Stability Investment Solutions Diligence Federated Investors, Inc. Acquisition of Hermes Fund Managers Limited from BT Pension Scheme 0, 47, 95 123, 161, 206 252, 141, 44 191, 191, 191 3, 189, 34 255, 192, 0 0, 0, 0 153, 204, 0 216, 164, 5 57, 111, 164 152, 143, 134

Forward-Looking Information This presentation is provided as of the date on the cover. Certain statements in this presentation, including those related to the potential for growth and stability constitute forward-looking statements, which involve known and unknown risks, uncertainties, and other factors that may cause the actual results, levels of activity, performance or achievements of Federated or industry results, to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Among other risks and uncertainties are that market conditions and the performance of company products affect the potential for growth and stability. Other risks and uncertainties also include the risk factors discussed in the company’s annual and quarterly reports as filed with the Securities and Exchange Commission. For a discussion of such risk factors, see the section titled Risk Factors in Federated’s Annual Report on Form 10-K and other reports on file with the Securities and Exchange Commission. As a result, no assurance can be given as to future results, levels of activity, performance or achievements, and neither Federated nor any other person assumes responsibility for the accuracy and completeness of such statements in the future. Federated does not undertake any obligation to update the statements in this presentation. About Federated Investors, Inc. Federated Investors, Inc. is one of the largest investment managers in the United States, managing $397.6 billion in assets as of Dec. 31, 2017. With 108 funds, as well as a variety of separately managed account options, Federated provides comprehensive investment management to more than 8,500 institutions and intermediaries including corporations, government entities, insurance companies, foundations and endowments, banks and broker/dealers. For more information, visit FederatedInvestors.com. About Hermes Investment Management We are an asset manager with a difference. We believe that, while our primary purpose is helping beneficiaries retire better by providing world class active investment management and stewardship services, our role goes further. We believe we have a duty to deliver holistic returns – outcomes for our clients that go far beyond the financial and consider the impact our decisions have on society, the environment and the wider world. Our goal is to help people invest better, retire better and create a better society for all. We offer clients access to a broad range of specialist, high conviction investment teams with £33.0 billion* assets under management. In Hermes EOS, we have one of the industry’s leading engagement resource, advising on £336.1 billion* of assets. * Please note the total AUM figure includes £5.8bn of assets managed or under an advisory agreement by Hermes GPE LLP (“HGPE”), a joint venture between Hermes Fund Managers Limited ("HFM") and GPE Partner Limited. Source: Hermes as at 31 December 2017. For more information, visit www.hermes-investment.com. About BT Pension Scheme BT Pension Scheme (“BTPS” or the “Scheme”) is one of the UK’s largest corporate defined benefit (DB) pension schemes with assets of over £49.3 billion (as of 30 June 2017) and 297,454 scheme members. For more information, visit www.btpensions.net. 2

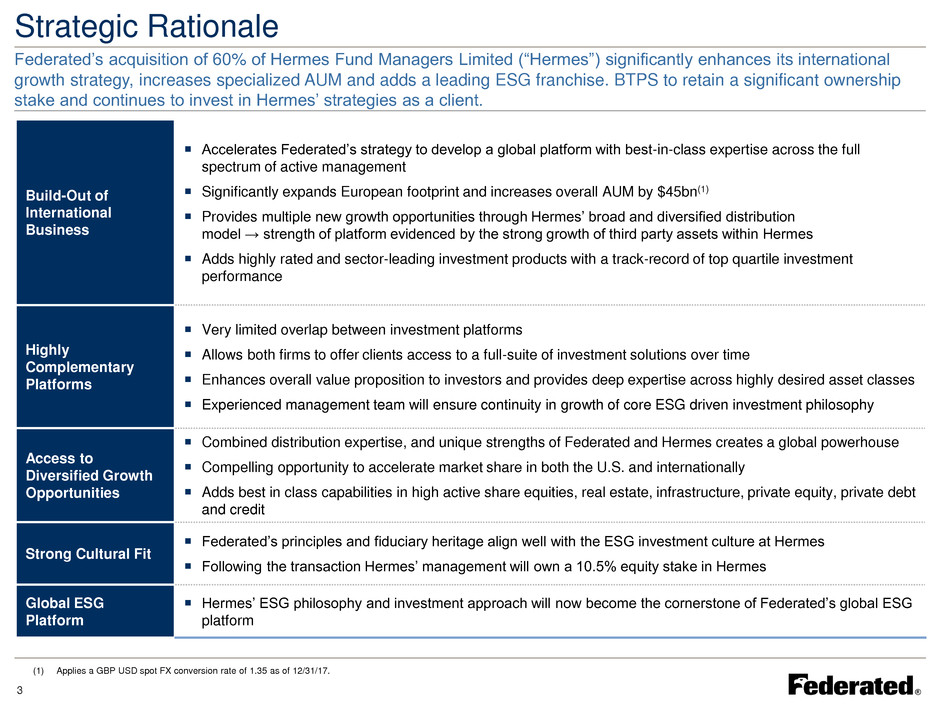

0, 47, 95 123, 161, 206 252, 141, 44 191, 191, 191 3, 189, 34 255, 192, 0 0, 0, 0 153, 204, 0 216, 164, 5 57, 111, 164 152, 143, 134 Strategic Rationale Federated’s acquisition of 60% of Hermes Fund Managers Limited (“Hermes”) significantly enhances its international growth strategy, increases specialized AUM and adds a leading ESG franchise. BTPS to retain a significant ownership stake and continues to invest in Hermes’ strategies as a client. Build-Out of International Business Accelerates Federated’s strategy to develop a global platform with best-in-class expertise across the full spectrum of active management Significantly expands European footprint and increases overall AUM by $45bn(1) Provides multiple new growth opportunities through Hermes’ broad and diversified distribution model → strength of platform evidenced by the strong growth of third party assets within Hermes Adds highly rated and sector-leading investment products with a track-record of top quartile investment performance Highly Complementary Platforms Very limited overlap between investment platforms Allows both firms to offer clients access to a full-suite of investment solutions over time Enhances overall value proposition to investors and provides deep expertise across highly desired asset classes Experienced management team will ensure continuity in growth of core ESG driven investment philosophy Access to Diversified Growth Opportunities Combined distribution expertise, and unique strengths of Federated and Hermes creates a global powerhouse Compelling opportunity to accelerate market share in both the U.S. and internationally Adds best in class capabilities in high active share equities, real estate, infrastructure, private equity, private debt and credit Strong Cultural Fit Federated’s principles and fiduciary heritage align well with the ESG investment culture at Hermes Following the transaction Hermes’ management will own a 10.5% equity stake in Hermes Global ESG Platform Hermes’ ESG philosophy and investment approach will now become the cornerstone of Federated’s global ESG platform (1) Applies a GBP USD spot FX conversion rate of 1.35 as of 12/31/17. 3

