UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2011

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file number 1-14045

LASALLE HOTEL PROPERTIES

(Exact name of registrant as specified in its charter)

| | |

| Maryland | | 36-4219376 |

(State or other jurisdiction of incorporation or organization) | | (IRS Employer Identification No.) |

3 Bethesda Metro Center, Suite 1200 Bethesda, Maryland | | 20814 |

| (Address of principal executive offices) | | (Zip Code) |

(301) 941-1500

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of each class | | Name of each exchange on which registered |

Common Shares of Beneficial Interest ($0.01 par value) | | New York Stock Exchange |

7 1/2% Series D Cumulative Redeemable Preferred Shares ($0.01 par value) | | New York Stock Exchange |

8% Series E Cumulative Redeemable Preferred Shares ($0.01 par value) | | New York Stock Exchange |

7 1/4% Series G Cumulative Redeemable Preferred Shares ($0.01 par value) | | New York Stock Exchange |

7 1/2% Series H Cumulative Redeemable Preferred Shares ($0.01 par value) | | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. Check one:

| | | | | | |

| Large accelerated filer x | | Accelerated filer ¨ | | Non-accelerated filer ¨ | | Smaller reporting company ¨ |

| | | | (Do not check if a smaller reporting company) | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the 85,061,919 common shares of beneficial interest held by non-affiliates of the registrant was approximately $2.2 billion based on the closing price on the New York Stock Exchange for such common shares of beneficial interest as of June 30, 2011.

Number of the registrant’s common shares of beneficial interest outstanding as of February 15, 2012: 85,631,189.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for its 2012 Annual Meeting of Shareholders to be held on or about April 20, 2012 are incorporated by reference in Part II and Part III of this report as noted therein.

LASALLE HOTEL PROPERTIES

INDEX

Forward-Looking Statements

This report, together with other statements and information publicly disseminated by LaSalle Hotel Properties (the “Company”), contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Company intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995 and includes this statement for purposes of complying with these safe harbor provisions. Forward-looking statements, which are based on certain assumptions and describe the Company’s future plans, strategies and expectations, are generally identifiable by use of the words “believe,” “expect,” “intend,” “anticipate,” “estimate,” “project,” “may,” “plan,” “seek,” “should,” “will” or similar expressions. Forward-looking statements in this report include, among others, statements about the Company’s business strategy, including its acquisition and development strategies, industry trends, estimated revenues and expenses, ability to realize deferred tax assets and expected liquidity needs and sources (including capital expenditures and the ability to obtain financing or raise capital). You should not rely on forward-looking statements since they involve known and unknown risks, uncertainties and other factors that are, in some cases, beyond the Company’s control and which could materially affect actual results, performances or achievements. Factors that may cause actual results to differ materially from current expectations include, but are not limited to:

| | • | | risks associated with the hotel industry, including competition, increases in wages, energy costs and other operating costs, potential unionization, actual or threatened terrorist attacks, any type of flu or disease-related pandemic and downturns in general and local economic conditions; |

| | • | | the availability and terms of financing and capital and the general volatility of securities markets; |

| | • | | the Company’s dependence on third-party managers of its hotels, including its inability to implement strategic business decisions directly; |

| | • | | risks associated with the real estate industry, including environmental contamination and costs of complying with the Americans with Disabilities Act of 1990, as amended (the “ADA”), and similar laws; |

| | • | | interest rate increases; |

| | • | | the possible failure of the Company to qualify as a real estate investment trust (“REIT”) and the risk of changes in laws affecting REITs; |

| | • | | the possibility of uninsured losses; |

| | • | | risks associated with redevelopment and repositioning projects, including delays and cost overruns; and |

| | • | | the risk factors discussed under the heading “Risk Factors” in this Annual Report on Form 10-K. |

Accordingly, there is no assurance that the Company’s expectations will be realized. Except as otherwise required by the federal securities laws, the Company disclaims any obligations or undertaking to publicly release any updates or revisions to any forward-looking statement contained herein (or elsewhere) to reflect any change in the Company’s expectations with regard thereto or any change in events, conditions or circumstances on which any such statement is based.

The “Company”, “we” or “us” means LaSalle Hotel Properties and one or more of its subsidiaries (including LaSalle Hotel Operating Partnership, L.P. (the “Operating Partnership”) and LaSalle Hotel Lessee, Inc. (“LHL”)), or, as the context may require, LaSalle Hotel Properties only, the Operating Partnership only or LHL only.

1

PART I

General

The Company, a Maryland REIT organized on January 15, 1998, primarily buys, owns, redevelops and leases upscale and luxury full-service hotels located in convention, resort and major urban business markets. The Company is a self-administered and self-managed REIT as defined in the Internal Revenue Code of 1986, as amended (the “Code”). As a REIT, the Company is generally not subject to federal corporate income tax on that portion of its net income that is currently distributed to shareholders. The income of LHL, the Company’s wholly owned taxable-REIT subsidiary, is subject to taxation at normal corporate rates.

As of December 31, 2011, the Company owned interests in 37 hotels with over 9,800 guest rooms located in nine states and the District of Columbia. Each hotel is leased to LHL or a wholly owned subsidiary of LHL under a participating lease that provides for rental payments equal to the greater of (i) base rent or (ii) participating rent based on hotel revenues. The LHL leases expire between December 2012 and December 2015. Lease revenue from LHL and its wholly owned subsidiaries is eliminated in consolidation. A third-party non-affiliated hotel operator manages each hotel, which is also subject to a hotel management agreement, the terms of which are discussed in more detail under “—Hotel Managers and Hotel Management Agreements”.

Substantially all of the Company’s assets are held by, and all of its operations are conducted through, the Operating Partnership. The Company is the sole general partner of the Operating Partnership. The Company owned, through a combination of direct and indirect interests, 99.6% of the common units of the Operating Partnership at December 31, 2011. The remaining 0.4% is held by limited partners who held 296,300 common units of limited partnership interest at December 31, 2011. On December 29, 2011, the Company issued the 296,300 units to two entities comprising the seller of Park Central Hotel as partial consideration for the acquisition. The common units of limited partnership interest are subject to a required hold period that ends on December 28, 2013, after which they are convertible into a like number of common shares of beneficial interest, par value $0.01 per share, of the Company.

The Company’s principal offices are located at 3 Bethesda Metro Center, Suite 1200, Bethesda, Maryland 20814. The Company’s website iswww.lasallehotels.com. The Company makes available on its website free of charge its filings with the Securities and Exchange Commission (“SEC”), including its Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports.

Strategies and Objectives

The Company’s primary objectives are to provide income to its shareholders through increases in distributable cash flow and to increase long-term total returns to shareholders through appreciation in the value of its common shares of beneficial interest. To achieve these objectives, the Company seeks to:

| | • | | enhance the return from, and the value of, the hotels in which it owns interests and any additional hotels the Company may acquire or develop; and |

| | • | | invest in or acquire additional hotel properties on favorable terms. |

The Company seeks to achieve revenue growth principally through:

| | • | | renovations, repositionings and/or expansions at selected hotels; |

| | • | | acquisitions of full-service hotels located in convention, resort and major urban markets in the U.S. especially upscale and luxury full-service hotels in such markets where the Company perceives strong demand growth or significant barriers to entry; |

| | • | | selective development of hotel properties, particularly upscale and luxury full-service hotels in high barrier-to-entry and high demand markets where development economics are favorable; and |

| | • | | revenue enhancing programs at the hotels. |

2

The Company intends to acquire additional hotels in urban, convention and resort markets, consistent with the growth strategies outlined above and which may:

| | • | | possess unique competitive advantages in the form of location, physical facilities or other attributes; |

| | • | | be available at significant discounts to replacement cost, including when such discounts result from reduced competition for hotels with long-term management and/or franchise agreements; |

| | • | | benefit from brand or franchise conversion or removal, new management, renovations or redevelopment or other active and aggressive asset management strategies; or |

