UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT

OF

REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-01766

| Name of Registrant: | Vanguard Wellesley Income Fund |

| Address of Registrant: | P.O. Box 2600 |

| | Valley Forge, PA 19482 |

| Name and address of agent for service: | John E. Schadl, Esquire |

| | P.O. Box 876 |

| | Valley Forge, PA 19482 |

Registrant’s telephone number, including area code: (610) 669-1000

Date of fiscal year end: September 30

Date of reporting period: October 1, 2023—September 30, 2024

Item 1: Reports to Shareholders.

TABLE OF CONTENTS

Vanguard Wellesley® Income Fund

Annual Shareholder Report | September 30, 2024

This annual shareholder report contains important information about Vanguard Wellesley Income Fund (the "Fund") for the period of October 1, 2023, to September 30, 2024. You can find additional information about the Fund at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature. You can also request this information by contacting us at 800-662-7447.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Admiral Shares | $17 | 0.16% |

How did the Fund perform during the reporting period?

For the 12 months ended September 30, 2024, the Fund underperformed its benchmark index.

U.S. economic growth hovered around 3% on a year-over-year basis during the period, quelling recession fears. The Federal Reserve began cutting interest rates for the first time since early 2020, and the year-over-year rate of consumer price inflation eased to around 2.5%. The Bloomberg U.S. Aggregate Bond Index of investment-grade bonds returned about 11.6%. Even with some negative monthly returns, U.S. stocks finished the period up sharply.

In the fixed income portion of the Fund, an underweight allocation to credit risk was the largest detractor from performance. Security selection among corporate issuers helped relative performance, particularly in insurance and electric utilities.

In the equity portion of the Fund, the value that security selection added in a handful of sectors was more than offset by subpar selection in consumer staples and financials, as well as an underweight allocation to financials and an overweight allocation to health care.

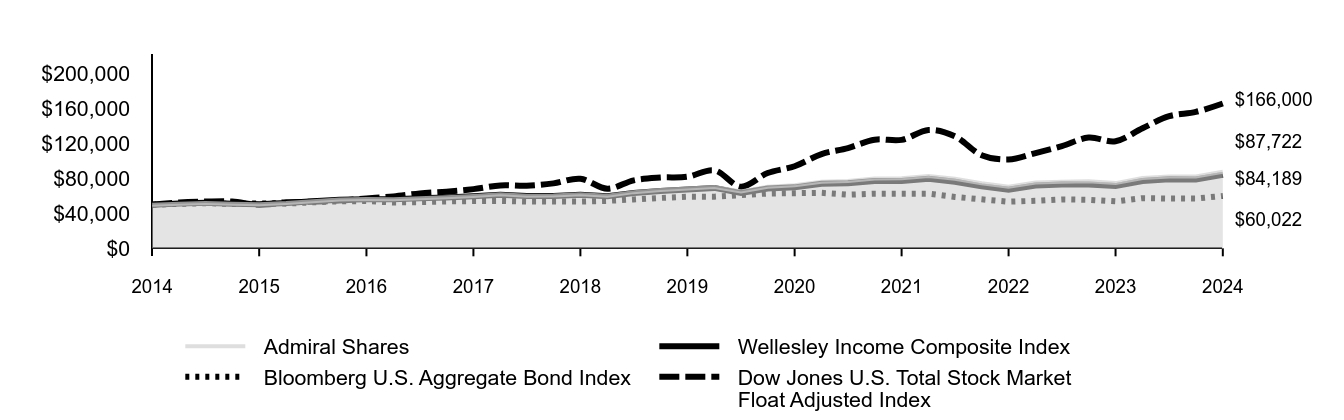

How did the Fund perform over the past 10 years?

Keep in mind that the Fund's past performance does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447. The graph and returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: September 30, 2014, Through September 30, 2024

Initial investment of $50,000

| Admiral Shares | Wellesley Income Composite Index | Bloomberg U.S. Aggregate Bond Index | Dow Jones U.S. Total Stock Market Float Adjusted Index |

|---|

| 2014 | $50,000 | $50,000 | $50,000 | $50,000 |

| 2014 | $51,170 | $51,453 | $50,897 | $52,614 |

| 2015 | $51,816 | $52,137 | $51,715 | $53,561 |

| 2015 | $50,967 | $51,196 | $50,845 | $53,625 |

| 2015 | $50,556 | $50,568 | $51,470 | $49,727 |

| 2015 | $51,860 | $51,862 | $51,177 | $52,846 |

| 2016 | $53,829 | $53,859 | $52,729 | $53,329 |

| 2016 | $55,825 | $55,687 | $53,896 | $54,723 |

| 2016 | $56,439 | $56,258 | $54,143 | $57,150 |

| 2016 | $56,089 | $56,240 | $52,532 | $59,514 |

| 2017 | $57,329 | $57,258 | $52,961 | $62,962 |

| 2017 | $58,638 | $58,324 | $53,726 | $64,856 |

| 2017 | $59,975 | $59,677 | $54,182 | $67,818 |

| 2017 | $61,842 | $61,335 | $54,393 | $72,109 |

| 2018 | $60,335 | $59,921 | $53,598 | $71,673 |

| 2018 | $60,536 | $59,972 | $53,513 | $74,449 |

| 2018 | $62,002 | $61,372 | $53,523 | $79,740 |

| 2018 | $60,304 | $59,624 | $54,399 | $68,290 |

| 2019 | $64,382 | $63,430 | $56,000 | $77,878 |

| 2019 | $66,729 | $65,689 | $57,724 | $81,062 |

| 2019 | $68,585 | $67,461 | $59,034 | $81,983 |

| 2019 | $70,236 | $69,210 | $59,140 | $89,391 |

| 2020 | $65,033 | $63,304 | $61,002 | $70,654 |

| 2020 | $70,541 | $68,526 | $62,769 | $86,261 |

| 2020 | $72,179 | $69,852 | $63,158 | $94,089 |

| 2020 | $76,235 | $74,068 | $63,580 | $107,976 |

| 2021 | $77,028 | $74,623 | $61,436 | $114,939 |

| 2021 | $80,112 | $77,259 | $62,560 | $124,465 |

| 2021 | $80,327 | $77,058 | $62,592 | $124,318 |

| 2021 | $82,771 | $79,657 | $62,600 | $135,680 |

| 2022 | $79,804 | $76,200 | $58,885 | $128,354 |

| 2022 | $74,491 | $70,958 | $56,121 | $106,744 |

| 2022 | $70,597 | $67,167 | $53,454 | $101,873 |

| 2022 | $75,317 | $72,011 | $54,455 | $109,183 |

| 2023 | $76,331 | $73,111 | $56,068 | $117,093 |

| 2023 | $76,927 | $73,255 | $55,595 | $126,920 |

| 2023 | $74,737 | $71,302 | $53,798 | $122,744 |

| 2023 | $80,663 | $77,127 | $57,466 | $137,635 |

| 2024 | $82,210 | $79,252 | $57,020 | $151,462 |

| 2024 | $82,261 | $78,869 | $57,057 | $156,368 |

| 2024 | $87,722 | $84,189 | $60,022 | $166,000 |

Average Annual Total Returns

| | 1 Year | 5 Years | 10 Years |

|---|

| Admiral Shares | 17.37% | 5.05% | 5.78% |

| Wellesley Income Composite Index | 18.07% | 4.53% | 5.35% |

| Bloomberg U.S. Aggregate Bond Index | 11.57% | 0.33% | 1.84% |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | 35.24% | 15.15% | 12.75% |

This table reflects the Fund's investments, including short-term investments, derivatives and other assets and liabilities.

Portfolio Composition % of Net Assets

(as of September 30, 2024)

| Asset-Backed/Commercial Mortgage-Backed Securities | 2.4% |

| Common Stocks | 37.4% |

| Corporate Bonds | 42.4% |

| Sovereign Bonds | 0.7% |

| Taxable Municipal Bonds | 3.1% |

| U.S. Government and Agency Obligations | 12.6% |

Other Assets and Liabilities—NetFootnote Reference | 1.4% |

Fund Statistics

(as of September 30, 2024)

| Fund Net Assets (in millions) | $51,927 |

| Number of Portfolio Holdings | 1,475 |

| Portfolio Turnover Rate | 59% |

| Total Investment Advisory Fees (in thousands) | $28,925 |

Where can I find additional information about the Fund?

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information is available at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature.

Connect with Vanguard® • vanguard.com

Fund Information • 800-662-7447

Direct Investor Account Services • 800-662-2739

Text Telephone for People Who Are Deaf or Hard of Hearing •

800-749-7273

© 2024 The Vanguard Group, Inc.

All rights reserved.

Vanguard Marketing Corporation, Distributor.

AR527

Vanguard Wellesley® Income Fund

Annual Shareholder Report | September 30, 2024

This annual shareholder report contains important information about Vanguard Wellesley Income Fund (the "Fund") for the period of October 1, 2023, to September 30, 2024. You can find additional information about the Fund at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature. You can also request this information by contacting us at 800-662-7447.

What were the Fund costs for the last year?

(based on a hypothetical $10,000 investment)

| Share Class Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

| Investor Shares | $25 | 0.23% |

How did the Fund perform during the reporting period?

For the 12 months ended September 30, 2024, the Fund underperformed its benchmark index.

U.S. economic growth hovered around 3% on a year-over-year basis during the period, quelling recession fears. The Federal Reserve began cutting interest rates for the first time since early 2020, and the year-over-year rate of consumer price inflation eased to around 2.5%. The Bloomberg U.S. Aggregate Bond Index of investment-grade bonds returned about 11.6%. Even with some negative monthly returns, U.S. stocks finished the period up sharply.

In the fixed income portion of the Fund, an underweight allocation to credit risk was the largest detractor from performance. Security selection among corporate issuers helped relative performance, particularly in insurance and electric utilities.

In the equity portion of the Fund, the value that security selection added in a handful of sectors was more than offset by subpar selection in consumer staples and financials, as well as an underweight allocation to financials and an overweight allocation to health care.

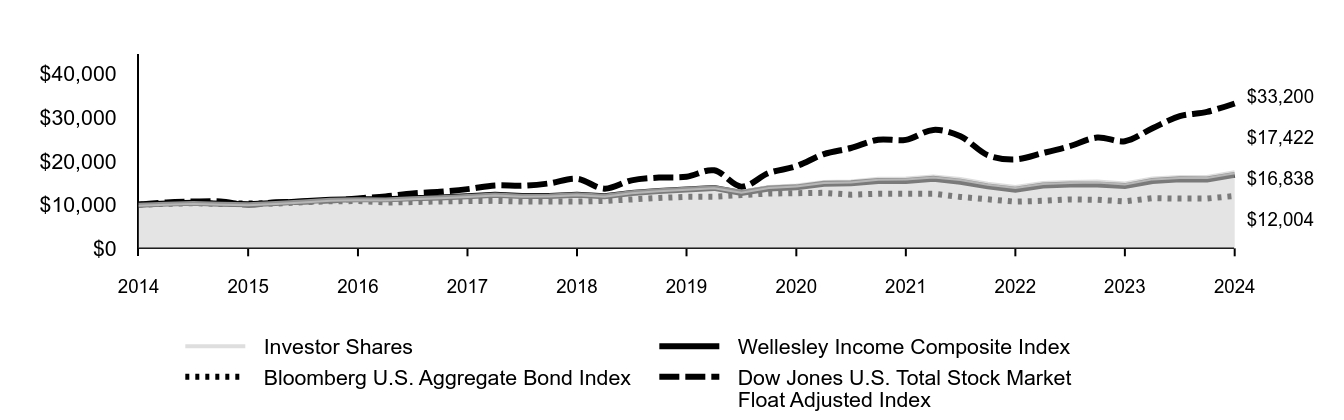

How did the Fund perform over the past 10 years?

Keep in mind that the Fund's past performance does not indicate how the Fund will perform in the future. Updated performance information is available on our website at vanguard.com/performance or by calling Vanguard toll-free at 800-662-7447. The graph and returns shown do not reflect taxes that a shareholder would pay on fund distributions or on the sale of fund shares.

