UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2007

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 1-14818

FEDERATED INVESTORS, INC.

(Exact name of registrant as specified in its charter)

| | |

| Pennsylvania | | 25-1111467 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

Federated Investors Tower Pittsburgh, Pennsylvania | | 15222-3779 |

| (Address of principal executive offices) | | (zip code) |

412-288-1900

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | |

| Class B Common Stock, no par value | | New York Stock Exchange |

| (Title of each class) | | (Name of each exchange on which registered) |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company (as defined in Rule 12b-2 of the Exchange Act).

Large accelerated filer x Accelerated filer ¨ Non-accelerated filer ¨ Smaller reporting company ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule12b-2 of the Exchange Act). Yes ¨ No x

The aggregate market value of the Class B Common Stock held by non-affiliates of the registrant as of June 30, 2007 was approximately $3.3 billion, based on the last reported sales price of $38.33 as reported by the New York Stock Exchange. For purposes of this calculation, the registrant has deemed all of its executive officers and directors to be affiliates, but has made no determination as to whether any other persons are “affiliates” within the meaning of Rule 12b-2 under the Securities Exchange Act of 1934. The number of shares of Class A and Class B Common Stock outstanding on February 22, 2008, was 9,000 and 101,735,511, respectively.

Documents incorporated by reference:

Selected portions of the 2007 Annual Report to Shareholders – Part I, Part II and Part IV of this Form 10-K.

Selected portions of the 2008 Information Statement – Part III of this Form 10-K.

Table of Contents

2

Part I

ITEM 1 – BUSINESS

General

Federated Investors, Inc., a Pennsylvania corporation, together with its consolidated subsidiaries (collectively, “Federated” or “the Company”), is a leading provider of investment management products and related financial services. Federated has been in the investment management business since 1955 and is one of the largest mutual fund managers in the United States with $301.6 billion in assets under management at December 31, 2007.

Federated sponsors, markets and provides investment-related services to various investment products, including mutual funds and Separate Accounts (which include separately managed accounts, institutional accounts, sub-advised funds (both variable annuity and other) and other managed products). Federated’s principal source of revenue is investment advisory fee income earned by various subsidiaries of Federated pursuant to investment advisory contracts with the investment products. These subsidiaries are registered as investment advisers under the Investment Advisers Act of 1940. Investment advisers are compensated for their services in the form of investment advisory fees based primarily upon the net assets of the fund or Separate Account.

Federated provided investment advisory services to 148 Federated-sponsored funds as of December 31, 2007. Federated markets these funds to banks, broker/dealers and other financial intermediaries who use them to meet the needs of their customers, including retail investors, corporations and retirement plans. The funds sponsored by Federated are domiciled in the U.S., with the exception of Federated International Funds Plc and Federated Unit Trust, which are domiciled in Dublin, Ireland. Most of Federated’s U.S.-domiciled funds are registered under the Investment Company Act of 1940 (“Investment Company Act”) and under applicable federal and state laws. Each of the funds enters into an advisory agreement that is subject to annual approval by the fund board of directors or trustees, a majority of whom are not “interested persons” of the funds or Federated as defined under the Investment Company Act. In general, amendments to such advisory agreements must be approved by the funds’ shareholders. A significant portion of Federated’s revenue is derived from these advisory agreements, which generally are terminable upon 60 days notice.

Of the 148 funds sponsored by Federated (the “Federated Funds”) as of December 31, 2007, Federated’s investment advisory subsidiaries managed 51 money market funds (and cash equivalents) totaling $215.0 billion in assets, 48 fixed-income funds with $17.9 billion in assets and 49 equity funds with $29.2 billion in assets.

As of December 31, 2007, Federated provided investment advisory services to $39.5 billion in Separate Account assets. These Separate Accounts (together with the Federated Funds, “Managed Assets”) represented assets from high net worth individuals, government entities, pension and other employee benefit plans, corporations, trusts, foundations, endowments, mutual funds and other products sponsored by third parties. Fees for Separate Accounts are typically based on the value of assets under management pursuant to investment advisory agreements that may be terminated at any time.

Certain Federated Funds have adopted distribution plans that, subject to applicable law, provide for payment to Federated for marketing expenses, including sales commissions paid to broker/dealers. These distribution plans are implemented through a distribution agreement between Federated and each respective fund. Although the specific terms of each such agreement vary, the basic terms of the agreements are similar. Pursuant to the agreements, Federated acts as underwriter for the funds and distributes shares of the funds primarily through unaffiliated dealers. Each distribution plan and agreement is initially approved by the directors or trustees of the respective fund and is reviewed for approval by such directors or trustees annually.

Federated also provides a broad range of services to support the operation and administration of the Federated Funds. These services, for which Federated receives fees pursuant to agreements with the Federated Funds, include administrative services, shareholder servicing and general support.

3

Total Managed Assets for the past three years were as follows:

Managed Assets by Asset Type

| | | | | | | | | | | | | | | |

| | | As of December 31, | | Growth Rate | |

(dollars in millions) | | 2007 | | 2006 | | 2005 | | 3 Yr. CAGR1 | | | 2007 | |

Money Market | | $ | 236,630 | | $ | 173,644 | | $ | 160,621 | | 24 | % | | 36 | % |

Equity | | | 42,162 | | | 40,894 | | | 29,785 | | 13 | % | | 3 | % |

Fixed-Income | | | 22,824 | | | 22,902 | | | 23,017 | | (4 | )% | | (0 | )% |

| | | | | | | | | | | | | | | |

Total Managed Assets | | $ | 301,616 | | $ | 237,440 | | $ | 213,423 | | 19 | % | | 27 | % |

| | | | | | | | | | | | | | | |

1 | Compound Annual Growth Rate |

Average Managed Assets for the past three years were as follows:

Average Managed Assets by Asset Type

| | | | | | | | | | | | | | | |

| | | Year ended December 31, | | Growth Rate | |

(dollars in millions) | | 2007 | | 2006 | | 2005 | | 3 Yr. CAGR1 | | | 2007 | |

Money Market | | $ | 199,673 | | $ | 163,901 | | $ | 144,356 | | 14 | % | | 22 | % |

Equity | | | 42,443 | | | 34,542 | | | 28,940 | | 17 | % | | 23 | % |

Fixed-Income | | | 22,939 | | | 22,259 | | | 24,351 | | (6 | )% | | 3 | % |

| | | | | | | | | | | | | | | |

Total Average Managed Assets | | $ | 265,055 | | $ | 220,702 | | $ | 197,647 | | 12 | % | | 20 | % |

| | | | | | | | | | | | | | | |

1 | Compound Annual Growth Rate |

Federated also derives revenue from providing mutual fund administrative services and various other fund-related services to institutions seeking to outsource all or part of their mutual fund service and distribution functions. The following chart shows period-end and average assets in funds sponsored by third parties (“Administered Assets”) for the past three years:

Administered Assets

| | | | | | | | | | | | | | | |

| | | As of and for the year ended

December 31, | | Growth Rate | |

(dollars in millions) | | 2007 | | 2006 | | 2005 | | 3 Yr. CAGR1 | | | 2007 | |

Period-End Administered Assets | | $ | 9,565 | | $ | 17,778 | | $ | 18,271 | | (36 | )% | | (46 | )% |

Average Administered Assets | | | 17,492 | | | 18,272 | | | 18,239 | | (25 | )% | | (4 | )% |

| | | | | | | | | | | | | | | |

1 | Compound Annual Growth Rate |

Federated’s revenues from investment advisory, administrative and other service fees provided under agreements with the Federated Funds and other entities over the last three years were as follows:

Revenue from Continuing Operations

| | | | | | | | | | | | | | | |

| | | Year ended December 31, | | Growth Rate | |

(dollars in thousands) | | 2007 | | 2006 | | 2005 | | 3 Yr. CAGR1 | | | 2007 | |

Investment advisory fees, net | | $ | 726,459 | | $ | 614,436 | | $ | 570,695 | | 10 | % | | 18 | % |

Administrative service fees, net | | | 171,847 | | | 147,865 | | | 135,070 | | 8 | % | | 16 | % |

Other service fees, net | | | 223,761 | | | 210,082 | | | 183,215 | | 17 | % | | 7 | % |

Other, net | | | 5,577 | | | 6,475 | | | 7,258 | | (9 | )% | | (14 | )% |

| | | | | | | | | | | | | | | |

Total revenue | | $ | 1,127,644 | | $ | 978,858 | | $ | 896,238 | | 11 | % | | 15 | % |

| | | | | | | | | | | | | | | |

1 | Compound Annual Growth Rate |

In terms of revenue concentration by product, approximately 17% of Federated’s total revenue for 2007 was derived from services provided to one sponsored fund (the Federated Kaufmann Fund). In addition, in terms of revenue concentration by customer, two intermediary customers [Edward D. Jones & Co., L.P. and the Bank of New York

4

Mellon Corporation, including Pershing (a subsidiary of the Bank of New York Mellon Corporation) and other assets from the Bank of New York Mellon Corporation] accounted for a total of approximately 13% and 15%, respectively, of Federated’s total revenue for 2007. With respect to both intermediary customers, most of this revenue is derived from broker/dealer cash sweep money market products. Significant changes in Federated’s relationship with these intermediary customers, including changes which may result from the Bank of New York Company, Inc. merger with Mellon Financial Corp., could have a significant adverse effect on Federated’s future revenues and, to a lesser extent, net income, due to corresponding significant reductions to Marketing and distribution expenses associated with such intermediaries.

Federated’s revenues from domestic and foreign operations over the last three years were as follows:

Revenue from Continuing Operations

| | | | | | | | | | | | | | | |

| | | Year ended December 31, | | Growth Rate | |

(dollars in thousands) | | 2007 | | 2006 | | 2005 | | 3 Yr. CAGR1 | | | 2007 | |

Domestic | | $ | 1,084,794 | | $ | 942,710 | | $ | 862,241 | | 11 | % | | 15 | % |

Foreign | | | 42,850 | | | 36,148 | | | 33,997 | | 8 | % | | 19 | % |

| | | | | | | | | | | | | | | |

Total revenue | | $ | 1,127,644 | | $ | 978,858 | | $ | 896,238 | | 11 | % | | 15 | % |

| | | | | | | | | | | | | | | |

1 | Compound Annual Growth Rate |

Investment Products

Federated offers a wide range of products, including money market, equity and fixed-income investments. Federated’s mix includes products that the Company expects to be in demand under a variety of economic and market conditions.

Federated is one of the largest U.S. managers of money market assets, with $236.6 billion in such assets under management at December 31, 2007. Federated has developed expertise in managing cash for institutions, which typically have stringent requirements for regulatory compliance, relative safety, liquidity and competitive yields. Federated has managed money market funds for over 30 years and began selling money market fund products to institutions in 1974. Federated also manages retail money market products that are typically distributed through broker/dealers. Federated manages money market assets in the following asset classes: government ($123.3 billion); prime corporate ($80.7 billion); and tax free ($32.6 billion).

In recent years, Federated has emphasized growth of its equity business as an important component of its growth strategy and has broadened its range of equity investment products. Equity assets total $42.2 billion at December 31, 2007 and are managed across a wide range of styles including small-mid cap growth ($14.5 billion); core equity ($9.2 billion); large-cap value ($4.8 billion); flexible ($3.3 billion); international/global ($3.1 billion); equity income ($3.0 billion); and mid-large cap growth ($1.2 billion). Federated also manages assets in equity index funds ($2.4 billion) and balanced and asset allocation funds ($0.7 billion). These asset allocation funds may include fixed-income assets.

Federated’s fixed-income assets total $22.8 billion at December 31, 2007 and are managed in a wide range of sectors including multi-sector ($6.3 billion); mortgage-backed ($3.6 billion); U.S. government ($3.0 billion); U.S. corporate ($3.0 billion); municipal ($2.7 billion); high-yield ($2.2 billion); and international/global ($2.0 billion). Federated’s fixed-income products offer fiduciaries and others a broad range of highly defined products designed to meet many of their investment needs.

Investment products are generally managed by a team of portfolio managers supported by fundamental and quantitative research analysts. Federated’s proprietary, independent investment research process is centered on the integration of several fundamentals: quantitative research models, fundamental research and credit analysis, style-consistent and disciplined portfolio construction and management, performance attribution and trading.

5

Distribution Channels

Federated’s distribution strategy is to provide products geared to financial intermediaries, primarily banks, broker/dealers, investment advisers and directly to institutions such as corporations and government entities. Through substantial investments in distribution for more than 50 years, Federated has developed relationships with 3,400 intermediaries and sells its products directly to another 2,000 corporations and government entities. Federated uses its trained sales force of approximately 175 representatives and managers to add new customer relationships and strengthen and expand existing relationships.

Product Markets

Federated’s investment products are distributed in three principal markets: the wealth management and trust market, the broker/dealer market and the global institutional market. The following chart shows Federated Managed Assets by market for the dates indicated:

Managed Assets by Market

| | | | | | | | | | | | | | | |

| | | As of December 31, | | Growth Rate | |

(dollars in millions) | | 2007 | | 2006 | | 2005 | | 3 Yr. CAGR1 | | | 2007 | |

Wealth Management & Trust | | $ | 143,881 | | $ | 106,350 | | $ | 105,918 | | 13 | % | | 35 | % |

Broker/Dealer2 | | | 120,627 | | | 103,081 | | | 82,886 | | 29 | % | | 17 | % |

Global Institutional2 | | | 25,057 | | | 20,785 | | | 18,592 | | 14 | % | | 21 | % |

Other | | | 12,051 | | | 7,224 | | | 6,027 | | 22 | % | | 67 | % |

| | | | | | | | | | | | | | | |

Total Managed Assets | | $ | 301,616 | | $ | 237,440 | | $ | 213,423 | | 19 | % | | 27 | % |

| | | | | | | | | | | | | | | |

1 | Compound Annual Growth Rate |

2 | Federated’s market definitions changed as of January 1, 2006. Channels that had been included in the former Institutional market are now included in the Broker/Dealer and the Wealth Management & Trust markets. For further explanations of these changes and historical data, please see the Historical Assets under the New Market Definition chart on the About Us page of FederatedInvestors.com. |

Wealth Management & Trust, Global Capital Markets and Institutional Cash. Federated pioneered the concept of providing cash management to bank trust departments through money market mutual funds over 30 years ago. Today, wealth management professionals in bank trust departments and at registered investment advisory firms (“RIAs”) use a broad range of Federated’s equity and fixed-income funds to invest the assets over which they have discretion. Federated also supports our clients’ asset allocation programs through Federated’s PRISM® series, which is comprised of quarterly market outlooks, asset allocation models and online proposals for investors.

Money market funds contain the majority of Federated’s Managed Assets in the wealth management channel. In allocating investments across various asset classes, investors typically maintain a portion of their portfolios in cash or cash equivalents, including money market funds, irrespective of trends in bond or stock prices. In addition, Federated offers an extensive menu of equity and fixed-income mutual funds and Separate Accounts structured for use in the wealth management and trust market. In addition to bank trust departments and RIAs, Federated provides products and services to capital markets clients (institutional brokerages generally within banks) and directly to cash management and treasury departments at major corporations and government entities. Assets from these clients totaled $53.7 billion, $53.1 billion of which was in money market assets as of December 31, 2007.