| | • | | have expansion opportunities. |

The Company continues to focus on eight primary urban markets; however, it will acquire assets in other markets if the investment is consistent with the Company’s strategies and return criteria. The primary urban markets are:

| | |

| • Boston | | • San Diego |

| • Chicago | | • San Francisco |

| • Los Angeles | | • Seattle |

| • New York | | • Washington, DC |

Hotel Managers and Hotel Management Agreements

The Company seeks to grow through strategic relationships with premier, internationally recognized hotel operating companies, including Westin Hotels and Resorts, Hilton Hotels Corporation, Outrigger Lodging Services, Noble House Hotels & Resorts, Hyatt Hotels Corporation, Benchmark Hospitality, White Lodging Services Corporation, Thompson Hotels, Sandcastle Resorts & Hotels, Davidson Hotel Company, Denihan Hospitality Group, Kimpton Hotel & Restaurant Group, L.L.C., Accor, Destination Hotels & Resorts, HEI Hotels & Resorts, JRK Hotel Group, Inc., Viceroy Hotel Group and Highgate Holdings. The Company believes that having multiple operators creates a network that will generate acquisition opportunities. In addition, the Company believes its acquisition capabilities are enhanced by its considerable experience, resources and relationships in the hotel industry specifically and the real estate industry generally.

As of December 31, 2011, all of our 37 hotels are leased by LHL, and are managed and operated by third parties pursuant to management agreements entered into between LHL and the respective hotel management companies.

Our management agreements for the 37 hotels leased to LHL have the terms described below.

| | • | | Base Management Fees. Our management agreements generally provide for the payment of base management fees between 1.0% and 4.0% of the applicable hotel’s revenues or a fixed amount, as determined in the agreements. |

| | • | | Incentive Management and Other Fees. Some of our management agreements provide for the payment of incentive management fees between 10.0% and 20.0% of gross operating profit or as a percentage of, or in excess of, certain thresholds of net operating income or cash flow of the applicable hotel, if certain criteria are met. Certain of the management agreements also provide for the payment by us of sales and marketing, accounting and other fees. |

| | • | | Terms. The terms of our management agreements range from one year to 22 years not including renewals, and one year to 52 years including renewals. Only one management agreement has a 52-year term including renewals. The next longest management agreement term including renewals is 37 years. |

| | • | | Ability to Terminate. We have 37 management agreements of which 31 are terminable at will and one is terminable upon sale. The remaining five management agreements are terminable only with cause. Termination fees range from zero to up to ten times annual base management and incentive |

3

| | management fees. Only one management agreement has termination fees at ten times, with the next highest at two times annual base management and incentive management fees. |

| | • | | Operational Services. Each manager has exclusive authority to supervise, direct and control the day-to-day operation and management of the respective hotel including establishing all room rates, processing reservations, procuring inventories, supplies and services, and preparing public relations, publicity and marketing plans for the hotel. |

| | • | | Executive Supervision and Management Services. Each manager supervises all managerial and other employees, reviews the operation and maintenance, prepares reports, budgets and projections, and provides other administrative and accounting support services to the respective hotel. |

| | • | | Chain Services. Our management agreements with major brands require the managers to furnish chain services that are generally made available to other hotels managed by such managers. Such services may, for example, include: (1) the development and operation of computer systems and reservation services; (2) management and administrative services; (3) marketing and sales services; (4) human resources training services and (5) such additional services as may from time to time be more efficiently performed on a national, regional or group level. |

| | • | | Working Capital. Our management agreements typically require us to maintain working capital for a hotel and to fund the cost of supplies such as linen and other similar items. We are also responsible for providing funds to meet the cash needs for the hotel operations if at any time the funds available from the hotel operations are insufficient to meet the financial requirements of the hotel. |

| | • | | Furniture, Fixtures and Equipment Replacements. We are required to provide to the managers all the necessary furniture, fixtures and equipment for the operation of the hotels (including funding any required furniture, fixture and equipment replacements). Our management agreements generally provide that once each year the managers will prepare a list of furniture, fixtures and equipment to be acquired and certain routine repairs to be performed in the next year and an estimate of funds that are necessary therefore, subject to our review and approval. For purposes of funding the furniture, fixtures and equipment replacements, a specified percentage of the gross revenues of each hotel is either deposited by the manager in an escrow account (typically 4.0% to 5.0%) or held by the owner. |

| | • | | Building Alterations, Improvements and Renewals. Our management agreements generally require the managers to prepare an annual estimate of the expenditures necessary for major repairs, alterations, improvements, renewals and replacements to the structural, mechanical, electrical, heating, ventilating, air conditioning, plumbing and vertical transportation elements of the hotels. In addition to the foregoing, the management agreements generally provide that the managers may propose such changes, alterations and improvements to the hotels as required by reason of laws or regulations or, in each manager’s reasonable judgment, to keep each respective hotel in a safe, competitive and efficient operating condition. |

| | • | | Sale of a Hotel. Six of our management agreements limit our ability to sell, lease or otherwise transfer a hotel, unless the transferee assumes the related management agreement and meets specified other conditions and/or unless the transferee is not a competitor of the manager. |

| | • | | Service Marks. During the term of our management agreements, the service mark, symbols and logos currently used by the managers may be used in the operation of the hotels. Any right to use the service marks, logo and symbols and related trademarks at a hotel will terminate with respect to that hotel upon termination of the management agreement with respect to such hotel. |

Recent Developments

On December 29, 2011, the Company acquired a 100% interest in the Park Central Hotel, a 934-room upscale, full-service hotel located in New York, NY, for $396.2 million. The sources of the funding for the acquisition were cash on hand consisting primarily of the remaining net proceeds from the Company’s previously

4

completed sale of common shares of beneficial interest on April 29, 2011, borrowings under the Company’s senior unsecured credit facility and the issuance of 296,300 common units of limited partnership interest (0.4% of the Operating Partnership).

From February 1, 2012 through February 15, 2012, the Company sold 1,714,939 common shares of beneficial interest, par value $0.01 per share, under its equity distribution agreement (the “2011 Agreement”) with Raymond James & Associates, Inc. (the “Manager”). After deducting the Manager’s discounts and commissions, the Company raised net proceeds of $46.6 million, which were used to pay down amounts outstanding under the Company’s senior unsecured credit facility and for general corporate purposes.

Hotel Renovations

The Company believes that its regular program of capital improvements at the hotels, including replacement and refurbishment of furniture, fixtures and equipment helps maintain and enhance its competitiveness and maximizes revenue growth.

Joint Ventures

On December 29, 2010, the Company, through Modern Magic Hotel LLC, a joint venture in which the Company holds a 95.0% controlling interest, sold its interest in the IBM Building located at 330 N. Wabash Avenue in downtown Chicago, IL for $58.8 million, resulting in an impairment loss of $8.4 million, which includes a $2.7 million termination fee paid to the development manager. On November 1, 2011, the joint venture was dissolved after final distributions were made to the partners.

Tax Status

The Company has elected to be taxed as a REIT under Sections 856 through 860 of the Code. As a result, the Company generally is not subject to corporate income tax on that portion of its net income that is currently distributed to shareholders. A REIT is subject to a number of highly technical and complex organizational and operational requirements, including requirements with respect to the nature of its gross income and assets and a requirement that it currently distribute at least 90% of its taxable income. The Company may, however, be subject to certain state and local taxes on its income and property.

Effective January 1, 2001, the Company elected to operate its wholly-owned subsidiary, LHL, as provided for under the REIT Modernization Act as a taxable-REIT subsidiary. Accordingly, LHL is required to pay corporate income taxes at the applicable rates.

Seasonality

The Company’s hotels’ operations historically have been seasonal. Taken together, the hotels maintain higher occupancy rates during the second and third quarters of each year. These seasonality patterns can be expected to cause fluctuations in the quarterly hotel operating revenues of LHL and the Company’s quarterly lease revenues from LHL.

