United States

Securities and Exchange Commission

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant To Rule 13a-16 or 15d-16

under the

Securities Exchange Act of 1934

For the month of April, 2015

GRUMA, S.A.B. de C.V.

(Translation of Registrant's name into English)

Calzada del Valle Ote. 407

Col. Del Valle, San Pedro Garza Garcia, N.L. Mexico 66220

(Address of principal office)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F X Form 40-F ___

(Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes ___ No X

If ''Yes'' is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-

CONTENTS

* Audited Fourth Quarter 2014 Results

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

GRUMA, S.A.B. de C.V.

By /s/ Raul Cavazos Morales

___________________________

Raul Cavazos Morales

Chief Financial Officer.

Date: April 29th, 2015

| IR Contact Information: |

| San Pedro Garza Garcia, N.L., Mexico, April 29, 2015 |

www.gruma.com |

GRUMA REPORTS FOURTH QUARTER 2014 RESULTS

HIGHLIGHTS

As experienced throughout the year, we concluded 2014 with continued improvements in our results and financial structure. The proceeds from the sale of the wheat flour operations coupled with improvements in EBITDA, allowed GRUMA to reach a sound financial position.

Sales volume grew 3% and net sales rose 5%, while operating profit increased 22% and EBITDA grew 16%; improvements in EBITDA were driven by most subsidiaries, and Gruma Corporation in particular. Majority net income was Ps.1,376 million and majority net margin was 10.7%.

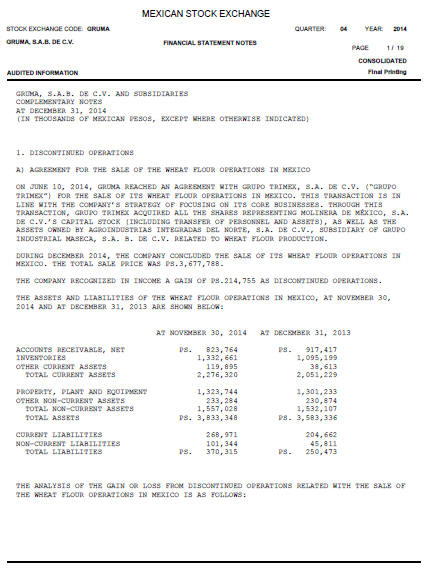

GRUMA reported Ps.477 million on the discontinued operations line, mainly reflecting a gain on the sale of the wheat flour operations, which was concluded in December 2014. The US$260 million proceeds from this sale were fully and immediately applied to debt reduction. The company paid down US$303 million of debt during the quarter, significantly improving its debt/EBITDA ratio to 1.4 times from 2.6 times at the end of 2013.

Also, during the quarter GRUMA successfully issued US$400 million Senior Notes due 2024 at an annual interest rate of 4.875%, mostly to redeem the former perpetual bonds, positioning GRUMA to reduce its interest expense by approximately US$9 million per year.

