Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

x | Definitive Proxy Statement | |||||

¨ | Definitive Additional Materials | |||||

¨ | Soliciting Material Pursuant to §240.14a-12 |

American Tower Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

March 31, 2004

Dear Stockholder:

It is a pleasure to invite you to our 2004 Annual Meeting in Boston, Massachusetts on Thursday, May 6, 2004 at 11:00 a.m., local time, at the offices of Palmer & Dodge LLP, 20th Floor, 111 Huntington Avenue, Boston, Massachusetts 02199. We have included the official notice of meeting, proxy statement and form of proxy with this letter. The proxy statement describes in detail the matters listed in the notice of meeting.

The vote of every stockholder is important. Therefore, I urge you to sign and date the enclosed proxy card and promptly return it in the enclosed envelope so that your shares will be represented at the meeting. Alternatively, you may also vote your shares over the Internet. Please refer to the enclosed proxy card for detailed instructions. You may withdraw your proxy and vote in person at the meeting if you wish to do so.

Your Board of Directors and management look forward to greeting those of you who are able to attend.

Sincerely,

James D. Taiclet, Jr.

Chairman of the Board, President and

Chief Executive Officer

Table of Contents

AMERICAN TOWER CORPORATION

116 Huntington Avenue

Boston, Massachusetts 02116

NOTICE OF 2004 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 6, 2004

To the Stockholders:

The 2004 Annual Meeting of Stockholders of American Tower Corporation, a Delaware corporation, will be held at the offices of Palmer & Dodge LLP, 20th Floor, 111 Huntington Avenue, Boston, Massachusetts 02199 on Thursday, May 6, 2004 at 11:00 a.m., local time, to consider and act upon the following matters:

| 1. | To elect five Directors for the ensuing year or until their successors are elected and qualified; |

| 2. | To ratify the selection of Deloitte & Touche LLP as our independent auditors for 2004; and |

| 3. | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

Stockholders of record at the close of business on March 30, 2004 are entitled to notice of, and to vote at, the Annual Meeting. Our stock transfer books will remain open for the transfer of our Class A Common Stock. For a period of ten days prior to the Annual Meeting, a complete list of the stockholders entitled to vote at the Annual Meeting will be available at our principal executive offices for inspection by any stockholder of record for any purpose germane to the Annual Meeting.

By order of the Board of Directors,

William H. Hess

Executive Vice President, General Counsel and

Secretary

Boston, Massachusetts

March 31, 2004

| WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE COMPLETE, DATE AND SIGN THE ENCLOSED PROXY CARD AND PROMPTLY MAIL THE PROXY CARD IN THE ENCLOSED ENVELOPE IN ORDER TO ASSURE REPRESENTATION OF YOUR SHARES AT THE ANNUAL MEETING. NO POSTAGE NEED BE AFFIXED IF THE PROXY CARD IS MAILED WITHIN THE UNITED STATES. ALTERNATIVELY, PLEASE VOTE OVER THE INTERNET BY FOLLOWING THE INSTRUCTIONS ON THE ENCLOSED PROXY CARD. |

Table of Contents

Table of Contents

AMERICAN TOWER CORPORATION

116 Huntington Avenue

Boston, Massachusetts 02116

PROXY STATEMENT

FOR THE 2004 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 6, 2004

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of American Tower Corporation, a Delaware corporation, for use at the 2004 Annual Meeting of Stockholders to be held on May 6, 2004, or any adjournments or postponements thereof.

We are mailing this Proxy Statement together with our Annual Report to Stockholders for the year ended December 31, 2003, on or about April 5, 2004. Our Annual Report to Stockholders includes a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2003, as filed with the Securities and Exchange Commission, or SEC, on March 12, 2004, except that exhibits are excluded.

Record Date, Voting Rights and Outstanding Shares

The Board of Directors has fixed March 30, 2004 as the record date for determining holders of our Common Stock who are entitled to vote at the Annual Meeting.

With respect to the matters submitted for vote at the Annual Meeting, each share of Class A Common Stock is entitled to one vote. On March 30, 2004, 221,086,441 shares of our Class A Common Stock were outstanding and entitled to vote. In February 2004, all outstanding shares of Class B Common Stock were converted into shares of Class A Common Stock on a one-for-one basis pursuant to the occurrence of the “Dodge Conversion Event” as defined in our charter. Also in February 2004, all outstanding shares of Class C Common Stock were voluntarily converted into shares of Class A Common Stock on a one-for-one basis by the holders of such shares.

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the shares of Class A Common Stock issued and outstanding on March 30, 2004, will constitute a quorum for the transaction of business. We will count votes withheld, abstentions and broker non-votes for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting.

Stockholders who do not attend the Annual Meeting in person may submit proxies by mail or over the Internet. Proxies in the enclosed form and proxies properly submitted over the Internet, if received in time for voting and not revoked, will be voted at the Annual Meeting in accordance with the instructions contained therein. If no instructions are indicated, the shares represented by the proxy will be voted:

| • | FOR the election of the Director nominees named herein; |

| • | FORthe ratification of the selection of Deloitte & Touche LLP as our independent auditors for fiscal year 2004; and |

| • | In accordance with the judgment of the proxy holders as to any other matter that may be properly brought before the Annual Meeting, or any adjournments or postponements thereof. |

We will not count shares that abstain from voting on a particular matter, and shares held in “street name” by brokers or nominees who indicate on their proxies that they do not have discretionary authority to vote the shares

Table of Contents

as to a particular matter (“broker non-votes”), as votes in favor of such matter. We will also not count them as votes cast or shares voting on such matter. Accordingly, abstentions and broker non-votes will have no effect on the outcome of voting on the matters to be voted on at the Annual Meeting that require the affirmative vote of a certain percentage or a plurality of the votes cast on a matter.

You may vote by any one of the following means:

| • | by mail; |

| • | over the Internet; or |

| • | in person, at the Annual Meeting. |

To vote by mail, sign, date and complete the enclosed proxy card and return it in the enclosed self-addressed envelope. No postage is necessary if the proxy card is mailed in the United States. Instructions for voting over the Internet can be found on your proxy card. If you hold your shares through a bank, broker or other nominee, it will give you separate instructions for voting your shares.

Any stockholder giving a proxy has the power to revoke it at any time before it is exercised. You may revoke the proxy by filing an instrument of revocation or a duly executed proxy bearing a later date with our Secretary, at our principal executive offices, 116 Huntington Avenue, Boston, Massachusetts 02116. You may revoke a proxy submitted over the Internet and submit a new proxy in its place in accordance with the instructions set forth on the Internet voting website. You may also revoke a proxy by attending the Annual Meeting and voting in person. If not revoked, we will vote the proxy at the Annual Meeting in accordance with your instructions indicated on the proxy card or, if submitted over the Internet, as indicated on the submission.

We will bear all costs of solicitation of proxies. In addition to solicitations by mail, our Directors, officers and regular employees, without additional remuneration, may solicit proxies by telephone, telecopy and personal interviews. We will request brokers, banks, custodians and other fiduciaries to forward proxy soliciting material to the beneficial owners of stock they hold of record. We will reimburse them for their reasonable out-of-pocket expenses incurred in connection with the distribution of the proxy materials.

Security Ownership of Certain Beneficial Owners and Management

The following sets forth certain information known to us as of February 29, 2004, with respect to the shares of Class A Common Stock that are beneficially owned as of such date by:

| • | each Director; |

| • | each person who served as Chief Executive Officer during the fiscal year ended December 31, 2003, and the four other most highly compensated executive officers who were serving as executive officers on December 31, 2003, whom we refer to collectively as the Named Executive Officers; |

| • | all Directors and executive officers as a group; and |

| • | each person known by us to beneficially own more than 5% of our outstanding Class A Common Stock. |

We determined the number of shares of Class A Common Stock beneficially owned by each person under rules promulgated by the SEC, and the information is not necessarily indicative of beneficial ownership for any

2

Table of Contents

other purpose. Under these rules, beneficial ownership includes any shares as to which the individual or entity has sole or shared voting power or investment power and also any shares which the individual or entity had the right to acquire within sixty days of February 29, 2004 through the exercise of an option, conversion feature or similar right. We refer to these options as Presently Exercisable Options. All percentages are based on the shares of Class A Common Stock outstanding as of February 29, 2004. Except as noted below, each holder has sole voting and investment power with respect to all shares of Class A Common Stock listed as owned by that holder.

