SCHEDULE 14A

(Rule 14-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

¨ | Preliminary Proxy Statement |

¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

¨ | Definitive Additional Materials |

¨ | Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12 |

AVANEX CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

¨ | Fee paid previously with preliminary materials. |

¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0- 11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

Notice of Annual Meeting of Stockholders

to be held October 24, 2002

TO THE STOCKHOLDERS:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Annual Meeting”) of AVANEX CORPORATION, a Delaware corporation (“Avanex”), will be held on October 24, 2002, at 10:00 a.m., local time, at Avanex’s corporate headquarters, 40919 Encyclopedia Circle, Fremont, California 94538, for the following purposes:

| | 1. | To elect one Class III director for a term of three years or until his successor has been duly elected and qualified. |

| | 2. | To ratify the appointment of Ernst & Young LLP as Avanex’s independent auditors. |

| | 3. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement of the Annual Meeting. |

These items of business are more fully described in the Proxy Statement accompanying this Notice of Annual Meeting.

Only stockholders of record at the close of business on September 6, 2002, the record date, are entitled to vote on the matters listed in this Notice of Annual Meeting.

All stockholders are cordially invited to attend the Annual Meeting in person. However, to ensure your representation at the Annual Meeting, please vote as soon as possible using one of the following methods: (1) by using the Internet as instructed on the enclosed proxy card, (2) by telephone as instructed on the enclosed proxy card, or (3) by mail, using the enclosed paper proxy card and postage-prepaid envelope. For further details, please see the section entitled “Voting” on page two of the accompanying Proxy Statement. Any stockholder attending the Annual Meeting may vote in person even if he or she has voted using the Internet, telephone, or proxy card.

By Order of the Board of Directors

of Avanex Corporation

Paul Engle

President, Chief Executive Officer and Director

Fremont, California

September 23, 2002

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE VOTE BY TELEPHONE OR BY USING THE INTERNET AS INSTRUCTED ON THE ENCLOSED PROXY CARD OR COMPLETE, SIGN, DATE, AND RETURN THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE IN THE ENCLOSED ENVELOPE.

PROXY STATEMENT

FOR

2002 ANNUAL MEETING OF STOCKHOLDERS

PROCEDURAL MATTERS

General

This Proxy Statement is being furnished to holders of common stock, par value $0.001 per share (the “Common Stock”), of Avanex Corporation, a Delaware corporation (“Avanex” or the “Company”), in connection with the solicitation of proxies by the Board of Directors of Avanex for use at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held on October 24, 2002, at 10:00 a.m., local time, and at any adjournment or postponement thereof for the purpose of considering and acting upon the matters set forth herein. The Annual Meeting will be held at Avanex’s corporate headquarters, 40919 Encyclopedia Circle, Fremont, California 94538. The telephone number at that location is (510) 897-4188.

This Proxy Statement, the accompanying form of proxy card and the Company’s Annual Report on Form 10-K are first being mailed on or about September 23, 2002 to all stockholders entitled to vote at the Annual Meeting.

Stockholders Entitled to Vote; Record Date

Only holders of record of Avanex’s Common Stock at the close of business on September 6, 2002 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting. Such stockholders are entitled to cast one vote for each share of Common Stock held as of the Record Date on all matters properly submitted for the vote of stockholders at the Annual Meeting. As of the Record Date, there were 69,687,516 shares of Common Stock outstanding and entitled to vote at the Annual Meeting. No shares of preferred stock were outstanding. For information regarding security ownership by management and by the beneficial owners of more than five percent (5%) of Avanex’s Common Stock, see “Security Ownership of Certain Beneficial Owners and Management.”

Quorum; Required Vote

The presence of the holders of a majority of the shares of Common Stock entitled to vote generally at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Such stockholders are counted as present at the meeting if they (1) are present in person at the Annual Meeting or (2) have properly submitted a proxy card or voted by telephone or by using the Internet. A plurality of the votes duly cast is required for the election of directors. The affirmative vote of a majority of the votes duly cast is required to ratify the appointment of auditors.

Under the General Corporation Law of the State of Delaware, an abstaining vote and a broker “non-vote” are counted as present and entitled to vote and are, therefore, included for purposes of determining whether a quorum is present at the Annual Meeting; however, broker “non-votes” are not deemed to be “votes cast.” As a result, broker “non-votes” are not included in the tabulation of the voting results on the election of directors or

1

issues requiring approval of a majority of the votes cast and, therefore, do not have the effect of votes in opposition in such tabulations. A broker “non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner.

Voting

Voting by attending the meeting. A stockholder may vote his or her shares in person at the Annual Meeting. A stockholder planning to attend the Annual Meeting should bring proof of identification for entrance to the Annual Meeting.

Voting by proxy card. All shares entitled to vote and represented by properly executed proxy cards received prior to the Annual Meeting, and not revoked, will be voted at the Annual Meeting in accordance with the instructions indicated on those proxy cards. If no instructions are indicated on a properly executed proxy card, the shares represented by that proxy card will be voted as recommended by the Board of Directors. If any other matters are properly presented for consideration at the Annual Meeting, including, among other things, consideration of a motion to adjourn the Annual Meeting to another time or place (including, without limitation, for the purpose of soliciting additional proxies), the persons named in the enclosed proxy card and acting thereunder will have discretion to vote on those matters in accordance with their best judgment. The Company does not currently anticipate that any other matters will be raised at the Annual Meeting. Any proxy card given pursuant to this solicitation may be revoked by the person giving it at any time before it is voted. A proxy card may be revoked (1) by filing with the Secretary of the Company, at or before the taking of the vote at the Annual Meeting, a written notice of revocation or a duly executed proxy card, in either case dated later than the prior proxy card relating to the same shares, or (2) by attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not of itself revoke a proxy). Any written notice of revocation or subsequent proxy card must be received by the Secretary of the Company prior to the taking of the vote at the Annual Meeting. Such written notice of revocation or subsequent proxy card should be hand delivered to the Secretary of the Company or should be sent to Avanex Corporation, 40919 Encyclopedia Circle, Fremont, California 94538, Attention: Corporate Secretary.

Voting by telephone or the Internet. A stockholder may vote his or her shares by calling the toll-free number indicated on the enclosed proxy card and following the recorded instructions or by accessing the website indicated on the enclosed proxy card and following the instructions provided.

When a stockholder votes via the Internet or by telephone, his or her vote is recorded immediately. Avanex encourages its stockholders to vote using these methods whenever possible. If a stockholder attends the Annual Meeting, he or she may also submit his or her vote in person, and any previous votes that were submitted by the stockholder, whether by Internet, phone or mail, will be superseded by the vote that such stockholder casts at the Annual Meeting.

Expenses of Solicitation

Avanex will bear all expenses of this solicitation, including the cost of preparing and mailing this proxy material. The Company may reimburse brokerage firms, custodians, nominees, fiduciaries and other persons representing beneficial owners of Common Stock for their reasonable expenses in forwarding solicitation material to such beneficial owners. Directors, officers and employees of the Company may also solicit proxies in person or by telephone, letter, e-mail, telegram, facsimile or other means of communication. Such directors, officers and employees will not be additionally compensated, but they may be reimbursed for reasonable out-of-pocket expenses in connection with such solicitation. The Company may engage the services of a professional proxy solicitation firm to aid in the solicitation of proxies from certain brokers, bank nominees and other institutional owners. The Company’s costs for such services, if retained, will not be material.

2

Procedure for Submitting Stockholder Proposals

Requirements for stockholder proposals to be considered for inclusion in the Company’s proxy material. Stockholders may present proper proposals for inclusion in the Company’s proxy statement and for consideration at the next annual meeting of its stockholders by submitting their proposals in writing to the Secretary of the Company in a timely manner. In order to be included in the Company’s proxy materials for the 2003 annual meeting of stockholders, stockholder proposals must be received by the Secretary of the Company no later than the Notice Deadline (as defined below), and must otherwise comply with the requirements of Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Requirements for stockholder proposals to be brought before an annual meeting. In addition, the Company’s Bylaws establish an advance notice procedure for stockholders who wish to present certain matters before an annual meeting of stockholders. In general, nominations for the election of directors may be made by the Board of Directors or any stockholder entitled to vote who has delivered written notice to the Secretary of the Company no later than the Notice Deadline (as defined below), which notice must contain specified information concerning the nominees and concerning the stockholder proposing such nominations.

