goodwill and other intangible assets from total shareholders' equity as presented in our balance sheet, both of which are unavailable on a prospective basis. Such estimates, ambitions, objectives and targets are calculated in a manner that is consistent with the accounting policies applied by us in preparing our financial statements.

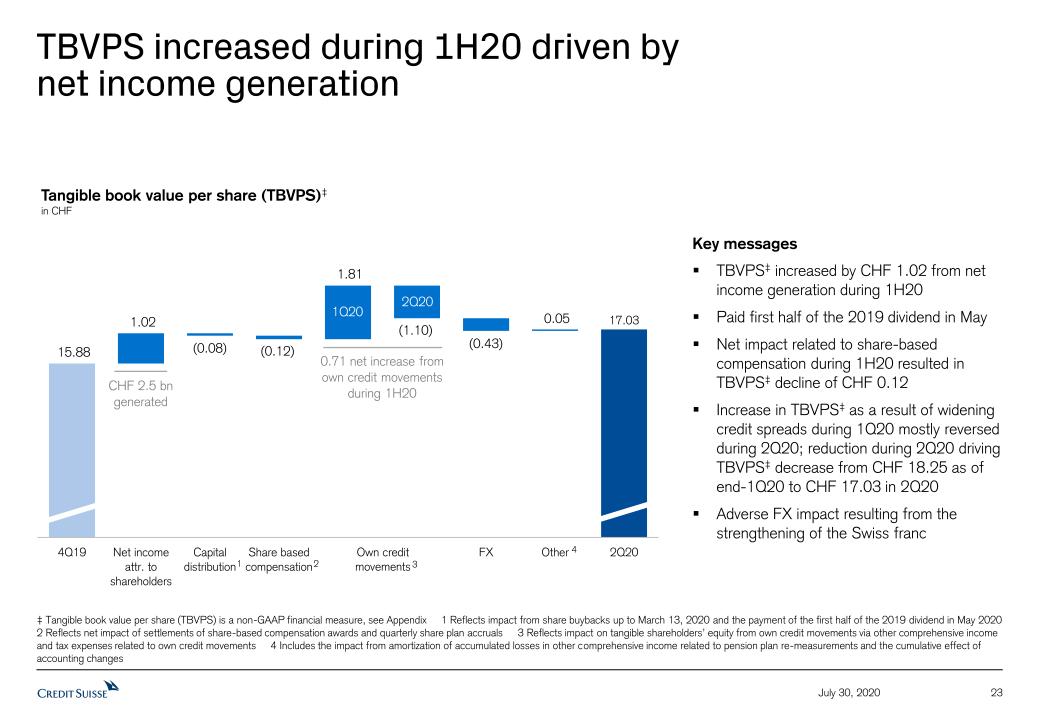

Return on tangible equity is based on tangible shareholders’ equity, a non-GAAP financial measure, which is calculated by deducting goodwill and other intangible assets from total shareholders’ equity as presented in our balance sheet. Management believes that return on tangible equity is meaningful as it is a measure used and relied upon by industry analysts and investors to assess valuations and capital adequacy. For end-2Q20, tangible shareholders’ equity excluded goodwill of CHF 4,676 million and other intangible assets of CHF 273 million from total shareholders’ equity of CHF 46,535 million as presented in our balance sheet. For end-1Q20, tangible shareholders’ equity excluded goodwill of CHF 4,604 million and other intangible assets of CHF 279 million from total shareholders’ equity of CHF 48,675 million as presented in our balance sheet. For end-4Q19, tangible shareholders’ equity excluded goodwill of CHF 4,663 million and other intangible assets of CHF 291 million from total shareholders’ equity of CHF 43,644 million as presented in our balance sheet. For end-3Q19, tangible shareholders’ equity excluded goodwill of CHF 4,760 million and other intangible assets of CHF 219 million from total shareholders’ equity of CHF 45,150 million as presented in our balance sheet.

Regulatory capital is calculated as the worst of 10% of RWA and 3.5% of leverage exposure. Return on regulatory capital (a non-GAAP financial measure) is calculated using income / (loss) after tax and assumes a tax rate of 30% and capital allocated based on the worst of 10% of average RWA and 3.5% of average leverage exposure. For the Markets business within the APAC division and for the Global Markets and Investment Banking & Capital Markets divisions, return on regulatory capital is based on US dollar denominated numbers.

Credit Suisse is subject to the Basel III framework, as implemented in Switzerland, as well as Swiss legislation and regulations for systemically important banks, which include capital, liquidity, leverage and large exposure requirements and rules for emergency plans designed to maintain systemically relevant functions in the event of threatened insolvency. Credit Suisse has adopted the Bank for International Settlements (BIS) leverage ratio framework, as issued by the Basel Committee on Banking Supervision (BCBS) and implemented in Switzerland by the Swiss Financial Market Supervisory Authority FINMA (FINMA).

Unless otherwise noted, all CET1 ratio, Tier-1 leverage ratio, risk-weighted assets and leverage exposure figures in this document are as of the end of the respective period and on a “look-through” basis.

Unless otherwise noted, leverage exposure is based on the BIS leverage ratio framework and consists of period-end balance sheet assets and prescribed regulatory adjustments. The tier 1 leverage ratio and CET1 leverage ratio are calculated as BIS tier 1 capital and CET1 capital, respectively, divided by period end leverage exposure. Swiss leverage ratios are measured on the same period-end basis as the leverage exposure for the BIS leverage ratio.

Generic references to profit and costs in this document refer to pre-tax income and operating expenses, respectively. When we refer to operating divisions throughout this document, we mean SUB, IWM, APAC, IBCM and GM. References to Private Banking mean SUB PC, IWM PB and APAC PB within WM&C or their combined results. References to Investment Banking mean GM, IBCM, APAC Markets or their combined results.

Investors and others should note that we announce material information (including quarterly earnings releases and financial reports) to the investing public using press releases, SEC and Swiss ad hoc filings, our website and public conference calls and webcasts. We intend to also use our Twitter account @creditsuisse (https://twitter.com/creditsuisse) to excerpt key messages from our public disclosures, including earnings releases. We may retweet such messages through certain of our regional Twitter accounts, including @csschweiz (https://twitter.com/csschweiz) and @csapac (https://twitter.com/csapac). Investors and others should take care to consider such abbreviated messages in the context of the disclosures from which they are excerpted. The information we post on these Twitter accounts is not a part of this document.

Information referenced in this document, whether via website links or otherwise, is not incorporated into this document.

Media Release Zurich, July 30, 2020 | |

Certain material in this document has been prepared by Credit Suisse on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. Credit Suisse has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information.

In various tables, use of “–” indicates not meaningful or not applicable.

