UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☒ | | Definitive Proxy Statement |

| |

| ☐ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting Material Pursuant to §240.14a-12 |

School Specialty, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

SCHOOL SPECIALTY, INC.

W6316 Design Drive

Greenville, WI 54942

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

April 27, 2018

To the Stockholders of School Specialty, Inc.:

The 2018 Annual Meeting of Stockholders of School Specialty, Inc. will be held at the auditorium, located at 701 E. 22nd Street, Lombard, IL 60148, on Tuesday, June 12, 2018 at 8:30 a.m. Central Time for the following purposes:

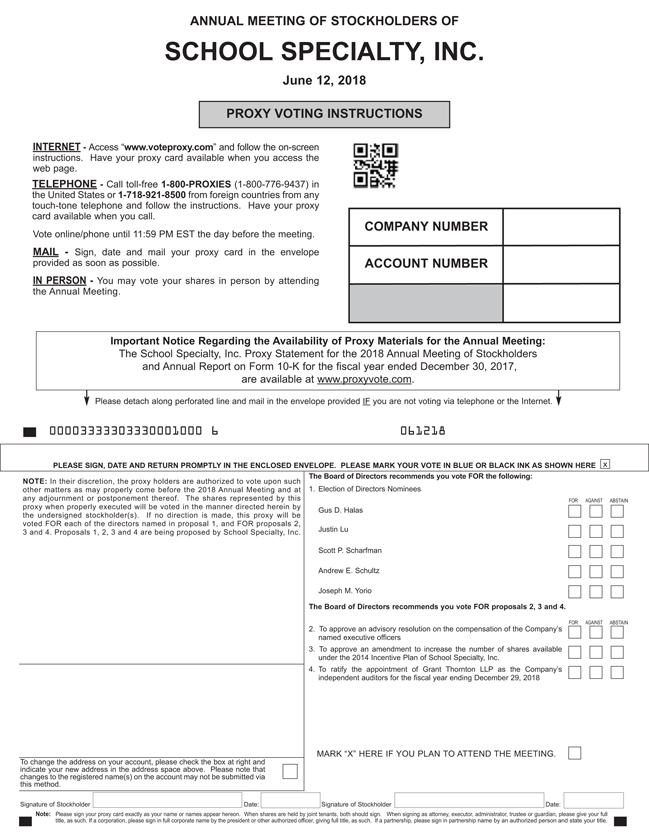

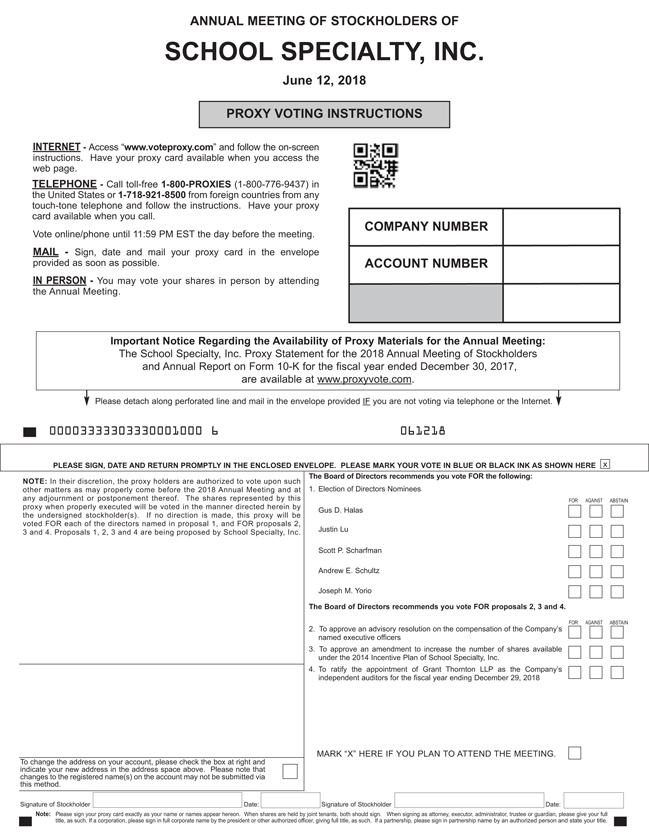

| | (1) | To elect the five individuals nominated by the Board of Directors of School Specialty, Inc. to serve as directors until the 2019 Annual Meeting of Stockholders; |

| | (2) | To approve an advisory resolution on the compensation of School Specialty, Inc.’s Named Executive Officers; |

| | (3) | To approve an amendment to increase the number of shares available under the 2014 Incentive Plan of School Specialty, Inc.; |

| | (4) | To ratify the appointment of Grant Thornton LLP as School Specialty, Inc.’s independent registered public accounting firm for the fiscal year ending December 29, 2018; and |

| | (5) | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

Stockholders of record at the close of business on April 20, 2018 are entitled to receive notice of and to vote at the Annual Meeting.

All stockholders are cordially invited to attend the Annual Meeting in person. However, whether or not you expect to attend the Annual Meeting in person, you are urged to vote by completing and returning the enclosed proxy card, or by telephone or via the Internet. Your prompt voting by proxy will help ensure a quorum. If you vote by proxy and then decide to attend the Annual Meeting to vote your shares in person, you may still do so. Your proxy is revocable in accordance with the procedures described in the attached Proxy Statement.

By Order of the Board of Directors

Joseph F. Franzoi IV,Secretary

April 27, 2018

SCHOOL SPECIALTY, INC.

W6316 Design Drive

Greenville, Wisconsin 54942

April 27, 2018

Proxy Statement

Unless the context requires otherwise, all references to “School Specialty,” the “Company,” “we,” “us” or “our” refer to School Specialty, Inc. and its subsidiaries. Effective December 26, 2015, we changed our fiscal year end from the last Saturday in April to the last Saturday in December. The December 27, 2015 to December 31, 2016 and the January 1, 2017 to December 30, 2017 years will be referred to as “fiscal 2016” and “fiscal 2017,” respectively, in this proxy statement. The April 26, 2015 to December 26, 2015 transition period will be referred to as “short year 2015” in this proxy statement. Prior to April 26, 2015, our fiscal year ended on the last Saturday in April of each year. In this proxy statement, we refer to these fiscal years by reference to the calendar year in which they ended (e.g., the fiscal year ended April 25, 2015 is referred to as “fiscal 2015”).

Following stockholder approval of the increase in the number of authorized shares of our common stock from 2,000,000 shares to 50,000,000 shares on August 15, 2017, we effected aseven-for-one stock split of School Specialty’s shares, effective August 23, 2017. Subsequently, the number of outstanding shares of School Specialty stock increased from 1,000,000 to 7,000,000. All previously stated values have been restated to adjust for thisseven-for-one stock split.

This Proxy Statement is furnished by the Board for the solicitation of proxies from the holders of our common stock, $0.001 par value (the “Common Stock”), in connection with the Annual Meeting of Stockholders to be held at the auditorium, located at 701 E. 22nd Street, Lombard, IL 60148, on Tuesday, June 12, 2018 at 8:30 a.m. Central Time, and at any adjournment or postponement thereof (the “Annual Meeting”). Stockholders may obtain directions to the Annual Meeting by contacting Ms. Amy Coenen, Assistant Secretary, School Specialty, Inc., W6316 Design Drive, Greenville, Wisconsin 54942, telephone: (888)388-3224.

It is expected that the Notice of Annual Meeting of Stockholders, this Proxy Statement and the enclosed proxy card, together with our Annual Report on Form10-K for the fiscal year ended December 30, 2017, will first be sent to stockholders on or about April 27, 2018.

Stockholders can ensure that their shares are voted at the Annual Meeting by signing, dating and returning the enclosed proxy card in the envelope provided, by calling the toll-free telephone number listed on the proxy card or by following the instructions on the proxy card for Internet voting. If you submit a signed proxy card or vote by telephone or via the Internet, you may still attend the Annual Meeting and vote in person. Any stockholder giving a proxy may revoke it before it is voted by submitting to School Specialty’s Secretary a written revocation or by submitting another proxy by telephone, Internet or mail that is received later. You will not revoke a proxy merely by attending the Annual Meeting unless you file a written notice of revocation of the proxy with School Specialty’s Secretary at any time prior to voting.

Proxies will be voted as specified by the stockholders. Where specific choices are not indicated, proxies will be voted as follows:

| | • | | FOR the election of the five individuals nominated by the Board to serve as directors; |

| | • | | FOR approval of the advisory resolution on the compensation of our Named Executive Officers (as defined in this Proxy Statement); |

| | • | | FOR approval of the amendment to increase the number of shares available under the 2014 Incentive Plan of School Specialty, Inc.; and |

1

| | • | | FOR ratification of the appointment of Grant Thornton LLP as our independent registered public accounting firm. |

The Board knows of no other matters to be presented for stockholder action at the Annual Meeting. If any other matters properly come before the Annual Meeting, the persons named as proxies will vote on the same in their discretion.