The Company’s Bylaws also provide that the only business that may be conducted at an annual meeting is business that is (1) specified in the notice of meeting given by or at the direction of the Board of Directors, (2) properly brought before the meeting by or at the direction of the Board of Directors, or (3) properly brought before the meeting by a stockholder who has delivered written notice to the Secretary of the Company no later than the Notice Deadline (as defined below), which notice must contain specified information concerning the matters to be brought before such meeting and concerning the stockholder proposing such matters.

The “Notice Deadline” is defined as that date which is 120 days prior to the one year anniversary of the date on which the Company first mailed its proxy materials for the previous year’s annual meeting of stockholders. As a result, the Notice Deadline for the 2003 annual stockholder meeting is May 26, 2003.

In addition, a stockholder who intends to present a proposal at the Company’s 2003 annual meeting of stockholders should be aware that the rules of the Securities and Exchange Commission (the “SEC”) provide that a proxy may confer discretionary authority on management to vote on a matter for an annual meeting of stockholders if the proponent fails to notify the Company by the date specified by an advance notice provision. Accordingly, if a proponent does not notify the Company on or before May 26, 2003, of a proposal for the 2003 annual meeting of stockholders, management may use its discretionary voting authority to vote on such proposal.

If a stockholder who has notified the Company of his or her intention to present a proposal at an annual meeting does not appear to present his or her proposal at such meeting, the Company need not present the proposal for vote at such meeting.

A copy of the full text of the Bylaw provisions discussed above may be obtained by writing to the Secretary of the Company. All notices of proposals by stockholders, whether or not included in the Company’s proxy materials, should be sent to Avanex Corporation, 40919 Encyclopedia Circle, Fremont, California 94538, Attention: Corporate Secretary.

3

PROPOSAL ONE

ELECTION OF DIRECTORS

General

The Company’s Board of Directors is currently comprised of six members who are divided into three classes with overlapping three-year terms. A director serves in office until his or her respective successor is duly elected and qualified or until his or her earlier death or resignation. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of an equal number of directors. Xiaofan Cao resigned as a director of the Company on June 30, 2002, which has created a vacancy on the Board of Directors. Federico Faggin has indicated that he does not intend to stand for reelection to the Company’s Board of Directors at the Annual Meeting, which will create an additional vacancy on the Board of Directors. The Board has not nominated a successor for Dr. Cao or Dr. Faggin and no more than one director shall be elected at the Annual Meeting.

Nominees for Class III Directors

One Class III director is to be elected at the Annual Meeting for a three-year term ending in 2005. The Board of Directors has nominated Joel Smith for election as the Class III director. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the election of Mr. Smith. The Company expects that Mr. Smith will accept such nomination; however, in the event that Mr. Smith is unable or declines to serve as a director at the time of the meeting, the proxies will be voted for any nominee who shall be designated by the Board of Directors to fill the vacancy. The term of office of the person elected as director will continue until such director’s term expires in 2005 or until such director’s successor has been elected and qualified.

The Board of Directors recommends a vote “FOR” the nominee listed above.

Information Regarding the Nominee and Other Directors

Nominee for Class III Director for a Term Expiring in 2005

Name

| | Age

| | Principal Occupation and Business Experience

|

| Joel Smith | | 57 | | Dean of Darla Moore School of Business of the University of South Carolina. Mr. Smith has served on the Company’s Board of Directors since December 1999. Mr. Smith has been the dean of the Darla Moore School of Business of the University of South Carolina from October 2000 to the present. Previously, Mr. Smith served as the President of Bank of America East, a financial institution, from October 1998 to September 2000. From July 1991 to October 1998, Mr. Smith served as President of Nations Bank Carolinas, a financial institution. Mr. Smith serves on the Boards of Directors of Ansaldo Signal N.V., Carolina National Bank & Trust Co., and NetBank, Inc. Mr. Smith received a B.A. degree from the University of the South in Sewanee, Tennessee. |

4

Incumbent Class I Directors Whose Terms Expire in 2003

Name

| | Age

| | Principal Occupation and Business Experience

|

|

| Walter Alessandrini | | 55 | | Chairman of the Board of Directors. Dr. Alessandrini has served on the Company’s Board of Directors since March 1999, and as Chairman of the Board of Directors since September 2000. He also served as Chairman of the Company from July 2001 to September 2002, Chief Executive Officer of the Company from March 1999 through June 2001 and as the Company’s President from March 1999 until September 2000. Dr. Alessandrini was President and Chief Executive Officer of Pirelli Cables and Systems North America LLC, a manufacturer of cables and communications systems, from November 1996 to March 1999. Dr. Alessandrini received a doctorate degree in Mechanical Engineering from the University of Genoa, Italy. |

|

| Paul Engle | | 56 | | President and Chief Executive Officer. Mr. Engle has served on the Company’s Board of Directors since February 2001, and as the Company’s President and Chief Executive Officer since July 2001. Mr. Engle joined the Company in September 2000 as President and Chief Operating Officer. Prior to joining the Company, Mr. Engle was Vice President and General Manager of the Fiber Optic Communications Division of Agilent Technologies, a communications infrastructure company, from November 1999 to September 2000. Mr. Engle served as a general manager of fiber optic components at Hewlett-Packard Company, a provider of computing and imaging solutions, from 1993 to November 1999. Mr. Engle holds a degree in Physics and Mathematics from Pan American University and a M.B.A. degree from the University of Dallas. |

Incumbent Class II Directors Whose Terms Expire in 2004

Name

| | Age

| | Principal Occupation and Business Experience

|

|

| Todd Brooks | | 41 | | General Partner at the Mayfield Fund. Mr. Brooks has served on the Company’s Board of Directors since February 1998. Mr. Brooks has been a general partner at the Mayfield Fund, a venture capital firm, since February 1999. From April 1995 to January 1999, Mr. Brooks served as a managing principal with JAFCO America Ventures, a venture capital firm. Mr. Brooks serves on the Boards of Directors of several privately-held companies. Mr. Brooks received a B.S. degree in Chemical Engineering from Texas A&M University, graduate degrees in Electrical Engineering and Chemical Engineering from the University of California at Berkeley and an M.B.A. degree from the Harvard Business School. |

5

Name

| | Age

| | Principal Occupation and Business Experience

|

|

| Vinton Cerf | | 59 | | Senior Vice President for Internet Architecture and Technology for WorldCom. Dr. Cerf has served on the Company’s Board of Directors since December 1999. Dr. Cerf has served as the Senior Vice President for Internet Architecture and Technology for WorldCom (formerly MCI WorldCom Corporation), a telecommunications company, since September 1998. From January 1996 to September 1998, Dr. Cerf was the Senior Vice President for Internet Architecture and Engineering at WorldCom. Dr. Cerf serves on the Boards of Directors of Nuance Communications, Inc. and CoSine Communications, Inc., as well as several privately-held companies. Dr. Cerf received a B.S. degree in Mathematics from Stanford University, an M.S. degree in Computer Science from the University of California, Los Angeles, and a Ph.D. degree in Computer Science from the University of California, Los Angeles. |

Board Meetings and Committees

During the fiscal year ended June 30, 2002, the Board of Directors of the Company met 11 times and no director attended fewer than 75% of the total number of meetings of the Board of Directors and the committees of which he was a member, if any.

The Company’s Board of Directors currently has four standing committees: an Audit Committee, a Compensation Committee, an Option Committee and a Governance and Nominating Committee. The following describes each committee, its current membership, the number of meetings held during the fiscal year ended June 30, 2002 and its function.

Audit Committee. The Audit Committee currently consists of Mr. Smith, Dr. Cerf and Dr. Faggin, each of whom is independent as defined under the rules of the Nasdaq Stock Market. The Audit Committee met 6 times during the fiscal year ended June 30, 2002. The Board has adopted a written charter for the Audit Committee. The Audit Committee makes recommendations regarding the selection of independent auditors, reviews the results and scope of audit and other services provided by the independent auditors, reviews the Company’s accounting principles, its systems of internal accounting controls and procedures to be used in preparing the Company’s financial statements, and receives and considers comments from the independent auditors on the Company’s internal audit controls and addresses other matters which may come before it or as directed by the Board of Directors.

