SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to

Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

| Check the appropriate box: |

| [X] | Preliminary Proxy Statement |

| [ ] | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| [ ] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to §240.14a-12 |

| FACTUAL DATA CORP. |

|

| (Name of Registrant as Specified In Its Charter) |

| |

| NONE |

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | 1) | Title of each class of securities to which transaction applies: |

| | | |

|

| | 2) | Aggregate number of securities to which transaction applies: |

| | | |

|

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

|

| 4) | Proposed maximum aggregate value of transaction: |

| | | |

|

| 5) | Total fee paid: |

| | | |

|

| [ ] | Fee paid previously by written materials. |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

| 1) | Amount Previously Paid: |

| | | |

|

| 2) | Form, Schedule or Registration Statement No.: |

| | | |

|

| 3) | Filing Party: |

| | | |

|

| 4) | Date Filed: |

| | | |

|

The Securities and Exchange Commission should contact:

| | | |

| | Samuel E. Wing, Esq.

Jones & Keller, P.C.

1625 Broadway, Suite 1600

Denver, Colorado 80202

303-573-1600 (telephone)

303-573-0769 (facsimile) |

with respect to comments.

PRELIMINARY COPIES

FACTUAL DATA CORP.

5200 Hahns Peak Drive

Loveland, Colorado 80538

(970) 663-5700

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

November 1, 2002

To the Shareholders of Factual Data Corp.:

| | | |

Date: | | November 1, 2002 |

Time: | | 8:00 a.m. |

Place: | | Building #1, Conference Center

5200 Hahns Peak Drive

Loveland, Colorado |

We are holding this meeting:

| |

| | 1. To elect two members of the Board of Directors to serve three year terms and until their successors are elected and qualified; |

| |

| | 2. To consider and act upon a proposal to amend our Articles of Incorporation to increase the number of authorized shares of our common stock from 10,000,000 to 50,000,000 shares; |

| |

| | 3. To consider and act upon a proposal to increase the number of shares reserved for issuance under our 1999 Employee Formula Award Stock Option Plan from 400,000 to 600,000 shares; |

| |

| | 4. To ratify the appointment of BDO Seidman, LLP as our independent public accountants for the fiscal year ending December 31, 2002; and |

| |

| | 5. To transact any other business properly brought before the meeting or any adjournment thereof. |

You are cordially invited to attend the meeting in person. To ensure that you are represented at the meeting, please fill in, sign, and return the enclosed proxy card as promptly as possible. Your early attention to the proxy statement and proxy card will be greatly appreciated.If your shares are held in street or nominee name, please respond to the record holder’s communication with you as soon as possible so that your shares can be represented at the meeting.

| |

| | By Order of the Board of Directors |

| |

| | /s/ RUSSELL E. DONNAN |

| |

|

| | Russell E. Donnan |

| | Secretary |

September 30, 2002

PRELIMINARY COPIES

FACTUAL DATA CORP.

5200 Hahns Peak Drive

Loveland, Colorado 80538

PROXY STATEMENT/ANNUAL MEETING OF SHAREHOLDERS

This Proxy Statement is furnished to you in connection with the solicitation of proxies by our Board of Directors for use at our annual meeting of shareholders to be held on November 1, 2002. This Proxy Statement and the enclosed proxy card were sent to shareholders on or about September 30, 2002.

The following matters will be acted on at our meeting:

| |

| | 1. Election of two members of our Board of Directors to serve three year terms and until their successors are elected and qualified; |

| |

| | 2. A proposal to amend our Articles of Incorporation to increase the number of authorized shares of our common stock from 10,000,000 to 50,000,000 shares; |

| |

| | 3. A proposal to increase the number of shares reserved for issuance under our 1999 Employee Formula Award Stock Option Plan from 400,000 to 600,000 shares; |

| |

| | 4. Ratification of the appointment of BDO Seidman, LLP as our independent public accountants for the fiscal year ending December 31, 2002; and |

| |

| | 5. Any other business as may properly come before our meeting or any adjournment thereof. |

GENERAL INFORMATION ABOUT VOTING

Who can vote?

You can vote your shares of common stock if our records show that you owned the shares on September 27, 2002. A total of 6,188,589 shares of common stock can vote at the meeting. Each share of common stock is entitled to one vote. Each proxy card indicates the number of shares that you will be entitled to vote at the meeting.

How do I vote by proxy?

Follow the instructions on the enclosed proxy card to vote on each proposal to be considered at the meeting. Sign and date the proxy card and mail it back to us in the enclosed envelope. The proxyholders named on the proxy card will vote your shares as you instruct. If you sign and return the proxy card but do not vote on a matter, the proxyholders will vote for you on that proposal. Unless you instruct otherwise, the proxyholders will vote:

| | |

| | • | For the election of the two nominees for director identified in this proxy statement; |

| |

| | • | For the proposal to amend our Articles of Incorporation to increase the number of authorized shares of our common stock from 10,000,000 to 50,000,000 shares; |

| |

| | • | For the proposal to increase the number of shares reserved for issuance under our 1999 Employee Formula Award Stock Option Plan from 400,000 shares to 600,000 shares; |

| |

| | • | For ratification of the appointment of BDO Seidman, LLP as our independent public accountants for the fiscal year ending December 31, 2002; and |

| |

| | • | in the discretion of the proxyholders with respect to any other matters properly brought before the meeting. |

What if other matters come up at the meeting?

The matters described in this proxy statement are the only matters we know will be voted on at the meeting. If other matters are properly presented at the meeting, the proxyholders will vote your shares in their discretion.

Can I change my vote after I return my proxy card?

Yes. At any time before the vote on a proposal, you can change your vote either by giving our secretary, Russell E. Donnan, at our address shown above, a written notice revoking your proxy card or by signing, dating, and returning to us a new proxy card. We will honor the proxy card with the latest date.

Can I vote in person at the meeting rather than by completing the proxy card?

Although we encourage you to complete and return the proxy card to ensure that your vote is counted, you can attend the meeting and vote your shares in person, even if you have previously completed and returned a proxy card.

What do I do if my shares are held in “street name”?

If your shares are held by your broker, a bank, or other nominee, you will probably receive this proxy statement from them with instructions for voting your shares. Please respond quickly so that they may represent you.

If your shares are held in the name of a broker, bank, or other nominee, and you do not tell that person how to vote your shares (so-called “broker non-votes”), that person can vote them as it sees fit only on matters that self regulatory organizations determine to be routine, and not on any other proposal such as the proposal to increase the number of shares of authorized common stock. Broker non-votes will be counted as present to determine if a quorum exists, but will not be counted as present and entitled to vote on any non-routine proposal.

How are votes counted?

We will proceed with the shareholders meeting if at least one-third of the outstanding shares of common stock entitled to vote either sign and return their proxy cards or attend the meeting. If you sign and return your proxy card, your shares will be counted to determine whether we have a quorum even if you abstain or fail to vote on any of the proposals listed on the proxy card. In the election of two directors, the two nominees receiving the highest number of votes cast in their favor will be elected to the board. The proposal to amend our Articles of Incorporation to increase the number of shares of our authorized common stock will require the approval of at least two-thirds of the shares of our common stock presently issued and outstanding. The proposal to increase from 400,000 to 600,000 the number of shares reserved for issuance under our 1999 Employee Formula Award Stock Option Plan and the proposal to ratify the appointment of independent public accountants will require the affirmative vote of a majority of the shares present in person or represented by proxy at the meeting.

Who pays for this proxy solicitation?

We will pay the cost of this solicitation. In addition to sending you these materials, some of our officers or directors may contact you by telephone, by mail, or in person. None of these individuals will receive any extra compensation for doing this.

