UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrant | x |

| | |

| Filed by a Party other than the Registrant | o |

| |

| Check the appropriate box: |

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to § 240.14a-12 |

| |

| PDI, INC. |

| (Name of Registrant as Specified in Its Charter) |

| |

| |

| Name of Person(s) Filing Proxy Statement, if other than the registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | | |

| | | |

| | 2) | Aggregate number of securities to which transaction applies: |

| | | |

| | | |

| | 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | |

| | 4) | Proposed maximum aggregate value of transaction: |

| | | |

| | | |

| | 5) | Total fee paid: |

| | | |

| | | |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | 1) | Amount Previously Paid: |

| | | |

| | | |

| | 2) | Form, Schedule or Registration Statement No.: |

| | | |

| | | |

| | 3) | Filing Party: |

| | | |

| | | |

| | 4) | Date Filed: |

| | | |

Nancy Lurker

Chief Executive Officer

April 30, 2010

Dear Stockholder:

You are invited to attend the Annual Meeting of Stockholders of PDI, Inc. (“PDI” or the “Company”) to be held on June 3, 2010, at 9:00 a.m., Eastern time, at PDI, Inc., Morris Corporate Center One, 300 Interpace Parkway, Building A, Parsippany New Jersey 07054.

At this meeting, you will be asked to elect three directors, to ratify the selection of the Company’s independent registered public accounting firm for fiscal 2010 and to transact such other business as may properly come before the meeting. The accompanying Notice of Meeting and Proxy Statement describe these proposals. We urge you to read this information carefully.

Your Board of Directors unanimously recommends a vote FOR the election of the nominees for director and FOR the ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2010.

Whether or not you plan to attend the Annual Meeting in person, it is important that your shares are represented. Therefore, please promptly complete, sign, date and return the enclosed proxy card in the accompanying envelope, which requires no postage if mailed in the United States. You are, of course, welcome to attend the Annual Meeting and vote in person even if you previously returned your proxy card. We are delighted to have you as a stockholder of PDI.

Sincerely,

Nancy Lurker

Chief Executive Officer

Morris Corporate Center 1, 300 Interpace Parkway, Parsippany, New Jersey 07054

Phone: 862.207.7800 · Toll Free: 800.242.7494 · www.pdi-inc.com

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD JUNE 3, 2010

________________________

To the Stockholders of PDI, Inc.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders of PDI, Inc. (the “Company”) will be held at PDI, Inc., Morris Corporate Center One, 300 Interpace Parkway, Building A, Parsippany, New Jersey 07054 on June 3, 2010 at 9:00 a.m., Eastern time, for the following purposes:

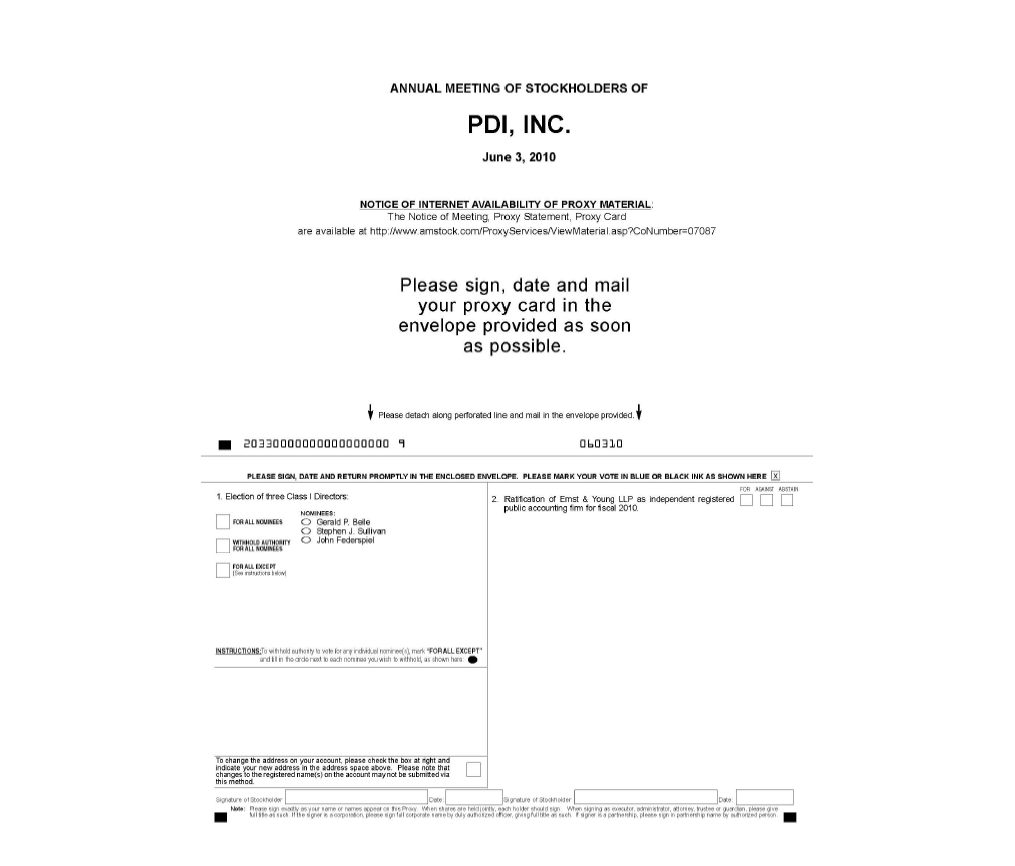

1. To elect three Class I directors of the Company, each to serve for a term of three years.

2. To ratify the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2010.

3. To transact such other business as may properly come before the meeting or any adjournments thereof.

Only the stockholders of record at the close of business on April 15, 2010 are entitled to notice of and to vote at the Annual Meeting and any adjournments or postponements thereof. All stockholders are cordially invited to attend the meeting. Whether or not you expect to attend, you are requested to sign, date and return the enclosed proxy promptly. Stockholders who execute proxies retain the right to revoke them at any time prior to the voting thereof. A return envelope, which requires no postage if mailed in the United States, is enclosed for your convenience.

By order of the Board of Directors,

Jeffrey E. Smith

Executive Vice President, Chief Financial Officer, Treasurer and Acting Corporate Secretary

Dated: April 30, 2010

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 3, 2010 The Company’s Proxy Statement for the 2010 Annual Meeting of Stockholders and Annual Report on Form 10-K are available on the Internet at http://www.amstock.com/ProxyServices/ViewMaterial.asp?CoNumber=07087 |

PROXY STATEMENT

Table of Contents

| Topic | Page |

| |

| General Information about the Annual Meeting and Voting | 1 |

| | |

| Proposal No. 1 – Election of Directors | 4 |

| | |

| Governance of the Company | 8 |

| | |

| Information about our Compensation of Directors | 11 |

| | |

| Security Ownership of Certain Beneficial Owners and Management | 13 |

| | |

| Executive Officers | 15 |

| | |

| Proposal No. 2 – Ratification of Appointment of our Independent Registered Public Accounting Firm | 16 |

| | |

| Audit Committee Report | 16 |

| | |

| Compensation Discussion and Analysis | 18 |

| | |

| Compensation and Management Development Committee Report | 26 |

| | |

| Information about our Executive Compensation | 26 |

| | |

| Certain Relationships and Related Transactions | 35 |

| | |

| Risk Oversight by the Board of Directors | 35 |

| | |

| Other Matters | 36 |

| | |

| Additional Information | 36 |

| | |

General Information About the Annual Meeting and Vote

_______________________

Why are you receiving these proxy materials?

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors of PDI, Inc., a Delaware corporation (the “Company”, “PDI”, “we”, “us” or “our”), of proxies in the form enclosed for the Annual Meeting of Stockholders to be held at PDI, Inc., Morris Corporate Center One, 300 Interpace Parkway, Building A, Parsippany, New Jersey 07054 on June 3, 2010 at 9:00 a.m., Eastern time, and for any adjournments or postponements thereof (the “Annual Meeting”), for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. Our Board of Directors knows of no other business which will come before the meeting. This Proxy Statement will be mailed to stockholders on or about April 30, 2010.

Who is entitled to vote at the Annual Meeting?

Only stockholders of record at the close of business on the record date, April 15, 2010, may vote at the Annual Meeting. There were 14,265,378 shares of our common stock outstanding on April 15, 2010. During the 10 days before the Annual Meeting, you may inspect a list of stockholders eligible to vote. If you would like to inspect the list, please call Jeffrey Smith, our Executive Vice President, Chief Financial Officer and Acting Corporate Secretary, at (862) 207-7832 to arrange a visit to our offices.

