UNITED STATES SECURITIES AND EXCHANGE COMMISSION

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 001-15244

(Translation of registrant’s name into English)

Paradeplatz 8, 8001 Zurich, Switzerland

(Address of principal executive office)

Commission File Number 001-33434

(Translation of registrant’s name into English)

Paradeplatz 8, 8001 Zurich, Switzerland

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F  Form 40-F

Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

This report includes the media release and the slides for the presentation to investors in connection with the 3Q21 results.

Ad hoc announcement pursuant to article 53 LR

Credit Suisse posts strong pre-tax income of CHF 1.0 bn, up 26% YoY, and reinforces its strong capital base with a CET1 ratio of 14.4%

"Credit Suisse reported strong third quarter pre-tax income and a CET1 ratio of 14.4 percent. Wealth Management businesses returned to robust net new assets and higher transaction revenues sequentially, while recurring commissions & fees and client business volumes demonstrated strong year on year momentum. Our Swiss Universal Bank had a record1 third quarter performance. Our Asia Pacific business had a resilient performance notwithstanding deleveraging by clients and we continue to invest in the region, including in relationship managers and building-out our mainland China presence. Our Investment Bank delivered solid profitability driven by strong performance across Advisory, Capital Markets, Securitized Products and Equity Derivatives. Asset Management reported a further improved underlying performance driven across all revenues lines. We have also taken decisive actions to strengthen our overall risk & controls foundation, continued our remediation efforts on the Supply Chain Finance Funds matter, with our priority to return cash to investors, and made significant progress in resolving legacy issues. Our objectives are clear: we want to become a stronger, more customer-centric bank that puts risk management at the very core of its DNA to deliver sustainable growth for investors, clients and colleagues. Thomas Gottstein, Chief Executive Officer of Credit Suisse Group AG |

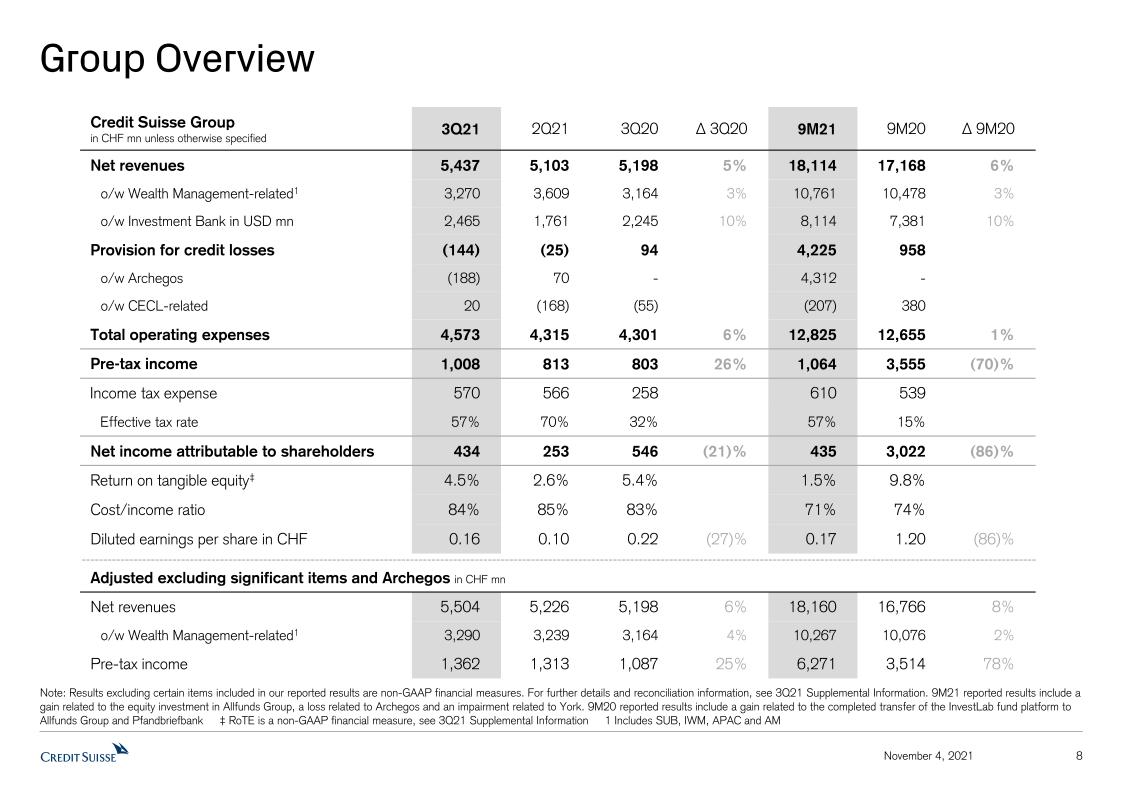

Credit Suisse Group Reported Results (CHF mn, unless otherwise specified) | 3Q21 | 2Q21 | 3Q20 | ∆3Q20 | | 9M21 | 9M20 | ∆9M20 |

| Net revenues | 5,437 | 5,103 | 5,198 | 5% | 18,114 | 17,168 | 6% |

| o/w Wealth Management-related | 3,270 | 3,609 | 3,164 | 3% | 10,761 | 10,478 | 3% |

| o/w Investment Bank in USD mn | 2,465 | 1,761 | 2,245 | 10% | 8,114 | 7,381 | 10% |

| Provision for credit losses | (144) | (25) | 94 | - | 4,225 | 958 | - |

| Total operating expenses | 4,573 | 4,315 | 4,301 | 6% | 12,825 | 12,655 | 1% |

| Pre-tax income / (loss) | 1,008 | 813 | 803 | 26% | 1,064 | 3,555 | (70)% |

| Net income / (loss) attributable to shareholders | 434 | 253 | 546 | (21)% | 435 | 3,022 | (86)% |

| Return on tangible equity attributable to shareholders | 4.5% | 2.6% | 5.4% | - | 1.5% | 9.8% | - |

| CET1 ratio | 14.4% | 13.7% | 13.0% | - | 14.4% | 13.0% | - |

CET1 leverage ratio2 | 4.3% | 4.2% | 4.5% | - | 4.3% | 4.5% | - |

Tier 1 leverage ratio3 | 6.1% | 6.0% | 6.3% | - | 6.1% | 6.3% | - |

| Adjusted excluding significant items and Archegos* (CHF mn) | 3Q21 | 2Q21 | 3Q20 | ∆3Q20 | 9M21 | 9M20 | ∆9M20 |

| Net revenues | 5,504 | 5,226 | 5,198 | 6% | 18,160 | 16,766 | 8% |

| Pre-tax income | 1,362 | 1,313 | 1,087 | 25% | 6,271 | 3,514 | 78% |

Highlights for the third quarter 2021

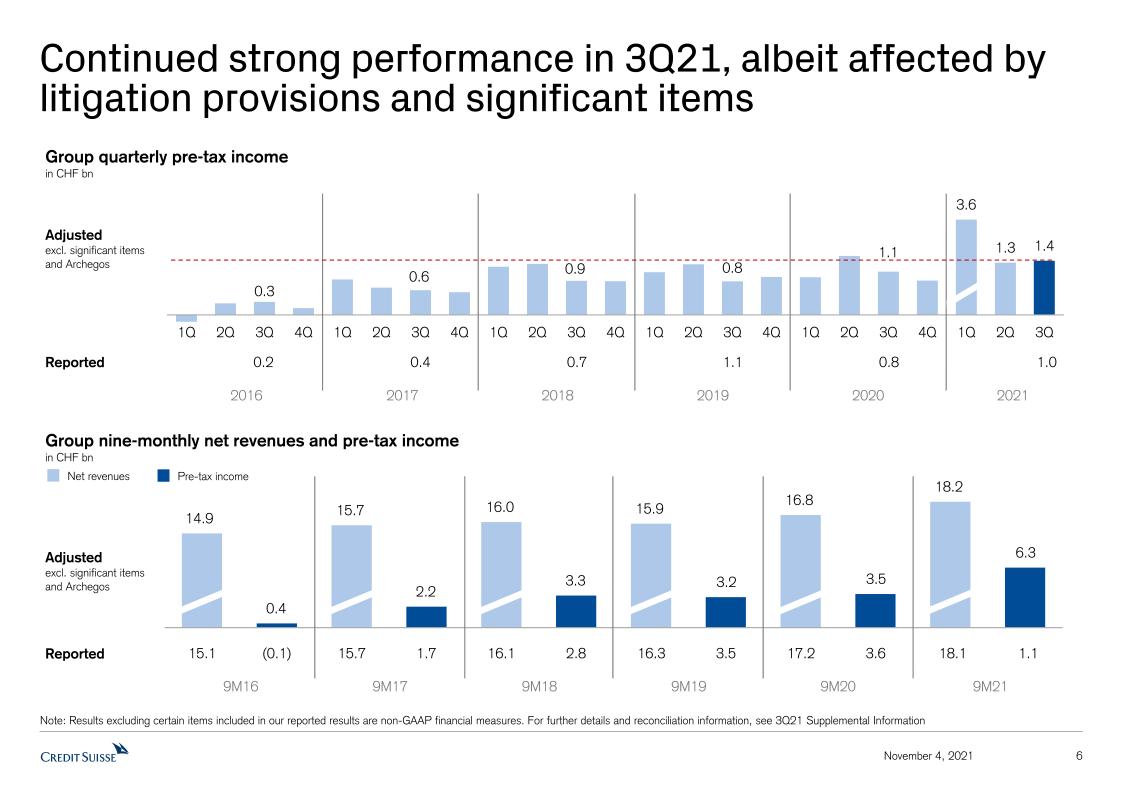

Strong pre-tax income growth year on year, together with more conservative risk appetite, driven by solid revenue growth and a net release of CHF 144 mn in provision for credit losses, partly offset by additional costs, including in relation to longstanding litigation issues

- Net income attributable to shareholders of CHF 434 mn, down 21% year on year driven by an elevated effective tax rate

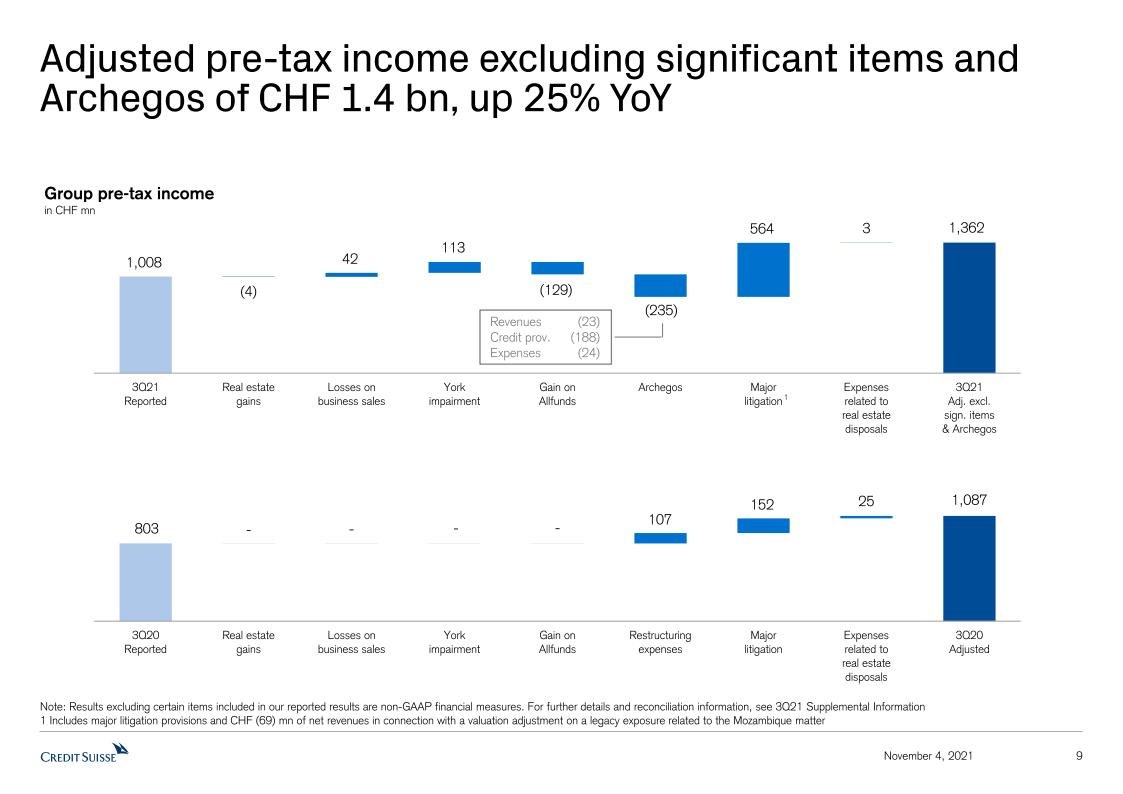

- Reported pre-tax income of CHF 1.0 bn, up 26% year on year, including a gain of CHF 235 mn relating to Archegos, mainly due to a release of provisions pertaining to an assessment of the future recoverability of receivables, and a CHF 129 mn gain related to our equity investment in Allfunds Group. These gains were offset by major litigation charges of CHF 564 mn4, including CHF 214 mn in connection with settlements we announced last month relating to the Mozambique matter and litigation provisions in connection with certain other legacy matters, including mortgage-related matters, and in connection with the Supply Chain Finance Funds (SCFF) matter. We also recorded a further impairment relating to York Capital Management of CHF 113 mn in AM

- On an adjusted basis, excluding significant items and Archegos*, record5 third quarter pre-tax income of CHF 1.4 bn, up 25% year on year

