Exhibit 99.1

Investor Presentation September 2014 Nasdaq: ALQA

This presentation contains forward - looking statements . Forward - looking statements are generally identifiable by the use of words like "may," "will," "should," "could," "expect," "anticipate," "estimate," "believe," "intend," or "project" or the negative of these words or other variations on these words or comparable terminology . The reader is cautioned not to put undue reliance on these forward - looking statements, as these statements are subject to numerous factors and uncertainties outside of our control that can make such statements untrue, including, but not limited to, the adequacy of the Company’s liquidity to pursue its complete business objectives ; inadequate capital ; the Company’s ability to obtain reimbursement from third party payers for its products ; loss or retirement of key executives ; adverse economic conditions or intense competition ; loss of a key customer or supplier ; entry of new competitors and products ; adverse federal, state and local government regulation ; technological obsolescence of the Company’s products ; technical problems with the Company’s research and products ; the Company’s ability to expand its business through strategic acquisitions ; the Company’s ability to integrate acquisitions and related businesses ; price increases for supplies and components ; and the inability to carry out research, development and commercialization plans . In addition, other factors that could cause actual results to differ materially are discussed in our Annual Report on Form 10 - K filed with the SEC on March 24 , 2014 and our most recent Form 10 - Q filings with the SEC . Investors and security holders are urge d to read these documents free of charge on the SEC's web site at www . sec . gov . We undertake no obligation to publicly update or revise our forward - looking statements as a result of new information, future events or otherwise . Forward - Looking Statement Disclaimer

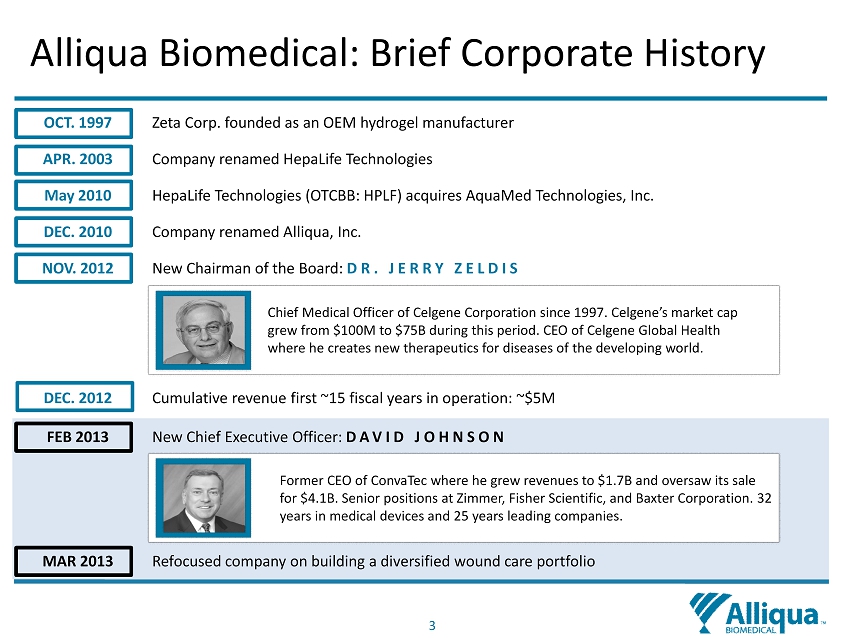

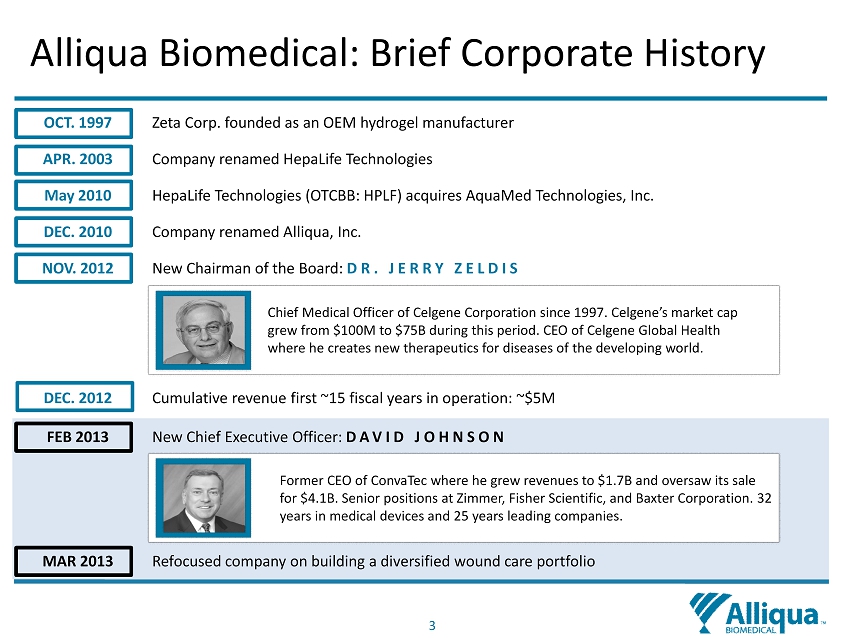

3 OCT. 1997 Zeta Corp. founded as an OEM hydrogel manufacturer APR. 2003 Company renamed HepaLife Technologies May 2010 HepaLife Technologies (OTCBB: HPLF) acquires AquaMed Technologies, Inc. DEC. 2010 Company renamed Alliqua, Inc. NOV. 2012 New Chairman of the Board: DR. JERRY ZELDIS DEC. 2012 Cumulative revenue first ~15 fiscal years in operation: ~$5M FEB 2013 New Chief Executive Officer: DAVID JOHNSON MAR 2013 Refocused company on building a diversified wound care portfolio Former CEO of ConvaTec where he grew revenues to $1.7B and oversaw its sale for $4.1B. Senior positions at Zimmer, Fisher Scientific, and Baxter Corporation. 32 years in medical devices and 25 years leading companies. Chief Medical Officer of Celgene Corporation since 1997. Celgene’s market cap grew from $100M to $75B during this period. CEO of Celgene Global Health where he creates new therapeutics for diseases of the developing world. Alliqua Biomedical: Brief Corporate History

4 Alliqua Biomedical: Mission To build a suite of advanced wound care solutions that will enable surgeons, clinicians & wound care practitioners to address the entire spectrum of challenges presented by chronic and acute wounds.

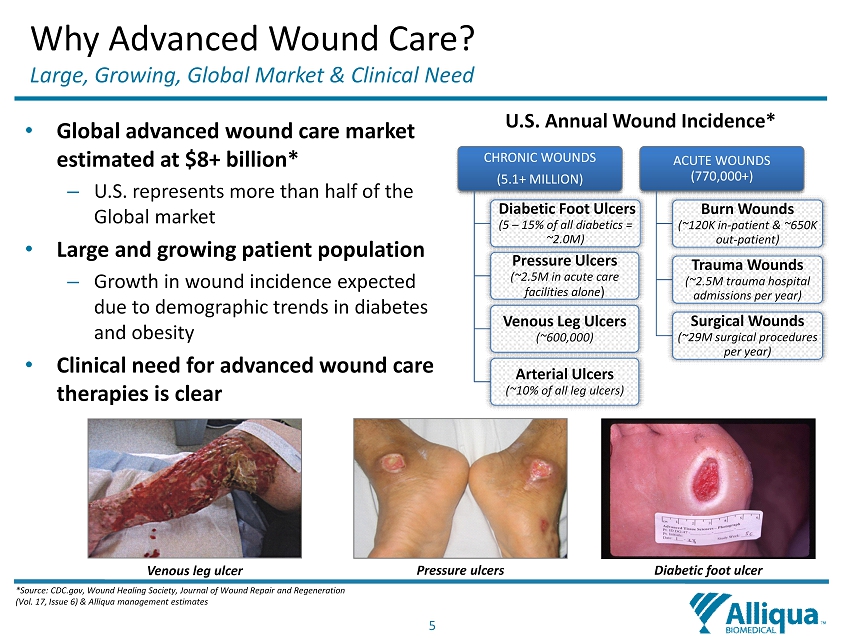

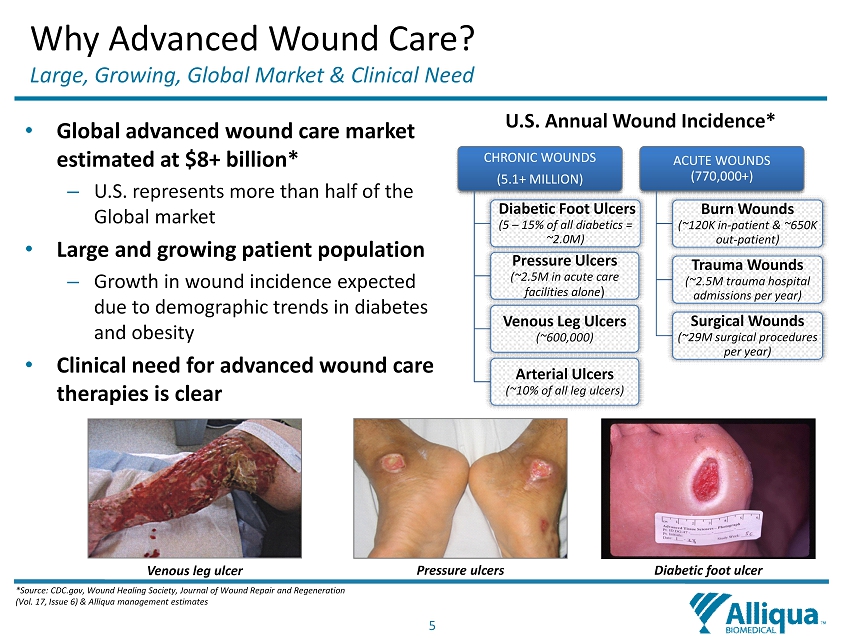

5 Why Advanced Wound Care? Large, Growing, Global Market & Clinical Need • Global a dvanced wound c are m arket estimated at $8+ billion* – U.S. represents more than half of the Global market • Large and growing patient population – Growth in wound incidence expected due to demographic trends in diabetes and obesity • Clinical need for advanced wound care therapies is clear *Source: CDC.gov, Wound Healing Society, Journal of Wound Repair and Regeneration (Vol. 17, Issue 6) & Alliqua management estimates CHRONIC WOUNDS (5.1+ MILLION) Diabetic Foot Ulcers (5 – 15% of all diabetics = ~2.0M) Pressure Ulcers (~2.5M in acute care facilities alone ) Venous Leg Ulcers (~600,000) Arterial Ulcers (~10% of all leg ulcers) ACUTE WOUNDS (770,000+) Burn Wounds (~120K in - patient & ~650K out - patient) Trauma Wounds (~2.5M trauma hospital admissions per year) Surgical Wounds (~29M surgical procedures per year) U.S. Annual Wound Incidence* Venous leg ulcer Pressure ulcers Diabetic foot ulcer