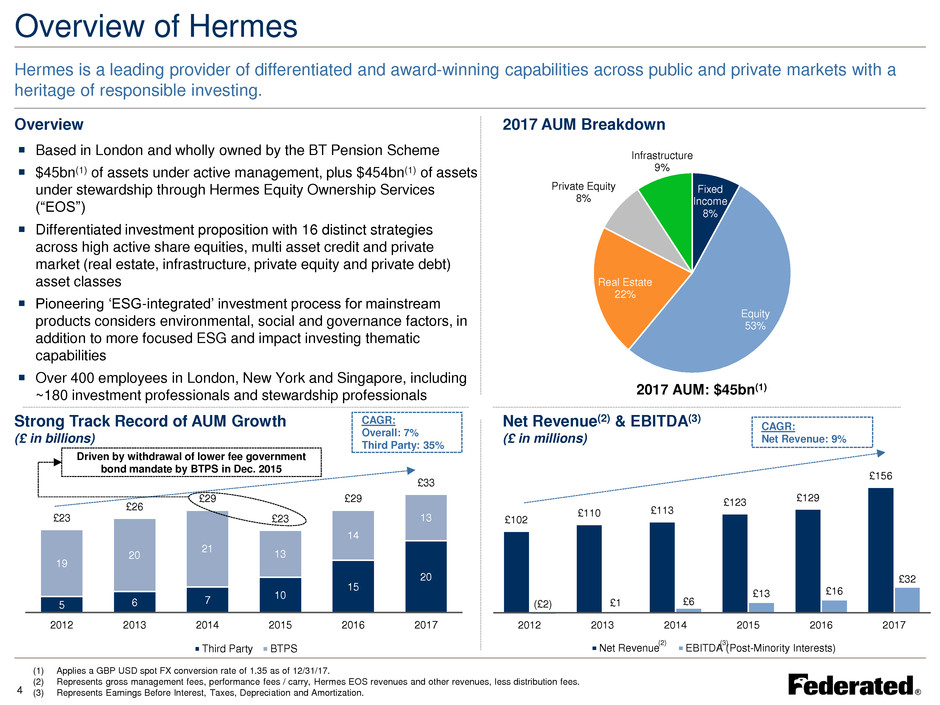

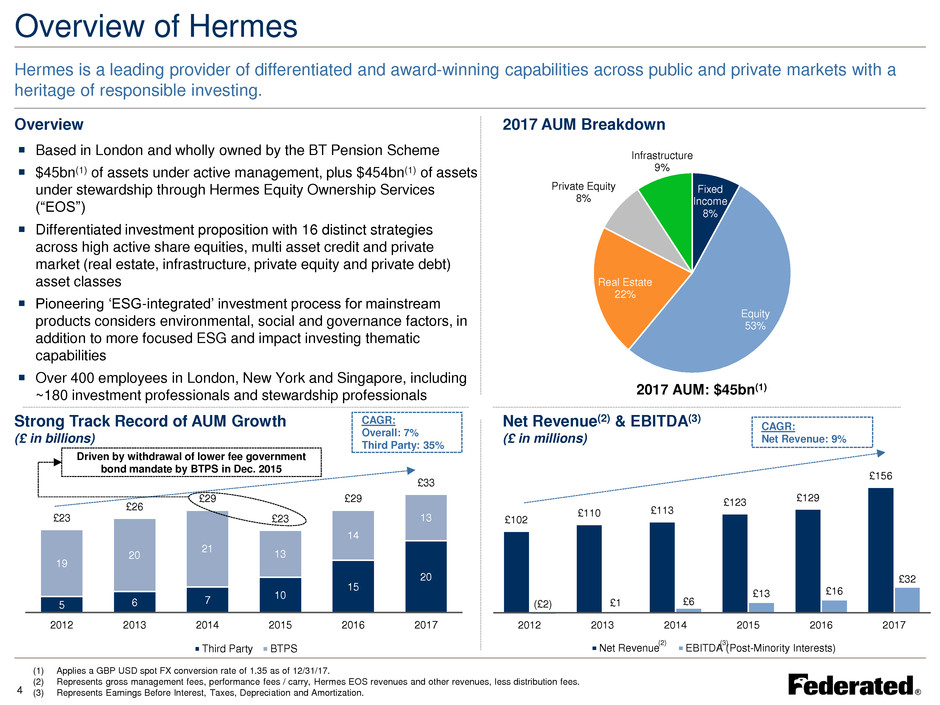

0, 47, 95 123, 161, 206 252, 141, 44 191, 191, 191 3, 189, 34 255, 192, 0 0, 0, 0 153, 204, 0 216, 164, 5 57, 111, 164 152, 143, 134 Overview of Hermes Hermes is a leading provider of differentiated and award-winning capabilities across public and private markets with a heritage of responsible investing. Overview Based in London and wholly owned by the BT Pension Scheme $45bn(1) of assets under active management, plus $454bn(1) of assets under stewardship through Hermes Equity Ownership Services (“EOS”) Differentiated investment proposition with 16 distinct strategies across high active share equities, multi asset credit and private market (real estate, infrastructure, private equity and private debt) asset classes Pioneering ‘ESG-integrated’ investment process for mainstream products considers environmental, social and governance factors, in addition to more focused ESG and impact investing thematic capabilities Over 400 employees in London, New York and Singapore, including ~180 investment professionals and stewardship professionals 2017 AUM Breakdown Strong Track Record of AUM Growth (£ in billions) 5 6 7 10 15 20 19 20 21 13 14 13 £23 £26 £29 £23 £29 £33 2012 2013 2014 2015 2016 2017 Third Party BTPS Fixed Income 8% Equity 53% Real Estate 22% Private Equity 8% Infrastructure 9% (1) Applies a GBP USD spot FX conversion rate of 1.35 as of 12/31/17. (2) Represents gross management fees, performance fees / carry, Hermes EOS revenues and other revenues, less distribution fees. (3) Represents Earnings Before Interest, Taxes, Depreciation and Amortization. 2017 AUM: $45bn(1) Net Revenue(2) & EBITDA(3) (£ in millions) CAGR: Overall: 7% Third Party: 35% £102 £110 £113 £123 £129 £156 (£2) £1 £6 £13 £16 £32 2012 2013 2014 2015 2016 2017 Net Revenue EBITDA (Post-Minority Interests) CAGR: Net Revenue: 9% (2) Driven by withdrawal of lower fee government bond mandate by BTPS in Dec. 2015 (3) 4