Annual Report and Other Matters

Our 2001 Annual Report to Shareholders, and our Quarterly Report on Form 10-Q for the six month period ended June 30, 2002, which were mailed to shareholders with this proxy statement, contains financial and other information about our company, but are not incorporated into this proxy statement and is not to be considered a part of these proxy soliciting materials or subject to Regulations 14A or 14C or to the liabilities of

2

Section 18 of the Securities Exchange Act of 1934, as amended. The information contained in “Compensation Committee Report on Executive Compensation,” “Report of the Audit Committee,” and “Performance Graph” below shall not be deemed “filed” with the Securities and Exchange Commission or subject to Regulations 14A or 14C or to the liabilities of Section 18 of the Exchange Act.

We will provide upon written request, without charge to each shareholder of record as of the record date, a copy of our annual report on Form 10-K for the fiscal year ended December 31, 2001, as filed with the Securities and Exchange Commission. Any exhibits listed in the Form 10-K report also will be furnished upon request at the actual expense incurred by us in furnishing such exhibits. Any such requests should be directed to our corporate secretary at our executive offices set forth in this proxy statement.

ELECTION OF TWO DIRECTORS

Our Board of Directors is divided into three classes, with each class serving a three-year term. Each director holds office until the first meeting of shareholders immediately following the expiration of his three-year term of office or until his successor is qualified and elected.

| | |

| | • | Messrs. Terry and Rajput were elected at our 1999 annual meeting of shareholders for terms expiring at this meeting; |

| |

| | • | Messrs. James Donnan, Neiberger, and Goodwin were elected at our 2000 annual meeting of shareholders for terms expiring at our 2003 meeting; and |

| |

| | • | Messrs. J.H. Donnan and Helle were elected at our 2001 annual meeting of shareholders for terms expiring at our 2004 meeting. |

We have nominated Messrs. Robert J. Terry and Abdul H. Rajput for re-election as directors for three-year terms expiring in 2005 or until their respective successors are elected and qualified. Although we anticipate that both of the nominees will be available to serve as directors, if either of them does not accept the nomination, or otherwise is unwilling or unable to serve, the proxies will be voted for a nominee, if any, designated by the Board of Directors to fill the vacancy.

Your Board of Directors recommends a vote FOR the election of Messrs. Terry and Rajput. Proxies solicited by the Board of Directors will be voted for them unless instructions are given to the contrary.

The following sets forth certain information regarding the two director nominees and each of our other directors and executive officers:

| | | | | | | |

| Name | | Age | | Position |

| |

| |

|

| J.H. Donnan(1) | | | 56 | | | Chairman of the Board and Chief Executive Officer |

| James N. Donnan | | | 31 | | | President and Director |

| Todd A. Neiberger | | | 37 | | | Chief Financial Officer and Director |

| Russell E. Donnan | | | 38 | | | Chief Information Officer and Corporate Secretary |

| Robert J. Terry(1)(2) | | | 61 | | | Director |

| Abdul H. Rajput(1)(2) | | | 55 | | | Director |

| Daniel G. Helle(1) | | | 40 | | | Director |

| J. Barton Goodwin(2) | | | 55 | | | Director |

| |

| (1) | Member of the Compensation Committee |

| |

| (2) | Member of the Audit Committee |

J.H. Donnan has served as our Chairman of the Board and Chief Executive Officer since he founded our company in January 1985 and served as our President until July 2000. Mr. Donnan is responsible for oversight of corporate development and services, operations, technical development, and policies and procedures. Mr. Donnan’s prior experience includes 15 years in financial services where he was responsible for lending and servicing a multi-hundred-million-dollar portfolio and managing geographically diverse branches with many

3

employees. Mr. Donnan served as a founding member and past president of the National Credit Reporting Association, a trade association established to promote ethical standards and fair competition within the credit reporting industry. Mr. Donnan is currently a Board member of Associated Credit Bureaus, Inc., an international trade association representing consumer credit, mortgage reporting, collection service, tenant screening, and employment reporting companies.

James N. Donnan has served as our President since July 2000 and as a director since January 1998, and is responsible for management of our internal operations. Mr. Donnan’s duties also include overall sales, growth, and customer service development. Mr. Donnan has been employed by us in various capacities on a full-time basis since 1994 and on a part-time basis from 1986 to 1994. Mr. Donnan served as our Corporate Secretary from January 1998 until July 2000, and as our Vice President from October 1999 until July 2000. Mr. Donnan graduated from Colorado State University in 1994 with a degree in history.

Todd A. Neiberger has served as our Chief Financial Officer since March 1995 and as a director since January 1998. Mr. Neiberger joined our company in March 1995 with 10 years’ experience in staff, senior, and management level positions with various public accounting firms. From 1994 through 1995, Mr. Neiberger served as the audit manager of Rickards & Co. P.C., and from 1991 through 1993 he served as the tax manager for Krutchen & Co., both Fort Collins, Colorado-based certified public accounting firms. From 1988 through 1990, Mr. Neiberger was employed with a local Colorado certified public accounting firm, as a staff and senior level accountant in the audit and tax department. Mr. Neiberger is a Certified Public Accountant. Mr. Neiberger graduated from the University of Northern Colorado in 1987 with a degree in accounting.

Russell E. Donnan has served as our Chief Information Officer since March 1998 and as our Corporate Secretary since July 2000. Mr. Donnan is responsible for technical project management for software and support services. Before joining our company in August 1993, Mr. Donnan served as a senior design engineer at Apple Computer, Inc. in the Power Book division from February 1992 through August 1993. Mr. Donnan is experienced in the super computer field and was previously employed by Convex Computer Corp. (from 1990 through 1992) and as a founding member and employee of Key Computer (from 1988 through 1990), now a subsidiary of Amdahl Corporation. Mr. Donnan graduated from The Ohio State University in 1987 with a degree in electrical engineering.

Robert J. Terry has served as a director of our company since February 1998. From February 1994 to his retirement in January 1998, Mr. Terry served as a director, president, and chief operating officer of Mail-Well, Inc., a publicly traded envelope manufacturer and printing company. Prior to his Mail-Well experience, Mr. Terry was associated with Georgia Pacific Corporation and its predecessor companies in various management positions, including Executive Vice President of its envelope division and as regional vice president for Butler Paper Company. Mr. Terry graduated from DePaul University with a degree in business, and the Advanced Executive Program at the University of Michigan in 1988.

Abdul H. Rajput has served as a director of our company since February 1998. Mr. Rajput served as an executive vice president of national operations of GreenPoint Credit, LLC from September 1998 through February 2002. From 1991 to September 1998, Mr. Rajput served as senior vice president of administration with a subsidiary of Bank of America Corporation. From 1990 and until its acquisition by us in August 1998, Mr. Rajput owned and operated Factual Data Minnesota, Inc., one of our former franchisees, which operated in Minnesota and Iowa. Mr. Rajput graduated from the university of Sindh, Pakistan with a degree in mathematics in 1968 and a masters degree in statistics in 1970.

Daniel G. Helle has served as a director of our company since March 1999. Since 1992, Mr. Helle has served as a Managing Director of CIVC Partners LLC and its predecessor, Continental Illinois Venture Corporation, a private equity investment subsidiary of Bank of America Corporation. From 1989 to 1992, Mr. Helle served as a vice president of Continental Illinois Venture Corporation. Mr. Helle is also a director of several private companies. Mr. Helle obtained a degree in finance from Western Illinois University in 1982 and a masters degree in finance from the University of Illinois in 1984.

J. Barton Goodwin has served as a director of our company since July 1999. Since 1986, Mr. Goodwin has served as a General Partner of BCI Partners, Inc., a private capital investment group. Mr. Goodwin is also

4

a director of BKF Capital Group, Inc., an asset management company traded on the New York Stock Exchange. Mr. Goodwin is also a director of several private companies. From 1974 to 1986, Mr. Goodwin was a shareholder and Vice President of Kidder, Peabody & Co., Inc. where he performed corporate finance services. Mr. Goodwin graduated from Washington & Lee University and he obtained a masters degree in business administration from Columbia University.

