SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | | Preliminary Proxy Statement |

| |

| ¨ | | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14A-6(E)(2)) |

| |

¨ | | Definitive Proxy Statement |

| |

x | | Definitive Additional Materials |

| |

¨ | | Soliciting Material Pursuant to Section 240.14a-12 |

Approved Financial Corp.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ No fee required.

¨ $125 per Exchange Act Rules 0-11(c) (1) (ii), 14a-6(i) (1), 14a-6(i) (2) or item 22(a) (2) of Schedule 14A.

¨ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

(1) Title of each class of securities to which transaction applies:

Common

(2) Aggregate number of securities to which transaction applies:

5,482,114

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

Assuming Book Value as adjusted pursuant to the Merger Agreement for each share as of the end of the last full month preceding closing to be .39, this would result in payment of $2,163,412.00 for all the outstanding common stock. This assumption is based on the estimated book value as of September 30, 2003.

| | (4) | | Proposed maximum aggregate value of transaction: $2,163,412.00 |

| | (5) | | Total fee paid: $175.02 |

x Fee paid previously with preliminary materials.

| | ¨ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

2

[LETTERHEAD OF Approved Financial Corp.]

November 10, 2003

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of Approved Financial Corp., which will be held at Approved Financial Corp.’s office at 1716 Corporate Landing Parkway, Virginia Beach, Virginia 23454 on December 11, 2003 at 2 PM Eastern Time.

The attached Notice of the Meeting and Proxy Statement describe the business to be transacted at the meeting. At the meeting, you will be asked to consider and vote upon a proposal to approve a merger pursuant to an Agreement and Plan of Merger dated September 30, 2003. If this merger is approved:

| | • | each share of our common stock will be exchanged for cash, without interest equal to the book value as of the end of the last full month preceding closing of one share of common stock of the company as determined by the merger agreement. The total merger consideration to be paid to all the holders of common stock will be the aggregate book value of which approximately 60% will be paid to directors and executive officers of the company who own approximately 60% of the common stock. |

| | • | the company will become a wholly owned subsidiary of Approved Acquisition Corp. a privately owned corporation; and |

| | • | all of the equity interests in the company (other than shares held by dissenting stockholders) will be owned by Approved Acquisition Corp. None of our directors or executive officers will own any stock in or be a director or executive officer of Approved Acquisition Corp. |

Based on our reasons for the merger described in the attached document, including the fairness opinion issued by our financial adviser, the Boards of Directors of Approved Financial Corp. and Approved Federal Savings Bank unanimously approved the merger agreement and believe that the terms of the merger are in the best interests of the company and its stockholders and fair to our stockholders.The board of directors recommends that you vote “F O R” approval of the merger agreement.

YOUR VOTE IS IMPORTANT. You are urged to sign, date and mail the enclosed Proxy Card promptly in the postage-paid envelope provided. If you attend the Meeting, you may vote in person even if you have already mailed in your Proxy Card or otherwise voted before the Meeting.

The accompanying material provides you with a summary of the merger and additional information.I encourage you to read and consider carefully the information contained in the enclosed material including the attached merger agreement. In addition, you may obtain information about the Company from documents that we have filed with the Securities and Exchange Commission.

Sincerely,

Allen D. Wykle

Chairman, President and Chief Executive Officer

For further information about

the Annual Meeting, please

call 1-757-430-1400

3

[LOGO]

Insert logo

APPROVED FINANCIAL CORP.

1716 Corporate Landing Parkway

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held on December 11, 2003

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Meeting”) of Approved Financial Corp. will be held at Approved Financial Corp.’s office at 1716 Corporate Landing Parkway, Virginia Beach, Virginia 23454 on December 11, 2003 at 2 PM.

A Proxy Statement and a Proxy Card for the meeting are enclosed. The meeting is being held for the purpose of considering and voting upon the following matters:

1. A proposal to approve an Agreement and Plan of Merger dated September 30, 2003 pursuant to which Company Acquisition Corp., a wholly owned subsidiary of Approved Acquisition Corp., will be merged with and into Approved Financial Corp., and each outstanding share of the Approved Financial common stock (other than shares held by stockholders who have properly perfected their dissenters’ rights) will be exchanged for the right to receive cash without interest, equal to the book value as of the end of the last full month preceding closing of one share of common stock as determined by the merger agreement. A copy of the merger agreement is attached as Appendix A to and is described in the accompanying Proxy Statement.

2. The approval of adjournments of the meeting in order to allow Approved Financial Corp. to continue to solicit proxies from holders of common stock who have not cast a vote by proxy with respect to the proposed merger, or whose proxies have not been voted in favor of the merger.

3. The reelection of two (2) directors to the board of directors.

4. Such other matters as may properly come before the meeting, or any adjournment thereof. The board of directors is not aware of any other business to come before the meeting.

The board of directors has established November 5, 2003 as the record date for the determination of stockholders entitled to notice of and to vote at the meeting and at any adjournments thereof. Only record holders of the common stock as of the close of business on that date will be entitled to vote at the meeting or any adjournment thereof. A list of common stockholders entitled to vote at the meeting

4

will be available at Approved Financial Corp., 1716 Corporate Landing Parkway, Virginia Beach, Virginia 23454 for a period of ten days prior to the meeting and also will be available for inspection at the meeting itself.

Stockholders are entitled to assert dissenters’ rights pursuant to the Virginia Stock Corporation Act. A copy of the dissenters’ rights provisions is attached to the enclosed proxy statement as Appendix C.

Our board of directors has determined that the merger agreement is fair and in the best interests of Approved Financial Corp.’s stockholders and unanimously recommends that stockholders vote “F O R” approval and adoption of the merger agreement, the proposal to adjourn the special meeting, if necessary, and the reelection of two directors.

EACH STOCKHOLDER, WHETHER HE OR SHE PLANS TO ATTEND THE MEETING, IS REQUESTED TO SIGN, DATE AND RETURN THE ENCLOSED PROXY CARD WITHOUT DELAY IN THE ENCLOSED POSTAGE-PAID ENVELOPE. ANY PROXY GIVEN BY A STOCKHOLDER MAY BE REVOKED AT ANY TIME BEFORE IT IS EXERCISED. A PROXY MAY BE REVOKED BY FILING WITH THE SECRETARY OF APPROVED FINANCIAL CORP. A WRITTEN REVOCATION OR A DULY EXECUTED PROXY BEARING A LATER DATE. ANY STOCKHOLDER PRESENT AT THE MEETING MAY REVOKE HIS OR HER PROXY AND VOTE PERSONALLY ON EACH MATTER BROUGHT BEFORE THE MEETING. HOWEVER, IF YOU ARE A STOCKHOLDER WHOSE SHARES ARE NOT REGISTERED IN YOUR NAME, YOU WILL NEED ADDITIONAL DOCUMENTATION FROM THE RECORD HOLDER OF YOUR SHARES TO VOTE PERSONALLY AT THE MEETING.

| | | By Order of the Board of Directors |

| |

| | | Stanley Broaddus |

Virginia Beach, Virginia | | Corporate Secretary |

| | | Approved Financial Corp. |

November 10, 2003 | | |

IMPORTANT: THE PROMPT RETURN OF PROXIES WILL SAVE APPROVED FINANCIAL CORP. THE EXPENSE OF FURTHER REQUESTS FOR PROXIES IN ORDER TO ENSURE A QUORUM AT THE MEETING. A SELF-ADDRESSED ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE. NO POSTAGE IS REQUIRED IF MAILED IN THE UNITED STATES.

5

TABLE OF CONTENTS

6

7

Insert logo

APPROVED FINANCIAL CORP.

1716 Corporate Landing Parkway

Virginia Beach, Virginia, 23454

SUMMARY

This summary term sheet highlights selected information from this Proxy Statement but may not contain all of the information that is important to you. To better understand the merger and for a more complete description of the terms of the merger, you should carefully read this entire Proxy Statement and its appendices and the other documents to which we refer. The actual terms of the merger are contained in the merger agreement included in this Proxy Statement as Appendix A.