Federated employs dedicated sales forces backed by experienced support staffs to offer products and services to each of the above sub-categories of the wealth management and trust market. As of December 31, 2007, Managed Assets in this market included $130.7 billion in money market assets, $7.0 billion in fixed-income assets and $6.2 billion in equity assets.

Broker/Dealer Market. Federated distributes its products in this market through a large, diversified group of approximately 2,600 national, regional and independent broker/dealers and bank broker/dealers. Federated maintains sales staff dedicated to calling on broker/dealers, bank broker/dealers and insurance interests. Broker/dealers use Federated’s products to meet the needs of their customers, who are typically retail investors. Federated offers products with a variety of commission structures that enable brokers to offer their customers a choice of pricing

6

options. Federated also offers money market mutual funds as cash management products designed for use by its broker/dealer clients. As of December 31, 2007, Managed Assets in the broker/dealer market included $80.1 billion in money market assets, $30.5 billion in equity assets and $10.0 billion in fixed-income assets.

Global Institutional Market.Federated has structured its investment process to meet the requirements of fiduciaries and others who use Federated’s products to meet the needs of their customers. Fiduciaries typically have stringent demands related to portfolio composition, risk and investment performance. Federated maintains a dedicated sales staff to focus on the distribution of its products to a wide variety of global institutional customers: corporations, corporate and public pension funds, government entities, foundations, endowments, hospitals, and non-Federated investment companies. Federated includes institutional assets gathered in the U.S. in this market, including two local government investment pools in the state of Texas ($19.8 billion). In addition, assets gathered from Federated’s distribution to areas outside the U.S. through Federated International Management Ltd. and Federated Asset Management GmbH, a venture with LVM Insurance, are included in this market. As of December 31, 2007, Managed Assets in the global institutional market included $20.5 billion in money market assets, $3.4 billion in fixed-income assets and $1.2 billion in equity assets.

Other Markets. Other markets at December 31, 2007, included assets under management from the following sources: certain affinity groups and direct sales efforts including the retail assets associated with the Federated Kaufmann Fund ($3.3 billion); and collateralized debt obligation (CDO) products for which Federated acts as the investment adviser ($1.1 billion).

Competition

The investment management business is highly competitive. Competition is particularly intense among mutual fund providers. According to the Investment Company Institute, at the end of 2007, there were over 8,000 open-end mutual funds, of varying sizes and investment objectives, whose shares are currently being offered to the public both on a sales-load and no-sales-load basis. In addition to competition from other mutual fund managers and investment advisers, Federated and the mutual fund industry compete with investment alternatives offered by insurance companies, commercial banks, broker/dealers, other financial institutions, hedge funds and exchange traded funds.

Competition for sales of investment products is influenced by various factors including investment performance in terms of attaining the stated objectives of the particular products and in terms of fund yields and total returns, advertising and sales promotional efforts, investor confidence and type and quality of services.

Recent Acquisitions

In the third quarter 2007, Federated completed a transaction with Rochdale Investment Management LLC (Rochdale) to acquire certain assets relating to its business of providing investment advisory and investment management services to the Rochdale Atlas Portfolio (Rochdale Acquisition). In connection with the acquisition, on August 24, 2007, the assets of the Rochdale Atlas Portfolio ($366 million as of August 24, 2007) were transitioned into the Federated InterContinental Fund, a new portfolio created for the purpose of continuing the investment operations of the Rochdale Atlas Portfolio as part of the Federated fund complex. This new fund is a solid addition to Federated’s international equity product group and is positioned to be a core international equity holding, investing in both developed and emerging markets. Federated paid $5.75 million of upfront purchase price in August 2007, and as of December 31, 2007, incurred approximately $1 million in transaction costs. As a result of the transaction, Federated recorded a customer relationship intangible asset and goodwill based upon preliminary valuation estimates. Although the preliminary valuation estimates are reflected in the Consolidated Financial Statements as of and for the period ended December 31, 2007, the final purchase price allocation may result in adjustments to these preliminary estimates and such adjustments may be material.

The Rochdale Acquisition agreement provides for two forms of contingent purchase price payments that are dependent upon asset growth and fund performance over the five-year period following the acquisition closing date. The first form of contingent payment is payable in 2010 and 2012 and could aggregate to as much as $20 million. The second form of contingent payment is payable on a semi-annual basis over the five-year period following the acquisition closing date and is based on certain revenue earned by Federated from the Federated InterContinental

7

Fund. Both forms of contingent payments will be recorded as additional goodwill at the time the related contingency is resolved.

In the second quarter 2007, Federated acquired a non-voting, minority interest in both Dix Hills Partners, LLC, a registered investment adviser and commodity trading adviser, and its affiliate, Dix Hills Associates, LLC (collectively, Dix Hills). Dix Hills is based in Westbury, New York and manages over $500 million in both absolute return and enhanced fixed-income mandates, including a hedge fund strategy and an enhanced cash strategy. The total purchase price included an upfront cash payment as well as contingent payments that could be paid annually based on growth in Dix Hills’ cash earnings for each of the first three anniversary years following the acquisition date. Federated accounted for its minority interest using the equity method of accounting. The investment in Dix Hills is included in Other long-term assets on Federated’s Consolidated Balance Sheet at December 31, 2007.

Federated continues to look for new alliances and acquisition opportunities.

Regulatory Matters

Substantially all aspects of Federated’s business are subject to federal and state regulation and to the extent operations take place outside the United States, they are subject to the regulations of foreign countries. Depending upon the nature of any non-compliance, the results could include the suspension or revocation of licenses or registration, including broker/dealer licenses and registrations and transfer agent registrations, as well as the imposition of civil fines and penalties and in certain limited circumstances, prohibition from acting as an adviser to registered investment companies. Federated’s advisory companies are registered with the Securities and Exchange Commission (the “SEC”) under the Investment Advisers Act of 1940 and with certain states. All of the mutual funds managed, distributed, and administered by Federated are registered with the SEC under the Investment Company Act. Certain wholly owned subsidiaries of Federated are registered as broker/dealers with the SEC under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and with various states and are members of the Financial Industry Regulatory Authority (“FINRA”) (formerly, the National Association of Securities Dealers). Their activities are regulated by the SEC, FINRA and the various states in which they are registered. These subsidiaries are required to meet capital requirements established by the SEC pursuant to the Exchange Act. Two other subsidiaries are registered with the SEC as transfer agents. One subsidiary is regulated by the Pennsylvania Department of Banking. Amendments to current laws and regulations or newly promulgated laws and regulations governing Federated’s operations, the compliance with which may require substantial resources, could have a material adverse impact on Federated.

The federal, state and foreign laws and regulations applicable to most aspects of Federated’s business are primarily intended to benefit or protect Federated’s customers and the funds’ shareholders and generally grant supervisory agencies and bodies broad administrative powers, including the power to limit or restrict Federated from carrying on its business in the event that it fails to comply with such laws and regulations. In such event, the possible sanctions that may be imposed include the suspension of individual employees, limitations on engaging in certain lines of business for specified periods of time, revocation of broker/dealer licenses and registrations and transfer agent registrations, censure and fines.

For further details regarding recent regulatory matters, see Note (22)(c) and (d) to the Consolidated Financial Statements incorporated by reference in Item 8 of Part II of this Form 10-K.

Employees

At December 31, 2007, Federated employed 1,270 persons. Federated considers its relationships with its employees to be satisfactory.