Meetings of the Audit Committee are frequently attended by the Company’s independent auditors. The Audit Committee meets with the Company’s independent auditors to approve the annual scope of the audit services to be performed, and, on a quarterly basis following completion of their quarterly reviews and annual audit and prior to the Company’s earnings announcements, to review the results of their work.

Compensation Committee. The Compensation Committee currently consists of Mr. Brooks, Dr. Cerf and Dr. Faggin. The Compensation Committee met 4 times during the fiscal year ended June 30, 2002. The Board has adopted a written charter for the Compensation Committee. The Compensation Committee reviews and approves the compensation and benefits for the Company’s executive officers, administers the Company’s stock plans and performs such other duties as may from time to time be determined by the Board.

Option Committee. The Option Committee currently consists of Mr. Engle. The Board has adopted a written charter for the Option Committee. The Option Committee is responsible for granting, on behalf of the

6

Board of Directors, to employees other than officers and directors, options to purchase Common Stock of the Company, pursuant to guidelines established by the Compensation Committee. The Option Committee fulfilled all of its duties through actions by written consent during the last fiscal year.

Governance and Nominating Committee. The Governance and Nominating Committee was established in August 2002 and currently consists of Dr. Alessandrini, Dr. Faggin and Mr. Brooks. The Governance and Nominating Committee will make recommendations regarding various corporate governance matters including succession plans for the Company’s officers, candidates to serve as directors of the Company, and compensation to be received for service on the Company’s Board. The Governance and Nominating Committee will also review the Company’s code of ethics for its senior financial officers. The Governance and Nominating Committee will also consider nominees for the Board of Directors submitted by the stockholders of the Company.

Director Compensation

Directors do not receive cash compensation for service on the Board of Directors or any committee thereof. Directors are eligible to receive options to purchase the Company’s Common Stock pursuant to the Company’s 1998 Stock Plan and 1999 Director Option Plan.

The 1999 Director Option Plan provides for annual automatic grants of nonqualified stock options to continuing non-employee directors. Under the 1999 Director Option Plan, each non-employee director will receive a nonqualified stock option grant of 40,000 shares of the Company’s Common Stock upon his or her initial election to the Board of Directors (an “Initial Grant”). On the date of each annual stockholders’ meeting, each individual who is at the time continuing to serve as a non-employee director will automatically be granted an option to purchase 10,000 shares of the Company’s Common Stock (a “Subsequent Grant”). All options automatically granted to non-employee directors will have an exercise price equal to 100% of the fair market value of the Company’s Common Stock on the date of grant. Each Initial Grant shall vest and become exercisable in four equal annual installments and each Subsequent Grant shall vest and become exercisable on the first anniversary of the grant date.

During the fiscal year ended June 30, 2002, the Company granted to each of Mr. Brooks, Dr. Cerf, Dr. Faggin and Mr. Smith an option to purchase 10,000 shares of the Company’s Common Stock under the 1999 Director Option Plan. Each option had an exercise price of $4.55 per share. In addition, the Board of Directors granted to each of Mr. Brooks, Dr. Cerf, Dr. Faggin and Mr. Smith an option to purchase 7,500 shares of the Company’s Common Stock pursuant to the Company’s 1998 Stock Plan. The options each had an exercise price of $4.89 per share, which is equal to 100% of the fair market value of the Company’s Common Stock on the date of grant, and vest and become exercisable on the first anniversary of the grant date.

Stock option agreements entered into by Mr. Brooks, Dr. Cerf, Dr. Faggin and Mr. Smith were amended to extend their exercise periods until two years after the termination of such person’s service with Avanex, but in no event beyond the options’ normal expiration dates.

7

PROPOSAL TWO

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Board of Directors has appointed Ernst & Young LLP as independent auditors of the Company to audit the consolidated financial statements of the Company for fiscal year 2003 and has determined that it would be desirable to request that the stockholders ratify such appointment.

The decision of the Board to appoint Ernst & Young LLP was based on the recommendation of the Audit Committee. Before making its recommendation to the Board, the Audit Committee carefully considered that firm’s qualifications as independent auditors. This included a review of the qualifications of the engagement team, the quality control procedures the firm has established, and any issues raised by the most recent quality control review of the firm, as well as its reputation for integrity and competence in the fields of accounting and auditing. The Audit Committee’s review also included matters required to be considered under the SEC’s Rules on Auditor Independence, including the nature and extent of non-audit services, to ensure that they will not impair the independence of the accountants. The Audit Committee expressed it satisfaction with Ernst & Young LLP in all of these respects.

Although ratification by stockholders is not required by law, the Board has determined that it is desirable to request ratification of this selection by the stockholders. Notwithstanding its selection, the Board, in its discretion, may appoint new independent auditors at any time during the year if the Board believes that such a change would be in the best interests of Avanex and its stockholders. If the stockholders do not ratify the appointment of Ernst & Young LLP, the Board may reconsider its selection.

Ernst & Young LLP has audited the Company’s financial statements since the Company’s inception. A representative of Ernst & Young LLP is expected to be present at the Annual Meeting with the opportunity to make a statement if he or she desires to do so, and is expected to be available to respond to appropriate questions.

The Board of Directors recommends a vote “FOR” this proposal.

Fee Disclosure

Audit Fees. The aggregate fees billed by Ernst & Young LLP for professional services rendered for the audit of the Company’s annual financial statements for the fiscal year ended June 30, 2002, and for the reviews of the financial statements included in the Company’s Quarterly Reports on Form 10-Q for that year, were $514,000.

Financial Information Systems Design and Implementation Fees. Ernst & Young LLP did not render any services related to financial information systems design and implementation for the fiscal year ended June 30, 2002.

All Other Fees. The aggregate fees billed by Ernst & Young LLP for services rendered to the Company for the fiscal year ended June 30, 2002, other than for services described above, were $784,000. These other services consisted of audit and tax related services, such as review of SEC registration statements, tax compliance and consultations on accounting and tax matters.

8

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information concerning the beneficial ownership of Avanex’s Common Stock as of September 6, 2002, for the following: (1) each person or entity who is known by the Company to own beneficially more than 5% of the outstanding shares of the Company’s Common Stock, (2) each of the Company’s directors; (3) each of the executive officers named in the Summary Compensation Table; and (4) all directors and executive officers of the Company as a group.

Name

| | Common Stock Beneficially Owned(1)

| | Percentage Beneficially Owned(2)

| |

Capital Group International(3) 11100 Santa Monica Boulevard 15th Floor Los Angeles, California 90025 | | 6,479,930 | | 9.3 | % |

| Walter Alessandrini(4) | | 4,701,149 | | 6.7 | |

| Todd Brooks(5) | | 85,749 | | * | |

| Vinton Cerf(6) | | 58,125 | | * | |

| Federico Faggin(7) | | 68,700 | | * | |

| Joel Smith(8) | | 78,700 | | * | |

| Paul Engle(9) | | 1,741,071 | | 2.5 | |

| Xiaofan Cao(10) | | 2,095,156 | | 3.0 | |

| Xiaoping Mao(11) | | 706,248 | | 1.0 | |

| Giovanni Barbarossa(12) | | 371,676 | | * | |

| Paul Jiang(13) | | 847,937 | | 1.2 | |

| All directors and executive officers as a group (13 persons)(14) | | 11,972,905 | | 16.6 | |

| * | Less than one percent of the outstanding Common Stock. |

| (1) | The number and percentage of shares beneficially owned is determined in accordance with Rule 13d-3 of the Exchange Act, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rule, beneficial ownership includes any shares over which the individual or entity has voting power or investment power and any shares of Common Stock that the individual has the right to acquire within 60 days of September 6, 2002, through the exercise of any stock option or other right. Unless otherwise indicated in the footnotes, each person or entity has sole voting and investment power (or shares such powers with his or her spouse) with respect to the shares shown as beneficially owned. |

