UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(A) OF THE SECURITIES

EXCHANGE ACT OF 1934 (AMENDMENT NO. )

Filed by the Registrant☒

Filed by a Party other than the Registrant☐

Check the appropriate box:

☐ Preliminary Proxy Statement ☐Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e) (2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to sec. 240.14a-12

Omega Protein Corporation

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(l) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

April 29, 2015

To Our Stockholders:

You are cordially invited to attend the 2015 Annual Meeting of Stockholders (the “Annual Meeting”) of Omega Protein Corporation (the “Company”) to be held on Thursday, June 25, 2015 at 9:00 a.m., local time, at The Denver Marriott City Center, 1701 California Street, Denver, Colorado 80202-3402. A Notice of the Annual Meeting, Proxy Statement and proxy card are enclosed with this letter. A copy of the Company’s Annual Report to Stockholders for the fiscal year ended December 31, 2014 also accompanies this mailing.

At the Annual Meeting, we will vote on certain matters being submitted to the stockholders, report on the progress of the Company, comment on matters of interest and respond to your questions. Stockholders can vote their shares by proxy by telephone, the Internet or the enclosed proxy card, or by attending the Annual Meeting in person.

It is important that your shares be represented at the Annual Meeting. Even if youplan to attend the Annual Meeting, we hope that you will read the enclosed Proxy Statement and the voting instructions on the enclosed proxy card and then vote by completing, signing, dating and mailing the proxy card in the enclosed, postage pre-paid envelope or vote by telephone or the Internet. If your shares are not registered in your own name and you would like to attend the Annual Meeting, please ask the broker, bank or other nominee that holds the shares to provide you with evidence of your share ownership.

We appreciate your continued interest in the Company.

Sincerely,

Gary R. Goodwin

Chairman of the Board

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 25, 2015

TO THE STOCKHOLDERS OF OMEGA PROTEIN CORPORATION:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Annual Meeting”) of Omega Protein Corporation (the “Company”) will be held at The Denver Marriott City Center, 1701 California Street, Denver, Colorado 80202-3402 on Thursday, June 25, 2015 at 9:00 a.m., local time, for the following purposes:

| | 1. | To elect three Class II directors for a term of three years and until their successors are duly elected and qualified; |

| | 2. | To ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm for the Company’s fiscal year ending December 31, 2015; |

| | 3. | To approve the Company’s 2015 Long Term Incentive Plan; |

| | 4. | To hold an advisory vote on executive compensation; and |

| | 5. | To transact such other business as may properly come before the meeting or any postponements or adjournments thereof. |

The Board of Directors recommends that you vote FOR all of the nominees for Class II director and FOR each of proposals 2, 3 and 4 above.

The Board of Directors has fixed the close of business on April 28, 2015 as the record date for determining the stockholders entitled to notice of, and to vote at, the Annual Meeting and at any postponement or adjournment thereof. If you are a stockholder of record, you may vote over the Internet, by telephone or by completing and mailing the enclosed proxy card in the envelope provided. If your shares are held in “street name,” that is, held for your account by a broker, bank or other nominee, you will receive instructions from the holder of record that you must follow for your shares to be voted.

You are cordially invited to attend the Annual Meeting.

By Order of the

Board of Directors,

JOHN D. HELD

Executive Vice President,

General Counsel and Secretary

Houston, Texas

April 29, 2015

OMEGA PROTEIN CORPORATION

2105 CityWest Blvd.

Suite 500

Houston, Texas 77042

PROXY STATEMENT

FOR

ANNUAL MEETING OF STOCKHOLDERS

JUNE 25, 2015

General Information

This proxy statement (the “Proxy Statement”) is being furnished in connection with the solicitation of proxies by the Board of Directors of Omega Protein Corporation (“Omega” or the “Company”) for use at the Annual Meeting of Stockholders of the Company to be held at The Denver Marriott City Center, 1701 California Street, Denver, Colorado 80202-3402 on Thursday, June 25, 2015 at 9:00 a.m., local time, and at any postponement or adjournment thereof (the “Annual Meeting”). The Annual Meeting is being held for the purposes set forth in this Proxy Statement. This Proxy Statement and the enclosed form of proxy (the “Proxy Card”) are first being mailed to stockholders on or about April 29, 2015.

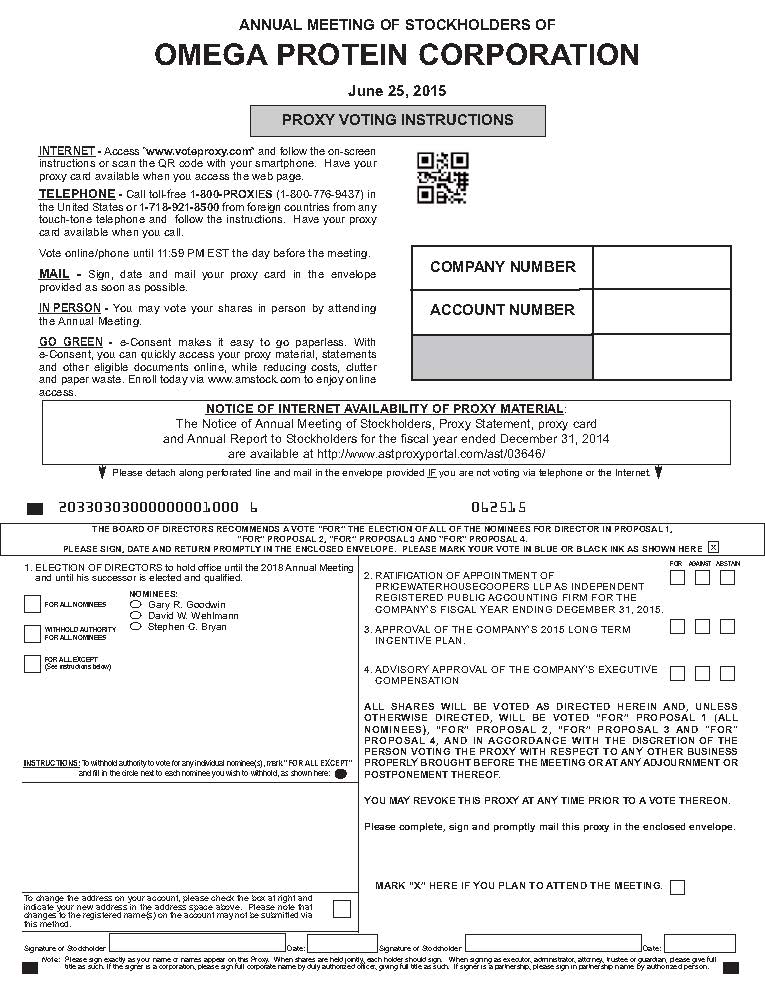

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to be held on June 25, 2015.

We have elected to provide access to our proxy materials both by sending you this full set of proxy materials, including a Notice of Annual Meeting of Stockholders, Proxy Card and Annual Report to Stockholders for the fiscal year ended December 31, 2014, and by notifying you of the availability of our proxy materials on the Internet.The Notice of Annual Meeting of Stockholders, Proxy Statement, Proxy Card and Annual Report to Stockholders for the Company’s fiscal year ended December 31, 2014 are available atwww.astproxyportal.com/ast/03646/.In accordance with rules of the Securities and Exchange Commission (the “SEC”), the materials on this website are searchable, readable and printable and the website does not have “cookies” or other tracking devices which identify visitors.

Voting Procedures

If you are a record holder, meaning your shares are registered in your own name, you may vote:

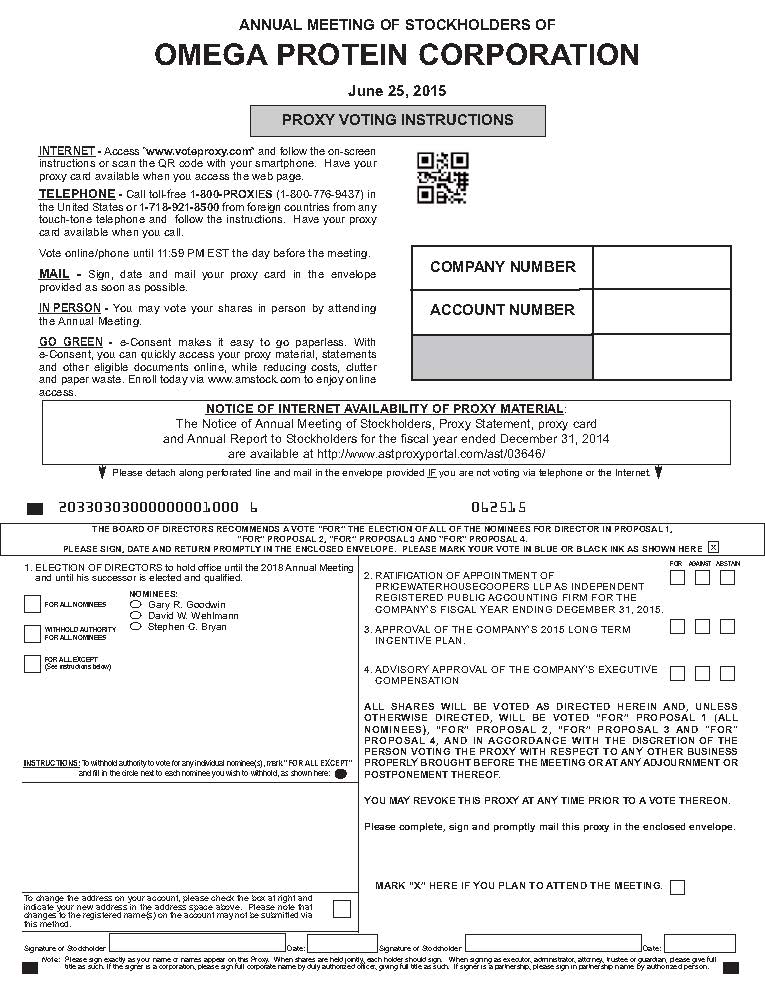

| | (1) | Over the Internet:Go to the website of our tabulator, American Stock Transfer & Trust Company, atwww.voteproxy.com. Use the vote control number printed on your enclosed proxy card to access your account and vote your shares. You must specify how you want your shares voted or your Internet vote cannot be completed and you will receive an error message. Your shares will be voted according to your instructions. |

