Exhibit (a)(5)(D)

David E. Bower (SBN 119546)

MONTEVERDE & ASSOCIATES PC

600 Corporate Pointe, Suite 1170

Culver City, CA 90230

Tel: (213) 446-6652

Fax: (212) 202-7880

Counsel for Plaintiff

UNITED STATES DISTRICT COURT

NORTHERN DISTRICT OF CALIFORNIA

DARRELL BOSWELL, Individually and on Behalf of All Others Similarly Situated, Plaintiff, v. iPASS INC., MICHAEL J. TEDESCO, GARY A. GRIFFITHS, DAVID PANOS, JUSTIN R. SPENCER, and NEAL I. GOLDMAN, Defendants. | Civil Action No. 3:18-cv-7486 CLASS ACTION COMPLAINT DEMAND FOR JURY TRIAL 1. VIOLATIONS OF SECTION 14(E) OF THE SECURITIES EXCHANGE ACT OF 1934 2 VIOLAITONS OF SECTION 20(A) OF THE EXCHANGE ACT |

Darrell Boswell (“Plaintiff”), by his undersigned attorneys, alleges upon personal knowledge with respect to himself, and upon information and belief based upon, inter alia, the investigation of counsel as to all other allegations herein, as follows:

NATURE OF THE ACTION

1. This action is brought as a class action by Plaintiff on behalf of himself and the other public holders of the common stock of iPass Inc. (“iPass” or the “Company”) against iPass and the members of the Company’s board of directors (collectively, the “Board” or “Individual Defendants,” and, together with iPass, the “Defendants”) for their violations of Sections 14(e) and 20(a) of the Securities Exchange Act of 1934 (the “Exchange Act”), 15 U.S.C. §§ 78n(e) and 78t(a) in connection with the tender offer (“Tender Offer”) by Pareteum Corporation, through its subsidiary TBR, Inc. (collectively “Pareteum”), to acquire all of the issued and outstanding shares of iPass (the “Proposed Merger”).

2. On November 12, 2018, iPass entered into an agreement and plan of merger (the “Merger Agreement”), whereby shareholders of iPass common stock will receive 1.17 shares of Pareteum common stock in exchange for each share of iPass stock they own (the “Merger Consideration”).

3. On December 4, 2018, in order to convince iPass shareholders to tender their shares, the Board authorized the filing of a materially incomplete and misleading Schedule 14D-9 Solicitation/Recommendation Statement (the “Recommendation Statement”) with the Securities and Exchange Commission (“SEC”). In particular, the Recommendation Statement contains materially incomplete and misleading information concerning: (i) financial projections; (ii) the valuation of Pareteum and the Merger Consideration; and (iii) the valuation analyses performed by the Company’s financial advisor, Raymond James & Associates, Inc. (“Raymond James”).

4. The Tender Offer is scheduled to expire at 12:00 midnight at the end of the day on January 3, 2018 (the “Expiration Date”). It is imperative that the material information that has been omitted from the Recommendation Statement is disclosed to the Company’s shareholders prior to the forthcoming Expiration Date so they may make an informed determination on whether to tender their shares.

5. For these reasons, and as set forth in detail herein, Plaintiff seeks to enjoin Defendants from closing the Tender Offer or taking any steps to consummate the Proposed Merger, unless and until the material information discussed below is disclosed to iPass shareholders or, in the event the Proposed Merger is consummated, to recover damages resulting from the Defendants’ violations of the Exchange Act.

JURISDICTION AND VENUE

6. This Court has subject matter jurisdiction pursuant to Section 27 of the Exchange Act (15 U.S.C. § 78aa) and 28 U.S.C. § 1331 (federal question jurisdiction) as Plaintiff alleges violations of Section 14(e) and 20(a) of the Exchange Act.

7. The Court has personal jurisdiction over each of the Defendants because each conducts business in and maintains operations in this District or is an individual who either is present in this District for jurisdictional purposes or has sufficient minimum contacts with this District as to render the exercise of jurisdiction by this Court permissible under traditional notions of fair play and substantial justice.