Competition

The hotel industry is highly competitive. Each of the hotels is located in a developed area that includes other hotel properties. The number of competitive hotel properties in a particular area could have a material adverse effect on occupancy, average daily rate (“ADR”) and room revenue per available room (“RevPAR”) at the Company’s current hotels or at hotels acquired in the future. The Company may be competing for investment opportunities with entities that have substantially greater financial resources than the Company. These entities may generally be able to accept more risk than the Company can prudently manage, including risks with respect to the amount of leverage utilized, creditworthiness of a hotel operator or the geographic proximity of its investments. Competition may generally reduce the number of suitable investment opportunities offered to the Company and increase the bargaining power of property owners seeking to sell.

5

Environmental Matters

In connection with the ownership of hotels, the Company is subject to various federal, state and local laws, ordinances and regulations relating to environmental protection. Under these laws, a current or previous owner or operator of real estate may be liable for the costs of removal or remediation of certain hazardous or toxic substances on, under or in such property. Such laws often impose liability without regard to whether the owner or operator knew of, or was responsible for, the presence of hazardous or toxic substances. In addition, the presence of contamination from hazardous or toxic substances, or the failure to remediate such contaminated property properly, may adversely affect the owner’s ability to borrow using such property as collateral. Furthermore, a person who arranges for the disposal or treatment of a hazardous or toxic substance at a property owned by another, or who transports such substance to or from such property, may be liable for the costs of removal or remediation of such substance released into the environment at the disposal or treatment facility. The costs of remediation or removal of such substances may be substantial, and the presence of such substances may adversely affect the owner’s ability to sell such real estate or to borrow using such real estate as collateral. In connection with the ownership of hotels, the Company may be potentially liable for such costs.

The Company believes that its hotels are in compliance, in all material respects, with all federal, state and local environmental ordinances and regulations regarding hazardous or toxic substances and other environmental matters, the violation of which could have a material adverse effect on the Company. The Company has not received verbal or written notice from any governmental authority of any material noncompliance, liability or claim relating to hazardous or toxic substances or other environmental matters in connection with any of its present properties.

Employees

The Company had 31 employees as of February 15, 2012. All persons employed in the day-to-day operations of the hotels are employees of the management companies engaged by the lessees to operate such hotels.

Additional Information

All reports filed with the SEC may also be read and copied at the SEC’s public reference room at 100 F Street, NE, Washington, DC 20549. Further information regarding the operation of the public reference room may be obtained by calling 1-800-SEC-0330. In addition, all of our filed reports can be obtained at the SEC’s website atwww.sec.gov or through the Company’s website atwww.lasallehotels.com.

The following risk factors and other information included in this Annual Report on Form 10-K should be carefully considered. The risks and uncertainties described below are not the only ones the Company faces. Additional risks and uncertainties not presently known to the Company or that it may currently deem immaterial also may impair its business operations. If any of the following risks occur, the Company’s business, financial condition, operating results and cash flows could be materially adversely affected.

In the past, events beyond our control, including an economic slowdown or downturn and terrorism, harmed the operating performance of the hotel industry generally and the performance of our hotels. If these or similar events occur or continue to occur, our operating and financial results may be harmed by declines in occupancy, average daily room rates and/or other operating revenues.

The performance of the lodging industry has traditionally been closely linked with the performance of the general economy and, specifically, growth in the U.S. gross domestic product (“GDP”). All of our hotels are classified as luxury, upper upscale or upscale. In an economic downturn, these types of hotels may be more susceptible to a decrease in revenue, as compared to hotels in other categories that have lower room rates. This

6

characteristic may result from the fact that upper upscale hotels generally target business and high-end leisure travelers. In periods of economic difficulties, business and leisure travelers may seek to reduce travel costs by limiting travel or seeking to reduce costs on their trips. In addition, the terrorist attacks of September 11, 2001 had a dramatic adverse effect on business and leisure travel, and on the occupancy and ADR of our hotels. Future terrorist activities could have a harmful effect on both the industry and us. Likewise, the volatility in the credit and equity markets and the economic recession will continue to have an adverse effect on our business. Even after an economic recovery begins, a significant period of time may elapse before RevPAR, operating margins and other key lodging fundamentals improve.

The return on our hotels depends upon the ability of the hotel operators to operate and manage the hotels.

To maintain our status as a REIT, we are not permitted to operate any of our hotels. As a result, we are unable to directly implement strategic business decisions with respect to the daily operation and marketing of our hotels, such as decisions with respect to the setting of room rates, repositioning of a hotel, food and beverage pricing and certain similar matters. Although LHL consults with the hotel operators with respect to strategic business plans, the hotel operators are under no obligation to implement any of our recommendations with respect to such matters. Thus, even if we believe our hotels are being operated inefficiently or in a manner that does not result in satisfactory occupancy rates, revenue per available room, average daily rates or operating profits, we may not have sufficient rights under our hotel operating agreements to enable us to force the hotel operator to change its method of operation. We generally can only seek redress if a hotel operator violates the terms of the applicable operating agreement, and then only to the extent of the remedies provided for under the terms of the agreement. Some of the operating agreements have lengthy terms and may not be terminable by us before the agreement’s expiration. In the event that we are able to and do replace any of our hotel operators, we may experience significant disruptions at the affected hotels, which may adversely affect our ability to make distributions to our shareholders.

We currently own only luxury, upper upscale and upscale hotels. These segments of the lodging market are highly competitive and generally subject to greater volatility than most other market segments, which could negatively affect our profitability.

The luxury, upper upscale and upscale segments of the hotel business are highly competitive. Our hotels compete on the basis of location, room rates, quality, service levels, reputation and reservations systems, among many factors. There are many competitors in the luxury, upper upscale and upscale segments, and many of these competitors may have substantially greater marketing and financial resources than we have. This competition could reduce occupancy levels and room revenue at our hotels, which would harm our operations. Over-building in the hotel industry may increase the number of rooms available and may decrease occupancy and room rates. In addition, in periods of weak demand, as may occur during a general economic recession, profitability is negatively affected by the relatively high fixed costs of operating luxury, upper upscale and upscale hotels.

Our performance and our ability to make distributions on our shares are subject to risks associated with the hotel industry.

Competition for guests, increases in operating costs, dependence on travel and economic conditions could adversely affect our cash flow. Our hotels are subject to all operating risks common to the hotel industry. These risks include:

| | • | | adverse effects of weak national, regional and local economic conditions; |

| | • | | tightening credit standards; |

| | • | | competition for guests and meetings from other hotels including competition and pricing pressure from internet wholesalers and distributors; |

7

| | • | | increases in operating costs, including wages, benefits, insurance, property taxes and energy, due to inflation and other factors, which may not be offset in the future by increased room rates; |

| | • | | labor strikes, disruptions or lockouts that may impact operating performance; |

| | • | | dependence on demand from business and leisure travelers, which may fluctuate and be seasonal; |

| | • | | increases in energy costs, airline fares and other expenses related to travel, which may negatively affect traveling; and |

| | • | | terrorism, terrorism alerts and warnings, military actions, pandemics or other medical events which may cause decreases in business and leisure travel. |

These factors could adversely affect the ability of the lessees to generate revenues and to make rental payments to us.

Unexpected capital expenditures could adversely affect our cash flow. Hotels require ongoing renovations and other capital improvements, including periodic replacement or refurbishment of furniture, fixtures and equipment. Under the terms of our leases, we are obligated to pay the cost of certain capital expenditures at the hotels, including new brand standards, and to pay for periodic replacement or refurbishment of furniture, fixtures and equipment. If capital expenditures exceed expectations, there can be no assurance that sufficient sources of financing will be available to fund such expenditures.

