InterCept, Inc.

Agenda

| | • | | InterCept Payment Solutions |

| | • | | Financial Institutions Division |

| | • | | Financial Overview & 2003 Forecast |

Forward Looking Statements

| | • | | Statements in this presentation relating to future events, projections, plans and underlying assumptions are “forward-looking statements” within the meaning of securities law |

| | • | | Actual results may differ materially from these forward-looking statements, which are subject to risks and uncertainties |

| | • | | For a discussion of the risks and factors that could cause InterCept’s actual results to differ materially from the forward-looking statements, see the discussion of “Risk Factors” in the company’s Annual Report on form 10-K filed March 31, 2003 |

Corporate Update

Jeff Berns

Senior Vice President

InterCept Today

| | • | | InterCept designs and implements advanced software solutions that help financial institutions and merchants prepare for and meet tomorrow’s challenges today |

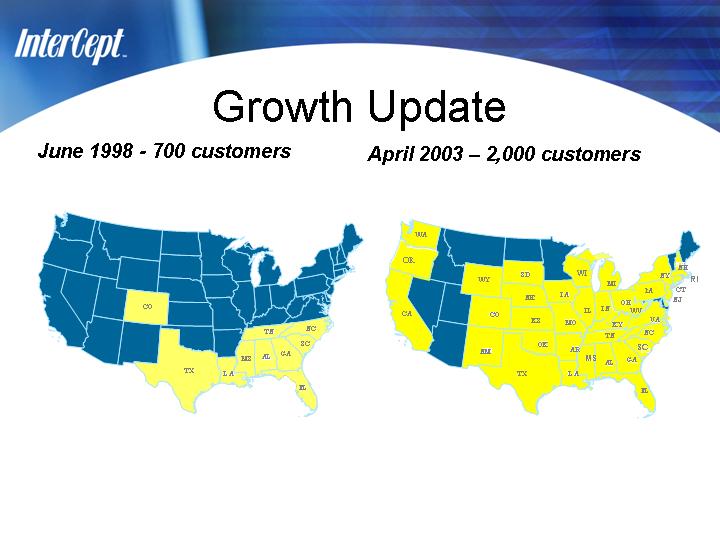

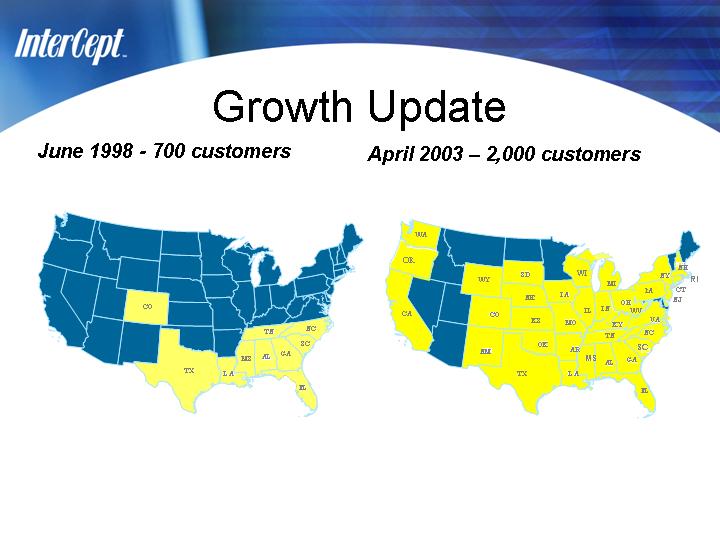

Growth Update

June 1998—700 customers | | April 2003 – 2,000 customers |

Locations

| | • | | Atlanta, GA (Corporate Headquarters) |

| | • | | San Antonio, TX (InterCept Output Solutions) |

| | • | | Item Processing Center Network |

| | • | | Deerfield Beach, FL (InterCept Payment Solutions) |

| | • | | New Castle, DE (InterCept Payment Solutions) |

Over 2,000 employees

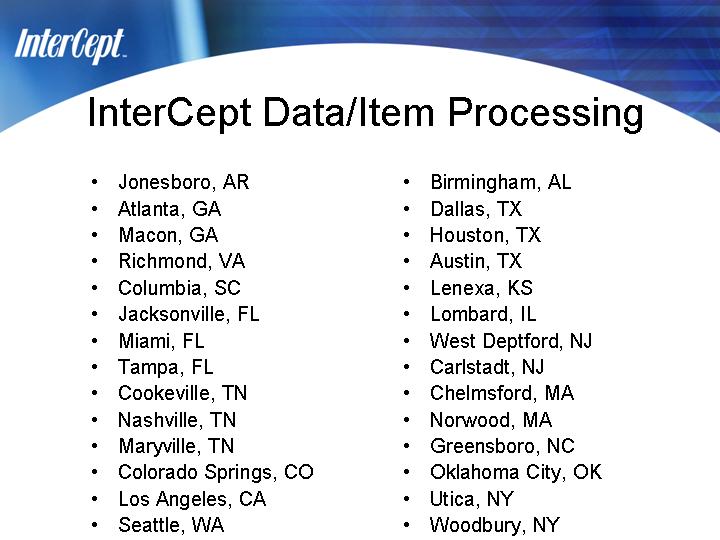

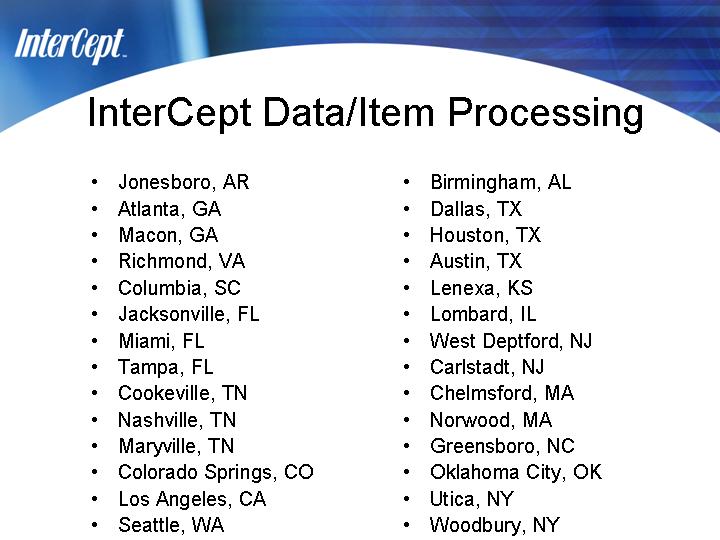

InterCept Data/Item Processing

• Jonesboro, AR • Atlanta, GA • Macon, GA • Richmond, VA • Columbia, SC • Jacksonville, FL • Miami, FL • Tampa, FL • Cookeville, TN • Nashville, TN • Maryville, TN • Colorado Springs, CO • Los Angeles, CA • Seattle, WA | | • Birmingham, AL • Dallas, TX • Houston, TX • Austin, TX • Lenexa, KS • Lombard, IL • West Deptford, NJ • Carlstadt, NJ • Chelmsford, MA • Norwood, MA • Greensboro, NC • Oklahoma City, OK • Utica, NY • Woodbury, NY |

Bankers Bank Alliances

Products & Services

Core Processing Software

| | • | | Client/Server—Windows NT® based that is fully descriptive with no codes to learn |

| | • | | Service bureau or in-house delivery |

Core Processing Software

| | • | | Online real-time core bank processing centered around the Customer Information File |

| | • | | Totally integrated software |

On-line Teller Platform System

| | • | | Windows®based teller system that integrates traditional transaction processing with client/server architecture |

| | • | | Teller operational efficiencies expanded with decreased balancing time, elimination of proof errors and reduced human errors |

Loan Management System

| | • | | Lenders see critical information before releasing additional funds |

| | • | | One relational data set provides a comprehensive “snapshot” of the customer’s entire loan portfolio |

Check Imaging

| | • | | Bank-wide electronic access retrieves checks on PCs for faster signature verification, improved customer service, faster research and bottom-line cost savings |

| | • | | At statement time customers receive compact, easy-to-read records of imaged checks |

| | • | | Single source for comprehensive and customized electronic commerce and transaction processing solutions |

| | • | | ATM and point-of-sale (POS) terminal driving, debit card transactions, funds transfer and remote banking services |

| | • | | Rapid response time and secure reliable transmission and processing of transactions and information |

| | • | | On-line monitoring and troubleshooting and a single point of contact for all communication needs |

Regulatory Reporting Software

| | • | | Currently used by approximately 7,000 financial institutions nationwide |

| | • | | Convenient Internet delivery and updates, real-time error checking and on-line FFIEC instructions |