8. Venue is proper in this District under Section 27 of the Exchange Act, 15 U.S.C. § 78aa, as well as pursuant to 28 U.S.C. § 1391, because: (i) the conduct at issue took place and had an effect in this District; (ii) iPass maintains its principal place of business in this District and each of the Individual Defendants, and Company officers or directors, either resides in this District or has extensive contacts within this District; (iii) a substantial portion of the transactions and wrongs complained of herein occurred in this District; (iv) most of the relevant documents pertaining to Plaintiffs’ claims are stored (electronically and otherwise), and evidence exists, in this District; and (v) Defendants have received substantial compensation in this District by doing business here and engaging in numerous activities that had an effect in this District.

PARTIES

9. Plaintiff is, and at all relevant times has been, a shareholder of iPass.

10. Defendant iPass is a Delaware corporation and maintains its principal executive office at 3800 Bridge Parkway, Redwood Shores, CA, 94065. iPass provides collaboration and technology solutions for large and medium enterprises in the United States. The Company’s common stock trades on the Nasdaq under the ticker symbol “IPAS”.

11. Individual Defendant Michael J. Tedesco is a director of iPass and is the Chairman of the Board.

12. Individual Defendant Gary A. Griffiths is a director of iPass and is the President and Chief Executive Officer of the Company.

13. Individual Defendant David Panos is, and has been at all relevant times, a director of the Company.

14. Individual Defendant Justin R. Spencer is, and has been at all relevant times, a director of the Company.

15. Individual Defendant Neal I. Goldman is, and has been at all relevant times, a director of the Company.

16. The defendants identified in paragraphs 10-15 are collectively referred to as the “Defendants”.

CLASS ACTION ALLEGATIONS

17. Plaintiff brings this class action pursuant to Fed. R. Civ. P. 23 on behalf of himself and the other public shareholders of iPass (the “Class”). Excluded from the Class are Defendants herein and any person, firm, trust, corporation, or other entity related to or affiliated with any Defendant.

18. This action is properly maintainable as a class action because:

a. The Class is so numerous that joinder of all members is impracticable. As of the close of business on November 30, 2018, there were 8,431,976 shares issued and outstanding, held by hundreds to thousands of individuals and entities scattered throughout the country. The actual number of public shareholders of iPass will be ascertained through discovery;

b. There are questions of law and fact that are common to the Class that predominate over any questions affecting only individual members, including the following:

| i) | whether Defendants have misrepresented or omitted material information concerning the Proposed Merger in the Recommendation Statement, in violation of Sections 14(e) of the Exchange Act; |

| ii) | whether the Individual Defendants have violated Section 20(a) of the Exchange Act; and |

| iii) | whether Plaintiff and other members of the Class will suffer irreparable harm if compelled to tender their shares based on the materially incomplete and misleading Recommendation Statement; |

c. Plaintiff is an adequate representative of the Class, has retained competent counsel experienced in litigation of this nature, and will fairly and adequately protect the interests of the Class;

d. Plaintiff’s claims are typical of the claims of the other members of the Class and Plaintiff does not have any interests adverse to the Class;

e. The prosecution of separate actions by individual members of the Class would create a risk of inconsistent or varying adjudications with respect to individual members of the Class, which would establish incompatible standards of conduct for the party opposing the Class;

f. Defendants have acted on grounds generally applicable to the Class with respect to the matters complained of herein, thereby making appropriate the relief sought herein with respect to the Class as a whole; and

g. A class action is superior to other available methods for fairly and efficiently adjudicating the controversy.

SUBSTANTIVE ALLEGATIONS

I. Background and the Proposed Merger

19. iPass, incorporated on February 3, 2000, is a provider of global mobile connectivity, offering wireless fidelity (Wi-Fi) on mobile devices. The Company, through its Mobile Connectivity Services segment, offers a cloud-based solution allowing its customers and their users’ access to its global Wi-Fi network to stay connected to people and information. The Company has categorized its services into two approaches: Enterprise or Strategic Partnerships. The Company has a Wi-Fi network footprint and supply chain that consists of approximately 50 million hotspots in over 100 countries and territories, including airports, convention centers, planes, trains, train stations, hotels, restaurants, retail, and small business locations.

