Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| x | Preliminary Proxy Statement. |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| ¨ | Definitive Proxy Statement. |

| ¨ | Definitive Additional Materials. |

| ¨ | Soliciting Material Pursuant to §240.14a-12. |

AMERICAN TOWER CORPORATION

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

Table of Contents

April [ ], 2011

Dear Stockholder:

It is a pleasure to invite you to our 2011 Annual Meeting in Boston, Massachusetts on Wednesday, May 18, 2011 at 11:00 a.m., local time, to be held in the Braemore/Kenmore Room at the Colonnade Hotel, 120 Huntington Avenue, Boston, Massachusetts 02116. We have included the official notice of meeting, proxy statement and form of proxy with this letter. The proxy statement describes in detail the matters listed in the notice of meeting.

The vote of every stockholder is important. Therefore, I urge you to vote as soon as possible so that your shares will be represented at the meeting. You may vote your shares over the Internet, or if you received a paper copy of the proxy materials by mail, you can also vote by mail by following the instructions on the proxy card or voting instruction card. Voting over the Internet or by written proxy card or voting instruction card will ensure your representation at the meeting regardless of whether you attend in person. You may withdraw your proxy and vote in person at the meeting if you wish to do so.

Your Board of Directors and management look forward to greeting those of you who are able to attend.

Sincerely, |

|

James D. Taiclet, Jr. |

Chairman of the Board, President and Chief Executive Officer |

Table of Contents

AMERICAN TOWER CORPORATION

116 Huntington Avenue

Boston, Massachusetts 02116

NOTICE OF 2011 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 18, 2011

To the Stockholders:

The 2011 Annual Meeting of Stockholders of American Tower Corporation, a Delaware corporation, will be held in the Braemore/Kenmore Room at the Colonnade Hotel, 120 Huntington Avenue, Boston, Massachusetts 02116, on Wednesday, May 18, 2011 at 11:00 a.m., local time, to consider and act upon the following matters:

| 1. | To elect nine Directors for the ensuing year or until their successors are elected and qualified; |

| 2. | To ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for 2011; |

| 3. | To approve an amendment to American Tower Corporation’s Amended and Restated Certificate of Incorporation to reduce the threshold required for stockholders to amend its Amended and Restated By-Laws; |

| 4. | To conduct an advisory vote on executive compensation; |

| 5. | To conduct an advisory vote on whether to hold the advisory vote on executive compensation every one, two or three years; and |

| 6. | To transact such other business as may properly come before the meeting or any adjournments or postponements thereof. |

Stockholders of record at the close of business on March 22, 2011 are entitled to notice of, and to vote at, the Annual Meeting. Our stock transfer books will remain open for the transfer of our Class A common stock. For a period of ten days prior to the Annual Meeting, a complete list of the stockholders entitled to vote at the Annual Meeting will be available at our principal executive offices for inspection by any stockholder of record for any purpose germane to the Annual Meeting.

By order of the Board of Directors, |

|

| Edmund DiSanto |

| Executive Vice President, Chief Administrative Officer, General Counsel and Secretary |

Boston, Massachusetts

April [ ], 2011

WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE VOTE AS SOON AS POSSIBLE TO ENSURE REPRESENTATION OF YOUR SHARES AT THE ANNUAL MEETING. YOU MAY VOTE YOUR SHARES OVER THE INTERNET OR BY MAIL (AS APPLICABLE) BY FOLLOWING THE INSTRUCTIONS ON THE PROXY CARD OR VOTING INSTRUCTION CARD.

Table of Contents

| Page No. | ||||

| 1 | ||||

Notice of Electronic Availability of Proxy-Related Materials and Annual Report to Stockholders | 1 | |||

| 1 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

| 3 | ||||

Security Ownership of Certain Beneficial Owners and Management | 3 | |||

| 6 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 10 | ||||

| 11 | ||||

Communications from Stockholders and Other Interested Parties | 12 | |||

Board Leadership Structure and its Role in the Oversight of Risk | 13 | |||

| 14 | ||||

| 15 | ||||

| 17 | ||||

| 18 | ||||

COMPENSATION AND OTHER INFORMATION CONCERNING DIRECTORS AND OFFICERS | 19 | |||

| 19 | ||||

| 39 | ||||

| 40 | ||||

| 46 | ||||

| 50 | ||||

Securities Authorized for Issuance under Equity Compensation Plans | 52 | |||

PROPOSAL 2 - RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 53 | |||

PROPOSAL 3 - AMENDMENT OF AMENDED AND RESTATED CERTIFICATE OF INCORPORATION | 53 | |||

| 54 | ||||

PROPOSAL 5 - FREQUENCY OF ADVISORY VOTE ON EXECUTIVE COMPENSATION | 55 | |||

| 55 | ||||

| 55 | ||||

| 55 | ||||

| 55 | ||||

| 56 | ||||

| 56 | ||||

ANNEX A - FORM OF PROPOSED AMENDMENT TO AMENDED AND RESTATED CERTIFICATE OF INCORPORATION | A-1 | |||

Table of Contents

AMERICAN TOWER CORPORATION

116 Huntington Avenue

Boston, Massachusetts 02116

PROXY STATEMENT

FOR THE 2011 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 18, 2011

This Proxy Statement is furnished in connection with the solicitation of proxies by the Board of Directors of American Tower Corporation, a Delaware corporation, for use at the 2011 Annual Meeting of Stockholders to be held on May 18, 2011, or any adjournments or postponements thereof.

Notice of Electronic Availability of Proxy-Related Materials and Annual Report to Stockholders

As permitted by rules adopted by the Securities and Exchange Commission (SEC), we are making this Proxy Statement and our Annual Report to Stockholders for the year ended December 31, 2010 available electronically via the Internet at www.proxyvote.com. Our Annual Report to Stockholders includes a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2010, as filed with the SEC on February 28, 2011, except that exhibits are excluded. On or about April [ ], 2011, we mailed to our stockholders a Notice containing instructions on how to access this Proxy Statement and our Annual Report and vote over the Internet. If you received the Notice by mail, you will not receive a printed copy of the proxy materials in the mail. Instead, the Notice instructs you on how to access and review all of the important information contained in the Proxy Statement and Annual Report over the Internet. The Notice also instructs you on how you may submit your proxy over the Internet. If you received the Notice by mail and would like to receive a printed copy of our proxy materials, you should follow the instructions for requesting such materials included in the Notice.

Record Date, Voting Rights and Outstanding Shares

The Board of Directors has fixed March 22, 2011 as the record date for determining holders of our Class A common stock (Common Stock) who are entitled to vote at the Annual Meeting.

With respect to the matters submitted for vote at the Annual Meeting, each share of Common Stock is entitled to one vote. On March 22, 2011, there were 397,418,444 shares of Common Stock outstanding and entitled to vote.

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the shares of Common Stock issued and outstanding on March 22, 2011, will constitute a quorum for the transaction of business. We will count votes withheld, abstentions and broker non-votes as present for purposes of determining the presence or absence of a quorum for the transaction of business at the Annual Meeting.

Stockholders who do not attend the Annual Meeting in person may submit proxies over the Internet. Stockholders that have received a paper copy of the proxy materials by mail may also vote by mail in accordance with the instructions on the proxy card or voting instruction card. Properly completed and submitted proxy cards and voting instruction cards, and proxies properly completed and submitted over the Internet, if received in time for voting and not revoked, will be voted at the Annual Meeting in accordance with the instructions contained therein.