Throughout this document, “Company,” “we” and “our” refer to Approved Financial Corp. The “Bank” refers to our wholly-owned banking subsidiary, Approved Federal Savings Bank. “Approved Acquisition” refers to Approved Acquisition Corp, “Company Acquisition” refers to Company Acquisition Corp, a newly formed wholly-owned subsidiary of Approved Acquisition, “Summit and Findley” refers to Summit Capital Partners, LLC and The Findley Group, who did the fairness opinion. Also we refer to the merger between Company Acquisition and Company as the “merger” and the Agreement and Plan of Merger dated September 30, 2003, as the “Merger Agreement.” We sometimes refer to the Annual Meeting of Stockholders as the “meeting.”

| 1. | WHAT WILL I RECEIVE IN THE MERGER? |

If the merger is completed and you do not assert your dissenter’s rights under Virginia law, you will receive cash, without interest, equal to the book value at the end of the last full month preceding closing of one share of common stock as determined by the merger agreement for each share of common stock that you own immediately prior to the merger. The exact amount will not be known until closing. As of September 30, 2003, the book value per share was estimated to be $.39. The cash at closing may be higher or lower depending on several factors including among others, whether the Company has a profit or loss for the period between September 30, 2003 and the end of the last full month preceding closing and the fair market value of held for sale and held for yield loans at the end of the last full month preceding closing. See “The Proposed Merger – Merger Consideration.”

| 2. | HOW DOES THE PRICE THAT I WILL RECEIVE FOR MY COMMON STOCK COMPARE TO THE HISTORICAL MARKET PRICES FOR THE STOCK? |

The September 30, 2003 estimated book value reflects a premium of $.19 over the closing market price of $0.20 on October 1, 2003, the last trading day before we publicly announced the merger and a premium of $.17 per share over the average closing price for days with trading activity for the 22 trading day period prior to the announcement of the merger of $.22. The closing price during the six months preceding September 30, 2003 ranged from $.15 to $.34. See “The Proposed Merger—Market Prices Of and Cash Dividends On Common Stock.”

The market price for the common stock did exceed $.39 at one point during the first quarter of 2003. However, the trading history for the common stock over more extended periods of time prior to the merger indicates that the common stock has not consistently maintained price levels in excess of $.39 since the third quarter of 2001. See “The Proposed Merger—Market Prices Of and Cash Dividends on Common Stock.”

8

| 3. | WHAT ARE THE FEDERAL INCOME TAX CONSEQUENCES OF THE MERGER? |

Generally, for United States federal income tax purposes, you will be treated as if you sold your common stock for the cash you receive in the merger. In general, you will recognize taxable gain or loss for federal income tax purposes equal to the difference between (1) the amount of cash you receive in the merger and (2) the adjusted tax basis of your shares of common stock surrendered in the merger. You may also be taxed under applicable foreign, state, local and other tax laws. In addition, if you do not provide certain certifications required by the Internal Revenue Service, a portion of the cash you are to receive may be withheld and paid to the Internal Revenue Service. You are encouraged to consult your own tax advisor regarding the specific tax consequences of the merger to you. See “The Proposed Merger–Material Federal Income Tax Consequences.”

| 4. | WHAT ARE THE REASONS FOR THE MERGER? |

The board of directors considered several factors in determining to recommend the approval of the merger, including:

| | • | | We have had regulatory restrictions primarily related to the Office of Thrift Supervision Letter of Directive dated April 2001 and Consent Supervisory Agreement dated December 2001. Since we have been operating under these Office of Thrift Supervision directives, we have experienced tremendous difficulty recruiting and retaining certain key management positions, have not been able to diversify into new lines of business, and have been operating under restrictions on the growth of our loan portfolio and lending practices. In addition we have been required to use a higher cost warehouse line of credit in lieu of FDIC certificates of deposit which has increased our interest expense. These restrictions and challenges have made it very difficult to create additional value for common stockholders. |

| | • | | The Office of Thrift Supervision verbally advised the boards of directors of the Company and the Bank to raise additional capital for the Bank either directly or through a merger or acquisition. |

| | • | | The opinion of Summit and Findley that the merger consideration is fair from a financial point of view to the holders of the common stock. |

| | • | | The board reviewed current and historical market prices for the Company’s shares, the declining per share price of the common stock prior to the time of the public announcement of the proposed merger, the possibility that the price would remain depressed or continue to decline. |

| | • | | The board of directors considered the alternatives. The board is of the opinion that the most likely alternative would be a voluntary or involuntary dissolution, both of which would, in the opinion of the board, result in less consideration than the merger. |

| | • | | The board considered prior proposals for merger or sale and concluded that the terms of this merger with Approved Acquisition were more favorable. |

See “The Proposed Merger—Recommendation of the Board of Directors; Reasons for the Merger.”

| 5. | HAS THE BOARD OF DIRECTORS RECOMMENDED THAT I VOTE FOR THE MERGER AGREEMENT? |

Yes. Your board of directors believes that the merger is fair to, and in the best interests of the Company and its stockholders. We evaluated the merits of the merger and the cash price to be paid to the common stockholders. The board then unanimously approved the merger.

9

For further information about how the board of directors arrived at their conclusions and the independent opinion that the board of directors received from their financial advisor, see “The Proposed Merger—Recommendation of the Board of Directors; Reasons for the Merger.”

| 6. | DO ANY DIRECTORS HAVE INTERESTS THAT MAY BE DIFFERENT FROM THE STOCKHOLDERS? |

Yes. In considering the recommendations of the board, you should be aware that certain directors and officers have interests that are different from your interests:

| | • | Officers and directors as a group own approximately 60% of the common stock of the Company. As a result, these individuals have a significant influence on the vote required for merger approval. |

| | • | Four directors as a group, hold subordinated debt of the Company in the amount of, $1,767,892. This subordinated debt will be assumed by Franklin Financial Group., a separate company owned by the principals of Approved Acquisition. However, these directors have agreed to pledge $700,000 of this subordinated debt or approximately forty percent (40%) of the $1,767,892 as collateral to Approved Acquisition as an indemnification setoff for unknown liabilities discovered subsequent to the merger related to events caused by Company and its subsidiary occurring before closing of the merger. |

| | • | Three executive officers who are also directors will receive severance compensation from Franklin Financial Group in an amount not to exceed the equivalent of one year of their current base salary. |

These interests are described in more detail in the Proxy Statement. See “The Proposed Merger—Interests of Certain Persons in the Merger; Conflicts of Interest.”

| 7. | DID THE BOARD RETAIN A FINANCIAL ADVISOR? |

Yes. The committee retained “Summit and Findley” as its financial advisor to help evaluate the Merger.

See “The Proposed Merger—Opinion of Summit and Findley”

Summit and Findley fairness opinion is based on analyses that contain estimates and valuation ranges, and does not necessarily indicate actual values or predict future results or values.

We have attached as Appendix B to this Proxy Statement the full text of the final opinion of Summit and Findley. This opinion sets forth assumptions made, matters considered and limitations on the review undertaken in connection with the opinion. YOU SHOULD READ THIS OPINION.

10

| 8. | WHAT WAS THE OPINION OF THE FINANCIAL ADVISOR? |

The board of directors received an opinion from its financial advisor that, as of September 30, 2003, the merger consideration is fair, from a financial point of view, to the public stockholders of Company. Please read the “The Proposed Merger – Opinion of Summit and Findley”.