What are the voting rights of the holders of our common stock?

Each outstanding share of our common stock will be entitled to one vote on each matter considered at the Annual Meeting.

How can you vote?

If you are a record holder, meaning your shares are registered in your name, you may vote or submit a proxy:

1. Over the Internet - If you have Internet access, you may authorize the voting of your shares by accessing www.voteproxy.com and following the instructions set forth on the enclosed proxy card. You must specify how you want your shares voted or your vote will not be completed and you will receive an error message. Your shares will be voted according to your instructions.

2. By Telephone – You may call toll-free 1-800-PROXIES (1-800-776-9437) in the United States, or 1-718-921-8500 from foreign countries from any touch-tone telephone and follow the instructions. You must have your proxy card available when you call, and use the Company Number and Account Number that are shown on your proxy card. Your shares will be voted according to your instructions.

3. By Mail - Complete and sign the enclosed proxy card and mail it in the enclosed postage prepaid envelope. Your shares will be voted according to your instructions. If you sign your proxy card but do not specify how you want your shares voted, they will be voted as recommended by our Board of Directors. Unsigned proxy cards will not be voted.

4. In Person at the Meeting - If you attend the Annual Meeting, you may deliver a completed and signed proxy card in person or you may vote by completing a ballot, which we will provide to you at the Annual Meeting.

Beneficial Owners and Broker Non-Votes

A significant portion of our stockholders hold their shares in “street name” through a stockbroker, bank, or other nominee, rather than directly in their own names. If you hold your shares in one of these ways, you are

considered the beneficial owner of shares held in street name, and these proxy materials are being forwarded to you by your stockbroker, bank, or other nominee who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to direct your stockbroker, bank, or other nominee on how to vote your shares. If you hold your shares in street name, your stockbroker, bank, or other nominee has enclosed a voting instruction card for you to use in directing your stockbroker, bank, or other nominee in how to vote your shares.

Stockbrokers, banks, or other nominees who hold shares in street name for customers have the discretion to vote those shares with respect to certain matters if they have not received instructions from the beneficial owners. Stockbrokers, banks, or other nominees will have this discretionary authority with respect to routine matters such as the ratification of the appointment of our independent registered public accounting firm; however, they will not have this discretionary authority with respect to the election of directors. As a result, with respect to the election of directors, if the beneficial owners have not provided instructions with respect to this matter (commonly referred to as “broker non-votes”), those beneficial owners’ shares will be included in determining whether a quorum is pres ent, but will not be voted and will be considered to be an abstention, having no effect on the vote for the election of directors.

Can you change your vote or revoke your proxy?

If you have signed and returned the enclosed proxy, you may revoke it at any time before it is voted by (i) submitting to us a properly executed proxy bearing a later date, (ii) submitting to us a written revocation of the proxy or (iii) voting in person at the Annual Meeting.

If you are the beneficial owner of shares held in street name, you must submit new voting instructions to your stockbroker, bank, or other nominee in accordance with the instructions you have received from them.

What is a proxy?

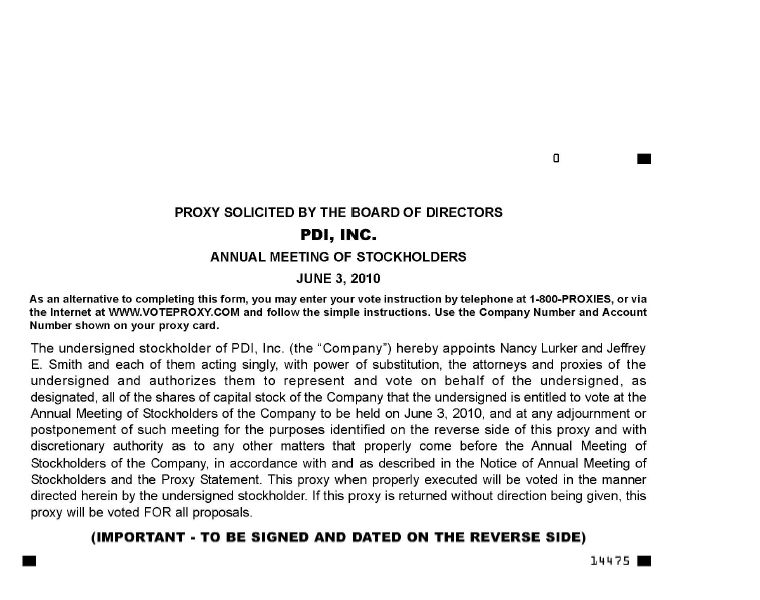

A proxy is a person you appoint to vote on your behalf. By using any of the methods discussed above, you will be appointing as your proxies Nancy Lurker, our Chief Executive Officer, and Jeffrey Smith, our Executive Vice President, Chief Financial Officer, Treasurer and Acting Corporate Secretary. They may act together or individually on your behalf, and will have the authority to appoint a substitute to act as proxy. If you are unable to attend the Annual Meeting, please use the means available to you to vote by proxy so that your shares of common stock may be voted.

How will your proxy vote your shares?

The persons acting as proxies pursuant to the enclosed proxy will vote the shares represented as directed in the signed proxy. Unless otherwise directed in the proxy, the proxyholders will vote the shares represented by the proxy: (i) FOR election of the three Class I director nominees named in this Proxy Statement; (ii) FOR ratification of the appointment of Ernst & Young LLP (“E&Y”) as independent registered public accounting firm to audit the financial statements of the Company for the fiscal year ending December 31, 2010; and (iii) in the proxyholders’ discretion, on any other business that may come properly before the meeting and any adjournments or postponements of the meeting.

What constitutes a quorum?

A quorum will be present at the Annual Meeting if a majority of the shares of common stock outstanding on the record date are present at the meeting in person or by proxy. A quorum is necessary in order to conduct the Annual Meeting. If you choose to have your shares represented by proxy at the Annual Meeting, you will be considered part of the quorum. Broker non-votes will be counted as present for the purpose of establishing a quorum. If a quorum is not present at the Annual Meeting, the stockholders present in person or by proxy may adjourn the meeting to a date when a quorum is present. If an adjournment is for more than 30 days or a new record date is fixed for the adjourned meeting, we will provide notice of the adjourned meeting to each stockholder of record entitled to vot e at the meeting.

What vote is required to approve each matter and how are votes counted?

Proposal No. 1: Election of Three Class I directors. The election of directors requires a plurality of the shares present in person or represented by proxy at the Annual Meeting and entitled to vote. Accordingly, the directorships to be filled at the Annual Meeting will be filled by the nominees receiving the highest number of votes. In the election of directors, votes may be cast in favor of or withheld with respect to any or all nominees; votes that are withheld and broker non-votes will be excluded entirely from the vote and will have no effect on the outcome of the vote.

Proposal No. 2: Ratification of the Appointment of our Independent Registered Public Accounting Firm. The affirmative vote of a majority of the votes cast for or against the matter by stockholders entitled to vote at the Annual Meeting is required to ratify the appointment of our independent registered public accounting firm. A properly executed proxy card marked ABSTAIN with respect to this proposal will not be voted, and therefore will have no effect on the vote for this proposal.

Why are you being asked to ratify the appointment of E&Y?

Although stockholder approval of the Audit Committee’s selection of E&Y as our independent registered public accounting firm is not required, we believe that it is advisable to give stockholders an opportunity to ratify this selection. If this proposal is not approved at the Annual Meeting, the Audit Committee has agreed to reconsider its selection of E&Y, but will not be required to take any action.

Are there other matters to be voted on at the Annual Meeting?

We do not know of any other matters that may come before the Annual Meeting other than the election of the Class I directors and the ratification of the appointment of our independent registered public accounting firm. If any other matters are properly presented to the Annual Meeting, the persons named as proxies in the accompanying proxy card intend to vote or otherwise act in accordance with their judgment on the matter.

Where can you find the voting results?

Voting results will be reported in a Current Report on Form 8-K, which we will file with the Securities and Exchange Commission (SEC) within four business days following the Annual Meeting.

Who is soliciting proxies, how are they being solicited, and who pays the cost?

The solicitation of proxies is being made on behalf of our Board of Directors and we will pay the expenses of the preparation of proxy materials and the solicitation of proxies for the Annual Meeting. In addition to the solicitation of proxies by mail, solicitation may be made by certain of our directors, officers or employees who will not receive additional compensation for those services, or by an outside firm, telephonically, electronically or by other means of communication. We will reimburse brokers and other nominees for costs incurred by them in mailing proxy materials to beneficial owners in accordance with applicable rules.