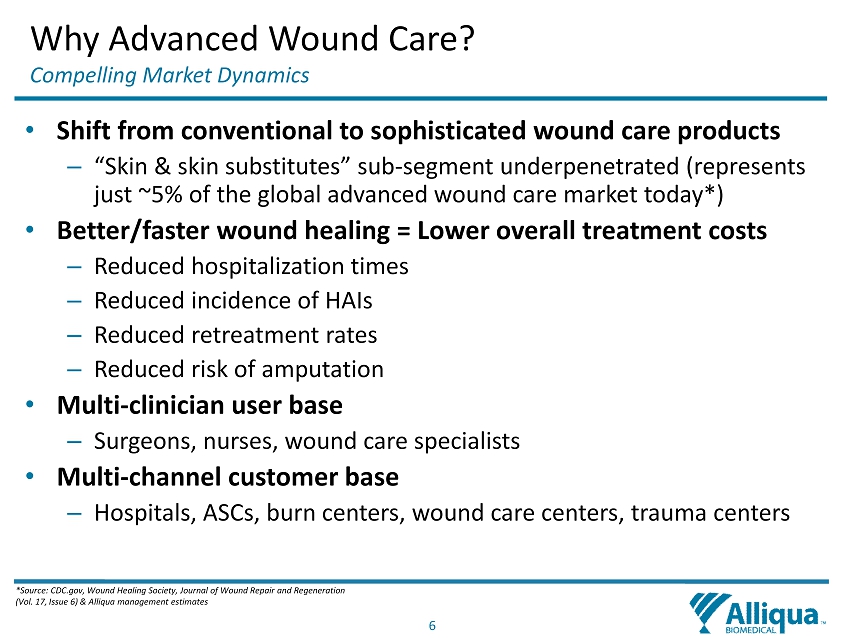

6 Why Advanced Wound Care? Compelling Market Dynamics • Shift from conventional to sophisticated wound care products – “Skin & skin substitutes” sub - segment underpenetrated (represents just ~5% of the global advanced wound care market today*) • Better/faster wound healing = Lower overall treatment costs – R educed hospitalization times – Reduced incidence of HAIs – Reduced retreatment rates – Reduced risk of amputation • Multi - clinician user base – S urgeons, nurses, wound care specialists • Multi - channel customer base – H ospitals, ASCs, burn centers, wound care centers, trauma centers *Source: CDC.gov, Wound Healing Society, Journal of Wound Repair and Regeneration (Vol. 17, Issue 6) & Alliqua management estimates

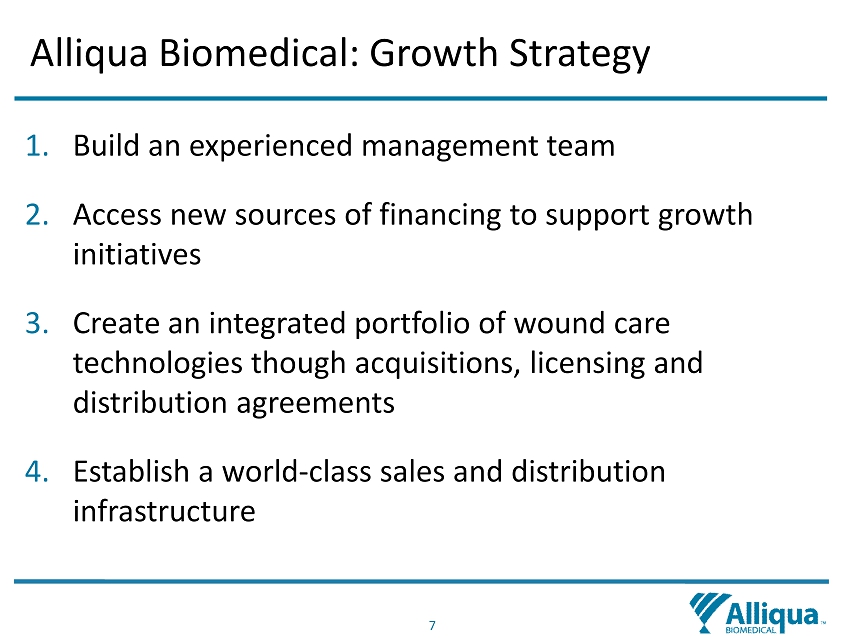

7 Alliqua Biomedical: Growth Strategy 1. Build an experienced management team 2. Access new sources of financing to support growth initiatives 3. Create an integrated portfolio of wound care technologies though acquisitions, licensing and distribution agreements 4. Establish a world - class sales and distribution infrastructure

8 Alliqua Biomedical: Growth Strategy 1. Build an Experienced M anagement T eam Name Title Previous Employers Brian Posner Chief Financial Officer Brad Barton Chief Operating Officer Lori Toner Chief Marketing Officer Janice Smeill , M.D. Chief Medical Officer Gregory Robb VP of Operations President of ConvaTec Americas Chief Financial Oficer VP of G lobal Marketing VP of Medical Affairs Exec. Director of Global Clinical R&D Senior Director of Global Clinical R&D VP of Operations 100+ YEARS OF COMBINED WOUND CARE EXPERIENCE

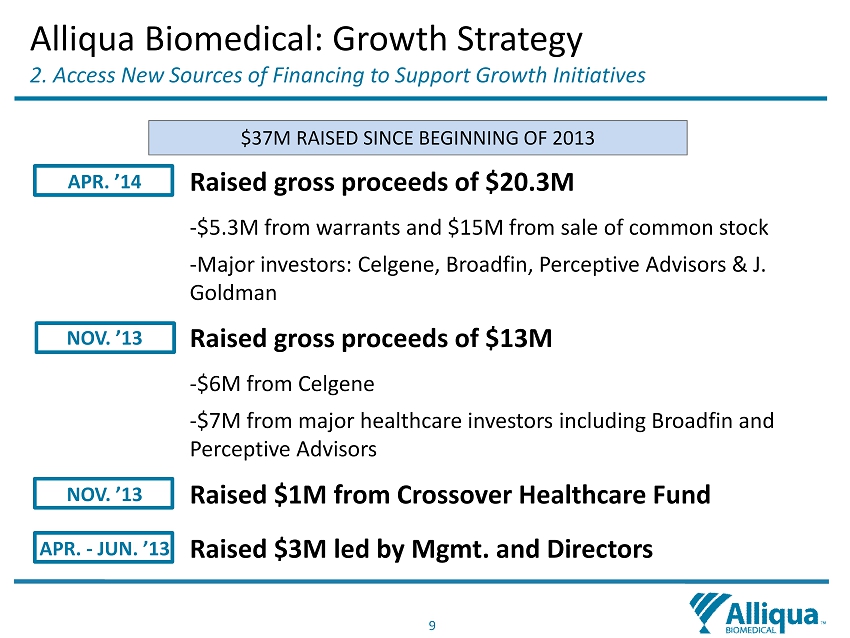

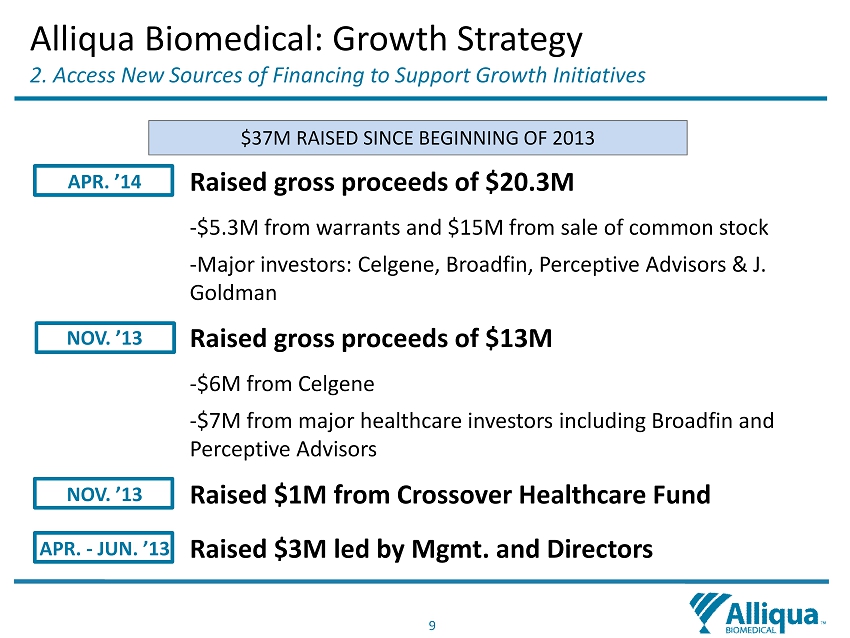

9 APR. ’14 Raised gross proceeds of $20.3M - $5.3M from warrants and $15M from sale of common stock - Major investors: Celgene, Broadfin , Perceptive Advisors & J. Goldman NOV. ’13 Raised gross proceeds of $13M - $6M from Celgene - $7M from major healthcare investors including Broadfin and Perceptive Advisors NOV. ’13 Raised $1M from Crossover Healthcare Fund APR. - JUN. ’13 Raised $3M led by Mgmt. and Directors Alliqua Biomedical: Growth Strategy 2 . Access New S ources of Financing to Support G rowth I nitiatives $37M RAISED SINCE BEGINNING OF 2013

10 Alliqua Biomedical: Growth Strategy 2. Access New Sources of Financing to Support Growth Initiatives (cont’d) *Includes contingent consideration liability of $2.7M related to Choice Therapeutics acquisition June 30, December 31, 2014 2013 Cash & C ash E quivalents $23,785,430 $12,100,544 Current Assets $25,289,176 $12,847,234 Total Assets: $36,007,933 $17,451,568 Current Liabilities $3,773,454 $3,353,464 Total Debt $0 $0 Total Liabilities: *$6,621,693 $3,498,876 Total Stockholder’s Equity $29,386,240 $13,952,696 BALANCE SHEET CONDITION AT END - Q2 PROVIDES REQUISITE FINANCIAL FLEXIBILITY TO EXECUTE GROWTH PLAN