Directors receiving a majority of votes cast will be elected (the number of shares cast “for” a Director nominee must exceed the number of votes cast “against” that nominee). Similarly, ratification of the selection of our independent registered public accounting firm requires a majority of the votes cast (the number of shares cast

1

Table of Contents

“for” ratification of the selection of our independent registered public accounting firm must exceed the number of votes cast “against” that ratification). The approval on an advisory basis of our executive compensation requires a majority of votes cast (the number of shares cast “for” approval of our executive compensation must exceed the number of votes cast “against” that approval). The option of one year, two years or three years that receives the highest number of votes cast by our stockholders will be deemed the frequency with which stockholders are provided an advisory vote on executive compensation. Amending our Amended and Restated Certificate of Incorporation requires a majority of the shares of Common Stock outstanding as of the record date. We will not count shares that abstain from voting on a particular matter as votes cast “for” or “against” such matter.

If a stockholder holds shares through a broker or nominee and does not provide the broker or nominee with specific voting instructions, under the rules that govern brokers or nominees in such circumstances, the stockholder’s broker or nominee will have the discretion to vote such shares on routine matters, but not on non-routine matters. As a result:

| • | The stockholder’s broker or nominee will not have the authority to exercise discretion to vote such shares with respect to the following proposals, because the New York Stock Exchange (NYSE) rules treat these matters as non-routine: |

| • | Proposal 1, election of Directors; |

| • | Proposal 3, amendment of our Amended and Restated Certificate of Incorporation; |

| • | Proposal 4, advisory vote on executive compensation; and |

| • | Proposal 5, frequency of the advisory vote on executive compensation. |

| • | The stockholder’s broker or nominee will have the authority to exercise discretion to vote such shares with respect to proposal 2, ratification of the selection of our independent registered public accounting firm, because that matter is treated as routine under the NYSE rules. |

Shares held by brokers or nominees who have not received instructions from the beneficial owner (broker non-votes) will be counted as present for purposes of determining the presence or absence of a quorum but will otherwise have no effect on the outcome of the vote on any of the proposals.

If you are a registered shareowner and no instructions are indicated on the proxy materials submitted by you, the shares represented by the proxy will be voted:

| • | FOR the election of the Director nominees named herein; |

| • | FOR the ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2011; |

| • | FOR the approval of an amendment to our Amended and Restated Certificate of Incorporation to reduce the threshold required for stockholders to amend our Amended and Restated By-Laws; |

| • | FOR the approval, on an advisory basis, of the compensation of our named executive officers as disclosed in this Proxy Statement; |

| • | FOR the approval of the option of ONE YEAR as the frequency with which stockholders are provided an advisory vote on executive compensation; and |

| • | In accordance with the judgment of the proxy holders as to any other matter that may be properly brought before the Annual Meeting, or any adjournments or postponements thereof. |

2

Table of Contents

You may vote by any one of the following means:

| • | By Internet—Stockholders who received a Notice about the Internet availability of our proxy materials may submit proxies over the Internet by following the instructions on the Notice. Stockholders who have received a paper copy of a proxy card or voting instruction card by mail may submit proxies over the Internet by following the instructions on the proxy card or voting instruction card. |

| • | By Mail—Stockholders who have received a paper copy of a proxy card or voting instruction card by mail may submit proxies by completing, signing and dating their proxy card or voting instruction card and mailing it in the accompanying self-addressed envelope. No postage is necessary if mailed in the United States. |

| • | In person, at the Annual Meeting. |

Although the advisory votes on executive compensation are non-binding, our Compensation Committee will consider the results of the votes and take them into account in making future determinations concerning executive compensation and the frequency of advisory votes on executive compensation.

Any stockholder giving a proxy has the power to revoke it at any time before it is exercised. You may revoke a proxy by filing an instrument of revocation or a duly executed proxy bearing a later date with our Secretary, at our principal executive offices, 116 Huntington Avenue, Boston, Massachusetts 02116. You may revoke a proxy submitted over the Internet and submit a new proxy in its place in accordance with the instructions set forth on the Internet voting website. You may also revoke a proxy by attending the Annual Meeting and voting in person. If not revoked, we will vote the proxy at the Annual Meeting in accordance with your instructions indicated on the proxy card or voting instruction card or, if submitted over the Internet, as indicated on the submission.

We will bear all costs of solicitation of proxies. In addition to solicitations by mail, our Board of Directors, our officers and our regular employees, without additional remuneration, may solicit proxies by telephone, facsimile and personal interviews. We will request brokers, banks, custodians and other fiduciaries to forward proxy soliciting materials to the beneficial owners of stock the brokers, banks, custodians and other fiduciaries hold of record. We will reimburse them for their reasonable out-of-pocket expenses incurred in connection with the distribution of the proxy materials.

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information known to us as of March 22, 2011, with respect to the shares of Common Stock that are beneficially owned as of such date by:

| • | each member of our Board of Directors; |

| • | each executive officer named in the Summary Compensation Table included in this Proxy Statement; |

| • | all Directors and executive officers as a group; and |

| • | each person known by us to beneficially own more than 5% of our outstanding Common Stock. |

We determined the number of shares of Common Stock beneficially owned by each person under rules promulgated by the SEC. The information is not necessarily indicative of beneficial ownership for any other purpose. Under these rules, beneficial ownership includes any shares as to which the individual or entity has sole

3

Table of Contents

or shared voting power or investment power and also any shares which the individual or entity had the right to acquire within sixty days of March 22, 2011. Accordingly, the number of shares set forth below includes shares underlying the restricted stock units (RSUs) or stock options that are expected to vest prior to May 21, 2011, which we collectively refer to below as presently vested equity. All percentages with respect to our Directors and executive officers are based on the shares of Common Stock outstanding as of March 22, 2011. Except as noted below, each holder has sole voting and investment power with respect to all shares of Common Stock listed as beneficially owned by that holder.

Name and Address of Beneficial Owner | Number of Shares | Percent of Common Stock | ||||||

Directors and Named Executive Officers | ||||||||

James D. Taiclet, Jr. (1) | 1,595,598 | * | ||||||

Thomas A. Bartlett (2) | 63,170 | * | ||||||

Edmund DiSanto (3) | 239,711 | * | ||||||

Raymond P. Dolan (4) | 91,285 | * | ||||||

Ronald M. Dykes (5) | 61,313 | * | ||||||

William H. Hess (6) | 303,244 | * | ||||||

Carolyn F. Katz (7) | 81,285 | * | ||||||

Gustavo Lara Cantu (8) | 48,385 | * | ||||||

Steven C. Marshall (9) | 199,255 | * | ||||||

JoAnn A. Reed (10) | 51,285 | * | ||||||

Pamela D.A. Reeve (11) | 66,285 | * | ||||||

David E. Sharbutt (12) | 61,285 | * | ||||||

Samme L. Thompson (13) | 54,543 | * | ||||||

All executive officers and Directors as a group (16 persons) (14) | 3,127,387 | * | ||||||