8

Forward-Looking Information

Certain statements in this Annual Report on Form 10-K and the 2007 Annual Report to Shareholders, including those related to opportunities provided by the Federated Kaufmann products, business mix; market share; obligations to make additional contingent payments pursuant to acquisition agreements; obligations to make additional payments pursuant to employment agreements; the costs associated with the settlement with the Securities and Exchange Commission and the New York State Attorney General; legal proceedings; future cash needs and the likelihood of borrowing under Federated’s credit facility; future principal uses of cash; performance indicators; impact of accounting policies and new accounting pronouncements; management’s estimates regarding certain tax matters; concentration risk; indemnification obligations; the impact of increased regulation; the prospect of increased marketing and distribution-related expenses; final purchase price allocations relating to the Rochdale transaction; insurance recoveries; changes in the demand for mutual fund distribution and administration, and the various items set forth in Federated’s 2007 Annual Report to Shareholders under the section entitled “Risk Factors” constitute forward-looking statements, which involve known and unknown risks, uncertainties, and other factors that may cause the actual results, levels of activity, performance or achievements of Federated or industry results, to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Among other risks and uncertainties, market conditions may change significantly resulting in changes to Federated’s business mix and market share, and potentially adversely affecting the results of the Federated Kaufmann products. The obligation to make contingent payments is based on certain growth and fund performance targets and will be affected by the achievement of such targets, and the obligation to make additional payments pursuant to employment agreements is based on satisfaction of certain conditions set forth in those agreements. Future cash needs and future uses of cash will be impacted by a variety of factors, including the number and size of any acquisitions, Federated’s success in distributing its products, the resolution of pending litigation, as well as potential changes in assets under management and/or changes in the terms of distribution and shareholder services contracts with intermediaries who offer Federated’s products to customers. Federated’s risks and uncertainties also include revenue risk, which will be affected by changes in market values of assets under management and may be affected by changing interest rates. Many of these factors may be more likely to occur as a result of the ongoing threat of terrorism and the increased scrutiny of the mutual fund industry by federal and state regulators. As a result, no assurance can be given as to future results, levels of activity, performance or achievements, and neither Federated nor any other person assumes responsibility for the accuracy and completeness of such statements in the future.

9

Executive Officers

The following section sets forth certain information regarding the executive officers of Federated as of February 28, 2008:

| | | | |

Name | | Position | | Age |

| John F. Donahue | | Chairman and Director | | 83 |

| | |

| J. Christopher Donahue | | President, Chief Executive Officer and Director | | 58 |

| | |

| Brian P. Bouda | | Vice President and Chief Compliance Officer | | 61 |

| | |

| Thomas R. Donahue | | Vice President, Treasurer and Chief Financial Officer and President, FII Holdings, Inc. | | 49 |

| | |

| John B. Fisher | | Vice President and President and Chief Executive Officer of Federated Advisory Companies* | | 51 |

| | |

| Eugene F. Maloney | | Vice President and Executive Vice President, Federated Investors Management Company | | 62 |

| | |

| Denis McAuley III | | Vice President, Principal Accounting Officer and President of Federated Shareholder Services Company | | 61 |

| | |

| John W. McGonigle | | Vice Chairman, Executive Vice President, Chief Legal Officer, Secretary and Director | | 69 |

| | |

| Thomas E. Territ | | Vice President and President, Federated Securities Corp. | | 48 |

| * | Federated Advisory Companies include the following subsidiaries of Federated: Federated Advisory Services Company, Federated Equity Management Company of Pennsylvania, Federated Global Investment Management Corp., Passport Research Ltd., Federated Investment Counseling, Federated Investment Management Company and Federated MDTA LLC. |

Mr. John F. Donahue is a founder of Federated. He has served as director and Chairman of Federated since Federated's initial public offering in May 1998. He is a director or trustee of 44 investment companies managed by subsidiaries of Federated. Mr. Donahue is the father of J. Christopher Donahue who serves as Chief Executive Officer and director of Federated and Thomas R. Donahue who serves as Chief Financial Officer.

Mr. J. Christopher Donahue has served as director, President and Chief Executive Officer of Federated since 1998. He is President of 41 investment companies managed by subsidiaries of Federated. He is also director or trustee of 44 investment companies managed by subsidiaries of Federated. Mr. Donahue is the son of John F. Donahue and the brother of Thomas R. Donahue who serves as Chief Financial Officer.

Mr. Brian P. Bouda has served as Vice President and Chief Compliance Officer of Federated and for each of Federated’s subsidiaries since 1999. Mr. Bouda has also served as Chief Compliance Officer of the investment companies managed by subsidiaries of Federated since 2004.

Mr. Thomas R. Donahue has served as Vice President, Treasurer and Chief Financial Officer of Federated since 1998. He is President of FII Holdings, Inc., a wholly owned subsidiary of Federated. Prior to joining Federated, Mr. Donahue was in the venture capital business and was employed by PNC Bank in its Investment Banking Division. Mr. Donahue is the son of John F. Donahue and the brother of J. Christopher Donahue.

10

Mr. John B. Fisher is President and Chief Executive Officer of Federated Advisory Companies. He has also served as Vice President of Federated since 1998. He previously served as President of the Institutional Sales Division of Federated Securities Corp., a wholly owned subsidiary of Federated in which capacity he was responsible for the distribution of Federated’s products and services to investment advisers, insurance companies, retirement plans and corporations.

Mr. Eugene F. Maloney has served as a Vice President of Federated since 1998. He is Executive Vice President of Federated Investors Management Company, a wholly owned subsidiary of Federated. Mr. Maloney provides certain legal, technical and management expertise to Federated’s sales divisions, including regulatory and legal requirements relating to a bank’s use of mutual funds in both trust and commercial environments.

Mr. Denis McAuley III has served as Vice President of Federated since 1999 and as Principal Accounting Officer of Federated since 2001. He also serves as Chairman and Chief Executive Officer of Federated Investors Trust Company, as President of Federated Shareholder Services Company and as Senior Vice President, Treasurer or Assistant Treasurer for various subsidiaries of Federated. Mr. McAuley is a Certified Public Accountant.

Mr. John W. McGonigle has been a director of Federated since 1998. He has served as Executive Vice President, Chief Legal Officer and Secretary of Federated since 1998 and as Vice Chairman since 2001. Mr. McGonigle is also Chairman of Federated International Management Limited a wholly owned subsidiary of Federated. Mr. McGonigle is also Executive Vice President and Secretary of 44 investment companies managed by subsidiaries of Federated.

Mr. Thomas E. Territ has served as a Vice President of Federated since 2006. He is President of Federated Securities Corp., a wholly owned subsidiary of Federated. As President of Federated Securities Corp., Mr. Territ is responsible for the marketing and sales efforts of Federated. Mr. Territ had previously served as Senior Vice President of Federated Securities Corp. since 1995, and held the position of National Sales Director for several of Federated’s sales divisions during that time.

Available Information

Federated makes available, free of charge on its website, its annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act of 1934 as soon as reasonably practicable after Federated electronically files such material with, or furnishes it to, the SEC. Reports may be viewed and obtained on the Company’s website, FederatedInvestors.com, or by calling Investor Relations at 412-288-1934.

The public may read and copy any materials the Company files with the SEC at the SEC’s Public Reference Room at 100 F Street, NE., Washington, DC 20549. Information on the operation of the Public Reference Room may be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains an Internet site that contains reports, proxies and information statements, and other information regarding issuers that file electronically with the SEC at http://www.sec.gov.

Other Information

All other information required by this Item is contained in Federated’s 2007 Annual Report to Shareholders under the captions “Consolidated Balance Sheets,” “Consolidated Statements of Income” and “Notes to the Consolidated Financial Statements” (including, but not limited to Note (21), Concentration Risk) and is incorporated herein by reference.