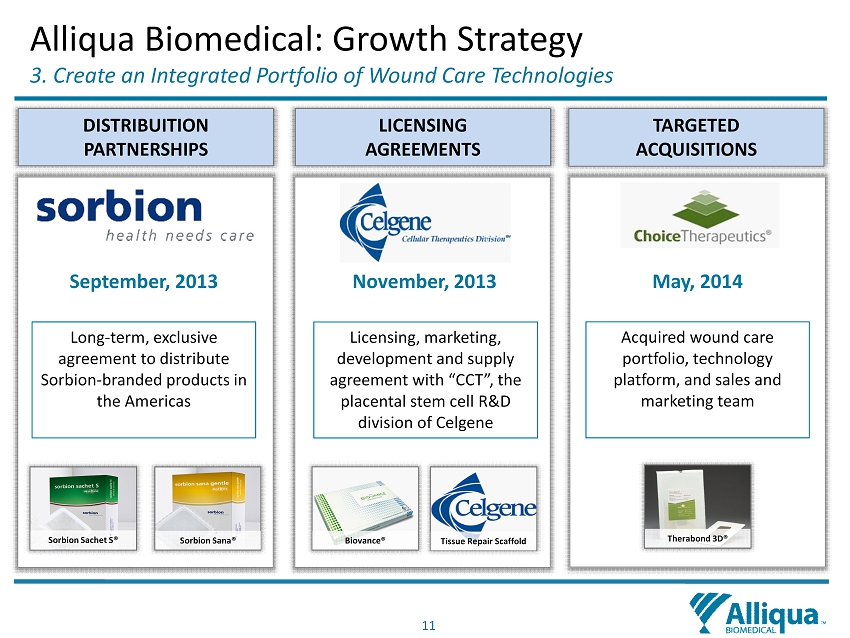

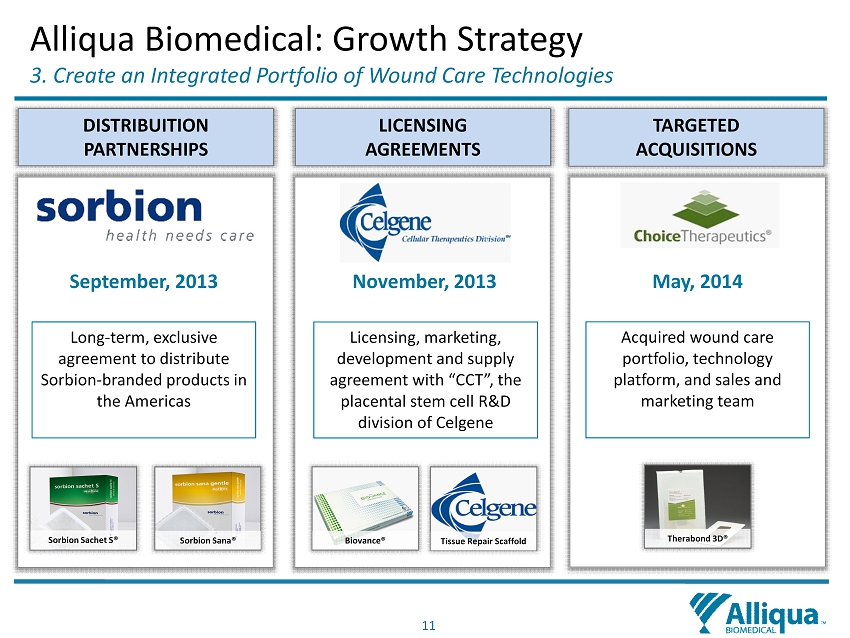

11 Alliqua Biomedical: Growth Strategy 3. Create an Integrated P ortfolio of Wound C are T echnologies DISTRIBUITION PARTNERSHIPS LICENSING AGREEMENTS TARGETED ACQUISITIONS November, 2013 May, 2014 September, 2013 Licensing, marketing, development and supply agreement with “CCT”, the placental stem cell R&D division of Celgene Acquired wound care portfolio, technology platform, and sales and marketing team Long - term, exclusive agreement to distribute S orbion - branded products in the Americas Tissue Repair Scaffold Biovance ® Sorbion Sana® Sorbion Sachet S® Therabond 3D®

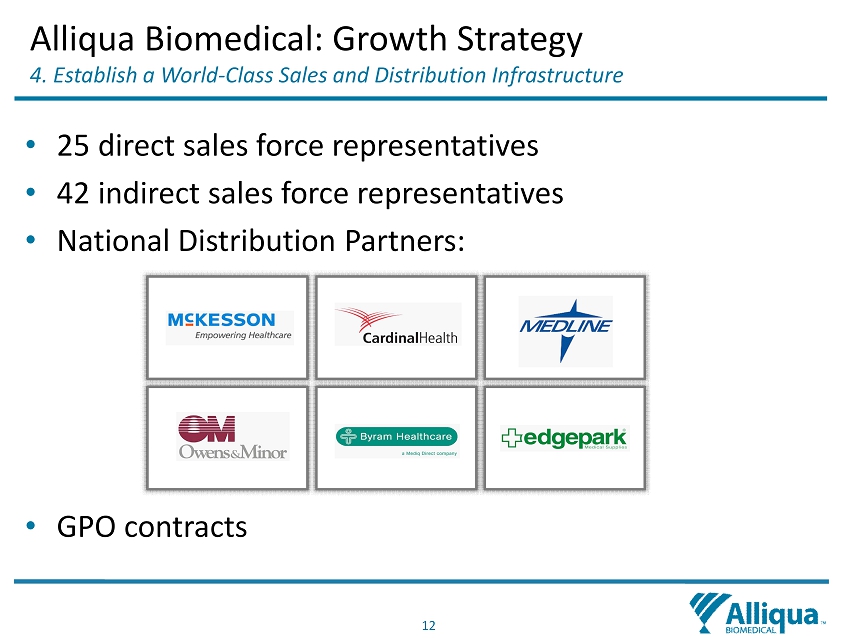

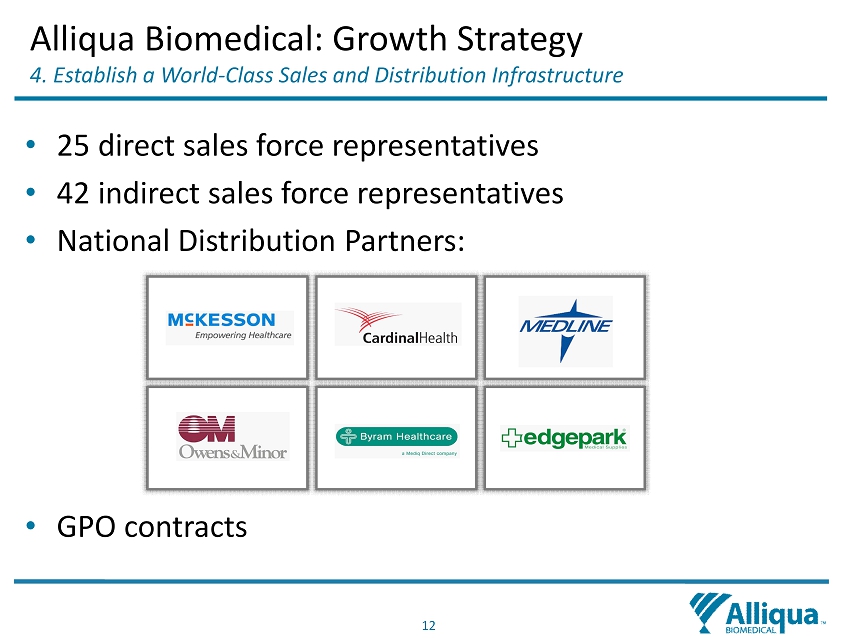

12 Alliqua Biomedical: Growth Strategy 4 . Establish a World - Class S ales and Distribution I nfrastructure • 25 direct sales force representatives • 42 indirect sales force representatives • National Distribution Partners: • GPO contracts

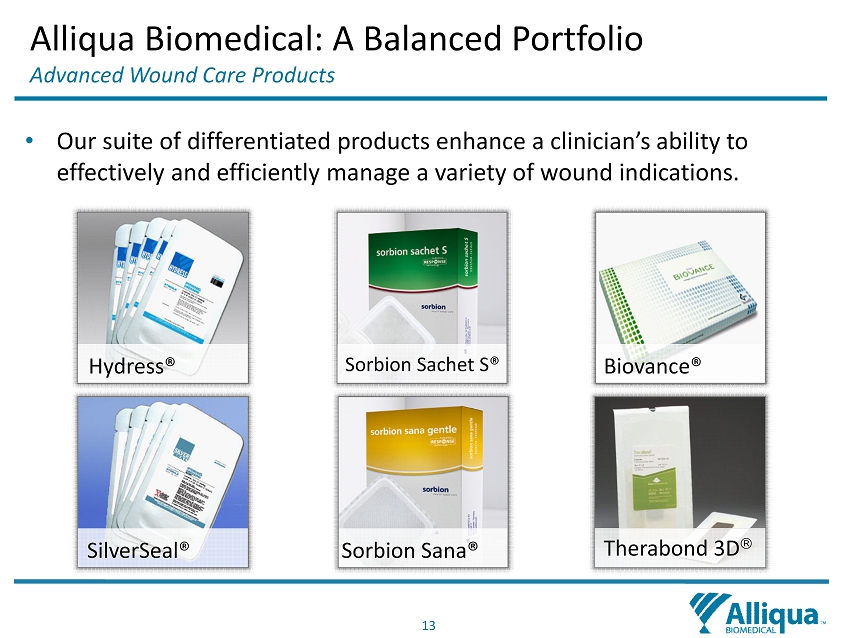

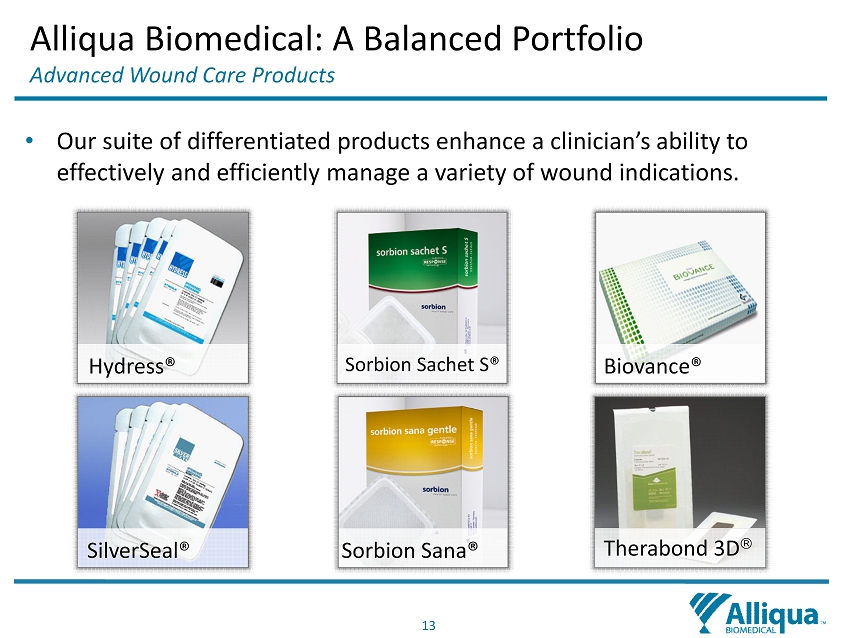

13 Therabond 3D® Hydress® SilverSeal® Sorbion Sana® Sorbion Sachet S® Biovance® • Our suite of differentiated products enhance a clinician’s ability to effectively and efficiently manage a variety of wound indications. Alliqua Biomedical: A Balanced Portfolio Advanced Wound Care Products

