UNITED STATES SECURITIES AND EXCHANGE COMMISSION

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

Commission File Number 001-15244

(Translation of registrant’s name into English)

Paradeplatz 8, 8001 Zurich, Switzerland

(Address of principal executive office)

Commission File Number 001-33434

(Translation of registrant’s name into English)

Paradeplatz 8, 8001 Zurich, Switzerland

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F  Form 40-F

Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Note: Regulation S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report to security holders.

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Note: Regulation S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated, domiciled or legally organized (the registrant’s “home country”), or under the rules of the home country exchange on which the registrant’s securities are traded, as long as the report or other document is not a press release, is not required to be and has not been distributed to the registrant’s security holders, and, if discussing a material event, has already been the subject of a Form 6-K submission or other Commission filing on EDGAR.

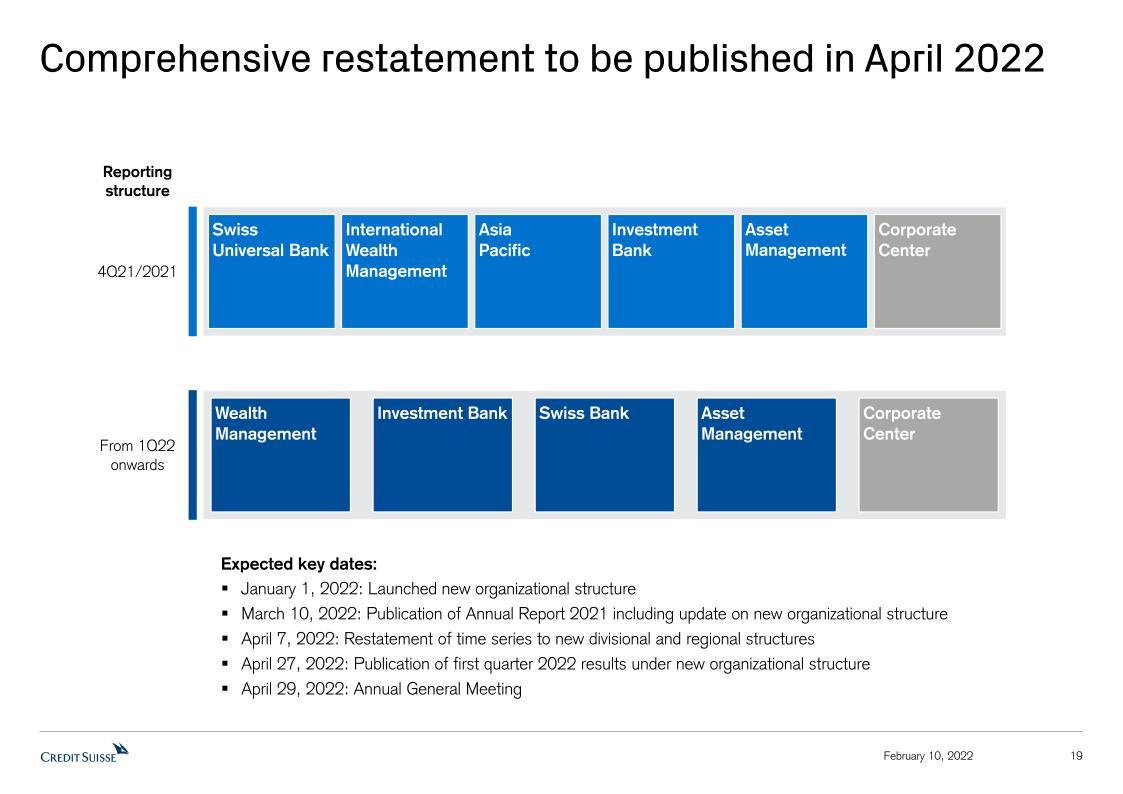

This report includes the media release and the slides for the presentation to investors in connection with the 4Q21 and full year 2021 results.

Ad hoc announcement pursuant to article 53 LR

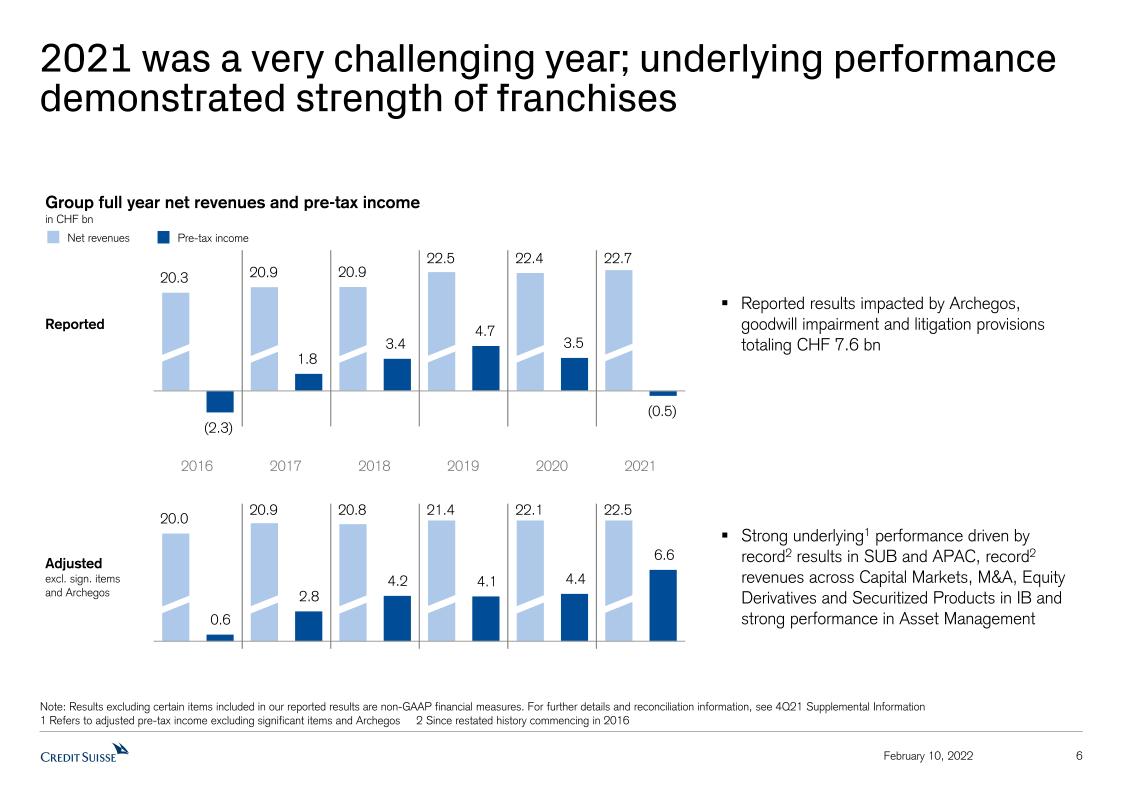

Credit Suisse reports pre-tax loss of CHF 522 mn in FY21, impacted by the Archegos matter, goodwill impairment and litigation provisions. On an underlying basis*, the bank posts pre-tax income of CHF 6.6 bn

"2021 was a very challenging year for Credit Suisse. Our reported financial results were negatively impacted by the Archegos matter, the impairment of goodwill relating to the Donaldson, Lufkin & Jenrette (DLJ) acquisition in 2000 and litigation provisions, as we look to proactively resolve legacy issues. For the full year, we delivered a resilient underlying* performance, with stable net revenues despite a significant reduction of risk weighted assets and leverage exposure – especially in our IB division – since the end of 1Q21. During the last three quarters of the year, we ran the bank with a constrained risk appetite across all divisions as we took decisive actions to strengthen our overall risk and controls foundation and continued our remediation efforts, including on the Supply Chain Finance Funds matter, where our priority is to return cash to investors.

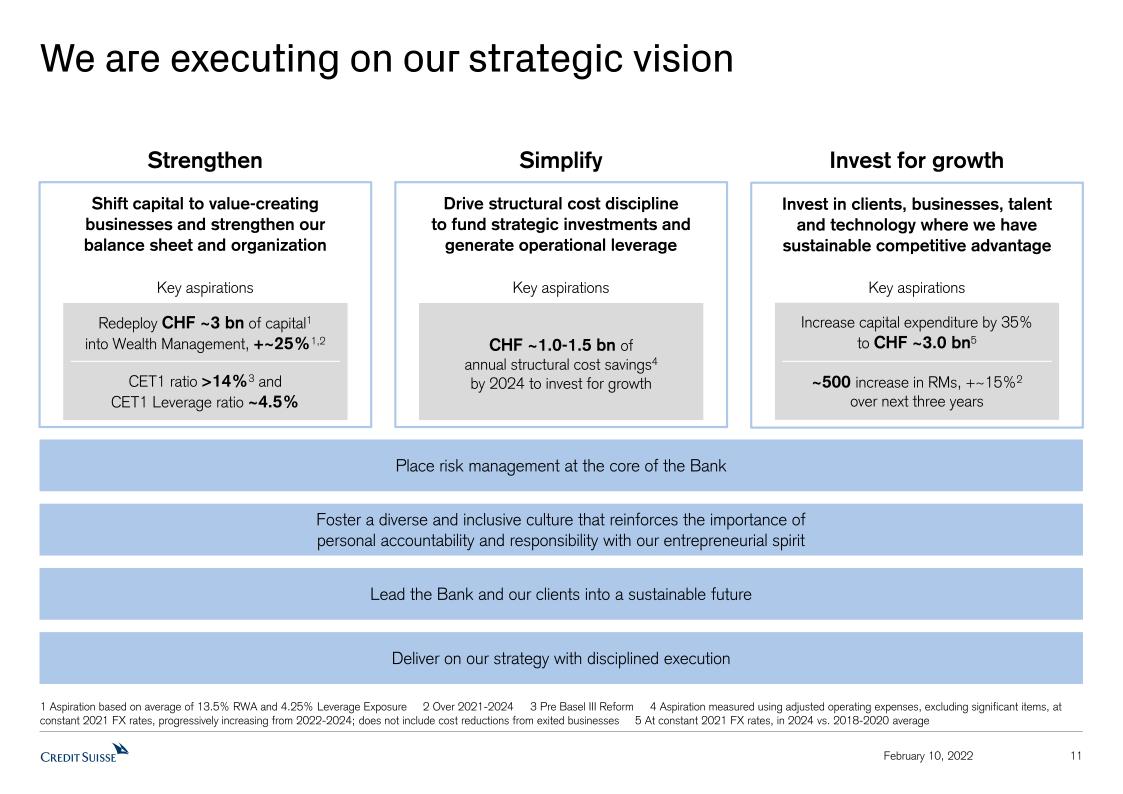

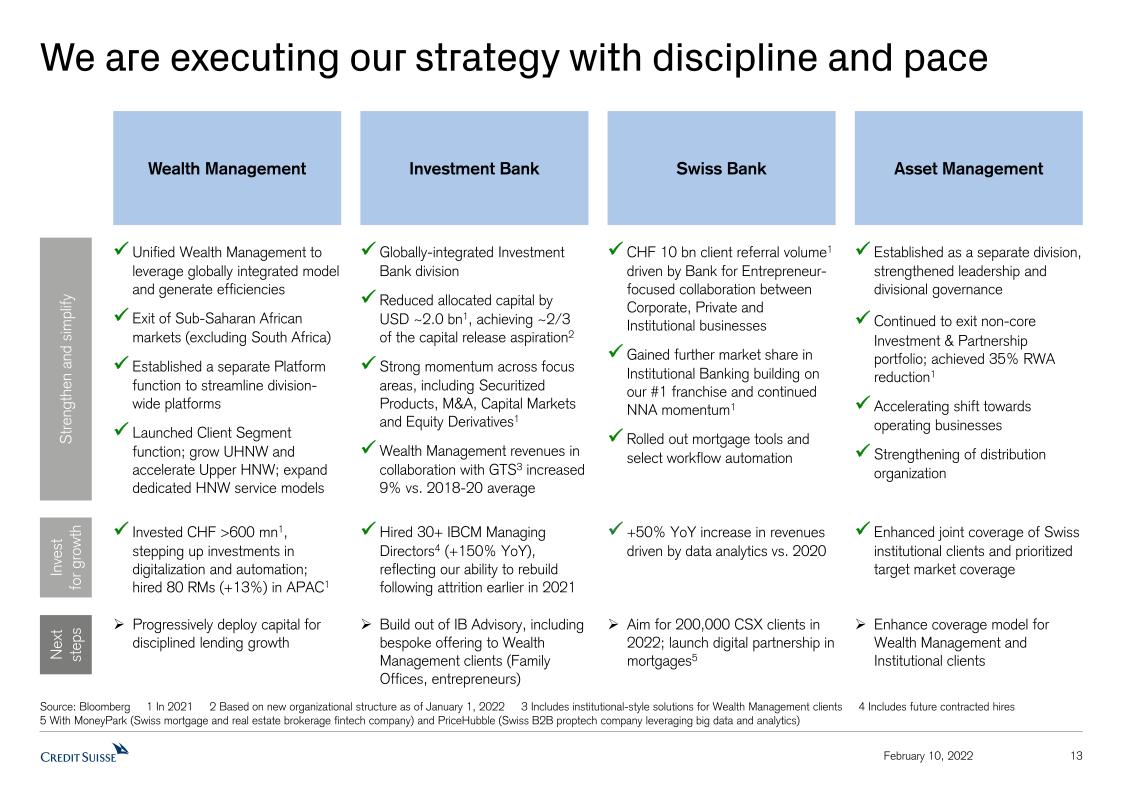

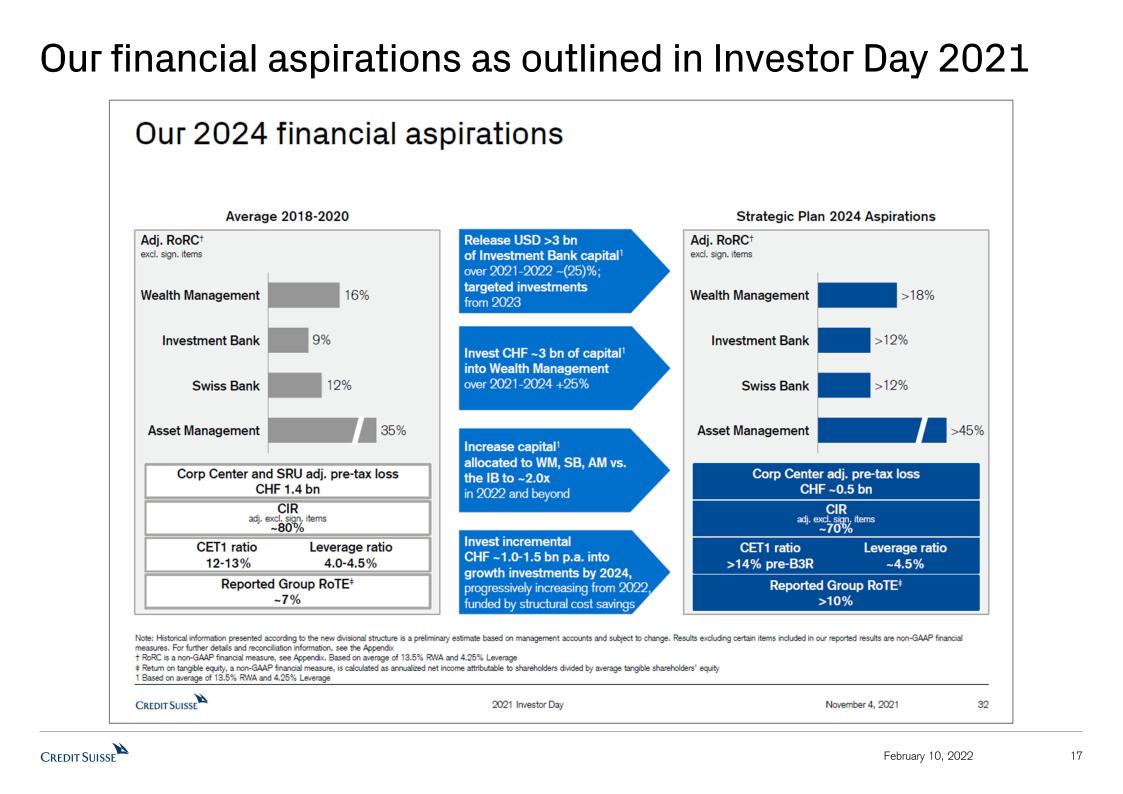

Our clear focus remains on the disciplined execution of our new Group strategy as announced in November 2021: strengthening our core and simplifying our organization as we look to invest for growth in key strategic business areas. We intend to continue to operate Credit Suisse Group with a stronger capital base and a CET1 ratio of at least 14%. Over the coming quarters, we expect to implement our strategy progressively. We have set clear financial goals for all our divisions and are now focused on delivering on our strategic objectives. I am confident that we are well-positioned to build a stronger and customer-centric bank that puts risk management at the very core of its DNA in order to deliver sustainable growth and value for investors, clients and colleagues." Thomas Gottstein, Chief Executive Officer of Credit Suisse Group AG |

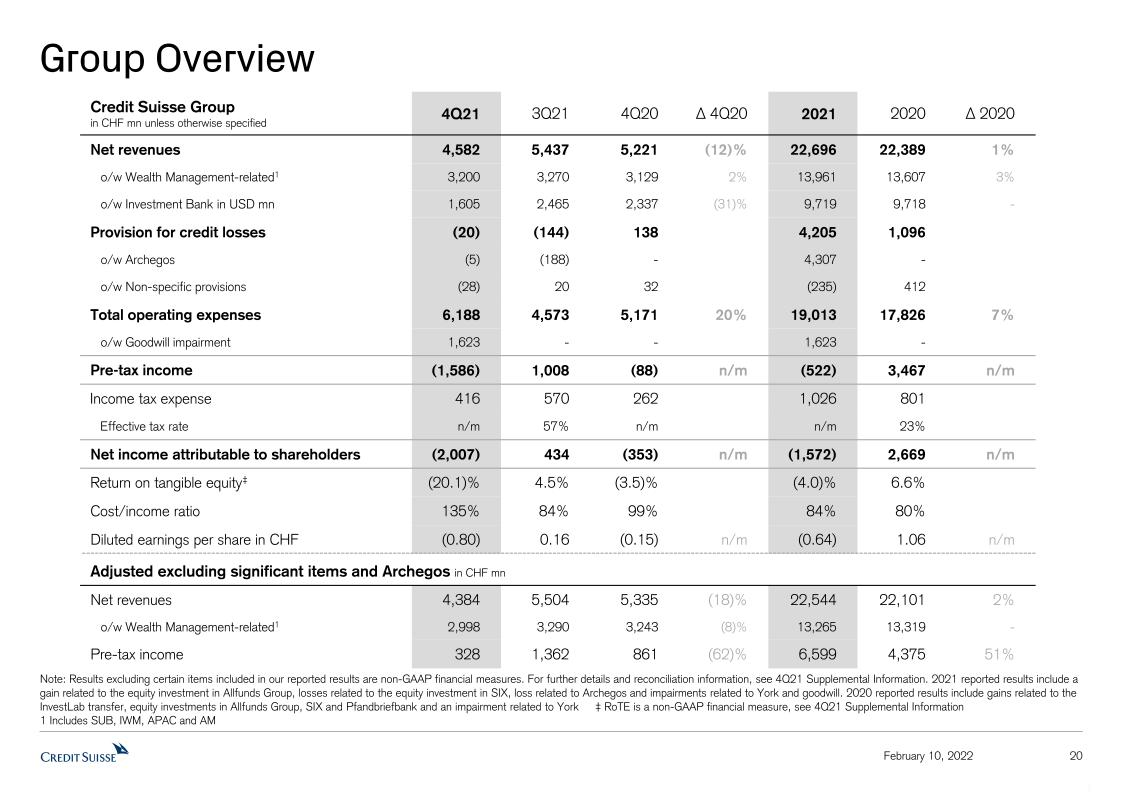

Credit Suisse Group Reported Results (CHF mn, unless otherwise specified) | 4Q21 | 3Q21 | 4Q20 | ∆4Q20 | | FY21 | FY20 | ∆FY20 |

| Net revenues | 4,582 | 5,437 | 5,221 | (12)% | 22,696 | 22,389 | 1% |

| o/w Wealth Management-related | 3,200 | 3,270 | 3,129 | 2% | 13,961 | 13,607 | 3% |

| o/w Investment Bank in USD mn | 1,605 | 2,465 | 2,337 | (31)% | 9,719 | 9,718 | - |

| Provision for credit losses | (20) | (144) | 138 | - | 4,205 | 1,096 | - |

| Total operating expenses | 6,188 | 4,573 | 5,171 | 20% | 19,013 | 17,826 | 7% |

| o/w Goodwill impairment | 1,623 | - | - | - | 1,623 | - | - |

| Pre-tax income / (loss) | (1,586) | 1,008 | (88) | - | (522) | 3,467 | - |

| Net income / (loss) attributable to shareholders | (2,007) | 434 | (353) | - | (1,572) | 2,669 | - |