Cumulative Performance: September 30, 2014, Through September 30, 2024

Initial investment of $10,000

| Investor Shares | Wellesley Income Composite Index | Bloomberg U.S. Aggregate Bond Index | Dow Jones U.S. Total Stock Market Float Adjusted Index |

|---|

| 2014 | $10,000 | $10,000 | $10,000 | $10,000 |

| 2014 | $10,233 | $10,291 | $10,179 | $10,523 |

| 2015 | $10,363 | $10,427 | $10,343 | $10,712 |

| 2015 | $10,189 | $10,239 | $10,169 | $10,725 |

| 2015 | $10,103 | $10,114 | $10,294 | $9,945 |

| 2015 | $10,364 | $10,372 | $10,235 | $10,569 |

| 2016 | $10,754 | $10,772 | $10,546 | $10,666 |

| 2016 | $11,154 | $11,137 | $10,779 | $10,945 |

| 2016 | $11,272 | $11,252 | $10,829 | $11,430 |

| 2016 | $11,201 | $11,248 | $10,506 | $11,903 |

| 2017 | $11,447 | $11,452 | $10,592 | $12,592 |

| 2017 | $11,708 | $11,665 | $10,745 | $12,971 |

| 2017 | $11,973 | $11,935 | $10,836 | $13,564 |

| 2017 | $12,343 | $12,267 | $10,879 | $14,422 |

| 2018 | $12,040 | $11,984 | $10,720 | $14,335 |

| 2018 | $12,078 | $11,994 | $10,703 | $14,890 |

| 2018 | $12,366 | $12,274 | $10,705 | $15,948 |

| 2018 | $12,026 | $11,925 | $10,880 | $13,658 |

| 2019 | $12,838 | $12,686 | $11,200 | $15,576 |

| 2019 | $13,303 | $13,138 | $11,545 | $16,212 |

| 2019 | $13,669 | $13,492 | $11,807 | $16,397 |

| 2019 | $13,997 | $13,842 | $11,828 | $17,878 |

| 2020 | $12,959 | $12,661 | $12,200 | $14,131 |

| 2020 | $14,053 | $13,705 | $12,554 | $17,252 |

| 2020 | $14,378 | $13,970 | $12,632 | $18,818 |

| 2020 | $15,181 | $14,814 | $12,716 | $21,595 |

| 2021 | $15,339 | $14,925 | $12,287 | $22,988 |

| 2021 | $15,949 | $15,452 | $12,512 | $24,893 |

| 2021 | $15,990 | $15,412 | $12,518 | $24,864 |

| 2021 | $16,471 | $15,931 | $12,520 | $27,136 |

| 2022 | $15,879 | $15,240 | $11,777 | $25,671 |

| 2022 | $14,818 | $14,192 | $11,224 | $21,349 |

| 2022 | $14,042 | $13,433 | $10,691 | $20,375 |

| 2022 | $14,980 | $14,402 | $10,891 | $21,837 |

| 2023 | $15,177 | $14,622 | $11,214 | $23,419 |

| 2023 | $15,290 | $14,651 | $11,119 | $25,384 |

| 2023 | $14,855 | $14,260 | $10,760 | $24,549 |

| 2023 | $16,028 | $15,425 | $11,493 | $27,527 |

| 2024 | $16,333 | $15,850 | $11,404 | $30,292 |

| 2024 | $16,343 | $15,774 | $11,411 | $31,274 |

| 2024 | $17,422 | $16,838 | $12,004 | $33,200 |

Average Annual Total Returns

| | 1 Year | 5 Years | 10 Years |

|---|

| Investor Shares | 17.29% | 4.97% | 5.71% |

| Wellesley Income Composite Index | 18.07% | 4.53% | 5.35% |

| Bloomberg U.S. Aggregate Bond Index | 11.57% | 0.33% | 1.84% |

| Dow Jones U.S. Total Stock Market Float Adjusted Index | 35.24% | 15.15% | 12.75% |

This table reflects the Fund's investments, including short-term investments, derivatives and other assets and liabilities.

Portfolio Composition % of Net Assets

(as of September 30, 2024)

| Asset-Backed/Commercial Mortgage-Backed Securities | 2.4% |

| Common Stocks | 37.4% |

| Corporate Bonds | 42.4% |

| Sovereign Bonds | 0.7% |

| Taxable Municipal Bonds | 3.1% |

| U.S. Government and Agency Obligations | 12.6% |

Other Assets and Liabilities—NetFootnote Reference | 1.4% |

Fund Statistics

(as of September 30, 2024)

| Fund Net Assets (in millions) | $51,927 |

| Number of Portfolio Holdings | 1,475 |

| Portfolio Turnover Rate | 59% |

| Total Investment Advisory Fees (in thousands) | $28,925 |

Where can I find additional information about the Fund?

Additional information about the Fund, including its prospectus, financial information, holdings, and proxy voting information is available at https://personal1.vanguard.com/ngf-next-gen-form-webapp/fund-literature.

Connect with Vanguard® • vanguard.com

Fund Information • 800-662-7447

Direct Investor Account Services • 800-662-2739

Text Telephone for People Who Are Deaf or Hard of Hearing •

800-749-7273

© 2024 The Vanguard Group, Inc.

All rights reserved.

Vanguard Marketing Corporation, Distributor.

AR27

Item 2: Code of Ethics.

The Registrant has adopted a code of ethics that applies to the Registrant’s principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions. The Code of Ethics was amended during the reporting period covered by this report to make certain technical, non-material changes.

Item 3: Audit Committee Financial Expert.

All members of the Audit Committee have been determined by the Registrant’s Board of Trustees to be Audit Committee Financial Experts and to be independent: F. Joseph Loughrey, Mark Loughridge, Sarah Bloom Raskin, and Peter F. Volanakis.

Item 4: Principal Accountant Fees and Services.

Includes fees billed in connection with services to the Registrant only.

| | | Fiscal Year Ended

September 30,

2024 | | | Fiscal Year Ended

September 30,

2023 | |

| (a) Audit Fees. | | $ | 30,000 | | | $ | 28,000 | |

| (b) Audit-Related Fees. | | | 0 | | | | 0 | |

| (c) Tax Fees. | | | 0 | | | | 0 | |

| (d) All Other Fees. | | | 0 | | | | 0 | |

| Total. | | $ | 30,000 | | | $ | 28,000 | |

| (e) | (1) Pre-Approval Policies. The audit committee is responsible for pre-approving all audit and non-audit services provided by PwC to: (i) the Vanguard funds; and (ii) Vanguard, or any entity controlled by Vanguard that provides ongoing services to the Vanguard funds. All services provided to Vanguard entities by the independent auditor, whether or not they are subject to preapproval, must be disclosed to the audit committee. The audit committee chair may preapprove any permissible audit and non-audit services as long as any preapproval is brought to the attention of the full audit committee at the next scheduled meeting. |

(2) No percentage of the principal accountant’s fees or services were approved pursuant to the waiver provision of paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

| (f) | For the most recent fiscal year, over 50% of the hours worked under the principal accountant’s engagement were not performed by persons other than full-time, permanent employees of the principal accountant. |

| (g) | Aggregate Non-Audit Fees. |

Includes fees billed for non-audit services provided to the Registrant, other registered investment companies in the Vanguard complex, The Vanguard Group, Inc., and Vanguard Marketing Corporation.

| | | Fiscal Year Ended

September 30,

2024 | | | Fiscal Year Ended

September 30,

2023 | |

| Non-audit fees to the Registrant only, listed as (b) through (d) above. | | $ | 0 | | | $ | 0 | |

| | | | | | | | | |

| Non-audit Fees to other registered investment companies in the Vanguard complex, The Vanguard Group, Inc., and Vanguard Marketing Corporation. | | | | | | | | |

| Audit-Related Fees. | | $ | 3,508,505 | | | $ | 3,295,934 | |

| Tax Fees. | | $ | 2,017,364 | | | $ | 1,678,928 | |

| All Other Fees. | | $ | 268,000 | | | $ | 25,000 | |

| Total. | | $ | 5,793,869 | | | $ | 4,999,862 | |

| (h) | For the most recent fiscal year, the Audit Committee has determined that the provision of all non-audit services was consistent with maintaining the principal accountant’s independence. |

Item 5: Audit Committee of Listed Registrants.

The Registrant is a listed issuer as defined in rule 10A-3 under the Securities Exchange Act of 1934 (“Exchange Act”). The Registrant has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Registrant’s audit committee members are: F. Joseph Loughrey, Mark Loughridge, Sarah Bloom Raskin, and Peter F. Volanakis.

Item 6: Investments.

Not applicable. The complete schedule of investments is included in the financial statements filed under Item 7 of this Form.

Item 7: Financial Statements and Financial Highlights for Open-End Management Investment Companies.

Financial Statements

For the year ended September 30, 2024

Vanguard Wellesley® Income Fund

Contents

Financial Statements

| 1 |

Report of Independent Registered Public Accounting Firm

| 33 |

Tax information

| 34 |

| | |

Schedule of Investments

As of September 30, 2024

The fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (SEC) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The fund’s Form N-PORT reports are available on the SEC’s website at www.sec.gov.

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| U.S. Government and Agency Obligations (12.6%) |

| U.S. Government Securities (10.7%) |

| | United States Treasury Note/Bond | 4.250% | 12/31/25 | 110,000 | 110,498 |

| | United States Treasury Note/Bond | 4.500% | 7/15/26 | 2,860 | 2,900 |

| | United States Treasury Note/Bond | 4.375% | 7/31/26 | 334,010 | 338,029 |

| | United States Treasury Note/Bond | 3.750% | 8/31/26 | 334,070 | 334,539 |

| | United States Treasury Note/Bond | 1.250% | 12/31/26 | 823 | 781 |

| | United States Treasury Note/Bond | 4.125% | 2/15/27 | 248,540 | 251,414 |

| | United States Treasury Note/Bond | 4.250% | 3/15/27 | 145,449 | 147,699 |

| | United States Treasury Note/Bond | 2.500% | 3/31/27 | 21,240 | 20,696 |

| | United States Treasury Note/Bond | 2.750% | 4/30/27 | 42,750 | 41,868 |

| | United States Treasury Note/Bond | 4.500% | 5/15/27 | 171,890 | 175,758 |

| | United States Treasury Note/Bond | 4.375% | 7/15/27 | 181,281 | 185,076 |

| | United States Treasury Note/Bond | 2.750% | 7/31/27 | 13,431 | 13,131 |

| | United States Treasury Note/Bond | 3.750% | 8/15/27 | 155,010 | 155,737 |

| | United States Treasury Note/Bond | 3.125% | 8/31/27 | 29,986 | 29,616 |

| | United States Treasury Note/Bond | 4.125% | 9/30/27 | 11,500 | 11,683 |

| | United States Treasury Note/Bond | 4.125% | 10/31/27 | 20,000 | 20,319 |

| | United States Treasury Note/Bond | 3.875% | 11/30/27 | 15,520 | 15,656 |

| | United States Treasury Note/Bond | 3.875% | 12/31/27 | 27,964 | 28,226 |

| | United States Treasury Note/Bond | 4.000% | 2/29/28 | 28,601 | 28,994 |

| | United States Treasury Note/Bond | 3.625% | 3/31/28 | 26,615 | 26,669 |

| | United States Treasury Note/Bond | 3.625% | 5/31/28 | 12,580 | 12,600 |

| | United States Treasury Note/Bond | 4.000% | 6/30/28 | 6,686 | 6,786 |

| | United States Treasury Note/Bond | 4.125% | 7/31/28 | 107,567 | 109,668 |

| | United States Treasury Note/Bond | 4.375% | 8/31/28 | 90,667 | 93,288 |

| | United States Treasury Note/Bond | 4.625% | 9/30/28 | 130,336 | 135,386 |

| | United States Treasury Note/Bond | 4.375% | 11/30/28 | 52,289 | 53,890 |

| | United States Treasury Note/Bond | 3.750% | 12/31/28 | 150,790 | 151,827 |

| | United States Treasury Note/Bond | 4.000% | 1/31/29 | 245,134 | 249,309 |

| | United States Treasury Note/Bond | 1.875% | 2/28/29 | 2,855 | 2,658 |

| | United States Treasury Note/Bond | 4.250% | 2/28/29 | 240,925 | 247,626 |

| | United States Treasury Note/Bond | 4.125% | 3/31/29 | 206,218 | 210,923 |

| | United States Treasury Note/Bond | 4.625% | 4/30/29 | 219,099 | 228,787 |

| | United States Treasury Note/Bond | 4.500% | 5/31/29 | 71,014 | 73,854 |

| | United States Treasury Note/Bond | 4.250% | 6/30/29 | 159,390 | 164,072 |

| | United States Treasury Note/Bond | 4.000% | 7/31/29 | 228,594 | 232,952 |

| | United States Treasury Note/Bond | 3.625% | 8/31/29 | 49,598 | 49,753 |

| | United States Treasury Note/Bond | 3.500% | 4/30/30 | 10,160 | 10,104 |

| | United States Treasury Note/Bond | 3.750% | 5/31/30 | 13,152 | 13,240 |

| | United States Treasury Note/Bond | 4.000% | 7/31/30 | 20,991 | 21,401 |

| | United States Treasury Note/Bond | 4.875% | 10/31/30 | 4,037 | 4,308 |

| | United States Treasury Note/Bond | 3.750% | 12/31/30 | 58,924 | 59,274 |

| | United States Treasury Note/Bond | 4.250% | 2/28/31 | 7,180 | 7,425 |

| | United States Treasury Note/Bond | 4.125% | 7/31/31 | 25,849 | 26,572 |

| | United States Treasury Note/Bond | 4.500% | 11/15/33 | 94,328 | 99,619 |

| 1 | United States Treasury Note/Bond | 4.000% | 2/15/34 | 203,679 | 207,211 |

| | United States Treasury Note/Bond | 4.375% | 5/15/34 | 335,799 | 351,697 |

| | United States Treasury Note/Bond | 3.875% | 8/15/34 | 61,072 | 61,492 |

| | United States Treasury Note/Bond | 2.000% | 11/15/41 | 152,871 | 112,384 |

| | United States Treasury Note/Bond | 3.375% | 8/15/42 | 51,456 | 46,431 |

| | United States Treasury Note/Bond | 4.000% | 11/15/42 | 117,907 | 116,028 |

| | United States Treasury Note/Bond | 3.875% | 2/15/43 | 45,866 | 44,261 |

| | United States Treasury Note/Bond | 4.750% | 11/15/43 | 47,755 | 51,523 |

| | United States Treasury Note/Bond | 4.500% | 2/15/44 | 26,384 | 27,530 |

| | United States Treasury Note/Bond | 4.625% | 5/15/44 | 83,077 | 88,062 |

| | United States Treasury Note/Bond | 4.125% | 8/15/44 | 12,373 | 12,276 |

| | United States Treasury Note/Bond | 3.625% | 5/15/53 | 706 | 642 |

| | United States Treasury Note/Bond | 4.750% | 11/15/53 | 4,770 | 5,269 |

| | United States Treasury Note/Bond | 4.250% | 2/15/54 | 45,033 | 45,899 |

| | United States Treasury Note/Bond | 4.625% | 5/15/54 | 55,479 | 60,178 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | United States Treasury Note/Bond | 4.250% | 8/15/54 | 113,697 | 116,096 |