Who is our independent registered public accounting firm, and will they be represented at the Annual Meeting?

E&Y served as our independent registered public accounting firm for the fiscal year ended December 31, 2009 and audited our financial statements and our internal control over financial reporting for such fiscal year. E&Y has been appointed by the Audit Committee to serve in the same role and to provide the same services for the fiscal year ending December 31, 2010. We expect that one or more representatives of E&Y will be present at the Annual Meeting. They will have an opportunity to make a statement, if they desire, and will be available to answer appropriate questions after the Annual Meeting.

How may you obtain additional copies of our Annual Report on Form 10-K or this Proxy Statement?

You may request a copy of our Annual Report on Form 10-K for the year ended December 31, 2009 or this Proxy Statement to be sent to you for no charge, by writing to PDI, Inc., Attn: Corporate Secretary, Morris Corporate Center One, 300 Interpace Parkway, Building A, Parsippany, NJ 07054.

PROPOSAL NO. 1 - ELECTION OF DIRECTORS

The Board of Directors currently consists of 10 members and is divided into three classes, with four directors in Class III and three directors in each of Class I and Class II. Directors serve for three-year terms with one class of directors being elected by the Company’s stockholders at each annual meeting. The Company reduced the size of its Board from 11 members to 10 members after the death of its former director, Dr. Joseph Curti. On March 29, 2010, John Pietruski announced that he would retire from the Board effective May 1, 2010. On April 13, 2010, John Dugan announced that he would retire from the Board and as an employee effective June 3, 2010, and that he would therefore not stand for re-election as a Class I director this year. After the effective dates of the ret irements of Messrs. Pietruski and Dugan, the Company intends to further reduce the size of its Board to 8 members.

At the Annual Meeting, three Class I directors will be elected to serve until the annual meeting of stockholders in 2013 and until each director’s successor is elected and qualified. Stephen J. Sullivan, Gerald P. Belle and John Federspiel are the nominees for election or re-election as the Class I directors. Mr. Federspiel currently serves as a Class III director. He has submitted a letter of resignation as a Class III director which is contingent on his re-election to the Board as a Class I director at the Annual Meeting. Mr. Federspiel will be changing from Class III to Class I to comply with the Company’s Certificate of Incorporation, which requires that no one class of directors shall have more than one director more than any other class. This change was precipita ted by the previously announced retirement of Mr. Dugan and by the death of Dr. Curti, both of whom served as Class I directors. If Mr. Federspiel is elected by the stockholders as a Class I director, then the Board will have three directors in each of Classes I and III and two directors in Class II. All of the nominees have been approved, recommended and nominated for election or re-election to the Board of Directors by the Nominating and Corporate Governance Committee (the “Nominating Committee”) and by the Board of Directors. The accompanying proxy will be voted for the election of Stephen J. Sullivan, Gerald P. Belle and John Federspiel as directors, unless the proxy contains instructions otherwise. Management has no reason to believe that Messrs. Sullivan, Belle or Federspiel will not be candidates or will be unable to serve. However, in the event that any of the nominees should become unable or unwilling to serve as a director, the proxy will be v oted for the election of such person or persons as shall be designated by the Board of Directors.

The Board of Directors Recommends a

Vote FOR the Election of the Foregoing Nominees and

Proxies That Are Returned Will Be So Voted

Unless Otherwise Instructed.

Set forth below is information regarding the nominees for election as Class I directors and all other members of the Board of Directors who will continue in office.

NOMINEES FOR ELECTION AS CLASS I DIRECTORS

TERM EXPIRING 2013

Stephen J. Sullivan, age 63. Mr. Sullivan became a director in September 2004. Mr. Sullivan was the president and chief executive officer and a member of the Board of Directors of Harlan Laboratories, Inc., a privately held global provider of preclinical research tools and services, from February 2006 through January 2010, when he retired from that position. Prior to joining Harlan in 2006, Mr. Sullivan was a senior vice president of Covance, Inc. and the president of Covance Central Laboratories, Inc., a major division of Covance. Prior to joining Covance, Mr. Sullivan was chairman and chief executive officer of Xenometrix, Inc., a biotechnology company with proprietary gene expression technology. He successfully merged Xenom etrix with Discovery Partners International. Prior to his work with Xenometrix, Mr. Sullivan was vice president and general manager of a global diagnostic sector of Abbott Laboratories. Mr. Sullivan graduated from the University of Dayton, was a commissioned officer in the Marine Corps, and completed his M.B.A. in Marketing and Finance at Rutgers University.

Mr. Sullivan has held senior leadership positions in companies in the life sciences and healthcare services industries. He possesses specific qualifications and skills to serve as a director in the areas of general operations, financial operations and administration, and mergers and acquisitions.

Gerald P. Belle, age 64. Mr. Belle has been a director since April 2008. From 2004 until his retirement in November 2007, Mr. Belle served as Executive Chairman of Merial Ltd., a global animal health company that was a joint venture between sanofi-aventis and Merck & Co. Prior to that, Mr. Belle served as President and Chief Executive Officer, North America Pharmaceuticals for Aventis, Inc. He retired after 35 years of service at Aventis and its predecessor companies. Mr. Belle is chairman of the Board of Directors of Myriad Pharmaceuticals, Inc., a publicly held biopharmaceutical company. He was a member of the Board of Directors of Myriad Genetics, Inc., a publicly-traded genetics diagnostic company, from Nove mber 2007 through November 2009. Mr. Belle earned a B.S.B.A. in Marketing from Xavier University in 1968 and an M.B.A. from Northwestern University in 1969.

Mr. Belle has held senior leadership positions in companies in the pharmaceutical and life sciences industries, and possesses specific experiences, qualifications, and skills to serve as a director in the functions of sales, sales management and general management in the United States, operations in the United States, Asia, Europe and Canada, and financial operations and administration.

John Federspiel, age 56. Mr. Federspiel has been a director since October 2001. Mr. Federspiel is president of Hudson Valley Hospital Center, a 128 bed, short-term, acute care, not-for-profit hospital in Westchester County, New York. Prior to joining Hudson Valley Hospital in 1987, Mr. Federspiel spent an additional 10 years in health administration, during which he held a variety of executive leadership positions. Mr. Federspiel has served as an appointed Member of the State Hospital Review and Planning Council, and has served as chairman of the Northern Metropolitan Hospital Association, as well as other affiliations. Mr. Federspiel received a B.S. degree from Ohio State University in 1975 and an M.B.A. from Temple University in 1977.

Mr. Federspiel has held senior leadership positions in the hospital and healthcare industries. He possesses specific experiences, qualifications, attributes and skills to serve as a director in the areas of operations and strategy.

INCUMBENT CLASS II DIRECTORS

TERM EXPIRING 2012

Nancy Lurker, age 52. Ms. Lurker joined us as Chief Executive Officer and a director in November 2008. Prior to joining PDI, Ms. Lurker was senior vice-president and chief marketing officer for Novartis Pharmaceuticals Corporation, the U.S. subsidiary of Novartis AG, where she oversaw a product portfolio in multiple therapeutic areas from 2006 to 2007. Prior to that, she served as president and chief executive officer of ImpactRx, Inc. since 2003, a privately owned company offering among its services the evaluation of the impact of pharmaceutical promotion on the prescribing behavior of the nation's highest prescribing physicians. From 2000 to 2003, Ms. Lurker served as group vice president-global primary care products for Pharmacia Corporation, wh ere she led a business unit that commercialized drugs for urology, cardiovascular, central nervous system, respiratory and women’s health. She was also a member of Pharmacia’s U.S. executive management committee, the group responsible for managing all U.S.-based profits as well as all U.S. management policies. Earlier in her career, she was vice president for business development at National Physicians Corporation, an IPA risk management and practice management group. During her 14 years at Bristol-Myers Squibb, Ms. Lurker rose from senior sales representative at Mead Johnson to various product management and business development positions, ultimately becoming senior director-worldwide cardiovascular franchise management. Ms. Lurker was a member of the Board of Directors of Elan Pharmaceuticals during 2005 and 2006 and of ConjuChem Biotechnologies Inc. from 2004 to 2006. Ms. Lurker received a B.S. in Biology with high honors from Seattl e Pacific University and an M.B.A. from the University of Evansville in Evansville, Indiana.

Ms. Lurker has held senior leadership roles in pharmaceutical companies and services companies serving the pharmaceutical industry, and has specific skills in strategy, sales and operations.