| (2) | The total number of shares of Common Stock outstanding as of September 6, 2002 was 69,687,516. |

| (3) | This information was obtained from filings made with the SEC pursuant to Section 13(g) of the Exchange Act. |

| (4) | Represents 4,351,388 shares held by the Alessandrini Family Trust dtd 7/20/00, of which Dr. Alessandrini is a trustee and over which he shares voting and dispositive power, 116,587 shares held by the C.J. Alessandrini Trust dtd 11/22/99, of which Dr. Alessandrini is a trustee and over which he shares voting and dispositive power, 116,587 shares held by the E.F. Alessandrini Trust dtd 11/22/99, of which Dr. Alessandrini is a trustee and over which he shares voting and dispositive power, and 116,587 shares held by the V. Alessandrini Trust dtd 11/22/99, of which Dr. Alessandrini is a trustee and over which he shares voting and dispositive power. |

| (5) | Represents 58,249 shares held by Mr. Brooks individually and 27,500 shares issuable pursuant to options exercisable within 60 days of September 6, 2002. |

| (6) | Represents 2,292 shares held by Dr. Cerf individually and 55,833 shares issuable pursuant to options exercisable within 60 days of September 6, 2002. |

| (7) | Represents 40,000 shares held by Dr. Faggin individually, 1,200 shares held by his spouse, and 27,500 shares issuable pursuant to options exercisable within 60 days of September 6, 2002. |

9

| (8) | Represents 50,000 shares held by Mr. Smith individually, 1,200 shares held by his spouse and 27,500 shares issuable pursuant to options exercisable within 60 days of September 6, 2002. |

| (9) | Represents 762,500 shares held by Mr. Engle individually and 978,571 shares issuable pursuant to options exercisable within 60 days of September 6, 2002. |

| (10) | Represents 2,055,156 shares held by the Xiaofan Cao and Whitney Lu Family Trust u/a 10/19/00, of which Dr. Cao is a trustee and over which he shares voting and dispositive power, and 40,000 shares owned by his spouse. Dr. Cao resigned as a director, officer and employee of Avanex effective as of June 30, 2002. |

| (11) | Represents 168,750 shares held by Mr. Mao individually and 537,498 shares issuable pursuant to options exercisable within 60 days of September 6, 2002. |

| (12) | Represents 728 shares held by Mr. Barbarossa individually and 370,948 shares issuable pursuant to options exercisable within 60 days of September 6, 2002. |

| (13) | Represents 677,194 shares held by Mr. Jiang individually and 110,000 shares held by the E. W. Z. Jiang Trust u/i dtd 10/22/99, of which Mr. Jiang is a trustee and over which he shares voting and dispositive power, and 62,500 shares issuable pursuant to options exercisable within 60 days of September 6, 2002. |

| (14) | Includes 2,222,850 shares of Common Stock issuable upon the exercise of options exercisable within 60 days of September 6, 2002. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act (“Section 16(a)”) requires the Company’s executive officers and directors, and persons who own more than ten percent (10%) of a registered class of the Company’s equity securities (“10% Stockholders”), to file reports of ownership on Form 3 and changes in ownership on Form 4 or 5 with the SEC and the Nasdaq Stock Market. Such executive officers, directors and 10% Stockholders are also required by SEC rules to furnish the Company with copies of all Section 16(a) forms they file.

Based solely on its review of the copies of such reports furnished to the Company and written representations that no other reports were required to be filed during the fiscal year ended June 30, 2002, the Company believes that its executive officers, directors and 10% Stockholders have complied with all filing requirements applicable to them, with the following exceptions: Dr. Alessandrini filed a late Form 4 reporting 10 transactions in November 2001, Mr. Barbarossa filed a late Form 4 reporting 2 transactions in November 2001, Dr. Cao filed a late Form 4 reporting 10 transactions in November 2001, Jessy Chao filed a late Form 4 reporting 5 transactions in November 2001, Mr. Engle filed a late Form 4 reporting 3 transactions in November 2001, Anthony Florence filed a late Form 4 reporting 3 transactions in November 2001, Mr. Jiang filed a late Form 4 reporting 6 transactions in November 2001, Mr. Mao filed a late Form 4 reporting 6 transactions in November 2001, and Margaret Quinn filed a late Form 4 reporting 3 transactions in November 2001.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

The Company’s Compensation Committee is currently composed of Mr. Brooks, Dr. Cerf and Dr. Faggin. No interlocking relationship exists between any member of the Company’s Compensation Committee and any member of the compensation committee of any other company, nor has any such interlocking relationship existed in the past. No member of the Compensation Committee is or was formerly an officer or an employee of the Company.

10

EQUITY COMPENSATION PLAN INFORMATION

The following table summarizes the number of outstanding options granted to employees and directors, as well as the number of securities remaining available for future issuance, under the Company’s compensation plans.

| | | (a) | | (b) | | (c) | |

Plan Category

| | Number of securities to be issued upon exercise of outstanding options, warrants and rights

| | Weighted-average exercise price of outstanding options, warrants and rights ($)

| | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

| |

| Equity compensation plans approved by security holders(1) | | 12,319,357 | | 11.61 | | 5,904,287 | (2) |

| Equity compensation plans not approved by security holders(3) | | 377,791 | | 3.91 | | — | |

| | |

| |

| |

|

|

| Total | | 12,697,148 | | 11.38 | | 5,904,287 | |

| (1) | | The Company’s 1998 Stock Plan provides that on the first day of the Company’s fiscal year the number of shares authorized under the plan shall be increased by the lesser of (i) 6,000,000 shares, (ii) 4.9% of the outstanding shares on such date or (iii) a lesser amount determined by the Board of Directors. The Company’s 1999 Director Option Plan provides that on the first day of the Company’s fiscal year the number of shares authorized under the plan shall be increased by the lesser of (i) 150,000 shares, (ii) 1/4 of 1% of the outstanding shares on such date or (iii) a lesser amount determined by the Board of Directors. The Company’s 1999 Employee Stock Purchase Plan provides that on the first day of the Company’s fiscal year the number of shares authorized under the plan shall be increased by the lesser of (i) 750,000 shares, (ii) 1% of the outstanding shares on such date or (iii) a lesser amount determined by the Board of Directors. |

| (2) | | Included in this amount are 1,651,623 shares available for future issuance under the Company’s 1999 Employee Stock Purchase Plan. |

| (3) | | These amounts represent outstanding options assumed in connection with previous business mergers and acquisitions. For a description of the plans under which the options were assumed see Note 9. “Stockholders Equity” in the Notes to the Company’s Consolidated Financial Statements in the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2002. |

11

EXECUTIVE COMPENSATION

Summary Compensation Table

The following table presents information concerning the total compensation of the Chief Executive Officer and certain other executive officers of Avanex (collectively, the “Named Executive Officers”) while employed by Avanex. The Avanex fiscal year ends on June 30.

The compensation of the Company’s Chief Executive Officer, which is shown in the table below, is comprised of (i) salary, (ii) bonus, which includes a loan/bonus arrangement entered into at the commencement of Mr. Engle’s employment, (iii) stock options and (iv) restricted stock awards granted to Mr. Engle in fiscal years 2001 and 2002 which vest over periods of 24 to 48 months based upon his continued employment. The table shows (i) the value of the restricted stock on the date of grant based upon the fair market value of the Company’s Common Stock on the date of such grant (notwithstanding the vesting requirements of such shares) and (ii) the value of the restricted stock held by Mr. Engle as of June 30, 2002, based upon the fair market value of the Company’s Common Stock on such date (notwithstanding the vesting requirements of such shares). The value of the unvested restricted stock held by Mr. Engle on June 30, 2002 was $1,479,251.

