As filed with the U.S. Securities and Exchange Commission on June 24, 2020

Securities Act File No. [__]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

Form N-14

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 x

Pre-Effective Amendment No. ¨

Post-Effective Amendment No. ¨

HARTFORD SERIES FUND, INC.

(Exact Name of Registrant as Specified in Charter)

690 Lee Road

Wayne, Pennsylvania 19087

(Address of Principal Executive Offices) (Zip Code)

1-610-386-4068

(Registrant’s Area Code and Telephone Number)

Thomas R. Phillips, Esquire

Hartford Funds Management Company, LLC

690 Lee Road

Wayne, Pennsylvania 19087

(Name and Address of Agent for Service)

With copies to:

John V. O’Hanlon, Esquire

Dechert LLP

One International Place, 40th Floor

100 Oliver Street

Boston, Massachusetts 02110-2605

Approximate Date of Proposed Public Offering:

As soon as practicable after this Registration Statement becomes effective.

It is proposed that this filing will become effective on July 24, 2020, pursuant to Rule 488

under the Securities Act of 1933, as amended.

No filing fee is required because an indefinite number of shares have previously been registered pursuant to Rule 24f-2 under the Investment Company Act of 1940, as amended.

HARTFORD SERIES FUND, INC.

HARTFORD HLS SERIES FUND II, INC.

[July 24], 2020

Dear Contract Owners and Plan Participants:

At a meeting held on June 16-17, 2020, the Boards of Directors (the “Board”) of Hartford Series Fund, Inc. (“HSF”) and Hartford HLS Series Fund II, Inc. (“HLS II”), each a Maryland corporation, approved an Agreement and Plan of Reorganization (the “Plan”) that provides for the reorganization of each Acquired Fund identified below (each an “Acquired Fund”) into the corresponding Acquiring Fund identified below (each an “Acquiring Fund”) (each a “Reorganization” and collectively, the “Reorganizations”).

| Acquired Fund and Share Class | Corresponding Acquiring Fund and Share Class |

Hartford Global Growth HLS Fund Class IA Class IB | Hartford Disciplined Equity HLS Fund Class IA Class IB |

Hartford Growth Opportunities HLS Fund Class IA Class IB Class IC | Hartford Disciplined Equity HLS Fund Class IA Class IB Class IC* |

Hartford MidCap Growth HLS Fund Class IA Class IB | Hartford MidCap HLS Fund Class IA Class IB |

Hartford MidCap Value HLS Fund Class IA Class IB | Hartford MidCap HLS Fund Class IA Class IB |

Hartford Value HLS Fund Class IA Class IB | Hartford Dividend and Growth HLS Fund Class IA Class IB |

Hartford High Yield HLS Fund Class IA Class IB | Hartford Total Return Bond HLS Fund Class IA Class IB |

Hartford U.S. Government Securities HLS Fund Class IA Class IB | Hartford Ultrashort Bond HLS Fund Class IA Class IB |

* Class IC shares of the Hartford Disciplined Equity HLS Fund is a newly created class that will commence operations upon the closing of the Reorganization.

Each Reorganization does not require shareholder approval. The Reorganizations are expected to occur after the close of business on the dates noted below (or at such earlier or later date as determined by an officer of HSF or HLS II, as applicable) (each, a “Closing Date”).

| Acquired Fund | Corresponding Acquiring Fund | Closing Date |

| Hartford Global Growth HLS Fund | Hartford Disciplined Equity HLS Fund | September 18, 2020 |

| Hartford Growth Opportunities HLS Fund | Hartford Disciplined Equity HLS Fund | September 18, 2020 |

| Hartford MidCap Growth HLS Fund | Hartford MidCap HLS Fund | September 18, 2020 |

| Hartford MidCap Value HLS Fund | Hartford MidCap HLS Fund | September 18, 2020 |

| Hartford Value HLS Fund | Hartford Dividend and Growth HLS Fund | September 18, 2020 |

| Hartford High Yield HLS Fund | Hartford Total Return Bond HLS Fund | September 25, 2020 |

| Hartford U.S. Government Securities HLS Fund | Hartford Ultrashort Bond HLS Fund | September 25, 2020 |

You are receiving the enclosed Combined Information Statement/Prospectus because you were invested in an Acquired Fund as of the close of business on July 17, 2020 through an insurance company separate account (“Separate Account”) or a qualified pension or retirement plan (“Qualified Plans”). The Separate Accounts and Qualified Plans or their trustees, as record owners of the Acquired Funds are, in most cases, the true “shareholders” of the Acquired Funds. For clarity and ease of reading, references to “shareholder” or “you” throughout the Combined Information Statement/Prospectus do not refer to the technical shareholder but rather refer to the Contract Owner or Plan Participant.

After carefully considering the merits of each Reorganization, the Board determined each Reorganization is in the best interests of the Acquired Fund and its corresponding Acquiring Fund. In connection with each Reorganization, you should note the following:

| · | The value of your investment will not change as a result of the Reorganization; |

| · | The Acquiring Fund will have the same or lower contractual management fees than the corresponding Acquired Fund following the Reorganization; |

| · | Each class of the Acquiring Fund after the Reorganization is expected to have a lower total annual operating expense ratio than the corresponding class of the corresponding Acquired Fund immediately prior to the Reorganization; and |

| · | The Reorganization is expected to provide an opportunity for shareholders to benefit from potential economies of scale that may be realized over time by combining the assets of one or more Acquired Funds with a corresponding Acquiring Fund’s assets in the Reorganization. |

With respect to each Reorganization, the Plan provides for:

| · | The transfer of all of the assets of an Acquired Fund to the corresponding Acquiring Fund in exchange for shares of the corresponding Acquiring Fund that have an aggregate net asset value equal to the aggregate net asset value of the shares of the Acquired Fund as of the close of regular trading on the New York Stock Exchange on the Closing Date (“Valuation Time”); |

| · | The assumption by the corresponding Acquiring Fund of all of the liabilities of the Acquired Fund; and |

| · | The distribution of shares of the corresponding Acquiring Fund to the shareholders of the Acquired Fund in complete liquidation of the Acquired Fund. |

Existing shareholders of an Acquired Fund are permitted to purchase additional shares of the Acquired Fund until the Closing Date, but any purchase request that cannot be settled prior to the Closing Date will be deemed to be, and will be processed as, a purchase request for shares of the corresponding Acquiring Fund.

Each Reorganization does not require shareholder approval, and you are not being asked to vote or take any other action in connection with the Reorganization. We do, however, ask that you review the enclosed Combined Information Statement/Prospectus, which contains information about each Acquiring Fund, including its investment objective, strategies, risks, performance, fees and expenses.

If you have any questions, please call the Funds at 1-888-843-7824.

Sincerely,

James E. Davey

President and Chief Executive Officer

QUESTIONS AND ANSWERS ABOUT THE INFORMATION STATEMENT/PROSPECTUS

The questions and answers below provide an overview of key points typically of interest to shareholders regarding a mutual fund reorganization. These questions and answers are intentionally brief to provide a concise summary. The responses are qualified in their entirety by the remainder of the enclosed Combined Information Statement/Prospectus (“Information Statement/Prospectus”), which contains additional information and further details about each reorganization. We encourage you to read the full Information Statement/Prospectus.

General Information About the Reorganizations

| Q. 1. | Why am I receiving the Information Statement/Prospectus? |

| A. 1. | Hartford Funds Management Company, LLC (“HFMC”) has recommended the reorganizations set forth below as part of an initiative to streamline the product offerings of the series of Hartford Series Fund, Inc. and Hartford HLS Series Fund II, Inc. As part of this initiative, the Boards of Directors of Hartford Series Fund, Inc. and Hartford HLS Series Fund II, Inc. (each, a “Company” and collectively, the “Companies”) approved the reorganization of each Acquired Fund set forth in the table below with and into the corresponding Acquiring Fund set forth below (each, a “Reorganization”). |

| Acquired Fund and Share Class | Corresponding Acquiring Fund and Share Class |

Hartford Global Growth HLS Fund* Class IA Class IB | Hartford Disciplined Equity HLS Fund* Class IA Class IB |

Hartford Growth Opportunities HLS Fund** Class IA Class IB Class IC | Hartford Disciplined Equity HLS Fund* Class IA Class IB Class IC*** |

Hartford MidCap Growth HLS Fund** Class IA Class IB | Hartford MidCap HLS Fund* Class IA Class IB |

Hartford MidCap Value HLS Fund* Class IA Class IB | Hartford MidCap HLS Fund* Class IA Class IB |

Hartford Value HLS Fund* Class IA Class IB | Hartford Dividend and Growth HLS Fund* Class IA Class IB |

Hartford High Yield HLS Fund* Class IA Class IB | Hartford Total Return Bond HLS Fund* Class IA Class IB |

Hartford U.S. Government Securities HLS Fund** Class IA Class IB | Hartford Ultrashort Bond HLS Fund* Class IA Class IB |

* The fund is a series of Hartford Series Fund, Inc., a Maryland corporation, registered with the U.S. Securities and Exchange Commission (the “SEC”) as an open-end management investment company.

** The fund is a series of Hartford HLS Series Fund II, Inc., a Maryland corporation, registered with the SEC as an open-end management investment company.

*** Class IC shares of the Hartford Disciplined Equity HLS Fund is a newly created class that will commence operations upon the closing of the Reorganization.

