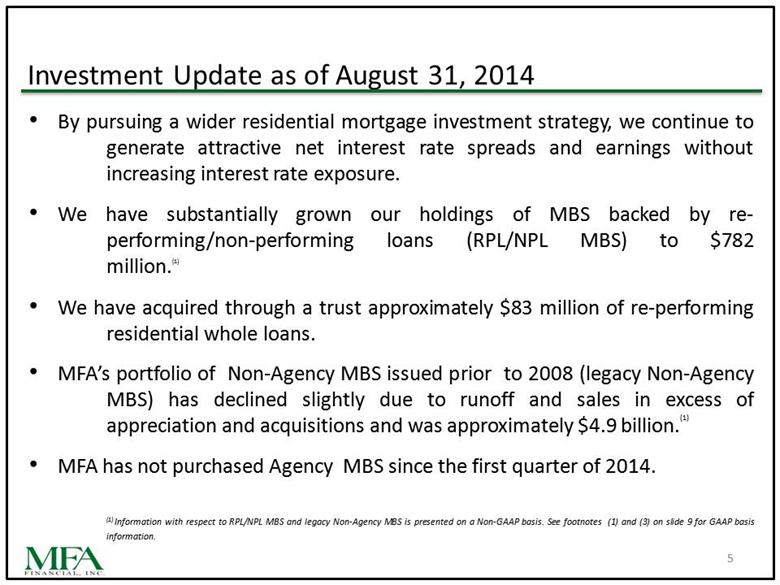

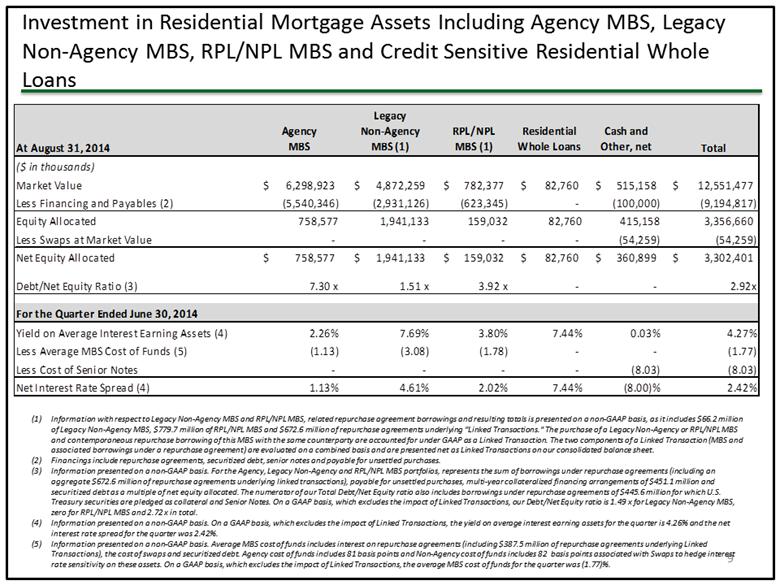

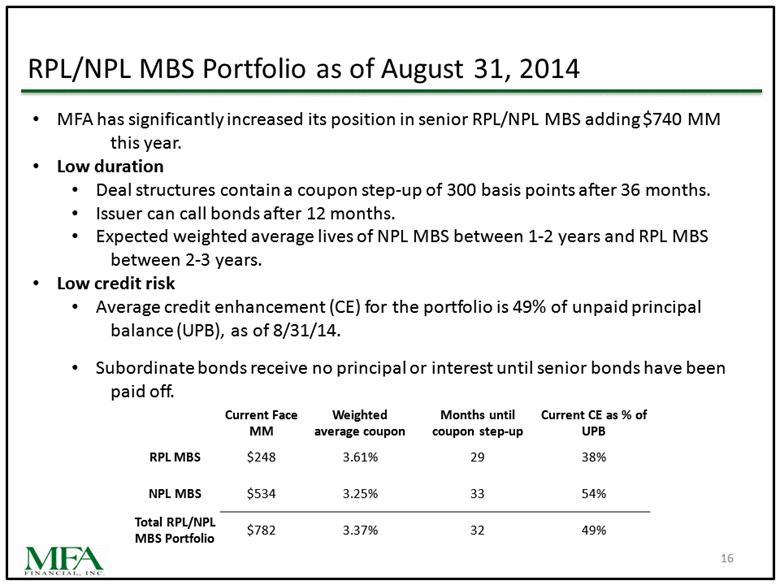

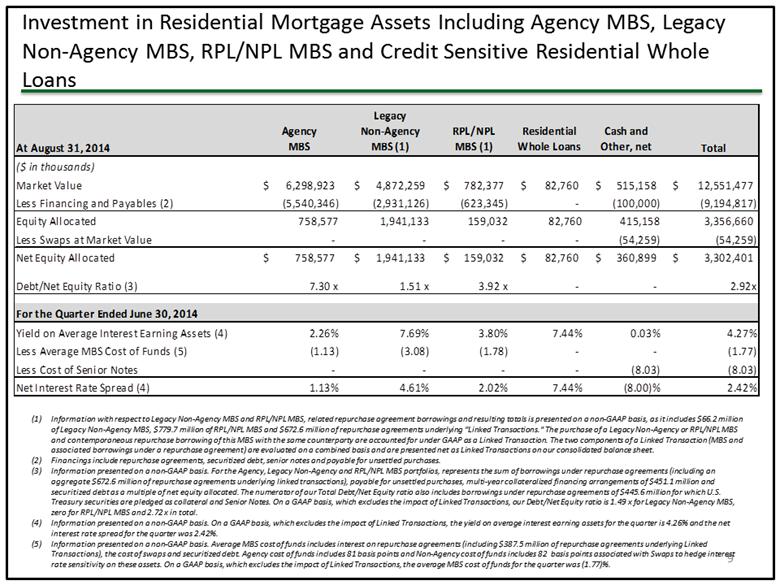

| Investment in Residential Mortgage Assets Including Agency MBS, Legacy Non-Agency MBS, RPL/NPL MBS and Credit Sensitive Residential Whole Loans 9 Information with respect to Legacy Non-Agency MBS and RPL/NPL MBS, related repurchase agreement borrowings and resulting totals is presented on a non-GAAP basis, as it includes $66.2 million of Legacy Non-Agency MBS, $779.7 million of RPL/NPL MBS and $672.6 million of repurchase agreements underlying "Linked Transactions." The purchase of a Legacy Non-Agency or RPL/NPL MBS and contemporaneous repurchase borrowing of this MBS with the same counterparty are accounted for under GAAP as a Linked Transaction. The two components of a Linked Transaction (MBS and associated borrowings under a repurchase agreement) are evaluated on a combined basis and are presented net as Linked Transactions on our consolidated balance sheet. Financings include repurchase agreements, securitized debt, senior notes and payable for unsettled purchases. Information presented on a non-GAAP basis. For the Agency, Legacy Non-Agency and RPL/NPL MBS portfolios, represents the sum of borrowings under repurchase agreements (including an aggregate $672.6 million of repurchase agreements underlying linked transactions), payable for unsettled purchases, multi-year collateralized financing arrangements of $451.1 million and securitized debt as a multiple of net equity allocated. The numerator of our Total Debt/Net Equity ratio also includes borrowings under repurchase agreements of $445.6 million for which U.S. Treasury securities are pledged as collateral and Senior Notes. On a GAAP basis, which excludes