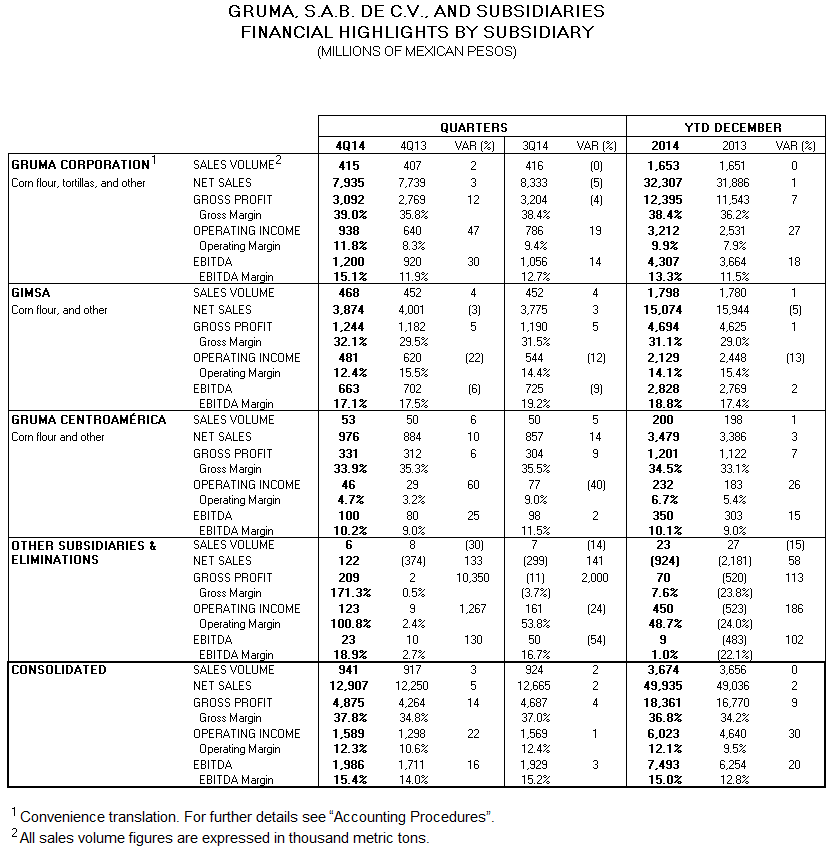

Consolidated Financial Highlights

(Ps millions)

| 4Q14 | 4Q13 | Var. | |

| Sales Volume (thousand metric tons) | 941 | 917 | 3% |

| Net sales | 12,907 | 12,250 | 5% |

| Operating income | 1,589 | 1,298 | 22% |

| Operating margin | 12.3% | 10.6% | 170 bp |

| EBITDA | 1,986 | 1,711 | 16% |

| EBITDAmargin | 15.4% | 14.0% | 140 bp |

| Majority net income | 1,376 | 2,097 | (34)% |

Debt

(US$ millions)

| Dec'14 |

CONSOLIDATED RESULTS OF OPERATIONS

4Q14 versus 4Q13

Sales volumeincreased 3% to 941 thousand metric tons. Most of the sales volume growth resulted from Gruma Corporation and GIMSA.

EBITDA increased 16% to Ps.1,986 million. EBITDA margin expanded to 15.4% from 14.0%.

|

FINANCIAL POSITION

December versus September 2014

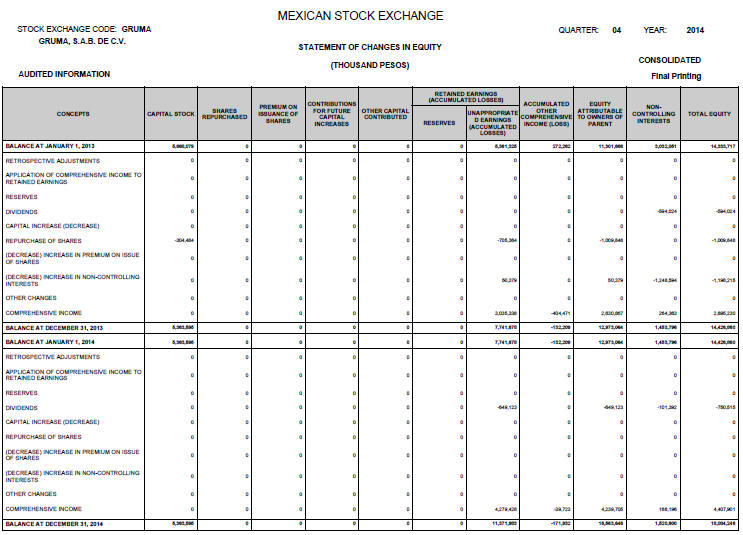

Balance Sheet Highlights | Total assets were Ps.40,637 million, a decrease of 3% in connection with the sale of GRUMA's wheat flour operations. Total liabilities were Ps.22,552 million, 12% lower, mainly as a result of debt reduction. Shareholders' equity totaled Ps.18,084 million, 11% more than in September 2014.

