- IOSP Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEFA14A Filing

Innospec (IOSP) DEFA14AAdditional proxy soliciting materials

Filed: 7 Apr 11, 12:00am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement | ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

¨ | Definitive Proxy Statement | |||||

x | Definitive Additional Materials | |||||

¨ | Soliciting Material Pursuant to §240.14a-12 |

INNOSPEC INC.

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

April 7, 2011

Dear Stockholder,

In the current economic world, one of the key elements in any business which is enhancing shareholder value is the quality, dedication and loyalty of the management team.

We are now seeking the support of our shareholders to continue our practice of using long-term equity incentive plans as part of our overall compensation program to ensure that our management team are motivated to drive Innospec onto the next stage of our development, and that their compensation in part is very closely linked to improvements in shareholder value. Over the past three years, our 2008 Plans proved to be very effective, and we seek to continue the use of these plans.

There will be three proposals to allocate shares to each of these plans presented to the shareholders at the Annual General Meeting on May 11, 2011, and we do hope you will follow the recommended vote FOR these proposals.

At Innospec, we are very proud of the achievements of our leadership group which includes:

| 1. | Development and execution of a highly successful strategy for our Fuel Specialties business, turning the business into one of the major global players in this market. |

| 2. | Turnaround of our Active Chemicals business, creating good top line growth and substantially improved margins, such that the business is now an excellent platform for future growth, based on innovative new chemistries for the Personal Care industry. |

| 3. | Resolution of a series of legacy issues which have previously impacted the business including: |

| • | Settlement with UK and US authorities under the FCPA investigation; |

| • | Development of alternative UK pension arrangements, which substantially reduced future liability for the company; and |

| • | Favourable outcomes from several outstanding taxation issues. |

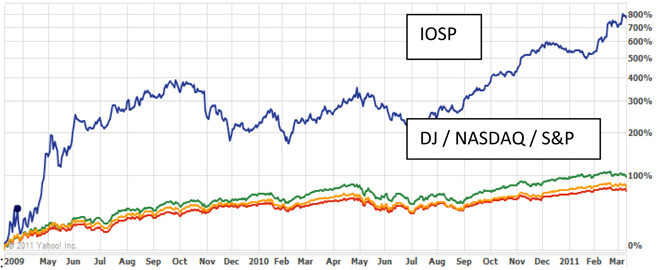

This outstanding performance has been reflected in Innospec’s share price, which has substantially outperformed the market during this period:

| Innospec Inc 8375 South Willow Street Littleton, Colorado 80124 Tel: 303-792-5554 Fax: 303-792-5668 www.innospecinc.com |

In line with best practice, we believe that it is important to have a portion of our key managers’ compensation closely aligned to shareholder interests.

Consistent with the 850,000 shares initially allocated to the 2008 Plans which have supported the equity compensation grants for the last three years, we are seeking to augment the existing plans with the same amount of shares to be used over the next three to four years. The full details of these plans are available in the appendix to this letter.

We value your continued support as a key shareholder, and we trust that we are able to rely on this support to implement this vital element of our compensation packages.

Yours faithfully,

Patrick Williams

President and CEO, Innospec Inc.

Shareholder Communication Long-Term Incentive Plans |

Purpose of Long-Term Incentive Plans (LTIPs) Equity based compensation a vital component of executive compensation creates variable compensation defers part of reward to the medium and long-term Aligns executives’ interests with creation of shareholder value option grants create direct link to company financial performance Focused on company performance 2 |

Innospec Share Option Plans Three Core Long-Term Incentive Plans Two for executives, including the CEO ; One specifically for Non-Employee Directors Plans initiated in 2008 850,000 shares allocated for use over a three- year period Request to augment the plans with 850,000 shares 3.6% of shares outstanding (provides total of 4.25% of outstanding shares available for future issuance) Allows Plans to continue to operate until approx 2014 based on past practice Exactly the same number of shares as allocated three years ago Balanced Plans Mix of market-priced and zero priced performance options, with performance measures linked to shareholder value 3 |

Innospec Business Performance Development and execution of a highly successful strategy for our Fuel Specialties business Now one of the major global players in this market Turnaround of our Active Chemicals business creating good top line growth substantially improved margins excellent platform for future growth innovative new chemistries for the Personal Care industry Resolution of a series of legacy issues which have previously impacted the business including: Settlement with UK and US authorities under the FCPA investigation Development of alternative UK pension arrangements, with consequent substantially reduced future liability for the company Favourable outcomes from several outstanding taxation issues 4 |

2008 2010 Sales $641m $683m EBITDA $50.4m $91.5m Net Income $12.5m $73.7m Net Income (exc Special Items) $45.4m $82.4m EPS (diluted) $0.51 $2.97 Innospec Financial Performance Period covered by 2008 Share Option Plans |

Innospec Share Price Performance 6 IOSP D-J/NASDAQ/S&P500 |

Performance-Related Share Option Plan (PRSOP) Main plan, covers all senior executives, including the CEO Represents approx 75% of options granted to executives Entirely performance-related with vesting based on improvement in shareholder value Annual grants typically with exercise price of zero Vesting after three years based on achievement of performance targets If targets are not met, options do not vest and will lapse 7 |

Company Share Option Plan (CSOP) Covers all senior executives, including the CEO Represents approx 25% of options granted to executives Annual grants typically with exercise price set at market price Vesting after three years Only deliver value to executives if the share price improves Hence shareholder value delivered 8 |

Non-Executive Director Share Option Plan (NEDSOP) Non-employee Directors (NEDs) only Annual grants, typically with exercise price set at market price Initial grant with exercise price of zero once director elected by shareholders Market-priced Options approx $45,000 per annum for each NED Only deliver real value if share price improves Vest after three years 9 |

Option Discipline 2008 Plans Initial allocation of 850,000 shares, almost fully utilized Utilization rate of 1-1.5% of shares outstanding per annum as part of normal grant process 2009-2010 - several special retention grants due to change of management team and company circumstances No further special grants anticipated in next three years Plans prohibit Repricing of options Amendment of targets to make achievement easier Options under PRSOP do not vest unless performance targets are met and options under CSOP only have value if share price increases Fully reported in Proxy Statement 10 |

Summary Innospec seeks to augment the 2008 Share Option Plans 850,000 shares from the original plan almost fully utilized in the last three years Augmenting with the same amount of shares allows the plans to operate on the same level for around the next 3-4 years Outstanding Business Performance Strong business growth in Fuel Specialties & Active Chemicals Successful resolution of legacy issues Creating shareholder value Strong EPS and Share price growth Option Plans help drive performance culture and align executive to shareholder interests Clear targets for achievement 11 |

Forward-Looking Statements This presentation and the accompanying letter contain certain "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts included herein or in the accompanying letter, such as statements describing growth and market position, may constitute forward-looking statements. Although forward-looking statements are believed by management to be reasonable when made, caution should be exercised not to place undue reliance on such statements because they are subject to certain risks, uncertainties and assumptions, including in respect of the general business environment, regulatory actions or changes. If the risks or uncertainties materialize or assumptions prove incorrect or change, our actual performance or results may differ materially from those expressed or implied by such forward-looking statements and assumptions. Additional information regarding risks, uncertainties and assumptions relating to the Company and affecting our business operations and prospects are described in the Company’s Annual Report on Form 10-K for the year ended December 31, 2010, and other reports filed with the U.S. Securities and Exchange Commission. You are urged to carefully review and consider the cautionary statements and other disclosures made in those filings, including specifically those under the heading "Risk Factors”. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. |