Optical Storage

| | • | | Advanced report storage and retrieval system that permanently stores vital information on CD |

| | • | | 32-bit technology provides 100% protection against data loss |

| | • | | InterCept Payment Solutions enables businesses to accept credit card, debit card and electronic check payments |

| | • | | Merchants process payments through any delivery channel, including point-of-sale, call center, Internet and wireless |

| | • | | Comprehensive services handle large-scale needs of financial institutions, major medical systems, utility companies and loan service operations |

| | • | | Clients outsource essential,non-core business operations including data processing, laser printing, mailing services and electronic bill presentment |

SBS Data Services

| | • | | Additional core processing option |

| | • | | Largest Kirchman Service Bureau center |

| | • | | Ability to target core functionality of larger institutions |

| | • | | Processed in Birmingham, AL location |

Summary

| | • | | InterCept takes the complexity out of technology for community financial institutions |

| | • | | Our end-to-end solutions simplify financial technology so our customers can focus on their core business |

| | • | | We deliver a wide range of integrated products, services and support that help banks compete in today’s challenging financial services arena |

John Perry

Chief Executive Officer

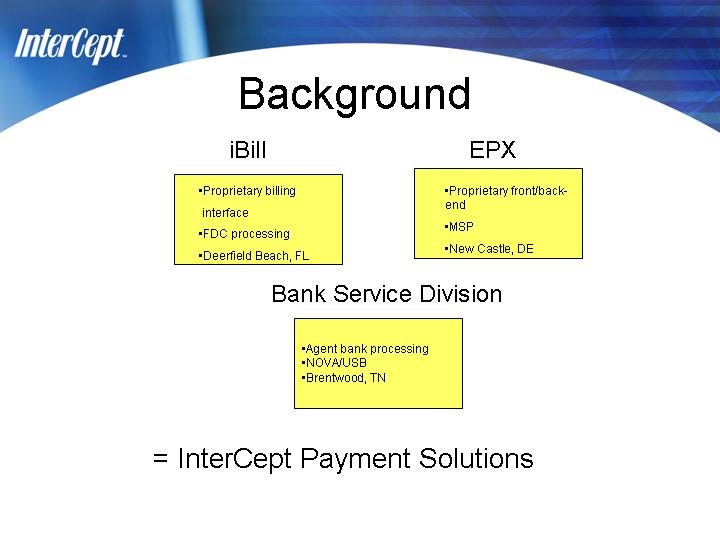

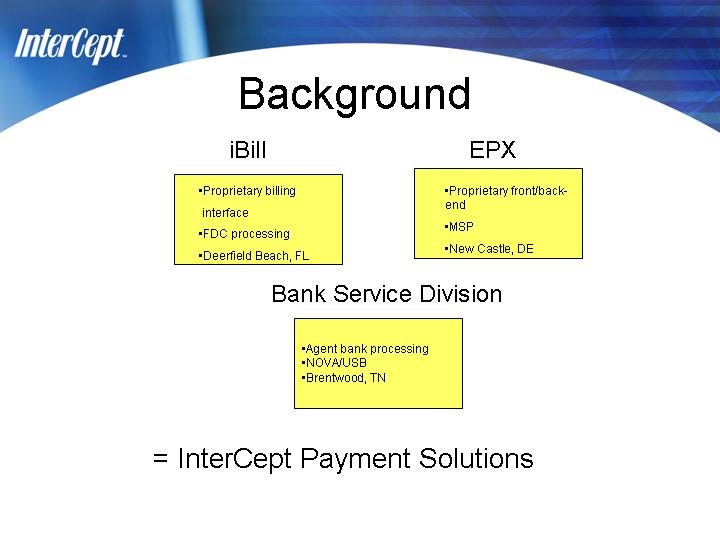

Background

iBill | | EPX |

• Proprietary billing interface • FDC processing • Deerfield Beach, FL | | • Proprietary front/back-end • MSP • New Castle, DE |

Bank Service Division

• Agent bank processing • NOVA/USB • Brentwood, TN |

= InterCept Payment Solutions

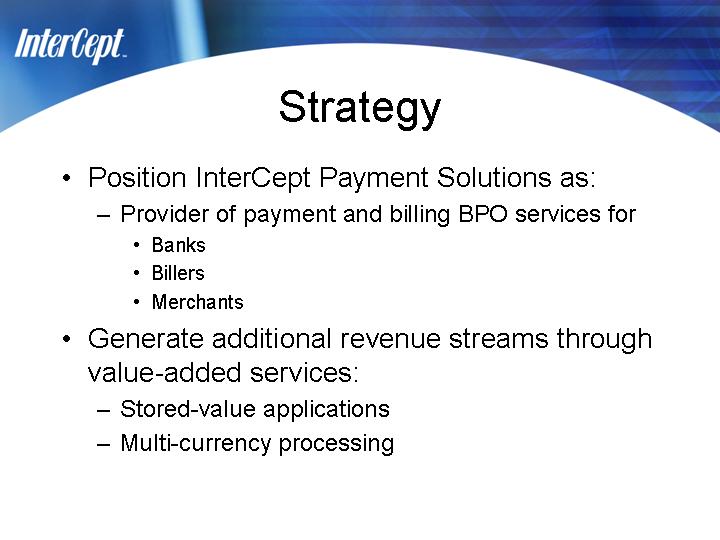

Strategy

| | • | | Position InterCept Payment Solutions as: |

| | – | | Provider of payment and billing BPO services for |

| | • | | Generate additional revenue streams through value-added services: |

| | – | | Stored-value applications |

| | – | | Multi-currency processing |

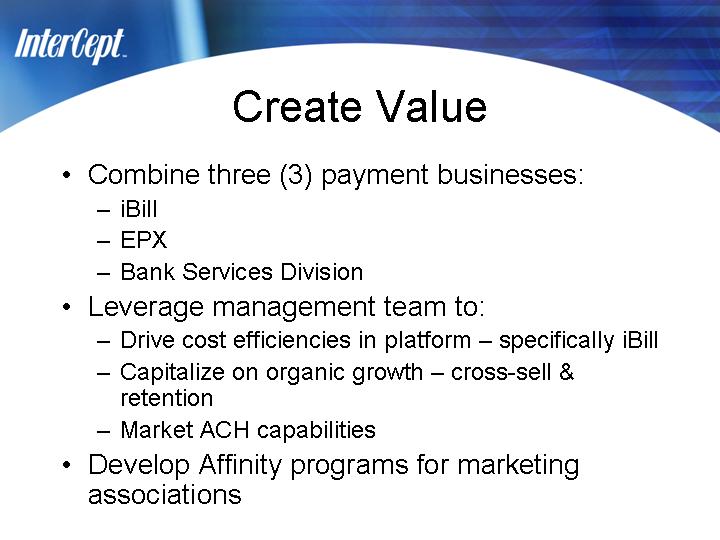

Create Value

| | • | | Combine three (3) payment businesses: |

| | • | | Leverage management team to: |

| | – | | Drive cost efficiencies in platform – specifically iBill |

| | – | | Capitalize on organic growth – cross-sell & retention |

| | – | | Market ACH capabilities |

| | • | | Develop Affinity programs for marketing associations |

180 Day Plan

| | – | | Focus technology efforts on DE authorization network and: |

| | • | | Customer service and fraud detection for small merchants |

| | – | | Finalize integrated strategic sales/marketing plan |

| | • | | Data mining of existing base – targeted lead generation |

| | • | | Initiate “positioning” and branding efforts |

| | • | | Assure sales comp and promotions support strategy |

| | – | | Ongoing and productive dialogue with card associations |

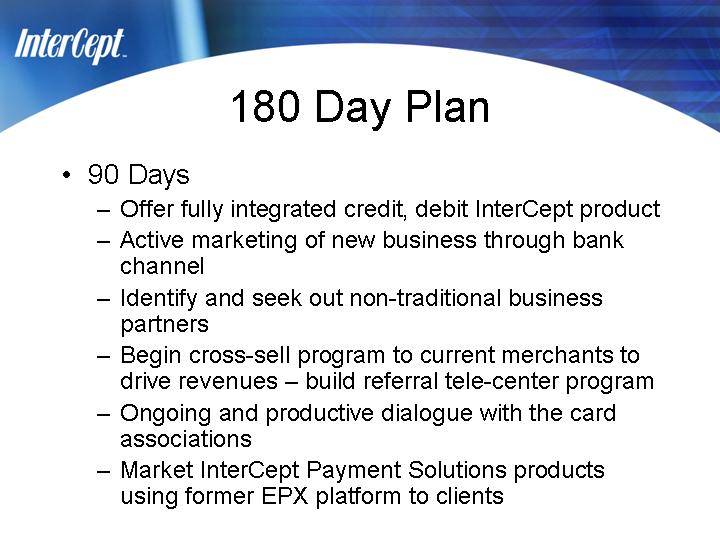

180 Day Plan

| | — | | Offer fully integrated credit, debit InterCept product |

| | — | | Active marketing of new business through bank channel |

| | — | | Identify and seek out non-traditional business partners |

| | — | | Begin cross-sell program to current merchants to drive revenues – build referral tele-center program |

| | — | | Ongoing and productive dialogue with the card associations |

| | — | | Market InterCept Payment Solutions products using former EPX platform to clients |