Russell and James Donnan are sons of J.H. Donnan.

In connection with a private placement of our securities completed in April 1999, the four members of the Donnan family agreed to vote their shares of common stock in favor of CIVC Fund L.P.’s nominee (currently Mr. Helle) as a director so long as the fund owns at least 177,600 shares of common stock. We also agreed that we would not liquidate, dissolve, or enter into any merger, consolidation, joint venture, recapitalization, partnership, or other combination, or sell, lease or dispose of or permit any subsidiary to sell, lease or otherwise dispose of, more than 50% of our consolidated assets without prior unanimous approval of a special committee of our Board of Directors. The special committee would consist of the CIVC director and two other members of our board who are (i) independent directors, and (ii) appointed to serve on the special committee by the CIVC director.

Director Compensation

Our directors who are also employees do not receive any additional compensation for their services as directors. During fiscal 2002, non-employee directors will receive an annual retainer of $10,000 plus a reasonable travel allowance per meeting, subject to a $500 deduction for each meeting not attended. Non-employee directors who serve on a committee will receive a $500 per committee assignment. We also intend to grant to each non-employee director options to purchase 2,500 shares of our common stock at an exercise price equal to the market price of our stock on the date of grant. The option will be prorated for non-employee directors who do not serve for the entire year.

Executive Compensation

The following table sets forth certain information concerning compensation paid to our Chief Executive Officer and each other executive officer whose salary and bonus exceeded $100,000 during fiscal 2001.

Summary Compensation Table

| | | | | | | | | | | | | | | | | | |

| | | | | | | | Long-Term |

| | | | | | | | Compensation |

| | | | | | | |

|

| | | | | | | | Awards |

| | | |

|

| | Annual Compensation | | Securities |

| |

| | Underlying |

| Name | | Year | | Salary(1) | | Bonus | | Options(3) |

| |

| |

| |

| |

|

| J.H. Donnan | | | 2001 | | | $ | 267,006 | | | $ | 241,203 | (2) | | | 7,644 | |

| | Chief Executive Officer | | | 2000 | | | | 172,414 | | | | — | | | | 4,202 | |

| | | | | 1999 | | | | 107,554 | | | | — | | | | — | |

| James N. Donnan | | | 2001 | | | $ | 149,939 | | | $ | 94,168 | (2) | | | 4,247 | |

| | President | | | 2000 | | | | 99,355 | | | | — | | | | 2,629 | |

| | | | 1999 | | | | 72,986 | | | | — | | | | — | |

| Todd A. Neiberger | | | 2001 | | | $ | 118,750 | | | $ | 57,012 | (2) | | | 17,297 | |

| | Chief Financial Officer | | | 2000 | | | | 86,929 | | | | — | | | | 1,579 | |

| | | | | 1999 | | | | 71,979 | | | | — | | | | — | |

| Russell E. Donnan | | | 2001 | | | $ | 177,856 | | | $ | 107,086 | (2) | | | 3,597 | |

| | Chief Information Officer | | | 2000 | | | | 124,609 | | | | — | | | | 2,143 | |

| | | | | 1999 | | | | 88,659 | | | | — | | | | — | |

5

| |

| (1) | The listed executive officers also received certain perquisites, the value of which did not exceed the lesser of $50,000 or 10% of their salary and bonus during any fiscal year. |

| |

| (2) | Represents bonuses earned by the executive officer during 2001 under our MBO Incentive-Based Compensation Plan and our EBITDA Bonus Plan. The bonuses were paid during March 2002. |

| |

| (3) | The exercise price of all stock options were equal to the fair market value of our common stock on the date of grant. |

Our Bonus Program

During 2001, our Board of Directors adopted two separate bonus programs for evaluating and compensating selected executive officers and key employees. Under the MBO Incentive-Based Compensation Program, our Compensation Committee sets performance objectives and goals at the beginning of the year for selected executive officers and key employees. If all performance objectives are achieved, the employee will be entitled to a bonus, as determined by the Compensation Committee, of 20% to 30% of the employee’s base salary. Our executive officers and key employees earned bonuses of $341,000 in 2001 under this program.

Under the EBITDA Bonus Program, our executive officers can earn bonuses of increasing percentages of their base salary if we achieve specified EBITDA thresholds during the fiscal year. Our executive officers earned bonuses of $383,313 in 2001 under this program.

1999 Formula Award Stock Option Plan

In August 1999, our Board of Directors adopted our 1999 Formula Award Stock Option Plan, and our shareholders approved the plan during October 1999. Our board amended the plan during June 2000, and our shareholders approved the amendment to the plan during July 2000. The purpose of the plan is to encourage ownership of our common stock by eligible employees, to provide increased incentive for such employees to render services and to exert maximum effort for our success, and to align further the interests of our employees and shareholders. Employees who have been employed by us for at least one year are eligible to participate in the 1999 plan. Full-time employees of companies that we acquire are eligible to participate in the 1999 plan beginning the month following 60 days after the closing date of the acquisition, so long as the employee has completed one year of service.

The 1999 plan provides for the annual grant of options to purchase shares of our common stock to eligible persons. We have reserved for issuance 400,000 shares of our common stock under the plan. As of September 3, 2002, we had issued 3,651 shares of common stock under the 1999 plan, there were outstanding options to purchase 321,050 shares of common stock under the plan, and there were 75,299 shares of common stock available for grant under the plan.

Our Board of Directors, or a committee of two or more non-employee directors designated by the board, administers the 1999 plan. The plan administrator will have full authority to construe, interpret, amend, and apply the terms of the plan. The plan administrator will have the right to either terminate the plan or indefinitely suspend or cancel the future grant of options under the 1999 plan. Unless earlier terminated by our Board of Directors, the plan will terminate December 14, 2009.

Annually on January 15, and subject to adjustment by the plan administrator, we will grant each eligible employee options to purchase that number of shares of common stock determined by the sum of

| | |

| | • | the quotient of (a) 10% of the employee’s compensation for the preceding year, divided by (b) the fair market value of the common stock; plus |

| |

| | • | the product of (i) 10% of the quotient obtained above, multiplied by (ii) the number of years in which the eligible person has been employed with our company. |

Fractional shares will not be issued and will be rounded down to the nearest whole share. Each option shall have a term of ten years, an exercise price equal to the fair market value of the common stock, and 20% of the shares underlying each option shall vest and become exercisable on each of the first five anniversaries of the

6

date of grant. As a result of the formula above, our more highly paid employees, such as our executive officers, likely will receive more options than other employees. If there are insufficient shares reserved under the plan to cover the number of option grants required under the plan in any year, then the number of shares underlying each grant will be proportionately reduced for each eligible employee.

If an employee ceases to be employed by us for any reason other than death, disability, or retirement, the employee may exercise any vested options for a three-month period following his or her termination. In the event of death, disability, or retirement, the optionee (or the optionee’s estate) may exercise any options, to the extent such options were exercisable on the date of death, disability, or retirement, for one year (or in no event after the expiration of the option) following the date of death, disability, or retirement.

In the event of a merger or consolidation of our company, the sale of all or substantially all of our assets, or a similar transaction in which we are not the surviving company and the plan will be discontinued, all options outstanding under the 1999 plan will immediately vest and become exercisable. In the event of such a transaction, the board will give no less than 20 days’ notice to the plan participants of such transaction so that the optionholders will have the right to exercise all or any portion of their options. At the end of the period, any options granted under the plan may be terminated as of a date fixed by the plan administrator. If any change is made in the common stock subject to the 1999 plan, or subject to any award granted under the plan (through stock dividends, stock splits, combination of shares, or otherwise), the plan provides that appropriate adjustments will be made as to the aggregate number and exercise prices with respect to each outstanding option.

