EXHIBIT 99.2

InterCept, Inc.

Agenda

| | • | | InterCept Payment Solutions |

| | • | | Financial Institutions Division |

| | • | | Financial Overview & 2003 Forecast |

Forward Looking Statements

| | • | | Statements in this presentation relating to future events, projections, plans and underlying assumptions are “forward-looking statements” within the meaning of securities laws |

| | • | | Actual results may differ materially from these forward-looking statements, which are subject to risks and uncertainties |

| | • | | For a discussion of the risks and factors that could cause InterCept’s actual results to differ materially from the forward-looking statements, see the discussion of “Risk Factors” in the company’s Quarterly Report on form 10-Q filed May 15, 2003 |

Corporate Update

Jeff Berns

Senior Vice President

InterCept, Inc.

| | • | | InterCept designs and implements advanced software solutions that help financial institutions and merchants prepare for and meet tomorrow’s challenges today |

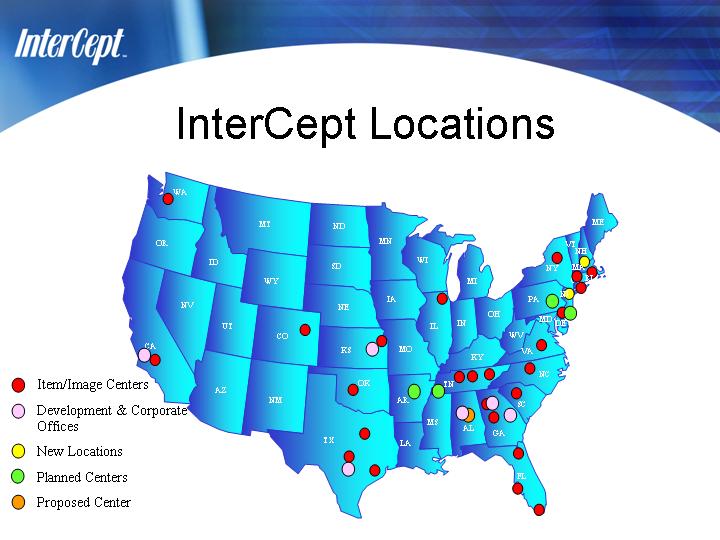

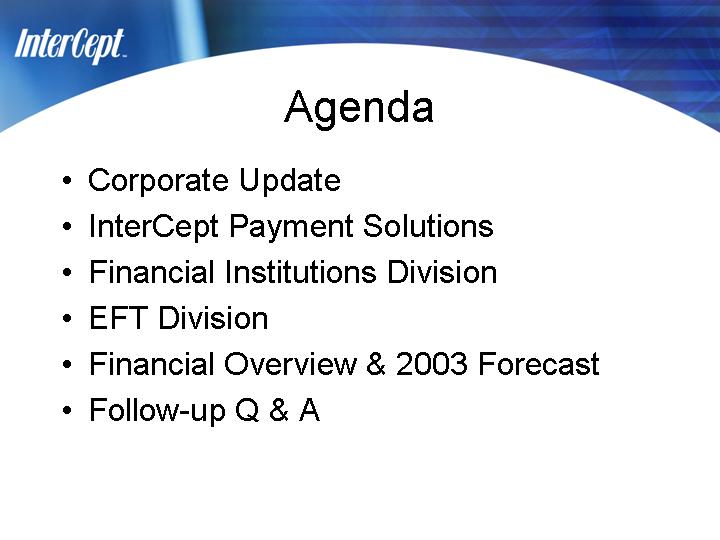

InterCept Locations

New, Planned & Proposed Centers

Bankers Bank Alliances

Products & Services

| | • | | Advanced electronic monthly statement delivery |

| | • | | Monthly statements sent directly to customers of financial institutions via the Internet |

| | • | | Customers log-on to secure web site and receive detailed online account statement streamlining entire statement process |

| | • | | Fully integrated management systems |

| | • | | Deposit platform automates tasks and functions associated with originating and processing checking, savings, certificates, IRA, and other deposit accounts |

| | • | | Loan platform automates origination and processing tasks of consumer, commercial and real estate based lending |

| | • | | Provides bank-wide access to all CRM (Customer Relationship Management) and SFA ( Sales Force Automation) functions |

| | • | | Flow of customer information is integrated between BancPac’s core accounting system and front-line deposit and loan platforms |