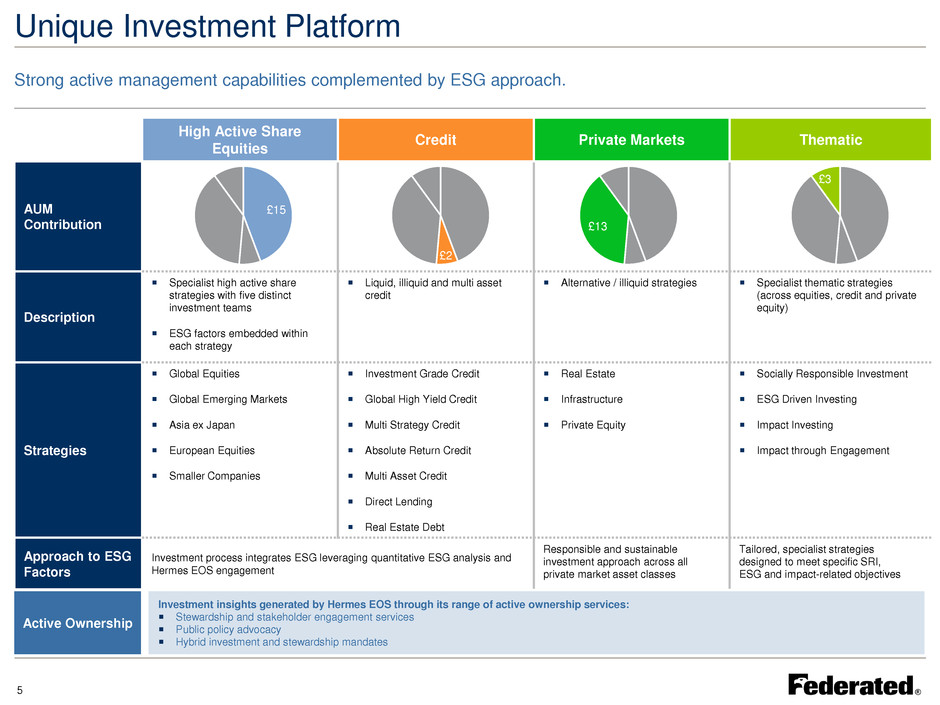

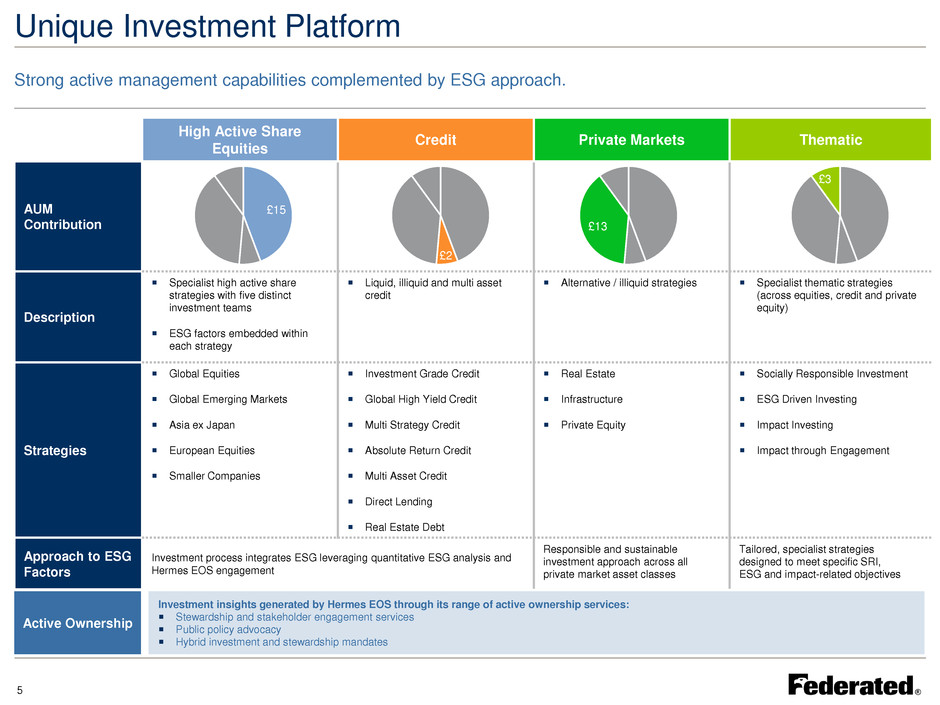

0, 47, 95 123, 161, 206 252, 141, 44 191, 191, 191 3, 189, 34 255, 192, 0 0, 0, 0 153, 204, 0 216, 164, 5 57, 111, 164 152, 143, 134 Unique Investment Platform Strong active management capabilities complemented by ESG approach. High Active Share Equities Credit Private Markets Thematic AUM Contribution Description Specialist high active share strategies with five distinct investment teams ESG factors embedded within each strategy Liquid, illiquid and multi asset credit Alternative / illiquid strategies Specialist thematic strategies (across equities, credit and private equity) Strategies Global Equities Global Emerging Markets Asia ex Japan European Equities Smaller Companies Investment Grade Credit Global High Yield Credit Multi Strategy Credit Absolute Return Credit Multi Asset Credit Direct Lending Real Estate Debt Real Estate Infrastructure Private Equity Socially Responsible Investment ESG Driven Investing Impact Investing Impact through Engagement Approach to ESG Factors Investment process integrates ESG leveraging quantitative ESG analysis and Hermes EOS engagement Responsible and sustainable investment approach across all private market asset classes Tailored, specialist strategies designed to meet specific SRI, ESG and impact-related objectives £15 £2 £13 £3 Investment insights generated by Hermes EOS through its range of active ownership services: Stewardship and stakeholder engagement services Public policy advocacy Hybrid investment and stewardship mandates Active Ownership 5