| | | | | | | 5,551,590 |

| Agency Bonds and Notes (0.0%) |

| | Tennessee Valley Authority | 4.625% | 9/15/60 | 19,800 | 19,476 |

| Conventional Mortgage-Backed Securities (1.6%) |

| 2,3 | Fannie Mae Pool | 1.770% | 1/1/36 | 20,188 | 16,252 |

| 2,4 | Ginnie Mae | 5.000% | 10/15/54 | 74,017 | 74,153 |

| 2 | Ginnie Mae I Pool | 6.000% | 6/15/31–7/15/35 | 12 | 12 |

| 2 | Ginnie Mae I Pool | 6.500% | 4/15/32–7/15/38 | 1,022 | 1,073 |

| 2,3 | UMBS Pool | 2.500% | 8/1/27–4/1/38 | 20,107 | 18,871 |

| 2,3 | UMBS Pool | 3.000% | 6/1/43 | 5,421 | 4,999 |

| 2,3 | UMBS Pool | 5.000% | 8/1/52–7/1/53 | 46,023 | 46,145 |

| 2,3 | UMBS Pool | 5.500% | 3/1/53–2/1/54 | 357,430 | 362,167 |

| 2,3,4 | UMBS Pool | 6.000% | 10/1/53–10/15/54 | 278,225 | 284,402 |

| | | | | | | 808,074 |

| Nonconventional Mortgage-Backed Securities (0.3%) |

| 2,3 | Fannie Mae REMICS | 1.250% | 2/25/28 | 3,601 | 3,466 |

| 2,3 | Fannie Mae REMICS | 3.500% | 4/25/31–11/25/57 | 47,227 | 45,846 |

| 2,3 | Fannie Mae REMICS | 3.000% | 12/25/39–9/25/57 | 28,763 | 26,531 |

| 2,3 | Fannie Mae REMICS | 1.500% | 8/25/41 | 1,668 | 1,593 |

| 2,3 | Fannie Mae REMICS | 1.700% | 6/25/43 | 443 | 436 |

| 2,3 | Fannie Mae REMICS | 2.000% | 6/25/43–6/25/44 | 3,322 | 3,169 |

| 2,3 | Fannie Mae REMICS | 2.500% | 8/25/46–2/25/47 | 32,009 | 27,295 |

| 2,3 | Fannie Mae REMICS | 4.000% | 7/25/53 | 1,539 | 1,529 |

| 2,3 | Freddie Mac REMICS | 4.000% | 12/15/30–2/15/31 | 2,218 | 2,222 |

| 2,3 | Freddie Mac REMICS | 3.500% | 3/15/31–12/15/46 | 14,766 | 13,874 |

| 2,3 | Freddie Mac REMICS | 2.000% | 9/15/31 | 3,265 | 3,198 |

| 2,3 | Freddie Mac REMICS | 2.500% | 9/15/32 | 35 | 35 |

| 2,3 | Freddie Mac REMICS | 3.000% | 6/15/44–5/15/46 | 29,295 | 27,131 |

| | | | | | | 156,325 |

| Total U.S. Government and Agency Obligations (Cost $6,456,671) | 6,535,465 |

| Asset-Backed/Commercial Mortgage-Backed Securities (2.4%) |

| 2,5 | Aaset Trust Class A Series 2019-1 | 3.844% | 5/15/39 | 865 | 835 |

| 2,5 | Affirm Asset Securitization Trust Class A Series 2021-Z2 | 1.170% | 11/16/26 | 475 | 469 |

| 2,5 | Aligned Data Centers Issuer LLC Class A2 Series 2021-1A | 1.937% | 8/15/46 | 43,730 | 41,447 |

| 2 | American Express Credit Account Master Trust Class A Series 2023-4 | 5.150% | 9/15/30 | 42,305 | 44,040 |

| 2,5,6 | Angel Oak Mortgage Trust Class A1 Series 2019-5 | 2.593% | 10/25/49 | 888 | 867 |

| 2,5,6 | Angel Oak Mortgage Trust Class A1 Series 2019-6 | 2.620% | 11/25/59 | 2,259 | 2,211 |

| 2,5,6 | Angel Oak Mortgage Trust Class A1 Series 2021-6 | 1.458% | 9/25/66 | 20,132 | 16,845 |

| 2,5,6 | BX Trust Class A Series 2021-ARIA, TSFR1M + 1.014% | 6.111% | 10/15/36 | 14,465 | 14,384 |

| 2,5 | Castlelake Aircraft Structured Trust Class A Series 2019-1A | 3.967% | 4/15/39 | 15,444 | 14,133 |

| 2,5 | CF Hippolyta Issuer LLC Class A1 Series 2020-1 | 1.690% | 7/15/60 | 4,983 | 4,821 |

| 2,5 | CF Hippolyta Issuer LLC Class A1 Series 2020-1A | 5.970% | 8/15/62 | 3,520 | 3,538 |

| 2,5 | CF Hippolyta LLC Class A1 Series 2021-A1 | 1.530% | 3/15/61 | 38,386 | 36,062 |

| 2,5 | DB Master Finance LLC Class A2II Series 2019-1A | 4.021% | 5/20/49 | 12,854 | 12,693 |

| 2,5 | Domino's Pizza Master Issuer LLC Class A2I Series 2021-1A | 2.662% | 4/25/51 | 16,542 | 15,240 |

| 2,5 | Domino's Pizza Master Issuer LLC Class A2II Series 2021-1A | 3.151% | 4/25/51 | 25,903 | 23,324 |

| 2,5 | Enterprise Fleet Financing LLC Class A2 Series 2023-3 | 6.400% | 3/20/30 | 40,938 | 41,845 |

| 2,5 | Enterprise Fleet Financing LLC Class A2 Series 2024-1 | 5.230% | 3/20/30 | 19,245 | 19,429 |

| 2,3,6 | Fannie Mae Connecticut Avenue Securities Class 2M2 Series 2016-C03, SOFR30A + 6.014% | 11.295% | 10/25/28 | 1,462 | 1,532 |

| 2,5 | FirstKey Homes Trust Class A Series 2021-SFR1 | 1.538% | 8/17/38 | 63,988 | 60,801 |

| 2,5 | Ford Credit Floorplan Master Owner Trust Class A1 Series 2024-1 | 5.290% | 4/15/29 | 40,670 | 41,665 |

| 2,3 | Freddie Mac Multifamily Structured Pass Through Certificates Class A2 Series K-1521 | 2.184% | 8/25/36 | 17,210 | 13,716 |

| 2,3 | Freddie Mac Multifamily Structured Pass Through Certificates Class A2 Series K516 | 5.477% | 1/25/29 | 41,561 | 43,759 |

| 2,3 | Freddie Mac Multifamily Structured Pass Through Certificates Class A2 Series K733 | 3.750% | 8/25/25 | 10,021 | 9,951 |

| 2,3 | Freddie Mac Multifamily Structured Pass Through Certificates Class A3 Series K-1512 | 3.059% | 4/25/34 | 7,200 | 6,523 |

| 2,3 | Freddie Mac Multifamily Structured Pass Through Certificates Class A3 Series K-1513 | 2.797% | 8/25/34 | 7,552 | 6,665 |

| 2,3 | Freddie Mac Seasoned Credit Risk Transfer Trust Class MA Series 2019-3 | 3.500% | 10/25/58 | 18,783 | 18,233 |

| 2 | Ginnie Mae REMICS Class KA Series 2021-215 | 2.500% | 10/20/49 | 62,935 | 56,500 |

| 2 | GM Financial Automobile Leasing Trust Class A3 Series 2024-2 | 5.390% | 7/20/27 | 22,150 | 22,555 |

| 2 | GM Financial Automobile Leasing Trust Class A3 Series 2024-2 | 5.100% | 3/16/29 | 23,030 | 23,468 |

| 2 | GM Financial Consumer Automobile Receivables Trust Class A3 Series 2023-2 | 4.470% | 2/16/28 | 18,225 | 18,250 |

| 2,5 | GM Financial Revolving Receivables Trust Class A Series 2023-2 | 5.770% | 8/11/36 | 31,269 | 32,997 |

| 2,5 | GM Financial Revolving Receivables Trust Class A Series 2024-1 | 4.980% | 12/11/36 | 50,295 | 51,634 |

| 2,5 | GMF Floorplan Owner Revolving Trust Class A Series 2024-2A | 5.060% | 3/15/31 | 22,795 | 23,485 |

| 2,5 | Home Partners of America Trust Class A Series 2021-2 | 1.901% | 12/17/26 | 31,920 | 30,168 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| 2 | Honda Auto Receivables Owner Trust Class A3 Series 2024-2 | 5.270% | 11/20/28 | 29,595 | 30,243 |

| 2,5 | Horizon Aircraft Finance II Ltd. Class A Series 2019-1 | 3.721% | 7/15/39 | 6,478 | 6,091 |

| 2,5 | Horizon Aircraft Finance III Ltd. Class A Series 2019-2 | 3.425% | 11/15/39 | 7,798 | 7,096 |

| 2,5 | MACH 1 Cayman Ltd. Class A Series 2019-1 | 3.474% | 10/15/39 | 6,095 | 5,669 |

| 2,5 | MAPS Ltd. Class A Series 2019-1A | 4.458% | 3/15/44 | 1,683 | 1,544 |

| 2,5 | New Economy Assets Phase 1 Sponsor LLC Class A1 Series 2021-1 | 1.910% | 10/20/61 | 122,825 | 113,209 |

| 2,5 | New Economy Assets Phase 1 Sponsor LLC Class B1 Series 2021-1 | 2.410% | 10/20/61 | 10,130 | 9,115 |

| 2,5 | OneMain Direct Auto Receivables Trust Class A Series 2021-1A | 0.870% | 7/14/28 | 12,189 | 11,952 |

| 2,5 | Retained Vantage Data Centers Issuer LLC Class A2A Series 2023-1A | 5.000% | 9/15/48 | 44,028 | 43,897 |

| 2,5,6 | SFAVE Commercial Mortgage Securities Trust Class A2B Series 2015-5AVE | 4.144% | 1/5/43 | 22,000 | 19,364 |

| 2,5 | SoFi Professional Loan Program Trust Class AFX Series 2021-B | 1.140% | 2/15/47 | 11,647 | 10,246 |

| 2,5 | Start II Ltd. Class A Series 2019-1 | 4.089% | 3/15/44 | 7,835 | 7,561 |

| 2,5 | Taco Bell Funding LLC Class A2I Series 2021-1A | 1.946% | 8/25/51 | 20,210 | 18,940 |

| 2,5 | Taco Bell Funding LLC Class A2II Series 2021-1A | 2.294% | 8/25/51 | 36,077 | 32,407 |

| 2,5 | Vantage Data Centers Issuer LLC Class A2 Series 2020-1A | 1.645% | 9/15/45 | 28,188 | 27,263 |

| 2,5 | Vantage Data Centers Issuer LLC Class A2 Series 2021-1A | 2.165% | 10/15/46 | 38,425 | 36,457 |

| 2 | Volkswagen Auto Lease Trust Class A3 Series 2024-A | 5.210% | 6/21/27 | 16,695 | 16,980 |

| 2,5 | Wheels Fleet Lease Funding 1 LLC Class A Series 2023-1A | 5.800% | 4/18/38 | 42,940 | 43,260 |

| 2,5 | Wheels Fleet Lease Funding 1 LLC Class A Series 2023-2A | 6.460% | 8/18/38 | 22,705 | 22,978 |

| 2,5 | Wheels Fleet Lease Funding 1 LLC Class A1 Series 2024-2A | 4.870% | 6/21/39 | 19,405 | 19,579 |

| Total Asset-Backed/Commercial Mortgage-Backed Securities (Cost $1,265,896) | 1,237,936 |

| Corporate Bonds (42.4%) |

| Communications (2.9%) |

| | America Movil SAB de CV | 3.625% | 4/22/29 | 25,600 | 24,786 |

| | America Movil SAB de CV | 6.125% | 3/30/40 | 10,010 | 10,878 |

| | AT&T Inc. | 2.750% | 6/1/31 | 71,900 | 64,993 |

| | AT&T Inc. | 5.400% | 2/15/34 | 84,400 | 88,548 |

| | AT&T Inc. | 3.500% | 6/1/41 | 3,825 | 3,134 |

| | AT&T Inc. | 4.300% | 12/15/42 | 10,645 | 9,490 |

| | AT&T Inc. | 3.650% | 6/1/51 | 1,686 | 1,293 |

| | Charter Communications Operating LLC / Charter Communications Operating Capital | 3.500% | 3/1/42 | 21,136 | 14,689 |