Frank Ryan, age 70. Mr. Ryan has been a director since November 2002. Mr. Ryan was a director of Digene Corporation from June 2005 until its acquisition by Qiagen N.V. in July 2007. Mr. Ryan’s career includes a 38-year tenure with Johnson & Johnson. Mr. Ryan retired in 2001 as Johnson & Johnson’s company group chairman with responsibility for worldwide Ethicon franchises and Johnson & Johnson Canada. In addition, Mr. Ryan was a member of the Medical Devices and Diagnostics Operating Group and Leader for the Group in Process Excellence (Six Sigma) and IT. Throughout his years at Johnson & Johnson, Mr. Ryan held positions of increasing responsibility, including worldwide president of Chicop ee, president of Johnson and Johnson Hospital Services Co. and president of Ethicon, Inc. Mr. Ryan received a B.S. degree in Mechanical Engineering from the Illinois Institute of Technology in 1965 and an M.B.A. from the University of Chicago Graduate School of Business in 1969.

Mr. Ryan has held senior leadership positions in the medical device industry, and possesses particular experiences, qualifications, attributes and skills to serve as a director in the areas of operations and six sigma.

INCUMBENT CLASS III DIRECTORS

TERM EXPIRING 2011

Jack E. Stover, age 57. Mr. Stover has been a director since August 2005. Mr. Stover is the executive chairman of Targeted Non Therapeutics LLC, a privately held biotechnology company focused on targeted delivery of peptides and proteins. Mr. Stover was a member of the board of directors of Arbios Systems Inc., a publicly held company, from 2005 to 2008. From 2004 to 2008, he served as chief executive officer, president and director of Antares Pharma, Inc., a publicly held company listed on the American Stock Exchange. Prior to that, Mr. Stover was executive vice president and chief financial officer of Sicor, Inc., a publicly held injectable pharmaceutical compan y, which was acquired by Teva Pharmaceutical Industries. Prior to that, Mr. Stover was executive vice

president and director of a proprietary women’s pharmaceutical company, Gynetics, Inc., and before Gynetics, he was senior vice president and director of B. Braun Medical, Inc., a private global medical device and pharmaceutical company. For more than five years prior to that, Mr. Stover was a partner with PricewaterhouseCoopers (then Coopers and Lybrand), working in the bioscience industry division in New Jersey. Mr. Stover received his B.A. in Accounting from Lehigh University and is a Certified Public Accountant.

Mr. Stover has held senior leadership positions in the pharmaceutical industry, and has specific experience and skills to serve as a director in the areas of operations, and financial operations and administration.

Jan Martens Vecsi, age 66. Ms. Vecsi has been a director since May 1998. Ms. Vecsi is the sister-in-law of John P. Dugan, our chairman. Ms. Vecsi was employed by Citibank, N.A. from 1967 to 1996 when she retired. Starting in 1984, she served as the senior human resources officer and vice president of the Citibank Private Bank. Ms. Vecsi received a B.A. in Psychology and Elementary Education from Immaculata College in 1965.

Ms. Vecsi has held senior leadership roles in the banking industry, and possesses particular expertise to serve as a director in the areas of banking and human resources.

Veronica A. Lubatkin, age 47. Ms. Lubatkin has been a director since November 2008. She is currently the executive vice president and chief financial officer of Railworks Corporation, which she joined in July 2009. From 2007 to March 2009, Ms. Lubatkin was executive vice president and chief financial officer of Par Pharmaceutical Companies, Inc. and previously served as Par Pharmaceutical Companies’ vice president and controller. Prior to joining Par Pharmaceutical Companies in April 2006, Ms. Lubatkin served in various positions at Schering-Plough Corporation from 1997 through 2006, most recently as executive director of strategic alliances for the cholesterol joint venture between Schering-Plough and Merck and prior to that as se nior director of finance for Schering-Plough’s global animal health business. Prior to joining Schering-Plough, Ms. Lubatkin was finance director for Neuman Distributors, Inc., formerly a U.S. pharmaceutical wholesaler. She began her career with Arthur Anderson in 1985. Ms. Lubatkin earned a B.A. degree in Accounting from Pace University in 1985 and is a Certified Public Account.

Ms. Lubatkin has held senior leadership roles in the pharmaceutical industry and possesses relevant experiences, qualifications, attributes and skills to serve as a director in financial operations and administration, risk management and information technology.

RETIRING DIRECTORS

On March 29, 2010, John Pietruski announced that he would retire from the Board effective May 1, 2010, and he would therefore not stand for re-election as a Class II director when his term expires in 2012. On April 13, 2010, John Dugan announced that he would retire from the Board and as an employee effective June 3, 2010, and that he would therefore not stand for re-election as a Class I director this year.

John P. Dugan, age 74. Mr. Dugan is our founder, Chairman of the Board of Directors and Director of Strategic Planning. He served as our president from inception until January 1995 and as our chief executive officer from inception until November 1997. In 1972, Mr. Dugan founded Dugan Communications, a medical advertising agency that later became known as Dugan Farley Communications Associates Inc. and served as its president until 1990. We were a wholly-owned subsidiary of Dugan Farley in 1990 when Mr. Dugan became our sole stockholder. Mr. Dugan was a founder and served as the president of the Medical Advertising Agency Association from 1983 to 1984. Mr. Dugan also served on the board of directors of the Pharmaceutical Advertising Council (now known as the Healthcare M arketing Communications Council, Inc.) and was its president from 1985 to 1986. Mr. Dugan received an M.B.A. from Boston University in 1964.

John M. Pietruski, age 77. Mr. Pietruski has been a director since May 1998. From 1990 to April 2008, Mr. Pietruski was the chairman of the board of Encysive Pharmaceuticals, Inc., a pharmaceutical research and development company. He is a retired chairman of the board and chief executive officer of Sterling Drug Inc., where he was employed from 1977 until his retirement in 1988. Mr. Pietruski is a member of the board of directors of Xylos Corporation and TrialCard, Inc. Mr. Pietruski graduated Phi Beta Kappa with a B.S. in Business Administration with honors from Rutgers University in 1954.

GOVERNANCE OF THE COMPANY

Director Independence

Our Board of Directors has determined that Messrs. Pietruski Ryan, Sullivan, Federspiel, Stover and Belle, and Ms. Lubatkin are independent within the meaning of the applicable rules of the Nasdaq Stock Market, LLC (“NASDAQ”).

Corporate Governance and Code of Business Conduct

Our Board of Directors has adopted a written Code of Business Conduct that applies to our directors, officers, and employees, as well as Corporate Governance Guidelines applicable specifically to our Board of Directors. You can find links to these documents on our website, www.pdi-inc.com under the “Corporate Governance” heading on the “Investor Relations” page. Disclosure regarding any amendments to, or any waivers from, a provision of our Code of Business Conduct that applies to one or more of our directors, our principal executive officer, our principal financial or our principal accounting officer will be included in a Current Report on Form 8-K within four business days following the date of the amendment or waiver, unless posting such information on our website (www.pdi-inc.com) is then permitted by the rules of NASDAQ.

Board Leadership and Structure

The Chairman of the Board presides at all meetings of the Board. Currently, Mr. Dugan serves as the Chairman of the Board, Ms. Lurker serves as a Director and Chief Executive Officer and Mr. Belle is the lead independent director. Because Mr. Dugan is an employee of the Company, the Board created the position of the lead independent director during 2009. A description of the responsibilities of the lead independent director can be accessed from the “Investor Relations” section of our website at www.pdi-inc.com. Among other things, our lead independent director presides at all meetings of our Board of Directors in the absence of the Chairman, chairs executive sessions of our independent directors and has the authority to call special meetings of our independent d irectors.

In connection with the retirement of the current Chairman of the Board on June 3, 2010, the Board will elect a new Chairman of the Board, and will decide whether it will be necessary to have both a Chairman of the Board and a lead independent director. Our Board of Directors believes that, after Mr. Dugan's retirement, having an independent director serve as Chairman of our Board of Directors will be in the best interests of our stockholders at this time. This structure provides more direct independent oversight of the Company and active participation of our independent directors in setting agendas and establishing policies and procedures of our Board of Directors. Further, this structure permits our Chief Executive Officer to focus on the management of our Company’s day to day operations.

The Board does not have a policy on whether or not the roles of Chief Executive Officer and Chairman of the Board should be separate. The Board believes that it should be free to make a choice from time to time in any manner that is in the best interests of the Company and its shareholders.