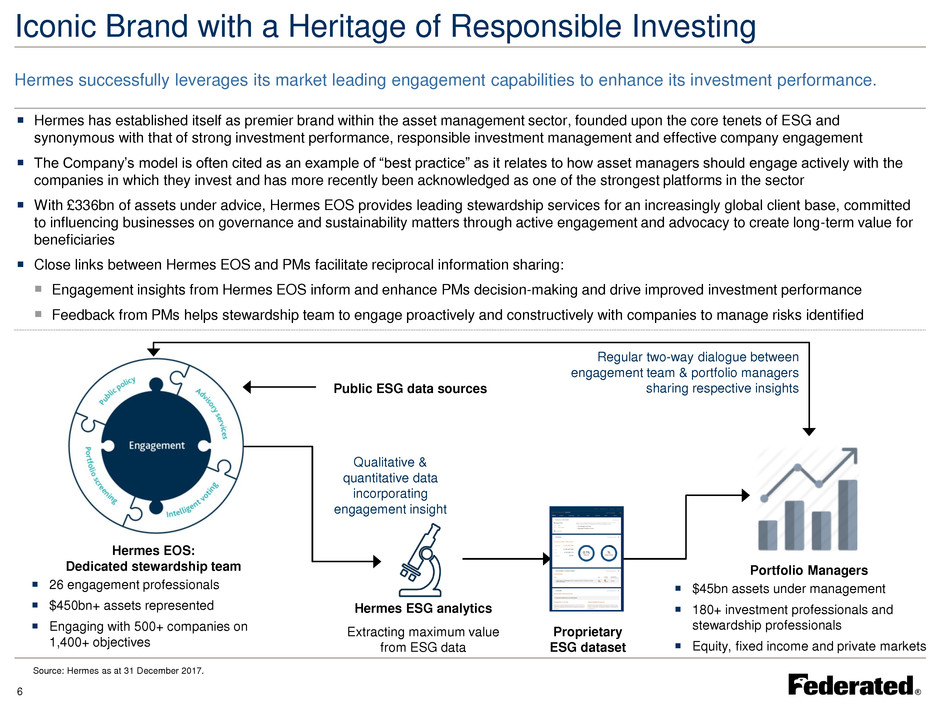

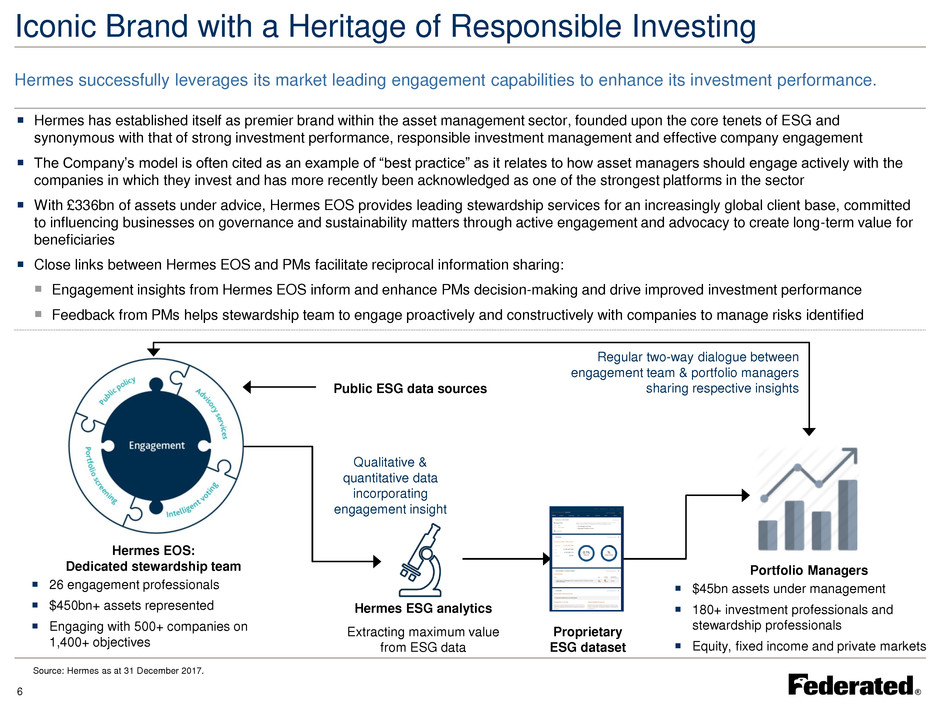

0, 47, 95 123, 161, 206 252, 141, 44 191, 191, 191 3, 189, 34 255, 192, 0 0, 0, 0 153, 204, 0 216, 164, 5 57, 111, 164 152, 143, 134 Iconic Brand with a Heritage of Responsible Investing Hermes has established itself as premier brand within the asset management sector, founded upon the core tenets of ESG and synonymous with that of strong investment performance, responsible investment management and effective company engagement The Company’s model is often cited as an example of “best practice” as it relates to how asset managers should engage actively with the companies in which they invest and has more recently been acknowledged as one of the strongest platforms in the sector With £336bn of assets under advice, Hermes EOS provides leading stewardship services for an increasingly global client base, committed to influencing businesses on governance and sustainability matters through active engagement and advocacy to create long-term value for beneficiaries Close links between Hermes EOS and PMs facilitate reciprocal information sharing: Engagement insights from Hermes EOS inform and enhance PMs decision-making and drive improved investment performance Feedback from PMs helps stewardship team to engage proactively and constructively with companies to manage risks identified Hermes EOS: Dedicated stewardship team 26 engagement professionals $450bn+ assets represented Engaging with 500+ companies on 1,400+ objectives Portfolio Managers $45bn assets under management 180+ investment professionals and stewardship professionals Equity, fixed income and private markets Hermes ESG analytics Extracting maximum value from ESG data Proprietary ESG dataset Qualitative & quantitative data incorporating engagement insight Regular two-way dialogue between engagement team & portfolio managers sharing respective insights 6 Source: Hermes as at 31 December 2017. Public ESG data sources Hermes successfully leverages its market leading engagement capabilities to enhance its investment performance.