Page 14

| Key metrics |

| | in / end of | | % change | | in / end of | | % change | |

| | 2Q20 | | 1Q20 | | 2Q19 | | QoQ | | YoY | | 6M20 | | 6M19 | | YoY | |

| Credit Suisse Group results (CHF million) |

| Net revenues | | 6,194 | | 5,776 | | 5,581 | | 7 | | 11 | | 11,970 | | 10,968 | | 9 | |

| Provision for credit losses | | 296 | | 568 | | 25 | | (48) | | – | | 864 | | 106 | | – | |

| Compensation and benefits | | 2,594 | | 2,316 | | 2,545 | | 12 | | 2 | | 4,910 | | 5,063 | | (3) | |

| General and administrative expenses | | 1,440 | | 1,346 | | 1,395 | | 7 | | 3 | | 2,786 | | 2,808 | | (1) | |

| Commission expenses | | 313 | | 345 | | 314 | | (9) | | – | | 658 | | 627 | | 5 | |

| Total other operating expenses | | 1,753 | | 1,691 | | 1,709 | | 4 | | 3 | | 3,444 | | 3,435 | | 0 | |

| Total operating expenses | | 4,347 | | 4,007 | | 4,254 | | 8 | | 2 | | 8,354 | | 8,498 | | (2) | |

| Income before taxes | | 1,551 | | 1,201 | | 1,302 | | 29 | | 19 | | 2,752 | | 2,364 | | 16 | |

| Net income attributable to shareholders | | 1,162 | | 1,314 | | 937 | | (12) | | 24 | | 2,476 | | 1,686 | | 47 | |

| Statement of operations metrics (%) |

| Return on regulatory capital | | 14.5 | | 10.8 | | 11.6 | | – | | – | | 12.6 | | 10.6 | | – | |

| Balance sheet statistics (CHF million) |

| Total assets | | 828,480 | | 832,166 | | 784,216 | | 0 | | 6 | | 828,480 | | 784,216 | | 6 | |

| Risk-weighted assets | | 299,293 | | 300,580 | | 290,798 | | 0 | | 3 | | 299,293 | | 290,798 | | 3 | |

| Leverage exposure | | 836,755 | | 869,706 | | 897,916 | | (4) | | (7) | | 836,755 | | 897,916 | | (7) | |

| Assets under management and net new assets (CHF billion) |

| Assets under management | | 1,443.4 | | 1,370.5 | | 1,455.7 | | 5.3 | | (0.8) | | 1,443.4 | | 1,455.7 | | (0.8) | |

| Net new assets | | 9.8 | | 5.8 | | 22.9 | | 69.0 | | (57.2) | | 15.6 | | 57.5 | | (72.9) | |

| Basel III regulatory capital and leverage statistics (%) |

| CET1 ratio | | 12.5 | | 12.1 | | 12.5 | | – | | – | | 12.5 | | 12.5 | | – | |

| CET1 leverage ratio | | 4.5 | | 4.2 | | 4.1 | | – | | – | | 4.5 | | 4.1 | | – | |

| Tier 1 leverage ratio | | 6.2 | | 5.8 | | 5.3 | | – | | – | | 6.2 | | 5.3 | | – | |

| Swiss Universal Bank |

| | in / end of | | % change | | in / end of | | % change | |

| | 2Q20 | | 1Q20 | | 2Q19 | | QoQ | | YoY | | 6M20 | | 6M19 | | YoY | |

| Results (CHF million) |

| Net revenues | | 1,504 | | 1,509 | | 1,476 | | 0 | | 2 | | 3,013 | | 2,855 | | 6 | |

| of which Private Clients | | 856 | | 798 | | 828 | | 7 | | 3 | | 1,654 | | 1,570 | | 5 | |

| of which Corporate & Institutional Clients | | 648 | | 711 | | 648 | | (9) | | 0 | | 1,359 | | 1,285 | | 6 | |

| Provision for credit losses | | 30 | | 124 | | 10 | | (76) | | 200 | | 154 | | 39 | | 295 | |

| Total operating expenses | | 787 | | 796 | | 812 | | (1) | | (3) | | 1,583 | | 1,612 | | (2) | |

| Income before taxes | | 687 | | 589 | | 654 | | 17 | | 5 | | 1,276 | | 1,204 | | 6 | |

| of which Private Clients | | 366 | | 311 | | 356 | | 18 | | 3 | | 677 | | 629 | | 8 | |

| of which Corporate & Institutional Clients | | 321 | | 278 | | 298 | | 15 | | 8 | | 599 | | 575 | | 4 | |

| Metrics (%) |

| Return on regulatory capital | | 20.3 | | 17.7 | | 20.1 | | – | | – | | 19.0 | | 18.6 | | – | |

| Cost/income ratio | | 52.3 | | 52.8 | | 55.0 | | – | | – | | 52.5 | | 56.5 | | – | |

| Private Clients |

| Assets under management (CHF billion) | | 201.8 | | 194.8 | | 214.7 | | 3.6 | | (6.0) | | 201.8 | | 214.7 | | (6.0) | |

| Net new assets (CHF billion) | | (1.6) | | (4.2) | | 1.2 | | – | | – | | (5.8) | | 4.5 | | – | |

| Gross margin (annualized) (bp) | | 171 | | 151 | | 156 | | – | | – | | 161 | | 150 | | – | |

| Net margin (annualized) (bp) | | 73 | | 59 | | 67 | | – | | – | | 66 | | 60 | | – | |

| Corporate & Institutional Clients |

| Assets under management (CHF billion) | | 427.4 | | 405.3 | | 410.7 | | 5.5 | | 4.1 | | 427.4 | | 410.7 | | 4.1 | |

| Net new assets (CHF billion) | | 1.6 | | 4.8 | | 8.9 | | – | | – | | 6.4 | | 36.5 | | – | |

| International Wealth Management |

| | in / end of | | % change | | in / end of | | % change | |

| | 2Q20 | | 1Q20 | | 2Q19 | | QoQ | | YoY | | 6M20 | | 6M19 | | YoY | |

| Results (CHF million) |

| Net revenues | | 1,274 | | 1,502 | | 1,369 | | (15) | | (7) | | 2,776 | | 2,786 | | 0 | |

| of which Private Banking | | 919 | | 1,061 | | 989 | | (13) | | (7) | | 1,980 | | 2,008 | | (1) | |

| of which Asset Management | | 355 | | 441 | | 380 | | (20) | | (7) | | 796 | | 778 | | 2 | |

| Provision for credit losses | | 35 | | 39 | | 9 | | (10) | | 289 | | 74 | | 19 | | 289 | |

| Total operating expenses | | 891 | | 926 | | 916 | | (4) | | (3) | | 1,817 | | 1,800 | | 1 | |

| Income before taxes | | 348 | | 537 | | 444 | | (35) | | (22) | | 885 | | 967 | | (8) | |

| of which Private Banking | | 268 | | 375 | | 340 | | (29) | | (21) | | 643 | | 742 | | (13) | |

| of which Asset Management | | 80 | | 162 | | 104 | | (51) | | (23) | | 242 | | 225 | | 8 | |

| Metrics (%) |

| Return on regulatory capital | | 21.4 | | 33.9 | | 28.9 | | – | | – | | 27.6 | | 32.2 | | – | |