Summit and Findley’s fairness opinion, dated October 20, 2003, is attached to this proxy statement as Appendix B. Summit and Findley does not intend to further update its opinion through the date of the meeting unless requested to do so by the Company. Summit and Findley will receive total fees of approximately $30,000 plus expenses for its merger-related services.

| 9. | HAVE OTHER PARTIES CONSIDERED THE FAIRNESS OF THE MERGER? |

No

| 10. | DO I HAVE SPECIAL RIGHTS IF I OPPOSE THE MERGER? |

Yes. Each stockholder who does not vote in favor of the merger may dissent and seek a judicial appraisal of his or her shares of common stock if the merger is completed. This option will be available only if the stockholder complies with all the appropriate legal requirements under Virginia law. See “Dissenters’ Rights Provisions of the Virginia Stock Corporation Act “ attached as Appendix C. These requirements are also summarized in the section “The Proposed Merger-Rights of Dissenting Shareholders.”

| 11. | WHAT WILL HAPPEN TO THE COMPANY’S STOCK OPTIONS? |

The Company has outstanding options for a total of 67,550 shares of common stock, all of which are exercisable at prices equal to or greater than $4.00 per share. The option agreements to these option holders have no value currently and are required to be cancelled as part of the transaction. See “The Proposed Merger—The Merger Agreement.”

| 12. | ARE THERE SUFFICIENT FINANCIAL RESOURCES TO PAY FOR THE COMMON STOCK? |

There are representations in the merger agreement from Approved Acquisition stating that it has and will have sufficient resources to pay the aggregate merger consideration. See “The Proposed Merger—The Merger Agreement.”

| 13. | WHEN IS THE MERGER EXPECTED TO BE COMPLETED? |

We expect the merger to be completed shortly after the meeting and receipt of regulatory approval. See “The Proposed Merger—Effective Time of the Merger and Payment for Shares.”

| 14. | WHAT ARE THE CONDITIONS TO COMPLETING THE MERGER? |

The completion of the merger is subject to several conditions, including the following:

| | • | | approval of the merger by the holders of more than two thirds of the Company’s outstanding common stock, |

| | • | | the holders of 13% or less of the common stock exercise their dissenters’ rights. |

| | • | | Office of Thrift Supervision regulatory approval of the merger. |

11

| | • | | all holders of Company options shall enter into cancellation agreements with respect to such Company options. |

| | • | | the Office of Thrift Supervision shall have terminated the Supervisory Agreement. |

| | • | | the average monthly nonconforming residential mortgage loan originations by the Company and the bank shall be no less than $12 million for the last full three-month period immediately prior to closing and no less than $12 million for the last full month immediately prior to closing. |

| | • | | the company and Approved Acquisition must have performed in all material respects their respective obligations under the merger agreement at or prior to closing. |

See “The Proposed Merger—The Merger Agreement.” We are not aware of any factors that would cause the failure of any of the closing conditions.

| 15. | CAN THE MERGER BE TERMINATED? |

Yes. The merger agreement may be terminated as follows:

| | • | by mutual consent of the parties; |

| | • | by the Company or Approved Acquisition if the merger is not completed by December 31, 2003, unless the failure to complete the merger by that date is due to the failure by the party seeking the termination of the merger agreement to perform its obligations under the merger agreement; |

| | • | by the Company or Approved Acquisition if the stockholders of the Company do not approve the merger agreement; |

| | • | by the Company or Approved Acquisition if any required regulatory approval for the completion of the transactions contemplated by the merger agreement is denied (or approved with a condition which would materially impair the value of the Company) or a regulatory application is withdrawn at the regulator’s request or recommendation unless a petition for rehearing or an amended application is filed within an agreed upon time frame, or if any governmental authority has issued a final order prohibiting the transactions; |

| | • | by the Company or Approved Acquisition if the other party breaches any of its representations, warranties, covenants or agreements under the merger agreement and the breach had a material adverse effect on the business assets or financial conditions, which breach has not been cured within 30 days of written notice of the breach; |

| | • | by the Company, at any time prior to the meeting, if the board of directors of the Company receives an offer that is superior to the Approved Acquisition offer and has determined that it must accept the superior offer to comply with its fiduciary duties; |

| | • | by Approved Acquisition, at any time before the annual meeting, if the board of directors of the Company does not recommend to its stockholders that the merger agreement be approved, or withdraws or modifies its recommendation in a manner adverse to Approved Acquisition, fails to call or convene the annual meeting or approves or recommends a merger with a person or entity other than Approved Acquisition contrary to the terms of the merger agreement; or |

| | • | by Approved Acquisition if the Company receives a tender offer for 20% or more of its common stock and the Company’s board of directors either recommends that the stockholders tender or fails to recommend that the stockholders reject the tender offer, and the stockholders fail to approve the Approved Acquisition merger agreement. |

12

| 16. | ARE THERE TERMINATION FEES IF THE MERGER IS TERMINATED? |

There are termination fees in certain events including:

Termination fees paid by the Company:

| | • | As a material inducement to Approved Acquisition to enter into the merger agreement, the Company agreed to pay Approved Acquisition $200,000.00 plus expenses not to exceed $100,000.00 if the Company breaches a covenant or representation which has a material adverse effect on the business operations, assets or financial condition of the Company or the Bank or upon the consummation of the merger if the breach is not cured in 30 days. |

| | • | As a material inducement to Approved Acquisition to enter into the merger agreement, the Company agreed to pay $400,000.00 to Approved Acquisition if the board of directors of the Company (i) does not recommend to its stockholders that the merger agreement be approved, (ii) withdraws or modifies its recommendation in a manner adverse to Approved Acquisition and the stockholders fail to approved the merger agreement, (iii) the board of directors fails to call or convene the meeting to vote on the merger agreement, (iv) the board approves a merger with a person or entity other than Approved Acquisition contrary to the terms of the merger agreement or (v) if the Company receives a tender offer for 20% or more of its common stock and the board of directors either recommends that the stockholders tender or fails to recommend that the stockholders reject the tender offer and the stockholders fail to approve the Approved Acquisition merger agreement. |

| | • | The Company agreed to pay $400,000.00 to Approved Acquisition if the Company decides to do a merger with a person or entity other than Approved Acquisition and in connection with that decision either intentionally breaches a representation or warranty or intentionally delays the Approved Acquisition merger beyond December 31, 2003 in order to have it terminated. |

Termination fees paid by Approved Acquisition:

| | • | As a material inducement to the Company entering into the merger agreement, Approved Acquisition agreed to pay the Company $200,000.00 plus expenses not to exceed $100,000.00 if Approved Acquisition breaches a covenant or representation which has a material adverse effect on the business, operations, assets or financial condition of the Company or Bank or upon the consummation of the merger, if the breach is not cured in 30 days. This $200,000.00 increases to $250,000.00 if Approved Acquisition, within 90 days of its breach, enters into a definitive agreement to purchase a bank or savings bank or bank holding company other than the Company and the Bank. |

| 17. | WHEN AND WHERE IS THE MEETING? |

The meeting will take place on December 11, 2003 @ 2PM Eastern Time, at 1716 Corporate Landing Parkway, Virginia Beach, Virginia 23454. See “Information About the Meeting.”

| 18. | WHAT WILL BE VOTED ON AT THE MEETING? |

At the meeting:

| | • | our stockholders will vote upon a proposal to approve the merger. |

13

| | • | if necessary, the stockholders may be asked to consider adjourning the meeting in order for the Company to continue to solicit proxies from stockholders who have not yet voted or who have not voted in favor of the merger. |

| | • | the stockholders will vote on the reelection of two directors. If the merger is approved, the newly reelected directors along with the other directors of the Company will resign pursuant to the merger agreement. |

| | • | the common stockholders will transact other business that may come before the meeting. |

See “Information About the Meeting—Voting at the Meeting.”

| 19. | WHO IS ENTITLED TO VOTE? |

Only stockholders of record at the close of business on November 5, 2003, which is the “Record Date,” are entitled to notice of, and to vote at, the meeting. However, all holders of common stock at the time the merger is completed will be entitled to receive the merger consideration (unless the holders are pursuing their rights to dissent and have their shares appraised under Virginia law). See “Information About the Meeting—Record Date, Quorum and Required Vote.”

| 20. | WHAT STOCKHOLDER VOTE IS REQUIRED TO APPROVE THE MERGER AGREEMENT? |

The merger must be approved by the holders of more than two thirds of the outstanding shares of common stock. See “Information About the Meeting—Record Date, Quorum and Required Vote.”

| 21. | HAVE ANY STOCKHOLDERS AGREED TO VOTE IN FAVOR OF THE MERGER AGREEMENT AND THE MERGER? |

Yes. Directors and certain stockholders have agreed to vote all of their shares of common stock, which represent in the aggregate approximately 60% of the outstanding shares of Company common stock, in favor of the approval of the merger agreement and the merger. See “The Proposed Merger—The Stockholders Agreement.”