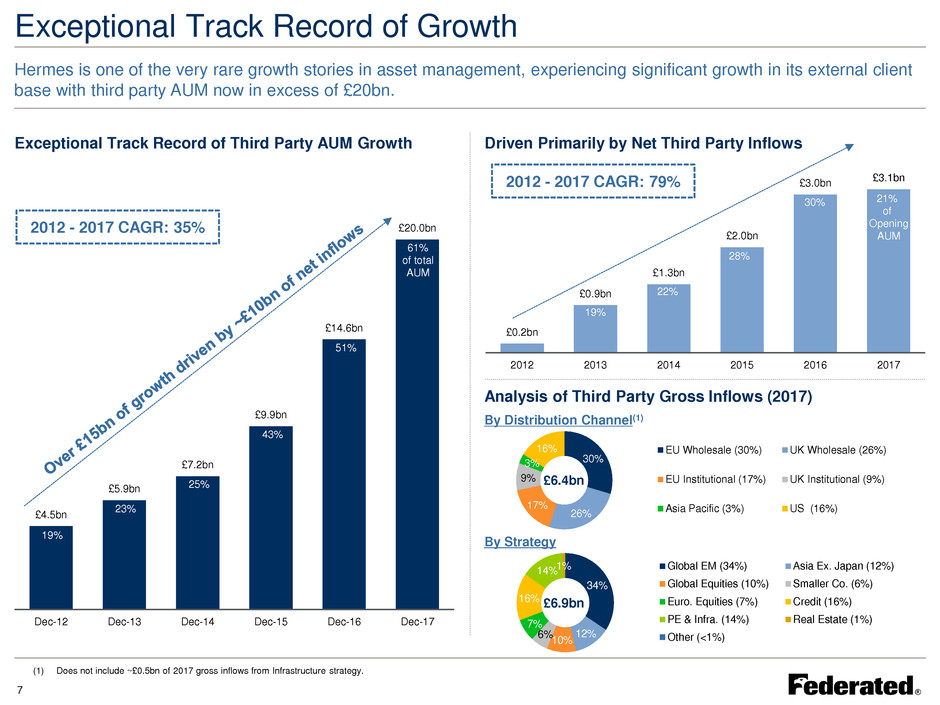

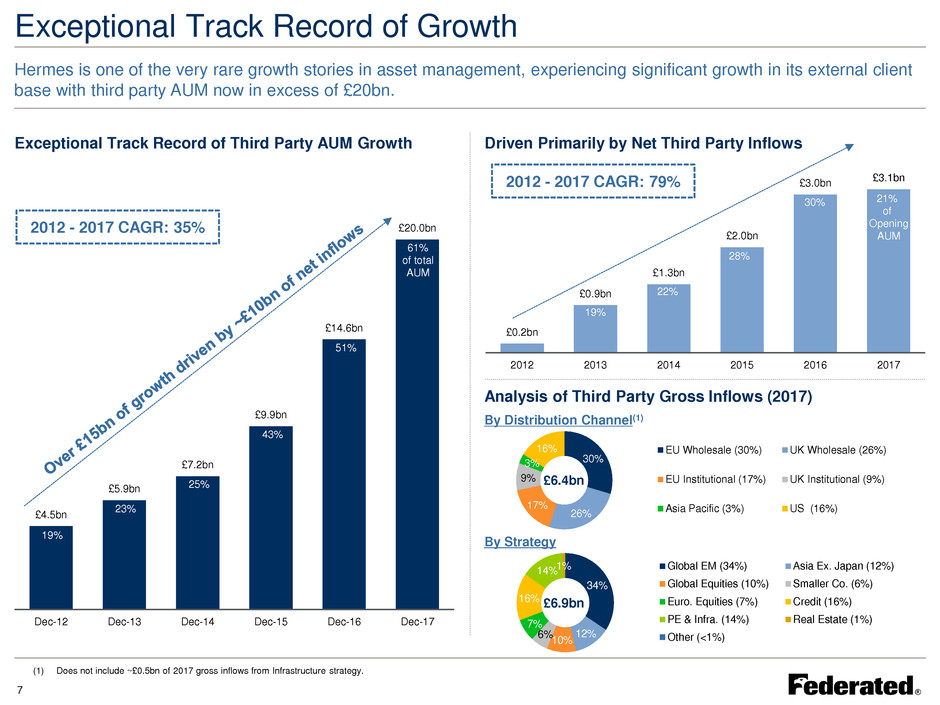

0, 47, 95 123, 161, 206 252, 141, 44 191, 191, 191 3, 189, 34 255, 192, 0 0, 0, 0 153, 204, 0 216, 164, 5 57, 111, 164 152, 143, 134 Exceptional Track Record of Growth Exceptional Track Record of Third Party AUM Growth Driven Primarily by Net Third Party Inflows Analysis of Third Party Gross Inflows (2017) Hermes is one of the very rare growth stories in asset management, experiencing significant growth in its external client base with third party AUM now in excess of £20bn. £4.5bn £5.9bn £7.2bn £9.9bn £14.6bn £20.0bn Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 Dec-17 19% 23% 25% 43% 51% 61% of total AUM £0.2bn £0.9bn £1.3bn £2.0bn £3.0bn £3.1bn 2012 2013 2014 2015 2016 2017 19% 22% 28% 30% 21% of Opening AUM By Distribution Channel(1) By Strategy 2012 - 2017 CAGR: 35% 30% 26% 17% 9% 3% 16% EU Wholesale (30%) UK Wholesale (26%) EU Institutional (17%) UK Institutional (9%) Asia Pacific (3%) US (16%) 3 % 12% 10% 6% 7% 16% 14% 1% Global EM (34%) Asia Ex. Japan (12%) Global Equities ( 0%) Smaller Co. (6%) Euro. Equities (7%) Credit (16%) PE & Infra. (14%) Real Estate (1%) Other (<1%) £6.4bn £6.9bn 2012 - 2017 CAGR: 79% (1) Does not include ~£0.5bn of 2017 gross inflows from Infrastructure strategy. 7