In addition, we have acquired hotels that have undergone significant renovation and may acquire additional hotels in the future that require significant renovation. Renovations of hotels involve numerous risks, including the possibility of environmental problems, construction cost overruns and delays, the effect on current demand, uncertainties as to market demand or deterioration in market demand after commencement of renovation and the emergence of unanticipated competition from other hotels.

Our lenders may have suffered losses related to the weakening economy and may not be able to fund our borrowings.

Our lenders, including the lenders participating in our $750.0 million senior unsecured credit facility, may have suffered losses related to their lending and other financial relationships, especially because of the general weakening of the national economy and increased financial instability of many borrowers. As a result, lenders may become insolvent or tighten their lending standards, which could make it more difficult for us to borrow under our credit facility or to obtain other financing on favorable terms or at all. Our financial condition and results of operations would be adversely affected if we were unable to draw funds under our credit facility because of a lender default or to obtain other cost-effective financing.

Our obligation to comply with financial covenants in our unsecured credit facilities and mortgages on some of our hotel properties could impact our operations, may require us to liquidate our properties and could adversely affect our ability to make distributions to our shareholders.

Our unsecured credit facilities. We have a senior unsecured credit facility with a syndicate of banks that provides for a maximum borrowing of up to $750.0 million, with the maximum borrowing potentially increased to $1.0 billion through an accordion feature. The senior unsecured credit facility matures on January 30, 2016, subject to a one-year extension that we may exercise at our option, pursuant to certain terms and conditions, including the payment of an extension fee. The senior unsecured credit facility contains certain financial covenants relating to net worth requirements, debt ratios and fixed charge coverage and other limitations that restrict our ability to make distributions or other payments to our shareholders upon events of default. The senior unsecured credit facility also contains a cross-default provision that allows the lenders under the credit facility to stop future extensions of credit and/or accelerate the maturity of any outstanding principal balances under the credit facility if we are in default under another debt obligation, including our non-recourse secured mortgage indebtedness.

8

LHL has an unsecured revolving credit facility with U.S. Bank National Association that provides for a maximum borrowing of up to $25.0 million. The unsecured revolving credit facility matures on January 30, 2016, subject to a one-year extension that LHL may exercise at its option, pursuant to certain terms and conditions, including the payment of an extension fee. The unsecured revolving credit facility contains certain financial covenants relating to net worth requirements, debt ratios and fixed charge coverage.

If we violate the financial covenants in our credit facilities, we could be required to repay all or a portion of our indebtedness with respect to such credit facility before maturity at a time when we might be unable to arrange financing for such repayment on attractive terms, or at all. Moreover, if we are unable to refinance our debt on acceptable terms, including at maturity of our credit facilities, we may be forced to dispose of hotel properties on disadvantageous terms, potentially resulting in losses that reduce cash flow from operating activities. Failure to comply with our financial covenants contained in our credit facilities, or our non-recourse secured mortgages described below, could result from, among other things, changes in our results of operations, the incurrence of additional debt or changes in general economic conditions.

Our non-recourse secured mortgages. In addition to our senior unsecured credit facility and the LHL unsecured revolving credit facility, we have from time to time entered into non-recourse mortgages secured by specific hotel properties. Under the terms of these debt obligations, a lender’s only remedy in the event of default is against the real property securing the mortgage, except where a borrower has, among other customary exceptions, engaged in an action constituting fraud or an intentional misrepresentation. In those cases, a lender may seek a remedy for a breach directly against the borrower, including its other assets. The Indianapolis Marriott Downtown, Hilton San Diego Gaslamp Quarter, Westin Copley Place, Hotel Deca, Westin Michigan Avenue, Hotel Solamar and Hotel Roger Williams are each mortgaged to secure payment of indebtedness aggregating $643.7 million (excluding loan premiums) as of December 31, 2011. The Harborside Hyatt Conference Center & Hotel is mortgaged to secure payment of principal and interest on bonds with an aggregate par value of $42.5 million. These mortgages contain debt service coverage tests related to the mortgaged property. If our debt service coverage ratio fails, for that specific property, to exceed a threshold level specified in a mortgage, cash flows from that hotel will automatically be directed to the lender to (i) satisfy required payments, (ii) fund certain reserves required by the mortgage and (iii) fund additional cash reserves for future required payments, including final payment. Cash flows will be directed to the lender until such time as we again become compliant with the specified debt service coverage ratio or the mortgage is paid off.

If we are unable to meet mortgage payment obligations, including the payment obligation upon maturity of the mortgage borrowing, the mortgage securing the specific property could be foreclosed upon by, or the property could be otherwise transferred to, the mortgagee with a consequent loss of income and asset value to us. We may also elect to sell the property, if we are able to sell the property, for a loss in advance of a foreclosure or other transfer. An event of default under our non-recourse secured mortgage may also constitute an event of default under our senior unsecured credit facility.

As of December 31, 2011, the Company is in compliance with all debt covenants, current on all loan payments and not otherwise in default under the credit facilities or mortgages.

9

Our liquidity may be reduced and our cost of debt financing may be increased because we may be unable to, or elect not to, remarket debt securities related to our Harborside Hyatt Conference Center & Hotel for which we may be liable.

We are the obligor with respect to a $37.1 million tax-exempt special project revenue bond and a $5.4 million taxable special project revenue bond, both issued by the Massachusetts Port Authority (collectively, the “Massport Bonds”). The Massport Bonds, which mature on March 1, 2018, bear interest based on weekly floating rates and have no principal reductions prior to their scheduled maturities. The Massport Bonds may be redeemed at any time, at our option, without penalty. The Royal Bank of Scotland provides the supporting letters of credit on the Massport Bonds. The letters of credit expire on February 14, 2014, pursuant to amendments to the agreements in 2011. The Royal Bank of Scotland letters of credit also have three one-year extensions that we may exercise at our option, subject to certain terms and conditions. If the Royal Bank of Scotland fails to renew its letters of credit at expiration and an acceptable replacement provider cannot be found, we may be required to pay off the bonds. If we are unable to, or elect not to, issue or remarket the Massport Bonds, we would expect to rely primarily on our available cash and revolving credit facility to pay off the Massport Bonds. At certain times, we may hold some of the Massport Bonds that have not been successfully remarketed. Our borrowing costs under our revolving credit facility may be higher than tax-exempt bond financing costs. Borrowings under the revolving credit facility to pay off the Massport Bonds would also reduce our liquidity to meet other obligations.

Our performance is subject to real estate industry conditions, the terms of our leases and management agreements.

Because real estate investments are illiquid, we may not be able to sell hotels when desired. Real estate investments generally cannot be sold quickly. We may not be able to vary our portfolio promptly in response to economic or other conditions. In addition, provisions of the Code limit a REIT’s ability to sell properties in some situations when it may be economically advantageous to do so.

Liability for environmental matters could adversely affect our financial condition. As an owner of real property, we are subject to various federal, state and local laws and regulations relating to the protection of the environment that may require a current or previous owner of real estate to investigate and clean-up hazardous or toxic substances at a property. These laws often impose such liability without regard to whether the owner knew of or caused the presence of the contaminants, and liability is not limited under the enactments and could exceed the value of the property and/or the aggregate assets of the owner. Persons who arrange for the disposal or treatment facility, whether or not such facility is owned or operated by the person may be liable for the costs of removal or remediation of such substance released into the environment at the disposal or treatment facility. Even if more than one person were responsible for the contamination, each person covered by the environmental laws may be held responsible for the entire amount of clean-up costs incurred.

Environmental laws also govern the presence, maintenance and removal of asbestos-containing materials. These laws impose liability for release of asbestos-containing materials into the air and third parties may seek recovery from owners or operators of real properties for personal injury associated with asbestos-containing materials. In connection with ownership (direct or indirect) of our hotels, we may be considered an owner or operator of properties with asbestos-containing materials. Having arranged for the disposal or treatment of contaminants, we may be potentially liable for removal, remediation and other costs, including governmental fines and injuries to persons and property.