The expense of printing and mailing proxy materials, including expenses involved in forwarding materials to beneficial owners of Common Stock held in the name of another person, will be paid by School Specialty. No solicitation, other than by mail, is currently planned, except that officers or employees of School Specialty may solicit the return of proxies from certain stockholders by telephone or other electronic means.

Only stockholders of record at the close of business on April 20, 2018 (the “Record Date”) are entitled to receive notice of and to vote the shares of Common Stock registered in their name at the Annual Meeting. As of the Record Date, we had 7,000,000 shares of Common Stock outstanding. Each share of Common Stock entitles its holder to cast one vote on each matter to be voted upon at the Annual Meeting.

Under Delaware law and School Specialty’s Bylaws, the presence of a quorum is required to conduct business at the Annual Meeting. A quorum is defined as the presence, either in person or by proxy, of a majority of the then-issued and outstanding shares of Common Stock entitled to vote at the Annual Meeting. The shares represented at the Annual Meeting by proxies that are marked, with respect to the director election or any other proposals, “abstain,” will be counted as shares present for the purpose of determining whether a quorum is present. Brokernon-votes occur when shares are held in “street” form through a broker or similar market intermediary rather than in the stockholder’s own name. The broker or other intermediary is authorized to vote the shares on routine matters but maynot vote on the election of directors and onnon-routine matters without the beneficial stockholder’s express authorization. The vote to approve the advisory resolution on the compensation of our Named Executive Officers and the proposed amendment to increase the number of shares available under the 2014 Incentive Plan of School Specialty, Inc. are not considered routine matters. Therefore, your broker or other intermediary holder of your shares willnot be permitted to vote your shares in the election of directors or on such other proposalsunless you provide voting instructions. Brokernon-votes are counted for purposes of determining the presence of a quorum, but under Delaware law are not counted for purposes of determining the voting power present, and therefore, will not be counted in the vote on proposals 1, 2, 3 and 4.

With respect to the vote required to approve the proposals to be considered at the Annual Meeting, the following rules apply:

| | • | | The directors will be elected by the affirmative vote of a majority of the shares of Common Stock present, either in person or by proxy, at the Annual Meeting and entitled to vote thereon. Abstentions will have the effect of a negative vote in the election. |

| | • | | Approval of the advisory resolution on the compensation of our Named Executive Officers, approval of the proposed amendment to increase the number of shares available under the 2014 Incentive Plan of School Specialty, Inc. and the ratification of the appointment of the independent registered public accounting firm each require the affirmative vote of a majority of the shares of Common Stock present, either in person or by proxy, at the Annual Meeting and entitled to vote thereon. Abstentions will have the effect of a negative vote on each of these proposals. |

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Stockholders to be held on June 12, 2018:

This Proxy Statement and the Company’s Fiscal 2017 Form10-K are available online at

www.proxyvote.com . Please have your control number from your proxy materials available.

(Select “View Materials Online” from the Stockholder Proxy Services menu.)

2

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table sets forth certain information as of the Record Date (unless otherwise specified) regarding the beneficial ownership of shares of Common Stock by each of our directors, the executive officers named in the summary compensation table (the “Named Executive Officers”), all of our directors and executive officers as a group and each person believed by us to be a beneficial owner of more than 5% of the outstanding Common Stock. Except as otherwise indicated, the business address of each of the following is W6316 Design Drive, Greenville, Wisconsin 54942.

| | | | | | | | |

Name and Address of Beneficial Owner | | Amount and Nature of

Beneficial Ownership | | | Percent of

Outstanding Shares (8) | |

Gus D. Halas | | | 0 | | | | * | |

James R. Henderson | | | 0 | | | | * | |

Justin Lu | | | 0 | | | | * | |

Scott P. Scharfman | | | 1,487,887 | (1) | | | 21.3 | % |

Andrew E. Schultz | | | 0 | | | | * | |

Joseph M. Yorio | | | 233,506 | (7) | | | 3.3 | % |

Ryan M. Bohr | | | 60,375 | (7) | | | * | |

Edward J. Carr, Jr. | | | 34,125 | (7) | | | * | |

Todd A. Shaw | | | 28,875 | (7) | | | * | |

Kevin L. Baehler | | | 31,005 | (7) | | | * | |

All executive officers and directors as a group (10 persons) | | | 1,875,773 | (7) | | | 26.8 | % |

| | |

Mill Road Capital II, L.P.(1) Mill Road Capital II GP Scott P. Scharfman Thomas E. Lynch 382 Greenwich Avenue Suite One Greenwich, CT 02210 | | | 1,487,887 | | | | 21.3 | % |

| | |

Zazove Associates, LLC (2) Zazove Associates, Inc. Gene T. Pretti 1001 Tahoe Blvd. Incline Village, NV 89451 | | | 1,136,415 | | | | 16.2 | % |

| | |

Steel Excel Inc. (3) 1133 Westchester Avenue, Suite N222 White Plains, NY 10604 Steel Partners Holdings L.P. SPH Group LLC SPH Group Holdings LLC Steel Partners Holdings GP Inc. 590 Madison Avenue, 32nd Floor New York, NY 10022 | | | 693,154 | | | | 9.9 | % |

| | |

Saybrook Corporate Opportunity Fund II, L.P. (4) SCOF II Side Pocket Fund, L.P. COF II Bonds Acquisition, LLC Jonathan Rosenthal Kenneth Slutsky 11400 Olympic Blvd., Suite 1400 Los Angeles, CA 90064 | | | 444,269 | | | | 6.3 | % |

3

| | | | | | | | |

Name and Address of Beneficial Owner | | Amount and Nature of

Beneficial Ownership | | | Percent of

Outstanding Shares (8) | |

Virginia Retirement System (5) 1200 East Main Street Richmond, VA 23219 | | | 396,032 | | | | 5.7 | % |

| | |

Anson Funds Management LP (6) Anson Management GP LLC Bruce R. Winson 5950 Berkshire Lane, Suite 210 Dallas, Texas 75225 Anson Advisors Inc. Adam Spears Moez Kassam 111 Peter Street, Suite 904 Toronto, ON M5V 2H1 | | | 393,215 | | | | 5.6 | % |

| * | Less than 1% of the outstanding Common Stock. |

| (1) | Based on a Schedule 13D filed with the SEC on November 16, 2017, Mill Road Capital II, L.P. (the “Fund”) had sole voting and sole dispositive power over 1,487,887 shares of Common Stock. The 1,487,887 shares reported are directly held by the Fund. Mill Road Capital II GP (the “GP”) is the sole general partner of the Fund and has sole authority to vote (or direct the vote of), and to dispose (or direct the disposal) of, the 1,487,887 shares on behalf of the Fund. Each of Mr. Scharfman, a director of the Company, and Mr. Lynch is a management committee director of the GP and has shared authority to vote (or direct the vote of), and to dispose (or direct the disposal) of, the 1,487,887 shares on behalf of the GP. Each of the Fund, the GP, Mr. Lynch and Mr. Scharfman disclaims beneficial ownership of such shares except to the extent of its or his pecuniary interest therein. |

| (2) | Based on Amendment No. 3 to Schedule 13D filed with the SEC on June 12, 2017, the parties beneficially owned and had sole voting and dispositive power over 1,136,415 shares of Common Stock. According to the filing, the shares of Common Stock covered by the report are held in accounts over which Zazove Associates, LLC has discretionary authority. Zazove Associates, Inc. is the managing member of Zazove Associates, LLC, and Mr. Pretti is a control person of Zazove Associates, Inc. and CEO and senior portfolio manager of Zazove Associates, LLC. |

| (3) | Based on Amendment No. 3 to Schedule 13D filed with the SEC on February 12, 2016, the parties had shared voting and dispositive power over 693,154 shares of Common Stock. SPH Group Holdings LLC (“SPHG Holdings”) owns 51% of the outstanding shares of Common Stock of Steel Excel Inc.; Steel Partners Holdings L.P. (“Steel Holdings”) owns 99% of the membership interests of SPH Group LLC (“SPHG”); SPHG is the sole member of SPHG Holdings and the manager of SPHG Holdings; Steel Partners Holdings GP Inc. (“Steel Holdings GP”) is the general partner of Steel Holdings. Accordingly, each of SPHG Holdings, SPHG, Steel Holdings and Steel Holdings GP may be deemed to beneficially own shares of Common Stock directly owned by Steel Excel Inc.; however, each of SPHG Holdings, SPHG, Steel Holdings and Steel Holdings GP disclaims beneficial ownership of the 693,154 shares except to the extent of their pecuniary interest therein. |

| (4) | Based on Amendment No. 1 to Schedule 13G filed with the SEC on February 16, 2016, the parties had shared voting and dispositive power over 444,269 shares of Common Stock. |

| (5) | Based on Amendment No. 2 to Schedule 13G filed with the SEC on February 13, 2018, the party beneficially owned and had sole voting and dispositive power over 396,032 shares of Common Stock. |

| (6) | Based on Amendment No. 5 to Schedule 13G filed with the SEC on February 14, 2018, the parties had shared voting and dispositive power over 393,215 shares of Common Stock. Anson Funds Management LP, |