Name and Address of Beneficial Owner | Number of Shares | Percent of Class A Common Stock | |||

Directors and Named Executive Officers | |||||

James D. Taiclet, Jr. (1) | 333,000 | * | |||

Steven B. Dodge (2) | 11,146,403 | 4.96 | % | ||

Raymond P. Dolan (3) | 25,000 | * | |||

J. Michael Gearon, Jr. (4) | 1,499,159 | * | |||

William H. Hess (5) | 81,400 | * | |||

Carolyn F. Katz (6) | — | — | |||

Fred R. Lummis (7) | 1,239,248 | * | |||

Steven J. Moskowitz (8) | 546,000 | * | |||

Pamela D.A. Reeve (9) | 27,500 | * | |||

Bradley E. Singer (10) | 362,500 | * | |||

Mary Agnes Wilderotter (11) | 97,000 | * | |||

All executive officers and Directors as a group (12 persons) (12) | 15,402,527 | 6.78 | % | ||

Five Percent Stockholders | |||||

Wellington Management Company, LLP (13) | 17,750,635 | 8.06 | % | ||

FMR Corp. (14) | 31,164,116 | 14.14 | % |

*Less than 1%

| (1) | Includes 8,000 shares of Class A Common Stock owned by Mr. Taiclet and Presently Exercisable Options to purchase an aggregate of 325,000 shares of Class A Common Stock. |

| (2) | Mr. Dodge retired as our Chief Executive Officer in October 2003. On February 13, 2004, Mr. Dodge retired from the Board of Directors and his position as Chairman. On such date, Mr. Dodge and his affiliates voluntarily elected to convert on a one-for-one basis all of their shares of Class B Common Stock, which were entitled to ten votes per share, into shares of Class A Common Stock, which are entitled to one vote per share. All beneficial ownership information about Mr. Dodge and his affiliates reflects this conversion and is as of February 13, 2004. Includes 2,106,799 shares of Class A Common Stock owned by Mr. Dodge, an aggregate of 88,737 shares of Class A Common Stock owned by three trusts for the benefit of Mr. Dodge’s children, 4,790,000 shares of Class A Common Stock owned by a limited liability company, of which Mr. Dodge is the sole member, 5,000 shares of Class A Common Stock owned by Mr. Dodge’s wife and 5,000 shares of Class A Common Stock owned by a charitable foundation of which Mr. and Mrs. Dodge are trustees. Mr. Dodge’s wife and a third party serve as co-trustees for the three trusts. Mr. Dodge disclaims beneficial ownership of all shares owned by such trusts, the charitable foundation and his wife. Includes Presently Exercisable Options to purchase an aggregate of 4,150,867 shares of Class A Common Stock. |

| (3) | Includes Presently Exercisable Options to purchase an aggregate of 25,000 shares of Class A Common Stock. |

| (4) | Includes 496,225 shares of Class A Common Stock owned by Mr. Gearon and an aggregate of 413,483 shares of Class A Common Stock owned by limited partnerships that Mr. Gearon controls. Does not include 520,799 shares of Class A Common Stock held by a trust for the benefit of Mr. Gearon’s children, of which J. Michael Gearon, Sr. is the trustee. Mr. Gearon disclaims beneficial ownership in all shares owned by such trust. Includes Presently Exercisable Options to purchase an aggregate of 589,451 shares of Class A Common Stock. We currently intend to issue approximately 2,204,000 shares of our Class A Common Stock to Mr. Gearon in connection with our acquisition of his interest in our Mexican subsidiary, ATC Mexico Holding Corp. See “Corporate Governance – Certain Relationships and Related Party Transactions.” |

3

Table of Contents

| (5) | Includes 150 shares of Class A Common Stock owned by Mr. Hess and Presently Exercisable Options to purchase an aggregate of 81,250 shares of Class A Common Stock. On July 14, 2004, Mr. Hess will have the right to receive up to approximately 622,000 shares of our Class A Common Stock in exchange for his interest in ATC Mexico Holding Corp. See “Corporate Governance – Certain Relationships and Related Party Transactions.” |

| (6) | Ms. Katz was elected to the Board in February 2004 and as of that month, held no equity securities of the Company. |

| (7) | Includes 69,105 shares of Class A Common Stock owned by Mr. Lummis, an aggregate of 256,252 shares of Class A Common Stock owned by trusts of which he is trustee, and 324,349 shares of Class A Common Stock owned by Summit Capital, Inc., an affiliate of Mr. Lummis by reason of Mr. Lummis’s 50% ownership of its common stock. Mr. Lummis disclaims beneficial ownership of all shares owned by the trusts and Summit Capital, except to the extent of his pecuniary interest therein. Includes Presently Exercisable Options to purchase an aggregate of 589,542 shares of Class A Common Stock. |

| (8) | Includes 3,000 shares of Class A Common Stock owned by Mr. Moskowitz and Presently Exercisable Options to purchase an aggregate of 543,000 shares of Class A Common Stock. |

| (9) | Includes Presently Exercisable Options to purchase 27,500 shares of Class A Common Stock. |

| (10) | Includes 5,000 shares of Class A Common Stock owned by Mr. Singer and Presently Exercisable Options to purchase an aggregate of 357,500 shares of Class A Common Stock. |

| (11) | Includes 4,500 shares of Class A Common Stock held indirectly by a family trust and Presently Exercisable Options to purchase an aggregate of 92,500 shares of Class A Common Stock. |

| (12) | Includes Presently Exercisable Options to purchase an aggregate of 6,826,927 shares of Class A Common Stock. |

| (13) | The address of Wellington Management Company, LLP (WMC) is 75 State Street, Boston, Massachusetts 02109. Based on WMC’s Schedule 13G filed February 12, 2004, MFS has shared voting power over 15,845,725 shares of Class A Common Stock, and sole dispositive power over 17,750,635 shares of Class A Common Stock. |

| (14) | The address of FMR Corp. (FMR) is 82 Devonshire Street, Boston, Massachusetts 02109. Based on FMR’s Schedule 13G filed February 17, 2004 and certain information known to the Company, Edward C. Johnson III and FMR have sole voting power over 1,692,146 shares of Class A Common Stock and dispositive power over 27,387,601 shares of Class A Common Stock. FMR’s Schedule 13G indicates that certain subsidiaries and affiliates of FMR are considered beneficial owners of such shares, as follows: Fidelity Management & Research Company, a wholly owned subsidiary of FMR, is the beneficial owner of 27,387,601 shares of Class A Common Stock (includes 1,259,843 shares of Class A Common Stock which may be acquired through 3.25% convertible bonds). Fidelity Management Trust Company, a wholly owned subsidiary of FMR, is the beneficial owner of 1,692,146 shares of Class A common stock (includes 170,486 shares of Class A Common Stock which may be acquired through 5.0% convertible bonds). Fidelity International Limited (FIL), who provides management services for certain investors, is the beneficial owner of 2,084,369 shares of Class A Common Stock. FMR and FIL are filing as if they own such shares on a joint basis. |

4

Table of Contents

ELECTION OF DIRECTORS

The Board of Directors currently consists of six Directors. In January 2004, Arnold L. Chavkin retired from the Board of Directors, and in February 2004 the Board of Directors elected Carolyn F. Katz to fill the vacancy created by Mr. Chavkin’s retirement. Also in February 2004, Steven B. Dodge retired from the Board. In March 2004, Mary Agnes Wilderotter notified the Company that she would retire from the Board at the expiration of her current term. The Board of Directors has voted to decrease its size to five directors effective as of the date of the Annual Meeting, and has nominated for election as Directors at the Annual Meeting the five Directors listed below. Mr. Taiclet and Ms. Katz are the only nominees for Director to be elected for the first time at the annual meeting. Mr. Taiclet was first recommended for nomination to the Board by our former Chief Executive Officer and Ms. Katz was recommended for nomination to the Board by an executive officer of the Company.