Board of Directors Meetings and Committees

During the year ended December 31, 2009, the Board of Directors held 7 meetings, the Audit Committee held 10 meetings, the Compensation and Management Development Committee (the “Compensation Committee”) held 9 meetings, and the Nominating Committee held 5 meetings. Each committee member is a non-employee director of the Company who meets the independence requirements of NASDAQ and applicable law. Each of our incumbent directors attended at least 75% of the total number of Board of Directors meetings and committee meetings on which he or she served during 2009, other than Mr. Sullivan, who attended 73% of such meetings.

We have adopted a policy encouraging our directors to attend annual meetings of stockholders and believe that attendance at annual meetings is just as important as attendance at meetings of the Board of Directors. All of our directors other than Mr. Sullivan attended our annual stockholders’ meeting held on June 4, 2009. Our Board of Directors has three standing committees, each of which is described below.

Audit Committee

The Audit Committee is currently comprised of Mr. Stover (chairperson), Mr. Belle, Ms. Lubatkin and Mr. Sullivan. The primary purposes of our Audit Committee are: (a) to assist the Board of Directors in its oversight of (a) (i) the integrity of our financial statements, (ii) our compliance with legal and regulatory requirements, (iii) the qualifications and independence of our independent registered public accounting firm and (iv) the performance of our internal audit function and independent registered public accounting firm; (b) to review and approve all transactions that are “related party” transactions under SEC rules; and (c) to prepare any report of the Audit Committee required by the rules and regulations of the U.S. Securities and Exchange Commission (the “SEC”) for inclusion in our annual proxy statement.

Our Board of Directors has determined that each member of our Audit Committee is independent within the meaning of the rules of both NASDAQ and the SEC. Our Board of Directors has determined that the chairperson of the Audit Committee, Mr. Stover, is an “audit committee financial expert,” as that term is defined in Item 407(d) of Regulation S-K under the Securities Exchange Act of 1934 (the “Exchange Act”).

The Audit Committee and our Board of Directors have established a procedure whereby complaints or concerns with respect to accounting, internal controls and auditing matters may be submitted to the Audit Committee, which is described in the section of this Proxy Statement entitled “Policies on Communicating with our Board of Directors and Reporting of Concerns Regarding Accounting or Auditing Matters.”

Our Audit Committee Charter is posted and can be viewed in the “Investor Relations” section of our website at www.pdi-inc.com.

Compensation and Management Development Committee

The Compensation Committee is currently comprised of Messrs. Ryan (chairperson), Pietruski, and Federspiel, and Ms. Lubatkin. Each member of our Compensation Committee is “independent” within the meaning of the rules of NASDAQ and as required by the Compensation Committee charter. The primary purposes of our Compensation Committee are: (a) to establish and maintain executive compensation policies for the Company consistent with corporate objectives and stockholder interests; and (b) to oversee the competency and qualifications of our senior management personnel and the provisions of senior management succession planning. In addition, the Compensation Committee is responsible for preparing any report of the Compensation Committee required by the rules and regulations of the SEC for inclusion in our annual proxy statement. The Compensation Committee also administers our equity compensation plans. Additional information on the Compensation Committee’s processes and procedures for the consideration and determination of executive compensation can be found in the section of this Proxy Statement entitled “Compensation Discussion and Analysis.”

Our Compensation Committee Charter is posted and can be viewed in the “Investor Relations” section of our website at www.pdi-inc.com.

Nominating and Corporate Governance Committee

The Nominating Committee is currently comprised of Messrs. Federspiel (chairperson), Belle and Sullivan. Each member of our Nominating Committee is “independent” within the meaning of the rules of NASDAQ and as required by the Nominating Committee charter. The primary purposes of the Nominating Committee are: (a) to select individuals qualified to serve as directors of the Company and on committees of the Board of Directors; (b) to advise the Board of Directors with respect to board composition, procedures and committees; (c) to advise the Board of Directors with respect to the corporate governance principles applicable to the Company; (d) to advise the Board of Directors with respect to director compensation issues; and (e) to oversee the evaluation of the Board of Directors. The Nominating Committee does not set specific, minimum qualifications that nominees must meet in order for the committee to recommend them to the Board of Directors, but rather believes that each nominee should be evaluated based on his or her individual merits, taking into account our needs and the composition of the Board of Directors. Members of the Nominating Committee discuss and evaluate possible candidates in detail, and suggest individuals to explore in more depth. Outside consultants have also been employed to help in identifying candidates. Once a candidate is identified whom the committee wants to seriously consider and move toward nomination, the chairperson of the Nominating Committee enters into a discussion with that nominee candidate. Subsequently, the chairperson will discuss the qualifications of the candidate with the other members of the committee, and the Nominating Committee will then make a final recommendation with respect to that candidate to the Board of Directors.

The Nominating Committee considers many factors when determining the eligibility of candidates for nomination as directors. The Nominating Committee does not have a diversity policy; however, its goal is to nominate candidates from a broad range of experiences and backgrounds who can contribute to the Board of Director’s deliberations by reflecting a range of perspectives, thereby increasing its overall effectiveness. In identifying and recommending nominees for positions on the Board of Directors, the Nominating Committee places primary emphasis on (i) a candidate’s judgment, character, expertise, skills and knowledge useful to the oversight of our business; (ii) a c andidate’s business or other relevant experience; and (iii) the extent to which the interplay of the candidate’s expertise, skills, knowledge and experience with that of other members of the Board of Directors will build a Board of Directors that is effective, collegial and responsive to our needs. The Nominating Committee will consider nominees recommended by stockholders, provided such nominations comply with the applicable provisions of our bylaws and the procedures to be followed in submitting proposals. Stockholders who wish to submit nominees for director for consideration by the Nominating Committee may do so by submitting in writing such nominees’ names and qualifications to PDI, Inc., Attn: Corporate Secretary, Morris Corporate Center One, 300 Interpace Parkway, Building A, Parsippany, NJ 07054. See “Stockholder Proposals for the 2011 Annual Meeting” for the procedures to be followed by stockholders in submitting proposals, including recommend ations for director nominees, to be included in our proxy statement relating to the 2011 annual meeting of stockholders. The Company’s Nominating Committee Charter is posted and can be viewed in the “Investor Relations” section of our website at www.pdi-inc.com.

Policies on Communicating with our Board of Directors and Reporting of Concerns Regarding Accounting or Auditing Matters

Stockholders may contact an individual director, a committee of our Board of Directors or our Board of Directors as a group. The name of any specific intended director recipient (or recipients) should be noted in the communication. Communications may be sent to PDI, Inc., Attn: Corporate Secretary, Morris Corporate Center One, 300 Interpace Parkway, Building A, Parsippany, NJ 07054. Our Corporate Secretary will forward such correspondence only to the intended recipients. Prior to forwarding any correspondence, however, the Corporate Secretary will review the correspondence and will not forward any communications deemed to be of a commercial or frivolous nature or otherwise inappropriate for our Board of Directors’ consi deration. In such cases, that correspondence may be forwarded elsewhere in the Company for review and possible response.

Any person who has a concern regarding accounting, internal accounting controls or auditing matters may, in a confidential or anonymous manner, communicate that concern in either of the following manners: (1) by reporting such concerns via a confidential and secure Internet and telephone based reporting system administered by an external vendor, which may be accessed via the Internet at www.guideline.lrn.com or toll-free by telephone at 1-888-577-9483; or (2) by setting forth such concerns in writing and forwarding them in a sealed envelope to the chairperson of the Audit Committee, in care of our Corporate Secretary at PDI, Inc. Attn: Corporate Secretary, Morris Corporate Center One, 300 Interpace Parkway, Building A, Parsippany, NJ 07054, such envelope to be labeled with a legend such as: “Anonymous Submission of Complaint or Concern.”

All communications received regarding concerns about accounting or auditing matters will be relayed to the chairperson of our Audit Committee. Additional information on how to access our whistleblower hotline is posted and can be viewed in the “Investor Relations” section of our website at www.pdi-inc.com.

INFORMATION ABOUT OUR COMPENSATION OF DIRECTORS

Each of our non-employee directors receives an annual director's fee of $40,000, payable quarterly in arrears. In addition, the lead independent director as well as the Chairperson of each of the Audit Committee, Compensation Committee and Nominating Committee received an additional annual fee of $25,000, $25,000, $15,000 and $5,000, respectively. With the anticipated election of a non-employee director to the position of Chairman of the Board, the Board intends to review the amount of the additional annual fee to be paid to the Chairman of the Board. Members of our Board of Directors may defer receipt of board and committee fees through participation in our Executive Deferred Compensation Plan. In addition, our directors are entitled to reimbursement for travel and related expenses incurred in connection with attendance at Board and committee meetings.