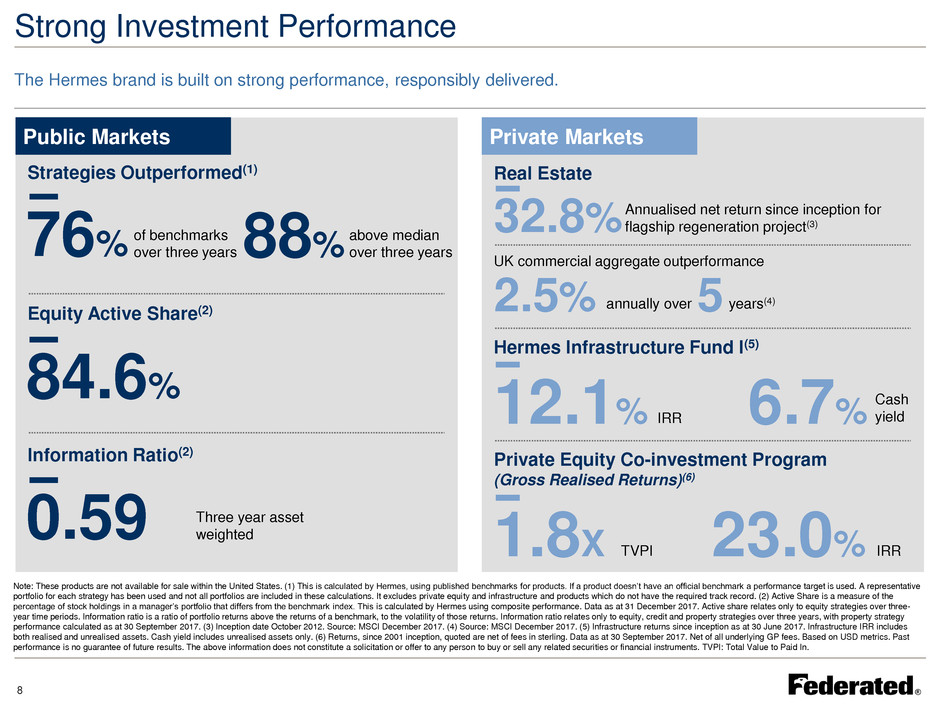

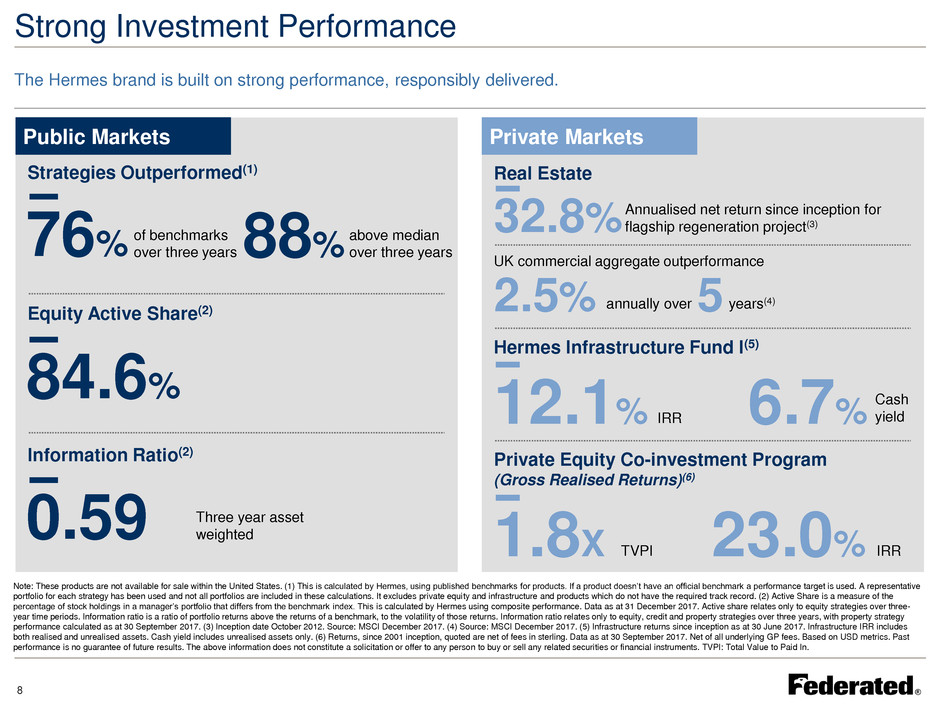

0, 47, 95 123, 161, 206 252, 141, 44 191, 191, 191 3, 189, 34 255, 192, 0 0, 0, 0 153, 204, 0 216, 164, 5 57, 111, 164 152, 143, 134 Strong Investment Performance The Hermes brand is built on strong performance, responsibly delivered. Public Markets Private Markets Strategies Outperformed(1) of benchmarks over three years 76% Equity Active Share(2) 84.6% above median over three years 88% Information Ratio(2) Three year asset weighted 0.59 Hermes Infrastructure Fund I(5) IRR 12.1% Private Equity Co-investment Program (Gross Realised Returns)(6) TVPI 1.8X Cash yield 6.7% IRR 23.0% Note: These products are not available for sale within the United States. (1) This is calculated by Hermes, using published benchmarks for products. If a product doesn’t have an official benchmark a performance target is used. A representative portfolio for each strategy has been used and not all portfolios are included in these calculations. It excludes private equity and infrastructure and products which do not have the required track record. (2) Active Share is a measure of the percentage of stock holdings in a manager’s portfolio that differs from the benchmark index. This is calculated by Hermes using composite performance. Data as at 31 December 2017. Active share relates only to equity strategies over three- year time periods. Information ratio is a ratio of portfolio returns above the returns of a benchmark, to the volatility of those returns. Information ratio relates only to equity, credit and property strategies over three years, with property strategy performance calculated as at 30 September 2017. (3) Inception date October 2012. Source: MSCI December 2017. (4) Source: MSCI December 2017. (5) Infrastructure returns since inception as at 30 June 2017. Infrastructure IRR includes both realised and unrealised assets. Cash yield includes unrealised assets only. (6) Returns, since 2001 inception, quoted are net of fees in sterling. Data as at 30 September 2017. Net of all underlying GP fees. Based on USD metrics. Past performance is no guarantee of future results. The above information does not constitute a solicitation or offer to any person to buy or sell any related securities or financial instruments. TVPI: Total Value to Paid In. Real Estate Annualised net return since inception for flagship regeneration project(3) 32.8% annually over 2.5% years(4) 5 UK commercial aggregate outperformance 8