20. Pareteum, formerly Elephant Talk Communications Corporation, incorporated on September 26, 2011, develops Communications Cloud Services Platform. The Company provides mobility, messaging, and security services and applications, with a single-sign-on, application program interface (API), and software development suite. Its platform hosts integrated information technology (IT)/Back Office and Core Network functionality for mobile network operators, and for enterprises implement and leverage mobile communications solutions on a outsourced Software as a Service (SaaS), Platform as a Service (PaaS), and/or Infrastructure as a Service (IaaS) basis: made available either as an on-premise solution or as a hosted service in the Cloud depending on the needs of its customers. It also delivers an Operational Support System (OSS) for channel partners, with APIs for integration with third party systems, workflows for complex application orchestration, customer support with branded portals and plug-ins for a multitude of other applications.

21. On November 12, 2018, iPass and Pareteum issued a joint press release announcing the Proposed Merger. The press release stated in relevant part:

Pareteum Enters into Definitive Agreement to Acquire iPass

November 12, 2018

All stock transaction creates significant shareholder value through powerful combination

Generates an anticipated $15 million in annual cost synergies with greater than $12 million expected to be realized in the first full quarter of combined operations

NEW YORK and REDWOOD SHORES, Calif., Nov. 12, 2018 /PRNewswire/ —Pareteum Corporation (TEUM), a cloud software platform company, andiPass, Inc. (IPAS), a provider of global mobile connectivity, and location and performance data, today announced that they have entered into a definitive agreement under which Pareteum will acquire iPass in an all-stock transaction whereby iPass shareholders will receive 1.17 shares of Pareteum common stock in an exchange offer.

With this accretive acquisition, Pareteum expects to gain a strategic position with new marquee brands and new markets including the enterprise, airline, hospitality, retail and internet of things (IoT) sectors. Pareteum expects to strengthen its established intellectual property portfolio with the addition of over 40 U.S. and international patents. With more than 500 expected new customers and a global network of over 68 million Wi-Fi hot spots, coupled with proven connection management technology, location services and Wi-Fi performance data, Pareteum is now poised to take its global communications software solutions to every market vertical.

Founder, Executive Chairman and Principal Executive Officer of Pareteum Hal Turner said, “iPass and Pareteum will now accelerate as one company with combined products and services, the expansion of addressable markets and the resulting executive and operating talent. It has been a pleasure to work with iPass President and CEO Gary Griffiths to combine our companies and execute on a shared vision for growth.”

“Pareteum has enjoyed a solid partnership with iPass over the past year and our mutual view on connectivity and mobile enablement made it easy to see that we could grow our business and accelerate our mission together,” said Pareteum President Denis McCarthy, who is leading the acquisition. “Our integration with iPass extends not only Pareteum’s customer base, but also our portfolio of services. Customers will now be able to use the Pareteum Global Software Defined Cloud to access premium wireless and Wi-Fi services, and experience location data analytics for a truly immersive experience.”

Gary Griffiths added, “By joining with Pareteum, our vision for iPass SmartConnect is amplified and expanded. Pareteum is one of the fastest growing companies in this industry, and we believe that the combination of our teams, technologies and products will materially accelerate revenue growth and earnings. Being part of Pareteum’s constellation is exciting, and clearly in the best interest of iPass shareholders, customers, business partners and employees.”

The transaction is expected to be immediately accretive to Pareteum’s non-GAAP EPS and free cash flow after anticipated synergies. Pareteum anticipates achieving more than $15 million in annual cost synergies with greater than $12 million of those expected to be realized in the first full quarter of combined operations. Pareteum currently estimates approximately $2.0 million of GAAP earnings accretion and $5.5 million of non-GAAP earnings accretion in the first full year after closing the transaction. In addition, the acquisition will add new offices and talent in Silicon Valley, California and Bangalore, India, expanding Pareteum’s presence globally.

Under the terms of the definitive acquisition agreement, a wholly-owned subsidiary of Pareteum will commence an exchange offer to acquire all of the outstanding shares of iPass common stock, offering 1.17 shares of Pareteum common stock in exchange for each share of iPass common stock tendered. Upon satisfaction of the conditions to the exchange offer, and after the shares tendered in the exchange offer are accepted for payment, the agreement provides for the parties to effect, as promptly as practicable, a merger, which would not require a vote by iPass stockholders, and which would result in each share of iPass common stock not tendered in the exchange offer being converted into the right to receive 1.17 shares of Pareteum common stock. The exchange offer is subject to customary conditions, including the tender of at least a majority of the outstanding shares of iPass common stock and certain regulatory approvals, and is expected to close in the first quarter of calendar year 2019. No approval of the stockholders of Pareteum is required in connection with the proposed transaction. Terms of the agreement were approved by the board of directors for both Pareteum and iPass.