|

Debt Profile | GRUMA's debt totaled US$737 million, US$303 million less than as of September 2014. Proceeds from the sale of the wheat flour operations and improvements in cash generation allowed the company to continue paying down its debt. Approximately 91% of GRUMA's debt is dollar-denominated. |

Debt

(US$ millions)

| Dec'14 |

Schedule of Debt Amortizations

(US$ millions)

| Rate | 2015 | 2016 | 2017 | 2018 | 2019 | Total | ||

| Senior Notes 2024 | 4.875% | 400 | 400 | |||||

| Rabobank Syndicated Facility | LIBOR+1.5%-3% | 22 | 33 | 33 | 121 | 209 | ||

| BBVA Syndicated Facility MXP | TIIE+1.375%-2.625% | 4.1 | 8.2 | 36.7 | 5.4 | 54.4 | ||

| Other | 3.06%(avg.) | 71.6 | 1.8 | 0.1 | 73.4 | |||

| TOTAL | 3.84% (avg.) | 97.6 | 42.9 | 69.7 | 126.4 | 400 | 736.8 |

CAPITAL EXPENDITURE PROGRAM GRUMA's capital expenditures totaled US$40 million during 4Q14, most of which were allocated to production and warehousing capacity expansions, especially in Europe and Asia. Year-to-date capital expenditures were US$130 million. |

SUBSIDIARY RESULTS OF OPERATIONS

4Q14 versus 4Q13

Gruma Corporation | Sales volume increased 2% to 415 thousand metric tons, reflecting a 6% increase at the U.S. operations, which was largely offset by the European operations due primarily to extraordinary sales of corn in Turkey in 4Q13. The volume increase in the U.S. was driven by both the corn flour and the tortilla operations. Corn flour grew by gaining share within customers that produce tortillas, organic growth at some snack manufacturers, and successful retail promotions. The U.S. tortilla operations rose due to (1) the foodservice segment, resulting from organic growth and expansion of some Mexican food restaurant chains, introduction of dishes made with tortillas by non-Mexican food restaurant chains, and (2) the retail segment, resulting from increased distribution, shelf space gains, product assortment optimization, more effective use of allowances and marketing tools, and the increasing popularity of some of our wheat flour tortillas, whose improved formula continues to be well accepted by consumers. EBITDA increased 30% to Ps.1,200 million. EBITDA margin expanded to 15.1% from 11.9%.

|

GIMSA

| Sales volume increased 4% to 468 thousand metric tons, mainly due to (1) commercial initiatives, especially related to increased support for customers with equipment for tortilla production, and changes in the variable compensation structure of the company's sales team; (2) price reductions in connection with lower cost of corn; and (3) higher sales to government channels. EBITDA decreased 6% to Ps.663 million. EBITDA margin declined to 17.1% from 17.5%. For additional information, please see GIMSA ''Fourth-Quarter 2014 Results'', available through GRUMA's website, www.gruma.com. |

Gruma Centroamerica | Sales volume increased 6% to 53 thousand metric tons due mainly to higher corn flour sales to government channels in Guatemala, and to institutional clients; the latter was driven by increased variable compensation to sales personnel.

EBITDA increased 25% to Ps.100 million. EBITDA margin expanded to 10.2% from 9.0%.

|

Other Subsidiaries and Eliminations | Operating income improved Ps.114 million to Ps.123 million. This resulted mainly from the royalties received from GIMSA and the U.S. operations related to the MASECA® trademark, better operational performance at the Asia and Oceania operations and the positive peso depreciation effect related to Gruma Corporation. |

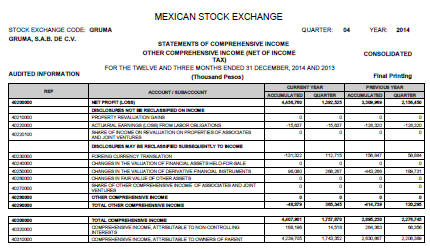

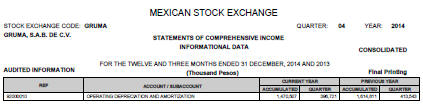

ACCOUNTING PROCEDURES

The consolidated figures have been prepared in accordance with the International Financial Reporting Standards (IFRS).