| Cost/income ratio | | 69.9 | | 61.7 | | 66.9 | | – | | – | | 65.5 | | 64.6 | | – | |

| Private Banking |

| Assets under management (CHF billion) | | 344.5 | | 327.7 | | 363.1 | | 5.1 | | (5.1) | | 344.5 | | 363.1 | | (5.1) | |

| Net new assets (CHF billion) | | 1.8 | | 3.7 | | 5.5 | | – | | – | | 5.5 | | 6.8 | | – | |

| Gross margin (annualized) (bp) | | 109 | | 119 | | 109 | | – | | – | | 114 | | 111 | | – | |

| Net margin (annualized) (bp) | | 32 | | 42 | | 37 | | – | | – | | 37 | | 41 | | – | |

| Asset Management |

| Assets under management (CHF billion) | | 423.8 | | 409.6 | | 414.0 | | 3.5 | | 2.4 | | 423.8 | | 414.0 | | 2.4 | |

| Net new assets (CHF billion) | | 4.1 | | 0.1 | | 8.6 | | – | | – | | 4.2 | | 8.1 | | – | |

| Asia Pacific |

| | in / end of | | % change | | in / end of | | % change | |

| | 2Q20 | | 1Q20 | | 2Q19 | | QoQ | | YoY | | 6M20 | | 6M19 | | YoY | |

| Results (CHF million) |

| Net revenues | | 1,064 | | 1,025 | | 913 | | 4 | | 17 | | 2,089 | | 1,767 | | 18 | |

| of which Wealth Management & Connected | | 605 | | 577 | | 614 | | 5 | | (1) | | 1,182 | | 1,179 | | 0 | |

| of which Markets | | 459 | | 448 | | 299 | | 2 | | 54 | | 907 | | 588 | | 54 | |

| Provision for credit losses | | 81 | | 97 | | (1) | | (16) | | – | | 178 | | 16 | | – | |

| Total operating expenses | | 685 | | 676 | | 677 | | 1 | | 1 | | 1,361 | | 1,331 | | 2 | |

| Income before taxes | | 298 | | 252 | | 237 | | 18 | | 26 | | 550 | | 420 | | 31 | |

| of which Wealth Management & Connected | | 123 | | 85 | | 216 | | 45 | | (43) | | 208 | | 386 | | (46) | |

| of which Markets | | 175 | | 167 | | 21 | | 5 | | – | | 342 | | 34 | | – | |

| Metrics (%) |

| Return on regulatory capital | | 21.8 | | 17.9 | | 17.0 | | – | | – | | 19.7 | | 15.3 | | – | |

| Cost/income ratio | | 64.4 | | 66.0 | | 74.2 | | – | | – | | 65.2 | | 75.3 | | – | |

| Wealth Management & Connected – Private Banking |

| Assets under management (CHF billion) | | 215.8 | | 197.0 | | 214.5 | | 9.5 | | 0.6 | | 215.8 | | 214.5 | | 0.6 | |

| Net new assets (CHF billion) | | 4.5 | | 3.0 | | 2.5 | | – | | – | | 7.5 | | 6.3 | | – | |

| Gross margin (annualized) (bp) | | 79 | | 101 | | 80 | | – | | – | | 90 | | 78 | | – | |

| Net margin (annualized) (bp) | | 26 | | 48 | | 30 | | – | | – | | 38 | | 28 | | – | |

| Global Markets |

| | in / end of | | % change | | in / end of | | % change | |

| | 2Q20 | | 1Q20 | | 2Q19 | | QoQ | | YoY | | 6M20 | | 6M19 | | YoY | |

| Results (CHF million) |

| Net revenues | | 1,901 | | 1,630 | | 1,553 | | 17 | | 22 | | 3,531 | | 3,025 | | 17 | |

| Provision for credit losses | | 77 | | 150 | | 2 | | (49) | | – | | 227 | | 13 | | – | |

| Total operating expenses | | 1,233 | | 1,150 | | 1,194 | | 7 | | 3 | | 2,383 | | 2,373 | | 0 | |

| Income before taxes | | 591 | | 330 | | 357 | | 79 | | 66 | | 921 | | 639 | | 44 | |

| Metrics (%) |

| Return on regulatory capital | | 17.3 | | 9.6 | | 11.0 | | – | | – | | 13.8 | | 10.0 | | – | |

| Cost/income ratio | | 64.9 | | 70.6 | | 76.9 | | – | | – | | 67.5 | | 78.4 | | – | |

| Investment Banking & Capital Markets |

| | in / end of | | % change | | in / end of | | % change | |

| | 2Q20 | | 1Q20 | | 2Q19 | | QoQ | | YoY | | 6M20 | | 6M19 | | YoY | |

| Results (CHF million) |

| Net revenues | | 702 | | 183 | | 454 | | 284 | | 55 | | 885 | | 810 | | 9 | |

| Provision for credit losses | | 67 | | 155 | | 1 | | (57) | | – | | 222 | | 9 | | – | |

| Total operating expenses | | 433 | | 406 | | 447 | | 7 | | (3) | | 839 | | 888 | | (6) | |

| Income/(loss) before taxes | | 202 | | (378) | | 6 | | – | | – | | (176) | | (87) | | 102 | |

| Metrics (%) |

| Return on regulatory capital | | 23.8 | | (43.4) | | 0.8 | | – | | – | | (10.3) | | (4.7) | | – | |

| Cost/income ratio | | 61.7 | | 221.9 | | 98.5 | | – | | – | | 94.8 | | 109.6 | | – | |

| Global advisory and underwriting revenues |

| | in | | % change | | in | | % change | |

| | 2Q20 | | 1Q20 | | 2Q19 | | QoQ | | YoY | | 6M20 | | 6M19 | | YoY | |

| Global advisory and underwriting revenues (USD million) |

| Advisory and other fees | | 245 | | 189 | | 208 | | 30 | | 18 | | 434 | | 379 | | 15 | |

| Debt underwriting | | 737 | | 65 | | 463 | | – | | 59 | | 802 | | 923 | | (13) | |

| Equity underwriting | | 438 | | 164 | | 253 | | 167 | | 73 | | 602 | | 391 | | 54 | |

| Global advisory and underwriting revenues | | 1,420 | | 418 | | 924 | | 240 | | 54 | | 1,838 | | 1,693 | | 9 | |

Cautionary statement regarding forward-looking information

This document contains statements that constitute forward-looking statements. In addition, in the future we, and others on our behalf, may make statements that constitute forward-looking statements. Such forward-looking statements may include, without limitation, statements relating to the following:

■ our plans, targets or goals;

■ our future economic performance or prospects;

■ the potential effect on our future performance of certain contingencies; and

■ assumptions underlying any such statements.

Words such as “believes,” “anticipates,” “expects,” “intends” and “plans” and similar expressions are intended to identify forward-looking statements but are not the exclusive means of identifying such statements. We do not intend to update these forward-looking statements.