4

| | a Texas limited partnership (“Anson”), and Anson Advisors Inc., an Ontario, Canada corporation (“Anson Advisors”), serve asco-investment advisors to private funds that hold the shares of Common Stock. As the general partner of Anson, Anson Management GP LLC, a Texas limited liability company (“Anson GP”), may direct the vote and disposition of the 393,215 shares of Common Stock held by the funds. As the principal of Anson and Anson GP, Mr. Winson may direct the vote and disposition of the 393,215 shares of Common Stock held by the funds. As directors of Anson Advisors, Mr. Kassam and Mr. Spears may each direct the vote and disposition of the 393,215 shares of Common Stock held by the funds. |

| (7) | Common Stock that may be acquired within 60 days of the Record Date through the exercise of stock options. |

| (8) | Based on 7,000,000 shares of Common Stock outstanding as of the Record Date. |

5

PROPOSAL ONE: ELECTION OF DIRECTORS

School Specialty’s Board currently consists of six members. The term of office of each of the directors expires at the 2018 Annual Meeting.

On January 31, 2018, James R. Henderson informed the Board that he would not stand forre-election at the Company’s 2018 Annual Meeting, and that he would continue to serve as a director of the Company until the 2018 Annual Meeting. The Company thanks Mr. Henderson for his service to the Company and wishes him the best in his future endeavors.

The Board proposes that Gus D. Halas, Justin Lu, Scott P. Scharfman, Andrew E. Schultz and Joseph M. Yorio be elected as directors for a new term ending at the 2019 Annual Meeting and until their successors are duly elected and qualified. Messrs. Halas, Lu, Schultz and Yorio are standing forre-election at the 2018 Annual Meeting. On January 16, 2018, Mr. Scharfman was appointed to the Board, and he is standing for election at the 2018 Annual Meeting.

The Board has determined that Messrs. Halas, Lu, Scharfman and Schultz are “independent.” School Specialty is not a listed issuer whose securities are listed on a national securities exchange or on an inter-dealer quotation system which has requirements that a majority of the Board be independent. In making this determination, the Board used the definition of independence under the listing standards of The NASDAQ Stock Market LLC (“NASDAQ”). Mr. Yorio was determined not be independent and is considered an inside director.

Each of the nominees is serving as a director as of the date of this Proxy Statement.

Each of the nominees has indicated a willingness to serve as a director, but if any of the nominees should decline or be unable to act as a director, the persons named in the proxy will vote for the election of another person or persons as the Board recommends.

The Board of Directors unanimously recommends that stockholders vote “for” the election of each of the nominees to serve as directors set forth below.

NOMINEES FOR DIRECTOR

| | |

| Name and Age of Director | | |

| |

Gus D. Halas Age 67 | | Mr. Halas is the Company’s Chairman of the Board and has been a director of the Company since July 2015. From 2011 to 2013, Mr. Halas served as the President and Chief Executive Officer of Central Garden & Pet Company. From 2009 to 2015, Mr. Halas served as a senior advisor to White Deer Energy, a private equity firm that targets investments in oil and gas exploration and production, oilfield service and equipment manufacturing and the midstream sectors of the energy business. Mr. Halas is currently a director of Triangle Petroleum Corporation, an independent energy holding company, OptimizeRx Corporation, a technology solutions company targeting the healthcare industry, Madalena Energy Inc., a Canadian-based oil and gas company, and Hooper Holmes, Inc., a U.S.-based company providing risk assessment services for the health insurance industry. Mr. Halas holds a BS in Physics and Economics from Virginia Tech. Mr. Halas’ expertise in distribution, track record of growing companies and building value, independent insight and industry relationships make him a valuable member of the Board of Directors. |

6

| | |

Justin Lu Age 47 | | Mr. Lu has been a director of the Company since June 2013. Mr. Lu is a principal and assistant high yield portfolio manager at Zazove Associates (“Zazove”), an investment advisory firm focused on convertible securities. Mr. Lu has been employed by Zazove since 2002, investing primarily in high yield convertible portfolios. Prior to joining Zazove, Mr. Lu worked at Merrill Lynch from 1998 to 2001 as an associate in the leveraged finance and technology investment banking groups. Mr. Lu received his B.A. in economics and mathematics from Dartmouth College and his J.D./M.B.A. from Columbia University. Mr. Lu is a CFA charterholder. Mr. Lu’s experience at sophisticated financial institutions with leveraged finance and other complex transactions make him a valuable member of the Board of Directors. |

| |

Scott P. Scharfman Age 55 | | Mr. Scharfman was appointed as a director of the Company in January 2018. Mr. Scharfman has served as a Managing Director of Mill Road Capital (“Mill Road”), an investment firm, since 2006. Mr. Scharfman has served as the Chairman of the Board of PRT Growing Services, a privately held service and logistics business since 2012, and has served as the Chairman of the Board of RG Barry Corporation, a privately held apparel business, since 2014. Mr. Scharfman has also served on the Board of Rubio’s Restaurants Inc., a privately held restaurant company since 2010, and in 2009 Mr. Scharfman served on the Board of Galaxy Nutritional Foods, Inc., a publicly held packaged food company. Mr. Scharfman was the Chief Financial Officer of Mercata Inc. and was formerly a Managing Director in the equity capital markets groups at Robertson Stephens and Bear Stearns & Co. His early private equity investing experience was with the Blackstone Group. Mr. Scharfman earned his A.B. from Princeton University. Mr. Scharfman’s experience as a corporate executive and investment banker, track record of growing companies and building value, and his industry relationships make him a valuable member of the Board of Directors. |

| |

Andrew E. Schultz Age 63 | | Mr. Schultz has been a director of the Company since July 2015. Mr. Schultz has been a member of Holding Capital Group, a private equity firm focusing on middle market companies, since 1999. From 1992 to 1999, Mr. Schultz served as Vice President and General Counsel of Greenwich Hospital. Mr. Schultz currently serves on the board of directors and as chairman of Legacy Cabinets, Inc., a leading manufacturer of semi-custom kitchen cabinets. He is also chairman of the board of directors of Physician’s Weekly, LLC, apoint-of-care medical news and information source for healthcare professionals supported by pharma, serves on the board of Sierra Hamilton, LLC, provider of drilling-related engineering and consulting services to oil and gas exploration and production, and serves on the board of managers of Mori Lee, LLC, a U.S.-based designer of wedding, prom and special occasion dresses. Previously, Mr. Schultz served on the boards of directors of Western Kentucky Coal Resources, LLC, formed post-restructuring with Murray Energy Corporation and the secured noteholders of Armstrong Energy, Inc., Niagara LaSalle Steel, Inc., an independent manufacturer of cold bar steel, Bankruptcy Management Solutions, Inc., a technology company providing anend-to-end platform for the bankruptcy industry, and Source Interlink Companies, Inc. (now known as TEN: The Enthusiast Network), a magazine publishing and logistics company. He also previously served as chairman of |

7

| | |

| | the board of directors of PSI, LLC, a provider of testing and evaluation services. Mr. Schultz holds a B.A. in Economics and Geography from Clark University and a J.D. from Fordham University School of Law. Mr. Schultz’s expertise in distribution and manufacturing, track record of growing companies and building value, independent insight and industry relationships make him a valuable member of the Board of Directors. |

| |

Joseph M. Yorio Age 53 | | Mr. Yorio joined the Company as its President and Chief Executive Officer and as a member of the Board of Directors in April 2014. Prior to joining the Company, Mr. Yorio served as President and Chief Executive Officer of NYX Global LLC, a business services and consulting company, from January 2011 to April 2014. Concurrently, he also performed the duties and responsibilities of Managing Director for Vertx (a NYX Global client), a developer, manufacturer, marketer and distributor of tactical and outdoor apparel and equipment. Prior to that, Mr. Yorio was President from March 2009 to December 2010 and Chief Executive Officer from June 2009 to December 2010 of Xe Services LLC (now known as Academi), a private aerospace and defense company. In addition, Mr. Yorio previously held a variety of executive, operations and sales positions primarily focused on distribution and logistics. He served as the Vice President, U.S. and North American Air Hub Operations with DHL Express, where he was responsible for sortation, inbound freight and outbound freight from the largest private airport in North America servicing the global markets. Prior to that, he was President of the Central Midwest Division of Corporate Express, where he led a self-sustaining operating division that included six distribution centers. He also served in the U.S. Army as a 75th Ranger Regiment and Special Forces officer and is a medically retired combat veteran. Mr. Yorio holds a B.A. degree in psychology from Saint Vincent College, a Master’s Certificate in executive leadership from Cornell University, S.C. Johnson Graduate School of Management, and an M.B.A in management from Florida Institute of Technology, Nathan M. Bisk College of Business. Mr. Yorio’s extensive experience in managing complex organizations and his leadership abilities make him a valuable member of the Board of Directors. |

8

CORPORATE GOVERNANCE

The Board of Directors held 11 meetings in fiscal 2017. Directors are expected to attend each regular and special meeting of the Board of Directors. Each director attended at least 75% of the meetings of the Board of Directors and Board committees of which he was a member held during the period for which he had been a director in fiscal 2017. School Specialty does not have a policy regarding Board members’ attendance at the annual meeting of stockholders. Each director then in office attended the annual and special meetings of stockholders in 2017.

