UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to § 240.14a-11(c) or § 240.14a-12 |

AVANEX CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | (1) | Amount Previously Paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

NOTICE OF 2005 ANNUAL MEETING OF STOCKHOLDERS

To Be Held on October 27, 2005

To Our Stockholders:

Notice is hereby given that the Annual Meeting of Stockholders (the “Annual Meeting”) of Avanex Corporation, a Delaware corporation (“Avanex”), will be held on October 27, 2005, at 10:00 a.m., local time, at Avanex’s corporate headquarters, 40919 Encyclopedia Circle, Fremont, California 94538, for the following purposes:

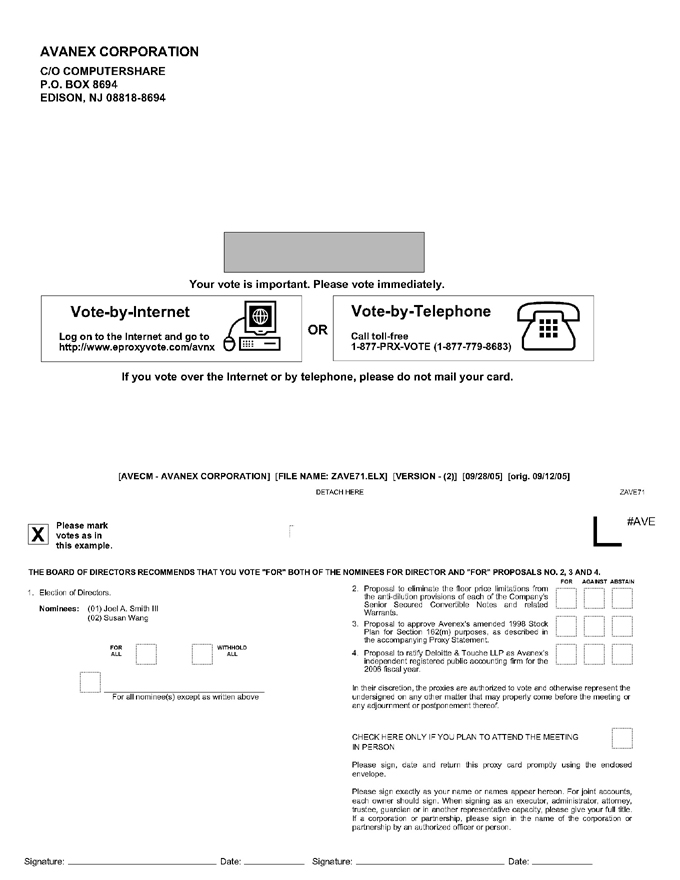

| | 1. | To elect two Class III directors for a term of three years or until their successors have been duly elected and qualified. |

| | 2. | To approve the elimination of the floor price limitations from the anti-dilution provisions of each of the Company’s Senior Secured Convertible Notes and related Warrants to purchase Common Stock. |

| | 3. | To approve Avanex’s amended 1998 Stock Plan so that awards granted thereunder can continue to qualify as “performance-based compensation” under Section 162(m) of the Internal Revenue Code. |

| | 4. | To ratify the appointment of Deloitte & Touche LLP as Avanex’s independent registered public accounting firm for the fiscal year ending June 30, 2006. |

| | 5. | To transact such other business as may properly come before the Annual Meeting or any adjournment or postponement thereof. |

These items of business are more fully described in the Proxy Statement accompanying this Notice of Annual Meeting.

Only holders of record of Avanex’s Common Stock at the close of business on September 15, 2005, the record date, are entitled to vote on the matters listed in this Notice of Annual Meeting.

All stockholders are cordially invited to attend the Annual Meeting in person. However, to ensure your representation at the Annual Meeting, please vote as soon as possible using one of the following methods: (1) by using the Internet as instructed on the enclosed proxy card, (2) by telephone as instructed on the enclosed proxy card, or (3) by mail by completing, signing, dating and returning the enclosed proxy card in the enclosed postage-prepaid envelope. For further details, please see the section entitled “Voting” on page two of the accompanying Proxy Statement. Any stockholder attending the Annual Meeting may vote in person even if he or she has voted using the Internet, telephone or proxy card.

By Order of the Board of Directors

of Avanex Corporation

Jo S. Major, Jr.

