#1050 – 625 Howe Street,

Vancouver, B.C. V6C 2T6

INFORMATION CIRCULAR

(Containing information as at July 22, 2013, unless indicated otherwise)

SOLICITATION OF PROXIES

This Information Circular is furnished in connection with the solicitation of proxies by the management ofPACIFIC RIM MINING CORP. (the “Company”) to the shareholders of the Company (“Shareholders”) for use at the Annual General Meeting of Shareholders (and any adjournment thereof) to be held on Thursday, September 12, 2013 (the “Meeting”), at the time and place and for the purposes set forth in the accompanying Notice of Meeting. While it is expected that the solicitation will be primarily by mail, proxies may be solicited personally or by telephone by the directors (the “Directors”), officers and regular employees or a proxy agent, if any, of the Company at nominal cost. All costs of solicitation by management will be borne by the Company.

The contents and the sending of this Information Circular have been approved by the Directors of the Company.

The term “Shareholders” used throughout this Information Circular refers to both registered and non-registered shareholders unless otherwise specified, except in the sections of this Information Circular titled “Appointment of Proxyholder”, “Revocation of Proxies” and “Voting Shares and Principal Holders Thereof” below, and in the accompanying form of proxy and Notice of Meeting, where the term “Shareholders” refers to registered shareholders only.

APPOINTMENT OF PROXYHOLDER

The purpose of a proxy is to designate persons who will vote the proxy on a Shareholder’s behalf in accordance with the instructions given by the Shareholder in the proxy. The individuals named in the accompanying form of proxy are Directors.A SHAREHOLDER WISHING TO APPOINT SOME OTHER PERSON (WHO NEED NOT BE A SHAREHOLDER) TO REPRESENT THE SHAREHOLDER AT THE MEETING HAS THE RIGHT TO DO SO, EITHER BY STRIKING OUT THE NAMES OF THOSE PERSONS NAMED IN THE ACCOMPANYING FORM OF PROXY AND INSERTING THE DESIRED PERSON’S NAME IN THE BLANK SPACE PROVIDED IN THE FORM OF PROXY OR BY COMPLETING ANOTHER FORM OF PROXY.A proxy will not be valid unless the completed form of proxy is received by Computershare Trust Company of Canada (“Computershare”) at its offices at Proxy Dept., 100 University Avenue, 8th Floor, Toronto, Ontario M5J 2Y1, not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time for holding the Meeting or any adjournment thereof unless the Chairman of the Meeting exercises her discretion to accept proxies received subsequently.

REVOCATION OF PROXIES

A Shareholder who has given a proxy may revoke it by an instrument in writing executed by the Shareholder or by such Shareholder’s attorney authorized in writing or, where the Shareholder is a corporation or association, by a duly authorized officer or attorney of that corporation or association, and delivered to the registered office of the Company located on the 10th Floor, 595 Howe Street, Vancouver, British Columbia, V6C 2T5, at any time up to and including the last business day preceding the day of the Meeting, or if adjourned, any reconvening thereof, or to the Chairman of the Meeting on the day of the Meeting or, if adjourned, any reconvening thereof or in any other manner provided by law. A revocation of a proxy does not affect any matter on which a vote has been taken prior to the revocation.

INFORMATION FOR NON-REGISTERED SHAREHOLDERS

Only registered Shareholders or duly appointed proxyholders are permitted to vote at the Meeting. Most Shareholders of the Company are “non-registered” Shareholders because the shares they own are not registered in their names but are instead registered in the names of a brokerage firm, bank or other intermediary or in the name of a clearing agency. Shareholders who do not hold their shares in their own name (referred to herein as “Beneficial Shareholders”) should note that only registered Shareholders may vote at the Meeting.If common shares are listed in an account statement provided to a Shareholder by a broker, then in almost all cases those common shares will not be registered in such Shareholder’s name on the records of the Company. Such common shares will more likely be registered under the name of the Shareholder’s broker or an agent of that broker. In Canada, the vast majority of such shares are registered under the name of CDS & Co. (the registration name for The Canadian Depository for Securities, which company acts as nominee for many Canadian brokerage firms). Common shares held by brokers (or their agents or nominees) on behalf of a broker’s client can in many cases only be voted (for or against resolutions) at the direction of the Beneficial Shareholder. Without specific instructions, brokers and their agents and nominees are prohibited from voting shares for the brokers’ clients in respect of certain matters to be considered at the Meeting.Therefore, each Beneficial Shareholder should ensure that voting instructions are communicated to the appropriate person well in advance of the Meeting.

1

Existing regulatory policy requires brokers and other intermediaries to seek voting instructions from Beneficial Shareholders in advance of shareholders’ meetings. The various brokers and other intermediaries have their own mailing procedures and provide their own return instructions to clients, which should be carefully followed by Beneficial Shareholders in order to ensure that their common shares are voted at the Meeting. Often the form of proxy supplied to a Beneficial Shareholder by its broker is identical to the form of proxy provided by the Company to the registered Shareholders. However, its purpose is limited to instructing the registered Shareholder (i.e. the broker or agent of the broker) how to vote on behalf of the Beneficial Shareholder. The majority of brokers now delegate responsibility for obtaining instructions from clients to Broadridge Investor Communications Solutions (“Broadridge”). Broadridge typically prepares machine-readable voting instruction forms (“VIFs”), mails those forms to the Beneficial Shareholders and asks Beneficial Shareholders to return the forms to Broadridge, or otherwise communicate voting instructions to Broadridge (by way of the internet or telephone, for example). Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of common shares to be represented at the Meeting. A Beneficial Shareholder who receives a Broadridge VIF cannot use that form to vote common shares directly at the Meeting. The VIF must be returned to Broadridge (or instructions respecting the voting of common shares must be communicated to Broadridge) well in advance of the Meeting in order to have the common shares voted.

In addition, as permitted by National Instrument 54-101 -Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”), the Company is sending the Meeting materials directly to “non-objecting beneficial owners” (“NOBOs”), as defined in NI 54-101. As a result, NOBOs can expect to receive a scannable Voting Instruction Form (“VIF”) from Computershare. These VIFs are to be completed and returned to Computershare in the envelope provided or by facsimile. In addition, Computershare provides both telephone voting and internet voting as described on the VIF itself which contain complete instructions. Computershare will tabulate the results of the VIFs received from NOBOs and will provide appropriate instructions at the Meeting with respect to the shares represented by the VIFs they receive. The name and address and information about the NOBOs' holdings of securities have been obtained in accordance with applicable securities regulatory requirements from the intermediary holding on the NOBO's behalf. By choosing to send these materials to NOBOs directly, the Company (and not the intermediary holding on behalf of the NOBOs) has assumed responsibility for (i) delivering these materials to NOBOs and (ii) executing the proper voting instructions of NOBOs.

The Company does not intend to pay for intermediaries to deliver the proxy-related materials and Form 54-101F7 –Request for Voting Instructions Made by Intermediary to “objecting beneficial owners” (“OBOs”), as defined under NI 54-101. As a result, OBOs will not receive the Meeting materials unless their intermediaries assume the costs of delivery.

NOTICE-AND-ACCESS

The Company is not sending this Information Circular to registered Shareholders or Beneficial Shareholders using “notice-and-access” as defined under NI 54-101.

VOTING OF PROXIES

The shares represented by a properly executed proxy in favour of persons proposed by management as proxyholders in the accompanying form of proxy will:

2

| | (a) | be voted or withheld from voting in accordance with the instructions of the person appointing the proxyholder on any ballot that may be called for; and |

| | | |

| | (b) | where a choice with respect to any matter to be acted upon has been specified in the form of proxy, be voted in accordance with the specification made in such proxy. |

ON A POLL SUCH SHARES WILL BE VOTEDIN FAVOUR OF EACH MATTER FOR WHICH NO CHOICE HAS BEEN SPECIFIED.