the impact of Linked Transactions, our Debt/Net Equity ratio is 1.49 x for Legacy Non-Agency MBS, zero for RPL/NPL MBS and 2.72 x in total. Information presented on a non-GAAP basis. On a GAAP basis, which excludes the impact of Linked Transactions, the yield on average interest earning assets for the quarter is 4.26% and the net interest rate spread for the quarter was 2.42%. Information presented on a non-GAAP basis. Average MBS cost of funds includes interest on repurchase agreements (including $387.5 million of repurchase agreements underlying Linked Transactions), the cost of swaps and securitized debt. Agency cost of funds includes 81 basis points and Non-Agency cost of funds includes 82 basis points associated with Swaps to hedge interest rate sensitivity on these assets. On a GAAP basis, which excludes the impact of Linked Transactions, the average MBS cost of funds for the quarter was (1.77)%. Residential Whole Loans At August 31, 2014 Agency MBS Legacy Non-Agency MBS (1) RPL/NPL MBS (1) Residential Whole Loans Cash and Other, net Total ($ in thousands) Market Value $ 6,298,923 $ 4,872,259 $ 782,377 $ 82,760 $ 515,158 $ 12,551,477 Less Financing and Payables (2) (5,540,346) (2,931,126) (623,345) - (100,000) (9,194,817) Equity Allocated 758,577 1,941,133 159,032 82,760 415,158 3,356,660 Less Swaps at Market Value - - - - (54,259) (54,259) Net Equity Allocated $ 758,577 $ 1,941,133 $ 159,032 $ 82,760 $ 360,899 $ 3,302,401 Debt/Net Equity Ratio (3) 7.30 x 1.51 x 3.92 x - - 2.92x For the Quarter Ended June 30, 2014 Yield on Average Interest Earning Assets (4) 2.26% 7.69% 3.80% 7.44% 0.03% 4.27% Less Average MBS Cost of Funds (5) (1.13) (3.08) (1.78) - - (1.77) Less Cost of Senior Notes - - - - (8.03) (8.03) Net Interest Rate Spread (4) 1.13% 4.61% 2.02% 7.44% (8.00)% 2.42% |