UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant¨

Filed by a Party other than the Registrantx

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-12 |

Mac-Gray Corporation

(Name of Registrant as Specified in Its Charter)

Fairview Capital

Fairview Capital Investment Management, LLC

Darlington Partners, L.P.

Andrew F. Mathieson

Scott W. Clark

Bruce C. Ginsberg

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

On April 6, 2009, Fairview Capital Investment Management, LLC, together with the other participants named herein (together, “Fairview Capital”), made a definitive filing with the Securities and Exchange Commission of a proxy statement and an accompanying GOLD proxy card to be used to solicit votes for the election of its director nominees and support for two corporate governance related shareholder proposals at the 2009 annual meeting of stockholders of Mac-Gray Corporation, a Delaware corporation (“Mac-Gray”).

On April 7, 2009, Fairview Capital Investment Management, LLC issued a press release announcing its mailing of definitive proxy materials and a letter to all Mac-Gray stockholders urging them to vote for Fairview Capital’s director nominees for election to the Board of Directors at Mac-Gray’s 2009 annual meeting of stockholders. A copy of such press release is attached hereto as Exhibit I and is incorporated herein by reference.

A copy of Fairview Capital’s slide presentation to Mac-Gray stockholders is attached hereto as Exhibit II and is incorporated herein by reference.

ON APRIL 6, 2009, FAIRVIEW CAPITAL FILED A DEFINITIVE PROXY STATEMENT WITH THE SECURITIES AND EXCHANGE COMMISSION. SECURITY HOLDERS ARE ADVISED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY DARLINGTON PARTNERS, L.P., FAIRVIEW CAPITAL, FAIRVIEW CAPITAL INVESTMENT MANAGEMENT, LLC, ANDREW F. MATHIESON, SCOTT W. CLARK, BRUCE C. GINSBERG AND CERTAIN OF THEIR RESPECTIVE AFFILIATES FROM THE STOCKHOLDERS OF MAC-GRAY CORPORATION, FOR USE AT ITS ANNUAL MEETING, BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PARTICIPANTS. THE DEFINITIVE PROXY STATEMENT AND A FORM OF PROXY IS AVAILABLE TO STOCKHOLDERS OF MAC-GRAY CORPORATION FROM THE PARTICIPANTS AT NO CHARGE AND IS ALSO AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S WEBSITE AT HTTP://WWW.SEC.GOV. THE DEFINITIVE PROXY STATEMENT AND A FORM OF PROXY WAS DISSEMINATED TO SECURITY HOLDERS ON OR ABOUT APRIL 7, 2009.

1

Exhibit I

FAIRVIEW CAPITAL MAILS PROXY MATERIALS TO MAC-GRAY’S

SHAREHOLDERS, URGING THEM TO VOTE FOR ITS HIGHLY QUALIFIED,

INDEPENDENT NOMINEES ON THE GOLD PROXY CARD

Greenbrae, CA – April 7, 2009 – Fairview Capital Investment Management, LLC (“Fairview”) today announced that it is mailing definitive proxy materials to all Mac-Gray Corporation (“Mac-Gray”) (NYSE: TUC) shareholders, urging them to vote for Fairview’s two highly qualified, independent director nominees on the GOLD proxy card. Mac-Gray’s Annual Meeting of Stockholders is scheduled to be held on May 8, 2009.

Fairview is also mailing a letter to all Mac-Gray shareholders, the text of which follows:

April 7, 2009

Dear Fellow Mac-Gray Shareholder:

CHANGE IS NEEDED NOW – SHAREHOLDERS NEED A VOICE ON

MAC-GRAY’S BOARD OF DIRECTORS

Fairview Capital Investment Management, LLC and its affiliates (“Fairview”) own 6.3% of the outstanding common stock of Mac-Gray Corporation. We have been a Mac-Gray shareholder for more than five years, during which time Mac-Gray’s financial results and stock price performance have been abysmal. We believe Mac-Gray’s Chief Executive Officer and his Board of Directors are responsible for this value destruction, and we believe it must stop. Shareholders need representation in the Boardroom to protect the value of your investment. We are seeking your support to elect two independent nominees to Mac-Gray’s Board. If elected, Scott W. Clark and Bruce C. Ginsberg will work to ensure that Mac-Gray lives up to its potential and is run for the benefit of all shareholders.

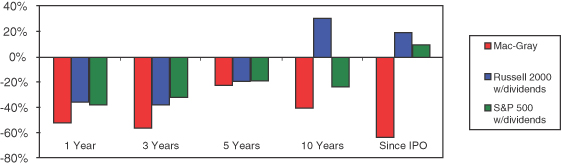

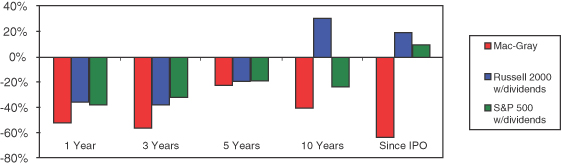

MAC-GRAY’S NEGATIVE SHARE PRICE PERFORMANCE IS INDEFENSIBLE

Nearly all Mac-Gray shareholders have lost money on their investment, regardless of when they purchased shares. One must try very hard to find a timeframe over which Mac-Gray has outperformed the stock market. In fact, Mac-Gray has underperformed the Russell 2000 and S&P 500 stock market indices over the past 1, 3, 5, and 10-year periods. We believe such consistent underperformance is astounding… and indefensible.

Notice on the far right of the chart above that Mac-Gray’s current share price is 63% below the closing price on the day of its IPO in 1997. Over the same timeframe, the Russell 2000 and S&P 500 indices have appreciated 20% and 9%, respectively, including reinvested dividends. We believe such extreme underperformance over such an extended timeframe is indicative of management’s inability to create value for shareholders.

MAC-GRAY’S ACQUISITIONS AND SO-CALLED “GROWTH” STRATEGY HAVE FAILED

Over the past five years, Mac-Gray spent $330 million of its shareholders’ money on 13 acquisitions that we believe have createdno value and are primarily responsible for the negative share price performance cited in the chart above.

Management promised the acquisitions would create market density, which would result in higher operating margins and earnings growth. Management proudly proclaimed in press releases and on conference calls that its four largest acquisitions, which collectively cost $312 million, would provide earnings accretion. Mac-Gray’s financial results indicate that management failed to deliver on its promises. Mac-Gray’s EBITDA margins today are only marginally better than when the acquisition binge began, and earnings per share are materially worse. The numbers are undeniable.