Sales & Marketing Update

| • | | Large bank sales division |

| • | | Revised Relationship Management program |

| | – | | First annual client conference April 27-30, 2003 |

| • | | September User’s Conference |

| | – | | New Orleans, LA 9/7-9/10 |

| | – | | Showcasing all products |

Summary

| | • | | InterCept takes the complexity out of technology for financial institutions |

| | • | | Our end-to-end solutions simplify financial technology so our customers can focus on their core business |

| | • | | We deliver a wide range of integrated products, services and support that help banks compete in today’s challenging financial services arena |

John Perry

Chief Executive Officer

Strategy

| • | | On track as provider of payment and billing services for |

| • | | Generate additional revenue streams through value-added services: |

| | – | | Stored-value applications – roll-out of stored value card for universities; scheduled for 4th quarter |

| | – | | Continue to grow international business using the iBill platform |

Value Creation

| • | | The combination of three payment businesses is on track: |

| | – | | The management team continues to focus on consolidation of the business’: |

| | • | | Focus on cost efficiencies in the iBill platform |

| | • | | Migration of the mainstream business to DE platform, is in process |

| | • | | Continue to move transaction volume to new NexGen platform |

| | • | | Increase ACH capabilities – new relationship with Amerinet |

| | – | | Develop Affinity programs |

| | • | | GMAC Bank selected InterCept Payment Solutions as preferred provider of b2b and b2c payments business |

Plan and Execution Status

| • | | Initiatives are on track |

| | – | | Drive new revenues through bank channel |

| | • | | Converted 1st Source Bank in June |

| | – | | Significant new merchants on iBill platform include: |

| | – | | Ongoing and productive dialogue with the card associations; focusing on a proactive approach |