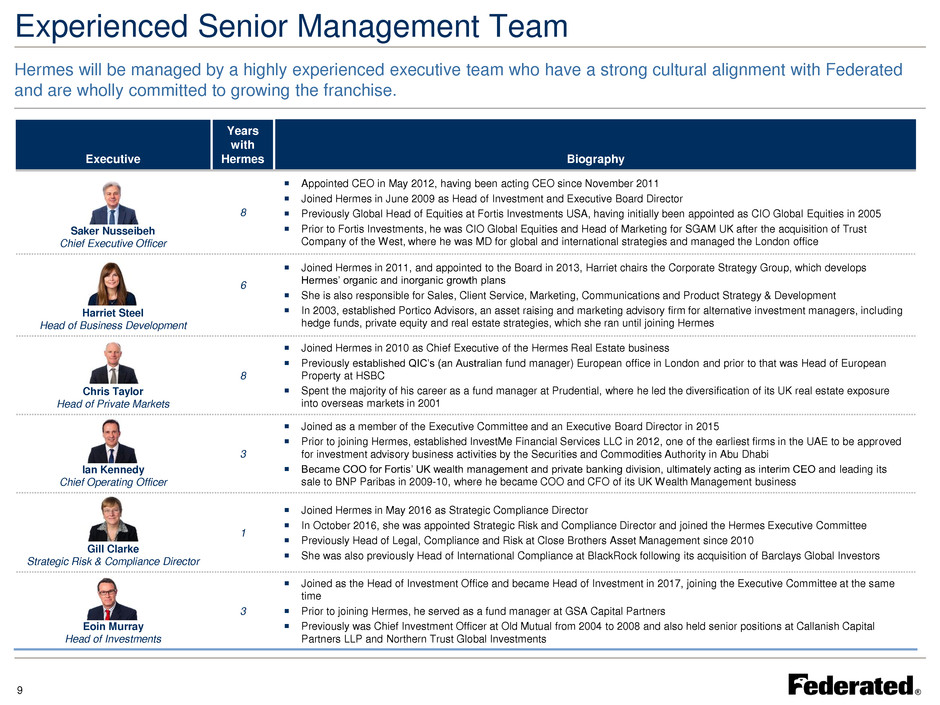

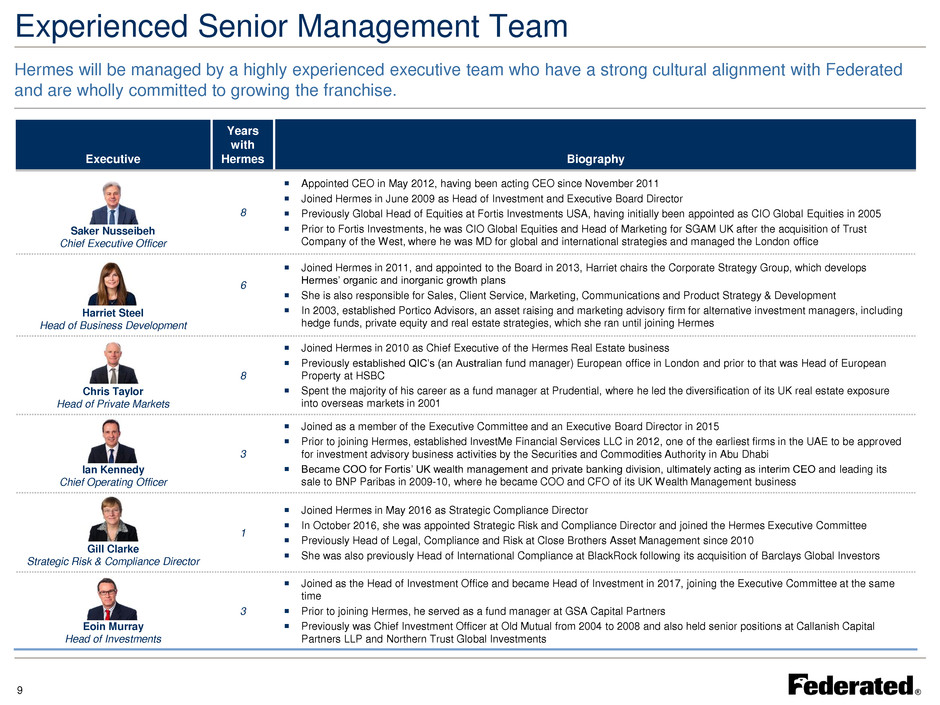

0, 47, 95 123, 161, 206 252, 141, 44 191, 191, 191 3, 189, 34 255, 192, 0 0, 0, 0 153, 204, 0 216, 164, 5 57, 111, 164 152, 143, 134 Experienced Senior Management Team Hermes will be managed by a highly experienced executive team who have a strong cultural alignment with Federated and are wholly committed to growing the franchise. Executive Years with Hermes Biography Saker Nusseibeh Chief Executive Officer 8 Appointed CEO in May 2012, having been acting CEO since November 2011 Joined Hermes in June 2009 as Head of Investment and Executive Board Director Previously Global Head of Equities at Fortis Investments USA, having initially been appointed as CIO Global Equities in 2005 Prior to Fortis Investments, he was CIO Global Equities and Head of Marketing for SGAM UK after the acquisition of Trust Company of the West, where he was MD for global and international strategies and managed the London office Harriet Steel Head of Business Development 6 Joined Hermes in 2011, and appointed to the Board in 2013, Harriet chairs the Corporate Strategy Group, which develops Hermes’ organic and inorganic growth plans She is also responsible for Sales, Client Service, Marketing, Communications and Product Strategy & Development In 2003, established Portico Advisors, an asset raising and marketing advisory firm for alternative investment managers, including hedge funds, private equity and real estate strategies, which she ran until joining Hermes Chris Taylor Head of Private Markets 8 Joined Hermes in 2010 as Chief Executive of the Hermes Real Estate business Previously established QIC’s (an Australian fund manager) European office in London and prior to that was Head of European Property at HSBC Spent the majority of his career as a fund manager at Prudential, where he led the diversification of its UK real estate exposure into overseas markets in 2001 Ian Kennedy Chief Operating Officer 3 Joined as a member of the Executive Committee and an Executive Board Director in 2015 Prior to joining Hermes, established InvestMe Financial Services LLC in 2012, one of the earliest firms in the UAE to be approved for investment advisory business activities by the Securities and Commodities Authority in Abu Dhabi Became COO for Fortis’ UK wealth management and private banking division, ultimately acting as interim CEO and leading its sale to BNP Paribas in 2009-10, where he became COO and CFO of its UK Wealth Management business Gill Clarke Strategic Risk & Compliance Director 1 Joined Hermes in May 2016 as Strategic Compliance Director In October 2016, she was appointed Strategic Risk and Compliance Director and joined the Hermes Executive Committee Previously Head of Legal, Compliance and Risk at Close Brothers Asset Management since 2010 She was also previously Head of International Compliance at BlackRock following its acquisition of Barclays Global Investors Eoin Murray Head of Investments 3 Joined as the Head of Investment Office and became Head of Investment in 2017, joining the Executive Committee at the same time Prior to joining Hermes, he served as a fund manager at GSA Capital Partners Previously was Chief Investment Officer at Old Mutual from 2004 to 2008 and also held senior positions at Callanish Capital Partners LLP and Northern Trust Global Investments 9

0, 47, 95 123, 161, 206 252, 141, 44 191, 191, 191 3, 189, 34 255, 192, 0 0, 0, 0 153, 204, 0 216, 164, 5 57, 111, 164 152, 143, 134 Institutional 45% BTPS 10% Wholesale / Retail 45% AUM ex. MM by Product AUM ex. MM by Client AUM ex. MM by Geography Highly Complementary Platforms – Ex. Money Market Assets US 73% America excl. US 1% UK 17% Europe excl. UK 8% Asia 1% US 96% America excl. US 1% UK 1% Europe excl. UK 2% Institutional 34 BTPS 39% Wholesale / Retail 27% Equities 53% Fixed Income 8% Real Estate 22% Private Equity 8% Infrastructure 9% Total AUM: $45bn Total AUM: $177bn Eq ities 2Fixed Income 38% Real Estate 6% Private Equity 2% Infrastructure 3% Total AUM: $132bn Note: Applies a GBP USD spot FX conversion rate of 1.35 as of 12/31/17. Financial data as of December 31, 2017. (1) Including BTPS. Institutional 49% Wholesale / Retail 51% Equities 51% Fixed Income 49% (1) The acquisition of Hermes creates a highly diversified global investment platform allowing Federated to reach a larg r client base with a breadth of strategies. 10 US 5% America excl. US 3% UK 61% Europe excl. UK 25% Asia 6% (1)