International Accounting Standard 29 (IAS 29) defines the criteria to consider when a company operates under a hyperinflationary economic environment, which are when:

the general population prefers to keep its wealth in non-monetary assets or in a relatively stable foreign currency. Amounts of local currency held are immediately invested to maintain purchasing power;

the general population regards monetary amounts not in terms of the local currency but in terms of a relatively stable foreign currency. Prices may be quoted in that currency;

sales and purchases on credit take place at prices that compensate for the expected loss of purchasing power during the credit period, even if the period is short;

interest rates, wages, and prices are linked to a price index; and

the cumulative inflation rate over three years is approaching, or exceeds, 100%.

Based on the above, the GRUMA's consolidated figures are determined as follows: the figures for subsidiaries in Mexico, the United States, Europe, Central America, Asia and Oceania operate in a non-hyperinflationary environment; therefore the effects of inflation are not recognized. Results for foreign subsidiaries that operate in a non-hyperinflationary environment are translated to Mexican pesos applying the historical exchange rate.

Under the section Subsidiary Results of Operations and the table of Financial Highlights by Subsidiary of this report, figures for Gruma Corporation were translated to Mexican pesos using a convenience translation with the exchange rate of Ps.14.718/dollar as of December 31, 2014. The differences between the use of convenience translation and the historical exchange rate are reflected under ''Other Subsidiaries and Eliminations''.

ABOUT GRUMA

Since 1949, GRUMA, S.A.B. de C.V., is one of the world's leading tortilla and corn flour producers. With leading brands in most of its markets, GRUMA has operations in the United States, Mexico, Central America, Europe, Asia and Oceania. GRUMA is headquartered in San Pedro Garza Garcia, Mexico, and has approximately 18,000 employees and 78 plants. In 2014, GRUMA had net sales of US$3.4 billion (excluding Venezuelan operations), of which 70% came from non-Mexican operations. For further information please visit www.gruma.com.

This report may contain certain forward-looking statements and information relating to GRUMA, S.A.B. de C.V., and its subsidiaries (collectively, ''GRUMA'') that are based on the beliefs of its management as well as assumptions made by and information then available to GRUMA. Such statements reflect the views of GRUMA with respect to future events and are subject to certain risks, uncertainties, and assumptions. Many factors could cause the actual results, performance, or achievements of GRUMA to be materially different from historical results or any future results, performance, or achievements that may be expressed or implied by such forward-looking statements. Such factors include, among others, changes in economic, political, social, governmental, business, or other factors globally or in Mexico, the United States, Latin America, or any other countries in which GRUMA does business, and world corn and wheat prices. If one or more of these risks or uncertainties materializes, or underlying assumptions are proven incorrect, actual results may vary materially from those described herein as anticipated, believed, estimated, expected, or targeted. GRUMA does not intend, and undertakes no obligation, to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

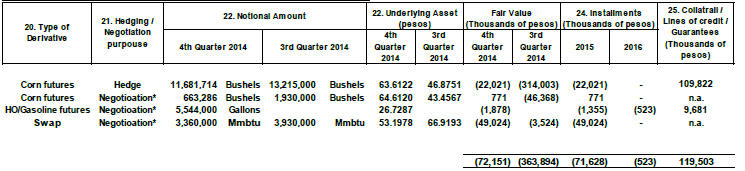

INFORMATION ON DERIVATIVE AND FINANCIAL INSTRUMENTS

I. Qualitative information.

A. Management's Discussion of the Policies for the use of Derivative Financial Instruments, and Purposes of the Same.

1. Derivative financial instruments contracting policies.

Gruma's policies regarding financial instruments establish that the acquisition of any derivative financial instruments agreement must be associated with the hedging of an underlying operation of the company, such as the purchase of inventory or fuel consumption (commodities), interest payment at a determined rate, foreign currency payments at an exchange rate, among others.