Persons elected at the meeting will hold office until the 2005 Annual Meeting or until their successors are elected and qualified, subject to earlier retirement, resignation or removal. If any of the nominees become unavailable to serve, we will vote the shares represented by proxies for the election of such other person as the Board of Directors may recommend. Unless otherwise instructed, we will vote all proxies we receive FOR the nominees listed below.

Required Vote

The election of Directors requires a plurality of the votes properly cast by or on behalf of the holders of Class A Common Stock at the Annual Meeting.

The Board of Directors recommends that you vote FOR the election of each of the nominees listed below to serve as our Directors until the next annual meeting or until their successors are elected and qualified.

Set forth below are the name and age of each Director, his or her principal occupation and business experience during the past five years and the names of other publicly traded companies of which he or she serves as a Director as of January 31, 2004.

Nominee | Principal Occupations and Business Experience During the Past Five Years | |

James D. Taiclet, Jr. Age 43 | Mr. Taiclet was elected Director in November 2003 and Chairman of the Board of Directors in February 2004. Mr. Taiclet has served as the Company’s Chief Executive Officer since October 2003, and as the Company’s President and Chief Operating Officer since September 2001. He joined American Tower from Honeywell International, where he served as President of Honeywell Aerospace Services. Prior to joining Honeywell in March 1999, Mr. Taiclet served as Vice President, Engine Services at Pratt & Whitney, a unit of United Technologies Corporation. Mr. Taiclet was also a consultant at McKinsey & Company, specializing in telecommunications and aerospace. | |

Raymond P. Dolan Age 46 | Mr. Dolan has been a Director and member of the Compensation Committee since February 2003, and was appointed to the Nominating and Corporate Governance Committee in January 2004. Mr. Dolan has been Chairman and Chief Executive Officer of Flarion Technologies, Inc. since May 2000. From 1996 until May 2000, Mr. Dolan was Chief Operating Officer of NextWave Telecom. Prior to joining NextWave, he was Executive Vice President of Marketing for Bell Atlantic/NYNEX Mobile. | |

5

Table of Contents

Nominee | Principal Occupations and Business Experience During the Past Five Years | |

Carolyn F. Katz Age 42 | Ms. Katz was elected a Director in February 2004. Since December 2001, Ms. Katz has been a consultant providing financial and strategic analysis for telecommunications companies. From May 2000 to October 2001, Ms. Katz served as a principal of Providence Equity Partners Inc., a private investment firm specializing in equity investments in telecommunications and media companies. From July 1984 to April 2000, Ms. Katz was employed by Goldman, Sachs & Co., most recently as a Managing Director and co-head of Emerging Communications. Ms. Katz currently serves on the board of directors of NII Holdings, Inc. | |

Fred R. Lummis Age 50 | Mr. Lummis has been a Director and member of the Audit Committee since our merger with American Tower Corporation (Old ATC), an unaffiliated company, in June 1998. Mr. Lummis was the Chairman, Chief Executive Officer and President of Old ATC from September 1994 through June 1998. From June 1998 until early 2000, Mr. Lummis served as the Chairman, President and Chief Executive Officer of Advantage Outdoor Company, L.P. Mr. Lummis has been the Managing Director of the CapStreet Group, LLC since May 2000 and the President of Summit Capital, Inc., a private investment firm, since June 1990. He serves as a director of Southwest Bancorporation of Texas. | |

Pamela D.A. Reeve Age 54 | Ms. Reeve has been a Director since March 2002. Ms. Reeve has been a member of the Audit Committee and the Nominating and Corporate Governance Committee since August 2002. Ms. Reeve previously also served as a member of our Compensation Committee. Ms. Reeve is the President and Chief Executive Officer and a director of Lightbridge, Inc., a global provider of mobile business solutions, offering products and services for the wireless telecommunications industry. Prior to joining Lightbridge in 1989, Ms. Reeve spent eleven years as a consultant and in a series of executive positions at the Boston Consulting Group, Inc. Ms. Reeve serves as a director of NMS Communications Corp. | |

6

Table of Contents

The role of our Board of Directors is to ensure that the Company is managed for the long-term benefit of our stockholders and other stakeholders. To fulfill this role, the Board has adopted corporate governance principles to assure full and complete compliance with all applicable corporate governance standards. In addition, the Board has established reporting protocols to ensure that the Board is informed regarding the Company’s activities and periodically reviews, and advises management with respect to, the Company’s annual operating plans and strategic initiatives.

During the past year, we have continued to review our corporate governance policies and practices and to compare them to those suggested by various authorities in corporate governance and the practices of other public companies. We have also continued to review the provisions of the Sarbanes-Oxley Act of 2002, the new and proposed rules of the SEC and the new listing standards of the New York Stock Exchange, or NYSE.

Based on this review, in February 2004, the Board of Directors adopted restated Corporate Governance Guidelines and a restated charter for our Nominating and Corporate Governance Committee. You can access our current committee charters, Corporate Governance Guidelines and Code of Conduct in the “Investors” section of our website, www.americantower.com, or by writing to: Anne Alter, Vice President of Finance, Investor Relations, American Tower Corporation, 116 Huntington Avenue, Boston, Massachusetts 02116.

Under NYSE rules, a Director of the Company only qualifies as “independent” if the Board of Directors affirmatively determines that the Director has no material relationship with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company). The Board has established guidelines to assist it in determining whether a Director has a material relationship with the Company under NYSE rules. Under these guidelines, a Director is not considered to have a material relationship with the Company solely on the grounds that he or she:

| • | is an executive officer or an employee, or has an immediate family member who is an executive officer, of a company that makes payments to, or receives payments from, American Tower for property or services, unless the amount of such payments or receipts, in any of the three fiscal years preceding the determination, exceeded the greater of $1 million or two percent (2%) of such other company’s consolidated gross revenues; or |

| • | is an executive officer of another company which is indebted to American Tower, or to which American Tower is indebted, unless the total amount of either company’s indebtedness to the other is more than five percent (5%) of the total consolidated assets of the company for which he or she serves as an executive officer; or |

| • | is a director of another company that does business with American Tower, provided that he or she owns less than five percent (5%) of the outstanding capital stock of the other company and recuses himself or herself from any deliberations of American Tower with respect to such other company; or |

| • | serves as an executive officer of a charitable organization, unless American Tower’s charitable contributions to the organization, in any of the three fiscal years preceding the determination, exceeded the greater of $1 million or 2% of such charitable organization’s consolidated gross revenues. |

In addition, ownership of a significant amount of the Company’s stock, by itself, does not constitute a material relationship.

For relationships not covered by the guidelines set forth above, the determination of whether a material relationship exists is made by the other members of the Board who are independent (as defined above).

7

Table of Contents

The Board has determined that each of Mr. Dolan, Mr. Lummis, Ms. Katz, Ms. Reeve and Ms. Wilderotter is “independent” under Section 303A.02(b) of the NYSE listing standards because none of them has a material relationship with the Company.

The Nominating and Corporate Governance Committee works with the Board of Directors on an annual basis to determine the appropriate characteristics, skills and experience of the Board as a whole and its individual members. The process followed by the Committee to identify and evaluate director candidates includes requests to Board members and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates and interviews of selected candidates by members of the Committee and the Board of Directors. In considering whether to recommend any particular candidate for inclusion in the Board’s slate of recommended director nominees, the Committee will apply the criteria set forth in the Company’s Corporate Governance Guidelines. These criteria include a candidate’s general understanding of marketing, finance and other elements relevant to the success of a large publicly traded company in today’s business environment, understanding of the Company’s business, and educational and professional background. The Committee evaluates each individual in the context of the Board as a whole, with the objective of recommending a group that can best perpetuate the success of the business and represent stockholder interests through the exercise of sound judgment using its diversity of experience in these various areas. In determining whether to recommend a Director for re-election, the Nominating and Governance Committee also considers the Director’s past attendance at meetings and participation in and contributions to the activities of the Board.