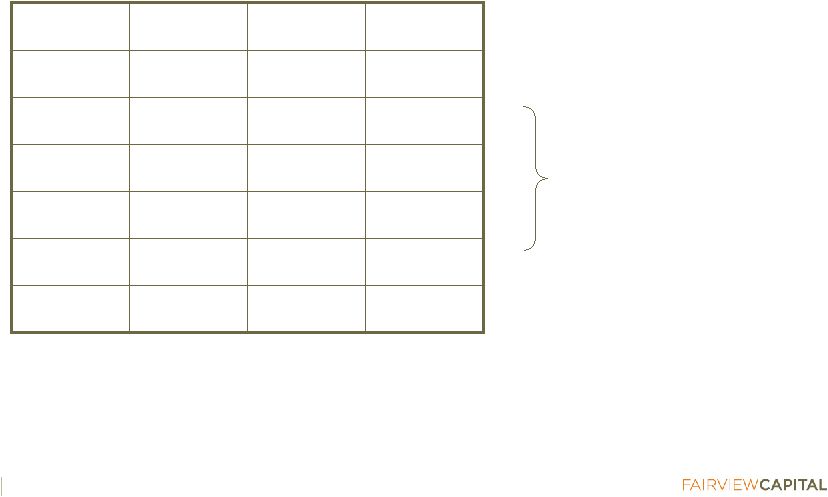

| | | | | | | | | | | | | | | | | | | | |

| | | 2004 | | | 2005 | | | 2006 | | | 2007 | | | 2008 | |

EBITDA margin, as adjusted | | | 18.8 | % | | | 20.1 | % | | | 19.4 | % | | | 19.8 | % | | | 20.1 | % |

EPS, as adjusted | | $ | 0.36 | | | $ | 0.39 | | | $ | 0.23 | | | $ | 0.26 | | | $ | 0.14 | |

Note: EBITDA margin, as adjusted, and EPS, as adjusted, are based on Mac-Gray’s publicly-filed financial statements.

Just as bad as the financial underperformance is the fact that management cannot explain the reasons for the disappointing results. We and other shareholders have been exasperated at management’s apparent lack of understanding of the basic concept of return on investment.

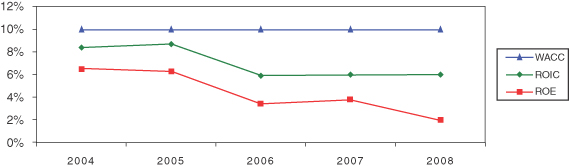

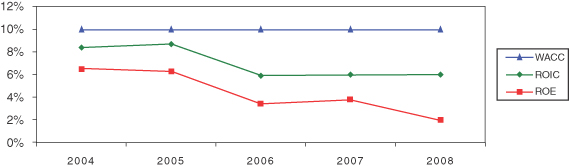

Management claims to achieve high returns on its acquisitions and capital investments, but it has never provided any supporting calculations, nor has it ever reconciled its claims with the stark reality of Mac-Gray’s consolidated financial results. The Company’s consolidated return on invested capital (ROIC) and return on equity (ROE) reflect the atrocious returns Mac-Gray has achieved on its acquisitions. Both ROIC and ROE are below the Company’s estimate of its weighted average cost of capital (WACC), and both have declined steadily since Mac-Gray began its acquisition binge in January 2004.

MAC-GRAY HAS PUT SHAREHOLDERS AT RISK BY ADDING TOO MUCH DEBT

We believe Mac-Gray’s acquisitions have also greatly reduced the Company’s financial strength and flexibility. Since 2003,

Mac-Gray’s debt has increased nearly 500%, from $51 million to $301 million. Mac-Gray’s Debt/EBITDA ratio has increased from a very reasonable 1.8x at the end of 2003 to an imprudently high 4.1x at the end of 2008.

In particular, the acquisitions of Hof Service Co. in late-2007 and Automatic Laundry Co. (ALC) in the second quarter of 2008 added $159 million of debt. We believe these acquisitions could not have been made at a more inopportune time, and appear even more ill-considered in the current environment.

THE BOARD HAS REWARDED MANAGEMENT FOR ITS POOR PERFORMANCE

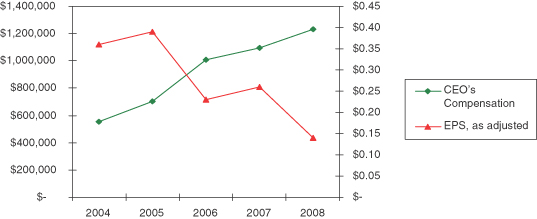

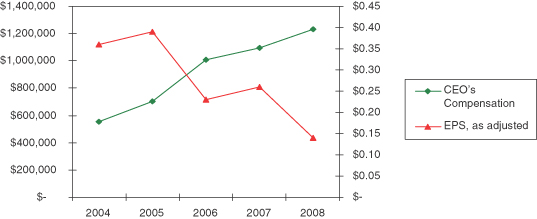

The only ones to benefit from Mac-Gray’s failed acquisition strategy are management, who have been paid handsomely by the Board. For example, between 2004 and 2008, while Mac-Gray’s profitability and the value of your investment in Mac-Gray were decreasing, the total compensation of Mac-Gray’s CEO, Stewart MacDonald, increased 123%. The following chart outlines the increase in the CEO’s total compensation (left axis) versus the decrease in Mac-Gray’s EPS, as adjusted (right axis). Notice that the CEO’s total compensation has exceeded $1 million in each of the past three years.

Another egregious example of the Board’s skewed incentive system and generosity toward management is the award of special salary increases following Mac-Gray’s $116-million acquisition of ALC in April 2008. According to Mac-Gray’s 2009 proxy statement, the Board awarded management raises of as much as 9.6% to reflect “the Company’s larger post-acquisition size.” This was after management had already received salary raises just a few months earlier.

Besides its excessive generosity with management salaries, the Board is responsible for Mac-Gray’s short-term “cash” incentive compensation plan, which we believe provides the wrong incentives for management. In 2008, the bonus objectives for revenue and EBITDA were set such that they could only be achieved with a major acquisition. The bonus objective for EPS was set 65%lower than Mac-Gray’s actual 2007 EPS, ensuring that management would not be penalized for dilutive acquisitions. Perhaps not surprisingly, the management team paid an excessive price to complete the ALC acquisition and collected nearly $1 million in cash bonuses in 2008.