| | (2) | By Telephone:Call 1-800-PROXIES (1-800-776-9437) toll free from the United States or 1-718-921-8500 from foreign countries from any touch-tone telephone, and follow the instructions on your enclosed proxy card. You must specify how you want your shares voted and confirm your vote at the end of the call or your telephone vote cannot be completed. Your shares will be voted according to your instructions. |

| | (3) | By Mail:Complete and sign your enclosed proxy card and mail it in the enclosed postage prepaid envelope. Your shares will be voted according to your instructions. If you sign and return your proxy card but do not specify how you want your shares voted, they will be voted as recommended by the Board. |

| | (4) | In Person at the Annual Meeting:If you attend the Annual Meeting, you may deliver your completed proxy card in person or you may vote by completing a ballot, which we will provide to you at the meeting. |

If your shares are held in “street name,” meaning they are held for your account by a broker, bank or other nominee, you may vote:

| | (1) | Over the Internet:You will receive instructions from your broker, bank or other nominee stating if they permit Internet voting and, if they do, explaining how to do so. You should follow those instructions. |

| | (2) | By Telephone:You will receive instructions from your broker, bank or other nominee stating if they permit telephone voting and, if they do, explaining how to do so. You should follow those instructions. |

| | (3) | By Mail:You will receive from your broker, bank or other nominee explaining how you can vote your shares by mail. You should follow those instructions. |

| | (4) | In Person at the Annual Meeting:You must contact your broker, bank or other nominee who holds your shares to obtain a brokers’ proxy card and bring it with you to the Annual Meeting.You will not be able to vote in person at the meeting unless you have a proxy from your broker, bank or other nominee issued in your name giving you the right to vote your shares. |

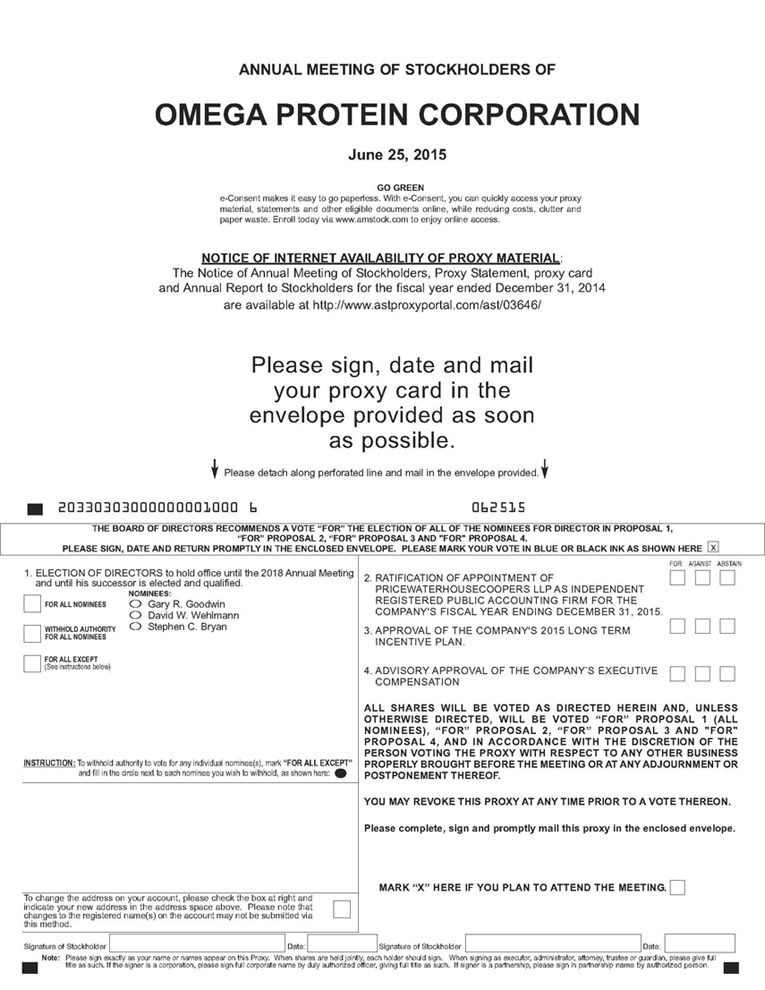

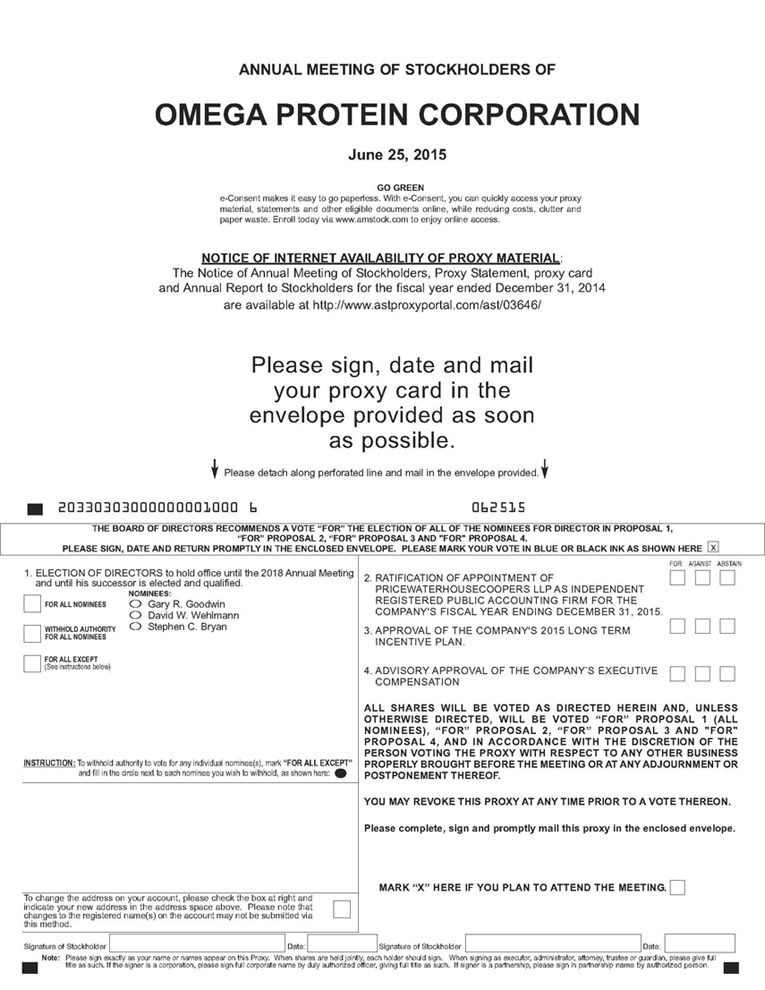

Proxy Card

The shares represented by any Proxy Card which is properly executed and received by the Company prior to or at the Annual Meeting (each, a “Conforming Proxy”) will be voted in accordance with the specifications made thereon. Conforming Proxies that are properly signed and returned but on which no specifications have been made by the stockholder will be voted in favor of the proposals described in the Proxy Statement. The Board of Directors is not aware of any matters that are expected to come before the Annual Meeting other than those described in the Proxy Statement. However, if any other matters are properly brought before the Annual Meeting, the persons named in the Proxy Card will vote the shares represented by each Conforming Proxy on those matters as instructed by the Board of Directors, or in the absence of express instructions from the Board of Directors, in accordance with their own best judgment. A stockholder who has executed and delivered a Conforming Proxy may revoke that Conforming Proxy at any time before it is voted by (i) executing a new proxy with a later date and delivering the new proxy to the Company Secretary, (ii) voting in person at the Annual Meeting, or (iii) giving written notice of revocation to the Company Secretary prior to the Annual Meeting. A stockholder who has voted over the Internet or by telephone may change his or her vote by voting again over the Internet or by telephone as instructed above. Only the stockholder’s latest Internet or telephone vote will be counted.