Stockholders may recommend individuals to the Nominating and Corporate Governance Committee for consideration as potential director candidates by submitting their names, together with appropriate biographical information and background materials to the “American Tower Nominating and Corporate Governance Committee” c/o General Counsel, American Tower Corporation, 116 Huntington Avenue, Boston, Massachusetts 02116. Assuming that appropriate biographical and background material is provided for candidates recommended by stockholders, the Nominating and Corporate Governance Committee will evaluate those candidates by following substantially the same process, and applying substantially the same criteria, as for candidates submitted by Board members.

Communications from Stockholders and Other Interested Parties

The Board will give appropriate attention to written communications submitted by stockholders and other interested parties, and will respond if and as appropriate. Absent unusual circumstances or as otherwise contemplated by committee charters, the Chairperson of the Nominating and Corporate Governance Committee will, with the assistance of the Company’s General Counsel, (1) be primarily responsible for monitoring communications from stockholders and (2) provide copies or summaries of such communications to the other Directors as he or she considers appropriate. Communications will be forwarded to all Directors if they relate to substantive matters and include suggestions or comments that the Chairperson of the Nominating and Corporate Governance Committee considers to be important for the Directors to know. In general, communications relating to corporate governance and long-term corporate strategy are more likely to be forwarded than communications relating to personal grievances and matters covered by repetitive or duplicative communications.

Stockholders and other interested parties who wish to send communications on any topic to the Board should address such communications to Pamela D.A. Reeve, Chairperson of the Nominating and Corporate Governance Committee, c/o General Counsel, American Tower Corporation, 116 Huntington Avenue, Boston, Massachusetts 02116.

8

Table of Contents

Board of Directors Meetings and Committees

During the fiscal year ended December 31, 2003, our Board held four regular meetings. Each of the current Directors who was then in office attended at least 75% of the aggregate number of meetings of our Board and all of its committees on which that Director served. One Director attended our 2003 Annual Meeting of Stockholders. We encourage, but do not require, Directors to attend the annual stockholders meeting. The Board currently has the following committees: an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. Each Committee has a charter that has been approved by the Board. All of the current members of each of the Board’s three standing committees are independent as defined under the new rules of the NYSE that become applicable to us on the date of the Annual Meeting, including, in the case of all members of the Audit Committee, the additional independence requirements of Rule 10A-3 under the Securities Exchange Act of 1934. In addition, all of the members of the Audit Committee are independent as defined by the rules of the NYSE that apply to us until the date of the Annual Meeting. On or before the expiration of Ms. Wilderotter’s term, the Board expects to appoint another member of the Board to replace Ms. Wilderotter on each of the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee.

Executive sessions of “non-management” Directors, as defined under the rules of the NYSE, are held at least four times a year. Any non-management Director can request that an additional executive session be scheduled. For each executive session, the non-management Directors appoint a non-management Director to serve as chairperson.

Audit Committee. Our Audit Committee consists of Mr. Lummis (Chairperson), Ms. Wilderotter and Ms. Reeve. Each of Mr. Lummis and Ms. Reeve is an “audit committee financial expert” under the rules of the SEC and has the accounting and/or related financial management expertise required under the rules of the NYSE. In addition, our Board of Directors has determined that each member of the Audit Committee is financially literate. None of the members serve on the audit committees of more than two other public companies. During the fiscal year ended December 31, 2003, the Audit Committee held nine meetings. The meetings were designed to facilitate and encourage communications between members of the Audit Committee, our internal auditors, and our independent auditors, Deloitte & Touche LLP. Our Audit Committee oversees management’s conduct of our financial reporting processes and meets privately, outside the presence of management, with our auditors to discuss our internal accounting controls and policies and procedures. This includes the selection and evaluation of our independent auditors, the oversight of our systems of internal accounting and financial controls, the review of the annual independent audit of our financial statements, the review of our financial disclosures, the review of the Company’s Code of Conduct, the establishment of “whistle-blowing” procedures, and the oversight of other compliance matters.

Compensation Committee. Our Compensation Committee consists of Ms. Wilderotter (Chairperson) and Mr. Dolan, who became a member in February 2003. Mr. Chavkin served on this committee until January 2004 and Ms. Reeve served on this committee from May 2002 through February 2003. During the fiscal year ended December 31, 2003, the Compensation Committee held four meetings. The primary responsibilities of the Compensation Committee are to assist the Board in establishing compensation policies for the Board and the Company’s executive officers, including approval of any employment agreements or arrangements with executive officers. This committee also is responsible for administering the Company’s stock option plans and approving any proposed amendments or modifications to our Amended and Restated 1997 Stock Option Plan (the “Stock Option Plan”).

Nominating and Corporate Governance Committee. Our Nominating and Corporate Governance Committee consists of Ms. Reeve (Chairperson), Mr. Dolan and Ms. Wilderotter. Mr. Chavkin served on this committee until January 2004. During the fiscal year ended December 31, 2003, the Nominating and Corporate Governance Committee held four meetings. This committee assists the Board by establishing performance criteria for the annual evaluation of the Board and its committees and identifying and recommending qualified individuals to serve on the Board and its committees. In addition, this committee assists the Board in developing and

9

Table of Contents

recommending Corporate Governance Guidelines (including the appropriate size, composition and responsibilities of the Board and its committees), and generally advises the Board with respect to Board committee charters, composition and protocol.

The Audit Committee of the Company’s Board of Directors is composed of three members and acts under a written charter as amended and restated in February 2003. The members of the Audit Committee are independent Directors, as required by the Audit Committee Charter, and as defined by the rules of the NYSE and the SEC. The Audit Committee held nine meetings during the fiscal year ended December 31, 2003.

The Audit Committee reviewed the Company’s audited financial statements for the fiscal year ended December 31, 2003 and discussed these financial statements with the Company’s management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements. Management is responsible for the Company’s financial reporting process, including its system of internal controls, and for the preparation of consolidated financial statements in accordance with generally accepted accounting principles. The Company’s independent auditors, Deloitte & Touche LLP, are responsible for performing an independent audit of the Company’s financial statements in accordance with generally accepted auditing standards and for issuing a report on the financial statements. The Audit Committee’s responsibility is to monitor and review these processes. The Audit Committee also reviewed and discussed with Deloitte & Touche LLP the audited financial statements and the matters required by Statement on Auditing Standards No. 61, as amended (Communication with Audit Committees).

The Company’s independent auditors also provided the Audit Committee with the written disclosures and the letter required by Independence Standards Board Standard No. 1 (Independence Discussions with Audit Committees). Independence Standards Board Standard No. 1 requires auditors annually to disclose in writing all relationships that in the auditor’s professional opinion may reasonably be thought to bear on independence, to confirm their independence and to engage in a discussion of independence. The Audit Committee also considered whether the independent auditors’ provision of other, non-audit related services to the Company is compatible with maintaining such auditors’ independence.

Based on its discussions with management and the independent auditors, and its review of the representations and information provided by management and the independent auditors, the Audit Committee recommended to the Company’s Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2003.

By the Audit Committee of the Board of Directors of American Tower Corporation.

AUDIT COMMITTEE

Fred R. Lummis, Chairperson

Pamela D. A. Reeve

Mary Agnes Wilderotter

10

Table of Contents

Independent Auditor Fees and Other Matters

The following table presents the aggregate fees billed for services rendered by Deloitte & Touche LLP for the fiscal years ended December 31, 2003 and 2002 (in thousands):

| 2003 | 2002 | |||||

Audit Fees | $ | 2,282 | $ | 1,929 | ||

Audit Related Fees | 1,152 | 25 | ||||

Tax Fees | 1,000 | 1,248 | ||||

Total Fees | $ | 4,434 | $ | 3,202 | ||

Audit Fees. These are fees related to professional services rendered in connection with the annual audit of our consolidated financial statements, the reviews of the consolidated financial statements performed in connection with each of our Quarterly Reports on Form 10-Q, services related to comfort letters and consents related to SEC and other registration statements, consultations regarding accounting and financial reporting and statutory audits required by foreign jurisdictions.