ITEM 1A – RISK FACTORS

The information required by this Item is contained in Federated’s 2007 Annual Report to Shareholders under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Risk Factors” and is incorporated herein by reference.

11

ITEM 1B – UNRESOLVED STAFF COMMENTS

None.

ITEM 2 – PROPERTIES

Federated’s facilities are concentrated in Pittsburgh, Pennsylvania where it leases space sufficient to meet its operating needs. Federated’s headquarters are located in the Federated Investors Tower, where Federated occupies approximately 259,000 square feet. Federated leases approximately 99,000 square feet at the Pittsburgh Office and Research Park and an aggregate of approximately 25,000 square feet at other locations in the Pittsburgh area. Federated maintains office space in Frankfurt, Germany for certain international initiatives; in New York, New York, where Federated Global Investment Management Corp. conducts its business; and in Boston, Massachusetts, where the MDT group is located. Additional offices in Wilmington, Delaware are subleased by Federated.

ITEM 3 – LEGAL PROCEEDINGS

Since October 2003, Federated has been named as a defendant in twenty-three cases filed in various federal district courts and state courts involving allegations relating to market timing, late trading and excessive fees. All of the pending cases involving allegations related to market timing and late trading have been transferred to the U.S. District Court for the District of Maryland and consolidated for pre-trial proceedings. One market timing/late trading case was voluntarily dismissed by the plaintiff without prejudice.

The seven excessive fee cases were originally filed in five different federal courts and one state court. All six of the federal cases are now pending in the U.S. District Court for the Western District of Pennsylvania. The state court case was voluntarily dismissed by the plaintiff without prejudice.

All of these lawsuits seek unquantified damages, attorneys’ fees and expenses. Federated is defending this litigation. The potential impact of these recent lawsuits and future potential similar suits, as well as the timing of settlements, judgments or other resolution of these matters, are uncertain. It is possible that an unfavorable determination will cause a material adverse impact to Federated’s reputation, financial position, results of operations and/or liquidity in the period in which the effect becomes reasonably estimable.

In addition, Federated has other claims asserted and threatened against it in the ordinary course of business. These other claims are subject to inherent uncertainties. It is possible that an unfavorable determination will cause a material adverse impact on Federated’s reputation, financial position, results of operations and/or liquidity in the period in which the effect becomes reasonably estimable.

For additional information, see the information contained in Federated’s 2007 Annual Report to Shareholders under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations – Contractual Obligations and Contingent Liabilities” incorporated by reference in Part II, Item 7 of this Form 10-K, and under the caption “Notes to the Consolidated Financial Statements – Note (22) – Commitments and Contingencies – (c) Past Mutual Fund Trading Issues and Related Legal Proceedings and (d) Other Legal Proceedings” incorporated by reference in Part II, Item 8 of this Form 10-K.

ITEM 4 – SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

None.

12

PART II

ITEM 5 – MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

The following table summarizes stock repurchases under Federated’s share repurchase program during the fourth quarter of 2007. Stock repurchases and dividend payments are subject to the restrictions outlined in Note (13) to the Consolidated Financial Statements incorporated by reference in Part II, Item 8 of this Form 10-K.

| | | | | | | | | |

| | | Total Number

of Shares

Purchased | | Average

Price Paid

per Share | | Total Number of Shares

Purchased as Part of

Publicly Announced

Plans or Programs1 | | Maximum Number of

Shares that May Yet

Be Purchased Under

the Plans or Programs |

October | | 0 | | $ | 0 | | 0 | | 3,995,719 |

November | | 60,000 | | | 37.64 | | 60,000 | | 3,935,719 |

December | | 10,000 | | | 38.76 | | 10,000 | | 3,925,719 |

| | | | | | | | | |

Total | | 70,000 | | $ | 37.80 | | 70,000 | | 3,925,719 |

| | | | | | | | | |

1 | Federated’s current share repurchase program was announced in July 2006, whereby the board of directors authorized management to purchase up to 7.5 million shares of Federated Class B common stock through December 31, 2008. No other plans existed as of December 31, 2007. |

13

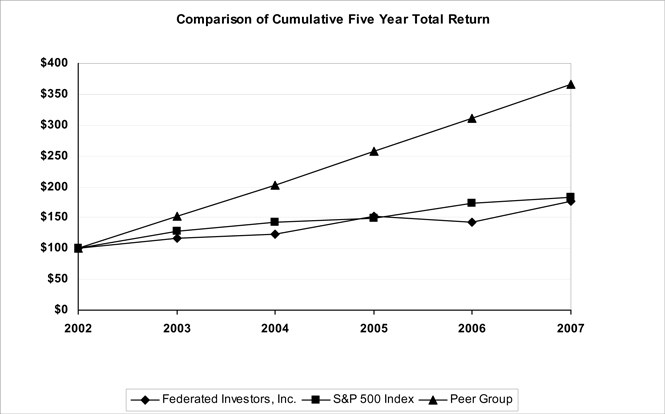

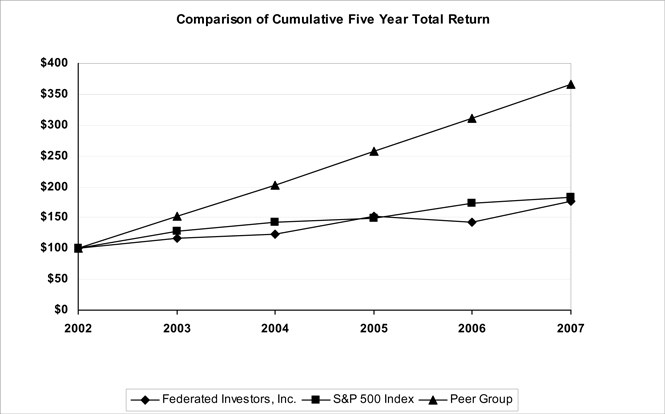

The following performance graph compares the total shareholder return of an investment in Federated’s Class B Common Stock to that of the Standard and Poor’s 500 ® Index (“S&P 500 Index”), and to a Peer Group Index of publicly traded asset management firms for the five-year period ending on December 31, 2007. The graph assumes that the value of the investment in Federated’s Class B Common Stock and each index was $100 on December 31, 2002. Total return includes reinvestment of all dividends. According to Standard & Poor’s, the S&P 500 Index is a market-value-weighted index of 500 stocks that tend to be the leading companies in leading industries within the U.S. economy. As a member of the S&P 500 Index, Federated is required to include this comparison. Peer Group returns are weighted by the market capitalization of each firm at the beginning of each measurement period. The historical information set forth below is not necessarily indicative of future performance. Federated does not make or endorse any predictions as to future stock performance.

| | | | | | | | | | |

| | | 12/31/03 | | 12/31/04 | | 12/31/05 | | 12/31/06 | | 12/31/07 |

Federated | | 116.96 | | 122.79 | | 152.35 | | 141.78 | | 176.51 |

S&P 500 ® Index | | 128.68 | | 142.69 | | 149.70 | | 173.34 | | 182.86 |

Peer Group * | | 151.90 | | 202.94 | | 256.78 | | 310.54 | | 366.13 |

| * | The following companies are included in the Peer Group: Affiliated Managers Group, Inc.; Eaton Vance Corp.; Franklin Resources, Inc.; T. Rowe Price Group, Inc.; and Waddell & Reed Financial, Inc. Nuveen Investments, Inc. was previously included in the peer group, but is no longer a publicly listed stock and has been excluded from all years. |

All other information required by this Item is contained in Federated’s 2007 Annual Report to Shareholders under the captions “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Notes to the Consolidated Financial Statements” (including, but not limited to Note (24), Supplementary Quarterly Financial Data (Unaudited)) and is incorporated herein by reference.