1997 Stock Incentive Plan

During June 1997, our Board of Directors adopted our 1997 Stock Incentive Plan, and our shareholders approved the plan during June 1997. The plan is intended to attract persons of training, experience, and ability to continue as employees, directors, and consultants of our company, and to furnish additional incentive to such persons to become shareholders of our company. Employees, directors, and consultants of our company are eligible to participate in the 1997 plan.

The 1997 plan provides for the granting of (a) incentive stock options or non-qualified stock options to acquire our common stock, and (b) shares of restricted common stock. We have reserved for issuance 200,000 shares of our common stock under the plan, which may be granted in the form of stock options or shares of restricted stock. As of September 3, 2002, we had issued 3,667 shares of common stock under the 1997 plan, there were outstanding options to purchase 42,725 shares of common stock under the plan, and there were 153,608 shares of common stock available for grant under the plan. If any option expires without being exercised in full, or if the conditions of a restricted stock award are not fulfilled, the shares underlying the option or the shares of restricted stock shall be available for granting of further options or restricted stock awards under the plan.

Our Board of Directors, or a committee consisting of at least two or more non-employee directors, administers the plan. The administrator has the discretion to interpret the provisions of the plan. The administrator will also determine the persons who will receive awards under the plan, and the number of shares, vesting period, and other terms and conditions of the awards. Our Board of Directors may amend or discontinue the plan at any time, and the plan will expire during June 2007.

Options granted under the plan may be either incentive stock options, as defined under the Internal Revenue Code, or nonqualified options. The expiration date, maximum number of shares purchasable, vesting provisions, and any other provisions of options granted under the plan will be established at the time of grant. The plan administrator will set the term of each option, but no options may be granted for terms of greater than ten years. Options will vest and become exercisable in whole or in one or more installments at such time as may be determined by the plan administrator. With respect to incentive stock options granted, the exercise price shall not be less than the fair market value of the common stock on the date of grant, and shall not be less than 110% of the fair market value of the common stock on the date of grant in the event an optionee owns 10% or more of our common stock. With respect to nonqualified options, the exercise price may be less than the fair market value of the common stock on the date of grant. If the optionee terminates his or her

7

relationship with our company for any reason, including death or disability, the optionee (or the optionee’s estate) may exercise any vested options for a three-month period following his or her termination.

We may grant shares of restricted stock to eligible persons upon the payment of consideration, if any, as determined by the plan administrator. The administrator may establish a performance goal that must be achieved as a condition to the retention of the restricted stock. The performance goal may be based on the attainment of performance measurement criteria, which may differ as to various eligible persons. The plan administrator will set the performance criteria and will communicate the criteria in writing to the award recipient prior to the commencement of the period to which the performance relates. During the restricted period, and subject to restrictions on transfer of the shares, the award recipient shall have all voting, dividend, liquidation, and other rights with respect to the common stock. In the event the eligible person ceases to be an employee, director, or consultant during a restriction period, or in the event performance goals attributable to a restricted stock award are not achieved, the shares subject to the award that have not been earned are subject to forfeiture.

If any change is made in the common stock subject to the 1997 plan, or subject to any award granted under the plan (through stock dividends, stock splits, combination of shares, or otherwise), the plan provides that appropriate adjustments will be made as to the aggregate number and exercise prices with respect to each outstanding award. In the event of a merger, consolidation, or other reorganization of our company, all restrictions relating to restricted stock awards will lapse, and optionees will be entitled to receive upon exercise of the option those shares or other securities that the optionee would have received had the option been exercised prior to such transaction. Upon any other liquidation of our company, any unexercised options under the 1997 plan will be canceled.

1999 Employee Stock Purchase Plan

During August 1999, our Board of Directors adopted our 1999 Employee Stock Purchase Plan, or ESPP, and our shareholders approved the ESPP during October 1999. The ESPP is intended to provide an opportunity for our employees to acquire a proprietary interest in our company by purchasing shares of our common stock through voluntary payroll deductions. Employees of our company who have completed at least one year of service are eligible to participate in the ESPP. Under the ESPP, eligible employees may purchase shares of our common stock at a purchase price per share equal to 90% of the closing price of our common stock on the offering termination date. The purchase price is to be paid through periodic payroll deductions not to exceed 10% of the participant’s earnings during each three-month offering period. An employee may not participate in the ESPP if the purchase would cause him or her to own 5% or more of our company’s combined voting power or value of our common stock. In addition, no participant may purchase more than $25,000 worth of common stock annually.

The ESPP provides for successive three-month offering periods, with a new offering period beginning the first day of each January, March, July, and October. The board has the power to change the duration of offering periods with respect to future offerings without shareholder approval if such change is announced at least five days prior to the scheduled beginning of the first offering period affected. Our Board of Directors, or a committee of the board, administers the ESPP and has the authority to construe, interpret, and apply the terms of the ESPP. The board may at any time and for any reason amend or terminate the plan. Unless otherwise terminated by the board, the ESPP will terminate upon the tenth anniversary of adoption by our Board of Directors.

We have reserved 75,000 shares of our common stock for issuance under the ESPP of which 59,393 remain unpurchased. If the number of shares with respect to which options are to be exercised exceeds the number of shares then available under the ESPP, we will make a pro rata allocation of the shares remaining available for purchase among the participants. The shares covered by the ESPP will be proportionately adjusted for any increase or decrease in the number of issued shares of common stock resulting from a stock split, reverse stock split, stock dividend, or other combination or reclassification of our common stock.

8

The purchase right of a participant will terminate automatically in the event the participant ceases to be an employee of our company, or in the event of the participant’s death. In such event, any payroll deductions collected from such individual during the three-month period in which such termination occurs will be refunded. In the event of the proposed dissolution or liquidation of our company, the offering period then in progress will be reduced by setting a new offering termination date, and will terminate immediately prior to the consummation of the proposed dissolution or liquidation, unless otherwise provided by the board.

In the event of a proposed sale of all or substantially all of the assets of our company, or other merger of our company with or into another company, each outstanding option will be assumed or an equivalent option substituted by the successor corporation. In the event the successor corporation refuses to assume or substitute for the option, the offering period then in progress will be reduced by setting a new offering termination date, which will be before the date of the sale or merger.

Option Grants

Options granted to the executive officers named in the table above during 2001 were as follows:

Option/ SAR Grants In Last Fiscal Year

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| | Individual Grants | | | | |

| |

| | |

| | | | Percent of | | | | Potential Realizable |

| | Number of | | Total | | | | Value at Assumed Annual |

| | Securities | | Options | | | | Rates of Stock Price |

| | Underlying | | Granted to | | | | Appreciation for Option |

| | Options | | Employees | | Exercise or | | | | Term(2) |

| | Granted | | in Fiscal | | Base Price | | Expiration | |

|

| Name | | (#)(1) | | Year | | ($/Sh) | | Date | | 5% | | 10% |

| |

| |

| |

| |

| |

| |

|

| J.H. Donnan | | | 7,644 | | | | 3.7% | | | $ | 6.31 | | | | 1/15/2011 | | | $ | 30,334 | | | $ | 76,872 | |

| James N. Donnan | | | 4,247 | | | | 2.1% | | | $ | 6.31 | | | | 1/15/2011 | | | $ | 16,853 | | | $ | 42,710 | |

| Todd A. Neiberger | | | 2,297 | | | | 1.1% | | | $ | 6.31 | | | | 1/15/2011 | | | $ | 9,115 | | | $ | 23,100 | |

| | | | 15,000 | | | | 7.3% | | | $ | 8.00 | | | | 5/04/2011 | | | $ | 75,467 | | | $ | 191,249 | |

| Russell E. Donnan | | | 3,597 | | | | 1.7% | | | $ | 6.31 | | | | 1/15/2011 | | | $ | 14,274 | | | $ | 36,173 | |

| |

| (1) | All options grants to the listed officers are non-qualified stock options exercisable during the ten-year period from the date of grant with such options vesting 20% on each of the first, second, third, fourth, and fifth anniversaries of the date of grant. |

| |

| (2) | Calculated from a base price equal to the exercise price of each option, which was the fair market value of the common stock on the date of grant. The amounts represent only certain assumed rates of appreciation. Actual gains, if any, on stock option exercises and common stock holders cannot be predicted, and there can be no assurance that the gains set forth on the table will be achieved. |

Recent Grants of Stock Options

During January 2002, we granted options to acquire an aggregate of 18,553 shares of our common stock to our executive officers for services rendered in 2001. These options include options to acquire 8,192 shares of common stock to Mr. J.H. Donnan, options to acquire 4,430 shares of common stock to Mr. James N. Donnan, options to acquire 3,637 shares of common stock to Mr. Russell Donnan, and options to acquire 2,294 shares of common stock to Mr. Neiberger. All of the options have an exercise price of $8.80 per share, have ten-year terms, and vest in one-fifth increments on each anniversary date.