The enclosed form of proxy when properly completed and delivered (and not revoked) confers discretionary authority upon the person appointed proxy thereunder to vote with respect to amendments or variations of matters identified in the Notice of Meeting, and with respect to other matters which may properly come before the Meeting. In the event that amendments or variations to matters identified in the Notice of Meeting are properly brought before the Meeting or any further or other business is properly brought before the Meeting, it is the intention of the persons designated in the enclosed form of proxy to vote in accordance with their best judgment on such matters or business. At the time of the printing of this Information Circular, the management of the Company knows of no such amendment, variation or other matter that may be presented to the Meeting.

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

| Authorized Capital: | unlimited common shares without par value |

| Issued and Outstanding: | 210,951,708(1)common shares without par value |

(1)As at July 22, 2013

Only Shareholders of record at the close of business on July 17, 2013 (the “RecordDate”) who either personally attend the Meeting or who have completed and delivered a form of proxy in the manner and subject to the provisions described above shall be entitled to vote or to have their shares voted at the Meeting.

On a show of hands, every individual who is present and is entitled to vote as a Shareholder, or as a representative of one or more corporate Shareholders, or who is holding a proxy on behalf of a Shareholder who is not present at the Meeting, will have one vote (no matter how many shares he holds). On a poll, every Shareholder present in person or represented by a proxy and every person who is a representative of one or more corporate Shareholders will have one vote for each common share registered in the name of the Shareholder on the register of Shareholders, which is available for inspection during normal business hours at Computershare Trust Company of Canada and will be available at the Meeting.

To the knowledge of the Directors and executive officers of the Company, no person beneficially owns, or controls or directs, directly or indirectly, shares carrying 10% or more of the voting rights attached to all outstanding common shares of the Company, as at the Record Date, except the following:

| Name | Number of Shares Owned orControlled(1) | Percentage of OutstandingShares |

| OceanaGold Corporation | 42,150,000 | 19.98% |

(1) Beneficial ownership of these shares is not known by the Company.

AUDIT COMMITTEE

Under National Instrument 52-110 –Audit Committees (“NI 52-110”), companies are required to provide disclosure with respect to the audit committee including the text of the audit committee’s charter, composition of the audit committee and the fees paid to the external auditor. This information is provided in the Company’s Form 20-F for the year ended April 30, 2013, under the headings “Audit Committee” and “Principal Accountant Fees and Services”. The Form 20-F is available for review by the public on the SEDAR website located atwww.sedar.com under the Company's profile, “Pacific Rim Mining Corp”. Management of the Company strongly encourages Shareholders to review the Form 20-F.

3

STATEMENT OF EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Compensation Philosophy

The Company’s compensation philosophy for executive officers is based on two basic objectives: (1) to attract, motivate and retain individuals with the appropriate skills; and, (2) to provide incentives to management to meet the Company’s strategic objectives, which works to align the interests of management with those of the Shareholders.

Executive Compensation

The Company has adopted a compensation philosophy consisting of two main components: (1) base salaries and, at the Compensation Committee’s discretion, a bonus; and (2) long term incentives in the form of stock options. Generally, executive compensation has been designed to be competitive with the executive compensation offered by companies comparable to the Company in terms of size, assets and stage of development within the precious metals mining industry. The Company has targeted total compensation to be near the median for those junior mining companies of comparable project development stage and market capitalization, with the relative importance of salary and stock options being equal. The Company's board of directors (the "Board" or the "Board of Directors") does not benchmark its executive compensation program, but from time to time does review compensation practices of companies of similar size and stage of development to ensure the compensation paid is competitive within the Company's industry and geographic location while taking into account the financial and other resources of the Company. To date, due to the limited cash available to the Company, the Board believes that the total level of compensation has been at the lower end of the range of comparable companies. Depending on market conditions, including metal prices, trading conditions, the availability of capital, and the demand for competent people, compensation packages for qualified executives and staff within the industry fluctuate, and the Company’s executive compensation will need to remain competitive in order to attract and retain qualified management.

Owing to the Company’s small size and limited executive pool, the Company’s process for determining executive compensation is relatively simple and does not include formal targets, criteria or analysis. While the Compensation Committee and the Board of Directors do not formally analyse risks associated with the Company’s compensation policies and practices, these policies and practices do not include structural inconsistencies that are likely to unduly encourage or cause an executive officer to expose the Company to inappropriate or excessive risks. Directors and Named Executive Officers (seeSummary Compensation Table, below) are not permitted to purchase financial instruments designed to hedge or offset a decrease in market value of equity securities granted as compensation or otherwise held by the Director or Named Executive Officer.

President and Chief Executive Officer and Chairman’s Compensation

The President and Chief Executive Officer’s salary is specified in his employment contract and is not generally subject to annual adjustment by the Compensation Committee. In setting the base salary of the President and Chief Executive Officer, the Compensation Committee targets the median compensation levels of individuals at other similar sized junior exploration companies with the same position and function and similar experience levels as the Company’s President and Chief Executive Officer. The Compensation Committee annually re-confirms the cash compensation of the President and Chief Executive Officer, bearing in mind the cash available to the Company for the current financial year.

The salary of the President and Chief Executive Officer is US$250,000 per year. From November 2008 to September 2012, in light of economic and market conditions, Thomas Shrake voluntarily drew only US$180,000 in salary per year, representing 72% of his official salary. In September 2012, the Compensation Committee approved a US$20,000 increase in the salary drawn by Mr. Shrake (to US$200,000), in recognition of his onerous workload and dedication to the Company’s goal of unlocking the value of its primary asset. Catherine McLeod-Seltzer, the Company’s Chairman, has not received a salary from the Company since September 30, 2008.

Base Salary and Bonus

To ensure that the Company will continue to attract and retain qualified and experienced executives, base salaries are reviewed annually, and if necessary adjusted, in order to ensure that they remain at a level at near the median for comparable companies. The Company has not adjusted base salaries for executives since September 2006, with the exception of one executive’s base salary that was increased by 5% during the current financial year. Bonuses, if any, are based upon a combination of individual and Company performances and are weighted more against Company performance for senior executives. The Company did not pay any bonuses during the current financial year.

4

Long Term Incentives – Stock Options

The Company grants stock options to executives in recognition that its base salary levels are at the lower end of industry norms for comparable executives at similar sized junior resource companies, to ensure significant incentive exists to maximize Shareholder value, and to reward those executives making a long-term commitment and contribution to the Company. Options granted under the Plan expire not later than the tenth anniversary of the date the options were granted. The Company has traditionally limited the term of its options granted to five years and vesting provisions for issued options are determined at the discretion of the Board. The amount of outstanding options and the terms thereof are considered before granting new options to ensure the grants are as consistent as possible.

Performance Graphs

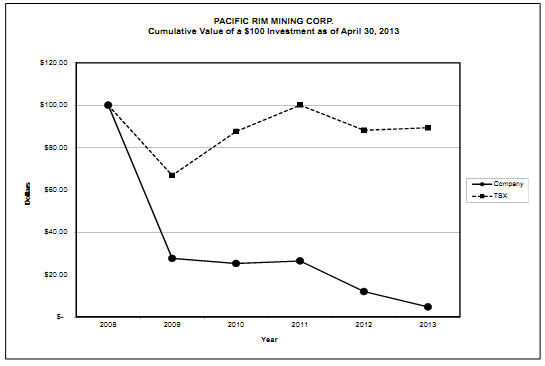

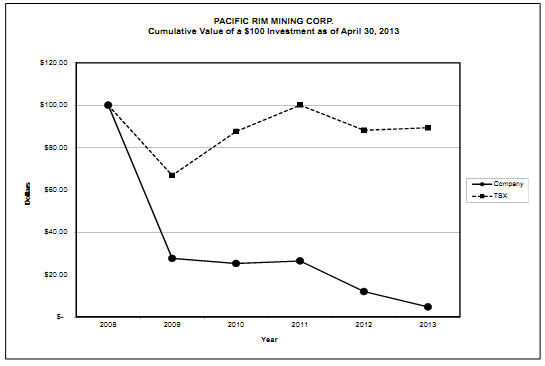

The following chart compares the yearly percentage change in the cumulative total Shareholder return on the Company’s common shares against the cumulative total shareholder return of the S&P/TSX Composite Index for the period April 30, 2008 to April 30, 2013.