| Return on tangible equity | (20.1)% | 4.5% | (3.5)% | - | (4.0)% | 6.6% | - |

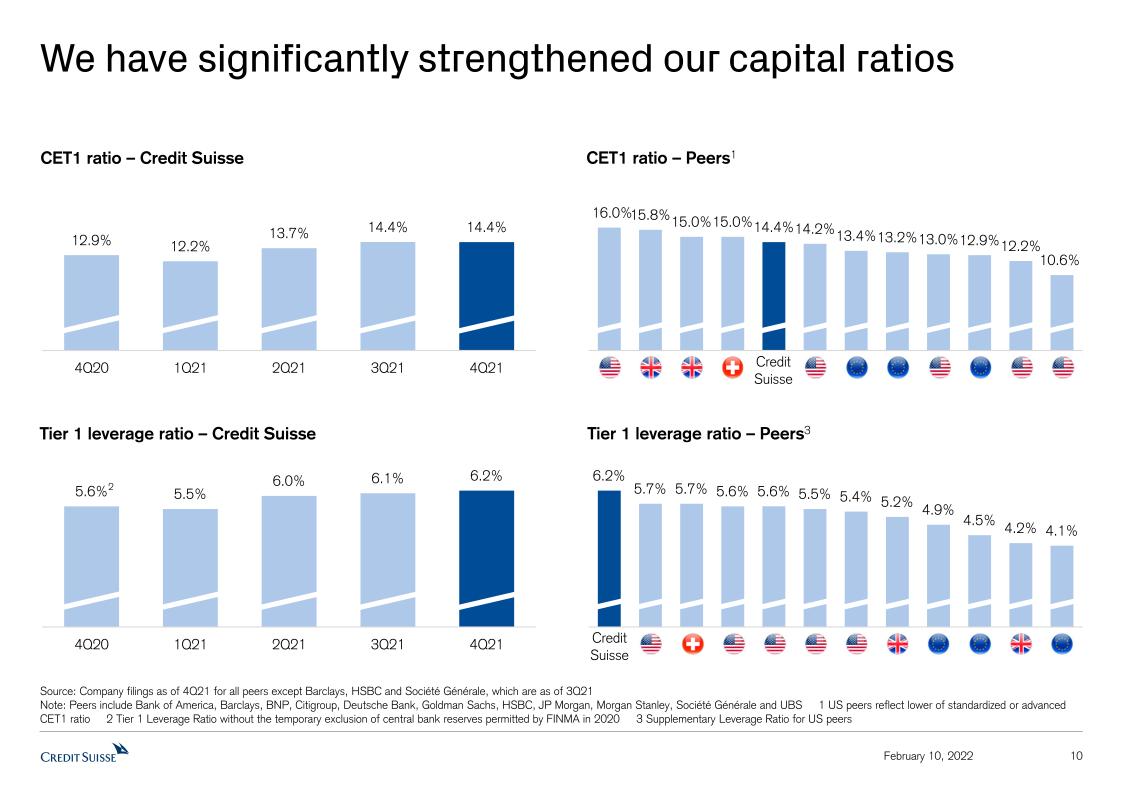

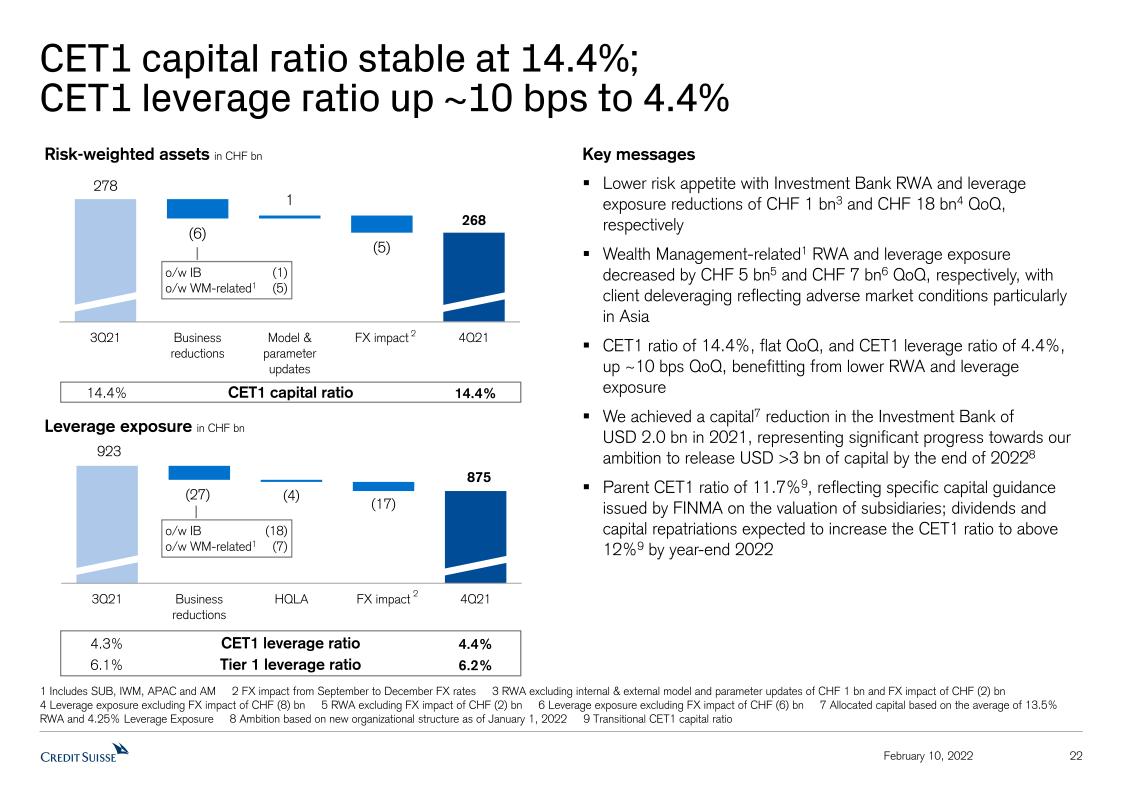

| CET1 ratio | 14.4% | 14.4% | 12.9% | - | 14.4% | 12.9% | - |

CET1 leverage ratio1 | 4.4% | 4.3% | 4.4% | - | 4.4% | 4.4% | - |

Tier 1 leverage ratio2 | 6.2% | 6.1% | 6.4% | - | 6.2% | 6.4% | - |

| Adjusted excluding significant items and Archegos* (CHF mn) | 4Q21 | 3Q21 | 4Q20 | ∆4Q20 | FY21 | FY20 | ∆FY20 |

| Net revenues | 4,384 | 5,504 | 5,335 | (18)% | 22,544 | 22,101 | 2% |

| Pre-tax income | 328 | 1,362 | 861 | (62)% | 6,599 | 4,375 | 51% |

Highlights for the fourth quarter of 2021

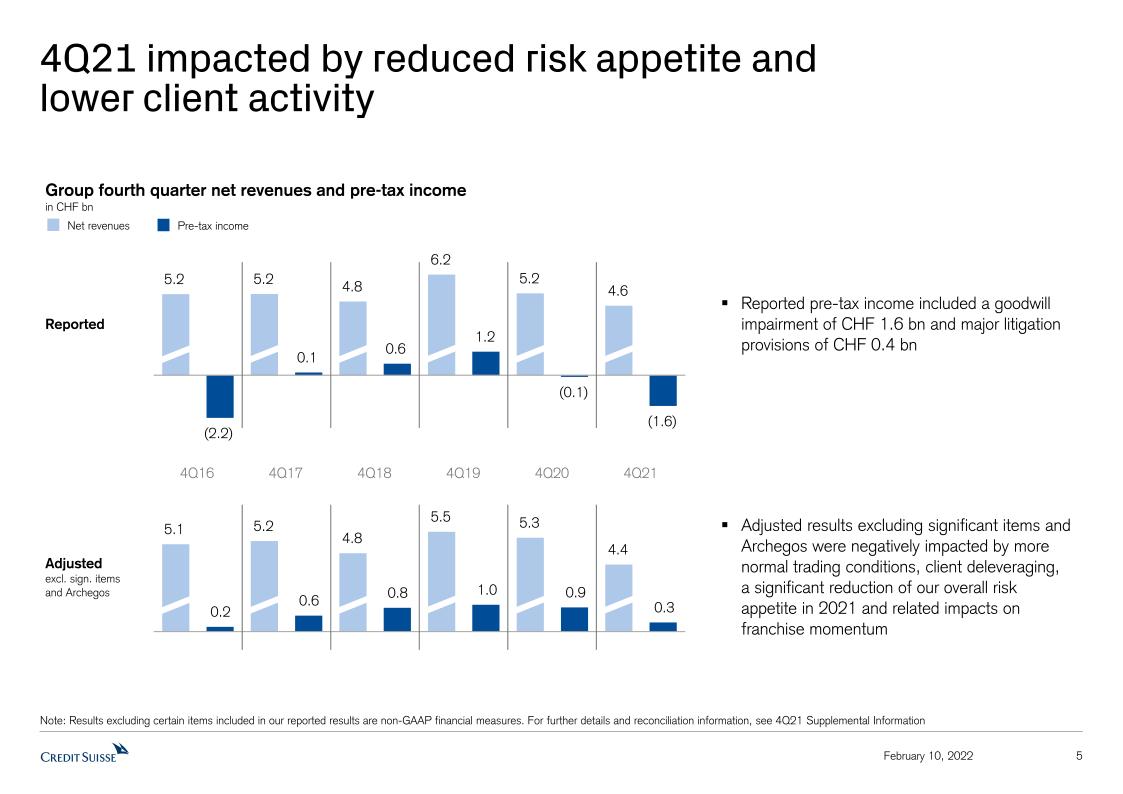

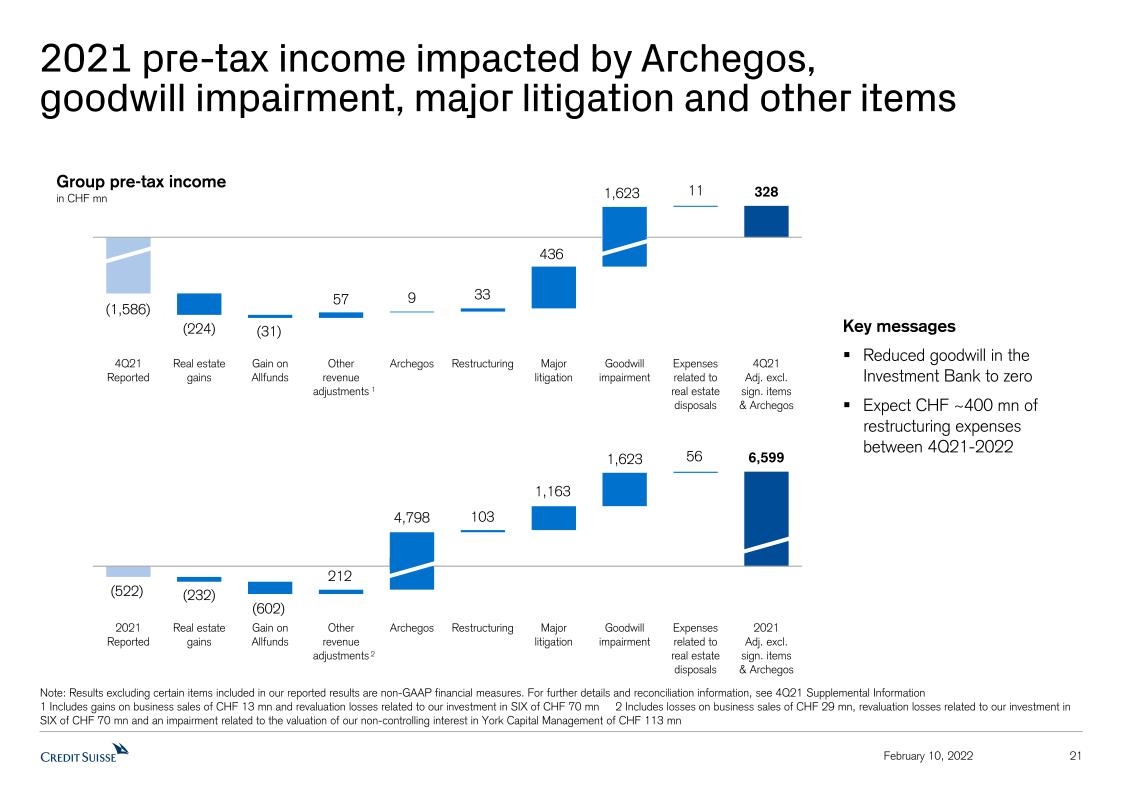

Net revenues were down 12% year on year, impacted by a reduced risk appetite across the Group in 2021, a negative impact on our franchise momentum and a return to a more normal trading environment after the exceptional conditions that prevailed for most of 2020 and 2021. This was most evident in the Investment Bank, largely due to our exit3 of Prime Services and the strong comparable performance in 4Q20, but our Wealth Management-related businesses also saw a reduction in transaction-based revenues. The pre-tax loss of CHF 1.6 bn compared to pre-tax loss of CHF 88 mn in 4Q20, included a goodwill impairment of CHF 1.6 bn relating to DLJ and major litigation provisions of CHF 436 mn, partly offset by real estate gains of CHF 224 mn.

– Reported pre-tax loss of CHF 1.6 bn for 4Q21, compared to a reported pre-tax loss of CHF 88 mn in 4Q20, predominantly driven by the previously announced goodwill impairment of CHF 1.6 bn taken in the quarter mainly relating to the acquisition of DLJ that was completed in 2000. We took major litigation provisions of CHF 436 mn in 4Q21, part of our progress towards addressing legacy issues

– On an adjusted basis, excluding significant items and Archegos*, 4Q21 pre-tax income of CHF 328 mn, down 62% year on year

– On an adjusted basis, excluding significant items and Archegos*, net revenues were down 18% year on year, impacted by the cumulative effect of our reduced risk appetite during the year, more normal trading conditions and client deleveraging

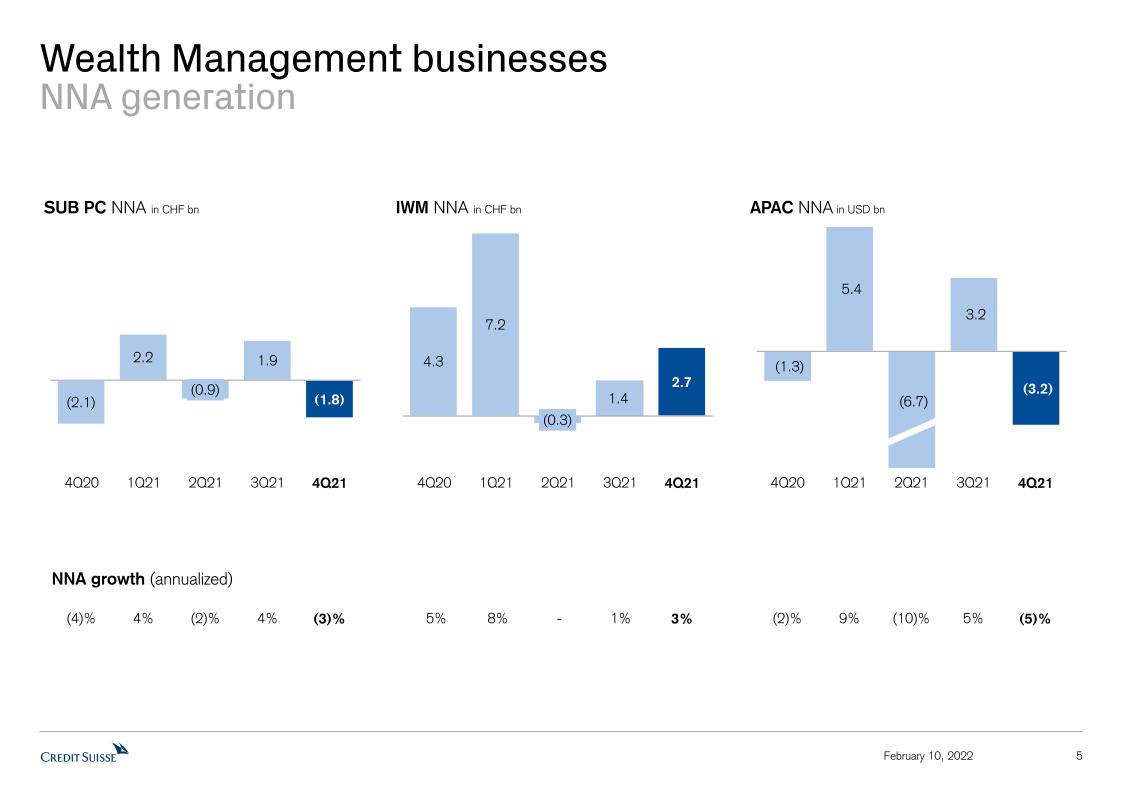

– NNA of CHF 1.6 bn compared to CHF 8.4 bn in 4Q20 across the Group, driven by NNA in AM of CHF 4.7 bn and in IWM of CHF 2.7 bn partly offset by net asset outflows in APAC of USD 3.2 bn (CHF 2.9 bn), which includes client deleveraging and de-risking measures we have taken, and in SUB of CHF 1.7 bn

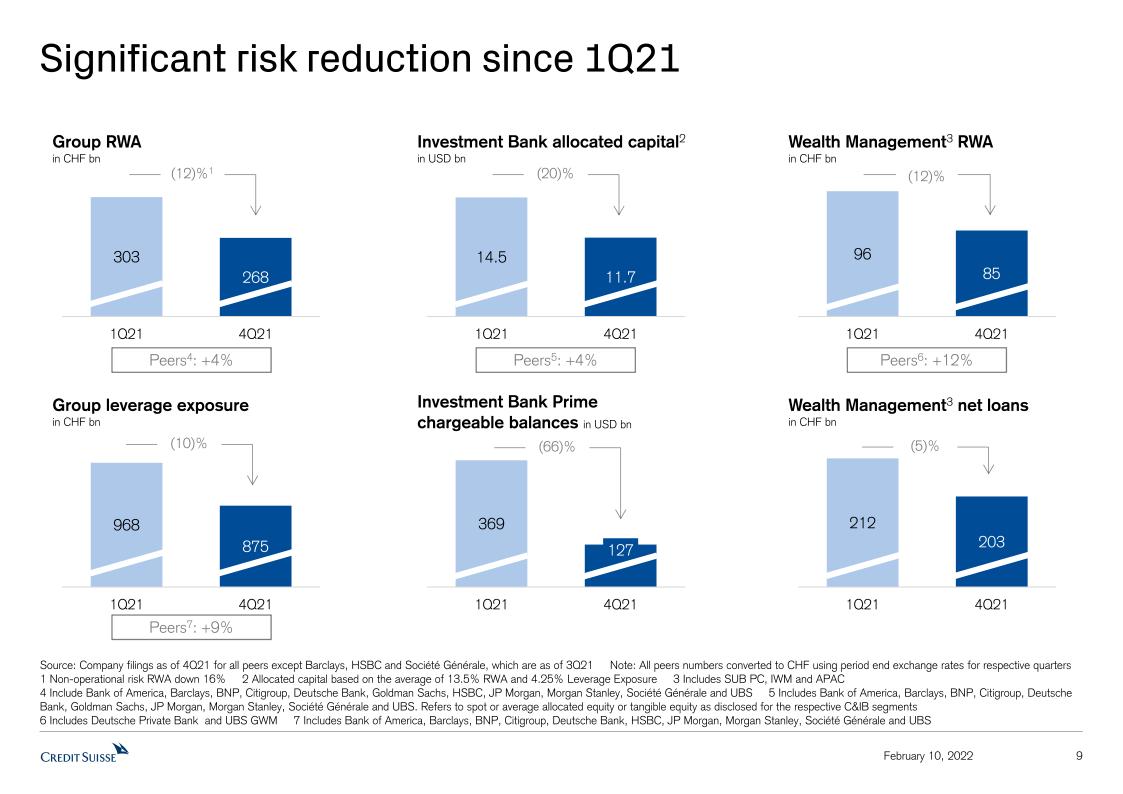

– Strong capital base, with CET1 ratio at 14.4% as of the end of 4Q21, stable compared to the end of 3Q21 and improved Tier 1 leverage ratio at 6.2% as well as CET1 leverage ratio at 4.4%; capital and leverage ratios benefitting from reductions of RWA and leverage exposure

– Continued progress on remediation work on the Supply Chain Finance Funds (SCFF) matter. Returning cash to investors remains a priority; total cash paid out and current cash and cash equivalents of approximately USD 7.2 bn as of December 31, 2021

Highlights for the full year 2021

Stable net revenues with increased net revenues in the Wealth Management-related businesses, partially offset by a net revenue decrease in the Investment Bank, due to the loss related to Archegos and the cumulative impact of our reduced risk appetite in 2021 as well as our exit4 of Prime Services. We had a pre-tax loss of CHF 522 mn compared to pre-tax income of CHF 3.5 bn in FY20 due to the impact of the Archegos matter, the cumulative impact of our more conservative risk approach in 2021 and a goodwill impairment of CHF 1.6 bn, taken in 4Q21; additionally, the bank took major litigation provisions of CHF 1.1 bn in FY21.