| | – | | Consolidate operations; select best of breed |

| | • | | Operations and Marketing in FL |

Financial Institutions Division

Randy Fluitt

Executive Vice President

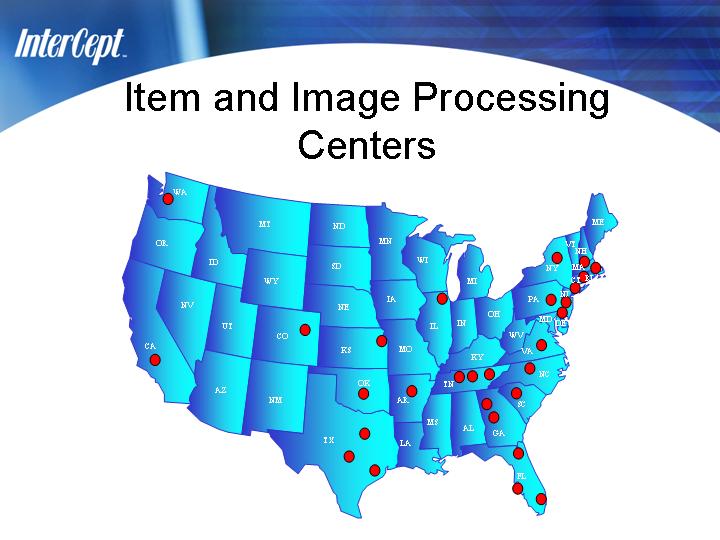

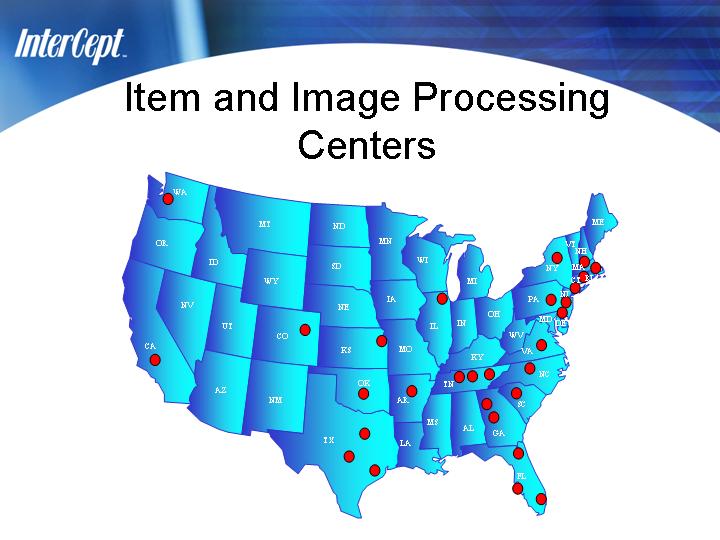

Item and Image Processing Centers

Image Exchange & Settlement

| • | | InterCept’s Oklahoma City Center |

| | – | | Three financial institutions |

| | – | | Expand to other local financial institutions |

| | – | | Expand to other InterCept centers |

Sovereign Conversion Status

| | • | | Started processing week of July 21st |

| | • | | Windsor, CT & Chelmsford and Norwood, MA |

| | • | | Processing all 255 New England community banking offices |

| | • | | Image statements to begin in September |

EFT Division

Todd Shiver

Vice President

EFT Division Update

| | • | | Visa/MasterCard Debit Settlement |

EFT Platform Upgrade

| | • | | Anticipated completion by September 30 |

| | • | | Migrated 83% of customers |

| | • | | 2004 estimated cost reduction of $1 million annually once legacy operation is fully discontinued |

Visa/MasterCard Debit Settlement

| • | | $3 billion dollar settlement to the merchants |

| • | | Rate reduction in effect August 1, 2003 |

| • | | Rate becomes adjustable again on Jan 1, 2004 |

| | – | | MasterCard and Visa can reset rates |

| | – | | Merchant will have option of accepting debit cards for signature based transactions |

Impact of Settlement

| • | | Possibility of reduction of signature-based transactions |

| • | | Decrease in interchange revenue for the financial institution |

| | – | | Lower interchange rates |

| • | | Consumer confusion (acceptance) |

Initiatives

| • | | Debit Card Reward/Loyalty Program |

| • | | Turnkey Marketing Tool Kits |

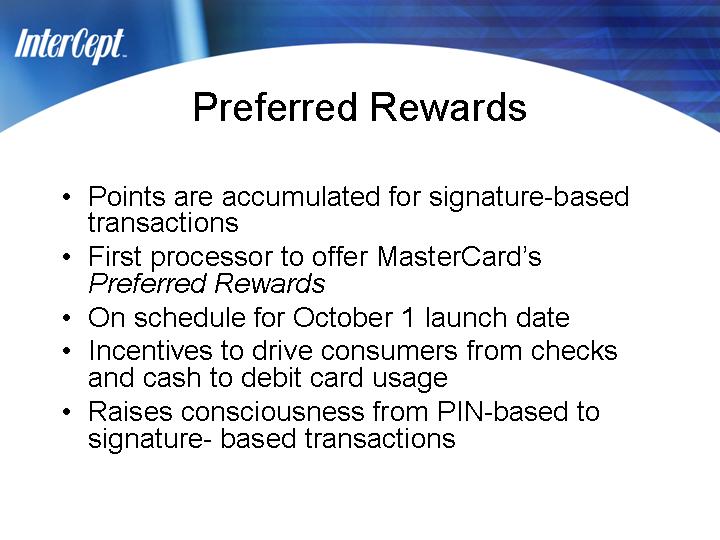

Preferred Rewards

| | • | | Points are accumulated for signature-based transactions |

| | • | | First processor to offer MasterCard’sPreferred Rewards |

| | • | | On schedule for October 1 launch date |

| | • | | Incentives to drive consumers from checks and cash to debit card usage |