MAC-GRAY’S CORPORATE GOVERNANCE POLICIES ARE AGAINST SHAREHOLDER INTERESTS

Mac-Gray’s corporate governance policies are inconsistent with current best practices and serve to entrench the current management and Board. In particular:

| | • | | Mac-Gray’s CEO also serves as Chairman, and there is no lead independent Director. |

| | • | | Mac-Gray continues to operate with a staggered Board. |

| | • | | Mac-Gray permits directors to be elected by a mere plurality vote. |

| | • | | Mac-Gray has adopted a poison pill that was never approved by shareholders. |

| | • | | Shareholders do not have the right to call special meetings. |

| | • | | Shareholders do not have the right to act by written consent. |

At this year’s Annual Meeting, shareholders will put forward two proposals to make improvements in Mac-Gray’s corporate governance. Proposal 3 seeks to declassify the Board, and Proposal 4 seeks to adopt a majority vote standard for director elections. Rather than embracing these proposals, which have been adopted by numerous public companies in recent years, the Mac-Gray Board rejected these proposals out of hand and is opposing them vigorously. This alone speaks volumes about the Board’s lack of commitment to good corporate governance.

FAIRVIEW’S NOMINEES WILL ADDRESS MAC-GRAY’S SHORTCOMINGS

Fairview is a long-term investor, and we have been a Mac-Gray shareholder for more than five years. Our ownership of Mac-Gray predates the elected terms of six of the seven independent Directors. We take great pride in the depth and quality of our investment research, and we believe our views on Mac-Gray are very well informed.

We believe the Board has endorsed Mac-Gray’s failed acquisition strategy, presided passively over the Company’s disastrous financial and share price performance, and rewarded management with a flawed approach to compensation.

Unfortunately, in our view, the Board’s faults do not end there. We have identified several additional deficiencies in Mac-Gray’s Board. Fairview’s nominees will address these deficiencies.

1.The Board composition lacks financial analysis and capital markets expertise. The independent Directors include two consultants, two retired accountants, and three current or retired executives. None of these Directors appear to possess significant experience in the financial analysis of acquisitions or capital investments.

Ú In contrast, Scott Clark has significant expertise in financial analysis with 14 years of investment and capital markets experience. Both Scott Clark and Bruce Ginsberg have meaningful experience evaluating mergers and acquisitions.

2.The independent Directors own a miniscule amount of Company stock. Excluding options, the seven independent Directors collectively own only 0.4% of Mac-Gray’s common stock. Incumbent Director nominee Christopher Jenny owns a mere 3,321 common shares, or 0.02% of Mac-Gray’s common stock, and has been a seller of his meager holdings of Mac-Gray shares over the past two years. How can Mr. Jenny and the other independent Directors claim to represent shareholder interests when they are barely shareholders themselves?

Ú In contrast, Fairview owns 6.3% of Mac-Gray, and Scott Clark has a significant personal investment in Mac-Gray through his investments in Fairview. Bruce Ginsberg has committed to buy shares in the open market upon election. Unlike the current Directors, Scott Clark and Bruce Ginsberg will choose to receive 100% of their Director’s fees in stock.

Fairview believes a Board of Directors should work for shareholders, and management should work for the Board. Scott Clark and Bruce Ginsberg intend to restore this chain of accountability at Mac-Gray.

NOW IS THE TIME FOR CHANGE – SHAREHOLDERS NEED A VOICE IN THE BOARDROOM

YOU HAVE AN OPPORTUNITY TO PROTECT YOUR INVESTMENT TODAY

Mac-Gray will address important strategic decisions within the next year. These include: (1) the determination of a target leverage range and timeframe for reaching the optimal debt level, (2) consideration of future acquisitions and other capital allocation alternatives, and (3) the determination of incentive compensation metrics and targets. Shareholders need a voice in the Boardroom when these important decisions are being considered.

The management and Board have a track record of value destruction. Shareholders need representation in the Boardroom now, to ensure your interests are protected before the management and Board can do any more damage. You have the choice of either supporting the current Board incumbents, with the Board’s record of overseeing a failed strategy and the destruction of significant shareholder value, or you can support new, highly qualified, independent nominees who are committed to working for the best interests of all shareholders.

We are not seeking control of the Company. Rather, we are seeking to improve the quality of the Board by electing two individuals who will add missing skills, bring an independent perspective and provide shareholders with representation in the Boardroom.

Please vote for Scott W. Clark and Bruce C. Ginsberg on the enclosed GOLD proxy card today.

| | | | |

| Very sincerely, | | | | |

| | |

| |  | | |

Scott W. Clark | | Andrew F. Mathieson | | |

|

Your Vote Is Important, No Matter How Many Or How Few Shares You Own. If you have questions about how to vote your shares, or need additional assistance, please contact the firm assisting us in the solicitation of proxies: INNISFREE M&A INCORPORATED Shareholders Call Toll-Free: (888) 750-5834 Banks and Brokers May Call Collect: (212) 750-5833 IMPORTANT We urge you NOT to sign any white proxy card sent to you by Mac-Gray. If you have already done so, you have every right to change your vote by using the enclosed GOLD proxy card to voteTODAY—by telephone, by Internet, or by signing, dating and returning theGOLD proxy card in the postage-paid envelope provided. |

About Fairview Capital Investment Management, LLC

Fairview is an SEC-registered independent investment advisor founded in 1995 and located in Greenbrae, CA. Key components of Fairview’s investment philosophy include a long-term focus, in-depth fundamental research, and constructive engagement with its portfolio companies.

Additional Information

ON APRIL 6, 2009, FAIRVIEW, TOGETHER WITH THE OTHER PARTICIPANTS, FILED A DEFINITIVE PROXY STATEMENT WITH THE SECURITIES AND EXCHANGE COMMISSION. SECURITY HOLDERS ARE ADVISED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER DOCUMENTS RELATED TO THE SOLICITATION OF PROXIES BY DARLINGTON PARTNERS, L.P., FAIRVIEW CAPITAL, FAIRVIEW CAPITAL INVESTMENT MANAGEMENT, LLC, ANDREW F. MATHIESON, SCOTT W. CLARK, BRUCE C. GINSBERG AND CERTAIN OF THEIR RESPECTIVE AFFILIATES FROM THE STOCKHOLDERS OF MAC-GRAY CORPORATION, FOR USE AT ITS ANNUAL MEETING, BECAUSE THEY CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATING TO THE PARTICIPANTS. THE DEFINITIVE PROXY STATEMENT AND A FORM OF PROXY IS AVAILABLE TO STOCKHOLDERS OF MAC-GRAY CORPORATION FROM THE PARTICIPANTS AT NO CHARGE AND IS ALSO AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S WEBSITE AT HTTP://WWW.SEC.GOV. THE DEFINITIVE PROXY STATEMENT AND A FORM OF PROXY WAS DISSEMINATED TO SECURITY HOLDERS ON OR ABOUT APRIL 7, 2009.