– Net loss attributable to shareholders of CHF 1.6 bn, compared to net income attributable to shareholders of CHF 2.7 bn in FY20

– Reported pre-tax loss of CHF 522 mn, down significantly year on year, compared to pre-tax income of CHF 3.5 bn in FY20; FY21 included gains made on our equity investment in Allfunds Group of CHF 602 mn as well as gains on real estate sales of CHF 232 mn. Results in FY21 were affected by the impact of CHF 4.8 bn relating to Archegos, CHF 1.6 bn in the form of a goodwill impairment, CHF 1.1 bn relating to major litigation provisions, a CHF 113 mn impairment related to the valuation of our non-controlling interest in York Capital Management and CHF 103 mn of restructuring costs

– On an adjusted basis, excluding significant items and Archegos*, FY21 pre-tax income of CHF 6.6 bn, up 51% year on year

– On an adjusted basis, excluding significant items and Archegos*, net revenues of CHF 22.5 bn, up 2% year on year, driven by higher net revenues across AM, IB and SUB, partly offset by lower net revenues in IWM

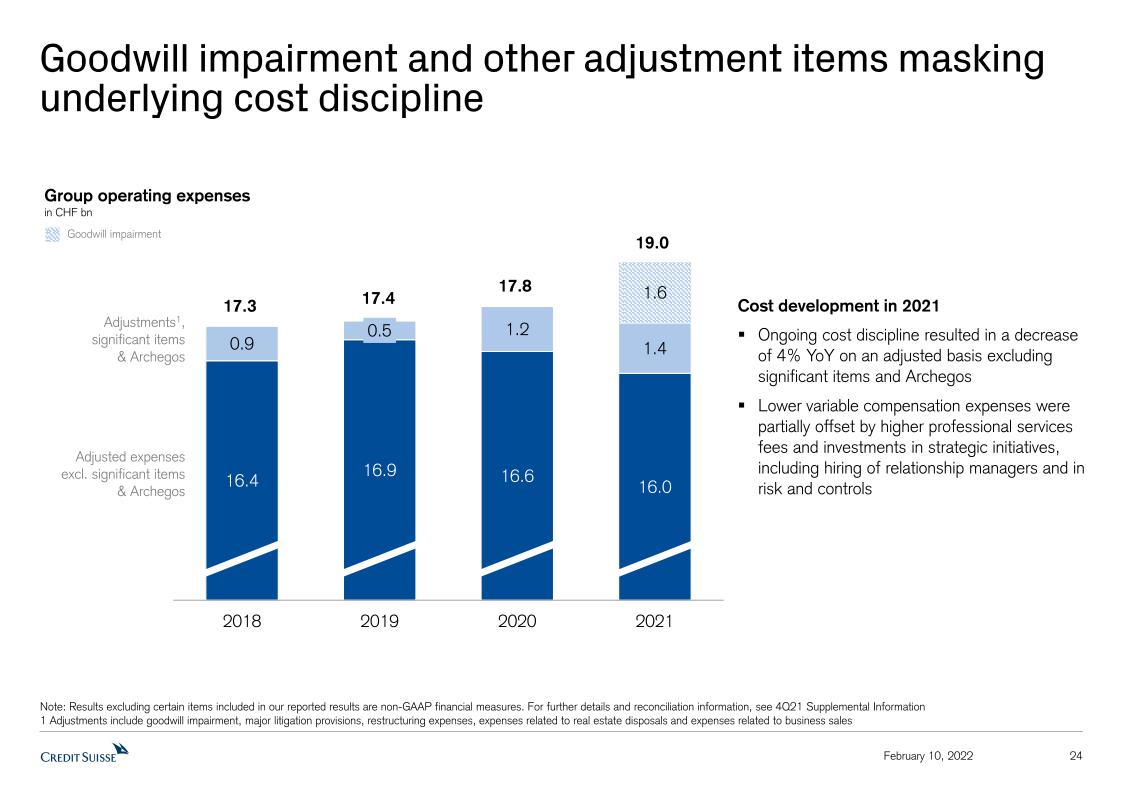

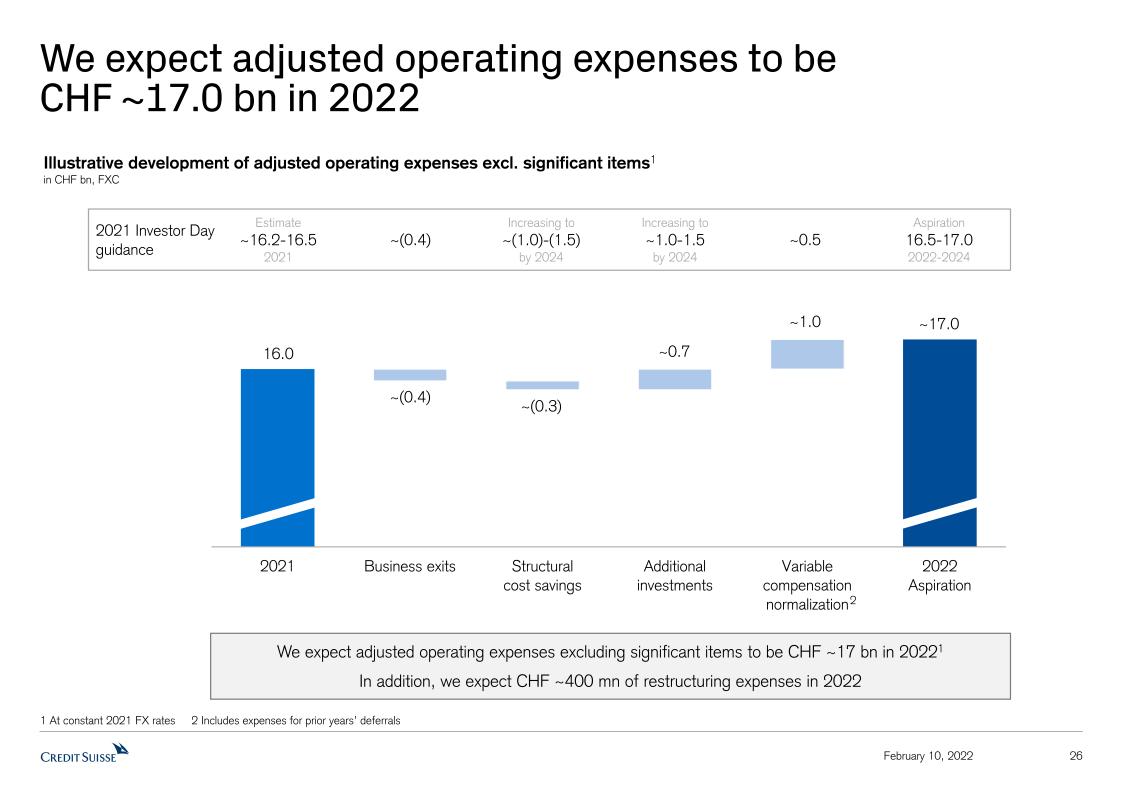

– Adjusted operating expenses, excluding significant items and Archegos*, of CHF 16.1 bn, down 4%, reflecting underlying cost discipline and resulting from lower variable compensation costs, partially offset by increased professional services fees and investments in strategic initiatives, including hiring of relationship managers in APAC and hiring in risk and controls. Reported operating expenses of CHF 19.0 bn, up 7% year on year, mainly driven by the goodwill impairment taken in 4Q21 in IB and APAC, partially offset by decreased compensation and benefits

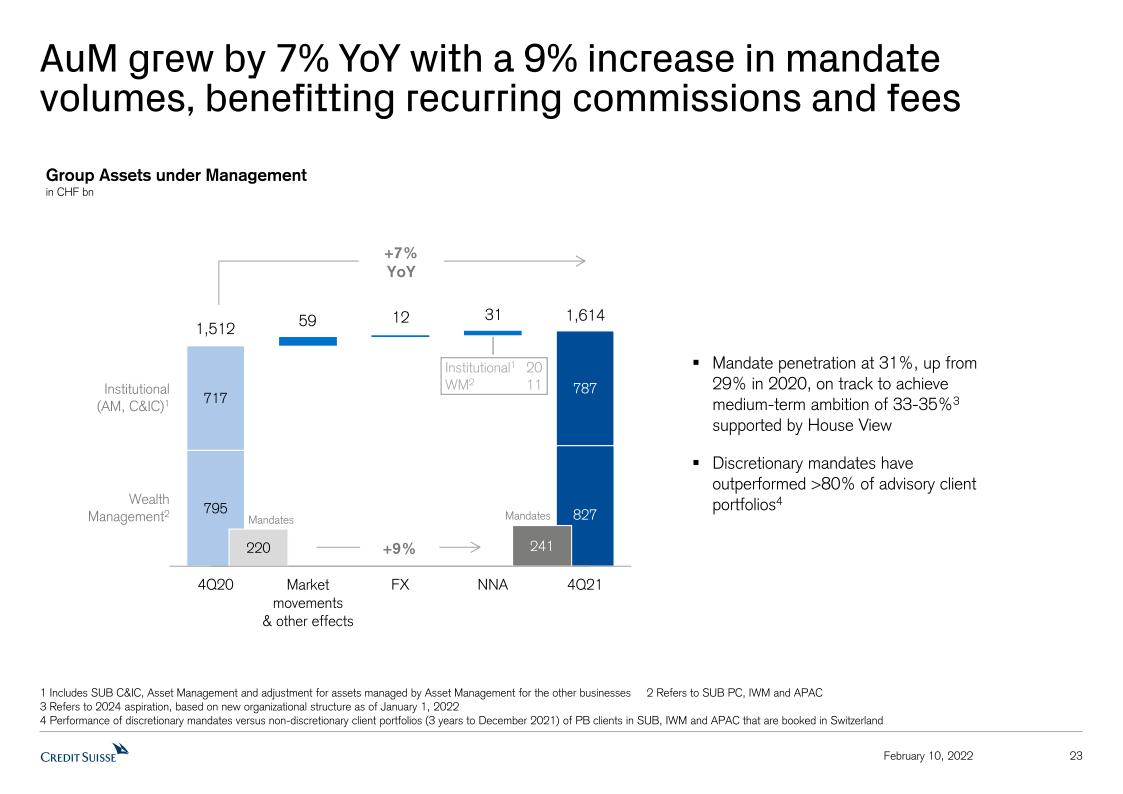

– Group AuM of over CHF 1.6 trn as of December 31, 2021, up approximately 7% year on year; NNA of CHF 30.9 bn with NNA in AM, IWM and SUB offsetting net asset outflows in APAC

– Wealth Management AuM of CHF 827 bn, up from CHF 795.3 bn as of December 31, 2020, with NNA of CHF 11.3 bn, supporting recurring commissions and fees’ growth of 9% year on year

Outlook

Compared to the exceptional levels of 1Q21, we have seen a reversion to lower, pre-pandemic levels of business activity, particularly given the monetary tightening that central banks have initiated. We also expect our Equities revenues to be impacted by the exit from Prime Services. However, after a weak start to the year, we are seeing encouraging signs of improving franchise momentum, including positive net new asset inflows year-to-date in our Wealth Management business.

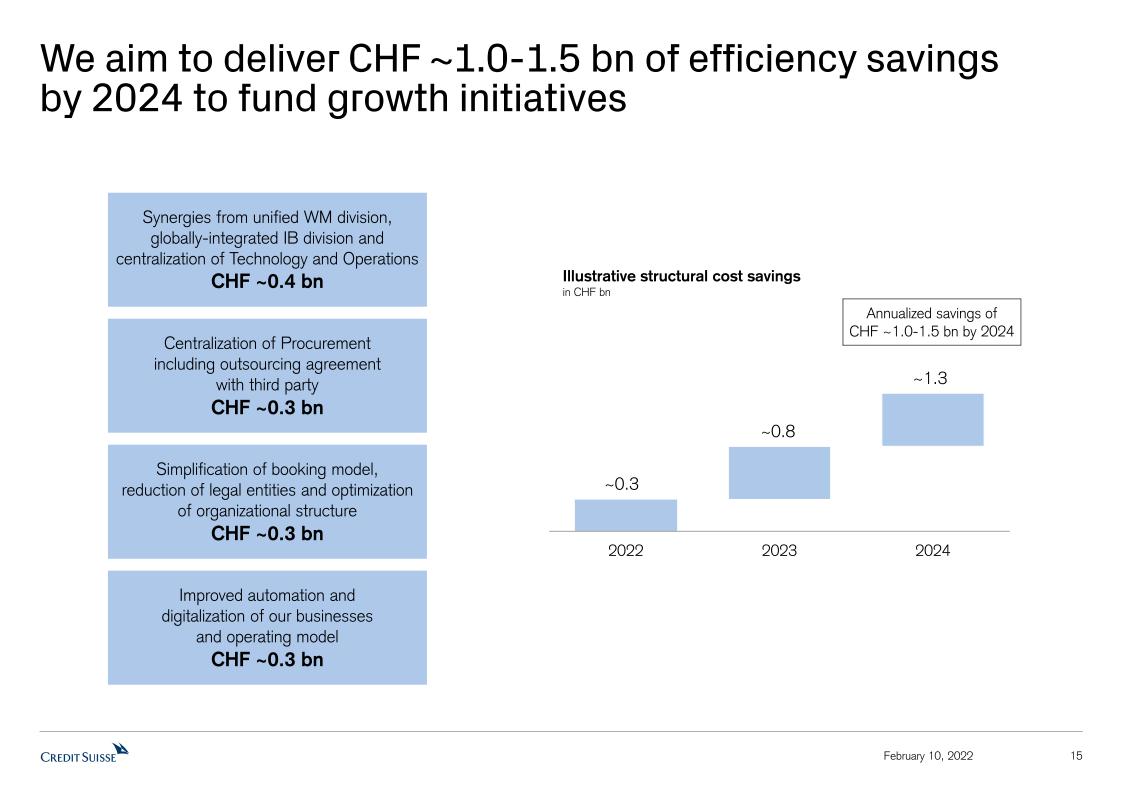

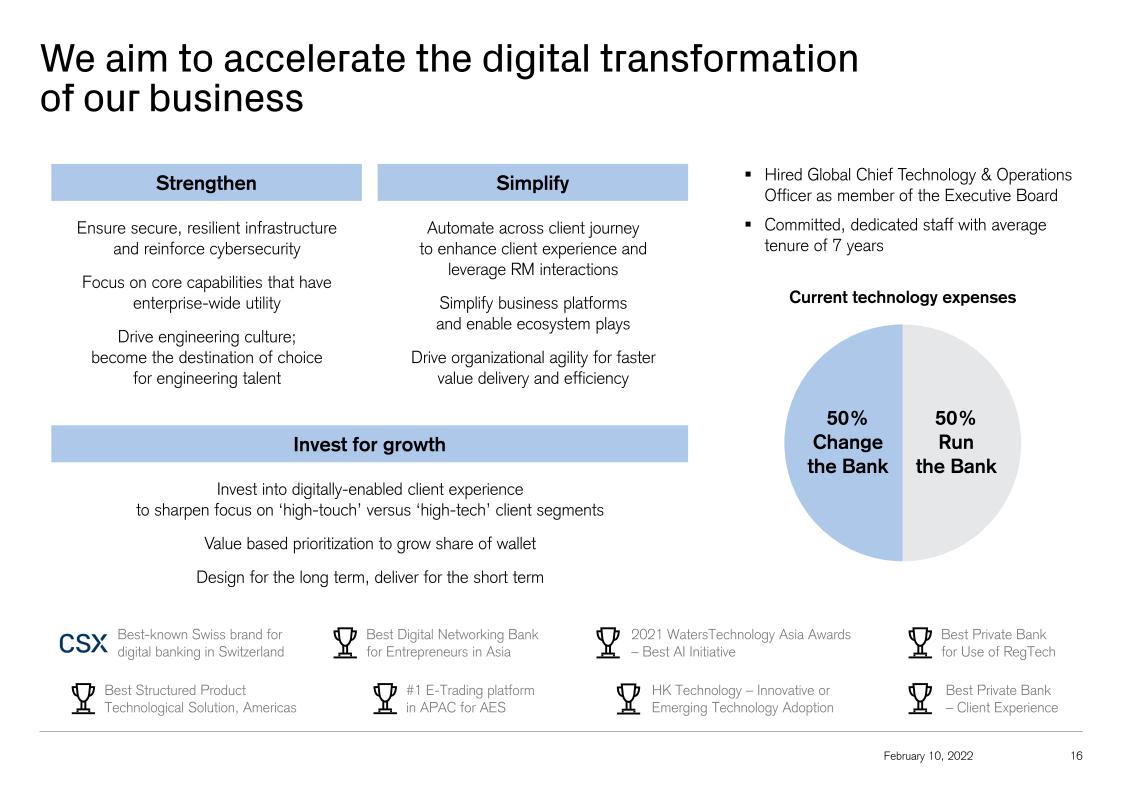

As previously highlighted at our Investor Day on November 4, 2021, the year 2022 will be a transition year for Credit Suisse as the benefits of our strategic capital reallocation towards core businesses and generating structural costs savings to invest for growth should largely materialize from 2023 onwards. In this context, the results for 2022 are expected to be adv2022 ersely affected by restructuring costs and higher compensation costs compared to last year. Our reported results are expected to also reflect volatility in the share price of our 8.6% holding in Allfunds Group (the value of which has declined by CHF 204 mn so far in 5). During 2022, we intend to meet our goal of releasing a cumulative USD 3 bn of allocated capital from our Investment Bank for reinvestment into Wealth Management and other core businesses.

Capital returns to shareholders

The Board of Directors (Board) will propose to the shareholders at the Annual General Meeting on April 29, 2022 a cash distribution of CHF 0.10 per share for the financial year 2021. This is consistent with the reduced dividend paid with respect to the financial year 2020 and reflects a prudent capital distribution approach for a challenging year. 50% of the distribution will be paid out of capital contribution reserves, free of Swiss withholding tax and will not be subject to income tax for Swiss resident individuals holding shares as a private investment, and 50% will be paid out of retained earnings, net of 35% Swiss withholding tax.

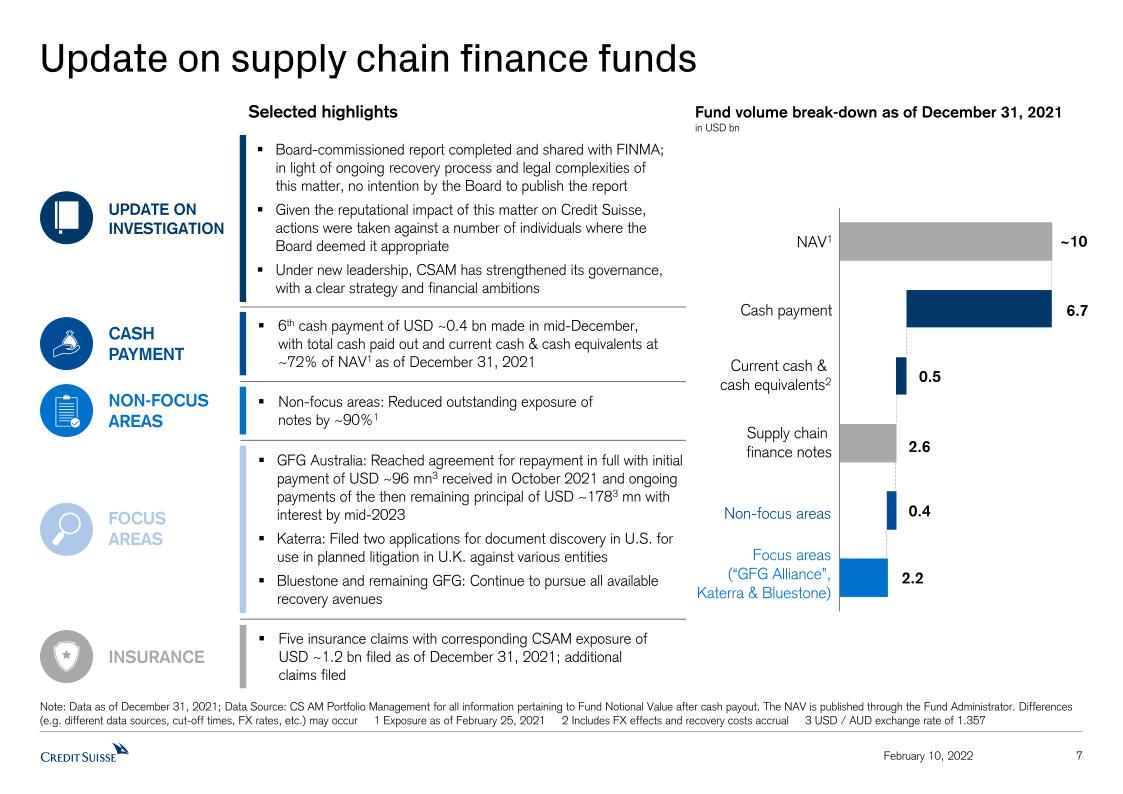

Supply Chain Finance Funds Matter Update

Last year, the Board commissioned Walder Wyss to execute an independent external investigation into the Supply Chain Finance Funds (SCFF). Walder Wyss appointed Deloitte Touche Tohmatsu Limited (Deloitte AG) to assist them in their work. The related report has been completed, the findings have been made available to the Board and the report was shared with FINMA. Given the reputational impact of the SCFF matter on Credit Suisse, actions have been taken against a number of individuals where the Board deemed it was appropriate. In light of the ongoing recovery process and the legal complexities of the matter, there is no intention by the Board to publish the report.

With regard to the funds themselves, we continue to pursue all available avenues for recovery on behalf of our investors. As of December 31, 2021, the focus areas account for approximately USD 2.2 bn of the NAV as of February 25, 2021. Regarding GFG Australia, after the initial payment we received in October 2021, we continued to receive monthly payments in 2021 in line with what GFG Australia agreed for the repayment of the then remaining principal of approximately USD 178 mn, including interest, by mid-20236. Regarding Katerra, we filed two applications for document discovery in the United States for use in planned litigation in the United Kingdom against various entities affiliated with Softbank Group Corp. Finally, with regard to Bluestone Resources and the remainder of GFG, we continue to pursue all available recovery avenues.

Furthermore, we have filed five insurance claims, as of December 31, 2021, through the filing process with Greensill Bank. These five claims have corresponding Credit Suisse Asset Management exposure of approximately USD 1.2 bn.

Following the sixth cash payment made in mid-December 2021, total cash paid out and current cash and cash equivalents, as of December 31, 2021, were at approximately 72% of the funds’ net asset value (NAV) as of February 25, 2021. In terms of cash payments, investors have received approximately USD 6.7 bn as of December 31, 2021. We continue to make good progress on our non-focus areas and have reduced the outstanding exposure of notes by approximately 90% of the February 25, 2021 exposure level. As of December 31, 2021, non-focus areas account for USD 0.4 bn of the NAV as of February 25, 2021.

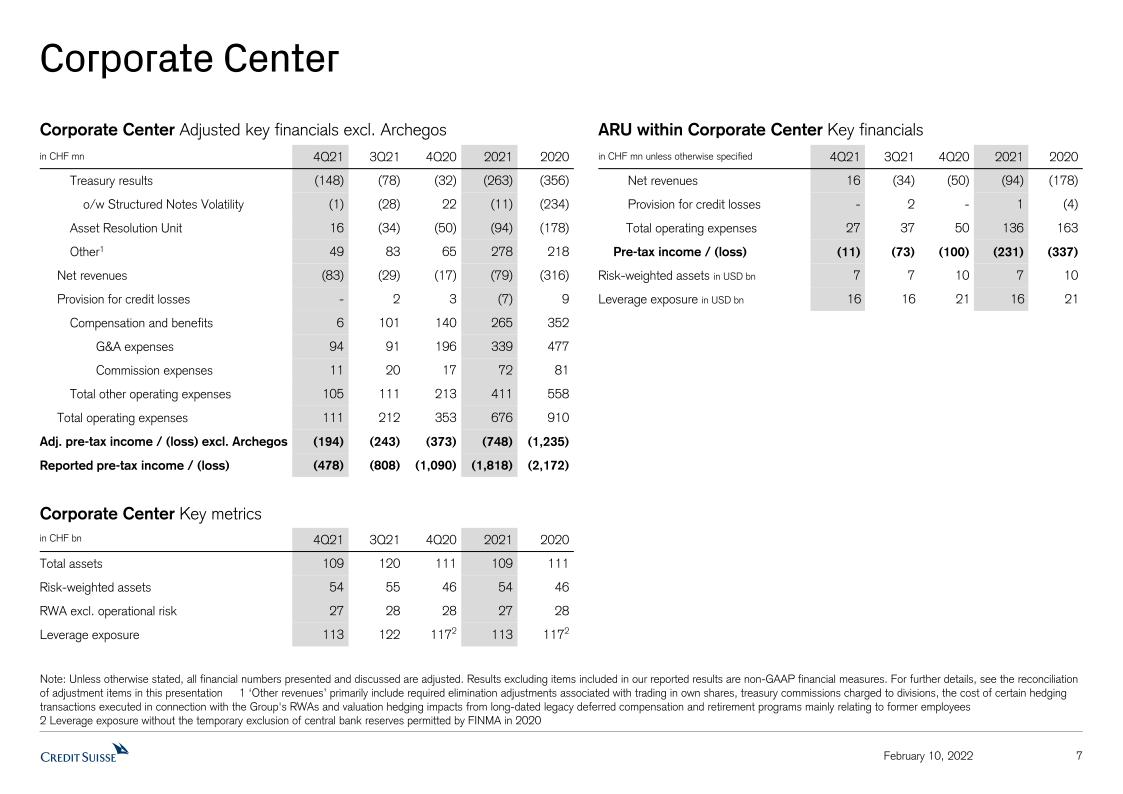

4Q21 Results – Review of Performance

We posted a pre-tax loss of CHF 1.6 bn in 4Q21 mainly due to the impact of the goodwill impairment taken in the Investment Bank and APAC, as well as major litigation provisions of CHF 436 mn and the impact of reduced net revenues, due in part to reduced risk appetite across divisions in 2021 and lower client activity. This led to a net loss attributable to shareholders of CHF 2.0 bn. We recorded a release of provision for credit losses of CHF 20 mn, which included a release pertaining to an assessment of the future recoverability of receivables related to Archegos of CHF 5 mn as well as a release of CHF 28 mn relating to non-specific provisions for expected credit losses. Our adjusted net revenues, excluding significant items and Archegos*, of CHF 4.4 bn, were down 18% year on year, and our adjusted pre-tax income, excluding significant items and Archegos*, of CHF 328 mn, was down 62%; this was in part due to our recalibrated risk appetite across divisions in 2021 as well as lower client activity.