The costs of compliance with the ADA and other government regulations could adversely affect our cash flow. Under the ADA, all public accommodations are required to meet certain federal requirements related to access and use by disabled persons. A determination that we are not in compliance with the ADA could result in imposition of fines or an award of damages to private litigants. If we are required to make substantial modifications to our hotels, whether to comply with ADA or other government regulation such as building codes or fire safety regulations, our financial condition, results of operations and ability to make shareholder distributions could be adversely affected.

10

Certain leases and management agreements may constrain us from acting in the best interest of shareholders or require us to make certain payments. The Harborside Hyatt Conference Center & Hotel, San Diego Paradise Point Resort and Spa, The Hilton San Diego Resort and Spa, Hotel Roger Williams and Viceroy Santa Monica are each subject to a ground or land and building lease with a third-party lessor which requires us to obtain the consent of the relevant third party lessor in order to sell any of these hotels or to assign our leasehold interest in any of the ground or land and building leases. Accordingly, if we determine that the sale of any of these hotels or the assignment of our leasehold interest in any of these ground or land and building leases is in the best interest of our shareholders, we may be prevented from completing such a transaction if we are unable to obtain the required consent from the relevant lessor. The Indianapolis Marriott Downtown, Westin Copley Place and Hotel Solamar are each subject to a ground or air rights lease and do not require approval from the relevant third-party lessor.

In some instances, we may be required to obtain the consent of the hotel operator or franchisor prior to selling the hotel. Typically, such consent is only required in connection with certain proposed sales, such as if the proposed purchaser is engaged in the operation of a competing hotel or does not meet certain minimum financial requirements. The operators of Harborside Hyatt Conference Center & Hotel and Alexis Hotel require approval of certain sales.

Some of our hotels are subject to rights of first offer which may adversely affect our ability to sell those properties on favorable terms or at all.

We are subject to a franchisor’s or operator’s right of first offer with respect to the Hilton Alexandria Old Town, Hilton San Diego Gaslamp Quarter, The Hilton San Diego Resort and Spa, Embassy Suites Philadelphia—Center City and Park Central Hotel. These third-party rights may adversely affect our ability to timely dispose of these properties on favorable terms, or at all.

Increases in interest rates may increase our interest expense.

As of December 31, 2011, $307.5 million of aggregate indebtedness (32.3% of total indebtedness) was subject to variable interest rates. An increase in interest rates could increase our interest expense and reduce our cash flow and may affect our ability to make distributions to shareholders and to service our indebtedness.

Failure to qualify as a REIT would be costly.

We have operated (and intend to so operate in the future) so as to qualify as a REIT under the Code beginning with our taxable year ended December 31, 1998. Although management believes that we are organized and operated in a manner to so qualify, no assurance can be given that we will qualify or remain qualified as a REIT.

If we fail to qualify as a REIT in any taxable year, we will be subject to federal income tax (including any applicable alternative minimum tax) on our taxable income at regular corporate rates. Moreover, unless entitled to relief under certain statutory provisions, we also will be disqualified from treatment as a REIT for the four taxable years following the year during which qualification was lost. This treatment would cause us to incur additional tax liabilities, significantly impair our ability to service indebtedness and reduce the amount of cash available to make new investments or to make distributions on our common shares of beneficial interest and preferred shares.

Current laws include provisions that could provide relief in the event we violate certain provisions of the Code that otherwise would result in our failure to qualify as a REIT. We cannot assure that these relief provisions would apply if we failed to comply with the REIT qualification laws. Even if the relief provisions do apply, we would be subject to a penalty tax of at least $50,000 for each disqualifying event in most cases.

11

Property ownership through partnerships and joint ventures could limit our control of those investments.

Partnership or joint venture investments may involve risks not otherwise present for investments made solely by us, including among others, the possibility that our co-investors might become bankrupt, might at any time have goals or interests that are different from ours because of disparate tax consequences or otherwise, and may take action contrary to our instructions, requests, policies or objectives, including our policy with respect to maintaining our qualification as a REIT. Other risks of joint venture investments include an impasse on decisions, such as a sale, because neither our co-investors nor we would have full control over the partnership or joint venture. There is no limitation under our organizational documents as to the amount of funds that may be invested in partnerships or joint ventures.

We may not have enough insurance.

We carry comprehensive liability, fire, flood, earthquake, extended coverage and business interruption policies that insure us against losses with policy specifications and insurance limits that we believe are reasonable. There are certain types of losses, such as losses from environmental problems or terrorism, that management may not be able to insure against or may decide not to insure against since the cost of insuring is not economical. We may suffer losses that exceed our insurance coverage. Further, market conditions, changes in building codes and ordinances or other factors such as environmental laws may make it too expensive to repair or replace a property that has been damaged or destroyed, even if covered by insurance.

Our organizational documents and agreements with our executives and applicable Maryland law contain provisions that may delay, defer or prevent change of control transactions and may prevent shareholders from realizing a premium for their shares.

Our trustees serve staggered three-year terms, the trustees may only be removed for cause and remaining trustees may fill board vacancies. Our Board of Trustees is divided into three classes of trustees, each serving staggered three-year terms. In addition, a trustee may only be removed for cause by the affirmative vote of the holders of a majority of our outstanding common shares. Our declaration of trust and bylaws also provide that a majority of the remaining trustees may fill any vacancy on the Board of Trustees and further effectively provide that only the Board of Trustees may increase or decrease the number of persons serving on the Board of Trustees. These provisions preclude shareholders from removing incumbent trustees, except for cause after a majority affirmative vote, and filling the vacancies created by such removal with their own nominees.

Our Board of Trustees may approve the issuance of shares with terms that may discourage a third party from acquiring the Company. The Board of Trustees has the power under the declaration of trust to classify any of our unissued preferred shares, and to reclassify any of our previously classified but unissued preferred shares of any series from time to time, in one or more series of preferred shares, without shareholder approval. The issuance of preferred shares could adversely affect the voting power, dividend and other rights of holders of common shares and the value of the common shares.

Our declaration of trust prohibits ownership of more than 9.8% of the common shares or 9.8% of any series of preferred shares. To qualify as a REIT under the Code, no more than 50% of the value of our outstanding shares may be owned, directly or under applicable attribution rules, by five or fewer individuals (as defined to include certain entities) during the last half of each taxable year. Our declaration of trust generally prohibits direct or indirect ownership by any person of (i) more than 9.8% of the number or value (whichever is more restrictive) of the outstanding common shares or (ii) more than 9.8% of the number or value (whichever is more restrictive) of the outstanding shares of any class or series of preferred shares. Generally, shares owned by affiliated owners will be aggregated for purposes of the ownership limitation. Any transfer of shares that would violate the ownership limitation will result in the shares that would otherwise be held in violation of the ownership limit being designated as “shares-in-trust” and transferred automatically to a charitable trust effective on the day before the purported transfer or other event giving rise to such excess ownership. The intended transferee will acquire no rights in such shares.

12

The Maryland Business Combination Statute applies to us. A Maryland “business combination” statute contains provisions that, subject to limitations, prohibit certain business combinations between us and an “interested stockholder” (defined generally as any person who beneficially owns 10% or more of the voting power of our shares or an affiliate thereof) for five years after the most recent date on which the shareholder becomes an interested stockholder, and thereafter impose special shareholder voting requirements on these combinations.

The Board of Trustees may choose to subject us to the Maryland Control Share Act. A Maryland law known as the “Maryland Control Share Act” provides that “control shares” of a company (defined as shares which, when aggregated with other shares controlled by the acquiring shareholder, entitle the shareholder to exercise one of three increasing ranges of voting power in electing trustees) acquired in a “control share acquisition” (defined as the direct or indirect acquisition of ownership or control of “control shares”) have no voting rights except to the extent approved by the company’s shareholders by the affirmative vote of at least two-thirds of all the votes entitled to be cast on the matter, excluding all interested shares. Our bylaws currently provide that we are not subject to these provisions. However, the Board of Trustees, without shareholder approval, may repeal this bylaw and cause us to become subject to the Maryland Control Share Act.