| 22. | WHAT DO I NEED TO DO NOW? |

First, read this proxy statement carefully. Then, you should complete, sign and mail your proxy card in the enclosed return envelope as soon as possible. If your shares are held by a broker as nominee, you should receive a proxy card from your broker. See “Information About the Meeting—Voting at the Meeting.”

| 23. | MAY I CHANGE MY VOTE AFTER I HAVE MAILED IN MY SIGNED PROXY CARD OR OTHERWISE VOTED? |

Yes. To change your vote you can:

| | • | send in a later-dated, signed proxy card or a written revocation before the meeting, or |

| | • | attend the meeting and give oral notice of your intention to vote in person. |

14

You should be aware that simply attending the meeting will not in and of itself constitute a revocation of your proxy. See “Information About the Meeting-Revocation of Proxies.”

| 24. | SHOULD I SEND IN MY STOCK CERTIFICATES NOW? |

No. If the merger is completed, you will receive written instructions about how to exchange your shares of common stock for your cash payment. See “The Proposed Merger—Effective Time of the Merger and Payment for Shares.”

| 25. | IF MY SHARES ARE HELD IN “STREET NAME” BY MY BROKER, WILL MY BROKER VOTE MY SHARES FOR ME? |

Your broker will vote your shares ONLY if you provide written instructions on how to vote. You should follow the directions provided by your broker regarding how to instruct your broker to vote your shares. See “Information About the Meeting.”

WHO CAN HELP ANSWER YOUR QUESTIONS?

If you have any questions concerning the merger or the meeting, if you would like additional copies of the Proxy Statement or if you will need special assistance at the meeting, please call the Company at 1-757-430-1400. The summary information provided above in “question and answer” format is for your convenience only and is merely a brief description of material information contained in this Proxy Statement. YOU SHOULD CAREFULLY READ THIS PROXY STATEMENT (INCLUDING THE APPENDICES) IN ITS ENTIRETY.

Approved Financial Corp.

PROXY STATEMENT

ANNUAL MEETING OF STOCKHOLDERS

December 11, 2003

INFORMATION ABOUT THE MEETING

Date, Time and Place

This Proxy Statement is being furnished to our stockholders in connection with the solicitation by its board of directors of proxies to be used at the annual meeting of stockholders to be held at 1716 Corporate Landing Parkway, Virginia Beach, Virginia 23454 on December 11, 2003, 2PM Eastern Time, and at any adjournments thereof. The 2002 Annual Report to Stockholders, including the consolidated financial statements for the year ended December 31, 2002, accompanies this Proxy Statement, which is first being mailed to stockholders on or about November 10, 2003.

Voting at the Meeting

Regardless of the number of shares of common stock of the Company owned, it is important that stockholders be represented by proxy or present in person at the meeting. Stockholders are requested to vote by completing the enclosed proxy card and returning it signed and dated in the enclosed postage-paid envelope. Stockholders are urged to indicate their vote in the spaces provided on the proxy card. Proxies solicited by the board of directors of the Company will be voted in accordance with directions given in the proxy card, the merger and the approval of adjournments of the meeting, if needed, and the reelection of two directors

15

are the only matters presently scheduled to be considered by the stockholders at the meeting. Where no instructions are indicated, proxies will be voted FOR the approval of the merger, FOR adjournment if applicable and FOR the reelection of two directors.

The board of directors knows of no additional matters that will be presented for consideration at the meeting. Execution of a proxy, however, confers on the designated proxy holders discretionary authority to vote the shares in accordance with their best judgment on such other business, if any, that may properly come before the meeting or any adjournments thereof.

Revocation of Proxies

A proxy may be revoked at any time prior to its exercise by filing written notice of revocation with the secretary of the Company, by delivering to the Company a duly executed proxy bearing a later date, or by attending the meeting, filing a notice of revocation with the secretary and voting in person. However, if you are a stockholder whose shares are not registered in your name, you will need additional documentation from the record holder of your shares to vote personally at the meeting.

Solicitation of Proxies

The cost of solicitation of proxies in the form enclosed will be borne by the Company. Proxies may also be solicited personally or by telephone, or by directors, officers, and regular employees of the Company or the Bank, without additional cost to the Company or the Bank. The Company will also request persons, firms and corporations holding shares in their names, or in the name of their nominees, which are beneficially owned by others, to send proxy material to and obtain proxies from such beneficial owners, and will reimburse such holders for their reasonable expenses in doing so.

16

Record Date, Quorum and Required Vote

The securities that may be voted at the meeting consist of shares of common stock, with each share entitling its owner to one vote on all matters to be voted on at the meeting, except as described below.

The close of business on November 5, 2003 has been established by the board of directors as the record date for the determination of stockholders entitled to notice of and to vote at the meeting, and any adjournments thereof. The total number of shares of common stock outstanding on the Record Date was 5,482,114.

The presence, in person or by proxy, of a majority of the total number of shares of common stock entitled to vote is necessary to constitute a quorum at the meeting. The meeting may be adjourned in order to permit the further solicitation of proxies if there are not sufficient votes for a quorum at the time of the meeting or for such other purposes as may be considered proper. The affirmative vote of more than two thirds of the total number of outstanding shares of common stock will be required to approve the merger and the affirmative vote of a majority of the shares voting on an action will be required to approve any other action at the meeting including the approval of any adjournment of the meeting and the reelection of two directors. The company will treat shares of common stock represented by proxies that reflect abstentions as shares that are present and entitled to vote for the purpose of determining the presence of a quorum at the meeting and for the purpose of determining the outcome of any question submitted to the stockholders for a vote.

For discussion of the circumstances under which the Company might seek to adjourn the meeting in order to solicit additional proxies in favor of the merger, see “The Proposed Merger—Adjournment of the Meeting.”

HOLDERS OF COMMON STOCK SHOULD NOT SEND ANY CERTIFICATES REPRESENTING COMMON STOCK WITH THEIR PROXY CARD. IF THE MERGER IS CONSUMMATED, HOLDERS OF COMMON STOCK WILL RECEIVE WRITTEN INSTRUCTIONS ON HOW TO EXCHANGE THEIR SHARES FOR THE MERGER CONSIDERATION.

17

THE PROPOSED MERGER

The Companies Involved

Approved Financial Corp.

Approved Financial Corp., a Virginia corporation operates primarily in the consumer finance business of originating, servicing and selling mortgage loans secured by first and subordinated liens on primarily one-to-four family residential properties. The Company currently sources mortgage loans through a network of mortgage brokers who use mortgage products offered by Approved to serve the needs of their customers who are individual borrowers. In the past we also sourced loans through an internal sales staff that originated mortgages directly with borrowers.

Its principal executive offices are located at 1716 Corporate Landing Parkway, Virginia Beach, Virginia 23454. Its telephone number is 757-430-1400.

Approved Federal Savings Bank

Approved Federal Savings Bank is a federally chartered thrift institution and is a wholly owned subsidiary of the Company. All loan originations for the Company were conducted through the Bank in 2002. Its principal executive offices are located at 1716 Corporate Landing Parkway, Virginia Beach, Virginia 23454. Its telephone number is 757-430-1400.

Approved Acquisition Corp.

Approved Acquisition Corp., a Michigan corporation, was organized to become the owner of the Company in the merger. It has not conducted any active business operations. Its principal executive offices are located at Maccabees Center, 25800 Northwestern Hwy., Suite 875, Southfield, Michigan 48075. Its telephone number is 248-799-4000. It was formed for the purpose of the merger.

Company Acquisition Corp.

Company Acquisition Corp., a Virginia corporation, is a wholly owned subsidiary of Approved Acquisition Corp. and was formed solely for the purpose of merging into the Company. It has not conducted any active business operations. Its principal executive offices are located at Maccabees Center, 25800 Northwestern Hwy., Suite 875, Southfield, Michigan 48075. Its telephone number is 248-799-4000. It will no longer exist after the merger.