| | Comcast Corp. | 4.250% | 1/15/33 | 7,560 | 7,426 |

| | Comcast Corp. | 4.200% | 8/15/34 | 30,155 | 29,161 |

| | Comcast Corp. | 4.400% | 8/15/35 | 32,657 | 31,847 |

| | Comcast Corp. | 3.750% | 4/1/40 | 2,300 | 1,990 |

| | Comcast Corp. | 3.969% | 11/1/47 | 40,576 | 33,894 |

| | Comcast Corp. | 4.000% | 3/1/48 | 17,415 | 14,596 |

| | Comcast Corp. | 3.999% | 11/1/49 | 26,848 | 22,407 |

| | Comcast Corp. | 2.887% | 11/1/51 | 37,513 | 25,182 |

| | Comcast Corp. | 2.450% | 8/15/52 | 35,080 | 21,340 |

| | Comcast Corp. | 4.049% | 11/1/52 | 19,891 | 16,535 |

| | Comcast Corp. | 5.350% | 5/15/53 | 54,022 | 55,250 |

| | Comcast Corp. | 2.937% | 11/1/56 | 156,916 | 102,510 |

| | Comcast Corp. | 2.987% | 11/1/63 | 92,954 | 58,906 |

| 5 | Cox Communications Inc. | 4.800% | 2/1/35 | 58,525 | 55,819 |

| | Meta Platforms Inc. | 4.950% | 5/15/33 | 49,016 | 51,359 |

| | Meta Platforms Inc. | 5.600% | 5/15/53 | 29,815 | 32,326 |

| | Meta Platforms Inc. | 5.400% | 8/15/54 | 19,205 | 20,111 |

| | Meta Platforms Inc. | 5.750% | 5/15/63 | 15,300 | 16,736 |

| | NBCUniversal Media LLC | 4.450% | 1/15/43 | 10,245 | 9,412 |

| 5 | NBN Co. Ltd. | 1.625% | 1/8/27 | 25,935 | 24,468 |

| 5 | NBN Co. Ltd. | 2.625% | 5/5/31 | 38,645 | 34,426 |

| 5 | NBN Co. Ltd. | 2.500% | 1/8/32 | 68,983 | 60,025 |

| 5 | NTT Finance Corp. | 1.162% | 4/3/26 | 76,700 | 73,268 |

| 5 | NTT Finance Corp. | 2.065% | 4/3/31 | 9,240 | 7,971 |

| | Omnicom Group Inc. | 5.300% | 11/1/34 | 13,535 | 14,064 |

| 5 | Ooredoo International Finance Ltd. | 2.625% | 4/8/31 | 45,300 | 41,029 |

| | Orange SA | 9.000% | 3/1/31 | 47,066 | 58,219 |

| 2,5 | Sprint Spectrum Co. LLC / Sprint Spectrum Co. II LLC / Sprint Spectrum Co. III LLC | 4.738% | 9/20/29 | 5,492 | 5,481 |

| | T-Mobile USA Inc. | 2.050% | 2/15/28 | 42,480 | 39,553 |

| | T-Mobile USA Inc. | 4.200% | 10/1/29 | 42,788 | 42,591 |

| | T-Mobile USA Inc. | 3.875% | 4/15/30 | 73,575 | 71,550 |

| | T-Mobile USA Inc. | 2.550% | 2/15/31 | 15,310 | 13,641 |

| | T-Mobile USA Inc. | 2.250% | 11/15/31 | 5,105 | 4,404 |

| | T-Mobile USA Inc. | 4.375% | 4/15/40 | 17,030 | 15,704 |

| | T-Mobile USA Inc. | 3.000% | 2/15/41 | 4,964 | 3,811 |

| | T-Mobile USA Inc. | 4.500% | 4/15/50 | 1,418 | 1,260 |

| | T-Mobile USA Inc. | 5.250% | 6/15/55 | 37,810 | 37,606 |

| | T-Mobile USA Inc. | 3.600% | 11/15/60 | 3,825 | 2,775 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | Uber Technologies Inc. | 4.800% | 9/15/34 | 8,340 | 8,331 |

| | Uber Technologies Inc. | 5.350% | 9/15/54 | 9,575 | 9,497 |

| | Verizon Communications Inc. | 2.355% | 3/15/32 | 23,109 | 19,905 |

| | Verizon Communications Inc. | 4.812% | 3/15/39 | 46,984 | 46,216 |

| | Verizon Communications Inc. | 3.400% | 3/22/41 | 2,500 | 2,043 |

| | Verizon Communications Inc. | 3.850% | 11/1/42 | 2,400 | 2,051 |

| | Verizon Communications Inc. | 2.875% | 11/20/50 | 4,045 | 2,739 |

| | Verizon Communications Inc. | 3.000% | 11/20/60 | 4,193 | 2,699 |

| | Walt Disney Co. | 3.500% | 5/13/40 | 48,198 | 41,035 |

| | | | | | | 1,510,980 |

| Consumer Discretionary (1.5%) |

| | Amazon.com Inc. | 3.600% | 4/13/32 | 75,375 | 72,831 |

| | Amazon.com Inc. | 2.875% | 5/12/41 | 2,100 | 1,671 |

| | Amazon.com Inc. | 4.950% | 12/5/44 | 15,220 | 15,804 |

| | Amazon.com Inc. | 4.050% | 8/22/47 | 1,700 | 1,528 |

| | Amazon.com Inc. | 3.950% | 4/13/52 | 16,465 | 14,336 |

| | Amazon.com Inc. | 4.250% | 8/22/57 | 32,895 | 29,733 |

| | American Honda Finance Corp. | 2.300% | 9/9/26 | 17,135 | 16,591 |

| | American Honda Finance Corp. | 2.000% | 3/24/28 | 34,925 | 32,505 |

| 5 | BMW US Capital LLC | 1.250% | 8/12/26 | 28,890 | 27,407 |

| | Brown University | 2.924% | 9/1/50 | 4,745 | 3,491 |

| 5 | ERAC USA Finance LLC | 5.000% | 2/15/29 | 8,020 | 8,260 |

| 5 | ERAC USA Finance LLC | 4.900% | 5/1/33 | 45,457 | 46,276 |

| 5 | ERAC USA Finance LLC | 5.200% | 10/30/34 | 7,610 | 7,927 |

| 5 | ERAC USA Finance LLC | 7.000% | 10/15/37 | 3,775 | 4,497 |

| 5 | ERAC USA Finance LLC | 5.625% | 3/15/42 | 31,000 | 32,903 |

| 5 | ERAC USA Finance LLC | 5.400% | 5/1/53 | 26,850 | 28,111 |

| | Georgetown University | 4.315% | 4/1/49 | 5,155 | 4,712 |

| | Georgetown University | 2.943% | 4/1/50 | 7,785 | 5,562 |

| | Georgetown University | 5.115% | 4/1/53 | 8,906 | 9,258 |

| | Home Depot Inc. | 4.850% | 6/25/31 | 18,010 | 18,665 |

| | Home Depot Inc. | 1.875% | 9/15/31 | 8,465 | 7,289 |

| | Home Depot Inc. | 3.250% | 4/15/32 | 30,653 | 28,678 |

| | Home Depot Inc. | 3.300% | 4/15/40 | 32,073 | 26,799 |

| | Home Depot Inc. | 4.875% | 2/15/44 | 5,600 | 5,566 |

| | Home Depot Inc. | 4.400% | 3/15/45 | 22,390 | 20,856 |

| | Home Depot Inc. | 4.250% | 4/1/46 | 18,668 | 16,980 |

| | Home Depot Inc. | 4.500% | 12/6/48 | 12,020 | 11,237 |

| | Home Depot Inc. | 3.125% | 12/15/49 | 2,435 | 1,797 |

| | Home Depot Inc. | 2.375% | 3/15/51 | 2,435 | 1,528 |

| | Home Depot Inc. | 2.750% | 9/15/51 | 11,970 | 8,097 |

| | Home Depot Inc. | 3.625% | 4/15/52 | 30,835 | 24,759 |

| | Home Depot Inc. | 4.950% | 9/15/52 | 935 | 933 |

| | Home Depot Inc. | 5.300% | 6/25/54 | 21,861 | 22,978 |

| | Home Depot Inc. | 5.400% | 6/25/64 | 3,070 | 3,250 |

| 5 | Hyundai Capital America | 1.650% | 9/17/26 | 36,110 | 34,242 |

| 2 | Johns Hopkins University | 4.083% | 7/1/53 | 7,145 | 6,444 |

| 2 | Johns Hopkins University | 2.813% | 1/1/60 | 2,920 | 1,960 |

| | Leland Stanford Junior University | 2.413% | 6/1/50 | 2,223 | 1,474 |

| | Lowe's Cos. Inc. | 3.100% | 5/3/27 | 100,000 | 97,512 |

| | Lowe's Cos. Inc. | 3.750% | 4/1/32 | 6,324 | 6,034 |

| | Lowe's Cos. Inc. | 2.800% | 9/15/41 | 3,825 | 2,808 |

| | Massachusetts Institute of Technology | 2.989% | 7/1/50 | 775 | 582 |

| | Massachusetts Institute of Technology | 2.294% | 7/1/51 | 1,918 | 1,227 |

| 2 | Northeastern University | 2.894% | 10/1/50 | 8,570 | 6,287 |

| 2 | Northwestern University | 2.640% | 12/1/50 | 735 | 507 |

| | President and Fellows of Harvard College | 3.745% | 11/15/52 | 410 | 351 |

| | Thomas Jefferson University | 3.847% | 11/1/57 | 5,590 | 4,328 |

| | Trustees of Princeton University | 2.516% | 7/1/50 | 1,824 | 1,279 |

| | Trustees of Princeton University | 4.201% | 3/1/52 | 1,968 | 1,831 |

| | Trustees of the University of Pennsylvania | 2.396% | 10/1/50 | 5,868 | 3,779 |

| 2 | University of Chicago | 2.761% | 4/1/45 | 9,540 | 7,691 |

| | University of Southern California | 2.945% | 10/1/51 | 1,570 | 1,140 |

| | University of Southern California | 4.976% | 10/1/53 | 20,625 | 21,297 |

| | Yale University | 2.402% | 4/15/50 | 1,245 | 828 |

| | | | | | | 764,416 |

| Consumer Staples (1.9%) |

| | Anheuser-Busch Cos. LLC / Anheuser-Busch InBev Worldwide Inc. | 4.700% | 2/1/36 | 19,960 | 20,032 |

| | Anheuser-Busch Cos. LLC / Anheuser-Busch InBev Worldwide Inc. | 4.900% | 2/1/46 | 72,126 | 71,010 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | Anheuser-Busch InBev Worldwide Inc. | 4.375% | 4/15/38 | 18,114 | 17,440 |