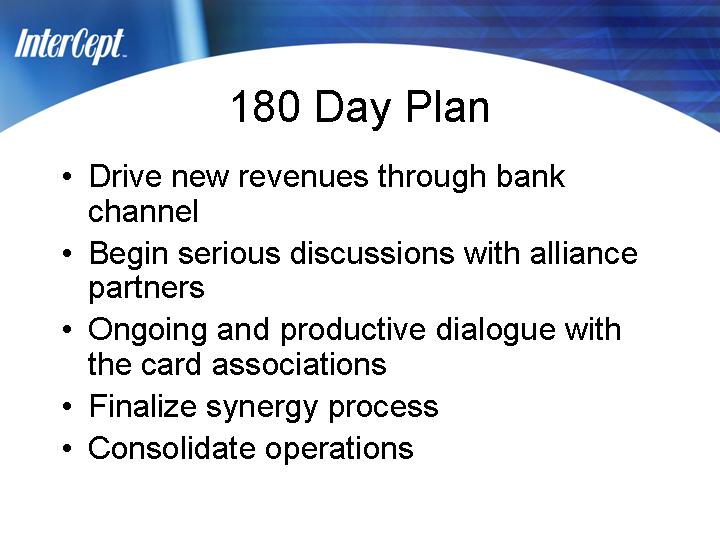

180 Day Plan

| | • | | Drive new revenues through bank channel |

| | • | | Begin serious discussions with alliance partners |

| | • | | Ongoing and productive dialogue with the card associations |

| | • | | Finalize synergy process |

Financial Institutions Division

Randy Fluitt

Executive Vice President

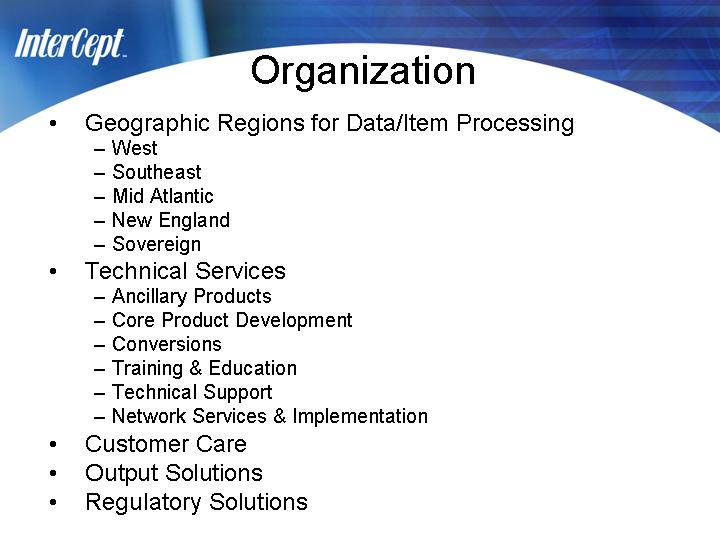

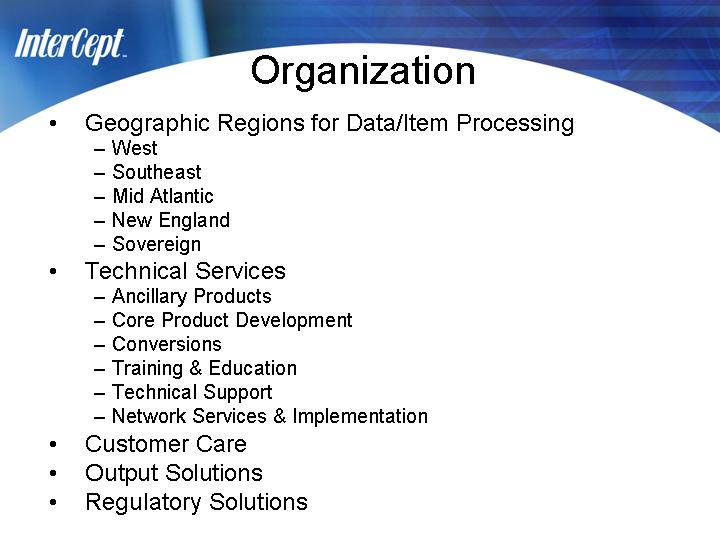

Organization

| | • | | Geographic Regions for Data/Item Processing |

| | — | | Core Product Development |

| | — | | Network Services & Implementation |

Data & Item Center Locations

Item/Image Centers

Support & Develop offices

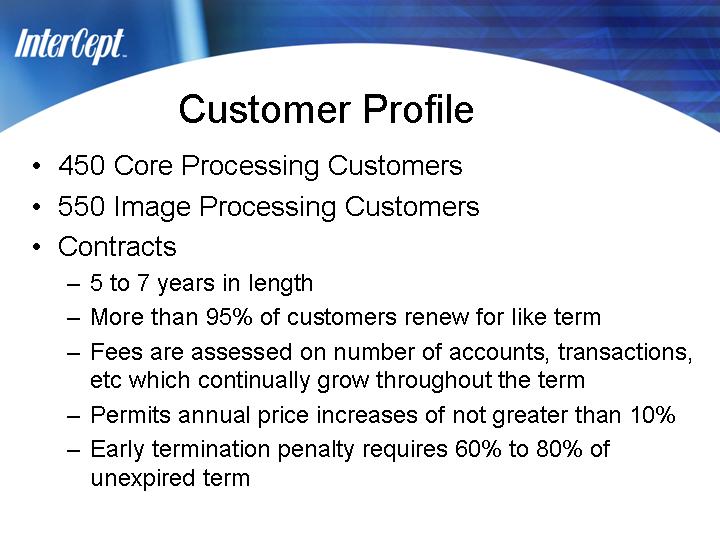

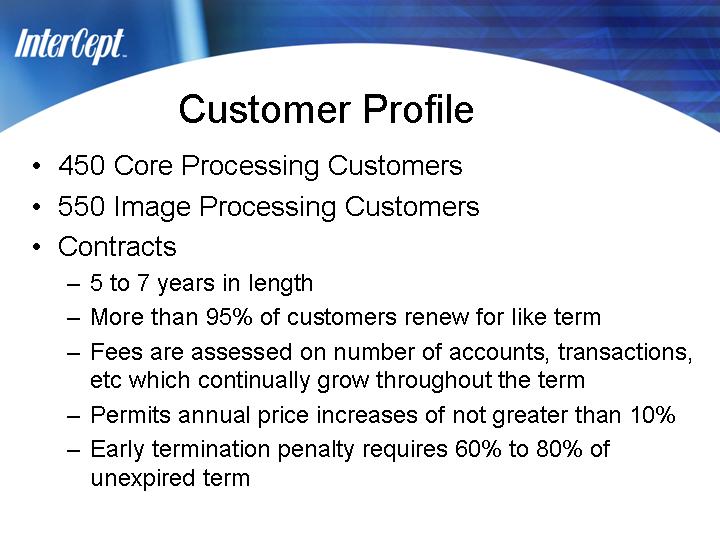

Customer Profile

| | • | | 450 Core Processing Customers |

| | • | | 550 Image Processing Customers |

| | — | | More than 95% of customers renew for like term |

| | — | | Fees are assessed on number of accounts, transactions, etc which continually grow throughout the term |