You are receiving the enclosed Information Statement/Prospectus because you were invested in an Acquired Fund as of the close of business on July 17, 2020 (the “Record Date”) through an insurance company separate account (“Separate Account”) or a qualified pension or retirement plan (“Qualified Plans”) and so that we can provide you with details about the Reorganization. We suggest that you keep the Information Statement/Prospectus for your records and future reference. The Separate Accounts and Qualified Plans or their trustees, as record owners of the Acquired Funds are, in most cases, the true “shareholders” of the Acquired Funds. For clarity and ease of reading, references to “shareholder” or “you” throughout the Information Statement/Prospectus do not refer to the technical shareholder but rather refer to the Contract Owner or Plan Participant. Each Acquiring Fund, following completion of the applicable Reorganization(s), may be referred to as a “Combined Fund.”

| Q. 2. | How did the Board of Directors (the “Board”) of each Company reach its decision to approve the Reorganizations? |

| A.2. | In determining whether to approve each Reorganization, the Board considered a variety of factors, including: (1) HFMC’s belief that the Acquired Fund would continue to experience net outflows; (2) the similarities and differences between the Acquired Fund’s and its corresponding Acquiring Fund’s investment objective, investment strategies, policies and restrictions, investment process, and principal risks; (3) the continuity provided by the fact that the Acquired Fund and its corresponding Acquiring Fund have the same investment manager and sub-adviser; (4) the terms and conditions of the Agreement and Plan of Reorganization (the “Plan”), which include provisions that are designed to avoid any dilution of shareholder interests; (5) the estimated costs of the Reorganization and the fact that the Acquired Fund will bear the costs associated with the Reorganization; (6) the tax considerations of the Reorganization; (7) the pro forma gross and net operating expenses of each share class of the Acquiring Fund after the Reorganization are estimated to be lower than the current gross and net operating expenses of each corresponding share class of the Acquired Fund; and (8) alternatives to the Reorganization. The Board also considered that each Reorganization does not require, and would be completed without incurring the costs associated with, holding a special meeting of the Acquired Fund’s shareholders. After careful consideration of these and other factors, the Board determined that the Reorganizations are in the best interests of the Acquired Funds and the corresponding Acquiring Funds and that the interests of the shareholders of the Acquired Funds and the corresponding Acquiring Funds would not be diluted as a result of the Reorganizations. For more information regarding the Board’s considerations in determining to approve the Reorganizations, please see the section entitled “REASONS FOR THE REORGANIZATIONS, BOARD CONSIDERATIONS AND BENEFITS OF THE REORGANIZATIONS” in the Information Statement/Prospectus. |

| Q. 3. | Why are shareholders not being asked to approve the Reorganizations? |

| A. 3. | Under each Company’s Articles of Incorporation and By-Laws, each Reorganization does not require the approval of shareholders. In addition, in adopting a rule governing reorganizations of affiliated investment companies, the U.S. Securities and Exchange Commission (“SEC”) stated its view that approval by shareholders of an acquired fund would be required if the reorganization would result in a change that, in a context other than a reorganization, would require the approval of the acquired fund’s shareholders under applicable provisions of the Investment Company Act of 1940, as amended. The types of differences between an acquired fund and an acquiring fund that would require the approval by the acquired fund’s shareholders for a reorganization generally include different boards of directors, materially different advisory contracts, materially different fundamental investment policies, or higher distribution fees for the acquiring fund as compared to the acquired fund. None of the factors requiring a shareholder vote are present with respect to each Reorganization. |

| Q. 4. | Who will bear the costs of each Reorganization? |

| A. 4. | With respect to each Reorganization, the Acquired Fund will bear the costs of the Reorganization. Reorganization costs include, but are not limited to: (1) the expenses associated with the preparation, printing and mailing of the Information Statement/Prospectus; (2) the preparation of the registration statement and other shareholder communications and any filings with the SEC and/or other governmental authorities in connection with the Reorganization; and (3) legal, audit, custodial and other fees incurred in connection with the Reorganizations (the “Reorganization Costs”). Fees and expenses incurred directly by an Acquired Fund will be allocated to that Fund. Fees and expenses incurred on behalf of multiple Acquired Funds, such as legal fees and the costs of preparing (but not printing and mailing) the Information Statement/Prospectus, will be allocated among participating Acquired Funds equally. The estimated Reorganization Costs expected to be borne by each Acquired Fund are set forth in the chart below. |

| Acquired Funds | Estimated Costs |

| Hartford Global Growth HLS Fund | $100,681 |

| Hartford Growth Opportunities HLS Fund | $121,570 |

| Hartford MidCap Growth HLS Fund | $69,130 |

| Hartford MidCap Value HLS Fund | $86,954 |

| Hartford Value HLS Fund | $98,156 |

| Hartford High Yield HLS Fund | $97,698 |

| Hartford U.S. Government Securities HLS Fund | $104,685 |

In addition, each Fund will bear brokerage expenses or similar transaction costs incurred in connection with the sale and purchase of portfolio securities, which typically are Fund expenses. For more information regarding brokerage expenses and similar transaction costs, see the section entitled “ADDITIONAL INFORMATION ABOUT THE REORGANIZATIONS – Brokerage Expenses and Other Transaction Costs” in the Information Statement/Prospectus.

| Q. 5. | How will the Reorganization affect me as a Shareholder? |

| A. 5. | The Reorganizations are expected to occur after the close of business on the dates noted below (or at such earlier or later date as determined by an officer of the applicable Company) (each, a “Closing Date”). |

| Acquired Fund | Corresponding Acquiring Fund | Closing Date |

| Hartford Global Growth HLS Fund | Hartford Disciplined Equity HLS Fund | September 18, 2020 |

| Hartford Growth Opportunities HLS Fund | Hartford Disciplined Equity HLS Fund | September 18, 2020 |

| Hartford MidCap Growth HLS Fund | Hartford MidCap HLS Fund | September 18, 2020 |

| Hartford MidCap Value HLS Fund | Hartford MidCap HLS Fund | September 18, 2020 |

| Hartford Value HLS Fund | Hartford Dividend and Growth HLS Fund | September 18, 2020 |

| Hartford High Yield HLS Fund | Hartford Total Return Bond HLS Fund | September 25, 2020 |

| Hartford U.S. Government Securities HLS Fund | Hartford Ultrashort Bond HLS Fund | September 25, 2020 |

Upon the Closing Date, shareholders of an Acquired Fund will become shareholders of the corresponding Acquiring Fund and will receive shares of the corresponding class of the corresponding Acquiring Fund that are equal in value to their shares in the Acquired Fund as of the close of regular trading on the New York Stock Exchange on the Closing Date (“Valuation Time”). The number of shares you receive will depend on the relative net asset value of the Acquired Fund’s and corresponding Acquiring Fund’s shares immediately prior to the Reorganization. Thus, although the aggregate net asset value of the shares in your account will be the same immediately after the close of business on the Closing Date, you may receive a greater or lesser number of shares than you currently hold in the Acquired Fund.

| Q. 6. | Can I purchase, exchange or redeem my Acquired Fund shares before the Reorganization takes place? |

| A. 6. | Existing shareholders of an Acquired Fund are permitted to purchase additional shares of the Acquired Fund until the Closing Date, but any purchase request that cannot be settled prior to the Closing Date will be deemed to be, and will be processed as, a purchase request for shares of the corresponding Acquiring Fund. Please refer to your variable contract prospectus (or other disclosure document) or plan documents for more information. |

General Information About the Funds

| Q. 7. | How comparable are the Funds’ investment objectives and principal investment strategies? |

| A. 7. | Each Acquired Fund and its corresponding Acquiring Fund have the same or similar investment objectives and similar principal investment strategies, but there are some differences you should consider. The “Synopsis” section in the Information Statement/Prospectus for each Reorganization provides a comparison of each Acquired Fund’s and the corresponding Acquiring Fund’s investment objective and principal investment strategy. This comparison can be found in the sub-sections entitled “Comparison of the Investment Objectives, Fundamental Investment Restrictions, Principal Investment Strategies and Principal Risks.” |

| Q. 8. | How comparable are the Funds’ principal risks? |

| A. 8. | Each Acquired Fund and its corresponding Acquiring Fund have similar principal risks, but there are some differences you should consider. The “Synopsis” section in the Information Statement/Prospectus for each Reorganization provides a comparison of each Acquired Fund’s and the corresponding Acquiring Fund’s principal risks. This comparison can be found in the sub-sections entitled “Comparison of the Investment Objectives, Fundamental Investment Restrictions, Principal Investment Strategies and Principal Risks.” |

| Q. 9. | Do each of the Acquiring Funds have a different investment manager and sub-adviser? |

| A. 9. | Each Acquired Fund and the corresponding Acquiring Fund have the same investment manager and sub-adviser. HFMC and Wellington Management Company LLP (“Wellington Management”) will continue to serve as each Acquiring Fund’s investment manager and sub-adviser, respectively, after the closing of the |

Reorganization.

| Q. 10. | Will the Plan result in different expenses for shareholders of the Acquired Funds? |

| A. 10. | Yes. Each Acquiring Fund has different expenses than the corresponding Acquired Fund. With respect to each Reorganization, it is anticipated that, immediately following the Reorganization, shareholders of the Combined Fund will incur lower actual management fees (i.e., the management fee rate payable calculated based on a fund’s asset level) than the shareholders of the corresponding Acquired Fund immediately prior to the Reorganization. With respect to each Reorganization, the total annual operating expense ratio of each class of the Combined Fund immediately after the Reorganization is expected to be lower than the total annual operating expense ratio of the corresponding class of the corresponding Acquired Fund immediately prior to the Reorganization. For more information on fees and expenses, see the section entitled “Comparison of the Fees and Expenses of the Acquired Fund and the Acquiring Fund” in the “Synopsis” section for each Reorganization in the Information Statement/Prospectus. |

| Q. 11. | Will the Reorganization be considered a taxable event for federal income tax purposes? |

| A. 11. | Shares of the Acquired Funds are offered only through variable annuity and variable life products and qualified plans. Because these products allow tax-free treatment for transactions within such products, you are not expected to recognize any gain or loss for federal income tax purposes on the exchange of shares of an Acquired Fund for shares of the corresponding Acquiring Fund. |

Important additional information about each Reorganization is set forth in the accompanying Information Statement/Prospectus. Please read it carefully.