Audit Related Fees. These fees relate to professional services provided in connection with (1) stand-alone audits of the consolidated financial statements of our Verestar, Inc. subsidiary, (2) due diligence services performed in connection with certain strategic transactions under consideration by the Company during 2003, (3) assistance with internal controls documentation in connection with our compliance under Section 404 of the Sarbanes-Oxley Act of 2002, and (4) audits of our employee benefit plans.

Tax Fees. These fees include $381 and $417 for the years ended December 31, 2003 and 2002, respectively, for professional services related to tax return compliance and related matters. In addition, tax fees also include consulting services related to tax planning and advice and assistance with international tax matters of $619 and $831 for the years ended December 31, 2003 and 2002, respectively.

Audit Committee Pre-approval Policy and Procedures. The Audit Committee has adopted policies and procedures relating to the approval of all audit and non-audit services that are to be performed by our independent auditor. This policy generally provides that we will not engage our independent auditor to render audit or non-audit services unless the service is specifically approved in advance by the Audit Committee or the engagement is entered into pursuant to one of the pre-approval procedures described below.

From time to time, the Audit Committee may pre-approve specified types of services that are expected to be provided to us by our independent auditor during the next twelve months. Any such pre-approval is detailed as to the particular service or type of services to be provided. The Audit Committee may also delegate to any member of the Audit Committee the authority to approve any audit or non-audit services to be provided by our independent auditor. Any approval of services by a member of the Audit Committee pursuant to this delegated authority is reported on at the next meeting of the Audit Committee.

The Audit Committee approved all of the services described above in accordance with its pre-approval policies and procedures.

11

Table of Contents

Certain Relationships and Related Party Transactions

In October 2001, we consummated the sale of an 8.7% interest in ATC Mexico Holding Corp. (ATC Mexico) to J. Michael Gearon, Jr., President of American Tower International, for $8.4 million. Giving effect to the January 2004 exercise of options described below, we currently own an 88% interest in ATC Mexico, which is the subsidiary through which we conduct our Mexico operations. Mr. Gearon paid $1.7 million in cash and paid the remaining portion of the purchase price with a 7% secured note due 2010 in the principal amount of $6.7 million. The note, which accrues interest and is payable quarterly, is secured by certain shares of our Class A Common Stock owned by Mr. Gearon and his interest in ATC Mexico. The purchase price represented the fair market value of an 8.7% interest in ATC Mexico on the date of the sale as determined by an independent appraiser. Pursuant to the terms of our stockholder agreement with Mr. Gearon, he may require us to purchase his interest in ATC Mexico, for its then fair market value, any time after the soonest to occur of July 1, 2004, a change in control (as defined in the stockholder agreement), or Mr. Gearon’s death or disability. In January 2003, as a result of the occurrence of a change in control, Mr. Gearon’s right to require us to purchase his interest in ATC Mexico was accelerated and became exercisable.

In January 2004, Mr. Gearon exercised his right to require us to purchase his interest in ATC Mexico. As contemplated under the stockholder agreement, in March 2004 our Board of Directors approved the determination of the fair market value of Mr. Gearon’s interest, which valuation was reviewed by an independent financial advisor. Based on this valuation, the net consideration (i.e., after repayment of Mr. Gearon’s loan from the Company) payable to Mr. Gearon is approximately $36.3 million. At our option, we may pay this amount in cash or shares of our Class A Common Stock. The number of shares will be determined based on a price of $11.30 per share, which was the closing price of our Class A Common Stock on the NYSE on March 18, 2004, and the number of shares issuable to Mr. Gearon will not change if the market price of our Class A Common Stock changes. In early April 2004, we intend to issue to Mr. Gearon approximately 2,204,000 shares of our Class A Common Stock and pay to Mr. Gearon approximately $4.2 million in cash in satisfaction of 80% of the net consideration due to him. Payment of the remaining 20% of the purchase price is contingent upon ATC Mexico satisfying certain performance criteria and will be paid, if at all, in January 2005.

The remaining 3.3% interest in ATC Mexico was reserved for issuance upon exercise of options granted to certain employees under the ATC Mexico Stock Option Plan (ATC Mexico Plan). The ATC Mexico Plan was approved by our Compensation Committee in May 2002, at which time options to acquire the remaining 3.3% interest were granted. These options became exercisable upon the exercise of Mr. Gearon’s put right, and were exercised in January 2004 by all optionees, including William H. Hess, our Executive Vice President and General Counsel, who exercised an option to purchase 144 shares of common stock of ATC Mexico for an aggregate exercise price of $1.44 million. The employees who exercised these options may require us to purchase their interests in ATC Mexico six months following the issuance of the ATC Mexico shares, which date will occur in July 2004, subject to our withholding 20% of the purchase price until January 2005 as described above. Any such purchases will be based on the March 2004 valuation and we intend to satisfy our obligation by issuing shares of our Class A Common Stock. The number of shares of our Class A Common Stock that may be issued in exchange for the ATC Mexico shares will be determined based on a price of $11.30 per share, and will not change if the market price of our Class A Common Stock changes. As a result of the exercise of his options, Mr. Hess owns a 1.4% interest in ATC Mexico. At any time after July 14, 2004, Mr. Hess may require us to purchase his interest in exchange for approximately 622,000 shares of our Class A Common Stock, subject to the 20% holdback described above.

As disclosed in our Proxy Statement for the 2001 Annual Meeting of Stockholders, in 2001 we negotiated an arrangement with Mr. Gearon pursuant to which he would purchase an equity interest in certain of our international subsidiaries, including ATC South America Holding Corp. (ATC South America), the subsidiary through which we conduct our Brazilian operations. Consistent with this arrangement, in January 2004 we entered into an agreement to sell Mr. Gearon a 1.68% interest in ATC South America for approximately $1.0 million in cash. The purchase price represented the fair market value of a 1.68% interest in ATC South America

12

Table of Contents

on the date of the agreement, as determined by an independent appraiser. Mr. Gearon may require us to purchase his interest in ATC South America, for its then fair market value, at any time after the earliest to occur of December 31, 2004 or Mr. Gearon’s death or disability, and we have the right to purchase Mr. Gearon’s interest in ATC South America, for its then fair market value, at any time after the earliest to occur of December 31, 2005, Mr. Gearon’s death or disability, or the occurrence of either a Gearon Termination Event or a Forfeiture Event (each as defined in our stockholder agreement with Mr. Gearon).

As part of Mr. Gearon’s investment, ATC South America’s Board of Directors also approved the formation of the ATC South America Stock Option Plan, which provides for the issuance of options to purchase up to an aggregate 10.32% interest in ATC South America to officers, employees, directors and consultants of ATC South America, including Mr. Gearon. In the first quarter of 2004, ATC South America granted 6,027 options to purchase shares of ATC South America common stock to officers and employees, including Messrs. Gearon and Hess, who received options to purchase shares representing a 6.72% and 1.6% interest, respectively. The exercise price per share is $1,000, which was the fair market value per share at the time of grant based on the independent appraisal referred to above. Options granted vest upon the earliest to occur of the exercise by Mr. Gearon of his right to require the Company to purchase his interest in ATC South America, or the exercise by the Company of its right to acquire Mr. Gearon’s interest in ATC South America, and expire ten years from the date of grant. The employees holding shares of ATC South America also may require the Company to purchase their interests in ATC South America, at its then fair market value, six months following their issuance.

William H. Hess, our Executive Vice President and General Counsel, received a $75,000 demand loan from us in March 2001, which was outstanding as of December 31, 2003. Interest on the loan does not accrue until demand, at which time such accrued interest is at the prime rate.

Bradley E. Singer, our Chief Financial Officer and Treasurer, received a $180,000 demand loan from us in 2001, $90,000 of which was repaid in December 2002 and the remaining $90,000 of which was repaid in June 2003.