| | — | | Permits annual price increases of not greater than 10% |

| | — | | Early termination penalty requires 60% to 80% of unexpired term |

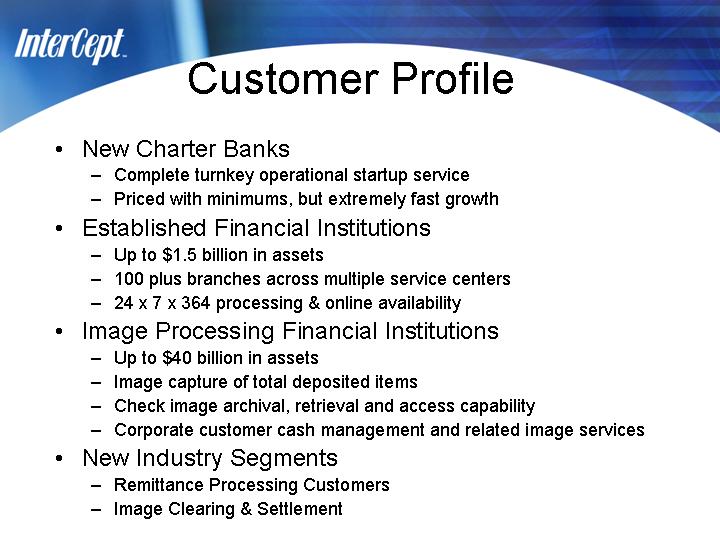

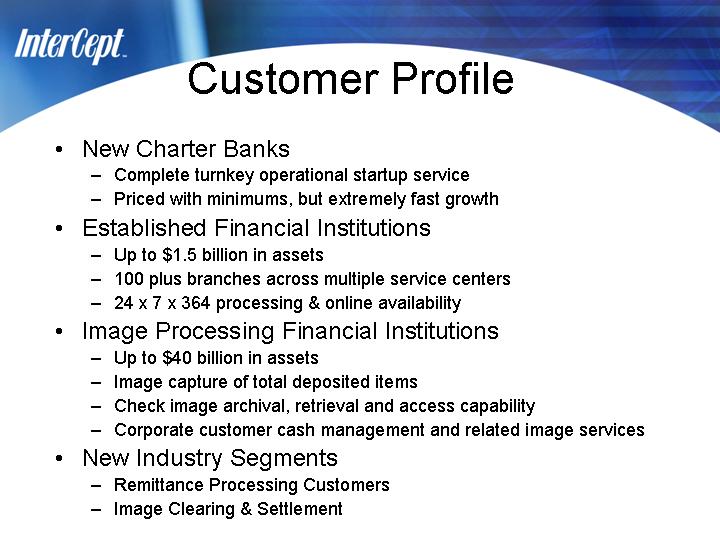

Customer Profile

| | — | | Complete turnkey operational startup service |

| | — | | Priced with minimums, but extremely fast growth |

| | • | | Established Financial Institutions |

| | — | | Up to $1.5 billion in assets |

| | — | | 100 plus branches across multiple service centers |

| | — | | 24 x 7 x 364 processing & online availability |

| | • | | Image Processing Financial Institutions |

| | — | | Up to $40 billion in assets |

| | — | | Image capture of total deposited items |

| | — | | Check image archival, retrieval and access capability |

| | — | | Corporate customer cash management and related image services |

| | — | | Remittance Processing Customers |

| | — | | Image Clearing & Settlement |

Service & Product Philosophy

| | • | | “Full Service Provider” to Financial Institutions |

| | — | | Fully integrated, single source technology solutions |

| | — | | Advanced product solutions |

| | — | | Executive and Operations conferences |

| | — | | Long term customer relationships |

| | • | | Commitment to banks’ operating efficiencies |

| | • | | Service & Product continuity nationwide |

| | • | | Business Unit accountability |

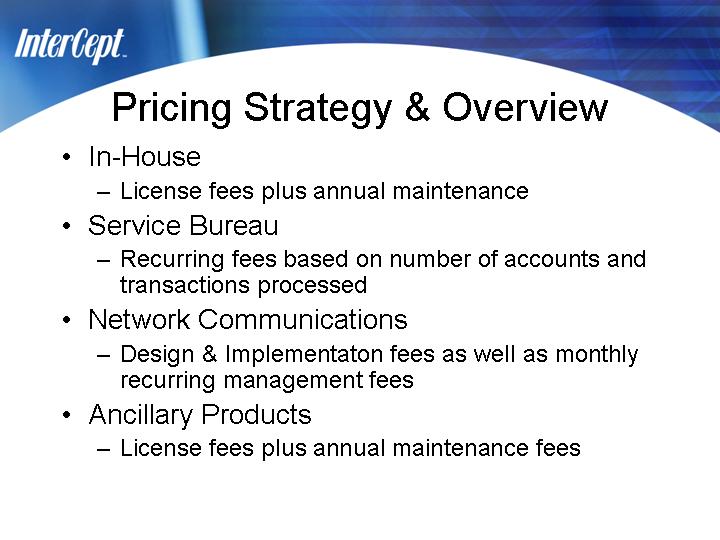

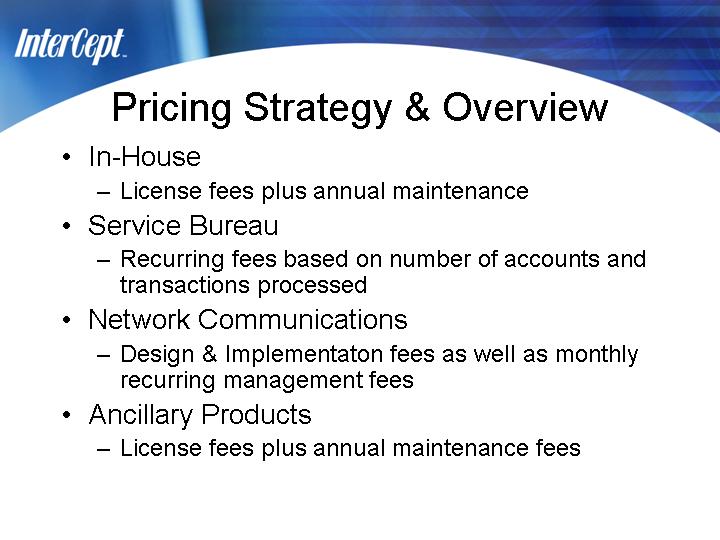

Pricing Strategy & Overview

| | — | | License fees plus annual maintenance |

| | — | | Recurring fees based on number of accounts and transactions processed |

| | — | | Design & Implementaton fees as well as monthly recurring management fees |

| | — | | License fees plus annual maintenance fees |

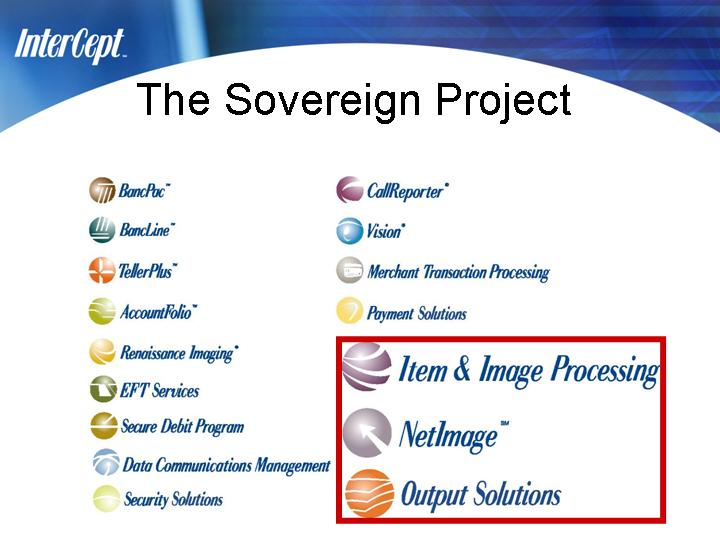

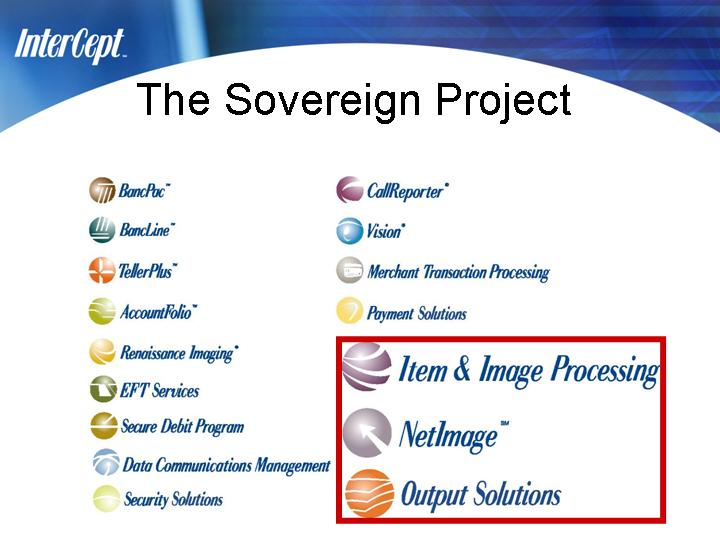

The Sovereign Project

The Process

| | • | | Joint effort, working closely together for two years |

| | • | | On-site for 16 months learning Sovereign’s customer philosophies and processes |

| | • | | Analyzed volumes, logistics and processes from all 525 community banking offices |

| | • | | Hosted Sovereign in Atlanta and at InterCept’s largest sites and customers |