Five Percent Stockholders | ||||||||

BlackRock, Inc. (15) | 20,175,282 | 5.1 | % | |||||

40 East 52nd Street, New York, New York 10022 | ||||||||

FMR LLC (16) | 20,787,178 | 5.2 | % | |||||

82 Devonshire Street, Boston, Massachusetts 02109 | ||||||||

T. Rowe Price Associates, Inc. (17) | 23,731,337 | 6.0 | % | |||||

100 E. Pratt Street, Baltimore, Maryland 21201 | ||||||||

| * | Less than 1% |

| (1) | Includes 50,185 shares of Common Stock owned by Mr. Taiclet and presently vested equity with respect to an aggregate of 1,545,413 shares of Common Stock. |

| (2) | Includes 3,975 shares of Common Stock owned by Mr. Bartlett and presently vested equity with respect to an aggregate of 59,195 shares of Common Stock. |

| (3) | Includes 27,292 shares of Common Stock owned by Mr. DiSanto and presently vested equity with respect to an aggregate of 212,419 shares of Common Stock. |

| (4) | Includes 6,313 shares of Common Stock owned by Mr. Dolan and presently vested equity with respect to an aggregate of 84,972 shares of Common Stock. |

| (5) | Includes 16,341 shares of Common Stock owned by Mr. Dykes and presently vested equity with respect to an aggregate of 44,972 shares of Common Stock. |

| (6) | Includes 18,900 shares of Common Stock owned by Mr. Hess and presently vested equity with respect to an aggregate of 284,344 shares of Common Stock. |

| (7) | Includes 6,313 shares of Common Stock owned by Ms. Katz and presently vested equity with respect to an aggregate of 74,972 shares of Common Stock. |

4

Table of Contents

| (8) | Includes 8,413 shares of Common Stock owned by Mr. Lara and presently vested equity with respect to an aggregate of 39,972 shares of Common Stock. |

| (9) | Includes 13,054 shares of Common Stock owned by Mr. Marshall and presently vested equity with respect to an aggregate of 186,201 shares of Common Stock. |

| (10) | Includes 6,313 shares of Common Stock owned by Ms. Reed and presently vested equity with respect to an aggregate of 44,972 shares of Common Stock. |

| (11) | Includes 6,313 shares of Common Stock owned by Ms. Reeve and presently vested equity with respect to an aggregate of 59,972 shares of Common Stock. |

| (12) | Includes 6,313 shares of Common Stock owned by Mr. Sharbutt and presently vested equity with respect to an aggregate of 54,972 shares of Common Stock. |

| (13) | Includes 14,571 shares of Common Stock owned by Mr. Thompson and presently vested equity with respect to an aggregate of 39,972 shares of Common Stock. |

| (14) | Includes presently vested equity with respect to an aggregate of 2,923,011 shares of Common Stock. |

| (15) | Based on a Schedule 13G filed on February 3, 2011, BlackRock, Inc. has sole voting power over 20,175,282 shares of Common Stock, sole dispositive power over 20,175,282 shares of Common Stock and beneficial ownership of 20,175,282 shares of Common Stock. |

| (16) | Based on a Schedule 13G filed on February 14, 2011, FMR LLC has sole voting power over 1,418,572 shares of Common Stock, sole dispositive power over 20,787,178 shares of Common Stock and beneficial ownership of 20,787,178 shares of Common Stock. |

| (17) | Based on a Schedule 13G/A filed on February 10, 2011, T. Rowe Price Associates, Inc. has sole voting power over 6,963,970 shares of Common Stock, sole dispositive power over 23,731,337 shares of Common Stock and beneficial ownership of 23,731,337 shares of Common Stock. |

5

Table of Contents

ELECTION OF DIRECTORS

Under our By-Laws, the number of members of our Board of Directors is fixed from time to time by the Board of Directors, but may be increased or decreased either by the stockholders or by the majority of Directors then in office. We currently have nine Directors serving on our Board of Directors.

Of our nine current Directors, all are standing for re-election at the Annual Meeting. The Board of Directors has nominated for election as Directors at the Annual Meeting the nine Directors listed below. All of the Directors nominated for election at the Annual Meeting were recommended for nomination to the Board of Directors by the Nominating and Corporate Governance Committee.

Directors elected at the Annual Meeting will hold office until the 2012 Annual Meeting or until their successors are elected and qualified, subject to earlier retirement, resignation or removal. If any of the nominees becomes unavailable to serve, we will vote the shares represented by proxies for the election of such other person as the Board of Directors may recommend. Unless otherwise instructed, we will vote all proxies we receive FOR the nominees listed below.

Required Vote

Our By-Laws require that each Director receive a majority of the votes properly cast with respect to such Director in uncontested elections (the number of shares voted “for” a Director nominee must exceed the number of votes cast “against” that nominee). As the election of Directors at the Annual Meeting is uncontested, the election of Directors requires a majority of the votes cast by, or on behalf of, the holders of Common Stock at the Annual Meeting. Abstentions and broker non-votes will not be considered as votes cast “for” or “against” a Director and will have no effect on the results of the election.

If stockholders do not elect a nominee who is serving as a Director, Delaware law provides that the Director would continue to serve on the Board as a “holdover director.” Under our By-Laws and Corporate Governance Guidelines, each Director is required to submit an irrevocable advance resignation that would be effective if the stockholders do not re-elect that Director and the Board accepts his or her resignation. In that situation, within 90 days from the date that the election results were certified, the Nominating and Corporate Governance Committee would make a recommendation to the Board about whether to accept or reject the resignation. The Board would then take action and promptly disclose its decision and the rationale behind it in a filing with SEC.

The Board of Directors recommends that you vote FOR the election of each of the nominees listed below to serve as our Directors until the next Annual Meeting or until their successors are duly elected and qualified.

Our Directors bring a wealth of leadership and management experience, as well as prior board experience. The process undertaken by our Nominating and Corporate Governance Committee in selecting qualified Director candidates is described below under “Corporate Governance—Selection of Director Candidates” in this Proxy Statement. Certain individual qualifications and skills of our Directors that contribute to the Board’s effectiveness and success are described in the Director biographies below.

6

Table of Contents

Set forth below are the name and age of each Director, his or her principal occupation and business experience during the past five years, and the names of other publicly traded companies where he or she served as a Director during the past five years, each as of March 22, 2011.

Nominee | Principal Occupations and Business Experience During the Past Five Years | |

James D. Taiclet, Jr. Age 50 | Mr. Taiclet is our Chairman, President and Chief Executive Officer. Mr. Taiclet joined us in September 2001 as President and Chief Operating Officer and was named our Chief Executive Officer in October 2003. Mr. Taiclet was elected to our Board of Directors in November 2003 and was named our Chairman in February 2004. Prior to joining us, Mr. Taiclet had been President of Honeywell Aerospace Services, a part of Honeywell International, since March 1999. From March 1996 until March 1999, Mr. Taiclet served as Vice President, Engine Services at Pratt & Whitney, a unit of United Technologies Corporation. Mr. Taiclet was also previously a consultant at McKinsey & Company, specializing in telecommunications and aerospace, and prior to that, a United States Air Force officer and pilot. We believe Mr. Taiclet is qualified to sit on our Board of Directors based on his years of executive experience, including his tenure as our Chairman, President and Chief Executive Officer, as well as his operational, international, and strategic experience with global technology and wireless communications companies. | |

Raymond P. Dolan Age 53 | Mr. Dolan has been a Director and member of the Compensation Committee since February 2003. In January 2004, Mr. Dolan was appointed to the Nominating and Corporate Governance Committee, and in February 2005, he was appointed the Chairperson. Mr. Dolan currently serves as the President and Chief Executive Officer of Sonus Networks, Inc., a supplier of voice, video and data infrastructure solutions for wireline and wireless telephone service providers, a position he was appointed to in October 2010. Until January 2008, Mr. Dolan served as Chief Executive Officer of QUALCOMM Flarion Technologies and Senior Vice President at QUALCOMM. Prior to that, Mr. Dolan had been Chairman and Chief Executive Officer of Flarion Technologies, Inc., a provider of mobile broadband communications systems, since May 2000, until its acquisition by QUALCOMM in January 2006. From 1996 until May 2000, Mr. Dolan was Chief Operating Officer of NextWave Telecom. Prior to joining NextWave, he was Executive Vice President of Marketing for Bell Atlantic/NYNEX Mobile. Mr. Dolan currently serves on the board of directors of NII Holdings, Inc. We believe Mr. Dolan is qualified to sit on our Board of Directors based on his years of leadership in the wireless communications industry, combined with his operational, international, strategic and corporate governance expertise acquired through his management and board experience. | |