Five-Year Cumulative Return on $100 Investment

April 30, 2008 – April 30, 2013

The Company’s share price has suffered significant declines over the past 5 year period and as such, has underperformed returns of the S&P/TSX Composite Index. A $100 investment in each of the Company’s shares and the S&P/TSX Composite Index on April 30, 2008 would be worth $4.82 and $89.38, respectively, at April 30, 2013. As the Compensation Committee believes the decline in the Company’s share price, and hence relative underperformance, is primarily due to factors outside of the control of the Company’s senior executives, it has not recommended a comparative decrease in executive compensation at this timewhich has remained relatively consistent during this 5 year period.

5

Option-based Awards

The Evergreen Plan (described below) has been and will be used to provide share purchase options which are granted in consideration of the level of responsibility and tenure of the executive as well as his or her impact or contribution to the longer-term operating performance of the Company. A proposal for option grants, indicating the number of options proposed to be granted to each executive, is provided from time to time, on a roughly annual basis, to the Compensation Committee by the President and Chief Executive Officer. The Compensation Committee reviews all elective option grant proposals and provides its recommendations to the Board of Directors, the members of which vote to approve or deny the proposed grant. In determining the number of options to be granted to the executive officers, the Board takes into account the number of options, if any, previously granted to each executive officer, and the exercise price of any outstanding options to ensure that such grants are in accordance with the policies of the Toronto Stock Exchange (“TSX”), and closely align the interests of the executive officers with the interests of the Shareholders.

The Compensation Committee has the responsibility to administer the compensation policies related to the executive management of the Company, including option-based awards.

Compensation Governance

Compensation Committee

The Compensation Committee is currently composed of Messrs. David K. Fagin (Chair) and William Myckatyn, both of whom are independent based upon the tests for independence set forth in NI 52-110. Neither of the Committee members is or was during the most recently completed financial year an employee of the Company or any of its subsidiaries, nor have either of the Committee members been an officer or an employee of the Company or any of its subsidiaries in the past three years. Messrs. Fagin and Myckatyn have each been involved in the mineral exploration and mining industries for well over 40 years, most of which includes executive- and director-level experience relevant to executive compensation.

The Compensation Committee is responsible for reviewing the salary levels for Named Executive Officers (seeSummary Compensation Table below) and other senior executives on a regular basis. It considers independent salary surveys as well as informal surveys prepared by the Company which are specific to mining and exploration companies. The Committee reviews the performance of senior executive officers with the President and CEO and, in an executive session without the President and CEO present, reviews the performance of the President and CEO.

Summary Compensation Table

The following table (presented in accordance with Form 51-102F6Statement of Executive Compensation (“Form 51-102F6”)) sets forth all annual and long term compensation for services in all capacities to the Company (to the extent required by Form 51-102F6) for the three most recently completed financial years of the Company, being the years ended April 30, 2011, April 30, 2012 and April 30, 2013, in respect of each Chief Executive Officer and Chief Financial Officer who acted in such capacity for all or any portion of the most recently completed financial year, and each of the other three most highly compensated executive officers of the Company, or the three most highly compensated individuals acting in a similar capacity (other than the Chief Executive Officer and the Chief Financial Officer), as at April 30, 2013, whose total compensation, for the most recently completed financial year, individually, exceeded CDN$150,000, and any individual who would have satisfied these criteria but for the fact that individual was neither an executive officer of the Company, nor acting in a similar capacity, at the end of the most recently completed financial year (collectively the “Named Executive Officers” or “NEOs”).

6

Name and

Principal

Position | Year

Ended

April 30 | Salary

US($) | Share-

Based

Awards

US($) | Option-Based

Awards

US($)(1) | Non-Equity Incentive

Plan Compensation

($) | Pension

Value

US($) | All OtherCompensation US($) | TotalC

ompensation

US($) |

Annual

Incentive

Plans | Long-term

Incentive

Plans |

| |

Thomas | 2011 | 180,000(2) | Nil | 65,835 | Nil | Nil | Nil | Nil | 245,835 |

Shrake | 2012 | 180,000(2) | Nil | 91,236 | Nil | Nil | Nil | Nil | 271,236 |

CEO | 2013 | 191,667(2) | Nil | 71,187 | Nil | Nil | Nil | Nil | 262,854 |

Steven | 2011 | Nil | Nil | 65,835 | Nil | Nil | Nil | Nil | 65,835 |

Krause(3) | 2012 | Nil | Nil | 28,366 | Nil | Nil | Nil | Nil | 28,366 |

CFO | 2013 | Nil | Nil | 18,733 | Nil | Nil | Nil | Nil | 18,733 |

William | 2011 | 120,000 | Nil | 39,501 | Nil | Nil | Nil | Nil | 159,501 |

Gehlen | 2012 | 120,000 | Nil | 34,039 | Nil | Nil | Nil | Nil | 154,039 |

VPExploration | 2013 | 120,000 | Nil | 18,733 | Nil | Nil | Nil | Nil | 138,733 |

| | (1) | The Company used the Black-Scholes model as the methodology to calculate the grant date fair value, and relied on the following key assumptions and estimates for each calculation: expected dividend yield 0%, expected stock price volatility of 103% and 114%, risk free interest rate 1.26%, and expected life of options of between 3.5 and 4.8 years. The Company chose this methodology as it is the standard for exploration companies in Canada and has been consistently applied by the Company for valuing option-based awards since 2003. The stock-based awards are determined in Canadian funds and then translated into US funds at the fiscal 2013 average foreign currency exchange rate of $1.00US = $0.9822 CDN or $1.00 CDN = $1.018 US. |

| | | |

| | (2) | Mr. Shrake’s official annual salary is US$250,000 per year. Between November 2008 and September 2013, in light of economic and market conditions, Mr. Shrake voluntarily drew only US$180,000 in salary per year, representing 72% of his official salary. In September 2012 (during the current financial year), Mr. Shrake’s annual salary draw increased to US$200,000. See “President and Chief Executive Officer and Chairman’s Compensation” above. |

| | | |

| | (3) | Mr. Krause, as CFO, is not an employee of the Company. He is employed by Avisar Chartered Accountants (“Avisar”). The portion of the compensation paid to Mr. Krause by Avisar during the fiscal years ended April 30, 2013, 2012 and 2011 and which Avisar attributed to the CFO services provided by Mr. Krause to the Company (based on Avisar’s revenue received from the Company as per its service agreement (see below) as a percentage of its total revenues) was CDN $9,637, $13,284 and $11,331, respectively. During the 2013 fiscal year, Avisar charged the Company CDN $130,800 for accounting, tax and financial consulting services. |

Mr. Shrake is employed by the Company under an employment agreement. Mr. Krause is engaged by the Company under a consulting agreement for his services as CFO, and a company in which Mr. Krause is a principal is engaged by the Company under a separate service agreement for the provision of accounting and tax services. Mr. Gehlen is employed by a subsidiary of the Company under an employment agreement. These employment and consulting agreements are more thoroughly described below under the heading“Termination and Change of Control Benefits for NEOs”.

None of the options granted to Messrs. Shrake, Krause or Gehlen were re-priced during the current fiscal year.