14

ITEM 6 – SELECTED FINANCIAL DATA

The information required by this Item is contained in Federated’s 2007 Annual Report to Shareholders under the caption “Selected Consolidated Financial Data” and is incorporated herein by reference.

ITEM 7 – MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The information required by this Item is contained in Federated’s 2007 Annual Report to Shareholders under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and is incorporated herein by reference.

ITEM 7A – QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

The information contained in Federated’s 2007 Annual Report to Shareholders under the caption “Management’s Discussion and Analysis of Financial Condition and Results of Operations” is incorporated herein by reference.

ITEM 8 – FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

The information required by this Item is contained in Federated’s 2007 Annual Report to Shareholders under the captions “Report of Ernst & Young LLP, Independent Registered Public Accounting Firm, on Consolidated Financial Statements,” “Consolidated Balance Sheets,” “Consolidated Statements of Income,” “Consolidated Statements of Changes in Shareholders’ Equity,” “Consolidated Statements of Cash Flows,” and “Notes to the Consolidated Financial Statements” and is incorporated herein by reference.

ITEM 9 – CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL DISCLOSURE

None.

ITEM 9A – CONTROLS AND PROCEDURES

Federated carried out an evaluation, under the supervision and with the participation of management, including Federated’s President and Chief Executive Officer and Chief Financial Officer, of the effectiveness of the design and operation of Federated’s disclosure controls and procedures as of December 31, 2007. Based upon that evaluation, the President and Chief Executive Officer and the Chief Financial Officer concluded that Federated’s disclosure controls and procedures are effective in providing reasonable assurance that information required to be disclosed by the registrant in the reports filed or submitted under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms.

There has been no change in Federated’s internal control over financial reporting that occurred during the fourth quarter ended December 31, 2007 that has materially affected, or is reasonably likely to materially affect, Federated’s internal control over financial reporting.

All other information required by this Item is contained in Federated’s 2007 Annual Report to Shareholders under the caption “Management’s Assessment of Internal Control Over Financial Reporting” and “Report of Ernst & Young LLP, Independent Registered Public Accounting Firm, on Effectiveness of Internal Control Over Financial Reporting” and is incorporated herein by reference.

ITEM 9B – OTHER INFORMATION

None.

15

PART III

ITEM 10 – DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE

The information required by this Item (other than the information set forth below) is contained in Federated’s Information Statement for its 2008 Annual Meeting of Shareholders under the captions “Board of Directors and Election of Directors,” “Executive Compensation” and “Security Ownership – Section 16(a) Beneficial Ownership Reporting Compliance,” and is incorporated herein by reference.

Executive Officers

The information required by this Item with respect to Federated’s executive officers is contained in Item 1 of Part I of this Form 10-K under the section “Executive Officers.”

Code of Ethics

In October 2003, Federated adopted a code of ethics for its senior financial officers. This code meets the requirements provided by Item 406 of Regulation S-K and is incorporated by reference in Part IV, Item 15(a)(3) of this Form 10-K as Exhibit 14.01. The code of ethics is available at FederatedInvestors.com. In the event that Federated amends or waives a provision of this code and such amendment or waiver relates to any element of the code of ethics definition enumerated in paragraph (b) of Item 406 of Regulation S-K, Federated would post such information on its internet website.

ITEM 11 – EXECUTIVE COMPENSATION

The information required by this Item is contained in Federated’s Information Statement for the 2008 Annual Meeting of Shareholders under the captions “Board of Directors and Election of Directors” and “Executive Compensation” and is incorporated herein by reference.

ITEM 12 – SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

The following table sets forth information regarding Federated’s share-based compensation as of December 31, 2007:

| | | | | | | |

Category of share-based compensation plan | | Number of securities to

be issued upon exercise

of outstanding options | | Weighted-average

exercise price of

outstanding options | | Number of securities

remaining available for

future issuance under

equity compensation plans |

Approved by shareholders | | 5,216,950 | | $ | 24.44 | | 4,369,694 |

Not approved by shareholders | | 0 | | | 0 | | 0 |

| | | | | | | |

Total | | 5,216,950 | | $ | 24.44 | | 4,369,694 |

| | | | | | | |

All other information required by this Item is contained in Federated’s Information Statement for the 2008 Annual Meeting of Shareholders under the caption “Security Ownership” and is incorporated herein by reference.

ITEM 13 – CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR INDEPENDENCE

The information required by this Item is contained in Federated’s Information Statement for the 2008 Annual Meeting of Shareholders under the captions “Transactions with Related Persons,” “Conflict of Interest Policies and Procedures” and “Nomination of Directors” and is incorporated herein by reference.

16

ITEM 14 – PRINCIPAL ACCOUNTANT FEES AND SERVICES

The information required by this Item is contained in Federated’s Information Statement for the 2008 Annual Meeting of Shareholders under the caption “Independent Registered Public Accounting Firm” and is incorporated herein by reference.

PART IV

ITEM 15 – EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

| | |

(a)(1) | | Financial Statements: |

The information required by this Item is contained in Federated’s 2007 Annual Report to Shareholders under the captions “Report of Ernst & Young LLP, Independent Registered Public Accounting Firm, on Consolidated Financial Statements,” “Consolidated Balance Sheets,” “Consolidated Statements of Income,” “Consolidated Statements of Changes in Shareholders’ Equity,” “Consolidated Statements of Cash Flows” and “Notes to the Consolidated Financial Statements” and is incorporated herein by reference.

| | |

(a)(2) | | Financial Statement Schedules: |

All schedules for which provisions are made in the applicable accounting regulations of the Securities and Exchange Commission have been omitted because such schedules are not required under the related instructions, are inapplicable, or because the required information is either incorporated herein by reference or included in the financial statements or notes thereto included in this Form 10-K.

The following exhibits are filed or incorporated as part of this Form 10-K:

| | |

Exhibit Number | | Description |

2.01 | | Agreement and Plan of Merger, dated as of February 20, 1998, between Federated Investors and Federated (incorporated by reference to Exhibit 2.01 to the Registration Statement on Form S-1 (File No. 333-48405)) |

| |

2.02 | | Asset Purchase Agreement dated as of October 20, 2000, by and among Federated Investors, Inc., Edgemont Asset Management Corporation, Lawrence Auriana and Hans P. Utsch (incorporated by reference to Exhibit 2.1 of Amendment No. 2 to the Current Report on Form 8-K dated April 20, 2001, filed with the Securities and Exchange Commission on July 3, 2001 (File No. 001-14818)) |

| |

2.03 | | Amendment No. 1, dated April 11, 2001, to the Asset Purchase Agreement dated as of October 20, 2000, by and among Federated Investors, Inc., Edgemont Asset Management Corporation, Lawrence Auriana and Hans P. Utsch (incorporated by reference to Exhibit 2.2 of Amendment No. 2 to the Current Report on Form 8-K dated April 20, 2001, filed with the Securities and Exchange Commission on July 3, 2001 (File No. 001-14818)) |

| |

2.04 | | Sale, Purchase and Put/Call Agreement dated as of May 11, 2006 among Federated Investors, Inc., MDTA LLC, HBSS Acquisition Co. and the Selling Parties (incorporated by reference to Exhibit 2.1 to the June 30, 2006 Quarterly Report on Form 10-Q (File No. 001-14818)) |

| |

3.01 | | Restated Articles of Incorporation of Federated (incorporated by reference to Exhibit 3.01 to the Registration Statement on Form S-1 (File No. 333-48405)) |

| |

3.02 | | Restated By-Laws of Federated (incorporated by reference to Exhibit 3.02 to the Registration |