Contacts

Scott Clark, 415-464-4640

Fairview Capital Investment Management, LLC

Alan Miller / Jennifer Shotwell / Scott Winter, 212-750-5833

Innisfree M&A Incorporated

Mac-Gray Shareholders Deserve a Voice on the Board Investor Presentation Spring 2009 Exhibit II |

Spring 2009 – Confidential 2 Mac-Gray Shareholders Deserve a Voice on the Board Contents Introduction Financial and share price performance: the numbers don’t lie Fairview’s nominees address Mac-Gray’s shortcomings Free cash flow is the key to value creation Shareholder representation is needed now Appendix |

Spring 2009 – Confidential 3 Mac-Gray Shareholders Deserve a Voice on the Board Introduction: Fairview Capital overview Firm background • SEC-registered investment advisor • Founded in 1995 and located in Marin County, CA • $300+ million AUM in client accounts and a private partnership (Darlington Partners, L.P.) Investment strategy • Long-term value investors; typical investment horizon is 5+ years • Own a concentrated portfolio based on extensive fundamental research • Strive to maintain constructive relationships with portfolio companies Investment team • Andrew F. Mathieson: President, Portfolio Manager; 25 yrs investment experience; Yale BA, Stanford MBA • Scott W. Clark: Portfolio Manager; 14 yrs investment experience; Brown BA, Stanford MBA • John F. Rutledge Jr., CFA: Director of Research; 16 yrs investment experience; Hamilton College BA • Ramsey B. Jishi: Research Analyst; 7 yrs investment experience; Yale BA, Stanford MBA |

Spring 2009 – Confidential 4 Business description Mac-Gray provides coin- and card-operated laundry services in multi-housing facilities such as apartment buildings and university residence halls. The company serves 43 states and is one of two national laundry facilities management contractors. Mac-Gray also sells laundry equipment to commercial users such as retail laundromats. In addition, Mac-Gray’s MicroFridge division sells and rents a combination refrigerator/freezer/microwave and other household appliances. Mac-Gray employs 939 full-time workers and is headquartered in Waltham, MA. Stock market information • NYSE: TUC • Share price = $5.19 • Equity market capitalization = $70 million 2008 Financial information • Revenue = $364 million • EBITDA, as adjusted = $73 million • EPS, as adjusted = $0.14 • Total debt = $301 million • Debt / EBITDA ratio = 4.1x Mac-Gray Shareholders Deserve a Voice on the Board Introduction: Mac-Gray Corporation overview 1. Stock market information as of 4/3/09. Financial information as of 12/31/08. “As adjusted” numbers are provided by Mac-Gray in its financial reports. 1 1 |

Spring 2009 – Confidential 5 Mac-Gray Shareholders Deserve a Voice on the Board Introduction: how we got to this point Fairview has a history of constructive engagement with Mac-Gray • Presently own 6.3% of common shares • Shareholder for >5 years (our ownership predates the elected terms of 6 independent Directors) • Dozens of communications with management over past five years • Numerous in-person meetings with management at Mac-Gray’s office and Fairview’s office • Attended Annual Meetings in 2005, 2007 and 2008 Fairview has advocated a consistent message for change • Mac-Gray’s financial performance and share price performance are unacceptable • The poor financial performance is primarily due to low investment returns on major acquisitions • Fairview advocates a more disciplined approach to capital allocation Mac-Gray’s poor share price performance indicates the market agrees with Fairview • Mac-Gray’s share price has underperformed the market over the past 1, 2, 3, 5, and 10-year periods¹ Mac-Gray has shown no inclination to change • The Board has expressed satisfaction with Mac-Gray’s financial and stock price performance, despite a 53% EPS decline and a 22% share price decline over the past five years¹ 1. Details on share price underperformance and EPS decline provided later in presentation. |

Spring 2009 – Confidential 6 Mac-Gray Shareholders Deserve a Voice on the Board Introduction: how we got to this point We became an “activist” reluctantly – after patiently exhausting other avenues We made the following attempts at constructive dialogue, with no results • Series of conversations with CFO regarding capital allocation in late-2006 and early-2007 • Conversations with Directors regarding capital allocation at 2007 Annual Meeting • Private letter to the Board in July 2007 • Private letter to the independent Directors in October 2007 • Two public letters to the Board in December 2007 and April 2008 • Met at the company with management and two independent Directors in May 2008 • Introduced Mac-Gray to an independent Director candidate with outstanding qualifications in July 2008 • Met at the company with Directors and management on April 2, 2009; the Directors and management refused to engage in substantive dialogue regarding capital allocation and corporate governance We believe our only recourse is to seek Board representation • Fairview merely wants a voice in the Boardroom • Shareholders need a voice now, before critical decisions are made later this year |

Spring 2009 – Confidential 7 Mac-Gray Shareholders Deserve a Voice on the Board Introduction: Board-level changes are needed now Mac-Gray’s Board has not adequately represented the interests of all shareholders • Board composition is lacking in key skill sets • Independent Directors own little equity; Board and management incentives not aligned with shareholders • Corporate governance policies are inconsistent with current best practices • Board has endorsed Mac-Gray’s flawed growth-by-acquisition strategy • Board has presided passively over poor financial results and share price performance Fairview’s candidates address these problems • Add complementary skill sets to create a well-rounded Board composition • Fairview’s significant equity ownership provides alignment of interests with shareholders • Aim to improve management incentive compensation programs and corporate governance policies • Pursue several potential operational and strategic improvements • Improve the company’s financial analysis of acquisitions and capital investments • Champion a disciplined approach to capital allocation |

Spring 2009 – Confidential 8 Mac-Gray Shareholders Deserve a Voice on the Board Financial performance: the numbers don’t lie 5-year average • Return on invested capital 7.0% • Return on equity 4.4% 5-year total change • Revenue 143% • EBITDA, as adjusted 159% • Total debt 492% • Interest expense 644% • EPS, as reported -88% • EPS, as adjusted -53% • Share price -22% • Implied price at 5x EBITDA -35% Over-priced (and thus low-return) acquisitions are the cornerstone of Mac-Gray’s strategy. High top-line and EBITDA growth… purchased at high cost… resulted in negative profit growth and... negative value creation for equity holders. 1. Historical financial information and supporting calculations located in later slides and in Appendix 1. 1 1 |