SUBJECT TO COMPLETION

PRELIMINARY COMBINED INFORMATION STATEMENT/PROSPECTUS DATED JUNE 24, 2020

The information in this Combined Information Statement/Prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This Combined Information Statement/Prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

COMBINED INFORMATION STATEMENT/PROSPECTUS

[July 24], 2020

Hartford Series Fund, Inc. and Hartford HLS Series Fund II, Inc.

690 Lee Road

Wayne, Pennsylvania 19087

(610) 386-4068

We Are Not Asking You for a Proxy and You Should Not Send Us a Proxy

This Combined Information Statement/Prospectus (“Information Statement/Prospectus”) relates to the reorganization of each Acquired Fund set forth in the table below (each an “Acquired Fund) with and into the corresponding Acquiring Fund set forth in the table below (each, an “Acquiring Fund”) (each, a “Reorganization” and collectively, the “Reorganizations”). You are receiving this Information Statement/Prospectus because you were invested in an Acquired Fund as of the close of business on July 17, 2020 (the “Record Date”) through an insurance company separate account (“Separate Account”) or a qualified pension or retirement plan (“Qualified Plans”).

| Acquired Fund and Share Class | Corresponding Acquiring Fund and Share Class |

Hartford Global Growth HLS Fund* Class IA Class IB | Hartford Disciplined Equity HLS Fund* Class IA Class IB |

Hartford Growth Opportunities HLS Fund** Class IA Class IB Class IC | Hartford Disciplined Equity HLS Fund* Class IA Class IB Class IC*** |

Hartford MidCap Growth HLS Fund** Class IA Class IB | Hartford MidCap HLS Fund* Class IA Class IB |

Hartford MidCap Value HLS Fund* Class IA Class IB | Hartford MidCap HLS Fund* Class IA Class IB |

Hartford Value HLS Fund* Class IA Class IB | Hartford Dividend and Growth HLS Fund* Class IA Class IB |

Hartford High Yield HLS Fund* Class IA Class IB | Hartford Total Return Bond HLS Fund* Class IA Class IB |

Hartford U.S. Government Securities HLS Fund** Class IA Class IB | Hartford Ultrashort Bond HLS Fund* Class IA Class IB |

* The fund is a series of Hartford Series Fund, Inc., a Maryland corporation, registered with the U.S. Securities and Exchange Commission (the “SEC”) as an open-end management investment company.

** The fund is a series of Hartford HLS Series Fund II, Inc., a Maryland corporation, registered with the SEC as an open-end management investment company.

*** Class IC shares of the Hartford Disciplined Equity HLS Fund is a newly created class that will commence operations upon the closing of the reorganization.

The Separate Accounts and Qualified Plans or their trustees, as record owners of the Acquired Funds are, in most cases, the true “shareholders” of the Acquired Funds. For clarity and ease of reading, references to “shareholder” or

“you” throughout this Information Statement/Prospectus do not refer to the technical shareholder but rather refer to the Contract Owner or Plan Participant. Each Acquiring Fund and Acquired Fund may be referred to herein as a “Fund.”

Each Reorganization will be completed pursuant to the terms of an Agreement and Plan of Reorganization (the “Plan”) that has been approved by the Boards (“Board”) of Directors of Hartford Series Fund, Inc. (“HSF”) and Hartford HLS Series Fund II, Inc. (“HLS II”). The Plan provides for the following: (1) the transfer of all of the assets of each Acquired Fund to the corresponding Acquiring Fund, in exchange for shares of the corresponding Acquiring Fund that have an aggregate net asset value equal to the aggregate net asset value of the shares of the Acquired Fund as of the close of regular trading on the New York Stock Exchange on the closing date of the Reorganization; (2) the assumption by the corresponding Acquiring Fund of all of the liabilities of the Acquired Fund; and (3) the distribution of shares of the corresponding Acquiring Fund to the shareholders of the Acquired Fund in complete liquidation of the Acquired Fund.

Each Reorganization is discussed in detail in this Information Statement/Prospectus, which you should read carefully and retain for future reference. It is both an information statement for each Acquired Fund and a prospectus for the corresponding Acquiring Fund. A Statement of Additional Information dated [July 24], 2020, relating to this Information Statement/Prospectus and each Reorganization has been filed with the SEC and is incorporated by reference into this Information Statement/Prospectus. Additional information is contained in the documents described below, all of which have been filed with the SEC.

| Documents: | How to Obtain a Copy: |

· The Statutory Prospectus for the Acquired Funds (Class IA, Class IB and Class IC, as applicable) and the Acquiring Funds (Class IA and Class IB) dated May 1, 2020, as may be amended, supplemented or restated (HSF File Nos. 333-45431 and 811-08629 and HLS II File Nos. 033-03920 and 811-04615) (the “Combined Prospectus”) · Statutory Prospectus for Class IC shares of the Hartford Disciplined Equity HLS Fund dated June 23, 2020, as may be amended, supplemented or restated (File Nos. 333-45431 and 811-08629) (the “Class IC Prospectus”) · Combined Statement of Additional Information for the Acquired Funds (Class IA, Class IB and Class IC, as applicable) and the Acquiring Funds (Class IA and Class IB) dated May 1, 2020, as may be amended, supplemented or restated (HSF File Nos. 333-45431 and 811-08629 and HLS II File Nos. 033-03920 and 811-04615) (the “Combined Statement of Additional Information”) · Statement of Additional Information for Class IC shares of the Hartford Disciplined Equity HLS Fund dated June 23, 2020, as may be amended, supplemented or restated (File Nos. 333-45431 and 811-08629) (the “Class IC Statement of Additional Information”) | The Combined Prospectus and the Combined Statement of Additional Information are available, without charge, on the Funds’ website at hartfordfunds.com/prospectuses.html#hls, by calling 1-888-843-7824, or by writing to the Hartford Funds, P.O. Box 219060, Kansas City, MO 64121-9060. The Class IC Shares Prospectus and Class IC Statement of Additional Information is available, without charge, by calling 1-888-843-7824, or by writing to the Hartford Funds, P.O. Box 219060, Kansas City, MO 64121-9060. Each of these documents is incorporated by reference into this Information Statement/Prospectus (meaning that they are legally considered to be part of this Information Statement/Prospectus) only insofar as they relate to the Acquiring Funds and Acquired Funds. No other parts of such documents are incorporated by reference herein. |

| · The Funds’ annual report dated December 31, 2019 (HSF File Nos. 333-45431 and 811-08629 and HLS II File Nos. 033-03920 and 811-04615) | This document is available, without charge, on the Funds’ website at hartfordfunds.com/prospectuses.html#hls, by calling 1-888-843-7824, or by writing to the Hartford Funds, P.O. Box 219060, Kansas City, MO 64121-9060. |

You can also obtain copies of any of these documents without charge on the EDGAR database on the SEC’s Internet site at http://www.sec.gov. Copies are available for a fee by electronic request at the following e-mail address: publicinfo@sec.gov, or from the Public Reference Section, Securities and Exchange Commission, 100 F Street, N.E., Room 1580, Washington, D.C. 20549-1520. HSF and HLS II are each subject to the informational requirements of the Securities Exchange Act of 1934, as amended, and certain other federal securities statutes, and files reports and other information with the SEC. Proxy materials, information statements, reports, and other information filed by the Funds can be inspected and copied at the Public Reference Room maintained by the SEC. Information on the operation of the SEC’s Public Reference Room may be obtained by calling 1-202-551-8090. The SEC maintains an Internet website (at http://www.sec.gov) which contains other information about the Funds.

No person has been authorized to give any information or to make any representations other than those contained in this Information Statement/Prospectus and in the materials expressly incorporated by reference.

If any person provides any other representation or information, you should not rely on those other representations or information since none of the Funds have authorized those representations.

The SEC and the Commodity Futures Trading Commission have not approved or disapproved of these securities or passed upon the adequacy or accuracy of this Information Statement/Prospectus. Any representation to the contrary is a criminal offense.

Please note that investments in the Funds are not bank deposits, are not federally insured, are not guaranteed by any bank or government agency and may lose value. There is no assurance that any fund will achieve its investment objectives.