President, Chief Executive Officer and

Chairman of the Board of Directors

Fremont, California

October 3, 2005

WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE VOTE BY TELEPHONE OR BY USING THE INTERNET AS INSTRUCTED ON THE ENCLOSED PROXY CARD OR COMPLETE, SIGN, DATE, AND RETURN THE ENCLOSED PROXY CARD AS PROMPTLY AS POSSIBLE IN THE ENCLOSED ENVELOPE.

AVANEX CORPORATION

PROXY STATEMENT

FOR THE

2005 ANNUAL MEETING OF STOCKHOLDERS

PROCEDURAL MATTERS

General

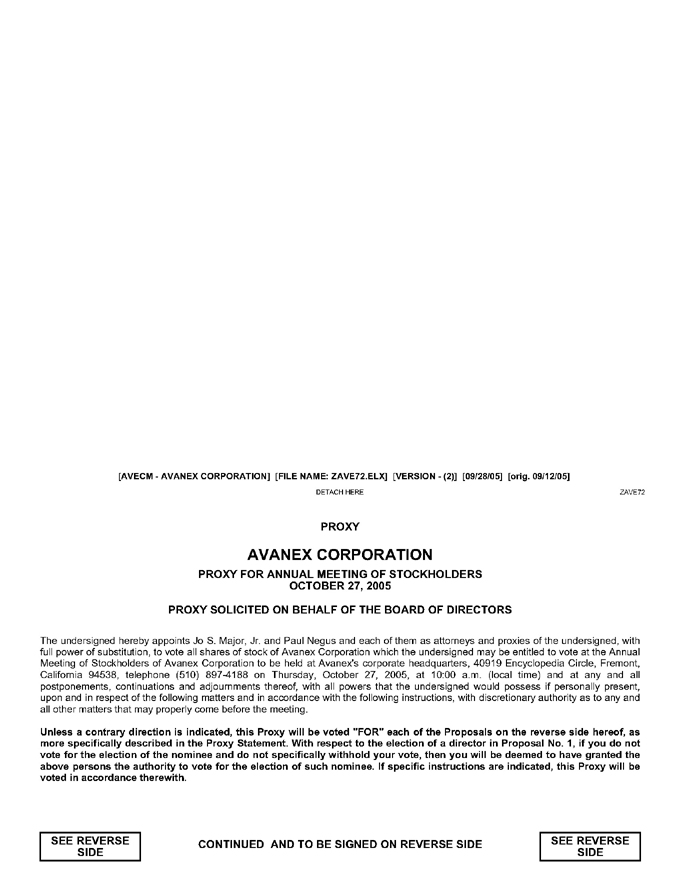

This Proxy Statement is being furnished to the holders of common stock, par value $0.001 per share (the “Common Stock”), of Avanex Corporation, a Delaware corporation (“Avanex” or the “Company”), in connection with the solicitation of proxies by the Board of Directors of Avanex for use at the Annual Meeting of Stockholders (the “Annual Meeting”) to be held on October 27, 2005, at 10:00 a.m., local time, and at any adjournment or postponement thereof, for the purpose of considering and acting upon the matters set forth herein. The Annual Meeting will be held at Avanex’s corporate headquarters, 40919 Encyclopedia Circle, Fremont, California 94538. The telephone number at that location is (510) 897-4188.

This Proxy Statement, the accompanying proxy card and the Company’s Annual Report on Form 10-K are first being mailed on or about October 3, 2005, to all stockholders entitled to vote at the Annual Meeting.

Stockholders Entitled to Vote; Record Date

Only holders of record of the Company’s Common Stock at the close of business on September 15, 2005 (the “Record Date”), are entitled to notice of and to vote at the Annual Meeting. Such stockholders are entitled to cast one vote for each share of Common Stock held as of the Record Date on all matters properly submitted for the vote of stockholders at the Annual Meeting. As of the Record Date, there were 145,465,099 shares of Common Stock outstanding and entitled to vote at the Annual Meeting. No shares of preferred stock were outstanding. For information regarding security ownership by management and by the beneficial owners of more than five percent of the Company’s Common Stock, see “Security Ownership of Certain Beneficial Owners and Management” beginning on page 24.

Quorum; Required Vote

The presence of the holders of a majority of the shares of Common Stock entitled to vote generally at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Such stockholders are counted as present at the Annual Meeting if they (1) are present in person at the Annual Meeting or (2) have properly submitted a proxy card or voted by telephone or by using the Internet. Under the General Corporation Law of the State of Delaware, an abstaining vote and a broker “non-vote” are counted as present and entitled to vote and are, therefore, included for purposes of determining whether a quorum is present at the Annual Meeting. A broker “non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that proposal and has not received instructions on how to vote from the beneficial owner.