Spring 2009 – Confidential 9 2 1 Mac-Gray Shareholders Deserve a Voice on the Board Financial performance: the numbers don’t lie We believe Mac-Gray’s poor performance is due mainly to overpriced acquisitions • Mac-Gray spent $330 million on acquisitions since 2003 • Our analysis indicates that these acquisitions have provided no margin expansion, no earnings growth, no improvement in returns on invested capital, and no value creation for shareholders Management promised earnings accretion from the four major acquisitions • WEB East: “The transaction is expected to be immediately accretive.” • WEB West: “The acquisition announced today is expected to… be accretive in the first full quarter of operations.” • Hof: “We anticipate that the acquisition will… be fully accretive to earnings in 2008.” • ALC: “The transaction is expected to be accretive to earnings in the first twelve months of combined operations.” Despite promises, EBITDA margins and earnings have shown no improvement 1. Quotes from Mac-Gray press releases dated 1/20/04, 1/10/05, 8/9/07, and 4/1/08, respectively. 2. “As adjusted” numbers are provided by Mac-Gray in its financial reports. 2003 2004 2005 2006 2007 2008 EBITDA margin, as adjusted 18.8% 18.8% 20.1% 19.4% 19.8% 20.1% EPS, as adjusted $0.30 $0.36 $0.39 $0.23 $0.26 $0.14 |

Spring 2009 – Confidential 10 1 Mac-Gray Shareholders Deserve a Voice on the Board Financial performance: the numbers don’t lie A closer look at Mac-Gray’s four major acquisitions • Mac-Gray paid higher multiples than its own trading multiples • We believe Mac-Gray gave the entire value of the synergies to the sellers • We believe single-digit run-rate returns on invested capital (“ROIC”) destroy value Low returns on acquisitions low consolidated returns on capital value destruction 1. Run-rate ROIC for acquisitions includes synergies and assumes a 10% cash tax rate. See Exhibit 2 in Fairview’s 7/9/07 letter to the Board (available in Fairview’s Schedule 13D filed with the SEC on December 7, 2007) for further analysis of the WEB acquisitions. Hof purchase price and revenue from Mac-Gray press release dated 8/9/07. ALC purchase price and financial information from Mac-Gray press release and conference call on 4/1/08. Mac-Gray’s enterprise value and trading multiples as of 4/3/09. Consolidated financial results 2003 2004 2005 2006 2007 2008 Return on invested capital ("ROIC") 7.0% 8.4% 8.7% 5.9% 6.0% 6.0% Return on equity ("ROE") 5.8% 6.5% 6.3% 3.4% 3.8% 2.0% $millions WEB East WEB West Hof ALC Mac-Gray Acquisition price $41 $112 $43 $116 $352 Trailing revenue $30 $69 $27 $65 $364 Multiple paid 1.4x 1.6x 1.6x 1.8x 1.0x Trailing EBITDA $4 $12 NA $16 $73 Multiple paid 9.3x 9.5x NA 7.3x 4.8x EBITDA with synergies $7 $20 NA $20 $73 Multiple paid 5.7x 5.7x NA 5.8x 4.8x Run-rate return on invested capital 7.6% 7.3% NA 8.6% |

Spring 2009 – Confidential 11 Mac-Gray Shareholders Deserve a Voice on the Board Financial performance: the numbers don’t lie Management wants shareholders to focus on EBITDA growth: still no value creation • We believe the analysis below properly evaluates the success of an “EBITDA company” • Debt has grown three times faster than EBITDA, swamping any benefit to shareholders • If Mac-Gray’s growth-by-acquisition strategy actually created value, the implied share price would increase over time (with the EBITDA multiple held constant) '03-'08 $millions, except share price 2003 2004 2005 2006 2007 2008 Change EBITDA, as adjusted $28.2 $34.3 $52.4 $54.1 $58.5 $72.9 159% Trailing EBITDA multiple 5.0x 5.0x 5.0x 5.0x 5.0x 5.0x Enterprise value $140.8 $171.3 $262.1 $270.4 $292.7 $364.6 Less: debt ($50.9) ($73.3) ($166.7) ($177.1) ($208.5) ($301.3) 492% Equity value $89.9 $98.0 $95.4 $93.3 $84.1 $63.3 Diluted shares 12.7 13.0 13.3 13.4 13.7 13.7 8% Implied share price $7.05 $7.52 $7.18 $6.94 $6.15 $4.62 -35% |

Spring 2009 – Confidential 12 Mac-Gray Shareholders Deserve a Voice on the Board Share price performance: the numbers don’t lie Comparative total returns 1. Based on Mac-Gray’s closing share price of $5.19 on 4/3/09. Russell 2000 and S&P 500 index results include reinvested dividends. 2. Measured from the close of trading on 10/17/97 (the day of Mac-Gray’s IPO). -23% +31% -40% 10 Years +9% +20% -63% Since IPO -18% -19% -22% 5 Years -31% -37% -56% 3 Years -39% -42% -66% 2 Years -37% -35% -52% 1 Year S&P 500 Russell 2000 Mac-Gray Mac-Gray has underperformed both market indices for every time period shown. 2 1 1 1 |

Spring 2009 – Confidential 13 Mac-Gray Shareholders Deserve a Voice on the Board Fairview’s nominees address Mac-Gray’s shortcomings Scott W. Clark: significant expertise in financial analysis and a major shareholder • Expertise in financial analysis of acquisitions and capital investments • 14 years of investment and capital markets experience • Significant personal investment in Mac-Gray through his investments in Fairview brings a shareholder orientation to the Board • As a Director, will conduct an objective financial analysis of proposed acquisitions and capital budgets Bruce C. Ginsberg: a proven executive with relevant operating experience • Decades of experience running asset-intensive and logistics-oriented businesses analogous to Mac-Gray • Track record of organic profit growth and shareholder value creation • Involved as a principal in several meaningful M&A transactions • Extensive Board-level experience • As a Director, will conduct a thorough audit of branch-based operations and capital budgeting |

Spring 2009 – Confidential 14 Mac-Gray Shareholders Deserve a Voice on the Board Fairview’s nominees address Mac-Gray’s shortcomings Scott W. Clark: significant expertise in financial analysis and a major shareholder • Fairview Capital, 2001–present • Managing Partner & Portfolio Manager for Darlington Partners, L.P., a private investment partnership • Director of Research from 2001-2007 • SPO Partners, 1997–1999 • Research Analyst focusing on public market and private equity investments • Conducted financial analysis for numerous significant investments • Morgan Stanley, Mergers, Acquisitions & Restructurings Department, 1995–1997 • Financial Analyst for Wall Street’s top-rated merger advisor at the time • Completed M&A transactions involving: Coltec Industries, Fallon Healthcare, IBM, Compaq • BA from Brown University; MBA and MA from Stanford University |