By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that predictions, forecasts, projections and other outcomes described or implied in forward-looking statements will not be achieved. We caution you that a number of important factors could cause results to differ materially from the plans, targets, goals, expectations, estimates and intentions expressed in such forward-looking statements. These factors include:

■ the ability to maintain sufficient liquidity and access capital markets;

■ market volatility and interest rate fluctuations and developments affecting interest rate levels, including the persistence of a low or negative interest rate environment;

■ the strength of the global economy in general and the strength of the economies of the countries in which we conduct our operations, in particular the risk of negative impacts of COVID-19 on the global economy and financial markets and the risk of continued slow economic recovery or downturn in the EU, the US or other developed countries or in emerging markets in 2020 and beyond;

■ the emergence of widespread health emergencies, infectious diseases or pandemics, such as COVID-19, and the actions that may be taken by governmental authorities to contain the outbreak or to counter its impact on our business;

■ potential risks and uncertainties relating to the severity of impacts from COVID-19 and the duration of the pandemic, including potential material adverse effects on our business, financial condition and results of operations;

■ the direct and indirect impacts of deterioration or slow recovery in residential and commercial real estate markets;

■ adverse rating actions by credit rating agencies in respect of us, sovereign issuers, structured credit products or other credit-related exposures;

■ the ability to achieve our strategic goals, including those related to our targets, ambitions and financial goals;

■ the ability of counterparties to meet their obligations to us and the adequacy of our allowance for credit losses;

■ the effects of, and changes in, fiscal, monetary, exchange rate, trade and tax policies, as well as currency fluctuations;

■ political, social and environmental developments, including war, civil unrest or terrorist activity and climate change;

■ the ability to appropriately address social, environmental and sustainability concerns that may arise from our business activities;

■ the effects of, and the uncertainty arising from, the UK’s withdrawal from the EU;

■ the possibility of foreign exchange controls, expropriation, nationalization or confiscation of assets in countries in which we conduct our operations;

■ operational factors such as systems failure, human error, or the failure to implement procedures properly;

■ the risk of cyber attacks, information or security breaches or technology failures on our business or operations;

■ the adverse resolution of litigation, regulatory proceedings and other contingencies;

■ actions taken by regulators with respect to our business and practices and possible resulting changes to our business organization, practices and policies in countries in which we conduct our operations;

■ the effects of changes in laws, regulations or accounting or tax standards, policies or practices in countries in which we conduct our operations;

■ the expected discontinuation of LIBOR and other interbank offered rates and the transition to alternative reference rates;

■ the potential effects of changes in our legal entity structure;

■ competition or changes in our competitive position in geographic and business areas in which we conduct our operations;

■ the ability to retain and recruit qualified personnel;

■ the ability to maintain our reputation and promote our brand;

■ the ability to increase market share and control expenses;

■ technological changes instituted by us, our counterparties or competitors;

■ the timely development and acceptance of our new products and services and the perceived overall value of these products and services by users;

■ acquisitions, including the ability to integrate acquired businesses successfully, and divestitures, including the ability to sell non-core assets; and

■ other unforeseen or unexpected events and our success at managing these and the risks involved in the foregoing.

We caution you that the foregoing list of important factors is not exclusive. When evaluating forward-looking statements, you should carefully consider the foregoing factors and other uncertainties and events, including the information set forth in “Risk factors” in I – Information on the company in our Annual Report 2019 and in “Risk factor” in I – Credit Suisse in our 1Q20 Financial Report.

Thomas Gottstein, Chief Executive OfficerDavid Mathers, Chief Financial OfficerJuly 30, 2020 Credit SuisseSecond Quarter 2020 ResultsAnalyst and Investor Call

Disclaimer (1/2) 2 July 30, 2020 This material does not purport to contain all of the information that you may wish to consider. This material is not to be relied upon as such or used in substitution for the exercise of independent judgment. Cautionary statement regarding forward-looking statements This presentation contains forward-looking statements that involve inherent risks and uncertainties, and we might not be able to achieve the predictions, forecasts, projections and other outcomes we describe or imply in forward-looking statements. A number of important factors could cause results to differ materially from the plans, targets, goals, expectations, estimates and intentions we express in these forward-looking statements, including those we identify in "Risk factors” in our Annual Report on Form 20-F for the fiscal year ended December 31, 2019, in “Credit Suisse – Risk Factor” in our 1Q20 Financial Report published on May 7, 2020 and in the “Cautionary statement regarding forward-looking information" in our 2Q20 Financial Report published on July 30, 2020 and filed with the US Securities and Exchange Commission, and in other public filings and press releases. We do not intend to update these forward-looking statements. In particular, the terms “Estimate”, “Illustrative”, “Ambition”, “Objective”, “Outlook” and “Goal” are not intended to be viewed as targets or projections, nor are they considered to be Key Performance Indicators. All such estimates, illustrations, ambitions, objectives, outlooks and goals are subject to a large number of inherent risks, assumptions and uncertainties, many of which are completely outside of our control. These risks, assumptions and uncertainties include, but are not limited to, general market conditions, market volatility, interest rate volatility and levels, global and regional economic conditions, challenges and uncertainties resulting from the COVID-19 pandemic, political uncertainty, changes in tax policies, regulatory changes, changes in levels of client activity as a result of any of the foregoing and other factors. Accordingly, this information should not be relied on for any purpose. We do not intend to update these estimates, illustrations, ambitions, objectives, outlooks or goals. We may not achieve the benefits of our strategic initiativesWe may not achieve all of the expected benefits of our strategic initiatives. Factors beyond our control, including but not limited to the market and economic conditions (including macroeconomic and other challenges and uncertainties, for example, resulting from the COVID-19 pandemic), changes in laws, rules or regulations and other challenges discussed in our public filings, could limit our ability to achieve some or all of the expected benefits of these initiatives. Estimates and assumptionsIn preparing this presentation, management has made estimates and assumptions that affect the numbers presented. Actual results may differ. Annualized numbers do not take into account variations in operating results, seasonality and other factors and may not be indicative of actual, full-year results. Figures throughout this presentation may also be subject to rounding adjustments. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information. This information is subject to change at any time without notice and we do not intend to update this information.Statement regarding non-GAAP financial measuresThis presentation also contains non-GAAP financial measures, including adjusted results as well as return on regulatory capital, return on tangible equity and tangible book value per share (which are based on tangible shareholders’ equity). Information needed to reconcile such non-GAAP financial measures to the most directly comparable measures under US GAAP can be found in this presentation, which is available on our website at www.credit-suisse.com.Our estimates, ambitions, objectives and targets often include metrics that are non-GAAP financial measures and are unaudited. A reconciliation of the estimates, ambitions, objectives and targets to the nearest GAAP measures is unavailable without unreasonable efforts. Return on tangible equity is based on tangible shareholders’ equity, a non-GAAP financial measure also known as tangible book value, which is calculated by deducting goodwill and other intangible assets from total shareholders’ equity as presented in our balance sheet, both of which are unavailable on a prospective basis. Return on regulatory capital (a non-GAAP financial measure) is calculated using income / (loss) after tax and assumes a tax rate of 30% and capital allocated based on the worst of 10% of average RWA and 3.5% of average leverage exposure; the essential components of this calculation are unavailable on a prospective basis. Adjusted results exclude goodwill impairment, major litigation provisions, real estate gains and other revenue and expense items included in our reported results, all of which are unavailable on a prospective basis. Such estimates, ambitions, objectives and targets are calculated in a manner that is consistent with the accounting policies applied by us in preparing our financial statements.