What We Will Do

| | • | | Image capture and processing of checks from all Sovereign Community Banking Offices |

| | • | | Replace 5 Fiserv centers with 6 InterCept centers |

| | • | | Process 25M check images each month |

| | • | | Produce 1.6M image statements each month |

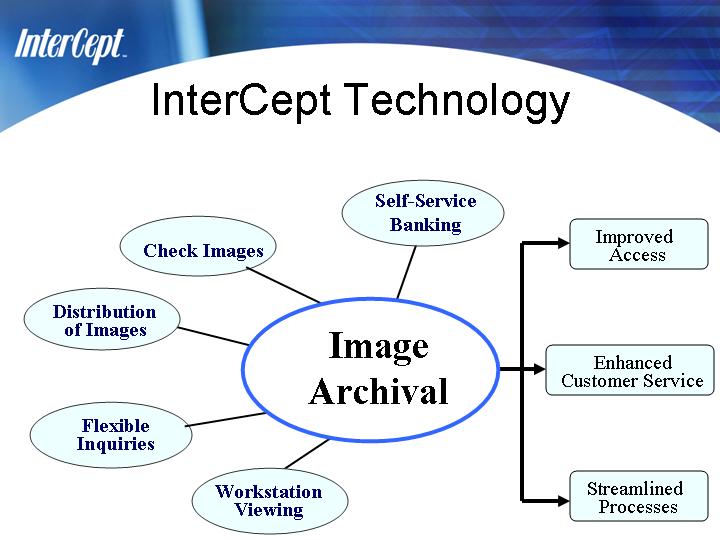

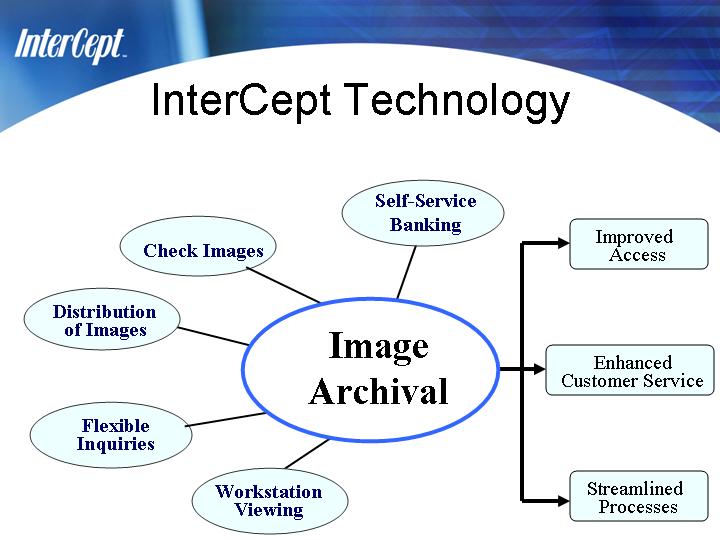

InterCept Technology

Self-Service Banking Check Images Distribution of Images Flexible Inquiries Workstation Viewing | | Image Archival

| | Improved Access Enhanced Customer Service Streamlined Processes |

EFT Division

Denise Saylor

Senior Vice President

EFT Division Today

| | • | | Gateway for approximately 500 financial institutions |

| | • | | Provides connectivity to all national and majority of regional networks |

| | • | | Commitment to customer service and long-term relationships |

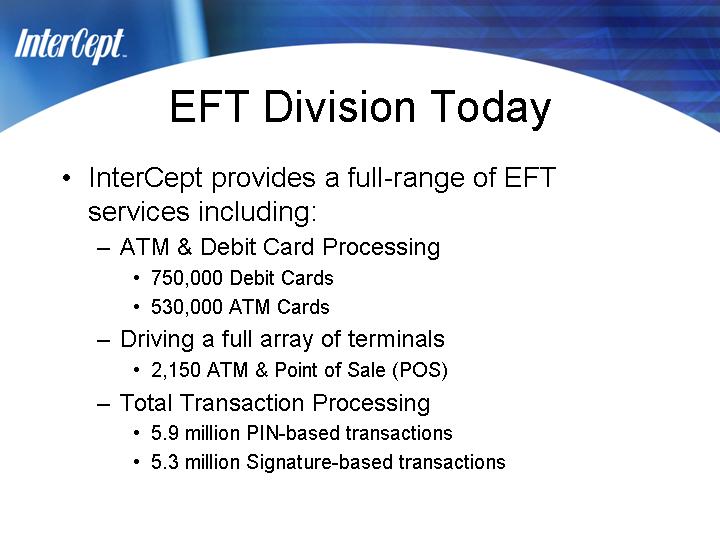

EFT Division Today

| | • | | InterCept provides a full-range of EFT services including: |

| | — | | ATM & Debit Card Processing |

| | — | | Driving a full array of terminals |

| | • | | 2,150 ATM & Point of Sale (POS) |

| | — | | Total Transaction Processing |

| | • | | 5.9 million PIN-based transactions |

| | • | | 5.3 million Signature-based transactions |

EFT Platform Upgrade

| | • | | Increased volume capacity |

| | • | | Increased functionality and flexibility |

| | • | | Greater platform stability |

| | • | | Provides ability to capitalize on growth opportunities |

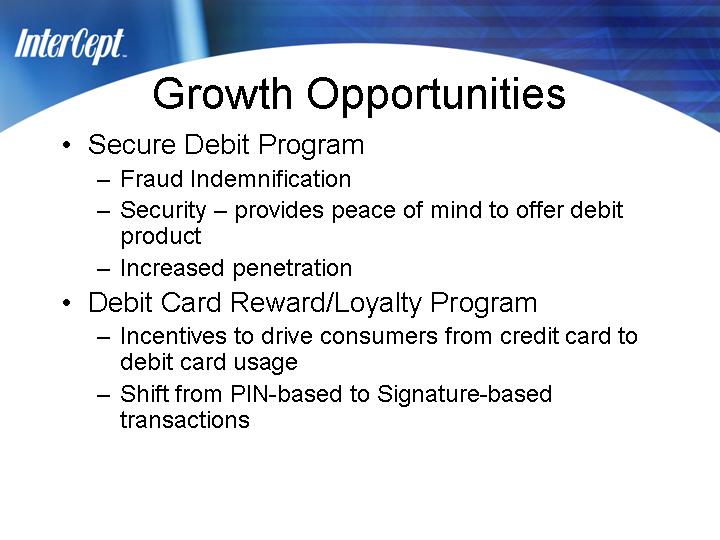

Growth Opportunities

| | – | | Security – provides peace of mind to offer debit product |

| | • | | Debit Card Reward/Loyalty Program |

| | – | | Incentives to drive consumers from credit card to debit card usage |

| | – | | Shift from PIN-based to Signature-based transactions |

New Market Opportunity

| | – | | Complement to debit cards and compete with cash |

| | – | | Full range of pre-paid cards |

| | – | | Capitalizes on the need for controlled and secure spending |

| | – | | Option to tap into the “un-banked” market segment |

| | – | | Fee income generator for institutions |

| | – | | Increased transaction revenues for InterCept |

Financial Overview & 2003

Forecast

Scott Meyerhoff

Chief Financial Officer

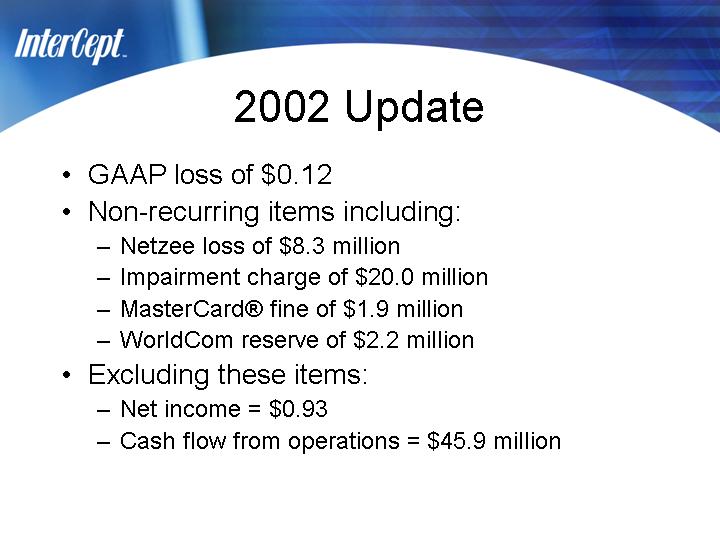

2002 Update

| | • | | Non-recurring items including: |

| | – | | Netzee loss of $8.3 million |

| | – | | Impairment charge of $20.0 million |

| | – | | MasterCard® fine of $1.9 million |

| | – | | WorldCom reserve of $2.2 million |

| | – | | Cash flow from operations = $45.9 million |

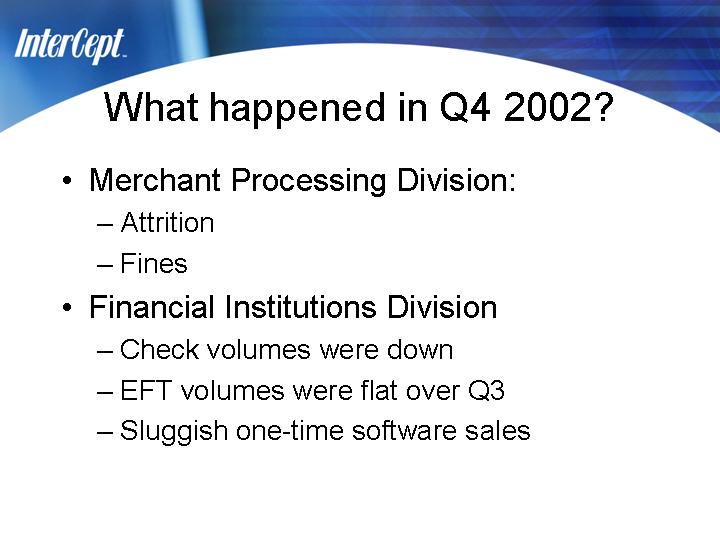

What happened in Q4 2002?