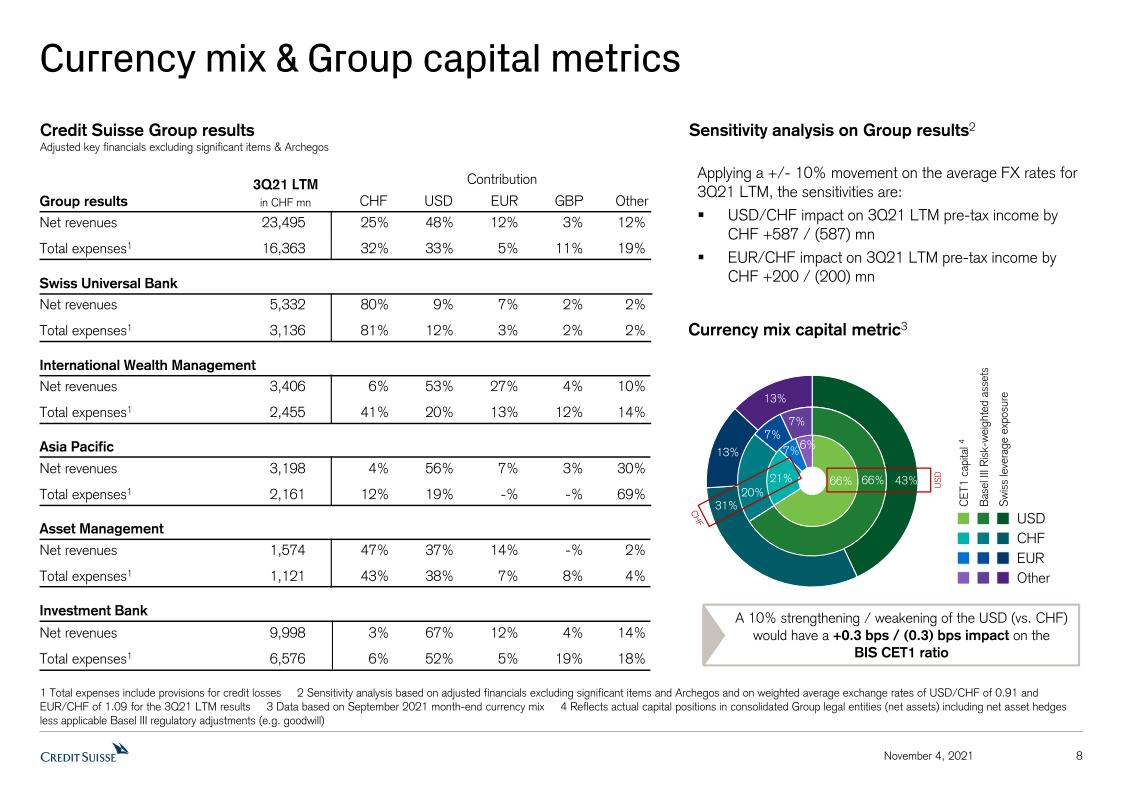

- On an adjusted basis, excluding significant items and Archegos*, net revenues were up 6% year on year driven by higher net revenues across IB, AM and SUB, partly offset by lower net revenues in IWM

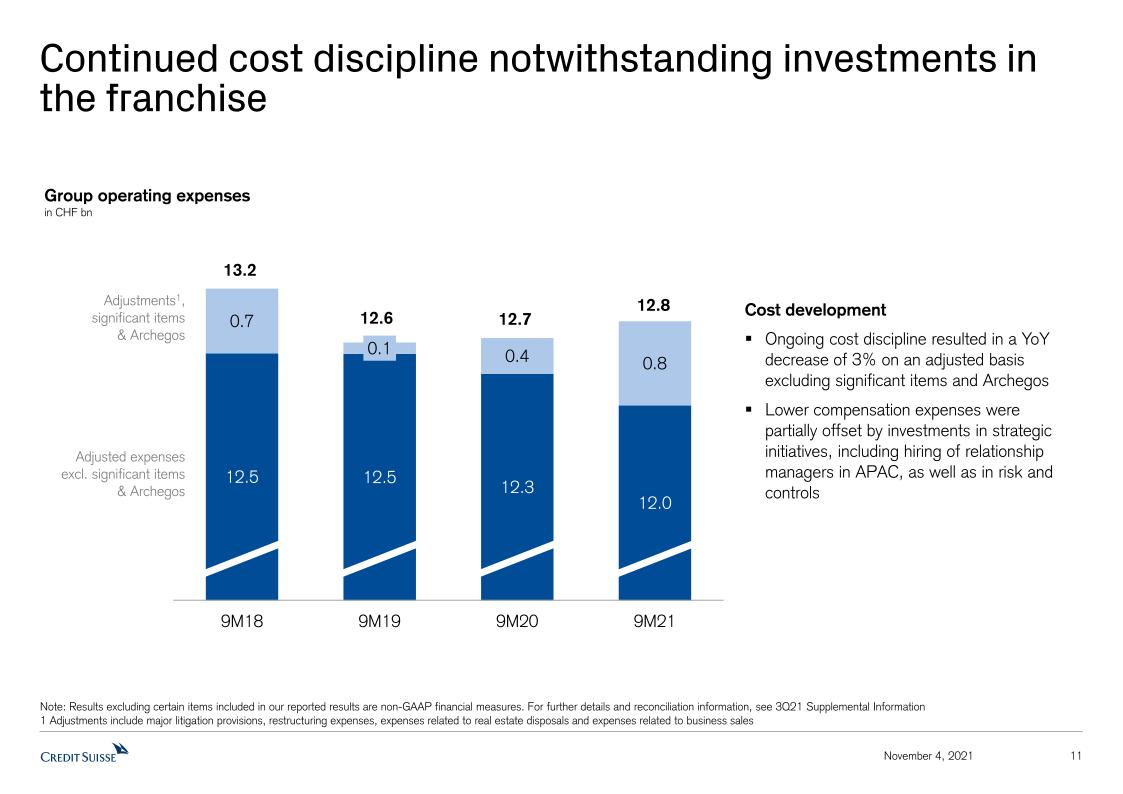

- Reported operating expenses of CHF 4.6 bn, up 6% year on year, primarily due to higher major litigation provisions and professional services fees. Adjusted operating expenses, excluding significant items and Archegos*, up 2% year on year, with continued investments in strategic initiatives, partially offset by lower compensation and benefits

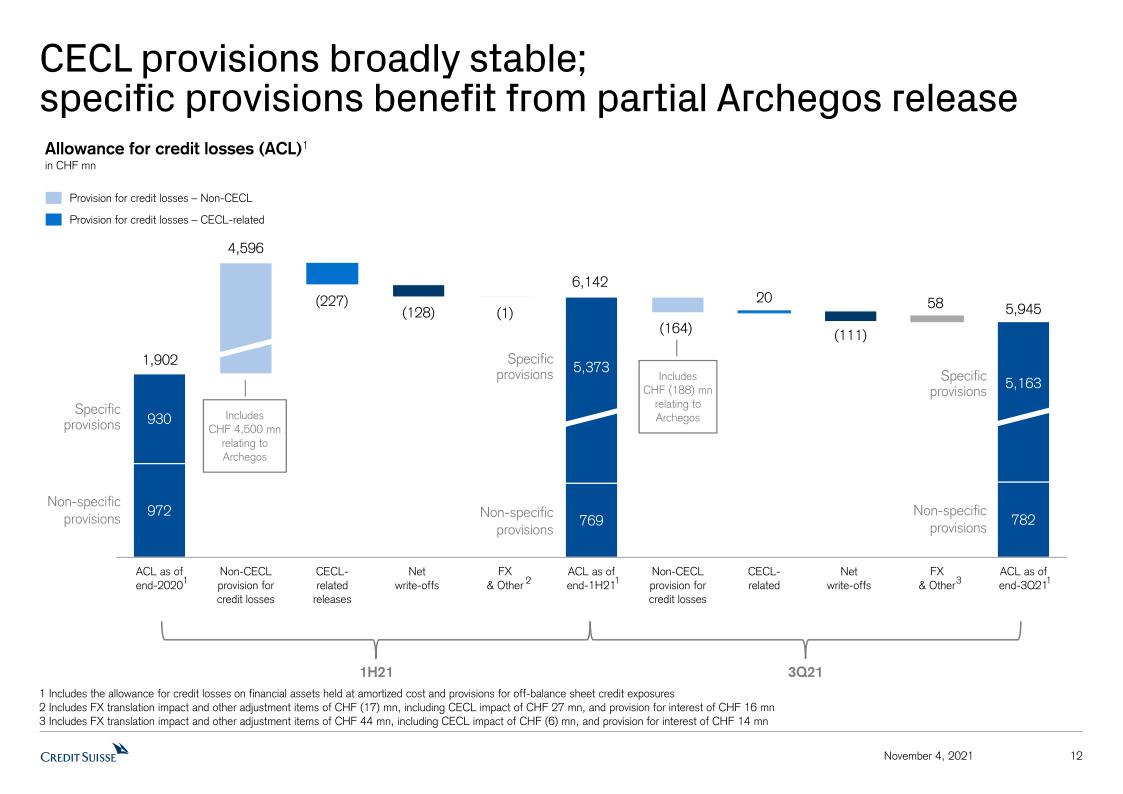

- Net release of provision for credit losses of CHF 144 mn relating primarily to a release of USD 202 mn (CHF 188 mn) pertaining to an assessment of the future recoverability of receivables related to Archegos in the IB

- Settlement with US, UK and Swiss regulators of legacy matters related to loan financing for Mozambique state enterprises and related securities transactions that took place between 2013 and 2016; concluded enforcement proceeding with Swiss regulator related to past observation activities

- Continued progress on remediation work on the SCFF matter. Returning cash to investors remains a priority; total cash paid out and current cash and cash equivalents of approximately USD 7.0 bn as of September 30, 2021

Strong capital position, stable Assets under Management (AuM), and Net New Assets (NNA) of CHF 5.6 bn

- Strong capital base, with CET1 ratio at 14.4% as of the end of 3Q21, up from 13.7% as of the end of 2Q21 benefitting from strong income generation and risk reduction across businesses; Tier 1 leverage ratio at 6.1%; CET1 leverage ratio at 4.3%

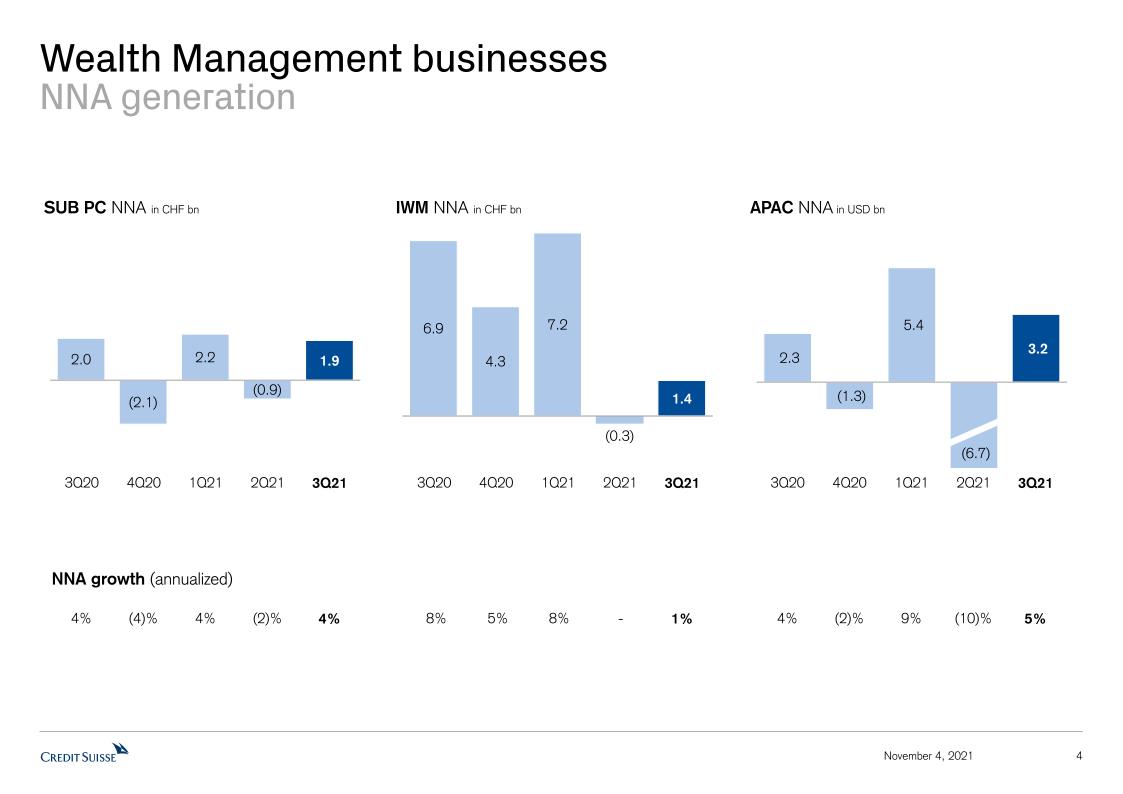

- Group AuM of over CHF 1.6 trn at the end of 3Q21, up approximately 10% year on year; NNA of CHF 5.6 bn with NNA in APAC, SUB and IWM offsetting net asset outflows in AM

- Wealth Management AuM of CHF 843 bn, up approximately 9% year on year, supporting recurring commissions and fees’ growth of 14% year on year

Highlights for the nine months of 2021

- Despite challenges year to date, we concluded our nine months ending September 2021 with a pre-tax income of CHF 1.1 bn, down 70% year on year due mainly to the charges incurred in relation to Archegos of CHF 4.8 bn (USD 5.1 bn)

- On an adjusted basis, excluding significant items and Archegos*, pre-tax income was CHF 6.3 bn, up 78% year on year, driven by a strong contribution from IB, SUB, APAC and AM; as well as lower operating expenses, down 3%

- On an adjusted basis, excluding significant items and Archegos*, net revenues were up 8% year on year, at CHF 18.2 bn, driven by growth in net revenues across IB, AM, and APAC, slightly offset by lower revenues in IWM

- NNA of CHF 29.3 bn compared to CHF 33.6 bn in 9M20 across the Group; NNA of CHF 13.3 bn across Wealth Management businesses in 9M21, compared to CHF 18.3 bn in 9M20

Outlook

Overall, we expect to see a further reduction in market volumes for the remainder of 2021 as the trading environment normalizes compared to the elevated levels seen in 2020, particularly as central banks begin to signal the end of the monetary support provided during the COVID-19 crisis.

In Wealth Management, we expect recurring commissions and fees to continue to benefit from higher levels of AuM as well as increased levels of mandate penetration. With regard to transaction-based revenues in Wealth Management and the Investment Bank, we would expect revenue performance to reflect the normalization of trading conditions as well as the usual seasonal slowdown in market activity. The exit from the majority of Prime Services6 is expected to also reduce Equity Sales & Trading revenues. We would, though, expect our capital markets and advisory revenues to continue to benefit from the strong pipelines in both ECM and M&A. As noted in our strategy update, we expect an impairment in 4Q21 of ~CHF 1.6 bn in respect of the remaining Investment Bank-related goodwill on our balance sheet, which primarily relates to the Donaldson, Lufkin & Jenrette acquisition in 2000, as a consequence of which we would expect to report a net loss in 4Q21. It should be noted that this is a non-cash charge, which will neither reduce the Group’s capital ratios, nor its tangible book value.

As we noted at the end of 1Q21, we would expect the effective tax rate to remain significantly elevated for the final quarter of the year.

Supply Chain Finance Funds Matter Update

The Board of Directors commissioned an externally-led investigation into the SCFF matter, which is being supervised by a special committee. This continues to be a focus for the bank, and work is ongoing. Credit Suisse recorded litigation provisions in connection with the SCFF matter in 3Q21. As we have disclosed in our Financial Report for 3Q21, the Group continues to assess the potential for recovery on behalf of the investors in the funds, and further analyze new, pending or threatened proceedings. As previously reported, the resolution of this matter, the timing of which is difficult to predict, could cause the Group to incur material losses.