Ronald M. Dykes Age 64 | Mr. Dykes has been a Director since March 2007 and was appointed to the Audit Committee in July 2007. Mr. Dykes most recently served as Chief Financial Officer of BellSouth Corporation, a position he retired from in 2005. Prior to his retirement, Mr. Dykes had worked for BellSouth Corporation and its predecessor entities in various capacities for over 34 years. Mr. Dykes served on the board of directors of Burger King Holdings, Inc. and chaired its audit committee from 2007 through October 2010. From October 2000 through December 31, 2005, he also served as a director of Cingular Wireless, most recently as Chairman of the Board. We believe Mr. Dykes is qualified to sit on our Board of Directors based on his extensive management experience in communications network operations and engineering, his financial expertise with companies in the wireless communications sector, his substantial experience as a director for public companies and his years of providing strategic development and advisory services to global companies. | |

7

Table of Contents

Nominee | Principal Occupations and Business Experience During the Past Five Years | |

Carolyn F. Katz Age 49 | Ms. Katz has been a Director since February 2004 and was appointed to the Audit Committee in April 2004. In May 2007, Ms. Katz was appointed as Chairperson of the Audit Committee. From April 2004 to May 2009, Ms. Katz served on the Compensation Committee. From May 2000 to October 2001, Ms. Katz served as a principal of Providence Equity Partners Inc., a private investment firm specializing in equity investments in telecommunications and media companies. From June 1984 to April 2000, Ms. Katz was employed by Goldman, Sachs & Co., most recently as a Managing Director and co-head of Emerging Communications. Ms. Katz currently serves on the board of directors of NII Holdings, Inc. We believe Ms. Katz is qualified to sit on our Board of Directors based on her extensive knowledge of global capital markets and investment matters, as well as her financial acumen and board experience with public companies in the wireless communications industry. | |

Gustavo Lara Cantu Age 61 | Mr. Lara has been a Director since November 2004 and was appointed to the Compensation Committee in May 2009. From February 2005 to May 2009, Mr. Lara served on the Nominating and Corporate Governance Committee. Mr. Lara most recently served as Chief Executive Officer of the Monsanto Company’s Latin America North division, a position he retired from in 2004. Prior to his retirement, Mr. Lara had worked for the Monsanto Company in various capacities for over 24 years. We believe Mr. Lara is qualified to sit on our Board of Directors based on his executive and governance experience with a global company, combined with his insight into business operations in Latin America, and his knowledge of financial and business developments in Mexico. | |

JoAnn A. Reed Age 55 | Ms. Reed has been a Director since May 2007 and was appointed to our Audit Committee in November 2007. Ms. Reed most recently served as the Senior Vice President, Finance and Chief Financial Officer of Medco Health Solutions, Inc., a leading pharmacy benefit manager, until March 2008. Upon joining Medco in 1988, Ms. Reed served in finance and accounting roles of increasing responsibility and was appointed Senior Vice President, Finance in 1992 and Chief Financial Officer in 1996. Prior to joining Medco, Ms. Reed’s experience included finance roles at Aetna/American Re-Insurance Co., CBS Inc., Standard and Poor’s Corp., and Unisys/Timeplex Inc. Ms. Reed currently serves on the board of directors of DynaVox Inc. and Waters Corp. and as a Trustee for St. Mary’s College of Notre Dame, Indiana. We believe Ms. Reed is qualified to sit on our Board of Directors based on her financial expertise, board experience and her more than twenty-five years of leadership experience with multinational companies in financial, strategic and business development initiatives. | |

Pamela D.A. Reeve Age 61 | Ms. Reeve has been a Director since March 2002 and has served as the Lead Director of the Board since May 2004. In April 2004, Ms. Reeve was appointed to the Compensation Committee, and served as its Chairperson from that date until May 2009. In May 2009, Ms. Reeve was reappointed to the Nominating and Corporate Governance Committee, having served on that Committee from August 2002 to February 2005. Ms. Reeve also served on the Audit Committee from August 2002 to July 2007. From November 1989 to August 2004, Ms. Reeve was the President and Chief Executive Officer and a director of Lightbridge, Inc., a global provider of mobile business solutions, offering products and services for the wireless communications industry. Prior to joining Lightbridge in 1989, Ms. Reeve spent eleven years as a consultant and in a series of executive positions at Boston | |

8

Table of Contents

Nominee | Principal Occupations and Business Experience During the Past Five Years | |

| Consulting Group, Inc. Ms. Reeve currently serves on the board of directors of Frontier Communications Company, and had previously served as a director of NMS Communications Corp. and Livewire Mobile, Inc. We believe Ms. Reeve is qualified to sit on our Board of Directors based on her leadership, operational, strategic and corporate governance expertise particularly in the communications and technology industries, combined with her financial expertise and extensive knowledge of the Company resulting from serving on our Board for nearly a decade. | ||

David E. Sharbutt Age 61 | Mr. Sharbutt has been a Director since July 2006 and was appointed to the Nominating and Corporate Governance Committee in May 2007. Mr. Sharbutt also served on the Audit Committee from May 2007 to November 2007. Mr. Sharbutt most recently served as Chief Executive Officer and Chairman of Alamosa Holdings, Inc., a provider of wireless communications services, which was acquired by Sprint Nextel Corporation in February 2006. Mr. Sharbutt had been Alamosa’s Chairman and a director since Alamosa was founded in July 1998 and was named Chief Executive Officer of Alamosa in October 1999. Mr. Sharbutt was formerly the President and Chief Executive Officer of Hicks & Ragland Engineering Co., an engineering consulting company, now known as CHR Solutions. While at CHR Solutions, Mr. Sharbutt worked with independent telephone companies in developing strategic, engineering and implementation plans for various types of telecommunications services. We believe Mr. Sharbutt is qualified to sit on our Board of Directors based on his leadership and board experience with wireless communications companies and his financial expertise, as well as his strategic, operational and advisory roles in leading complex telecommunications enterprises. | |

Samme L. Thompson Age 65 | Mr. Thompson has been a Director since August 2005 and was appointed to the Compensation Committee in May 2006. In May 2009, he was appointed as Chairperson of the Compensation Committee. Mr. Thompson served as a director of SpectraSite, Inc. from June 2004, until our merger with SpectraSite in August 2005. Beginning in 2002 to present, Mr. Thompson has served as the President of Telit Associates, Incorporated, a financial and strategic advisory firm. Mr. Thompson worked for Motorola, Inc. as Senior Vice President and Director, Strategy and Corporate Development from 1999 to 2002. Mr. Thompson has over thirty-five years of management experience and currently serves on the board of directors of USA Mobility, Inc. Prior to the merger between Arch Wireless, Inc. and Metrocall Holdings, Inc. to form USA Mobility, Inc., Mr. Thompson was a director at Arch Wireless, Inc. We believe Mr. Thompson is qualified to sit on our Board of Directors based on his strategic and global advisory experience, combined with his prior board experience with companies in the wireless communications industry. | |

9

Table of Contents

The role of our Board of Directors is to oversee how the Company is managed for the long-term benefit of our stockholders and other stakeholders. To fulfill this role, the Board has adopted corporate governance principles to ensure full and complete compliance with all applicable corporate governance standards. In addition, the Board has established reporting protocols to ensure that it is informed regarding the Company’s activities and periodically reviews, and advises management with respect to, the Company’s annual operating plans and strategic initiatives.