Table of Contents

| General Synopsis | 13 |

| The Reorganizations | 13 |

| Comparison of Fund Classes and Distribution Arrangements | 13 |

| Comparison of Buying and Selling Shares | 14 |

| Comparison of Fund Distributions | 14 |

| Synopsis – Comparison of Hartford Global Growth HLS Fund and Hartford Disciplined Equity HLS Fund | 14 |

| Comparison of the Investment Objectives, Fundamental Investment Restrictions, Principal Investment Strategies and Principal Risks | 14 |

| Comparison of the Fees and Expenses of the Acquired Fund and the Acquiring Fund | 16 |

| Portfolio Turnover | 16 |

| Performance of the Acquired Fund and the Acquiring Fund | 17 |

| Synopsis – Comparison of Hartford Growth Opportunities HLS Fund and Hartford Disciplined Equity HLS Fund | 18 |

| Comparison of the Investment Objectives, Fundamental Investment Restrictions, Principal Investment Strategies and Principal Risks | 18 |

| Comparison of the Fees and Expenses of the Acquired Fund and the Acquiring Fund | 19 |

| Portfolio Turnover | 20 |

| Performance of the Acquired Fund and the Acquiring Fund | 20 |

| Synopsis – Comparison of Hartford MidCap Growth HLS Fund and Hartford MidCap HLS Fund | 22 |

| Comparison of the Investment Objectives, Fundamental Investment Restrictions, Principal Investment Strategies and Principal Risks | 22 |

| Comparison of the Fees and Expenses of the Acquired Fund and the Acquiring Fund | 23 |

| Portfolio Turnover | 23 |

| Performance of the Acquired Fund and the Acquiring Fund | 24 |

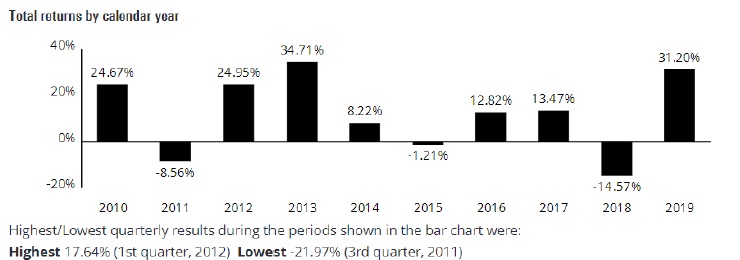

| Synopsis – Comparison of Hartford MidCap Value HLS Fund and Hartford MidCap HLS Fund | 25 |

| Comparison of the Investment Objectives, Fundamental Investment Restrictions, Principal Investment Strategies and Principal Risks | 25 |

| Comparison of the Fees and Expenses of the Acquired Fund and the Acquiring Fund | 26 |

| Portfolio Turnover | 27 |

| Performance of the Acquired Fund and the Acquiring Fund | 27 |

| Synopsis – Comparison of Hartford Value HLS Fund and Hartford Dividend and Growth HLS Fund | 28 |

| Comparison of the Investment Objectives, Fundamental Investment Restrictions, Principal Investment Strategies and Principal Risks | 28 |

| Comparison of the Fees and Expenses of the Acquired Fund and the Acquiring Fund | 29 |

| Portfolio Turnover | 30 |

| Performance of the Acquired Fund and the Acquiring Fund | 30 |

| Synopsis – Comparison of Hartford High Yield HLS Fund and Hartford Total Return Bond HLS Fund | 32 |

| Comparison of the Investment Objectives, Fundamental Investment Restrictions, Principal Investment Strategies and Principal Risks | 32 |

| Comparison of the Fees and Expenses of the Acquired Fund and the Acquiring Fund | 34 |

| Portfolio Turnover | 34 |

| Performance of the Acquired Fund and the Acquiring Fund | 35 |

| Synopsis – Comparison of Hartford U.S. Government Securities HLS Fund and Hartford Ultrashort Bond HLS Fund | 36 |

| Comparison of the Investment Objectives, Fundamental Investment Restrictions, Principal Investment Strategies and Principal Risks | 36 |

| Comparison of the Fees and Expenses of the Acquired Fund and the Acquiring Fund | 37 |

| Portfolio Turnover | 38 |

| Performance of the Acquired Fund and the Acquiring Fund | 38 |

| Performance Notes | 40 |

| Comparison of the Principal Risks | 41 |

| Reasons for the Reorganizations, Board Considerations and Benefits of the Reorganizations | 46 |

| Management of the Funds | 48 |

| The Investment Manager and Sub-Adviser | 48 |

| Additional Information about the Reorganizations | 52 |

General SYNOPSIS

You should read this entire Information Statement/Prospectus carefully. For additional information, you should consult the Combined Prospectus and the Class IC Prospectus (each, a “Prospectus” and collectively, the “Prospectuses”); the Combined Statement of Additional Information and the Class IC Statement of Additional Information (each, a “SAI” and collectively, the “SAIs”); and the Agreement and Plan of Reorganization (the “Plan”). A form of the Plan is attached hereto as APPENDIX A.

The Reorganizations

At a meeting held on June 16-17, 2020, the Boards of Directors (the “Board”) of Hartford Series Fund, Inc. (“HSF”) and Hartford HLS Series Fund II, Inc. (“HLS II” and together with “HSF,” the “Companies”) reviewed a proposal from Hartford Funds Management Company, LLC (“HFMC”) regarding an initiative to streamline the product offerings of the series of the Companies given, among other reasons, the continued net outflow of assets of the Acquired Funds. For the reasons set forth herein, the Board approved the Plan that provides for the reorganization of each Acquired Fund set forth in the table below with and into the corresponding Acquiring Fund set forth in the table below (each, a “Reorganization” and collectively, the “Reorganizations”). Each Reorganization does not require shareholder approval. Each Reorganization is expected to occur after the close of business on the dates set forth below (or at such earlier or later date as determined by an officer of HSF and HLS II, as applicable) (each a “Closing Date”).

| Acquired Fund | Corresponding Acquiring Fund | Closing Date |

| Hartford Global Growth HLS Fund | Hartford Disciplined Equity HLS Fund | September 18, 2020 |

| Hartford Growth Opportunities HLS Fund | Hartford Disciplined Equity HLS Fund | September 18, 2020 |

| Hartford MidCap Growth HLS Fund | Hartford MidCap HLS Fund | September 18, 2020 |

| Hartford MidCap Value HLS Fund | Hartford MidCap HLS Fund | September 18, 2020 |

| Hartford Value HLS Fund | Hartford Dividend and Growth HLS Fund | September 18, 2020 |

| Hartford High Yield HLS Fund | Hartford Total Return Bond HLS Fund | September 25, 2020 |

| Hartford U.S. Government Securities HLS Fund | Hartford Ultrashort Bond HLS Fund | September 25, 2020 |

With respect to each Reorganization, the Plan provides for:

| · | the transfer of all of the assets of the Acquired Fund to the corresponding Acquiring Fund in exchange for shares of the Acquiring Fund that have an aggregate net asset value equal to the aggregate net asset value of the shares of the Acquired Fund as of the close of regular trading on the New York Stock Exchange (4:00 pm, Eastern Standard Time) on the Closing Date (“Valuation Time”); |

| · | the assumption by the corresponding Acquiring Fund of all of the liabilities of the Acquired Fund; and |

| · | the distribution of shares of the corresponding Acquiring Fund to the shareholders of the Acquired Fund in complete liquidation of the Acquired Fund. |

The Reorganizations are expected to be completed after the close of business on the Closing Date based on the net asset value of each Fund’s shares as of the Valuation Time. Each Acquiring Fund, following completion of the Reorganization(s), may be referred to as the “Combined Fund.”

Each shareholder of an Acquired Fund will hold, immediately after the Closing Date, shares of the same class of the corresponding Acquiring Fund having an aggregate value equal to the aggregate value of the same class of shares of the Acquired Fund held by that shareholder as of the Valuation Time. Each Reorganization does not require shareholder approval, and you are not being asked to vote or take any other action in connection with the Reorganization. Your investment in an Acquired Fund will automatically be invested in the corresponding Acquiring Fund upon completion of the Reorganization.

Prior to or at the completion of each Reorganization, each Acquired Fund and the corresponding Acquiring Fund will receive a tax opinion from Dechert LLP, legal counsel to the Companies, to the effect that, no gain or loss is expected to be recognized for federal income tax purposes by the Acquired Fund or its shareholders as a result of the Reorganization. Additional information about the federal income tax consequences of the Reorganization is included under “ADDITIONAL Information About the ReorganizationS – Tax Considerations.”

Comparison of Fund Classes and Distribution Arrangements

In connection with each Reorganization, shareholders of an Acquired Fund will receive shares of the same class of the corresponding Acquiring Fund. Class IA and Class IB shares, respectively, of each Acquiring Fund will have substantially identical legal characteristics as the corresponding shares of the Acquired Fund with respect to such matters as voting rights, accessibility, conversion rights, and transferability. Class IC shares of Hartford Disciplined Equity HLS Fund (Acquiring Fund) will have substantially identical legal characteristics as Class IC shares of Hartford Growth Opportunities HLS Fund (Acquired Fund) with respect to such matters as voting rights, accessibility, conversion rights, and transferability. Class IC shares of Hartford Disciplined Equity HLS Fund will commence operations upon the closing of the Reorganization. Each Fund is organized as a series of a Maryland corporation. There are no material differences between the rights of shareholders of a class of shares of an Acquiring Fund and shareholders of a corresponding class of the corresponding Acquired Fund.

Comparison of Buying and Selling Shares

Shares of the Acquiring Funds and the Acquired Funds may be purchased and redeemed by separate accounts that fund variable annuity contracts and variable life insurance policies, including individual and group annuity and group funding agreement contracts and corporate-owned life insurance and other group life insurance policies issued by insurance companies, including affiliated insurance companies. Shares of the Acquiring Funds and the Acquired Funds may also be purchased and redeemed by certain qualified pension or retirement plans and other investors as permitted by the diversification and other requirements of section 817(h) of the Internal Revenue Code of 1986, as amended and the underlying U.S. Treasury Regulations. Class IC shares are currently only sold to variable annuity and variable life insurance separate accounts of the Insurance Companies. Any minimum or subsequent investment requirements and redemption procedures are governed by the applicable variable contract or plan through which you invest.

Comparison of Fund Distributions

The current policy for each Acquiring Fund and each Acquired Fund is to pay dividends from net investment income and to make distributions of realized capital gains, if any, at least once per year. Dividends and distributions are automatically invested in full or fractional shares at the net asset value on the reinvestment date. Each Acquiring Fund and each Acquired Fund reserve the right to change its dividend distribution policy at the discretion of the applicable Board.