Gruma has a Risks Management policy that details the procedure to authorize their contracting.

2. General description of the objectives to use derivative financial instruments.

The availability and price of corn and other agricultural commodities are subject to important fluctuations due to factors that are beyond our control, such as the weather, planting seasons, agricultural programs and government policies (both national and foreign), changes in the global supply/demand created by population growth, competitors and global production of similar harvests. The objective of using derivative financial instruments is to reduce the aforementioned risks.

Likewise, in the normal course of business, Gruma enters into transactions in which it could be exposed to risks for changes in the interest rates or for fluctuations of exchange rates. The variations in the exchange rates can result from changes in the economic conditions, tax and monetary policies, volatile conditions, global markets liquidity, international and local political events, among others. In order to minimize these risks Gruma has entered into certain financial instruments.

3. Instruments used and hedging or negotiation strategies implemented.

We hedge a part of our production requirements through futures and options contracts in order to minimize the risk generated by the fluctuations in the price and supply of corn, wheat, natural gas, and diesel, risk that exists as an ordinary part of our business.

Additionally, Gruma has entered into certain financial instruments such as interest rate swaps and foreign exchange financial instruments (FX).

4. Allowed negotiation markets and eligible counterparties.In order to minimize the counterparty solvency risk, Gruma enters into derivative financial instruments only with major national and international financial institutions using mainly, when applicable depending on the derivative instrument used, the standard International Swaps and Derivatives Association, Inc. (''ISDA'') authorized forms and long form confirmation agreements.

5. Policies on the appointment of calculation or valuation agents.

Gruma appoints the counterparties as calculation agents who periodically send the account statements of the open positions of the financial instruments.

6. Policies on margins, collaterals, credit lines, VAR.

The Central Risks Committee of Gruma establishes that the derivative financial transactions may be performed with collaterals or using credit lines for that purpose.

The majority of the executed transactions establish certain obligations on behalf of the Issuer to guarantee, from time to time, the differential between fair value and the credit line (risk margin) established with the respective financial institutions, consequently the timely compliance of those obligations are assured. Additionally, it is made clear that, upon failure to fulfill the obligations of providing collateral, the counterparty will have the right, but not the obligation, to early terminate the transactions in place, and to demand the corresponding consideration pursuant to the agreed terms. In addition and in order to maintain a risk exposure level within the boundaries authorized by the Central Risks Committee and the Audit Committee, the Corporate Treasury department reports, in a weekly and monthly manner, the information about the Derivative Financial Instruments to such organs, respectively, and quarterly to the Board of Directors.

As of this date, Gruma has margin calls with their counterparty for $119,503 thousand pesos.

7. Internal control procedures to manage the exposure to market and liquidity risks.

The Finance Department of each region in which the company has operations, evaluates the changes in the exposure of the derivative financial instruments and periodically informs them to the Corporate Financial & Planning Management, and the latter informs the General Management and the Central Risks Committee when the market conditions have materially changed. The execution of the derivative financial instruments is authorized pursuant to the guidelines set forth in the Risks Management policy of the company.

8. Existence of an independent third party who reviews the aforementioned procedures.

The procedures are reviewed in the external audit process performed by PricewaterhouseCoopers, S.C. annually.

9. Information regarding the authorization of the use of derivatives and if there is a committee in charge of giving those authorizations and the derivatives risk management.

All derivative financial transactions must be previously authorized by a Divisional Risks Committee and by the Central Risks Committee which is formed by members of the senior management and approved by the Audit Committee and the Board of Directors.