During the past several years, we retained several wholly owned subsidiaries of Nordblom Co. Inc. to provide various real estate services in connection with our acquisition, financing, ownership and leasing of several properties. Two brothers and the father of the wife of our former Chief Executive Officer (Mr. Dodge) own the controlling interest of Nordblom Co. Inc. and Nordic Properties, an affiliate of Nordblom. Mr. Dodge’s wife has no interest in Nordblom Co. Inc. or Nordic Properties and Mr. Dodge was not involved in the negotiation of any of the arrangements. We paid the Nordblom companies, including Nordic Properties, an aggregate of $151,000 in 2003. We believe that all of the arrangements with the Nordblom companies are on terms and conditions that are customary in the industry and at least as favorable to us as could be obtained from an unrelated real estate management company.

In December 2002, in connection with a potential financing transaction between us and SPO Partners II, LP (SPO), we entered into a letter agreement with SPO, which at the time was a holder of more than 5% of our Class A Common Stock. The agreement provided for a $2.0 million break-up fee (plus expenses) payable to SPO in the event that we consummated an alternative financing transaction. As a result of our 12.25% senior subordinated discount notes and warrants offering in January 2003, we paid the $2.0 million break-up fee to SPO and reimbursed their related expenses during the year ended December 31, 2003.

13

Table of Contents

COMPENSATION AND OTHER INFORMATION CONCERNING DIRECTORS AND OFFICERS

In 2003, our standard compensatory arrangement with our non-employee Directors was as follows: a $40,000 annual payment, paid on a quarterly basis, for serving on the Board, and an additional $10,000 annual payment for serving as the chairperson of a Board committee. In addition, Directors are eligible to receive options to purchase shares of our Class A Common Stock, although no grants were made to Directors during 2003 except for a grant to Mr. Dolan of an option to purchase 25,000 shares in connection with his election to the Board in February 2003. The option granted to Mr. Dolan was immediately exercisable for 100% of the underlying shares and will expire ten years from the date of grant.

The following table provides certain information concerning compensation earned by each of the Named Executive Officers for the fiscal years ended December 31, 2003, 2002 and 2001:

Summary Compensation Table

| Annual Compensation | Long-Term Compensation | |||||||||||||||

| Year | Salary | Bonus | Other Annual Compensation | Securities Underlying Options | All Other Compensation (1) | |||||||||||

James D. Taiclet, Jr. (2) | 2003 | $ | 550,000 | $ | 185,000 | – | 375,000 | $ | 16,040 | |||||||

Chairman of the Board, President and Chief Executive Officer | 2002 2001 | | 500,000 156,250 | | 150,000 – | – – | 300,000 500,000 | | 137,542 3,210 | | ||||||

Steven B. Dodge (3) | 2003 | 550,000 | – | – | 300,000 | 1,384,388 | (4) | |||||||||

Former Chairman of the Board and Chief Executive Officer | 2002 2001 | | 200,000 220,395 | | 100,000 – | – – | 300,000 – | | 44,374 3,971 | | ||||||

J. Michael Gearon, Jr. (5) | 2003 | 375,000 | 115,000 | – | 250,000 | 6,979 | ||||||||||

President, American Tower International and Vice Chairman, American Tower Corporation | 2002 2001 | | 200,000 268,750 | | 100,000 – | – – | 100,000 – | | 3,662 3,461 | | ||||||

Steven J. Moskowitz (6) | 2003 | 375,000 | 145,000 | – | 275,000 | 15,760 | ||||||||||

Executive Vice President and President, U.S. Tower Division | 2002 2001 | | 300,000 282,292 | | 125,000 – | – – | 450,000 10,000 | | 11,782 11,915 | | ||||||

Bradley E. Singer (7) | 2003 | 575,000 | 175,000 | – | 275,000 | 22,436 | ||||||||||

Chief Financial Officer and Treasurer | 2002 2001 | | 475,000 325,000 | | 150,000 – | – – | 510,000 – | | 21,643 20,903 | | ||||||

William H. Hess (8) | 2003 | 275,000 | 110,000 | – | 100,000 | 10,172 | ||||||||||

Executive Vice President, General Counsel and Secretary | 2002 2001 | | 220,000 166,667 | | 100,000 67,273 | – – | 100,000 100,000 | | 5,473 2,571 | | ||||||

| (1) | Included in this category for 2003 are amounts paid with respect to the Named Executive Officers for: (A) matching contributions to our 401(k) plan of $3,500, $2,100, $3,500, $3,220, $3,500 and $3,500, respectively; (B) imputed income for group term life insurance provided by the Company of $540, $2,288, $479, $540, $486 and $532, respectively; (C) automobile expenses of $12,000, $3,000, $12,000, $12,000 and $5,000 for Messrs. Taiclet, Gearon, Moskowitz, Singer and Hess, respectively; (D) original issue discount on loans to Messrs. Singer and Hess of $6,450 and $1,140, respectively; and (E) tax planning and preparation fees paid on behalf of Mr. Dodge of $15,000. |

| (2) | Mr. Taiclet joined the Company in September 2001 as President and Chief Operating Officer. He was elected Chief Executive Officer in October 2003 and Chairman of the Board in February 2004. |

14

Table of Contents

| (3) | Mr. Dodge served as Chairman of the Board, President and Chief Executive Officer through September 3, 2001; Chairman and Chief Executive Officer from September 2001 through October 2003; and Chairman until February 2004. |

| (4) | In connection with Mr. Dodge’s retirement as our Chief Executive Officer, we adopted a retirement plan providing for the lump-sum payment of $1,365,000 to Mr. Dodge. In addition to the retirement plan compensation, in November 2003 the Compensation Committee granted an immediately exercisable option to Mr. Dodge to purchase 300,000 shares of our Class A Common Stock. |

| (5) | Mr. Gearon served as an Executive Vice President until December 2001. |

| (6) | Mr. Moskowitz served as our Executive Vice President-Tower Division in 2003 and 2002 and as Executive Vice President—Marketing and Vice President and General Manager of Northeast Region in 2001. |

| (7) | Mr. Singer joined the Company in September 2000 as Executive Vice President—Strategy. He served as Executive Vice President—Finance and Vice President and General Manager of Southeast Region in 2001. |

| (8) | Mr. Hess joined the Company in 2001 as Chief Financial Officer of American Tower International and was appointed Executive Vice President in May 2001. In September 2002, he was elected to his current position. |

The following table sets forth certain information relating to options granted in 2003 pursuant to our Stock Option Plan to the individuals named in the Summary Compensation Table above.

Option Grants in Last Fiscal Year

| Individual Grants | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (3) | |||||||||||||

Name | Number of Securities Underlying Options Granted | Percent of Total Options Granted to Employees in Fiscal 2003 (1) | Exercise Price Per Share (2) | Expiration Date | 5% | 10% | ||||||||

James D. Taiclet, Jr. (4) | 375,000 | 21.75% | $10.50 | 11/17/2013 | $ | 2,476,263 | $ | 6,275,361 | ||||||

Steven B. Dodge | 300,000 | 17.40 | 10.50 | 11/17/2013 | 1,981,018 | 5,020,289 | ||||||||

J. Michael Gearon, Jr. | 250,000 | 14.50 | 10.50 | 11/17/2013 | 1,650,848 | 4,183,574 | ||||||||

Steven J. Moskowitz | 275,000 | 15.95 | 10.50 | 11/17/2013 | 1,815,933 | 4,601,931 | ||||||||

Bradley E. Singer | 275,000 | 15.95 | 10.50 | 11/17/2013 | 1,815,933 | 4,601,931 | ||||||||

William H. Hess | 100,000 | 5.80 | 10.50 | 11/17/2013 | 660,339 | 1,673,430 | ||||||||

| (1) | Based on options to purchase an aggregate of 1,724,300 shares granted to our employees and Directors pursuant to our Stock Option Plan during the year ended December 31, 2003. |

| (2) | The exercise price per share of each option was equal to the closing price of our Class A Common Stock on the NYSE on the date of grant. |

| (3) | The potential realizable value is calculated based on the term of option at the time of grant. Stock price appreciation of 5% and 10% is assumed pursuant to rules promulgated by the SEC and does not represent our prediction of stock price performance. The potential realizable values at 5% and 10% appreciation are calculated by assuming that the exercise price on the date of grant appreciates at the indicated rate for the entire term of the option and that the option is exercised at the exercise price and sold on the last day of its term at the appreciated price. |

| (4) | See “Employment and Severance Agreements.” |

15

Table of Contents

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

The following table sets forth certain information regarding the unexercised options granted pursuant to our Stock Option Plan (or outstanding with respect to options granted under predecessor plans) to the individuals referred to in the Summary Compensation Table above. None of the Named Executive Officers exercised any options during 2003.