Media Release Zurich, November 4, 2021 | |

In terms of an update, along with the fifth cash payment made at the end of September 2021, total cash paid out and current cash and cash equivalents are at approximately 70% of the funds’ net asset value (NAV) as of February 25, 2021. In terms of cash payments, investors have received approximately USD 6.3 bn as of September 30, 2021.

We continue to make good progress on our non-focus areas and have reduced the outstanding exposure of notes by 86% of the February 25, 2021 exposure level. Non-focus areas currently account for USD 0.6 bn of the NAV as of February 25, 2021.

In terms of our focus areas, we continue to pursue all available recovery avenues, and they currently account for approximately USD 2.2 bn of the NAV as of February 25, 2021. Regarding GFG Australia, we received an initial payment of approximately USD 96 mn, and GFG Australia has agreed to repay the remaining principal of approximately USD 178 mn, including interest, by mid-20237.

We continue to file insurance claims through the filing process with Greensill Bank; further claims are being prepared.

Finally, we are actively engaged with private bank investors in the SCFF to offer a waiver on certain fees for the bank’s services.

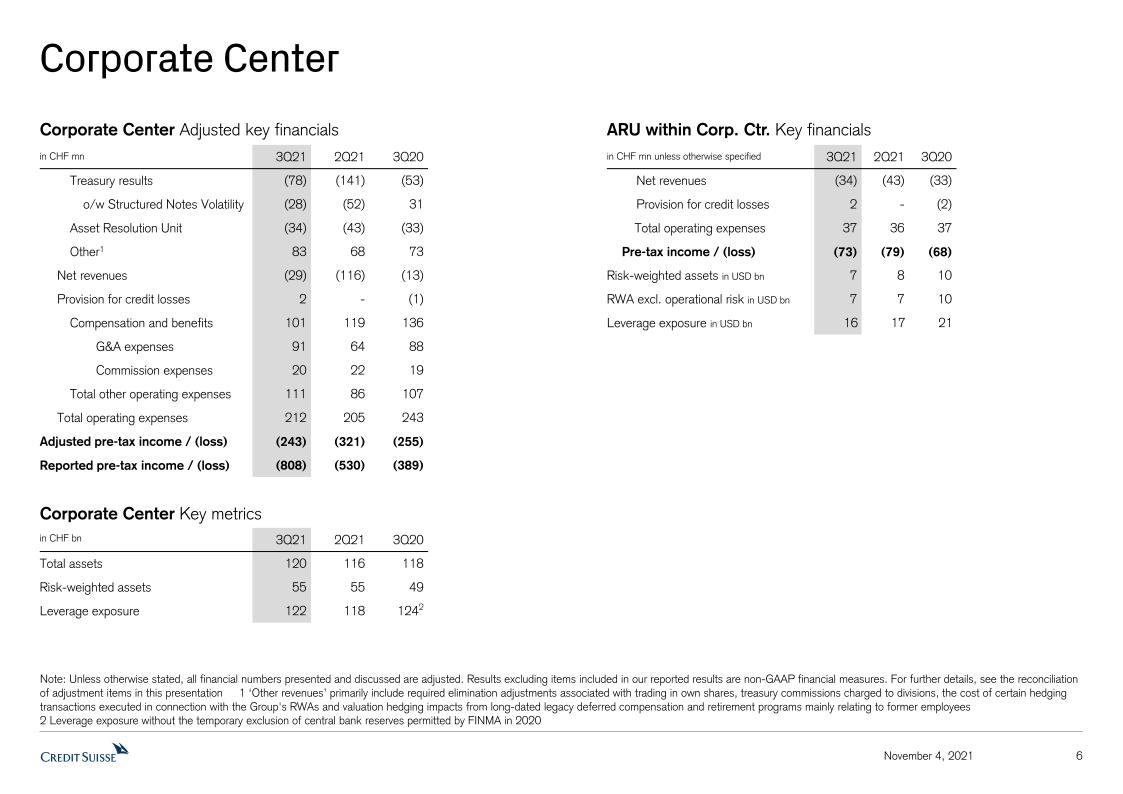

3Q21 Results – Review of Performance

We posted a pre-tax income of CHF 1.0 bn in 3Q21 benefitting from a positive impact relating to Archegos of CHF 235 mn, mainly due to a release of provision for credit losses pertaining to an assessment of the future recoverability of receivables, and gains on our equity investment in Allfunds Group of CHF 129 mn, partially offset by major litigation charges of CHF 564 mn, including CHF 214 mn related to the Mozambique matter as well as provisions for certain other legacy matters, including mortgage-related matters, and in connection with the SCFF matter. We also recorded a further impairment of CHF 113 mn relating to the valuation of our non-controlling interest in York Capital Management. Our net income attributable to shareholders of CHF 434 mn continued to be impacted by a significantly elevated effective tax rate, as previously guided, mainly due to only a partial tax recognition of the Archegos loss. We recorded a release in provision for credit losses of CHF 144 mn, which includes a release pertaining to an assessment of the future recoverability of receivables related to Archegos, partly offset by an increase in CECL-related provision for credit losses. The underlying business results8 were strong, despite our more conservative approach to risk. Our adjusted net revenues, excluding significant items and Archegos*, of CHF 5.5 bn, were up 6% year on year, and our adjusted pre-tax income, excluding significant items and Archegos*, of CHF 1.4 bn, was up 25%.

Our Wealth Management-related businesses reported net revenues of CHF 3.3 bn, up 3% year on year; on an adjusted basis, excluding significant items*, net revenues were up 4%. We saw strong momentum in recurring commissions and fees, up 12%, benefitting from higher client business volumes and an increased mandate penetration at 30%, up from 28% in 3Q20. We also recorded higher transaction- and performance-based revenues, up 6%. Net interest income was down 4%, impacted by lower deposit and loan margins, reflecting a reduction in risk appetite and deleveraging by clients, primarily in APAC.

Our Investment Bank delivered a solid underlying performance9 despite continued discipline in risk and capital management with reductions to RWA and leverage exposure in Prime Services. Net revenues of USD 2.5 bn were up 10% year on year; IB reported results included a release of provision for credit losses of USD 202 mn (CHF 188 mn) as well as a USD 24 mn (CHF 23 mn) benefit to revenues and USD 26 mn (CHF 24 mn) net cost recovery in operating expenses relating to Archegos. Adjusted net revenues, excluding Archegos*, were up 9% driven by strong client activity across Capital Markets, M&A and Equity Derivatives. Fixed Income Sales & Trading revenues were down 13% year on year and Equity Sales & Trading revenues, excluding Archegos*, were down 9% due to continued de-risking in Prime Services. Excluding Prime Services, Equity Sales & Trading revenues substantially increased driven by robust Equity Derivatives performance and higher Cash Equities results. Capital Markets revenues were up 14% and Advisory revenues were up significantly, by 182%, year on year. Revenues in Global Trading Solutions, our collaboration between the IB and our wealth management businesses, declined, in part due to our reduced capital usage and more conservative risk appetite coupled with lower volumes and volatility compared to an exceptional comparable in 3Q20.

Operating expenses for the Group of CHF 4.6 bn increased by 6% year on year, mainly driven by higher litigation provisions and professional services fees; adjusted operating expenses, excluding significant items and Archegos*, increased by 2% in part due to continued strategic investments across our businesses, including our investments in IT infrastructure, the build out of our mainland China business and the expansion of Private Banking coverage teams in APAC, as well as in risk and controls.

The Group reported AuM totaling CHF 1.6 trn at the end of 3Q21, up approximately 10% year on year, with a mandate penetration of approximately 30%, up 2 percentage points compared to 3Q20, supporting our recurring commissions and fees. We saw NNA of CHF 5.6 bn in 3Q21, compared to NNA of CHF 18.0 bn in 3Q20 and net asset outflows of CHF 4.7 bn in 2Q21.

We continued to improve our capital ratios with a CET1 ratio of 14.4% at the end of 3Q21, compared to 13.7% at the end of 2Q21, and a CET1 leverage ratio of 4.3%, compared to 4.2% at the end of 2Q21. Our CET1 and leverage ratios benefitted from strong income generation and risk reduction across businesses.

Media Release Zurich, November 4, 2021 | |

9M21 Results – Review of Performance

The underlying resilience of our franchise, despite the impact of both the Archegos and SCFF matters, major litigation provisions, and our more conservative approach to risk and capital management, particularly in the Investment Bank, is evident in our results for the first nine months of 2021.

On an adjusted basis, excluding significant items and Archegos*, our net revenues were up 8% year on year, at CHF 18.2 bn, driven by revenue growth in IB, AM, and APAC, partially offset by lower revenues in IWM.

In 9M21, our adjusted pre-tax income, excluding significant items and Archegos*, increased 78% year on year, to CHF 6.3 bn, driven by growth in adjusted pre-tax income, excluding significant items and Archegos*, across most divisions, except for IWM where there was a 6% decrease year on year. It also reflects the net release in CECL-related provision for credit losses of CHF 207 mn and lower adjusted operating expenses, excluding significant items and Archegos*, down 3%, mainly reflecting lower compensation expenses partly offset by investments in strategic initiatives, including the hiring of relationship managers in APAC as well as investments in risk and controls.

Our Wealth Management-related businesses reported net revenues of CHF 10.8 bn, up 3% year on year. On an adjusted basis, excluding significant items*, net revenues were up 2%, driven by higher recurring commissions and fees, up 10% year on year, as well as higher transaction- and performance-based revenues, up 3%, partly offset by lower net interest income, down 6%.

Our Investment Bank reported net revenues of USD 8.1 bn, up 10% year on year. Our adjusted net revenues, excluding Archegos*, were up 17% reflecting the strong revenue environment. Fixed Income Sales & Trading revenues were down 6% year on year. Equity Sales & Trading revenues were down 25% year on year, however, excluding Archegos*, they were up 1%10. Capital Markets revenues were up 69% due to robust markets and increased client activity. Advisory revenues were up 50% due to a significant increase in M&A activity.

NNA for 9M21 were CHF 29.3 bn compared to CHF 33.6 bn in 9M20, with contributions from SUB of CHF 8.2 bn, IWM of CHF 8.3 bn, AM of CHF 9.9 bn and APAC of CHF 1.8 bn.

Media Release Zurich, November 4, 2021 | |

Detailed Divisional Summaries

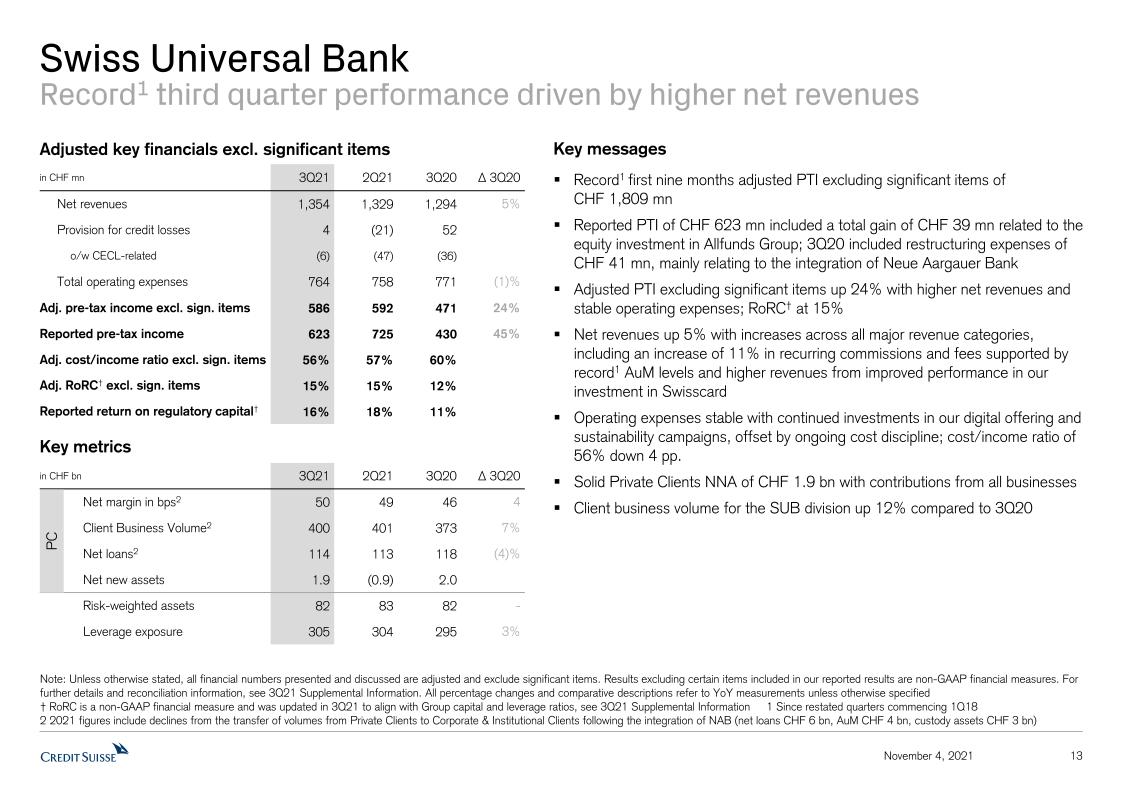

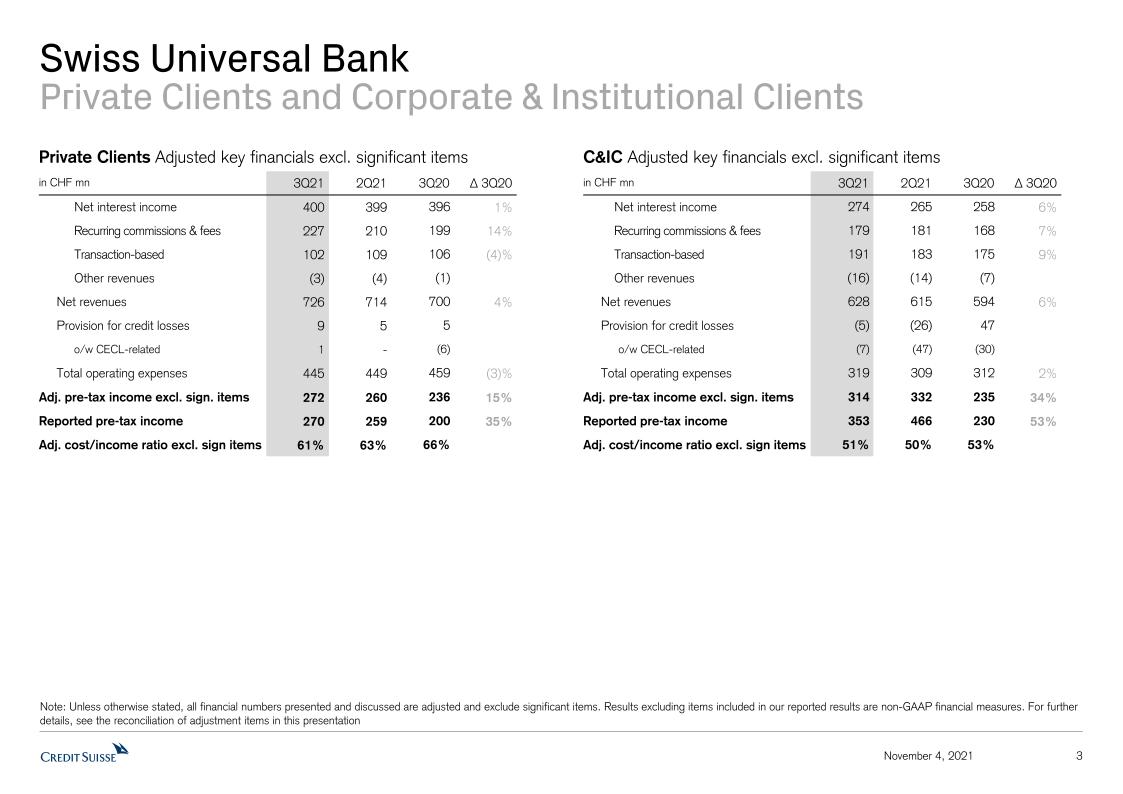

| Swiss Universal Bank (SUB) |

| Reported results (in CHF mn) | 3Q21 | 2Q21 | 3Q20 | ∆3Q20 | | 9M21 | 9M20 | ∆9M20 |