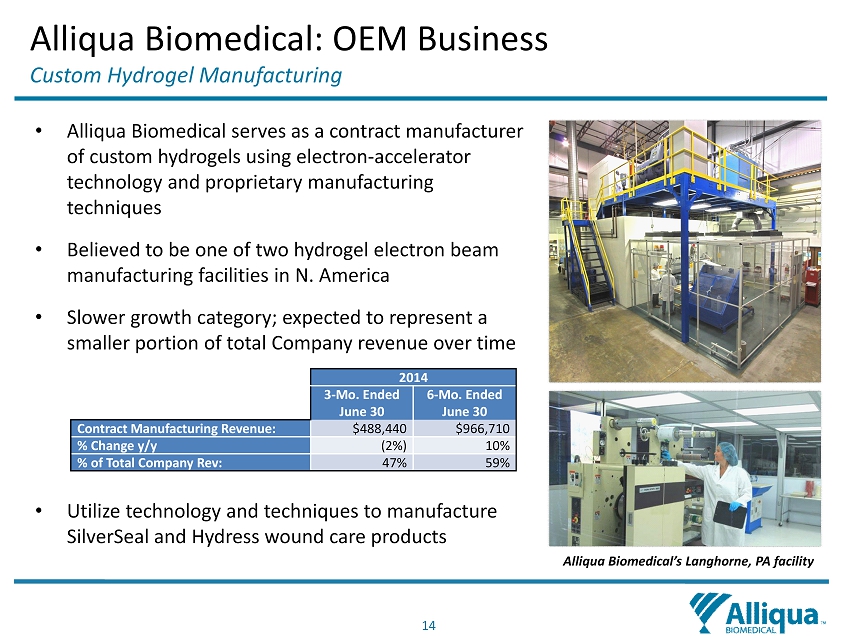

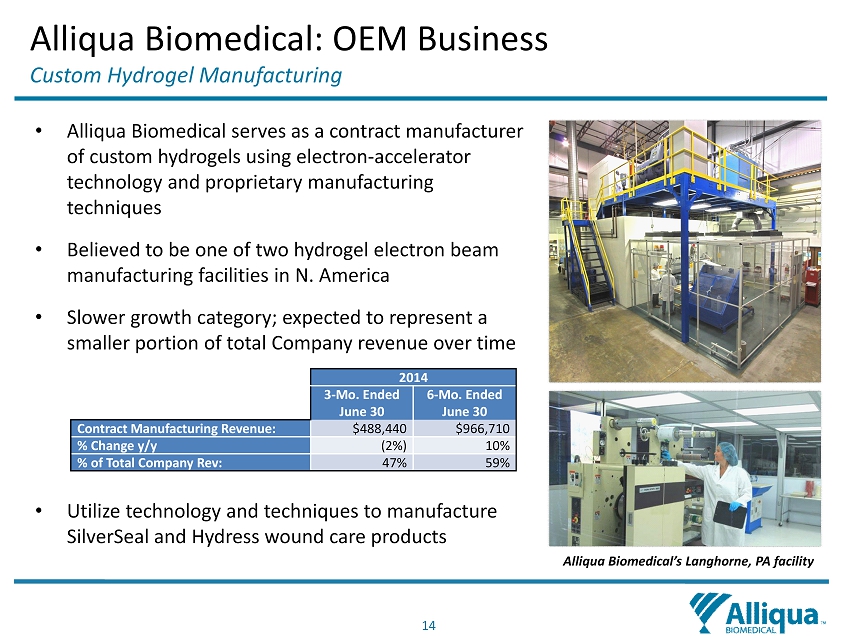

14 • Alliqua Biomedical serves as a contract manufacturer of custom hydrogels using electron - accelerator technology and proprietary manufacturing techniques • Believed to be one of two hydrogel electron beam manufacturing facilities in N. America • Slower growth category; expected to represent a smaller portion of total Company revenue over time • Utilize technology and techniques to manufacture SilverSeal and Hydress wound care products Alliqua Biomedical’s Langhorne, PA facility 2014 3 - Mo. Ended June 30 6 - Mo. Ended June 30 Contract Manufacturing Revenue : $488,440 $966,710 % Change y/y (2%) 10% % of Total Company Rev: 47% 59% Alliqua Biomedical: OEM Business Custom Hydrogel Manufacturing

15 Alliqua Biomedical: Regulatory & Reimbursement Product FDA Clearance Medicare Reimbursement Hydress ® n/a HCPCS A - Code ‘Hydrogel Dressing’ SilverSeal ® 510(k) HCPCS A - Code ‘Hydrogel Dressing’ Sorbion Products® 510(k) HCPCS A - Code ‘Alginate Dressing’ Therabond 3D® 510(k) HCPCS A - Code ‘Contact Layer’ Biovance ® PHS 361 product* Applied for HCPCS Q - Code (‘skin - substitute’) in Dec. ‘13; received HCPCS A - Code status (‘collagen dressing’) in preliminary ruling in May ’ 14; final ruling expected in Nov. ‘14 for effective date of Jan. 1, 2015 Tissue Repair Scaffold 510(k) submission scheduled for 2H’14 Pending regulatory clearance * commercially available under Section 361 of the Public Health Service Act, which allows “minimally manipulated” human cells, tis sues, and cellular and tissue - based products (HCT/Ps) to be marketed in the United States (U.S.) without pre - market FDA approval (also called a ‘36 1 product )

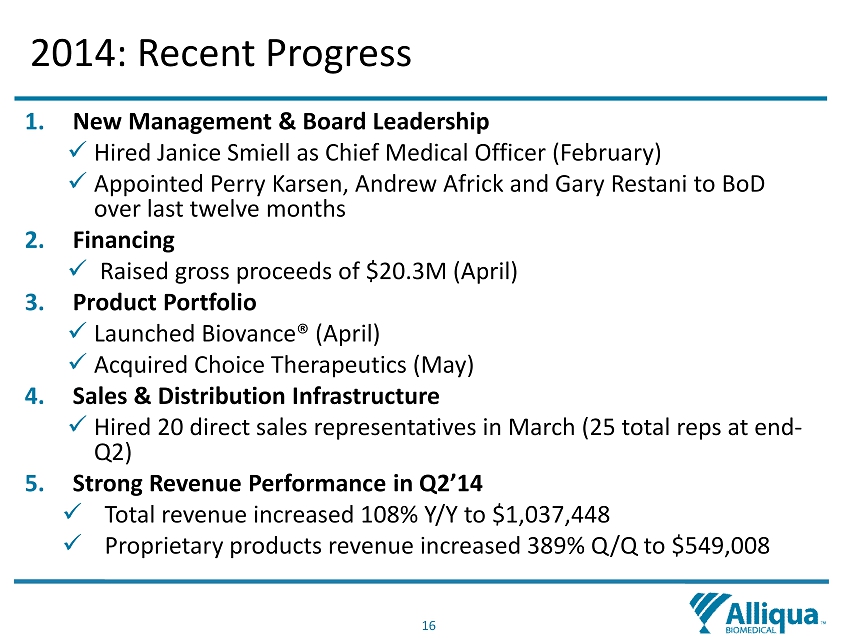

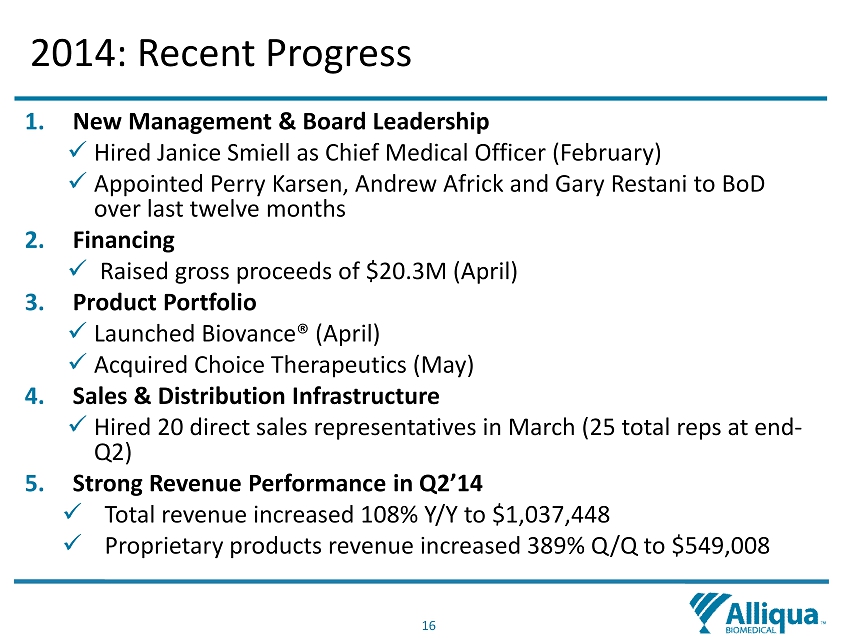

16 2014: Recent Progress 1. New Management & Board Leadership x Hired Janice Smiell as Chief Medical Officer (February) x Appointed Perry Karsen , Andrew Africk and Gary Restani to BoD over last twelve months 2. Financing x Raised gross proceeds of $20.3M (April ) 3. Product Portfolio x Launched Biovance® ( April) x Acquired Choice Therapeutics ( May) 4. Sales & Distribution Infrastructure x Hired 20 direct sales representatives in March (25 total reps at end - Q2) 5. Strong Revenue Performance in Q2’14 x Total revenue increased 108% Y/Y to $1,037,448 x Proprietary products revenue increased 389% Q/Q to $549,008