9

Option Values and Holdings

The following table provides information regarding unexercised stock options held by the executive officers listed as of December 31, 2001. None of these officers exercised options during fiscal 2001.

Number and Value of Options Held as of December 31, 2001

| | | | | | | | | | | | | | | | | |

| | | | |

| | Number of Securities | | Value of Unexercised |

| | Underlying Unexercised | | In-The-Money Options |

| | Options at Fiscal Year-End | | at Fiscal Year-End |

| |

| |

|

| Name | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

| |

| |

| |

| |

|

| J.H. Donnan | | | 3,208 | | | | 8,638 | | | $ | 5,648 | | | $ | 16,849 | |

| James N. Donnan | | | 1,900 | | | | 4,976 | | | $ | 3,299 | | | $ | 9,603 | |

| Todd A. Neiberger | | | 7,590 | | | | 17,786 | | | $ | 16,370 | | | $ | 12,824 | |

| Russell E. Donnan | | | 1,576 | | | | 4,164 | | | $ | 2,749 | | | $ | 8,065 | |

Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information regarding the beneficial ownership of our common stock as of September 3, 2002 by

| | |

| | • | each of our executive officers and directors; |

| |

| | • | all of our executive officers and directors as a group; and |

| |

| | • | each person who is known by us to own beneficially more than 5% of our outstanding common stock. |

| | | | | | | | | |

| | Number of | | |

| | Shares | | Percent |

| | Beneficially | | Beneficially |

| Name of Beneficial Owner | | Owned(1) | | Owned(2) |

| |

| |

|

Executive Officers and Directors: | | | | | | | | |

| J.H. Donnan(3)(13) | | | 1,257,312 | | | | 20.5 | % |

| James N. Donnan(4)(13) | | | 276,964 | | | | 4.5 | |

| Todd A. Neiberger(5) | | | 7,590 | | | | * | |

| Russell E. Donnan(6)(13) | | | 274,108 | | | | 4.5 | |

| Robert J. Terry(7) | | | 40,500 | | | | * | |

| Abdul H. Rajput(8) | | | 10,000 | | | | * | |

| Daniel G. Helle(9)(13) | | | 1,112,829 | | | | 18.2 | |

| J. Barton Goodwin(10) | | | 556,414 | | | | 9.1 | |

| All officers and directors as a group (eight persons) | | | 3,535,717 | | | | 57.5 | |

| |

5% Shareholders: | | | | | | | | |

| Marcia R. Donnan(3) | | | 1,257,312 | | | | 20.5 | |

| CIVC Fund L.P.(9)(13) | | | 1,112,829 | | | | 18.2 | |

| BCI Growth V, L.P.(10) | | | 545,286 | | | | 8.9 | |

| Gruber & McBaine Capital Management, LLC(11) | | | 428,200 | | | | 7.0 | |

| Marshall Financial Partners, L.P.(12) | | | 399,111 | | | | 6.5 | |

| | |

| | * | Less than 1.0% |

| |

| | (1) | Except as otherwise indicated, each person named in the table has sole voting and investment power with respect to all common stock beneficially owned, subject to applicable community property law. Except as otherwise indicated, each person may be reached at 5200 Hahns Peak Drive, Loveland, Colorado 80538. |

10

| | |

| | (2) | The percentages shown are calculated based upon 6,119,893 shares of common stock outstanding on May 1, 2002. The numbers and percentages shown include the shares of common stock actually owned as of May 1, 2002 and the shares of common stock that the identified person or group had the right to acquire within 60 days of such date. In calculating the percentage of ownership, all shares of common stock that the identified person or group had the right to acquire within 60 days of May 1, 2002 upon the exercise of options or warrants are deemed to be outstanding for the purpose of computing the percentage of shares of common stock owned by such person or group, but are not deemed to be outstanding for the purpose of computing the percentage of the shares of common stock owned by any other person. |

| |

| | (3) | Represents 626,202 shares of common stock held by each of J.H. Donnan and Marcia Donnan. Amounts listed for Mr. Donnan include 3,208 shares of common stock issuable upon exercise of stock options and the amounts for Ms. Donnan include 1,700 shares of common stock issuable upon exercise of stock options. J.H. Donnan and Marcia Donnan are husband and wife but each disclaims beneficial ownership of the other’s shares shown above. |

| |

| | (4) | Represents 275,064 shares of common stock and 1,900 shares of common stock issuable upon exercise of stock options. Includes 5,064 shares of common stock held in trust for the benefit of Mr. Russell Donnan’s children. Mr. James Donnan serves as trustee of the trust and retains voting and dispositive power over such shares. |

| |

| | (5) | Represents 7,590 shares of common stock issuable upon exercise of stock options. |

| |

| | (6) | Represents 272,532 shares of common stock and 1,576 shares of common stock issuable upon exercise of stock options. Includes 2,532 shares of common stock held in trust for the benefit of Mr. James Donnan’s son. Mr. Russell Donnan serves as trustee of the trust and retains voting and dispositive power over such shares. |

| |

| | (7) | Represents 35,500 shares of common stock and 5,000 shares of common stock issuable upon exercise of stock options. |

| |

| | (8) | Represents 5,000 shares of common stock and 5,000 shares of common stock issuable upon exercise of stock options. |

| |

| | (9) | Mr. Helle is a managing director of CIVC Fund L.P., and is deemed to be a beneficial owner of its shares. Mr. Helle has shares voting and dispositive power with respect to the shares held by CIVC Fund L.P. The address of CIVC Fund L.P. is 231 South LaSalle Street, Chicago, Illinois 60697. |

| |

| (10) | Mr. Goodwin is a general partner of BCI Partners, Inc., an investment management company which advises BCI Growth V, L.P. and BCI Investors, LLC, and is deemed to be a beneficial owner of the shares held by these entities. Amounts listed for Mr. Goodwin include 545,286 shares held by BCI Growth V, L.P. and 11,128 shares held by BCI Investors, LLC. Mr. Goodwin has shared voting and dispositive power over shares held by BCI Growth V, L.P. and BCI Investors, LLC. The address for BCI Growth V, L.P. is c/o BCI Partners, Inc., Glenpointe Centre West, Teaneck, New Jersey 07666. |

| |

| (11) | Represents 428,200 shares of common stock beneficially owned by Gruber & McBaine Capital Management, LLC, or its controlling persons, in its capacity as registered investment adviser on behalf of its clients. GMCM has shared voting and dispositive power over 363,000 of such shares, and certain controlling persons of GMCM have sole voting and dispositive power over 65,200 of such shares. Information is based solely upon a Schedule 13G filed with the Commission on February 13, 2002. The address of Gruber & McBaine Capital Management, LLC is 50 Osgood Place, Penthouse, San Francisco, California 94133. |

| |

| (12) | The address for Marshall Financial Partners, L.P. is 903 North 3rd Street, Suite 300, Minneapolis, Minnesota 55401. |

| |

| (13) | J.H. Donnan, Marcia Donnan, James Donnan, Russell Donnan, and CIVC Fund, L.P. are parties to an Investors Agreement. The parties to the agreement have agreed to vote their shares of common stock in all elections of directors in favor of the director designated by CIVC for so long as CIVC beneficially owns at least 177,600 shares of our common stock. Currently, Mr. Helle is the designee of CIVC. In addition, without the prior approval of a special committee of the Board of Directors, which must be |