SYNOPSIS – COMPARISON OF HARTFORD GLOBAL GROWTH HLS FUND AND HARTFORD DISCIPLINED EQUITY HLS FUND

Comparison of the Investment Objectives, Fundamental Investment Restrictions, Principal Investment Strategies and Principal Risks

The investment objective of each Fund is the same. Each Fund seeks growth of capital. Each Fund’s investment objective may be changed by the Board without approval of the shareholders of the Fund. Each Fund has the same fundamental investment restrictions. Each Fund has some similar principal investment strategies, but there are some differences in the Funds’ principal investment strategies that you should consider.

| · | Each Fund invests in common stocks. Under normal market and economic conditions, the Acquired Fund invests at least 65% of its net assets in common stocks. In comparison, under normal circumstances, the Acquiring Fund invests at least 80% of its assets in common stocks (“80% Policy”). The 80% Policy is a non-fundamental policy that may be changed by the Board without shareholder approval upon 60 days’ prior notice to shareholders. In contrast, the Acquired Fund has not adopted a similar policy. |

| · | Each Fund invests in a broad range of market capitalizations. However, the Acquired Fund tends to focus on mid to large capitalization companies with market capitalizations greater than $1 billion while the Acquiring Fund tends to focus on large capitalization companies with market capitalizations similar to those of companies in the S&P 500 Index. As of December 31, 2019, the market capitalization of companies included in the S&P 500 Index ranged from approximately $4.58 billion to $1.30 trillion. The market capitalization range of the S&P 500 Index changes over time. |

| · | Each Fund may invest in foreign securities. Under normal circumstances, the Acquired Fund will invest at least 40% of its net assets in foreign securities and may invest up to 25% of its net assets in emerging market securities. While the Acquiring Fund is permitted to invest in foreign securities, the Acquiring Fund has not invested in foreign securities to a material extent during the past year. |

| · | The Acquired Fund employs a multiple portfolio manager structure whereby the portfolio is divided into segments, each under a separate portfolio manager or team with its own approach. The Acquiring Fund is not structured in the same manner. |

| · | With respect to each Fund, the sub-adviser uses fundamental analysis to identify securities to purchase. With respect to the Acquired Fund, the sub-adviser invests at least 65% of its net assets in common stocks of growth companies. In comparison, the sub-adviser chooses the Acquiring Fund’s investments using fundamental research designed to identify issuers with improving quality metrics, business momentum and attractive relative valuations. |

The following comparisons summarize the principal investment strategies of each Fund.

| | Hartford Global Growth HLS Fund (Acquired Fund) | Hartford Disciplined Equity HLS Fund

(Acquiring Fund) |

| Principal Investment Strategies | The Acquired Fund invests primarily in a diversified portfolio of common stocks covering abroad range of countries, industries and companies. Under normal market and economic conditions, the Acquired Fund invests at least 65% of its net assets in common stocks of growth companies located worldwide, including the United States. The Acquired Fund has no limit on the amount of assets that may be invested in each country. The Acquired Fund may invest in a broad range of market capitalizations, but tends to focus on mid to large capitalization companies with market capitalizations greater than $1 billion. Securities in which the Acquired Fund invests are denominated in both U.S. dollars and foreign currencies and may trade in both U.S. and foreign markets. | Under normal circumstances, the Acquiring Fund invests at least 80% of its assets in common stocks. The Acquiring Fund invests in a diversified portfolio of common stocks of issuers located primarily in the United States. Wellington Management Company LLP (“Wellington Management”), the Acquiring Fund’s sub-adviser, chooses the Acquiring Fund’s investments using fundamental research designed to identify issuers with improving quality metrics, business momentum and attractive relative valuations. The fundamental research emphasizes the sustainability of a business’s competitive advantages, revenue and margin |

| | Hartford Global Growth HLS Fund (Acquired Fund) | Hartford Disciplined Equity HLS Fund

(Acquiring Fund) |

| | The Acquired Fund may invest up to 25% of its net assets in securities of companies that conduct their principal business activities in emerging markets or whose securities are traded principally on exchanges in emerging markets. Under normal circumstances, the Acquired Fund will invest at least 40% of its net assets in foreign securities or derivative instruments or other investments with exposure to foreign securities of at least three different countries outside the United States. During periods of unfavorable market conditions, the Acquired Fund may reduce its exposure to foreign securities, but typically will continue to invest at least 30% of its net assets in foreign securities as described above. Investments are deemed to be “foreign” if: (a) an issuer’s domicile or location of headquarters is in a foreign country; (b) an issuer derives a significant proportion (at least 50%) of its revenues or profits from goods produced or sold, investments made, or services performed in a foreign country or has at least 50% of its assets situated in a foreign country; (c) the principal trading market for a security is located in a foreign country; or (d) it is a foreign currency. The sub-adviser, Wellington Management Company LLP (“Wellington Management”), uses fundamental analysis to select securities for the Acquired Fund. Based on market or economic conditions, the Acquired Fund may, through its normal bottom-up stock selection process, focus in one or more sectors of the market. The Acquired Fund employs a multiple portfolio manager structure whereby the portfolio is divided into segments, each under a separate portfolio manager or team with its own approach. | drivers, and cash generation capacity. This research is aided by a proprietary screening tool that helps to identify companies with these characteristics. The Acquiring Fund’s portfolio seeks to be broadly diversified by industry and company. The Acquiring Fund may invest in a broad range of market capitalizations, but tends to focus on large capitalization companies with market capitalizations similar to those of companies in the S&P 500 Index. |

| Additional Investment Strategies | Wellington Management’s investment process emphasizes bottom-up research with a focus on companies with improving fundamentals exemplified by identifiable catalysts and strong earnings growth and/or high free cash flow margins and organic revenue growth. Wellington Management may also consider certain environmental, social and/or governance (ESG) factors during its assessment. Wellington Management may also consider the research provided by its Global Industry Analysts (GIAs), who provide in-depth company analysis by sector coverage, in addition to other resources and tools. In pursuit of its principal investment strategy, the Acquired Fund may use derivatives for hedging purposes, to gain exposure to certain issuers or market sectors, and/or to equitize cash. The Acquired Fund may also invest in other investment companies (including exchange traded funds (ETFs)), exchange traded notes, real estate investment trusts (REITs), depositary receipts, and restricted securities. | As part of the fundamental research discussed in the summary section, Wellington Management also evaluates the following regarding a company: capital allocation discipline, off-financial statement factors, management track record, and analysis of products and competition. Wellington Management also considers secular (longer term) and cyclical growth prospects. Wellington Management may also consider certain environmental, social and/or governance (ESG) factors during its assessment. Wellington Management may also consider the research provided by its Global Industry Analysts (GIAs), who provide in-depth company analysis by sector coverage, in addition to other resources and tools. As of December 31, 2019, the market capitalization of companies included in the S&P 500 Index ranged from approximately $4.58 billion to $1.30 trillion. The market capitalization range of the index changes over time. In pursuit of its principal investment strategy, the Acquiring Fund may invest in securities of foreign issuers and non-dollar securities and may also use derivatives for hedging purposes, to gain exposure to certain issuers or market sectors, and/or to equitize cash. The derivatives in which the Acquiring Fund may invest include exchange and over-the-countertraded transactions including, but not limited to, futures, options and similar derivative instruments or combinations thereof. The Acquiring Fund may also invest in other investment companies (including exchange traded funds (ETFs)), exchange traded notes, real estate investment trusts (REITs), and restricted securities. |

The Funds are subject to similar principal risks; however, the degree to which each Fund is subject to any particular investment risk will depend on the extent to which the Fund is invested in a particular security or types of securities that expose the Fund to such risk. Each Fund is subject to the following principal risks: Market Risk, Active Investment Management Risk, Equity Risk, Securities Lending Risk, and Large Shareholder Transaction Risk. The Acquired Fund is also subject to the following principal risks: Asset Allocation Risk, Growth Investing Style Risk, Mid-Cap Securities Risk, Foreign Investments Risk, Emerging Markets Risk, and Currency Risk.

The descriptions of these principal risks are described in the “COMPARISON OF THE PRINCIPAL RISKS” section below.

Comparison of the Fees and Expenses of the Acquired Fund and the Acquiring Fund

Fees and Expenses

The fees and expenses of each Fund and estimated pro forma fees and expenses after giving effect to the Reorganizations of Hartford Global Growth HLS Fund and Hartford Growth Opportunities HLS Fund into Hartford Disciplined Equity HLS Fund (“Disciplined Equity Reorganizations”) are shown in the table below. The fees and expenses of each Fund are based on the fees and expenses of the Funds for the twelve months ended December 31, 2019; except as noted in the footnotes to the tables below. Pro forma fees and expenses show estimated fees and expenses of the Acquiring Fund after giving effect to the Disciplined Equity Reorganizations. Pro forma numbers are estimated in good faith and are hypothetical. The tables below describe the fees and expenses that you may pay if you buy and hold shares of the Funds. Please note that fees and expenses in this table and the example below do not include fees and expenses that will be applied at the variable contract level or by a qualified pension or retirement plan and would be higher if such fees and expenses were included.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| | Hartford Global Growth HLS

Fund (Acquired Fund) | Hartford Disciplined Equity

HLS Fund (Acquiring Fund) | Hartford Disciplined Equity

HLS Fund (Acquiring Fund) Pro Forma(1) |

| Share Classes | IA | IB | IA | IB | IA | IB |

| Management fees | 0.75% | 0.75% | 0.68%(2) | 0.68%(2) | 0.57%(3) | 0.57%(3) |

| Distribution and/or service (12b-1) fees | None | 0.25% | None | 0.25% | None | 0.25% |

| Other expenses | 0.05% | 0.05% | 0.05% | 0.05% | 0.04% | 0.04% |

| Total annual fund operating expenses | 0.80% | 1.05% | 0.73% | 0.98% | 0.61% | 0.86% |

| (1) | Reflects pro forma amounts following the Disciplined Equity Reorganizations. |

| (2) | “Management fees” have been restated to reflect current fees. |

| (3) | “Management fees” have been restated to reflect the new management fee that will be effective upon the closing of the Reorganization. |