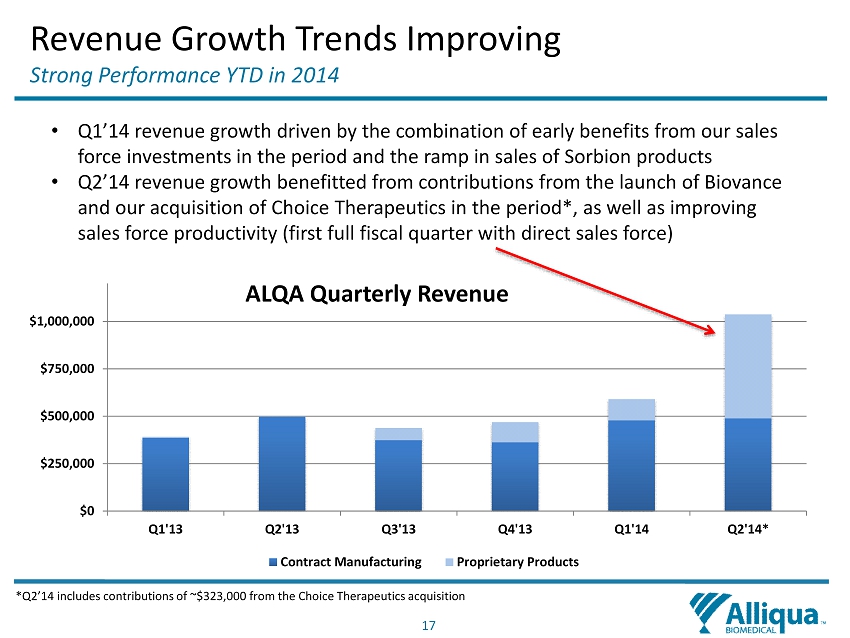

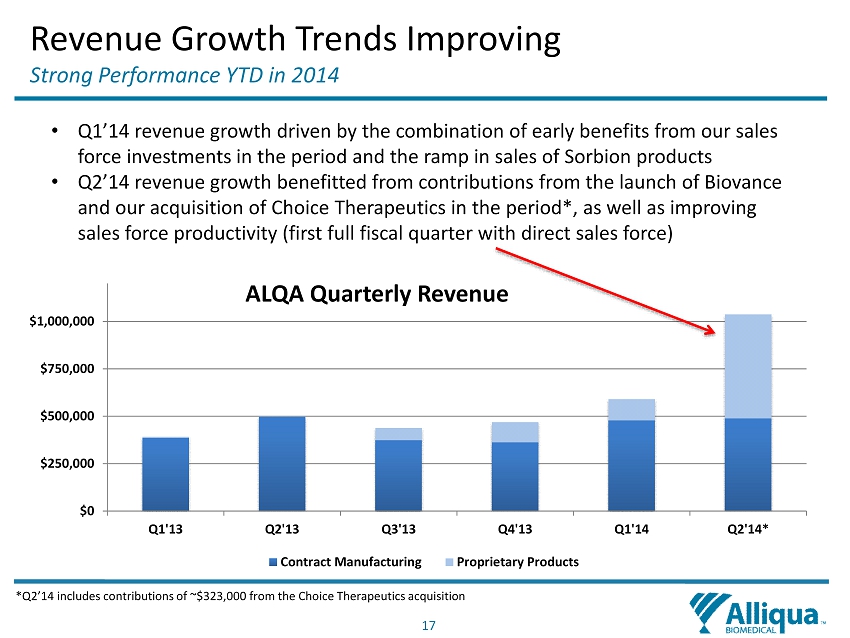

17 Revenue Growth Trends Improving Strong Performance YTD in 2014 *Q2’14 includes contributions of ~$323,000 from the Choice Therapeutics acquisition $0 $250,000 $500,000 $750,000 $1,000,000 Q1'13 Q2'13 Q3'13 Q4'13 Q1'14 Q2'14* ALQA Quarterly Revenue Contract Manufacturing Proprietary Products • Q1’14 revenue growth driven by the combination of early benefits from our sales force investments in the period and the ramp in sales of S orbion products • Q2’14 revenue growth benefitted from contributions from the launch of Biovance and our acquisition of Choice Therapeutics in the period *, as well as improving sales force productivity (first full fiscal quarter with direct sales force)

18 2014: Initiatives & Upcoming Milestones □ Continue to drive revenue growth through improving sales force productivity, contributions from new products and future GPO contracts □ Continue to expand product portfolio through acquisitions and/or licensing agreements □ Submit Tissue Repair Scaffold product for 510(k) clearance (2H’14 ) □ Final CMS reimbursement code decision expected for Biovance ® (November)

Nasdaq: ALQA Alliqua Biomedical, Inc. info@alliqua.com 2150 Cabot Blvd West Langhorne, PA 19047 (215) 702 - 8550

Appendix ADVANCED WOUND CARE MARKET ESTIMATES, ALLIQUA BIOMEDICAL PRODUCT DETAILS & CLINICAL SUPPORT

21 Product Category Est. Market Size ($B)* Est. CAGR* Alliqua Biomedical Products Negative Pressure wound therapy $2.00 LSD Antimicrobial Dressings $1.25 HSD SilverSeal TheraBond 3D Non - Adherent Dressings $1.00 LSD - Foam Dressings $0.90 HSD Sorbion sachet S and sana Hydrocolloids $0.80 LSD Hydress Bioengineered Skin & Skin Substitutes $0.60 Mid - Teens Biovance TRS Product Film Dressings $0.40 MSD - Growth Factors $0.40 Mid - teens - Alginate Dressings $0.40 Mid - Teens Sorbion sachet S and sana Hydrogels $0.25 HSD Hydress & SliverSeal Advanced Wound Care Market *Source: Management estimates

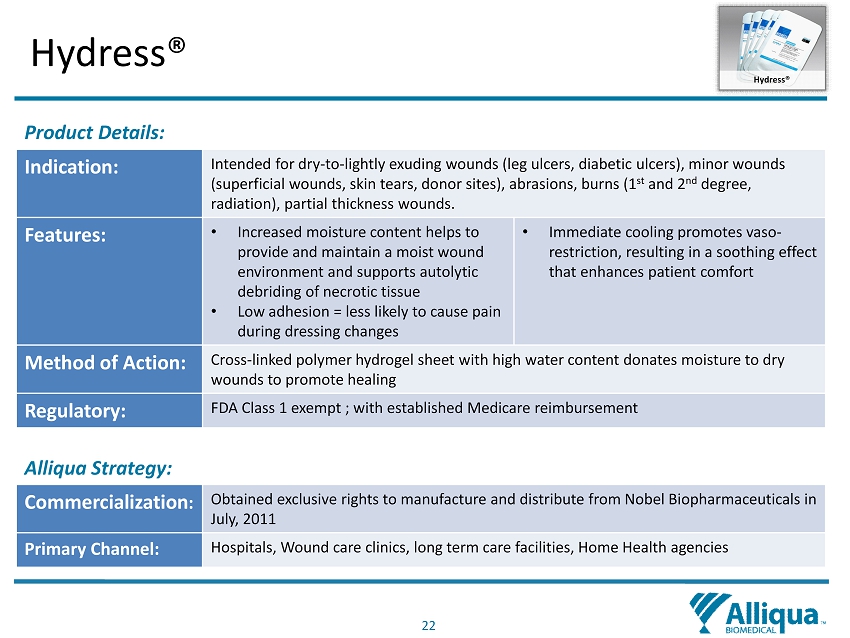

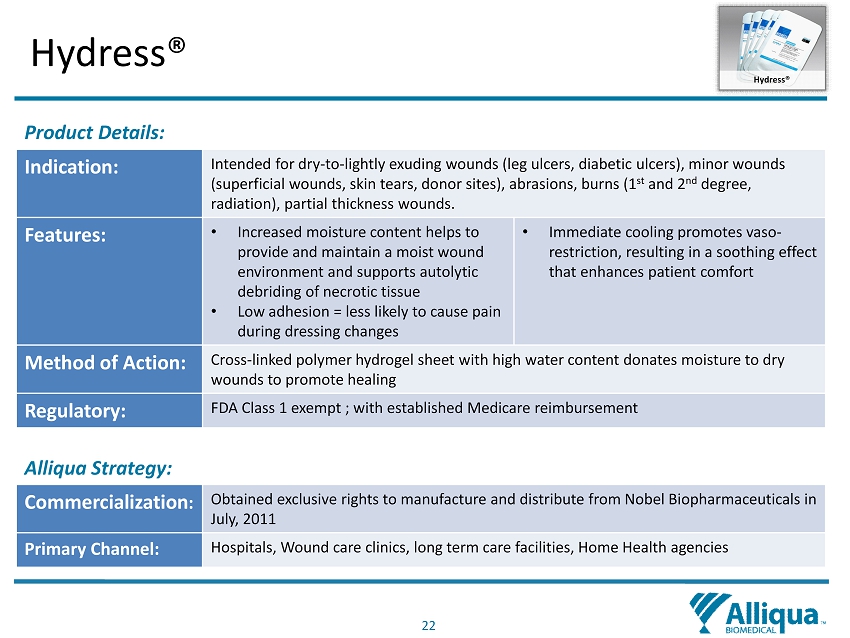

22 Hydress ® Product Details: Indication: Intended for dry - to - lightly exuding wounds (leg ulcers, diabetic ulcers), minor wounds (superficial wounds, skin tears, donor sites), abrasions, burns (1 st and 2 nd degree, radiation), partial thickness wounds. Features: • Increased moisture content helps to provide and maintain a moist wound environment and supports autolytic debriding of necrotic tissue • Low adhesion = less likely to cause pain during dressing changes • Immediate cooling promotes vaso - restriction, resulting in a soothing effect that enhances patient comfort Method of Action: Cross - linked polymer hydrogel sheet with high water content donates moisture to dry wounds to promote healing Regulatory: FDA Class 1 exempt ; with established Medicare reimbursement Alliqua Strategy: Commercialization : Obtained exclusive rights to manufacture and distribute from Nobel Biopharmaceuticals in July, 20 11 Primary Channel: Hospitals, Wound care clinics, long term care facilities, Home Health agencies Hydress®