Proof of Ownership Required for Attending the Annual Meeting in Person

You are entitled to attend the Annual Meeting only if you are a stockholder as of the close of business on April 28, 2015, the record date set by the Board of Directors (“Record Date”), or hold a valid proxy for the Annual Meeting. If you are a named stockholder or a beneficial owner of Common Stock that is held of record by a broker, bank or other nominee, you will need to provide valid identification and proof of ownership to be admitted to the Annual Meeting. This proof can be:

| | ● | a brokerage statement or letter from a broker, bank or other nominee indicating ownership on April 28, 2015, |

| | ● | a legal proxy provided by your broker, bank or other nominee. |

Any holder of a proxy from a stockholder must present the proxy card, properly executed, and a copy of proof of ownership. Stockholders and proxy holders must also present a form of photo identification such as a driver’s license. We will be unable to admit anyone who does not present identification or refuses to comply with our security procedures. No cameras, recording equipment, electronic devices, large bags or packages will be permitted at the Annual Meeting.

Quorum and Other Matters

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the outstanding shares of the Company’s common stock, par value $0.01 per share (“Common Stock”), is necessary to constitute a quorum. Shares of Common Stock represented by Conforming Proxies will be counted as present at the Annual Meeting for purposes of determining a quorum without regard as to whether the proxy is marked as casting a vote or abstaining. Shares of Common Stock represented by Conforming Proxies that are voted on at least one matter coming before the Annual Meeting will also be counted as present for purposes of determining a quorum, even if the beneficial owner’s discretion has been withheld (a “broker non-vote”) for voting on some or all other matters.

Proposal No. 1, the three directors to be elected, will require approval of a plurality of the votes cast. With plurality voting, the three nominees for director who receive the largest number of shares voted will be elected, irrespective of the number or percentage of votes cast. Directors will be elected by a favorable vote of the plurality of shares of Common Stock present, in person or by proxy, at the Annual Meeting and entitled to vote. You may either vote “FOR” or “WITHHOLD” authority to vote for the Company’s director nominees. If you withhold authority to vote with respect to any nominee, your shares will be counted for purposes of establishing a quorum, but will have no effect on the election of that nominee.

All other matters to come before the Annual Meeting, including Proposals No. 2, 3 and 4, will require the approval of a majority of the shares of Common Stock present, in person or by proxy, at the Annual Meeting and entitled to vote. You may vote “FOR,” “AGAINST” or “ABSTAIN” on the other proposals to be presented at the Annual Meeting. If you abstain from voting on these proposals, your shares will be counted as present for purposes of establishing a quorum at the Annual Meeting. An abstention will have the same practical effect as a vote against the ratification of the appointment of the Company’s independent registered public accounting firm (Proposal No. 2), the proposal on the Company’s 2015 Long-Term Incentive Plan (Proposal No. 3) and the advisory proposal on executive compensation (Proposal No. 4).

Broker non-votes are counted as present for purposes of determining the presence or absence of a quorum but will not be counted for purposes of determining whether a proposal has been approved. Broker non-votes occur when brokers, banks and other nominees do not receive voting instructions from their customers and the broker, bank or other nominee does not have discretionary voting authority with respect to a proposal. If you hold shares through a broker, bank or other nominee and you do not give instructions as to how to vote, your broker, bank or other nominee may have authority to vote your shares on certain routine matters but not on non-routine matters. Routine matters do not include the election of directors, the adoption of, or amendments to, stock incentive plans, or the advisory proposal on executive compensation. If your shares are held by a broker, your broker cannot vote your shares for the election of directors, the proposal on the 2015 Long-Term Incentive Plan or the advisory proposal on executive compensation unless you provide voting instructions. Therefore,please instruct your broker how to vote your shareson these matters promptly. Broker non-votes will not be counted for purposes of the election of directors and will have no effect on the outcome of the vote for the proposal on the 2015 Long-Term Incentive Plan or the advisory proposal on executive compensation.

Solicitation of Proxies

This solicitation of proxies is being made by the Board of Directors of the Company and all expenses of this solicitation will be borne by the Company. Directors, officers and employees may solicit proxies on behalf of the Board of Directors, without additional compensation, personally or by telephone. The Company has retained Georgeson, Inc. to solicit proxies. Under our agreement with Georgeson, Inc., Georgeson, Inc. will receive a fee of $6,250 plus the reimbursement of reasonable expenses. The Company also expects to reimburse brokerage houses, banks and other fiduciaries for reasonable expenses incurred when forwarding proxy materials to beneficial owners.

VOTING SECURITIES AND SECURITY OWNERSHIP

OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The outstanding voting securities of the Company consist entirely of shares of Common Stock. Each share of Common Stock entitles its owner to one vote upon each matter to come before the Annual Meeting. Only stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting and at any postponement or adjournment thereof. At the close of business on the Record Date, the Company had outstanding 21,718,072 shares of Common Stock.

Security Ownership of Certain Beneficial Owners

To the Company’s knowledge, the following persons are the only persons who are beneficial owners of more than five percent of the Common Stock based on the number of shares outstanding on December 31, 2014 (21,527,319 shares):

| Name and Address of Beneficial Owner | | Amount andNature of Beneficial Ownership(1) | | | PercentofClass | |

| | | | | | | | | |

Dimensional Fund Advisors, LP(1) Building One 6300 Bee Cave Road Austin, Texas 78746 | | | 1,789,139 | | | | 8.3% | |

| | | | | | | | | |

Blackrock, Inc.(2) 55 East 52nd Street New York, New York 10022 | | | 1,620,474 | | | | 7.5% | |

| | | | | | | | | |

Franklin Resources, Inc.(3) One Franklin Parkway San Mateo, California 94403 | | | 1,200,000 | | | | 5.6% | |

| | | | | | | | | |

LSV Asset Management(4) 155 N. Wacker Drive, Suite 4600 Chicago, Illinois 60606 | | | 1,176,078 | | | | 5.5% | |

| | | | | | | | | |

| | (1) | Based on a Schedule 13G/A dated February 5, 2015 filed with the SEC by Dimensional Fund Advisors LP showing sole voting power over 1,717,884 shares and sole dispositive power over 1,789,139 shares. |

| | (2) | Based on a Schedule 13G/A dated January 12, 2015 filed with the SEC by Blackrock, Inc. showing sole voting power over 1,563,355 shares and sole dispositive power over 1,620,474 shares. |

| | (3) | Based on a Schedule 13G/A dated January 27, 2015 filed with the SEC by Franklin Resources, Inc. showing sole voting power over 1,200,000 shares and sole dispositive power over 1,200,000 shares. |

| | (4) | Based on a Schedule 13G dated February 12, 2015 filed with the SEC by LSV Asset Management showing sole voting power over 443,100 shares and sole dispositive power over 1,176,078 shares. |

Security Ownership of Directors and Executive Officers

The following table sets forth the number of shares of Common Stock of the Company beneficially owned as of March 31, 2015 by each of the Company’s directors and executive officers, including each of the Named Executive Officers set forth in the Summary Compensation Table in this Proxy Statement, and by all directors and executive officers as a group. Unless otherwise noted, each of the named persons and members of the group has sole voting and investment power with respect to the shares of Common Stock shown.

Name of Beneficial Owner | | Shares of the Company’s Common Stock(1) | | | Percentage of the Company’s Common Stock(2) | |

EXECUTIVE OFFICERS: | | | | | | | | |

Bret D. Scholtes | | | 450,381 | | | | 2.1% | |

Dr. Mark E. Griffin | | | 253,929 | | | | 1.2% | |

John D. Held | | | 197,595 | | | | * | |

Joseph R. Vidal | | | 148,445 | | | | * | |

Andrew C. Johannesen | | | 92,073 | | | | * | |

Gregory P. Toups | | | 69,899 | | | | * | |

Matthew W. Phillips | | | 58,033 | | | | * | |

Terry Olson(3) | | | 36,196 | | | | * | |

Montgomery C. Deihl | | | 21,426 | | | | * | |

DIRECTORS: | | | | | | | | |

Dr. Gary L. Allee | | | 69,357 | | | | * | |

David A. Owen | | | 45,342 | | | | * | |

Paul M. Kearns | | | 39,126 | | | | * | |

David W. Wehlmann | | | 32,871 | | | | * | |

Gary R. Goodwin | | | 27,585 | | | | * | |

Gary J. Ermers | | | 3,620 | | | | * | |

Stephen C. Bryan | | | 3,620 | | | | * | |

| | | | | | | | | |

All directors and executive officers as a group, including those persons named above (16 total) | | | 1,549,498 | | | | 7.4% | |

* Represents ownership of less than 1.0%.

| | (1) | Includes 300,000; 168,334; 125,000; 40,834; 40,000; 28,929; 30,000; 24,200; 20,000; and 777,297 shares of Common Stock subject to stock options exercisable on March 31, 2015 or within 60 days thereafter held by, respectively, Messrs. Scholtes, Griffin, Held, Toups, Allee, Owen, Kearns, Wehlmann, Goodwin, and all directors and executive officers as a group. None of the directly owned shares of Common Stock or stock options are pledged as collateral. Some of the directly owned shares of Common Stock held by directors or executive officers are held pursuant to the Company’s Stock Retention Guidelines. See “Proposal 1 Election of Directors — Stock Retention Guidelines.” |

| | (2) | For purposes of computing the percentage of outstanding shares of Common Stock held by each person or group of persons, any security which such person has the right to acquire within 60 days after March 31, 2015 is deemed to be outstanding for that person, but is not deemed to be outstanding in computing the percentage ownership of any other person. |

| | (3) | Mr. Olson’s employment with the Company ended on March 31, 2015. |

PROPOSAL 1

ELECTION OF DIRECTORS

The Company’s Articles of Incorporation divide the Board of Directors into three classes designated as Class I, Class II and Class III. Each class of directors is elected to serve a three-year term. The Board presently consists of eight directors, two in Class I, three in Class II and three in Class III, whose terms expire at the 2017, 2015 and 2016 Annual Meetings, respectively, or as soon thereafter as their successors are duly elected and qualified.