| | | | | | | | | | Long-Term Compensation Awards

| |

| | | | | | | | | | | | Restricted Stock Awards

| |

| | | | | Annual Compensation

| | | Number of Shares Underlying Options

| | Fair Market Value on Date of Grant ($)

| | | Fair Market Value of Shares Held on June 30, 2002 ($)

| |

| | | | | | | |

Name and Principal Position

| | Year

| | Salary ($)

| | Bonus ($)

| | | | |

Paul Engle(1) President, Chief Executive Officer and Director | | 2002 2001 2000 | | 339,916 269,240 — | | 386,603 76,550 — | (2) (5) | | 1,400,000 1,600,000 — | | 7,199,000 7,878,060 — | (3) (6) | | 1,364,063 115,188 | (4) (4) |

|

Xiaofan Cao(7) Former Chief Technology Officer, Senior Vice President Business Development and Director | | 2002 2001 2000 | | 252,668 199,052 169,244 | | — — — | | | 1,000,000 — — | | — — — | (8) | | | |

|

Xiaoping Mao Senior Vice President, Sales and Marketing | | 2002 2001 2000 | | 189,327 156,159 138,707 | | — — — | | | 500,000 110,000 225,000 | | — — — | | | | |

|

Giovanni Barbarossa Chief Technology Officer and Senior Vice President, Product Development | | 2002 2001 2000 | | 182,019 144,227 140,000 | | — — — | | | 750,000 31,990 150,000 | | — — — | | | | |

|

Paul Jiang Senior Vice President, Manufacturing and Supplier Management | | 2002 2001 2000 | | 179,567 173,585 138,706 | | — — — | | | 250,000 — — | | — — — | (9) | | | |

| (1) | Mr. Engle joined the Company in September 2000 as President and Chief Operating Officer, and became Chief Executive Officer in July 2001. Pursuant to the terms of his employment offer, Mr. Engle is entitled to receive an annual salary of $350,000 with an annual performance-based bonus of up to $175,000. |

| (2) | In September 2000, in accordance with the terms of his employment offer, the Company loaned Mr. Engle $150,000 pursuant to a promissory note with an annual interest rate of 6.5%. Principal and interest on the note were to become due and payable at the earlier of one year from the date of the note or the termination of Mr. Engle’s employment. Further, pursuant to the terms of Mr. Engle’s employment with the Company, |

12

| | upon the completion of one year of employment, the Company was to pay Mr. Engle a bonus of $150,000, either in cash or by cancellation of Mr. Engle’s debt to the Company. In either case the Company agreed to provide Mr. Engle with a gross-up payment to provide for any state or federal tax liability associated with the bonus or loan cancellation (Mr. Engle paid interest of $9,908.44 directly to the Company). This gross-up plus the principal amounted to $299,103. In addition Mr. Engle received $87,500 in additional bonus payments. |

| (3) | On August 16, 2001, Mr. Engle purchased 1,000,000 shares of restricted stock at par value, $0.001 per share. The fair market value of the Company’s Common Stock on such date was $7.20 per share. Pursuant to the restricted stock award agreement, as amended, the shares vest according to the following schedule: 250,000 shares vested on August 16, 2001, and 46,875 shares vested on November 16, 2001. The remaining 703,125 shares will vest over a 34-month period beginning on November 5, 2002. As of June 30, 2002, Mr. Engle held an aggregate of 762,500 shares of restricted stock, which had an aggregate fair market value of $1,479,251. The Company does not anticipate paying a dividend on its Common Stock. |

| (4) | Based on the fair market value of the Company’s Common Stock of $1.94 on June 30, 2002 and the number of shares held on such date. |

| (5) | Mr. Engle received a pro rata portion of his annual performance-based bonus for the period from September 19, 2000 to June 30, 2001. |

| (6) | On September 19, 2000, Mr. Engle was granted 50,000 shares of Common Stock. The fair market value of the Company’s Common Stock on such date was $125.81 per share. Pursuant to the restricted stock award agreement, as amended, these shares vest according to the following schedule: 12,500 shares vested on August 19, 2001, and 3,125 shares vested on November 19, 2001. The remaining 34,375 shares will vest over a 22-month period beginning on November 5, 2002. On February 14, 2001, Mr. Engle purchased 40,000 shares of restricted stock at par value, $0.001 per share. The fair market value of the Company’s Common Stock on such date was $39.69. Pursuant to the restricted stock award agreement, as amended, these shares vest according to the following vesting schedule: 5,000 shares vested on each of May 14, 2001, August 14, 2001 and November 14, 2001. The remaining 25,000 shares will vest over a three-month period beginning on November 5, 2002. As of June 30, 2002, Mr. Engle held an aggregate of 762,500 shares of restricted stock, which had an aggregate fair market value of $1,479,251. The Company does not anticipate paying a dividend on its Common Stock. |

| (7) | Dr. Cao resigned as a director, officer and employee of Avanex effective as of June 30, 2002. |

| (8) | In August 1999, Dr. Cao purchased 900,000 shares of restricted stock at $0.10 per share (the fair market value on the date of purchase). These shares are subject to the Company’s right of repurchase, which lapses over four years. Such repurchase right lapsed as to one-fourth of his shares on June 17, 2000, and lapses pro rata monthly thereafter. In addition, on October 1999, Dr. Cao purchased 1,020,726 shares of restricted stock at $0.39 per share. These shares are subject to the Company’s right of repurchase which lapses over four years. The right of repurchase lapsed as to one-fourth of his shares on October 8, 2000, and lapses pro rata monthly thereafter. As of June 30, 2002, Dr. Cao held an aggregate of 565,242 shares of restricted Common Stock, which had an aggregate fair market value of $1,096,569. Pursuant to the provisions of Dr. Cao’s restricted stock purchase agreements, the Company has exercised its repurchase option as to 565,242 shares of the Company’s Common Stock, for an aggregate repurchase price of $155,194. |

| (9) | In July 1999, Mr. Jiang purchased 450,000 shares of restricted stock at $0.03 per share (the fair market value on the day of purchase). These shares are subject to the Company’s right of repurchase, which lapses over four years. Such repurchase right lapsed as to one-fourth of his shares on February 8, 1999, and lapses pro rata monthly thereafter. In addition, on November 1999, Mr. Jiang purchased 150,000 shares of restricted stock at $2.67 per share. These shares are subject to the Company’s right of repurchase which lapses over four years. The right of repurchase lapsed as to one-fourth of his shares on November 23, 2000, and lapses pro rata monthly thereafter. As of June 30, 2002, Mr. Jiang held an aggregate of 53,125 shares of restricted Common Stock, which had an aggregate fair market value of $103,063. |

13

Option Grants in Last Fiscal Year

The following table sets forth, as to the Named Executive Officers, information concerning stock options granted during the fiscal year ended June 30, 2002.

Name

| | Number of Shares Underlying Options Granted(1)

| | % of Total Options Granted to Employees in Year(2)

| | | Exercise Price Per Share

| | Market Price on Date of Grant

| | Expiration Date(3)

| | Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term(4)

|

| | | | | | | 0%

| | 5%

| | 10%

|

| Paul Engle | | 1,400,000 | | 15.89 | % | | $ | 4.90 | | $ | 4.90 | | 11/4/2011 | | 0 | | 4,314,217 | | 10,933,073 |

|

| Xiaofan Cao(5) | | 1,000,000 | | 11.35 | % | | $ | 4.90 | | $ | 4.90 | | 11/4/2011 | | 0 | | 3,081,584 | | 7,809,338 |

|

| Xiaoping Mao | | 500,000 | | 5.67 | % | | $ | 4.90 | | $ | 4.90 | | 11/4/2011 | | 0 | | 1,540,792 | | 3,904,669 |

|

| Giovanni Barbarossa | | 350,000 200,000 200,000 | | 3.97 2.27 2.27 | % % % | | $ $ $ | 4.90 2.45 7.45 | | $ $ $ | 4.90 4.90 7.45 | | 11/4/2011 11/4/2011 8/13/2011 | | 0 490,000 0 | | 1,078,544 1,106,317 937,053 | | 2,733,268 2,051,868 2,374,676 |

|

| Paul Jiang | | 250,000 | | 2.84 | % | | $ | 4.90 | | $ | 4.90 | | 11/4/2011 | | 0 | | 770,396 | | 1,952,335 |

