The information in this preliminary prospectus is not complete and may be changed. We may not offer or sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities, nor a solicitation of an offer to buy these securities, in any jurisdiction where the offering, solicitation or sale is not permitted.

SUBJECT TO COMPLETION, DATED June 26, 2020

PRELIMINARY PROSPECTUS

Broadcom Inc.

Exchange Offer for

$525,342,000 3.125% Senior Notes due 2021

$692,841,000 3.125% Senior Notes due 2022

$1,044,409,000 3.625% Senior Notes due 2024

$2,500,000,000 4.250% Senior Notes due 2026

$3,000,000,000 4.750% Senior Notes due 2029

$2,250,000,000 4.700% Senior Notes due 2025

$2,250,000,000 5.000% Senior Notes due 2030

$1,000,000,000 2.250% Senior Notes due 2023

$2,250,000,000 3.150% Senior Notes due 2025

$2,750,000,000 4.150% Senior Notes due 2030

$2,000,000,000 4.300% Senior Notes due 2032

$1,695,320,000 3.459% Senior Notes due 2026

$2,222,349,000 4.110% Senior Notes due 2028

Broadcom Inc., a Delaware corporation (the “Issuer,” “Broadcom,” “we” or “us”), is offering to issue up to $525,342,000 aggregate principal amount of 3.125% senior notes due 2021 (the “April 2021 Notes”), $692,841,000 aggregate principal amount of 3.125% senior notes due 2022 (the “October 2022 Notes”), $1,044,409,000 aggregate principal amount of 3.625% senior notes due 2024 (the “October 2024 Notes”), $2,500 million aggregate principal amount of 4.250% senior notes due 2026 (the “April 2026 Notes”) and $3,000 million aggregate principal amount of 4.750% senior notes due 2029 (the “April 2029 Notes” and, together with the April 2021 Notes, the October 2022 Notes, the October 2024 Notes and the April 2026 Notes, the “April 2019 Notes”); $2,250 million aggregate principal amount of 4.700% senior notes due 2025 (the “April 2025 Notes”) and $2,250 million aggregate principal amount of 5.000% senior notes due 2030 (the “April 2030 Notes,” and together with the April 2025 Notes, the “April 2020 Notes”); $1,000 million aggregate principal amount of 2.250% senior notes due 2023 (the “November 2023 Notes”), $2,250 million aggregate principal amount of 3.150% senior notes due 2025 (the “November 2025 Notes”), $2,750 million aggregate principal amount of 4.150% senior notes due 2030 (the “November 2030 Notes”) and $2,000 million aggregate principal amount of 4.300% senior notes due 2032 (the “November 2032 Notes,” and together with the November 2023 Notes, the November 2025 Notes and the November 2030 Notes, the “May 2020 Notes”); and $1,695,320,000 aggregate principal amount of 3.459% Senior Notes due 2026 (the “September 2026 Notes”) and $2,222,349,000 aggregate principal amount of 4.110% Senior Notes due 2028 (the “September 2028 Notes” and, together with the September 2026 Notes, the “June 2020 Notes”) (the April 2019 Notes, the April 2020 Notes, the May 2020 Notes and the June 2020 Notes, collectively the “exchange notes”), in an exchange offer registered under the Securities Act of 1933, as amended (the “Securities Act”), in exchange for any and all of the $525,342,000 aggregate principal amount of the April 2021 Notes, $692,841,000 aggregate principal amount of the October 2022 Notes, $1,044,409,000 aggregate principal amount of the October 2024 Notes, $2,500 million aggregate principal amount of the April 2026 Notes and $3,000 million aggregate principal amount of the April 2029 Notes; $2,250 million aggregate principal amount of the April 2025 Notes and $2,250 million aggregate principal amount of the April 2030 Notes; $1,000 million aggregate principal amount of the November 2023 Notes, $2,250 million aggregate principal amount of the November 2025 Notes, $2,750 million aggregate principal amount of the November 2030 Notes and $2,000 million aggregate principal amount of the November 2032 Notes; and $1,695,320,000 aggregate principal amount of September 2026 Notes and $2,222,349,000 aggregate principal amount of the September 2028 Notes, respectively (collectively, the “outstanding notes”), that we issued on April 5, 2019 (in the case of the April 2019 Notes), April 9, 2020 (in the case of the April 2020 Notes), May 8, 2020 (in the case of the May 2020 Notes) and May 21, 2020 and June 4, 2020 (in the case of the June 2020 Notes).