11

| |

| comprised of Mr. Helle and two independent directors appointed by Mr. Helle, we may not enter into any merger, consolidation, joint venture, recapitalization, partnership, or other combination, or sell or otherwise dispose of more than 50% of our consolidated assets, or similar transaction. |

Certain Relationships and Related Transactions

There were no transactions between us and any of our officers, directors, or shareholders owning more than 5% of our voting securities during the year ended December 31, 2001.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Securities Exchange Act of 1934 requires our directors and executive officers, and persons who own more than 10% of our common stock to file with the Securities and Exchange Commission initial reports of ownership and reports of changes in ownership of our common stock. Executive officers, directors and greater than 10% shareholders are required by SEC regulations to furnish us with copies of all Section 16(a) reports they file. To our knowledge, based solely on review of the copies of such reports furnished to us or advice that no filings were required, during fiscal year 2001 all executive officers, directors and greater than 10% beneficial owners complied with the Section 16(a) filing requirements.

Board Meetings and Committees

Our Board of Directors held eight meetings during the fiscal year ended December 31, 2001. No director attended fewer than 75 percent of the total number of meetings of our board or the total number of meetings held by all committees of the board on which he served. Our Board of Directors has a compensation and audit committee, the function and membership of which are each described below. Our audit committee held five meetings and our compensation committee held two meetings during the fiscal year ended December 31, 2001. We do not have a nominating committee.

Our bylaws authorize our Board of Directors to appoint among its members one or more committees consisting of one or more directors. Our Audit Committee reviews the annual financial statements, any significant accounting issues, and the scope of the audit with our independent auditors, and discusses with the auditors any other audit-related matters that may arise during the year. Our Compensation Committee reviews and acts on matters relating to compensation levels and benefit plans for key executives of our company.

COMPENSATION COMMITTEE REPORT ON EXECUTIVE COMPENSATION

The following report on executive compensation is furnished by the Compensation Committee of the Board of Directors. In 2001, as in prior years, the non-employee members of the Board of Directors determined the compensation to be paid to our executive officers taking into account recommendations by our Chief Executive Officer.

Compensation Philosophy

Compensation of the executive officers is designed to link compensation directly to our growth and financial performance. Compensation consists of base compensation, bonuses under the two bonus programs, and options under our stock option and incentive plans. The objective of these elements, taken together, is to provide reasonable base compensation and to retain, recognize, and reward superior performance through bonuses and stock options. The compensation philosophy also assures that we provide a compensation package that is competitive in the marketplace.

In reviewing and approving base salaries and bonus awards for the executive officers, the Compensation Committee relied on its experience and industry studies in our geographic area to assess our compensation competitiveness and compensation range for each position. Base salaries are based upon individual performance, experience, competitive pay practices, and level of responsibilities. Our executive officers are paid

12

bonuses if certain individually specific performance objectives are met and if company financial thresholds are achieved.

Chief Executive Officer Compensation

The Compensation Committee considers the same factors as outlined above with respect to our other executive officers in evaluating the base salary, incentive bonus, and other compensation of J.H. Donnan, our Chief Executive Officer. The Compensation Committee’s evaluation of Mr. J. H. Donnan’s base salary and incentive bonus is subjective, with no particular weight assigned to any one factor. During our review, we noted the growth of the company and the challenges presented in the company’s acquisition program. We took into account that under Mr. Donnan’s leadership the company has (i) become one of a very limited number of approved vendors of Freddie Mac and Fannie Mae, (ii) expanded into the consumer credit industry by entering into three lease agreements with Experian Information Solutions, Inc., and (iii) continued to be an industry leader in customer service and automated technology. Based on the foregoing factors and other considerations, such as Mr. Donnan’s significant industry experience and comparative compensation data in the region, we set Mr. Donnan’s 2001 base salary at $275,000. We also awarded Mr. Donnan a bonus $241,203 in 2001 since he and the company met the objectives and thresholds we set under our bonus programs.

Compensation for Other Executive Officers

Base salaries for executive officers other than our Chief Executive Officer have been set based upon the Compensation Committee’s determination of compensation levels required to remain competitive, given each executive officer’s performance, financial performance, and the competitive environment for executive talent. In setting compensation for these executive officers, we also considered the recommendations of J.H. Donnan, our Chief Executive Officer, along with compensation data obtained from an independent employment council which collects and disseminates compensation information in the company’s region. We also awarded our executive officers bonuses in 2001 since they all met specified individual objectives and the company met certain financial thresholds under our bonus programs.

This report has been furnished by the members of the Compensation Committee of the Board of Directors of Factual Data Corp.

| |

| | Daniel G. Helle, Chairman |

| | Robert J. Terry |

| | Abdul H. Rajput |

| | J.H. Donnan |

Compensation Committee Interlocks and Insider Participation

During the fiscal year ended December 31, 2001, our Compensation Committee consisted of Daniel G. Helle, Robert J. Terry, Abdul H. Rajput, and J.H. Donnan. None of such individuals had any contractual or other relationships with our company during such fiscal year except as directors and, in Mr. Donnan’s case, as a director and officer. Mr. Donnan’s compensation was determined by the three independent members of the Compensation Committee. In addition, there are no Compensation Committee interlocks between us and other entities in which any of our directors or executive officers serve as executive officers of such entities.

Audit Committee

We have adopted an Audit Committee Charter which was attached to our Proxy Statement for our 2000 Annual Meeting of Shareholders. The Charter requires our Audit Committee to undertake a variety of activities designed to assist our Board of Directors in fulfilling its oversight role regarding our auditors’ independence, our financial reporting process, our systems of internal control and compliance with applicable laws, rules, and regulations. The Charter states that the independent public accountants are ultimately accountable to the Board of Directors and the Audit Committee.

13

The Audit Committee members do not serve as professional accountants or auditors and their functions are not intended to duplicate or to certify the activities of management and the independent public accountants. The Committee serves a board-level oversight role where it receives information from, consults with, and provides its views and directions to, management and the independent public accountants on the basis of the information it receives and the experience of its members in business, financial, and accounting matters. The members of our Audit Committee for the year 2001 were Messrs. Goodwin, Terry, and Rajput.

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The Audit Committee has reviewed and discussed our consolidated financial statements for the fiscal year ended December 31, 2001, with management and the independent public accountants. The Audit Committee has discussed with the independent public accountants matters required to be discussed by Statement on Auditing Standards No. 61 (Communication with Audit Committees). In addition, the independent public accountants provided to the Audit Committee the written disclosures required by Independent Standards Board Standard No. 1 (Independent Discussions with Audit Committees), and the Audit Committee and the independent public accountants have discussed their independence from the company and its management, including the matters in those written disclosures. Additionally, the Audit Committee considered the fees and costs billed and expected to be billed by the independent public accountants for our audit services. The Audit Committee has discussed with management the procedures for selection of consultants and the related competitive bidding practices and fully considered whether those services provided by the independent public accountants are compatible with maintaining auditing independence.

The Audit Committee has discussed with the independent public accountants, with and without management present, their evaluations of our internal accounting controls and the overall quality of our financial reporting.