Example

The examples below are intended to help you compare the cost of investing in the Funds and in the Acquiring Fund (after the Disciplined Equity Reorganizations) on a pro forma basis. The examples assume that:

| · | Your investment has a 5% return each year |

| · | The Fund’s operating expenses remain the same |

| · | You reinvest all dividends and distributions |

The pro forma expense examples are estimated. The expense examples do not include the cost of the Disciplined Equity Reorganizations. Your actual costs may be higher or lower. Based on these assumptions, you would pay the following expenses whether or not you were to redeem your investment at the end of each time period indicated:

| | Year 1 | Year 3 | Year 5 | Year 10 |

| Share Classes | IA | IB | IA | IB | IA | IB | IA | IB |

Hartford Global Growth HLS Fund (Acquired Fund) | $82 | $107 | $255 | $334 | $444 | $579 | $990 | $1,283 |

Hartford Disciplined Equity HLS Fund (Acquiring Fund) | $75 | $100 | $233 | $312 | $406 | $542 | $906 | $1,201 |

Hartford Disciplined Equity HLS Fund (Acquiring Fund) Pro Forma(1) | $62 | $88 | $195 | $274 | $340 | $477 | $762 | $1,061 |

| (1) | Reflects pro forma amounts following the Disciplined Equity Reorganizations. |

Portfolio Turnover

The Funds pay transaction costs, such as commissions, when they buy and sell securities (or “turn over” their portfolios). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or in the example, affect a Fund’s performance. During the most recent fiscal year ended on December 31, 2019, the portfolio turnover rate for the Acquired Fund was 49% of the average value of its portfolio. During the most recent fiscal year ended on December 31, 2019, the portfolio turnover rate for the Acquiring Fund was 15% of the average value of its portfolio.

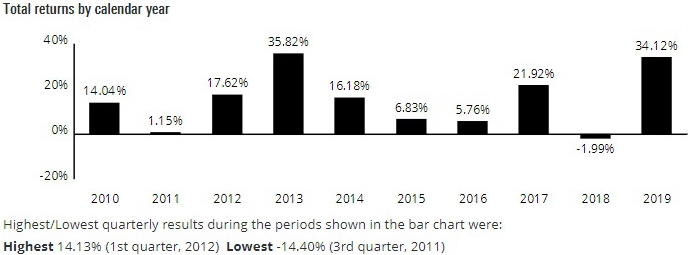

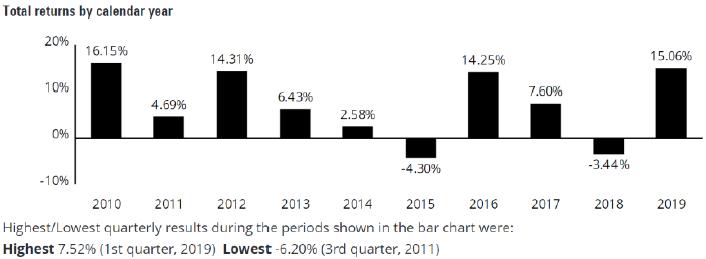

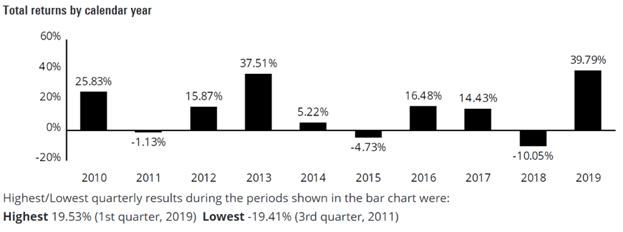

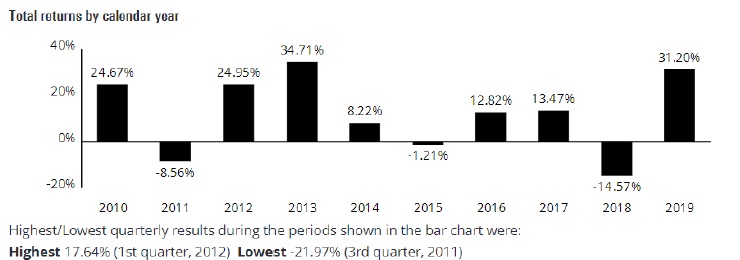

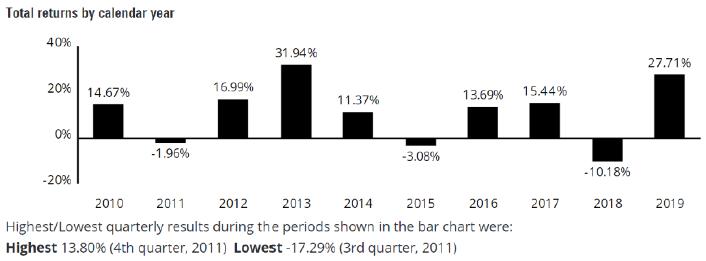

Performance of the Acquired Fund and the Acquiring Fund

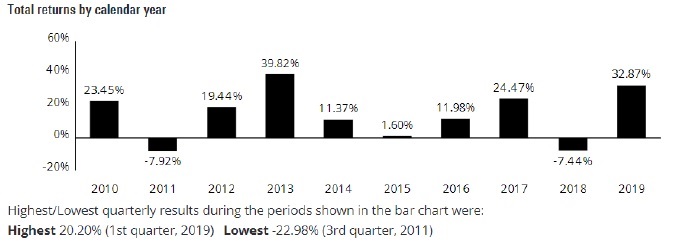

The performance information below indicates the risks of investing in each Fund. Keep in mind that past performance does not indicate future results. Updated performance information is available at hartfordfunds.com. With respect to each Fund, the returns in the bar chart and table:

| · | Assume reinvestment of all dividends and distributions |

| | · | Would be lower if the effect of sales charges or other fees that may be applied at the contract or plan level were included |

With respect to each Fund, the bar chart:

| · | Shows how the Fund’s total return has varied from year to year |

| | · | Shows the returns of the Fund’s Class IA shares. Returns for the Fund’s other classes differ only to the extent that the classes do not have the same expenses. |

The table following each Fund’s bar chart shows returns for the Fund over time compared to those of the Fund’s benchmark. Please see the section entitled “Performance Notes” for the benchmark descriptions.

The Acquired Fund

The year-to-date return for the Acquired Fund’s Class IA shares as of March 31, 2020 was -14.21%.

Average annual total returns for periods ending December 31, 2019

| Share Classes | | 1 Year | | 5 Years | | 10 Years |

| Class IA | | | 32.61% | | | | 13.28% | | | | 12.67% | |

| Class IB | | | 32.29% | | | | 12.98% | | | | 12.38% | |

| MSCI World Growth Index (Net) (reflects reinvested dividends net of withholding taxes but reflects no deduction for fees, expenses or other taxes) | | | 33.68% | | | | 11.09% | | | | 11.08% | |

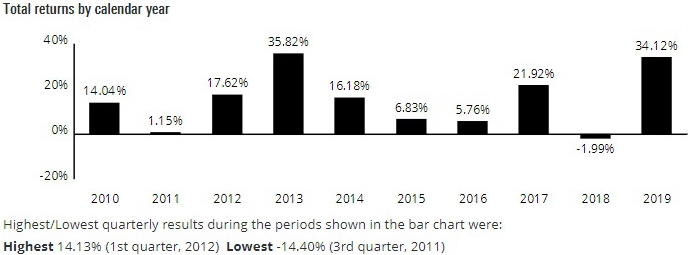

The Acquiring Fund

The year-to-date return for the Acquiring Fund’s Class IA shares as of March 31, 2020 was -19.79%.

Average annual total returns for periods ending December 31, 2019

| Share Classes | | 1 Year | | 5 Years | | 10 Years |

| Class IA | | | 34.12% | | | | 12.61% | | | | 14.51% | |

| Class IB | | | 33.76% | | | | 12.33% | | | | 14.22% | |

| S&P 500 Index (reflects no deduction for fees, expenses or taxes) | | | 31.49% | | | | 11.70% | | | | 13.56% | |

SYNOPSIS – COMPARISON OF HARTFORD GROWTH OPPORTUNITIES HLS FUND AND HARTFORD DISCIPLINED EQUITY HLS FUND

Comparison of the Investment Objectives, Fundamental Investment Restrictions, Principal Investment Strategies and Principal Risks

The investment objective of each Fund is similar. The Acquired Fund seeks capital appreciation. The Acquiring Fund seeks growth of capital. Each Fund’s investment objective may be changed by the Board without approval of the shareholders of the Fund. Each Fund has the same fundamental investment restrictions. Each Fund has some similar principal investment strategies, but there are some differences in the Funds’ principal investment strategies that you should consider.