| Net revenues | 1,391 | 1,477 | 1,294 | 7% | 4,317 | 4,222 | 2% |

| Provision for credit losses | 4 | (21) | 52 | - | 9 | 204 | - |

| Operating expenses | 764 | 773 | 812 | (6)% | 2,295 | 2,401 | (4)% |

| Pre-tax income | 623 | 725 | 430 | 45% | 2,013 | 1,617 | 24% |

| Cost/income ratio (%) | 55% | 52% | 63% | - | 53% | 57% | - |

| Net New Assets (bn) | 1.5 | 0.6 | 5.5 | - | 8.2 | 6.1 | - |

| o/w Private Clients (bn) | 1.9 | (0.9) | 2.0 | - | 3.2 | (3.8) | - |

Adjusted results, excluding significant items* (in CHF mn) | 3Q21 | 2Q21 | 3Q20 | ∆3Q20 | 9M21 | 9M20 | ∆9M20 |

| Net revenues | 1,354 | 1,329 | 1,294 | 5% | 4,089 | 4,063 | 1% |

| Operating expenses | 764 | 758 | 771 | (1)% | 2,271 | 2,359 | (4)% |

| Pre-tax income | 586 | 592 | 471 | 24% | 1,809 | 1,500 | 21% |

| Cost/income ratio (%) | 56% | 57% | 60% | - | 56% | 58% | - |

3Q21

- On an adjusted basis, excluding significant items*, SUB had a record11 third quarter pre-tax income of CHF 586 mn, up 24% year on year, driven by higher net revenues up 5%, with stable operating expenses. Our ongoing cost discipline further supported our adjusted cost/income ratio, excluding significant items*, of 56%, while we continued to invest in our digital offering and sustainability initiatives

- Reported net revenues of CHF 1.4 bn were up 7% year on year and included a CHF 39 mn gain on our equity investment in Allfunds Group. Adjusted net revenues, excluding significant items,* were up 5% driven by increases across all major revenue categories with recurring commissions and fees up 11% supported by record12 AuM levels and higher revenues from improved performance in our investment in Swisscard. Transaction-based revenues were up 4% and net interest income was up 3%

- Solid NNA of CHF 1.5 bn reflecting net inflows from Private Clients of CHF 1.9 bn, with contributions from all businesses, partially offset by net outflows in Corporate & Institutional Clients

- SUB recorded higher client business volume of CHF 1.1 trn, up 12% year on year

9M21

- On an adjusted basis, excluding significant items*, strong and record13 pre-tax income for the first nine months at CHF 1.8 bn, up 21% year on year, driven by significantly lower provision for credit losses, lower operating expenses down 4% and 1% net revenue growth

- Reported net revenues up 2% compared to 9M20; adjusted net revenues, excluding significant items*, of CHF 4.1 bn, up 1%, driven by higher recurring commissions and fees, up 8%, with stable net interest income, partly offset by lower transaction-based revenues, down 5%

- NNA of CHF 8.2 bn at an annualized growth rate of 2%, and supported by net inflows from Private Clients of CHF 3.2 bn, with contributions from all businesses

Media Release Zurich, November 4, 2021 | |

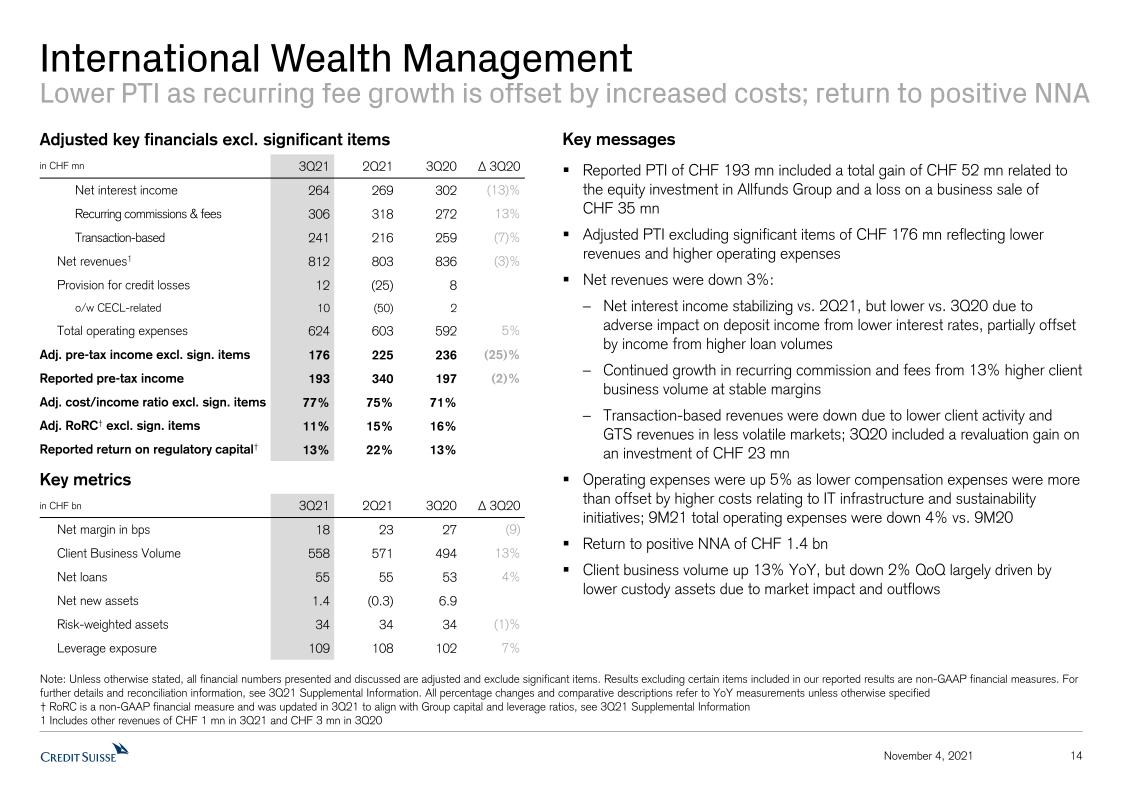

| International Wealth Management (IWM) |

| Reported results (in CHF mn) | 3Q21 | 2Q21 | 3Q20 | ∆3Q20 | | 9M21 | 9M20 | ∆9M20 |

| Net revenues | 829 | 930 | 836 | (1)% | 2,746 | 2,773 | (1)% |

| Provision for credit losses | 12 | (25) | 8 | - | (13) | 79 | - |

| Operating expenses | 624 | 615 | 631 | (1)% | 1,818 | 1,896 | (4)% |

| Pre-tax income | 193 | 340 | 197 | (2)% | 941 | 798 | 18% |

| Cost/income ratio (%) | 75% | 66% | 75% | - | 66% | 68% | - |

| Net New Assets (bn) | 1.4 | (0.3) | 6.9 | - | 8.3 | 12.4 | - |

Adjusted results, excluding significant items* (in CHF mn) | 3Q21 | 2Q21 | 3Q20 | ∆3Q20 | 9M21 | 9M20 | ∆9M20 |

| Net revenues | 812 | 803 | 836 | (3)% | 2,544 | 2,758 | (8)% |

| Operating expenses | 624 | 603 | 592 | 5% | 1,812 | 1,890 | (4)% |

| Pre-tax income | 176 | 225 | 236 | (25)% | 745 | 789 | (6)% |

| Cost/income ratio (%) | 77% | 75% | 71% | - | 71% | 69% | - |

3Q21

- On an adjusted basis, excluding significant items*, IWM recorded pre-tax income of CHF 176 mn, down 25% year on year, driven by lower net revenues down 3%, as well as higher operating expenses up 5% due in part to higher costs relating to our IT infrastructures and sustainability initiatives

- Stable reported net revenues, of CHF 829 mn, included a CHF 52 mn gain on our equity investment in Allfunds Group and a loss of CHF 35 mn relating to a business sale. Adjusted net revenues, excluding significant items*, of CHF 812 mn, were down 3%. This was driven by lower net interest income, down 13%, due to an adverse impact on deposit income from lower interest rates, as well as lower transaction and performance-based revenues, down 7%, due to lower client activity and GTS revenues in less volatile markets; additionally, 3Q20 included a revaluation gain on an investment of CHF 23 mn. However, higher recurring commissions and fees, up 13%, were driven by higher client business volume

- NNA of CHF 1.4 bn with strong inflows in Western Europe

- Client business volume of CHF 558 bn, up 13% year on year reflecting higher AuM of CHF 396 bn

9M21

- On an adjusted basis, excluding significant items*, pre-tax income was down 6% year on year at CHF 745 mn, mainly reflecting lower net revenues, which were only partly offset by lower operating expenses, down 4%, and a net release of provision for credit losses of CHF 13 mn

- Reported net revenues were stable compared to 9M20. Adjusted net revenues, excluding significant items*, of CHF 2.5 bn, were down 8% year on year, driven by lower transaction- and performance-based revenues, down 16%, mainly due to lower GTS revenues in less volatile markets, lower structured products revenues, and lower fees from foreign exchange client business as well as lower net interest income, down 15%, partially due to lower USD interest rates. This was partly offset by higher recurring commissions and fees, up 10%, with higher client business volume

- NNA of CHF 8.3 bn, reflecting an annualized growth rate of 3%

Media Release Zurich, November 4, 2021 | |

| Asia Pacific (APAC) |

| Reported results (in USD mn) | 3Q21 | 2Q21 | 3Q20 | ∆3Q20 | | 9M21 | 9M20 | ∆9M20 |

| Net revenues | 837 | 874 | 800 | 5% | 2,877 | 2,507 | 15% |

| Provision for credit losses | 7 | 6 | 49 | - | 43 | 241 | - |

| Operating expenses | 583 | 595 | 557 | 5% | 1,737 | 1,641 | 6% |

| Pre-tax income | 247 | 273 | 194 | 27% | 1,097 | 625 | 76% |

| Cost/income ratio (%) | 70% | 68% | 70% | - | 60% | 65% | - |

| Net New Assets (bn) | 3.2 | (6.7) | 2.3 | - | 1.9 | 10.2 | - |

Adjusted results, excluding significant items* (in USD mn) | 3Q21 | 2Q21 | 3Q20 | ∆3Q20 | 9M21 | 9M20 | ∆9M20 |

| Net revenues | 795 | 770 | 800 | (1)% | 2,684 | 2,481 | 8% |

| Operating expenses | 582 | 586 | 554 | 5% | 1,726 | 1,638 | 5% |

| Pre-tax income | 206 | 178 | 197 | 5% | 915 | 602 | 52% |

| Cost/income ratio (%) | 73% | 76% | 69% | - | 64% | 66% | - |

3Q21

- On an adjusted basis, excluding significant items*, pre-tax income, up 5% year on year at USD 206 mn, was resilient despite volatility in Greater China markets and higher investment costs. Provision for credit losses significantly decreased, reflecting lower specific provisions; no impairments in China real estate. Adjusted operating expenses, excluding significant items*, was up 5% year on year, mainly due to our continued relationship manager hiring coupled with other investments, particularly in China, risk and controls and sustainability initiatives

- Reported net revenues of USD 837 mn, up 5% year on year, included a gain on the equity investment in Allfunds Group of USD 42 mn. Excluding significant items*, adjusted net revenues at USD 795 mn were stable, as lower net interest income was offset by higher recurring commissions and fees and transaction-based revenues. Net interest income was down 14%, reflecting a reduction in risk appetite and deleveraging by clients and lower loan and deposit margins. Recurring commissions and fees were up 19%, reflecting strong mandate and fund volumes and continued growth in mandate penetration. Transaction-based revenues were also up 4%14 due in part to higher fees from increased M&A activity, partly offset by weaker private client activity and lower revenues from GTS

- NNA of USD 3.2 bn achieved notwithstanding significant deleveraging and market-driven client outflows

- Client business volume of USD 380 bn, up 5% year on year

9M21

- On an adjusted basis, excluding significant items*, APAC recorded higher pre-tax income of USD 915 mn, up 52% year on year, driven by higher net revenues and significantly lower provision for credit losses, offsetting higher operating expenses

- Higher reported net revenues, up 15% year on year; adjusted net revenues, excluding significant items*, of USD 2.7 bn, were up 8%, driven by higher transaction-based revenues, up 16%, and higher recurring commission and fees, up 22%, reflecting higher mandates and funds volumes. These were partly offset by lower net interest income, down 8%, driven by lower deposit and loan margins