| (1) | The options in this table are incentive stock options or nonstatutory stock options granted under the Company’s 1998 Stock Plan. All of these options have 10 year terms and vest over a four year period at the rate of one-fourth of the shares subject to each option at the end of one year from the date of grant and 1/48th each month thereafter, except that the option to purchase 200,000 shares of the Company’s Common Stock for $7.45 per share held by Dr. Barbarossa vests over a four year period at the rate of 6/48ths of the shares subject to the option at the end of six months from the date of grant and 1/48th each month thereafter, and the option to purchase 200,000 shares of the Company’s Common Stock for $2.45 per share held by Dr. Barbarossa vests as to 50% of the shares subject to the option on the date of grant and as to the remaining 50% of the shares subject to the option on the one year anniversary of the date of grant. Immediately upon a change of control of the Company, each of the options in this table will become vested and exercisable as to 50% of the shares underlying such option, if such options are not already vested. Upon or within twelve (12) months of a change of control, if any such individual’s employment terminates as a result of an involuntary termination (other than for cause), each such option will become fully vested. In addition, in the event that either the Company terminates Mr. Engle’s employment without cause or Mr. Engle is subjected to a constructive termination, then Mr. Engle will receive six months of accelerated vesting. |

| (2) | Avanex granted options to employees to purchase 8,813,170 shares of Common Stock in the fiscal year ended June 30, 2002. |

| (3) | The options in this table may terminate before their expiration upon the termination of the optionee’s status as a director, employee or consultant or upon the optionee’s disability or death. |

| (4) | Under rules promulgated by the SEC, the amounts in these three columns represent the hypothetical gain or “option spread” that would exist for the options in this table based on assumed stock price appreciation from the date of grant until the end of such options’ ten-year term at assumed annual rates of 0%, 5% and 10%. Annual compounding results in total appreciation of 63% (at 5% per year) and 159% (at 10% per year). The 0%, 5% and 10% assumed annual rates of appreciation are specified in SEC rules and do not represent the Company’s estimate or projection of future stock price growth. The Company does not necessarily agree that this method can properly determine the value of an option, and there can be no assurance that the potential realizable values shown in this table will be achieved. |

| (5) | Dr. Cao resigned as a director, officer and employee of Avanex effective as of June 30, 2002. |

14

Option Exercises and Holdings

The following table sets forth, as to the Named Executive Officers, certain information concerning the number of shares of the Company’s Common Stock subject to both exercisable and unexercisable stock options as of June 30, 2002. Also reported are values for “in-the-money” options that represent the positive spread between the respective exercise prices of outstanding stock options and the fair market value of the Company’s Common Stock as of June 30, 2002.

| | | Shares Acquired on Exercise

| | Value Realized

| | Number of Shares Underlying Unexercised Options at Year-End

| | Value of Unexercised In-The-Money Options at Year-End(1)

|

Name

| | | | Exercisable

| | Unexercisable

| | Exercisable

| | Unexercisable

|

| Paul Engle | | — | | | — | | 499,047 | | 2,500,953 | | | — | | | — |

| Xiaofan Cao(2) | | — | | | — | | — | | — | | | — | | | — |

| Xiaoping Mao | | 450,000 | | $ | 353,800 | | 315,103 | | 766,147 | | $ | 375,315 | | $ | 214,875 |

| Giovanni Barbarossa | | 100,000 | | $ | 585,000 | | 147,825 | | 671,665 | | | — | | | — |

| Paul Jiang | | — | | | — | | — | | 250,000 | | | — | | | — |

| (1) | The market value of underlying securities is based on the closing price of the Company’s Common Stock on June 28, 2002 (the last trading day of the Company’s 2002 fiscal year). |

| (2) | Dr. Cao resigned as a director, officer and employee of Avanex effective as of June 30, 2002. |

EMPLOYMENT AND CHANGE OF CONTROL ARRANGEMENTS

Pursuant to the terms of his employment offer, Mr. Engle is entitled to receive an annual salary of $350,000 and an annual performance-based bonus of up to $175,000. The Company also loaned $150,000 to Mr. Engle upon commencement of his employment. The loan was cancelled by the Company in September 2001. See “Certain Transactions — Loans to Executive Officers and Directors.”

Pursuant to the restricted stock award agreements between Avanex and Mr. Engle dated September 19, 2000, February 14, 2001, and August 16, 2001, pursuant to which Mr. Engle acquired an aggregate of 1,090,000 shares of Common Stock, immediately upon a change of control the restricted stock subject to such restricted stock award agreements will become vested as to 50% of the shares subject to such agreements, if such shares are not already so vested. Upon or within twelve (12) months of a change of control, if Mr. Engle’s employment terminates as a result of an involuntary termination (other than for cause), all of the restricted stock subject to such restricted stock award agreements will become fully vested. In the event that either the Company terminates Mr. Engle’s employment without cause or Mr. Engle is subjected to a constructive termination, then Mr. Engle will receive six months of accelerated vesting and six months’ salary and bonus.

Each of the stock option agreements between the Company and Messrs. Engle, Barbarossa, Jiang and Mao provide that immediately upon a change of control, each such option will become vested and exercisable as to 50% of the shares underlying such option, if such options are not already so vested. Upon or within twelve (12) months of a change of control, if any such individual’s employment terminates as a result of an involuntary termination (other than for cause), each such option will become fully vested. In addition, in the event that either the Company terminates Mr. Engle’s employment without cause or Mr. Engle is subjected to a constructive termination, then Mr. Engle will receive (i) the greater of six months of additional vesting or vesting through the first year cliff of his vesting schedule, and (ii) six months’ salary and bonus.

Option agreements entered into by each of the executive officers of Avanex after October 18, 2001 provide that such officers may exercise their options for up to twenty-four months following involuntary termination, other than for cause, upon or within 12 months after a change of control. In addition, the option agreements dated February 2, 2000, March 19, 2001, April 30, 2001 and August 14, 2001, between Avanex and Mr. Barbarossa, the option agreement dated April 30, 2001, between Avanex and Mr. Engle, the option agreements dated

15

April 17, 2001, between Avanex and Mr. Mao, and the option agreement dated July 23, 2000, between Avanex and Margaret Quinn have been amended to provide for the same extended exercise period.

The restricted stock purchase agreements between the Company and Mr. Jiang provide that, upon or within twelve (12) months of a change of control, if his employment terminates as a result of an involuntary termination (other than for cause), all of the restricted stock subject to such restricted stock purchase agreements will become fully vested.

CERTAIN TRANSACTIONS

Loans to Executive Officers and Directors

Jessy Chao, Vice President, Finance and Chief Financial Officer. In November 1999, in connection with Mr. Chao’s purchase of 150,000 shares of the Company’s Common Stock, the Company loaned Mr. Chao $400,000 under a secured full recourse promissory note with an annual interest rate of 6.2% compounded semi-annually. Principal and interest on the note become due and payable on November 26, 2004. The note also provides that the Company may accelerate payment of the amounts outstanding under the loan in the event Mr. Chao ceases to be an employee or consultant of the Company. The largest amount of principal and accrued interest outstanding on Mr. Chao’s loans during the period from the beginning of the Company’s last fiscal year to June 30, 2002, was $468,894, and as of September 1, 2002, $473,880 of principal and accrued interest remained outstanding.

Paul Engle, President, Chief Executive Officer and Director. In September 2000, in accordance with the terms of his employment offer, the Company loaned Mr. Engle $150,000 pursuant to a promissory note with an annual interest rate of 6.5%. Principal and interest on the note were to become due and payable at the earlier of one year from the date of the note or the termination of Mr. Engle’s employment. Further, pursuant to the terms of Mr. Engle’s employment with the Company, upon the completion of one year of employment, the Company was to pay Mr. Engle a bonus of $150,000 either in cash or by cancellation of Mr. Engle’s debt to the Company. In either case the Company agreed to provide Mr. Engle with a gross-up payment to provide for any state or federal tax liability associated with the bonus or loan cancellation. The largest amount of principal and accrued interest outstanding on Mr. Engle’s loan during the period from the beginning of the Company’s last fiscal year to June 30, 2002, was $159,908. The loan was cancelled by the Company in September 2001 pursuant to the foregoing terms and Mr. Engle paid all interest that had accrued on the loan to the termination date in the amount of $9,908.