A plurality of the votes duly cast is required for the election of directors. The affirmative vote of a majority of the votes duly cast is required to: (1) approve the elimination of the floor price limitations from the anti-dilution provisions of each of the Company’s Senior Secured Convertible Notes and related Warrants to purchase Common Stock, (2) approve Avanex’s amended 1998 Stock Plan for purposes of Section 162(m) of the Internal Revenue Code and (3) ratify the appointment of Deloitte & Touche LLP as the company’s independent registered public accounting firm. Abstentions are deemed to be “votes cast,” and have the same effect as a vote against these proposals. However, broker non-votes are not deemed to be votes cast, and therefore are not included in the tabulation of the voting results on these proposals.

1

Voting

Voting by Proxy Card. All shares entitled to vote and represented by properly executed proxy cards received prior to the Annual Meeting, and not revoked, will be voted at the Annual Meeting in accordance with the instructions indicated on those proxy cards. If no instructions are indicated on a properly executed proxy card, the shares represented by that proxy card will be voted as recommended by the Board of Directors. If any other matters are properly presented for consideration at the Annual Meeting, including, among other things, consideration of a motion to adjourn the Annual Meeting to another time or place (including, without limitation, for the purpose of soliciting additional proxies), the persons named in the enclosed proxy card and acting thereunder will have discretion to vote on those matters in accordance with their best judgment. The Company does not currently anticipate that any other matters will be raised at the Annual Meeting.

Voting by Telephone or the Internet. If you are a registered stockholder, you may vote your shares by calling the toll-free number indicated on the enclosed proxy card and following the recorded instructions or by accessing the website indicated on the enclosed proxy card and following the instructions provided. If your shares are registered in the name of a bank or brokerage firm, you may be eligible to vote your shares electronically over the Internet or by telephone. A large number of banks and brokerage firms are participating in the ADP Investor Communication Services online program. This program provides eligible stockholders who receive a paper copy of the annual report and proxy statement the opportunity to vote via the Internet or by telephone. If your bank or brokerage firm is participating in ADP’s program, your voting form will provide instructions. If your voting form does not reference Internet or telephone information, please complete and return the paper proxy card in the self-addressed postage paid envelope provided. When a stockholder votes via the Internet or by telephone, his or her vote is recorded immediately. Avanex encourages its stockholders to vote using these methods whenever possible.

Voting by Attending the Meeting. A stockholder may vote his or her shares in person at the Annual Meeting. A stockholder planning to attend the Annual Meeting should bring proof of identification for entrance to the Annual Meeting. If a stockholder attends the Annual Meeting, he or she may submit his or her vote in person, and any previous votes that were submitted by the stockholder, whether by Internet, telephone or mail, will be superseded by the vote that such stockholder casts at the Annual Meeting.

Changing Vote; Revocability of Proxies. If a stockholder has voted by telephone, over the Internet or by returning a proxy card, such stockholder may change his or her vote before the Annual Meeting.

A stockholder who has voted by telephone or over the Internet may later change his or her vote by making a timely and valid telephone or Internet vote, as the case may be.

A stockholder may revoke any proxy given pursuant to this solicitation at any time before it is voted by: (1) filing with the Secretary of the Company, at or before the taking of the vote at the Annual Meeting, a written notice of revocation or a duly executed proxy card, in either case dated later than the prior proxy relating to the same shares, or (2) attending the Annual Meeting and voting in person (although attendance at the Annual Meeting will not by itself revoke a proxy). Any written notice of revocation or subsequent proxy card must be received by the Secretary of the Company prior to the taking of the vote at the Annual Meeting. Such written notice of revocation or subsequent proxy card should be hand delivered to the Secretary of the Company or should be sent to Avanex Corporation, 40919 Encyclopedia Circle, Fremont, California 94538, Attention: Corporate Secretary.

Expenses of Solicitation

Avanex will bear all expenses of this solicitation, including the cost of preparing and mailing this solicitation material. The Company may reimburse brokerage firms, custodians, nominees, fiduciaries, and other persons representing beneficial owners of Common Stock for their reasonable expenses in forwarding solicitation material to such beneficial owners. Directors, officers and employees of the Company may also solicit proxies in

2

person or by telephone, letter, electronic mail, telegram, facsimile or other means of communication. Such directors, officers and employees will not be additionally compensated, but they may be reimbursed for reasonable out-of-pocket expenses in connection with such solicitation. The Company has retained the services of Morrow & Co., a professional proxy solicitation firm, to assist in the solicitation of proxies. Avanex will pay Morrow & Co. approximately $6,500 for its services, in addition to reimbursement of its out-of-pocket expenses.