| | • | | Raises consciousness from PIN-based to signature- based transactions |

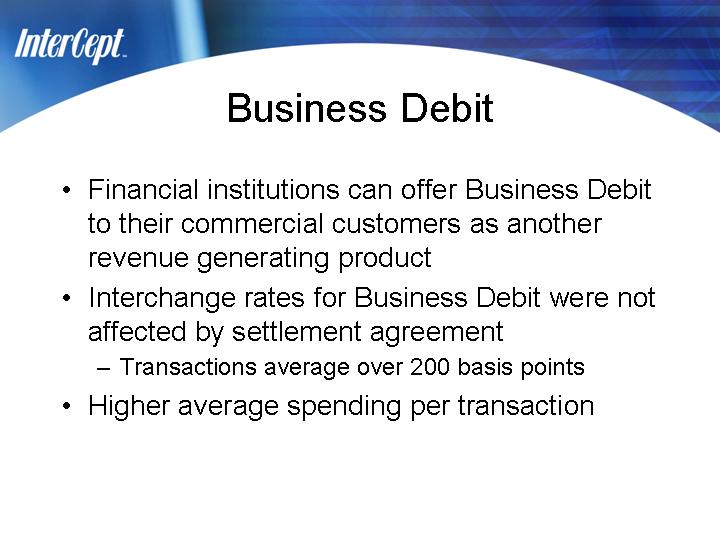

Business Debit

| • | | Financial institutions can offer Business Debit to their commercial customers as another revenue generating product |

| • | | Interchange rates for Business Debit were not affected by settlement agreement |