| | Anheuser-Busch InBev Worldwide Inc. | 5.450% | 1/23/39 | 825 | 882 |

| | Anheuser-Busch InBev Worldwide Inc. | 4.950% | 1/15/42 | 41,888 | 41,870 |

| | Anheuser-Busch InBev Worldwide Inc. | 5.550% | 1/23/49 | 44,482 | 47,955 |

| | Anheuser-Busch InBev Worldwide Inc. | 5.800% | 1/23/59 | 2,451 | 2,762 |

| | Anheuser-Busch InBev Worldwide Inc. | 4.600% | 6/1/60 | 9,109 | 8,634 |

| | Archer-Daniels-Midland Co. | 4.500% | 3/15/49 | 34,425 | 31,504 |

| | BAT Capital Corp. | 4.390% | 8/15/37 | 4,500 | 4,093 |

| | BAT Capital Corp. | 7.079% | 8/2/43 | 11,080 | 12,694 |

| 5 | Cargill Inc. | 4.760% | 11/23/45 | 57,879 | 55,430 |

| | Coca-Cola Consolidated Inc. | 5.250% | 6/1/29 | 25,303 | 26,331 |

| | Coca-Cola Consolidated Inc. | 5.450% | 6/1/34 | 13,000 | 13,700 |

| | Conagra Brands Inc. | 1.375% | 11/1/27 | 4,905 | 4,488 |

| 5 | Danone SA | 2.947% | 11/2/26 | 68,785 | 67,041 |

| | Diageo Capital plc | 2.375% | 10/24/29 | 14,420 | 13,267 |

| | Diageo Capital plc | 2.000% | 4/29/30 | 11,315 | 10,086 |

| | Diageo Finance plc | 5.625% | 10/5/33 | 14,623 | 15,757 |

| | Kenvue Inc. | 5.000% | 3/22/30 | 33,735 | 35,220 |

| | Kenvue Inc. | 5.100% | 3/22/43 | 15,210 | 15,722 |

| | Kenvue Inc. | 5.050% | 3/22/53 | 16,540 | 16,966 |

| | Keurig Dr Pepper Inc. | 5.050% | 3/15/29 | 28,690 | 29,596 |

| | Molson Coors Beverage Co. | 3.000% | 7/15/26 | 50,000 | 49,098 |

| | Philip Morris International Inc. | 5.125% | 11/17/27 | 34,170 | 35,181 |

| | Philip Morris International Inc. | 5.625% | 11/17/29 | 21,285 | 22,589 |

| | Philip Morris International Inc. | 5.125% | 2/15/30 | 107,883 | 111,883 |

| | Philip Morris International Inc. | 5.125% | 2/13/31 | 11,665 | 12,113 |

| | Philip Morris International Inc. | 5.375% | 2/15/33 | 83,514 | 87,317 |

| | Philip Morris International Inc. | 5.250% | 2/13/34 | 16,435 | 17,068 |

| | Philip Morris International Inc. | 4.375% | 11/15/41 | 6,383 | 5,813 |

| | Philip Morris International Inc. | 4.500% | 3/20/42 | 17,272 | 15,932 |

| | Philip Morris International Inc. | 4.125% | 3/4/43 | 13,565 | 11,861 |

| | Philip Morris International Inc. | 4.875% | 11/15/43 | 15,078 | 14,646 |

| | Philip Morris International Inc. | 4.250% | 11/10/44 | 19,410 | 17,149 |

| | | | | | | 963,130 |

| Energy (2.6%) |

| 5 | Aker BP ASA | 6.000% | 6/13/33 | 17,345 | 18,177 |

| 4,5 | Aker BP ASA | 5.125% | 10/1/34 | 4,945 | 4,883 |

| | BP Capital Markets America Inc. | 1.749% | 8/10/30 | 23,705 | 20,681 |

| | BP Capital Markets America Inc. | 2.721% | 1/12/32 | 58,224 | 51,880 |

| | BP Capital Markets America Inc. | 4.812% | 2/13/33 | 38,735 | 39,247 |

| | BP Capital Markets America Inc. | 4.893% | 9/11/33 | 39,620 | 40,308 |

| | BP Capital Markets America Inc. | 5.227% | 11/17/34 | 41,585 | 43,296 |

| | BP Capital Markets America Inc. | 2.772% | 11/10/50 | 17,760 | 11,677 |

| | BP Capital Markets America Inc. | 2.939% | 6/4/51 | 32,550 | 22,104 |

| | BP Capital Markets America Inc. | 3.001% | 3/17/52 | 46,980 | 32,220 |

| | BP Capital Markets America Inc. | 3.379% | 2/8/61 | 19,795 | 13,936 |

| | Cheniere Energy Partners LP | 5.950% | 6/30/33 | 19,460 | 20,594 |

| 5 | Columbia Pipelines Holding Co. LLC | 5.097% | 10/1/31 | 7,195 | 7,258 |

| 5 | Columbia Pipelines Holding Co. LLC | 5.681% | 1/15/34 | 4,070 | 4,198 |

| 5 | Columbia Pipelines Operating Co. LLC | 5.927% | 8/15/30 | 11,685 | 12,377 |

| 5 | Columbia Pipelines Operating Co. LLC | 6.036% | 11/15/33 | 3,825 | 4,089 |

| 5 | Columbia Pipelines Operating Co. LLC | 6.497% | 8/15/43 | 39,029 | 43,430 |

| 5 | Columbia Pipelines Operating Co. LLC | 6.544% | 11/15/53 | 825 | 928 |

| | ConocoPhillips Co. | 3.758% | 3/15/42 | 11,185 | 9,522 |

| | Eastern Gas Transmission & Storage Inc. | 3.000% | 11/15/29 | 19,580 | 18,353 |

| | Eastern Gas Transmission & Storage Inc. | 4.800% | 11/1/43 | 14,190 | 13,182 |

| | Eastern Gas Transmission & Storage Inc. | 4.600% | 12/15/44 | 7,003 | 6,312 |

| 5 | EIG Pearl Holdings Sarl | 3.545% | 8/31/36 | 20,033 | 17,773 |

| 5 | EIG Pearl Holdings Sarl | 4.387% | 11/30/46 | 24,880 | 20,492 |

| | Enbridge Inc. | 6.700% | 11/15/53 | 10,606 | 12,303 |

| | Energy Transfer LP | 6.550% | 12/1/33 | 16,575 | 18,305 |

| | Energy Transfer LP | 5.550% | 5/15/34 | 1,100 | 1,139 |

| | Energy Transfer LP | 5.350% | 5/15/45 | 4,335 | 4,128 |

| | Energy Transfer LP | 6.125% | 12/15/45 | 4,200 | 4,377 |

| | Energy Transfer LP | 5.300% | 4/15/47 | 5,600 | 5,273 |

| | Energy Transfer LP | 5.400% | 10/1/47 | 16,385 | 15,602 |

| | Energy Transfer LP | 5.950% | 5/15/54 | 14,405 | 14,744 |

| 5 | Eni SpA | 5.950% | 5/15/54 | 19,305 | 19,897 |

| | Enterprise Products Operating LLC | 4.900% | 5/15/46 | 5,000 | 4,778 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | Equinor ASA | 2.875% | 4/6/25 | 4,965 | 4,920 |

| | Equinor ASA | 3.125% | 4/6/30 | 59,622 | 56,641 |

| | Exxon Mobil Corp. | 2.610% | 10/15/30 | 36,910 | 34,015 |

| | Exxon Mobil Corp. | 4.114% | 3/1/46 | 10,845 | 9,666 |

| 5 | Galaxy Pipeline Assets Bidco Ltd. | 2.160% | 3/31/34 | 40,627 | 36,056 |

| 5 | Galaxy Pipeline Assets Bidco Ltd. | 2.940% | 9/30/40 | 35,042 | 29,542 |

| 5 | Greensaif Pipelines Bidco Sarl | 5.853% | 2/23/36 | 14,255 | 14,757 |

| 2,5 | Greensaif Pipelines Bidco Sarl | 6.129% | 2/23/38 | 6,563 | 6,952 |

| 2,5 | Greensaif Pipelines Bidco Sarl | 6.510% | 2/23/42 | 27,045 | 29,177 |

| 2,5 | Greensaif Pipelines Bidco Sarl | 6.103% | 8/23/42 | 23,730 | 24,597 |

| | MPLX LP | 2.650% | 8/15/30 | 5,855 | 5,269 |

| | MPLX LP | 5.500% | 6/1/34 | 17,645 | 18,142 |

| | ONEOK Inc. | 5.650% | 11/1/28 | 10,600 | 11,082 |

| | ONEOK Inc. | 4.750% | 10/15/31 | 19,180 | 19,183 |

| | ONEOK Inc. | 6.050% | 9/1/33 | 4,500 | 4,810 |

| | ONEOK Inc. | 5.700% | 11/1/54 | 37,380 | 37,185 |

| 5 | QatarEnergy | 3.125% | 7/12/41 | 23,670 | 18,793 |

| 5 | Saudi Arabian Oil Co. | 3.500% | 4/16/29 | 27,885 | 26,824 |

| 5 | Saudi Arabian Oil Co. | 5.250% | 7/17/34 | 21,695 | 22,300 |

| 5 | Schlumberger Holdings Corp. | 3.900% | 5/17/28 | 20,724 | 20,495 |

| 5 | Schlumberger Holdings Corp. | 5.000% | 11/15/29 | 12,140 | 12,532 |

| | Shell International Finance BV | 4.125% | 5/11/35 | 40,575 | 39,360 |

| | Shell International Finance BV | 5.500% | 3/25/40 | 10,795 | 11,493 |

| | Shell International Finance BV | 4.550% | 8/12/43 | 2,400 | 2,265 |

| | Shell International Finance BV | 4.375% | 5/11/45 | 96,925 | 88,031 |

| | Shell International Finance BV | 3.000% | 11/26/51 | 47,570 | 33,241 |

| | Suncor Energy Inc. | 5.950% | 12/1/34 | 13,000 | 14,006 |

| | Targa Resources Corp. | 6.150% | 3/1/29 | 9,835 | 10,480 |

| | TotalEnergies Capital SA | 5.150% | 4/5/34 | 16,960 | 17,647 |

| | TotalEnergies Capital SA | 5.488% | 4/5/54 | 12,510 | 12,934 |

| | TotalEnergies Capital SA | 5.275% | 9/10/54 | 12,425 | 12,453 |

| | TotalEnergies Capital SA | 5.638% | 4/5/64 | 18,665 | 19,488 |

| | TotalEnergies Capital SA | 5.425% | 9/10/64 | 16,450 | 16,546 |

| | TransCanada PipeLines Ltd. | 4.875% | 1/15/26 | 44,505 | 44,696 |

| | TransCanada PipeLines Ltd. | 4.100% | 4/15/30 | 11,955 | 11,757 |

| 5 | Whistler Pipeline LLC | 5.400% | 9/30/29 | 6,430 | 6,566 |

| 5 | Whistler Pipeline LLC | 5.700% | 9/30/31 | 4,820 | 4,989 |

| | | | | | | 1,366,353 |

| Financials (17.8%) |

| 5 | Abu Dhabi Developmental Holding Co. PJSC | 5.375% | 5/8/29 | 32,130 | 33,469 |

| 4,5 | Abu Dhabi Developmental Holding Co. PJSC | 4.375% | 10/2/31 | 32,900 | 32,716 |

| 5 | Abu Dhabi Developmental Holding Co. PJSC | 5.500% | 5/8/34 | 50,695 | 53,817 |

| | AerCap Ireland Capital DAC / AerCap Global Aviation Trust | 3.300% | 1/30/32 | 1,410 | 1,271 |

| 5 | AIB Group plc | 5.871% | 3/28/35 | 5,785 | 6,099 |

| | Allstate Corp. | 5.250% | 3/30/33 | 17,610 | 18,363 |

| | Allstate Corp. | 5.550% | 5/9/35 | 6,152 | 6,561 |

| | Allstate Corp. | 3.850% | 8/10/49 | 4,153 | 3,402 |

| | American Express Co. | 6.489% | 10/30/31 | 9,945 | 10,989 |

| | American Express Co. | 5.043% | 5/1/34 | 66,296 | 67,963 |

| | American Express Co. | 5.625% | 7/28/34 | 825 | 863 |

| | American Express Co. | 5.915% | 4/25/35 | 1,100 | 1,174 |

| | American Express Co. | 5.284% | 7/26/35 | 4,500 | 4,686 |

| | American International Group Inc. | 6.250% | 5/1/36 | 8,338 | 9,295 |

| | American International Group Inc. | 4.800% | 7/10/45 | 9,065 | 8,660 |

| | American International Group Inc. | 4.750% | 4/1/48 | 13,990 | 13,258 |

| | American International Group Inc. | 4.375% | 6/30/50 | 6,125 | 5,487 |

| | Ameriprise Financial Inc. | 5.700% | 12/15/28 | 7,333 | 7,764 |

| | Ameriprise Financial Inc. | 4.500% | 5/13/32 | 14,270 | 14,391 |

| | Ameriprise Financial Inc. | 5.150% | 5/15/33 | 24,095 | 25,096 |

| | Aon Corp. / Aon Global Holdings plc | 2.850% | 5/28/27 | 13,420 | 13,024 |

| 5 | Athene Global Funding | 5.349% | 7/9/27 | 30,160 | 30,815 |

| 5 | Athene Global Funding | 1.985% | 8/19/28 | 700 | 636 |

| 5 | Athene Global Funding | 2.717% | 1/7/29 | 42,315 | 39,104 |

| 5 | Athene Global Funding | 5.583% | 1/9/29 | 25,540 | 26,438 |

| | Athene Holding Ltd. | 4.125% | 1/12/28 | 5,630 | 5,556 |

| | Athene Holding Ltd. | 6.250% | 4/1/54 | 1,100 | 1,170 |

| 5 | Aviation Capital Group LLC | 1.950% | 9/20/26 | 23,950 | 22,685 |

| | Banco Santander SA | 1.849% | 3/25/26 | 48,600 | 46,720 |

| | Banco Santander SA | 5.365% | 7/15/28 | 30,200 | 30,907 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | Banco Santander SA | 2.749% | 12/3/30 | 10,200 | 9,009 |

| | Bank of America Corp. | ��� 3.559% | 4/23/27 | 41,870 | 41,363 |

| | Bank of America Corp. | 3.593% | 7/21/28 | 35,495 | 34,837 |

| | Bank of America Corp. | 3.419% | 12/20/28 | 48,603 | 47,296 |

| | Bank of America Corp. | 5.202% | 4/25/29 | 4,500 | 4,627 |

| | Bank of America Corp. | 4.271% | 7/23/29 | 72,640 | 72,426 |

| | Bank of America Corp. | 3.974% | 2/7/30 | 69,430 | 68,192 |

| | Bank of America Corp. | 3.194% | 7/23/30 | 33,250 | 31,481 |

| | Bank of America Corp. | 2.496% | 2/13/31 | 99,085 | 89,737 |

| | Bank of America Corp. | 2.687% | 4/22/32 | 31,625 | 28,197 |

| | Bank of America Corp. | 2.572% | 10/20/32 | 21,500 | 18,844 |

| | Bank of America Corp. | 5.015% | 7/22/33 | 3,915 | 4,015 |

| | Bank of America Corp. | 5.872% | 9/15/34 | 5,105 | 5,510 |

| | Bank of America Corp. | 6.110% | 1/29/37 | 30,000 | 33,148 |

| | Bank of America Corp. | 3.846% | 3/8/37 | 50,484 | 46,625 |

| | Bank of America Corp. | 5.875% | 2/7/42 | 8,770 | 9,796 |

| | Bank of America Corp. | 3.311% | 4/22/42 | 25,000 | 20,336 |

| | Bank of America Corp. | 5.000% | 1/21/44 | 24,180 | 24,599 |

| | Bank of America Corp. | 3.946% | 1/23/49 | 5,290 | 4,514 |

| | Bank of America Corp. | 4.330% | 3/15/50 | 48,915 | 44,363 |

| | Bank of America Corp. | 2.972% | 7/21/52 | 29,030 | 20,617 |

| | Bank of New York Mellon Corp. | 5.148% | 5/22/26 | 17,505 | 17,572 |

| | Bank of New York Mellon Corp. | 5.834% | 10/25/33 | 24,651 | 26,698 |

| | Bank of New York Mellon Corp. | 4.706% | 2/1/34 | 14,775 | 14,855 |

| | Bank of New York Mellon Corp. | 4.967% | 4/26/34 | 32,713 | 33,492 |

| | Bank of New York Mellon Corp. | 5.188% | 3/14/35 | 935 | 971 |

| | Bank of Nova Scotia | 2.700% | 8/3/26 | 60,225 | 58,716 |

| | Bank of Nova Scotia | 5.350% | 12/7/26 | 52,930 | 54,262 |

| | Bank of Nova Scotia | 1.950% | 2/2/27 | 12,170 | 11,583 |

| 5 | Banque Federative du Credit Mutuel SA | 1.604% | 10/4/26 | 33,875 | 32,130 |