Procedure for Submitting Stockholder Proposals

Requirements for Stockholder Proposals to be Considered for Inclusion in the Company’s Proxy Materials. Stockholders may present proper proposals for inclusion in the Company’s proxy statement and for consideration at the annual meeting of its stockholders to be held in 2006 by submitting their proposals in writing to the Secretary of the Company in a timely manner. In order to be included in the Company’s proxy materials for the 2006 annual meeting of stockholders, stockholder proposals must be received by the Secretary of the Company no later than the Notice Deadline (as defined below), and must otherwise comply with the requirements of Rule 14a-8 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Requirements for Stockholder Proposals to be Brought Before an Annual Meeting. In addition, the Company’s Bylaws establish an advance notice procedure for stockholders who wish to present certain matters before an annual meeting of stockholders. In general, nominations for the election of directors may be made by (1) the Board of Directors, (2) the Corporate Governance and Nominating Committee or (3) any stockholder entitled to vote who has delivered written notice to the Secretary of the Company no later than the Notice Deadline, which notice must contain specified information concerning the nominees and concerning the stockholder proposing such nominations. However, if a stockholder wishes only to recommend a candidate for consideration by the Corporate Governance and Nominating Committee as a potential nominee for the Company’s Board of Directors, see the procedures discussed in “Proposal One: Election of Directors — Corporate Governance Matters” on page 9.

The Company’s Bylaws also provide that the only business that may be conducted at an annual meeting is business that is (1) specified in the notice of meeting given by or at the direction of the Board of Directors, (2) properly brought before the meeting by or at the direction of the Board of Directors, or (3) properly brought before the meeting by a stockholder who has delivered written notice to the Secretary of the Company no later than the Notice Deadline, which notice must contain specified information concerning the matters to be brought before such meeting and concerning the stockholder proposing such matters.

The “Notice Deadline” is defined as that date which is 120 days prior to the one-year anniversary of the date on which the Company first mailed its proxy materials for the previous year’s annual meeting of stockholders. As a result, the Notice Deadline for the 2006 annual stockholder meeting is June 5, 2006.

If a stockholder who has notified the Company of his or her intention to present a proposal at an annual meeting does not appear to present his or her proposal at such meeting, or does not send a representative who is qualified under Delaware law to present the proposal on his or her behalf, the Company need not present the proposal for vote at such meeting.

A copy of the full text of the Bylaw provisions discussed above may be obtained by writing to the Secretary of the Company. All notices of proposals by stockholders, whether or not included in the Company’s proxy materials, should be sent to Avanex Corporation, 40919 Encyclopedia Circle, Fremont, California 94538, Attention: Corporate Secretary.

3

PROPOSAL ONE

ELECTION OF DIRECTORS

General

The Company’s Bylaws currently authorize seven directors who are divided into three classes with staggered three-year terms. A director serves in office until his or her respective successor is duly elected and qualified or until his or her earlier death or resignation. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of an equal number of directors.

Pursuant to a stockholders’ agreement between Avanex, Corning Incorporated and Alcatel, Avanex has agreed that, so long as Corning owns five percent or more of the outstanding shares of Avanex Common Stock, Avanex will use reasonable efforts to have an individual designated by Corning elected to the Board of Directors of Avanex. Dr. Joseph A. Miller, Jr., Executive Vice President and Chief Technology Officer of Corning, currently serves on the Board of Directors of Avanex as the Corning designee. Dr. Miller has informed Avanex that he intends to resign from the Board of Directors of the Company effective October 27, 2005, and Corning has informed the Company that it does not currently intend to nominate an individual to replace Dr. Miller on the Board of Directors.

Nominees for Class III Directors

Two Class III directors have been nominated for election at the Annual Meeting for a three-year term expiring in 2008. Upon the recommendation of the Corporate Governance and Nominating Committee, the Board of Directors has nominated Joel A. Smith III and Susan Wang for reelection as Class III directors. Unless otherwise instructed, the proxyholders will vote the proxies received by them for the reelection of Mr. Smith and Ms. Wang. The Company expects that Mr. Smith and Ms. Wang will accept such nominations; however, in the event that either nominee is unable or declines to serve as a director at the time of the Annual Meeting, the proxies will be voted for any nominee who shall be designated by the Board of Directors to fill such vacancy. The term of office of each person elected as director will continue until such director’s term expires in 2008 or until such director’s successor has been elected and qualified.