Jefferies LLC is acting as exclusive financial advisor to Pareteum, along with Sichenzia Ross Ference LLP, which is serving as its legal counsel.

Raymond James & Associates, Inc. is acting as financial advisor to iPass and Cooley LLP is acting as its legal counsel.

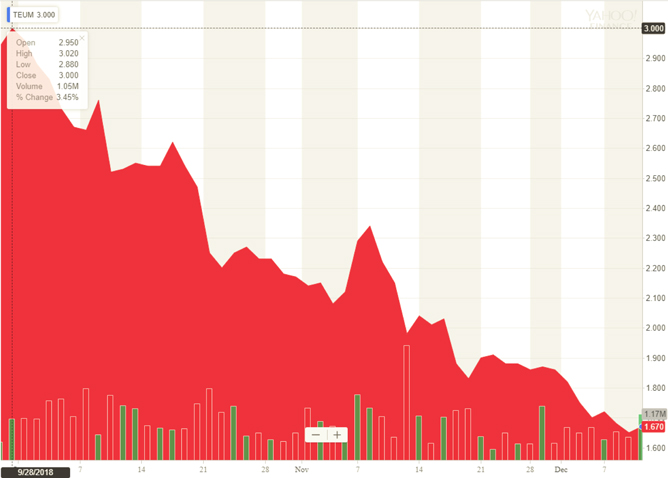

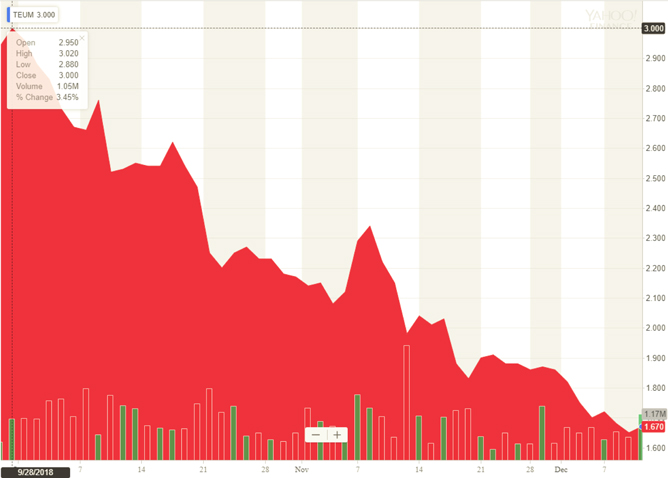

22. The Merger Consideration is inadequate consideration for iPass shareholders. In the six weeks leading up to the announcement of the Merger Agreement and the time since, the price of Pareteum common stock (ticker symbol TEUM) has collapsed, falling from over $3.00 per share at the end of September to $1.67 on December 12, 2018, as illustrated by the chart below:

Accordingly, based on the current prices, each of the valuation analyses performed by Raymond James indicates that the implied value of the Merger Consideration falls below the range of fairness. It is therefore imperative that shareholders receive the material information (discussed in detail below) that Defendants have omitted from the Recommendation Statement, which is necessary for shareholders to properly exercise their corporate suffrage rights and make an informed decision concerning whether to tender their shares in the Proposed Merger.

II. The Materially Incomplete and Misleading Recommendation Statement

23. On December 4, 2018, Defendants filed the Recommendation Statement with the SEC. The Recommendation Statement has been disseminated to the Company’s shareholders, and solicits the Company’s shareholders to tender their shares in the Tender Offer. The Individual Defendants were obligated to carefully review the Recommendation Statement before it was filed with the SEC and disseminated to the Company’s shareholders to ensure that it did not contain any material misrepresentations or omissions. However, the Recommendation Statement misrepresents and/or omits material information that is necessary for the Company’s shareholders to make an informed decision concerning whether to tender their shares, in violation of Sections 14(e) and 20(a) of the Exchange Act.

24. First, the Recommendation Statement fails to disclose any financial projections or valuation information for Pareteum or any of the synergies projected for the combined company. This financial information is plainly material to iPass shareholders who are being asked to surrender their shares in the Company in exchange for a partial stake in the post-merger combined company. In order to make an informed decision on whether to tender their shares, iPass shareholders require two critical pieces of information: (i) the value of the Company they are receiving shares of, Pareteum; and (ii) the value of the combined company, including synergies.