The positions of Chairman of the Board and Chief Executive Officer of the Company are currently separate, with Mr. Halas serving as Chairman of the Board and Mr. Yorio serving as President and Chief Executive Officer. The Company believes this leadership structure is appropriate at this time because it allows the Company to benefit fully from the unique leadership abilities and industry experience that each of these individuals possesses.

The Board has established three standing committees: the Governance/Nominating Committee, the Compensation Committee and the Audit Committee.

Governance/Nominating Committee. The Governance/Nominating Committee has adopted, and the Board has approved, a charter for the Governance/Nominating Committee. Under its charter, the Governance/Nominating Committee is responsible for overseeing the director nominations process. In connection with the selection and nomination process, the Governance/Nominating Committee will review the desired experience, skills and other qualities of potential candidates to assure the appropriate Board composition, taking into account the current Board members and the specific needs of School Specialty and the Board. The Governance/Nominating Committee intends to seek individuals who have displayed high ethical standards, integrity, sound business judgment and a willingness to devote adequate time to Board duties. This process is designed to ensure that the Board includes members with diverse backgrounds, skills and experience, including appropriate financial and other expertise relevant to School Specialty.

The Governance/Nominating Committee and the Board will consider candidates nominated by stockholders of School Specialty (“Proposing Stockholder”) in accordance with the procedures set forth in School Specialty’s Bylaws. Under the Bylaws, a Proposing Stockholder’s request to nominate a person for director, together with the written consent of that person to serve as a director, must be received by the Secretary of School Specialty at its principal office (i) with respect to an election held at an annual meeting of stockholders, not less than 90 days nor more than 150 days prior to the anniversary date of the annual meeting of stockholders in the immediately preceding year, or (ii) with respect to an election held at a special meeting of stockholders for the election of directors, not later than the close of business on the eighth day following the date on which notice of such meeting is given to stockholders.

To be in proper written form, a Proposing Stockholder’s notice must set forth in writing (a) as to each person whom the Proposing Stockholder proposes to nominate for election or reelection as a director (i) the name, age, business address and residence address of such person, (ii) the principal occupation or employment of such person, (iii) the class and number of shares of stock of School Specialty which are beneficially owned by such person, and (iv) such other information relating to such person as is required to be disclosed in solicitations of proxies for election of directors, or as otherwise required, in each case pursuant to Regulation 14A under the Securities Exchange Act of 1934, as amended (the “Exchange Act”); and (b) as to the Proposing Stockholder (i) the name and address, as they appear on School Specialty’s books, of the Proposing Stockholder, (ii) the class and number of shares of stock of School Specialty which are beneficially owned by the Proposing Stockholder, and (iii) a representation that the Proposing Stockholder is a holder of record of stock of School Specialty entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons specified in the notice. School Specialty may require any proposed nominee to furnish such other information as may reasonably be required by School Specialty to determine the eligibility of such proposed

9

nominee to serve as a director of School Specialty or the Proposing Stockholder to nominate the proposed nominee.

The members of the Governance/Nominating Committee are Messrs. Henderson (Chairman), Lu, Halas and Schultz, each of whom is “independent” as defined under the listing standards of NASDAQ. The Governance/Nominating Committee met twice in fiscal 2017. The charter of the Governance/Nominating Committee is available under the “Investors” tab on our website at www.schoolspecialty.com.

Compensation Committee. Executive officer compensation is overseen by the Compensation Committee of the Board of Directors.

The Compensation Committee has adopted, and the Board has approved, a charter for the Compensation Committee. Under its charter, the Compensation Committee has authority over each aspect of executive officer compensation, including base salaries, incentive compensation, and equity awards. Through the end of fiscal 2017, the Compensation Committee served as the committee of “outside directors” for purposes of Section 162(m) (“Section 162(m)”) of the Internal Revenue Code of 1986, as amended (the “Code”), and was the Administrator under the 2014 Incentive Plan for any awards granted thereunder to the extent such awards were intended to qualify as “performance-based compensation” under Section 162(m). At the start of fiscal 2018, the Compensation Committee will serve as a committee of “outside directors” with respect to the administration and certification of performance goals for awards subject to the transition rule for performance-based compensation under Section 162(m) (as described further below). The Chief Executive Officer participates in deliberations and decisions relating to executive officer compensation, but does not participate in decisions regarding his own compensation.

Subject to the limitations of the 2014 Incentive Plan as they relate to awards granted thereunder, the Compensation Committee may delegate authority and assign responsibility with respect to such of its functions to a subcommittee of the Committee, as it may deem appropriate from time to time.

During fiscal 2017, the Compensation Committee engaged the services of Lyons, Benenson & Company, Inc. (“LB&Co.”) to provide advice on executive officer compensation. Because the Company is not a listed issuer, the Compensation Committee did not make a determination regarding LB&Co.’s independence under the NASDAQ listing standards. LB&Co. provided one report to the Compensation Committee that included recommendations with respect to the proposed management incentive plan for fiscal 2017.

The Compensation Committee’s decisions with respect to Mr. Yorio’s compensation for fiscal 2017 were ratified by the Board as required by the Compensation Committee’s charter.

The members of the Compensation Committee are Messrs. Lu (Chairman), Halas, Scharfman and Schultz, each of whom is “independent” as defined under the listing standards of NASDAQ, except that Mr. Lu and Mr. Scharfman may not be considered “independent” under the heightened NASDAQ independence standards for committee members because Mr. Lu is employed by Zazove and Mr. Scharfman is employed by Mill Road, respectively. The Compensation Committee held three meetings and took two actions by written consent in fiscal 2017. The charter of the Compensation Committee is available under the “Investors” tab on our website at www.schoolspecialty.com.

Audit Committee. The Audit Committee is a separately designated standing committee of the Board which was established in accordance with Section 3(a)(58)(A) of the Exchange Act. The Audit Committee has adopted, and the Board has approved, a charter for the Audit Committee. Under its charter, the Audit Committee is responsible for oversight of School Specialty’s accounting and financial reporting processes and the audit of School Specialty’s financial statements. In addition, the Audit Committee is responsible for monitoring compliance with the Company’s Code of Ethics as it relates to financial records and use of Company assets and compliance with the Company’s Insider Trading Policy.

10

The members of the Audit Committee are Messrs. Schultz (Chairman), Halas, Henderson and Lu, each of whom is “independent” as defined under the listing standards of NASDAQ, except that Mr. Lu may not be considered “independent” under the heightened NASDAQ independence standards for committee members because he is employed by Zazove. Mr. Lu has been determined by the Board of Directors to be an “audit committee financial expert” for purposes of the rules promulgated under the Exchange Act. The Audit Committee held four meetings in fiscal 2017. The charter of the Audit Committee is available under the “Investors” tab on our website at www.schoolspecialty.com.

Stockholder Communications. Stockholders wishing to communicate with members of the Board of Directors may direct correspondence to such individuals c/o Ms. Amy Coenen, Assistant Secretary, W6316 Design Drive, Greenville, Wisconsin 54942. The Assistant Secretary will regularly forward such communications to the appropriate Board member(s).

Board Oversight of Risk.Our Board of Directors has overall responsibility for risk oversight with a focus on the most significant risks facing the Company. Throughout the year, the Board reviews risks brought to its attention by management and our independent registered public accounting firm from time to time.

11

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

No member of the Compensation Committee has ever been an officer or employee of School Specialty or any of our subsidiaries or had any relationships requiring disclosure under Item 404 ofRegulation S-K. None of our executive officers has served on the compensation committee or board of directors of any company of which any of our other directors is an executive officer.

RELATED PARTY TRANSACTIONS

The Board of Directors, or the Audit Committee if requested by the Board of Directors, reviews and approves all related party transactions with directors, executive officers, persons that are beneficial owners of more than 5% of the Common Stock (“5% Holders”), members of their family and persons or entities affiliated with any of them. While the Amended and Restated Certificate of Incorporation and Bylaws do not provide specific procedures as to the review of related party transactions, the Board requires management to present to the Board the details of any such transactions. Any such related party transactions would be reviewed and evaluated by the Board members based on the specific facts and circumstances of each transaction.