The current Class II directors are Gary R. Goodwin, David W. Wehlmann and Stephen C. Bryan and their terms expire at the Annual Meeting, or as soon thereafter as their successors are duly elected and qualified. Each of Mr. Goodwin, Mr. Wehlmann and Mr. Bryan has been nominated by the Board of Directors pursuant to the recommendation of the Corporate Governance and Nominating Committee to be elected by the holders of the Common Stock to serve a three-year term as a Class II director. The Board has determined that each of Mr. Goodwin, Mr. Wehlmann and Mr. Bryan is independent under the rules of the New York Stock Exchange (“NYSE”) and the definition of “independent director” as established by the Board.

Our Board of Directors includes eight members who we believe are well-qualified to serve on the Board and represent our stockholders’ best interests. The basic responsibility of a Company director is to exercise his or her business judgment prudently and act in a manner that he or she believes in good faith to be in the best interests of the Company and its stockholders.

The Corporate Governance and Nominating Committee and the Board consider individuals who have records for leadership and success in their areas of activity and who will make meaningful contributions to the Board. Nominees for director are selected on the basis of Board experience, character, integrity, ability to make independent analytical inquiries, business background, as well as an understanding of the Company’s business environment.

We believe that each of the director nominees and our other directors bring these qualifications in a positive manner to our Board of Directors. Moreover, our members provide our Board with a diverse complement of specific business skills, experience and perspectives. In addition to the general qualifications described above and the information included in each director’s biographical summary, the following table describes some of the key qualifications, business skills, experience and perspectives that each of our directors brings to our Board:

Director | | Additional Qualifications |

Bret D. Scholtes | | Expertise in the Company’s business and industry. |

| | | |

Paul M. Kearns | | Expertise in insurance markets and risk management. |

| | | |

Gary R. Goodwin | | Expertise in energy markets. |

| | | |

Dr. Gary L. Allee | | Expertise in swine nutrition research and production and other animal feed markets. |

| | | |

Gary J. Ermers | | Financial accounting expertise; Audit Committee financial expert; expertise in the healthcare industry. |

| | | |

Stephen C. Bryan | | Expertise in the manufacturing and sales of vitamin and mineral supplements and food ingredients. |

| | | |

David A. Owen | | Expertise in law and complex commercial litigation. |

| | | |

David W. Wehlmann | | Financial accounting expertise; Audit Committee financial expert; expertise in the oil and gas industry. |

The Company’s Articles of Incorporation provide that no more than a minority of the number of directors necessary to constitute a quorum of the Board of Directors may be non-U.S. citizens. Each of the Company’s directors is a citizen of the United States except for Paul M. Kearns, who is a Class III director and citizen of the United Kingdom.

Conforming Proxies representing shares of Common Stock held on the Record Date that are returned will be voted, unless otherwise specified, in favor of the nominees for the Class II directors named below. The nominees have consented to be named in this Proxy Statement and to serve if elected, but should any nominee be unavailable to serve (which event is not anticipated) the persons named in the Proxy Card intend to vote for such substitute nominee or nominees as the Corporate Governance and Nominating Committee may recommend and that the Board of Directors may nominate.

Class II Nominees — Current Term Expires at the 2015 Annual Meeting

GARY R. GOODWIN, age 67, has been a director of the Company since November 2006 and Chairman of the Board since February 2013. Mr. Goodwin currently manages his personal investments. Mr. Goodwin served as a Principal and Vice President — Crude Oil Marketing of Texon, L.P., a privately held crude oil marketing company from 1996 until his retirement in March 2010.

DAVID W. WEHLMANN, age 56, has been a director of the Company since April 2012. Mr. Wehlmann is currently a business consultant and private investor. Mr. Wehlmann served as Executive Vice President, Investor Relations of Precision Drilling Corporation, a publicly traded oilfield services company, until March 2012. He assumed this position in December 2008 upon the acquisition of Grey Wolf, Inc. by Precision Drilling Corporation. Mr. Wehlmann previously served as Executive Vice President, Chief Financial Officer and Secretary of Grey Wolf, Inc., a publicly traded oilfield services company, from March 2003. He was Senior Vice President, Chief Financial Officer and Secretary of Grey Wolf, Inc. from February 1998 to March 2003. He joined Grey Wolf in July 1996 and served as Vice President and Controller. Mr. Wehlmann has served as a director of Xtreme Drilling and Coil Services Corp., a publicly traded Canadian-based land rig drilling contractor, since May 2013, and as a director of Paragon Offshore plc, a publicly traded provider of offshore drilling services, since August 2014. Mr. Wehlmann previously served as a director of Cano Petroleum, Inc., a publicly traded oil and gas exploration and production company, from December 2007 until September 2010. Mr. Wehlmann is a Certified Public Accountant.

STEPHEN C. BRYAN, age 68, has been a director of the Company since June 2014. Mr. Bryan currently manages his personal investments. Mr. Bryan served as the President and Chief Executive Officer of Delavau, LLC, a vitamin and mineral supplement and technology-based food ingredient manufacturer, from 2003 to March 2013 and was responsible for directing all aspects of Delavau's business with a focus on sales, operations and product development. Prior thereto, Mr. Bryan was President of the Great Lakes Division of TCI/AT&T Broadband, a cable, telecommunications and internet service company, and President of Entenmann's Bakery Company, a fresh baked goods manufacturing company. Mr. Bryan also has more than twenty years of general management and marketing experience with Kraft Foods, General Foods, and Frito-Lay. Mr. Bryan also served as a pilot for the U.S. Navy.

Vote Required.Each nominee shall be elected by a plurality of the votes cast in the election by the holders of the Common Stock represented and entitled to vote at the Annual Meeting.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS VOTEFORTHE ELECTION OF EACH OF MR. GOODWIN, MR. WEHLMANN AND MR. BRYAN AS A CLASS II DIRECTOR.

Continuing Directors

Biographical and other information with respect to all members of the Board of Directors whose current terms will continue after the Annual Meeting is set forth below:

Class III Directors—Current Term Expires at the 2016 Annual Meeting

PAUL M. KEARNS, age 50, has been a director of the Company since June 2001. Since August 2013, Mr. Kearns has served as Managing Director — Marine at Price Forbes Ltd., a London-based insurance brokerage firm which is the successor to Prentis, Donegan & Partners, Ltd., an insurance brokerage firm which Mr. Kearns co-founded in 1993. Prior to August 2013, Mr. Kearns served as Director — Marine at Price Forbes Ltd. Mr. Kearns has more than 25 years of experience in the global risk management and insurance industries. Mr. Kearns is a citizen of the United Kingdom.

BRET D. SCHOLTES, age 45, has served as the Company’s President and Chief Executive Officer since January 2012 and as a director of the Company since February 2013. Prior thereto, Mr. Scholtes served as the Company’s Senior Vice President — Corporate Development from April 2010 to December 2010 and as the Company’s Executive Vice President and Chief Financial Officer from January 2011 to December 2011. From 2006 to April 2010, Mr. Scholtes served as a Vice President at GE Energy Financial Services, a global energy investment firm. Prior to that, Mr. Scholtes held positions with two publicly traded energy companies. Mr. Scholtes also has five years of public accounting experience.

GARY J. ERMERS, age 55, has been a director of the Company since June 2014. Mr. Ermers serves as the Associate Director of Healthcare Consulting Services at Dean Dorton Allen Ford, PLLC, a public accounting firm, a position he has held since 2013. From 1996 to 2012, Mr. Ermers served as Chief Financial Officer of Saint Joseph Health System, Inc., a large multi-hospital and physician network. Mr. Ermers also served as interim CEO of that organization in 2004. Mr. Ermers holds an MBA degree in Finance from DePaul University and a BA degree in Accounting from the University of Wisconsin – Eau Claire.

Class I Directors — Current Term Expires at the 2017 Annual Meeting

DR. GARY L. ALLEE, age 70, has been a director of the Company since May 1998. For more than twenty years, Dr. Allee was Professor of Swine Nutrition at the University of Missouri, a position from which he retired in 2010. Dr. Allee has also served as President and as a member of the Board of Directors of the Midwest Section of the American Society of Animal Science. Dr. Allee has B.S. and M.S. degrees in Animal Husbandry and Swine Nutrition from the University of Missouri and a Ph.D. in Nutritional Sciences from the University of Illinois.