In reliance on the reviews and discussions with management and the independent public accountants referred to above, the Audit Committee recommended to the Board of Directors and the board has approved the inclusion of the audited financial statements in our Annual Report on Form 10-K for the year ended December 31, 2001, for filing with the Securities and Exchange Commission. The Audit Committee also recommended to the Board of Directors, and the board has approved the selection of our independent public accountants for fiscal 2002.

| |

| | J. Barton Goodwin, Chairman |

| | Robert J. Terry |

| | Abdul H. Rajput |

Performance Graph

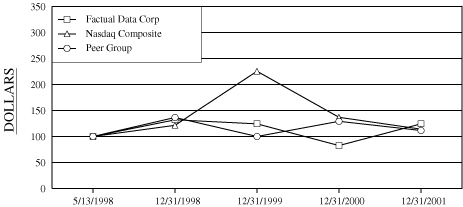

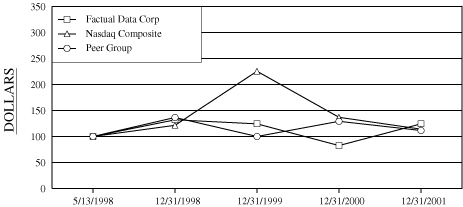

The following line graph compares cumulative total shareholder returns for (i) our common stock; (ii) the Nasdaq Composite Index; and (iii) a peer group consisting of the five companies listed below the graph. The graph assumes an investment of $100 in our common stock on May 13, 1998, the date on which our common stock became registered under Section 12 of the Securities Exchange Act of 1934 as a result of our initial public offering, and an investment in each of the Nasdaq Composite Index and peer group of $100 on May 13, 1998. The graph covers the period from May 13, 1998 through December 31, 2001.

14

The calculation of cumulative shareholder return for the Nasdaq Composite Index and the peer group includes reinvestment of dividends. The calculation of cumulative shareholder return on our common stock does not include reinvestment of dividends because we did not pay dividends during the measurement period. The performance shown is not necessarily indicative of future performance.

| | | | | | | | | | | | | | | | | | | | | |

|

|

| | 5/13/1998 | | 12/31/1998 | | 12/31/1999 | | 12/31/2000 | | 12/31/2001 |

|

|

| Factual Data Corp | | $ | 100.00 | | | $ | 132.04 | | | $ | 124.27 | | | $ | 82.52 | | | $ | 124.27 | |

| Peer Group | | $ | 100.00 | | | $ | 136.54 | | | $ | 99.99 | | | $ | 129.15 | | | $ | 111.51 | |

| Nasdaq Composite | | $ | 100.00 | | | $ | 121.48 | | | $ | 225.45 | | | $ | 136.87 | | | $ | 114.09 | |

Source: Carl Thompson Associates www.ctaonline.com (800) 959-9677. Data from BRIDGE Information Systems, Inc.

We believe the mortgage credit reporting business has similarities to, and can be affected by factors in the general credit reporting business. We are the only publicly traded company whose principal line of business is mortgage credit reporting, so a directly comparable peer group is not available. The peer group presented consists of SourceCorp, Incorporated (SRCP) which provides business outsourcing; First Service Corporation (FSRV) which provides property and business services; Fidelity National Information Solutions, Inc. (FNIS) which provides mortgage related services; Pro Business Services, Inc. (PRBZ) which provides business service outsourcing; and Administaff, Inc. (ASF) which provides human resources outsourcing.

PROPOSAL TO AMEND OUR ARTICLES OF INCORPORATION

TO INCREASE THE NUMBER OF AUTHORIZED

SHARES OF COMMON STOCK

To provide for our future capital needs, our Board of Directors on January 30, 2002 unanimously adopted a resolution, subject to shareholder approval, to amend Article IV of our Articles of Incorporation to provide additional authorized shares of common stock (a copy of Article IV, as it is proposed to be amended, is attached to this proxy statement as Exhibit A). The proposal provides for an increase in the authorized number of shares of common stock from 10,000,000 to 50,000,000 shares. Provisions in Article IV concerning our Preferred Stock are not proposed to be amended.

Of our presently authorized 10,000,000 shares of common stock, 6,188,589 shares are outstanding and approximately 803,568 shares are reserved for issuance under our existing option plans, employee stock purchase plan, or outstanding warrants to purchase common stock. Therefore, we have approximately 3,000,000 authorized, unissued, and unreserved shares. Our Board of Directors believes that it is in our company’s best interests to increase the number of authorized shares of common stock in order to have additional authorized but unissued shares available for issuance to meet business needs as they arise. The

15

Board of Directors believes that the availability of such additional shares will provide our company with the flexibility to issue common stock for possible future financing transactions, stock dividends or distributions, acquisitions, and other proper corporate purposes that may be identified by the Board of Directors. We have no other plans, arrangements, agreements, or understandings at the present time for the issuance or use of the additional shares of common stock proposed to be authorized. The Board of Directors does not intend to issue any common stock except on terms that the Board of Directors deems to be in the best interests of our company and its then existing shareholders.

The authorized shares of common stock in excess of those issued will be available for issuance at such times and for such corporate purposes as our Board of Directors may deem advisable, without further action by our shareholders, except as may be required by applicable law or by the rules of the Nasdaq National Market. Upon issuance, such shares will have the same rights as the outstanding shares of common stock. Holders of common stock have no preemptive rights.

The issuance of additional shares of common stock, other than through a stock split in the form of a stock dividend, may have a dilutive effect on earnings per share and on such shareholders’ percentage voting power. Any future issuance of common stock will be subject to the rights of holders of outstanding shares of any preferred stock that our company may issue in the future.

Preferred Stock

The proposed amendment will not affect our ability to issue preferred stock. Our Board of Directors is authorized to issue preferred stock in one or more series and to fix the rights, preferences, privileges, and restrictions, including dividend rights, conversion rights, voting rights, rights and terms of redemption, redemption price or prices, liquidation preferences, and the number of shares constituting any series or the designation of such series, without any further vote or action by our shareholders. The issuance of preferred stock may have the effect of delaying, deferring, or preventing a change in control of our company without further action by our shareholders. The issuance of preferred stock with voting and conversion rights may adversely affect the voting power of the holders of common stock, including the loss of voting control to others. No preferred stock currently is outstanding, and we have no present plans to issue any shares of preferred stock. The proposed amendment will not affect our ability to issue preferred stock.

Potential Effects of the Proposed Amendment

In deciding whether to issue additional shares of common stock, our Board of Directors will carefully consider the effect of the issuance on our operating results and our then-existing shareholders. Although we have no present intention to issue shares of common stock in the future in order to make acquisition of control of our company more difficult, future issuances of common stock, with the exception of stock splits effected as dividends, could have that effect. For example, the acquisition of shares of our common stock by an entity in order to acquire control of our company might be discouraged through the public or private issuance of additional shares of common stock, since such issuance would dilute the stock ownership of the acquiring entity. Common stock could also be issued to existing shareholders as a dividend or privately placed with purchasers that might side with the board in opposing a takeover bid, thus discouraging such a bid. Our Board of Directors did not propose this amendment for the purpose of discouraging mergers, tender offers, proxy contests, or other changes in control of our company and we are not aware of any specific effort to accumulate our common stock or obtain control of our company by means of a merger, tender offer, solicitation, or otherwise.

No rights of appraisal or similar rights of dissenters exist with respect to this matter.

Ratification by Shareholders of the Proposed Amendment

Approval of the proposed amendment to our articles of incorporation will require the affirmative vote of the holders of two-thirds of the total number of the issued and outstanding shares of our common stock. Upon approval by our shareholders, the proposed amendment will become effective upon filing of articles of amendment with the Colorado Secretary of State, which will occur as soon as practicable following the

16

meeting. In the event that the proposed amendment is not approved by our shareholders at the meeting, the current articles of incorporation will remain in effect.