Franklin Financial Group

Michigan Fidelity Acceptance Corp., d/b/a Franklin Financial Group, a Michigan corporation, is in the mortgage loan origination business similar to the Company. Its principal

18

executive offices are located at Maccabees Center, 25800 Northwestern Hwy., Suite 875, Southfield, Michigan 48075. Its telephone number is 248-799-4000. It is owned by the same two principals that own Approved Acquisition.

Background of the Merger

We began to explore various opportunities to raise capital through the issuance of private or public, equity or debt securities in 2000. We filed a registration with the SEC on December 14, 2000 for the issuance of subordinated debt. However, at the request of the Office of Thrift Supervision we terminated plans to raise capital through this source.

In early 2001, the Company engaged a small investment banking firm specializing in merger and acquisition transactions within the financial services industry on a non-exclusive basis. We considered several merger, acquisition and investor opportunities, introduced by this firm as well as opportunities presented from our own network of financial services industry contacts, for sale of the Company and/or issuance of equity securities to new investors, none of which materialized.

In early 2001, negotiations were underway with an investor to acquire the Company for cash and effect a change in control. However, the investor was unsuccessful in efforts to raise capital for the transaction through the private placement of equity securities and the negotiations were terminated.

In 2001, we had regulatory restrictions primarily related to the Office of Thrift Supervision Letter of Directive dated April 2001 and Consent Supervisory Agreement dated December 2001. Since we have been operating under these directives, we have experienced tremendous difficulty recruiting and retaining certain key management positions, have not been able to diversify into new lines of business, and have been operating under restrictions on the growth of our loan portfolio and lending practices and been required to use a higher cost warehouse line of credit in lieu of FDIC certificates of deposit thus increasing our interest expense. These restrictions and challenges have made it very difficult to create additional value for common stockholders.

In October of 2001, the Office of Thrift Supervision held a conference call with the boards of the Company and the Bank and instructed them to retain an investment advisor specializing in the banking industry by December 31, 2001 for purpose of raising a minimum of $5 million in new capital.

During 2001, discussions were held with various medium to large sized investment banking firms with solid reputations in this area. However, the size of our capital need was too small for consideration by these firms. We then explored smaller, less known firms, and engaged, in December of 2001, a firm known to the Office of Thrift Supervision on a non-exclusive basis in addition to the adviser we had been working with beforehand.

We explored numerous potential investor opportunities during 2002 and 2003 of which a few progressed to advanced level negotiations whereby the investor held meetings with the Office of Thrift Supervision to discuss the potential transaction terms and business plan. The first of these advanced level negotiation investors was a foreign company, which was determined during 2002 not qualified for approval as a thrift holding company. In 2002, another investor lost its primary source for funding the acquisition when an opportunity to acquire a state chartered banking institution in lieu of our federal thrift charter became available.

In October of 2002, the OFFICE OF THRIFT SUPERVISION held a meeting with the boards of the Company and the Bank and advised that they would not remove the regulatory enforcement orders simply by means of the Company continuing to comply with the implemented corrective actions and effecting payoff of the Intercompany Promissory Note through future earnings. They instructed the directors that the OFFICE OF THRIFT SUPERVISION requires either a change in control transaction whereby the Company is recapitalized by a suitable investor who also brings in seasoned banking expertise or would expect the Company to elect for voluntary dissolution. As a result the board of directors ordered the management to prioritize the OFFICE OF THRIFT SUPERVISION instructions related to capital initiatives and to run a parallel analysis and plan for voluntary dissolution of the Company.

In late 2002, we began negotiations with another investor and entered into a nonbinding letter of intent in December 2002. This investor also held meetings with the Office of Thrift Supervision. This proposed transaction, which would have provided stock as opposed to cash consideration to stockholders, reached the stage of a near final definitive agreement in the summer of 2003, however, the definitive agreement was not approved because the acquiror could not confirm the availability of financial resources to consummate the transaction.

During 2003, we also began discussions with the principals who now own Approved Acquisition. We entered into a nonbinding letter of intent after they confirmed the availability of financial resources to be able to close the transaction. This resulted in the merger agreement which was signed September 30, 2003.

During 2003, the Company also ran an analysis for voluntary dissolution. We began selling aged loans formally designated as held for yield loan portfolio and recorded expenses related to valuation allowance charges to mark to market the few remaining loans in this category to facilitate an easier wind down should the Office of Thrift institution enforce this option. Due to the numerous unknown variables related to a voluntary dissolution and the unpredictable cash flow timing and quantification, it is the opinion of the board of directors that a liquidation would result in less consideration to stockholders and that the merger agreement would be in the best interest of the stockholders.

Opinion of Summit and Findley

The Company has retained Summit and Findley to provide a fairness opinion in connection with the merger. Summit and Findley rendered to the board of directors of the Company a preliminary opinion in connection with the execution of the merger agreement followed by its updated formal written opinion dated October 20, 2003 that the merger consideration as defined in the merger agreement was fair from a financial point of view to the holders of Company common stock. A copy of that opinion letter issued by Summit and Findley is attached as Appendix B to this proxy statement and should be read in its entirety. The following summary is qualified in its entirety by reference to the full text of the opinion. The opinion is addressed to the board of directors of Company and does not constitute a recommendation to any shareholder of Company as to how such shareholder should vote.

In connection with its fairness opinion, Summit and Findley, among other things:

| (a) | reviewed certain publicly available financial and other data with respect to Company, including the financial statements for recent years and the interim period to June 30, 2003, and certain other relevant financial and operating data relating to Company made available to Summit and Findley from published sources and from the internal records of Company; |

| (b) | reviewed certain financial and other data with respect to the Company and its principals; |

| (c) | reviewed the agreement; |

| (d) | reviewed certain historical market prices and trading volumes of the Company’s stock; |

| (e) | compared Company from a financial point of view with certain other banks and savings institutions and bank and savings institution holding companies that Summit and Summit and Findley deemed to be relevant; |

19

| (f) | considered the financial terms, to the extent publicly available, of selected recent business combinations of banks and savings institutions and bank and savings institution holding companies that Summit and Findley deemed to be comparable, in whole or in part, to the merger; |

| (g) | reviewed and discussed with representatives of the management of Company certain information of a business and financial nature regarding Company furnished to Summit and Findley by Company, including financial forecasts and related assumptions of Company; |

| (h) | made inquiries regarding and discussed the merger and the merger agreement, and other matters related to the merger and merger agreement with Company’s counsel; and |

| (i) | performed such other analyses and examinations as Summit and Findley deemed appropriate. |

Specifically, Summit and Findley reviewed the following documentation of the Company and the Bank relative to issuing its opinion:

| i) | the audited financial statements for the fiscal years ended December 31, 1999 through December 31, 2002 and the unaudited financial statements for the six months ended June 30, 2003, as reported in the companies’ quarterly reports on Form 10-Q and internal financial reports; |

| ii) | the Thrift Financial Reports covering the period through June 30, 2003, the latest available period; |

| iii) | the latest available asset/liability composition and performance statistics; |

| iv) | internally-generated management information and reports on loan sales, portfolio performance statistics, payroll reports, deposit statistics, furniture, fixtures, and equipment itemizations, and other information, as they have deemed necessary, including requiring management to generate ad hoc reports where feasible, timely, and non cost-prohibitive; and |

| v) | the Office of Thrift Supervision regulatory issues and current status thereof including operational restrictions or requirements of the Letter of Directive and Supervisory Agreement issued in 2001. |

In consideration with its opinion, Summit and Findley:

| | • | Used a book value per share of Company common stock of $0.39 at September 30, 2003; |

| | • | Assumed that all outstanding options would be cancelled; |

| | • | Assumed that there would be 5,482,114 shares of Company common stock outstanding immediately prior to completion of the merger; and |

| | • | Used a total consideration to be paid to the Company’s stockholders in the merger of $2,163,142, based on the September 30, 2003 book value. |

Company Share Price Trading Range.The September 30, 2003 estimated book value of $.39 a share reflects a premium of $.19 over the closing market price of $0.20 on October 1, 2003, the last trading day before the public

20

announcement of the merger and a premium of $.17 per share over the average closing price of $.22 for days with trading activity for the 22 trading day period prior to the announcement of the merger. The closing price during the six months preceding September 30, 2003 ranged from $.15 to $.34.