- NNA of USD 1.9 bn, including USD 6.7 bn of net asset outflows in 2Q21

Media Release Zurich, November 4, 2021 | |

| Investment Bank (IB) |

| Reported results (in USD mn) | 3Q21 | 2Q21 | 3Q20 | ∆3Q20 | | 9M21 | 9M20 | ∆9M20 |

| Net revenues | 2,465 | 1,761 | 2,245 | 10% | 8,114 | 7,381 | 10% |

| Provision for credit losses | (182) | 16 | (16) | - | 4,452 | 447 | - |

| Operating expenses | 1,815 | 1,831 | 1,856 | (2)% | 5,476 | 5,492 | - |

| Pre-tax income/loss | 832 | (86) | 405 | 105% | (1,814) | 1,442 | - |

| Cost/income ratio (%) | 74% | 104% | 83% | - | 67% | 74% | - |

| Return on Regulatory Capital (%) | 20% | (2)% | 9% | - | (14)% | 10% | - |

| Adjusted results, excluding Archegos* (in USD mn) | 3Q21 | 2Q21 | 3Q20 | ∆3Q20 | 9M21 | 9M20 | ∆9M20 |

| Net revenues | 2,441 | 2,303 | 2,245 | 9% | 8,632 | 7,381 | 17% |

| Operating expenses | 1,839 | 1,763 | 1,797 | 2% | 5,380 | 5,409 | (1)% |

| Pre-tax income | 582 | 601 | 465 | 25% | 3,382 | 1,525 | 122% |

| Cost/income ratio (%) | 75% | 77% | 80% | - | 62% | 73% | - |

| Return on Regulatory Capital (%) | 14% | 13% | 10% | - | 26% | 11% | - |

3Q21

- Strong adjusted pre-tax income, excluding Archegos*, of USD 582 mn, up 25% year on year, with an adjusted return on regulatory capital (RoRC), excluding Archegos*, of 14%, resulting in record third quarter performance15, reflecting strength of the franchise, continued disciplined risk and capital management as well as constructive market conditions

- Reported provision for credit losses decreased due to a release of USD 202 mn related to Archegos in 3Q21; excluding this release, the adjusted* provision for credit losses, of USD 20 mn, increased due to CECL-related adjustments

- Despite significantly lower year on year capital usage, reported net revenues of USD 2.5 bn, were up 10% year on year; adjusted net revenues, excluding Archegos*, of USD 2.4 bn, up 9%, were driven by record16 third quarter revenues across several businesses including Capital Markets, M&A, Equity Derivatives, Securitized Products and Cash Equities

- Revenues in our Fixed Income Sales & Trading business were down 13% year on year, as continued outperformance in securitized products revenues, particularly in our number 1 ranked Asset Finance franchise17 and non-agency trading business, was offset by normalization in Emerging Markets, Macro and Global Credit Products compared to elevated volumes and volatility in 3Q20

- Equity Sales & Trading revenues, excluding Archegos*, declined by 9% year on year due to continued de-risking in Prime Services; excluding Prime Services, revenues substantially increased driven by a robust Equity Derivatives performance as well as higher Cash Equities revenues. Our Capital Markets revenues were up 14% driven by a strong ECM performance as well as a rebound in leverage finance activity; finally Advisory revenues were up 182% driven by very strong M&A fees which resulted in the best quarterly performance since 201818

- Continued disciplined capital management with RWA down USD 12 bn year on year due to reductions in the corporate bank and Prime Services, and leverage exposure down USD 38 bn, mainly driven by a reduction in Prime Services

9M21

- Significantly higher adjusted pre-tax income, excluding Archegos*, of USD 3.4 bn resulted in an adjusted return on regulatory capital, excluding Archegos*, of 26% for 9M21. The reported pre-tax loss of USD 1.8 bn included losses from Archegos of approximately USD 5.1 bn

- Adjusted net revenues, excluding Archegos*, of USD 8.6 bn, up 17% year on year, resulting in a strong performance in 9M21 with notable results in capital markets, advisory and securitized products, while adjusted operating expenses, excluding Archegos*, were flat

Media Release Zurich, November 4, 2021 | |

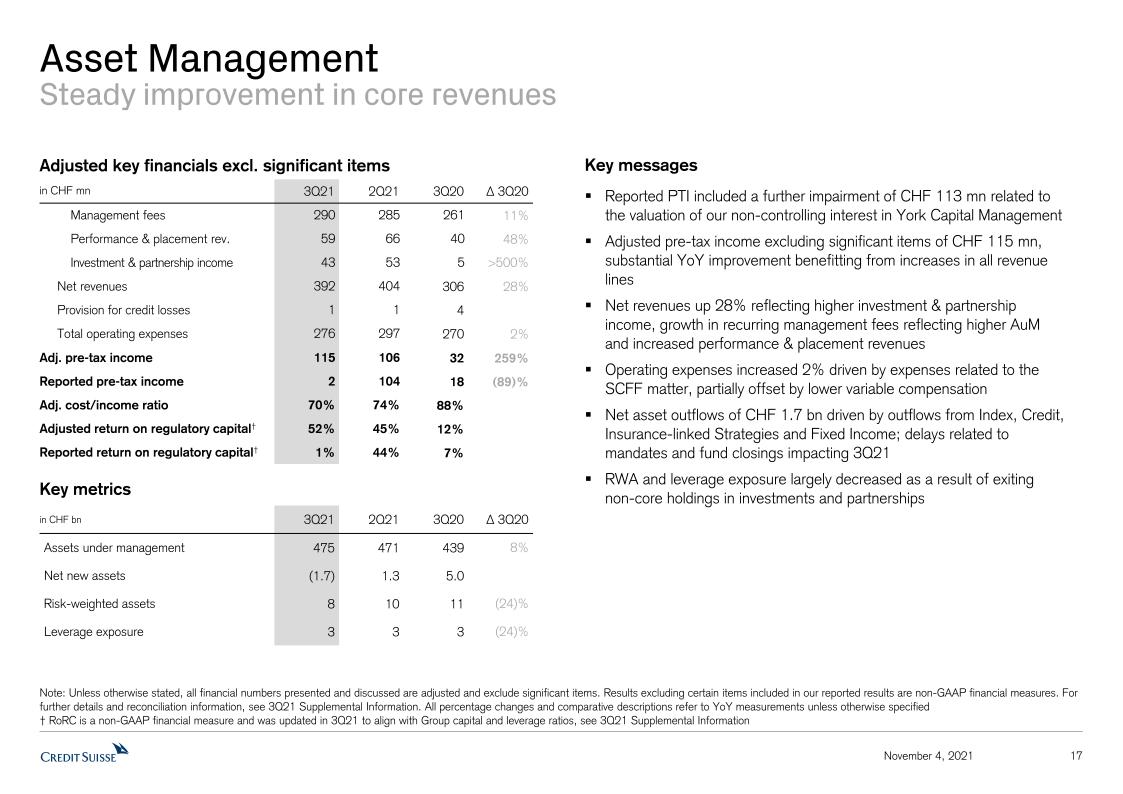

| Asset Management (AM) |

| Reported results (in CHF m) | 3Q21 | 2Q21 | 3Q20 | ∆3Q20 | | 9M21 | 9M20 | ∆9M20 |

| Net revenues | 279 | 404 | 306 | (9)% | 1,069 | 1,112 | (4)% |

| Provision for credit losses | 1 | 1 | 4 | - | 2 | 6 | - |

| Operating expenses | 276 | 299 | 284 | (3)% | 846 | 840 | 1% |

| Pre-tax income | 2 | 104 | 18 | (89)% | 221 | 266 | (17)% |

| Cost/income ratio (%) | 99% | 74% | 93% | - | 79% | 76% | - |

| Net New Assets (bn) | (1.7) | 1.3 | 5.0 | - | 9.9 | 9.2 | - |

Adjusted results, excluding significant items* (in CHF m) | 3Q21 | 2Q21 | 3Q20 | ∆3Q20 | 9M21 | 9M20 | ∆9M20 |

| Net revenues | 392 | 404 | 306 | 28% | 1,182 | 909 | 30% |

| Operating expenses | 276 | 297 | 270 | 2% | 842 | 826 | 2% |

| Pre-tax income / (loss) | 115 | 106 | 32 | 259% | 338 | 77 | 339% |

| Cost/income ratio (%) | 70% | 74% | 88% | - | 71% | 91% | - |

3Q21

- On adjusted basis, excluding significant items*, pre-tax income was up significantly year on year at CHF 115 mn, driven by higher net revenues, up 28%, reflecting increases in investment & partnership income, management fees and performance & placement revenues. Adjusted operating expenses, excluding significant items*, were up 2%, mainly due to higher expenses related to the SCFF matter. Reported pre-tax income includes a further impairment of CHF 113 mn relating to the valuation of our non-controlling interest in York Capital Management

- Reported net revenues were down 9% year on year due to the impairment loss relating to York Capital Management; strong adjusted net revenues, excluding significant items*, of CHF 392 mn driven by significantly increased investment & partnership income, higher management fees up 11%, reflecting higher AuM, and improved performance and placement revenues up 48%, mainly due to higher placement fees

- Net asset outflows of CHF 1.7 bn, driven by outflows from Index, Credit, Insurance-linked Strategies and Fixed Income; AuM of CHF 475 bn

9M21

- On an adjusted basis, excluding significant items*, AM had significantly higher pre-tax income, year on year, of CHF 338 mn compared to CHF 77 mn, driven by higher net revenues, partly offset by higher operating expenses up 2%

- Reported net revenues of CHF 1.1 bn, down 4% year on year, mainly due to the gains related to the InvestLab transfer in 9M20 along with the impairment loss relating to York Capital Management in 9M21. Strong adjusted net revenues, excluding significant items*, up 30% year on year, driven by a significant increase in performance and placement revenues due to higher performance fees and carried interest, higher placement fees, and positive investment-related gains compared to 9M20. Also driven by higher management fees, up 10%, on a higher average AuM, as well as higher investment & partnership income up 74%

- NNA of CHF 9.9 bn at annualized growth rate of 3%

Media Release Zurich, November 4, 2021 | |

PROGRESS WITHIN SUSTAINABILITY, RESEARCH & INVESTMENT SOLUTIONS

One year after its creation, the Sustainability, Research & Investment Solutions (SRI) function continues to unlock value for our clients through the provision of sustainable solutions and insight in financial services

Sustainability

- As of the end of 3Q21, Credit Suisse’s assets managed according to sustainability criteria (Sustainable AuM) were CHF 144 bn, up 33% compared to December 31, 2020

- We continue to progress our 2050 net zero emissions commitment, by developing reduction pathways for the highest carbon-emitting sector exposures and expanding efforts to align our financing activities with the Paris Agreement global warming limit of 1.5º C. Furthermore, we have introduced a time-bound commitment to restrict financing and capital market underwriting to businesses involved in activities related to thermal coal mining and coal power. Details are available in our external summary of Credit Suisse’s Sector Policies and Guidelines

Research

- We continued to innovate our Research platform by exploring non-traditional channels, propelling sustainability thought leadership with key publications (e.g., ROE of a Tree, the 2021 edition of CSRI Gender 3000, Women to Women Investing reports) and advancing our Industry Immersion strategy, which enables proprietary access to public and private companies

Investment Solutions & Products

- Investment solutions have benefitted from strong client demand with mandate volumes up >10% year on year and private and alternative holdings up >30% year on year benefitting recurring revenues in Wealth Management-related businesses

- House View continues to perform well and generate positive growth for our clients across tactical and strategic allocations, themes and Supertrends

Media Release Zurich, November 4, 2021 | |

CONTACT DETAILS

Kinner Lakhani, Investor Relations, Credit Suisse Tel: +41 44 333 71 49 Email: investor.relations@credit-suisse.com |

Dominik von Arx, Corporate Communications, Credit Suisse Tel: +41 844 33 88 44 Email: media.relations@credit-suisse.com |

The Financial Report and Presentation Slides for 3Q21 are available to download from 06:45 CET today at: https://www.credit-suisse.com/results |

PRESENTATION OF 3Q21 RESULTS AND GROUP’S STRATEGY REVIEW

THURSDAY, NOVEMBER 4, 2021

| Event | Media Call on 3Q21 Results | Analyst Call | Media Call on Group’s Strategy Review |

| Time | 07:30 CET (Zurich) 06:30 GMT (London) 02:30 EDT (New York) | 08:15 CET (Zurich) 07:15 GMT (London) 03:15 EDT (New York) | 14:30 CET (Zurich) 13:30 GMT (London) 09:30 EDT (New York) |

| Language | English | English | English |

| Access | Switzerland +41 044 580 37 45 UK +44 (0) 2030 576 560 USA +1 877 741 80 64 Reference: "Credit Suisse early media call" Conference ID: 1396859 Please dial in 10 minutes before the start of the call | Switzerland: +41 44 580 48 67 Europe: +44 203 057 6528 US: +1 866 276 8933 Reference: Credit Suisse Analysts and Investors Call Conference ID: 9946919 Please dial in 10 minutes before the start of the call Webcast link here. | Switzerland +41 044 580 48 67 UK +44 (0) 2030 576 528 USA Free Call 1866 276 89 33 Reference: "Credit Suisse Media Call"

Conference ID: 1859665

Please dial in 10 minutes before the start of the call The call is also available via webcast. |

| Q&A Session | Following the presentation, you will have the opportunity to ask the speakers questions | Following the presentation, you will have the opportunity to ask the speakers questions | Following the presentation, you will have the opportunity to ask the speakers questions |

| Playback | | Replay available at the webcast link. | Replay available at the webcast link. |

Media Release Zurich, November 4, 2021 | |

* Refers to results excluding certain items included in our reported results. These results are non-GAAP financial measures. For a reconciliation to the most directly comparable US GAAP measures, see the Appendix of this Media Release.

1 Since restated quarters, commencing 1Q18

2 In 3Q20 and 9M20, leverage exposure excludes CHF 110 billion of central bank reserves, after adjusting for the dividend paid in 2020 as required by FINMA. FINMA announced the temporary exclusion for purposes of leverage ratio calculations in response to the COVID-19 pandemic, which temporary measure expired as of January 1, 2021

3 In 3Q20 and 9M20, leverage exposure excludes CHF 110 billion of central bank reserves, after adjusting for the dividend paid in 2020 as required by FINMA. FINMA announced the temporary exclusion for purposes of leverage ratio calculations in response to the COVID-19 pandemic, which temporary measure expired as of January 1, 2021

4 Consists of major litigation provisions of CHF 495 mn and a valuation adjustment related to major litigation of CHF 69 mn

5 Since 3Q16

6 With the exception of Index Access and APAC Delta One

7 AUD / USD exchange rate of 0.7416 used for purposes of calculating GFG Australian amounts

8 References to underlying results or performance mean adjusted pre-tax income, excluding significant items and Archegos*

9 References to underlying results or performance mean adjusted pre-tax income, excluding Archegos*

10 Excludes Archegos loss of USD 518 mn from Equity Sales & Trading revenues in 9M21

11 Since restated quarters, commencing 1Q18

12 Since restated quarters, commencing 1Q18

13 Since restated quarters, commencing 1Q18

14 3Q21 financing revenues included mark-to-market losses of USD 15 mn (net of USD (8) mn of hedges). 3Q20 included mark-to-market losses of USD 40 mn (net of hedges of USD (11) mn)

15 Since restated quarters, commencing 1Q18

16 Since restated quarters, commencing 1Q18

17 Source: Thomson Reuters as of September 30, 2021 for the period

18 Since restated quarters, commencing 1Q18

Abbreviations

AM – Asset Management; APAC – Asia Pacific; AUD – Australian dollar; AuM – assets under management; BCBS – Basel Committee on Banking Supervision; BIS – Bank for International Settlements; bn – billion; CECL – US GAAP accounting standard for current expected credit losses; CET1 – common equity tier 1; CHF – Swiss francs; CSRI – Credit Suisse Research Institute; ECM – Equity Capital Markets; FINMA – Swiss Financial Market Supervisory Authority FINMA; FX – Foreign Exchange; GAAP – Generally accepted accounting principles; GTS – Global Trading Solutions; IB – Investment Bank; IWM – International Wealth Management; mn – million; M&A – Mergers & Acquisitions; NAV – Net Asset Value; NNA – net new assets; PC – Private Clients; RoRC – Return on Regulatory Capital; RoTE – Return on Tangible Equity; RWA – risk weighted assets; SEC – US Securities and Exchange Commission; SRI – Sustainability, Research & Investment Solutions; SUB – Swiss Universal Bank; SCFF – Supply Chain Finance Funds; trn – trillion; UK – United Kingdom; US – United States; USD – US dollar; WM – Wealth Management; YoY – year on year.