Spring 2009 – Confidential 15 Mac-Gray Shareholders Deserve a Voice on the Board Fairview’s nominees address Mac-Gray’s shortcomings Bruce C. Ginsberg: a proven executive with relevant operating experience • MooBella LLC, President, CEO and Director, 2001–present (served as COO from 2001-2006) • R&D-stage company offering an innovative ice cream dispensing system; primary partner is Nestle’s Inventages • New England Ice Cream, Founder and Sole Owner, 1999–present • Serves 1,500 vending accounts and 4,000 points of distribution in Eastern Massachusetts • $16 million revenue; profitable; 60 full-time employees • Analogous to running a Mac-Gray branch operation • International Ice Cream / New England Frozen Foods / C&S Wholesale Grocers, 1982–1999 • Grew up working in family business, International Ice Cream (“IIC”) • Bought IIC from father in 1983; grew sales from $8 million to $50 million • Merged IIC with much-larger New England Frozen Foods (“NEFF”) in 1993 • President of combined NEFF/IIC business; over 300 employees; grew sales from $200 million to $240 million • Sold NEFF/IIC to C&S Wholesale Grocers (“C&S”) in 1997 • Managed C&S’ $300-million ice cream business from 1997-1999 • Analogous to running Mac-Gray corporate headquarters • Board service • Founding Director – Worcester Tornadoes professional baseball team • Founding Director – The Edge Sports Complex in Bedford, MA • Board of Advisors – Condyne Real Estate Fund • Director - Need to Lead • Former Trustee – Nichols College • Hall of Fame Inductee -New England Convenience Store Association • Director or former Director of numerous national and regional food and retail industry associations • BS and MBA from Boston College |

Spring 2009 – Confidential 16 Mac-Gray Shareholders Deserve a Voice on the Board Fairview’s nominees address Mac-Gray’s shortcomings Composition of Mac-Gray’s Board is lacking in key areas • No significant expertise in the financial analysis of acquisitions or capital investments • No professional investment or capital markets experience • Limited operational experience in asset-intensive and logistics-oriented businesses Fairview nominees’ complementary skill sets create a well-rounded Board composition • Scott Clark has significant expertise in financial analysis and 14 years of investment and capital markets experience • Both Scott Clark and Bruce Ginsberg have meaningful experience evaluating mergers and acquisitions • Bruce Ginsberg has extensive operational experience in asset-intensive and logistics-oriented businesses analogous to Mac-Gray |

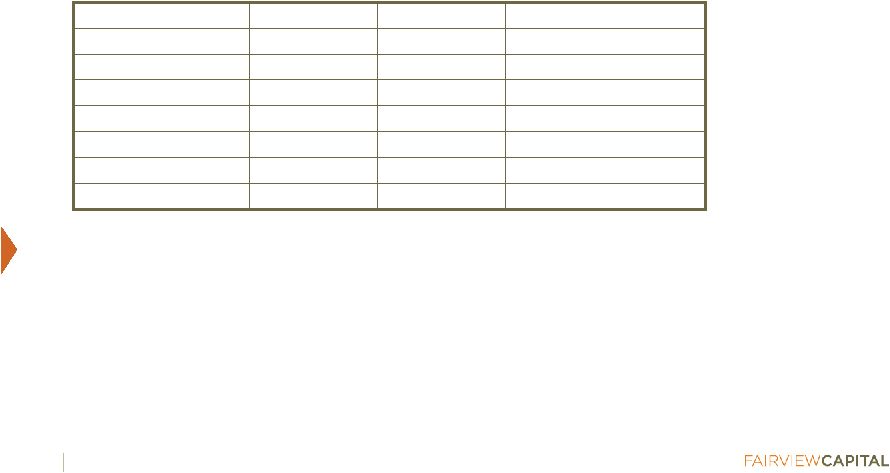

Spring 2009 – Confidential 17 Mac-Gray Shareholders Deserve a Voice on the Board Fairview’s nominees address Mac-Gray’s shortcomings The Board’s incentives are not aligned with shareholders • Limited share ownership and negligible share purchases by independent Directors Fairview nominees’ equity ownership aligns our interests directly with shareholders • Fairview Capital owns 6.3%; Scott Clark has a significant personal investment in Mac-Gray through his investments in Fairview • Bruce Ginsberg has committed to buy shares in the open market upon election • Scott Clark and Bruce Ginsberg will elect to receive 100% of their Director’s fees in stock (2,161) 3,321 2005 Christopher Jenny 0 1,265 2008 Alistair Robertson 2,500 4,762 2007 William Meagher 3,800 30,543 2000 Thomas Bullock 0 4,067 2006 Mary Anne Tocio 0 6,214 2004 David Bryan 0 6,036 2004 Edward McCauley Shares Purchased (Sold) Shares Owned Director Since Independent Director 1. Based on disclosure in Mac-Gray’s 2009 Proxy Statement. Ownership excludes options. Purchases and sales cover the past two years. 1 1 |

Spring 2009 – Confidential 18 1 Mac-Gray Shareholders Deserve a Voice on the Board Fairview’s nominees address Mac-Gray’s shortcomings Management incentives are not aligned with shareholders • Compensation programs emphasize the size of the enterprise rather than shareholder value • Management may derive intangible benefits from increasing the size of the organization Examples of compensation flaws • 2008 extraordinary salary increases awarded to management • Raises awarded following the ALC acquisition to reflect “the Company’s larger post-acquisition size” • Salary increases ranged from +2% to +9.6%; this is in addition to 3% increases awarded in early 2008 • 2008 cash bonus program encouraged a major acquisition – regardless of price • Cash bonus program weighted 25% revenue and 25% EBITDA, but only 10% EPS • Revenue objective = $361 million; 22% higher than 2007 actual $296 million • EBITDA objective = $71.4 million; 22% higher than 2007 actual $58.5 million • EPS objective = $0.09; 65% lower than 2007 actual $0.26 • The revenue and EBITDA objectives could only be achieved with a major acquisition • The EPS objective ensured that management would not be penalized for a dilutive acquisition • 2005–2007 special discretionary cash bonuses awarded to management • Bonuses totaled $695,000 for “furthering the Company’s financial and strategic objectives” • In addition to established cash and stock incentive programs Fairview nominees intend to align compensation with positive shareholder outcomes • Reward improvements in consolidated ROIC, free cash flow, and the share price • Set the bar high: generous pay for strong performance; no incentive pay for weak performance 1. Based on disclosure in Mac-Gray’s 2006–2009 Proxy Statements. |