The market price for the common stock did exceed $.39 at one point during the first quarter of 2003. However, the trading history for the common stock over more extended periods of time prior to the announcement of the merger indicates that the common stock has not consistently maintained price levels in excess of $.39 since the third quarter of 2001.

Although public companies sales tend to use the highest recent trading-price as a base-line for price, the Company’s trading price does not take into consideration the discount applied to purchase price for small companies due to the lack of float, the limited number of suitors, and any regulatory enforcement action impacting the company’s operations. Based on preliminary analysis, the Company’s adjusted book value, calculated as of September 30, 2003 is approximately $2,163,214, which takes into account an accrual provision for estimated transaction expenses totaling $432,500. The fact that the company has been trading below book value, makes its public price a poor proxy for value.

Discounted Cash Flow Analysis. Summit and Findley examined the results of a discounted cash flow analysis designed to compare the current merger consideration with the present value, under certain assumptions, that would be attained if Company remained independent through 2006 and was at that time acquired by a larger financial institution. The results produced in the analysis did not purport to be indicative of actual values or expected values of Company at such future date. The uncertainty surrounding this method of determining value is derived from a number of significant factors, including the ability of the Company to continue as a going concern with the regulatory restrictions on operations. Although Summit and Findley performed numerous calculations to test its hypothesis, the results are deemed meaningless, as they believe the probability that the Company can reach a terminal value over any holding period significant enough to validate an analysis is highly unlikely. Therefore, Summit and Findley discarded the Discounted cash Flow method of valuation in rendering its Opinion.

21

Liquidation Analysis. Summit and Findley performed a liquidation analysis of Company which assumed the Company’s assets were sold to satisfy debt holders and the proceeds were distributed to its shareholders in lieu of the contemplated merger. In their opinion, the Company would generate a liquidation value (assets being sold piecemeal to prospective buyers for cash, minus associated liabilities, over a 180-270 day period in accordance with an Office of Thrift Supervision approved liquidation plan) of approximating $1.32 million, not including the expense associated with their sale (commissions, fees, attorneys costs, etc.) and with no estimated provision for expense related to unforeseen risks or liabilities. Based on 5,482,114 shares of Company common stock outstanding this would equate to $.24 per share.

Net Tangible Equity after Liquidation Adjustments

Asset Adjustments

| | As of Sept. 30, 2003

| | Adj.(+/-)

| | | Liquidated Value

|

Mortgage loans held for sale, net | | 22,395,994 | | (335,940 | ) | | 22,060,054 |

Real estate owned, net | | 620,968 | | (186,290 | ) | | 434,678 |

Premises and equipment, net | | 2,757,047 | | (57,047 | ) | | 2,700,000 |

Other assets | | 640,332 | | (64,033 | ) | | 576,299 |

| | |

| |

|

| |

|

Total Assets (Adj.) | | 26,414,341 | | (643,311 | ) | | 25,771,030 |

| | |

| |

|

| |

|

Liabilities Adjustments | | | | | | | |

Certificates of deposit | | 39,936,129 | | (399,361 | ) | | 39,536,768 |

Money Market Accounts | | 513,206 | | (10,264 | ) | | 502,942 |

Accrued Liabilities | | 1,425,597 | | 213,840 | | | 1,211,757 |

| | |

| |

|

| |

|

Total Liabilities (Adj.) | | 41,874,932 | | (195,786 | ) | | 41,251,467 |

| | |

| |

|

| |

|

Total Shareholders’ Equity | | 2,163,412 | | (839,097 | ) | | 1,324,315 |

| | |

| |

|

| |

|

22

Analysis of Selected Bank Merger Transactions. Summit and Findley reviewed the consideration paid in recently completed transactions in which banks, thrifts, and financial institution holding companies were acquired. Specifically, Summit and Findley reviewed eleven (11) transactions involving acquisitions of banks or savings institutions in Virginia, Pennsylvania, North Carolina, South Carolina, Illinois, Texas and other states completed since May 30, 2003. These transactions were selected due to their regional location in proximity to Company, their charter, their asset size and range, and whether or not they were held by a bank or thrift holding company, together with other characteristics that make them a proxy for Company. Although Company is a single branch entity, branch sales of larger institutions were not considered, as they do not represent a full-fledged banking operation. The transactions analyzed were:

| • | Marked Tree Bancshares, Inc. of Marked Tree, Arkansas sold to Pocahontas Bancorp, Inc of Jonesboro, Arkansas |

| • | Liberty Savings & Loan Association of Liberty, North Carolina sold to Security Savings Bank, SSB of Southport, South Carolina |

| • | Northern State Bank of Towanda, Pennsylvania sold to Legacy Bank of Harrisburg, Harrisburg, Pennsylvania |

| • | Carolina Community Bancshares, Inc. of Latta, South Carolina sold to First Bancorp, Inc. of Troy, North Carolina |

| • | State Bank of Seaton, Seaton, Illinois sold to River Valley Bancorp, Inc. of Eldridge, Indiana |

| • | Wyman Park, Bancorp, Inc. of Lutherville Maryland sold to Bradford bank of Baltimore, Maryland |

| • | Corpus Christi Bancshares of Corpus Christi, Texas sold to Texas Regional Bancshares, Inc. of Allen, Texas |

| • | Enterprise Bancorp, Inc. of Oxon Hill, Maryland merged with First Liberty Bancorp, Inc. of Washington, D.C. |

| • | CNB Holdings Inc. of Pulaski, Virginia sold to Mountain Bank Financial Corporation of Hendersonville, North Carolina |

| • | BankDallas State Savings Bank of Dallas, Texas sold to Prosperity Bancshares, Inc. of Houston, Texas |

| • | SFSB Holding Co. of Pittsburgh, Pennsylvania sold to Laurel Capital Group, Inc. of Allison Park, Pennsylvania. |

23

For each bank acquired in such transactions, Summit and Findley compiled figures illustrating, among other things, the ratio of the premium or discount (i.e. purchase price relative to book value) to deposits, purchase price to book value and purchase price to previous year’s earnings. Summit and Findley compared the information with respect to those transactions to the ratios implied by the merger:

The following table presents the results of that analysis:

| | | Median All Selected

Acquisitions

| | Median 5 Selected Thrift Transactions

| | Company

Value

|

Premium to deposits | | 6.73 | | 2.17 | | -0.97 |

| | | |

Ratio of purchase price to book value | | 1.39 | | 1.18 | | 1.00 |

| | | |

Ratio of purchase price to previous years earnings | | 16.60 | | 13.89 | | N/A |

The Company Value results were based on total merger consideration of $2,163,412. Summit and Findley determined that while the price to book value for Company and ratio of purchase price to book value is below the median ratios for all selected acquisitions and the ratio of purchase price to previous years earnings is below the median ratios for the selected transactions, Company’s operating history, recent economic factors and general economic uncertainties warrants a lower ratio of purchase price to book value. Summit and Findley has observed over the past two years a general decrease in the purchase prices of bank and thrift acquisitions in the $50-150 million range.

No other company or transaction used in the above analysis as a comparison is identical to Company, or the merger. Accordingly, an analysis of the results of the foregoing is not mathematical; rather, it involves complex considerations and judgments concerning differences in financial and operating characteristics of the companies and other factors that could affect the value of the companies to which Company, and the merger are being compared.

Comparable Company Analysis. Using public and other available information, Summit and Findley compared certain financial ratios of Company, including the ratio of net income to average total assets (“return on average assets”), the ratio of net income to average total equity (“return on average equity”), the ratio of average equity to average assets and certain credit ratios estimate for the year ending December 31, 2002, to a peer group consisting of 20 selected banks, savings institutions and bank and savings institution holding companies located in the Mid-Atlantic States. No company used in the analysis is identical to Company. The analysis necessarily involved complex considerations and judgments concerning differences in financial and operating characteristics of the companies.