Nominees for Class III Directors for Terms Expiring in 2008

| | | | |

Name

| | Age

| | Principal Occupation and Business Experience

|

| | |

Joel A. Smith III | | 60 | | Dean of Darla Moore School of Business of the University of South Carolina. Mr. Smith has served on the Company’s Board of Directors since December 1999. Mr. Smith has been the dean of the Darla Moore School of Business of the University of South Carolina from October 2000 to the present. Previously, Mr. Smith served as the President of Bank of America East, a financial institution, from October 1998 to September 2000. From July 1991 to October 1998, Mr. Smith served as President of Nations Bank Carolinas, a financial institution. Mr. Smith serves on the boards of directors of Carolina National Bank & Trust Co. and NetBank, Inc. Mr. Smith received a B.A. from the University of the South in Sewanee, Tennessee. |

| | |

Susan Wang | | 54 | | Former Chief Financial Officer of Solectron Corporation. Ms. Wang has served on the Company’s Board of Directors since December 2002. Ms. Wang previously served as Executive Vice President of Corporate Development, Chief Financial Officer, and Corporate Secretary of Solectron Corporation, a provider of supply-chain and product life-cycle services to original equipment manufacturers, from October 1984 through May 2002. Before joining Solectron, she held positions |

4

| | | | |

Name

| | Age

| | Principal Occupation and Business Experience

|

| | |

| | | | | with Xerox Corporation, Westvaco Corporation and Price Waterhouse & Co. Ms. Wang serves on the boards of directors of Calpine Corporation, Altera Corporation and Nektar Therapeutics. Ms. Wang received her B.B.A. in accounting from the University of Texas and her M.B.A. from the University of Connecticut. |

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR”

THE NOMINEES LISTED ABOVE.

Information Regarding Other Directors Continuing in Office

Incumbent Class I Directors Whose Terms Expire in 2006

| | | | |

Name

| | Age

| | Principal Occupation and Business Experience

|

| | |

Greg Dougherty | | 45 | | Chief Executive Officer, Picarro, Inc. Mr. Dougherty has served on the Company’s Board of Directors since April 2005. Mr. Dougherty has served as Chief Executive Officer of Picarro, Inc., a company focused on developing lasers and optical instruments, since January 2003 and has served as a director of Picarro since October 2002. From February 2001 to September 2002, Mr. Dougherty held a number of positions at JDS Uniphase, an optical technology company, including Chief Operating Officer, Executive President and Chief Operating Officer of the Amplification and Transmission Business Group. Mr. Dougherty held a number of positions at SDL, Inc., an optical technology company, from March 1997 to February 2001, including Chief Operating Officer, Vice President of the Communications Business Unit and Corporate Marketing and Sales, Vice President of Communications and Information Products, Vice President of the Components Group and President of SDL Optics. Prior to joining SDL, from 1989 to 1997, Mr. Dougherty was the Director of Product Management and Marketing at Lucent Technologies Microelectronics in the Optoelectronics Strategic Business Unit. Mr. Dougherty received a B.Sc. degree in optics from Rochester University. |

| | |

Jo S. Major, Jr. | | 43 | | President, Chief Executive Officer and Chairman of the Board of Directors. Dr. Major has served on the Company’s Board of Directors and as its President and Chief Executive Officer since August 2004 and as Chairman of the Board of Directors since April 2005. From February 2001 to August 2004, he served in various management roles in the Active Components Group of JDS Uniphase, an optical technology company, including Senior Vice President, Component Products Group, and Vice President, Active Components Business Unit. Dr. Major was employed by SDL, Inc. in a variety of technical managerial positions from 1990 to February 2001, when SDL was acquired by JDS Uniphase. Dr. Major holds a B.S., with high honors, M.S. and Ph.D. from the University of Illinois, and has been granted industry awards for the development of 980nm lasers, high power near-infrared lasers, Raman amplifiers and high performance laser packaging. Dr. Major was an Intel Fellow from 1988 to 1990. |