Spring 2009 – Confidential 19 1 Mac-Gray Shareholders Deserve a Voice on the Board Fairview’s nominees address Mac-Gray’s shortcomings Mac-Gray’s corporate governance policies are inconsistent with current best practices • Staggered board • Plurality voting • No lead independent Director and no way for shareholders to contact the independent Directors without going through management • Shareholders cannot call special meetings or act by written consent • Poison pill never approved by shareholders Fairview nominees will continue to advocate improved governance • Fairview’s support for Proposals 3 and 4 exemplify our willingness to push for reform • We will act as a point of contact for shareholders and as a means to communicate with the Board • We believe a Board’s main role is to serve shareholders • As Directors, our loyalty will be to shareholders 1. Proposal 3 aims to declassify the Board, and Proposal 4 aims to adopt a majority vote standard for Director elections. |

Spring 2009 – Confidential 20 1 Mac-Gray Shareholders Deserve a Voice on the Board Fairview’s nominees address Mac-Gray’s shortcomings Fairview nominees will pursue several potential operational and strategic improvements • Bruce Ginsberg has volunteered to conduct a thorough audit of branch-based operations • Explore the possibility of better equipment pricing through the use of multiple suppliers • Seek ways to increase the annual renewal rate, which we calculate in the 60-67% range • Investigate the lackluster adoption of PrecisionWash, a revenue-generating technology • Evaluate the disposition of low-density markets and non-core operations in order to increase consolidated profit margins and reduce debt 1. Assumes 10-12% of Mac-Gray’s contracts are up for renewal each year. Mac-Gray’s reported 96% retention rate implies that 4% of the machine base is lost each year, implying annual attrition of 33-40%. |

Spring 2009 – Confidential 21 Mac-Gray Shareholders Deserve a Voice on the Board Fairview’s nominees address Mac-Gray’s shortcomings Board has endorsed Mac-Gray’s flawed growth-by-acquisition strategy and presided passively over poor financial results and share price performance Fairview nominees will improve the analysis of acquisitions and capital investments • We will conduct our own objective financial analysis of proposed acquisitions and capital budgets • Bruce Ginsberg has volunteered to complete a thorough audit of branch-based capital budgeting Fairview nominees will champion a disciplined approach to capital allocation • Mac-Gray should determine a target leverage range and articulate this to shareholders • Mac-Gray should declare a minimum IRR hurdle rate for new investments and articulate this to shareholders; we suggest a minimum pretax, unlevered IRR of 12% • First, use free cash flow to reduce debt to the target level • Then, pursue all acquisitions and capital expenditures that exceed to minimum IRR hurdle rate (properly calculated; taking into account all related future capital spending; including a full allocation of corporate overhead) • Finally, return any remaining free cash flow to shareholders |

Spring 2009 – Confidential 22 1 1 2 2 Mac-Gray Shareholders Deserve a Voice on the Board Free cash flow is the key to value creation Fairview’s 2007 free cash flow analysis (from our 7/9/07 Board letter ) • Starting with Mac-Gray’s audited financial statements, we made certain adjustments to estimate the company’s run-rate free cash flow potential • Our analysis indicated Mac-Gray could generate $19 million of annual free cash flow by eliminating acquisitions and reducing investment spending to $25 million (8.8% of expected ‘07 revenue) July 2007 Analysis ($millions) 2006 cash flow statement Net cash flows provided by operating activities $36.5 Net cash flows used in investing activities ($45.0) Free cash flow ($8.5) Adjustments: +Cash payments for acquisitions (actual) $19.4 +Capital expenditures (actual) $25.9 +Customer incentive payments (actual) $4.5 -Fairview recommended investment spending ($25.0) +Estimated 2007 operating cash flow growth $3.0 Adjusted run-rate free cash flow $19.3 Common shares 13.2 Free cash flow per share $1.46 1. Available in Fairview’s Schedule 13D filed with the SEC on December 7, 2007. 2. “Investment spending” refers to capital spending plus customer incentive payments. “Fairview recommended investment spending” equaled 8.8% of expected 2007 total revenue, based on the midpoint of management’s 2007 revenue guidance provided on 5/3/07. |

Spring 2009 – Confidential 23 1 2 2 2 3 Mac-Gray Shareholders Deserve a Voice on the Board Free cash flow is the key to value creation We have never suggested that Mac-Gray under-invest in its business Our first letter to the Board stated: “Our analysis indicates that Mac-Gray could return $19 million annually to shareholders by reducing annual acquisition and capital spending to $25 million. This level of spending would not limit the company’s ability to renew expiring customer contracts and would still allow the company to pursue growth through selective investments in high-return opportunities.” – Fairview’s July 9, 2007 letter (note: written prior to the Hof and ALC acquisitions) Our $25 million investment spending number equaled 8.8% of expected 2007 revenue Mac-Gray said this level of investment spending was too low to maintain its business To help finance the ALC acquisition, Mac-Gray reduced its 2008 investment spending to 8.2% of revenue, and Mac-Gray still generated +3.6% organic revenue growth in 2008 1. Available in Fairview’s Schedule 13D filed with the SEC on December 7, 2007. 2. “Investment spending” refers to capital spending plus customer incentive payments. 3. Based on the midpoint of management’s 2007 revenue guidance provided on 5/3/07. 4. According to Mac-Gray earnings press release dated 3/5/09. 4 This demonstrates that investment spending² of 8-9% of revenue is sufficient to grow the business and return capital to shareholders, consistent with our original analysis |

Spring 2009 – Confidential 24 Mac-Gray Shareholders Deserve a Voice on the Board Free cash flow is the key to value creation Fairview’s 2009 free cash flow analysis (below on right) • We now believe Mac-Gray can generate annual free cash flow of approximately $20 million by limiting investment spending¹ to $32 million (8.8% of revenue) • Note that $32 million investment spending¹ is within the range of Mac-Gray’s 2009 guidance 1. “Investment spending” refers to capital spending plus customer incentive payments. “Fairview recommended investment spending” equals 8.8% of expected total revenue in both the 2007 and 2009 analyses (based on midpoint of management’s 2007 revenue guidance provided on 5/3/07 and the midpoint of 2009 revenue guidance provided on 3/5/09). Mac-Gray’s 2008 actual investment spending equated to 8.2% of total revenue. July 2007 Analysis ($millions) April 2009 Analysis ($millions) 2006 cash flow statement 2008 cash flow statement Net cash flows provided by operating activities $36.5 Net cash flows provided by operating activities $56.7 Net cash flows used in investing activities ($45.0) Net cash flows used in investing activities ($131.1) Free cash flow ($8.5) Free cash flow ($74.4) Adjustments: Adjustments: +Cash payments for acquisitions (actual) $19.4 +Cash payments for acquisitions (actual) $106.2 +Capital expenditures (actual) $25.9 +Capital expenditures (actual) $25.3 +Customer incentive payments (actual) $4.5 +Customer incentive payments (actual) $4.5 -Fairview recommended investment spending¹ ($25.0) -Fairview recommended investment spending¹ ($32.0) +Estimated 2007 operating cash flow growth $3.0 +Estimated 2009 operating cash flow growth $0.0 -Reversal of 2008 working capital benefits ($9.0) Adjusted run-rate free cash flow $19.3 Adjusted run-rate free cash flow $20.6 Common shares 13.2 Common shares 13.4 Free cash flow per share $1.46 Free cash flow per share $1.54 |