Important information

This document contains select information from the full 3Q21 Financial Report and 3Q21 Results Presentation slides that Credit Suisse believes is of particular interest to media professionals. The complete 3Q21 Financial Report and 3Q21 Results Presentation slides, which have been distributed simultaneously, contain more comprehensive information about our results and operations for the reporting quarter, as well as important information about our reporting methodology and some of the terms used in these documents. The complete 3Q21 Financial Report and 3Q21 Results Presentation slides are not incorporated by reference into this document.

We may not achieve all of the expected benefits of our strategic initiatives. Factors beyond our control, including but not limited to the market and economic conditions (including macroeconomic and other challenges and uncertainties, for example, resulting from the COVID-19 pandemic), changes in laws, rules or regulations and other challenges discussed in our public filings, could limit our ability to achieve some or all of the expected benefits of these initiatives.

In particular, the terms “Estimate”, “Illustrative”, “Expectation”, “Ambition”, “Objective”, “Outlook”, “Goal”, “Commitment” and “Aspiration” are not intended to be viewed as targets or projections, nor are they considered to be Key Performance Indicators. All such estimates, illustrations, expectations, ambitions, objectives, outlooks, goals, commitments and aspirations are subject to a large number of inherent risks, assumptions and uncertainties, many of which are completely outside of our control. These risks, assumptions and uncertainties include, but are not limited to, general market conditions, market volatility, increased inflation, interest rate volatility and levels, global and regional economic conditions, challenges and uncertainties resulting from the COVID-

Media Release Zurich, November 4, 2021 | |

19 pandemic, political uncertainty, changes in tax policies, regulatory changes, changes in levels of client activity as a result of any of the foregoing and other factors. Accordingly, this information should not be relied on for any purpose. We do not intend to update these estimates, illustrations, expectations, ambitions, objectives, outlooks, goals, commitments or aspirations.

In preparing this document, management has made estimates and assumptions that affect the numbers presented. Actual results may differ. Annualized numbers do not take into account variations in operating results, seasonality and other factors and may not be indicative of actual, full-year results. Figures throughout this document may also be subject to rounding adjustments. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information. This information is subject to change at any time without notice and we do not intend to update this information.

Return on tangible equity, a non-GAAP financial measure, is calculated as annualized net income attributable to shareholders divided by average tangible shareholders’ equity. Tangible shareholders’ equity, a non-GAAP financial measure, is calculated by deducting goodwill and other intangible assets from total shareholders’ equity as presented in our balance sheet. Management believes that return on tangible equity is meaningful as it is a measure used and relied upon by industry analysts and investors to assess valuations and capital adequacy. For end-3Q21, tangible shareholders’ equity excluded goodwill of CHF 4,615 million and other intangible assets of CHF 234 million from total shareholders’ equity of CHF 44,498 million as presented in our balance sheet. For end-2Q21, tangible shareholders’ equity excluded goodwill of CHF 4,588 million and other intangible assets of CHF 245 million from total shareholders’ equity of CHF 43,580 million as presented in our balance sheet. For end-3Q20, tangible shareholders’ equity excluded goodwill of CHF 4,577 million and other intangible assets of CHF 256 million from total shareholders’ equity of CHF 45,740 million as presented in our balance sheet.

Beginning in 3Q21, the return on regulatory capital calculation has been updated to closer align with the actual capital and leverage ratio levels under which Credit Suisse operates, rather than the previously used minimum requirements set by regulators. Regulatory capital is calculated as the average of 13.5% of RWA and 4.25% of leverage exposure and return on regulatory capital, a non-GAAP financial measure, is calculated using income/(loss) after tax and assumes a tax rate of 30% for periods prior to 2020 and 25% from 2020 onward. Prior periods have been restated. For the Investment Bank division, return on regulatory capital is based on US dollar denominated numbers. Return on regulatory capital excluding certain items included in our reported results is calculated using results excluding such items, applying the same methodology. For periods in 2020, for purposes of calculating Group return on regulatory capital, leverage exposure excludes cash held at central banks, after adjusting for the dividend paid in 2020.

Credit Suisse is subject to the Basel III framework, as implemented in Switzerland, as well as Swiss legislation and regulations for systemically important banks, which include capital, liquidity, leverage and large exposure requirements and rules for emergency plans designed to maintain systemically relevant functions in the event of threatened insolvency. Credit Suisse has adopted the Bank for International Settlements (BIS) leverage ratio framework, as issued by the Basel Committee on Banking Supervision (BCBS) and implemented in Switzerland by the Swiss Financial Market Supervisory Authority FINMA (FINMA).

Unless otherwise noted, all CET1 ratio, Tier 1 leverage ratio, risk-weighted assets and leverage exposure figures in this document are as of the end of the respective period.

Unless otherwise noted, leverage exposure is based on the BIS leverage ratio framework and consists of period-end balance sheet assets and prescribed regulatory adjustments. The tier 1 leverage ratio and CET1 leverage ratio are calculated as BIS tier 1 capital and CET1 capital, respectively, divided by period end leverage exposure.

Client business volume includes assets under management, custody assets (including assets under custody and commercial assets) and net loans.

Mandate penetration reflects advisory and discretionary mandates volumes as a percentage of assets under management, excluding those from the external asset manager business.

References to Wealth Management mean SUB PC, IWM and APAC or their combined results. References to Wealth Management-related mean SUB, IWM, APAC and AM or their combined results.

Investors and others should note that we announce important company information (including quarterly earnings releases and financial reports as well as our annual sustainability report) to the investing public using press releases, SEC and Swiss ad hoc filings, our website and public conference calls and webcasts. We also routinely use our Twitter account @creditsuisse (https://twitter.com/creditsuisse), our LinkedIn account (https://www.linkedin.com/company/credit-suisse/), our Instagram accounts (https://www.instagram.com/creditsuisse_careers/ and https://www.instagram.com/creditsuisse_ch/), our Facebook account (https://www.facebook.com/creditsuisse/) and other social media channels as additional means to disclose public information, including to excerpt key messages from our public disclosures. We may share or retweet such messages through certain of our regional accounts, including through Twitter at @csschweiz (https://twitter.com/csschweiz) and @csapac (https://twitter.com/csapac). Investors and others should take care to consider such abbreviated messages in the context of the disclosures from which they are excerpted. The information we post on these social media accounts is not a part of this document.

Media Release Zurich, November 4, 2021 | |

Information referenced in this document, whether via website links or otherwise, is not incorporated into this document.

Certain material in this document has been prepared by Credit Suisse on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. Credit Suisse has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information.

In various tables, use of “–” indicates not meaningful or not applicable.

The English language version of this document is the controlling version.

| Key metrics |

| | in / end of | | % change | | in / end of | | % change | |

| | 3Q21 | | 2Q21 | | 3Q20 | | QoQ | | YoY | | 9M21 | | 9M20 | | YoY | |

| Credit Suisse Group results (CHF million) |

| Net revenues | | 5,437 | | 5,103 | | 5,198 | | 7 | | 5 | | 18,114 | | 17,168 | | 6 | |

| Provision for credit losses | | (144) | | (25) | | 94 | | 476 | | – | | 4,225 | | 958 | | 341 | |

| Compensation and benefits | | 2,255 | | 2,356 | | 2,441 | | (4) | | (8) | | 6,818 | | 7,351 | | (7) | |

| General and administrative expenses | | 2,012 | | 1,589 | | 1,458 | | 27 | | 38 | | 4,977 | | 4,244 | | 17 | |

| Commission expenses | | 306 | | 325 | | 295 | | (6) | | 4 | | 960 | | 953 | | 1 | |

| Restructuring expenses | | – | | 45 | | 107 | | – | | – | | 70 | | 107 | | (35) | |

| Total other operating expenses | | 2,318 | | 1,959 | | 1,860 | | 18 | | 25 | | 6,007 | | 5,304 | | 13 | |

| Total operating expenses | | 4,573 | | 4,315 | | 4,301 | | 6 | | 6 | | 12,825 | | 12,655 | | 1 | |

| Income before taxes | | 1,008 | | 813 | | 803 | | 24 | | 26 | | 1,064 | | 3,555 | | (70) | |

| Net income attributable to shareholders | | 434 | | 253 | | 546 | | 72 | | (21) | | 435 | | 3,022 | | (86) | |

| Statement of operations metrics (%) |

| Return on regulatory capital | | 7.9 | | 6.1 | | 6.4 | | – | | – | | 2.8 | | 9.3 | | – | |

| Balance sheet statistics (CHF million) |

| Total assets | | 805,889 | | 796,799 | | 821,296 | | 1 | | (2) | | 805,889 | | 821,296 | | (2) | |

| Risk-weighted assets | | 278,139 | | 283,611 | | 285,216 | | (2) | | (2) | | 278,139 | | 285,216 | | (2) | |

| Leverage exposure | | 923,075 | | 916,888 | | 824,420 | | 1 | | 12 | | 923,075 | | 824,420 | | 12 | |

| Assets under management and net new assets (CHF billion) |

| Assets under management | | 1,623.0 | | 1,632.0 | | 1,478.3 | | (0.6) | | 9.8 | | 1,623.0 | | 1,478.3 | | 9.8 | |

| Net new assets | | 5.6 | | (4.7) | | 18.0 | | – | | (68.9) | | 29.3 | | 33.6 | | (12.8) | |

| Basel III regulatory capital and leverage statistics (%) |

| CET1 ratio | | 14.4 | | 13.7 | | 13.0 | | – | | – | | 14.4 | | 13.0 | | – | |

| CET1 leverage ratio | | 4.3 | | 4.2 | | 4.5 | | – | | – | | 4.3 | | 4.5 | | – | |

| Tier 1 leverage ratio | | 6.1 | | 6.0 | | 6.3 | | – | | – | | 6.1 | | 6.3 | | – | |

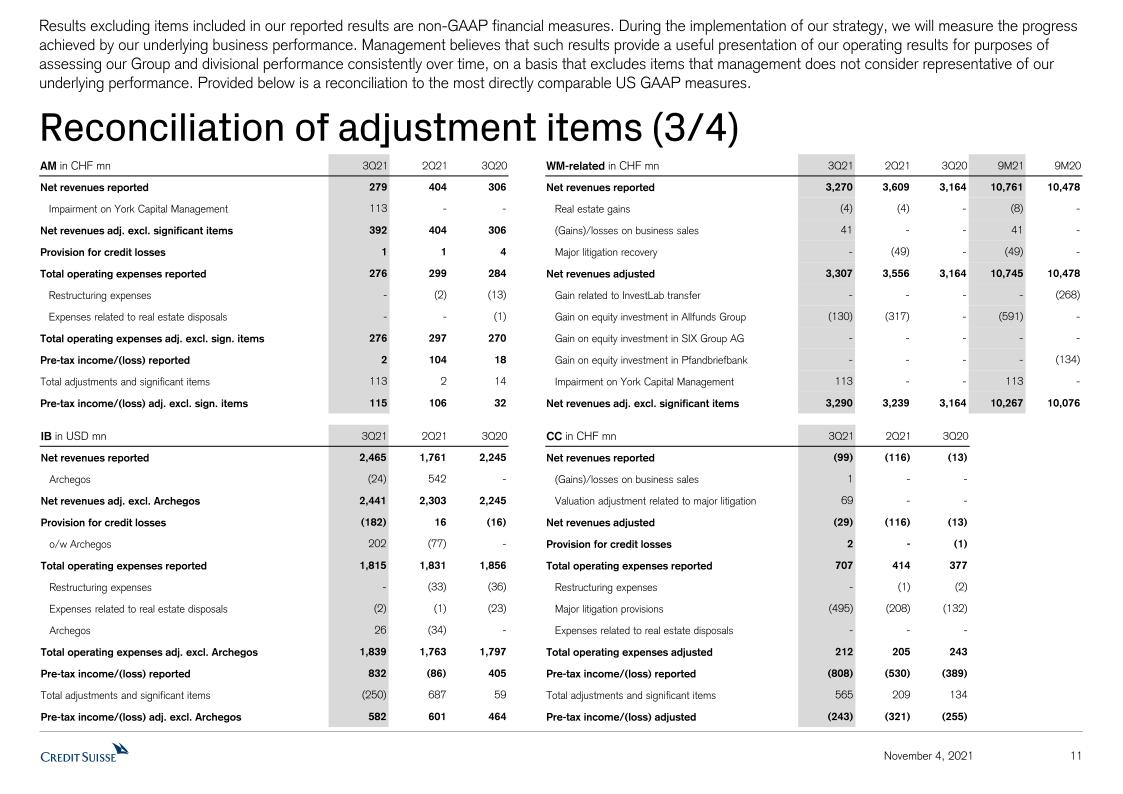

Results excluding certain items included in our reported results are non-GAAP financial measures. Management believes that such results provide a useful presentation of our operating results for purposes of assessing our Group and divisional performance consistently over time, on a basis that excludes items that management does not consider representative of our underlying performance. Provided below is a reconciliation to the most directly comparable US GAAP measures.