| | Barclays plc | 2.852% | 5/7/26 | 9,735 | 9,608 |

| | Barclays plc | 3.330% | 11/24/42 | 7,760 | 5,967 |

| | BlackRock Funding Inc. | 5.250% | 3/14/54 | 17,560 | 18,177 |

| | BlackRock Funding Inc. | 5.350% | 1/8/55 | 15,860 | 16,670 |

| | BlackRock Inc. | 2.100% | 2/25/32 | 20,194 | 17,442 |

| | BlackRock Inc. | 4.750% | 5/25/33 | 37,605 | 38,691 |

| 5 | Blackstone Holdings Finance Co. LLC | 2.550% | 3/30/32 | 19,945 | 17,325 |

| 5 | BNP Paribas SA | 1.323% | 1/13/27 | 20,420 | 19,567 |

| 5 | BNP Paribas SA | 3.500% | 11/16/27 | 74,220 | 72,359 |

| 5 | BNP Paribas SA | 2.591% | 1/20/28 | 58,145 | 55,787 |

| 5 | BNP Paribas SA | 5.335% | 6/12/29 | 20,000 | 20,597 |

| 5 | BNP Paribas SA | 3.132% | 1/20/33 | 1,545 | 1,380 |

| 5 | BNP Paribas SA | 5.894% | 12/5/34 | 36,990 | 39,965 |

| 5 | BPCE SA | 2.045% | 10/19/27 | 24,910 | 23,619 |

| 5 | BPCE SA | 3.500% | 10/23/27 | 64,900 | 62,865 |

| 5 | BPCE SA | 5.281% | 5/30/29 | 7,710 | 7,951 |

| 5 | BPCE SA | 2.700% | 10/1/29 | 48,550 | 44,668 |

| 5 | BPCE SA | 7.003% | 10/19/34 | 825 | 925 |

| 5 | BPCE SA | 5.936% | 5/30/35 | 8,555 | 8,960 |

| 5 | Brighthouse Financial Global Funding | 1.750% | 1/13/25 | 16,695 | 16,513 |

| 5 | Brighthouse Financial Global Funding | 1.550% | 5/24/26 | 37,050 | 35,264 |

| 5 | Brighthouse Financial Global Funding | 2.000% | 6/28/28 | 27,235 | 24,594 |

| 5 | Brighthouse Financial Global Funding | 5.650% | 6/10/29 | 33,368 | 34,489 |

| | Canadian Imperial Bank of Commerce | 5.237% | 6/28/27 | 29,945 | 30,764 |

| | Canadian Imperial Bank of Commerce | 4.508% | 9/11/27 | 25,435 | 25,566 |

| | Canadian Imperial Bank of Commerce | 4.631% | 9/11/30 | 30,090 | 30,293 |

| | Capital One Financial Corp. | 7.149% | 10/29/27 | 14,255 | 15,024 |

| | Capital One Financial Corp. | 6.312% | 6/8/29 | 3,831 | 4,033 |

| | Capital One Financial Corp. | 5.700% | 2/1/30 | 7,310 | 7,575 |

| | Capital One Financial Corp. | 7.624% | 10/30/31 | 6,325 | 7,191 |

| | Capital One Financial Corp. | 5.817% | 2/1/34 | 6,750 | 7,026 |

| | Capital One Financial Corp. | 6.377% | 6/8/34 | 59,015 | 63,767 |

| | Capital One Financial Corp. | 6.051% | 2/1/35 | 48,604 | 51,468 |

| | Capital One Financial Corp. | 5.884% | 7/26/35 | 5,400 | 5,651 |

| | Charles Schwab Corp. | 3.200% | 3/2/27 | 14,840 | 14,504 |

| | Charles Schwab Corp. | 2.000% | 3/20/28 | 32,514 | 30,271 |

| | Chubb INA Holdings LLC | 3.350% | 5/3/26 | 12,280 | 12,135 |

| | Chubb INA Holdings LLC | 4.350% | 11/3/45 | 24,795 | 22,875 |

| | Citibank NA | 5.570% | 4/30/34 | 22,425 | 23,920 |

| | Citigroup Inc. | 1.462% | 6/9/27 | 90,770 | 86,506 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | Citigroup Inc. | 4.125% | 7/25/28 | 8,695 | 8,618 |

| | Citigroup Inc. | 3.520% | 10/27/28 | 33,358 | 32,559 |

| | Citigroup Inc. | 5.174% | 2/13/30 | 4,500 | 4,619 |

| | Citigroup Inc. | 3.878% | 1/24/39 | 37,225 | 33,223 |

| | Citigroup Inc. | 5.875% | 1/30/42 | 7,460 | 8,192 |

| | Citigroup Inc. | 2.904% | 11/3/42 | 19,070 | 14,355 |

| | Citigroup Inc. | 5.300% | 5/6/44 | 12,142 | 12,332 |

| | Citizens Financial Group Inc. | 5.841% | 1/23/30 | 5,170 | 5,378 |

| 5 | CNO Global Funding | 1.650% | 1/6/25 | 8,460 | 8,375 |

| 5 | CNO Global Funding | 5.875% | 6/4/27 | 29,098 | 29,982 |

| 5 | CNO Global Funding | 2.650% | 1/6/29 | 22,195 | 20,298 |

| 5 | Commonwealth Bank of Australia | 5.071% | 9/14/28 | 35,285 | 36,731 |

| 5 | Commonwealth Bank of Australia | 2.688% | 3/11/31 | 70,000 | 61,447 |

| 5 | Cooperatieve Rabobank UA | 1.106% | 2/24/27 | 50,065 | 47,734 |

| 5 | Cooperatieve Rabobank UA | 4.655% | 8/22/28 | 42,315 | 42,621 |

| | Corebridge Financial Inc. | 3.900% | 4/5/32 | 24,463 | 22,939 |

| | Corebridge Financial Inc. | 6.050% | 9/15/33 | 7,560 | 8,066 |

| | Corebridge Financial Inc. | 4.350% | 4/5/42 | 5,430 | 4,803 |

| | Corebridge Financial Inc. | 4.400% | 4/5/52 | 6,265 | 5,359 |

| 5 | Corebridge Global Funding | 5.750% | 7/2/26 | 17,540 | 17,987 |

| 5 | Corebridge Global Funding | 5.900% | 9/19/28 | 8,200 | 8,630 |

| 5 | Corebridge Global Funding | 5.200% | 1/12/29 | 21,620 | 22,213 |

| 5 | Corebridge Global Funding | 5.200% | 6/24/29 | 28,580 | 29,483 |

| 5 | Credit Agricole SA | 5.589% | 7/5/26 | 39,945 | 40,848 |

| 5 | Credit Agricole SA | 4.631% | 9/11/28 | 27,255 | 27,373 |

| 5 | Credit Agricole SA | 6.316% | 10/3/29 | 7,398 | 7,872 |

| 5 | Danske Bank A/S | 1.621% | 9/11/26 | 30,135 | 29,233 |

| 5 | Danske Bank A/S | 6.259% | 9/22/26 | 33,405 | 33,923 |

| 5 | Danske Bank A/S | 1.549% | 9/10/27 | 55,390 | 52,491 |

| 5 | Danske Bank A/S | 5.705% | 3/1/30 | 10,425 | 10,858 |

| | Deutsche Bank AG | 6.720% | 1/18/29 | 6,705 | 7,096 |

| | Deutsche Bank AG | 6.819% | 11/20/29 | 13,370 | 14,379 |

| 5 | DNB Bank ASA | 1.535% | 5/25/27 | 51,450 | 49,093 |

| 5 | DNB Bank ASA | 1.605% | 3/30/28 | 45,295 | 42,276 |

| 5 | Equitable Financial Life Global Funding | 1.400% | 7/7/25 | 15,285 | 14,908 |

| 5 | Equitable Financial Life Global Funding | 1.300% | 7/12/26 | 26,910 | 25,593 |

| 5 | Equitable Financial Life Global Funding | 1.700% | 11/12/26 | 12,195 | 11,564 |

| 5 | Equitable Financial Life Global Funding | 1.400% | 8/27/27 | 33,510 | 30,969 |

| 5 | Equitable Financial Life Global Funding | 1.800% | 3/8/28 | 30,265 | 27,692 |

| 5 | Federation des Caisses Desjardins du Quebec | 5.147% | 11/27/28 | 33,100 | 34,577 |

| 5 | Federation des Caisses Desjardins du Quebec | 5.250% | 4/26/29 | 48,480 | 49,956 |

| | Fifth Third Bancorp | 4.055% | 4/25/28 | 24,480 | 24,201 |

| 5 | Five Corners Funding Trust III | 5.791% | 2/15/33 | 26,645 | 28,568 |

| 5 | Five Corners Funding Trust IV | 5.997% | 2/15/53 | 48,671 | 53,526 |

| 5 | GA Global Funding Trust | 4.400% | 9/23/27 | 28,900 | 28,850 |

| 5 | GA Global Funding Trust | 5.500% | 1/8/29 | 14,414 | 14,946 |

| | Goldman Sachs Group Inc. | 3.500% | 11/16/26 | 28,000 | 27,578 |

| | Goldman Sachs Group Inc. | 1.431% | 3/9/27 | 17,585 | 16,825 |

| | Goldman Sachs Group Inc. | 1.542% | 9/10/27 | 43,275 | 41,018 |

| | Goldman Sachs Group Inc. | 3.691% | 6/5/28 | 22,025 | 21,676 |

| | Goldman Sachs Group Inc. | 3.814% | 4/23/29 | 72,755 | 71,324 |

| | Goldman Sachs Group Inc. | 4.223% | 5/1/29 | 54,990 | 54,662 |

| | Goldman Sachs Group Inc. | 3.800% | 3/15/30 | 21,120 | 20,541 |

| | Goldman Sachs Group Inc. | 2.615% | 4/22/32 | 88,650 | 78,293 |

| | Goldman Sachs Group Inc. | 2.383% | 7/21/32 | 97,372 | 84,422 |

| | Goldman Sachs Group Inc. | 2.650% | 10/21/32 | 24,510 | 21,525 |

| | Goldman Sachs Group Inc. | 3.102% | 2/24/33 | 13,209 | 11,882 |

| | Goldman Sachs Group Inc. | 6.250% | 2/1/41 | 20,700 | 23,535 |

| | Goldman Sachs Group Inc. | 3.210% | 4/22/42 | 10,000 | 7,956 |

| | Goldman Sachs Group Inc. | 4.800% | 7/8/44 | 19,895 | 19,414 |

| 5 | Guardian Life Global Funding | 1.250% | 5/13/26 | 7,235 | 6,902 |

| | HSBC Holdings plc | 5.887% | 8/14/27 | 43,923 | 45,126 |

| | HSBC Holdings plc | 4.041% | 3/13/28 | 27,520 | 27,227 |

| | HSBC Holdings plc | 5.597% | 5/17/28 | 72,900 | 74,874 |

| | HSBC Holdings plc | 2.013% | 9/22/28 | 10,000 | 9,333 |

| | HSBC Holdings plc | 7.390% | 11/3/28 | 36,110 | 39,086 |

| | HSBC Holdings plc | 4.583% | 6/19/29 | 15,190 | 15,199 |

| | HSBC Holdings plc | 2.357% | 8/18/31 | 62,305 | 54,794 |

| | HSBC Holdings plc | 7.625% | 5/17/32 | 15,800 | 18,327 |

| | HSBC Holdings plc | 2.804% | 5/24/32 | 2,790 | 2,468 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | HSBC Holdings plc | 6.500% | 5/2/36 | 19,800 | 21,884 |