Paul Jiang, Senior Vice President, Manufacturing and Vendor Management. In July 1999, in connection with Mr. Jiang’s purchase of 450,000 shares of the Company’s Common Stock, Avanex loaned Mr. Jiang $11,700 under a secured full recourse promissory note with an annual interest rate of 5.69% compounded semi-annually. Principal and interest on the note were to become due and payable on July 22, 2003. The note also provides that the Company may accelerate payment of the amounts outstanding under the loan in the event Mr. Jiang ceases to be an employee or consultant to the Company. In July 1999, in consideration for Mr. Jiang’s continued employment with the Company, Avanex agreed to forgive 25% of the principal and accrued interest under the note on each one-year anniversary of July 22, 1999, for so long as Mr. Jiang remains an employee of the Company.

In November 1999, in connection with Mr. Jiang’s purchase of 150,000 shares of the Company’s Common Stock, Avanex loaned Mr. Jiang $400,000 under a secured full recourse promissory note with an annual interest rate of 6.2% compounded semi-annually. Principal and interest on the note become due and payable on November 26, 2004. The note also provides that the Company may accelerate payment of the amounts outstanding under the loan in the event Mr. Jiang ceases to be an employee or consultant of the Company. The largest amount of principal and accrued interest outstanding on all of Mr. Jiang’s loans during the period from the beginning of the Company’s last fiscal year to June 30, 2002 was $478,175, and as of September 1, 2002, $476,826 of principal and accrued interest remained outstanding.

16

Xiaofan Cao, Former Chief Technology Officer, Senior Vice President Business Development and Director. In August 1999, in connection with Dr. Cao’s purchase of 900,000 shares of the Company’s Common Stock, the Company loaned Dr. Cao $90,000 under a secured full recourse promissory note with an annual interest rate of 5.96% compounded semi-annually. Principal and interest on the note were to become due and payable on August 4, 2003. The note also provided that the Company may accelerate payment of the amounts outstanding under the loan in the event Dr. Cao ceased to be an employee or consultant to the Company. In August 1999, in consideration for Dr. Cao’s continued employment with the Company, Avanex agreed to forgive 25% of the principal and accrued interest under the note on each one-year anniversary of August 4, 1999, for so long as Dr. Cao remained an employee of the Company.

In October 1999, in connection with Dr. Cao’s purchase of 1,020,726 shares of the Company’s Common Stock, Avanex loaned Dr. Cao $394,681 under a secured full recourse promissory note with an annual interest rate of 6.02% compounded semi-annually. Principal and interest on the note were to become due and payable on October 12, 2003. The note also provided that the Company may accelerate payment of the amounts outstanding under the loan in the event Dr. Cao ceased to be an employee or consultant of the Company.

On June 30, 2002, Dr. Cao resigned as an employee of the Company and as a member of the Board of Directors. The largest amount of principal and accrued interest outstanding on all of Dr. Cao’s loans during the period from the beginning of the Company’s last fiscal year to June 30, 2002, was $535,539, and as of September 1, 2002, $516,684 of principal and accrued interest remained outstanding.

Brett Casebolt, Former Vice President, Business Development. In January 2000, in connection with Mr. Casebolt’s purchase of 195,000 shares of the Company’s Common Stock, the Company loaned him $2,535,000 under a secured full recourse promissory note with an annual interest rate of 6.21% compounded semi-annually. Principal and interest on the note were to become due and payable on January 31, 2005. The largest amount of principal and accrued interest outstanding on Mr. Casebolt’s loan during the period from the beginning of the Company’s last fiscal year to June 30, 2002, was $383,169. Mr. Casebolt resigned from the Company on July 16, 2001, and repaid the loans’ principal and accrued interest as of July 16, 2001.

Anthony Florence, Former Vice President, Corporate Marketing and External Relations. In November 1999, in connection with Mr. Florence’s purchase of 195,000 shares of the Company’s Common Stock, the Company loaned him $455,000 under a secured full recourse promissory note with an annual interest rate of 5.99% compounded semi-annually. The note also provided that Avanex could accelerate payment of the amounts outstanding under the loan in the event Mr. Florence ceased to be an employee or consultant of the Company.

Mr. Florence resigned as Vice President, Corporate Marketing and External Relations effective as of October 19, 2001. Pursuant to the terms of Mr. Florence’s separation agreement with the Company, the Company forgave $75,000 of the principal and accrued interest under Mr. Florence’s loan. The largest amount of principal and accrued interest outstanding under Mr. Florence’s loan during the period from the beginning of the Company’s last fiscal year to June 30, 2002, was $239,774. Mr. Florence repaid all remaining principal and accrued interest on the loan as of November 16, 2001.

James Pickering, Former Vice President, Quality. In October 1999, in connection with Mr. Pickering’s purchase of 263,880 shares of the Company’s Common Stock, the Company loaned him $102,034 under a secured full recourse promissory note with an annual interest rate of 5.54% compounded semi-annually. The largest amount of principal and accrued interest outstanding on Mr. Pickering’s loan during the period from the beginning of the Company’s last fiscal year to June 30, 2002 was $114,491. Mr. Pickering resigned from the Company on November 9, 2001, and repaid the loan’s principal and all accrued interest as of November 9, 2001.

17

Other Transactions

On July 1, 2001, Dr. Alessandrini accepted an offer to serve as Chairman of the Company for an annual salary of $100,000. Dr. Alessandrini resigned as an employee of the Company as of September 4, 2002. Dr. Alessandrini remains Chairman of the Company’s Board of Directors and currently receives no cash compensation for his service on the Board of Directors. As of May 14, 2002, Dr. Alessandrini held 1,314,763 shares of the Company’s Common Stock issued pursuant to restricted stock purchase agreements dated October 8, 1999, and March 26, 1999, that provide for a right of repurchase by the Company in the event that Dr. Alessandrini ceased being a service provider to the Company. On May 14, 2002, the Company’s Board of Directors released such shares from the Company’s right of repurchase.

Dr. Cao resigned as an employee and as a member of the Company’s Board of Directors effective as of June 30, 2002. Pursuant to the provisions of Dr. Cao’s restricted stock purchase agreements, the Company exercised its repurchase option as to 565,242 shares of the Company’s Common Stock, for an aggregate repurchase price of $155,194. The repurchase price was paid by the Company through the cancellation of indebtedness equal to $155,194.

In addition to being a director of the Company, Dr. Cerf is a Senior Vice President of WorldCom, Inc. WorldCom has in the past been a major customer of the Company and accounted for 16% of the Company’s revenue in the fiscal year ended June 30, 2002, 35% of the Company’s revenue in the fiscal year ended June 30, 2001 and 92% of the Company’s revenue in the fiscal year ended June 30, 2000.

On February 1, 2002, the vesting schedules of restricted stock award agreements between the Company and Mr. Engle dated September 19, 2000, February 14, 2001 and August 16, 2001, were amended to provide for monthly vesting, instead of quarterly vesting, beginning on April 5, 2002. The amendments also provided that any shares that would otherwise be scheduled to be released from the Mr. Engle’s forfeiture option from December 2001 to the effective date of a Rule 10b5-1 trading plan to be adopted by Mr. Engle would not be released from the forfeiture option on the dates otherwise scheduled. Instead, such shares would accumulate and be released in six equal weekly installments beginning on the fifth day of the calendar month that immediately follows the calendar month in which the results are announced for the Company’s fiscal quarter in which Mr. Engle adopted a Rule 10b5-1 trading plan.

Mr. Florence resigned as Vice President, Corporate Marketing and External Relations of the Company effective as of October 19, 2001. The Company exercised its repurchase option as to 62,563 shares of the Company’s Common Stock held by Mr. Florence for $2.34 per share and an aggregate repurchase price of $146,397. In addition, the Company released 39,000 shares of the Company’s Common Stock held by Mr. Florence from its repurchase option and forgave $75,000 of the principal of a loan from the Company to Mr. Florence.