DAVID A. OWEN, age 56, has been a director of the Company since February 2010. Mr. Owen has been a partner in the law firm of Dickinson Wright PLLC since January 2015. Prior to that date, Mr. Owen was a partner in the law firm of Bingham Greenebaum Doll LLP and its predecessor entity, Greenebaum Doll & McDonald PLLC, for more than the last five years, where he served in firm management as Deputy Chairman, a member of the Compensation Committee and various other management positions. He represents businesses in a variety of complex commercial litigation matters. Mr. Owen's litigation practice includes environmental, agribusiness, anti-trust, securities and environmental enforcement matters. Mr. Owen received his B.S. in Chemical Engineering from Clemson University and his J.D. from Northern Kentucky University, Salmon P. Chase College of Law.

Board of Directors and Board Committees

The Company’s Board of Directors has eight directors and has established the Audit, Compensation and Corporate Governance and Nominating Committees as its standing committees. The Board of Directors does not have an executive committee or any committees performing a similar function.

The Board of Directors has adopted Corporate Governance Guidelines to assist the Board in the exercise of its responsibilities. The Corporate Governance Guidelines reflect the Board’s commitment to monitor the effectiveness of policy and decision making both at the Board and management level, with a view to enhancing stockholder value over the long-term. The Corporate Governance Guidelines also contain the Board’s definitions for determining director independence. The Corporate Governance Guidelines are posted on the Company’s website atwww.omegaprotein.com.The Company will also provide a copy of the Corporate Governance Guidelines to any stockholder upon request.

During 2014, the Board of Directors met six times and acted five times by unanimous written consent, the Audit Committee met four times, the Compensation Committee met five times and acted one time by unanimous written consent, and the Corporate Governance and Nominating Committee met three times. Each incumbent director, during the period for which he was a director in 2014, attended at least 75% of the aggregate of the total number of meetings of the Board of Directors and the total number of meetings held by all committees of the Board on which such director served.

Audit Committee.The Audit Committee consists of Mr. Wehlmann (Chairman), Mr. Goodwin and Mr. Ermers. Each of these Audit Committee members served on the Audit Committee for all of 2014, except for Mr. Ermers who joined the Audit Committee on June 19, 2014. In addition, Dr. Allee served as a member of the Audit Committee in 2014 until June 19, 2014.

The Board of Directors has determined each Audit Committee member to be “independent” under the definition set forth in the NYSE listing standards, under the standards set for audit committee members by the Exchange Act, and under the definition of independent director established by the Board. The Board of Directors has also determined that Mr. Wehlmann and Mr. Ermers are audit committee financial experts as that term is used in applicable SEC regulations.

The Audit Committee reviews the adequacy of the Company’s internal control systems and financial reporting procedures, reviews the general scope of the annual audit and reviews and monitors the performance of non-audit services by the Company’s independent registered public accounting firm. The Audit Committee meets with the Company’s independent registered public accounting firm and with appropriate financial personnel of the Company regarding these matters. The Audit Committee also appoints the Company’s independent registered public accounting firm. The independent registered public accounting firm may meet alone with the Audit Committee and has unrestricted access to the Audit Committee. The Audit Committee operates under a written charter which is posted on the Company’s website atwww.omegaprotein.com.The Company will also provide a copy of this charter to any stockholder upon request.

Compensation Committee.The Compensation Committee consists of Dr. Allee (Chairman), Mr. Bryan and Mr. Wehlmann. Each of these Compensation Committee members served on the Compensation Committee for all of 2014, except for Mr. Bryan who joined the Compensation Committee on June 19, 2014. In addition, Mr. Kearns served as a member of the Compensation Committee in 2014 until March 31, 2014 and Mr. Goodwin served as a member of the Compensation Committee in 2014 until June 19, 2014.

The Board of Directors has determined each Compensation Committee member to be independent under the definition set forth in the NYSE listing standards and under the definition of independent director established by the Board. The Compensation Committee determines the compensation (both salary and performance incentive compensation) to be paid to the Chief Executive Officer and certain other officers of the Company, and makes grants of long-term incentive awards. The Compensation Committee operates under a written charter which is posted on the Company’s website atwww.omegaprotein.com. The Company will also provide a copy of this charter to any stockholder upon request.

We believe our compensation program for employees and executives is not likely to have a material adverse effect on the Company because we believe our combination of base salary, bonus and long-term equity incentives is balanced and serves to motivate our employees to accomplish our Company objectives while avoiding unreasonable risk-taking.

For a description of the Company’s processes and procedures for considering and determining executive and director compensation and the role of any compensation consultants in executive and director compensation, see “Compensation Discussion and Analysis for the Year Ended December 31, 2014”.

Corporate Governance and Nominating Committee.The Corporate Governance and Nominating Committee consists of Mr. Owen (Chairman), Mr. Goodwin and Dr. Allee. Each of these Corporate Governance and Nominating Committee members served on the Corporate Governance and Nominating Committee for all of 2014, except for Mr. Goodwin who joined the Corporate Governance and Nominating Committee on June 19, 2014. In addition, Mr. Kearns served as a member of the Corporate Governance and Nominating Committee in 2014 until March 31, 2014 and Dr. William E.M. Lands, a former director, served as a member of the Corporate Governance and Nominating Committee until his retirement as a Board member on June 19, 2014.

The Board of Directors has determined each member of the Corporate Governance and Nominating Committee to be “independent” under the definition set forth in the NYSE listing standards and under the definition of independent director established by the Board. The Corporate Governance and Nominating Committee reviews and reports to the Board on a periodic basis on corporate governance matters, periodically reviews and assesses the effectiveness of the Board’s Corporate Governance Guidelines and recommends proposed revisions to the Corporate Governance Guidelines to the Board. The Committee also identifies individuals qualified to become members of the Board, recommends to the Board director nominees for Board seats and committee seats, and monitors and evaluates the orientation and training needs of directors. The Corporate Governance and Nominating Committee operates under a written charter which is posted on the Company’s website atwww.omegaprotein.com.The Company will also provide a copy of this charter to any stockholder upon request.

Other than the provisions contained in the Company’s Bylaws set forth below, the Corporate Governance and Nominating Committee has not established formal procedures to be followed by stockholders submitting recommendations for candidates for the Board, nor has it established a formal process for identifying candidates for directors. The Corporate Governance and Nominating Committee considers individuals who have distinguished records for leadership and success in their area of activity and who will make meaningful contributions to the Board. The Corporate Governance and Nominating Committee recommends to the Board nominees for director on the basis of broad experience, character, integrity, ability to make independent analytical inquiries, as well as their understanding of the Company’s business environment. The Company has not paid fees to any third party to identify, evaluate or assist any director candidates.

Although not part of any formal policy, our goal with regard to diversity is to have a balanced and diverse Board, with members whose skills, backgrounds and experiences are complementary and, together cover the broad spectrum of areas that impact our business. Our directors bring a broad range of leadership experience to the boardroom that is useful to our Company. We believe all Board members are well-engaged in their responsibilities, and all Board members express their views and are open to the opinions expressed by other directors.

The Board believes that it should generally have no fewer than five and no more than nine directors. This range permits diversity of experience without hindering effective discussions or diminishing individual accountability. The Board believes that stockholders will benefit from the continuity, experience and stability that comes with longevity of service on the Board. As such, the Board does not limit the terms of its directors or require retirement at a specific age.

The Company’s Bylaws provide that nominations for the election of directors may be made upon timely notice given by a stockholder. A timely notice must be made in writing, and physically received by the Secretary of the Company, not later than the close of business on the 60th calendar day, nor earlier than the close of business on the 90th calendar day, before the first anniversary of the preceding year’s annual meeting. However, in the event that the date of the upcoming annual meeting is more than 30 calendar days before, or more than 60 calendar days after, such anniversary date, notice by the stockholder to be timely must be delivered not earlier than the close of business on the 90th calendar day before such annual meeting and not later than the close of business on the later of the 60th calendar day before such annual meeting or the 10th calendar day following the day on which public announcement of a meeting date is first made by the Company. The stockholder notice must contain: (i) the name and address of the nominee for director, (ii) the name and address, as they appear on the books of the Company, of the stockholder proposing the nomination, (iii) the class and number of shares of the stock of the Company that are beneficially owned by the stockholder, and (iv) any material interest of the stockholder in the nomination.

Independent Directors.The Board of Directors has determined that all members of the Board, other than the Company’s President and Chief Executive Officer, Bret Scholtes, are “independent” under the definition set forth in the NYSE listing standards and under the definition of independent director established by the Board. In addition, the Board of Directors has determined that all members of the Company’s Audit Committee, in addition to meeting the above standards, also meet the criteria for independence for audit committee members under the Securities Exchange Act of 1934, as amended (“Exchange Act”). The Board’s policy on the number or percentage of independent directors on the Board is that a majority of directors on the Board shall be independent. In addition, pursuant to the NYSE listing standards, the Company is required to have, and currently has, a majority of independent directors on the Board.