Our current practice with respect to equity awards to our non-employee directors is as follows: Upon initial appointment to the Board of Directors, each non-employee director receives approximately $60,000 in restricted stock units (“RSUs”) which vest in equal annual installments over a three-year period. In addition, each non-employee director receives approximately $45,000 in RSUs (with the exception of the lead independent director who receives $50,000 in RSUs), on the date of our annual meeting each year which vest in equal annual installments over a three-year period. Our non-employee directors are subject to certain stock ownership guidelines, which are described in the section of this Proxy Statement entitled “Compensation Discussion and Analysis – Stock Ownership Guideli nes.”

The following table presents information relating to total compensation for our non-employee directors for the year ended December 31, 2009. The value of equity awards is based on the aggregate grant date fair value of the award, computed in accordance with FASB ASC Topic 718.

| DIRECTOR COMPENSATION |

| Name | | Fees earned or paid in cash ($) | | | Stock awards ($) (1) | | | Option awards ($) | | | Nonqualified Compensation Earnings ($) | | | All Other Compen -sation ($) | | | Total ($) |

Gerald Belle (2) (3) | | $ | 50,598 | | | $ | 45,002 | | | $ | - | | | $ | - | | | $ | - | | | $ | 95,599 |

Joseph T. Curti (2) | | | 40,000 | | | | 45,002 | | | | - | | | | - | | | | - | | | | 85,002 |

John P. Dugan (4) | | | - | | | | - | | | | - | | | | - | | | | 184,000 | | | | 184,000 |

John C. Federspiel (2) (5) | | | 45,000 | | | | 45,002 | | | | - | | | | - | | | | - | | | | 90,002 |

Veronica A. Lubatkin (2) | | | 40,000 | | | | 45,002 | | | | - | | | | - | | | | - | | | | 85,002 |

John M. Pietruski (2) | | | 40,000 | | | | 45,002 | | | | - | | | | - | | | | - | | | | 85,002 |

Frank J. Ryan (2) (6) | | | 55,000 | | | | 45,002 | | | | - | | | | - | | | | - | | | | 100,002 |

Stephen Sullivan (2) | | | 40,000 | | | | 45,002 | | | | - | | | | - | | | | - | | | | 85,002 |

Jack Stover (2) (7) | | | 65,000 | | | | 45,002 | | | | - | | | | 5,664 | | | | - | | | | 115,666 |

Jan Vecsi (2) | | | 40,000 | | | | 45,002 | | | | - | | | | - | | | | - | | | | 85,002 |

Information regarding Ms. Lurker’s compensation can be found elsewhere in this Proxy Statement under the caption “Executive Compensation.”

| | (1) | The dollar amounts set forth under the heading “Stock Awards” represent aggregate grant date fair value computed in accordance with FASB ASC Topic 718. For purposes of computing such amounts, we disregarded estimates of forfeitures related to service-based vesting conditions. For additional information regarding our valuation assumptions, please refer to Note 1—“Stock-Based Compensation” to our consolidated financial statements incorporated as Item 8 of our Annual Report on Form 10-K for the year ended December 31, 2009, filed with the SEC on March 8, 2010. |

| | (2) | Each non-employee director received a grant of 12,262 restricted stock units on June 4, 2009 (the date of last year’s annual meeting). These restricted stock units vest in three equal installments, on June 4, 2010, 2011, and 2012. The fair market value of each restricted stock unit on the date of grant was $3.67. |

| | (3) | Mr. Belle’s fees represent the annual director’s fee of $40,000 plus the $25,000 lead independent director fee, prorated to reflect the portion of the fiscal year that Mr. Belle served as the lead independent director. |

| | (4) | Pursuant to an agreement (as amended) that we entered into with Mr. Dugan in January 1998, Mr. Dugan receives an annual salary of $150,000 as the Director of Strategic Planning. In addition to his salary, Mr. Dugan received automobile-related and healthcare benefits, with a total value of approximately $34,000, during the fiscal year ended December 31, 2009. |

| | (5) | Mr. Federspiel’s fees represent the annual director’s fee of $40,000 plus an additional $5,000 fee paid to Mr. Federspiel for his service as the chair of the Nominating Committee. |

| | (6) | Mr. Ryan’s fees represent the annual director’s fee of $40,000 plus an additional $15,000 fee paid to Mr. Ryan for his service as the chair of the Compensation Committee. |

| | (7) | Mr. Stover’s fees represent the annual director’s fee of $40,000 plus an additional $25,000 fee paid to Mr. Stover for his service as the chair of the Audit Committee. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table shows, as of April 1, 2010, the number of shares of our common stock beneficially owned by (i) each stockholder who is known by us to own beneficially in excess of 5% of our outstanding common stock, (ii) each director, (iii) each of our current and former executive officers included in the section of this Proxy Statement entitled “Summary Compensation Table” (each, a “named executive officer”) who is a beneficial owner of our common stock, and (iv) all directors and current executive officers as a group.

Except as otherwise indicated, the persons listed below have sole voting and investment power with respect to all shares of common stock owned by them and all information with respect to beneficial ownership has been furnished to us by the respective stockholder. Except as otherwise listed below, the address of the persons listed below is c/o PDI, Inc., 300 Interpace Parkway, Parsippany, New Jersey 07054. The percentage of beneficial ownership is based on 14,264,784 shares of common stock outstanding on April 1, 2010.

| PRINCIPAL STOCKHOLDERS |

| Name of Beneficial Owner | Number of Shares Beneficially Owned (1) | Percent of Shares Outstanding |

| Executive officers and directors: | | |

| John P. Dugan | 4,869,878 | | 34.1% |

| Nancy Lurker | 65,960 | | * |

| Jeffrey E. Smith | 150,811 | (2) | 1.1% |

| Howard Drazner | 12,118 | | * |

| David Kerr | - | | - |

| Richard Micali | - | | - |

| Peter Tilles | 1,725 | (3) | * |

| Gerald Belle | 9,852 | | * |

| John C. Federspiel | 52,509 | (4) | * |

| Veronica A. Lubatkin | 4,673 | | * |

| John M. Pietruski | 56,509 | (5) | * |

| Frank J. Ryan | 48,009 | (6) | * |

| Jack Stover | 19,509 | (7) | * |

| Stephen Sullivan | 27,459 | (8) | * |

| Jan Martens Vecsi | 70,109 | (5) (9) | * |

| All executive officers and directors as a group (14 persons) | 5,387,396 | | 37.8% |

| 5% stockholders: | | | |

Heartland Advisors, Inc. (10) | 1,830,498 | | 12.8% |

| 789 North Water Street | | | |

| Milwaukee, WI 53202 | | | |

Royce & Associates, LLC (11) | 1,217,214 | | 8.5% |

| 745 Fifth Avenue | | | |

| New York, NY 10151 | | | |

Dimensional Fund Advisors LP (12) | 1,199,596 | | 8.4% |

| 6300 Bee Cave Road | | | |

| Austin, TX 78746 | | | |

* Represents less than 1% of shares of common stock outstanding.

| | (1) | Beneficial ownership and percentage ownership are determined in accordance with the rules and regulations of the SEC and include voting or investment power with respect to shares of stock. This information does not necessarily indicate beneficial ownership for any other purpose. In computing the number of shares beneficially owned by a person and the percentage ownership of that person, we include shares underlying common stock derivatives, such as options, restricted stock units, and stock appreciation rights, that a person has the right to acquire within 60 days of April 1, 2010. Such shares, however, are not deemed outstanding for the purpose of computing the percentage ownership of any other person. |

| | (2) | Includes 41,027 restricted stock units that would vest immediately upon Mr. Smith’s retirement. |

| | (3) | Mr. Tilles’s employment with the Company was terminated on September 30, 2009. The beneficial ownership set forth above is based on the Form 3 filed by Mr. Tilles with the SEC on April 20, 2009. |

| | (4) | Includes options to purchase 40,000 shares of common stock. |

| | (5) | Includes options to purchase 45,000 shares of common stock. |

| | (6) | Includes options to purchase 32,500 shares of common stock. |

| | (7) | Includes options to purchase 10,000 shares of common stock. |

| | (8) | Includes options to purchase 17,500 shares of common stock. |

| | (9) | Includes 400 shares held in an irrevocable Trust Account for her son, John S. Vecsi, Jr. of which Ms. Vecsi is the trustee. |

| | (10) | Represents 1,830,498 shares of common stock beneficially owned by (i) Heartland Advisors, Inc., by virtue of its investment discretion and voting authority granted by certain clients, which may be revoked at any time and (ii) William J. Nasgovitz, by virtue of his control of Heartland Advisors, Inc. This information is based on the Schedule 13G/A filed by Heartland Advisors, Inc. filed with the SEC on February 10, 2010. |

| | (11) | This information is based on the Schedule 13G filed by Royce & Associates, LLC filed with the SEC on January 26, 2010. |

| | (12) | Represents 1,179,947 shares of common stock over which Dimensional Fund Advisors LP has sole power to vote, or to direct the vote, and 19,649 shares of common stock that it indirectly controls by virtue of its status as an investment advisor or sub-advisor to certain other investment companies. This information is based on the Schedule 13G/A filed by Dimensional Fund Advisors LP filed with the SEC on February 8, 2010 |

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our executive officers and directors, and persons who own more than ten percent (10%) of a registered class of our common stock to file reports of ownership and changes in ownership with the SEC. Executive officers, directors and greater than ten percent (10%) stockholders are required by SEC regulations to furnish us with copies of all Section 16(a) forms they file.