| | – | | Transactions average over 200 basis points |

| • | | Higher average spending per transaction |

Marketing Tool Kits

| • | | Development of turnkey marketing campaigns |

| • | | Designed to increase activation and usage |

| • | | Targets new merchant demographics |

| | – | | Non-traditional merchants |

| • | | Encourages card over cash (regardless of PIN or signature-based) |

Financial Overview & 2003

Forecast

Scott Meyerhoff

Chief Financial Officer

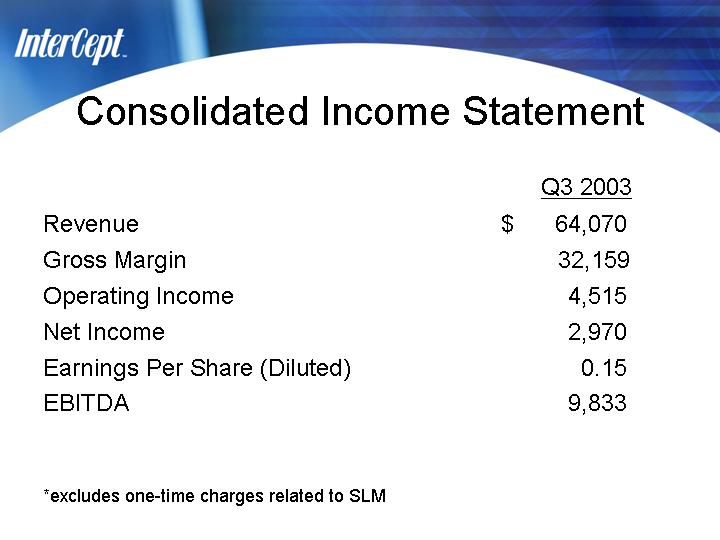

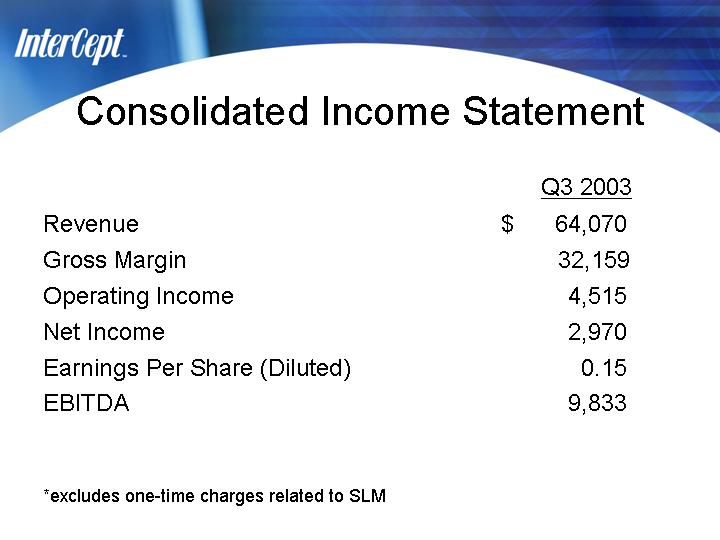

Consolidated Income Statement

| | | Q3 2003

|

Revenue | | $ | 64,070 |

Gross Margin | | | 32,159 |

Operating Income | | | 4,515 |

Net Income | | | 2,970 |

Earnings Per Share (Diluted) | | | 0.15 |

EBITDA | | | 9,833 |

| * | | excludes one-time charges related to SLM |

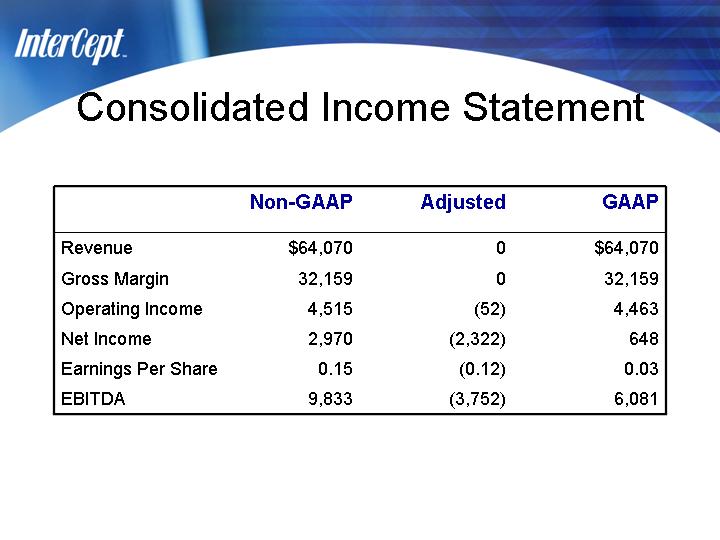

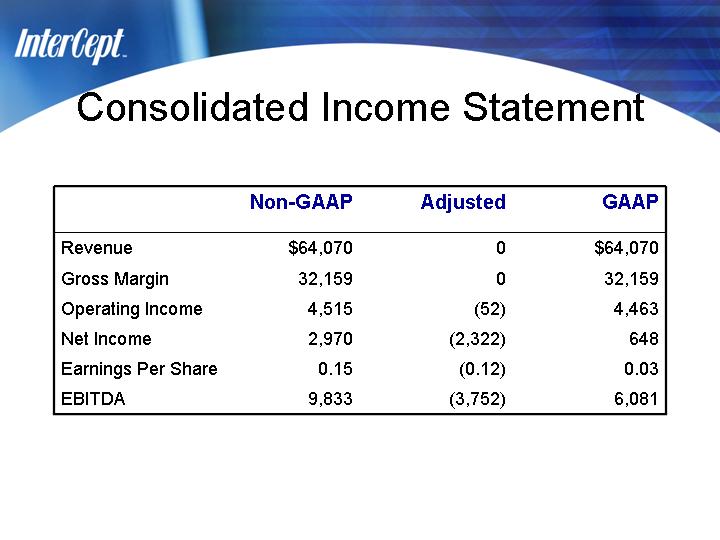