25. In explaining their reasons for the Board’s recommendation, the Recommendation Statement lists the “upside” in the equity ownership of the combined company and “the risks and uncertainties associated with maintaining iPass’s existence as a stand-alone company compared to the opportunities presented by the Offer and the Merger and related synergies” among the material factors they considered. Recommendation Statement at 16-17. In fact, Defendants concede the materiality of this information: “The foregoing discussion of the information and factors considered by the iPass board is not intended to be exhaustive, but includes the material factors considered by the iPass board.” Recommendation Statement at 17 (emphasis added). Recommending that shareholders tender their shares on the basis of the value of the combined company without providing the financial information or synergy values used to make that determination renders such statements misleading. This is especially true here, where the price of Pareteum has collapsed both in the weeks preceding and following the announcement of the Proposed Merger—making it difficult to discern what “upside” the Board was referring to.

26. Similarly, the use of $2.60 as the “Per Share Amount,” or an implied value of the Merger Consideration, misleads iPass shareholders into thinking that the value they stand to receive from the Merger Consideration represents anywhere near “fair” value for their shares. Multiple times throughout summary of Raymond James’ valuation analyses, the Recommendation Statement asserts “the Per Share Amount which, for purposes of Raymond James’s analysis and its opinion, and with the iPass board’s consent, Raymond James assumed would have an implied value of $2.60 per share of iPass’s common stock.” See Recommendation Statement at 21-22. At the time of the Merger Agreement, $2.60 represented approximately the value implied by the exchange ratio and Pareteum’s stock price. However, Raymond James and the Board knew, or should have known, that the implied value of the Merger Consideration would have been far below $2.60 by the time the Recommendation Statement reached shareholders. In fact, the current implied share value is, as of December 12, 2018, $1.92—down over 25% from the Per Share Amount. Accordingly, Defendants must disclose the financial information for Pareteum and all information related to the synergies of the Proposed Merger, so that iPass shareholder may understand the decision they are being asked to make.

27. Second, in summarizing Raymond James’Discounted Cash Flow Analysis the Recommendation Statement fails to disclose the following key components used in its analysis that must be disclosed for shareholders to comprehend the analyses: (i) the inputs and assumptions underlying the calculation of the discount rate range of 16.0% to 20.0%, (including WACC and CAPM components); (ii) the inputs and assumptions underlying the selection of the 1.0% to 3.0% perpetual growth rate used to derive the terminal values; (iii) the actual terminal values Raymond James calculated; and (iv) the balance of Net Operating Losses (“NOLs”) as of the periods contemplated by the Projections to evaluate the additional potential equity value of iPass’s standalone tax attributes (the “NOL tax savings”).

28. These key inputs are material to iPass shareholders, and their omission renders the summary of Raymond James’Discounted Cash Flow Analysis incomplete and misleading. As a highly-respected professor explained in one of the most thorough law review articles explaining the fundamental flaws with the valuation analyses bankers perform in support of fairness opinions: in a discounted cash flow analysis a banker takes management’s forecasts, and then makes several key choices “each of which can significantly affect the final valuation.” Steven M. Davidoff,Fairness Opinions, 55 Am. U.L. Rev. 1557, 1576 (2006). Such choices include “the appropriate discount rate, and the terminal value…”Id. As Professor Davidoff explains:

| | CLASS ACTION COMPLAINT 10. | |

There is substantial leeway to determine each of these, and any change can markedly affect the discounted cash flow value. For example, a change in the discount rate by one percent on a stream of cash flows in the billions of dollars can change the discounted cash flow value by tens if not hundreds of millions of dollars….This issue arises not only with a discounted cash flow analysis, but with each of the other valuation techniques. This dazzling variability makes it difficult to rely, compare, or analyze the valuations underlying a fairness opinionunless full disclosure is made of the various inputs in the valuation process, the weight assigned for each, and the rationale underlying these choices. The substantial discretion and lack of guidelines and standards also makes the process vulnerable to manipulation to arrive at the “right” answer for fairness. This raises a further dilemma in light of the conflicted nature of the investment banks who often provide these opinions.

Id. at 1577-78.