On January 28, 2013, School Specialty and certain of its subsidiaries filed voluntary petitions for relief under Chapter 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”). The cases (the “Chapter 11 Cases”) were jointly administered as CaseNo. 13-10125 (KJC) under the caption “In re School Specialty, Inc., et al.” The Second Amended Joint Plan of Reorganization under the Bankruptcy Code entered by the Bankruptcy Court on June 3, 2013 (the “Reorganization Plan”) became effective on June 11, 2013.

Term Loan Credit Agreement

On June 11, 2013, the Company entered into a Term Loan Credit Agreement by and among the Company, Credit Suisse AG, as Administrative Agent and Collateral Agent, and the lenders party thereto (the “Term Loan Credit Agreement”). The Company’s entry into the Term Loan Credit Agreement occurred in connection with the Chapter 11 Cases and was in accordance with the Reorganization Plan.

Under the Term Loan Credit Agreement, the lenders agreed to make a term loan to the Company in the aggregate principal amount of $145 million. Certain 5% Holders and their affiliates were lenders under the Term Loan Credit Agreement. The 5% Holders and their affiliates that were lenders during fiscal 2017 received regularly scheduled payments of interest. In April 2017, the Company voluntarily prepaid the Term Loan Credit Agreement in full. Each of the 5% Holders and their affiliates who were lenders under the Term Loan Credit Agreement at that time are listed below and received a proportional share of this prepayment. The table below summarizes the portion of the voluntary prepayment received by each.

| | | | |

Lender | | Prepayment

Amount ($) | |

Zazbond Master LLC | | | 33,433 | |

Zazove High Yield Convertible Securities Fund, L.P. | | | 564,176 | |

Steel Excel Inc. | | | 12,101,229 | |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires School Specialty’s directors and officers, among others, to file reports with the SEC disclosing their ownership, and changes in their ownership, of stock in School Specialty. Copies of these reports must also be furnished to School Specialty. Based solely on a review of these copies, School Specialty believes that all filing requirements were complied with on a timely basis during fiscal 2017.

12

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis.This CD&A is a discussion and analysis of the various policies, programs and practices developed by the Board of Directors and the Compensation Committee, and is intended to provide insight into the decision making process of the Board and the Compensation Committee for determining the compensation of our Named Executive Officers during fiscal 2017.

The objectives of the Board and the Compensation Committee regarding compensation matters include:

| | • | | Providing a competitive total compensation package that enables us to attract and retain key personnel, but that remains cost-effective; |

| | • | | Providing short-term compensation opportunities, through our 2014 Incentive Plan, that are directly linked to objective corporate performance goals; and |

| | • | | Providing long-term compensation opportunities through equity awards that align executive compensation with value received by our stockholders. |

The Board and the Compensation Committee have designed our executive compensation program to directly link executive compensation to corporate performance and increased stockholder value. Relative to other companies, we believe that our program is relatively simple and conservative. For our most senior executive officers, the program consists primarily of three elements—base salary, an opportunity for an annual cash incentive award and equity incentives. The Compensation Committee has the flexibility to use these elements, along with certain benefits and perquisites, in proportions that will most effectively accomplish its objectives. In the future, the Compensation Committee may decide to realign the total compensation package to place greater emphasis on annual or long-term compensation, depending on the focus of our business and the market cycle.

Since our emergence from bankruptcy in the beginning of fiscal 2014, one of the Board’s primary objectives was to assemble a senior leadership team that could restructure our operations and drive growth and stockholder value. To assemble this team, the Board recruited individuals primarily from outside the company to fill key leadership positions, beginning with Mr. Joseph Yorio, who was hired as the Company’s Chief Executive Officer at the end of fiscal 2014. Led by Mr. Yorio, the Board then recruited Mr. Todd Shaw in July 2014, who was appointed as the Company’s Executive Vice President, Operations in December 2014; Mr. Ryan Bohr, who was appointed as the Company’s Executive Vice President and Chief Financial Officer in October 2014; and Mr. Edward Carr, who was appointed as the Company’s Executive Vice President and Chief Sales Officer in January 2015. In addition, Mr. Kevin Baehler, who had served as the Company’s Interim Chief Financial Officer, was appointed as the Company’s Senior Vice President and Chief Accounting Officer in October 2014. Effective June 8, 2017, Messrs. Bohr, Shaw and Baehler were appointed as Executive Vice President and Chief Operating Officer, Executive Vice President and Chief Supply Chain Officer and Senior Vice President and Chief Financial Officer, respectively. Effective August 7, 2017, Mr. Baehler’s Senior Vice President title changed to Executive Vice President.

During fiscal 2017, the Compensation Committee engaged the services of LB&Co. to provide advice on executive officer compensation. Because the Company is not a listed issuer, the Compensation Committee did not make a determination regarding LB&Co.’s independence under the NASDAQ listing standards. The Compensation Committee considered the report of LB&Co. received in fiscal 2017 in determining bonuses under the management incentive plan (as described below).

In fiscal 2017, the Compensation Committee adopted a management incentive plan under the terms of our 2014 Incentive Plan similar to the plan adopted for fiscal 2016, short year 2015 and fiscal 2015, with the purpose of providing a cash incentive program for the leadership of the Company. The goal of the plan was to gain 100% alignment and engagement from senior leaders around the Chief Executive Officer’s priorities of growing and stabilizing our business, aligning our infrastructure better and lowering our costs and improving our bottom line performance. The Compensation Committee concluded that the achievement of this goal would be best reflected

13

in our Adjusted EBITDA and free cash flow for fiscal 2017. The payout level for each participant, including our Named Executive Officers, required the achievement of Adjusted EBITDA in excess of the established threshold. The Compensation Committee considered thethreshold performance level representative of results that were minimally acceptable, but likely to be attained based on our business plans for fiscal 2017. The pre-target Adjusted EBITDA reflected our budget for fiscal 2017, and was intended to be reasonably attainable, taking into account our performance improvement objectives, market conditions, and industry trends. Thetarget Adjusted EBITDA reflected a goal above our budget and was intended to be a reasonable stretch goal. The performance required to achieve themaximum payment was considered a significant, meaningful and realistic challenge to the leadership team. Furthermore, the Compensation Committee believes that additional annual incentive payments exceeding the maximum level have limited to no beneficial effect. As such, payments under the plan were scaled based on the Adjusted EBITDA performance between the threshold and the level at which the maximum bonus opportunity is attained. In addition, payments under the plan were subject to the attainment of minimum free cash flow amounts.

Following the Company’s acquisition of the assets of Triumph Learning, LLC (“Triumph”) in August 2017, the Adjusted EBITDA levels were increased in December 2017 to reflect the anticipated contributions from acquiring Triumph. Further, the Compensation Committee increased Mr. Baehler’s threshold,pre-target, target and maximum payout opportunity percentages in December 2017 to reflect his new title and to match the payout opportunities as a percentage of base salary of the other Named Executive Officers, excluding Mr. Yorio. The Adjusted EBITDA levels and the associated threshold,pre-target, target and maximum payout opportunities for fiscal 2017 were as follows:

| | | | | | | | | | | | | | | | |

| | | Threshold | | | Pre-Target | | | Target (1) | | | Maximum | |

| | | | |

Adjusted EBITDA | | $ | 52.3 million | | | $ | 53.5 million | | | $ | 55.0 million | | | $ | 60.4 million | |

| | | | |

Percent of achievement relative to Target | | | 95.1 | % | | | 97.3 | % | | | 100 | % | | | 109.8 | % |

| | | | |

Minimum Free Cash Flow | | $ | 19.98 million | | | $ | 19.98 million | | | $ | 22.2 million | | | | N/A | |

| | | | |

Payment (as a percent of base salary for fiscal 2017): | | | | | | | | | | | | | | | | |

| | | | |

Mr. Yorio | | | 25 | % | | | 87.5 | % | | | 125 | % | | | 250 | % |

| | | | |

Mr. Bohr | | | 15 | % | | | 52.5 | % | | | 75 | % | | | 150 | % |

| | | | |

Mr. Carr | | | 15 | % | | | 52.5 | % | | | 75 | % | | | 150 | % |

| | | | |

Mr. Shaw | | | 15 | % | | | 52.5 | % | | | 75 | % | | | 150 | % |

| | | | |

Mr. Baehler | | | 15 | % | | | 52.5 | % | | | 75 | % | | | 150 | % |

| (1) | Any payments made under the 2017 management incentive plan required minimum free cash flow of $19.98 million. Payments above target required minimum free cash flow of $22.2 million. |

14

Our Adjusted EBITDA for fiscal 2017 was $53.1 million1 and free cash flow for fiscal 2017 was $20.1 million2. Based on a straight-line interpolation of the actual Adjusted EBITDA result between threshold andpre-target, a payout of 54.2% of target for fiscal 2017 was therefore achieved. Accordingly, we paid an incentive award to the Named Executive Officers and certain other members of the leadership team for fiscal 2017 at this level. The resulting incentive payouts represented 67.8% of base salary for Mr. Yorio and 40.7% for each of Messrs. Bohr, Carr, Shaw and Baehler.

Our equity awards are granted under our 2014 Incentive Plan. Under this plan, the Compensation Committee has the flexibility to choose among a number of forms of equity-based compensation awards, including stock options, stock appreciation rights, stock awards, performance share units or other incentive awards. The Board used stock options for purposes of the fiscal 2017 awards of equity to our senior executive officers. In fiscal 2016, the Compensation Committee granted RSUs under the 2017 Incentive Plan to members of the Company’s senior management. The Compensation Committee decided to award options in fiscal 2017,

| 1 | The reconciliation of Adjusted EBITDA to net income is as follows (in millions): |

| | | | |

| | | December 30, 2017 | |

Adjusted Earnings before interest, taxes, depreciation, amortization, bankruptcy-related costs, restructuring and impairment charges (EBITDA) reconciliation: | | | | |

Net income | | $ | 6,779 | |

Benefit from income taxes | | | (1,409 | ) |

Purchase accounting deferred revenue adjustment | | | 786 | |

Restructuring costs | | | 421 | |

Restructuring-related costs incl in SG&A | | | 5,211 | |

Gain on sale of unconsolidated affiliate | | | — | |

Change in fair value of interest rate swap | | | — | |

Loss on early extinguishment of debt | | | 4,298 | |

Depreciation and amortization expense | | | 14,061 | |

Amortization of development costs | | | 5,559 | |

Net interest expense | | | 15,190 | |

Stock-based compensation | | | 2,234 | |

| | | | |

Adjusted EBITDA | | $ | 53,130 | |

| | | | |

| 2 | The reconciliation of Free Cash Flow to net cash provided from operating activities is as follows (in thousands): |

| | | | |

| | | December 30, 2017 | |

Adjusted EBITDA | | $ | 53,130 | |

Capital expenditures | | | (14,744 | ) |

Product development | | | (3,999 | ) |

Unrealized foreign exchange gain | | | 6 | |

Proceeds from sale of unconsolidated affiliate | | | — | |

Other | | | (8,269 | ) |

Change in working capital | | | 3,457 | |

| | | | |

Unleveraged free cash flow | | $ | 29,581 | |

Cash interest | | | (10,918 | ) |

Taxes | | | 1,409 | |

| | | | |

Leveraged free cash flow | | $ | 20,072 | |

| | | | |

15

and such form of award was the initial award to members of the Company’s senior management. Effective March 13, 2017 (the “Grant Date”), Mr. Yorio was granted an option to purchase 21,000 shares, which will vest 25% on the first, second, third and fourth anniversary of the Grant Date. Effective as of the Grant Date, Messrs. Bohr, Carr, Shaw and Baehler were granted options to purchase 24,500, 17,500, 17,500 and 7,000 shares of Common Stock, respectively, each of which will vest 50% on the second anniversary of the Grant Date and 25% on the third and fourth anniversaries of the Grant Date.

While the Board’s overriding considerations in granting equity awards to executives were to create an incentive for future performance and to create a retention incentive, the Board did take into account our share overhang (that is, the stock options and RSUs outstanding, plus remaining stock options and RSUs that may be granted, as a percentage of our total outstanding shares). In granting stock options, the Board took a consistent approach of using an exercise price of $18.57 per share (which has been higher than the closing price on the date of each grant to the Named Executive Officers). This amount was based on the enterprise value of our Company established pursuant to the Reorganization Plan. The Board believed this price was appropriate to use because the grantees would only realize value to the extent our stockholders, many of whom have been our stockholders since we emerged from bankruptcy, have an opportunity to realize value above this amount. The Board and the Compensation Committee recognize, however, that to date, these options have provided no value to the recipients even though we are required to assign significant value to these grants in our summary compensation table. Consequently, the effectiveness of these options as an incentive for future performance and as a retention incentive may be diminished. The Compensation Committee may take this into consideration in determining compensation elements and amounts in future periods.

We provide certain of our Named Executive Officers with certain perquisites in order to provide a competitive total rewards package that supports retention of key talent. These include commuting and/or relocation expense reimbursement, which for Mr. Yorio is capped at an aggregate amount of $75,000 and for Mr. Bohr is capped at $22,000 per year, plus a taxgross-up on this amount. We believe these perquisites are reasonable based on the relatively small expense in relation to both executive pay and our total benefit expenditures.

We have entered into employment agreements with Messrs. Yorio, Bohr, Carr, Shaw and Baehler. The Board believes that employment agreements were necessary to attract these executives to and retain them at our company and are important to both these executives and to us in that the executive benefits from clarity of the terms of his employment, as well as protection in certain termination events, while we benefit from nondisclosure andnon-competition protection, enhancing our ability to retain the services of our executives. Details of the terms of the specific employment agreements are discussed elsewhere in this proxy statement.

Through the end of fiscal 2017, Section 162(m) of the Code generally disallowed a tax deduction to public corporations for compensation over $1,000,000 for any fiscal year paid to a company’s Chief Executive Officer and three most highly compensated executive officers in service as of the end of any fiscal year (other than the Chief Executive Officer and Chief Financial Officer). However, Section 162(m) provided through the end of fiscal 2017 that qualifying performance-based compensation would not be subject to the deduction limit if certain requirements were met. Neither the Board nor the Compensation Committee had a policy requiring aggregate compensation to meet the requirements for deductibility under Section 162(m).

Following the end of fiscal 2017, the U.S. Tax Cuts and Jobs Act of 2017 (the “Tax Act”) repealed the qualifying performance-based compensation exception to the $1,000,000 deduction limitation. The Tax Act provided some transition relief preserving the qualifying performance-based compensation exception for certain qualifying performance-based compensation payable pursuant to a legally binding contract in place on November 2, 2017. Given the uncertain scope of such transition relief under Tax Reform, no assurance can be given that compensation payable to the Named Executive Officers in future years for past grants under the 2014 Incentive Plan will satisfy the requirements for the qualifying performance-based compensation exemption from Section 162(m) as extended through transition relief. Further, the Committee reserves the right to modify

16

compensation that was initially intended to be exempt from Section 162(m) if it determines that such modifications are consistent with the Company’s business needs.

Under the Tax Act and starting in fiscal 2018, except to the extent preserved by transition relief, Section 162(m) will disallow a tax deduction for compensation payable to each of our Named Executive Officers (including our Chief Financial Officer) in excess of $1,000,000 in any tax year. In addition, for any officer that is a Named Executive Officer of the Company whose compensation was subject to this limitation in fiscal 2017 or any later tax year, that officer’s compensation will remain subject to this annual deductibility limitation for any future tax year regardless of whether he remains a Named Executive Officer.

Summary Compensation Information. The following table sets forth the compensation earned by our Named Executive Officers:

Summary Compensation Table

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | Fiscal

Year | | | Salary

($) (1) | | | Bonus

($) | | | Stock

Awards

($) (9) | | | Option

Awards

($) (2) | | | Non-Equity

Incentive Plan

Compensation

($) | | | All Other

Compensation

($) (3) | | | Total

Compensation

($) | |

Joseph M. Yorio | | | 2017 | | | | 624,923 | | | | — | | | | — | | | | 213,030 | | | | 430,890 | | | | — | | | | 1,268,843 | |

President and Chief | | | 2016 | | | | 611,538 | | | | 36,975 | | | | 1,318,668 | | | | — | | | | 668,334 | | | | — | | | | 2,635,515 | |

Executive Officer (4) | | | SY2015 | | | | 402,000 | | | | — | | | | — | | | | — | | | | 804,000 | | | | — | | | | 1,206,000 | |

| | | 2015 | | | | 600,000 | | | | — | | | | — | | | | 1,797,027 | | | | — | | | | 20,805 | | | | 2,417,832 | |

| | | | | | | | |

Ryan M. Bohr | | | 2017 | | | | 364,538 | | | | — | | | | — | | | | 248,535 | | | | 150,812 | | | | 14,317 | | | | 778,202 | |

Executive Vice President and | | | 2016 | | | | 356,731 | | | | 14,067 | | | | 465,060 | | | | — | | | | 254,258 | | | | 10,602 | | | | 1,100,718 | |

Chief Operating Officer (5) | | | SY2015 | | | | 234,500 | | | | — | | | | — | | | | — | | | | 281,400 | | | | 13,676 | | | | 529,576 | |

| | | 2015 | | | | 165,000 | | | | — | | | | — | | | | 633,305 | | | | — | | | | — | | | | 798,305 | |

| | | | | | | | |

Edward J. Carr, Jr. | | | 2017 | | | | 338,500 | | | | — | | | | — | | | | 177,525 | | | | 140,039 | | | | — | | | | 656,064 | |

Executive Vice President and | | | 2016 | | | | 331,250 | | | | 13,062 | | | | 262,860 | | | | — | | | | 236,096 | | | | — | | | | 843,268 | |

Chief Sales Officer (6) | | | SY2015 | | | | 217,750 | | | | — | | | | — | | | | — | | | | 261,300 | | | | — | | | | 479,050 | |

| | | 2015 | | | | 87,500 | | | | — | | | | — | | | | 354,055 | | | | — | | | | — | | | | 441,555 | |

| | | | | | | | |

Todd A. Shaw | | | 2017 | | | | 286,423 | | | | — | | | | — | | | | 177,525 | | | | 118,495 | | | | — | | | | 582,443 | |

Executive Vice President and | | | 2016 | | | | 280,288 | | | | 11,052 | | | | 222,420 | | | | — | | | | 199,774 | | | | — | | | | 713,534 | |

Chief Supply Chain Ofcr (7) | | | SY2015 | | | | 184,250 | | | | — | | | | — | | | | — | | | | 221,100 | | | | — | | | | 405,350 | |

| | | 2015 | | | | 188,942 | | | | — | | | | — | | | | 304,480 | | | | — | | | | — | | | | 493,422 | |

| | | | | | | | |

Kevin L. Baehler | | | 2017 | | | | 260,385 | | | | — | | | | — | | | | 71,010 | | | | 107,723 | | | | — | | | | 439,118 | |

Executive Vice President and | | | 2016 | | | | 254,808 | | | | 8,038 | | | | — | | | | — | | | | 145,290 | | | | — | | | | 408,136 | |

Chief Financial Officer (8) | | | SY2015 | | | | 167,500 | | | | — | | | | — | | | | — | | | | 167,500 | | | | — | | | | 335,000 | |

| | | 2015 | | | | 290,385 | | | | 50,500 | | | | — | | | | 277,266 | | | | — | | | | — | | | | 618,152 | |

| (1) | Base salary amounts reflect(a) fifty-two weeks of salary for fiscal 2017, (b) fifty-three weeks of salary for fiscal 2016; (c) thirty-five weeks of salary for short-year 2015; and(d) fifty-two weeks of salary for fiscal 2015 for the Named Executive Officers who were employed by the Company during that entire fiscal year. |

| (2) | These amounts reflect the grant date fair value of the option awards granted during fiscal 2015 and fiscal 2017, computed in accordance with FASB ASC Topic 718, Compensation-Stock Compensation. Pursuant to SEC rules, the amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions. The assumptions made in valuing the option awards are included under the caption “Share-Based Compensation Expense” in Note 13 of the Notes to Consolidated Financial Statements in the Company’s Fiscal 2017 Form10-K. |

| (3) | Consists of relocation benefits for Mr. Yorio and commuting expense reimbursement for Mr. Bohr. |

| (4) | Mr. Yorio was appointed President and Chief Executive Officer effective April 23, 2014. |

17

| (5) | Mr. Bohr joined the Company in October 2014 and was appointed as its Executive Vice President and Chief Operating Officer effective as of June 8, 2017, prior to which he served as the Company’s Executive Vice President and Chief Financial Officer. |

| (6) | Mr. Carr joined the Company as its Executive Vice President and Chief Sales Officer effective as of January 19, 2015. |

| (7) | Mr. Shaw joined the Company in July 2014 and was appointed Executive Vice President and Chief Supply Chain Officer effective June 8, 2017, prior to which he served as the Company’s Executive Vice President, Operations. |

| (8) | Mr. Baehler has served as the Company’s Executive Vice President since August 7, 2017 and Chief Financial Officer since June 8, 2017, prior to which he served as the Company’s Senior Vice President and Chief Accounting Officer and Interim Chief Financial Officer. |

| (9) | These amounts reflect the grant date fair value of the RSU awards granted during fiscal 2016, computed in accordance with FASB ASC Topic 718, Compensation-Stock Compensation. Pursuant to SEC rules, the amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions. |

Agreements with Named Executive Officers

The Company is party to employment related agreements with each of Messrs. Yorio, Bohr, Carr, Shaw and Baehler. Material terms of these arrangements are described below.

Yorio Agreement. The Company entered into an amended and restated employment agreement with Mr. Yorio on March 23, 2016, which provides that Mr. Yorio will serve as President and Chief Executive Officer of the Company until December 29, 2018, which period shall be automatically extended on December 29, 2018 and the last day of each fiscal year thereafter until the end of the next succeeding fiscal year unless either party gives timely notice ofnon-extension. The terms of Mr. Yorio’s employment under the employment agreement include:

| | • | | An annual base salary of $600,000, which is subject to review annually and may be increased at any time and from time to time by the Board or the compensation committee of the Board. During fiscal 2017, Mr. Yorio’s annual base salary was increased to $636,000. |

| | • | | Eligibility for participation in the Company’s annual incentive bonus plans offered by the Company to its senior executives from time to time. Mr. Yorio’s annual target cash bonus opportunity is equal to a minimum of 115% of his base salary, and is subject to annual review by the Board or compensation committee. For fiscal 2017, this amount was set at 125%. |

| | • | | Rights and obligations of the Company and Mr. Yorio upon a voluntary or involuntary termination of Mr. Yorio’s employment, as specified in the employment agreement. |

| | • | | Obligations of Mr. Yorio to comply with confidentiality,non-competition andnon-solicitation restrictions during the term of his employment and for a specified period of time thereafter. |

Bohr Agreement. The Company entered into an employment agreement with Mr. Bohr on October 27, 2014, which provides that Mr. Bohr will serve as Executive Vice President and Chief Financial Officer of the Company. Effective June 8, 2017, Mr. Bohr was appointed as Executive Vice President and Chief Operating Officer. His compensation did not change in connection with the foregoing. The terms of Mr. Bohr’s employment under the employment agreement include:

| | • | | An annual base salary of $330,000. During fiscal 2017, Mr. Bohr’s annual base salary was increased to $371,000. |

| | • | | Eligibility for participation in the Company’s annual incentive bonus plans offered by the Company to its senior executives from time to time. Mr. Bohr’s annual target cash bonus opportunity is equal to a minimum of 60% of his base salary, and is subject to annual review by the Board or compensation committee. For fiscal 2017, this amount was set at 75%. |

18

| | • | | Rights and obligations of the Company and Mr. Bohr upon a voluntary or involuntary termination of Mr. Bohr’s employment, as specified in the employment agreement. |

| | • | | Obligations of Mr. Bohr to comply with confidentiality,non-competition andnon-solicitation restrictions during the term of his employment and for a specified period of time thereafter. |

Carr Agreement. The Company entered into an employment agreement with Mr. Carr on January 19, 2015, which provides that Mr. Carr will serve as Executive Vice President and Chief Sales Officer of the Company. The terms of Mr. Carr’s employment under the employment agreement include:

| | • | | An annual base salary of $325,000. During fiscal 2017, Mr. Carr’s annual base salary was increased to $344,500. |

| | • | | Eligibility for participation in the Company’s annual incentive bonus plans offered by the Company to its senior executives from time to time. Mr. Carr’s annual target cash bonus opportunity is equal to a minimum of 60% of his base salary, prorated for partial years of service, and is subject to annual review by the Board or compensation committee. For fiscal 2017, this amount was set at 75%. |

| | • | | Rights and obligations of the Company and Mr. Carr upon a voluntary or involuntary termination of Mr. Carr’s employment, as specified in the employment agreement. |

| | • | | Obligations of Mr. Carr to comply with confidentiality,non-competition andnon-solicitation restrictions during the term of his employment and for a specified period of time thereafter. |

Shaw Agreement. The Company entered into an employment agreement with Mr. Shaw on October 12, 2016, which provides that Mr. Shaw will continue to serve as the Company’s Executive Vice President, Operations. Effective June 8, 2017, Mr. Shaw was appointed as Executive Vice President and Chief Supply Chain Officer. His compensation did not change in connection with the foregoing. The terms of Mr. Shaw’s employment under the employment agreement include:

| | • | | An annual base salary of $275,000. During fiscal 2017, Mr. Shaw’s annual base salary was increased to $291,500. |

| | • | | Eligibility for participation in the Company’s annual incentive bonus plans offered by the Company to its senior executives from time to time, with an annual target cash bonus opportunity equal to 75% of his base salary, prorated for partial years of service, and subject to annual review by the Board or compensation committee. For fiscal 2017, this amount was set at 75%. |

| | • | | Rights and obligations of the Company and Mr. Shaw upon a voluntary or involuntary termination of his employment, as specified in the employment agreement. |

| | • | | Obligations of Mr. Shaw to comply with confidentiality,non-competition andnon-solicitation restrictions during the term of his employment and for a specified period of time thereafter. |