Incentive Plan Awards

Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth information concerning all awards outstanding under incentive plans of the Company pursuant to which compensation that depends on achieving certain performance goals or similar conditions within a specified period, at the end of the most recently completed financial year, including awards granted before the most recently completed financial year, to each of the NEOs:

7

| | Option-Based Awards | Share-Based Awards |

Name | Number of

Securities

Underlying

Unexercised

Options

(#) |

Option Exercise

Price

US($)(2) |

Option Expiration

Date (M/D/Y) |

Value of

Unexercised In-

The-Money

Options(1,2)

US($) |

Number of

Shares or Units

of Shares That

Have Not Vested

(#) | Market or

Payout Value of

Share-Based

Awards That

Have Not Vested

US($) |

Thomas Shrake | 500,000 | 0.17 | 12/29/2013 | Nil | N/A | N/A |

CEO | 400,000 | 0.21 | 01/26/2015 | Nil | N/A | N/A |

| 500,000 | 0.21 | 12/16/2015 | Nil | N/A | N/A |

| 800,000 | 0.16 | 09/28/2016 | Nil | N/A | N/A |

| 800,000 | 0.11 | 10/03/2017 | Nil | N/A | N/A |

Steven Krause | 250,000 | 0.17 | 12/29/2013 | Nil | N/A | N/A |

CFO | 250,000 | 0.21 | 01/26/2015 | Nil | N/A | N/A |

| 250,000 | 0.20 | 06/10/2015 | Nil | N/A | N/A |

| 250,000 | 0.21 | 12/16/2015 | Nil | N/A | N/A |

| 250,000 | 0.16 | 09/28/2016 | Nil | N/A | N/A |

| 250,000 | 0.11 | 10/03/2017 | Nil | N/A | N/A |

William Gehlen | 200,000 | 0.17 | 12/29/2013 | Nil | N/A | N/A |

VP Exploration | 200,000 | 0.21 | 01/26/2015 | Nil | N/A | N/A |

| | 300,000 | 0.21 | 12/16/2015 | Nil | N/A | N/A |

| | 300,000 | 0.16 | 09/28/2016 | Nil | N/A | N/A |

| | 250,000 | 0.11 | 10/03/2017 | Nil | N/A | N/A |

| | (1) | This amount is calculated based on the difference between the market value of the securities underlying the options at the end of the most recently completed financial year, which was CDN$0.04 per share, and the exercise or base price of the option. If the exercise price of the option is higher than the year-end market value of the securities underlying the options, options are not In- the-Money and their value is Nil. |

| | | |

| | (2) | The Company’s options are set with an exercise price in CDN dollars and were converted to US dollars at the April 30, 2013 foreign currency exchange rate of $1.00 US = $1.0072 CDN or $1.00 CDN = $0.99285 US. The value of the unexercised in-the- money options is determined in Canadian funds and then translated into US funds at the exchange rate quoted above. |

Incentive Plan Awards - Value Vested Or Earned During The Year

The value vested or earned duringthe most recently completed financial year of incentive plan awards granted to NEOs is as follows:

NEO Name |

Option-Based Awards –

Value Vested

During The Year(1)

US($) |

Share-Based Awards -

Value Vested

During The Year

US($) | Non-Equity Incentive Plan

Compensation -

Value Earned

During The Year

US($) |

Thomas Shrake

CEO | 3,971 | Nil | Nil |

Steven Krause

CFO | 1,241 | Nil | Nil |

William Gehlen

VP Exploration | 1,241 | Nil | Nil |

| | (1) | This amount is the dollar value that would have been realized had the newly vested options been exercised on the vesting date, computed by obtaining the difference between the market price of the underlying securities at exercise and the exercise price of the options under the option-based award on the vesting date. As the Company’s stock options and share price are quoted in $CDN, the value was computed in CDN dollars and converted to US dollars at the April 30, 2013 foreign currency exchange rate of $1.00 US = $1.0072 CDN or $1.00 CDN = $0.99285 US. |

The Company’s stock option awards normally vest as follows: 1/3 upon the date of grant; 1/3 upon the first anniversary of the grant date; and 1/3 upon the second anniversary of the grant date. During the period from May 1, 2012 to April 30, 2013, the following options vested: the last third of options granted on to the NEOs on December 17, 2012; the second third of options granted on September 29, 2012; and the first third of options granted on October 4, 2012.

8

Description of Incentive Plan

In 2006 the Company established an Evergreen Incentive Stock Option Plan (the “Evergreen Plan”), which was initially approved by Shareholders on August 29, 2006 and reapproved by Shareholders on August 26, 2009 and September 6, 2012.

The following is only a summary of certain provisions of the Evergreen Plan and is qualified in its entirety by the provisions of the Evergreen Plan. A Shareholder or other interested party may obtain a copy of the Evergreen Plan by contacting the Corporate Secretary of the Company in writing at Suite 1050, 625 Howe Street, Vancouver, British Columbia, V6C 2TC or by telephone at 604-689-1976.

Description of the Evergreen Plan

On September 6, 2012, Shareholders reapproved the Company's Evergreen Plan, which was initially adopted in 2006 and reapproved in 2009. The Evergreen Plan is designed to attract and retain highly qualified employees, service providers, consultants, directors and officers of the Company and its subsidiaries (collectively, the “Eligible Participants”). The method of establishing the maximum number of shares reserved for grant under option is equal to 10% of the number of shares outstanding at the time of grant. All of the Company’s outstanding options, including those currently granted to the NEOs as well as to the directors, employees and consultants of the Company are governed by the Evergreen Plan, as all options granted under the Company’s former 2002 incentive stock option and stock bonus plan have expired, been exercised or cancelled.

Under the Evergreen Plan, the Board of Directors is authorized to designate Eligible Participants to whom options should be granted. As well, the directors have the power under the terms of the Evergreen Plan to appoint a committee of not less than three (3) directors to administer the Evergreen Plan. The exercise price for an option granted under the Evergreen Plan shall be determined by the directors at the time of grant, provided such price shall not be less than the "market price", being the volume weighted average trading price for the five trading days immediately preceding the date of grant. The Company presently does not have a share purchase plan and does not grant stock appreciation rights.

The Board of Directors fixes the vesting terms which it deems appropriate when options are granted. On a “change of control” (as defined in the Evergreen Plan), all shares subject to outstanding options will become vested and exercisable by the optionees. Options granted under the Evergreen Plan have a maximum fixed term of ten (10) years, subject only to the expiration date of the fixed term falling within, or immediately after, a blackout period that was self-imposed by the Company, in which case the option will expire within a 10 business day period after the blackout is lifted. No option may be assigned other than by will or pursuant to the laws of succession, and to a trust, RESP or RRSP or similar legal entity established by the optionee.

The Evergreen Plan provides that under no circumstances shall the Evergreen Plan, together with all of the Company's other previously established or proposed stock options, stock option plans, employee stock purchase plans or any other compensation or incentive mechanisms involving the issuance or potential issuance of shares, result, at any time, in the number of shares: (i) issued to insiders, within any one year period, exceeding 10% of the number of shares then outstanding; (ii) issuable to insiders, at any time, exceeding 10% of the number of shares then outstanding; (iii) issued to any one insider and such insider's associates, within any one year period, exceeding 5% of the number of shares then outstanding; and (iv) issuable to any one participant, at any time, exceeding 5% of the number of shares then outstanding.

In the event of the death of an optionee, options held by such optionee may be exercised until the earlier of the expiry date of such options or one year from the date of death, after which the options terminate. In the event that an optionee ceases to be an Eligible Participant for any reason other than for cause or by virtue of death, then options held by such optionee shall remain exercisable for a period of 30 days after the date on which such optionee ceases to be an Eligible Participant or the expiration date of such options, whichever is earlier. Where, however, the employment or service contract with an optionee is terminated for cause, no option held by such optionee shall be exercisable following the date on which such optionee ceases to be an Eligible Participant.