Disclaimer (2/2) 3 July 30, 2020 Statement regarding capital, liquidity and leverageCredit Suisse is subject to the Basel III framework, as implemented in Switzerland, as well as Swiss legislation and regulations for systemically important banks (Swiss Requirements), which include capital, liquidity, leverage and large exposure requirements and rules for emergency plans designed to maintain systemically relevant functions in the event of threatened insolvency. Credit Suisse has adopted the Bank for International Settlements (BIS) leverage ratio framework, as issued by the Basel Committee on Banking Supervision (BCBS) and implemented in Switzerland by the Swiss Financial Market Supervisory Authority FINMA.References to phase-in and look-through included herein refer to Basel III capital requirements and Swiss Requirements. Phase-in reflects that, for the years 2014-2018, there was a five-year (20% per annum) phase-in of goodwill, other intangible assets and other capital deductions (e.g., certain deferred tax assets) and a phase-out of an adjustment for the accounting treatment of pension plans. For the years 2013-2022, there is a phase-out of certain capital instruments. Look-through assumes the full phase-in of goodwill and other intangible assets and other regulatory adjustments and the phase-out of certain capital instruments.Unless otherwise noted, leverage exposure is based on the BIS leverage ratio framework and consists of period-end balance sheet assets and prescribed regulatory adjustments. The tier 1 leverage ratio and CET1 leverage ratio are calculated as BIS tier 1 capital and CET1 capital, respectively, divided by period-end leverage exposure. Swiss leverage ratios are measured on the same period-end basis as the leverage exposure for the BIS leverage ratio.SourcesCertain material in this presentation has been prepared by Credit Suisse on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. Credit Suisse has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information.

Executive Summary 4 July 30, 2020

Executive Summary 5 July 30, 2020 Key financial highlights for 2Q20Net income in 2Q20 increased 24% YoY to CHF 1.2 bn1, the highest second quarter in a decade;RoTE‡ of 11.0% in 2Q20, 12.0% in 1H20 and 10.4% in last twelve months Net revenues in 2Q20 increased by 11% YoY, supported by the strong momentum across GM, IBCM and APAC Markets and solid performances in our Private Banking businessesTotal operating expenses in 2Q20 increased 2% YoY, with 15th consecutive quarter of positive operating leverageAdditional provision for credit losses of CHF 296 mn in 2Q20, totaling CHF 864 mn for 1H20PTI of CHF 1.6 bn in 2Q20, up 19% YoY Over the last few years, Credit Suisse has successfully de-risked and has a strong balance sheetCET1 ratio of 12.5% and CET1 leverage ratio of 4.5%2 or 4.0% including cash held at central banks Group LCR of 196%3, among the strongest in the industry84% of Group loans are collateralized4; SUB accounts for 59% of Group gross loansStrategic initiatives and structural refinements to accelerate growth and drive efficiencyStrategy of being a leading Wealth Manager with strong global Investment Banking capabilities has delivered success. We intend to continue to allocate the majority of our capital deployed to Wealth Management to accelerate growthWe will optimize our model to drive further upside in the context of secular trends, which have been accentuated by COVID-19 Create one global Investment BankCombine and integrate Risk and Compliance functionsLaunch SRI capability (Sustainability, Research & Investment Solutions), led at Executive Board levelThis should make our organization even more effective and generate efficiencies for further investments and digitalization in our 4 divisionsDisciplined capital distributionOur Board of Directors intends to propose to the shareholders the second half of the 2019 dividend at an EGM on November 27, 20205Subsequent to the EGM and subject to market and economic conditions, the Board intends to review the share buyback program 1 2 3 ‡ Return on Tangible Equity (RoTE) is a non-GAAP financial measures, see AppendixNote: 2Q20 results include a gain related to the equity investment revaluation of Pfandbriefbank, 1Q20 and 3Q19 results include gains related to the transfer of the InvestLab fund platform to Allfunds Group and 4Q19 results include a gain related to the revaluation of our equity investment in SIX Group1 Relating to net income attributable to shareholders 2 Leverage exposure excludes cash held at central banks, adjusted for the dividend paid in 2Q20 and the planned dividend payment in 4Q20 as required by FINMA 3 Calculated using a three-month average, which is calculated on a daily basis 4 Percentage of collateralized loans held at amortized cost in relation to Group gross loans 5 Subject to market and economic conditions