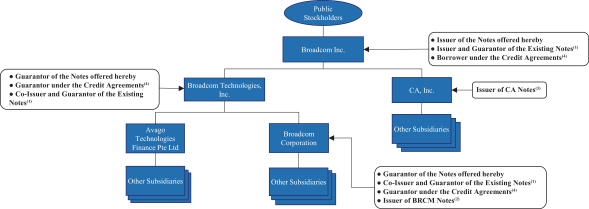

Each series of exchange notes will initially be, and each series of outstanding notes is, fully and unconditionally guaranteed, jointly and severally, on an unsecured, unsubordinated basis by Broadcom Technologies Inc., a Delaware corporation (“BTI”), and Broadcom Corporation, a California corporation (“Broadcom Corporation,” and, together with BTI, the “Guarantors”). The guarantee of the Guarantors may be released under certain circumstances as described in this prospectus under “Description of Notes—Guarantees.”

We are offering to exchange the outstanding notes for the exchange notes to satisfy our obligations in the registration rights agreements that we entered into when the outstanding notes were sold pursuant to Rule 144A and Regulation S under the Securities Act.

The Exchange Offer

| | • | | We will exchange all outstanding notes that are validly tendered and not validly withdrawn for an equal principal amount of the respective series of exchange notes that are freely tradable, except in limited circumstances as described below. |

| | • | | You may withdraw tenders of your outstanding notes at any time prior to the expiration date of the exchange offer. |

| | • | | The exchange offer expires at 11:59 p.m., New York City time, on , 2020, unless extended. We do not currently intend to extend the expiration date. |

| | • | | The exchange of the outstanding notes for exchange notes in the exchange offer will not be a taxable event for U.S. federal income tax purposes. |

| | • | | We will not receive any proceeds from the exchange offer. |

The Exchange Notes

| | • | | The terms of the exchange notes to be issued in the exchange offer are identical in all material respects to the terms of the respective series of outstanding notes, except that the exchange notes will be freely tradable, except in limited circumstances as described below. |

Resales of the Exchange Notes

| | • | | The exchange notes may be resold in theover-the-counter market, in negotiated transactions or through a combination of such methods. We do not plan to list the exchange notes on any securities exchange or market. |

All untendered outstanding notes will continue to be subject to the restrictions on transfer set forth in the outstanding notes and in the related indentures. In general, the outstanding notes may not be offered or sold, except in transactions that are registered under the Securities Act or pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. We currently do not anticipate that we will register the resale of the outstanding notes under the Securities Act.

See “Risk Factors” beginning on page 14 for a discussion of certain risks that you should consider before participating in the exchange offer.

Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. The letter of transmittal states that by so acknowledging and delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for outstanding notes where such outstanding notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. In addition, all dealers effecting transactions in the exchange notes may be required to deliver a prospectus. We have agreed that, for a period of 180 days after the date of this prospectus (or such shorter period if a broker-dealer is no longer required to deliver the prospectus), we will make this prospectus available to any broker-dealer for use in connection with such resales. See “Plan of Distribution.”

If you are an affiliate of ours or any Guarantor, or are engaged in, or intend to engage in, or have an agreement or understanding to participate in, a distribution of the exchange notes, then you cannot rely on the applicable interpretations of the Securities and Exchange Commission and you must comply with the registration requirements of the Securities Act in connection with any resale of the exchange notes.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2020.