| | HSBC Holdings plc | 6.100% | 1/14/42 | 33,700 | 38,641 |

| | Huntington National Bank | 4.552% | 5/17/28 | 17,175 | 17,185 |

| | ING Groep NV | 3.950% | 3/29/27 | 31,310 | 31,055 |

| | ING Groep NV | 1.726% | 4/1/27 | 33,125 | 31,789 |

| | ING Groep NV | 5.335% | 3/19/30 | 7,030 | 7,276 |

| | Intercontinental Exchange Inc. | 4.350% | 6/15/29 | 17,315 | 17,448 |

| | Intercontinental Exchange Inc. | 1.850% | 9/15/32 | 16,125 | 13,368 |

| | Intercontinental Exchange Inc. | 2.650% | 9/15/40 | 6,100 | 4,603 |

| | Intercontinental Exchange Inc. | 3.000% | 6/15/50 | 55,840 | 39,890 |

| | Intercontinental Exchange Inc. | 4.950% | 6/15/52 | 46,610 | 46,484 |

| | Intercontinental Exchange Inc. | 3.000% | 9/15/60 | 27,695 | 18,499 |

| 5 | Jackson National Life Global Funding | 1.750% | 1/12/25 | 18,300 | 18,120 |

| 5 | Jackson National Life Global Funding | 5.550% | 7/2/27 | 16,565 | 17,010 |

| | JPMorgan Chase & Co. | 3.300% | 4/1/26 | 26,730 | 26,402 |

| | JPMorgan Chase & Co. | 2.950% | 10/1/26 | 75,000 | 73,469 |

| | JPMorgan Chase & Co. | 4.250% | 10/1/27 | 9,275 | 9,336 |

| | JPMorgan Chase & Co. | 4.851% | 7/25/28 | 4,500 | 4,582 |

| | JPMorgan Chase & Co. | 2.069% | 6/1/29 | 14,530 | 13,443 |

| | JPMorgan Chase & Co. | 4.452% | 12/5/29 | 40,000 | 40,178 |

| | JPMorgan Chase & Co. | 5.012% | 1/23/30 | 4,500 | 4,615 |

| | JPMorgan Chase & Co. | 3.702% | 5/6/30 | 18,940 | 18,423 |

| | JPMorgan Chase & Co. | 1.953% | 2/4/32 | 17,965 | 15,428 |

| | JPMorgan Chase & Co. | 2.580% | 4/22/32 | 22,175 | 19,774 |

| | JPMorgan Chase & Co. | 5.350% | 6/1/34 | 15,410 | 16,125 |

| | JPMorgan Chase & Co. | 3.109% | 4/22/41 | 38,075 | 30,670 |

| | JPMorgan Chase & Co. | 5.600% | 7/15/41 | 70,000 | 76,085 |

| | JPMorgan Chase & Co. | 5.400% | 1/6/42 | 16,235 | 17,292 |

| | JPMorgan Chase & Co. | 3.157% | 4/22/42 | 19,440 | 15,592 |

| | JPMorgan Chase & Co. | 5.625% | 8/16/43 | 13,500 | 14,665 |

| | JPMorgan Chase & Co. | 4.950% | 6/1/45 | 12,000 | 11,971 |

| | JPMorgan Chase & Co. | 3.964% | 11/15/48 | 170,360 | 147,108 |

| | JPMorgan Chase & Co. | 3.109% | 4/22/51 | 38,610 | 28,520 |

| 5 | KBC Group NV | 5.796% | 1/19/29 | 4,168 | 4,322 |

| 5 | KBC Group NV | 6.324% | 9/21/34 | 27,180 | 29,626 |

| 5 | Liberty Mutual Group Inc. | 5.500% | 6/15/52 | 28,825 | 28,403 |

| 5 | Liberty Mutual Insurance Co. | 8.500% | 5/15/25 | 21,665 | 22,104 |

| 5 | Lseg US Fin Corp. | 5.297% | 3/28/34 | 7,265 | 7,604 |

| 5 | LSEGA Financing plc | 1.375% | 4/6/26 | 97,795 | 93,679 |

| 5 | LSEGA Financing plc | 2.000% | 4/6/28 | 63,125 | 58,430 |

| 5 | LSEGA Financing plc | 2.500% | 4/6/31 | 51,246 | 45,217 |

| | M&T Bank Corp. | 7.413% | 10/30/29 | 23,720 | 25,978 |

| 5 | Macquarie Group Ltd. | 1.935% | 4/14/28 | 42,250 | 39,584 |

| 5 | Macquarie Group Ltd. | 2.871% | 1/14/33 | 31,280 | 27,153 |

| | Manufacturers & Traders Trust Co. | 2.900% | 2/6/25 | 20,085 | 19,903 |

| | Manufacturers & Traders Trust Co. | 4.700% | 1/27/28 | 59,086 | 59,374 |

| | Marsh & McLennan Cos. Inc. | 4.900% | 3/15/49 | 5,400 | 5,177 |

| | Marsh & McLennan Cos. Inc. | 2.900% | 12/15/51 | 18,280 | 12,312 |

| 5 | Massachusetts Mutual Life Insurance Co. | 3.200% | 12/1/61 | 19,410 | 12,821 |

| 5 | Met Tower Global Funding | 5.250% | 4/12/29 | 9,525 | 9,963 |

| | MetLife Inc. | 4.125% | 8/13/42 | 5,300 | 4,739 |

| | MetLife Inc. | 4.875% | 11/13/43 | 17,500 | 17,194 |

| | MetLife Inc. | 5.000% | 7/15/52 | 5,333 | 5,273 |

| 5 | Metropolitan Life Global Funding I | 3.450% | 12/18/26 | 29,970 | 29,598 |

| 5 | Metropolitan Life Global Funding I | 3.000% | 9/19/27 | 43,250 | 41,908 |

| 5 | Metropolitan Life Global Funding I | 4.300% | 8/25/29 | 23,695 | 23,752 |

| 5 | Metropolitan Life Global Funding I | 2.400% | 1/11/32 | 61,345 | 53,198 |

| 5 | Metropolitan Life Global Funding I | 5.150% | 3/28/33 | 16,670 | 17,293 |

| 5 | Metropolitan Life Insurance Co. | 7.800% | 11/1/25 | 25,000 | 25,794 |

| | Mitsubishi UFJ Financial Group Inc. | 5.017% | 7/20/28 | 24,105 | 24,580 |

| | Morgan Stanley | 3.125% | 7/27/26 | 36,950 | 36,297 |

| | Morgan Stanley | 4.350% | 9/8/26 | 15,000 | 15,034 |

| | Morgan Stanley | 3.625% | 1/20/27 | 31,000 | 30,705 |

| | Morgan Stanley | 3.772% | 1/24/29 | 56,830 | 55,868 |

| | Morgan Stanley | 2.699% | 1/22/31 | 72,345 | 66,280 |

| | Morgan Stanley | 7.250% | 4/1/32 | 51,100 | 60,700 |

| | Morgan Stanley | 2.239% | 7/21/32 | 59,815 | 51,466 |

| | Morgan Stanley | 2.511% | 10/20/32 | 90,340 | 78,876 |

| | Morgan Stanley | 2.943% | 1/21/33 | 31,085 | 27,766 |

| | Morgan Stanley | 5.466% | 1/18/35 | 9,260 | 9,682 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | Morgan Stanley | 2.484% | 9/16/36 | 48,680 | 40,742 |

| | Morgan Stanley | 5.297% | 4/20/37 | 14,345 | 14,450 |

| | Morgan Stanley | 5.948% | 1/19/38 | 50,276 | 52,753 |

| | Morgan Stanley | 4.300% | 1/27/45 | 24,705 | 22,764 |

| | Nasdaq Inc. | 5.550% | 2/15/34 | 18,570 | 19,582 |

| | Nasdaq Inc. | 3.950% | 3/7/52 | 17,300 | 13,925 |

| | Nasdaq Inc. | 5.950% | 8/15/53 | 18,070 | 19,679 |

| | Nasdaq Inc. | 6.100% | 6/28/63 | 4,495 | 4,951 |

| | National Australia Bank Ltd. | 3.905% | 6/9/27 | 60,000 | 59,875 |

| 5 | National Australia Bank Ltd. | 5.134% | 11/28/28 | 47,132 | 49,243 |

| 5 | National Australia Bank Ltd. | 2.332% | 8/21/30 | 83,980 | 73,136 |

| 5 | National Securities Clearing Corp. | 5.100% | 11/21/27 | 54,105 | 55,667 |

| 5 | Nationwide Financial Services Inc. | 3.900% | 11/30/49 | 47,630 | 37,935 |

| 5 | Nationwide Mutual Insurance Co. | 4.350% | 4/30/50 | 66,415 | 53,943 |

| | NatWest Group plc | 1.642% | 6/14/27 | 30,570 | 29,141 |

| 5 | NBK SPC Ltd. | 1.625% | 9/15/27 | 67,250 | 63,386 |

| 5 | New York Life Global Funding | 5.000% | 1/9/34 | 35,520 | 36,648 |

| 5 | New York Life Insurance Co. | 5.875% | 5/15/33 | 44,785 | 48,280 |

| 5 | New York Life Insurance Co. | 3.750% | 5/15/50 | 17,810 | 14,290 |

| 5 | New York Life Insurance Co. | 4.450% | 5/15/69 | 14,535 | 12,642 |

| 5 | Nordea Bank Abp | 1.500% | 9/30/26 | 65,000 | 61,595 |

| 5 | Northwestern Mutual Global Funding | 5.160% | 5/28/31 | 23,720 | 24,877 |

| 5 | Northwestern Mutual Life Insurance Co. | 3.850% | 9/30/47 | 28,508 | 23,009 |

| 5 | Northwestern Mutual Life Insurance Co. | 3.625% | 9/30/59 | 9,060 | 6,735 |

| 5 | Nuveen LLC | 5.550% | 1/15/30 | 3,630 | 3,805 |

| 5 | Nuveen LLC | 5.850% | 4/15/34 | 8,225 | 8,715 |

| 5 | Pacific Life Global Funding II | 1.375% | 4/14/26 | 51,785 | 49,598 |

| 5 | Pacific LifeCorp. | 5.400% | 9/15/52 | 29,000 | 29,563 |

| 5 | Penske Truck Leasing Co. LP / PTL Finance Corp. | 3.950% | 3/10/25 | 53,520 | 53,248 |

| 5 | Penske Truck Leasing Co. LP / PTL Finance Corp. | 5.875% | 11/15/27 | 44,935 | 46,807 |

| 5 | Penske Truck Leasing Co. LP / PTL Finance Corp. | 5.700% | 2/1/28 | 40,085 | 41,505 |

| 5 | Penske Truck Leasing Co. LP / PTL Finance Corp. | 6.050% | 8/1/28 | 36,460 | 38,362 |

| 5 | Penske Truck Leasing Co. LP / PTL Finance Corp. | 5.350% | 3/30/29 | 5,220 | 5,389 |

| | PNC Bank NA | 3.100% | 10/25/27 | 42,485 | 41,208 |

| | PNC Bank NA | 3.250% | 1/22/28 | 30,960 | 29,971 |

| 5 | Pricoa Global Funding I | 5.100% | 5/30/28 | 33,652 | 34,751 |

| 5 | Pricoa Global Funding I | 4.650% | 8/27/31 | 16,396 | 16,607 |

| 5 | Principal Life Global Funding II | 2.500% | 9/16/29 | 45,000 | 41,338 |

| | Progressive Corp. | 4.950% | 6/15/33 | 53,892 | 55,846 |

| | Progressive Corp. | 4.125% | 4/15/47 | 9,270 | 8,179 |

| 5 | Protective Life Global Funding | 4.714% | 7/6/27 | 30,000 | 30,418 |

| | Prudential Financial Inc. | 3.000% | 3/10/40 | 8,200 | 6,501 |

| 5 | RGA Global Funding | 2.700% | 1/18/29 | 32,500 | 30,189 |

| 5 | RGA Global Funding | 5.448% | 5/24/29 | 16,445 | 17,118 |

| 5 | RGA Global Funding | 5.500% | 1/11/31 | 14,750 | 15,417 |

| | Royal Bank of Canada | 5.000% | 2/1/33 | 37,098 | 38,359 |

| | S&P Global Inc. | 2.700% | 3/1/29 | 6,613 | 6,241 |

| 5 | Standard Chartered plc | 6.301% | 1/9/29 | 27,400 | 28,778 |

| | State Street Corp. | 4.821% | 1/26/34 | 14,895 | 15,083 |

| 5 | Svenska Handelsbanken AB | 1.418% | 6/11/27 | 65,775 | 62,470 |

| 5 | Swedbank AB | 6.136% | 9/12/26 | 32,595 | 33,670 |

| 5 | Teachers Insurance & Annuity Assn. of America | 4.900% | 9/15/44 | 28,400 | 27,211 |

| 5 | Teachers Insurance & Annuity Assn. of America | 4.270% | 5/15/47 | 42,865 | 37,392 |