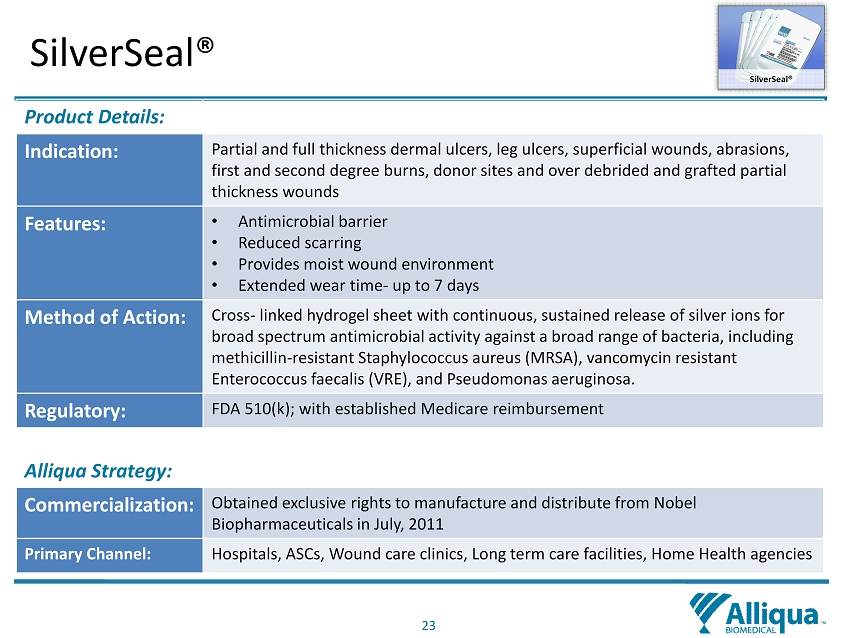

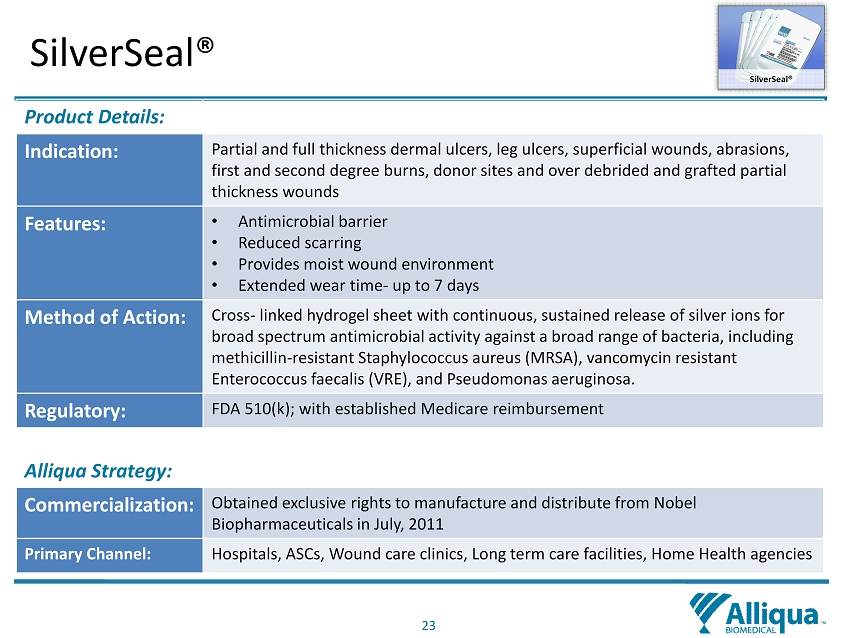

23 SilverSeal ® Product Details: Indication: Partial and full thickness dermal ulcers, leg ulcers, superficial wounds, abrasions, first and second degree burns, donor sites and over debrided and grafted partial thickness wounds Features: • Antimicrobial barrier • Reduced scarring • Provides moist wound environment • Extended wear time - up to 7 days Method of Action: Cross - linked hydrogel sheet with c ontinuous, sustained release of silver ions for broad spectrum antimicrobial activity against a broad range of bacteria, including methicillin - resistant Staphylococcus aureus (MRSA), vancomycin resistant Enterococcus faecalis (VRE), and Pseudomonas aeruginosa. Regulatory: FDA 510(k); with established Medicare reimbursement Alliqua Strategy: Commercialization: Obtained exclusive rights to manufacture and distribute from Nobel Biopharmaceuticals in July, 2011 Primary Channel: Hospitals, ASCs, Wound care clinics, Long term care facilities, Home Health agencies SilverSeal®

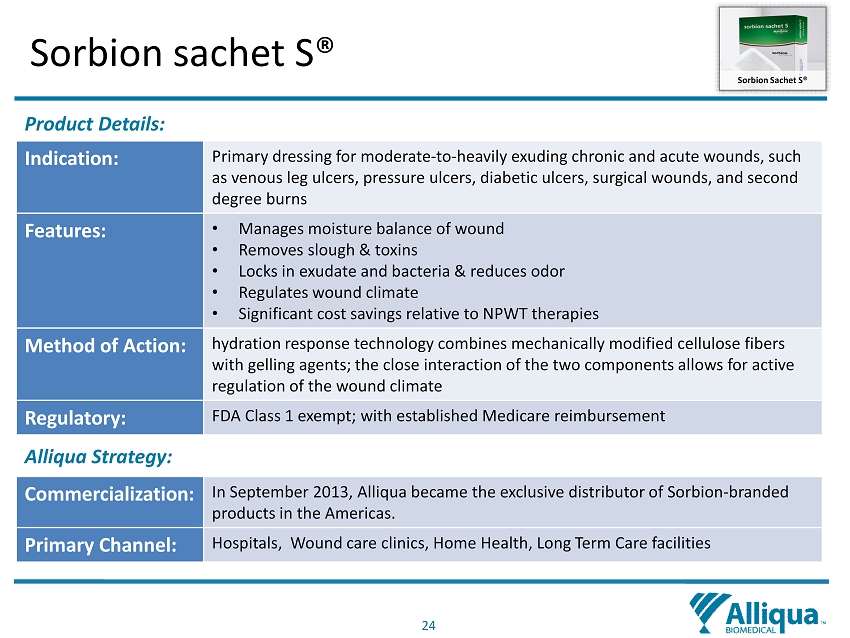

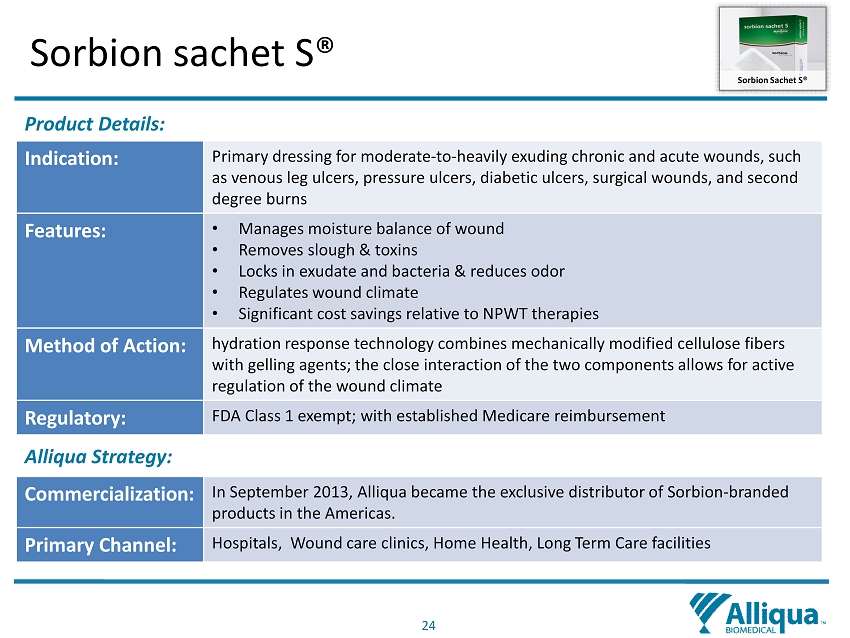

24 S orbion sachet S® Product Details: Indication: Primary dressing for moderate - to - heavily exuding chronic and acute wounds, such as venous leg ulcers, pressure ulcers, diabetic ulcers, surgical wounds, and second degree burns Features: • Manages moisture balance of wound • Removes slough & toxins • Locks in exudate and bacteria & reduces odor • R egulates wound climate • Significant cost savings relative to NPWT therapies Method of Action: hydration response technology combines mechanically modified cellulose fibers with gelling agents; the close interaction of the two components allows for active regulation of the wound climate Regulatory: FDA Class 1 exempt; with established Medicare reimbursement Alliqua Strategy: Commercialization: In September 2013, Alliqua became the exclusive distributor of Sorbion - branded products in the Americas. Primary Channel: Hospitals, Wound care clinics, Home Health, Long Term Care facilities Sorbion Sachet S®

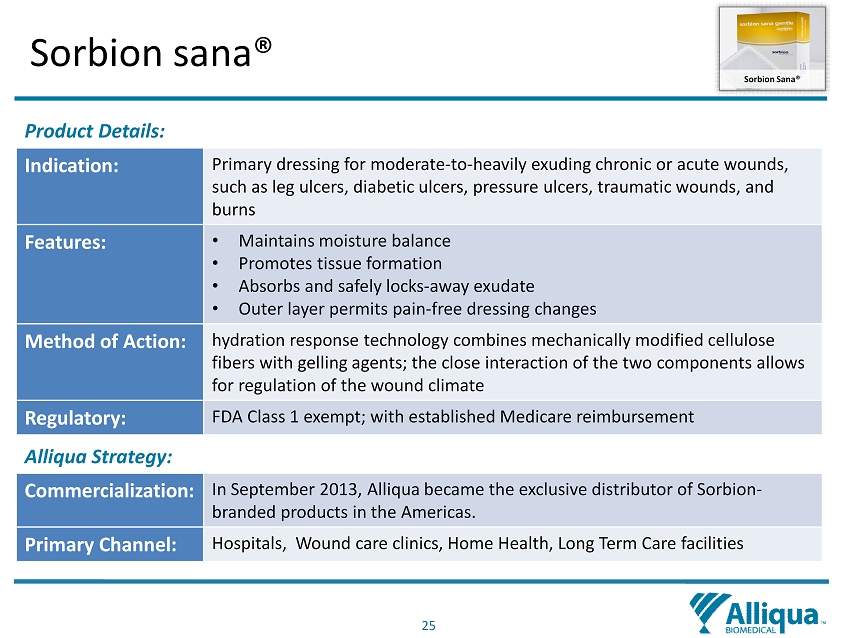

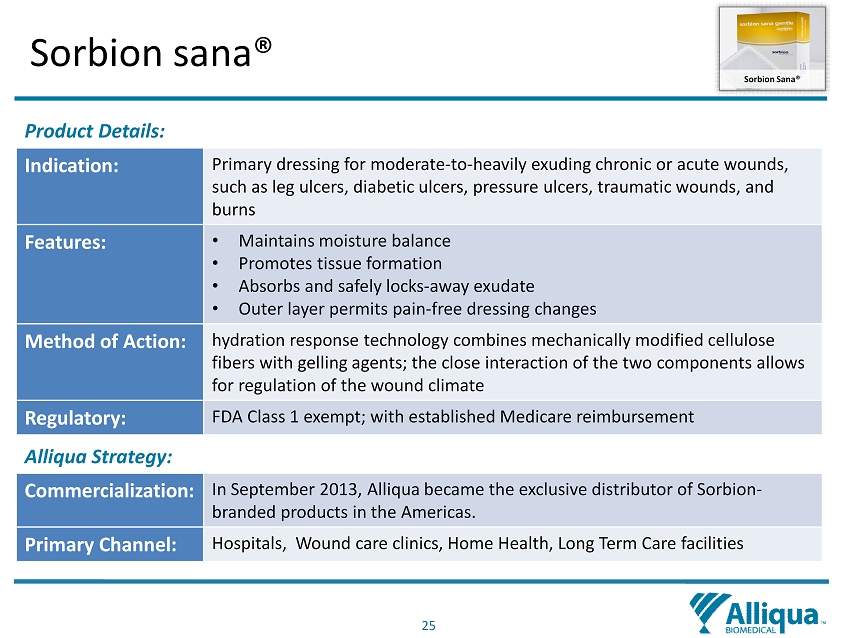

25 S orbion sana ® Product Details: Indication: Primary dressing for moderate - to - heavily exuding chronic or acute wounds, such as leg ulcers, diabetic ulcers, pressure ulcers, traumatic wounds, and burns Features: • Maintains moisture balance • Promotes tissue formation • Absorbs and safely locks - away exudate • Outer layer permits pain - free dressing changes Method of Action: hydration response technology combines mechanically modified cellulose fibers with gelling agents; the close interaction of the two components allows for regulation of the wound climate Regulatory: FDA Class 1 exempt; with established Medicare reimbursement Alliqua Strategy: Commercialization: In September 2013, Alliqua became the exclusive distributor of Sorbion - branded products in the Americas. Primary Channel: Hospitals, Wound care clinics, Home Health, Long Term Care facilities Sorbion Sana®