Amendments to the Evergreen Plan

The Evergreen Plan requires Shareholder approval for amendments to the Evergreen Plan (other than those requiring only Board approval as set out below) including the following:

9

| | (a) | any amendment to the fixed percentage of shares issuable under the Evergreen Plan, including a change from the fixed maximum percentage of 10% of the issued and outstanding shares to a fixed maximum number; |

| | (b) | any change to the definition of “Eligible Participant” which would have the potential of broadening or increasing insider participation; |

| | (c) | the addition of any form of financial assistance; |

| | (d) | the addition of a cashless exercise feature, payable in cash or securities, which does not provide for a full deduction of the number of underlying shares from the Evergreen Plan reserve; |

| | (e) | the addition of a deferred or restricted share unit or any other provision which results in Eligible Participants receiving shares while no cash consideration is received by the Company; and |

| | (f) | any other amendments that may lead to significant or unreasonable dilution in the Company's outstanding securities or may provide additional benefits to Eligible Participants, especially insiders of the Company, at the expense of the Company and its existing Shareholders. |

The Evergreen Plan requires only Board approval for the following types of amendments, as outlined in the Evergreen Plan:

| | (a) | amendments considered to be of a clerical nature; |

| | (b) | a change to the vesting provisions of a security or to the Evergreen Plan itself; |

| | (c) | a change to the termination provisions of a security or to the Evergreen Plan itself which does not entail an extension beyond the original expiry date; |

| | (d) | a change to reduce the exercise price of a security for an Eligible Participant who is not an insider (as defined in the Evergreen Plan); |

| | (e) | the addition of a cashless exercise feature, payable in cash or securities, which provides for a full deduction of the number of underlying securities from the Evergreen Plan's reserve; and |

| | (f) | amendments of a non-material nature which are approved by the TSX. |

On August 26, 2009, the Shareholders approved certain amendments to the Evergreen Plan in order to: adjust the securities that an optionee will receive on exercise after the completion of a compulsory acquisition or other going private transaction following a take-over bid; adjust the expiry date of options received by an optionee in a new company in the event that the Company completes a plan of arrangement or spin-out transaction; clarify existing adjustment provisions with respect to outstanding options on completion of share reorganizations, special distributions and other corporation reorganizations; and update certain legislative and statutory references and correct certain typographical errors and cross referencing errors.

On July 23, 2012, the Board of Directors also made certain non-material amendments to the Evergreen Plan (a) to clarify, and conform to the TSX Company Manual, the wording regarding the insider participation limits in the Evergreen Plan, and (b) to provide that the Company's optionholders who are resident in the United States are required to provide for certain representations and warranties to the Company, in order to ensure compliance by the Company with the provisions of the U.S. Securities Act. These non-material amendments to the Evergreen Plan were ratified by Shareholders on September 6, 2012 and approved by the TSX on September 14, 2012.

The Evergreen Plan requires Shareholder approval every three years. As the Evergreen Plan was implemented by the Company in 2006 and re-approved by the Shareholders in 2009 and 2012, Shareholder approval of the Evergreen Plan is not required at the Meeting.

There is a maximum of 16,860,170 common shares reserved for issuance under the Evergreen Plan, representing approximately 7.99% of the issued and outstanding common shares of the Company as at the date of this Information Circular.

A total of 12,800,000 options were under grant prior to re-approval of the Evergreen Plan by Shareholders in September 2012. Since then, 3,660,000 new options have been granted, 1,200,000 previously-granted options expired and no options have been exercised. Accordingly, as of the date hereof, 15,260,000 options are currently under grant, representing approximately 7.23% of the issued and outstanding common shares of the Company as of the date of this Information Circular.

Pension Plan Benefits

The Company does not have a pension plan that provides for payments or benefits to the NEOs at, following, or in connection with retirement.

10

Termination and Change of Control Benefits for NEOs

Thomas Shrake, President and CEO

The Company has a current employment agreement with Thomas Shrake, the President and CEO, which includes termination and change of control benefits.

In Mr. Shrake’s employment agreement, “change of control” is defined as any change in the effective control or direction of the Company and includes:

| | (a) | an acquisition of 20% or more of the voting rights attached to all outstanding shares of the Company by a person or combination of persons acting in concert by virtue of an agreement, arrangement, commitment or understanding; or |

| | | |

| | (b) | a change in the Company’s officers or Directors, which alters the effective control or direction of the Company. |

An “event of termination” is defined in the employment agreement as the occurrence of any of the following events at any time after a “change of control”, without the executive’s written consent:

| | (a) | a change (other than changes that are clearly and exclusively consistent with a promotion) in the executive’s position or duties (including any position or duties as a Director of the Company), responsibilities (including, without limitation, the person(s) to whom the executive reports, and who report to the executive), title or office in effect immediately prior to the change of control, which includes any removal of the executive from or any failure to re-elect or re- appoint the executive to any such positions or offices; |

| | | |

| | (b) | any failure by the Company to increase the executive’s remuneration in a manner consistent (both as to frequency and as to percentage increase) with increases granted generally to the Company’s other senior personnel; |

| | | |

| | (c) | the Company permanently relocating the executive to any place other than the location at which he reported to work on a regular basis immediately prior to the change of control; |

| | | |

| | (d) | the Company taking any action to deprive the executive of any material fringe benefits enjoyed by him immediately prior to the change of control or the Company failing to increase or improve such material fringe benefits on a basis consistent with increases or improvements granted to the Company’s other senior personnel; |

| | | |

| | (e) | any breach of the Company of any provision of the employment agreement; |

| | | |

| | (f) | the good faith determination by the executive that, as a result of the change of control or any action or event thereafter, the executive’s status or responsibility in the Company has been diminished or the executive is effectively being prevented from carrying out his duties and responsibilities as they existed immediately prior to the change of control; or |

| | | |

| | (g) | failure by the Company to obtain, in a form satisfactory to the executive, an effective assumption of its obligations hereunder by a successor to the Company, including a successor to a material portion of its business. |

If, as a result of a “change of control” of the Company, Mr. Shrake experiences an “event of termination” as described above, Mr. Shrake is entitled to a severance payment of 24 months’ salary (based on his official annual salary of US$250,000) and is able to exercise any stock options previously granted within 45 business days in the event of termination after a change of control. The estimated incremental value of his non-vested stock options that would vest assuming a triggering event took place on the last day of the most recently completed financial year would have been $Nil as the Company’s closing share price on April 30, 2013 was CDN$0.04, lower than the exercise price of all vested and non-vested stock options granted to Mr. Shrake.

11

Steven Krause, CFO

Steven Krause has a consulting agreement with the Company which includes a “change of control” clause. In this consulting agreement, “change of control” means the acquisition by any person or by any person and joint actor, whether directly or indirectly, of voting securities as defined in theSecurities Act of British Columbia, as amended from time to time (the “BCSecuritiesAct”), which, when added to all other voting securities of the Company at the time held by such person or by such person and a person acting “jointly or in concert with” another person as that phrase is interpreted by the BC Securities Act, totals for the first time not less than fifty percent (50%) of the outstanding voting securities of the Company or the votes attached to those securities are sufficient, if exercised, to elect a majority of the Board of Directors.

Should a “change of control” occur, all outstanding stock options held by Mr. Krause will become fully vested in accordance with the terms of the Evergreen Plan whereupon such options may be exercised in whole or in part by Mr. Krause. The estimated incremental value of his non-vested stock options that would vest assuming a triggering event took place on the last day of the most recently completed financial year would have been $Nil as the Company’s closing share price on April 30, 2013 was CDN$0.04, lower than the exercise price of all vested and non-vested stock options granted to Mr. Krause.

William Gehlen, Vice President Exploration

William Gehlen has an employment agreement with a subsidiary of the Company that includes termination and change of control conditions which are the same as those in Mr. Shrake’s employment agreement described above. If, as a result of a “change of control” of the Company, Mr. Gehlen experiences an “event of termination” as defined above, Mr. Gehlen is entitled to a severance payment of 12 months’ salary, plus one month’s salary per year of service after one year, up to a maximum of 24 months’ salary, and is able to exercise any stock options previously granted within 30 calendar days in the event of termination after a change of control. The estimated incremental value of his non-vested stock options that would vest assuming a triggering event took place on the last day of the most recently completed financial year would have been $Nil as the Company’s closing share price on April 30, 2013 was CDN$0.04, lower than the exercise price of all vested and non-vested stock options granted to Mr. Gehlen.

Other than as set forth above, neither the Company nor its subsidiaries has a contract, agreement, plan or arrangement that provides for payments to a Named Executive Officer following or in connection with any termination (whether voluntary, involuntary or constructive), resignation, retirement, a change of control of the Company or its subsidiaries, or a change in responsibilities of the Named Executive Officer following a change in control.