The results of this analysis indicated that Company performed in the lowest quintile relative to the peer group level on the basis of profitability in 2002. Company’s return on average assets and return on average equity for 2002 were slightly below peer group levels, inclusive of its interest spread factors (interest earned on assets minus interest paid on liabilities). Company’s performance in 2002 showed below peer group levels concerning non-performing assets. Company’s capital ratios were significantly below peer group level.

Other Specific Factors Affecting the Opinion were:

a) Company stockholders shall receive cash at closing for the full value of their shares and are not relying on the performance of the acquiring entity for consideration. If this transaction was structured as a stock-swap (which is customary in merger transactions), it would be difficult to determine an appropriate exchange rate (based on the illiquid, non-public nature of acquiror) and the shareholders would be relying on the future performance. They also noted that based on prior offers issued for Company stock, which were tendered as stock-for-stock transactions, the cash nature of this transaction represents a more satisfactory solution.

24

b) According to the terms of the transaction, all indemnification liability will rest with the insider subordinated promissory note holders, capped at $700,000 in the aggregate. It is customary for the holders of common stock in any sale or merger to bear that liability for a pre-negotiated period of time, in compliance with applicable federal and state statutes governing the sale of securities. In this particular case, the shareholders will bear no liability associated with representations and warranties made to the acquiring company.

c) The adjustments to book value (market value determination metrics) are both fair and in some cases even lenient with respect to the sale of mortgage loans and the assignment of certificates of deposits. To determine the fair market value of the loans held for sale and yield, the transaction contemplates Company garnering at least two bids for all loan portfolios, stratified in any manner the company selects, to obtain the highest bids by secondary market loan investors the company chooses at its sole discretion. Historically, the premiums realized upon sale have averaged between 250 and 450 basis points above the face amounts. The fair market value shall be realized as that purchase price quotation assigned by the highest bidder. This is a far more lenient methodology than applying a discounted cash flow methodology, which is customary. Furthermore, in our opinion, Company maintains a cost of funds on its deposits, excluding the certificates of indebtedness, that is 75-100 basis points above the average for banks its size, yet there is no discount applied to their cost or non-core nature.

d) The the Company is currently operating under a supervisory agreement issued by the Office of Thrift Supervision, which regulates the Company and the Bank. The Office of Thrift Supervision deems the Bank to be in the category of a troubled institution. Typically, banks of similar size that have been sanctioned in a similar format by the regulators will trade at a discount (ranging from slight to steep, on an adjusted price basis) to book value (as the perceived cost to improve the banks capital structure, risk profile, market position and other factors can be prohibitive to a suitor). In this case, the company is being sold at the equivalent of adjusted book value.

e) Other factors adversely affecting a company’s going-concern position, such as the cost to maintain its public reporting requirements with the Securities and Exchange Commission and a significant lack of access to liquidity enjoyed by healthier institutions, is not factored into the purchase price, since the acquiror will take the company private and provide additional liquidity in the form of a recapitalization.

The foregoing summarizes the material portions of Summit and Findley’s report, but does not purport to be a complete description of the presentation by Summit and Findley to Company’s board of directors of the analyses performed by Summit and Findley. The preparation of a fairness opinion is not necessarily susceptible to partial analysis or summary description. Summit and Findley believe that its analyses and the summary set forth above must be considered as a whole and that selecting a portion of its analyses and of the factors considered, without considering all analyses and factors, would create an incomplete view of the process underlying the analyses set forth in its presentation to the Company board of directors.

In performing its analyses, Summit and Findley made numerous assumptions with respect to industry performance, general business and economic conditions and other matters, many of which are beyond the control of Company. The analyses performed by Summit and Findley are not necessarily indicative of actual values or actual future results, which may be significantly more or less favorable than suggested by such analyses. Such analyses were prepared solely as part of Summit and Findley’s analysis of the fairness, from a financial standpoint, of the merger consideration to be received by the holders of Company stock and was provided to Company board of directors in connection with the delivery of Summit and Findley’s opinion. The analyses do not purport to be appraisals or to

25

reflect the prices at which any securities may trade at the present time or at any time in the future. Summit and Findley used in its analyses various projections of future performance prepared by the management of Company. The projections are based on numerous variables and assumptions which are inherently unpredictable and must be considered not certain of occurrence as projected. Accordingly, actual results could vary significantly from those set forth in such projections.

In rendering its fairness opinion, Summit and Findley relied upon and assumed without independent verification the accuracy and completeness of all of the financial and other information reviewed by Summit and Findley for purposes of its opinion. Summit and Findley did not make an independent evaluation or appraisal of the assets and liabilities of Company, Company did not impose any limitations or restrictions with respect to the scope of Summit and Findley’s investigation or the procedures or methods it followed, or with regard to any other matters relating to Summit and Findley’s rendering of the opinion regarding the fairness of terms of the merger. Summit and Findley did not participate in negotiations regarding the merger agreement.

Company’s board of directors selected and instructed Summit and Findley to render an opinion with respect to the fairness of the Company merger consideration to the holders of Company common stock from a financial point of view based on its belief that Summit and Findley is experienced and qualified in such matters. Summit and Findley has extensive experience in the evaluation of banks in connection with mergers and acquisitions, and valuations for corporate and other purposes. In over 40 years of bank consulting, Summit and Findley has been involved in the creation, development, merger and acquisition of hundreds of financial institutions.

Pursuant to its engagement letter with Summit and Findley, Company agreed to pay Summit and Findley a fee of $30,000 for Summit and Findley’s services rendered to Company in connection with the fairness opinion plus time and expenses identified with updates to the fairness opinion and commenting on applications or the proxy statement. Company has agreed to indemnify Summit and Findley against certain liabilities and expenses in connection with its services as financial advisor to Company. Summit and Findley do not own any shares of Company stock.

Financial Interests of Certain Persons in the Merger; Conflicts of Interest

In considering the recommendation of the board with respect to the merger, the common stockholders should be aware that the directors of the Company have financial interests in connection with the Merger that may be different from the stockholders.. The board was aware of these interests and considered them among the other matters described under “—Recommendation of the Board of Directors; Reasons for the Merger.” These interests include the following:

| | • | Officers and directors as a group own approximately 60% of the common stock of the Company and therefore have a significant influence on the vote required for approval of the merger. |

| | • | Four directors as a group, hold subordinated debt of the Company in the amount of, $1,767,892. This subordinated debt as part of the merger will be assumed by Franklin Financial Group., a separate company owned by the principals of Approved Acquisition. However, these directors have agreed to pledge $700,000 of this subordinated debt or approximately forty percent (40%) of the $1,767,892 as collateral to Approved Acquisition as an indemnification setoff for unknown liabilities discovered post closing of this merger related to events caused by Company or its subsidiary occurring before closing. |

26

| | • | Three executive officers will receive severance compensation in an amount not to exceed the equivalent of one year of their current base salary. |

Material Federal Income Tax Consequences

The following discussion summarizes the material federal income tax considerations relevant to the merger. This discussion is based on currently existing provisions of the Internal Revenue Code of 1986, as amended (the “Code”), existing and proposed Treasury Regulations thereunder and current administrative rulings and court decisions, all of which are subject to change. Any such change, which may or may not be retroactive, could alter the tax consequences to the holders of common stock as described herein. Special tax consequences not described below may be applicable to particular classes of taxpayers, including financial institutions, broker-dealers, persons who are not citizens or residents of the United States or who are foreign corporations, foreign partnerships or foreign estates or trusts as to the United States and holders who acquired their stock through the exercise of an employee stock option or otherwise as compensation.

THIS TAX DISCUSSION IS BASED UPON PRESENT LAW. THE COMPANY DID NOT OBTAIN A TAX OPINION REGARDING THE INCOME TAX CONSEQUENCES OF THE MERGER. EACH HOLDER OF COMMON STOCK SHOULD CONSULT SUCH HOLDER’S OWN TAX ADVISOR AS TO THE SPECIFIC TAX CONSEQUENCES OF THE MERGER TO SUCH HOLDER, INCLUDING THE APPLICATION AND EFFECT OF FEDERAL, STATE, LOCAL AND OTHER TAX LAWS, THE POSSIBLE EFFECT OF CHANGES IN SUCH TAX LAWS, AND THE BASIS OF THE HOLDER IN THE COMMON STOCK.