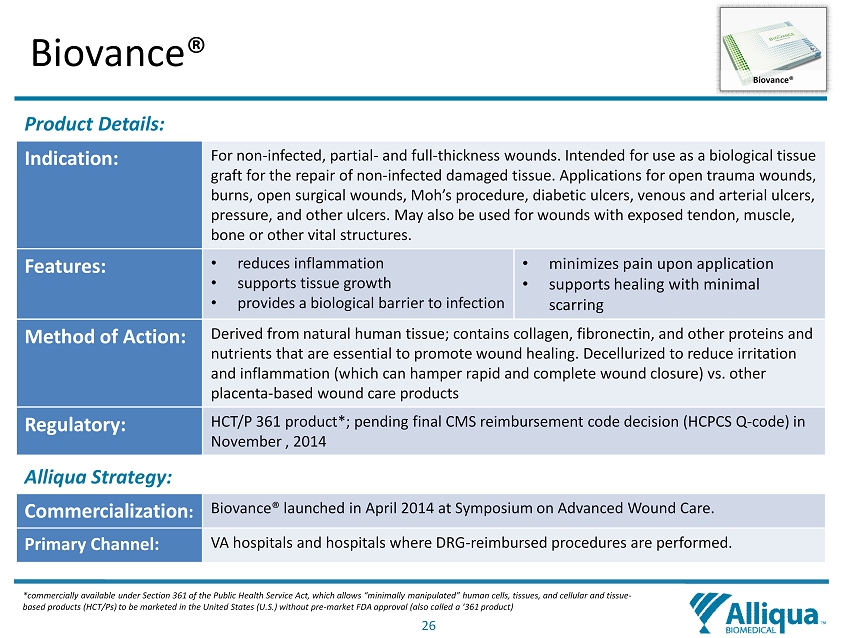

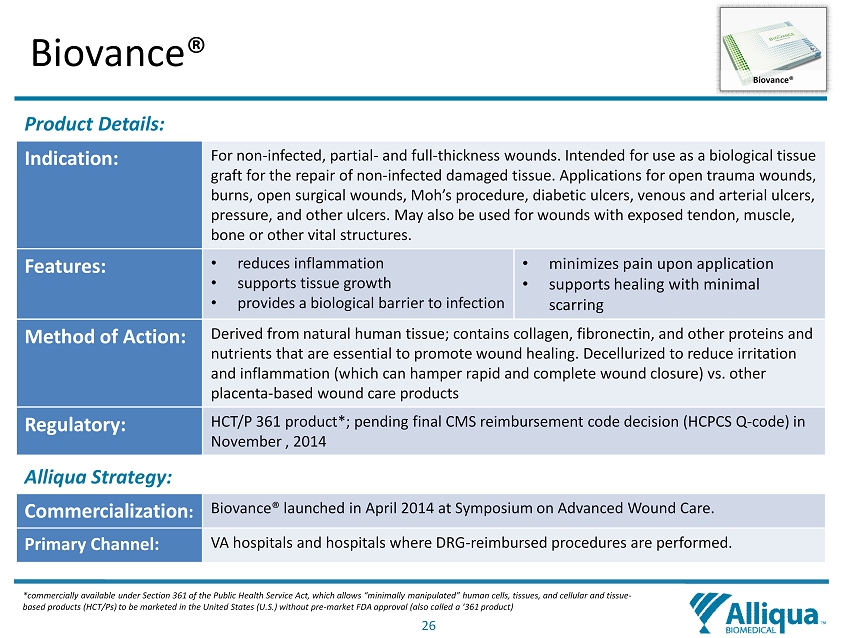

26 Biovance® Product Details: Indication: For non - infected, partial - and full - thickness wounds. Intended for use as a biological tissue graft for the repair of non - infected damaged tissue. Applications for open trauma wounds, burns, open surgical wounds, Moh’s procedure, diabetic ulcers, venous and arterial ulcers, pressure, and other ulcers. May also be used for wounds with exposed tendon, muscle, bone or other vital structures. Features: • reduces inflammation • supports tissue growth • provides a biological barrier to infection • minimizes pain upon application • supports healing with minimal scarring Method of Action: Derived from natural human tissue; contains collagen, fibronectin , and other proteins and nutrients that are essential to promote wound healing. Decellurized to reduce irritation and inflammation (which can hamper rapid and complete wound closure) vs. other placenta - based wound care products Regulatory: HCT/P 361 product*; pending final CMS reimbursement code decision (HCPCS Q - code) in November , 20 14 Alliqua Strategy: Commercialization : Biovance ® launched in April 2014 at Symposium on Advanced Wound Care. Primary Channel: VA hospitals and hospitals where DRG - reimbursed procedures are performed. Biovance ® * commercially available under Section 361 of the Public Health Service Act, which allows “minimally manipulated” human cells, tis sues, and cellular and tissue - based products (HCT/Ps) to be marketed in the United States (U.S.) without pre - market FDA approval (also called a ‘361 product )

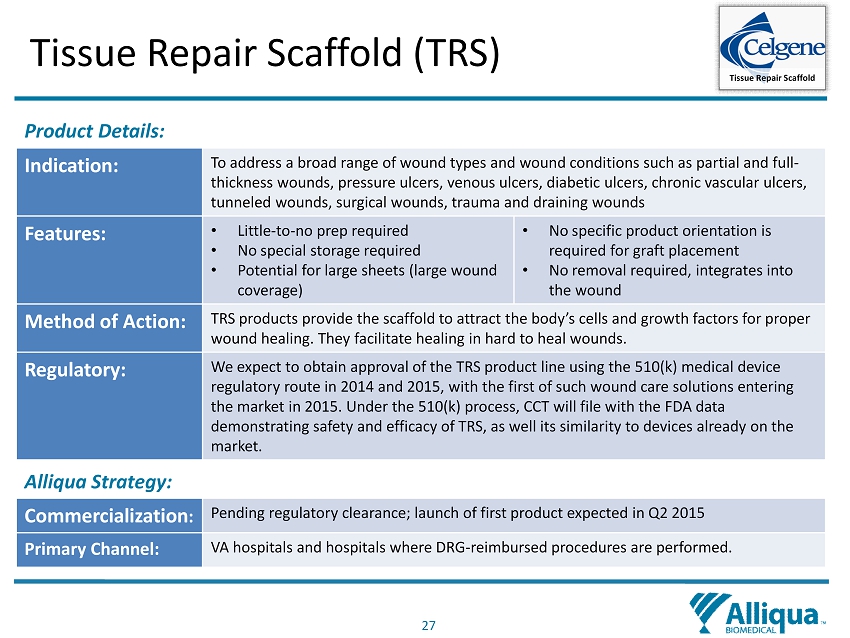

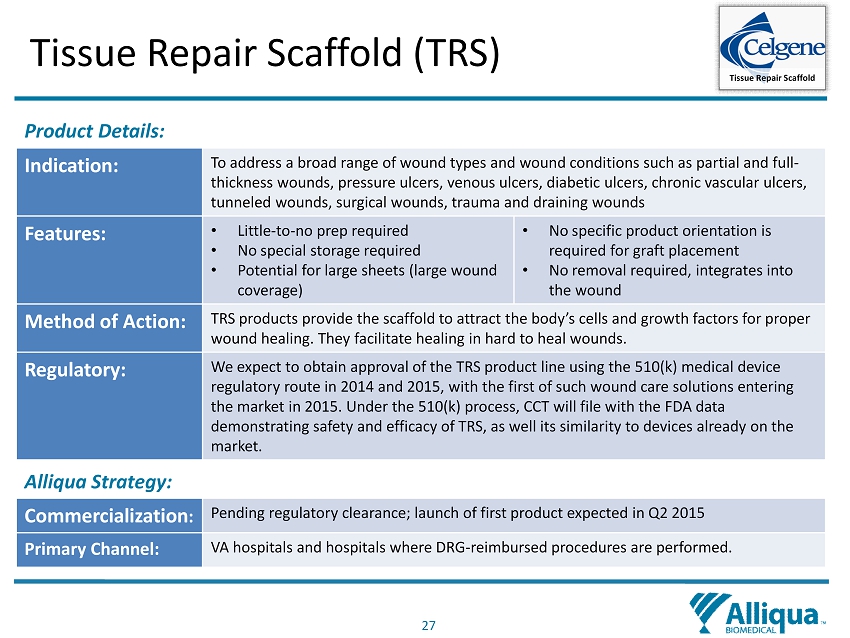

27 Tissue Repair Scaffold (TRS) Product Details: Indication: To address a broad range of wound types and wound conditions such as partial and full - thickness wounds, pressure ulcers, venous ulcers, diabetic ulcers, chronic vascular ulcers, tunneled wounds, surgical wounds, trauma and draining wounds Features: • Little - to - no prep required • No special storage required • Potential for large sheets (large wound coverage) • No specific product orientation is required for graft placement • No removal required, integrates into the wound Method of Action: TRS products provide the scaffold to attract the body’s cells and growth factors for proper wound healing. They facilitate healing in hard to heal wounds. Regulatory: We expect to obtain approval of the TRS product line using the 510(k) medical device regulatory route in 2014 and 2015, with the first of such wound care solutions entering the market in 2015. Under the 510(k) process, CCT will file with the FDA data demonstrating safety and efficacy of TRS, as well its similarity to devices already on the market. Alliqua Strategy: Commercialization : Pending regulatory clearance; launch of first product expected in Q2 2015 Primary Channel: VA hospitals and hospitals where DRG - reimbursed procedures are performed. Tissue Repair Scaffold

28 Therabond 3D ® Product Details: Indication: Partial - and full - thickness wounds; 1 st & 2 nd degree burns, Diabetic Foot Ulcers , Venous Leg Ulcers, Surgical wounds. Available in Contact Dressings, Wraps and Island Dressings Features: • One - piece construction • Unique struts between contact and outer layers • Silver Ions provide sustained antimicrobial activity • Reduces risk of maceration by moving drainage to absorbent cover dressing Method of Action: 3D technology for efficient transfer of fluid and exudate away from wound. Provides an effective barrier to pathogens for 14 days. Regulatory: FDA 510(k); with established Medicare reimbursement Alliqua Strategy: Commercialization : April 2014, acquired Choice Therapeutics’ wound care portfolio, technology platform and sales and distribution team. Primary Channel: Hospitals, ASCs, Wound care clinics, burn centers Therabond 3D®