B. Generic Description of Valuation Techniques.

10. Description of methods, valuation techniques and valuation frequency:

Derivative financial instruments that are not reported as hedging instruments for accounting purposes are initially recorded at fair value, and at the end of each reporting period they are re-measured at their fair value. The result of this valuation is recognized in the income statement. All accounting records comply with applicable regulations and are based on the official financial statements of each Financial Institution.

For derivative financial instruments that qualify as cash flow hedges, the effects of changes in the fair value of such derivative financial instrument are included within the other comprehensive income in equity, based on an evaluation of the hedge effectiveness. Such changes in the fair value are reclassified to income in the period when the firm commitment or projected transaction is realized. Derivative financial instruments that qualify as fair value hedges are initially recorded at fair value and the effects of changes in the fair value are recorded in the income statement, together with any changes in the fair value of the hedged asset or liability that are attributable to the hedged risk.

11. Clarification concerning if the valuation is performed by an independent third party or if it is an internal valuation and on which cases one or the other valuation is used. If it is performed by a third party, if his arranger, seller or counterparty of the derivative financial instrument is mentioned.Gruma determines the fair value based on recognized market prices. When not quoted in markets, fair value is determined using valuation techniques commonly used in the financial sector. Fair value reflects the credit risk of the instrument and includes adjustments to consider the credit risk of the Company or the counterparty, when applicable. Regarding purchases of corn, wheat and natural gas futures the market values of the US Chicago, Kansas and New York futures exchanges are taken as reference, through the specialized Financial Institutions engaged for such purposes. These valuations are made periodically.

12. For hedging instruments, explanation of the method used to determine the effectiveness of the same, identifying the current available hedging level of the global position.

Effectiveness of hedges is determined when the changes in fair value or cash flows of the underlying operation are offset by changes in fair value or cash flows of the hedging instrument in a ratio that falls within an inverse correlation range from 80% to 125%.

When a hedge is no longer effective as well as when the hedge does not comply with the documentation requirements set forth in the International Financial Reporting Standards the results of the valuation of the financial instruments at their fair value are recognized in the income statement.

C. Management discussion about the sources of liquidity that could be used to deal with derivative financial instruments.

13. Discussion about the internal and external sources of liquidity that could be used to attend the requirements related to derivative financial instruments.

There is potential liquidity requirements under our derivative financial instruments described in Section II below. Gruma plans to use its available cash flow as well as other available liquidity sources to satisfy such liquidity requirements.

D. Description of the changes in the exposure to major identified risks.

14. Description of the changes in the exposure to major identified risks, its management and contingencies that could affect it in future reports.

The availability and price of corn and other agricultural commodities are subject to important fluctuations due to factors that are beyond our control, such as the weather, planting seasons, agricultural programs and government policies (both national and foreign), changes in the global supply/demand created by population growth, competitors and global production of similar harvests. We hedge a part of our production requirements through futures contracts and options in order to reduce the risk generated by the fluctuations in price and supply of corn, wheat, natural gas, and diesel, risks that exist in the normal course of our business.

Gruma carried out forward transactions with the intention of hedging the currency risk of the Mexican peso with respect to the U.S. dollar, related with the price of corn purchases for domestic and imported harvest. The fair value of these derivative instruments can decrease or increase in the future before the instruments expire.

The variations in the exchange rate can result from changes in the economic conditions, tax and monetary policies, volatile conditions, global markets liquidity, international and local political events, among others.

15. Disclosure of eventualities, such as changes on the value of the underlying asset, which cause it to differ from the one originally agreed, that modify it, or that the hedging level has changed, pursuant to which the issuer is required to assume new obligations or affect its liquidity:

Gruma carried out forward transactions with the intention of hedging the currency risk of the Mexican peso with respect to the U.S. dollar, related with the price of corn purchases for domestic and imported harvest. The fair value of these derivative instruments can decrease or increase in the future before the instruments expire. The variations in the exchange rate can result from changes in the economic conditions, tax and monetary policies, volatile conditions, global markets liquidity, international and local political events, among others.