5

Incumbent Class II Directors Whose Terms Expire in 2007

| | | | |

Name

| | Age

| | Principal Occupation and Business Experience

|

| | |

Todd Brooks | | 44 | | Private Investor and Former General Partner at the Mayfield Fund. Mr. Brooks has served on the Company’s Board of Directors since February 1998. Since October 2003, Mr. Brooks has been a private investor. From February 1999 to October 2003, Mr. Brooks was a general partner at the Mayfield Fund, a venture capital firm. From April 1995 to January 1999, Mr. Brooks served as a managing principal with JAFCO America Ventures, a venture capital firm. Mr. Brooks received a B.S. in Chemical Engineering from Texas A&M University, a graduate degree in Chemical Engineering from the University of California at Berkeley and an M.B.A. from the Harvard Business School. |

| | |

Vinton Cerf | | 62 | | Senior Vice President for Technology Strategy for MCI. Dr. Cerf has served on the Company’s Board of Directors since December 1999. In October 2005, Dr. Cerf will join Google Inc. as Chief Internet Evangelist. Dr. Cerf served as the Senior Vice President for Technology Strategy for MCI (formerly WorldCom, Inc.), a telecommunications company, from September 1998 to September 2005. From January 1996 to September 1998, Dr. Cerf was the Senior Vice President for Internet Architecture and Engineering at MCI. Dr. Cerf also serves on the board of directors of Nuance Communications, Inc. Dr. Cerf received a B.S. in Mathematics from Stanford University, an M.S. in Computer Science from the University of California, Los Angeles, and a Ph.D. in Computer Science from the University of California, Los Angeles. |

Board Meetings and Committees

During the fiscal year ended June 30, 2005, the Board of Directors of the Company met 18 times, and no director attended fewer than 75% of the total number of meetings of the Board of Directors and the committees of which he or she was a member, except for Dr. Cerf, Mr. Dougherty and Dr. Miller, who were unable to attend certain meetings due to extenuating circumstances.

The Company’s Board of Directors currently has four standing committees: an Audit Committee, a Compensation Committee, an Option Committee and a Corporate Governance and Nominating Committee.

Audit Committee. The Audit Committee, which has been established in accordance with Section 3(a)(58)(A) of the Exchange Act, consisted of Mr. Brooks, Dr. Cerf, Dr. Miller, Mr. Smith and Ms. Wang at June 30, 2005 and currently consists of Mr. Brooks, Mr. Dougherty, Dr. Miller, Mr. Smith and Ms. Wang, each of whom is “independent” as such term is defined for audit committee members by the listing standards of the Nasdaq Stock Market. The Board of Directors has determined that each of Mr. Smith and Ms. Wang is an “audit committee financial expert” as defined under the rules of the Securities Exchange Commission (the “SEC”). The Audit Committee met 13 times during the fiscal year ended June 30, 2005. The Audit Committee is responsible for overseeing the Company’s accounting and financial reporting processes and the audit of the Company’s financial statements, and assisting the Board of Directors in oversight of (1) the integrity of the Company’s financial statements, (2) the Company’s internal accounting and financial controls, (3) the Company’s compliance with legal and regulatory requirements, and (4) the independent registered public accounting firm’s qualifications, independence and performance. The Audit Committee acts pursuant to a written charter adopted by the Board of Directors, a copy of which is available at http://www.avanex.com under “Investors — Governance — Committee Charters.”

6

Compensation Committee. The Compensation Committee consisted of Mr. Brooks, Mr. Smith and Ms. Wang at June 30, 2005 and currently consists of Dr. Cerf, Mr. Dougherty and Ms. Wang, each of whom is “independent” as defined by the listing standards of the Nasdaq Stock Market. The Compensation Committee met 14 times during the fiscal year ended June 30, 2005. The Compensation Committee is primarily responsible for evaluating and approving the compensation and benefits for the Company’s executive officers, administering the Company’s 1998 Stock Plan and 1999 Employee Stock Purchase Plan and performing such other duties as may from time to time be determined by the Board of Directors. The Compensation Committee acts pursuant to a written charter adopted by the Board of Directors, a copy of which is available at http://www.avanex.com under “Investors — Governance — Committee Charters.”

Option Committee. The Option Committee currently consists of Dr. Major. The Option Committee is responsible for granting options to purchase Common Stock of the Company, on behalf of the Board of Directors, to employees other than officers and directors, pursuant to guidelines established by the Compensation Committee. The Option Committee fulfilled all of its duties through actions by written consent during the fiscal year ended June 30, 2005. The Option Committee acts pursuant to a written charter adopted by the Board of Directors, a copy of which is available at http://www.avanex.com under “Investors — Governance — Committee Charters.”