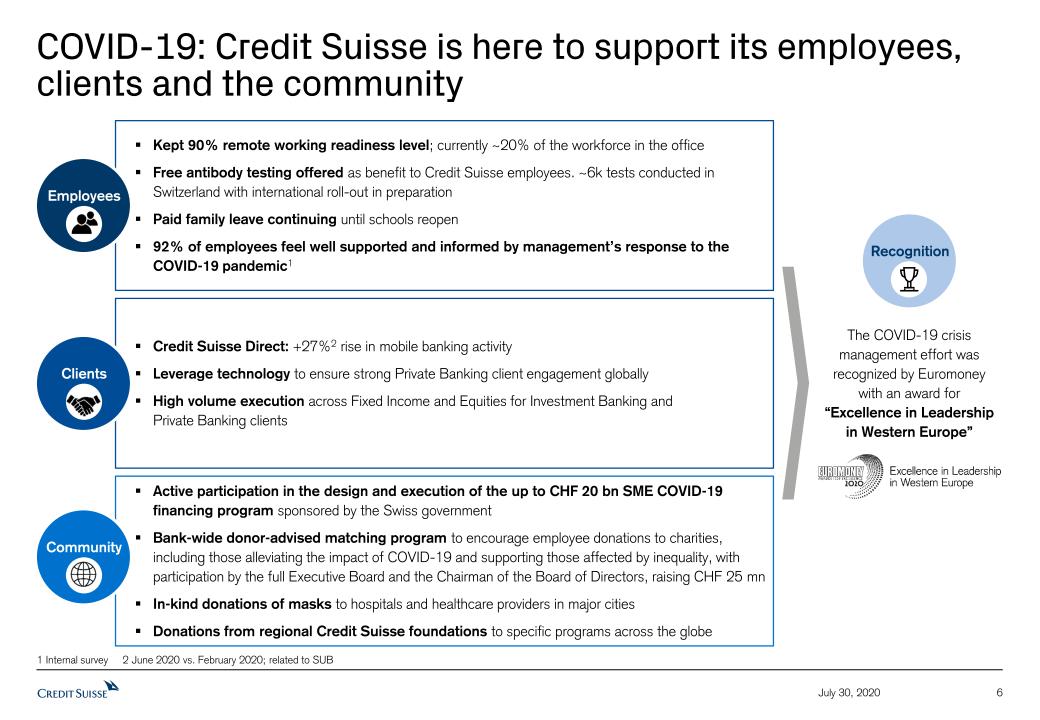

Kept 90% remote working readiness level; currently ~20% of the workforce in the officeFree antibody testing offered as benefit to Credit Suisse employees. ~6k tests conducted in Switzerland with international roll-out in preparationPaid family leave continuing until schools reopen92% of employees feel well supported and informed by management’s response to the COVID-19 pandemic1 6 July 30, 2020 COVID-19: Credit Suisse is here to support its employees, clients and the community 1 Internal survey 2 June 2020 vs. February 2020; related to SUB Credit Suisse Direct: +27%2 rise in mobile banking activityLeverage technology to ensure strong Private Banking client engagement globallyHigh volume execution across Fixed Income and Equities for Investment Banking andPrivate Banking clients Active participation in the design and execution of the up to CHF 20 bn SME COVID-19 financing program sponsored by the Swiss governmentBank-wide donor-advised matching program to encourage employee donations to charities, including those alleviating the impact of COVID-19 and supporting those affected by inequality, with participation by the full Executive Board and the Chairman of the Board of Directors, raising CHF 25 mnIn-kind donations of masks to hospitals and healthcare providers in major citiesDonations from regional Credit Suisse foundations to specific programs across the globe Employees Clients Community The COVID-19 crisis management effort was recognized by Euromoneywith an award for“Excellence in Leadershipin Western Europe” Recognition

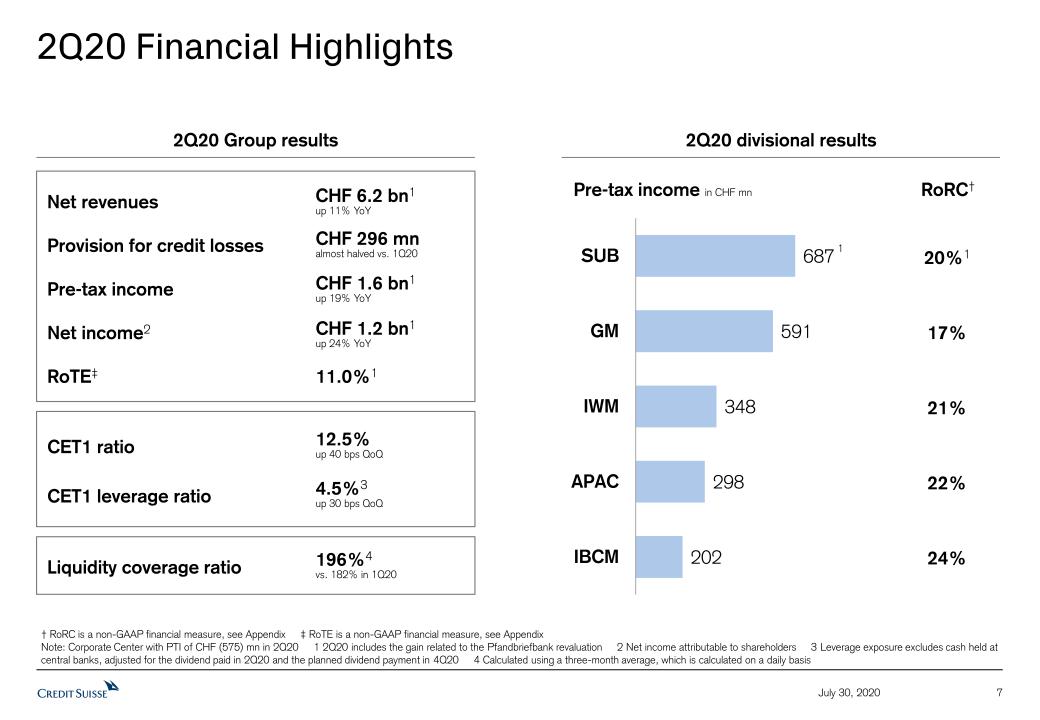

2Q20 Financial Highlights 7 July 30, 2020 † RoRC is a non-GAAP financial measure, see Appendix ‡ RoTE is a non-GAAP financial measure, see AppendixNote: Corporate Center with PTI of CHF (575) mn in 2Q20 1 2Q20 includes the gain related to the Pfandbriefbank revaluation 2 Net income attributable to shareholders 3 Leverage exposure excludes cash held at central banks, adjusted for the dividend paid in 2Q20 and the planned dividend payment in 4Q20 4 Calculated using a three-month average, which is calculated on a daily basis 2Q20 Group results 2Q20 divisional results Pre-tax income in CHF mn RoRC† 20%1 17% 21% 22% 24% 1 RoTE‡ 11.0%1 Pre-tax income CHF 1.6 bn1up 19% YoY Net income2 CHF 1.2 bn1up 24% YoY CET1 ratio 12.5%up 40 bps QoQ 4.5%3up 30 bps QoQ Liquidity coverage ratio 196%4vs. 182% in 1Q20 Provision for credit losses CHF 296 mnalmost halved vs. 1Q20 CET1 leverage ratio Net revenues CHF 6.2 bn1up 11% YoY

8 July 30, 2020 In 1H20 we achieved an RoTE of 12.0% and deliveredthe highest net income in a decade Note: 1H20 reported results include the gains related to the Pfandbriefbank revaluation and to the second tranche of the InvestLab transfer ‡ RoTE is a non-GAAP financial measure, see Appendix1 Net income attributable to shareholders Return on tangible equity‡based on CHF Net income1in CHF mn (132) 899 1,341 1,686 2,476