The Board of Directors recommends a vote FOR the proposal to amend the Articles of Incorporation to increase the number of our authorized shares of common stock.

PROPOSAL TO INCREASE THE NUMBER OF SHARES

RESERVED FOR ISSUANCE UNDER OUR

1999 EMPLOYEE FORMULA AWARD STOCK OPTION PLAN

We are requesting that you approve an increase of 200,000 shares to the number of shares reserved for issuance under our 1999 Employee Formula Award Stock Option Plan, which was adopted by shareholders in October 1999. When initially adopted, there were only 100,000 shares of our common stock reserved for issuance under the plan. At our annual meeting held on July 28, 2000, shareholders approved an increase in shares reserved under the plan to 400,000. We are proposing a further increase from 400,000 to 600,000 at this meeting.

All of the material terms of the plan are set forth above under “Our 1999 Employee Formula Award Stock Option Plan.”

We have grown substantially over the past few years, and as of September 3, 2002, we had approximately 240 full-time employees. In January 2002, after annual option grants to our employees pursuant to the formula provisions of the plan, we were left with fewer than 75,000 shares to cover future option grants. We believe that the number of shares reserved for issuance under the plan should be increased by 200,000 shares. Our Board of Directors believes that this plan, which provides option grants to most full-time employees, aligns the interests of our employees with our shareholders, assists us with recruiting and retaining qualified personnel, and provides our employees with another form of compensation.

The affirmative vote of the holders of a majority of the shares of our common stock represented at the meeting is required to approve this proposal.

The Board of Directors recommends a vote FOR the approval of the proposal to increase the number of shares reserved under the 1999 Employee Formula Award Stock Option Plan by an additional 200,000 shares.

RATIFICATION OF APPOINTMENT OF

INDEPENDENT PUBLIC ACCOUNTANTS

We have appointed BDO Seidman, LLP, independent public accountants, to audit our consolidated financial statements for the fiscal year ending December 31, 2002, and recommend that the shareholders vote in favor of the ratification of such appointment. In the event of a negative vote on such ratification, the Board of Directors will reconsider its selection. The Board of Directors anticipates that representatives of BDO Seidman, LLP will be present at the meeting, will have the opportunity to make a statement if they desire, and will be available to respond to appropriate questions.

Aggregate fees billed to our company for the fiscal year ended December 31, 2001 by our principal accounting firm, BDO Seidman, LLP, are as follows:

| | | | | |

| Audit fees and quarterly reviews | | $ | 65,000 | |

| All other fees (tax services and 401(k) plan audit) | | $ | 24,122 | |

The members of our audit committee believe that the non-audit services provided by BDO Seidman, LLP, referenced above in “Financial Information Systems Design and Implementation Fees” and “All Other Fees,” are compatible with maintaining our principal accounting firm’s independence.

The Board of Directors recommends a vote FOR the ratification of the appointment of BDO Seidman, LLP as our independent public accountants for the year 2002.

17

DEADLINE FOR RECEIPT OF SHAREHOLDER PROPOSALS

Any shareholder who wishes to present a proposal to be considered at our 2003 annual meeting of shareholders and who wishes to have such proposal receive consideration for inclusion in our proxy statement for such meeting must deliver such proposal in writing to the company at 5200 Hahns Peak Drive, Loveland, Colorado 80538, not later than January 15, 2003. Any such shareholder proposal must comply with the requirements of Rule 14a-8 promulgated under the Securities Exchange Act of 1934.

The persons named as proxies for the 2003 annual meeting of shareholders will generally have discretionary authority to vote on any matter presented by a shareholder for action at that meeting. In the event that we receive notice of any shareholder proposal no later than forty-five (45) days before the date on which we first mail our 2003 proxy statement, then so long as we include in our proxy statement for the 2003 annual meeting of shareholders advice on the nature of the matter and how the named proxies intend to vote the shares for which they have received discretionary authority, such proxies may exercise discretionary authority with respect to such matter, except to the extent limited by the rules of the Securities and Exchange Commission governing shareholder proposals.

OTHER MATTERS

At the date of mailing of this proxy statement, we are not aware of any business to be presented at the meeting other than the proposals discussed above. If other proposals are properly brought before the meeting, any proxies returned to us will be voted as the proxyholders see fit.

| |

| | By Order of the Board of Directors |

| |

| |

|

| | Russell E. Donnan |

| | Secretary |

Loveland, Colorado

September 30, 2002

18

PRELIMINARY COPIES

FACTUAL DATA CORP.

5200 Hahns Peak Drive

Loveland, Colorado 80538

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The undersigned shareholder of Factual Data Corp. acknowledges receipt of the notice of the annual meeting of shareholders, to be held Friday, November 1, 2002, at 8:00 a.m., at the Conference Center, 5200 Hahns Peak Drive, Loveland, Colorado and hereby appoints J.H. Donnan and Todd A. Neiberger, or either of them, each with the power of substitution, as attorneys and proxies to vote all the shares of the undersigned at the annual meeting and at all adjournments thereof, hereby ratifying and confirming all that the attorneys and proxies may do or cause to be done by virtue hereof. The above-named attorneys and proxies are instructed to vote all of the undersigned’s shares as follows:

| | 1. | | ELECTION OF DIRECTORS: |

| |

| | | | [ ] FOR both nominees listed below (except as indicated) |

| |

| | | | [ ] WITHHOLD AUTHORITY to vote for both nominees listed below. |

| |

| | | | If you wish to withhold authority to vote for any individual nominee, strike a line through that nominee’s name in the list below: |

| | | |

| Robert J. Terry | | Abdul H. Rajput |

| | 2. | | Proposal to approve the amendment to our Articles of Incorporation to increase the number of authorized shares of our common stock from 10,000,000 to 50,000,000 shares. |

| | | | | |

| [ ] FOR | | [ ] AGAINST | | [ ] ABSTAIN |

| | 3. | | Proposal to approve the amendment to increase by 200,000 the number of shares reserved for future issuance under our 1999 Employee Formula Award Stock Option Plan. |

| | | | | |

| [ ] FOR | | [ ] AGAINST | | [ ] ABSTAIN |

| | 4. | | Ratification of the appointment of BDO Seidman, LLP as our independent public accountants for the fiscal year ending December 31, 2002. |

| | | | | |

| [ ] FOR | | [ ] AGAINST | | [ ] ABSTAIN |

| | 5. | | Transaction of such other business as may properly come before the meeting or any adjournment thereof. |

THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED SHAREHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR THE ELECTION OF DIRECTORS, FOR THE APPROVAL OF THE AMENDMENT TO OUR ARTICLES OF INCORPORATION, FOR THE APPROVAL OF THE AMENDMENT TO OUR 1999 EMPLOYEE FORMULA AWARD STOCK OPTION PLAN, FOR THE RATIFICATION OF THE APPOINTMENT OF BDO SEIDMAN LLP AS THE INDEPENDENT PUBLIC ACCOUNTANTS OF THE COMPANY, AND AS THE PROXIES DEEM ADVISABLE ON SUCH OTHER MATTERS AS MAY COME BEFORE THE MEETING.

| | | |

| DATED: 2002 | |

SIGNATURE |

| |

| | |

SIGNATURE IF HELD JOINTLY |

| |

| | | Please sign your name exactly as it appears

below. When shares are held by joint tenants,

both should sign. When signing as attorney,

executor, administrator, trustee or guardian,

please give full title as such. If a corporation,

please sign in full corporate name by

President or other authorized officer. If a

partnership, please sign in partnership name

by authorized person. |

PLEASE MARK, SIGN, DATE AND RETURN THE PROXY CARD PROMPTLY. NOTE: SECURITIES DEALERS PLEASE STATE THE NUMBER OF SHARES VOTED BY THIS PROXY: