Schedule 14A Information

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

[ ] Preliminary Proxy Statement

[ ] Confidential, for Use of the Commission only (as permitted by Rule 14a-6(e)(2))

[ ] Definitive Proxy Statement

[X]Definitive Additional Materials

[ ] Soliciting Material under Rule 14a-12

Vanguard Admiral Funds

Vanguard Bond Index Funds

Vanguard California Tax-Free Funds

Vanguard Charlotte Funds

Vanguard Chester Funds

Vanguard CMT Funds

Vanguard Explorer Fund

Vanguard Fenway Funds

Vanguard Fixed Income Securities Funds

Vanguard Horizon Funds

Vanguard Index Funds

Vanguard Institutional Index Funds

Vanguard International Equity Index Funds

Vanguard Malvern Funds

Vanguard Massachusetts Tax-Exempt Funds

Vanguard Money Market Reserves

Vanguard Montgomery Funds

Vanguard Municipal Bond Funds

Vanguard New Jersey Tax-Free Funds

Vanguard New York Tax-Free Funds

Vanguard Ohio Tax-Free Funds

Vanguard Pennsylvania Tax-Free Funds

Vanguard Quantitative Funds

Vanguard Scottsdale Funds

Vanguard Specialized Funds

Vanguard STAR Funds

Vanguard Tax-Managed Funds

Vanguard Trustees’ Equity Fund

Vanguard Valley Forge Funds

Vanguard Variable Insurance Funds

Vanguard Wellesley Income Fund

Vanguard Wellington Fund

Vanguard Whitehall Funds

Vanguard Windsor Funds

Vanguard World Fund

(Name of Registrant as Specified in its Declaration of Trust)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

[X]No fee required.

[ ] Fee computed on table below per Exchange Act Rules 14a-6(i) and 0-11.

(1)Title of each class of securities to which transaction applies:

(2)Aggregate number of securities to which transaction applies:

(3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

(4)Proposed maximum aggregate value of transaction:

(5)Total Fee Paid:

[ ] Fee paid previously with preliminary materials.

[ ] Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11 (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

(1)Amount previously paid:

(2)Form, schedule or registration statement no.:

(3)Filing Party:

(4)Date filed:

Answers to questions about the Vanguard funds’ proxy

Contents

1General proxy questions

5Proposal to elect trustees for each fund

7Funds and the proposal

General proxy questions

Upcoming proxy of the Vanguard funds’ shareholders

Starting on November 27, 2024, shareholders of each U.S.-domiciled Vanguard fund are being asked to elect trustees for the Vanguard funds. Trustees oversee the funds to make sure they effectively serve the interests of shareholders.

On February 26, 2025, the funds will host a virtual Joint Special Meeting of Shareholders (the “Meeting”).

What is a proxy?

A proxy is the legal authority or means to permit shareholders’ votes to be registered without their presence at a shareholder meeting. Shareholders may vote their proxy online, by phone, or by mail. The Vanguard funds’ shareholders have the right to vote on certain matters concerning the fund or funds they own.

What is a Joint Special Meeting of Shareholders?

A Joint Special Meeting of Shareholders is a shareholder meeting of multiple funds held concurrently to obtain a shareholder vote on one or more proposals impacting the funds.

How often do the Vanguard funds hold shareholder meetings?

The Vanguard funds hold shareholder meetings periodically when certain matters arise that require shareholder approval.

Which Vanguard funds are involved in the proxy?

The proxy involves all U.S.-domiciled Vanguard funds.

Who can vote?

Any person who owned shares of a U.S.- domiciled Vanguard fund as of the record date of November 26, 2024, even if that person sold those shares after the record date, gets to vote. This group of eligible voters

includes investors living outside the United States who are invested in a U.S.-domiciled Vanguard fund. However, there may be instances in which the authority to vote resides with a retirement plan sponsor, financial intermediary, or financial advisor.

When does voting take place?

Voting by proxy will start on November 27, 2024, and voting concludes at the Meeting on February 26, 2025.

Why is my vote important?

As a shareholder, it is your right to vote on certain matters concerning your funds. If many shareholders choose not to vote, the funds might not receive enough votes to reach quorum and conduct the Joint Special Meeting of Shareholders on February 26, 2025 (the “Meeting”). If quorum cannot be reached, the funds will have to adjourn the Meeting and send additional communications to shareholders to try to get more votes—a process that would result in additional costs for the funds and thus for you as a fund shareholder.

Who is Computershare Fund Services?

Computershare Fund Services (“Computershare”) is a third-party proxy vendor that has been hired to solicit shareholders and collect and tabulate proxy votes.

How will I receive notice and information about the proxy?

The Vanguard funds have elected to utilize the Securities and Exchange Commission rules that allow the funds to furnish proxy materials to their shareholders by providing notice of and access to these documents online instead of mailing printed copies (commonly referred to as “notice and access”).

Please note that one copy of the Proxy Statement or Notice Regarding the Availability of Proxy Materials may be delivered to two or more shareholders of a fund who share an address, unless the fund has received instructions to the contrary. To request a separate copy of the Proxy Statement or Notice Regarding the Availability of Proxy Materials, or for instructions on how to request a separate copy of such documents or how to request a single copy if multiple copies of such documents are received, shareholders should contact the appropriate fund at the address and phone number provided in the Proxy Statement.

You will receive proxy information in one of the following ways based on your document delivery preferences:

• If you have previously elected to receive fund materials by email, a link to view the Proxy Statement and the accompanying proxy materials is expected to be sent to the email address on file on or about December 3, 2024.

• If you have previously elected to receive fund materials by mail, a Notice Regarding the Availability of Proxy Materials (the “Notice”) is expected to be mailed to the address on file on or about November 27, 2024. The Notice will include instructions on how to request the Proxy Statement and accompanying proxy materials.

• For certain shareholders holding their shares through intermediaries that are set to receive paper proxy materials by mail, the Proxy Statement and related proxy materials are expected to be mailed to the address on file on or about November 27, 2024.

If you’re unable to locate materials, please call Computershare toll-free at 866-643-5201.

How do I vote?

Shareholders can vote their shares using one of the following methods:

• Online, by visiting the website provided on your proxy card, voting instruction card, voting instruction form, or Notice.

• By phone, by calling the toll-free phone number on your proxy card, voting instruction card, voting instruction form, or on the website provided on the Notice.

• By mail, if you have requested a full set of paper proxy materials, by signing and dating the enclosed proxy card, voting instruction card, or voting instruction form.

• By attending the virtual Meeting, which is to be held on Wednesday, February 26, 2025, at 8:00 a.m., Eastern Time.

Shareholders are urged to vote as soon as possible to ensure that the funds receive enough votes to reach quorum, which is required to hold the Meeting.

Shareholders are encouraged to vote online or by phone using the voting control number that appears on your proxy card, voting instruction card, or voting instruction form. Votes may also be submitted during the Meeting. In most instances, shareholders may vote up until voting closes at the Meeting. If your shares are held through a brokerage account, bank, or other holder of record (each, an “intermediary”), your intermediary may request that voting instructions are received in advance of the Meeting and provide additional information related to voting. All shares represented by valid proxies received on a timely basis prior

to the tallying of the votes at the Meeting, regardless of the way they were provided, will be voted. Please contact your intermediary for additional information related to voting.

What if I want to change my vote?

Your last vote is the one that counts. Therefore, you can revoke a prior proxy simply by voting again—online, with your proxy card, voting instruction card, or voting instruction form (if you have requested paper proxy materials), or by phone.

What is a proxy card?

A proxy card is a ballot used to vote by mail.

What is a voting instruction card?

A voting instruction card is another kind of ballot used to vote by mail. Voting instruction cards are provided to fund shareholders who invest through certain financial intermediaries, including Vanguard Brokerage Services. In these cases, shareholders are instructing their financial intermediaries how they want their shares voted. The financial intermediaries then place the votes pursuant to the shareholders’ instructions.

How will materials for clients with Vanguard brokerage accounts be handled?

Shareholders who hold shares in a Vanguard brokerage account (VBA) will receive a voter instruction card with their proxy materials.

Shareholders who hold both a mutual fund account on our legacy investment platform (a “mutual fund only account”) and a VBA will receive separate proxy materials for each account.

Shareholders whose mutual fund only account had been converted to VBA between October 24, 2024, and November 26, 2024, received proxy materials for the mutual fund only account previously, and will also receive proxy materials related to the VBA in January 2025. Only votes cast using the VBA proxy materials

will be counted.

If I requested paper proxy materials, how long will it take for me to receive them?

Paper proxy materials will be mailed via first class mail or by other reasonably prompt means to the address on file at no cost within three business days of receipt of your request.

What should I do if my security code and/or control number is not working?

For all technical difficulties, shareholders should call Computershare toll-free at 866-643-5201 to speak with a representative.

When is Computershare voting call center open?

The voting service by phone is available 24 hours a day. Computershare representatives are available to take votes and answer questions Monday through Friday from 9:00 a.m. to 5:00 p.m., Eastern Time.

How do I sign the proxy card, voting instruction card, or voting instruction form if I am voting by mail?

If you have requested a full set of paper proxy materials to vote by mail, you must sign your name exactly as it appears on the enclosed proxy card or voting instruction card, or voting instruction form. Unless your account preferences provide alternative instructions, either owner of a joint account may sign the card or form, but the signature must match the name exactly as it appears on the card or form.

How many votes are needed to reach quorum for the Meeting to be held?

Quorum must be achieved for the Meeting to occur. Each trust must achieve quorum by having shares representing more than thirty-three and one-third percent (33 1/3%) of the total combined net asset value of a trust’s shares

on record date represented at the Meeting, either by virtual attendance or proxy. Virtual attendance is considered in person attendance. All returned proxies count toward quorum, regardless of how they are voted (“For,” “Against,” or “Abstain”).

How many votes are needed to elect trustees?

Shareholders of funds that are part of the same trust will elect their trustees on a joint basis. (A list of funds and the trust in which each fund is part of a series is included in Part V of the Proxy Statement.) For each trust, the 13 nominees receiving the highest number of affirmative votes cast at the meeting will be elected.

How do I access and participate in the virtual Meeting?

The Meeting will be held in a virtual format only. You will not be able to attend the Meeting in person. You are invited to attend the Meeting by visiting https://meetnow.global/MW4PNCM.

You will be required to enter the voting control number found on the proxy card, voting instruction card, voting instruction form, or the Notice you received. If you have lost or misplaced your voting control number, please email Computershare at shareholdermeetings@computershare.com (include your full name, street address, city, state, and zip code) to verify your identity and obtain your voting control number.

The Meeting will begin promptly at 8:00 a.m., Eastern Time, on Wednesday, February 26, 2025. You are asked to access the Meeting prior to the start time to leave ample time for check-in.

If your shares are held through an intermediary, such as a brokerage account, bank, or other holder of record, you will need to request a legal proxy from the intermediary (“Legal Proxy”) to receive access to the Meeting, which serves as proof of your proxy power and reflects your holdings. You must submit the Legal Proxy along with your name and email address to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than February 21, 2025, 5:00 p.m., Eastern Time. You will receive a confirmation of your registration by email that includes the voting control number necessary to access and vote at the Meeting. Requests for registration should be directed to Computershare at shareholdermeetings@computershare.com.

During the Meeting, shareholders will have an opportunity to submit questions and comments via a moderated chat function. The chat will not be visible to other attendees and will be monitored for questions and comments that relate directly to the proposal included in the Proxy Statement. The submission of questions and comments does not guarantee that any of them will be addressed during the Meeting. For questions related to participation at the virtual Meeting, please call Computershare toll-free at 866-643-5201. For technical support, please call Computershare technical support toll-free at 888-724-2416.

Proposal to elect trustees for each fund

(For all shareholders of U.S.-domiciled funds)

Each fund’s Board of Trustees recommends a vote “For” this proposal.

Who are the nominees?

The 13 individuals listed below have been approved by the Boards for election as trustees of the Vanguard funds by the funds’ shareholders. Effective upon their election, the trustees would serve together as the Boards for all Vanguard funds. Ms. Bunch, Mr. Loughridge, Mr. Malpass, Mr. Pastor, Mr. Perold, Ms. Raskin, Mr. Reid, Dr. Thomas, and Mr. Volanakis currently serve as trustees for all Vanguard funds and are included in this slate of nominees. Mr. Loughridge,

Mr. Malpass, Mr. Perold, Ms. Raskin, and Mr. Volanakis were previously elected by the shareholders of the Vanguard funds in 2017. Ms. Bunch, Mr. Pastor, Mr. Reid, and Dr. Thomas were previously appointed to the Boards following recommendations by the Nominating Committees of the Boards, but not elected by shareholders. Mr. Murphy, Ms. Patterson, Mr. Ramji, and Ms. Venneman have not previously served as trustees of the Vanguard funds, and are included in this slate of nominees for trustee for the Vanguard funds. Mr. Murphy, Ms. Patterson, and Ms. Venneman were initially identified during a search process for potential nominees taken by the Nominating Committees with the assistance of a third-party search firm and were recommended for consideration as nominees by the Nominating Committees.

Mr. Ramji was also recommended for consideration as a nominee by the Nominating Committees and such recommendation was approved by the Boards. Each nominee was recommended by the Nominating Committees and nominated by the Boards for election by shareholders. All nominees have consented to being named in the Proxy Statement and have agreed to serve if elected. Each nominee, except for Ms. Patterson and Ms. Venneman, currently serve as a director of Vanguard. Ms. Patterson and Ms. Venneman have been appointed as

directors of Vanguard effective as of February 26, 2025. The mailing address of the Vanguard funds’ trustees and officers is The Vanguard Group, Inc., P.O. Box 876, Valley Forge, PA 19482.

How many of the nominees will be “independent” trustees if elected?

If elected by shareholders, twelve of the 13 nominees, all but Mr. Ramji, will be independent trustees, as that term is defined under applicable federal securities laws. Independent trustees are not employees of Vanguard. Independent trustees play a critical role in overseeing fund operations and representing the interests of each fund’s shareholders. Trustees’ independence from the funds enhances their service on the Vanguard funds’ Boards and their committees.

How are the Boards of the Vanguard funds structured?

The Vanguard funds are grouped into 35 separate trusts, and each trust is governed by a Board. Each of these trusts is made up of one or more Vanguard funds, which are sometimes called “series” of the trust. Trustees are elected collectively by the shareholders of each of the Vanguard funds within the trust. The same individuals currently serve as trustees for all Vanguard funds, commonly referred to as a “unitary board.” A unitary board is beneficial because each fund has trustees who serve on the Boards of the other Vanguard funds. The trustees develop greater familiarity with operations that are common to all Vanguard funds and can address common issues consistently and efficiently. The unitary board also avoids substantial additional costs, administrative complexities, and redundancies that would result from having a different Board for every Vanguard fund. While there are many areas of common interest among the funds, the trustees recognize that they are responsible for exercising their responsibilities at all times on a fund-by-fund basis. Part V of the Proxy Statement includes an alphabetical list of the Vanguard funds, identifies the trust of which each fund is a series, and provides additional information about the funds.

What is the Board’s leadership structure?

The trustees have elected Mr. Loughridge as the independent chair of the Board. The independent chair is a spokesperson and principal point of contact for the trustees and is responsible for coordinating the activities of the trustees, including calling regular executive sessions of the trustees, developing the agenda of each meeting together with Vanguard’s chief executive officer, and chairing the meetings of the trustees. An independent trustee also chairs the meetings of the Audit, Compensation, Nominating, and Independent Governance Committees.

How long will each trustee serve?

If elected, each trustee will serve until he or she resigns, retires (typically by age 75), or is removed from the Board pursuant to the funds’ governing documents.

What are the Board’s responsibilities?

The primary responsibility of the Board of each fund is to oversee the management of the fund for the benefit of its shareholders. Each fund’s Board has a supermajority of independent trustees who are not “interested persons” of the fund. Mr. Ramji would be the only interested trustee on the funds’ Boards. The independent trustees bring a broad range of relevant backgrounds, experiences, and skills to the Boards, particularly in matters critical to the funds and their shareholders.

In exercising their oversight responsibilities, the funds’ trustees focus on matters they determine to be important to fund shareholders, which includes the management, performance, and risk management of the funds, as well as the approval of arrangements with material service providers.

What is the Board’s role in risk oversight?

The trustees play an active role, as a Board and at the committee level, in overseeing risk management for each fund. The trustees delegate the day-to-day risk management of the funds to various groups within Vanguard, including portfolio review, investment management, risk management, compliance, legal, fund accounting, and fund services and

oversight. These groups provide the trustees with regular reports regarding investment, valuation, liquidity, and compliance, as well as the risks associated with each. The trustees also oversee risk management for the funds through regular interactions with the funds’ internal and external auditors.

The Boards participate in the funds’ risk oversight, in part, through the Vanguard funds’ compliance program, which covers the following broad areas of compliance: investment and other operations; recordkeeping; valuation and pricing; communications and disclosure; reporting and accounting; oversight of service providers; fund governance; and code of ethics, insider trading controls, and protection of nonpublic information. The funds’ chief compliance officer regularly provides reports to the Boards in writing and

in person.

How are nominees for trustee selected?

The independent trustees who serve on the Nominating Committee nominate candidates for election to the Board of each fund. The Boards approve the slate of nominees that is recommended by the Nominating Committee for election by shareholders. The committee considers shareholder recommendations for trustee nominees, which can be sent to

Mr. Loughridge, independent chair of the committee. All candidates recommended to the committee are evaluated in the same manner regardless of how the candidates are recommended.

What factors are considered when selecting nominees?

In determining whether an individual is qualified to serve as a trustee of the funds, the Nominating Committee and each fund’s Board consider a wide variety of information about a candidate, and multiple factors contribute to each nomination. The Nominating Committee and each fund’s Board consider, among other things, a candidate’s integrity, strength of character, judgment, business experience, specific areas of expertise, length of tenure, ability to devote sufficient time to attendance at and preparation for Board meetings, factors relating to the

composition of the Boards (including their size and structure), and principles of diversity. Each nominee is determined to have the requisite experience, skills, and attributes necessary to serve the funds and their shareholders. Each nominee also demonstrates a track record of substantial professional accomplishment and an exceptional ability to consider complex business and financial matters, evaluate the relative importance and priority of issues, make decisions, and contribute effectively to the deliberations of each fund’s Board.

Why are the funds’ shareholders being asked to elect trustees?

Electing trustees enables the funds to avoid costly proxy solicitations and shareholder meetings for each new trustee appointment. Federal law permits fund boards to appoint new trustees as needed, provided at least two-thirds of the board members have been elected by shareholders.

How are the trustees compensated?

Each fund (other than Vanguard Market Liquidity Fund, Vanguard Municipal Low Duration Fund, and Vanguard’s funds of funds) pays its proportionate share of the independent trustees’ compensation.1 Mr. Ramji, who will be an interested trustee if elected, will receive no compensation from the funds. The funds compensate their independent trustees through payment of an annual fee for their service to the funds. The independent trustees are also reimbursed for travel and other related expenses that they incur in attending Board meetings.

Do nominees for trustee own shares of the funds?

The nominees for trustee invest in the Vanguard funds according to their own investment needs. Please see Part V of the Proxy Statement for information on the dollar range of fund shares owned by each nominee for trustee

for each fund.

What happens if the nominees are not elected by shareholders?

If shareholders fail to elect one or more of the nominees, then the Boards will take such further action as deemed to be in the best interests of the funds’ shareholders.

Funds and the proposal

Shareholders of the Vanguard funds are being asked to vote on the proposal set forth below. Only shareholders of record on November 26, 2024, are entitled to vote on the proposal.

Vanguard Proposal | Vanguard Funds |

| |

Elect trustees for each fund. | Applies to all Vanguard funds. |

| |

1 The trustees of Vanguard Market Liquidity Fund and Vanguard Municipal Low Duration Fund receive no compensation directly from those funds, but Vanguard is responsible for paying the trustees for their service. The trustees of Vanguard’s funds of funds receive no compensation from those funds.

Connect with Vanguard®

vanguard.com

Legal notices

For more information about Vanguard funds, visit vanguard.com to obtain a prospectus or, if available, a summary prospectus. Investment objectives, risks, charges, expenses, and other important information are contained in the prospectus; read and consider it carefully before investing.

All investing is subject to risk, including the possible loss of the money you invest.

© 2025 The Vanguard Group, Inc.

All rights reserved. Vanguard Marketing Corporation, Distributor.

PRXFAQ 012025

P.O. Box 982901

El Paso, TX 79998-2901

Vote your Vanguard fund shares today

Dear Vanguard Client,

The trustees of U.S.-domiciled Vanguard funds are requesting your vote on an important matter. Shareholders of each U.S.-domiciled Vanguard fund as of the record date of November 26, 2024, are being asked to elect trustees for the Vanguard funds.

You may be receiving this notice because between October 24, 2024, and November 26, 2024, you were an existing Vanguard client and one of the following occurred: (1) you opened a new Vanguard account, and your account holds shares of Vanguard funds, or (2) you purchased shares of a new Vanguard fund. You must cast your vote for your new funds for your vote to be counted.

You may also be receiving this notice because between October 24, 2024, and November 26, 2024, your Vanguard account type changed (i.e., transitioned from a mutual fund to brokerage account platform). Please note that while you may have received notice of available proxy materials previously and voted using those materials, those votes have been nullified. You must cast your vote using the updated ballot for your vote to be counted.

If you have any questions about the proxy, please call Computershare Fund Services at 866-643-5201.

Thank you for voting.

Connect with Vanguard® > vanguard.com

Legal notices

For more information about Vanguard funds, visit vanguard.com to obtain a prospectus or, if available, a summary prospectus. Investment objectives, risks, charges, expenses, and other important information are contained in the prospectus; read and consider it carefully before investing.

All investing is subject to risk, including the possible loss of the money you invest.

© 2025 The Vanguard Group, Inc. All rights reserved. Vanguard Marketing Corporation, Distributor of the Vanguard Funds. | FRDLTR 012025 |

Vanguard Chester Funds

Vanguard Institutional Index Funds

JOINT SPECIAL MEETING OF SHAREHOLDERS

IMPORTANT SHAREHOLDER INFORMATION

VOTING IS QUICK AND EASY

Read the enclosed materials and vote by one of these four options:

Dear Shareholder:

You recently received proxy materials concerning an important proposal regarding your investment in a Vanguard fund, which will be considered at the Joint Special Meeting of Shareholders to be held virtually on February 26, 2025, at 8:00 a.m., Eastern Time. This letter is being sent to you because you held shares on the record date, and we have not received your vote.

Please vote as soon as possible in accordance with the instructions in the proxy materials prior to the Joint Special Meeting on February 26, 2025.

Thank you for your prompt attention to this matter. If you have already voted, we appreciate your participation.

Legal notices

Vote Online | Vote by Mail |

Visit the website noted on | Mail your signed proxy |

the enclosed proxy card or | card(s) or voting |

voting instruction form and | instruction form(s) in the |

follow the instructions. | postage-paid envelope. |

Vote by Phone | Speak with a |

Call the toll-free | Proxy Specialist |

Call 866-643-5201 with |

number printed on the | any questions. Specialists |

enclosed proxy card or | can assist with voting. |

voting instruction form and | Available Monday-Friday |

follow the automated | from 9:00 a.m. – 5:00 |

instructions. Available 7 | p.m., Eastern Time. |

days a week | |

24 hours a day. | |

For more information about Vanguard funds, visit vanguard.com to obtain a prospectus or, if available, a summary prospectus. Investment objectives, risks, charges, expenses, and other important information are contained in the prospectus; read and consider it carefully before investing.

All investing is subject to risk, including the possible loss of the money you invest.

© 2025 The Vanguard Group, Inc. All rights reserved. Vanguard Marketing Corporation, Distributor of the Vanguard Funds.

34206 vg remail

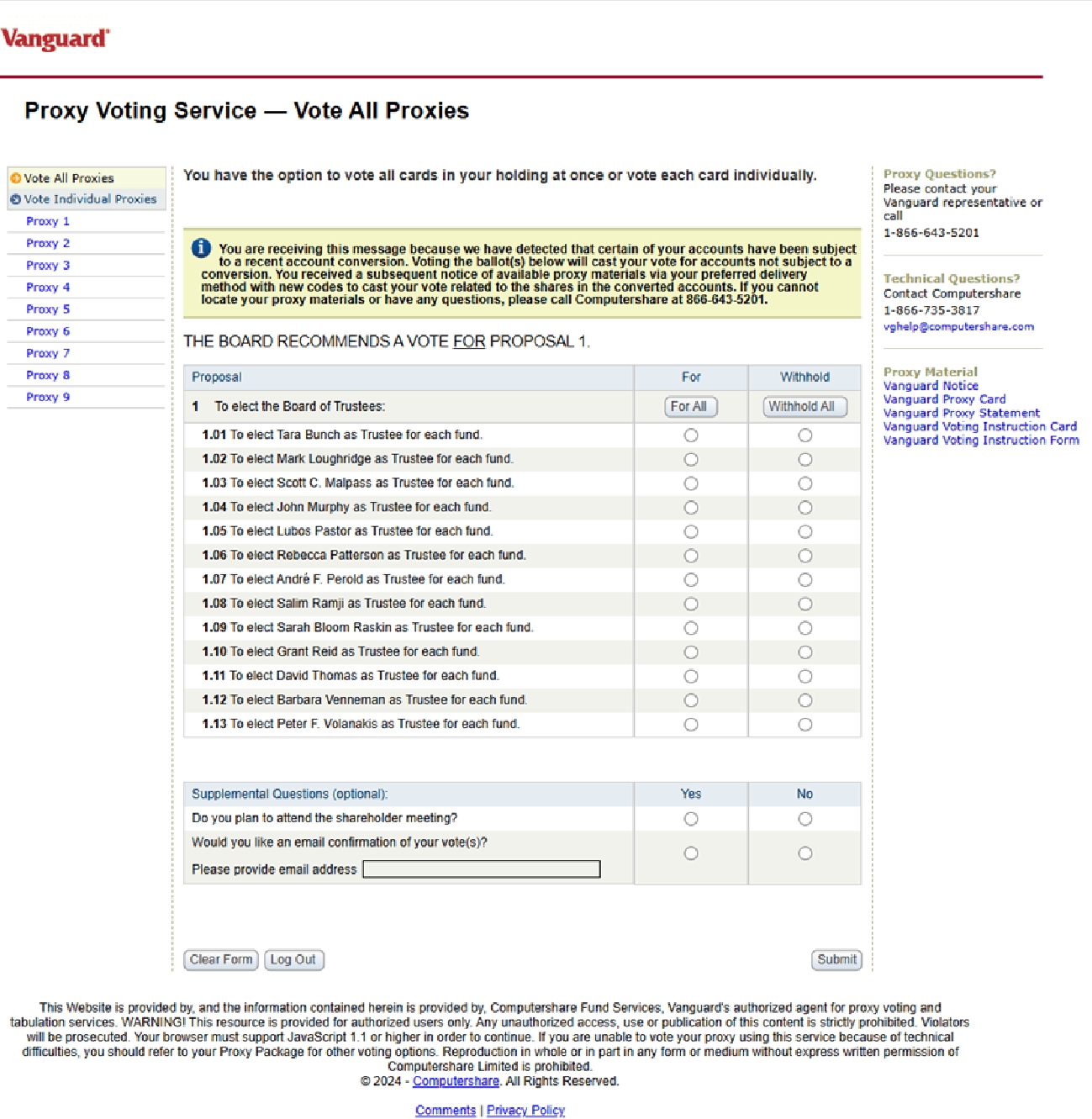

COMPUTERSHARE INTERNET SCREEN SCRIPT FOR INTERNET VOTING AND NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS

https://www.proxy-direct.com/vanguard/pages/login.aspx

Screen 1: Logon

[If shareholder would like to access materials they can do so with links along the right panel under “Proxy Materials”]

Screen 1: Logon – error message for invalid Control Number and Security Code

Screen 6: Vote All Proxies – important message for recent account conversion

[After clicking “Click Here to Acknowledge” on Screen 5, shareholder sees Screen 6]

[After selecting their voting choice(s), and hitting submit shareholder will see a confirmation page with their selections shown]

Vanguard Corporate Site webpage content

URL = https://corporate.vanguard.com/content/corporatesite/us/en/corp/fund-proxy-vote.html

Vanguard funds’ proxy

The Vanguard funds’ proxy is your opportunity to vote on an important proposal. Learn more about it on this page. Vote now .

About the Vanguard funds’ proxy

Why are the funds conducting a shareholder meeting and proxy?

Starting on November 27, 2024, shareholders of each U.S.-domiciled Vanguard fund are being asked to elect trustees for the Vanguard funds. Trustees oversee the funds to make sure they effectively serve the interests of shareholders.

On February 26, 2025, the funds will host a virtual Joint Special Meeting of Shareholders (the “Meeting”). The Vanguard funds hold shareholder meetings periodically when certain matters arise that require shareholder approval.

What is a proxy?

A proxy is the legal authority or means to permit shareholders’ votes to be registered without their presence at a shareholder meeting. Shareholders may vote their proxy online, by phone, or by mail. The Vanguard funds’ shareholders have the right to vote on certain matters concerning the fund or funds they own.

What is a Joint Special Meeting of Shareholders?

A Joint Special Meeting of Shareholders is a shareholder meeting of multiple funds held concurrently to obtain a shareholder vote on one or more proposals impacting the funds.

A shareholder who does not wish or is not able to attend the meeting to vote may instead vote through what is known as a “proxy vote.” For more information on how to cast your vote, please refer to the “Information on Voting” section of the proxy materials and/or the information on your proxy card, voting instruction card, voting instruction form, or Notice.

Which Vanguard funds are involved in the proxy?

The proxy involves all U.S.-domiciled Vanguard funds.

Commonly asked questions

Review our frequently asked questions about the funds’ proxy and voting process.

Who can vote?

Any person who owned shares of a U.S.-domiciled Vanguard fund as of the record date of November 26, 2024, even if that person sold those shares after the record date, gets to vote. This group of eligible voters includes investors living outside the United States who are invested in a U.S.-domiciled Vanguard fund. However, there may be instances in which the authority to vote resides with a retirement plan sponsor, financial intermediary, or financial advisor.

When does voting take place?

Voting by proxy will start after the record date of November 26, 2024. Shareholders can vote once they receive their proxy materials after that date. Voting concludes at the Meeting on February 26, 2025.

The Proxy Statement

Take time to read the Proxy Statement , then prepare to cast your vote.

Cast your vote

Shareholders can vote their shares using one of the following methods:

•Online, by visiting the website provided on your proxy card, voting instruction card, voting instruction form, or Notice.

•By phone, by calling the toll-free phone number on your proxy card, voting instruction card, voting instruction form, or on the website provided on the Notice.

•By mail, if you have requested a full set of paper proxy materials, by signing and dating the enclosed proxy card, voting instruction card, or voting instruction form.

•By attending the virtual Meeting, which is to be held on Wednesday, February 26, 2025, at 8:00 a.m., Eastern Time.

Shareholders are encouraged to vote online or by phone using the voting control number that appears on your proxy card, voting instruction card, or voting instruction form. Votes may also be submitted during the Meeting. In most instances, shareholders may vote up until voting closes at the Meeting. If your shares are held through a brokerage account, bank, or other holder of record (each, an “intermediary”), your intermediary may request that voting instructions are received in advance of the Meeting and provide additional information related to voting. All shares represented by valid proxies received on a timely basis prior to the tallying of the votes at the Meeting, regardless of the way they were provided, will be voted. Please contact your intermediary for additional information related to voting.

How will materials for clients with Vanguard brokerage accounts be handled?

Shareholders who hold shares in a Vanguard brokerage account (VBA) will receive a voter instruction card with their proxy materials.

Shareholders who hold both a mutual fund account on our legacy investment platform (a “mutual fund only account”) and a VBA will receive separate proxy materials for each account.

Shareholders whose mutual fund only account had been converted to VBA between October 24, 2024, and November 26, 2024, received proxy materials for the mutual fund only account previously, and will

also receive proxy materials related to the VBA in January 2025. Only votes cast using the VBA proxy materials will be counted.

For more information about Vanguard funds, visit vanguard.com to obtain a prospectus or, if available, a summary prospectus. Investment objectives, risks, charges, expenses, and other important information are contained in the prospectus; read and consider it carefully before investing.

All investing is subject to risk, including the possible loss of the money you invest.

IIG Send Text

Subject: We need your help because every vote matters

#FirstName#,

Vanguard’s U.S.-domiciled funds announced an important proxy voting campaign on November 22, 2024. Plan sponsors with proxy voting authority are being asked to elect trustees for the Vanguard funds.

Prompt voting ensures that the funds receive enough votes to reach quorum, which is required to hold the meeting. If quorum cannot be reached, the funds will have to adjourn the Joint Special Meeting of Shareholders and send additional communications to shareholders to try to get more votes—a process that would result in additional costs for the funds and thus the funds’ shareholders.

-----------------------------------------------------------------------------------------------------------------------------

Visit our online proxy resource center or call Computershare Fund Services toll-free at 866-643-5201 for all proxy information.

------------------------------------------------------------------------------------------------------------------------------

If you have additional questions, please don’t hesitate to contact us.

#VGI_Name# #VGI_Title#

Phone: #VGI_Phone#, Ext. #VGI_EXT#

_____________________________________________________________

For more information about Vanguard funds, visit vanguard.com to obtain a prospectus or, if available, a summary prospectus. Investment objectives, risks, charges, expenses, and other important information are contained in the prospectus; read and consider it carefully before investing.

Whenever you invest, there’s a chance you could lose the money.

For institutional use only. Not for distribution to retail investors.

© 2025 The Vanguard Group, Inc. All rights reserved. Vanguard Marketing Corporation, Distributor. Privacy statement: http://www.vanguard.com/instlprivacystmt

100 Vanguard Boulevard | Malvern, PA 19355 | institutional.vanguard.com

IIG Send Text

Subject: We need your help because every vote matters

#FirstName#,

Vanguard’s U.S.-domiciled funds announced an important proxy voting campaign on November 22, 2024. Based on your plan agreement, your participants have proxy voting authority for Vanguard’s U.S.- domiciled funds proxy. They are being asked to elect trustees for the Vanguard funds.

Prompt voting ensures that the funds receive enough votes to reach quorum, which is required to hold the meeting. If quorum cannot be reached, the funds will have to adjourn the Joint Special Meeting of Shareholders and send additional communications to shareholders to try to get more votes—a process that would result in additional costs for the funds and thus the funds’ shareholders.

-----------------------------------------------------------------------------------------------------------------------------

Visit our online proxy resource center or call Computershare Fund Services toll-free at 866-643-5201 for all proxy information.

------------------------------------------------------------------------------------------------------------------------------

If you have additional questions, please don’t hesitate to contact us.

#VGI_Name# #VGI_Title#

Phone: #VGI_Phone#, Ext. #VGI_EXT#

_____________________________________________________________

For more information about Vanguard funds, visit vanguard.com to obtain a prospectus or, if available, a summary prospectus. Investment objectives, risks, charges, expenses, and other important information are contained in the prospectus; read and consider it carefully before investing.

Whenever you invest, there’s a chance you could lose the money.

For institutional use only. Not for distribution to retail investors.

© 2025 The Vanguard Group, Inc. All rights reserved. Vanguard Marketing Corporation, Distributor. Privacy statement: http://www.vanguard.com/instlprivacystmt

100 Vanguard Boulevard | Malvern, PA 19355 | institutional.vanguard.com

Secure Email

SUBJECT: Vote your Vanguard fund shares today

Dear <<FIRSTNAME>>,

The trustees of U.S.-domiciled Vanguard funds are requesting your vote on an important matter. Shareholders of each U.S.-domiciled Vanguard fund as of the record date of November 26, 2024, are being asked to elect trustees for the Vanguard funds.

You may be receiving this notice because between October 24, 2024, and November 26, 2024, you were an existing client and one of the following occurred: (1) you opened a new Vanguard account, and your account holds shares of Vanguard funds, or (2) you purchased shares of a new Vanguard fund. You must cast your vote for your new funds using the ballot in the link below for your vote to be counted.

You may also be receiving this notice because between October 24, 2024, and November 26, 2024, your Vanguard account type changed (i.e., transitioned from a mutual fund to brokerage account platform).

Please note that while you may have received notice of available proxy materials previously and voted using those materials, those votes have been nullified. You must cast your vote using the ballot in the link below for your vote to be counted.

VOTE TODAY

Click on your personalized link below to access Vanguard’s fund proxy voting website, administered by Computershare Fund Services (Computershare). This will allow you to review the proxy materials that ask you and other Vanguard fund shareholders to vote on a proposal related to your fund ownership.

Please cast your vote using the updated ballot in the link below so that your vote may be counted.

Vote today!

LEARN MORE

Visit our online proxy resource center or call Computershare toll-free at 866-643-5201 for all proxy information, including how to vote online, by phone, or by mail.

Control number: <<CONTROLNUMBER>>

Security code: <<SECURITYNUMBER>>

Legal notices

For more information about Vanguard funds, visit vanguard.com to obtain a prospectus or, if available, a summary prospectus. Investment objectives, risks, charges, expenses, and other important information are contained in the prospectus; read and consider it carefully before investing.

All investing is subject to risk, including the possible loss of the money you invest.

© 2025 The Vanguard Group, Inc. All rights reserved. Vanguard Marketing Corporation, Distributor.

P.O. Box 982901 | El Paso, TX 79998-2901 | vanguard.com Privacy policy | Contact us | Online security | Home P.O. Box 982902 | El Paso, TX 79998-2902 | vanguard.com Privacy policy | Contact us | Online security | Home

FAS optional email

Subject: Action needed: We need your help because every vote matters

#FirstName#,

Vanguard’s U.S.-domiciled funds announced an important proxy voting campaign on November 22, 2024. Shareholders of each U.S.-domiciled Vanguard fund as of the record date of November 26, 2024, are being asked to elect trustees for the Vanguard funds.

Proxy service intermediaries (e.g., Broadridge) will send to shareholders the proxy materials, including information regarding the ways to vote.

Voting concludes at the Joint Special Meeting of Shareholders on February 26, 2025 (the “Meeting”).

Prompt voting ensures that the funds receive enough votes to reach quorum, which is required to hold the Meeting. If quorum cannot be reached, the funds will have to adjourn the Meeting and send additional communications to shareholders to try to get more votes—a process that would result in additional costs for the funds and thus the funds’ shareholders.

If you have additional questions, please don’t hesitate to contact us. #VGI_Name#

#VGI_Title#

Phone: #VGI_Phone#, Ext. #VGI_EXT#

------------------------------------------------------------------------------------------------------------------------------

For more information about Vanguard funds, visit advisors.vanguard.com to obtain a prospectus or, if available, a summary prospectus. Investment objectives, risks, charges, expenses, and other important information are contained in the prospectus; read and consider it carefully before investing.

All investing is subject to risk, including the possible loss of the money you invest.

FOR FINANCIAL ADVISOR USE ONLY. NOT FOR PUBLIC DISTRIBUTION.

© 2025 The Vanguard Group, Inc. All rights reserved. Vanguard Marketing Corporation, Distributor.