29. Without the above-omitted information iPass shareholders are misled as to the reasonableness or reliability of Raymond James’ analyses and are unable to properly assess the fairness of the Proposed Merger. As such, these material omissions render the summary of theDiscounted Cash Flow Analysis included in the Recommendation Statement misleading.

30. Third, with respect to Raymond James’Selected Companies Analysis and Selected Transaction Analysis, the Recommendation Statement fails to disclose the individual multiples for each company and transaction utilized in the analyses. A fair summary of a companies or transactions analysis requires the disclosure of the individual multiples for each company and transaction; merely providing the quartile range of values, or the means or medians, that a banker applied is insufficient, as shareholders are unable to assess whether the banker applied appropriate multiples, or, instead, applied unreasonably low multiples in order to present the Merger Consideration in the most favorable light—i.e. as low as possible. Accordingly, the omission of this material information renders the summaries of these analyses provided in the Recommendation Statement misleading.

31. In sum, the omission and/or misstatement of the above-referenced information renders statements in the Recommendation Statement materially incomplete and misleading in contravention of the Exchange Act. Absent disclosure of the foregoing material information prior to the expiration of the Tender Offer, Plaintiff and the other members of the Class will be unable to make a fully-informed decision regarding whether to tender their shares, and they are thus threatened with irreparable harm, warranting the injunctive relief sought herein.

| | CLASS ACTION COMPLAINT 11. | |

COUNT I

Claims Against All Defendants for Violations of Section 14(e) of the Exchange Act

32. Plaintiffs repeat and reallege the preceding allegations as if fully set forth herein.

33. Defendants caused the Recommendation Statement to be issued with the intention of soliciting shareholder support of the Proposed Merger.

34. Section 14(e) of the Exchange Act provides that it is unlawful “for any person to make any untrue statement of a material fact or omit to state any material fact necessary in order to make the statements made, in the light of the circumstances under which they are made, not misleading . . . in connection with any tender offer or request or invitation for tenders, or any solicitation of security holders in opposition to or in favor of any such offer, request, or invitation.” 15 U.S.C. § 78n(e).

35. Defendants violated this clause of Section 14(e) because they negligently caused or allowed the Recommendation Statement to be disseminated to iPass shareholders in order to solicit them to tender their shares in the Tender Offer, and the Recommendation Statement contained untrue statements of material fact and/or omitted to state material facts necessary in order to make the statements made, in the light of the circumstances under which they were made, not misleading.

36. Defendants negligently omitted the material information identified above from the Recommendation Statement or negligently failed to notice that such material information had been omitted from the Recommendation Statement, which caused certain statements therein to be materially incomplete and therefore misleading. Indeed, while Defendants undoubtedly had access to and/or reviewed the omitted material information in connection with approving the Proposed Merger, they allowed it to be omitted from the Recommendation Statement, rendering certain portions of the Recommendation Statement materially incomplete and therefore misleading. As directors and officers of iPass, the Individual Defendants had a duty to carefully review the Recommendation Statement before it was disseminated to the Company’s shareholders to ensure that it did not contain untrue statements of material fact and did not omit material facts. The Individual Defendants were negligent in carrying out their duty.

| | CLASS ACTION COMPLAINT 12. | |

37. iPass is imputed with the negligence of the Individual Defendants, who are each directors and/or senior officers of iPass.

38. As a direct result of Defendants’ negligent preparation, review, and dissemination of the false and/or misleading Recommendation Statement, Plaintiffs and the Class are impeded from exercising their right to seek appraisal on a fully informed basis and are induced to tender their shares and accept the inadequate Merger Consideration in connection with the Proposed Merger. The false and/or misleading Recommendation Statement used to solicit the tendering of shares impedes Plaintiffs and the Class from making a fully informed decision regarding the Tender Offer and is an essential link in consummating the Proposed Merger, which will deprive them of full and fair value for their iPass shares. At all times relevant to the dissemination of the materially false and/or misleading Recommendation Statement, Defendants were aware of and/or had access to the true facts concerning the process involved in selling iPass, the projections for iPass, and iPass’s true value, which is greater than the Merger Consideration iPass’s shareholders will receive. Thus, as a direct and proximate result of the dissemination of the false and/or misleading Recommendation Statement Defendants used to obtain shareholder approval of and thereby consummate the Proposed Merger, Plaintiffs and the Class will suffer damage and actual economic losses (i.e., the difference between the price iPass shareholders receive and the true value of their shares at the time of the Proposed Merger) in an amount to be determined at trial.