The Board of Directors determines whether each director is independent based upon all relevant facts and circumstances appropriate for consideration in the judgment of the Board. In the context of this review, the Board has adopted a definition of independent director which includes the NYSE definition of independent director and is included in the Board’s Corporate Governance Guidelines, which are available on the Company’s website atwww.omegaprotein.com. The Company’s definition of independent director is set forth in full below:

| | (a) | No director qualifies as “independent” unless the Board affirmatively determines that the director has no material relationship with the Company (either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company). The Company will disclose these determinations annually in its proxy statement. |

| | (b) | In addition, a director is not independent if: |

| | (i) | The director is, or has been within the last three years, an employee of the Company, or an immediate family member (as defined in the NYSE Listed Company Manual) who is, or has been within the last three years, an executive officer, of the Company. Employment as an interim Chairman or CEO or other executive officer shall not disqualify a director from being considered independent following that employment. |

| | (ii) | The director has received, or has an immediate family member who has received, during any twelve-month period within the last three years, more than $120,000 in direct compensation from the Company, other than director and committee fees and pension or other forms of deferred compensation for prior service (provided such compensation is not contingent in any way on continued service). Compensation received by a director for former service as an interim Chairman or CEO or other executive officer need not be considered in determining independence under this test. Compensation received by an immediate family member for service as an employee of the Company (other than an executive officer) need not be considered in determining independence under this test. |

| | (iii) | (A) The director is a current partner or employee of a firm that is the Company’s internal or external auditor; (B) the director has an immediate family member who is a current partner of such a firm; (C) the director has an immediate family member who is a current employee of such a firm and personally works on the Company’s audit; or (D) the director or an immediate family member was within the last three years a partner or employee of such a firm and personally worked the Company’s audit within that time. |

| | (iv) | The director or an immediate family member is, or has been with the last three years, employed as an executive officer of another company where any of the Company’s present executive officers at the same time serves or served on that company’s compensation committee. |

| | (v) | The director is a current employee, or an immediate family member is a current executive officer, of a company that has made payments to, or received payments from, the Company for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2% of such other company’s consolidated gross revenues. Both the payments and the consolidated gross revenues to be measured shall be those reported in the last completed fiscal year of such other company. The look-back provision for this test applies solely to the financial relationship between the Company and the director or immediate family member’s current employer; the Company need not consider former employment of the director or immediate family member. Contributions to tax exempt organizations shall not be considered payments for purposes of this test, provided however the Company shall disclose in its annual proxy statement, or if the Company does not file an annual proxy statement, in the Company’s annual report on Form 10-K filed with the SEC, any such contributions made by the Company to any tax exempt organization in which any independent director serves as an executive officer if, within the preceding three years, contributions in any single fiscal year from the Company to the organization exceeded the greater of $1 million, or 2% of such tax exempt organization’s consolidated gross revenues. The Board is obligated to consider the materiality of any such relationship in accordance with Section (a) above. |

| | | |

| | (vi) | A director who is a control person or director, or the immediate family member of a control person or director, of an entity that is the beneficial owner of 25% of the outstanding shares of Common Stock of the Company is not independent until three years after the end of such control or director relationship. |

In addition, in affirmatively determining the independence of any director who will serve on the Company’s Compensation Committee, the Board of Directors must consider all factors specifically relevant to determining whether a director has a relationship to the Company which is material to that director's ability to be independent from management in connection with the duties of a Compensation Committee member, including, but not limited to:

| | (a) | the source of compensation of such director, including any consulting, advisory or other compensatory fee paid by the Company to such director; and |

| | (b) | whether such director is affiliated with the Company, a subsidiary of the Company or an affiliate of a subsidiary of the Company. |

In its determination of Board member independence, the Board determined that each of Dr. Allee, Mr. Goodwin, Mr. Ermers, Mr. Bryan, Mr. Wehlmann and Mr. Owen has no direct or indirect relationship with the Company of any type, other than in his capacity as a Board member, and that Mr. Kearns has no direct relationship with the Company, other than in his capacity as a Board member. The Board is aware that Mr. Kearns’ employer, Price Forbes Ltd. (“Price Forbes”), has provided insurance services in the past for certain lines of insurance utilized by the Company, and that the Company has paid commissions on those insurance policies, either to Price Forbes directly or to insurance carriers who in turn reimbursed Price Forbes.

In 2014, the aggregate commissions paid to Price Forbes that related to the Company’s business were $858,342. The Board determined that these commissions were reasonable given the nature of the Company’s marine business, the availability of the insurance lines, the Company’s relationships with underwriters introduced by Price Forbes, and the complexity of the work performed by Price Forbes. The Board also noted that Mr. Kearns owns less than a 1% equity interest in Price Forbes and that his compensation from Price Forbes was not tied in any way to any commission relating to the Company’s business. Therefore, the Board concluded that Mr. Kearns was independent for purposes of the Company’s definition of director independence.

Stockholder and Interested Party Communications.The Board of Directors maintains a process for stockholders or other interested parties to communicate with the Board or any Board member. Stockholders or interested parties who desire to communicate with the Board should send any communication to the Company’s Corporate Secretary, Omega Protein Corporation, 2105 City West Blvd., Suite 500, Houston, Texas 77042. The Corporate Secretary will forward such communication to the full Board of Directors or to any individual director or directors to whom the communication is directed unless the communication is threatening or illegal, uses inappropriate expletive language or is similarly inappropriate, in which case the Corporate Secretary has the authority to discard the communication or take appropriate legal action regarding the communication.

Director Attendance at Annual Meetings.The Board does not have a policy requiring that all directors attend Company annual meetings of stockholders, but it encourages all directors to do so. The 2014 Annual Meeting of Stockholders was attended by all directors.

Board Leadership Structure.We recognize that different board leadership structures may be appropriate for companies in different situations and believe that no one structure is suitable for all companies. In order to permit maximum flexibility, our Board does not have a policy on whether the roles of the Chief Executive Officer and Chairman of the Board should be separate and whether the Chairman of the Board should be selected from the non-employee directors or be an employee.

Gary R. Goodwin has been a director of the Company since November 2006 and Chairman of the Board since February 2013. Through his years of Board service, Mr. Goodwin has extensive knowledge of the Company and our industry and is dedicated to working closely with other members of our Board. Mr. Goodwin’s knowledge facilitates the Board decision-making process because he chairs the Board meetings where the Board discusses strategic and business issues. Mr. Goodwin also acts as the Presiding Director at all meetings of the independent directors.

Our Board is currently comprised of seven independent directors and one employee director. We believe that the members of our Board and the three standing Board Committees provide appropriate oversight for our Company. In this regard, the Audit Committee oversees the accounting and financial reporting processes, as well as risk and compliance matters. The Compensation Committee oversees the annual compensation and performance evaluation of our Chief Executive Officer and other Company officers. The Corporate Governance and Nominating Committee monitors matters such as the composition of the Board and its committees, board performance and “best practices” in corporate governance. We believe this framework strikes a sound balance with appropriate oversight.

Our Board conducts an annual evaluation in order to determine whether it and its committees are functioning effectively. As part of this annual self-evaluation, the Board evaluates whether the current leadership structure continues to be optimal for the Company and its stockholders. Our Corporate Governance Guidelines provide the flexibility for our Board to modify or continue our leadership structure in the future, as it deems appropriate.

Consideration of Risks.Our management is responsible for the Company’s day-to-day risk management activities. Our Board, which functions in an oversight role in risk management, focuses on understanding the nature of our risks, including our operations, strategic direction and overall risk management systems. Our Board receives periodic updates on our business operations, financial results, strategy and risks related to our business. These updates are accomplished primarily through discussions with appropriate management personnel and with the Board’s committees as discussed below.

In addition, each of our Board committees considers risk within its specific area of responsibility. For instance, our Audit Committee often asks management or our independent public accounting firm to address critical accounting issues at its meetings, and then considers the overall impact that these issues may have on our financial position and risk profile. In addition, the Audit Committee often discusses legal and compliance matters, and also assesses our disclosure controls and procedures and internal controls over financial reporting. Likewise, the Compensation Committee considers our executive compensation programs with a goal of providing incentives to appropriately reward executives for growth without undue risk taking. On an annual basis, the Nominating and Corporate Governance Committee reviews our Board and Board Committees’ structure to ensure appropriate oversight of risk.

The three Company officers who supervise the Company’s overall risk management generally are its Chief Executive Officer, Chief Financial Officer and General Counsel. The Chief Executive Officer reports directly to the Board. The Chief Financial Officer and the General Counsel each report to the Chief Executive Officer and generally attend every Board meeting. The Board receives information on risk oversight issues from these three officers freely and without any restrictions, usually in the form of Board or Committee presentations or a question and answer format. Board members may also communicate directly with any of these officers at any time. Accordingly, the Board does not believe it necessary for the Chief Financial Officer or General Counsel positions to report directly to the Board.

Presiding Director for Board Executive Sessions.The Company schedules regular executive sessions in which directors meet without management present. Gary Goodwin, the Company’s Chairman of the Board, acts as the Presiding Director at all Board executive sessions. Stockholders may communicate with the Presiding Director in the same manner described above under “—Stockholder and Interested Party Communications.”