| | Truist Financial Corp. | 3.700% | 6/5/25 | 48,000 | 47,633 |

| | UBS AG | 1.250% | 6/1/26 | 60,465 | 57,649 |

| | UBS AG | 7.500% | 2/15/28 | 22,042 | 24,207 |

| | UBS AG | 5.650% | 9/11/28 | 44,090 | 46,259 |

| 5 | UBS Group AG | 1.494% | 8/10/27 | 40,025 | 37,829 |

| 5 | UBS Group AG | 3.869% | 1/12/29 | 11,050 | 10,806 |

| 5 | UBS Group AG | 5.617% | 9/13/30 | 30,555 | 31,918 |

| 5 | UBS Group AG | 3.091% | 5/14/32 | 42,560 | 38,325 |

| 5 | UBS Group AG | 2.746% | 2/11/33 | 5,670 | 4,909 |

| 5 | UBS Group AG | 6.537% | 8/12/33 | 18,710 | 20,658 |

| 5 | UBS Group AG | 6.301% | 9/22/34 | 30,305 | 33,236 |

| 5 | UBS Group AG | 3.179% | 2/11/43 | 29,380 | 22,832 |

| 5 | UniCredit SpA | 1.982% | 6/3/27 | 37,130 | 35,508 |

| 5 | UniCredit SpA | 3.127% | 6/3/32 | 33,730 | 29,887 |

| | Wachovia Corp. | 6.605% | 10/1/25 | 15,000 | 15,290 |

| | Wells Fargo & Co. | 3.000% | 4/22/26 | 24,915 | 24,475 |

| | Wells Fargo & Co. | 3.000% | 10/23/26 | 6,435 | 6,289 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | Wells Fargo & Co. | 3.196% | 6/17/27 | 30,000 | 29,433 |

| | Wells Fargo & Co. | 3.526% | 3/24/28 | 70,000 | 68,679 |

| | Wells Fargo & Co. | 6.303% | 10/23/29 | 33,470 | 35,790 |

| | Wells Fargo & Co. | 2.879% | 10/30/30 | 28,045 | 26,015 |

| | Wells Fargo & Co. | 2.572% | 2/11/31 | 98,745 | 89,675 |

| | Wells Fargo & Co. | 3.350% | 3/2/33 | 21,795 | 19,930 |

| | Wells Fargo & Co. | 4.897% | 7/25/33 | 109,912 | 111,187 |

| | Wells Fargo & Co. | 5.606% | 1/15/44 | 34,961 | 36,011 |

| | Wells Fargo & Co. | 4.650% | 11/4/44 | 20,735 | 18,936 |

| | Wells Fargo & Co. | 4.900% | 11/17/45 | 16,060 | 15,070 |

| | Wells Fargo & Co. | 4.400% | 6/14/46 | 36,200 | 31,625 |

| | Wells Fargo & Co. | 4.750% | 12/7/46 | 38,790 | 35,547 |

| | Wells Fargo & Co. | 4.611% | 4/25/53 | 58,110 | 53,835 |

| | | | | | | 9,261,878 |

| Health Care (4.1%) |

| | AbbVie Inc. | 4.950% | 3/15/31 | 19,235 | 19,989 |

| | AbbVie Inc. | 5.350% | 3/15/44 | 15,873 | 16,750 |

| | AbbVie Inc. | 4.850% | 6/15/44 | 4,300 | 4,247 |

| | AbbVie Inc. | 4.700% | 5/14/45 | 1,300 | 1,257 |

| | AbbVie Inc. | 5.400% | 3/15/54 | 33,057 | 35,056 |

| | AdventHealth Obligated Group | 2.795% | 11/15/51 | 21,620 | 14,917 |

| | Advocate Health & Hospitals Corp. | 2.211% | 6/15/30 | 17,670 | 15,836 |

| | Advocate Health & Hospitals Corp. | 3.008% | 6/15/50 | 19,220 | 13,975 |

| 5 | Alcon Finance Corp. | 2.750% | 9/23/26 | 5,645 | 5,478 |

| 5 | Alcon Finance Corp. | 2.600% | 5/27/30 | 8,540 | 7,799 |

| 5 | Alcon Finance Corp. | 5.375% | 12/6/32 | 10,270 | 10,743 |

| 5 | Alcon Finance Corp. | 3.800% | 9/23/49 | 8,670 | 6,994 |

| 5 | Alcon Finance Corp. | 5.750% | 12/6/52 | 4,280 | 4,599 |

| | Ascension Health | 2.532% | 11/15/29 | 48,025 | 44,610 |

| 2 | Ascension Health | 4.847% | 11/15/53 | 1,950 | 1,962 |

| | AstraZeneca plc | 4.000% | 1/17/29 | 23,315 | 23,322 |

| | Banner Health | 2.907% | 1/1/42 | 12,150 | 9,368 |

| 5 | Bayer US Finance II LLC | 4.250% | 12/15/25 | 23,781 | 23,603 |

| 5 | Bayer US Finance II LLC | 5.500% | 7/30/35 | 15,000 | 14,998 |

| | Beth Israel Lahey Health Inc. | 3.080% | 7/1/51 | 8,165 | 5,516 |

| | Bon Secours Mercy Health Inc. | 4.302% | 7/1/28 | 19,830 | 19,866 |

| 2 | Bon Secours Mercy Health Inc. | 3.464% | 6/1/30 | 17,675 | 17,010 |

| | Bon Secours Mercy Health Inc. | 2.095% | 6/1/31 | 11,525 | 9,939 |

| | Bristol-Myers Squibb Co. | 3.400% | 7/26/29 | 9,086 | 8,826 |

| | Bristol-Myers Squibb Co. | 3.550% | 3/15/42 | 49,805 | 41,686 |

| | Bristol-Myers Squibb Co. | 5.500% | 2/22/44 | 4,270 | 4,523 |

| | Bristol-Myers Squibb Co. | 4.250% | 10/26/49 | 15,145 | 13,300 |

| | Bristol-Myers Squibb Co. | 2.550% | 11/13/50 | 10,415 | 6,634 |

| | Bristol-Myers Squibb Co. | 5.550% | 2/22/54 | 1,100 | 1,166 |

| | Bristol-Myers Squibb Co. | 5.650% | 2/22/64 | 36,000 | 38,156 |

| | Children's Hospital Corp. | 2.585% | 2/1/50 | 5,670 | 3,810 |

| | Cigna Group | 4.375% | 10/15/28 | 9,615 | 9,652 |

| | CommonSpirit Health | 2.760% | 10/1/24 | 22,990 | 22,990 |

| | CommonSpirit Health | 3.347% | 10/1/29 | 44,950 | 42,812 |

| | CommonSpirit Health | 2.782% | 10/1/30 | 22,715 | 20,645 |

| | CommonSpirit Health | 5.205% | 12/1/31 | 35,195 | 36,260 |

| 2 | CommonSpirit Health | 4.350% | 11/1/42 | 21,485 | 19,277 |

| | CommonSpirit Health | 3.910% | 10/1/50 | 2,570 | 2,061 |

| | Cottage Health Obligated Group | 3.304% | 11/1/49 | 10,000 | 7,655 |

| 5 | CSL Finance plc | 4.250% | 4/27/32 | 43,415 | 42,694 |

| 5 | CSL Finance plc | 4.750% | 4/27/52 | 4,415 | 4,130 |

| | CVS Health Corp. | 1.750% | 8/21/30 | 4,915 | 4,187 |

| | CVS Health Corp. | 4.875% | 7/20/35 | 15,315 | 14,994 |

| 2,5 | CVS Pass-Through Trust | 5.926% | 1/10/34 | 9,611 | 9,797 |

| | Dignity Health | 3.812% | 11/1/24 | 18,560 | 18,523 |

| | Elevance Health Inc. | 3.650% | 12/1/27 | 5,000 | 4,929 |

| | Elevance Health Inc. | 4.101% | 3/1/28 | 34,795 | 34,650 |

| | Elevance Health Inc. | 2.550% | 3/15/31 | 34,925 | 31,275 |

| | Elevance Health Inc. | 5.500% | 10/15/32 | 15,105 | 16,047 |

| | Eli Lilly & Co. | 4.875% | 2/27/53 | 8,855 | 8,851 |

| | Eli Lilly & Co. | 5.050% | 8/14/54 | 11,450 | 11,721 |

| | Eli Lilly & Co. | 4.950% | 2/27/63 | 7,695 | 7,673 |

| | Eli Lilly & Co. | 5.200% | 8/14/64 | 3,875 | 4,002 |

| | Gilead Sciences Inc. | 2.600% | 10/1/40 | 25,658 | 19,197 |

| | | | Coupon | Maturity

Date | Face

Amount

($000) | Market

Value•

($000) |

| | Gilead Sciences Inc. | 4.500% | 2/1/45 | 37,302 | 34,520 |

| | GlaxoSmithKline Capital Inc. | 5.375% | 4/15/34 | 7,086 | 7,635 |

| | HCA Inc. | 5.450% | 4/1/31 | 8,910 | 9,281 |

| | HCA Inc. | 6.000% | 4/1/54 | 29,985 | 31,699 |

| | Humana Inc. | 5.750% | 12/1/28 | 470 | 494 |

| | Humana Inc. | 5.950% | 3/15/34 | 15,481 | 16,561 |

| | Humana Inc. | 4.950% | 10/1/44 | 3,300 | 3,064 |

| | Humana Inc. | 5.500% | 3/15/53 | 13,655 | 13,470 |

| | Indiana University Health Inc. Obligated Group | 2.852% | 11/1/51 | 12,815 | 9,055 |

| | Inova Health System Foundation | 4.068% | 5/15/52 | 14,145 | 12,457 |

| | Kaiser Foundation Hospitals | 3.150% | 5/1/27 | 10,994 | 10,776 |

| | Kaiser Foundation Hospitals | 2.810% | 6/1/41 | 39,420 | 30,423 |

| | Kaiser Foundation Hospitals | 4.875% | 4/1/42 | 1,225 | 1,226 |

| | Kaiser Foundation Hospitals | 4.150% | 5/1/47 | 11,730 | 10,521 |

| | Kaiser Foundation Hospitals | 3.002% | 6/1/51 | 38,650 | 27,712 |

| | Mass General Brigham Inc. | 3.192% | 7/1/49 | 32,645 | 24,590 |

| | Mass General Brigham Inc. | 3.342% | 7/1/60 | 31,285 | 22,727 |

| | Mayo Clinic | 4.128% | 11/15/52 | 6,465 | 5,699 |

| | Memorial Sloan-Kettering Cancer Center | 5.000% | 7/1/42 | 11,505 | 11,646 |

| | Memorial Sloan-Kettering Cancer Center | 2.955% | 1/1/50 | 20,260 | 14,680 |

| | Memorial Sloan-Kettering Cancer Center | 4.125% | 7/1/52 | 7,820 | 6,914 |

| | Memorial Sloan-Kettering Cancer Center | 4.200% | 7/1/55 | 5,940 | 5,308 |

| | Merck & Co. Inc. | 3.400% | 3/7/29 | 53,490 | 52,251 |

| | Merck & Co. Inc. | 4.150% | 5/18/43 | 28,405 | 25,937 |

| | Merck & Co. Inc. | 4.900% | 5/17/44 | 25,000 | 25,132 |

| | Novartis Capital Corp. | 4.400% | 5/6/44 | 21,485 | 20,450 |

| | OhioHealth Corp. | 2.297% | 11/15/31 | 12,575 | 10,853 |

| | Pfizer Inc. | 3.450% | 3/15/29 | 8,025 | 7,860 |

| | Pfizer Inc. | 1.700% | 5/28/30 | 9,100 | 8,027 |

| | Pfizer Inc. | 4.100% | 9/15/38 | 52,715 | 49,475 |

| | Pfizer Inc. | 2.550% | 5/28/40 | 230 | 172 |

| | Pfizer Investment Enterprises Pte Ltd. | 4.750% | 5/19/33 | 18,770 | 19,160 |

| | Pfizer Investment Enterprises Pte Ltd. | 5.110% | 5/19/43 | 13,500 | 13,724 |

| | Piedmont Healthcare Inc. | 2.044% | 1/1/32 | 8,750 | 7,417 |

| | Piedmont Healthcare Inc. | 2.719% | 1/1/42 | 8,750 | 6,533 |

| | Piedmont Healthcare Inc. | 2.864% | 1/1/52 | 11,625 | 8,018 |

| | Providence St. Joseph Health Obligated Group | 2.746% | 10/1/26 | 10,125 | 9,810 |

| | Providence St. Joseph Health Obligated Group | 2.532% | 10/1/29 | 25,655 | 23,536 |

| | Providence St. Joseph Health Obligated Group | 5.403% | 10/1/33 | 14,415 | 14,979 |

| 2 | Providence St. Joseph Health Obligated Group | 3.930% | 10/1/48 | 12,030 | 9,811 |

| | Providence St. Joseph Health Obligated Group | 2.700% | 10/1/51 | 34,000 | 21,613 |

| | Royalty Pharma plc | 5.400% | 9/2/34 | 11,880 | 12,185 |

| | Royalty Pharma plc | 3.550% | 9/2/50 | 48,265 | 34,978 |

| | Royalty Pharma plc | 5.900% | 9/2/54 | 9,065 | 9,377 |

| | SSM Health Care Corp. | 3.823% | 6/1/27 | 41,615 | 41,253 |

| | Sutter Health | 2.294% | 8/15/30 | 10,490 | 9,392 |

| | Takeda Pharmaceutical Co. Ltd. | 5.300% | 7/5/34 | 44,728 | 46,665 |

| | Takeda Pharmaceutical Co. Ltd. | 3.025% | 7/9/40 | 4,050 | 3,149 |

| | Toledo Hospital | 5.750% | 11/15/38 | 17,965 | 18,328 |

| | UnitedHealth Group Inc. | 3.850% | 6/15/28 | 10,000 | 9,954 |