Consolidated Income Statement

| | | Non-GAAP

| | Adjusted

| | | GAAP

|

Revenue | | $ | 64,070 | | 0 | | | $ | 64,070 |

Gross Margin | | | 32,159 | | 0 | | | | 32,159 |

Operating Income | | | 4,515 | | (52 | ) | | | 4,463 |

Net Income | | | 2,970 | | (2,322 | ) | | | 648 |

Earnings Per Share | | | 0.15 | | (0.12 | ) | | | 0.03 |

EBITDA | | | 9,833 | | (3,752 | ) | | | 6,081 |

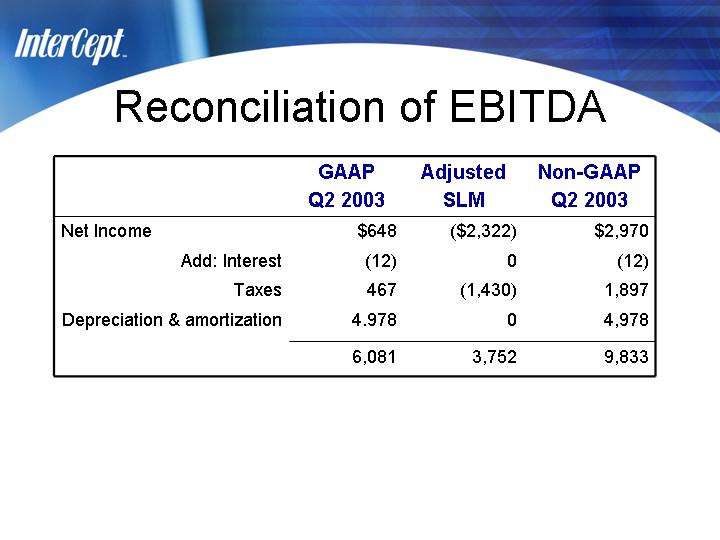

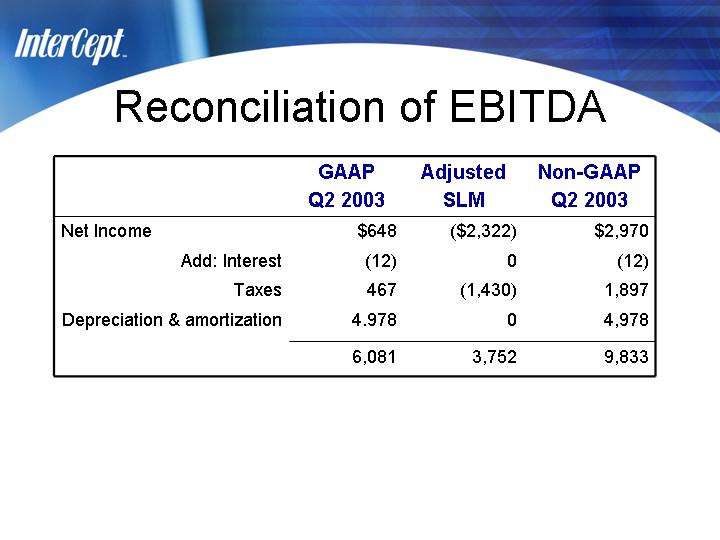

Reconciliation of EBITDA

| | | GAAP Q2 2003

| | | Adjusted SLM

| | | Non-GAAP Q2 2003

| |

Net Income | | $ | 648 | | | $ | (2,322 | ) | | $ | 2,970 | |

Add: Interest | | | (12 | ) | | | 0 | | | | (12 | ) |

Taxes | | | 467 | | | | (1,430 | ) | | | 1,897 | |

Depreciation & amortization | | | 4.978 | | | | 0 | | | | 4,978 | |

| | |

|

|

| |

|

|

| |

|

|

|

| | | | 6,081 | | | | 3,752 | | | | 9,833 | |

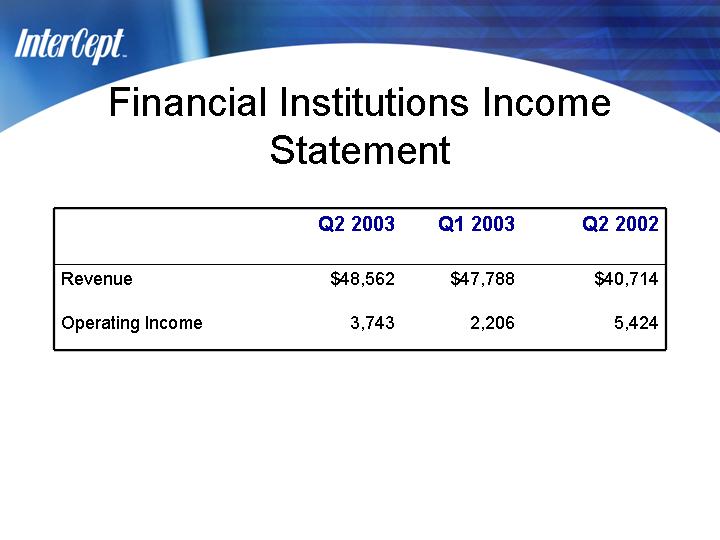