The lower risk appetite in 2021 led to reductions in our Investment Bank’s Risk Weighted Assets (RWA) and Leverage Exposure of CHF 1 bn7 and CHF 18 bn8, respectively, quarter on quarter. Additionally, we achieved a capital9 reduction in the Investment Bank of USD 2.0 bn in 2021, representing significant progress towards our ambition to release > USD 3 bn of capital by the end of 2022. In terms of our Wealth Management-related businesses, RWA and Leverage exposure decreased by CHF 5 bn10 and CHF 7 bn11, respectively, quarter on quarter; this was mainly as a result of client deleveraging reflecting adverse market conditions, particularly in Asia.

Our capital ratios remain strong with a CET1 ratio of 14.4% at the end of 4Q21, stable compared to the end of 3Q21, and a CET1 leverage ratio of 4.4%, compared to 4.3% at the end of 3Q21. Our CET1 and leverage ratios benefitted from our lower RWA and leverage exposure.

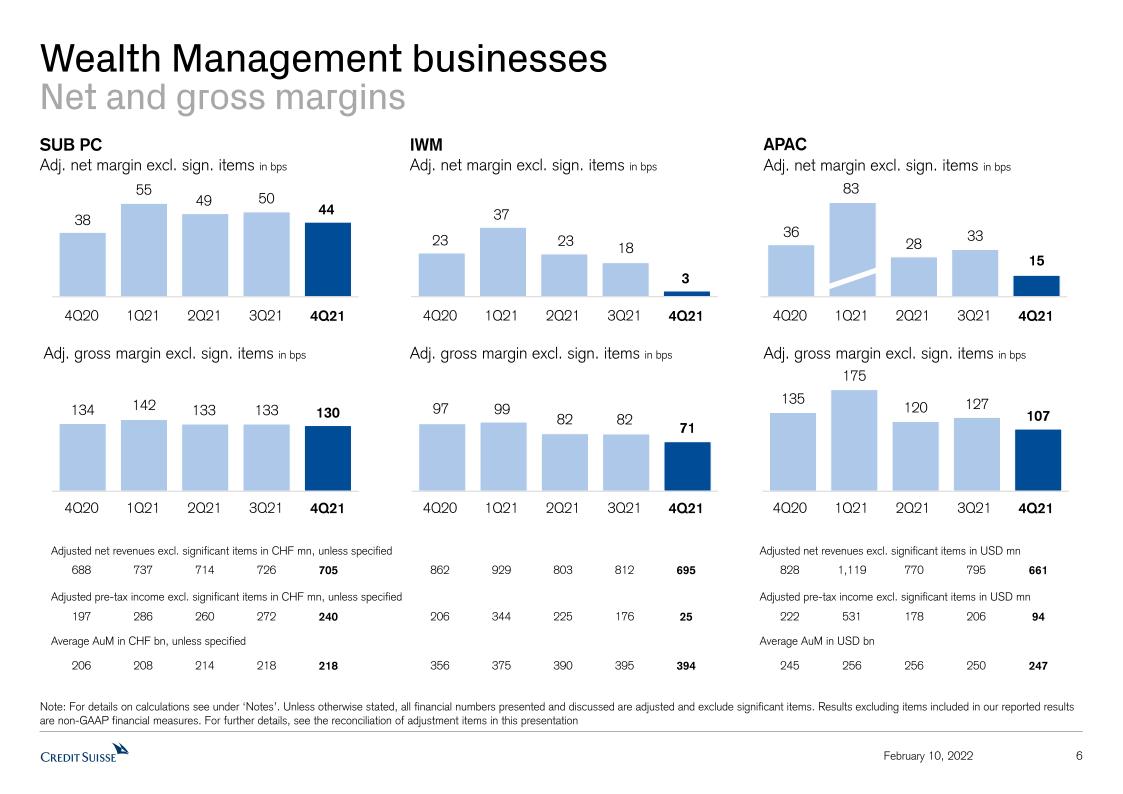

Our Wealth Management-related businesses reported net revenues of CHF 3.2 bn, up 2% year on year; on an adjusted basis, excluding significant items*, net revenues were down 8% due to lower transaction- and performance-based revenues, down 25% year on year, impacted by lower revenues from Global Trading Solutions (GTS) and lower client activity, as well as lower net interest

income, down 5%. However we saw strong momentum in recurring commissions and fees, up 6%, in line with the growth in our asset base.

Our Investment Bank’s reported net revenues of USD 1.6 bn were down 31% year on year, reflecting our strategy to reduce capital and risk across our businesses and more normalized trading conditions, particularly in Fixed Income. IB reported results included a charge of USD 1.7 bn relating to a goodwill impairment. Fixed Income Sales & Trading revenues were down 38% year on year, mainly reflecting weaker trading conditions in Credit. Equity Sales & Trading revenues were down 26% due to continued de-risking in and the exit12 of Prime Services. Capital Markets revenues were down 48%, reflecting a slowdown in SPAC activity, compared to a strong 4Q20, and lower risk appetite in our Leveraged Finance business. Advisory revenues were up significantly, by 51%, year on year, driven by higher revenues from completed M&A transactions. Revenues in GTS, our collaboration between the IB and our wealth management businesses, declined in part due to our reduced capital usage and more conservative risk appetite in 2021 coupled with lower volumes and volatility compared to an exceptional 4Q20.

Operating expenses for the Group of CHF 6.2 bn increased by 20% year on year, mainly driven by the goodwill impairment taken in the quarter of CHF 1.6 bn relating to DLJ. We also had litigation provisions of CHF 436 mn in the quarter. Our adjusted operating expenses, excluding significant items and Archegos*, decreased by 6%, illustrating continued cost discipline and driven by lower compensation expenses more than offsetting continued strategic investments across our businesses, including our investments in IT infrastructure, relationship manager hiring in APAC, as well as investments in risk and controls.

The Group reported AuM totaling CHF 1.6 trn at the end of 4Q21, up approximately 7% year on year. We saw NNA of CHF 1.6 bn in 4Q21, compared to NNA of CHF 8.4 bn in 4Q20 and NNA of CHF 5.6 bn in 3Q21.

FY21 Results – Review of Performance

2021 has been a year of challenges for Credit Suisse. It was paramount that we reviewed, reflected and comprehended the impact that both the Archegos and SCFF matters had on our bank, our culture, our strategy and the way we work. It is also imperative that we take action and remain focused on offering our clients continued excellent services and innovative solutions. We set a new path for our bank in our new Group strategy and simplified structure, which was effective as of January 1, 2022. What is clear from our FY21 results, is that despite the challenges, our franchise remains resilient.

On an adjusted basis, excluding significant items and Archegos*, our net revenues were up 2% year on year, at CHF 22.5 bn, driven by revenue growth in AM, IB and SUB partially offset by lower revenues in IWM.

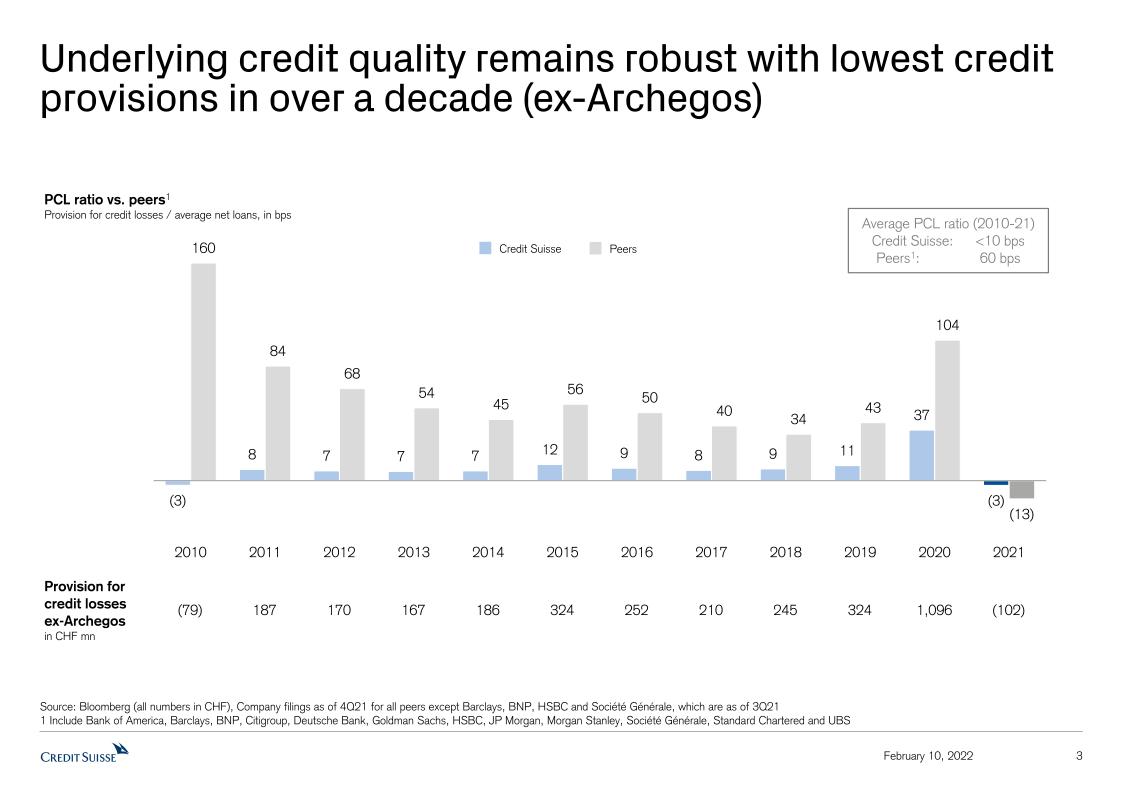

Our adjusted pre-tax income, excluding significant items and Archegos*, increased 51% year on year, to CHF 6.6 bn, driven by growth across most divisions, except for IWM where there was a 23% decrease year on year. Provision for credit losses for FY21 were CHF 4.2 bn, of which CHF 4.3 bn was related to Archegos, also included a net release of CHF 235 mn relating to non-specific provisions for expected credit losses.

Our Wealth Management-related businesses reported net revenues of CHF 14.0 bn, up 3% year on year. On an adjusted basis, excluding significant items*, net revenues were flat, driven by higher recurring commissions and fees, up 9% year on year, in line with growth in our asset base, partly offset by lower net interest income, down 6% year on year, as well as lower transaction- and performance-based revenues, down 4%.

Our Investment Bank reported net revenues of USD 9.7 bn, stable year on year. Our adjusted net revenues, excluding Archegos*, were up 5%. This was despite our disciplined approach to risk during the year and a strong FY20; revenues were driven by record13 performances across Capital Markets, M&A, Equity Derivatives and Securitized Products. Fixed Income Sales & Trading revenues were down 12% year on year, compared to a strong prior year, which benefited from more favorable market conditions across macro, global credit products and emerging markets, partially offset by significantly higher securitized products revenues. Equity Sales & Trading revenues were down 25% year on year, mainly reflecting the loss related to Archegos in Prime Services as well as the exit of Prime Services14, however, excluding Archegos*, they were down 5%15, in light of our strategy to resize the Prime Services franchise, partially offset by significantly higher equity derivatives revenues. Capital Markets revenues were up 30%, driven by robust markets, and Advisory revenues were up 50% due to a significant increase in M&A activity.

Operating expenses for the Group of CHF 19.0 bn increased by 7% year on year, mainly driven by the goodwill impairment taken in 4Q21 and higher litigation provisions, partially offset by decreased compensation and benefits. This masked our underlying cost discipline, as adjusted operating expenses, excluding significant items and Archegos*, decreased by 4% in part due to lower variable compensation costs, partially offset by increased professional services fees and investments in strategic initiatives, including hiring of relationship managers in APAC, investments in IT infrastructure and in risk and controls.

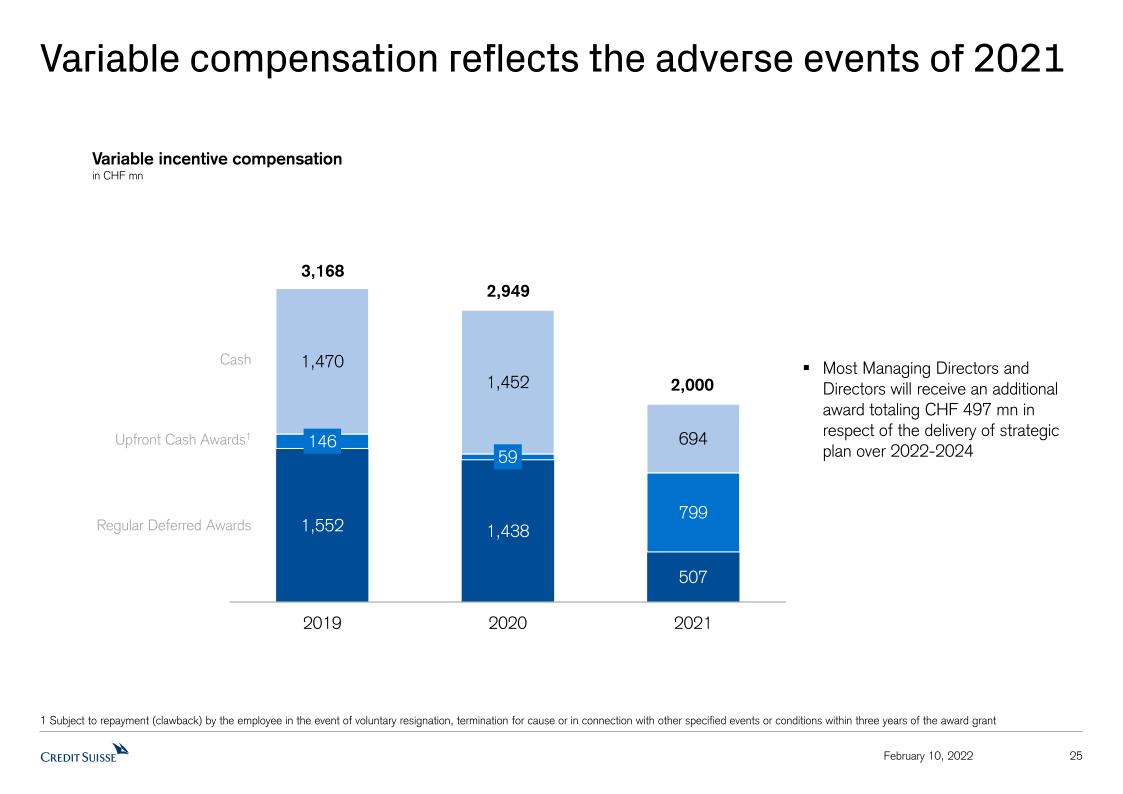

In setting compensation awards recently communicated to employees, the Executive Board and Board have sought to balance three competing priorities. First, to recognize the impact of significant matters in 2021 on our financial performance, most notably the Archegos matter, but also the reputational damage from the SCFF matter, as well as the goodwill impairment relating to the DLJ acquisition and the high level of legal provisions against a number of significant litigation issues. Second, to reflect the strength of the underlying* performance during 2021 of many of our businesses, notwithstanding our significant reduction in risk appetite during the year. Third, to ensure, going forward, that we are able to align the incentives for our employees to the delivery on the strategic plan that we announced on November 4, 2021, and that we remain competitive.

Our variable compensation awards are aligned to these goals. With regard to awards that relate to our 2021 performance, the Group variable compensation pool is 32% lower than in 2020 to reflect the aforementioned issues. The overall structure of these variable compensation awards is consistent with prior years for the majority of employees. However, most employees at a more senior level (Managing Directors and Directors), who have taken a higher proportionate share of the reduction in the variable compensation pool, have received a cash award with a pro-rata repayment (clawback) provision16 that applies in the event that they voluntarily leave the firm during the three-year period ending in February 2025, together with a regular deferred share-based award that generally vests linearly over the next three years.

To increase the alignment of executive compensation with shareholder interests, and recognizing the role of senior management in the implementation of our strategic plan, most Managing Directors and Directors have received a separate one-time share-based award (Strategic Delivery Plan or SDP), which will vest in its entirety in three years’ time if certain financial metrics are achieved over the course of 2022-2024. We will provide further details on these compensation awards in our Annual Report which will be published on March 10, 2022.

Our goal is to remain a competitive employer in what is a highly competitive compensation environment. We believe that with the above compensation outcome, Credit Suisse has found the right balance for all stakeholders in what was a very challenging year for the firm.

NNA for FY21 were CHF 30.9 bn compared to CHF 42.0 bn in FY20, with contributions from AM of CHF 14.6 bn, IWM of CHF 11.0 bn, SUB of CHF 6.5 bn, partly offset by net asset outflows in APAC of CHF 1.1 bn (USD 1.3 bn).

Detailed Divisional Summaries

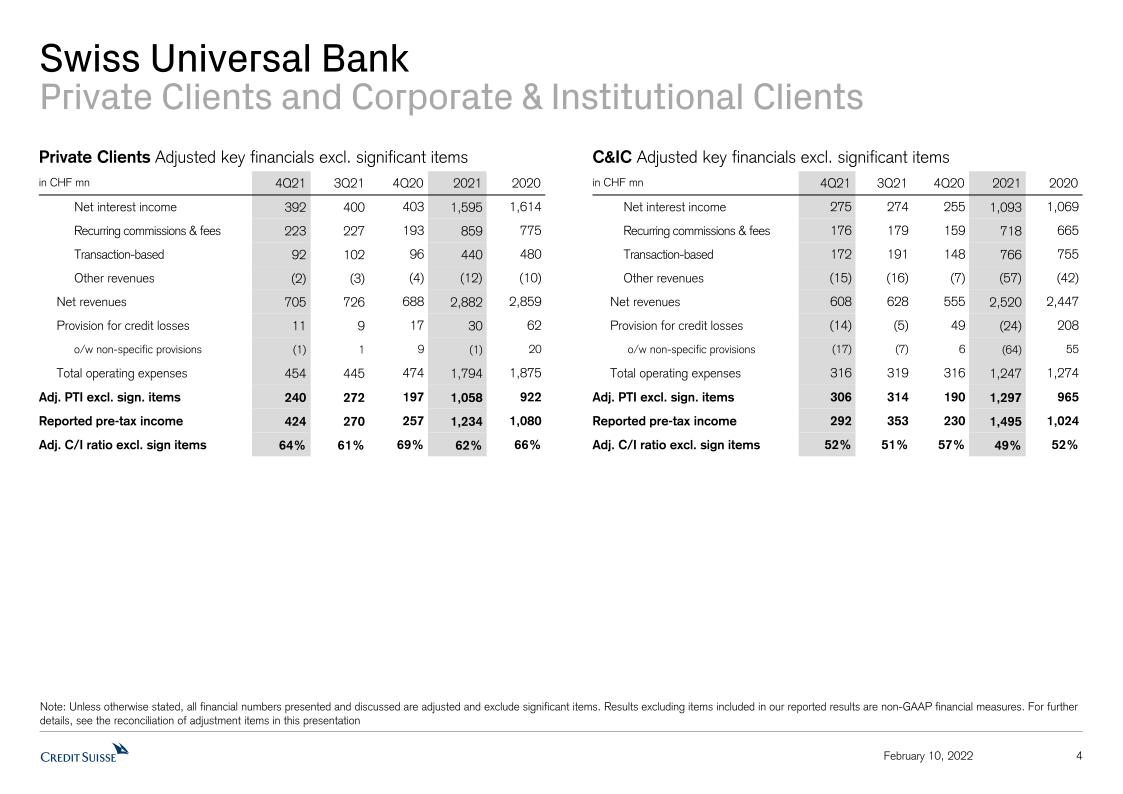

| Swiss Universal Bank (SUB) |

| Reported results (in CHF mn) | 4Q21 | 3Q21 | 4Q20 | ∆4Q20 | | FY21 | FY20 | ∆FY20 |

| Net revenues | 1,484 | 1,391 | 1,393 | 7% | 5,801 | 5,615 | 3% |

| Provision for credit losses | (3) | 4 | 66 | - | 6 | 270 | (98)% |

| Operating expenses | 771 | 764 | 840 | (8)% | 3,066 | 3,241 | (5)% |

| Pre-tax income | 716 | 623 | 487 | 47% | 2,729 | 2,104 | 30% |

| Cost/income ratio (%) | 52% | 55% | 60% | - | 53% | 58% | - |

| Net New Assets (bn) | (1.7) | 1.5 | 1.7 | - | 6.5 | 7.8 | - |

| o/w Private Clients (bn) | (1.8) | 1.9 | (2.1) | - | 1.4 | (5.9) | - |

Adjusted results, excluding significant items* (in CHF mn) | 4Q21 | 3Q21 | 4Q20 | ∆4Q20 | FY21 | FY20 | ∆FY20 |

| Net revenues | 1,313 | 1,354 | 1,243 | 6% | 5,402 | 5,306 | 2% |

| Operating expenses | 770 | 764 | 790 | (3)% | 3,041 | 3,149 | (3)% |

| Pre-tax income | 546 | 586 | 387 | 41% | 2,355 | 1,887 | 25% |

| Cost/income ratio (%) | 59% | 56% | 64% | - | 56% | 59% | - |

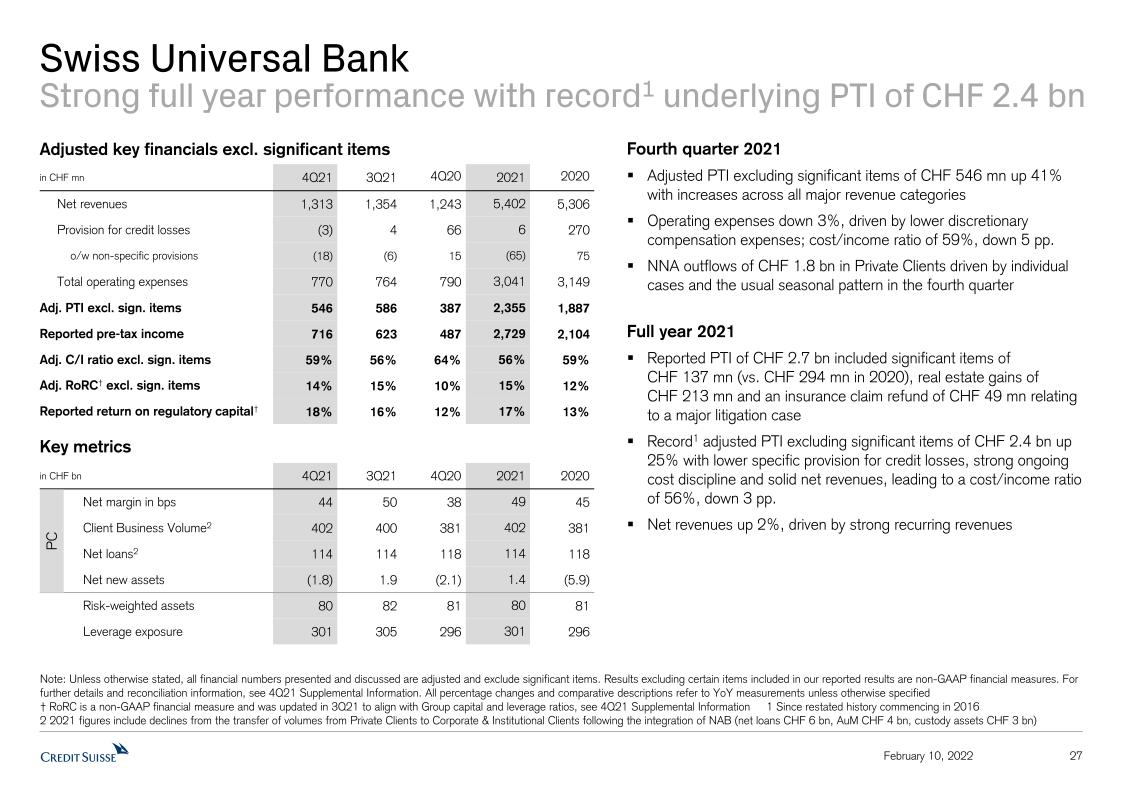

– On an adjusted basis, excluding significant items*, SUB had a record17 fourth quarter pre-tax income of CHF 546 mn, up 41% year on year, due to higher net revenues up 6%, lower operating expenses, and a release of provision for credit losses. Our adjusted operating expenses, excluding significant items*, were down 3% year on year with lower discretionary compensation expenses; this in turn supported our adjusted cost/income ratio, excluding significant items*, of 59% down compared to 4Q20