During the past year, we have continued to review our corporate governance policies and practices and to compare them to those suggested by various authorities in corporate governance and the practices of other public companies. We have also continued to review guidance and interpretations provided by the SEC and the NYSE. Accordingly, in February 2009, we amended and restated our By-Laws, and in August 2010, we amended and restated the charters of our Nominating and Corporate Governance Committee, Audit Committee and Compensation Committee, as well as our Corporate Governance Guidelines. You can access our current committee charters, Corporate Governance Guidelines and Code of Conduct in the “Investors” section of our website, www.americantower.com, or by writing to: American Tower Corporation, 116 Huntington Avenue, Boston, Massachusetts 02116, Attention: Investor Relations.

Our Board of Directors conducts annual evaluations of its performance and that of each of its three standing committees. In 2010, the Board hired an independent consultant to design and implement a process for these self-evaluations. Using a set of prepared questions as a guide, the consultant conducted interview and discussion sessions with the members of each of the committees and the full Board. The information gathered in these sessions was reported to and reviewed by our Nominating and Corporate Governance Committee, which used these results to review and assess the Board’s composition, responsibilities, structure, processes and effectiveness. This report was then presented to the full Board. We expect to conduct similar Board and committee self-evaluations in 2011.

Each newly elected Director is required to participate in a customized Board orientation program at our corporate headquarters that includes information on our corporate governance policies and briefings by each of our senior operational and functional leaders on the Company’s business and practices. In addition, we offer customized standing Committee orientation programs to our Directors upon a new appointment to a standing Committee on which he or she has not previously served. We are committed to the ongoing education of our Directors, and from time to time, conduct presentations to the Board of Directors regarding corporate governance processes and practices, our business and our industry, and we typically utilize external experts in their respective fields for these presentations. Additionally, we encourage each independent Director to attend annually at least one board education course offered by either academic institutions or professional service organizations at the Company’s expense.

Under the NYSE rules, a Director of the Company only qualifies as “independent” if the Board of Directors affirmatively determines that the Director has no material relationship with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company). Included in the NYSE rules are bright-line standards for independence. The effect of the NYSE rules is to create a two-step process for determining independence. First, a Director must satisfy the bright-line standards for independence established by the NYSE. Second, the Board must affirmatively determine that the Director has no material relationship with the Company.

10

Table of Contents

As set forth in our Corporate Governance Guidelines, the Board has established guidelines to assist it in determining whether a Director has a material relationship with the Company. Under these guidelines, a Director is not considered to have a material relationship with the Company solely on the grounds that he or she:

| • | is an executive officer or employee, or has an immediate family member who is an executive officer, of a company that makes payments to, or receives payments from, American Tower for property or services, unless the amount of such payments or receipts, in any of the three fiscal years preceding the determination, exceeded the greater of $1 million or two percent (2%) of such other company’s consolidated gross revenues; or |

| • | is an executive officer of another company which is indebted to American Tower, or to which American Tower is indebted, unless the total amount of either company’s indebtedness to the other is more than five percent (5%) of the total consolidated assets of the company for which he or she serves as an executive officer; or |

| • | is a director of another company that does business with American Tower, provided that he or she owns less than five percent (5%) of the outstanding capital stock of the other company and recuses himself or herself from any deliberations of American Tower with respect to such other company; or |

| • | serves as an executive officer of any tax-exempt organization, unless American Tower’s charitable contributions to the organization, in any of the three fiscal years preceding the determination, exceeded the greater of $1 million or 2% of such charitable organization’s consolidated gross revenues. |

In addition, ownership of a significant amount of Common Stock, by itself, does not constitute a material relationship.

For relationships not covered by the guidelines set forth above, the determination of whether a material relationship exists is made by the other members of the Board who are independent (as defined above).

Based on their compliance with the guidelines established by the Board, the Board has determined that each of our non-management Directors has no material relationship with the Company and is “independent” under Section 303A.02(b) of the NYSE listing standards. In making its assessment, the Board determined that each of Messrs. Dykes and Lara and Ms. Reed had no relationship with the Company, other than being a Director or stockholder. With respect to Messrs. Dolan, Sharbutt and Thompson and Mses. Katz and Reeve, the Board determined that only immaterial relationships existed with the Company. Specifically, the Board considered that Messrs. Dolan, Sharbutt and Thompson and Mses. Katz and Reeve currently serve as directors of companies that do business with American Tower, as follows: Mr. Dolan and Ms. Katz serve as directors of NII Holdings, Inc., Mr. Sharbutt serves as a director of Flat Wireless, LLC, Mr. Thompson serves as a director of USA Mobility, Inc., and Ms. Reeve serves as a director of Frontier Communications Company. In each case, the Board determined that such service was in accordance with the NYSE listing standards and our Corporate Governance Guidelines, in that none of these Directors beneficially own five percent or more of the outstanding capital stock of such companies and each recuses himself or herself from deliberations of the Board with respect to such companies.

Selection of Director Candidates

The Nominating and Corporate Governance Committee works with the Board of Directors annually to review the characteristics, skills and experience of the Board as a whole and its individual members and to assess those traits against the needs identified to benefit the Company, its management and its stockholders. The process followed by the Committee to identify and evaluate Director candidates includes requests to Board members and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates and interviews of selected candidates by members of the Committee and the Board of Directors.

11

Table of Contents

In considering whether to recommend any particular candidate for inclusion in the Board’s slate of recommended Director nominees, the Nominating and Corporate Governance Committee applies the criteria set forth in our Corporate Governance Guidelines. These criteria include a candidate’s financial expertise, as well as a candidate’s prior experience in a leadership/executive role, operational experience, wireless industry experience, international experience, strategic/technology experience, and prior board and governance experience. The Committee has determined that these desired skills, capabilities and experiences are relevant to the success of a large publicly traded company in today’s business environment and understanding of our business. While the Committee does not assign specific weights to these criteria, any Director candidate is expected to individually possess several of these criteria to serve on our Board. A description of the individual criteria that led our Board to conclude that each of the candidates should serve as a Director until our next Annual Meeting follows the biographical information of each candidate set forth above.

In addition to reviewing the qualifications and criteria of Director candidates, the Nominating and Corporate Governance Committee considers whether a candidate has agreed to tender an irrevocable advance resignation in accordance with the Company’s Corporate Governance Guidelines. In determining whether to recommend a Director for re-election, the Committee also considers the Director’s past attendance at meetings and participation in, and contributions to, the activities of the Board.

The Nominating and Corporate Governance Committee also focuses on issues of diversity, such as traditional diversity categories such as gender, race and national origin, as well as diversity and differences in viewpoints and skills. While the Committee does not have a formal policy with respect to diversity, the Committee seeks to create a Board that is strong in its collective knowledge and has a diversity of skills, ability and experience to allow the Board the opportunity to successfully fulfill its responsibilities. The Committee evaluates each individual Director candidate in the context of the Board as a whole. In considering candidates for the Board, the Committee strives to recommend a group that can best perpetuate and enhance the success of the business and represent stockholder interests through the exercise of sound judgment using the group’s diversity of experience.