| | • | | Merchant Processing Division: |

| | • | | Financial Institutions Division |

| | – | | Check volumes were down |

| | – | | EFT volumes were flat over Q3 |

| | – | | Sluggish one-time software sales |

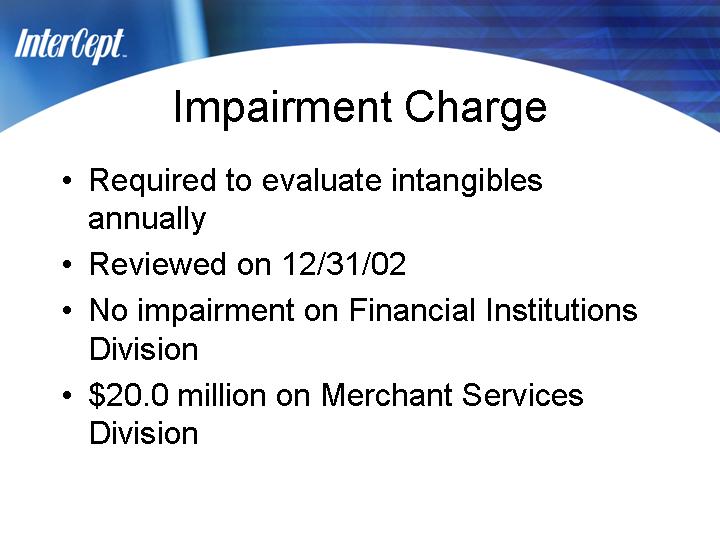

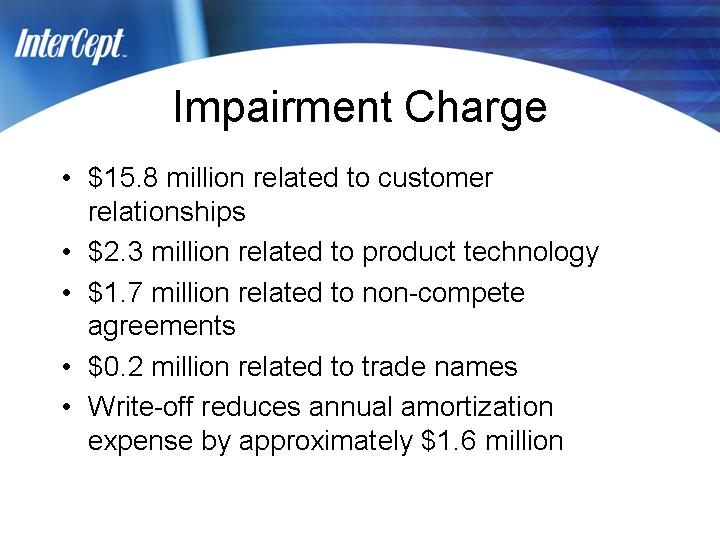

Impairment Charge

| | • | | Required to evaluate intangibles annually |

| | • | | No impairment on Financial Institutions Division |

| | • | | $20.0 million on Merchant Services Division |

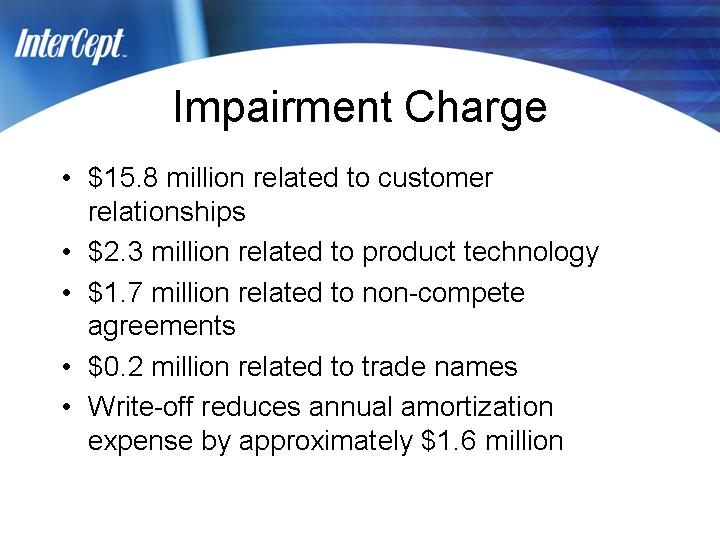

Impairment Charge

| | • | | $15.8 million related to customer relationships |

| | • | | $2.3 million related to product technology |

| | • | | $1.7 million related to non-compete agreements |

| | • | | $0.2 million related to trade names |

| | • | | Write-off reduces annual amortization expense by approximately $1.6 million |