Spring 2009 – Confidential 25 Mac-Gray Shareholders Deserve a Voice on the Board Free cash flow is the key to value creation We have not solely advocated a dividend strategy In fact, we have recommended a disciplined approach to capital allocation that starts with establishing a high hurdle rate for new investments; our first letter to the Board stated: “The returns the company achieves on its investments in acquisitions and new customer contracts are the primary determinant of long-term value creation… Mac-Gray should adopt a capital allocation strategy more appropriate for its low-growth, cash-generative financial profile… It could accomplish this by raising meaningfully its required rate of return (hurdle rate) and being more conservative and rigorous in its financial analysis. This would result in: (1) fewer, better investments and (2) excess free cash flow that could be returned to shareholders through dividends or share repurchases. – Fairview’s July 9, 2007 letter (note: written prior to the Hof and ALC acquisitions)¹ We do believe a dividend is a likely outcome of a disciplined capital allocation strategy • We would prefer that Mac-Gray allocate every possible penny toward high-return investments • Mac-Gray’s history of low-return acquisitions suggests that high-return opportunities are rare • Absent high-return opportunities, Mac-Gray should return excess free cash flow to shareholders • We generally prefer share repurchases because they are more tax efficient than dividends • In the past, we have focused on an annual dividend because we believe high-return acquisitions are unlikely, and material share repurchases may be difficult to execute due to low trading volumes • Following the ALC acquisition, Mac-Gray’s strategy now must reflect its over-leveraged balance sheet 1. Available in Fairview’s Schedule 13D filed with the SEC on December 7, 2007. |

Spring 2009 – Confidential 26 Mac-Gray Shareholders Deserve a Voice on the Board Free cash flow is the key to value creation – summary Future free cash flow • We believe Mac-Gray can generate annual free cash flow of approximately $20 million • This assumes capital spending consistent with Mac-Gray’s 2008 results and 2009 guidance • Disciplined investment of this FCF will drive future shareholder returns this is our value-add We advocate the following • At present, free cash flow should be used to reduce Mac-Gray’s acquisition-related debt burden • After debt is reduced to an appropriate level, free cash flow will be available for high-return investment opportunities or return to shareholders • Fairview’s rigorous analysis will help evaluate the alternatives Our approach will work, but will require our hands-on participation at the Board level • Important strategic decisions will be made within the next year • Shareholders need Board representation now, before these decisions are considered |

Spring 2009 – Confidential 27 Mac-Gray Shareholders Deserve a Voice on the Board Shareholder representation is needed now Important strategic decisions will be made within the next year • Mac-Gray will determine a target leverage range and timeframe for reaching its optimal debt level • Thereafter, the Board may consider acquisitions or a return of capital to shareholders • Incentive compensation metrics and targets will be decided • Two Directors are at or near Mac-Gray’s mandatory retirement age Shareholders need Board representation now, before these decisions are considered • Management and Board have not earned the benefit of the doubt • Management has demonstrated a preference for expensive acquisitions dating back to 1998, when it completed its first value-destroying acquisition binge (including Copico and MicroFridge) • Board composition lacks financial analysis expertise to properly evaluate investments • Independent Directors own little equity and therefore lack incentive to ensure change |

Spring 2009 – Confidential 28 Mac-Gray Shareholders Deserve a Voice on the Board Shareholder representation is needed now We will protect shareholders and add value through hands-on Board participation • Ensure disciplined allocation of Mac-Gray’s $20 million of annual free cash flow • Review operations and conduct an audit of branch-based operations and capital budgeting • Continue to improve Mac-Gray’s corporate governance for the benefit of minority shareholders Vote FOR Scott Clark and Bruce Ginsberg • Shareholders need watchdogs on the Board • Two seats are required to effect change • Now is the time, before Mac-Gray addresses important strategic decisions later this year Protect Your Investment Vote FOR the Fairview Nominees on the GOLD Proxy Card Today |

Spring 2009 – Confidential 29 1 Mac-Gray Shareholders Deserve a Voice on the Board Appendix 1: historical financial information 1. “As adjusted” numbers are provided by Mac-Gray in its financial reports. 2. ROIC = EBIT, as adjusted less 10% cash taxes divided by average invested capital. ROE = net income, as adjusted divided by average shareholders’ equity. 5-year $millions, except per-share numbers 2003 2004 2005 2006 2007 2008 Change Total revenue $149.7 $182.7 $260.6 $279.3 $295.9 $363.6 143% EBITDA, as adjusted 1 $28.2 $34.3 $52.4 $54.1 $58.5 $72.9 159% % margin 18.8% 18.8% 20.1% 19.4% 19.8% 20.1% Total debt $50.9 $73.3 $166.7 $177.1 $208.5 $301.3 492% Interest expense, net $2.8 $4.3 $10.9 $13.7 $13.7 $20.9 644% Diluted shares 12.74 13.03 13.28 13.45 13.68 13.71 8% EPS, as reported $0.32 $0.40 $0.91 $0.06 $0.18 $0.04 -88% EPS, as adjusted $0.30 $0.36 $0.39 $0.23 $0.26 $0.14 -53% Shareholders' equity $68.7 $75.9 $88.6 $91.6 $97.8 $98.0 43% Debt $50.9 $73.3 $166.7 $177.1 $208.5 $301.3 492% Invested capital $119.6 $149.3 $255.3 $268.7 $306.4 $399.3 234% Return on invested capital ("ROIC") 2 7.0% 8.4% 8.7% 5.9% 6.0% 6.0% Return on equity ("ROE") 2 5.8% 6.5% 6.3% 3.4% 3.8% 2.0% Total debt / EBITDA, as adjusted 1.8x 2.1x 3.2x 3.3x 3.6x 4.1x |

Spring 2009 – Confidential 30 Contact information Fairview Capital 300 Drakes Landing Road, Suite 250 Greenbrae, CA 94904 Tel: (415) 464-4640 Innisfree M&A Incorporated 501 Madison Avenue, 20 Floor New York, NY 10022 Stockholders call toll-free: (888) 750-5834 Banks and brokers call collect: (212) 750-5833 th |