Estimated Incremental Payment on Change of Control

Under the terms of Thomas Shrake’s employment agreement, the estimated incremental payment to Mr. Shrake upon termination by the Company on a change of control of the Company, would be approximately US$500,000 (calculated as at April 30, 2013) based upon an amount equal to 24 months’ salary, plus any amounts owed in respect of accrued vacation and the accelerated option value of his existing stock options.

There are no provisions in Steven Krause’s consulting agreement that would require the Company to make any payments to Mr. Krause upon a change of control of the Company.

Under the terms of William Gehlen’s employment agreement, the estimated incremental payment to Mr. Gehlen upon termination by the Company’s subsidiary on a change of control of the Company, would be approximately US$240,000 (calculated as at April 30, 2013) based upon an amount equal to 12 months’ salary plus one months’ salary for every year of service beyond one year to a maximum of 24 months’ salary, plus any amounts owed in respect of accrued vacation and the accelerated option value of his existing stock options.

12

Director Compensation

The following table sets forth all amounts of compensation provided to the Directors, who are not also Named Executive Officers, for the Company’s most recently completed financial year:

Director

Name(1) |

Fees

Earned

US($)(2) |

Share-Based

Awards

US($) | Option-

Based

Awards

US($)(3) | Non-Equity

Incentive Plan

Compensation

US($) |

Pension

Value

US($) |

All Other

Compensation

US($) |

Total

US($) |

| Catherine McLeod-Seltzer | Nil | Nil | 44,492 | Nil | Nil | Nil | 44,492 |

| William Myckatyn | Nil | Nil | 19,576 | Nil | Nil | Nil | 19,576 |

| David K. Fagin | Nil | Nil | 19,576 | Nil | Nil | Nil | 19,576 |

| Timothy C. Baker | Nil | Nil | 19,576 | Nil | Nil | Nil | 19,576 |

| | (1) | Relevant disclosure has been provided in the Summary Compensation Table above, for Mr. Shrake, a Director who is also a Named Executive Officer. Mr. Shrake’s total compensation is related to his role as CEO, and he receives no compensation for his services as a Director. |

| | | |

| | (2) | The Company’s three independent directors (Messrs. Myckatyn, Fagin and Baker) are entitled to receive annual directors’ compensation of CDN $10,000 plus 100,000 stock options but elected to forego the cash component of this compensation during the current financial year (only) in lieu of 120,000 additional compensatory stock options, which proposal was approved by the Board of Directors on October 3, 2012. |

| | | |

| | (3) | The Company used the Black-Scholes model as the methodology to calculate the grant date fair value, and relied on the following key assumptions and estimates for each calculation: expected dividend yield 0%, expected stock price volatility of 103% and 114%, risk free interest rate 1.26%, and expected life of options of between 3.5 and 4.8 years. The Company chose this methodology as it is the standard for exploration companies in Canada and has been consistently applied by the Company for valuing option-based awards since 2003. The stock-based awards are determined in Canadian funds and then translated into US funds at the fiscal 2013 average foreign currency exchange rate of $1.00US = $0.9822 CDN or $1.00 CDN = $1.018 US. |

The Company has no arrangements, standard or otherwise, pursuant to which Directors are compensated by the Company or its subsidiaries for their services in their capacity as Directors, or for committee participation, involvement in special assignments, or for services as a consultant or expert during the most recently completed financial year or subsequently, up to and including the date of this Information Circular, except as follows:

| | (a) | Each of the Company’s three independent Directors (Messrs. Myckatyn, Fagin and Baker) is entitled to receive an annual fee of CDN$10,000 to be paid upon his election or re-election to the Board at the annual general meeting of the Company. See footnote (2) to the table above. |

| | | |

| | (b) | Each independent Director is currently entitled to receive a grant of 100,000 stock options upon his election or re-election at the Company’s annual general meeting under the Evergreen Plan, which options immediately vest in full. |

| | | |

| | (c) | Directors are reimbursed for individual travel and other ancillary expenses incurred in connection with attending Board and committee meetings. |

The Evergreen Plan, as described above, allows for the granting of incentive stock options to the officers, employees and Directors of the Company. The purpose of granting such options is to assist the Company in compensating, attracting, retaining and motivating the Directors of the Company and to closely align the personal interests of such persons to that of the Shareholders.

Incentive Plan Awards - Outstanding Share-Based Awards and Option-Based Awards

The following table sets forth information concerning all awards outstanding at the end of the most recently completed financial year, including awards granted before the most recently completed financial year, to the Directors who are not Named Executive Officers:

13

| | Option-Based Awards | Share-Based Awards |

Director Name |

Number of

Securities

Underlying

Unexercised

Options

(#) |

Option

Exercise Price

US($) |

Option

Expiration Date |

Value of

Unexercised

In-The-Money

Options(1,2)

US($) |

Number of

Shares Or Units

Of Shares That

Have Not

Vested

(#) | Market or

Payout Value

Of Share-

Based Awards

That Have Not

Vested

US($) |

Catherine | 300,000 | 0.17 | 12/29/2013 | Nil | N/A | N/A |

McLeod-Seltzer | 200,000 | 0.21 | 01/26/2015 | Nil | N/A | N/A |

| 300,000 | 0.21 | 12/16/2015 | Nil | N/A | N/A |

| 500,000 | 0.16 | 09/28/2016 | Nil | N/A | N/A |

| 500,000 | 0.11 | 10/03/2017 | Nil | N/A | N/A |

William Myckatyn | 125,000 | 0.17 | 12/29/2013 | Nil | N/A | N/A |

| 75,000 | 0.17 | 12/29/2013 | Nil | N/A | N/A |

| 75,000 | 0.21 | 08/25/2014 | Nil | N/A | N/A |

| 50,000 | 0.21 | 01/26/2015 | Nil | N/A | N/A |

| 75,000 | 0.17 | 08/25/2015 | Nil | N/A | N/A |

| 50,000 | 0.21 | 12/16/2015 | Nil | N/A | N/A |

| 75,000 | 0.19 | 09/18/2016 | Nil | N/A | N/A |

| 50,000 | 0.16 | 09/28/2016 | Nil | N/A | N/A |

| 220,000(3) | 0.11 | 10/03/2017 | Nil | N/A | N/A |

David K. Fagin | 125,000 | 0.17 | 12/29/2013 | Nil | N/A | N/A |

| 75,000 | 0.17 | 12/29/2013 | Nil | N/A | N/A |

| 75,000 | 0.21 | 08/25/2014 | Nil | N/A | N/A |

| 50,000 | 0.21 | 01/26/2015 | Nil | N/A | N/A |

| 75,000 | 0.17 | 08/25/2015 | Nil | N/A | N/A |

| 50,000 | 0.21 | 12/16/2015 | Nil | N/A | N/A |

| 75,000 | 0.19 | 09/18/2016 | Nil | N/A | N/A |

| 50,000 | 0.16 | 09/28/2016 | Nil | N/A | N/A |

| 220,000(3) | 0.11 | 10/03/2017 | Nil | N/A | N/A |

Timothy C. Baker | 200,000 | 0.13 | 03/26/2017 | Nil | N/A | N/A |

| 220,000(3) | 0.11 | 10/03/2017 | Nil | N/A | N/A |

| (1) | This amount is calculated based on the difference between the market value of the securities underlying the options at the end of the most recently completed financial year, which was CDN$0.04 per share, and the exercise or base price of the option. If the exercise price of the option is higher than the year-end market value of the securities underlying the options, options are not In- the-Money and their value is Nil. |

| | |

| (2) | The Company’s options are set with an exercise price in CDN dollars and were converted to US dollars at the April 30, 2013 foreign currency exchange rate of $1.00 US = $1.0072 CDN or $1.00 CDN = $0.99285 US. The value of the unexercised in-the- money options is determined in Canadian funds and then translated into US funds at the exchange rate quoted above. |

| | |

| (3) | The Company’s three independent Directors (Messrs. Myckatyn, Fagin and Baker) are entitled to receive annual directors’ compensation of CDN $10,000 plus 100,000 stock options but elected to forego the cash component of this compensation during the current financial year (only) in lieu of 120,000 additional compensatory stock options, which proposal was approved by the Board of Directors on October 3, 2012. |