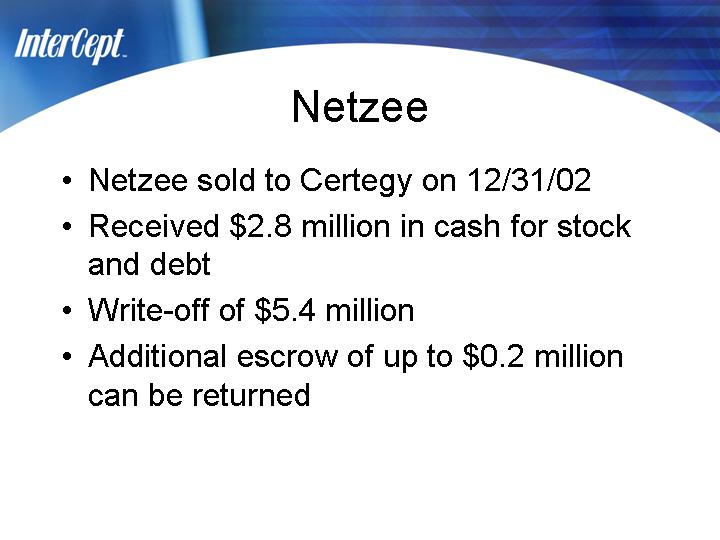

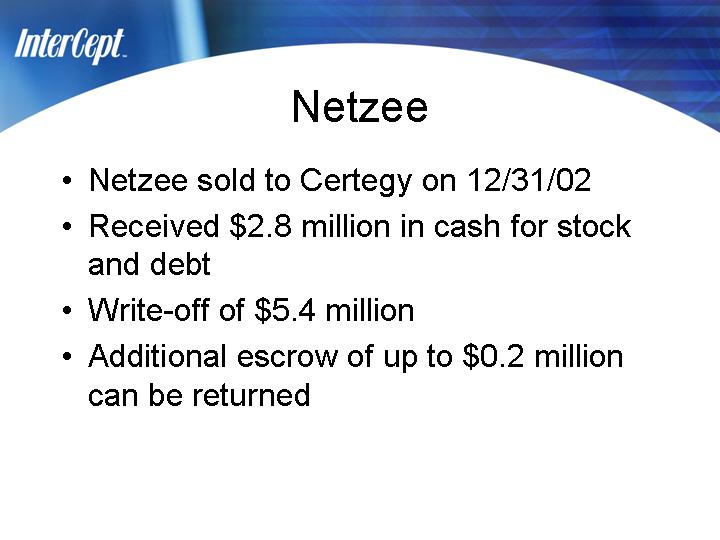

Netzee

| | • | | Netzee sold to Certegy on 12/31/02 |

| | • | | Received $2.8 million in cash for stock and debt |

| | • | | Write-off of $5.4 million |

| | • | | Additional escrow of up to $0.2 million can be returned |

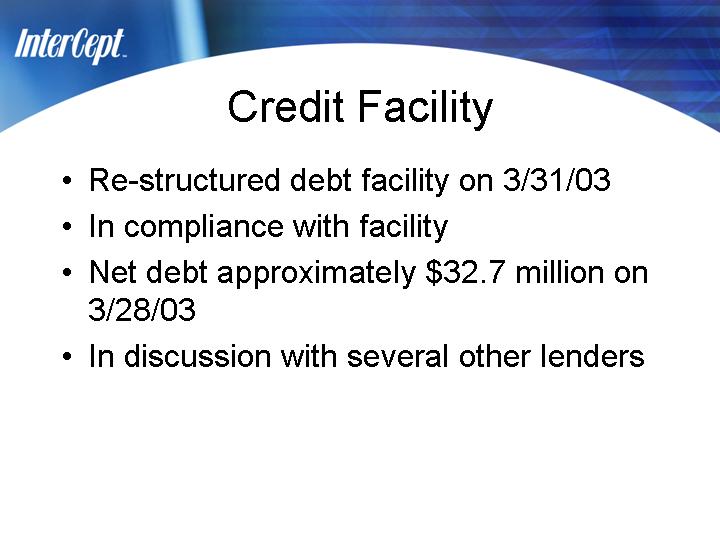

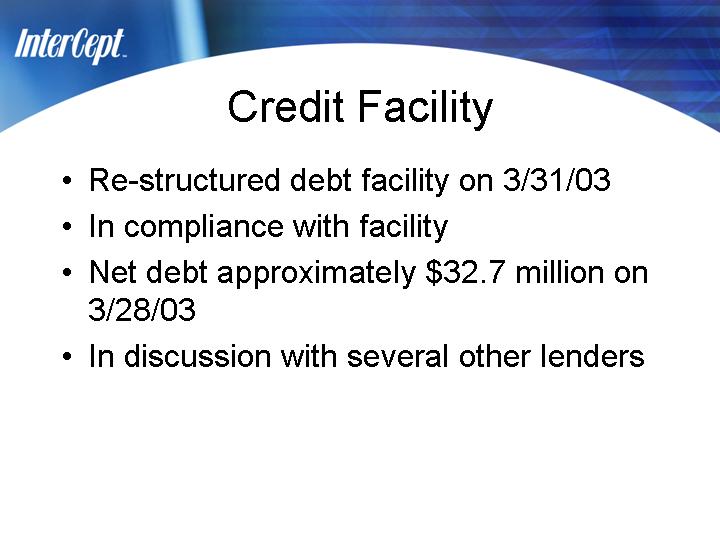

Credit Facility

| | • | | Re-structured debt facility on 3/31/03 |

| | • | | In compliance with facility |

| | • | | Net debt approximately $32.7 million on 3/28/03 |

| | • | | In discussion with several other lenders |

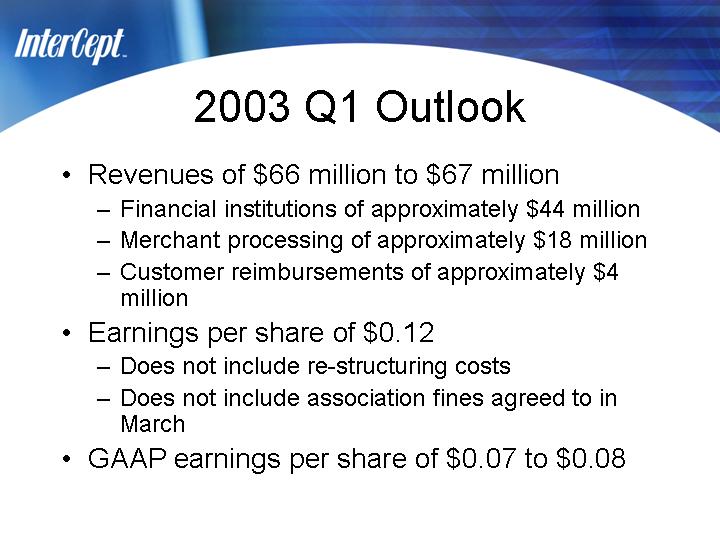

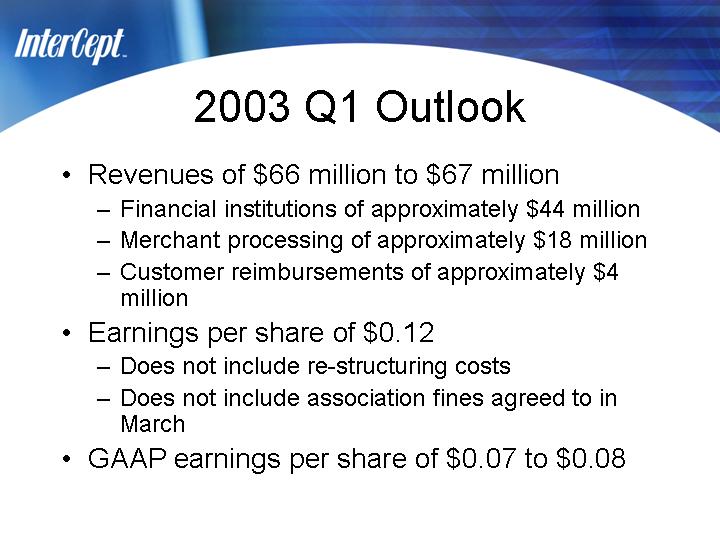

2003 Q1 Outlook

| | • | | Revenues of $66 million to $67 million |

| | – | | Financial institutions of approximately $44 million |

| | – | | Merchant processing of approximately $18 million |

| | – | | Customer reimbursements of approximately $4 million |

| | • | | Earnings per share of $0.12 |

| | – | | Does not include re-structuring costs |

| | – | | Does not include association fines agreed to in March |

| | • | | GAAP earnings per share of $0.07 to $0.08 |

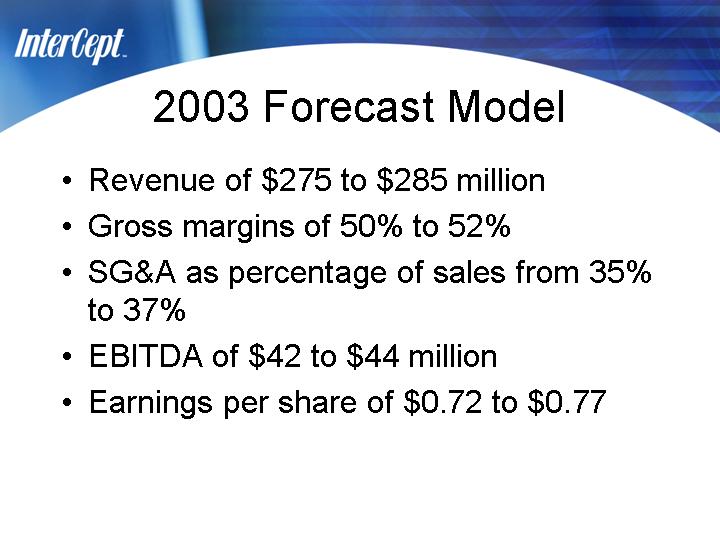

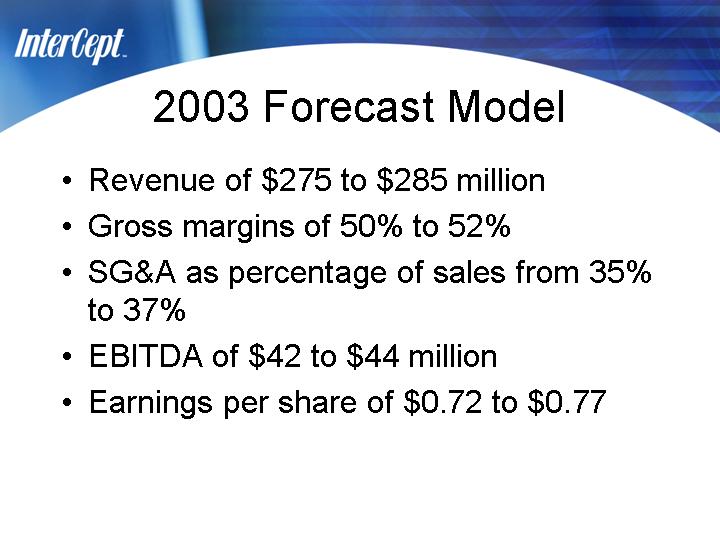

2003 Forecast Model

| | • | | Revenue of $275 to $285 million |

| | • | | Gross margins of 50% to 52% |

| | • | | SG&A as percentage of sales from 35% to 37% |