| Reconciliation of adjustment items |

| | Group | |

| in | | 3Q21 | | 2Q21 | | 3Q20 | | 9M21 | | 9M20 | |

| Results (CHF million) |

| Net revenues | | 5,437 | | 5,103 | | 5,198 | | 18,114 | | 17,168 | |

| Real estate (gains)/losses | | (4) | | (4) | | 0 | | (8) | | 0 | |

| (Gains)/losses on business sales | | 42 | | 0 | | 0 | | 42 | | 0 | |

| Major litigation recovery | | 0 | | (49) | | 0 | | (49) | | 0 | |

| Valuation adjustment related to major litigation | | 69 | | 0 | | 0 | | 69 | | 0 | |

| Adjusted net revenues | | 5,544 | | 5,050 | | 5,198 | | 18,168 | | 17,168 | |

| Significant items | | | | | | | | | | | |

| Gain related to InvestLab transfer | | 0 | | 0 | | 0 | | 0 | | (268) | |

| Gain on equity investment in Allfunds Group | | (130) | | (317) | | 0 | | (591) | | 0 | |

| Gain on equity investment in Pfandbriefbank | | 0 | | 0 | | 0 | | 0 | | (134) | |

| Impairment on York Capital Management | | 113 | | 0 | | 0 | | 113 | | 0 | |

| Adjusted net revenues excluding significant items | | 5,527 | | 4,733 | | 5,198 | | 17,690 | | 16,766 | |

| Archegos | | (23) | | 493 | | 0 | | 470 | | 0 | |

| Adjusted net revenues excluding significant items and Archegos | | 5,504 | | 5,226 | | 5,198 | | 18,160 | | 16,766 | |

| Provision for credit losses | | (144) | | (25) | | 94 | | 4,225 | | 958 | |

| Archegos | | 188 | | (70) | | 0 | | (4,312) | | 0 | |

| Provision for credit losses excluding Archegos | | 44 | | (95) | | 94 | | (87) | | 958 | |

| Total operating expenses | | 4,573 | | 4,315 | | 4,301 | | 12,825 | | 12,655 | |

| Restructuring expenses | | – | | (45) | | (107) | | (70) | | (107) | |

| Major litigation provisions | | (495) | | (208) | | (152) | | (707) | | (231) | |

| Expenses related to real estate disposals | | (3) | | (4) | | (25) | | (45) | | (23) | |

| Adjusted total operating expenses | | 4,075 | | 4,058 | | 4,017 | | 12,003 | | 12,294 | |

| Significant items | | | | | | | | | | | |

| Expenses related to equity investment in Allfunds Group | | (1) | | (19) | | 0 | | (20) | | 0 | |

| Adjusted total operating expenses excluding significant items | | 4,074 | | 4,039 | | 4,017 | | 11,983 | | 12,294 | |

| Archegos | | 24 | | (31) | | 0 | | (7) | | 0 | |

| Adjusted total operating expenses excluding significant items and Archegos | | 4,098 | | 4,008 | | 4,017 | | 11,976 | | 12,294 | |

| Income before taxes | | 1,008 | | 813 | | 803 | | 1,064 | | 3,555 | |

| Adjusted income before taxes | | 1,613 | | 1,017 | | 1,087 | | 1,940 | | 3,916 | |

| Adjusted income/(loss) before taxes excluding significant items | | 1,597 | | 719 | | 1,087 | | 1,482 | | 3,514 | |

| Adjusted income/(loss) before taxes excluding significant items and Archegos | | 1,362 | | 1,313 | | 1,087 | | 6,271 | | 3,514 | |

| Swiss Universal Bank |

| | in / end of | | % change | | in / end of | | % change | |

| | 3Q21 | | 2Q21 | | 3Q20 | | QoQ | | YoY | | 9M21 | | 9M20 | | YoY | |

| Results (CHF million) |

| Net revenues | | 1,391 | | 1,477 | | 1,294 | | (6) | | 7 | | 4,317 | | 4,222 | | 2 | |

| of which Private Clients | | 724 | | 718 | | 700 | | 1 | | 3 | | 2,179 | | 2,305 | | (5) | |

| of which Corporate & Institutional Clients | | 667 | | 759 | | 594 | | (12) | | 12 | | 2,138 | | 1,917 | | 12 | |

| Provision for credit losses | | 4 | | (21) | | 52 | | – | | (92) | | 9 | | 204 | | (96) | |

| Total operating expenses | | 764 | | 773 | | 812 | | (1) | | (6) | | 2,295 | | 2,401 | | (4) | |

| Income before taxes | | 623 | | 725 | | 430 | | (14) | | 45 | | 2,013 | | 1,617 | | 24 | |

| of which Private Clients | | 270 | | 259 | | 200 | | 4 | | 35 | | 810 | | 823 | | (2) | |

| of which Corporate & Institutional Clients | | 353 | | 466 | | 230 | | (24) | | 53 | | 1,203 | | 794 | | 52 | |

| Metrics (%) |

| Return on regulatory capital | | 15.6 | | 17.9 | | 10.8 | | – | | – | | 16.8 | | 13.8 | | – | |

| Cost/income ratio | | 54.9 | | 52.3 | | 62.8 | | – | | – | | 53.2 | | 56.9 | | – | |

| Private Clients |

| Assets under management (CHF billion) | | 217.3 | | 217.0 | | 205.0 | | 0.1 | | 6.0 | | 217.3 | | 205.0 | | 6.0 | |

| Net new assets (CHF billion) | | 1.9 | | (0.9) | | 2.0 | | – | | – | | 3.2 | | (3.8) | | – | |

| Gross margin (annualized) (bp) | | 133 | | 134 | | 138 | | – | | – | | 136 | | 150 | | – | |

| Net margin (annualized) (bp) | | 50 | | 48 | | 39 | | – | | – | | 51 | | 54 | | – | |

| Corporate & Institutional Clients |

| Assets under management (CHF billion) | | 506.3 | | 504.8 | | 441.0 | | 0.0 | | 14.8 | | 506.3 | | 441.0 | | 14.8 | |

| Net new assets (CHF billion) | | (0.4) | | 1.5 | | 3.5 | | – | | – | | 5.0 | | 9.9 | | – | |

| Reconciliation of adjustment items |

| | Private Clients | | Corporate & Institutional Clients | | Swiss Universal Bank | |

| in | | 3Q21 | | 2Q21 | | 3Q20 | | 3Q21 | | 2Q21 | | 3Q20 | | 3Q21 | | 2Q21 | | 3Q20 | |

| Results (CHF million) |

| Net revenues | | 724 | | 718 | | 700 | | 667 | | 759 | | 594 | | 1,391 | | 1,477 | | 1,294 | |

| Real estate (gains)/losses | | (4) | | (4) | | 0 | | 0 | | 0 | | 0 | | (4) | | (4) | | 0 | |

| (Gains)/losses on business sales | | 6 | | 0 | | 0 | | 0 | | 0 | | 0 | | 6 | | 0 | | 0 | |

| Major litigation recovery | | 0 | | 0 | | 0 | | 0 | | (49) | | 0 | | 0 | | (49) | | 0 | |

| Adjusted net revenues | | 726 | | 714 | | 700 | | 667 | | 710 | | 594 | | 1,393 | | 1,424 | | 1,294 | |

| Significant items | | | | | | | | | | | | | | | | | | | |

| Gain on equity investment in Allfunds Group | | 0 | | 0 | | 0 | | (39) | | (95) | | 0 | | (39) | | (95) | | 0 | |

| Adjusted net revenues excluding significant items | | 726 | | 714 | | 700 | | 628 | | 615 | | 594 | | 1,354 | | 1,329 | | 1,294 | |

| Provision for credit losses | | 9 | | 5 | | 5 | | (5) | | (26) | | 47 | | 4 | | (21) | | 52 | |

| Total operating expenses | | 445 | | 454 | | 495 | | 319 | | 319 | | 317 | | 764 | | 773 | | 812 | |

| Restructuring expenses | | – | | (1) | | (36) | | – | | (4) | | (5) | | – | | (5) | | (41) | |

| Expenses related to real estate disposals | | 0 | | (4) | | 0 | | 0 | | 0 | | 0 | | 0 | | (4) | | 0 | |

| Adjusted total operating expenses | | 445 | | 449 | | 459 | | 319 | | 315 | | 312 | | 764 | | 764 | | 771 | |

| Significant items | | | | | | | | | | | | | | | | | | | |

| Expenses related to equity investment in Allfunds Group | | 0 | | 0 | | 0 | | 0 | | (6) | | 0 | | 0 | | (6) | | 0 | |

| Adjusted total operating expenses excluding significant items | | 445 | | 449 | | 459 | | 319 | | 309 | | 312 | | 764 | | 758 | | 771 | |

| Income before taxes | | 270 | | 259 | | 200 | | 353 | | 466 | | 230 | | 623 | | 725 | | 430 | |

| Adjusted income before taxes | | 272 | | 260 | | 236 | | 353 | | 421 | | 235 | | 625 | | 681 | | 471 | |

| Adjusted income before taxes excluding significant items | | 272 | | 260 | | 236 | | 314 | | 332 | | 235 | | 586 | | 592 | | 471 | |

| Reconciliation of adjustment items (continued) |

| |

Private Clients | | Corporate &

Institutional Clients | | Swiss

Universal Bank | |

| in | | 9M21 | | 9M20 | | 9M21 | | 9M20 | | 9M21 | | 9M20 | |

| Results (CHF million) |

| Net revenues | | 2,179 | | 2,305 | | 2,138 | | 1,917 | | 4,317 | | 4,222 | |

| Real estate (gains)/losses | | (8) | | 0 | | 0 | | 0 | | (8) | | 0 | |

| (Gains)/losses on business sales | | 6 | | 0 | | 0 | | 0 | | 6 | | 0 | |

| Major litigation recovery | | 0 | | 0 | | (49) | | 0 | | (49) | | 0 | |

| Adjusted net revenues | | 2,177 | | 2,305 | | 2,089 | | 1,917 | | 4,266 | | 4,222 | |

| Significant items | | | | | | | | | | | | | |

| Gain related to InvestLab transfer | | 0 | | 0 | | 0 | | (25) | | 0 | | (25) | |

| Gain on equity investment in Allfunds Group | | 0 | | 0 | | (177) | | 0 | | (177) | | 0 | |

| Gain on equity investment in Pfandbriefbank | | 0 | | (134) | | 0 | | 0 | | 0 | | (134) | |

| Adjusted net revenues excluding significant items | | 2,177 | | 2,171 | | 1,912 | | 1,892 | | 4,089 | | 4,063 | |

| Provision for credit losses | | 19 | | 45 | | (10) | | 159 | | 9 | | 204 | |

| Total operating expenses | | 1,350 | | 1,437 | | 945 | | 964 | | 2,295 | | 2,401 | |

| Restructuring expenses | | (6) | | (36) | | (8) | | (5) | | (14) | | (41) | |

| Major litigation provisions | | 0 | | 0 | | 0 | | (1) | | 0 | | (1) | |

| Expenses related to real estate disposals | | (4) | | 0 | | 0 | | 0 | | (4) | | 0 | |

| Adjusted total operating expenses | | 1,340 | | 1,401 | | 937 | | 958 | | 2,277 | | 2,359 | |

| Significant items | | | | | | | | | | | | | |

| Expenses related to equity investment in Allfunds Group | | 0 | | 0 | | (6) | | 0 | | (6) | | 0 | |

| Adjusted total operating expenses excluding significant items | | 1,340 | | 1,401 | | 931 | | 958 | | 2,271 | | 2,359 | |

| Income before taxes | | 810 | | 823 | | 1,203 | | 794 | | 2,013 | | 1,617 | |

| Adjusted income before taxes | | 818 | | 859 | | 1,162 | | 800 | | 1,980 | | 1,659 | |

| Adjusted income before taxes excluding significant items | | 818 | | 725 | | 991 | | 775 | | 1,809 | | 1,500 | |

| International Wealth Management |

| | in / end of | | % change | | in / end of | | % change | |

| | 3Q21 | | 2Q21 | | 3Q20 | | QoQ | | YoY | | 9M21 | | 9M20 | | YoY | |

| Results (CHF million) |

| Net revenues | | 829 | | 930 | | 836 | | (11) | | (1) | | 2,746 | | 2,773 | | (1) | |

| Provision for credit losses | | 12 | | (25) | | 8 | | – | | 50 | | (13) | | 79 | | – | |

| Total operating expenses | | 624 | | 615 | | 631 | | 1 | | (1) | | 1,818 | | 1,896 | | (4) | |

| Income before taxes | | 193 | | 340 | | 197 | | (43) | | (2) | | 941 | | 798 | | 18 | |

| Metrics (%) |

| Return on regulatory capital | | 12.6 | | 22.0 | | 13.1 | | – | | – | | 20.6 | | 18.0 | | – | |

| Cost/income ratio | | 75.3 | | 66.1 | | 75.5 | | – | | – | | 66.2 | | 68.4 | | – | |

| Assets under management (CHF billion) | | 395.7 | | 399.5 | | 352.0 | | (1.0) | | 12.4 | | 395.7 | | 352.0 | | 12.4 | |

| Net new assets (CHF billion) | | 1.4 | | (0.3) | | 6.9 | | – | | – | | 8.3 | | 12.4 | | – | |

| Gross margin (annualized) (bp) | | 84 | | 95 | | 96 | | – | | – | | 95 | | 106 | | – | |

| Net margin (annualized) (bp) | | 20 | | 35 | | 23 | | – | | – | | 32 | | 31 | | – | |

| Reconciliation of adjustment items |

| | International Wealth Management | |

| in | | 3Q21 | | 2Q21 | | 3Q20 | | 9M21 | | 9M20 | |

| Results (CHF million) |

| Net revenues | | 829 | | 930 | | 836 | | 2,746 | | 2,773 | |

| (Gains)/losses on business sales | | 35 | | 0 | | 0 | | 35 | | 0 | |

| Adjusted net revenues | | 864 | | 930 | | 836 | | 2,781 | | 2,773 | |

| Significant items | | | | | | | | | | | |

| Gain related to InvestLab transfer | | 0 | | 0 | | 0 | | 0 | | (15) | |

| Gain on equity investment in Allfunds Group | | (52) | | (127) | | 0 | | (237) | | 0 | |

| Adjusted net revenues excluding significant items | | 812 | | 803 | | 836 | | 2,544 | | 2,758 | |

| Provision for credit losses | | 12 | | (25) | | 8 | | (13) | | 79 | |

| Total operating expenses | | 624 | | 615 | | 631 | | 1,818 | | 1,896 | |

| Restructuring expenses | | – | | (5) | | (16) | | (5) | | (16) | |

| Major litigation provisions | | 0 | | 0 | | (20) | | 11 | | 12 | |

| Expenses related to real estate disposals | | 0 | | 0 | | (3) | | (5) | | (2) | |

| Adjusted total operating expenses | | 624 | | 610 | | 592 | | 1,819 | | 1,890 | |

| Significant items | | | | | | | | | | | |

| Expenses related to equity investment in Allfunds Group | | 0 | | (7) | | 0 | | (7) | | 0 | |

| Adjusted total operating expenses excluding significant items | | 624 | | 603 | | 592 | | 1,812 | | 1,890 | |

| Income before taxes | | 193 | | 340 | | 197 | | 941 | | 798 | |

| Adjusted income before taxes | | 228 | | 345 | | 236 | | 975 | | 804 | |

| Adjusted income before taxes excluding significant items | | 176 | | 225 | | 236 | | 745 | | 789 | |

| Adjusted return on regulatory capital (%) | | 14.8 | | 22.4 | | 15.6 | | 21.3 | | 18.1 | |