– Reported net revenues of CHF 1.5 bn were up 7% year on year, which included real estate gains of CHF 205 mn, a gain of CHF 9 mn on our equity investment in Allfunds Group and a revaluation loss of CHF 43 mn on our equity investment in SIX Group. Adjusted net revenues, excluding significant items*, were up 6% driven by increases across all major revenue categories with recurring commissions and fees up 13% supported by record18 AuM levels and higher revenues from improved performance in our investment in Swisscard. Transaction-based revenues were up 8% and net interest income was stable

– Net asset outflows of CHF 1.7 bn reflecting net outflows from Private Clients of CHF 1.8 bn, primarily due to individual cases in the ultra-high-net-worth (UHNW) and high-net-worth (HNW) client segments and the usual seasonal slowdown for the quarter, partially offset by net inflows of CHF 0.1 bn in Corporate & Institutional Clients

– Client business volume of CHF 1.1 trn, up 9% year on year

– On an adjusted basis, excluding significant items*, record19 full-year pre-tax income of CHF 2.4 bn, up 25% year on year, driven by significantly lower provision for credit losses, and higher net revenues, up 2%, with operating expenses down 3%

– Reported net revenues were up 3% compared to FY20; adjusted net revenues, excluding significant items*, of CHF 5.4 bn, up 2%, mainly driven by higher recurring commissions and fees, up 10%, with stable net interest income, partly offset by lower transaction-based revenues, down 2%

– NNA of CHF 6.5 bn at an annualized growth rate of 1%, with contributions from both Private Clients and Corporate & Institutional Clients businesses

| International Wealth Management (IWM) |

| Reported results (in CHF mn) | 4Q21 | 3Q21 | 4Q20 | ∆4Q20 | | FY21 | FY20 | ∆FY20 |

| Net revenues | 716 | 829 | 974 | (26)% | 3,462 | 3,747 | (8)% |

| Provision for credit losses | (1) | 12 | 31 | - | (14) | 110 | - |

| Operating expenses | 682 | 624 | 650 | 5% | 2,500 | 2,546 | (2)% |

| Pre-tax income | 35 | 193 | 293 | (88)% | 976 | 1,091 | (11)% |

| Cost/income ratio (%) | 95% | 75% | 67% | - | 72% | 68% | - |

| Net New Assets (bn) | 2.7 | 1.4 | 4.3 | - | 11.0 | 16.7 | - |

Adjusted results, excluding significant items* (in CHF mn) | 4Q21 | 3Q21 | 4Q20 | ∆4Q20 | FY21 | FY20 | ∆FY20 |

| Net revenues | 695 | 812 | 862 | (19)% | 3,239 | 3,620 | (11)% |

| Operating expenses | 671 | 624 | 625 | 7% | 2,483 | 2,515 | (1)% |

| Pre-tax income | 25 | 176 | 206 | (88)% | 770 | 995 | (23)% |

| Cost/income ratio (%) | 97% | 77% | 73% | - | 77% | 69% | - |

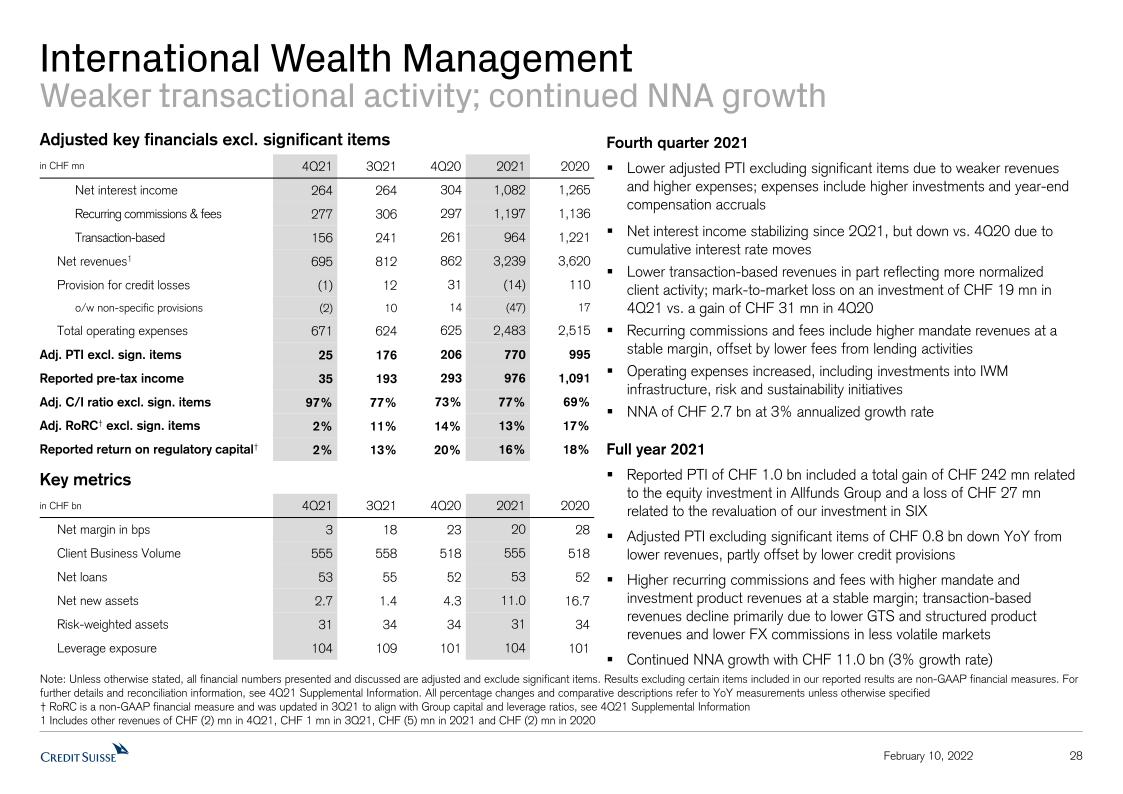

– On an adjusted basis, excluding significant items*, IWM pre-tax income fell to CHF 25 mn, down 88% year on year, driven by lower net revenues, down 19%, as well as higher operating expenses, up 7%, reflecting higher investments and year-end compensation accruals

– Reported net revenues of CHF 716 mn were down 26% year on year and included gains on real estate and business sales of CHF 36 mn and a negative net impact of CHF 15 mn from the equity investment gain in Allfunds Group and an equity investment revaluation loss in SIX Group. Adjusted net revenues, excluding significant items*, of CHF 695 mn, were down 19% driven by lower transaction- and performance-based revenues, down 40%, due to more normalized client activity, lower GTS revenues in less volatile markets and a mark-to-market loss on an investment of CHF 19 mn in 4Q21 compared to a gain of CHF 31 mn in 4Q20. We also saw lower net interest income, down 13%, due in part to cumulative interest rate moves. Finally, recurring commissions and fees were down 7%, with lower fees from lending activities, partially offset by higher mandate revenues at a stable margin

– NNA of CHF 2.7 bn with inflows in emerging markets and Western Europe

– Client business volume of CHF 555 bn, up 7% year on year, reflecting higher AuM of CHF 391 bn

– On an adjusted basis, excluding significant items*, pre-tax income was down 23% year on year at CHF 770 mn, mainly reflecting lower net revenues, down 11%, which were only partly offset by slightly lower operating expenses, down 1%, and a net release of provision for credit losses of CHF 14 mn

– Reported net revenues were down 8% year on year; adjusted net revenues, excluding significant items*, of CHF 3.3 bn, were down 11% year on year, driven by lower transaction- and performance-based revenues, down 21%, mainly due to lower GTS and structured products revenues and lower FX commissions in less volatile markets. We also had lower net interest income, down 14%, with lower deposit and treasury income, partly offset by higher loan income. Recurring commissions and fees were up 5%, with higher mandate and investment product revenues at a stable margin

– NNA of CHF 11.0 bn, reflecting an annualized growth rate of 3%

| Asia Pacific (APAC) |

| Reported results (in USD mn) | 4Q21 | 3Q21 | 4Q20 | ∆4Q20 | | FY21 | FY20 | ∆FY20 |

| Net revenues | 671 | 837 | 871 | (23)% | 3,548 | 3,378 | 5% |

| Provision for credit losses | (14) | 7 | 7 | - | 29 | 248 | (88)% |

| Operating expenses | 694 | 583 | 600 | 16% | 2,431 | 2,241 | 8% |

| Pre-tax income/loss | (9) | 247 | 264 | - | 1,088 | 889 | 22% |

| Cost/income ratio (%) | 103% | 70% | 69% | - | 69% | 66% | - |

| Net New Assets (bn) | (3.2) | 3.2 | (1.3) | - | (1.3) | 8.9 | - |

Adjusted results, excluding significant items* (in USD mn) | 4Q21 | 3Q21 | 4Q20 | ∆4Q20 | FY21 | FY20 | ∆FY20 |

| Net revenues | 661 | 795 | 828 | (20)% | 3,345 | 3,309 | 1% |

| Operating expenses | 581 | 582 | 599 | (3)% | 2,307 | 2,237 | 3% |

| Pre-tax income | 94 | 206 | 222 | (58)% | 1,009 | 824 | 22% |

| Cost/income ratio (%) | 88% | 73% | 72% | - | 69% | 68% | - |

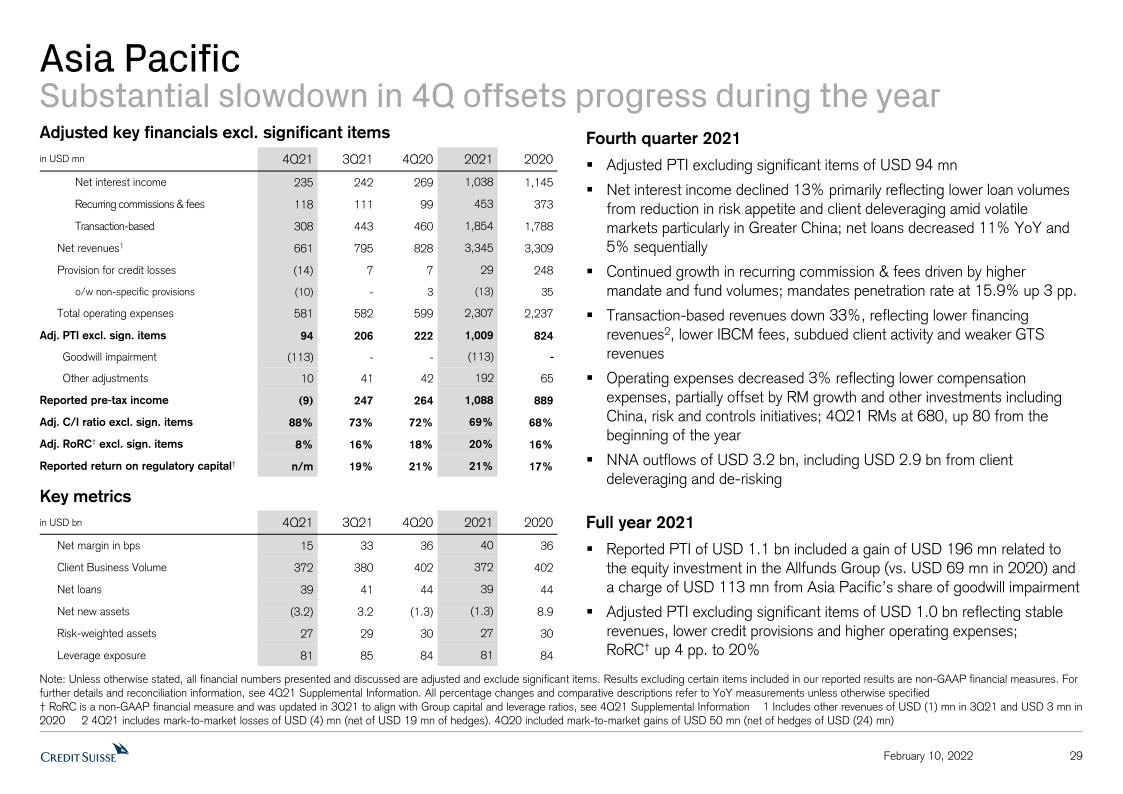

– On an adjusted basis, excluding significant items*, pre-tax income of USD 94 mn, down 58% year on year, largely due to lower net revenues, driven mainly by lower transaction activity. Adjusted operating expenses, excluding significant items*, were down 3% year on year reflecting lower compensation expenses

– Reported net revenues of USD 671 mn, down 23% year on year, included a gain on the equity investment in Allfunds Group of USD 10 mn in 4Q21 compared to a gain of USD 43 mn in 4Q20. Reported operating expenses, up 17%, include a charge of USD 113 mn from Asia Pacific’s share of the goodwill impairment related to DLJ

– On an adjusted basis, excluding significant items*, net revenues of USD 661 mn were down 20%, as lower transaction-based revenues and lower net interest income were partially offset by higher recurring commissions and fees. Transaction-based revenues were down 33%, reflecting lower financing revenues20, lower structured equity origination revenues, lower brokerage and product issuing fees and lower revenues from GTS. Net interest income was down 13%, mainly reflecting lower loan margins and lower loan volumes due to de-risking measures and client deleveraging amid volatile markets, particularly in Greater China. Finally, recurring commissions and fees were up 19%, reflecting higher mandates and fund volumes

– Net asset outflows of USD 3.2 bn, including USD 2.9 bn from client deleveraging as well as de-risking measures we have taken

– Client business volume of USD 372 bn, down 7% year on year; AuM of CHF 218.8 mn

– On an adjusted basis, excluding significant items*, APAC recorded higher pre-tax income of USD 1.0 bn, up 22% year on year, reflecting significantly lower provision for credit losses and stable net revenues, more than offsetting higher operating expenses, up 3% due in part to our continued relationship manager hiring coupled with other investments in private banking compliance and digitalization initiatives. Reported pre-tax income included a gain on the equity investment in Allfunds Group of USD 196 mn in 2021 compared to a gain of USD 69 mn in 2020 and a charge of USD 113 mn from APAC’s share of the goodwill impairment on DLJ

– Reported net revenues were up 5% year on year; adjusted net revenues, excluding significant items*, of USD 3.3 bn were stable. Recurring commission and fees were higher, up 21%, driven by higher mandates and funds volumes and resulting in higher managed solutions penetration. Transaction-based revenues were higher, up 4%, as a strong 1Q21 was largely offset by weaker performance thereafter, impacted by negative China market sentiment and interest rate uncertainties. These revenue increases were largely offset by lower net interest income, down 9%, mainly from significantly lower deposit margins, despite higher average deposits volumes, and lower loan margins on a decreasing loan portfolio during the year due to client deleveraging and de-risking measures we have taken

– Net asset outflows of USD 1.3 bn, mainly reflecting outflows in North Asia, including client deleveraging as well as de-risking measures taken in 2021

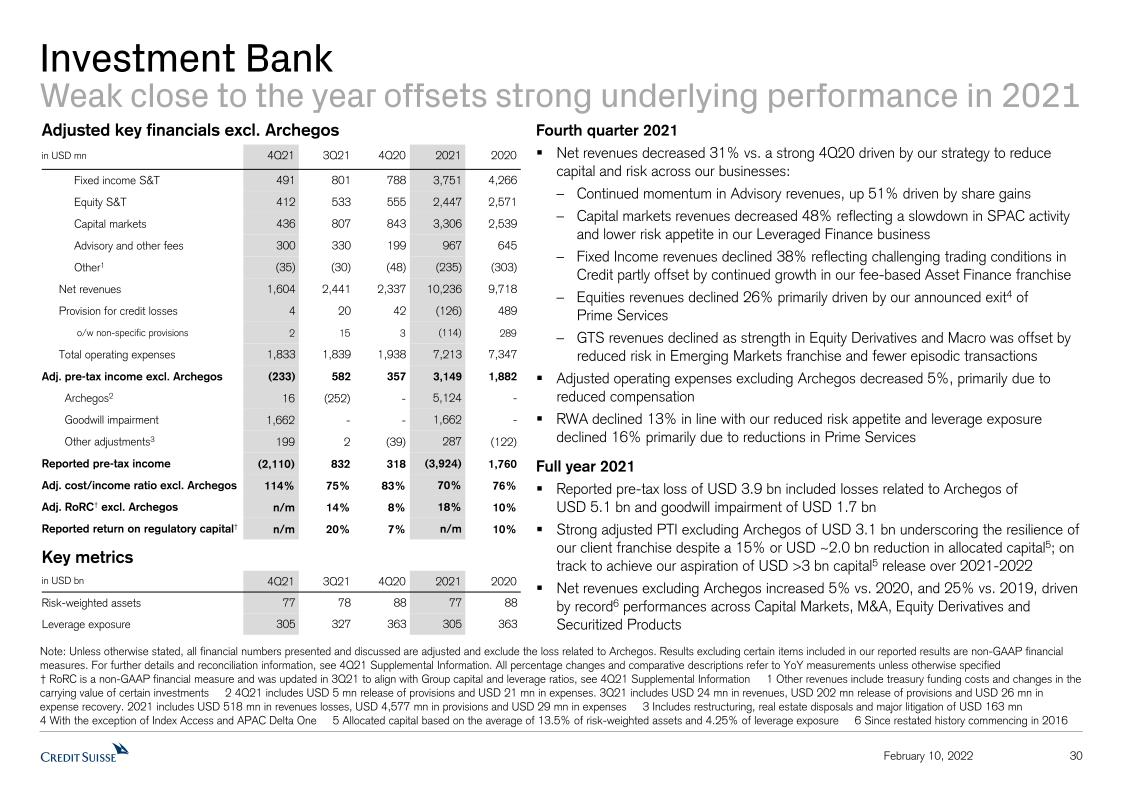

| Investment Bank (IB) |

| Reported results (in USD mn) | 4Q21 | 3Q21 | 4Q20 | ∆4Q20 | | FY21 | FY20 | ∆FY20 |

| Net revenues | 1,605 | 2,465 | 2,337 | (31)% | 9,719 | 9,718 | - |

| Provision for credit losses | (1) | (182) | 42 | - | 4,451 | 489 | - |

| Operating expenses | 3,716 | 1,815 | 1,977 | 88% | 9,192 | 7,469 | 23% |

| Pre-tax income/loss | (2,110) | 832 | 318 | - | (3,924) | 1,760 | - |

| Cost/income ratio (%) | 232% | 74% | 85% | - | 95% | 77% | - |

| Return on Regulatory Capital (%) | (53)% | 20% | 7% | - | (23)% | 10% | - |

| Adjusted results, excluding Archegos* (in USD mn) | 4Q21 | 3Q21 | 4Q20 | ∆4Q20 | FY21 | FY20 | ∆FY20 |

| Net revenues | 1,604 | 2,441 | 2,337 | (31)% | 10,236 | 9,718 | 5% |

| Operating expenses | 1,833 | 1,839 | 1,938 | (5)% | 7,213 | 7,347 | (2)% |

| Pre-tax income | (233) | 582 | 357 | - | 3,149 | 1,882 | 67% |

| Cost/income ratio (%) | 114% | 75% | 83% | - | 70% | 76% | - |

| Return on Regulatory Capital (%) | (6)% | 14% | 8% | - | 18% | 10% | - |

– On an adjusted basis, excluding Archegos*, the IB posted a pre-tax loss of USD 233 mn, down from pre-tax income of USD 357 mn in 4Q20, reflecting lower revenues in the quarter; total reported operating expenses, up 88% year on year, included a goodwill impairment of USD 1.7 bn relating to DLJ; adjusted operating expenses, excluding Archegos*, decreased by 5% year on year, primarily due to reduced compensation

– Reported net revenues of USD 1.6 bn, were down 31% year on year due to a strong comparable in 4Q20 and reflecting our strategy to reduce capital and risk across our businesses during 2021

– We saw continued momentum in our Advisory revenues, up 51% year on year and resulting in market share gains21