17

| | |

| | Statement on Form S-1 (File No. 333-48405)) |

| |

4.01 | | Form of Class A Common Stock certificate (incorporated by reference to Exhibit 4.01 to the Registration Statement on Form S-1 (File No. 333-48405)) |

| |

4.02 | | Form of Class B Common Stock certificate (incorporated by reference to Exhibit 4.02 to the Registration Statement on Form S-1 (File No. 333-48405)) |

| |

4.05 | | Shareholder Rights Agreement, dated August 1, 1989, between Federated and The Standard Fire Insurance Company, as amended January 31, 1996 (incorporated by reference to Exhibit 4.06 to the Registration Statement on Form S-1 (File No. 333-48405)) |

| |

9.01 | | Voting Shares Irrevocable Trust dated May 31, 1989 (incorporated by reference to Exhibit 9.01 to the Registration Statement on Form S-1 (File No. 333-48405)) |

| |

10.06 | | Federated Program Master Agreement, dated as of October 24, 1997, among Federated, Federated Funding 1997-1, Inc., Federated Investors Management Company, Federated Securities Corp., Wilmington Trust Company, PLT Finance, L.P., Putnam, Lovell & Thornton Inc. and Bankers Trust Company (incorporated by reference to Exhibit 4.09 to the Registration Statement on Form S-1 (File No. 333-48405)) |

| |

10.09 | | Federated Investors Program Revolving Purchase Agreement, dated as of October 24, 1997, between Federated Funding 1997-1, Inc. and PLT Finance, L.P. (incorporated by reference to Exhibit 4.11 to the Registration Statement on Form S-1 (File No. 333-48405)) |

| |

10.10 | | Federated Investors Program Fee Agreement, dated as of October 24, 1997, between Federated Investors and PLT Finance, L.P. (incorporated by reference to Exhibit 4.12 to the Registration Statement on Form S-1 (File No. 333-48405)) |

| |

10.11 | | Schedule X to Federated Program Master Agreement, dated as of October 24, 1997, among Federated, Federated Funding 1997-1, Inc., Federated Investors Management Company, Federated Securities Corp., Wilmington Trust Company, PLT Finance, L.P., Putnam, Lovell & Thornton Inc. and Bankers Trust Company (incorporated by reference to Exhibit 4.13 to the Registration Statement on Form S-1 (File No. 333-48405)) |

| |

10.14 | | Form of Bonus Stock Option Agreement (incorporated by reference to Exhibit 10.13 of the Form 10-K for the fiscal year ended December 31, 1998 (File No. 001-14818)) |

| |

10.15 | | Federated Investors Tower Lease dated January 1, 1993 (incorporated by reference to Exhibit 10.03 to the Registration Statement on Form S-1 (File No. 333-48405)) |

| |

10.16 | | Federated Investors Tower Lease dated February 1, 1994 (incorporated by reference to Exhibit 10.04 to the Registration Statement on Form S-1 (File No. 333-48405)) |

| |

10.18 | | Employment Agreement, dated January 16, 1997, between Federated Investors and an executive officer (incorporated by reference to Exhibit 10.06 to the Registration Statement on Form S-1 (File No. 333-48405)) |

| |

10.19 | | Employment Agreement, dated December 28, 1990, between Federated Investors and an executive officer (incorporated by reference to Exhibit 10.08 to the Registration Statement on Form S-1 (File No. 333-48405)) |

| |

10.20 | | Employment Agreement, dated December 22, 1993, between Federated Securities Corp. and an executive officer (incorporated by reference to Exhibit 10.09 to the Registration Statement on Form S-1 (File No. 333-48405)) |

18

| | |

10.26 | | Purchase and Sale Agreement, dated as of December 21, 2000, among Federated Investors Management Company, Federated Securities Corp., Federated Funding 1997-1, Inc., Federated Investors, Inc., Citibank, N.A., and Citicorp North America, Inc. Company (incorporated by reference to Exhibit 10.26 of the Annual Report on Form 10-K for the year ended December 31, 2000 (File No. 001-14818)) |

| |

10.27 | | Amendment No. 2 to the Federated Investors Program Documents dated as of December 21, 2000, among Federated Investors, Inc., Federated Funding 1997-1, Inc., Federated Investors Management Company, Federated Securities Corp., Wilmington Trust Company, Putnam Lovell Finance L.P., Putnam Lovell Securities Inc., and Bankers Trust Company (incorporated by reference to Exhibit 10.27 of the Annual Report on Form 10-K for the year ended December 31, 2000 (File No. 001-14818)) |

| |

10.33 | | Employment agreement, dated May 13, 2002, between Federated Investors, Inc. and an executive officer (incorporated by reference to Exhibit 10.2 to the March 31, 2002 Quarterly Report on Form 10-Q (File No. 001-14818)) |

| |

10.34 | | Annual Stock Option Agreement dated April 24, 2002 between Federated Investors, Inc. and the independent directors (incorporated by reference to Exhibit 10.1 to the June 30, 2002 Quarterly Report on Form 10-Q (File No. 001-14818)) |

| |

10.39 | | Federated Investors, Inc. Guaranty and Suretyship Agreement, dated as of September 30, 2003 (incorporated by reference to Exhibit 10.2 to the September 30, 2003 Quarterly Report on Form 10-Q (File No. 001-14818)) |

| |

10.40 | | Amendment to Purchase and Sale Agreement, dated as of December 31, 2003, among Federated Investors Management Company, Federated Securities Corp., Federated Funding 1997-1, Inc., Federated Investors, Inc., Citibank, N.A., and Citicorp North America, Inc. Company (incorporated by reference to Exhibit 10.40 to the Annual Report on Form 10-K for the fiscal year ended December 31, 2003 (File No. 001-14818)) |

| |

10.41 | | Amendments No. 6, 5, 4, 3 and 2 to Federated Investors Tower Lease dated as of December 31, 2003; November 10, 2000; June 30, 2000; February 10, 1999; and September 19, 1996 (incorporated by reference to Exhibit 10.41 to the Annual Report on Form 10-K for the fiscal year ended December 31, 2003 (File No. 001-14818)) |

| |

10.43 | | Federated Investors, Inc. Annual Incentive Plan, amended as of February 5, 2004 (incorporated by reference to Exhibit 10.1 to the March 31, 2004 Quarterly Report on Form 10-Q (File No. 001-14818)) |

| |

10.44 | | Federated Investors, Inc. Stock Incentive Plan, amended as of April 19, 2004 (incorporated by reference to Exhibit 10.2 to the March 31, 2004 Quarterly Report on Form 10-Q (File No. 001-14818)) |

| |

10.45 | | Agreement with Boston Financial Data Services (incorporated by reference to Exhibit 10.1 to the June 30, 2004 Quarterly Report on Form 10-Q (File No. 001-14818)) |

| |

10.46 | | Agreement with Alliance Capital Management L.P., dated as of October 28, 2004 (incorporated by reference to Exhibit 10.46 to the Annual Report on Form 10-K for the fiscal year ended December 31, 2004 (File No. 001-14818)) |

| |

10.47 | | Amendment dated December 31, 2004 to the Federated Investors Program Documents dated as of December 21, 2000, among Federated Investors Management Company, Federated Securities Corp., Federated Funding 1997-1, Inc., Federated Investors, Inc., Citibank, N.A. and Citicorp North |