To the best of our knowledge, based solely on review of the copies of such forms furnished to us, or written representations that no other forms were required, we believe that all Section 16(a) filing requirements applicable to our executive officers, directors and greater than ten percent (10%) stockholders were complied with during the fiscal year ended December 31, 2009 with the following exception: an Initial Statement of Beneficial Ownership on Form 3 was not timely filed for Messrs. Tilles and Micali.

EXECUTIVE OFFICERS

The following table sets forth the names, ages and principal position of the executive officers of the Company as of the date of this Proxy Statement:

| Name | Age | Position |

| Nancy Lurker | 52 | Chief Executive Officer |

| Jeffrey E. Smith | 63 | Executive Vice President, Chief Financial Officer and Treasurer |

| Howard Drazner | 50 | Senior Vice President - Business Development, Promotional Medical Education |

| David Kerr | 52 | Senior Vice President, Business Development |

| Richard Micali | 53 | Senior Vice President, Sales Services |

The principal occupation and business experience for at least the last five years for each executive officer is set forth below (except for Ms. Lurker, whose business experience is discussed above).

Jeffrey E. Smith joined us as Executive Vice President, Chief Financial Officer (“CFO”) and Treasurer in May 2006. During the period June through November 2008 he served as Interim Chief Executive Officer of PDI, and he is currently serving as Acting Corporate Secretary. Immediately prior to joining PDI, Mr. Smith was senior vice president, finance and chief financial officer of Pliva, Inc., a specialty generic pharmaceutical company. From 1985 to 2002, Mr. Smith served in various executive positions with Alpharma, Inc., a global specialty pharmaceutical company. While with Alpharma, Inc., Mr. Smith was executive vice president, finance and chief financial officer and, for a three-year period, was responsible for worldwide operations while servin g as acting president and member of the office of the chief executive. Mr. Smith is a Certified Public Accountant who began his career with Coopers & Lybrand, now PricewaterhouseCoopers. Mr. Smith received his B.S. from Fairleigh Dickinson University.

Howard Drazner joined us in 2004 upon our acquisition of Pharmakon. He has served as the President of our Pharmakon business unit since September 2007, and in April 2010 he became the Senior Vice President of Business Development, Promotional Medical Education. Prior to that, Mr. Drazner spent 10 years in senior management roles at Pharmakon (formerly known as C. Beck) where he was responsible for sales and marketing of interactive peer programs for physicians. Mr. Drazner began his career in the pharmaceutical industry with Stuart Pharmaceuticals, a division of ICI Americas, now known as AstraZeneca. In addition, he has worked in a number of sales, marketing and management positions, including advertising space sales for the Amer ican College of Surgeons and direct marketing sales, management and marketing for Buckley Dement, an American Medical Association franchisee. Mr. Drazner received a B.S. in Life Sciences from the University of Wisconsin.

David Kerr. Mr. Kerr joined us as Senior Vice President of Business Development in April 2009. Prior to joining PDI, Mr. Kerr was senior vice president of commercial business at Endo Pharmaceuticals, Inc., where he was responsible for branded and generic pharmaceutical product sales, marketing, managed markets, portfolio and strategic planning and analytics since 2006. From 2001 to 2006, Mr. Kerr served as vice president of business development at Endo Pharmaceuticals, responsible for leading product licensing and acquisition activities. Prior to that, Mr. Kerr spent six years at Knoll Pharmaceuticals, which was at that time a division of

BASF Corporation, where he was senior director of the pain management business unit with responsibility for sales, marketing and business development activity. Also while at Knoll, Kerr served as director of sales operations and strategic planning. Prior to that, Mr. Kerr worked with American Cyanamid in international agricultural chemicals marketing. Mr. Kerr also spent 15 years with the DuPont Company in roles of increasing responsibility within the commercial side of DuPont’s life science business. Mr. Kerr received a B.S. in Accounting from Pennsylvania State University and an M.B.A. from the University of Delaware.

Richard P. Micali joined us as Senior Vice President of Sales Services in February 2009. Prior to joining PDI, Mr. Micali spent 25 years at Bristol-Myers Squibb where he held positions of increasing responsibility in sales, marketing and managed markets. He began his career as a sales representative and most recently was vice president, oncology sales. Mr. Micali has broad sales leadership experience across several therapeutic areas and customer channels. He has extensive experience building and leading sales organizations. Throughout his career, he has successfully launched a variety of new products and indications. Mr. Micali is a member of the Board of Trustees for Mercer Street Friends, a non-profit organization. He received his B.S. from Bowling Green S tate University and an M.B.A. from John Carroll University.

PROPOSAL NO. 2 - RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of our Board of Directors has appointed E&Y as our independent registered public accounting firm for the fiscal year ending December 31, 2010. Although stockholder approval is not required, we desire to obtain from the stockholders an indication of their approval or disapproval of the Audit Committee’s action in appointing E&Y as the independent registered public accounting firm of the Company and its subsidiaries. The accompanying proxy will be voted FOR the ratification of the appointment of E&Y unless the proxy contains instructions otherwise. If the stockholders do not ratify this appointment, such appointment will be reconsidered by the Audit Committee, but the Audit Committee will not be required to take any action.

A representative of E&Y will be present at the Annual Meeting and will be afforded an opportunity to make a statement and to respond to questions.

The Board of Directors Recommends a Vote FOR the Ratification of the

Appointment of Ernst & Young LLP for Fiscal Year 2010 and Proxies That Are

Returned Will Be So Voted Unless Otherwise Instructed.

AUDIT COMMITTEE REPORT

The following Report of the Audit Committee shall not be deemed incorporated by reference into any of our filings under the Securities Act of 1933, as amended, or the Exchange Act, except to the extent we specifically incorporate it by reference therein.

The Audit Committee has reviewed and discussed with management and E&Y, the independent registered public accounting firm, our audited financial statements for fiscal 2009, management’s assessment of the effectiveness of our internal control over financial reporting and E&Y’s evaluation of the effectiveness of our internal control over financial reporting. The Audit Committee has also discussed with E&Y the matters required to be discussed by Statement on Auditing Standards No. 61, Communication with Audit Committees, as amended (AICPA, Professional Standards, Vol.1 AU section 380) and as adopted by the Public Company Accounting Oversight Board in Rule 3200T. The Audit Committe e also received the written disclosures and the letter from E&Y required by Rule 3526 of the Public Company Accounting Oversight Board (Communications with Audit Committees Concerning Independence), and the Audit Committee discussed with E&Y the firm’s independence.

Management is responsible for the preparation, presentation and integrity of our financial statements, accounting and financial reporting principles and internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations, including the effectiveness of internal control over financial reporting. E&Y is responsible for performing an independent audit of our financial statements,

expressing an opinion as to their conformity with generally accepted accounting principles, and expressing an opinion on the effectiveness of internal control over financial reporting. E&Y has free access to the Audit Committee to discuss any matters they deem appropriate.

Based on the reports and discussions described in this report, the Audit Committee recommended to the Board of Directors that our audited financial statements for fiscal 2009 be included in our Annual Report on Form 10-K for the year ended December 31, 2009 for filing with the SEC.