Incentive Plan Awards - Value Vested Or Earned During The Year

The value vested or earned duringthe most recently completed financial year of incentive plan awards granted to Directors who are not Named Executive Officers is as follows:

14

Director Name

|

Option-Based Awards -

Value Vested

During The Year(1)

US($)

|

Share-Based Awards -

Value Vested

During The Year

US($)

| Non-Equity Incentive

Plan Compensation -

Value Earned

During The Year

US($)

|

Catherine McLeod-Seltzer | 2,482 | N/A | N/A |

William Myckatyn | 3,276 | N/A | N/A |

David K. Fagin | 3,276 | N/A | N/A |

Timothy C. Baker | 3,276 | N/A | N/A |

| (1) | This amount is the dollar value that would have been realized had the newly vested options been exercised on the vesting date, computed by obtaining the difference between the market price of the underlying securities at exercise and the exercise price of the options under the option-based award on the vesting date. As the Company’s stock options and share price are quoted in $CDN, the value was computed in CDN dollars and converted to US dollars at the April 30, 2013 foreign currency exchange rate of $1.00 US = $1.0072 CDN or $1.00 CDN = $0.99285 US. |

The Company’s stock option awards normally vest as follows: 1/3 upon the date of grant; 1/3 upon the first anniversary of the grant date; and 1/3 upon the second anniversary of the grant date. Options granted to independent Directors in connection with their annual compensation normally vest in their entirety upon the date of grant. During the period from May 1, 2012 to April 30, 2013, the following options granted to Directors who are not NEOs vested: the last third of options granted to Directors on December 17, 2012; and the second third of options granted on September 29, 2012. Additionally during this period, the first third of options granted to Ms. McLeod-Seltzer on October 4, 2012, and all of the options granted to Messrs. Myckatyn, Fagin and Baker on October 4, 2012, vested.

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

Plan Category |

Number of Securities to be

issued upon exercise of

outstanding options,

warrants and rights |

Weighted average

exercise price of

outstanding options,

warrants and rights

CDN($) | Number of securities

remaining available for future

issuance under equity

compensation plans

(excluding securities

reflected in column (a)) |

Equity compensation plans approved by securityholders | 15,260,000 | 0.19 | 5,835,170 |

Equity compensation plans not approved by securityholders | Nil | N/A | N/A |

Total: | 15,260,000 | 0.19 | 5,835,170 |

Details of the Company’s Evergreen Plan are set out above under the heading “Description of Incentive Plan”.

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

As at July 22, 2013, there was no indebtedness outstanding of any current or former Director, executive officer or employee of the Company or its subsidiaries which is owing to the Company or its subsidiaries, or which is owing to another entity, which indebtedness is the subject of a guarantee, support agreement, letter of credit or other similar arrangement or understanding provided by the Company or its subsidiaries, whether entered into in connection with a purchase of securities or otherwise.

No individual who is, or at any time during the most recently completed financial year was, a Director or executive officer of the Company, no proposed nominee for election as a Director and no associate of such persons:

| | (a) | is, or at any time since the beginning of the most recently completed financial year has been, indebted to the Company or its subsidiaries; or |

| | | |

| | (b) | is indebted to another entity, which indebtedness is, or at any time since the beginning of the most recently completed financial year has been, the subject of a guarantee, support agreement, letter of credit or other similar arrangement or understanding provided by the Company or its subsidiaries, |

15

whether in relation to a securities purchase program or other program.

CORPORATE CEASE TRADE ORDERS OR BANKRUPTCIES

To the knowledge of the Company, no proposed Director:

| | (a) | is, as at the date of this Information Circular, or has been, within 10 years before the date of this Information Circular, a director, chief executive officer (“CEO”) or chief financial officer (“CFO”) of any company (including the Company) that: |

| | | | |

| | | (i) | was the subject, while the proposed Director was acting in the capacity as director, CEO or CFO of such company, of a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days; or |

| | | | |

| | | (ii) | was subject to a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days, that was issued after the proposed Director ceased to be a director, CEO or CFO but which resulted from an event that occurred while the proposed Director was acting in the capacity as director, CEO or CFO of such company; or |

| | | | |

| | (b) | is, as at the date of this Information Circular, or has been within 10 years before the date of this Information Circular, a director or executive officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or |

| | | | |

| | (c) | has, within the 10 years before the date of this Information Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the proposed Director; or |

| | | | |

| | (d) | has been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or |

| | | | |

| | (e) | has been subject to any penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for a proposed Director. |

STATEMENT OF CORPORATE GOVERNANCE PRACTICES

Corporate governance relates to the activities of the Company’s Board of Directors, the members of which are elected by and are accountable to the Shareholders, and takes into account the role of the individual members of management who are appointed by the Board and who are charged with the day-to-day management of the Company. The Board is committed to sound corporate governance practices which are both in the interests of the Shareholders and contribute to effective and efficient decision making.

National Policy 58-201,Corporate Governance Guidelines, establishes corporate governance guidelines which apply to all public companies. The Company has reviewed its own corporate governance practices in light of these guidelines. In certain cases, the Company’s practices comply with the guidelines; however, the Board considers that some of the guidelines are not suitable for the Company at its current stage of development and level of activity and therefore these guidelines have not been adopted. National Instrument 58-101, Disclosure of Corporate Governance Practices, mandates disclosure of corporate governance practices, which disclosure is set out below.

16

Independence of Members of Board and Management Supervision by Board

The Board currently consists of five Directors, a majority of whom are independent based upon the tests for independence set forth in NI 52-110. Assuming each of the nominated Directors is elected by Shareholders at the Meeting on September 12, 2013, the Board will include three (3) independent Directors: Messrs. Myckatyn, Fagin and Baker. Mr. Shrake and Ms. McLeod-Seltzer are not considered independent as they are the President and Chief Executive Officer, and Board Chairman, respectively, of the Company.

The Board facilitates the exercise of independent judgement in carrying out its responsibilities, by the effective supervision of management by the independent Directors on an informal basis, through active and regular involvement in reviewing and supervising the operations of the Company and through regular and full access to management. Further independent supervision is performed through the Audit Committee which is composed entirely of independent Directors who meet regularly with the Company’s auditors without management being in attendance. The independent Directors hold meetings without the presence of non-independent Directors on a quarterly basis and are also encouraged to meet at any time they consider necessary without any members of management, including the non-independent Directors, being present. The Company’s auditors, legal counsel and certain employees may be invited to attend. During the Company’s most recently completed financial year, the independent Directors met a total of four (4) times.

Leadership is provided for the Board’s independent Directors through access to management and the independent operation of the Audit Committee, as discussed above, and through its Lead Director, Mr. Myckatyn. As Lead Director, Mr. Myckatyn’s role and responsibilities are to:

| | (a) | assist the Chairman to manage the Board and its committees in a manner that ensures that these relationships are effective and efficient and further the best interests of the Company; |

| | | |

| | (b) | oversee the process of evaluation of the Board, its committees and individual Directors; |

| | | |

| | (c) | act as the principal sounding board and counsellor for the Chairman; |

| | | |

| | (d) | ensure that the Chairman is aware of concerns of the independent Directors, Shareholders and other stakeholders; |

| | | |

| | (e) | work with the Chairman to assist the Chairman in fulfilling her responsibilities in managing the Board; |

| | | |

| | (f) | work with the Chairman to co-ordinate the agenda for Board meetings; |

| | | |

| | (g) | chair and manage all meetings for the independent Directors; |

| | | |

| | (h) | attend committee meetings when it is appropriate to do so; and |

| | | |

| | (i) | meet, from time to time, with the Chairman and the President and Chief Executive Officer to convey and discuss concerns of the independent Directors. |

Participation of Directors in Other Reporting Issuers

The following table sets forth each Director of the Company that is also a director of any other issuer that is a reporting issuer (or equivalent) in any jurisdiction.