| Adjusted return on regulatory capital excluding significant items (%) | | 11.5 | | 14.6 | | 15.6 | | 16.3 | | 17.8 | |

| Asia Pacific |

| | in / end of | | % change | | in / end of | | % change | |

| | 3Q21 | | 2Q21 | | 3Q20 | | QoQ | | YoY | | 9M21 | | 9M20 | | YoY | |

| Results (CHF million) |

| Net revenues | | 771 | | 798 | | 728 | | (3) | | 6 | | 2,629 | | 2,371 | | 11 | |

| Provision for credit losses | | 7 | | 6 | | 45 | | 17 | | (84) | | 40 | | 230 | | (83) | |

| Total operating expenses | | 536 | | 542 | | 506 | | (1) | | 6 | | 1,587 | | 1,550 | | 2 | |

| Income before taxes | | 228 | | 250 | | 177 | | (9) | | 29 | | 1,002 | | 591 | | 70 | |

| Metrics (%) |

| Return on regulatory capital | | 19.2 | | 20.3 | | 15.1 | | – | | – | | 28.1 | | 16.0 | | – | |

| Cost/income ratio | | 69.5 | | 67.9 | | 69.5 | | – | | – | | 60.4 | | 65.4 | | – | |

| Assets under management (CHF billion) | | 230.1 | | 236.3 | | 218.5 | | (2.6) | | 5.3 | | 230.1 | | 218.5 | | 5.3 | |

| Net new assets (CHF billion) | | 2.9 | | (6.1) | | 2.2 | | – | | – | | 1.8 | | 9.7 | | – | |

| Gross margin (annualized) (bp) | | 134 | | 136 | | 135 | | – | | – | | 151 | | 149 | | – | |

| Net margin (annualized) (bp) | | 40 | | 43 | | 33 | | – | | – | | 58 | | 37 | | – | |

| Results (USD million) |

| Net revenues | | 837 | | 874 | | 800 | | (4) | | 5 | | 2,877 | | 2,507 | | 15 | |

| Provision for credit losses | | 7 | | 6 | | 49 | | 17 | | (86) | | 43 | | 241 | | (82) | |

| Total operating expenses | | 583 | | 595 | | 557 | | (2) | | 5 | | 1,737 | | 1,641 | | 6 | |

| Income before taxes | | 247 | | 273 | | 194 | | (10) | | 27 | | 1,097 | | 625 | | 76 | |

| Reconciliation of adjustment items |

| | Asia Pacific | |

| in | | 3Q21 | | 2Q21 | | 3Q20 | | 9M21 | | 9M20 | |

| Results (CHF million) |

| Net revenues | | 771 | | 798 | | 728 | | 2,629 | | 2,371 | |

| Significant items | | | | | | | | | | | |

| Gain related to InvestLab transfer | | 0 | | 0 | | 0 | | 0 | | (25) | |

| Gain on equity investment in Allfunds Group | | (39) | | (95) | | 0 | | (177) | | 0 | |

| Adjusted net revenues excluding significant items | | 732 | | 703 | | 728 | | 2,452 | | 2,346 | |

| Provision for credit losses | | 7 | | 6 | | 45 | | 40 | | 230 | |

| Total operating expenses | | 536 | | 542 | | 506 | | 1,587 | | 1,550 | |

| Restructuring expenses | | – | | (3) | | (2) | | (4) | | (2) | |

| Adjusted total operating expenses | | 536 | | 539 | | 504 | | 1,583 | | 1,548 | |

| Significant items | | | | | | | | | | | |

| Expenses related to equity investment in Allfunds Group | | (1) | | (6) | | 0 | | (7) | | 0 | |

| Adjusted total operating expenses excluding significant items | | 535 | | 533 | | 504 | | 1,576 | | 1,548 | |

| Income before taxes | | 228 | | 250 | | 177 | | 1,002 | | 591 | |

| Adjusted income before taxes | | 228 | | 253 | | 179 | | 1,006 | | 593 | |

| Adjusted income before taxes excluding significant items | | 190 | | 164 | | 179 | | 836 | | 568 | |

| Reconciliation of adjustment items |

| | Asia Pacific | |

| in | | 3Q21 | | 2Q21 | | 3Q20 | | 9M21 | | 9M20 | |

| Results (USD million) |

| Net revenues | | 837 | | 874 | | 800 | | 2,877 | | 2,507 | |

| Significant items | | | | | | | | | | | |

| Gain related to InvestLab transfer | | 0 | | 0 | | 0 | | 0 | | (26) | |

| Gain on equity investment in Allfunds Group | | (42) | | (104) | | 0 | | (193) | | 0 | |

| Adjusted net revenues excluding significant items | | 795 | | 770 | | 800 | | 2,684 | | 2,481 | |

| Provision for credit losses | | 7 | | 6 | | 49 | | 43 | | 241 | |

| Total operating expenses | | 583 | | 595 | | 557 | | 1,737 | | 1,641 | |

| Restructuring expenses | | 0 | | (3) | | (3) | | (4) | | (3) | |

| Adjusted total operating expenses | | 583 | | 592 | | 554 | | 1,733 | | 1,638 | |

| Significant items | | | | | | | | | | | |

| Expenses related to equity investment in Allfunds Group | | (1) | | (6) | | 0 | | (7) | | 0 | |

| Adjusted total operating expenses excluding significant items | | 582 | | 586 | | 554 | | 1,726 | | 1,638 | |

| Income before taxes | | 247 | | 273 | | 194 | | 1,097 | | 625 | |

| Adjusted income before taxes | | 247 | | 276 | | 197 | | 1,101 | | 628 | |

| Adjusted income before taxes excluding significant items | | 206 | | 178 | | 197 | | 915 | | 602 | |

| Adjusted return on regulatory capital (%) | | 19.4 | | 20.9 | | 15.8 | | 28.4 | | 16.2 | |

| Adjusted return on regulatory capital excluding significant items (%) | | 16.1 | | 13.5 | | 15.8 | | 23.6 | | 15.5 | |

| Asset Management |

| | in / end of | | % change | | in / end of | | % change | |

| | 3Q21 | | 2Q21 | | 3Q20 | | QoQ | | YoY | | 9M21 | | 9M20 | | YoY | |

| Results (CHF million) |

| Net revenues | | 279 | | 404 | | 306 | | (31) | | (9) | | 1,069 | | 1,112 | | (4) | |

| Provision for credit losses | | 1 | | 1 | | 4 | | 0 | | (75) | | 2 | | 6 | | (67) | |

| Total operating expenses | | 276 | | 299 | | 284 | | (8) | | (3) | | 846 | | 840 | | 1 | |

| Income before taxes | | 2 | | 104 | | 18 | | (98) | | (89) | | 221 | | 266 | | (17) | |

| Metrics (%) |

| Return on regulatory capital | | 1.2 | | 43.5 | | 6.9 | | – | | – | | 32.8 | | 35.1 | | – | |

| Cost/income ratio | | 98.9 | | 74.0 | | 92.8 | | – | | – | | 79.1 | | 75.5 | | – | |

| Reconciliation of adjustment items |

| | Asset Management | |

| in | | 3Q21 | | 2Q21 | | 3Q20 | | 9M21 | | 9M20 | |

| Results (CHF million) |

| Net revenues | | 279 | | 404 | | 306 | | 1,069 | | 1,112 | |

| Significant items | | | | | | | | | | | |

| Gain related to InvestLab transfer | | 0 | | 0 | | 0 | | 0 | | (203) | |

| Impairment on York Capital Management | | 113 | | 0 | | 0 | | 113 | | 0 | |

| Adjusted net revenues excluding significant items | | 392 | | 404 | | 306 | | 1,182 | | 909 | |

| Provision for credit losses | | 1 | | 1 | | 4 | | 2 | | 6 | |

| Total operating expenses | | 276 | | 299 | | 284 | | 846 | | 840 | |

| Restructuring expenses | | – | | (2) | | (13) | | (3) | | (13) | |

| Expenses related to real estate disposals | | 0 | | 0 | | (1) | | (1) | | (1) | |

| Adjusted total operating expenses | | 276 | | 297 | | 270 | | 842 | | 826 | |

| Income before taxes | | 2 | | 104 | | 18 | | 221 | | 266 | |

| Adjusted income before taxes | | 2 | | 106 | | 32 | | 225 | | 280 | |

| Adjusted income before taxes excluding significant items | | 115 | | 106 | | 32 | | 338 | | 77 | |

| Adjusted return on regulatory capital (%) | | 1.2 | | 44.6 | | 12.1 | | 33.4 | | 36.9 | |

| Adjusted return on regulatory capital excluding significant items (%) | | 52.1 | | 44.6 | | 12.1 | | 50.2 | | 10.1 | |

| Wealth Management-related - Reconciliation of adjustment items |

| | Wealth Management-related | |

| in | | 3Q21 | | 2Q21 | | 3Q20 | | 9M21 | | 9M20 | |

| Results (CHF million) |

| Net revenues | | 3,270 | | 3,609 | | 3,164 | | 10,761 | | 10,478 | |

| Real estate (gains)/losses | | (4) | | (4) | | 0 | | (8) | | 0 | |

| (Gains)/losses on business sales | | 41 | | 0 | | 0 | | 41 | | 0 | |

| Major litigation recovery | | 0 | | (49) | | 0 | | (49) | | 0 | |

| Adjusted net revenues | | 3,307 | | 3,556 | | 3,164 | | 10,745 | | 10,478 | |

| Significant items | | | | | | | | | | | |

| Gain related to InvestLab transfer | | 0 | | 0 | | 0 | | 0 | | (268) | |

| Gain on equity investment in Allfunds Group | | (130) | | (317) | | 0 | | (591) | | 0 | |

| Gain on equity investment in Pfandbriefbank | | 0 | | 0 | | 0 | | 0 | | (134) | |

| Impairment on York Capital Management | | 113 | | 0 | | 0 | | 113 | | 0 | |

| Adjusted net revenues excluding significant items | | 3,290 | | 3,239 | | 3,164 | | 10,267 | | 10,076 | |

| Provision for credit losses | | 24 | | (39) | | 109 | | 38 | | 519 | |

| Total operating expenses | | 2,200 | | 2,229 | | 2,233 | | 6,546 | | 6,687 | |

| Restructuring expenses | | – | | (15) | | (72) | | (26) | | (72) | |

| Major litigation provisions | | 0 | | 0 | | (20) | | 11 | | 11 | |

| Expenses related to real estate disposals | | 0 | | (4) | | (4) | | (10) | | (3) | |

| Adjusted total operating expenses | | 2,200 | | 2,210 | | 2,137 | | 6,521 | | 6,623 | |

| Significant items | | | | | | | | | | | |

| Expenses related to equity investment in Allfunds Group | | (1) | | (19) | | 0 | | (20) | | 0 | |

| Adjusted total operating expenses excluding significant items | | 2,199 | | 2,191 | | 2,137 | | 6,501 | | 6,623 | |

| Income before taxes | | 1,046 | | 1,419 | | 822 | | 4,177 | | 3,272 | |

| Adjusted income before taxes | | 1,083 | | 1,385 | | 918 | | 4,186 | | 3,336 | |

| Adjusted income before taxes excluding significant items | | 1,067 | | 1,087 | | 918 | | 3,728 | | 2,934 | |

| Investment Bank |

| | in / end of | | % change | | in / end of | | % change | |

| | 3Q21 | | 2Q21 | | 3Q20 | | QoQ | | YoY | | 9M21 | | 9M20 | | YoY | |

| Results (CHF million) |

| Net revenues | | 2,266 | | 1,610 | | 2,047 | | 41 | | 11 | | 7,419 | | 6,989 | | 6 | |

| Provision for credit losses | | (170) | | 14 | | (14) | | – | | – | | 4,194 | | 433 | | – | |

| Total operating expenses | | 1,666 | | 1,672 | | 1,691 | | 0 | | (1) | | 4,998 | | 5,191 | | (4) | |

| Income/(loss) before taxes | | 770 | | (76) | | 370 | | – | | 108 | | (1,773) | | 1,365 | | – | |

| Metrics (%) |

| Return on regulatory capital | | 20.4 | | (1.9) | | 8.9 | | – | | – | | (13.8) | | 10.5 | | – | |

| Cost/income ratio | | 73.5 | | 103.9 | | 82.6 | | – | | – | | 67.4 | | 74.3 | | – | |

| Results (USD million) |

| Net revenues | | 2,465 | | 1,761 | | 2,245 | | 40 | | 10 | | 8,114 | | 7,381 | | 10 | |

| Provision for credit losses | | (182) | | 16 | | (16) | | – | | – | | 4,452 | | 447 | | – | |

| Total operating expenses | | 1,815 | | 1,831 | | 1,856 | | (1) | | (2) | | 5,476 | | 5,492 | | 0 | |

| Income/(loss) before taxes | | 832 | | (86) | | 405 | | – | | 105 | | (1,814) | | 1,442 | | – | |

| Net revenue detail |

| in | | 3Q21 | | 2Q21 | | 3Q20 | | 9M21 | | 9M20 | |

| Net revenue detail (USD million) |

| Fixed income sales and trading | | 801 | | 890 | | 921 | | 3,260 | | 3,478 | |

| Equity sales and trading | | 557 | | (28) | | 588 | | 1,517 | | 2,016 | |

| Capital markets | | 807 | | 874 | | 708 | | 2,870 | | 1,696 | |

| Advisory and other fees | | 330 | | 123 | | 117 | | 667 | | 446 | |

| Other revenues | | (30) | | (98) | | (89) | | (200) | | (255) | |

| Net revenues | | 2,465 | | 1,761 | | 2,245 | | 8,114 | | 7,381 | |

| Reconciliation of adjustment items |

| | Investment Bank | |

| in | | 3Q21 | | 2Q21 | | 3Q20 | | 9M21 | | 9M20 | |

| Results (CHF million) |

| Net revenues | | 2,266 | | 1,610 | | 2,047 | | 7,419 | | 6,989 | |

| Archegos | | (23) | | 493 | | 0 | | 470 | | 0 | |

| Adjusted net revenues excluding Archegos | | 2,243 | | 2,103 | | 2,047 | | 7,889 | | 6,989 | |

| Provision for credit losses | | (170) | | 14 | | (14) | | 4,194 | | 433 | |

| Archegos | | 188 | | (70) | | 0 | | (4,312) | | 0 | |

| Provision for credit losses excluding Archegos | | 18 | | (56) | | (14) | | (118) | | 433 | |

| Total operating expenses | | 1,666 | | 1,672 | | 1,691 | | 4,998 | | 5,191 | |

| Restructuring expenses | | – | | (29) | | (33) | | (46) | | (33) | |

| Major litigation provisions | | 0 | | 0 | | 0 | | 0 | | (24) | |

| Expenses related to real estate disposals | | (3) | | 0 | | (21) | | (35) | | (20) | |