| · | Each Fund invests in common stocks. Under normal circumstances, the Acquired Fund invests primarily in a diversified portfolio of common stocks. In comparison, under normal circumstances, the Acquiring Fund invests at least 80% of its assets in common stocks (“80% Policy”). The 80% Policy is a non-fundamental policy that may be changed by the Board without shareholder approval upon 60 days’ prior notice to shareholders. In contrast, the Acquired Fund has not adopted a similar policy. |

| · | Each Fund invests in a broad range of market capitalizations. However, the Acquired Fund tends to focus on mid to large capitalization stocks while the Acquiring Fund tends to focus on large capitalization companies with market capitalizations similar to those of companies in the S&P 500 Index. As of December 31, 2019, the market capitalization of companies included in the S&P 500 Index ranged from approximately $4.58 billion to $1.30 trillion. The market capitalization range of the S&P 500 Index changes over time. |

| · | Each Fund may invest in foreign securities. The Acquired Fund may invest up to 25% of its net assets in foreign issuers and non-dollar securities. While the Acquiring Fund is permitted to invest in foreign securities and non-dollar securities, the Acquiring Fund has not invested in foreign securities or non-dollar securities to a material extent during the past year. |

| · | With respect to each Fund, the sub-adviser uses fundamental analysis to identify securities to purchase. With respect to the Acquired Fund, the sub-adviser invests in common stocks that it believes exhibit long-term growth potential. In comparison, the sub-adviser chooses the Acquiring Fund’s investments using fundamental research designed to identify issuers with improving quality metrics, business momentum and attractive relative valuations. |

The following comparisons summarize the principal investment strategies of each Fund.

| | Hartford Growth Opportunities HLS Fund

(Acquired Fund) | Hartford Disciplined Equity HLS Fund

(Acquiring Fund) |

| Principal Investment Strategies | Under normal circumstances, the Acquired Fund invests primarily in a diversified portfolio of common stocks covering a broad range of industries, companies and market capitalizations that the sub-adviser, Wellington Management Company LLP (“Wellington Management”), believes exhibit long-term growth potential. The Acquired Fund may invest in securities of companies of any market capitalization, but tends to focus on mid to large capitalization stocks. The Acquired Fund may invest up to 25% of its net assets in foreign issuers and non-dollar securities. The Acquired Fund may trade securities actively. Wellington Management uses fundamental analysis to identify companies with accelerating operating characteristics for purchase. Based on market or economic conditions, the Acquired Fund may, through its normal bottom-up stock selection process, focus in one or more sectors of the market. | Under normal circumstances, the Acquiring Fund invests at least 80% of its assets in common stocks. The Acquiring Fund invests in a diversified portfolio of common stocks of issuers located primarily in the United States. Wellington Management Company LLP (“Wellington Management”), the Acquiring Fund’s sub-adviser, chooses the Acquiring Fund’s investments using fundamental research designed to identify issuers with improving quality metrics, business momentum and attractive relative valuations. The fundamental research emphasizes the sustainability of a business’s competitive advantages, revenue and margin drivers, and cash generation capacity. This research is aided by a proprietary screening tool that helps to identify companies with these characteristics. The Acquiring Fund’s portfolio seeks to be broadly diversified by industry and company. The Acquiring Fund may invest in a broad range of market capitalizations, but tends to focus on large capitalization companies with market capitalizations similar to those of companies in the S&P 500 Index. |

| Additional Investment Strategies | Fundamental analysis of a company involves the qualitative and quantitative assessment of such factors as its business environment, management quality, balance sheet, income statement, anticipated earnings, revenues and dividends, and other related measures or indicators of valuation and growth potential. As part of its fundamental analysis, Wellington Management may also consider certain environmental, social and/or governance (ESG) factors during its assessment. Wellington | As part of the fundamental research discussed in the summary section, Wellington Management also evaluates the following regarding a company: capital allocation discipline, off-financial statement factors, management track record, and analysis of products and competition. Wellington Management also considers secular (longer term) and cyclical growth prospects. |

| | Hartford Growth Opportunities HLS Fund

(Acquired Fund) | Hartford Disciplined Equity HLS Fund

(Acquiring Fund) |

| | Management may also consider the research provided by its Global Industry Analysts (GIAs), who provide in-depth company analysis by sector coverage, in addition to other resources and tools. In pursuit of its principal investment strategy, the Acquired Fund may also use derivatives for hedging purposes, to gain exposure to certain issuers or market sectors, and/or to equitize cash. The derivatives in which the Acquired Fund may invest include exchange and over-the-counter traded transactions. The Acquired Fund may also invest in other investment companies (including exchange traded funds (ETFs)), exchange traded notes, real estate investment trusts (REITs), and restricted securities, including private placements. | Wellington Management may also consider certain environmental, social and/or governance (ESG) factors during its assessment. Wellington Management may also consider the research provided by its Global Industry Analysts (GIAs), who provide in-depth company analysis by sector coverage, in addition to other resources and tools. As of December 31, 2019, the market capitalization of companies included in the S&P 500 Index ranged from approximately $4.58 billion to $1.30 trillion. The market capitalization range of the index changes over time. In pursuit of its principal investment strategy, the Acquiring Fund may invest in securities of foreign issuers and non-dollar securities and may also use derivatives for hedging purposes, to gain exposure to certain issuers or market sectors, and/or to equitize cash. The derivatives in which the Acquiring Fund may invest include exchange and over-the-countertraded transactions including, but not limited to, futures, options and similar derivative instruments or combinations thereof. The Acquiring Fund may also invest in other investment companies (including exchange traded funds (ETFs)), exchange traded notes, real estate investment trusts (REITs), and restricted securities. |

The Funds are subject to similar principal risks; however, the degree to which each Fund is subject to any particular investment risk will depend on the extent to which the Fund is invested in a particular security or types of securities that expose the Fund to such risk. Each Fund is subject to the following principal risks: Market Risk, Active Investment Management Risk, Equity Risk, Securities Lending Risk, and Large Shareholder Transaction Risk. The Acquired Fund is also subject to the following principal risks: Active Trading Risk, Growth Investing Style Risk, Mid-Cap Securities Risk, Foreign Investments Risk, Currency Risk, and Sector Risk. The descriptions of the principal risks are described in the “COMPARISON OF THE PRINCIPAL RISKS” section below.

Comparison of the Fees and Expenses of the Acquired Fund and the Acquiring Fund

Fees and Expenses

The fees and expenses of each Fund and estimated pro forma fees and expenses after giving effect to the Reorganizations of Hartford Global Growth HLS Fund and Hartford Growth Opportunities HLS Fund into Hartford Disciplined Equity HLS Fund (“Disciplined Equity Reorganizations”) are shown in the table below. The fees and expenses of each Fund are based on the fees and expenses of the Funds for the twelve months ended December 31, 2019; except as noted in the footnotes to the tables below. Pro forma fees and expenses show estimated fees and expenses of the Acquiring Fund after giving effect to the Disciplined Equity Reorganizations. Pro forma numbers are estimated in good faith and are hypothetical. The tables below describe the fees and expenses that you may pay if you buy and hold shares of the Funds. Please note that fees and expenses in this table and the example below do not include fees and expenses that will be applied at the variable contract level or by a qualified pension or retirement plan and would be higher if such fees and expenses were included.

Annual Fund Operating Expenses (expenses that you pay each year as a percentage of the value of your investment)

| | Hartford Growth Opportunities

HLS Fund (Acquired Fund) | Hartford Disciplined Equity HLS

Fund (Acquiring Fund) | Hartford Disciplined Equity HLS

Fund (Acquiring Fund) Pro Forma(1) |

| Share Classes | IA | IB | IC | IA | IB | IC | IA | IB | IC |

| Management fees | 0.61% | 0.61% | 0.61% | 0.68%(2) | 0.68%(2) | 0.68%(2) | 0.57%(3) | 0.57%(3) | 0.57%(3) |

Distribution and/or service (12b-1) fees | None | 0.25% | 0.25% | None | 0.25% | 0.25% | None | 0.25% | 0.25% |

| Total other expenses | 0.04% | 0.04% | 0.29% | 0.05% | 0.05% | 0.30%(4) | 0.04% | 0.04% | 0.29%(4) |

| Administrative services fee | None | None | 0.25% | None | None | 0.25% | None | None | 0.25% |

| Other expenses | 0.04% | 0.04% | 0.04% | 0.05% | 0.05% | 0.05% | 0.04% | 0.04% | 0.04% |

| Total annual fund operating expenses | 0.65% | 0.90% | 1.15% | 0.73% | 0.98% | 1.23% | 0.61% | 0.86% | 1.11% |

| (1) | Reflects pro forma amounts following the Disciplined Equity Reorganizations. |

| (2) | “Management fees” have been restated to reflect current fees. |

| (3) | “Management fees” have been restated to reflect the new management fee that will be effective upon the closing of the Reorganization. |

| (4) | “Total other expenses” are based on estimated amounts for the current year. |

Example

The examples below are intended to help you compare the cost of investing in the Funds and in the Acquiring Fund (after the Disciplined Equity Reorganizations) on a pro forma basis. The examples assume that:

| · | Your investment has a 5% return each year |

| · | The Fund’s operating expenses remain the same |

| · | You reinvest all dividends and distributions |

The pro forma expense examples are estimated. The expense examples do not include the cost of the Disciplined Equity Reorganizations. Your actual costs may be higher or lower. Based on these assumptions, you would pay the following expenses whether or not you were to redeem your investment at the end of each time period indicated:

| | Year 1 | Year 3 | Year 5 | Year 10 |

| Share Classes | IA | IB | IC | IA | IB | IC | IA | IB | IC | IA | IB | IC |

| Hartford Growth Opportunities HLS Fund (Acquired Fund) | $66 | $92 | $117 | $208 | $287 | $365 | $362 | $498 | $633 | $810 | $1,108 | $1,398 |

| Hartford Disciplined Equity HLS Fund (Acquiring Fund) | $75 | $100 | $125 | $233 | $312 | $390 | $406 | $542 | $676 | $906 | $1,201 | $1,489 |

Hartford Disciplined Equity HLS Fund (Acquiring Fund) Pro Forma(1) | $62 | $88 | $113 | $195 | $274 | $353 | $340 | $477 | $612 | $762 | $1,061 | $1,352 |

| (1) | Reflects pro forma amounts following the Disciplined Equity Reorganizations. |

Portfolio Turnover

The Funds pay transaction costs, such as commissions, when they buy and sell securities (or “turn over” their portfolios). A higher portfolio turnover rate may indicate higher transaction costs. These costs, which are not reflected in annual fund operating expenses or in the example, affect a Fund’s performance. During the most recent fiscal year ended on December 31, 2019, the portfolio turnover rate for the Acquired Fund was 66% of the average value of its portfolio. During the most recent fiscal year ended on December 31, 2019, the portfolio turnover rate for the Acquiring Fund was 15% of the average value of its portfolio.