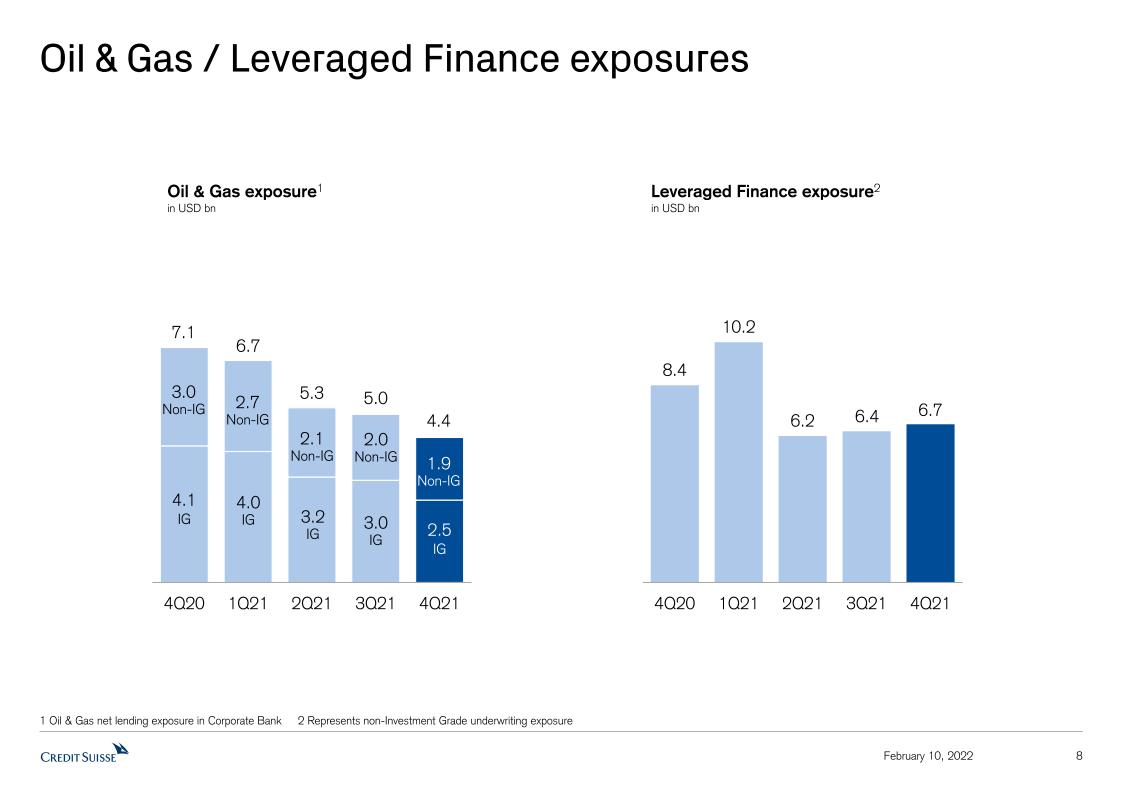

– Capital markets revenues decreased 48% year on year, reflecting a slowdown in SPAC activity, compared to a strong comparable in 4Q20, and lower risk appetite in our Leveraged Finance business

– Revenues in our Fixed Income Sales & Trading business were down 38% year on year, reflecting lower trading activity in Credit partly offset by continued growth in our number 1 ranked22 fee-based Asset Finance franchise and higher Macro revenues

– Equity Sales & Trading revenues declined by 26% year on year primarily due to our announced exit23 from Prime Services

– GTS revenues declined as strength in Equity Derivatives and Macro was offset by de-risking in our Emerging Markets franchise and fewer episodic transactions

– Risk Weighted Assets declined 13% year on year in line with our reduced risk appetite in 2021, and leverage exposure declined 16% year on year primarily due to reductions in Prime Services

– Strong adjusted pre-tax income, excluding Archegos*, of USD 3.1 bn, up 67% year on year, resulted in an adjusted return on regulatory capital, excluding Archegos*, of 18% underscoring the resilience of our client franchise despite a 15% reduction in allocated capital24. The reported pre-tax loss of USD 3.9 bn included losses from Archegos of approximately USD 5.1 bn as well as a goodwill impairment of USD 1.7 bn in 4Q21 relating to DLJ

– Adjusted net revenues, excluding Archegos*, of USD 10.2 bn, were up 5% compared to a strong FY20, driven by record25 fourth quarter performances across Capital Markets, M&A, Equity Derivatives and Securitized Products

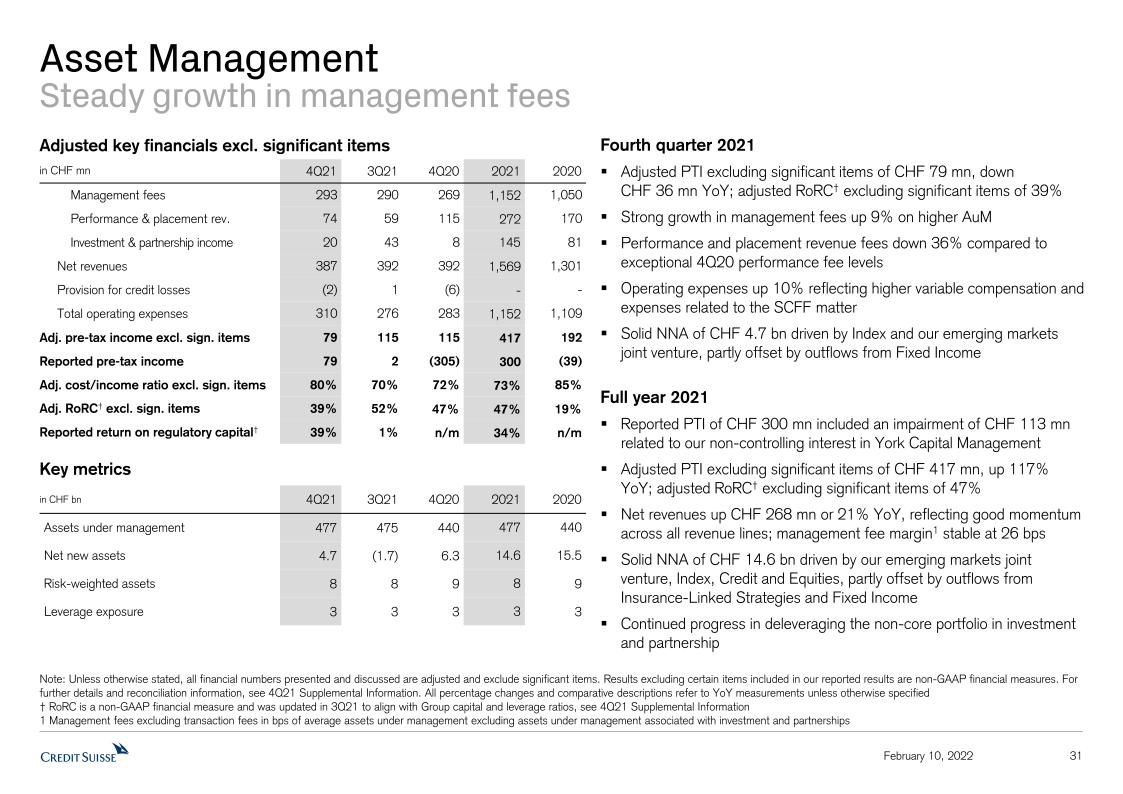

| Asset Management (AM) |

| Reported results (in CHF m) | 4Q21 | 3Q21 | 4Q20 | ∆4Q20 | | FY21 | FY20 | ∆FY20 |

| Net revenues | 387 | 279 | (22) | - | 1,456 | 1,090 | 34% |

| Provision for credit losses | (2) | 1 | (6) | - | 0 | 0 | - |

| Operating expenses | 310 | 276 | 289 | 7% | 1,156 | 1,129 | 2% |

| Pre-tax income | 79 | 2 | (305) | - | 300 | (39) | - |

| Cost/income ratio (%) | 80% | 99% | - | - | 79% | 104% | - |

| Net New Assets (bn) | 4.7 | (1.7) | 6.3 | - | 14.6 | 15.5 | - |

Adjusted results, excluding significant items* (in CHF m) | 4Q21 | 3Q21 | 4Q20 | ∆4Q20 | FY21 | FY20 | ∆FY20 |

| Net revenues | 387 | 392 | 392 | (1)% | 1,569 | 1,301 | 21% |

| Operating expenses | 310 | 276 | 283 | 10% | 1,152 | 1,109 | 4% |

| Pre-tax income / (loss) | 79 | 115 | 115 | (31)% | 417 | 192 | - |

| Cost/income ratio (%) | 80% | 70% | 72% | - | 73% | 85% | - |

– On an adjusted basis, excluding significant items*, pre-tax income of CHF 79 mn, was down 31% year on year, mainly due to higher operating expenses, however, net revenues were stable year on year. Adjusted operating expenses, excluding significant items*, were up 10%, mainly due to higher variable compensation and higher expenses related to the SCFF matter

– Reported net revenues were up significantly year on year at CHF 387 mn; in 4Q20 revenues included an impairment of CHF 414 million to the valuation of our non-controlling interest in York Capital Management

– We recorded stable adjusted net revenues, excluding significant items*, of CHF 387 mn; revenues were driven by higher management fees, up 9% reflecting higher average AuM, and increased investment & partnership income, offset by lower performance and placement revenues, down 36%, reflecting very strong performance fees in 4Q20

– NNA of CHF 4.7 bn, implying a 4% annualized growth rate, driven by Index Solutions and our emerging markets joint venture, partly offset by outflows from fixed income; AuM of CHF 476.8 bn

– On an adjusted basis, excluding significant items*, AM had significantly higher pre-tax income, year on year, of CHF 417 mn compared to CHF 192 mn in 2020, driven mainly by higher net revenues, partially offset by higher operating expenses, up 4% year on year, primarily related to the SCFF matter and increased commission expenses

– Reported net revenues of CHF 1.5 bn were up 34% year on year; strong adjusted net revenues, excluding significant items*, of CHF 1.6 bn were up 21%, reflecting good momentum across all revenue lines with higher management fees, up 10% year on year, and higher performance and placement revenues, up 60%, as well as a significant improvement in investment and partnership income

– NNA of CHF 14.6 bn at annualized growth rate of 3% driven by our emerging markets joint venture, Index Solutions, credit and equities, partly offset by outflows from Insurance-Linked Strategies and fixed income

– Continued progress in deleveraging the non-core portfolio in investment and partnership

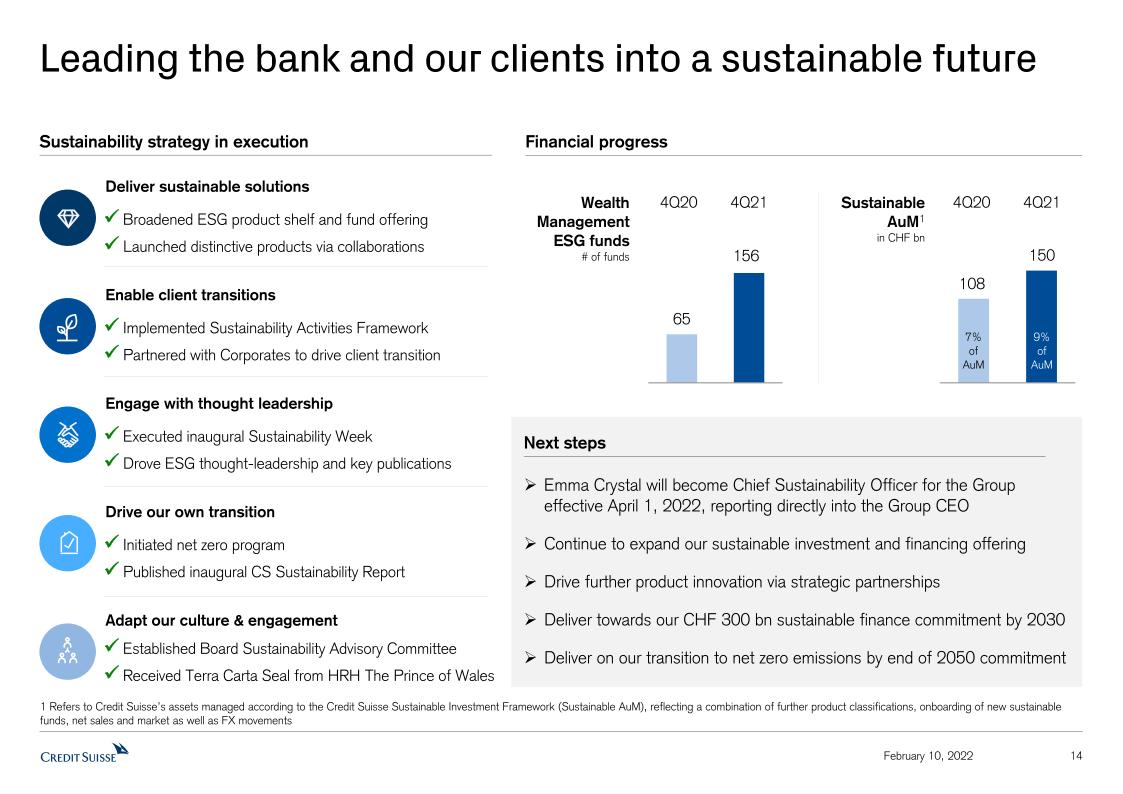

Progress on our sustainability ambitions and investing for growth in light of our new Group strategy

Throughout 2021 and during the fourth quarter 2021, Credit Suisse continued to focus on its sustainability strategy and driving activity across divisions and functions. The bank continues to emphasize the importance of sustainability as a core element of our value proposition for our clients, shareholders and employees; we are committed to consistently executing on our sustainability strategy and ambitions.

Our key achievements in 4Q21 regarding sustainability include:

– 4Q21 Sustainable AuM of CHF 150 bn26, up 4% quarter on quarter, and 39% year on year; resulting in 9.3% Sustainable AuM penetration as of December 31, 2021

– The launch of our Sustainable Activities Framework to provide clarity on our approach to classification, as well as establish credibility, transparency and governance around how the Group accounts for and reports its sustainable finance activities contributing to our commitment of providing at least CHF 300 bn of sustainable finance by 2030

– The announcement relating to being one of the first recipients of the Terra Carta Seal from HRH The Prince of Wales as part of his Sustainable Markets Initiative, recognizing firms at the forefront of the sustainable transition

Furthermore, and in light of our new Group strategy, with a clear focus on investing for growth, we announced that Emma Crystal will become Chief Sustainability Officer for the Group effective April 1, 2022. Reporting directly into the Group CEO, her mandate will include partnering with the four global business divisions, the four geographic regions and our corporate functions, to deliver on our existing sustainability and ESG ambitions. Emma has a deep breadth of experience as the leader of the Sustainable Client Solutions unit in our IWM business and Head of Northern and Western Europe for IWM.

CONTACT DETAILS

Kinner Lakhani, Investor Relations, Credit Suisse Tel: +41 44 333 71 49 Email: investor.relations@credit-suisse.com |

Dominik von Arx, Corporate Communications, Credit Suisse Tel: +41 844 33 88 44 Email: media.relations@credit-suisse.com |

The Earnings Release and Presentation Slides for 4Q21 and FY21 are available to download from 06:45 CET today at: https://www.credit-suisse.com/results |

PRESENTATION OF 4Q21 AND FY21 RESULTS

THURSDAY, FEBRUARY 10, 2022

| Event | Analyst Call | Media Call on 4Q21 Results |

| Time | 08:15 CET (Zurich) 07:15 GMT (London) 02:15 EDT (New York) | 10:30 CET (Zurich) 09:30 GMT (London) 04:30 EDT (New York) |

| Language | English | English |

| Access | Switzerland +41 44 580 71 45 UK +44 (0) 2071 928 338 USA +1 877 870 9135 Reference: Credit Suisse Analysts and Investors Call Conference ID: 6641537 Please dial in 10 minutes before the start of the call. When dialing in please enter the Passcode/Conference ID and leave your first, last name and company name after the tone. You will be joined automatically to the conference. Webcast link here. | Switzerland +41 44 580 71 45 UK +44 (0) 2071 928 338 USA +1 877 870 9135 Reference: "Credit Suisse Media Conference" Conference ID: 3386188 Please dial in 10 minutes before the start of the call. When dialing in please enter the Passcode/Conference ID and leave your first, last name and company name after the tone. You will be joined automatically to the conference. Webcast link here. |

| Q&A Session | Following the presentation, you will have the opportunity to ask the speakers questions | Following the presentation, you will have the opportunity to ask the speakers questions |

| Playback | Replay available at the webcast link. | Replay available at the webcast link. |

* Refers to results excluding certain items included in our reported results. These results are non-GAAP financial measures. For a reconciliation to the most directly comparable US GAAP measures, see the Appendix of this Media Release.

Footnotes

1 In 4Q20 and FY20, leverage exposure excludes CHF 111 billion of central bank reserves, after adjusting for the dividend paid in 2020 as required by FINMA. FINMA announced the temporary exclusion for purposes of leverage ratio calculations in response to the COVID-19 pandemic, which temporary measure expired as of January 1, 2021

2 In 4Q20 and FY20, leverage exposure excludes CHF 111 billion of central bank reserves, after adjusting for the dividend paid in 2020 as required by FINMA. FINMA announced the temporary exclusion for purposes of leverage ratio calculations in response to the COVID-19 pandemic, which temporary measure expired as of January 1, 2021

3 With the exception of Index Access and APAC Delta One

4 With the exception of Index Access and APAC Delta One

5 As of market close on February 9, 2022

6 AUD / USD exchange rate of 0.7416 used for purposes of calculating GFG Australian amounts

7 RWA excluding methodology and FX impact of CHF (2) bn

8 Leverage exposure excluding HQLA and FX impact of CHF (8) bn

9 Allocated capital based on the average of 13.5% of risk-weighted assets and 4.25% of leverage exposure

10 RWA excluding methodology and FX impact of CHF (2) bn

11 Leverage exposure excluding HQLA and FX impact of CHF (6) bn

12 With the exception of Index Access and APAC Delta One

13 Since restated history commencing in 2016

14 With the exception of Index Access and APAC Delta One

15 Excludes Archegos loss of USD 517 mn from Equity Sales & Trading revenues in FY21

16 Only in jurisdictions where legally permitted

17 Since restated quarters, commencing 1Q18

18 Since restated quarters, commencing 1Q18

19 Since restated quarters, commencing 1Q18

20 4Q21 includes unrealized mark-to-market losses of USD (4) mn, net of hedges. 4Q20 included unrealized mark-to-market gains of USD 50 mn, net of hedges

21 Dealogic (Americas and EMEA) as of December 31, 2021

22 Thomson Reuters as of December 31, 2021

23 With the exception of Index Access and APAC Delta One

24 Allocated capital based on the average of 13.5% of risk-weighted assets and 4.25% of leverage exposure

25 Since restated history, commencing in 2016

26 F Credit Suisse’F the Credit Suisse Sustainable Investment Framework (Sustainable AuM), reflecting a combination of further product classifications, onboarding of new sustainable funds, net sales and market as well as FX movements

Abbreviations

AM – Asset Management; APAC – Asia Pacific; AUD – Australian dollar; AuM – assets under management; BCBS – Basel Committee on Banking Supervision; BIS – Bank for International Settlements; bn – billion; CET1 – common equity tier 1; CHF – Swiss francs; CSAM – Credit Suisse Asset Management; DLJ – Donaldson, Lufkin & Jenrette; EMEA – Europe, Middle East and Africa; ESG – Environmental, Social and Governance; ECM – Equity Capital Markets; FINMA – Swiss Financial Market Supervisory Authority FINMA; FX – Foreign Exchange; GAAP – Generally accepted accounting principles; GTS – Global Trading Solutions; HQLA – High-quality liquid assets; HRH – His Royal Highness; IB – Investment Bank; IWM – International Wealth Management; mn – million; M&A – Mergers & Acquisitions; NAV – Net Asset Value; NNA – net new assets; PC – Private Clients; RoTE – Return on Tangible Equity; RWA – risk weighted assets; SCFF – Supply Chain Finance Funds; SEC – US Securities and Exchange Commission; SIX – SIX Swiss Exchange; SPAC – Special-Purpose Acquisition Company; SRI – Sustainability, Research & Investment Solutions; SUB – Swiss Universal Bank; SCFF – Supply Chain Finance Funds; TBTF – Too big to fail; trn – trillion; (U)HNW – (Ultra) high-net-worth; UK – United Kingdom; US – United States; USD – US dollar.

Important information

This document contains select information from the full 4Q21 Earnings Release and 4Q21 Results Presentation slides that Credit Suisse believes is of particular interest to media professionals. The complete 4Q21 Earnings Release and 4Q21 Results Presentation slides, which have been distributed simultaneously, contain more comprehensive information about our results and operations for the reporting quarter, as well as important information about our reporting methodology and some of the terms used in these documents. The complete 4Q21 Earnings Release and 4Q21 Results Presentation slides are not incorporated by reference into this document.

Credit Suisse has not finalized its 2021 Annual Report and Credit Suisse’s independent registered public accounting firm has not completed its audit of the consolidated financial statements for the period. Accordingly, the financial information contained in this document is subject to completion of year-end procedures, which may result in changes to that information.

This document contains certain unaudited interim financial information for the first quarter of 2022. This information has been derived from management accounts, is preliminary in nature, does not reflect the complete results of the first quarter of 2022 and is subject to change, including as a result of any normal quarterly adjustments in relation to the financial statements for the first quarter of 2022. This information has not been subject to any review by our independent registered public accounting firm. There can be no assurance that the final results for these periods will not differ from these preliminary results, and any such differences could be material. Quarterly financial results for the first quarter of 2022 will be included in our 1Q22 Financial Report. These interim results of operations are not necessarily indicative of the results to be achieved for the remainder of the full first quarter of 2022.

We may not achieve all of the expected benefits of our strategic initiatives. Factors beyond our control, including but not limited to the market and economic conditions (including macroeconomic and other challenges and uncertainties, for example, resulting from the COVID-19 pandemic), changes in laws, rules or regulations and other challenges discussed in our public filings, could limit our ability to achieve some or all of the expected benefits of these initiatives.

In particular, the terms “Estimate”, “Illustrative”, “Ambition”, “Objective”, “Outlook”, “Goal”, “Commitment” and “Aspiration” are not intended to be viewed as targets or projections, nor are they considered to be Key Performance Indicators. All such estimates, illustrations, ambitions, objectives, outlooks, goals, commitments and aspirations are subject to a large number of inherent risks, assumptions and uncertainties, many of which are completely outside of our control. These risks, assumptions and uncertainties include, but are not limited to, general market conditions, market volatility, increased inflation, interest rate volatility and levels, global and regional economic conditions, challenges and uncertainties resulting from the COVID-19 pandemic, political uncertainty, changes in tax policies, regulatory changes, changes in levels of client activity as a result of any of the foregoing and other factors. Accordingly, this information should not be relied on for any purpose. We do not intend to update these estimates, illustrations, ambitions, objectives, outlooks, goals, commitments or aspirations.

In preparing this document, management has made estimates and assumptions that affect the numbers presented. Actual results may differ. Annualized numbers do not take into account variations in operating results, seasonality and other factors and may not be indicative of actual, full-year results. Figures throughout this document may also be subject to rounding adjustments. All opinions and views constitute judgments as of the date of writing without regard to the date on which the reader may receive or access the information. This information is subject to change at any time without notice and we do not intend to update this information.