Stockholders may recommend individuals to the Nominating and Corporate Governance Committee for consideration as potential Director candidates by submitting their names, together with appropriate biographical information and background materials to Raymond P. Dolan, Chairperson of the Nominating and Corporate Governance Committee, c/o General Counsel, American Tower Corporation, 116 Huntington Avenue, Boston, Massachusetts 02116. Assuming that appropriate biographical and background material is provided for candidates recommended by stockholders, the Committee will evaluate those candidates by following substantially the same process, and applying substantially the same criteria, as for candidates submitted by Board members. The Committee will specifically review the candidate’s qualifications in light of the needs of the Board and the Company at that time, given the current mix of Director attributes. Stockholders proposing Director nominations must comply with the advance notice and specific information requirements set forth in our By-Laws, which provide among other things, disclosure of hedging, derivative interests and other material interests of that stockholder and the Director nominee. In addition, each Director nominee proposed by a stockholder must deliver a statement that, promptly following the stockholder meeting at which such nominee is elected or re-elected, he or she agrees to tender an irrevocable advance resignation in accordance with the Company’s Corporate Governance Guidelines.

Communications from Stockholders and Other Interested Parties

The Board will give appropriate attention to written communications submitted by stockholders and other interested parties, and will respond if and as appropriate. The Board has designated the Nominating and Corporate Governance Committee, which consists solely of independent Directors, to consider and determine responses to communications from stockholders and other interested parties. Stockholders and other interested parties who wish to send communications on any topic to the Board and its non-management Directors should address such communications to Raymond P. Dolan, Chairperson of the Nominating and Corporate Governance

12

Table of Contents

Committee, c/o General Counsel, American Tower Corporation, 116 Huntington Avenue, Boston, Massachusetts 02116. Stockholders proposing Director nominations or any other business for consideration at a meeting of stockholders must comply with the advance notice and related provisions set forth in our By-Laws.

Absent unusual circumstances or as otherwise contemplated by our committee charters, the Chairperson of the Nominating and Corporate Governance Committee will, with the assistance of our General Counsel, (1) be primarily responsible for monitoring communications from stockholders, and (2) provide copies or summaries of such communications to the other Directors as he or she considers appropriate. Communications will be forwarded to all Directors if those communications relate to substantive matters and include suggestions or comments that the Chairperson of the Committee considers to be important for the Directors to know. In general, communications relating to corporate governance and long-term corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs or matters that are personal or that are otherwise not relevant to the Company, including mass mailings and repetitive or duplicative communications.

Board Leadership Structure and its Role in the Oversight of Risk

The Board of Directors is led by our President and Chief Executive Officer, Mr. Taiclet. Mr. Taiclet assumed the role of Chairman of the Board in February 2004. In May 2004, Ms. Reeve was appointed Lead Director, and she continues to serve the Board in this role. Mr. Taiclet is the only management Director and Ms. Reeve was selected by the independent Directors.

The Lead Director assists the Chairman in communicating with, and assigning tasks to, the other Board members. Moreover, the Lead Director, after obtaining input from the independent Directors, works with the Chairman to establish agendas for upcoming Board meetings. The agendas are then distributed in advance of the Board meetings to the independent Directors for any further input. The Lead Director prepares and conducts the annual performance review of the Chief Executive Officer, with input from each Director on the Chief Executive Officer’s performance and achievements during the year and from the Compensation Committee on proposed compensation matters. Additionally, the Lead Director serves as chairperson of the Board’s executive sessions of non-management Directors, as defined under the rules of the NYSE. Executive sessions of non-management Directors are held at least four times a year on a quarterly basis, and any non-management Director can request that an additional executive session be scheduled. The purpose of these executive sessions is to promote open and candid discussion among the non-management Directors to consider among other things, governance, operational and strategic issues or concerns.

We believe that having a single Chairman and Chief Executive Officer with a strong Lead Director, complemented by an independent Board of Directors, has provided the appropriate balance and has helped contribute to our pursuit of sound corporate governance. The current board leadership structure offers directional clarity and allows our Board to operate more effectively and efficiently by focusing on the shared interests of the Company. This leadership structure promotes effective communication between the Board and management, which directly benefits our stockholders and other stakeholders.

The Board oversees the management of the Company’s risk exposure. At each Board meeting, management presents information concerning strategic and operational risks to the Company’s primary business goals and initiatives in each geographic area and each functional group, as well as the Company’s mitigation efforts related to those risks. The Lead Director regularly engages with the other independent directors to discuss management’s assessment of those risks in executive sessions to determine whether further review or action by the full Board or a particular committee is necessary or appropriate. In addition, each year, one Board meeting is dedicated to reviewing the Company’s strategies, including consideration of significant risks facing the Company.

The Company also conducts periodic enterprise risk management assessments and surveys to help management identify risks and mitigation procedures and measures, and assess their effectiveness. These results are then presented to the full Board of Directors. It is the responsibility of the Board to understand the

13

Table of Contents

Company’s most significant risks, to ensure that management is responding appropriately, and to make risk-informed strategic decisions. In its oversight capacity, the Board of Directors monitors risk exposure to ensure it is consistent and in balance with the Company’s overall tolerance for, and ability to, manage risk.

Each of our standing committees, which is composed of independent directors, most of whom have had extensive experience in providing strategic and advisory services to other public companies, assists the Board in fulfilling its responsibility for oversight of the evaluation of the Company’s risk and policies for risk management and assessment. At each regularly scheduled meeting, the Chairperson of each standing committee provides the full Board with a report, which includes any identified risks associated with their respective principal areas of focus.

The Audit Committee has primary responsibility for assisting the Board with risk oversight for the Company overall. In particular, the Audit Committee considers audit, accounting, financial reporting and compliance risk, including material litigation instituted against the Company and resolution of any issues raised through our Ethics Committee process. In connection with its risk oversight role, at each regularly scheduled meeting, the Audit Committee also holds separate executive sessions that often include representatives from the Company’s independent registered public accounting firm, internal audit department, finance department and legal department to identify and assess risks and oversee the methodologies management implements to address those risks.

The Compensation Committee assesses and balances risk in our compensation practices, programs and policies. Together with its independent compensation consultant and management, the Compensation Committee annually reviews the Company’s compensation plans for all employees to determine if any elements of these plans create an inappropriate level of risk and to oversee management’s methods to mitigate any potential risks.

The Nominating and Corporate Governance Committee oversees risks associated with board composition, including the current director skill set and anticipated future needs of the Company, as well as risks associated with the Company’s corporate governance structure and related party transactions.

The Board’s role in risk oversight of the Company complements the Company’s leadership structure, with senior management having responsibility for assessing and managing our risk exposure, and the Board and its committees providing oversight in connection with those efforts. We believe this division of responsibility is an effective approach to addressing the risks facing the Company and supports our current Board leadership structure, as it allows our independent directors to evaluate the Company’s risks and policies for risk management and assessment through fully independent Board committees, with ultimate oversight by the full Board as led by our Chairman and Chief Executive Officer and independent Lead Director.

Approval of Related Party Transactions

Our Corporate Governance Guidelines include a policy for the review and approval of all transactions involving the Company and related parties by the Nominating and Corporate Governance Committee. Under the policy, related parties mean our executive officers and Directors and stockholders owning in excess of five percent of our Common Stock, as well as any such person’s immediate family members. The policy also covers entities that are owned or controlled by related parties, or entities in which related parties have a substantial ownership interest or control of such entities. The policy covers any transaction that is not available to employees or Directors generally and any transaction exceeding $120,000 in which related parties have a direct or indirect material interest.

Under the policy, management will recommend to the Nominating and Corporate Governance Committee any related party transaction to be entered into by the Company, including the proposed aggregate value of the transaction. After review, the Committee will approve or disapprove the transaction and management will continue to update the Committee as to any material change to that proposed transaction. In the event a related

14

Table of Contents

party transaction is entered into by management prior to approval by the Committee, the transaction will be subject to ratification by the Committee. If ratification is not forthcoming, management will make all reasonable efforts to cancel or annul the transaction.