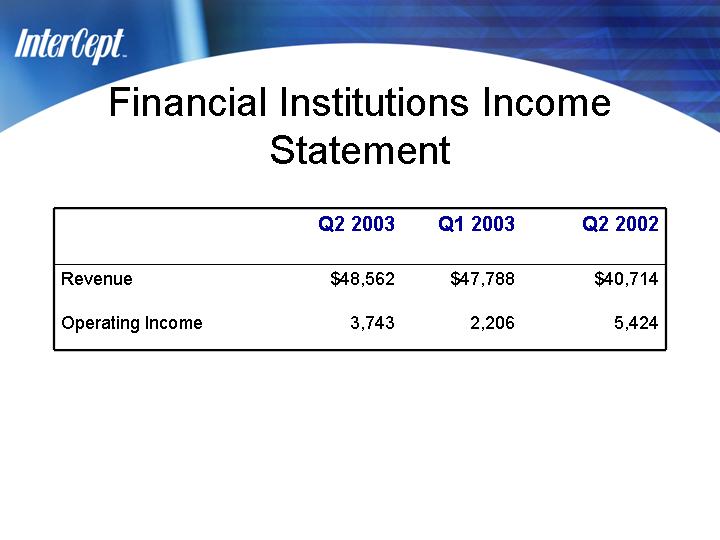

Financial Institutions Income Statement

| | | Q2 2003

| | Q1 2003

| | Q2 2002

|

Revenue | | $ | 48,562 | | $ | 47,788 | | $ | 40,714 |

Operating Income | | | 3,743 | | | 2,206 | | | 5,424 |

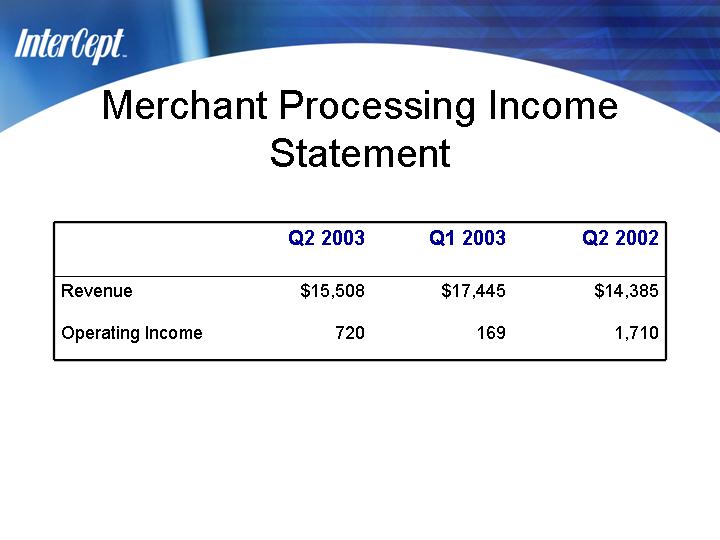

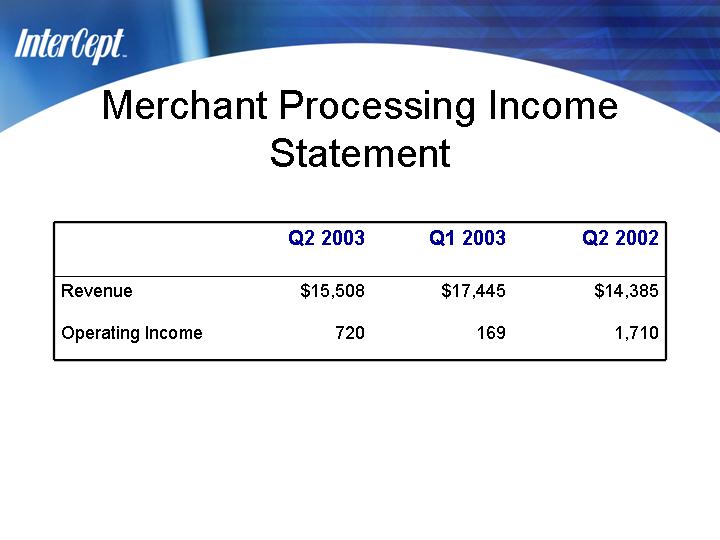

Merchant Processing Income Statement

| | | Q2 2003

| | Q1 2003

| | Q2 2002

|

Revenue | | $ | 15,508 | | $ | 17,445 | | $ | 14,385 |

Operating Income | | | 720 | | | 169 | | | 1,710 |

Credit Facility

| | • | | Commitment letter for $50.0 million credit facility |

| | • | | Three-years in duration |

| | • | | Expected to close by September 30, 2003 |

2003 Update

| | • | | Sovereign conversion completion later than planned |

| | • | | Costs related to debt facility |

| | • | | Net impact of above items $3.0mm pre-tax |

| | • | | Expected EPS FY 2003 = $0.63—$0.68 |

InterCept, Inc.