Return on tangible equity, a non-GAAP financial measure, is calculated as annualized net income attributable to shareholders divided by average tangible shareholders’ equity. Tangible shareholders’ equity, a non-GAAP financial measure, is calculated by deducting goodwill and other intangible assets from total shareholders’ equity as presented in our balance sheet. Management believes that return on tangible equity is meaningful as it is a measure used and relied upon by industry analysts and investors to assess valuations and capital adequacy. For end-4Q21, tangible shareholders’ equity excluded goodwill of CHF 2,917 million and other intangible assets of CHF 276 million from total shareholders’ equity of CHF 44,032 million as presented in our balance sheet. For end-3Q21, tangible shareholders’ equity excluded goodwill of CHF 4,615 million and other intangible assets of CHF 234 million from total shareholders’ equity of CHF 44,498 million as presented in our balance sheet. For end-4Q20, tangible shareholders’ equity excluded goodwill of CHF 4,426 million and other intangible assets of CHF 237 million from total shareholders’ equity of CHF 42,677 million as presented in our balance sheet.

Beginning in 3Q21, the return on regulatory capital calculation has been updated to closer align with the actual capital and leverage ratio levels under which Credit Suisse operates, rather than the previously used minimum requirements set by regulators. Regulatory capital is calculated as the average of 13.5% of RWA and 4.25% of leverage exposure and return on regulatory capital, a non-GAAP financial measure, is calculated using income/(loss) after tax and assumes a tax rate of 30% for periods prior to 2020 and 25% from 2020 onward. Prior periods have been restated. For periods in 2020, for purposes of calculating Group return on regulatory capital, leverage exposure excludes cash held at central banks, after adjusting for the dividend paid in 2020. For the Investment Bank division, return on regulatory capital is based on US dollar denominated numbers. Return on regulatory capital excluding certain items included in our reported results is calculated using results excluding such items, applying the same methodology.

Credit Suisse is subject to the Basel framework, as implemented in Switzerland, as well as Swiss legislation and regulations for systemically important banks, which include capital, liquidity, leverage and large exposure requirements and rules for emergency plans designed to maintain systemically relevant functions in the event of threatened insolvency. Credit Suisse has adopted the Bank for International Settlements (BIS) leverage ratio framework, as issued by the Basel Committee on Banking Supervision (BCBS) and implemented in Switzerland by the Swiss Financial Market Supervisory Authority FINMA (FINMA).

Unless otherwise noted, all CET1 ratio, Tier-1 leverage ratio, risk-weighted assets and leverage exposure figures in this document are as of the end of the respective period.

Unless otherwise noted, leverage exposure is based on the BIS leverage ratio framework and consists of period-end balance sheet assets and prescribed regulatory adjustments. The tier 1 leverage ratio and CET1 leverage ratio are calculated as BIS tier

1 capital and CET1 capital, respectively, divided by period end leverage exposure. Unless otherwise noted, for periods in 2020, leverage exposure excludes cash held at central banks, after adjusting for the dividend paid in 2020.

Client business volume includes assets under management, custody assets (including assets under custody and commercial assets) and net loans.

References to Wealth Management mean SUB PC, IWM and APAC or their combined results. References to Wealth Management-related mean SUB, IWM, APAC and AM or their combined results.

Investors and others should note that we announce important company information (including quarterly earnings releases and financial reports as well as our annual sustainability report) to the investing public using press releases, SEC and Swiss ad hoc filings, our website and public conference calls and webcasts. We also routinely use our Twitter account @creditsuisse (https://twitter.com/creditsuisse), our LinkedIn account (https://www.linkedin.com/company/credit-suisse/), our Instagram accounts (https://www.instagram.com/creditsuisse_careers/ and https://www.instagram.com/creditsuisse_ch/), our Facebook account (https://www.facebook.com/creditsuisse/) and other social media channels as additional means to disclose public information, including to excerpt key messages from our public disclosures. We may share or retweet such messages through certain of our regional accounts, including through Twitter at @csschweiz (https://twitter.com/csschweiz) and @csapac (https://twitter.com/csapac). Investors and others should take care to consider such abbreviated messages in the context of the disclosures from which they are excerpted. The information we post on these social media accounts is not a part of this document.

Information referenced in this document, whether via website links or otherwise, is not incorporated into this document.

Certain material in this document has been prepared by Credit Suisse on the basis of publicly available information, internally developed data and other third-party sources believed to be reliable. Credit Suisse has not sought to independently verify information obtained from public and third-party sources and makes no representations or warranties as to accuracy, completeness or reliability of such information.

In various tables, use of “–” indicates not meaningful or not applicable.

The English language version of this document is the controlling version.

| Key metrics |

| | in / end of | | % change | | in / end of | | % change | |

| | 4Q21 | | 3Q21 | | 4Q20 | | QoQ | | YoY | | 2021 | | 2020 | | YoY | |

| Credit Suisse Group results (CHF million) |

| Net revenues | | 4,582 | | 5,437 | | 5,221 | | (16) | | (12) | | 22,696 | | 22,389 | | 1 | |

| Provision for credit losses | | (20) | | (144) | | 138 | | (86) | | – | | 4,205 | | 1,096 | | 284 | |

| Compensation and benefits | | 2,145 | | 2,255 | | 2,539 | | (5) | | (16) | | 8,963 | | 9,890 | | (9) | |

| General and administrative expenses | | 2,104 | | 2,012 | | 2,279 | | 5 | | (8) | | 7,081 | | 6,523 | | 9 | |

| Commission expenses | | 283 | | 306 | | 303 | | (8) | | (7) | | 1,243 | | 1,256 | | (1) | |

| Goodwill impairment | | 1,623 | | 0 | | 0 | | – | | – | | 1,623 | | 0 | | – | |

| Restructuring expenses | | 33 | | – | | 50 | | – | | (34) | | 103 | | 157 | | (34) | |

| Total other operating expenses | | 4,043 | | 2,318 | | 2,632 | | 74 | | 54 | | 10,050 | | 7,936 | | 27 | |

| Total operating expenses | | 6,188 | | 4,573 | | 5,171 | | 35 | | 20 | | 19,013 | | 17,826 | | 7 | |

| Income/(loss) before taxes | | (1,586) | | 1,008 | | (88) | | – | | – | | (522) | | 3,467 | | – | |

| Net income/(loss) attributable to shareholders | | (2,007) | | 434 | | (353) | | – | | 469 | | (1,572) | | 2,669 | | – | |

| Statement of operations metrics (%) |

| Return on regulatory capital | | (12.7) | | 7.9 | | (0.7) | | – | | – | | (1.0) | | 6.9 | | – | |

| Balance sheet statistics (CHF million) |

| Total assets | | 741,781 | | 805,889 | | 805,822 | | (8) | | (8) | | 741,781 | | 805,822 | | (8) | |

| Risk-weighted assets | | 267,787 | | 278,139 | | 275,084 | | (4) | | (3) | | 267,787 | | 275,084 | | (3) | |

| Leverage exposure | | 875,086 | | 923,075 | | 799,853 | | (5) | | 9 | | 875,086 | | 799,853 | | 9 | |

| Assets under management and net new assets (CHF billion) |

| Assets under management | | 1,614.0 | | 1,623.0 | | 1,511.9 | | (0.6) | | 6.8 | | 1,614.0 | | 1,511.9 | | 6.8 | |

| Net new assets | | 1.6 | | 5.6 | | 8.4 | | (71.4) | | (81.0) | | 30.9 | | 42.0 | | (26.4) | |

| Basel III regulatory capital and leverage statistics (%) |

| CET1 ratio | | 14.4 | | 14.4 | | 12.9 | | – | | – | | 14.4 | | 12.9 | | – | |

| CET1 leverage ratio | | 4.4 | | 4.3 | | 4.4 | | – | | – | | 4.4 | | 4.4 | | – | |

| Tier 1 leverage ratio | | 6.2 | | 6.1 | | 6.4 | | – | | – | | 6.2 | | 6.4 | | – | |

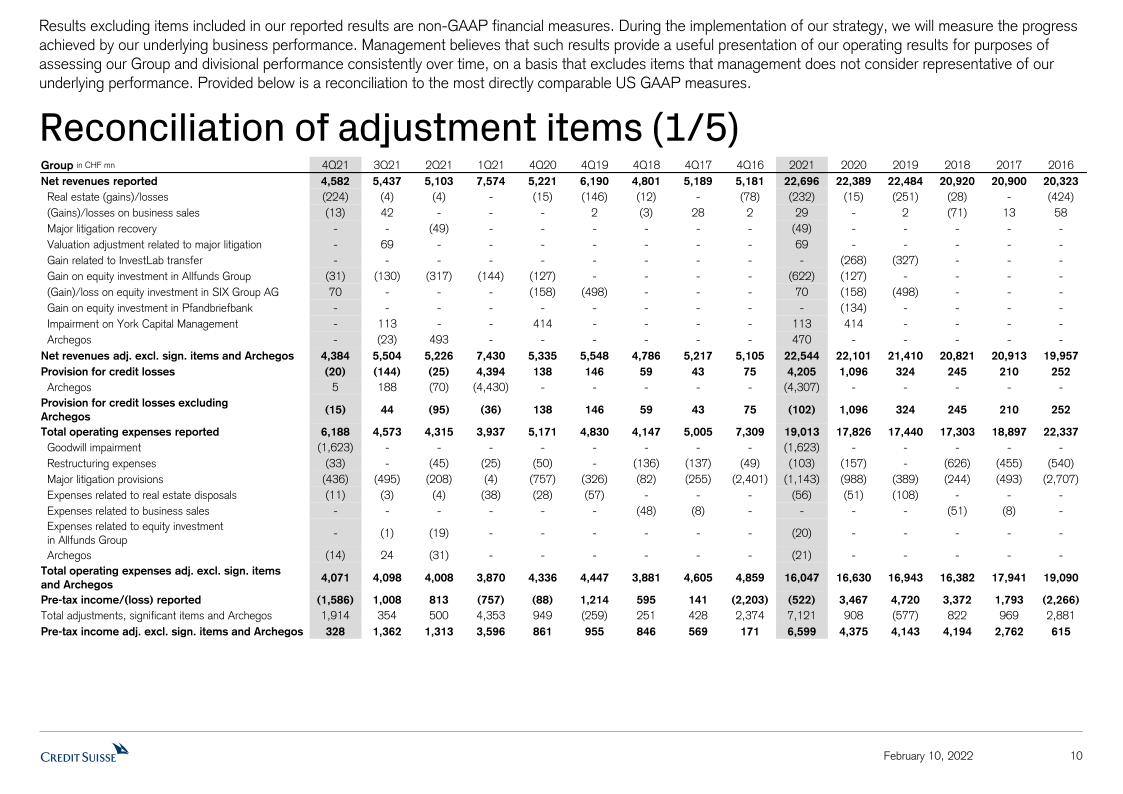

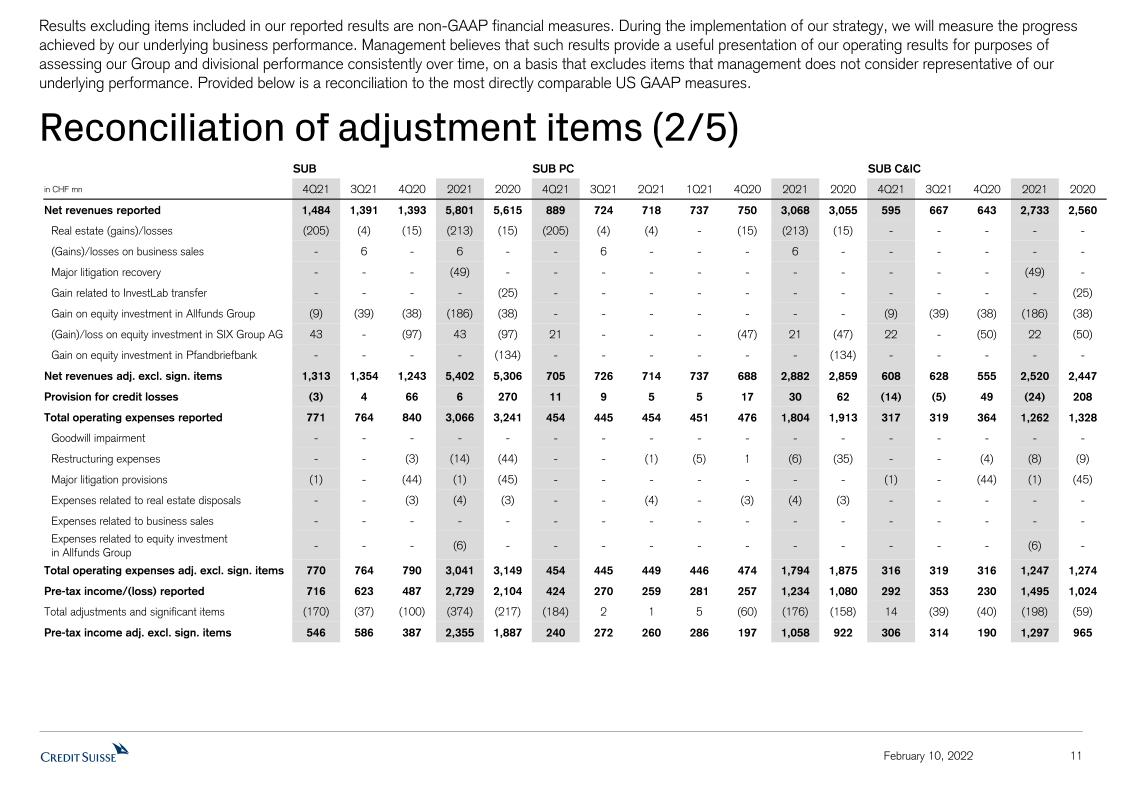

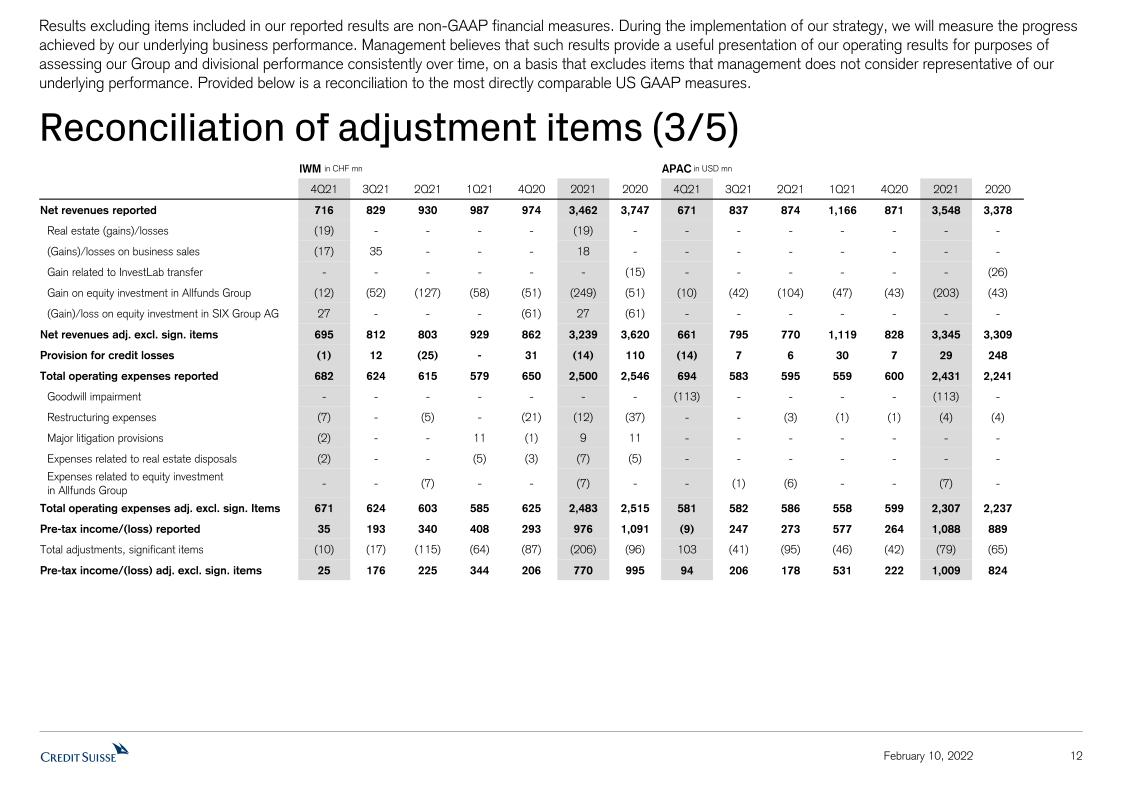

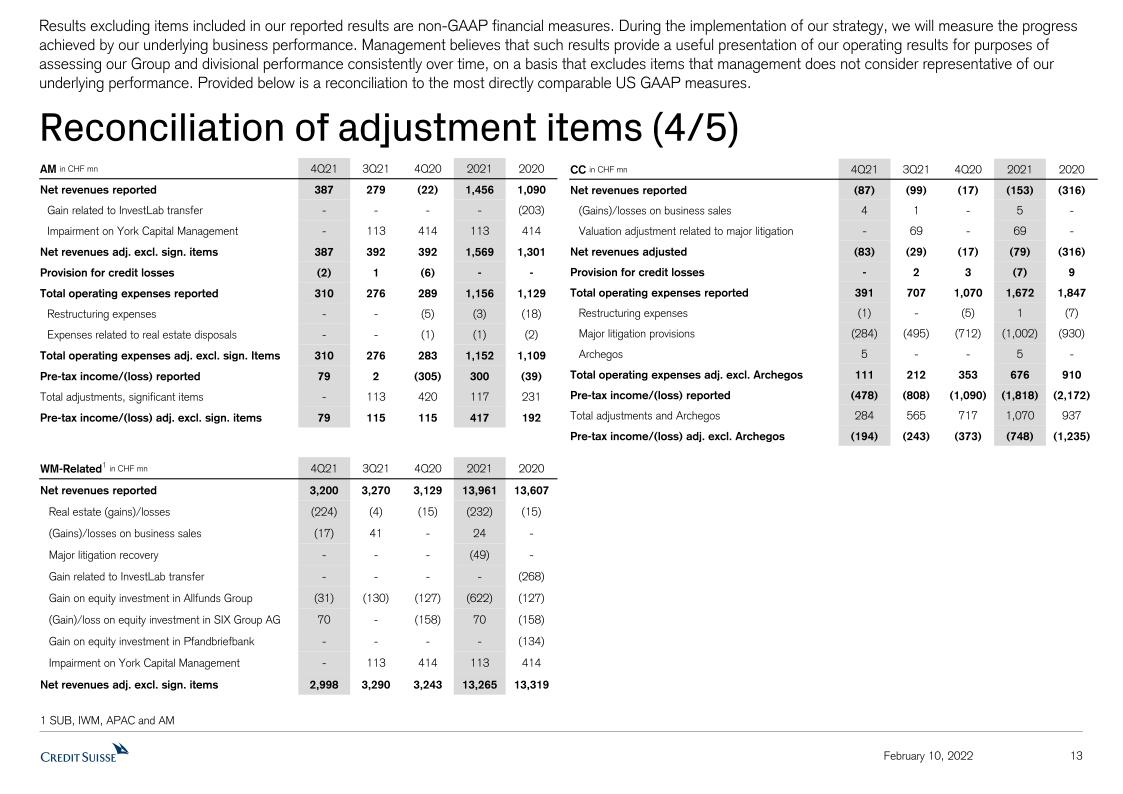

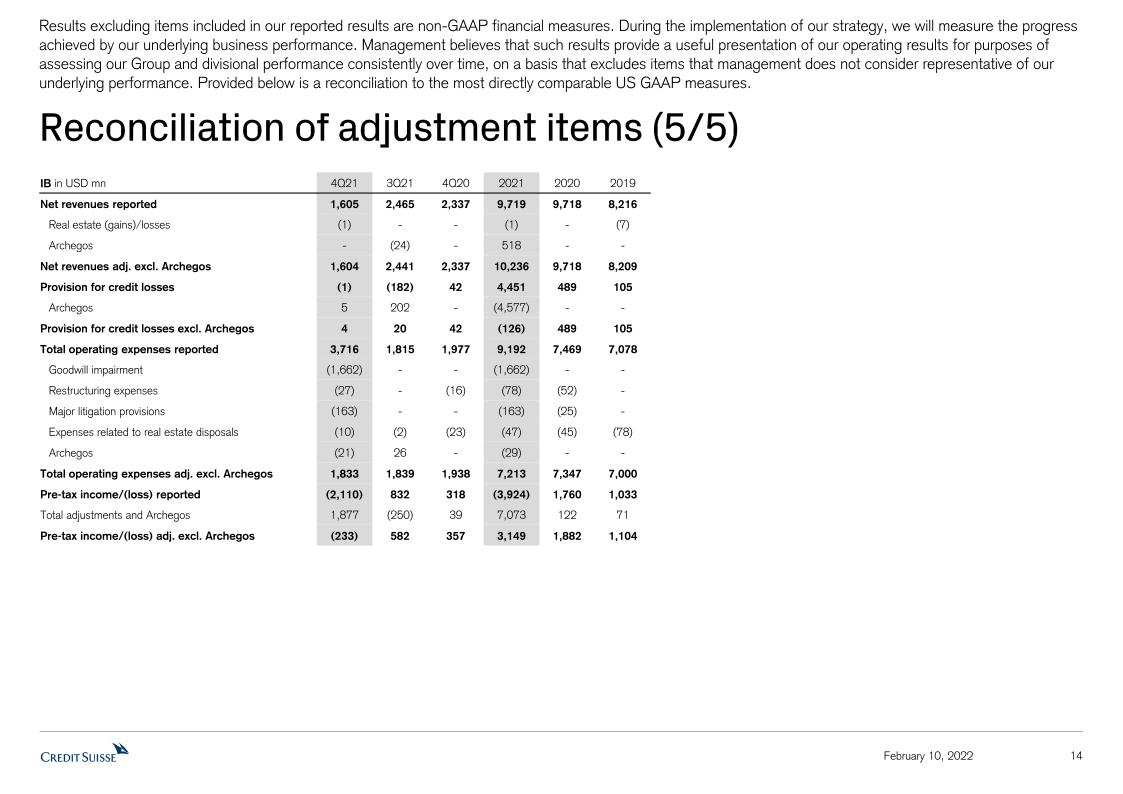

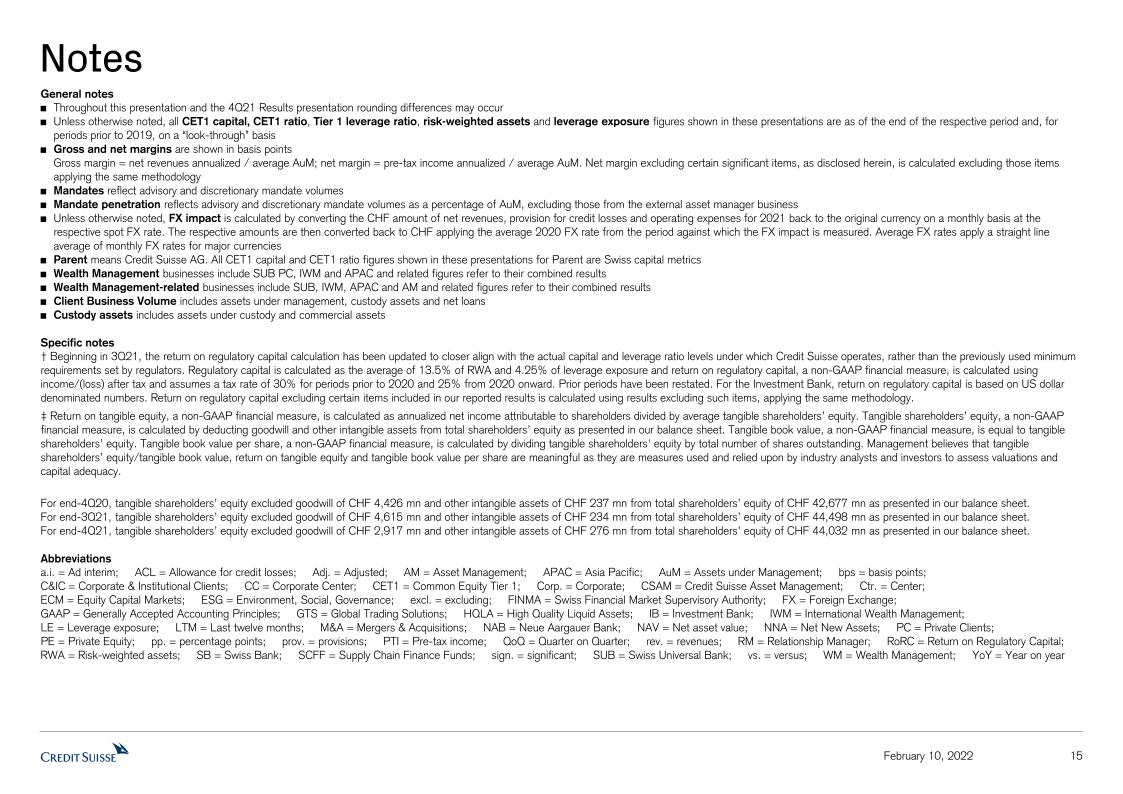

Results excluding certain items included in our reported results are non-GAAP financial measures. Management believes that such results provide a useful presentation of our operating results for purposes of assessing our Group and divisional performance consistently over time, on a basis that excludes items that management does not consider representative of our underlying performance. Provided below is a reconciliation to the most directly comparable US GAAP measures.