Baehler Agreement. The Company entered into an employment agreement with Mr. Baehler on October 12, 2016, which provides that Mr. Baehler will continue to serve as the Company’s Senior Vice President and Chief Accounting Officer. Effective June 8, 2017, Mr. Baehler was appointed as Senior Vice President and Chief Financial Officer. Effective August 7, 2017, Mr. Baehler’s Senior Vice President title changed to Executive Vice President. His compensation did not change in connection with the foregoing. The terms of Mr. Baehler’s employment under the employment agreement include:

| | • | | An annual base salary of $250,000. During fiscal 2017, Mr. Baehler’s salary was increased to $265,000. |

| | • | | Eligibility for participation in the Company’s annual incentive bonus plans offered by the Company to its senior executives from time to time, with an annual target cash bonus opportunity equal to 50% of his base salary, prorated for partial years of service, and subject to annual review by the Board or compensation committee. For fiscal 2017, this amount was set at 75%. |

19

| | • | | Rights and obligations of the Company and Mr. Baehler upon a voluntary or involuntary termination of his employment, as specified in the employment agreement. |

| | • | | Obligations of Mr. Baehler to comply with confidentiality,non-competition andnon-solicitation restrictions during the term of his employment and for a specified period of time thereafter. |

Annual Incentive Compensation

The Board of Directors approved a management incentive plan under the terms of our 2014 Incentive Plan for fiscal 2017 (the “2017 Plan”), which provided an annual cash incentive to participants based on Adjusted EBITDA for fiscal 2017. Each of the Company’s executive officers was a participant in the 2017 Plan. Potential payouts under the 2017 Plan were equal to a percentage of each participant’s base salary based on achievement of threshold, target and maximum Adjusted EBITDA and minimum free cash flow outcomes established by the Board of Directors.

Our Adjusted EBITDA for fiscal 2017 was $53.1 million and our free cash flow was $20.1 million for fiscal 2017. Based on a straight-line interpolation of the actual Adjusted EBITDA result between threshold and target, a payout of 54.2% of target was therefore achieved. Accordingly, we paid an incentive award to the Named Executive Officers and certain other members of the leadership team for fiscal 2017 at this level. The resulting incentive payments represented 67.8% of base salary for Mr. Yorio and 40.7% of base salary for each of Messrs. Bohr, Carr, Shaw and Baehler.

Outstanding Equity Awards

Outstanding Equity Awards. The following table provides information regarding options and RSUs held at fiscalyear-end by the Named Executive Officers:

Outstanding Equity Awards at December 30, 2017

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | Option Awards | | | Stock Awards | |

Name | | Number of

Securities

Underlying

Unexercised

Options (#)

Exercisable | | | Number of

Securities

Underlying

Unexercised

Options (#)

Unexercisable | | | Option

Exercise

Price

($) | | | Option

Expiration

Date | | | Number of

Shares or

Units of

Stock That

Have Not

Vested (#) (9) | | | Market

Value of

Shares or

Units of

Stock That

Have Not

Vested ($) | |

Joseph M. Yorio | | | 171,192 | | | | 57,064 | (1) | | | 18.57 | | | | 4/24/2024 | | | | 114,128 | | | | 1,900,231 | |

| | | — | | | | 21,000 | (2) | | | 18.57 | | | | 3/13/2027 | | | | — | | | | — | |

Ryan M. Bohr | | | 60,375 | | | | 20,125 | (3) | | | 18.57 | | | | 10/27/2024 | | | | 40,250 | | | | 670,163 | |

| | | — | | | | 24,500 | (4) | | | 18.57 | | | | 3/13/2027 | | | | — | | | | — | |

Edward J. Carr, Jr. | | | 22,750 | | | | 22,750 | (5) | | | 18.57 | | | | 1/19/2025 | | | | 22,750 | | | | 378,788 | |

| | | — | | | | 17,500 | (4) | | | 18.57 | | | | 3/13/2027 | | | | — | | | | — | |

Todd A. Shaw | | | 21,000 | | | | 7,000 | (6) | | | 18.57 | | | | 12/18/2024 | | | | 19,250 | | | | 320,513 | |

| | | 7,875 | | | | 2,625 | (7) | | | 18.57 | | | | 9/25/2024 | | | | — | | | | — | |

| | | — | | | | 17,500 | (4) | | | 18.57 | | | | 3/13/2027 | | | | — | | | | — | |

Kevin L. Baehler | | | 14,266 | | | | 4,753 | (8) | | | 18.57 | | | | 5/22/2024 | | | | — | | | | — | |

| | | 11,984 | | | | 3,997 | (7) | | | 18.57 | | | | 9/25/2024 | | | | — | | | | — | |

| | | — | | | | 7,000 | (4) | | | 18.57 | | | | 3/13/2027 | | | | — | | | | — | |

| (1) | This option vests in four equal installments on April 24, 2015, April 24, 2016, April 24, 2017 and April 24, 2018. |

| (2) | This option vests in four equal installments on March 13, 2018, March 13, 2019, March 13, 2020 and March 13, 2021. |

20

| (3) | This option vests as toone-half of the shares subject to the option on October 27, 2016 and as toone-fourth of the shares subject to the option on each of October 27, 2017 and October 27, 2018. |

| (4) | This option vests as toone-half of the shares subject to the option on March 13, 2019 and as toone-fourth of the shares subject to the option on each of March 13, 2020 and March 13, 2021. |

| (5) | This option vests as toone-half of the shares subject to the option on January 19, 2017 and as toone-fourth of the shares subject to the option on each of January 19, 2018 and January 19, 2019. |

| (6) | This option vests as toone-half of the shares subject to the option on December 18, 2016 and as toone-fourth of the shares subject to the option on each of December 18, 2017 and December 18, 2018. |

| (7) | This option vests as toone-half of the shares subject to the option on September 25, 2016 and as toone-fourth of the shares subject to the option on each of September 25, 2017 and September 25, 2018. |

| (8) | This option vests as toone-half of the shares subject to the option on May 22, 2016 and as toone-fourth of the shares subject to the option on each of May 22, 2017 and May 22, 2018. |

| (9) | Awards of restricted stock units (“RSUs”) that will vest on the third anniversary of the date of grant based on the15-day volume weighted average price of the Company’s common stock (“15 Day VWAP”) on the vesting date. The percentage of RSUs that will vest on the vesting date is as follows: 0% of total RSUs at a15-day VWAP of less than $15.43; 20% of total RSUs at a15-Day VWAP of at least $15.43 but less than $16.86; 40% of total RSUs at a15-day VWAP of at least $16.86 but less than $18.29; 60% of total RSUs at a15-day VWAP of at least $18.29 but less than $19.71; 80% of total RSUs at a15-day VWAP of at least $19.71 but less than $21.14; and 100% of total RSUs at a15-day VWAP of at least $21.14. Any RSUs that vest will be settled in shares of common stock on a1-for-1 basis. |

Option Exercises.There were no options to acquire Common Stock exercised during fiscal 2017 by the Named Executive Officers.

21

POTENTIAL PAYMENTS UPON TERMINATION OR CHANGE IN CONTROL

Potential Payments upon Termination without Cause or for Good Reason orNon-Renewal by the Company

Under the employment agreements in effect for Messrs. Yorio, Bohr, Carr, Shaw and Baehler, upon termination of his employment without cause or for good reason (as defined in his employment agreement), or, in the case or Mr. Yorio, due tonon-renewal of his employment agreement by the Company, the executive shall have the right to receive (i) payment of any unpaid base salary, (ii) payment of any accrued but unpaidtime-off, consistent with the Company’s policy related to carryovers of unused time, (iii) payment of all vested benefits under any benefit plans in accordance with the terms of such plans, (iv) reimbursement of expenses (we refer to (i)-(iv) as the “Accrued Obligations”), and (v) severance payments consisting of 12 months of base salary continuation (contingent upon the execution and delivery of a release of all employment-related claims, and expiration of the statutory rescission period for such release), apro-rated annual incentive bonus payment for the fiscal year in which termination occurs based on actual performance-based bonus attainments for such fiscal year in a lump sum, and to the extent it does not result in a tax or penalty on the Company, reimbursement for that portion of the premiums paid by the executive to obtain COBRA continuation health coverage. Had the employment of Mr. Yorio, Mr. Bohr, Mr. Carr, Mr. Shaw or Mr. Baehler been terminated without cause or for good reason on the last business day of fiscal 2017, they would have been entitled to a severance payment of $1,066,890, $521,812, $484,539, $409,995 and $372,723, respectively, paid in accordance with the schedule above, in addition to the Accrued Obligations.

Potential Payments upon Termination for Cause

Upon termination for cause, each of the executives is entitled to receive the Accrued Obligations.

Potential Payments upon Retirement, Death or Disability