| | • | | EBITDA of $42 to $44 million |

| | • | | Earnings per share of $0.72 to $0.77 |

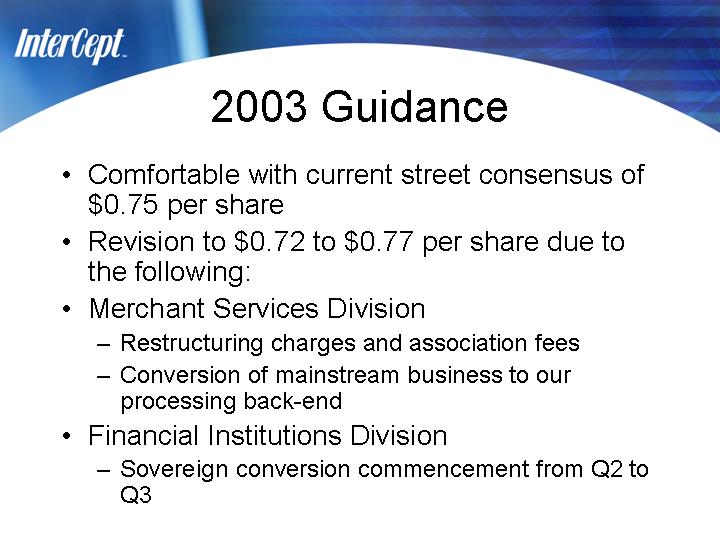

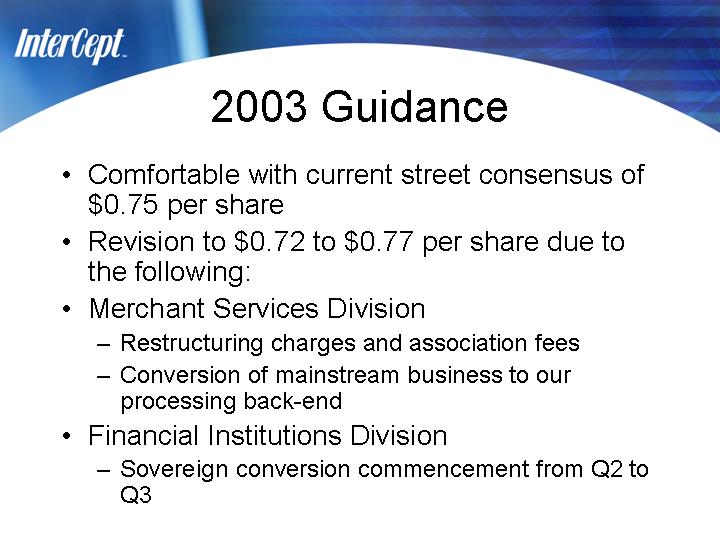

2003 Guidance

| | • | | Comfortable with current street consensus of $0.75 per share |

| | • | | Revision to $0.72 to $0.77 per share due to the following: |

| | • | | Merchant Services Division |

| | – | | Restructuring charges and association fees |

| | – | | Conversion of mainstream business to our processing back-end |

| | • | | Financial Institutions Division |

| | – | | Sovereign conversion commencement from Q2 to Q3 |

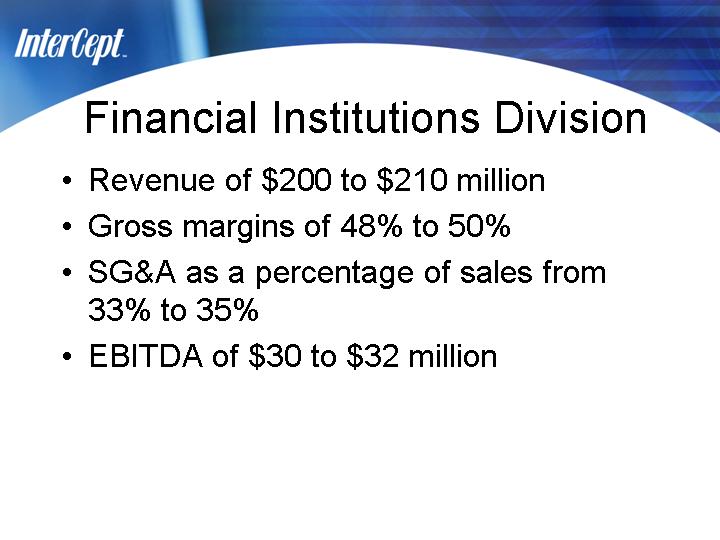

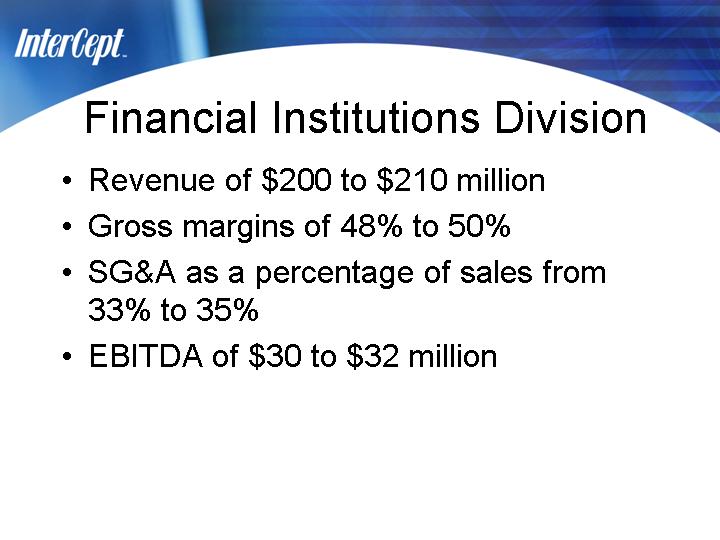

Financial Institutions Division

| | • | | Revenue of $200 to $210 million |

| | • | | Gross margins of 48% to 50% |

| | • | | SG&A as a percentage of sales from 33% to 35% |

| | • | | EBITDA of $30 to $32 million |

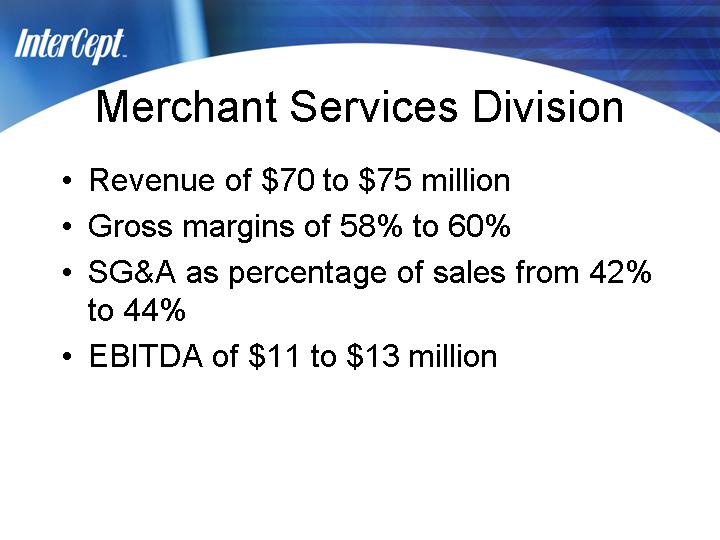

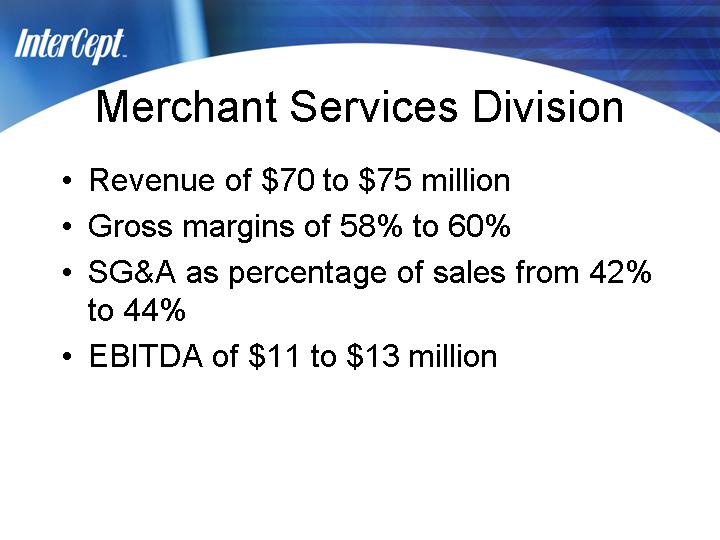

Merchant Services Division

| | • | | Revenue of $70 to $75 million |

| | • | | Gross margins of 58% to 60% |

| | • | | SG&A as percentage of sales from 42% to 44% |

| | • | | EBITDA of $11 to $13 million |

Sovereign Conversion

| | • | | Originally anticipated conversion of Phase I in June 2003 |

| | • | | Revised Phase I conversion date scheduled for July-August 2003 |

| | • | | Phase II scheduled for November—December 2003 |

InterCept, Inc.