18

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

With respect to the Company’s financial reporting process, the management of the Company is responsible for (1) establishing and maintaining internal controls and (2) preparing the Company’s consolidated financial statements. The independent auditors are responsible for auditing these financial statements. It is the responsibility of the Audit Committee to oversee these activities. The Board of Directors has determined that each member of the Audit Committee is “independent” as required by the listing standards of the Nasdaq National Market. The Board of Directors has adopted a written charter for the Audit Committee. In the performance of its oversight function, the Audit Committee has:

| | • | reviewed and discussed the audited financial statements with management; |

| | • | discussed with Ernst & Young LLP, the Company’s independent auditors, the matters required to be discussed by the Statement on Auditing Standards No. 61,Communication with Audit Committees, as currently in effect; |

| | • | received the written disclosures and the letter from the independent accountants required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees, as currently in effect; |

| | • | considered whether the provision of information technology consulting services relating to financial information systems design and implementation and other non-audit services by Ernst & Young LLP is compatible with maintaining Ernst & Young LLP’s independence and has discussed Ernst & Young LLP’s independence with them. |

Based upon the reports and discussions described in this Report, the Audit Committee recommended to the Board of Directors that the audited financial statements be included in the Company’s Annual Report on Form 10-K for the year ended June 30, 2002.

AUDIT COMMITTEE OF

THE BOARD OF DIRECTORS

Joel Smith

Vinton Cerf

Federico Faggin

19

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF DIRECTORS

The Company’s Compensation Committee was formed in April 1999 and currently consists of Mr. Brooks, Dr. Cerf and Dr. Faggin. The Compensation Committee generally reviews and approves the Company’s executive compensation policies, including the base salary levels and target incentives for the Company’s executive officers at the beginning of each year, and approves the performance objectives of the executive officers in their areas of responsibility. The Compensation Committee also administers the Company’s 1998 Stock Plan and the 1999 Employee Stock Purchase Plan. No member of the Compensation Committee is a former or current officer or employee of Avanex or any of its subsidiaries. Meetings of the Compensation Committee are also attended by members of management who provide background and market information and make recommendations to the Compensation Committee on salary levels, officer performance objectives, and corporate financial goals. However, members of management are not entitled to vote on any actions taken by the Compensation Committee.

Executive Officer Compensation Programs

The objectives of the executive officer compensation program are to attract, retain, motivate and reward key personnel who possess the necessary leadership and management skills, through competitive base salary, annual cash bonus incentives, long-term incentive compensation in the form of stock options, and various benefits, including medical and life insurance plans. The executive compensation policies of the Compensation Committee are intended to combine competitive levels of compensation and rewards for above average performance and to align relative compensation with the achievements of key business objectives, optimal satisfaction of customers, and maximization of stockholder value. The Compensation Committee believes that stock ownership by management is beneficial in aligning management and stockholder interests, thereby enhancing stockholder value.

Base Salaries. Salaries for the Company’s executive officers are determined primarily on the basis of the executive officer’s level of responsibility, general salary practices of peer companies and the officer’s individual qualifications and experience. The base salaries are regularly reviewed and may be adjusted by the Compensation Committee in accordance with certain criteria which include individual performance, the functions performed by the executive officer, the scope of the executive officer’s on-going duties, general changes in the compensation peer group in which the Company competes for executive talent, and the Company’s financial performance generally. The weight given each such factor by the Compensation Committee may vary from individual to individual.

Incentive Bonuses. The Compensation Committee believes that a cash incentive bonus plan can serve to motivate the Company’s executive officers and management to address annual performance goals, using more immediate measures for performance than those reflected in the appreciation in value of stock options. The bonus amounts are based upon the achievement of objective financial criteria and recommendations by the Chief Executive Officer based on subjective consideration of factors including such officer’s level of responsibility, individual performance, contributions to the Company’s success and the Company’s financial performance generally.

Stock Option Grants. Stock options may be granted to executive officers and other employees under the 1998 Stock Plan. Because of the direct relationship between the value of an option and the stock price, the Compensation Committee believes that options motivate executive officers to manage the Company in a manner that is consistent with stockholder interests. Stock option grants are intended to focus the attention of the recipient on the Company’s long-term performance which the Company believes results in improved stockholder value, and to retain the services of the executive officers in a competitive job market by providing significant long-term earnings potential. To this end, stock options generally vest and become fully exercisable over a four-year period. The principal factors considered in granting stock options to executive officers of the Company are prior performance, level of responsibility, other compensation and the executive officer’s ability to influence the

20

Company’s long-term growth and profitability. However, the 1998 Stock Plan does not provide any quantitative method for weighting these factors, and a decision to grant an award is primarily based upon a subjective evaluation of the past as well as future anticipated performance of the executive officer.

Other Compensation Plans. The Compensation Committee also administers certain general employee benefit plans in which executive officers are permitted to participate on parity with other employees. The Company also provides a 401(k) deferred compensation plan.

Deductibility of Compensation. The Compensation Committee has considered the potential effects of Section 162(m) of the Internal Revenue Code on the compensation paid to the Company's executive officers. Section 162(m) disallows a tax deduction for any publicly held corporation for individual compensation exceeding $1.0 million in any taxable year for any of the Named Executive Officers, unless compensation is performance-based. The Company has adopted a policy that, where reasonably practicable, the Company will seek to qualify the variable compensation paid to its executive officers for an exemption from the deductibility limitations of Section 162(m).

Chief Executive Officer Compensation

The compensation of the Chief Executive Officer is reviewed annually on the same basis as discussed above for all executive officers. Mr. Engle’s base salary for the year ended June 30, 2002 was $350,000, although Mr. Engle, and all other officers, voluntarily agreed to a one time 10% reduction in base salary during the first quarter of the fiscal year due to difficult business conditions. As a result, Mr. Engle’s actual salary was $339,916. Mr. Engle’s base salary was established in part by comparing the base salaries of chief executive officers at other companies of similar size. Mr. Engle’s base salary was at the median of the base salary range for chief executive officers of comparable companies. Mr. Engle also received a cash bonus in the amount of $87,500 for the year ended June 30, 2002. Mr. Engle was also granted an option to purchase 1,400,000 shares of the Company’s Common Stock and a restricted stock award of 1,000,000 shares in the year ended June 30, 2002. The option and the shares granted to Mr. Engle are subject to vesting over a four-year period. The Company also forgave a loan to Mr. Engle in the amount of $150,000 and provided $149,102 to pay his tax obligation relating to such loan forgiveness pursuant to the terms of Mr. Engle’s employment offer.

COMPENSATION COMMITTEE OF

THE BOARD OF DIRECTORS

Todd Brooks

Vinton Cerf

Federico Faggin

21

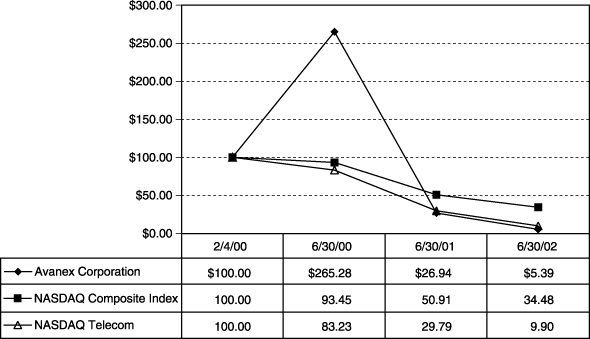

COMPANY STOCK PRICE PERFORMANCE GRAPH

The following graph compares the cumulative total return to stockholders on the Company’s Common Stock with the cumulative total return of the Nasdaq Composite (U.S. Companies) Index and the Nasdaq Telecom Index. The graph assumes that $100 was invested on February 4, 2000 (the date of the Company’s initial public offering) in the Company’s Common Stock and in each of the indices discussed above, including reinvestment of dividends. No dividends have been declared or paid on the Company’ Common Stock. Note that historic stock price performance is not necessarily indicative of future stock price performance. Also note that the stock price performance graph contained in the Company’s proxy statement for last year’s annual meeting of stockholders included the S&P Technology Index. The S&P Technology Index is no longer maintained and the Company has therefore substituted the Nasdaq Telecom Index for the S&P Technology Index.

22

OTHER MATTERS

The Board of Directors does not know of any other matters to be presented at the Annual Meeting. If any additional matters are properly presented at the Annual Meeting, the persons named in the enclosed proxy card will have discretion to vote shares they represent in accordance with their own judgment on such matters.