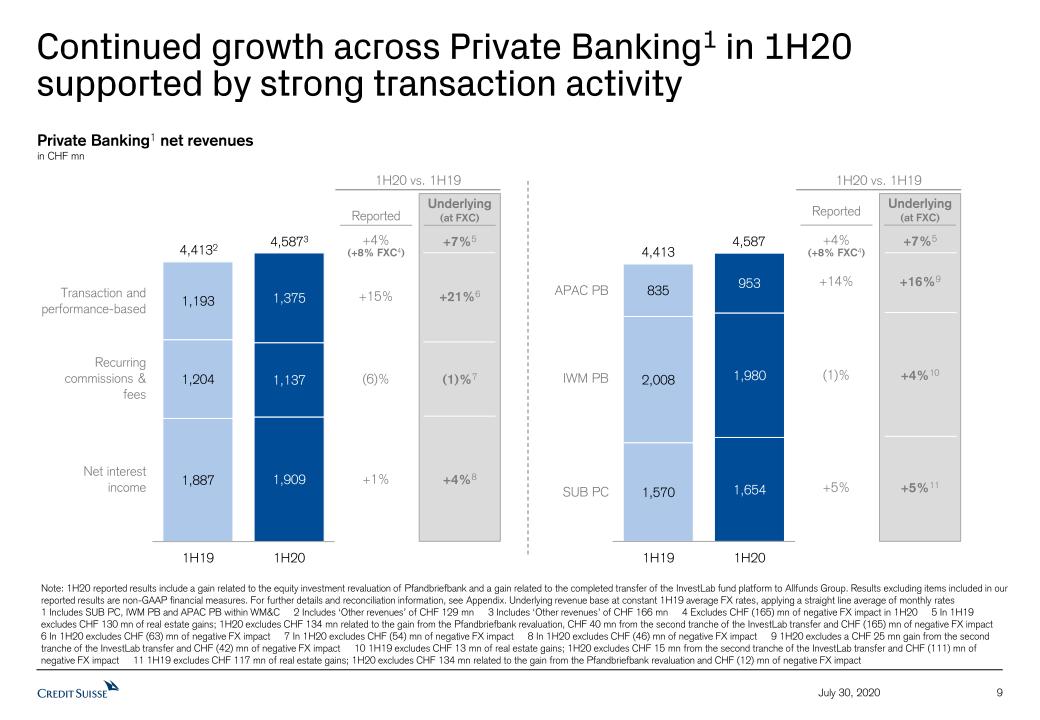

Continued growth across Private Banking1 in 1H20 supported by strong transaction activity July 30, 2020 9 Note: 1H20 reported results include a gain related to the equity investment revaluation of Pfandbriefbank and a gain related to the completed transfer of the InvestLab fund platform to Allfunds Group. Results excluding items included in our reported results are non-GAAP financial measures. For further details and reconciliation information, see Appendix. Underlying revenue base at constant 1H19 average FX rates, applying a straight line average of monthly rates1 Includes SUB PC, IWM PB and APAC PB within WM&C 2 Includes ‘Other revenues’ of CHF 129 mn 3 Includes ‘Other revenues’ of CHF 166 mn 4 Excludes CHF (165) mn of negative FX impact in 1H20 5 In 1H19 excludes CHF 130 mn of real estate gains; 1H20 excludes CHF 134 mn related to the gain from the Pfandbriefbank revaluation, CHF 40 mn from the second tranche of the InvestLab transfer and CHF (165) mn of negative FX impact6 In 1H20 excludes CHF (63) mn of negative FX impact 7 In 1H20 excludes CHF (54) mn of negative FX impact 8 In 1H20 excludes CHF (46) mn of negative FX impact 9 1H20 excludes a CHF 25 mn gain from the second tranche of the InvestLab transfer and CHF (42) mn of negative FX impact 10 1H19 excludes CHF 13 mn of real estate gains; 1H20 excludes CHF 15 mn from the second tranche of the InvestLab transfer and CHF (111) mn of negative FX impact 11 1H19 excludes CHF 117 mn of real estate gains; 1H20 excludes CHF 134 mn related to the gain from the Pfandbriefbank revaluation and CHF (12) mn of negative FX impact 4,413 SUB PC IWM PB APAC PB 4,587 1H20 vs. 1H19 +5% (1)% +14% +4% +5%11 +4%10 +16%9 +7%5 Underlying(at FXC) Reported (+8% FXC4) 4,4132 Net interestincome Recurring commissions & fees Transaction and performance-based 4,5873 1H20 vs. 1H19 +1% (6)% +15% +4% +4%8 (1)%7 +21%6 Underlying(at FXC) Reported Private Banking1 net revenuesin CHF mn +7%5 (+8% FXC4)

Total Investment Banking1 revenues increasedacross products July 30, 2020 10 4,8084 Fixed IncomeSales & Trading3 EquitySales & Trading3 Advisory &Underwriting2 5,8255 Note: Average USD/CHF exchange rate of 0.9982 for 1H19 and 0.9628 for 1H20 applied1 Includes net revenues from GM, IBCM, APAC Markets and APAC advisory, underwriting and financing as well as M&A, DCM and ECM revenues in SUB C&IC 2 Includes underwriting revenues from GM, advisory andother fees, debt underwriting and equity underwriting revenues from IBCM, advisory, underwriting and financing revenues from APAC WM&C as well as M&A, DCM and ECM revenues in SUB C&IC of USD 31 mn andUSD 57 mn in 1H19 and 1H20, respectively 3 Includes GM and APAC Markets 4 Includes Other revenues from GM and IBCM of USD (195) mn and USD (53) mn, respectively and MtM losses of USD (42) mn in APAC Financing Group (net of USD (61) mn of hedges) 5 Includes Other revenues from GM and IBCM of USD (305) mn and USD (38) mn, respectively and MtM losses of USD (206) mn in APAC Financing Group (net of USD (31) mn of hedges) and USD (78) mn in Leveraged Finance 6 1H20 excludes MtM losses of USD (78) mn in Leveraged Finance and USD (206) mn in APAC Financing Group (net of USD (31) mn of hedges); 1H19 excludes MtM losses of USD (42) mn in APAC Financing Group (net of USD (61) mn of hedges) 7 1H20 excludes MtM losses of USD (39) mn in Leveraged Finance and USD (206) mn in APAC Financing Group (net of USD (31) mn of hedges); 1H19 excludes MtM losses of USD (42) mn in APAC Financing Group (net of USD (61) mn of hedges) 8 1H20 excludes MtM losses of USD (39) mn in Leveraged Finance Total Investment Banking1 net revenuesin USD mn 1H20 vs. 1H19 +43% +13% +5% +21% +45%8 +13% +17%7 +26%6 Excl. MtM Reported

Update on Strategic Initiatives and Structural Refinements 11 July 30, 2020

July 30, 2020 We reaffirm our strategy… 12 A leading Wealth Manager with strong global Investment Banking capabilities Balanced approach between Mature and Emerging MarketsBank for Entrepreneurs focused on UHNWI as core strengthRegional Wealth Management model with proximity to clients