| Reconciliation of adjustment items |

| | Group | |

| in | | 4Q21 | | 3Q21 | | 4Q20 | | 2021 | | 2020 | |

| Results (CHF million) |

| Net revenues | | 4,582 | | 5,437 | | 5,221 | | 22,696 | | 22,389 | |

| Real estate (gains)/losses | | (224) | | (4) | | (15) | | (232) | | (15) | |

| (Gains)/losses on business sales | | (13) | | 42 | | 0 | | 29 | | 0 | |

| Major litigation recovery | | 0 | | 0 | | 0 | | (49) | | 0 | |

| Valuation adjustment related to major litigation | | 0 | | 69 | | 0 | | 69 | | 0 | |

| Adjusted net revenues | | 4,345 | | 5,544 | | 5,206 | | 22,513 | | 22,374 | |

| Significant items | | | | | | | | | | | |

| Gain related to InvestLab transfer | | 0 | | 0 | | 0 | | 0 | | (268) | |

| Gain on equity investment in Allfunds Group | | (31) | | (130) | | (127) | | (622) | | (127) | |

| (Gain)/loss on equity investment in SIX Group AG | | 70 | | 0 | | (158) | | 70 | | (158) | |

| Gain on equity investment in Pfandbriefbank | | 0 | | 0 | | 0 | | 0 | | (134) | |

| Impairment on York Capital Management | | 0 | | 113 | | 414 | | 113 | | 414 | |

| Adjusted net revenues excluding significant items | | 4,384 | | 5,527 | | 5,335 | | 22,074 | | 22,101 | |

| Archegos | | 0 | | (23) | | 0 | | 470 | | 0 | |

| Adjusted net revenues excluding significant items and Archegos | | 4,384 | | 5,504 | | 5,335 | | 22,544 | | 22,101 | |

| Provision for credit losses | | (20) | | (144) | | 138 | | 4,205 | | 1,096 | |

| Archegos | | 5 | | 188 | | 0 | | (4,307) | | 0 | |

| Provision for credit losses excluding Archegos | | (15) | | 44 | | 138 | | (102) | | 1,096 | |

| Total operating expenses | | 6,188 | | 4,573 | | 5,171 | | 19,013 | | 17,826 | |

| Goodwill impairment | | (1,623) | | 0 | | 0 | | (1,623) | | 0 | |

| Restructuring expenses | | (33) | | – | | (50) | | (103) | | (157) | |

| Major litigation provisions | | (436) | | (495) | | (757) | | (1,143) | | (988) | |

| Expenses related to real estate disposals | | (11) | | (3) | | (28) | | (56) | | (51) | |

| Adjusted total operating expenses | | 4,085 | | 4,075 | | 4,336 | | 16,088 | | 16,630 | |

| Significant items | | | | | | | | | | | |

| Expenses related to equity investment in Allfunds Group | | 0 | | (1) | | 0 | | (20) | | 0 | |

| Adjusted total operating expenses excluding significant items | | 4,085 | | 4,074 | | 4,336 | | 16,068 | | 16,630 | |

| Archegos | | (14) | | 24 | | 0 | | (21) | | 0 | |

| Adjusted total operating expenses excluding significant items and Archegos | | 4,071 | | 4,098 | | 4,336 | | 16,047 | | 16,630 | |

| Income/(loss) before taxes | | (1,586) | | 1,008 | | (88) | | (522) | | 3,467 | |

| Adjusted income before taxes | | 280 | | 1,613 | | 732 | | 2,220 | | 4,648 | |

| Adjusted income before taxes excluding significant items | | 319 | | 1,597 | | 861 | | 1,801 | | 4,375 | |

| Adjusted income before taxes excluding significant items and Archegos | | 328 | | 1,362 | | 861 | | 6,599 | | 4,375 | |

| Adjusted return on regulatory capital (%) | | 2.2 | | 12.6 | | 6.1 | | 4.4 | | 9.3 | |

| Adjusted return on regulatory capital excluding significant items (%) | | 2.6 | | 12.4 | | 7.1 | | 3.5 | | 8.7 | |

| Adjusted return on regulatory capital excluding significant items and Archegos (%) | | 2.6 | | 10.6 | | 7.1 | | 13.0 | | 8.7 | |

| Swiss Universal Bank |

| | in / end of | | % change | | in / end of | | % change | |

| | 4Q21 | | 3Q21 | | 4Q20 | | QoQ | | YoY | | 2021 | | 2020 | | YoY | |

| Results (CHF million) |

| Net revenues | | 1,484 | | 1,391 | | 1,393 | | 7 | | 7 | | 5,801 | | 5,615 | | 3 | |

| of which Private Clients | | 889 | | 724 | | 750 | | 23 | | 19 | | 3,068 | | 3,055 | | 0 | |

| of which Corporate & Institutional Clients | | 595 | | 667 | | 643 | | (11) | | (7) | | 2,733 | | 2,560 | | 7 | |

| Provision for credit losses | | (3) | | 4 | | 66 | | – | | – | | 6 | | 270 | | (98) | |

| Total operating expenses | | 771 | | 764 | | 840 | | 1 | | (8) | | 3,066 | | 3,241 | | (5) | |

| Income before taxes | | 716 | | 623 | | 487 | | 15 | | 47 | | 2,729 | | 2,104 | | 30 | |

| of which Private Clients | | 424 | | 270 | | 257 | | 57 | | 65 | | 1,234 | | 1,080 | | 14 | |

| of which Corporate & Institutional Clients | | 292 | | 353 | | 230 | | (17) | | 27 | | 1,495 | | 1,024 | | 46 | |

| Metrics (%) |

| Return on regulatory capital | | 18.1 | | 15.6 | | 12.4 | | – | | – | | 17.1 | | 13.4 | | – | |

| Cost/income ratio | | 52.0 | | 54.9 | | 60.3 | | – | | – | | 52.9 | | 57.7 | | – | |

| Private Clients |

| Assets under management (CHF billion) | | 217.5 | | 217.3 | | 208.6 | | 0.1 | | 4.3 | | 217.5 | | 208.6 | | 4.3 | |

| Net new assets (CHF billion) | | (1.8) | | 1.9 | | (2.1) | | – | | – | | 1.4 | | (5.9) | | – | |

| Gross margin (annualized) (bp) | | 163 | | 133 | | 146 | | – | | – | | 143 | | 149 | | – | |

| Net margin (annualized) (bp) | | 78 | | 50 | | 50 | | – | | – | | 58 | | 53 | | – | |

| Corporate & Institutional Clients |

| Assets under management (CHF billion) | | 513.5 | | 506.3 | | 462.6 | | 1.4 | | 11.0 | | 513.5 | | 462.6 | | 11.0 | |

| Net new assets (CHF billion) | | 0.1 | | (0.4) | | 3.8 | | – | | – | | 5.1 | | 13.7 | | – | |

| Reconciliation of adjustment items |

| | Private Clients | | Corporate & Institutional Clients | | Swiss Universal Bank | |

| in | | 4Q21 | | 3Q21 | | 4Q20 | | 4Q21 | | 3Q21 | | 4Q20 | | 4Q21 | | 3Q21 | | 4Q20 | |

| Results (CHF million) |

| Net revenues | | 889 | | 724 | | 750 | | 595 | | 667 | | 643 | | 1,484 | | 1,391 | | 1,393 | |

| Real estate (gains)/losses | | (205) | | (4) | | (15) | | 0 | | 0 | | 0 | | (205) | | (4) | | (15) | |

| (Gains)/losses on business sales | | 0 | | 6 | | 0 | | 0 | | 0 | | 0 | | 0 | | 6 | | 0 | |

| Adjusted net revenues | | 684 | | 726 | | 735 | | 595 | | 667 | | 643 | | 1,279 | | 1,393 | | 1,378 | |

| Significant items | | | | | | | | | | | | | | | | | | | |

| Gain on equity investment in Allfunds Group | | 0 | | 0 | | 0 | | (9) | | (39) | | (38) | | (9) | | (39) | | (38) | |

| (Gain)/loss on equity investment in SIX Group AG | | 21 | | 0 | | (47) | | 22 | | 0 | | (50) | | 43 | | 0 | | (97) | |

| Adjusted net revenues excluding significant items | | 705 | | 726 | | 688 | | 608 | | 628 | | 555 | | 1,313 | | 1,354 | | 1,243 | |

| Provision for credit losses | | 11 | | 9 | | 17 | | (14) | | (5) | | 49 | | (3) | | 4 | | 66 | |

| Total operating expenses | | 454 | | 445 | | 476 | | 317 | | 319 | | 364 | | 771 | | 764 | | 840 | |

| Restructuring expenses | | 0 | | – | | 1 | | 0 | | – | | (4) | | 0 | | – | | (3) | |

| Major litigation provisions | | 0 | | 0 | | 0 | | (1) | | 0 | | (44) | | (1) | | 0 | | (44) | |

| Expenses related to real estate disposals | | 0 | | 0 | | (3) | | 0 | | 0 | | 0 | | 0 | | 0 | | (3) | |

| Adjusted total operating expenses | | 454 | | 445 | | 474 | | 316 | | 319 | | 316 | | 770 | | 764 | | 790 | |

| Income before taxes | | 424 | | 270 | | 257 | | 292 | | 353 | | 230 | | 716 | | 623 | | 487 | |

| Adjusted income before taxes | | 219 | | 272 | | 244 | | 293 | | 353 | | 278 | | 512 | | 625 | | 522 | |

| Adjusted income before taxes excluding significant items | | 240 | | 272 | | 197 | | 306 | | 314 | | 190 | | 546 | | 586 | | 387 | |

| Adjusted return on regulatory capital (%) | | – | | – | | – | | – | | – | | – | | 12.9 | | 15.6 | | 13.3 | |

| Adjusted return on regulatory capital excluding significant items (%) | | – | | – | | – | | – | | – | | – | | 13.8 | | 14.6 | | 9.9 | |

| Reconciliation of adjustment items (continued) |

| |

Private Clients | | Corporate &

Institutional Clients | | Swiss

Universal Bank | |

| in | | 2021 | | 2020 | | 2021 | | 2020 | | 2021 | | 2020 | |

| Results (CHF million) |

| Net revenues | | 3,068 | | 3,055 | | 2,733 | | 2,560 | | 5,801 | | 5,615 | |

| Real estate (gains)/losses | | (213) | | (15) | | 0 | | 0 | | (213) | | (15) | |

| (Gains)/losses on business sales | | 6 | | 0 | | 0 | | 0 | | 6 | | 0 | |

| Major litigation recovery | | 0 | | 0 | | (49) | | 0 | | (49) | | 0 | |

| Adjusted net revenues | | 2,861 | | 3,040 | | 2,684 | | 2,560 | | 5,545 | | 5,600 | |

| Significant items | | | | | | | | | | | | | |

| Gain related to InvestLab transfer | | 0 | | 0 | | 0 | | (25) | | 0 | | (25) | |

| Gain on equity investment in Allfunds Group | | 0 | | 0 | | (186) | | (38) | | (186) | | (38) | |

| (Gain)/loss on equity investment in SIX Group AG | | 21 | | (47) | | 22 | | (50) | | 43 | | (97) | |

| Gain on equity investment in Pfandbriefbank | | 0 | | (134) | | 0 | | 0 | | 0 | | (134) | |

| Adjusted net revenues excluding significant items | | 2,882 | | 2,859 | | 2,520 | | 2,447 | | 5,402 | | 5,306 | |

| Provision for credit losses | | 30 | | 62 | | (24) | | 208 | | 6 | | 270 | |

| Total operating expenses | | 1,804 | | 1,913 | | 1,262 | | 1,328 | | 3,066 | | 3,241 | |

| Restructuring expenses | | (6) | | (35) | | (8) | | (9) | | (14) | | (44) | |

| Major litigation provisions | | 0 | | 0 | | (1) | | (45) | | (1) | | (45) | |

| Expenses related to real estate disposals | | (4) | | (3) | | 0 | | 0 | | (4) | | (3) | |

| Adjusted total operating expenses | | 1,794 | | 1,875 | | 1,253 | | 1,274 | | 3,047 | | 3,149 | |

| Significant items | | | | | | | | | | | | | |

| Expenses related to equity investment in Allfunds Group | | 0 | | 0 | | (6) | | 0 | | (6) | | 0 | |

| Adjusted total operating expenses excluding significant items | | 1,794 | | 1,875 | | 1,247 | | 1,274 | | 3,041 | | 3,149 | |

| Income before taxes | | 1,234 | | 1,080 | | 1,495 | | 1,024 | | 2,729 | | 2,104 | |

| Adjusted income before taxes | | 1,037 | | 1,103 | | 1,455 | | 1,078 | | 2,492 | | 2,181 | |

| Adjusted income before taxes excluding significant items | | 1,058 | | 922 | | 1,297 | | 965 | | 2,355 | | 1,887 | |

| Adjusted return on regulatory capital (%) | | – | | – | | – | | – | | 15.6 | | 13.9 | |

| Adjusted return on regulatory capital excluding significant items (%) | | – | | – | | – | | – | | 14.8 | | 12.0 | |

| International Wealth Management |

| | in / end of | | % change | | in / end of | | % change | |

| | 4Q21 | | 3Q21 | | 4Q20 | | QoQ | | YoY | | 2021 | | 2020 | | YoY | |

| Results (CHF million) |

| Net revenues | | 716 | | 829 | | 974 | | (14) | | (26) | | 3,462 | | 3,747 | | (8) | |

| Provision for credit losses | | (1) | | 12 | | 31 | | – | | – | | (14) | | 110 | | – | |

| Total operating expenses | | 682 | | 624 | | 650 | | 9 | | 5 | | 2,500 | | 2,546 | | (2) | |

| Income before taxes | | 35 | | 193 | | 293 | | (82) | | (88) | | 976 | | 1,091 | | (11) | |

| Metrics (%) |

| Return on regulatory capital | | 2.4 | | 12.6 | | 19.7 | | – | | – | | 16.2 | | 18.4 | | – | |

| Cost/income ratio | | 95.3 | | 75.3 | | 66.7 | | – | | – | | 72.2 | | 67.9 | | – | |

| Assets under management (CHF billion) | | 390.7 | | 395.7 | | 365.4 | | (1.3) | | 6.9 | | 390.7 | | 365.4 | | 6.9 | |

| Net new assets (CHF billion) | | 2.7 | | 1.4 | | 4.3 | | – | | – | | 11.0 | | 16.7 | | – | |

| Gross margin (annualized) (bp) | | 73 | | 84 | | 109 | | – | | – | | 89 | | 107 | | – | |

| Net margin (annualized) (bp) | | 4 | | 20 | | 33 | | – | | – | | 25 | | 31 | | – | |

| Reconciliation of adjustment items |

| | International Wealth Management | |

| in | | 4Q21 | | 3Q21 | | 4Q20 | | 2021 | | 2020 | |

| Results (CHF million) |

| Net revenues | | 716 | | 829 | | 974 | | 3,462 | | 3,747 | |

| Real estate (gains)/losses | | (19) | | 0 | | 0 | | (19) | | 0 | |

| (Gains)/losses on business sales | | (17) | | 35 | | 0 | | 18 | | 0 | |

| Adjusted net revenues | | 680 | | 864 | | 974 | | 3,461 | | 3,747 | |

| Significant items | | | | | | | | | | | |

| Gain related to InvestLab transfer | | 0 | | 0 | | 0 | | 0 | | (15) | |

| Gain on equity investment in Allfunds Group | | (12) | | (52) | | (51) | | (249) | | (51) | |

| (Gain)/loss on equity investment in SIX Group AG | | 27 | | 0 | | (61) | | 27 | | (61) | |

| Adjusted net revenues excluding significant items | | 695 | | 812 | | 862 | | 3,239 | | 3,620 | |

| Provision for credit losses | | (1) | | 12 | | 31 | | (14) | | 110 | |

| Total operating expenses | | 682 | | 624 | | 650 | | 2,500 | | 2,546 | |

| Restructuring expenses | | (7) | | – | | (21) | | (12) | | (37) | |

| Major litigation provisions | | (2) | | 0 | | (1) | | 9 | | 11 | |

| Expenses related to real estate disposals | | (2) | | 0 | | (3) | | (7) | | (5) | |

| Adjusted total operating expenses | | 671 | | 624 | | 625 | | 2,490 | | 2,515 | |

| Significant items | | | | | | | | | | | |

| Expenses related to equity investment in Allfunds Group | | 0 | | 0 | | 0 | | (7) | | 0 | |

| Adjusted total operating expenses excluding significant items | | 671 | | 624 | | 625 | | 2,483 | | 2,515 | |

| Income before taxes | | 35 | | 193 | | 293 | | 976 | | 1,091 | |

| Adjusted income before taxes | | 10 | | 228 | | 318 | | 985 | | 1,122 | |

| Adjusted income before taxes excluding significant items | | 25 | | 176 | | 206 | | 770 | | 995 | |

| Adjusted return on regulatory capital (%) | | 0.7 | | 14.8 | | 21.4 | | 16.3 | | 18.9 | |

| Adjusted return on regulatory capital excluding significant items (%) | | 1.8 | | 11.5 | | 13.8 | | 12.8 | | 16.8 | |

| Asia Pacific |

| | in / end of | | % change | | in / end of | | % change | |

| | 4Q21 | | 3Q21 | | 4Q20 | | QoQ | | YoY | | 2021 | | 2020 | | YoY | |

| Results (CHF million) |

| Net revenues | | 613 | | 771 | | 784 | | (20) | | (22) | | 3,242 | | 3,155 | | 3 | |

| Provision for credit losses | | (13) | | 7 | | 6 | | – | | – | | 27 | | 236 | | (89) | |

| Total operating expenses | | 634 | | 536 | | 541 | | 18 | | 17 | | 2,221 | | 2,091 | | 6 | |

| Income/(loss) before taxes | | (8) | | 228 | | 237 | | – | | – | | 994 | | 828 | | 20 | |

| Metrics (%) |

| Return on regulatory capital | | (0.7) | | 19.2 | | 21.1 | | – | | – | | 21.3 | | 17.1 | | – | |

| Cost/income ratio | | 103.4 | | 69.5 | | 69.0 | | – | | – | | 68.5 | | 66.3 | | – | |

| Assets under management (CHF billion) | | 218.8 | | 230.1 | | 221.3 | | (4.9) | | (1.1) | | 218.8 | | 221.3 | | (1.1) | |

| Net new assets (CHF billion) | | (2.9) | | 2.9 | | (1.1) | | – | | – | | (1.1) | | 8.6 | | – | |

| Gross margin (annualized) (bp) | | 108 | | 134 | | 141 | | – | | – | | 141 | | 147 | | – | |

| Net margin (annualized) (bp) | | (1) | | 40 | | 43 | | – | | – | | 43 | | 39 | | – | |

| Results (USD million) |

| Net revenues | | 671 | | 837 | | 871 | | (20) | | (23) | | 3,548 | | 3,378 | | 5 | |

| Provision for credit losses | | (14) | | 7 | | 7 | | – | | – | | 29 | | 248 | | (88) | |

| Total operating expenses | | 694 | | 583 | | 600 | | 19 | | 16 | | 2,431 | | 2,241 | | 8 | |

| Income/(loss) before taxes | | (9) | | 247 | | 264 | | – | | – | | 1,088 | | 889 | | 22 | |

| Reconciliation of adjustment items |

| | Asia Pacific | |

| in | | 4Q21 | | 3Q21 | | 4Q20 | | 2021 | | 2020 | |

| Results (CHF million) |

| Net revenues | | 613 | | 771 | | 784 | | 3,242 | | 3,155 | |

| Significant items | | | | | | | | | | | |

| Gain related to InvestLab transfer | | 0 | | 0 | | 0 | | 0 | | (25) | |

| Gain on equity investment in Allfunds Group | | (10) | | (39) | | (38) | | (187) | | (38) | |