The receipt of the merger consideration by holders of common stock will be a taxable transaction for federal income tax purposes. Each holder’s gain or loss per share will be equal to the difference between the merger consideration and the holder’s cost basis per share in the common stock. Such gain or loss generally will be a capital gain or loss provided that the holder held the common stock as a capital asset. Capital gain or loss will be treated as long-term capital gain or loss if the holder held the common stock for more than one year, and will be treated as short-term capital gain or loss if the holder held the common stock for one year or less.

A holder of common stock may be subject to backup withholding at the rate of 31% with respect to the merger consideration received, unless the holder: (i) is a corporation or comes within certain other exempt categories and, when required, demonstrates this fact, or (ii) provides a correct taxpayer identification number (“TIN”), and otherwise complies with applicable requirements of the backup withholding rules. To prevent the possibility of backup federal income tax withholding, each holder must provide the Company or its agent with his or her correct TIN by completing a Form W-9 or Substitute Form W-9. A holder of common stock who does not provide the Company with his or her correct TIN may be subject to penalties imposed by the Internal Revenue Service (the “IRS”), as well as backup withholding. The Company (or its agent) will report to the holders of common stock and the IRS the amount of any “reportable payments,” as defined in Section 3406 of the Code, and the amount of tax, if any, withheld with respect thereto.

Recommendations of Boards of Directors of Approved Financial Corp and Approved Federal Savings Bank and Reasons for the Merger

The Company’s reason for carrying out the merger is to provide the public holders of the Company’s common stock with the opportunity to receive a fair price for their shares. The

27

board of directors has unanimously determined that the terms of the merger are fair to, and in the best interests of all the stockholders. The merger agreement was unanimously approved by the board, including the members of the board who are not employees of the Company, and the board recommends that stockholders vote for the proposal to approve and adopt the merger agreement.

Pursuant to the stockholder agreement, each of the Company’s directors and executive officers will vote all of his or her shares of common stock in favor of the proposal to approve and adopt the merger agreement.

In making its unanimous determination that the terms of the merger are fair to, and in the best interests of, the holders of the common stock, to approve the merger agreement and to recommend that stockholders approve and adopt the merger agreement, the board considered:

| | • | We have had regulatory restrictions primarily related to the Office of Thrift Supervision Letter of Directive dated April 2001 and Consent Supervisory Agreement dated December 2001. Since we have been operating under these directives, we have experienced tremendous difficulty recruiting and retaining certain key management positions, have not been able to diversify into new lines of business, and have been operating under restrictions on the growth of our loan portfolio and lending practices and been required to use a higher cost warehouse line of credit in lieu of FDIC certificates of deposit thus increasing our interest expense. These restrictions and challenges have made it very difficult to create additional value for common stockholders. |

| | • | The Office of Thrift Supervision verbally advised the boards of directors of the Company and the Bank to raise additional capital for the Bank either directly or through a merger or acquisition. |

| | • | The opinion of Summit and Findley that the merger consideration is fair from a financial point of view to the holders of the common stock. The board of directors reviewed the independent financial analyses performed by Summit and Findley and found them to be reasonable and believed that Summit and Findley’s conclusion that the price to be paid in the merger was fair from a financial point of view to the holders of the common stock was a reasonable conclusion based on the analyses performed. The board did not perform any independent analysis of the factors described in Summit and Findley report or of other factors not considered by Summit and Findley. The opinion of Summit and Findley indicates that the merger is fair from a financial point of view to the holders of the common stock based on the September 30, 2003 estimated book value, which could be higher or lower at closing. |

| | • | The board reviewed current and historical market prices for the Company’s shares, the declining per share price of the common stock prior to the time of the public announcement of the proposed merger, the possibility that the price would remain depressed or continue to decline. The board also concluded that the merger consideration as of September 30, 2003 represented a premium over the market price of the common stock one week prior to the October 1, 2003 announcement of the proposed merger, one month prior to that date, three months prior to that date, and over the 22-day trading period (approximately one month) immediately preceding the announcement. |

| | • | The board of directors considered the alternatives. The board is of the opinion that the most likely alternative would be a voluntary or involuntary dissolution, both of which would, in the opinion of the board, result in less consideration than the merger consideration. |

28

| | • | The board considered prior proposals for merger or sale and concluded that the terms of this merger were more favorable. |

| | • | The requirement that the merger be approved by more than two thirds of the holders of common stock. |

| | • | The availability of appraisal rights under Virginia law for stockholders of the Company who believe that the terms of the merger do not reflect the value of the common stock, which rights are described under “—Rights of Dissenting Shareholders.” |

The board also considered the following negative factors:

| | • | the fact that the holders of the common stock will have no ongoing equity participation in the Company following the merger; |

| | • | the fact that in the event of a sale of the Company in the future, the holders of common stock will not be able to participate in any premium that might result from such a sale. |

In connection with its advice with respect to the merger, Summit and Findley discussed with the board information it had considered and a number of statistical analyses performed by it. Summit and Findley also provided the board a written report, reflecting a portion of such information and analyses (the “Report”). The Report was one of a variety of factors considered by the board. See “—Opinion of Summit and Findley.”

The board recognized that consummation of the merger will deprive the holders of the common stock of the opportunity to participate in any future growth of the Company and, accordingly, gave consideration to the Company’s results of operations and the Company’s future prospects in reaching its determination to recommend approval and adoption of the merger agreement.

Based upon its consideration of all of the factors described above, the board arrived at its determination that the terms of the merger are fair to, and in the best interests of, the holders of the common stock and that the board of directors should recommend that the stockholders of the Company approve and adopt the merger agreement.

In view of the circumstances and the factors considered in connection with its evaluation of the merger, the board of directors did not find it practicable to assign relative weights to the factors considered in reaching its decision.

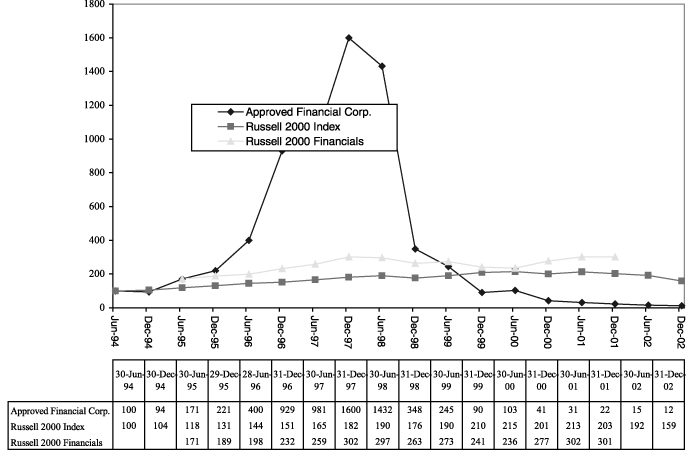

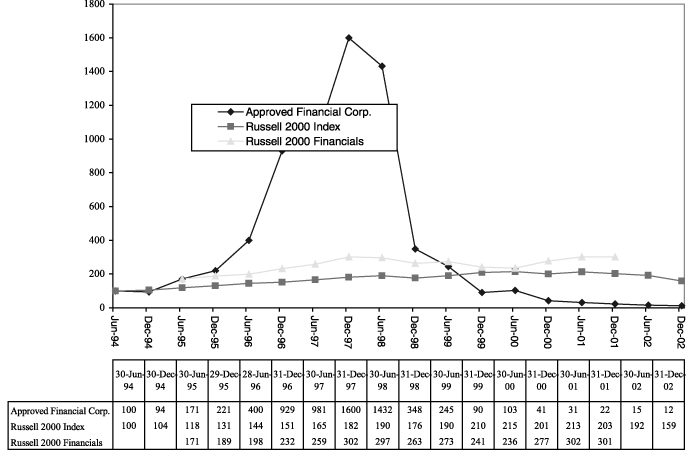

Certain Effects of the Merger