Other provisions of our organization documents may delay or prevent a change of control of the Company. Among other provisions, our organizational documents provide that the number of trustees constituting the full Board of Trustees may be fixed only by the trustees and that a special meeting of shareholders may not be called by holders of common shares holding less than a majority of the outstanding common shares entitled to vote at such meeting.

Our executive officers have agreements that provide them with benefits in the event of a change in control of the Company. We entered into agreements with our executive officers that provide them with severance benefits if their employment ends under certain circumstances within one year following a “change in control” of the Company (as defined in the agreements) or if the executive officer resigns for “good reason” (as defined in the agreements). These benefits could increase the cost to a potential acquirer of the Company and thereby prevent or deter a change in control of the Company that might involve a premium price for the common shares or otherwise be in our shareholders’ best interests.

We depend on the efforts and expertise of our key executive officers and would be adversely affected by the loss of their services.

We depend on the efforts and expertise of our President and Chief Executive Officer, as well as our other executive officers, to execute our business strategy. The loss of their services, and our inability to find suitable replacements, would have an adverse effect on our business.

A large number of shares available for future sale could adversely affect the market price of our common shares and may be dilutive to current shareholders.

The sales of a substantial number of our common shares, or the perception that such sales could occur, could adversely affect prevailing market prices for our common shares. As of December 31, 2011, there were 200,000,000 common shares authorized under our declaration of trust, as amended, of which 83,786,932 were outstanding. Our Board of Trustees may authorize the issuance of additional authorized but unissued common shares or other authorized but unissued securities at any time, including pursuant to our 2009 Equity Incentive Plan. We also have filed a registration statement with the SEC allowing us to offer, from time to time, an indefinite amount of equity securities (including common or preferred shares) on an as-needed basis and subject to our ability to affect offerings on satisfactory terms based on prevailing conditions. In addition, in February 2011, our Board of Trustees authorized us to issue common shares having an aggregate offering price of up to $250.0 million in a continuous equity issuance program. Our ability to execute our business strategy depends on our access to an appropriate blend of debt financing, including unsecured lines of credit and other forms of

13

secured and unsecured debt, and equity financing, including issuances of common and preferred equity. No prediction can be made about the effect that future distributions or sales of our common shares will have on the market price of our common shares.

Holders of our outstanding preferred shares have dividend, liquidation and other rights that are senior to the rights of the holders of our common shares.

Our Board of Trustees has the authority to designate and issue preferred shares with liquidation, dividend and other rights that are senior to those of our common shares. As of December 31, 2011, 3,170,000 shares of our 7 1/2% Series D Cumulative Redeemable Preferred Shares (the “Series D Preferred Shares”), 3,500,000 shares of our 8% Series E Cumulative Redeemable Preferred Shares (the “Series E Preferred Shares”), 6,348,888 shares of our 7 1/4% Series G Cumulative Redeemable Preferred Shares (the “Series G Preferred Shares”) and 2,750,000 shares of our 7 1/2% Series H Cumulative Redeemable Preferred Shares (the “Series H Preferred Shares”) were issued and outstanding. The aggregate liquidation preference with respect to the outstanding preferred shares is approximately $394.2 million, and annual dividends on our outstanding preferred shares are approximately $29.6 million. Holders of our Series D Preferred Shares, our Series E Preferred Shares, our Series G Preferred Shares and our Series H Preferred Shares are entitled to cumulative dividends before any dividends may be declared or set aside on our common shares. Upon our voluntary or involuntary liquidation, dissolution or winding up, before any payment is made to holders of our common shares, holders of these preferred shares are entitled to receive a liquidation preference of $25.00 per share plus any accrued and unpaid distributions. This will reduce the remaining amount of our assets, if any, available to distribute to holders of our common shares. In addition, holders of these preferred shares have the right to elect two additional trustees to our Board of Trustees whenever dividends on the preferred shares are in arrears in an aggregate amount equivalent to six or more quarterly dividends, whether or not consecutive. Because our decision to issue securities will depend on market conditions and other factors beyond our control, we cannot predict or estimate the amount, timing or nature of our future preferred offerings. Thus, our shareholders bear the risk of our future securities issuances reducing the market price of our common shares and diluting their interest.

| Item 1B. | Unresolved Staff Comments |

None.

14

Hotel Properties

As of December 31, 2011, the Company owned interests in the following 37 hotel properties:

| | | | | | |

Hotel Properties | | Number of

Guest Rooms | | | Location |

1. Le Montrose Suite Hotel | | | 133 | | | WestHollywood, CA |

2. San Diego Paradise Point Resort and Spa(1) | | | 462 | | | San Diego, CA |

3. Harborside Hyatt Conference Center & Hotel(1)(2) | | | 270 | | | Boston,MA |

4. Hotel Viking | | | 209 | | | Newport,RI |

5. Topaz Hotel | | | 99 | | | Washington,D.C. |

6. Hotel Rouge | | | 137 | | | Washington,D.C. |

7. Hotel Madera | | | 82 | | | Washington,D.C. |

8. Hotel Helix | | | 178 | | | Washington,D.C. |

9. The Liaison Capitol Hill | | | 343 | | | Washington,D.C. |

10. Lansdowne Resort | | | 296 | | | Lansdowne,VA |

11. Hotel George | | | 139 | | | Washington,D.C. |

12. Indianapolis Marriott Downtown(1)(2) | | | 622 | | | Indianapolis,IN |

13. Hilton Alexandria Old Town | | | 246 | | | Alexandria,VA |

14. Chaminade Resort and Conference Center | | | 156 | | | SantaCruz, CA |

15. Hilton San Diego Gaslamp Quarter(2) | | | 283 | | | San Diego, CA |

16. The Grafton on Sunset | | | 108 | | | WestHollywood, CA |

17. Onyx Hotel | | | 112 | | | Boston,MA |

18. Westin Copley Place(2)(3) | | | 803 | | | Boston,MA |

19. Hotel Deca(2) | | | 158 | | | Seattle,WA |

20. The Hilton San Diego Resort and Spa(1) | | | 357 | | | San Diego, CA |

21. Donovan House | | | 193 | | | Washington,D.C. |

22. Le Parc Suite Hotel | | | 154 | | | WestHollywood, CA |

23. Hotel Sax Chicago | | | 353 | | | Chicago,IL |

24. Westin Michigan Avenue(2) | | | 752 | | | Chicago,IL |

25. Alexis Hotel | | | 121 | | | Seattle,WA |

26. Hotel Solamar(1)(2) | | | 235 | | | San Diego, CA |

27. Gild Hall | | | 126 | | | New York, NY |

28. Hotel Amarano Burbank | | | 99 | | | Burbank,CA |

29. Sofitel Washington, DC Lafayette Square | | | 237 | | | Washington,D.C. |

30. Hotel Monaco San Francisco | | | 201 | | | San Francisco, CA |

31. Westin Philadelphia | | | 294 | | | Philadelphia,PA |

32. Embassy Suites Philadelphia – Center City | | | 288 | | | Philadelphia,PA |

33. Hotel Roger Williams(1)(2) | | | 193 | | | New York, NY |

34. Chamberlain West Hollywood | | | 113 | | | WestHollywood, CA |

35. Viceroy Santa Monica(1) | | | 162 | | | SantaMonica, CA |

36. Villa Florence | | | 182 | | | San Francisco, CA |

37. Park Central Hotel | | | 934 | | | New York, NY |

| | | | | | |

Total number of guest rooms | | | 9,830 | | | |

| | | | | | |

| (1) | Property subject to a long-term ground or land and building lease. |

| (2) | Property subject to a mortgage/debt. |

| (3) | Property subject to a long-term air rights lease. |

Each of our hotels is full service, with six classified as “luxury”, 25 classified as “upper upscale” and six classified as “upscale”, as defined by Smith Travel Research (“STR”), a provider of hotel industry data.