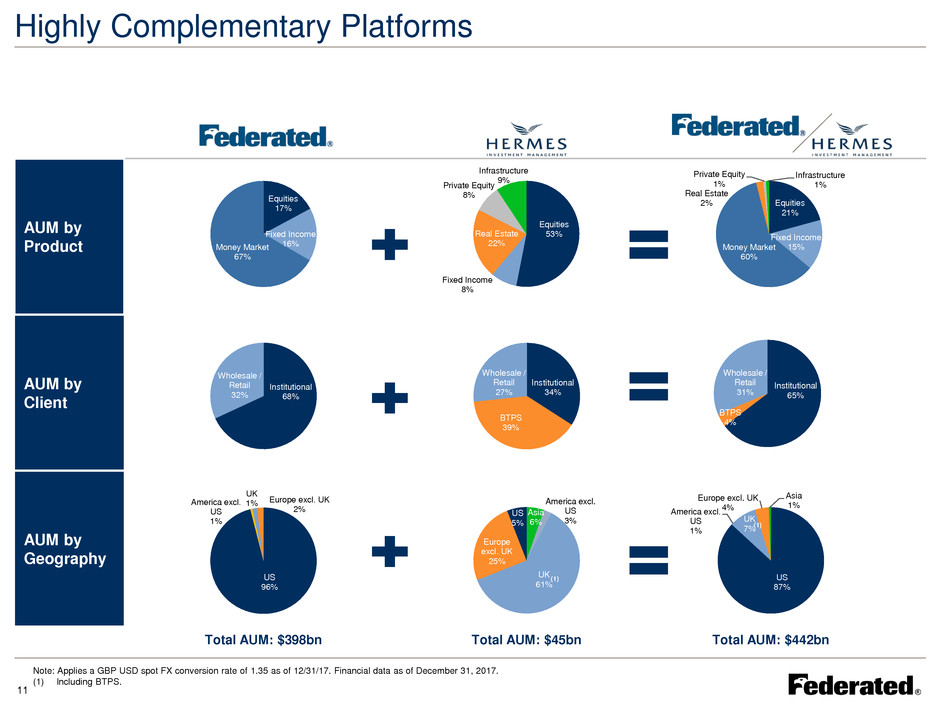

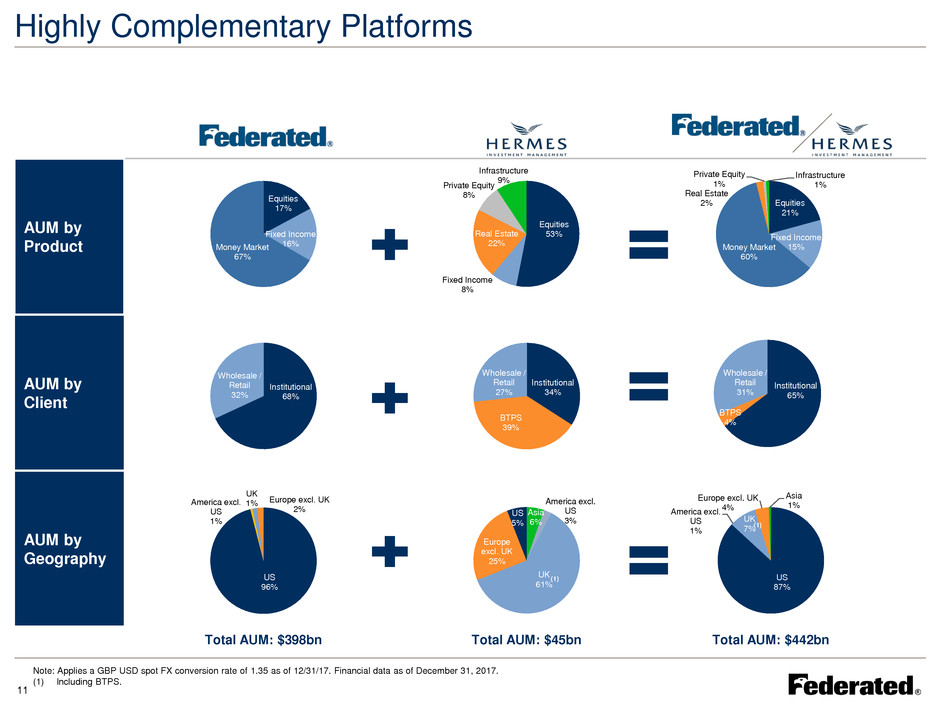

0, 47, 95 123, 161, 206 252, 141, 44 191, 191, 191 3, 189, 34 255, 192, 0 0, 0, 0 153, 204, 0 216, 164, 5 57, 111, 164 152, 143, 134 AUM by Product AUM by Client AUM by Geography Highly Complementary Platforms Institutional 68% Wholesale / Retail 32% Institutional 65% BTPS 4% Wholesale / Retail 31% Total AUM: $45bn Total AUM: $442bn Total AUM: $398bn US 96% America excl. US 1% UK 1% Europe excl. UK 2% US 87% America excl. US 1% UK 7% Europe excl. UK 4% Asia 1% Equities 21% Fixed Income 15%Money Market 60% Real Estate 2% Private Equity 1% Infrastructure 1% Equities 17% Fixed Income 16%Money Market 67% Note: Applies a GBP USD spot FX conversion rate of 1.35 as of 12/31/17. Financial data as of December 31, 2017. (1) Including BTPS. 11 Equities 53% Fixed Income 8% Real Estate 22 Private Equity 8% Infrastructur 9% Institutional 34% BTPS 39% Wholesale / Retail 27% US 5% America excl. US 3% UK 61% Europe excl. UK 25% Asia 6% (1) (1)

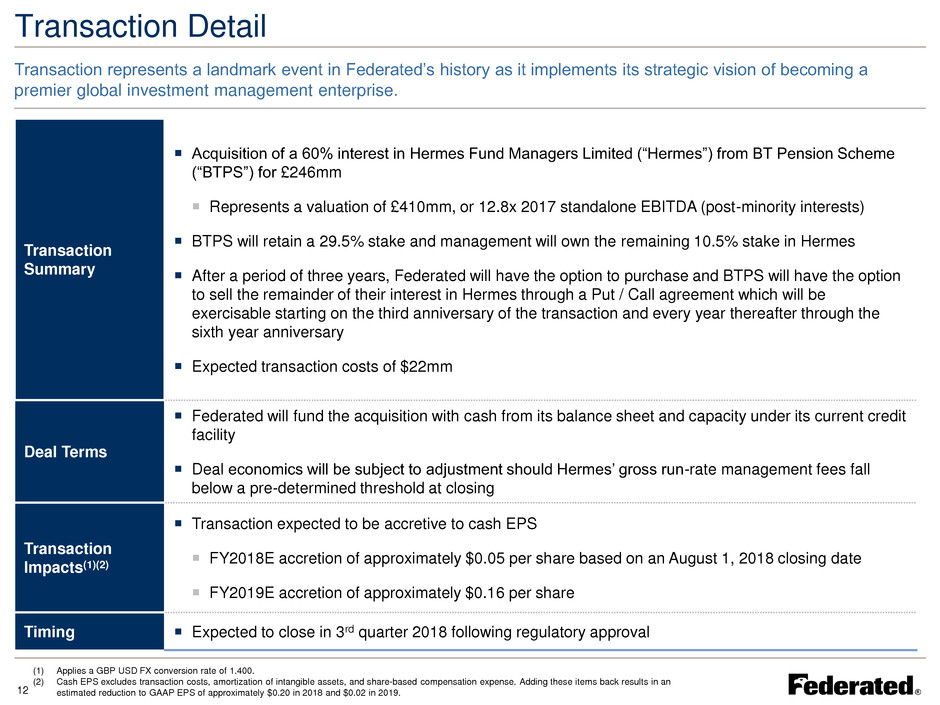

0, 47, 95 123, 161, 206 252, 141, 44 191, 191, 191 3, 189, 34 255, 192, 0 0, 0, 0 153, 204, 0 216, 164, 5 57, 111, 164 152, 143, 134 Transaction Detail Transaction represents a landmark event in Federated’s history as it implements its strategic vision of becoming a premier global investment management enterprise. Transaction Summary Acquisition of a 60% interest in Hermes Fund Managers Limited (“Hermes”) from BT Pension Scheme (“BTPS”) for £246mm Represents a valuation of £410mm, or 12.8x 2017 standalone EBITDA (post-minority interests) BTPS will retain a 29.5% stake and management will own the remaining 10.5% stake in Hermes After a period of three years, Federated will have the option to purchase and BTPS will have the option to sell the remainder of their interest in Hermes through a Put / Call agreement which will be exercisable starting on the third anniversary of the transaction and every year thereafter through the sixth year anniversary Expected transaction costs of $22mm Deal Terms Federated will fund the acquisition with cash from its balance sheet and capacity under its current credit facility Deal economics will be subject to adjustment should Hermes’ gross run-rate management fees fall below a pre-determined threshold at closing Transaction Impacts(1)(2) Transaction expected to be accretive to cash EPS FY2018E accretion of approximately $0.05 per share based on an August 1, 2018 closing date FY2019E accretion of approximately $0.16 per share Timing Expected to close in 3rd quarter 2018 following regulatory approval (1) Applies a GBP USD FX conversion rate of 1.400. (2) Cash EPS excludes transaction costs, amortization of intangible assets, and share-based compensation expense. Adding these items back results in an estimated reduction to GAAP EPS of approximately $0.20 in 2018 and $0.02 in 2019. 12