Board of Directors Meetings and Committees

During the year ended December 31, 2010, our Board held four regular meetings in person and six special meetings in person or by telephone. Each current Director attended at least 75% of the aggregate number of meetings of our Board and the committees on which he or she served during the period that he or she was in office. Each of the nine Directors standing for re-election at the Annual Meeting was serving as a Director as of our 2010 Annual Meeting of Stockholders. All of these nine Directors attended the 2010 Annual Meeting of Stockholders in person. We encourage, but do not require, Directors to attend our annual meeting of stockholders.

The Board currently has three standing committees: the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. Each of these committees has a charter that has been approved by the Board. These charters, along with our Corporate Governance Guidelines, are reviewed annually and amended, as necessary. All of the current members of each of the Board’s three standing committees are independent as defined under the rules of the NYSE, including, in the case of all members of the Audit Committee, the additional independence requirements of Rule 10A-3 under the Securities Exchange Act of 1934 (Exchange Act).

The current membership of each standing committee, the number of meetings held by each standing committee during the year ended December 31, 2010, and other descriptive information is summarized below.

Director | Audit Committee | Compensation Committee | Nominating and Corporate Governance Committee | |||

Raymond P. Dolan | – | X | Chair | |||

Ronald M. Dykes | X | – | – | |||

Carolyn F. Katz | Chair | – | – | |||

Gustavo Lara Cantu | – | X | – | |||

JoAnn A. Reed | X | – | – | |||

Pamela D.A. Reeve (1) | – | X | X | |||

David E. Sharbutt | – | – | X | |||

James D. Taiclet, Jr. (2) | – | – | – | |||

Samme L. Thompson | – | Chair | – | |||

Total meetings in 2010 | 8 | 6 | 4 | |||

| (1) | Ms. Reeve is the Lead Director of the Board. |

| (2) | Mr. Taiclet is the Chairman of the Board, President and Chief Executive Officer and currently the sole management Director. |

Audit Committee. Our Audit Committee consists of Ms. Katz (Chairperson), Mr. Dykes and Ms. Reed, each of whom was determined to be an audit committee financial expert under the SEC rules and to have the accounting and/or related financial management expertise required under the NYSE rules. In addition, our Board of Directors has determined that each member of the Audit Committee is financially literate. None of the members serve on the audit committees of more than two other public companies.

During the year ended December 31, 2010, the Audit Committee held eight meetings. The meetings were designed to facilitate and encourage communications between members of the Committee, management, our internal auditors, and our independent registered public accounting firm, Deloitte & Touche LLP. Our Audit Committee oversees management’s conduct of our financial reporting processes and meets privately, outside the

15

Table of Contents

presence of management, with our independent registered public accounting firm to discuss our internal accounting controls and policies and procedures. Among other things, the Committee’s responsibilities include the selection and evaluation of our independent registered public accounting firm, the oversight of our systems of internal accounting and financial controls, the review of the annual independent audit of our financial statements, the review of our financial disclosures, the review and implementation of our Code of Conduct, the establishment and implementation of “whistle-blowing” procedures, and the oversight of risk and other compliance matters.

Compensation Committee. Our Compensation Committee consists of Mr. Thompson (Chairperson), Mr. Dolan, Mr. Lara and Ms. Reeve. During the year ended December 31, 2010, the Compensation Committee held six meetings. The primary responsibilities of the Committee are to assist the Board in establishing compensation policies for the Board and our executive officers, including approval of any employment agreements or arrangements with executive officers. The Committee also reviews and approves individual and overall corporate goals and objectives related to executive compensation, evaluates executive performance in light of those goals and objectives, and determines executive compensation levels based on this evaluation, including as it relates to our President and Chief Executive Officer. This Committee also administers our equity incentive plans, approving any proposed amendments or modifications thereto, assesses and balances risk in our compensation policies and programs, and reviews Committee reports for inclusion in appropriate regulatory filings. For more information on the role of the Committee and our processes and procedures for the consideration and determination of executive compensation, see our Compensation Discussion and Analysis included in this Proxy Statement.

In establishing and reviewing compensation practices, programs and policies, the Compensation Committee, together with its independent compensation consultant and management, annually reviews the specific factors and criteria underlying the Company’s compensation plans for all employees to determine whether any elements create an inappropriate level of risk, as well as methods to mitigate any potential identified risks. In conducting its review, the Committee asks critical questions and considers, among other things, whether each plan provides for an overachievement mechanism or cap on bonus opportunity, the existence of discretionary authority, whether payouts are linked to overall Company goals, the timing of prospective payments, the inclusion of certain windfall or “claw back” provisions, the contribution of the awards to a participant’s total mix of compensation, and any risk-mitigating factors.

Nominating and Corporate Governance Committee. Our Nominating and Corporate Governance Committee consists of Mr. Dolan (Chairperson), Ms. Reeve and Mr. Sharbutt. During the year ended December 31, 2010, the Nominating and Corporate Governance Committee held four meetings. This Committee establishes performance criteria for the annual evaluation of the Board and its committees and oversees the annual self-evaluation by Board members. This Committee identifies and recommends qualified individuals to serve on the Board and its committees. In addition, this Committee develops and makes recommendations with respect to our Corporate Governance Guidelines (including the appropriate size, composition and responsibilities of the Board and its committees), approves or ratifies all related party transactions, and generally advises the Board with respect to Board committee charters, composition and protocol.

In addition to these three standing committees, in May 2006, the Board established a special committee of independent Directors to review our historical stock option granting practices and related accounting (Special Committee) and a special committee of independent Directors to review all litigation claims made against certain of our current and former officers and Directors in connection with our historical stock option granting practices and related accounting (Special Litigation Committee). Through 2010, the members of the Special Committee were Messrs. Sharbutt and Thompson and the members of the Special Litigation Committee were Ms. Katz and Mr. Thompson. On December 17, 2010, the SEC notified us that it did not intend to recommend any enforcement action, and as of December 31, 2010, all litigation claims in connection with our historical stock option granting practices and related accounting had been concluded. Accordingly, the Special Committee and Special Litigation Committee were formally disbanded as of March 31, 2011.

16

Table of Contents

The Audit Committee reviewed the Company’s audited financial statements for the fiscal year ended December 31, 2010 and discussed these financial statements with the Company’s management, including a discussion of the quality, not just the acceptability, of the accounting principles, the reasonableness of significant judgments and the clarity of disclosures in the financial statements. Management is responsible for the Company’s financial reporting process, including its system of internal controls, and for the preparation of consolidated financial statements in accordance with generally accepted accounting principles. The Company’s independent registered public accounting firm, Deloitte & Touche LLP, is responsible for performing an independent audit of the Company’s financial statements in accordance with standards of the Public Company Accounting Oversight Board (United States) (PCAOB) and issuing a report on those financial statements and the effectiveness of the Company’s internal control over financial reporting. The Audit Committee’s responsibility is to monitor and review these processes. The Audit Committee also reviewed and discussed with Deloitte & Touche LLP the audited financial statements and the matters required by Statement on Auditing Standards No. 61, as amended (Communication with Audit Committees).

The Company’s independent registered public accounting firm also provided the Audit Committee with the written disclosures and the letter required by applicable requirements of the PCAOB regarding the independent public accounting firm’s communications with the Audit Committee concerning independence. The Audit Committee has discussed with the independent registered accounting firm its independence and has considered whether such firm’s provision of other, non-audit related services to the Company is compatible with maintaining such auditors’ independence.