19

| | |

| | America, Inc. (incorporated by reference to Exhibit 10.47 to the Annual Report on Form 10-K for the fiscal year ended December 31, 2004 (File No. 001-14818)) |

| |

10.49 | | Form of Bonus Restricted Stock Program Award Agreement (incorporated by reference to Exhibit 10.1 to the March 31, 2005 Quarterly Report on Form 10-Q (File No. 001-14818)) |

| |

10.50 | | Amendment dated June 29, 2005 to the definitive agreement between Federated Investors and Alliance Capital Management L.P. dated October 28, 2004 and filed as Exhibit 10.46 to Federated’s Annual Report on Form 10-K for the year ended December 31, 2004 (incorporated by reference to Exhibit 10.1 to the June 30, 2005 Quarterly Report on Form 10-Q (File No. 001-14818)) |

| |

10.51 | | Amendment dated June 30, 2005 to the Federated Investors Program Documents dated as of December 21, 2000, among Federated Investors Management Company, Federated Securities Corp., Federated Funding 1997-1, Inc., Federated Investors, Inc., Citibank, N.A. and Citicorp North America, Inc. (incorporated by reference to Exhibit 10.2 to the June 30, 2005 Quarterly Report on Form 10-Q (File No. 001-14818)) |

| |

10.52 | | Amendment dated June 30, 2005 to the Federated Program Master Agreement, dated as of October 24, 1997, among Federated Investors Management Company, Federated Securities Corp., Federated Funding 1997-1, Inc., Federated Investors Inc., Wilmington Trust Company, Putnam Lovell Finance, L.P., Putnam, Lovell NBF Securities Inc. and Deutsche Bank Trust Company Americas (incorporated by reference to Exhibit 10.3 to the June 30, 2005 Quarterly Report on Form 10-Q (File No. 001-14818)) |

| |

10.54 | | Agreement, effective March 13, 2006, by and among Federated Investors, Inc., Federated Investment Management Company, Federated Global Investment Management Corp., Federated Investment Counseling, Federated Advisory Services Company, Passport Research Ltd., Federated Equity Management Company of Pennsylvania, Passport Research II, Ltd. and Keith M. Schappert (incorporated by reference to Exhibit 10.1 to the March 16, 2006 Report on Form 8-K (File No. 001-14818)) |

| |

10.55 | | Asset Purchase Agreement dated as of February 15, 2006 by and between Matrix Settlement & Clearing Services, LLC and Edgewood Services, Inc. (incorporated by reference to Exhibit 10.1 to the March 31, 2006 Quarterly Report on Form 10-Q (File No. 001-14818)) |

| |

10.56 | | Federated Investors, Inc. Stock Incentive Plan most recently amended as of April 27, 2006 (incorporated by reference to Exhibit 10.1 to the June 30, 2006 Quarterly Report on Form 10-Q (File No. 001-14818)) |

| |

10.58 | | Federated Investors, Inc. Employee Stock Purchase Plan, amended as of October 26, 2006 (incorporated by reference to Exhibit 10.2 to the September 30, 2006 Quarterly Report on Form 10-Q (File No. 001-14818)) |

| |

10.59 | | Credit Agreement, dated as of October 31, 2006, by and among Federated Investors, Inc., certain of its subsidiaries, the banks set forth therein and PNC Bank, National Association (incorporated by reference to Exhibit 10.59 to the Annual Report on Form 10-K for the fiscal year ended December 31, 2006 (File No. 001-14818)) |

| |

10.60 | | Amendment dated December 29, 2006 to the Federated Investors Program Documents dated as of December 21, 2000, among Federated Investors Management Company, Federated Securities Corp., Federated Funding 1997-1, Inc., Federated Investors, Inc., Citibank, N.A. and Citicorp North America, Inc. (incorporated by reference to Exhibit 10.60 to the Annual Report on Form 10-K for the fiscal year ended December 31, 2006 (File No. 001-14818)) |

| |

10.61 | | Agreement, effective March 1, 2007, by and among Federated, Federated Investors Management |

20

| | |

| | Company, as transferor, Federated Securities Corp., as distributor, principal shareholder servicer and servicer, Federated Funding 1997-1, Inc., as Seller, Citibank, N.A., as purchaser, and Citicorp North America, Inc., as Program Agent (incorporated by reference to Exhibit 10.1 to the March 7, 2007 Report on Form 8-K (File No. 001-14818)) |

| |

10.62 | | Definitive Agreement between Federated Investors, Inc. and Rochdale Investment Management, LLC (incorporated by reference to Exhibit 10.1 to the June 30, 2007 Quarterly Report on Form 10-Q (File No. 001-14818)) |

| |

10.63 | | Federated Investors, Inc. Annual Incentive Plan, as amended (incorporated by reference to Exhibit 10.2 to the June 30, 2007 Quarterly Report on Form 10-Q (File No. 001-14818)) |

| |

13.01 | | Selected Portions of 2007 Annual Report to Shareholders (Filed herewith) |

| |

14.01 | | Federated Investors, Inc. Code of Ethics for Senior Financial Officers (incorporated by reference to Exhibit 14.01 to the Annual Report on Form 10-K for the fiscal year ended December 31, 2003 (File No. 001-14818)) |

| |

21.01 | | Subsidiaries of the Registrant (Filed herewith) |

| |

23.01 | | Consent of Ernst & Young LLP, Independent Registered Public Accounting Firm (Filed herewith) |

| |

31.01 | | Certification of the Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (Filed herewith) |

| |

31.02 | | Certification of the Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (Filed herewith) |

| |

32.01 | | Certification pursuant to 18 U.S.C. Section 1350 as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 (Filed herewith) |

See (a)(3) above.

| (c) | Financial Statement Schedules: |

See (a)(2) above.

21

SIGNATURES

Pursuant to the requirements of Section 13 or 15(d) of the Securities Exchange Act of 1934, the Registrant has duly caused this Annual Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | |

| FEDERATED INVESTORS, INC. |

| |

| By: | | /s/ J. Christopher Donahue |

| | J. Christopher Donahue |

| | President and Chief Executive Officer |

| |

| | Date: February 28, 2008 |

Pursuant to the requirements of the Exchange Act, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

| | | | |

Signature | | Title | | Date |

| | |

/s/ John F. Donahue | | Chairman and Director | | February 28, 2008 |

| John F. Donahue | | | | |

| | |

/s/ J. Christopher Donahue | | President, Chief Executive Officer | | February 28, 2008 |

| J. Christopher Donahue | | and Director (Principal Executive Officer) | | |

| | |

/s/ Thomas R. Donahue | | Chief Financial Officer | | February 28, 2008 |

| Thomas R. Donahue | | | | |

| | |

/s/ Michael J. Farrell | | Director | | February 28, 2008 |

| Michael J. Farrell | | | | |

| | |

/s/ David M. Kelly | | Director | | February 28, 2008 |

| David M. Kelly | | | | |

22

| | | | |

Signature | | Title | | Date |

| | |

/s/ Denis McAuley III | | Principal Accounting Officer | | February 28, 2008 |

| Denis McAuley III | | | | |

| | |

/s/ John W. McGonigle | | Director | | February 28, 2008 |

| John W. McGonigle | | | | |

| | |

/s/ James L. Murdy | | Director | | February 28, 2008 |

| James L. Murdy | | | | |

| | |

/s/ Edward G. O’Connor | | Director | | February 28, 2008 |

| Edward G. O’Connor | | | | |

23

EXHIBIT INDEX

| | |

Exhibit Number | | Description |

13.01 | | Selected Portions of 2007 Annual Report to Shareholders |

| |

21.01 | | Subsidiaries of the Registrant |

| |

23.01 | | Consent of Ernst & Young LLP, Independent Registered Public Accounting Firm |

| |

31.01 | | Certification of the Chief Executive Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| |

31.02 | | Certification of the Chief Financial Officer pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 |

| |

32.01 | | Certification pursuant to 18 U.S.C. Section 1350 as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 |

24