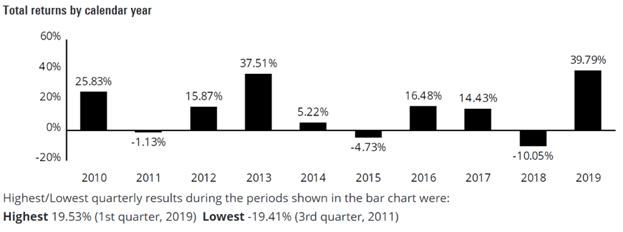

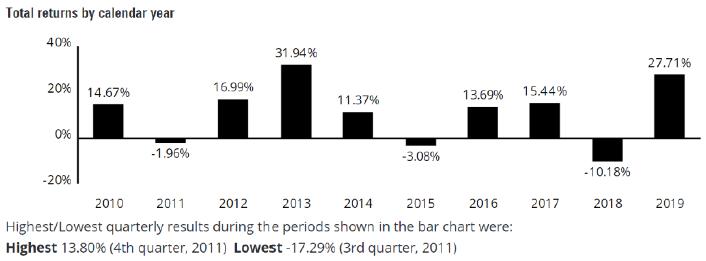

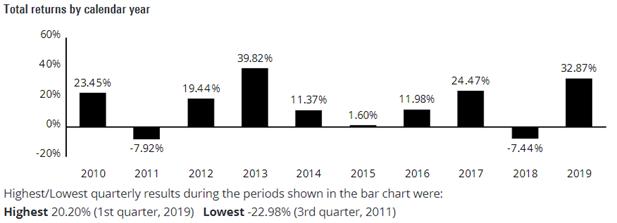

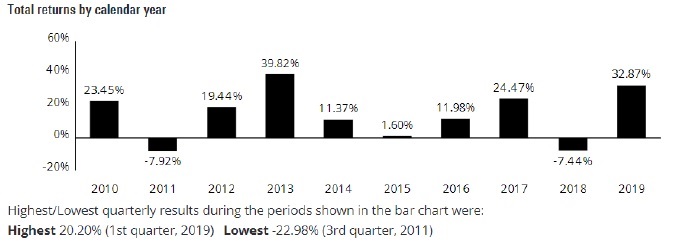

Performance of the Acquired Fund and the Acquiring Fund

The performance information below indicates the risks of investing in each Fund. Keep in mind that past performance does not indicate future results. Updated performance information is available at hartfordfunds.com.

With respect to each Fund, the returns in the bar chart and table:

| · | Assume reinvestment of all dividends and distributions |

| · | Would be lower if the effect of sales charges or other fees that may be applied at the contract or plan level were included |

With respect to each Fund, the bar chart:

| · | Shows how the Fund’s total return has varied from year to year |

| · | Shows the returns of the Fund’s Class IA shares. Returns for the Fund’s other classes differ only to the extent that the classes do not have the same expenses. |

The table following each Fund’s bar chart shows returns for the Fund over time compared to those of the Fund’s benchmark(s). The Acquired Fund’s Class IC shares commenced operations on April 30, 2014 and performance prior to that date reflects the Acquired Fund’s Class IA shares performance adjusted to reflect the 12b-1 fee of 0.25% and the administrative services fee of 0.25% applicable to Class IC shares. As of the date of this Information Statement/Prospectus, Class IC shares of the Acquiring Fund have not commenced operations. Performance information for Class IC shares of the Acquiring Fund reflects the performance of the Acquiring Fund’s Class IA shares adjusted to reflect the 12b-1 fee of 0.25% and the administrative services fee of 0.25% applicable to Class IC shares. Please see the section entitled “Performance Notes” for the benchmark descriptions.

The Acquired Fund

The year-to-date return for the Acquired Fund’s Class IA shares as of March 31, 2020 was -13.15%.

Average annual total returns for periods ending December 31, 2019

| Share Classes | | 1 Year | | 5 Years | | 10 Years |

| Class IA | | | 30.68% | | | | 13.76% | | | | 14.91% | |

| Class IB | | | 30.35% | | | | 13.48% | | | | 14.62% | |

| Class IC | | | 30.04% | | | | 13.20% | | | | 14.34% | |

| Russell 3000 Growth Index (reflects no deduction for fees, expenses or taxes) | | | 35.85% | | | | 14.23% | | | | 15.05% | |

| Russell 1000 Growth Index (reflects no deduction for fees, expenses or taxes) | | | 36.39% | | | | 14.63% | | | | 15.22% | |

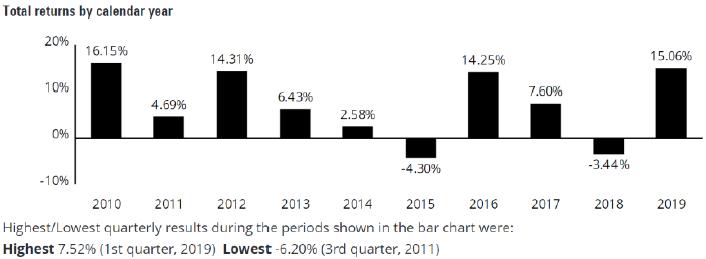

The Acquiring Fund

The year-to-date return for the Acquiring Fund’s Class IA shares as of March 31, 2020 was -19.79%.

| Average annual total returns for periods ending December 31, 2019 |

| Share Classes | 1 Year | 5 Years | 10 Years |

| Class IA | 34.12% | 12.61% | 14.51% |

| Class IB | 33.76% | 12.33% | 14.22% |

| Class IC | 33.46% | 12.05% | 13.94% |

| S&P 500 Index (reflects no deduction for fees, expenses or taxes) | 31.49% | 11.70% | 13.56% |

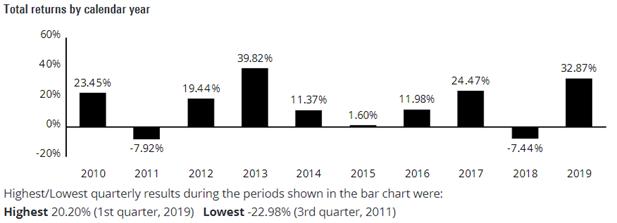

SYNOPSIS – COMPARISON OF Hartford MidCap Growth HLS Fund AND Hartford MidCap HLS Fund

Comparison of the Investment Objectives, Fundamental Investment Restrictions, Principal Investment Strategies and Principal Risks

The investment objective of each Fund is the same. Each Fund seeks long-term growth of capital. Each Fund’s investment objective may be changed by the Board without approval of the shareholders of the Fund. Each Fund has the same fundamental investment restrictions. Each Fund has some similar principal investment strategies, but there are some differences in the Funds’ principal investment strategies that you should consider.

| · | Each Fund invests at least 80% of its assets in common stocks of mid-capitalization companies. |

| · | Each Fund may invest in foreign securities. The Acquired Fund may invest up to 15% of its net assets in securities of foreign issuers and non-dollar securities. While the Acquiring Fund is permitted to invest in foreign securities and non-dollar securities, the Acquiring Fund has not invested in foreign securities or non-dollar securities to a material extent during the past year. |

| · | With respect to each Fund, the sub-adviser uses fundamental analysis to identify securities to purchase. With respect to the Acquired Fund, the sub-adviser uses fundamental analysis to identify securities that it believes have superior growth potential. In comparison, the sub-adviser favors companies that it believes are high-quality with respect to the Acquiring Fund. |

The following comparisons summarize the principal investment strategies of each Fund.

| | Hartford MidCap Growth HLS Fund

(Acquired Fund) | Hartford MidCap HLS Fund (Acquiring Fund) |

| Principal Investment Strategies | Under normal circumstances, the Acquired Fund invests at least 80% of its assets in common stocks of mid-capitalization companies. The Acquired Fund may invest up to 15% of its net assets in securities of foreign issuers and non-dollar securities. The sub-adviser, Wellington Management Company LLP (“Wellington Management”), uses fundamental analysis to identify securities that it believes have superior growth potential. Based on market or economic conditions, the Acquired Fund may, through its normal bottom-up stock selection process, focus in one or more sectors of the market. The Acquired Fund defines mid-capitalization companies as companies with a market capitalization within the collective range of the Russell Midcap Index and the S&P MidCap 400 Index. As of December 31, 2019, this range was approximately $824 million to $78.72 billion. The market capitalization range of these indices changes over time. | The Acquiring Fund seeks its investment objective by investing primarily in stocks selected by the sub-adviser, Wellington Management Company LLP (“Wellington Management”), on the basis of potential for capital appreciation. Under normal circumstances, the Acquiring Fund invests at least 80% of its assets in common stocks of mid-capitalization companies. Wellington Management favors companies that it believes are high-quality. The key characteristics of high-quality companies include a leadership position within an industry, a strong balance sheet, a high return on equity, and/or a strong management team. Based on market or economic conditions, the Acquiring Fund may, through its normal bottom-up stock selection process, focus in one or more sectors of the market. The Acquiring Fund defines mid-capitalization companies as companies with market capitalizations within the collective range of the Russell Midcap and S&P MidCap 400 Indices. As of December 31, 2019, this range was approximately $824 million to $78.72 billion. The market capitalization range of these indices changes over time. |