Codes of Ethics.The Board of Directors has adopted a Code of Business Conduct and Ethics, which applies to all Company employees, as well as a Code of Ethics for Financial Professionals which applies to all Company professionals who serve in a finance, accounting, treasury or investor relations role. The Codes are posted on the Company’s website atwww.omegaprotein.com.The Company intends to post amendments to or waivers from the Codes to the extent applicable to its principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions on the Company’s website. No waivers were sought or granted under these Codes in 2014. The Company will also provide a copy of these Codes to any stockholder upon request.

Shareholder Rights Plan.In April 2014, the Company’s Board of Directors terminated the Company’s Shareholder Rights Plan. The Plan was originally adopted in June 2010 in view of various factors that were then impacting the price of the Company’s Common Stock, including the BP oil spill in the U.S. Gulf of Mexico.

Stock Retention Requirements.The Board has adopted stock ownership requirements for senior management and independent directors because it believes these executives will more effectively pursue the long-term interests of stockholders if they are stockholders themselves. The following table provides the Company’s current share ownership requirements, by position:

Leadership Position | Value of Shares |

Independent Board Member | 3x annual retainer |

| | |

Chief Executive Officer | 3x base salary |

| | |

Executive Vice Presidents, Senior Vice Presidents and Presidents of Divisions | 2x base salary |

| | |

Vice Presidents and other key employees (as designated from time to time by the Chief Executive Officer) | 1x base salary |

The Corporate Governance and Nominating Committee will review annually the share ownership requirements and where executives stand against their respective requirements. Once an executive becomes subject to the share ownership requirements, he or she has five years to satisfy the requirements. A three-year period to comply restarts when an executive is promoted to a higher ownership requirement or receives an increase in base salary or Board retainer fees.

EXECUTIVE OFFICERS

The following sets forth certain information with respect to the executive officers of the Company as of April 1, 2015.

| Name | | | Age | | Position |

Bret D. Scholtes | | | 45 | | President, Chief Executive Officer and Director |

Andrew C. Johannesen | | | 47 | | Executive Vice President and Chief Financial Officer |

John D. Held | | | 52 | | Executive Vice President, General Counsel and Secretary |

Dr. Mark E. Griffin | | | 46 | | President — Animal Nutrition Division |

Gregory P. Toups | | | 39 | | Vice President, Chief Accounting Officer and Controller |

Matthew W. Phillips | | | 44 | | Chief Commercial Officer — Nutegrity |

Montgomery C. Deihl | | | 51 | | Vice President — Operations |

Joseph R. Vidal | | | 54 | | President — Bioriginal Food & Science Corp. |

BRET D. SCHOLTES has served as the Company’s President and Chief Executive Officer since January 2012 and as a director since February 2013. Prior thereto, Mr. Scholtes served as the Company’s Senior Vice President — Corporate Development from April 2010 to December 2010 and as the Company’s Executive Vice President and Chief Financial Officer from January 2011 to December 2011. From 2006 to April 2010, Mr. Scholtes served as a Vice President at GE Energy Financial Services, a global energy investment firm. Prior to that, Mr. Scholtes held positions with two publicly traded energy companies. Mr. Scholtes also has five years of public accounting experience.

ANDREW C. JOHANNESEN has served as Executive Vice President and Chief Financial Officer of the Company since January 2012 and as Senior Vice President — Finance and Treasurer from July 2011 to December 2011. From December 2010 to July 2011, Mr. Johannesen served as Vice President and Treasurer of Westlake Chemical Corporation, a chemicals and plastic products manufacturer. From 2007 to December 2010, Mr. Johannesen served as Vice President and Treasurer of RRI Energy, Inc. (formerly Reliant Energy, Inc.), an electricity and energy service provider, and from 2005 to 2007 served as Vice President and Assistant Treasurer of RRI. Prior to that, Mr. Johannesen held various corporate development and finance positions at Reliant Energy and worked for Exxon Mobil Corporation and a major public accounting firm. Mr. Johannesen is a Certified Public Accountant.

JOHN D. HELD has served as the Company’s Executive Vice President, General Counsel and Secretary since June 2006 and has served as General Counsel and various other executive officer positions with the Company since 2000. From 1996 to 1999, Mr. Held was Senior Vice President, General Counsel and Secretary of American Residential Services, Inc., a then public company engaged in the consolidation of the air-conditioning, plumbing and electrical service industries. Prior to that, Mr. Held practiced law with Baker Botts LLP in Houston, Texas.

DR. MARK E. GRIFFIN has served as President — Animal Nutrition Division since June 2013, as Vice President — Research and Development from July 2009 to December 2010 and as Senior Vice President — R&D and Sales and Marketing since January 2011. From April 2009 to July 2009, Dr. Griffin served as Technical Director of the Specialty Group of Land O’Lakes Purina Feed, LLC, a co-operative of agricultural producers and marketer of agriculture food products. From 2003 to April 2009, Dr. Griffin served as Director of the Zoo and Aquaculture divisions of Land O’Lakes Purina Feed, LLC. Dr. Griffin also previously held several positions in the aquaculture, companion animal, zoo and private label divisions of Purina Mills, Inc. and Land O’ Lakes Purina Feed, LLC.

GREGORY P. TOUPS has served as the Company’s Chief Accounting Officer since June 2011, as the Company’s Vice President and Controller since May 2008, as Controller since May 2005, and as Assistant Controller from March 2005 to May 2005. Prior thereto, Mr. Toups was employed by the accounting firms Kushner LaGraize LLC, from November 2001 to March 2005, and by PricewaterhouseCoopers, LLP, from January 1998 to November 2001. Mr. Toups is a Certified Public Accountant.

MATTHEW W. PHILLIPS has served as the Chief Commercial Officer — Nutegrity since June 2013 and the President of Cyvex Nutrition, Inc. (a subsidiary acquired by the Company in December 2010) since March 2008. Prior thereto, Mr. Phillips served as Vice President, Marketing and Sales American/Europe for BI Nutraceuticals, a botanical ingredient supplier, from January 2002 until March 2008. Prior thereto, Mr. Phillips held sales and marketing positions of increasing responsibility with various botanical, nutrition and wellness companies.

MONTGOMERY C. DEIHL has served as the Company’s Vice President — Operations since March 2015, as Senior Director of Operations from January 2015 to March 2015, as Senior Director — Fishing Plant Operations from April 2012 to January 2015, and as General Manager of the Company’s Reedville, Virginia facility from August 2009 to April 2012. Prior to joining the Company in August 2009, Mr. Deihl was a Senior Managing Consultant for IBM Corporation (supply chain management) from July 2007 to July 2009. Prior to that, Mr. Deihl served in the United States Air Force from 1987 to 2007, retiring as a Lieutenant Colonel. Mr. Deihl is a fifth generation menhaden fisherman.

JOSEPH R. VIDAL has served since 2005 as the President and Chief Executive Officer of Bioriginal Food & Science Corp., a subsidiary acquired by the Company in September 2014 (“Bioriginal”). Prior thereto, Mr. Vidal served as Bioriginal’s Chief Financial Officer since 1999. From 1991 to 1998, Mr. Vidal was employed by Hitachi Canadian Industries, a turbine and generator manufacturer, where his career included positions as General Manager, Deputy General Manager, Production Manager, and Accounting and Human Resources Manager. Mr. Vidal's experience also includes eight years with KPMG, an audit, tax and advisory firm, where he was a manager in the Accounting Systems group in the Saskatoon, Canada office and manager of the Information Technology Group in Toronto, Canada.

COMPENSATION DISCUSSION AND ANALYSIS

FOR THE YEAR ENDED DECEMBER 31, 2014

Introduction

This discussion and analysis provides an overview of the Company’s executive compensation program and policies, the material compensation decisions that we made with regard to our 2014 compensation program, including decisions made in early 2015 that relate to our program, as well as the material factors that we considered in making those decisions, and the policies that we generally intend to use to guide compensation decisions.

Unless otherwise indicated, this discussion and analysis refers only to the compensation of those five executive officers whom we refer to as our “Named Executive Officers.” These executive officers are:

Bret D. Scholtes, President and Chief Executive Officer

Andrew C. Johannesen, Executive Vice President and Chief Financial Officer

John D. Held, Executive Vice President, General Counsel and Secretary

Dr. Mark E. Griffin, President – Animal Nutrition

Terry M. Olson, Former President – Human Nutrition (Mr. Olson resigned his executive officer position with the Company in January 2015 and his employment with the Company ended on March 31, 2015.)

Compensation Program Overview

Our executive compensation program is subject to the oversight of the Compensation Committee (“Committee”) of our Board of Directors. The Committee is composed of Dr. Gary L. Allee (Chairman), David W. Wehlmann and Stephen C. Bryan. Each of these Committee members served on the Committee for all of 2014, except for Mr. Bryan who joined the Committee on June 19, 2014. In addition, Paul Kearns served as a member of the Committee in 2014 until March 31, 2014 and Gary Goodwin served as a member of the Committee in 2014 until June 19, 2014.

The Committee determines the compensation to be paid to the Chief Executive Officer (the “CEO”) and other executive officers of the Company, including the Named Executive Officers. The Committee also determines the compensation to be paid to the Company’s independent directors unless otherwise undertaken by the Board.