Corporate Governance and Nominating Committee. The Corporate Governance and Nominating Committee consisted of Mr. Brooks, Dr. Cerf, Dr. Miller and Ms. Wang at June 30, 2005 and currently consists of Mr. Brooks, Dr. Cerf and Mr. Smith, each of whom is “independent” as defined by the listing standards of the Nasdaq Stock Market. The Corporate Governance and Nominating Committee met four times during the fiscal year ended June 30, 2005. The Corporate Governance and Nominating Committee is responsible for (1) reviewing and making recommendations to the Board of Directors regarding matters concerning corporate governance, (2) reviewing the composition and evaluating the performance of the Board of Directors, (3) recommending persons for election to the Board of Directors and evaluating director compensation, (4) reviewing the composition of committees of the Board of Directors and recommending persons to be members of such committees, (5) reviewing conflicts of interest of members of the Board of Directors and corporate officers and (6) performing such other duties as may from time to time be determined by the Board of Directors. The Corporate Governance and Nominating Committee’s policy is to consider recommendations of candidates for the Board of Directors submitted by the stockholders of the Company. For more information see the discussion in “Corporate Governance Matters” on page 9. The Governance and Nominating Committee acts pursuant to a written charter adopted by the Board of Directors, a copy of which is available at http://www.avanex.com under “Investors — Governance — Committee Charters.”

Director Compensation

Cash Compensation. Each director receives an annual retainer of $16,000 per year in cash compensation for service on the Board of Directors. In addition, directors receive the following cash compensation for service on committees of the Board of Directors: chair of the Audit Committee, $12,000 per year; chairs of the Compensation Committee and Corporate Governance and Nominating Committee, $8,000 per year; member of the Audit Committee, $6,000 per year; member of the Compensation Committee and Corporate Governance and Nominating Committee, $4,000 per year.

Restricted Stock Grants. Effective January 1, 2005, each non-employee director is eligible to receive shares of restricted stock for attendance at meetings of the Board of Directors. For each in-person meeting of the Board of Directors that a non-employee director attends, such director receives a number of shares of restricted stock with an aggregate fair market value of $1,500. For each telephonic meeting of the Board of Directors that a non-employee director attends, such director receives a number of shares of restricted stock with an aggregate fair market value of $500. The shares of restricted stock are granted pursuant to the Company’s 1998 Stock Plan once per year at the first regular meeting of the Board of Directors held following the end of the Company’s fiscal year, and the fair market value and aggregate number of the restricted shares is determined at such meeting

7

in accordance with the Company’s 1998 Stock Plan. Non-employee directors who attended meetings of the Board of Directors during the previous fiscal year but who are no longer directors on the date that such restricted stock is granted will not be eligible to receive such grants.

In connection with meetings of the Board of Directors held from January 1, 2005 through June 30, 2005, the Company granted shares of restricted stock to the following non-employee directors in July 2005: Mr. Brooks, 7,000 shares; Dr. Cerf, 3,500 shares; Mr. Dougherty, 2,500 shares; Mr. Smith, 7,000 shares; and Ms. Wang, 7,000 shares. Dr. Miller did not receive a restricted stock grant due to certain policies of his employer, Corning Incorporated.

Option Grants. Directors are also eligible to receive options to purchase the Company’s Common Stock pursuant to the Company’s 1998 Stock Plan and 1999 Director Option Plan. The 1999 Director Option Plan provides for annual automatic grants of nonstatutory stock options to continuing non-employee directors who beneficially own less than one percent of the voting power represented by the outstanding securities of Avanex. Under the 1999 Director Option Plan, each such director receives a nonstatutory stock option grant of 40,000 shares of the Company’s Common Stock upon his or her initial election to the Board of Directors (an “Initial Grant”). On the date of each annual stockholders’ meeting, each individual who is at the time continuing to serve as a non-employee director meeting the criteria described above is automatically granted an option to purchase 20,000 shares of the Company’s Common Stock (a “Subsequent Grant”). All options automatically granted to directors under the 1999 Director Option Plan have an exercise price equal to 100% of the fair market value of the Company’s Common Stock on the date of grant. Each Initial Grant vests and becomes exercisable in four equal annual installments, and each Subsequent Grant vests and becomes exercisable on the first anniversary of the grant date.