16. Include Influence on results or cash flow of the mentioned derivative transactions:

As of December 31, 2014, the open positions of corn and fuels financial instruments were valued at their fair value. The financial instruments of corn that qualified as hedges for accounting purposes represented a loss of $25,133 thousand pesos which was applied to other comprehensive income in equity.

The Company entered into hedge contracts for corn purchases of $1,483 thousand pesos, which were designated as fair value hedges. Therefore, the derivative financial instruments, as well as the assets and liabilities being hedged, are recognized at fair value at the trade date. Changes in the fair value of the derivative financial instruments and the assets and liabilities being hedged are recognized in income of the year. As of December 31, 2014, the effectiveness of these hedges was 100%.

The open positions of corn and fuels financial instruments that did not qualify as hedges for accounting purposes represented a loss of $45,534 thousand pesos which was applied to the income statement.

As of December 31, 2104, the Company does not have open positions of foreign exchange derivative financial instruments.

17. Description and number of the derivative financial instruments that had expired during the quarter and those which its position has been closed.

As of December 31, 2014, the Company reclassified the amount of $251,746 thousand pesos from comprehensive income and recognized it as part of inventory. This amount refers to the loss from the closed operations for corn hedges, in which the grain, subject to these hedges, was received. Additionally, the corn hedges terminated during the period and for which no corn has been received, originated an income of $2,395 thousand pesos, which was recognized in comprehensive income, and will be transferred to inventory once the corn is received.

The operations that concluded during the fourth quarter of 2014, for financial instruments of corn and fuels, recognized in income, represented a loss of $53,288 thousand pesos. As of December 31, 2014, the loss in the results of the concluded transactions of these instruments is of $76,365 thousand pesos.

There were no concluded transactions during the fourth quarter of 2014 regarding the foreign exchange financial instruments. As of December 31, 2014, the adverse effect in the results of the concluded transactions of these instruments is of $23,375 thousand pesos.

18. Description and number of the margin calls presented during the quarter.

As of December 31, 2014, the company has revolving funds denominated ''margin calls'' for $119,503 thousand pesos. The margin calls are required upon the variations in the prices of the underlying asset as collateral in favor of the counterparty in order to reduce the risk of non-payment in an event of default.

19. Disclosure of any breach that has been presented to the respective agreements.The company has complied with all obligations under its derivative financial instruments agreements.

II. Quantitative Information.

I. Characteristics of the derivative financial instruments as of the date of this report.

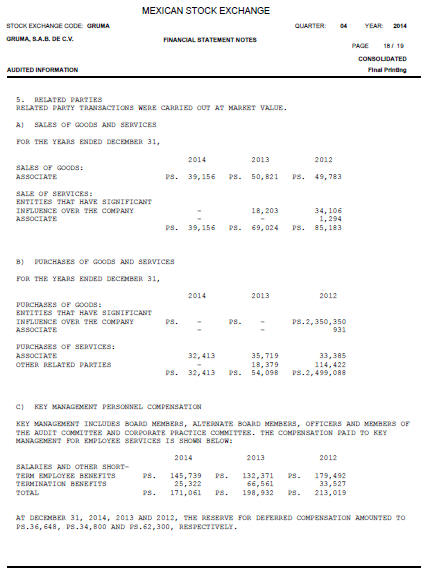

Summary of Derivative Financial

Instruments as of December 31, 2014

Amounts in Thousands of PesosCorn and Fuels Derivative Financial Instruments

1 * The sole purpose of the Company's acquisition of derivative financial instruments is hedging market and liquidity risks, notwithstanding, the accounting rules require specific documentation and evidence to classify a derivative financial instrument as a hedging instrument, and consequently the company classified its derivative financial instruments as negotiation instruments.

23. As of December 31, 2014, the financial instruments transactions of corn and fuels in long positions represented a loss of $76,149 thousand pesos and in short positions represented a profit of $3,998 thousand pesos.