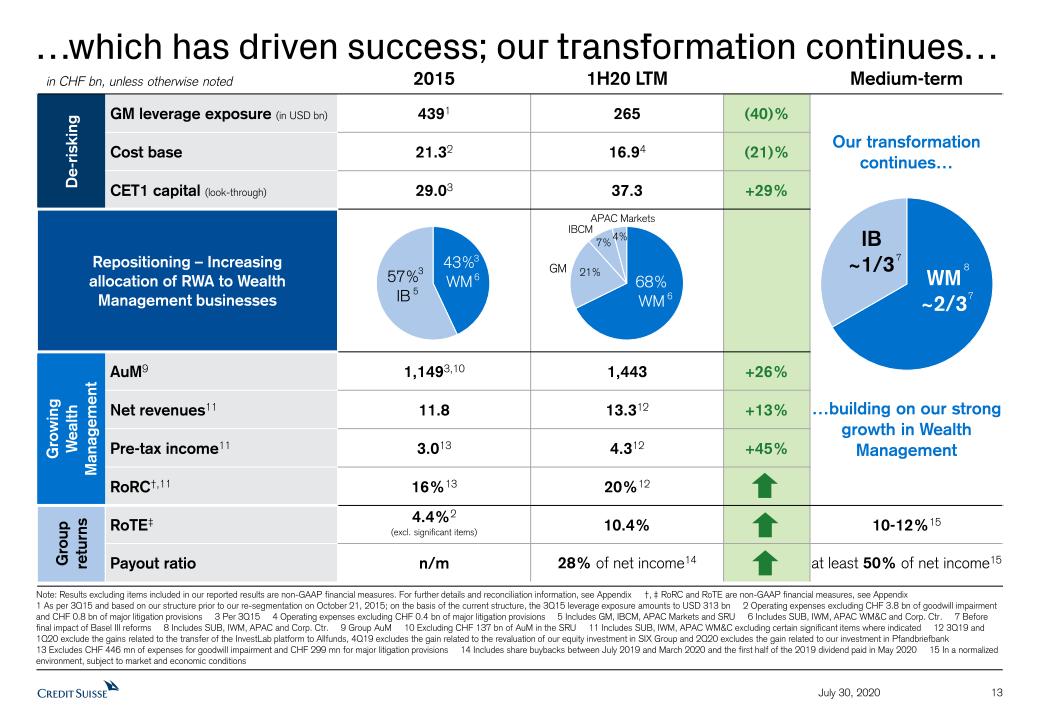

July 30, 2020 13 …which has driven success; our transformation continues… Note: Results excluding items included in our reported results are non-GAAP financial measures. For further details and reconciliation information, see Appendix †, ‡ RoRC and RoTE are non-GAAP financial measures, see Appendix1 As per 3Q15 and based on our structure prior to our re-segmentation on October 21, 2015; on the basis of the current structure, the 3Q15 leverage exposure amounts to USD 313 bn 2 Operating expenses excluding CHF 3.8 bn of goodwill impairment and CHF 0.8 bn of major litigation provisions 3 Per 3Q15 4 Operating expenses excluding CHF 0.4 bn of major litigation provisions 5 Includes GM, IBCM, APAC Markets and SRU 6 Includes SUB, IWM, APAC WM&C and Corp. Ctr. 7 Before final impact of Basel III reforms 8 Includes SUB, IWM, APAC and Corp. Ctr. 9 Group AuM 10 Excluding CHF 137 bn of AuM in the SRU 11 Includes SUB, IWM, APAC WM&C excluding certain significant items where indicated 12 3Q19 and 1Q20 exclude the gains related to the transfer of the InvestLab platform to Allfunds, 4Q19 excludes the gain related to the revaluation of our equity investment in SIX Group and 2Q20 excludes the gain related to our investment in Pfandbriefbank13 Excludes CHF 446 mn of expenses for goodwill impairment and CHF 299 mn for major litigation provisions 14 Includes share buybacks between July 2019 and March 2020 and the first half of the 2019 dividend paid in May 2020 15 In a normalized environment, subject to market and economic conditions in CHF bn, unless otherwise noted 2015 1H20 LTM Medium-term De-risking GM leverage exposure (in USD bn) 4391 265 (40)% Our transformation continues… Cost base 21.32 16.94 (21)% CET1 capital (look-through) 29.03 37.3 +29% Repositioning – Increasing allocation of RWA to Wealth Management businesses GrowingWealthManagement AuM9 1,1493,10 1,443 +26% …building on our strong growth in Wealth Management Net revenues11 11.8 13.312 +13% Pre-tax income11 3.013 4.312 +45% RoRC†,11 16%13 20%12 Groupreturns RoTE‡ 4.4%2(excl. significant items) 10.4% 10-12%15 Payout ratio n/m 28% of net income14 at least 50% of net income15 6 5 6 GM IBCM APAC Markets 8 7 7 3 3

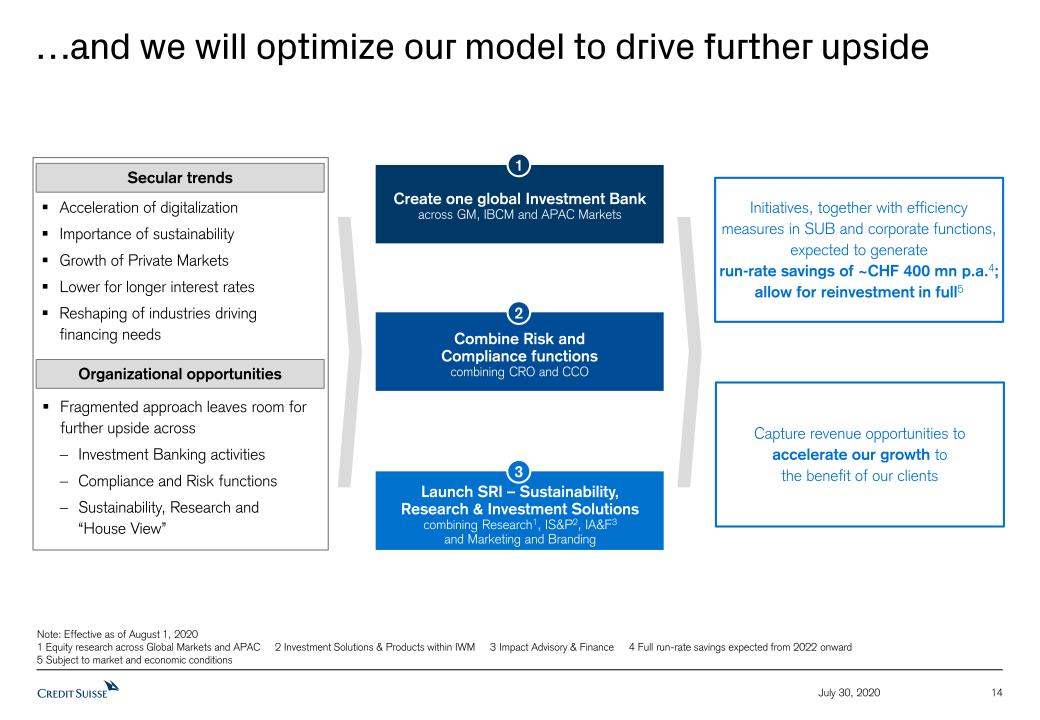

14 July 30, 2020 …and we will optimize our model to drive further upside Fragmented approach leaves room for further upside acrossInvestment Banking activitiesCompliance and Risk functionsSustainability, Research and“House View” Acceleration of digitalizationImportance of sustainabilityGrowth of Private MarketsLower for longer interest ratesReshaping of industries drivingfinancing needs Note: Effective as of August 1, 20201 Equity research across Global Markets and APAC 2 Investment Solutions & Products within IWM 3 Impact Advisory & Finance 4 Full run-rate savings expected from 2022 onward5 Subject to market and economic conditions Secular trends Organizational opportunities Create one global Investment Bankacross GM, IBCM and APAC Markets 1 Combine Risk andCompliance functionscombining CRO and CCO 2 Launch SRI – Sustainability,Research & Investment Solutionscombining Research1, IS&P2, IA&F3and Marketing and Branding 3 Initiatives, together with efficiency measures in SUB and corporate functions, expected to generaterun-rate savings of ~CHF 400 mn p.a.4;allow for reinvestment in full5 Capture revenue opportunities toaccelerate our growth tothe benefit of our clients