39. The misrepresentations and omissions in the Recommendation Statement are material in that a reasonable shareholder would consider them important in deciding whether to tender their shares in the Tender Offer. In addition, a reasonable investor would view a full and accurate disclosure as having significantly altered the “total mix” of information made available in the Recommendation Statement and in other information reasonably available to shareholders.

| | CLASS ACTION COMPLAINT 13. | |

COUNT II

Against the Individual Defendants for Violations of Section 20(a) of the Exchange Act

40. Plaintiffs repeat and reallege the preceding allegations as if fully set forth herein.

41. The Individual Defendants acted as controlling persons of iPass within the meaning of Section 20(a) of the Exchange Act as alleged herein. By virtue of their positions as officers and/or directors of iPass and participation in and/or awareness of the Company’s operations and/or intimate knowledge of the false and misleading statements contained in the Recommendation Statement, they had the power to influence and control and did influence and control, directly or indirectly, the decision making of the Company, including the content and dissemination of the various statements that Plaintiffs contend are false and misleading.

42. Each of the Individual Defendants was provided with or had unlimited access to copies of the Recommendation Statement alleged by Plaintiffs to be misleading prior to and/or shortly after these statements were issued and had the ability to prevent the issuance of the statements or cause them to be corrected.

43. In particular, each of the Individual Defendants had direct and supervisory involvement in the day-to-day operations of the Company, and, therefore, is presumed to have had the power to control and influence the particular transactions giving rise to the violations as alleged herein, and exercised the same. The Recommendation Statement contains the unanimous recommendation of the Individual Defendants to approve the Proposed Merger. They were thus directly involved in the making of the Recommendation Statement.

44. By virtue of the foregoing, the Individual Defendants violated Section 20(a) of the Exchange Act.

45. As set forth above, the Individual Defendants had the ability to exercise control over and did control a person or persons who have each violated Section 14(e) of the Exchange Act, by their acts and omissions as alleged herein. By virtue of their positions as controlling persons, these defendants are liable pursuant to Section 20(a) of the Exchange Act. As a direct and proximate result of the Individual Defendants’ conduct, Plaintiffs and the Class have suffered damage and actual economic losses (i.e., the difference between the price iPass shareholders received and the true value of their shares at the time of the Proposed Merger) in an amount to be determined at trial.

| | CLASS ACTION COMPLAINT 14. | |

RELIEF REQUESTED

WHEREFORE, Plaintiff demands relief in his favor and in favor of the Class and against the Defendants jointly and severally, as follows:

A. Declaring that this action is properly maintainable as a Class Action and certifying Plaintiff as Class Representative and his counsel as Class Counsel;

B. Preliminarily enjoining Defendants and their counsel, agents, employees and all persons acting under, in concert with, or for them, from proceeding with, consummating, or closing the Proposed Merger, unless and until Defendants disclose the material information identified above which has been omitted from the Recommendation Statement;

C. Rescinding, to the extent already implemented, the Merger Agreement or any of the terms thereof, or granting Plaintiff and the Class rescissory damages;

D. Directing the Defendants to account to Plaintiff and the Class for all damages suffered as a result of their wrongdoing;

E. Awarding Plaintiff the costs and disbursements of this action, including reasonable attorneys’ and expert fees and expenses; and

F. Granting such other and further equitable relief as this Court may deem just.

JURY DEMAND

Plaintiff demands a trial by jury.

| December 12, 2018 | Respectfully submitted, |

| | |

| OF COUNSEL | /s/ David E. Bower |

MONTEVERDE & ASSOCIATES PC Juan E. Monteverde The Empire State Building 350 Fifth Avenue, Suite 4405 New York, New York 10118 Tel: 212-971-1341 Fax: 212-202-7880 Email: jmonteverde@monteverdelaw.com Counsel for Plaintiff | David E. Bower David E. Bower SBN 119546 MONTEVERDE & ASSOCIATES PC 600 Corporate Pointe, Suite 1170 Culver City, CA 90230 Tel: (213) 446-6652 Fax: (212) 202-7880 Email: dbower@monteverdelaw.com Counsel for Plaintiff |

| | CLASS ACTION COMPLAINT 15. | |