| Name of Director | Name of Other Public Company |

| Catherine McLeod-Seltzer | Bear Creek Mining Corporation, Kinross Gold Corporation, Troon Ventures Ltd. and Major Drilling Group International, Inc. |

| William Myckatyn | First Point Minerals Corp., San Marco Resources Inc., OceanaGold Corporation and Delta Gold Corporation |

| David K. Fagin | Atna Resources Ltd. |

| Timothy C. Baker | Augusta Resource Corporation, Antofagasta Plc., Golden Star Resources Ltd. |

17

Participation of Directors in Board Meetings

The Board meets at least once every quarter to review the performance of the Company and address other business matters. The Board also holds a meeting each year to review and assess the Company’s financial forecasts and business plan for the ensuing year and its overall strategic objectives. Other meetings of the Board are called to deal with special matters as circumstances require. During the Company’s most recently completed financial year, five (5) Board meetings were held. The attendance record of each Director for the Board meetings held is as follows:

Name of Director | No. of Board Meetings Attended in the Most Recently

Completed Financial Year |

| Catherine McLeod-Seltzer | 5 |

| Thomas Shrake | 5 |

| William Myckatyn | 5 |

| David K. Fagin | 5 |

| Timothy C. Baker | 5 |

Board Mandate

The mandate of the Board is to manage or supervise the management of the business and affairs of the Company and to act with a view to the best interests of the Company. The Board sets long-term goals and objectives for the Company, formulates the plans and strategies necessary to achieve those objectives and goals, and supervises and offers guidance to the Company’s senior management in their implementation. Although the Board has delegated to senior management personnel the responsibility for managing the day-today affairs of the Company, the Board is ultimately responsible for all matters relating to the Company and its business. In fulfilling its mandate, the Board, among other matters, is responsible for reviewing and approving the Company’s overall business strategies and its annual business plan; reviewing and approving the quarterly corporate and cash flow forecasts; reviewing and approving significant capital investments; reviewing major strategic initiatives to ensure that the Company’s proposed actions accord with Shareholder objectives; reviewing succession planning; assessing management’s performance against approved business plans and industry standards; reviewing and approving the reports and other disclosure issued to Shareholders; ensuring the effective operation of the Board; and safeguarding Shareholders’ equity interests through the optimum utilization of the Company’s capital resources.

The Board expects management to efficiently implement its strategic plans for the Company in a professional, competent and ethical manner, to keep the Board fully apprised of its progress in doing so and to be fully accountable to the Board in respect to all matters for which it has been assigned responsibility. In addition to matters which must, by law or pursuant to the constating documents of the Company, be approved by the Board, all matters of strategic importance to the Company are referred to the Board for prior review and approval. Any material expenditures or legal commitments, including without limitation debt or equity financings, acquisitions and divestitures by the Company, financial statements and major disclosure documents, are subject to prior approval by the Board. The Board holds meetings on a regular basis to review the Company’s strategy as well as to consider and approve particular matters. One of the Board’s responsibilities is to review and, if thought fit, to approve opportunities as presented by management and to provide guidance to management. The Board expects management to operate the business of the Company in a manner that enhances Shareholder value and is consistent with the highest level of integrity. Management is expected to execute the Company’s business plan and to meet performance goals and objectives.

The Board oversees the management of the Company’s affairs directly and through its committees. The Board also meets to plan for the future growth of the Company; to identify risks of the Company’s business, thus ensuring the implementation of appropriate systems to manage these risks; to monitor senior management; and to ensure timely disclosure of material transactions. The frequency of Board meetings as well as the nature of agenda items, change, depending upon the state of the Company’s affairs and in light of opportunities or risks that the Company faces. When necessary and appropriate, issues may be approved and adopted by the Board by way of written resolutions in accordance with applicable corporate law.

18

Position Descriptions

The Board has developed written position descriptions for the Chairman, the President and CEO and for the Directors at large. On a quarterly basis, the Board approves the operating and capital forecasts, and the Chairman and President and CEO are required to ensure the Company operates within those guidelines. Material departures must be approved by the Board. The Board is of the view that the respective corporate governance roles of the Board and management, as represented by the Chairman and President and CEO, are clear, and that the limits to management’s responsibility and authority are well defined.

The Board has not developed written position descriptions for the Chair of each Board committee. The Chairs of the Audit Committee, the Nominating Committee, the Compensation Committee, and the Health, Safety and Environmental Committee are responsible for calling the meetings of each Committee, establishing meeting agenda with input from management, and supervising the conduct of the meetings.

Orientation and Continuing Education

New Directors are provided with a Board Manual, as reviewed and adopted by the Board, which contains comprehensive information and guidelines on the duties of the Board, and members of management, terms of reference for committees and policies adopted by the Board. New Directors are given a detailed briefing by the Chairman of the Board and by the President and CEO on the Company and its business, and the legal duties and obligations of Directors. The President and CEO reports at each Board meeting on the Company’s activities and provides Directors with a monthly written report. All Directors are encouraged to contact senior management for updates at any time.

The Board currently does not provide continuing education for its Directors. By using a Board composed of experienced professionals with a wide range of financial, legal, exploration and mining expertise, the Company ensures that the Board operates effectively and efficiently.

Board members are encouraged to communicate with management, legal counsel and, where applicable, auditors and technical consultants of the Company; to keep themselves current with industry trends and developments and changes in legislation with management’s assistance; and to attend related industry seminars and visit the Company’s operations. Board members have full access to the Company’s records.

Ethical Business Conduct

The Board has adopted a written Code of Conduct and Ethics and a Whistleblower Policy by which it and all officers and employees of the Company abide. The Whistleblower Policy outlines a confidential and anonymous process in which to report any accounting concerns while the Code of Conduct helps define and establish a standard of professional behaviour and responsibility, acceptable to the Company, for all employees. A copy of the Code of Conduct and Ethics and the Whistleblower Policy is available for review on the Company’s website and on SEDAR atwww.sedar.com. In addition, the Board, through its meetings with management and other informal discussions with management, monitors in compliance with the Code of Conduct and Ethics and encourages a culture of ethical business conduct. The Company’s high calibre management team promotes a culture of ethical business conduct throughout the Company’s operations and is expected to monitor the activities of the Company’s employees, consultants and agents in that regard. The Board encourages any concerns regarding ethical conduct in respect of the Company’s operations to be raised, on an anonymous basis, with the President and CEO, the Chairman, or another Board member as appropriate.

It is a requirement of applicable corporate law that Directors and senior officers who have an interest in a transaction or agreement with the Company promptly disclose that interest at any meeting of the Board at which the transaction or agreement will be discussed and, in the case of Directors, abstain from discussions and voting in respect to same if the interest is material. These requirements are also contained in the Company’s Articles, which are made available to the Directors and senior officers of the Company.

Nomination of Directors

The Nominating Committee is composed of two Directors, Messrs. Baker (Chair) and Myckatyn, each of whom is independent based upon the tests for independence set forth in NI 52-110. The Nominating Committee has the responsibility for recommending to the Board the nominees to fill vacancies on the Board or to be proposed by any member of the Board as candidates for election as Directors at the annual general meeting. The Nominating Committee also recommends to the Board a desirable balance of expertise among the Board members, seeks out possible candidates to fill Board positions and aids in attracting qualified candidates to the Board. In addition, the Nominating Committee’s responsibilities include reviewing and monitoring the orientation of new Board members; reviewing and approving officers’ directorships in other companies and reviewing Directors’ relationships with outside entities with regard to potential conflicts of interest.

19

Compensation Committee

The Compensation Committee is composed of Messrs. Fagin (Chair) and Myckatyn, each of whom is independent based upon the tests for independence set forth in NI 52-110. The overall purpose of the Compensation Committee is to make recommendations to the Board for human resources and compensation policies and to implement and oversee same if the Board approves the recommendations for the Company.

The Compensation Committee is responsible for reviewing all overall compensation strategy, objectives and policies; annually reviewing and assessing the performance of the executive officers; recommending to the Board the compensation of the executive officers; reviewing executive appointments; and reviewing the adequacy and form of Directors’ compensation.