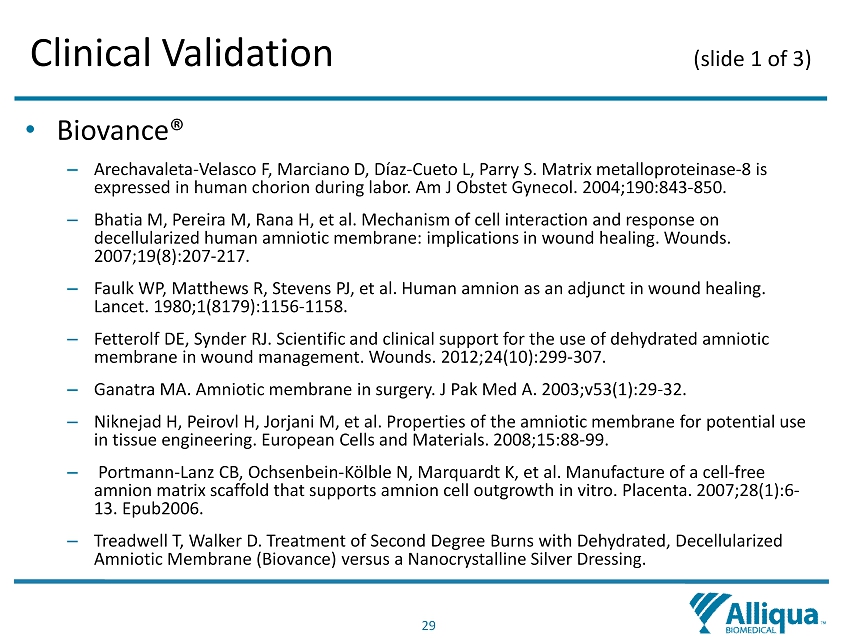

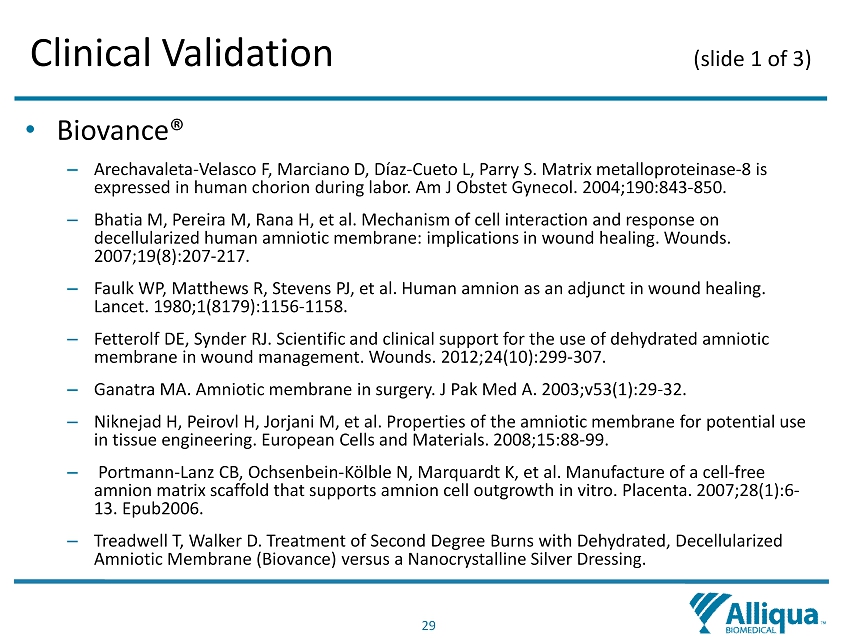

29 Clinical Validation (slide 1 of 3) • Biovance ® – Arechavaleta - Velasco F, Marciano D, Díaz - Cueto L, Parry S. Matrix metalloproteinase - 8 is expressed in human chorion during labor. Am J Obstet Gynecol. 2004;190:843 - 850 . – Bhatia M, Pereira M, Rana H, et al. Mechanism of cell interaction and response on decellularized human amniotic membrane: implications in wound healing. Wounds. 2007;19(8):207 - 217. – Faulk WP, Matthews R, Stevens PJ, et al. Human amnion as an adjunct in wound healing. Lancet. 1980;1(8179):1156 - 1158. – Fetterolf DE, Synder RJ. Scientific and clinical support for the use of dehydrated amniotic membrane in wound management. Wounds. 2012;24(10):299 - 307. – Ganatra MA. Amniotic membrane in surgery. J Pak Med A. 2003;v53(1):29 - 32. – Niknejad H, Peirovl H, Jorjani M, et al. Properties of the amniotic membrane for potential use in tissue engineering. European Cells and Materials. 2008;15:88 - 99 . – Portmann - Lanz CB, Ochsenbein - Kölble N, Marquardt K, et al. Manufacture of a cell - free amnion matrix scaffold that supports amnion cell outgrowth in vitro. Placenta. 2007;28(1):6 - 13. Epub2006. – Treadwell T, Walker D. Treatment of Second Degree Burns with Dehydrated, Decellularized Amniotic Membrane (Biovance) versus a Nanocrystalline Silver Dressing .

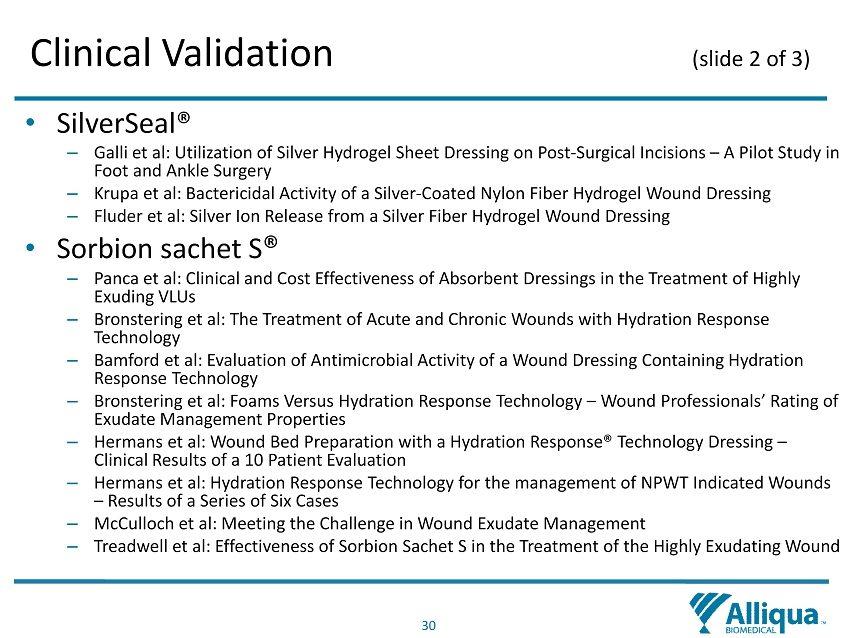

30 Clinical Validation ( slide 2 of 3) • SilverSeal® – Galli et al: Utilization of Silver Hydrogel Sheet Dressing on Post - Surgical Incisions – A Pilot Study in Foot and Ankle Surgery – Krupa et al: Bactericidal Activity of a Silver - Coated Nylon Fiber Hydrogel Wound Dressing – Fluder et al: Silver Ion Release from a Silver Fiber Hydrogel Wound Dressing • S orbion sachet S ® – Panca et al: Clinical and Cost Effectiveness of Absorbent Dressings in the Treatment of Highly Exuding VLUs – Bronstering et al: The Treatment of Acute and Chronic Wounds with Hydration Response Technology – Bamford et al: Evaluation of Antimicrobial Activity of a Wound Dressing Containing Hydration Response Technology – Bronstering et al: Foams Versus Hydration Response Technology – Wound Professionals’ Rating of Exudate Management Properties – Hermans et al: Wound Bed Preparation with a Hydration Response® Technology Dressing – Clinical Results of a 10 Patient Evaluation – Hermans et al: Hydration Response Technology for the management of NPWT Indicated Wounds – Results of a Series of Six Cases – McCulloch et al: Meeting the Challenge in Wound Exudate Management – Treadwell et al: Effectiveness of Sorbion Sachet S in the Treatment of the Highly Exudating Wound

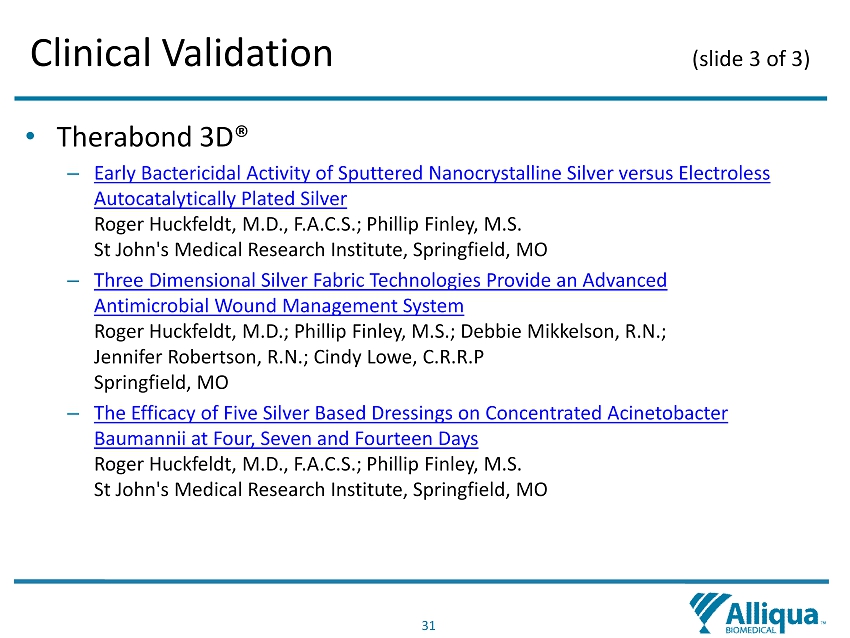

31 Clinical Validation ( slide 3 of 3) • Therabond 3D® – Early Bactericidal Activity of Sputtered Nanocrystalline Silver versus Electroless Autocatalytically Plated Silver Roger Huckfeldt , M.D., F.A.C.S.; Phillip Finley, M.S. St John's Medical Research Institute, Springfield, MO – Three Dimensional Silver Fabric Technologies Provide an Advanced Antimicrobial Wound Management System Roger Huckfeldt , M.D.; Phillip Finley, M.S.; Debbie Mikkelson , R.N.; Jennifer Robertson, R.N.; Cindy Lowe, C.R.R.P Springfield, MO – The Efficacy of Five Silver Based Dressings on Concentrated Acinetobacter Baumannii at Four, Seven and Fourteen Days Roger Huckfeldt , M.D., F.A.C.S.; Phillip Finley, M.S. St John's Medical Research Institute, Springfield, MO