Aggregated Option Values in Last Fiscal Year

and Fiscal Year-End Option Values

| Number of Securities Underlying Unexercised Options at December 31, 2003 | Value of Unexercised In- the-Money Options at December 31, 2003 (1) | |||||||||

Name | Exercisable | Unexercisable | Exercisable | Unexercisable | ||||||

James D. Taiclet, Jr. | 325,000 | 850,000 | $ | 1,879,688 | $ | 3,339,063 | ||||

Steven B. Dodge | 4,150,867 | 285,000 | 5,382,590 | 1,750,500 | ||||||

J. Michael Gearon, Jr. | 589,451 | 395,000 | 194,500 | 663,500 | ||||||

Steven J. Moskowitz | 490,500 | 654,500 | 845,175 | 2,279,125 | ||||||

Bradley E. Singer | 307,500 | 777,500 | 846,800 | 2,628,400 | ||||||

William H. Hess (2) | 75,000 | 225,000 | 231,750 | 727,250 | ||||||

| (1) | Based on the closing price of the Class A Common Stock on the NYSE on December 31, 2003 of $10.82 per share. |

| (2) | As of December 31, 2003, Mr. Hess held an option to purchase 144 shares of our Mexican subsidiary, ATC Mexico, at an exercise price of $10,000 per share, which represents a 1.4% interest in ATC Mexico. On January 14, 2004, Mr. Hess exercised these options in connection with Mr. Gearon exercising his put right to require the Company to purchase Mr. Gearon’s 8.7% interest in ATC Mexico. After July 14, 2004, Mr. Hess may require the Company to purchase his shares of ATC Mexico for up to approximately 622,000 shares of Class A Common Stock of the Company. For more information, see “Corporate Governance – Certain Relationships and Related Party Transactions.” |

Securities Authorized For Issuance Under Equity Compensation Plans

The following table provides information about the securities authorized for issuance under our equity compensation plans as of December 31, 2003:

Equity Compensation Plan Information

Plan Category | (a) Number of securities to be issued upon exercise of outstanding options, warrants and rights | (b) Weighted-average exercise price of outstanding options, warrants and rights | (c) Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (3) | ||||

Equity compensation | 16,767,302 | $ | 10.67 | 16,828,864 | |||

Equity compensation | N/A | N/A | N/A | ||||

Total | 16,767,302 | 16,828,864 | |||||

| (1) | Includes our Stock Option Plan and our American Tower Corporation 2000 Employee Stock Purchase Plan (ESPP). All options to purchase shares of Class B Common Stock have been converted to purchase shares of Class A Common Stock. No additional options to purchase Class B Common Stock can be granted by the Company. |

16

Table of Contents

| (2) | Excludes aggregate of 597,592 shares issuable upon exercise of outstanding options granted under equity compensation plans which we assumed in connection with various merger and acquisition transactions. The weighted-average exercise price of the options under those assumed plans is $4.08. No additional options are to be granted under those assumed plans. Also excludes an aggregate of 1,060,827 shares of Class A Common Stock issuable upon exercise of outstanding options pursuant to exchanged option agreements that we entered into with certain individuals in connection with our spin-off from American Radio in June 1998. The weighted-average exercise price of options under those agreements is $6.84. |

| (3) | Includes 4,138,367 shares available for issuance under the ESPP and 12,690,497 shares available for grant under the Stock Option Plan as of December 31, 2003. The number of authorized shares under the Stock Option Plan is subject to annual increases based upon an evergreen provision. The evergreen provision provides that the number of shares authorized under the Stock Option Plan shall be increased annually by the lesser of: (a) the amount, if any, necessary so that the total shares authorized under the Stock Option Plan, including all past and future issuances, equals 12% of our outstanding Common Stock calculated based on a modified fully-diluted share basis on such date, or (b) a lesser amount as may be determined by our Board of Directors. This evergreen provision was approved by our stockholders at our Annual Meeting of Stockholders in May 2001. |

The Compensation Committee of the Board provides overall guidance for the Company’s executive compensation policies and the administration of the Company’s Stock Option Plan. The current members of the Compensation Committee are Ms. Wilderotter (Chairperson) and Mr. Dolan. Arnold L. Chavkin also served on the Committee during 2003, but resigned from the Board of Directors effective January 13, 2004. The Board intends to elect another member of the Board to the Committee at or before its next regular meeting on May 7, 2004. Each member of the Committee is an independent Director as determined by our Board of Directors, based upon the NYSE listing guidelines. This report relates to the Company’s compensation policy for its executive officers, including the Named Executive Officers, for the year ended December 31, 2003.

The Committee believes that the quality, capabilities and commitment of the Company’s senior management are critical factors affecting the long-term value of the Company. Accordingly, the Company’s executive compensation policy is designed to: (1) attract, motivate and retain the highest quality executive officers, (2) reward those officers for superior performance, and (3) establish an appropriate relationship between executive pay and the creation of long-term stockholder value. To achieve these goals, the Company’s executive compensation policy supplements annual base compensation with an opportunity to earn bonuses based upon corporate performance and factors related to each individual’s performance. In addition, the policy combines cash compensation with long-term incentive compensation in the form of stock option grants under the Company’s Stock Option Plan.

Corporate performance is measured primarily based upon objective data concerning the Company’s financial performance in light of industry conditions and the Company’s performance compared to the performance of its competitors. The performance of individual executives is evaluated on the basis of both pre-determined performance goals for the Company and factors related to the contributions of each individual. The Committee also may consider other strategic achievements, including improved operating efficiencies and customer and employee satisfaction. As in prior years, the Committee’s final determination as to any executive officer’s performance for the year is based upon its assessment of the executive’s achievement of certain goals and objectives and his or her potential to enhance long-term stockholder value, and is not based upon rigid guidelines or formulas or short-term changes in the Company’s stock price.

In establishing the total compensation package for each year and in considering appropriate performance measures, the Committee also reviews compensation practices for executives in comparable positions at a peer group of other companies in the tower and wireless telecommunications industries. This peer group may change

17

Table of Contents

from year to year depending on changes in the marketplace and the business focus of the Company, and generally will not correspond to the list of companies comprising the peer group used in the stock performance graph in this proxy statement. For 2003, the peer group used by the Committee consisted of the following companies, among others: Crown Castle International, SpectraSite Holdings, SBA Communications, Nextel Partners, Western Wireless, Triton PCS, and Lightbridge, Inc. Total compensation for all employees, including executive officers, generally is targeted at median levels for the peer group of companies.

Based on the factors and policy described above, the Compensation Committee determined the total compensation, including option grants, for each of the Named Executive Officers for 2003 as detailed in the Summary Compensation Table. The Committee based its determination primarily on the Company’s financial performance relative to its competitors, the achievement of certain strategic goals established for 2003, and each individual’s contribution to the Company’s overall performance and the achievement of these goals. In addition, during 2003 we continued our policy, adopted in 2002, of increasing total compensation for executive officers to median levels for the peer group of companies, and increased the percentage of total compensation tied to Company and individual performance to align more closely executive compensation with the creation of long-term value for stockholders.

The general policies and guidelines described above for the compensation of executive officers also apply to the compensation determinations made with respect to Mr. Dodge as the Company’s Chief Executive Officer prior to his retirement in October 2003, and to Mr. Taiclet, who was named Chief Executive Officer upon Mr. Dodge’s retirement. In addition, the Committee believed that it was appropriate to adopt a retirement plan for Mr. Dodge in recognition of his significant contributions to the Company, and for his leadership and impact on the Company as its founder and first Chairman and Chief Executive Officer. Pursuant to the retirement plan, Mr. Dodge received a lump-sum payment of $1.365 million in December 2003. In addition to the retirement plan compensation, in November 2003, the Committee granted an immediately exercisable option to Mr. Dodge to purchase 300,000 shares of the Company’s Class A Common Stock.