15

The nature of the operations of the hotels exposes the hotels and the Company to the risk of claims and litigation in the normal course of their business. The Company is not presently subject to any material litigation nor, to the Company’s knowledge, is any litigation threatened against the Company, other than routine actions for negligence or other claims and administrative proceedings arising in the ordinary course of business, some of which are expected to be covered by liability insurance and all of which collectively are not expected to have a material adverse effect on the liquidity, results of operations, business or financial condition of the Company.

| Item 4. | Mine Safety Disclosures |

Not applicable.

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities |

Information about the Company’s equity compensation plans is incorporated by reference to the material in the Company’s Proxy Statement for the 2012 Annual Meeting of Shareholders (the “Proxy Statement”).

Market Information

The common shares of the Company began trading on the New York Stock Exchange (“NYSE”) on April 24, 1998 under the symbol “LHO.” The following table sets forth, for the periods indicated, the high and low sale prices per common share and the cash distributions declared per share:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Calendar Year 2011 | | | Calendar Year 2010 | |

| | | High | | | Low | | | Distribution | | | High | | | Low | | | Distribution | |

First Quarter | | $ | 29.58 | | | $ | 25.05 | | | $ | 0.11 | | | $ | 23.75 | | | $ | 18.91 | | | $ | 0.01 | |

Second Quarter | | $ | 28.69 | | | $ | 23.98 | | | $ | 0.11 | | | $ | 28.22 | | | $ | 20.10 | | | $ | 0.01 | |

Third Quarter | | $ | 27.47 | | | $ | 15.17 | | | $ | 0.11 | | | $ | 24.65 | | | $ | 19.12 | | | $ | 0.11 | |

Fourth Quarter | | $ | 25.25 | | | $ | 17.22 | | | $ | 0.11 | | | $ | 26.92 | | | $ | 21.39 | | | $ | 0.11 | |

The closing price for the Company’s common shares, as reported by the NYSE on December 31, 2011, was $24.21 per share.

16

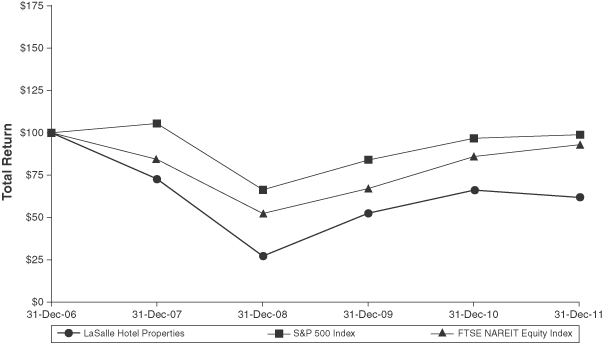

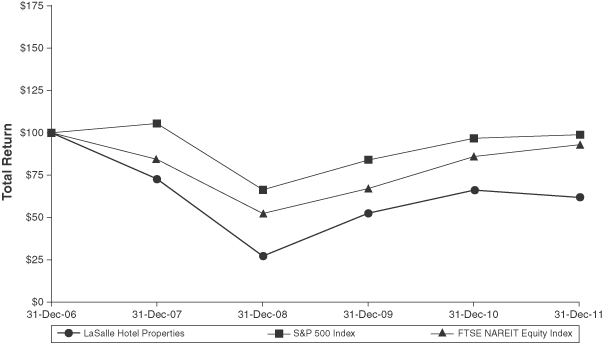

SHARE PERFORMANCE GRAPH

The following graph provides a comparison of the cumulative total return on the common shares from December 31, 2006 to the NYSE closing price per share on December 31, 2011 with the cumulative total return on the Standard & Poor’s 500 Composite Stock Price Index (the “S&P 500”) and the FTSE National Association of Real Estate Investment Trusts Equity REITs Index (“FTSE NAREIT Equity Index”). In 2007, the National Association of Real Estate Investment Trusts replaced the Total Return Index previously used by the Company in its Share Performance Graph with the FTSE NAREIT Equity Index. Total return values were calculated assuming a $100 investment on December 31, 2006 with reinvestment of all dividends in (i) the common shares, (ii) the S&P 500 and (iii) the FTSE NAREIT Equity Index.

The actual returns on the graph above are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | |

Name | | Initial

Investment at

December 31,

2006 | | | Value of

Initial

Investment at

December 31,

2007 | | | Value of

Initial

Investment at

December 31,

2008 | | | Value of

Initial

Investment at

December 31,

2009 | | | Value of

Initial

Investment at

December 31,

2010 | | | Value of

Initial

Investment at

December 31,

2011 | |

LaSalle Hotel Properties | | $ | 100.00 | | | $ | 72.92 | | | $ | 27.38 | | | $ | 52.78 | | | $ | 66.28 | | | $ | 61.92 | |

S&P 500 Index | | $ | 100.00 | | | $ | 105.49 | | | $ | 66.46 | | | $ | 84.05 | | | $ | 96.71 | | | $ | 98.76 | |

FTSE NAREIT Equity Index | | $ | 100.00 | | | $ | 84.31 | | | $ | 52.50 | | | $ | 67.20 | | | $ | 85.98 | | | $ | 93.10 | |

Shareholder Information

As of February 15, 2012, there were 103 record holders of the Company’s common shares of beneficial interest, including shares held in “street name” by nominees who are record holders, and approximately 15,600 beneficial holders.

17

Distribution Information

For 2011, the Company paid $0.44 per common share in distributions, of which $0.33 was recognized as 2011 distributions for tax purposes. Additionally, distributions of $0.0881 per common share for 2010 were recognized as 2011 distributions for tax purposes, bringing total 2011 distributions for tax purposes to $0.4182 per common share (rounded). Of the $0.4182, 27.33% represented ordinary income and 72.67% represented return of capital. Distributions for 2011 were paid quarterly to the Company’s common shareholders at a level of $0.11 per common share. Finally, distributions were paid to common unitholders at $0.11 per common unit for the fourth quarter of 2011.

For 2010, the Company paid $0.24 per common share in distributions, of which $0.1519 was recognized as 2010 distributions for tax purposes. Of the $0.1519, 100% represented ordinary income. These distributions were paid quarterly to the Company’s common shareholders at a level of $0.01 per common share for the first and second quarters of 2010 and $0.11 per common share for the third and fourth quarters of 2010.

The declaration of distributions by the Company is in the sole discretion of the Company’s Board of Trustees, and depends on the actual cash flow of the Company, its financial condition, capital expenditure requirements for the Company’s hotels, the annual distribution requirements under the REIT provisions of the Code and such other factors as the Board of Trustees deems relevant.

Operating Partnership Units and Recent Sales of Unregistered Securities

The Operating Partnership issued 3,181,723 common units of limited partnership interest to third parties on April 24, 1998 (inception), in conjunction with the Company’s initial public offering. The following is a summary of common unit activity since inception:

| | | | |

Common units issued at initial public offering | | | 3,181,723 | |

Common units issued: | | | | |

2000-2006 | | | 86,667 | |

2011 | | | 296,300 | |

Common units redeemed: | | | | |

1999-2008 | | | (3,198,390 | ) |

2009 | | | (70,000 | ) |

| | | | |

Common units outstanding at December 31, 2011 | | | 296,300 | |

| | | | |

Holders of common units of limited partnership interest receive distributions per unit in the same manner as distributions on a per common share basis to the common shareholders of beneficial interest.

Common shares issued upon redemption of common units of limited partnership interest were issued in reliance on an exemption from registration under Section 4(2) of the Securities Act. The Company relied on the exemption based on representations given by the limited partners that redeemed the units.