Submitted by the Audit Committee

Jack E. Stover, Chairperson

Gerald P. Belle

Veronica A. Lubatkin

Stephen J. Sullivan

Audit Committee Matters and Fees Paid to Independent Registered Public Accounting Firm

Under its charter, the Audit Committee must pre-approve all engagements of our independent registered public accounting firm unless an exception to such pre-approval exists under the Exchange Act or the rules of the SEC. Each year, the independent registered public accounting firm’s retention to audit our financial statements and the effectiveness of our internal control over financial reporting, and permissible non-audit services, including the associated fees, is approved by the Audit Committee. At the beginning of each fiscal year, the Audit Committee evaluates other known potential engagements of the independent registered public accounting firm, in light of the scope of the work proposed to be performed and the proposed fees, and approves or rejects each service, taking into account whether the service s are permissible under applicable law and the possible impact of each non-audit service on the independent registered public accounting firm’s independence. At subsequent Audit Committee meetings, the Audit Committee receives updates on the services actually provided by the independent registered public accounting firm, and management may present additional services for approval. Typically, these would be services, such as due diligence for an acquisition, that were not known at the beginning of the year. The Audit Committee has delegated to the Chairperson of the Audit Committee the authority to evaluate and approve engagements on behalf of the Audit Committee in the event that a need arises for pre-approval between committee meetings. If the Chairperson so approves any such engagements, he will report that approval to the full Audit Committee at the next Audit Committee meeting.

E&Y, an independent registered public accounting firm, has served as our independent accountants continuously since 2005. The Audit Committee believes that the knowledge of our business E&Y has gained through this period of service is valuable. Fees for services provided by E&Y for the past two completed years ended December 31 were as follows:

| PRINCIPAL ACCOUNTANT FEES AND SERVICES |

| | | 2009 | | | 2008 |

| Audit Fees | | $ | 656,410 | | | $ | 849,467 |

| Audit-Related Fees | | | 15,204 | | | | 29,860 |

| Tax Fees | | | - | | | | 20,000 |

| All Other Fees | | | - | | | | - |

| Total Fees | | $ | 671,614 | | | $ | 899,327 |

Fees for audit services include the audit of our consolidated financial statements and the audit of the effectiveness of internal control over financial reporting. Fees for audit-related services consist of the audit of our 401(k) plan, which in 2008 consisted of an audit of our 401(k) plan for the year ended December 31, 2007 by an affiliate of E&Y. Fees for tax services include tax advisory services related to state and local tax matters.

COMPENSATION DISCUSSION AND ANALYSIS

The following discussion and analysis of executive compensation arrangements should be read together with the compensation tables and related disclosures set forth elsewhere in this Proxy Statement under the caption “Executive Compensation”. This discussion contains forward looking statements that are based on our current plans, considerations, expectations and determinations regarding executive compensation. These statements involve known and unknown risks, uncertainties and other factors that may cause our future compensation programs to differ materially from currently planned programs.

Our current named executive officers who received compensation from the Company during 2009 are as follows: (i) Nancy Lurker, the Chief Executive Officer; (ii) Jeffrey Smith, our Executive Vice President, Chief Financial Officer and Treasurer; (iii) Howard Drazner, Senior Vice President – Business Development, Promotional Medical Education, (iv) David Kerr, Senior Vice President of Business Development, and (v) Richard P. Micali, the Senior Vice President of Sales Services. The discussion below also includes Peter Tilles, the former President of our TVG Marketing Research & Consulting business unit, whose employment terminated during 2009.

Compensation Philosophy and Objectives

We believe that executive compensation should be aligned with the performance and growth objectives of the Company and long-term stockholder value. The primary objectives of our executive compensation plans are to:

| | · | provide overall levels of compensation that are competitive in order to attract, retain and motivate highly qualified, experienced executives; |

| | · | provide annual and long-term incentives that emphasize performance-based compensation, and |

| | · | align the interests of our executives with those of our stockholders by having a meaningful portion of executive compensation comprised of equity-based incentives and by having minimum stock ownership guidelines. |

The amounts awarded to each executive under our compensation plans are wholly within the discretion of the Compensation Committee (and the full Board of Directors in the case of our CEO). Some of the factors which the Compensation Committee and the Board of Directors consider in the exercise of their discretion are: (i) the financial performance of the Company as a whole, (ii) the financial performance of the individual business units, (iii) progress towards the Company’s strategic objectives, (iv) individual performance of each executive, and (v) an assessment of the leadership and decision-making abilities, innovation and industry knowledge of each executive.

Taking such factors into account, and in light of the challenging economic conditions for the Company’s pharmaceutical clients as well as general economic conditions, the 2009 annual cash incentive bonus pool for our executives ranged from 20% to 40% of their respective target bonuses. With respect to the grant of long-term equity awards, these varied for each executive based in part on the factors referenced above.

The Compensation Committee froze base salaries for the executive officers during 2009 and continued to freeze base salaries for the executive officers during 2010. In addition, they decided to limit the bonus pool to a maximum amount equal to 100% of our executives’ bonus targets during both of 2009 and 2010. It is expected that the Compensation Committee (or the full Board of Directors in the case of our CEO) will apply the same general factors in the exercise of their discretion to determine the amount of cash incentive awards to be granted under the 2010 bonus plan as for the 2009 bonus plan. In addition, the 2010 bonus plan: (1) contains lower long-term equity grant value ranges consistent with Competitive Market Data (as defined below), and (2) provides for the grant o f long-term equity compensation in the form of restricted stock, rather than restricted stock units and stock appreciation rights. The change to restricted stock was made in order to allow the Company’s executives to be able to better understand and determine the value of their equity awards at all times, thereby serving as a better tool for the retention of our executives.

Role of the Compensation Committee and the Board of Directors

The Compensation Committee provides overall guidance for our executive compensation policies and determines the value and elements of compensation for our executive officers, except for our CEO, whose compensation is approved by our full Board of Directors. In making its determinations with respect to executive compensation, since 2002 the Compensation Committee has retained the services of a compensation consultant, Pearl Meyer & Partners, to assist with the design of our executive compensation programs. Pearl Meyer & Partners does not provide any services to PDI other than executive compensation services. We believe that the use of an independent compensation consultant provides additional expertise to help us structure our executive compensation arrangements in a manner that is reasonable an d consistent with our objectives, in alignment with general survey data we use for benchmarking purposes and external market trends. Specifically, the scope of Pearl Meyer’s services for PDI during 2009 included: (a) assistance in the development of incentive compensation plans; (b) executive compensation benchmarking; and (c) review of the Compensation Discussion and Analysis section of this Proxy Statement. While the Compensation Committee typically reserves a portion of its meetings for executive sessions without the presence of management or the compensation consultant, the compensation consultant regularly participates in Compensation Committee meetings and advises the Compensation Committee on such matters as compensation trends and best practices, plan design and appropriate benchmarking.

In addition, our CEO and Senior Vice President, Human Resources participate in the process of determining the compensation for our executive officers and regularly participate in Compensation Committee meetings when requested by the Compensation Committee. During the first quarter of each year, the CEO, with the assistance of the Senior Vice President, Human Resources, undertakes a performance evaluation of each executive officer. The Compensation Committee then meets with the CEO to discuss and review each executive officer’s performance during the last fiscal year. The CEO provides the Compensation Committee with recommendations regarding base salary, the annual cash incentives as well as the long-term equity incentive awards to be made to each executive officer. The Compensation Com mittee then makes a final determination, in its sole discretion, regarding the compensation package of each executive officer. This determination is based on the recommendation of the CEO as well as a review of the Company’s financial results and any relevant position-based executive compensation benchmarking data provided by the Compensation Committee’s independent compensation consultant.

The process for determination of CEO compensation differs as follows. On an annual basis, the CEO completes a self-assessment of his or her performance for review by the Compensation Committee and the Board of Directors, and then the CEO meets with the Board of Directors to discuss his or her performance during the year. The Board of Directors then meets in executive session without the CEO present to discuss and evaluate his or her performance and compensation package. Ultimately, decisions regarding the CEO’s compensation package are made by the Board of Directors (excluding the CEO) based primarily upon the following considerations: (1) the Company’s financial performance and the Board of Director’s evaluation of the CEO’s performance; (2) the Compensation Committee’s a nd compensation consultant’s input to the Board of Directors; and (3) any relevant benchmarking data provided by the compensation consultant, as well as any other factors that the Board of Directors deems relevant.

Benchmarking

Compensation levels for executives are determined based on a number of factors, including among other things, the compensation levels in the marketplace for similar positions. Benchmarking compensation is a challenge for the Company, however, as there are no public companies of similar size and scope which provide the types of sales and marketing support services that we provide to our customers in the marketplace. Because there is not a true comparison group, the Compensation Committee, beginning in 2009, established a peer group of publicly-traded companies in the pharmaceutical and biotechnology industry, as well as commercial and