Our ability to hire and retain employees with the requisite skills and experience to develop, expand and execute business opportunities is essential to our success and the success of our stockholders. While we hope to offer a work environment in which employees can find attractive career challenges and opportunities, we also understand that employees have choices regarding where they pursue their careers and compensation plays a significant role in their decision to choose us as their employer.

Our compensation program is designed to support the successful recruitment, development and retention of key employees in order to achieve our corporate goals, align management’s interests with those of our stockholders, and optimize long-term financial returns. Because we believe that employee continuity and retention of institutional knowledge are important corporate goals, we believe that our compensation program must support the retention of our key employees.

Compensation Best Practices

We ensure that our executive compensation is closely aligned with our stockholders as follows:

| | ● | A majority of our officers’ compensation is at risk as variable compensation. |

| | ● | A majority of our officers’ compensation is tied to the Company’s annual financial and operational performance. |

| | ● | Fifty percent of our officer’s short-term incentive awards are linked to the achievement of objective pre-established performance goals tied to specific operational and financial objectives. |

| | ● | Fifty percent of our officers’ long-term incentive equity-based awards have value tied to the Company’s common stock’s relative outperformance of the Russell 2000 Index over a multi-year period. |

| | ● | All officers and directors are subject to stock ownership requirements. |

| | ● | The Committee engages an independent compensation consultant to advise on executive compensation. |

2014 Executive Compensation Program

In connection with its review of executive compensation for 2014, the Committee retained Frederic W. Cook & Co., Inc. (“FWC”) as its independent compensation consultant to assist and advise the Committee. The firm was selected by the Committee based on its reputation and expertise and the Committee’s prior work with the firm. In connection with the appointment of FWC as the Committee’s compensation consultant, the Committee determined that FWC was independent based on criteria prescribed by the NYSE.

Peer Group Market Positioning

In connection with its engagement, FWC reviewed our executive compensation program for eight selected senior management positions, including the Named Executive Officers. In connection with its review of our executive compensation program, FWC compared the Company’s base salaries, short-term incentives and long-term incentives for the Named Executive Officer positions to marketplace base salaries, marketplace short-term incentives and marketplace long-term incentives for similar positions. To generate this market data, FWC used two sources of information. The first source was proxy data from a 19 company peer group developed by FWC and approved by the Committee which is set forth below (“Peer Group”). The second source was survey data from the 2014 Aon Hewitt US Total Comp Measurement Survey. These two sources were blended together to form the “market data.”

The Peer Group was developed by FWC based on size of company, industry, and certain financial metrics. The Peer Group used to compare executive compensation is presented below:

Company | Revenue* (in millions) | | Company | Market Cap* (in millions) |

Diamond Foods Inc | $877 | | USANA Health Sciences Inc | $1,213 |

John B. Sanfilippo & Son Inc | $833 | | Diamond Foods Inc | $771 |

Calavo Growers Inc | $783 | | Calavo Growers Inc | $632 |

USANA Health Sciences Inc | $749 | | Boulder Brands Inc | $613 |

Farmer Brothers Company | $535 | | NutriSystem Inc | $513 |

Boulder Brands Inc | $514 | | Farmer Brothers Company | $496 |

NutriSystem Inc | $394 | | John B. Sanfilippo & Son Inc | $406 |

Nature’s Sunshine Products | $380 | | Medifast Inc | $382 |

Omega Protein Corporation | $350 - $375 | | Alico Inc | $350 |

Medifast Inc | $319 | | Lifeway Foods Inc | $299 |

MGP Ingredients Inc | $314 | | MGP Ingredients Inc | $280 |

Inventure Foods Inc | $271 | | Nature’s Sunshine Products | $261 |

Nutraceutical International Corp | $214 | | Omega Protein Corporation | $227 |

LifeVantage Corp | $214 | | Craft Brew Alliance Inc | $227 |

Craft Brew Alliance Inc | $197 | | Inventure Foods Inc | $199 |

Golden Enterprises Inc | $133 | | Nutraceutical International Corp | $189 |

Bridgford Foods Corp | $133 | | LifeVantage Corp | $128 |

Lifeway Foods Inc | $115 | | Bridgford Foods Corp | $68 |

Coffee Holding Co Inc | $109 | | Golden Enterprises Inc | $43 |

Alico Inc | $89 | | Coffee Holding Co Inc | $31 |

25th Percentile | $165 | | 25th Percentile | $194 |

Median | $314 | | Median | $299 |

75th Percentile | $524 | | 75th Percentile | $505 |

*Revenue is the trailing twelve months; market capitalization is as of January 31, 2015. |

The FWC data showed that in the aggregate, Company executive officers were positioned near the market median (50th percentile) for base salary, near the 75th percentile for total cash compensation (salary plus short-term incentives), and between the market median (50th percentile) and the 75th percentile for long-term incentive awards. In addition, Company total direct compensation (salary, short-term incentives plus long-term incentives) for the Company’s executive officers was positioned at approximately the 75th percentile.

FWC noted that in terms of overall compensation mix, the Company’s weighting of base salary compared to short-term and long-term incentives was lower than that of market and that the Company placed a greater emphasis on annual incentives than the market.

Based on the above, the Committee believes that the Company’s executive compensation program positioning was within a reasonable range when compared to FWC’s market data.

Elements of Executive Compensation

The key elements of our executive compensation program are: (i) base salary, (ii) short-term incentives such as annual cash awards, (iii) long- term incentives such as equity or equity-linked awards, and (iv) perquisites and generally available benefit programs. The balance among these elements of compensation is established annually by the Committee and is designed to retain key employees and encourage future performance. Our approach with respect to these four components of compensation is discussed below.

1. Base Salary.We pay our executive officers a base salary to compensate them for their services and to provide a steady source of income. The Committee has generally reviewed and established the base salaries of the CEO and the other Named Executive Officers on an annual basis. In establishing base salaries, the Committee considers the effect of any new base salary level on total compensation, the length of time since the last salary increase, the importance of the position, the skills and background required for the position, internal equity considerations among the Company’s senior officer positions and market data for similar positions. The Committee has not generally used any mechanical formulations or weighting of any of the factors it considers, although it may do so from time to time.

The base salaries of the Named Executive Officers for 2014 and 2015 are as follows:

Officer | Title | 2014 Base Salary | 2015 Base Salary | Percentage Change |

Bret D. Scholtes | President and Chief Executive Officer | $550,000 | $550,000 | 0% |

Andrew C. Johannesen | Executive Vice President and Chief Financial Officer | $325,000 | $340,000 | 4.6% |

John D. Held | Executive Vice President, General Counsel and Secretary | $325,000 | $325,000 | 0% |

Dr. Mark E. Griffin | President – Animal NTutrition Division | $325,000 | $325,000 | 0% |

Terry M. Olson | Former President – Human Nutrition Division | $290,000 | $290,000 | 0% |

The Committee increased the annual base salary of Andrew Johannesen, the Company’s Executive Vice President and Chief Financial Officer, from $325,000 to $340,000, effective as of March 1, 2015. The Committee approved this increase to make the Chief Financial Officer’s base salary closer to the 75th percentile for that position and after considering the importance of the position, Mr. Johannesen’s skill set, experience and contributions, as well as internal equity considerations.

2. Short-Term Incentives.We pay short-term incentives to our executive officers to reward them for short-term performance and the achievement of annual goals related to key business drivers. The Committee has generally granted short-term performance awards in the form of annual cash bonuses.

The Company’s short-term incentive program is a combination of formulaic measures and Committee discretion. The short-term incentive program for 2014 was weighted 50% for formulaic measures (the“2014 Formulaic Component”) and 50% for discretionary measures (the“2014 Discretionary Component”). The Committee then generated a potential Target value for the 2014 Formulaic Component for each Named Executive Officer which is referred to as the“2014 Formulaic Target Amount.” The Committee also generated a potential Target value for the 2014 Discretionary Component for each Named Executive Officer which is referred to as the“2014 Discretionary Target Amount.” The aggregate of the 2014 Formulaic Target Amount and the 2014 Discretionary Target Amount is referred to as the“2014 Aggregate Short-Term Target Incentive Amount.”

In setting targets and criteria for short-term incentives in 2014, the Committee considered the Company’s compensation strategy, the market data provided by FWC, the importance of the position, the skills and background required for the position and internal equity considerations among the Company’s senior officer positions. The Committee adopted the following 2014 Aggregate Short-Term Target Incentive Amounts for its Named Executive Officers:

Officer | Title | 2014 Aggregate Short-Term Target IncentiveAmount as a Percentage of 2014 Base Salary | 2014 Aggregate Short-Term Target Incentive Amount | 2014 Formulaic Target Amount | 2014 Discretionary Target Amount |

Bret D. Scholtes | President and Chief Executive Officer | 100% | $550,000 | $275,000 | $275,000 |

| | | | | | |

Andrew C. Johannesen | Executive Vice President and Chief Financial Officer | 75% | $243,750 | $121,875 | $121,875 |

| | | | | | |

John D. Held | Executive Vice President, General Counsel and Secretary | 75% | $243,750 | $121,875 | $121,875 |

| | | | | | |