Section 162(m) of the Internal Revenue Code of 1986, as amended, generally disallows a tax deduction to public companies for certain compensation in excess of $1 million paid in any year to a company’s chief executive officer and the four other most highly compensated officers. Certain compensation, including qualified performance based compensation, will not be subject to the deduction limitation if certain requirements are met. Although the Compensation Committee has not adopted any specific policy with respect to the application of Section 162(m), the Committee generally seeks to structure any long-term incentive compensation granted to the Company’s executive officers in a manner that is intended to avoid disallowance of deductions under Section 162(m).

COMPENSATION COMMITTEE

Mary Agnes Wilderotter, Chairperson

Raymond P. Dolan

18

Table of Contents

Employment and Severance Arrangements

In October 2003, Mr. Dodge announced his retirement as our Chief Executive Officer. In connection with his retirement, we adopted a retirement plan providing for the lump-sum payment of $1.365 million to Mr. Dodge and non-competition and non-solicitation agreements. In addition to the retirement plan compensation, in November 2003 Mr. Dodge received an immediately exercisable option grant to purchase 300,000 shares of the Company’s Class A Common Stock under our Stock Option Plan. In January 2004, we entered into an employment agreement with Mr. Dodge, pursuant to which Mr. Dodge will perform certain duties for us on a part-time basis, as specified by the terms of such agreement. In February 2004, Mr. Dodge retired from the Board of Directors.

In November 2003 and March 2004 (with respect to Mr. Gearon), we entered into letter agreements with each of Messrs. Gearon, Hess, Moskowitz and Singer relating to their employment with the Company. Pursuant to each letter agreement, we are required to provide severance benefits to the applicable executive officer if such officer is terminated without cause (as defined in the letter agreement) or terminates his employment for good reason (as defined in the letter agreement). If such a termination occurs, the executive is entitled to receive the following severance benefits: (1) bi-weekly payment of his then current salary for eighteen months following the date of termination, (2) a prorated target cash bonus for the year of termination, (3) continued health benefits for eighteen months following the date of termination (to run concurrent with COBRA coverage), and (4) a gross-up benefit to cover any taxes payable on the receipt of the severance benefits described in this paragraph pursuant to Sections 280G and 4999 of the Internal Revenue Code. In addition, each executive will be entitled to continued vesting and extension of the exercise period for any stock options held by the executive for the earlier of three years following the date of termination and the expiration of such options (except for Mr. Gearon, whose stock options will survive for the duration of the applicable vesting period unless he is terminated for cause). The foregoing severance benefits are contingent upon each executive signing a separation and release agreement in acceptable form, which would include customary non-compete and non-solicitation provisions restricting the executive’s right to engage in the communications infrastructure business or soliciting certain employees for a period of time following termination.

In August 2001, we entered into a letter agreement with Mr. Taiclet in connection with his joining the Company. Pursuant to that letter, we agreed to pay Mr. Taiclet an initial annual salary of $500,000 and an annual salary of $550,000 for 2002, with any subsequent salary increases to be determined by our Compensation Committee. In 2002, Mr. Taiclet voluntarily agreed to forego his scheduled salary increase for 2002. We also agreed to grant Mr. Taiclet 500,000 options upon joining us, 175,000 options in the fourth quarter of 2002, and 175,000 options in the fourth quarter of each of 2003 and 2004. All such grants were or will be at fair market value on the date of issuance, subject to incremental vesting over a four year period and otherwise made in accordance with the terms of our Stock Option Plan. Pursuant to the letter agreement, Mr. Taiclet’s options will fully vest if there is a change of control (as defined in the letter). The letter also provides Mr. Taiclet a severance of his then-current annual base salary and benefits package if (1) he is terminated other than for cause (as defined in the letter), (2) he leaves voluntarily after being asked to assume a position of lesser responsibility, or (3) he leaves due to a change of control.

19

Table of Contents

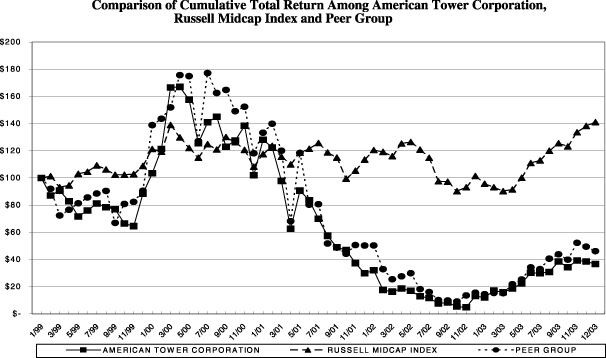

The following graph compares the cumulative total stockholder return on our Class A Common Stock with the cumulative total return of the Russell Midcap Index (Broad Market index), and the group of companies selected as our current peers in the wireless and broadcast communications site industry (the “Peer Group”).(1) The graph assumes that on December 31, 1998, $100 was invested in each of our Class A Common Stock, the Russell Midcap Index and the Peer Group. The Peer Group consists of Crown Castle International Corp., SpectraSite, Inc.(2) and SBA Communications Corp.(3)

The cumulative return shown in the graph assumes reinvestment of all dividends. The performance of our Class A Common Stock reflected below is not necessarily indicative of future performance.

| Cumulative Total Returns | ||||||||||||

| 12/31/1998 | 12/31/1999 | 12/29/2000 | 12/31/2001 | 12/31/2002 | 12/31/2003 | |||||||

American Tower Corporation | 100 | 103 | 128 | 32 | 12 | 37 | ||||||

Russell Midcap Index | 100 | 121 | 118 | 121 | 96 | 141 | ||||||

Peer Group | 100 | 139 | 133 | 50 | 14 | 46 | ||||||

| (1) | The Peer Group in prior years included Pinnacle Holdings, Inc. (Pinnacle). In 2002, Pinnacle emerged from Chapter 11 bankruptcy and merged into a privately-held corporation. As a result, Pinnacle has been removed from the Peer Group. |

| (2) | SpectraSite, Inc. (formerly SpectraSite Holdings, Inc.) (SpectraSite) emerged from Chapter 11 bankruptcy in February 2003, at which time it canceled its outstanding common stock and issued new common stock in accordance with its plan of reorganization. Information about SpectraSite is included in the Peer Group beginning in February 2003. |

| (3) | SBA Communications Corp. (SBA) became a public company in June 1999. Information about SBA is included in the Peer Group beginning at that time. |

20

Table of Contents

RATIFICATION OF SELECTION OF INDEPENDENT AUDITORS

The Audit Committee of the Board of Directors has selected, and the Audit Committee and the Board of Directors recommend stockholder ratification of, the firm of Deloitte & Touche LLP as our independent auditors for the current year. Deloitte & Touche LLP has served as our independent auditors since our inception.

Representatives of Deloitte & Touche LLP are expected to be present at the Annual Meeting. They will have the opportunity to make a statement if they so desire and will also be available to respond to appropriate questions from stockholders.

If the stockholders do not ratify the selection of Deloitte & Touche LLP as our independent auditors, the Audit Committee will reconsider their selection.

The Audit Committee and the Board of Directors recommend that the stockholders vote FOR the ratification of the selection of Deloitte & Touche LLP to serve as our independent auditors for the current fiscal year.

The Board of Directors does not know of any other matters that may come before the Annual Meeting. However, if any other matters are properly presented at the meeting, it is the intention of the persons named in the accompanying proxy or their substitutes acting thereunder, to vote, or otherwise act, in accordance with their best judgment on those matters.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our Directors, executive officers and persons who own more than ten percent of a registered class of our equity securities to file reports of ownership on Form 3 and changes in ownership on Form 4 or 5 with the SEC. Such officers, Directors and ten-percent stockholders are also required by SEC rules to furnish us with copies of all Section 16(a) reports they file. We reviewed copies of the forms received by us or written representations from certain reporting persons that they were not required to file a Form 5. Based solely on that review, we believe that, during the fiscal year ended December 31, 2003, our officers, Directors and ten-percent stockholders complied with all Section 16(a) filing requirements applicable to them.