On December 29, 2011, in connection with the Company’s acquisition of Park Central Hotel and as part of the consideration for the hotel acquisition, the Operating Partnership issued 296,300 common units of limited partnership interest. The issuance of the common units was effected in reliance upon an exemption from registration provided by Section 4(2) under the Securities Act. The Company relied on the exemption based on representations given by the holders of the common units.

On November 17, 2006, in connection with the Company’s acquisition of Gild Hall and as part of the consideration for the hotel acquisition, the Operating Partnership issued 70,000 common units of limited

18

partnership interest and 1,098,348 Series F Preferred Units (liquidation preference $25.00 per unit) of limited partnership interest. During 2008, all 1,098,348 of the Series F Preferred Units were redeemed for 568,786 common shares of beneficial interest and a cash payment of $14.5 million. During 2009, all 70,000 common units and the Series F Preferred Units were redeemed for 69,500 common shares of beneficial interest and an insignificant amount of cash. The issuance of the common units and the Series F Preferred Units and the subsequent issuance of common shares upon the redemption of the common units were each effected in reliance upon an exemption from registration provided by Section 4(2) under the Securities Act. The Company relied on the exemption based on representations given by the holder of the common units and the Series F Preferred Units.

In August 2005, the Company acquired the Westin Copley Place in Boston, Massachusetts. As part of the consideration to acquire the hotel, the Operating Partnership issued 2,348,888 7 1/4% Series C Cumulative Redeemable Preferred Units (liquidation preference $25.00 per unit) of the Operating Partnership (the “Series C Preferred Units”). The Series C Preferred Units were redeemable for 7 1/4% Series C Cumulative Redeemable Preferred Shares of Beneficial Interest (liquidation preference $25.00 per share), $0.01 par value per share, of the Company (the “Series C Preferred Shares”) on a one-for-one basis. On February 1, 2009, each of the Series C Preferred Units was redeemed and the Company issued 2,348,888 Series C Preferred Shares. Prior to the exchange described below, the Series C Preferred Shares were held by SCG Hotel DLP, L.P. (“SCG”). On April 16, 2009, SCG exchanged its Series C Preferred Shares for an equal number of Series G Preferred Shares (liquidation preference $25.00 per share), $0.01 par value per share, of the Company in a private transaction. Each of the issuance of the Series C Preferred Shares and the exchange of the Series C Preferred Shares for Series G Preferred Shares was exempt from registration pursuant to Section 4(2) of the Securities Act. On April 17, 2009, the Company filed a registration statement with the SEC to register the resale of the Series G Preferred Shares. On May 13, 2009, in connection with the exchange, SCG paid the Company a fee of $1.0 million, which the Company recognized as income.

Issuer Purchases of Equity Securities

| | | | | | | | | | | | | | | | |

| | | Total Number

of Shares

Purchased(1) | | | Average

Price Paid

per Share | | | Total Number

of Shares

Purchased as

Part of

Publicly

Announced

Plans or

Programs | | | Approximate

Dollar Value

of Shares that

May Yet Be

Purchased

Under the

Plans or

Programs(2) | |

October 1, 2011 — October 31, 2011 | | | 337,718 | | | $ | 17.77 | | | | 337,718 | | | $ | 75,498,000 | |

November 1, 2011 — November 30, 2011 | | | — | | | | — | | | | — | | | $ | 75,498,000 | |

December 1, 2011 — December 31, 2011 | | | — | | | | — | | | | — | | | $ | 75,498,000 | |

| | | | | | | | | | | | | | | | |

Total | | | 337,718 | | | $ | 17.77 | | | | 337,718 | | | $ | 75,498,000 | |

| | | | | | | | | | | | | | | | |

| (1) | During the fourth quarter of 2011, the Company repurchased 337,718 common shares of beneficial interest under the Repurchase Program (as defined below). |

| (2) | On August 29, 2011, the Company announced its Board of Trustees had authorized a share repurchase program (the “Repurchase Program”) to acquire up to $100.0 million of the Company’s common shares of beneficial interest. The timing of the purchases and the exact number of shares to be purchased depend upon market conditions. The authorization did not include specific price targets or an expiration date. Since the time the Company ceased repurchasing activity on October 11, 2011 (the date of the Company’s last repurchase of common shares), the Company has had availability under the Repurchase Program to acquire up to $75.5 million of common shares of beneficial interest. However, the Company is not currently authorized by its Board of Trustees to repurchase or offer to repurchase any common shares. If authorized by its Board of Trustees, the Company may resume using the Repurchase Program on a future date. |

19

| Item 6. | Selected Financial Data |

The following tables set forth selected historical operating and financial data for the Company. The selected historical operating and financial data for the Company for the years ended December 31, 2011, 2010, 2009, 2008 and 2007 have been derived from the historical financial statements of the Company. The following selected financial information should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and all of the financial statements and notes thereto included elsewhere in this Annual Report on Form 10-K.

LASALLE HOTEL PROPERTIES

Selected Historical Operating and Financial Data

(Unaudited, in thousands, except share data)

| | | | | | | | | | | | | | | | | | | | |

| | | For the year ended December 31, | |

| | | 2011 | | | 2010 | | | 2009 | | | 2008 | | | 2007 | |

Operating Data: | | | | | | | | | | | | | | | | | | | | |

Revenues: | | | | | | | | | | | | | | | | | | | | |

Hotel operating revenues | | $ | 714,005 | | | $ | 594,642 | | | $ | 535,944 | | | $ | 587,449 | | | $ | 545,941 | |

Participating lease revenue | | | 0 | | | | 0 | | | | 0 | | | | 12,799 | | | | 27,193 | |

Other income | | | 5,002 | | | | 5,715 | | | | 6,702 | | | | 7,504 | | | | 5,421 | |

| | | | | | | | | | | | | | | | | | | | |

Total revenues | | | 719,007 | | | | 600,357 | | | | 542,646 | | | | 607,752 | | | | 578,555 | |

Expenses: | | | | | | | | | | | | | | | | | | | | |

Hotel operating expenses | | | 452,838 | | | | 380,459 | | | | 338,539 | | | | 366,518 | | | | 338,758 | |

Depreciation and amortization | | | 111,282 | | | | 105,587 | | | | 102,856 | | | | 99,365 | | | �� | 85,234 | |

Real estate taxes, personal property taxes and insurance | | | 35,425 | | | | 30,897 | | | | 29,460 | | | | 31,664 | | | | 29,478 | |

Ground rent | | | 7,720 | | | | 5,825 | | | | 5,706 | | | | 7,091 | | | | 6,838 | |

General and administrative | | | 17,120 | | | | 18,802 | | | | 15,033 | | | | 17,361 | | | | 13,425 | |

Lease termination expense | | | 0 | | | | 0 | | | | 0 | | | | 4,296 | | | | 0 | |

Acquisition transaction costs | | | 2,571 | | | | 3,003 | | | | 0 | | | | 0 | | | | 0 | |

Impairment of development property | | | 0 | | | | 8,427 | | | | 0 | | | | 0 | | | | 0 | |

Other expenses | | | 2,527 | | | | 3,287 | | | | 3,016 | | | | 3,504 | | | | 2,966 | |

| | | | | | | | | | | | | | | | | | | | |

Total operating expenses | | | 629,483 | | | | 556,287 | | | | 494,610 | | | | 529,799 | | | | 476,699 | |

Operating income | | | 89,524 | | | | 44,070 | | | | 48,036 | | | | 77,953 | | | | 101,856 | |

Interest income | | | 48 | | | | 126 | | | | 63 | | | | 159 | | | | 1,386 | |

Interest expense | | | (39,704 | ) | | | (36,500 | ) | | | (37,951 | ) | | | (48,207 | ) | | | (46,279 | ) |

| | | | | | | | | | | | | | | | | | | | |

Income before income tax (expense) benefit, equity in earnings of joint venture and discontinued operations | | | 49,868 | | | | 7,696 | | | | 10,148 | | | | 29,905 | | | | 56,963 | |