Based on its discussions with management and the independent registered public accounting firm, and its review of information provided by management and the independent registered public accounting firm, the Audit Committee recommended to the Company’s Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2010.

By the Audit Committee of the Board of Directors of American Tower Corporation.

AUDIT COMMITTEE

Carolyn F. Katz, Chairperson

Ronald M. Dykes

JoAnn A. Reed

17

Table of Contents

Independent Auditor Fees and Other Matters

The following table presents the aggregate fees billed for services rendered by Deloitte & Touche LLP for the fiscal years ended December 31, 2010 and 2009 (in thousands):

| 2010 | 2009 | |||||||

Audit Fees | $ | 3,194 | $ | 2,748 | ||||

Audit Related Fees | 1,420 | 1,260 | ||||||

Tax Fees | 157 | 118 | ||||||

Total Fees | $ | 4,771 | $ | 4,126 | ||||

Audit Fees. These fees relate to professional services rendered in connection with the annual audit of our consolidated financial statements and internal control over financial reporting, the reviews of the condensed consolidated financial statements performed in connection with each of our Quarterly Reports on Form 10-Q, consultations regarding accounting and financial reporting and statutory audits required by foreign jurisdictions.

Audit Related Fees. Audit related fees primarily include fees for certain audits that are not required for purposes of the audit of our consolidated financial statements or for statutory or regulatory requirements. In 2010, these fees primarily related to due diligence, valuation and accounting services performed in connection with strategic transactions, as well as services performed in connection with financing activities and review of tax accounting matters. In 2009, these fees primarily related to services performed in connection with financing activities, as well as due diligence and accounting services performed in connection with strategic transactions.

Tax Fees. These fees include fees for consulting services related to tax planning, advice and assistance with international and other tax matters.

Audit Committee Pre-approval Policy and Procedures. The Audit Committee has adopted policies and procedures relating to the approval of all audit and non-audit services to be performed by our independent auditor. This policy provides that we will not engage our independent auditor to render audit or non-audit services unless the service is specifically approved in advance by the Audit Committee or the engagement is entered into pursuant to one of the pre-approval procedures described below.

From time to time, the Audit Committee may pre-approve specified types of services that are expected to be provided to us by our independent registered public accounting firm during the next twelve months. Any such pre-approval is detailed as to the particular service or type of services to be provided. The Audit Committee may also delegate to any Audit Committee member the authority to approve any audit or non-audit services to be provided by our independent registered public accounting firm. Any approval of services by an Audit Committee member pursuant to this delegated authority is reported at the next meeting of the Audit Committee.

The Audit Committee approved all of the services described above in accordance with its pre-approval policies and procedures.

18

Table of Contents

COMPENSATION AND OTHER INFORMATION CONCERNING DIRECTORS AND OFFICERS

Compensation Discussion and Analysis

The following compensation discussion and analysis summarizes our philosophy and objectives regarding the compensation of our named executive officers, including how we determine the elements and amounts of executive compensation. This discussion and analysis should be read in conjunction with our tabular disclosures regarding the compensation of our named executive officers in the year ended December 31, 2010 and the report of the Compensation Committee of our Board of Directors, which can be found on page 39 of this Proxy Statement.

In accordance with SEC rules and regulations, our named executive officers for the year ended December 31, 2010 include our Chief Executive Officer, our Chief Financial Officer and the three other most highly compensated executive officers who were serving as executive officers on December 31, 2010. Accordingly, our named executive officers for the year ended December 31, 2010 consist of the following five individuals:

| • | James D. Taiclet, Jr., Chairman of the Board, President and Chief Executive Officer |

| • | Thomas A. Bartlett, Executive Vice President and Chief Financial Officer |

| • | William H. Hess, Executive Vice President, International Operations and President, Latin America and EMEA |

| • | Steven C. Marshall, Executive Vice President and President, U.S. Tower Division |

| • | Edmund DiSanto, Executive Vice President, Chief Administrative Officer and General Counsel |

For a complete list of our current executive officers, see Part III, Item 10 in our Annual Report on Form 10-K for the year ended December 31, 2010, filed with the SEC on February 28, 2011.

Executive Summary

The guiding principle of our executive compensation philosophy is to pay-for-performance, in that we reward our executives for individual performance and for contributions to Company performance. Our executive compensation objectives include retaining our executives and aligning their interests with those of our stockholders, while rewarding our executives for individual performance that furthers the Company’s achievement of its business strategies, and for contributions by our executives to Company performance of both its financial and strategic goals.

Executive Compensation Program in 2010

To achieve our compensation objectives, for 2010, the primary components of our executive compensation program were:

| • | annual base salary; |

| • | performance bonus awards; and |

| • | long-term equity-based incentive compensation. |

In considering the peer group and benchmarking analyses, the Compensation Committee’s (Committee) overall philosophy, given the background and experience of our executives, is to initially target total compensation for our executives at the median of our peer group, and increase target total compensation as our executives demonstrate their performance over time. In considering total compensation for our current executive officers, the Committee takes into account the relatively small size of our management team and the substantial scope of their roles relative to achievement of Company short- and long-term business strategies, as well as their continued demonstration of superior performance as it contributes to Company performance.

19

Table of Contents

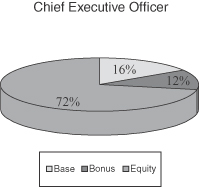

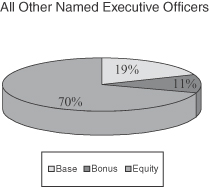

For 2010, our mix of compensation at targeted levels for our Chief Executive Officer and other four named executive officers was comprised of varying percentages of base salary, performance bonus awards, and long-term equity-based compensation, as indicated in the charts below.

Impact of our Business Results in 2010 on Compensation Determinations

As described below under “—Performance Bonus Awards,” each of our named executive officers overachieved on his individual goals for 2010, and the Company exceeded its performance goals for the year. The annual cash bonus awards are tied directly to accomplishing Company-specific financial and strategic individual goals. Fifty percent (50%) of the award encourages executive collaboration in the achievement of financial targets (rental and management revenue and Adjusted EBITDA) and fifty percent (50%) of the award encourages individual executive achievement of strategic goals (for example, expansion of business scope, offering of new products and optimization of capital structure). In addition, 2010 compensation determinations were influenced by Company performance against external measures. For 2010, the Committee awarded target total compensation (base salary, performance bonus awards and long-term equity-based incentive compensation) for our current executive officers at or above the seventy-fifth percentile, as compared to the companies included in the peer group and other survey data. Based on market data for select S&P 500 companies, 2010 target total compensation awarded to our current executive officers ranged from the twenty-fifth to the seventy-fifth percentiles.

Other Key Features of our Executive Compensation Program

Other key features of our executive compensation program include:

| • | Equity vesting upon a change in control only upon a termination of employment (“double-trigger”) with no tax gross-ups provided in the event of a change in control of the Company; |

20

Table of Contents

| • | Retirement and welfare benefits consistent with all employees, with no supplemental pension or deferred compensation plans for executives and limited perquisites; |

| • | Annual performance bonus awards and long-term equity-based awards with terms that provide for the “claw back” by the Company of cash and shares received pursuant to such awards, respectively, or, in the latter case, the payment to the Company of all gains realized upon disposition of such shares in certain circumstances; |

| • | Anti-Insider Trading Policy that governs all Company employees, including our executive officers and Directors, imposing limits as to when and how employees can engage in transactions in our securities, and that prohibits short sales of our Common Stock by any Company personnel; and |