25. As of December 31, 2014, the Company has revolving funds denominated ''margin calls'' for $119,503 thousand pesos, required upon variations in prices of the underlying asset as collateral in favor of the counterparty in order to reduce the risk of non-payment in an event of default.

As of December 31, 2014, the Company reclassified the amount of $251,746 thousand pesos from comprehensive income and recognized it as part of inventory. This amount refers to the loss from the closed operations for corn hedges, in which the grain, subject to these hedges, was received. Additionally, the corn hedges terminated during the period and for which no corn has been received, originated an income of $2,395 thousand pesos, which was recognized in comprehensive income, and will be transferred to inventory once the corn is received.

The operations that concluded during the fourth quarter of 2014, for financial instruments of corn and fuels, recognized in income, represented a loss of $53,288 thousand pesos. As of December 31, 2014, the loss in the results of the concluded transactions of these instruments is of $76,365 thousand pesos.

There were no concluded transactions during the fourth quarter of 2014 regarding the foreign exchange financial instruments. As of December 31, 2014, the adverse effect in the results of the concluded transactions of these instruments is of $23,375.

II. Sensibility Analysis

Corn and Fuels Derivative Financial Instruments:

According to the position as of December 31, 2014, a hypothetical 10 percent loss of the corn and natural gas value would result in an additional adverse effect of $108,620 thousand pesos. This sensitivity analysis is determined based on the underlying assets' values obtained from the valuation performed as of December 31, 2014.

* The sole purpose of the Company's acquisition of derivative financial instruments is hedging market and liquidity risks, notwithstanding, the accounting rules require specific documentation and evidence to classify a derivative financial instrument as a hedging instrument, and consequently the company classified its derivative financial instruments as negotiation instruments.

26. For derivative financial instruments with negotiation purposes or those whose ineffectiveness of the hedge must be acknowledged, description of the method applied in determining the expected losses or the price sensitivity of the derivatives, including volatility.

The potential losses of the derivative financial instruments were determined pursuant to the underlying assets' value and their volatility, under a sensibility analysis considering a 10%, 25% and 50% loss in the underlying assets' value.

27. Presentation of a sensitivity analysis for such transactions that includes, at least, the following elements:

a) Identification of the risks that may create losses in the issuer for derivative transactions.

b) Identification of the instruments that would create such losses.

The fair value of the raw materials derivative financial instruments can decrease or increase in the future before the date of maturity of the instruments. These variations can be the result of factors that are beyond our control, such as the weather, planting seasons, agricultural programs and government policies (both national and foreign), changes in the global supply/demand created by population growth, competitors and global production of similar harvests.

The fair value of the foreign exchange financial instruments can decrease or increase in the future before the expiration date of said instruments. These variations in the exchange rate can be the result of changes in the economic, fiscal policies or monetary conditions, volatility, liquidity in global markets, international or local political events, among others.

28. Presentation of 3 scenarios (probable, possible and remote or stress) that can create negative circumstances for the issuer, identifying the assumptions and factors taken into consideration in their execution.

a) Possible scenario with a variation of at least 25% in the underlying asset's Price and remote scenario with a variation of at least 50%.

The sensitivity chart already contains this information.

29. Estimation of the potential loss reflected in the income statement and cash flow for each scenario.

For the derivative financial instruments of corn and natural gas, based on our position as of December 31, 2014, a hypothetical change of 10%, 25% and 50% loss in market prices applied to the fair value of the instruments would result in an additional charge to income for $108,620, $271,549 and $543,099 thousands of pesos, respectively.

30. For hedging financial instruments, indicate the stress level or the variation of the underlying assets under which the effectiveness measures result sufficient.

Effectiveness of hedges are determined when the changes in fair market value or cash flows of the underlying operation are offset by changes in fair market value or cash flows of the hedging instrument in a ratio that falls within an inverse correlation range from 80% to 125%.