During the fiscal year ended June 30, 2005, the Company granted a Subsequent Grant to each of Mr. Brooks, Dr. Cerf, Mr. Smith and Ms. Wang. Each such option had an exercise price of $2.79 per share, which is equal to 100% of the fair market value of the Company’s Common Stock on the date of grant. The Company also granted an Initial Grant to Mr. Dougherty upon his election to the Board of Directors. Mr. Dougherty’s option had an exercise price of $1.28 per share, which is equal to 100% of the fair market value of the Company’s Common Stock on the date of grant. Dr. Miller did not receive an Initial Grant and did not and will not receive any Subsequent Grants due to certain policies of his employer, Corning Incorporated.

Corporate Governance Matters

Corporate Governance Principles. Avanex is committed to sound corporate governance. The Board of Directors has adopted Corporate Governance Principles, which are available on at http://www.avanex.com under “Investors — Governance — Corporate Governance Principles.”

Independence of the Board of Directors. The Board of Directors has determined that, with the exception of Dr. Major, all of its members are “independent directors” as defined in the listing standards of the Nasdaq Stock Market.

Contacting the Board of Directors. Any stockholder who desires to contact a non-employee director may do so electronically by sending an e-mail to the following address: directorcom@avanex.com. The e-mails are automatically forwarded unfiltered to the Lead Independent Director, who monitors these communications and forwards communication to the appropriate committee of the Board of Directors or non-employee director.

Code of Conduct. Avanex has adopted a Code of Business Conduct and Ethics that applies to all of its directors, officers (including its principal executive officer, principal financial officer and controller) and employees, which is available at http://www.avanex.com under “Investors — Governance — Code of Business Conduct and Ethics.” Avanex will also post on this section of its website any amendment to the Code of Business Conduct, as well as any waivers that are required to be disclosed by the rules of the SEC or the Nasdaq Stock Market.

8

Executive Sessions. Avanex’s non-management directors meet in executive sessions, without management present, at least two times per year. The sessions are scheduled and chaired by the Lead Independent Director. Any independent director can request that an executive session be scheduled.

Attendance at Annual Stockholder Meetings by the Board of Directors. Directors are encouraged, but not required, to attend the annual meeting of stockholders. Dr. Major attended the Company’s 2004 annual meeting of stockholders.

Process for Recommending Candidates for Election to the Board of Directors. The Corporate Governance and Nominating Committee is responsible for, among other things, determining the criteria for membership to the Board of Directors and recommending candidates for election to the Board of Directors. It is the policy of the Committee to consider recommendations for candidates to the Board of Directors from stockholders. Such recommendations must be received by June 30 of the year in which the recommended candidate will be considered for nomination. Stockholder recommendations for candidates to the Board of Directors must be directed in writing to Avanex Corporation, 40919 Encyclopedia Circle, Fremont, California 94538, Attention: Corporate Secretary, and must include the candidate’s name, home and business contact information, detailed biographical data and qualifications, information regarding any relationships between the candidate and the Company within the last three years and evidence of the nominating person’s ownership of Company stock. Such recommendations must also include a statement from the recommending stockholder in support of the candidate, particularly within the context of the criteria for membership on the Board of Directors, including issues of character, judgment, diversity, age, independence, expertise, corporate experience, other commitments and the like, personal references, and an indication of the candidate’s willingness to serve.

The Committee’s general criteria and process for evaluating and identifying the candidates that it selects, or recommends to the full Board of Directors for selection, as director nominees, are as follows:

| | • | | The Committee regularly reviews the current composition and size of the Board of Directors. |

| | • | | The Committee oversees an annual evaluation of the performance of the Board of Directors as a whole and evaluates the performance of individual members of the Board of Directors eligible for reelection at the annual meeting of stockholders. |

| | • | | In its evaluation of director candidates, including the members of the Board of Directors eligible for reelection, the Committee seeks to achieve a balance of knowledge, experience and capability on the Board of Directors and considers (1) the current size and composition of the Board of Directors and the needs of the Board of Directors and the respective committees of the Board of Directors, (2) such issues as character, judgment, diversity, age, expertise, business experience, length of service, independence, other commitments and the like, and (3) such other factors as the Committee may consider appropriate. |

| | • | | While the Committee has not established specific minimum qualifications for director candidates, the Committee believes that candidates and nominees must reflect a Board of Directors that is comprised of directors who (1) are predominantly independent, (2) are of high integrity, (3) have broad, business-related knowledge and experience at the policy-making level in business, government or technology, including their understanding of the telecommunications industry and Avanex’s business in particular, (4) have qualifications that will increase the overall effectiveness of the Board of Directors and (5) meet other requirements as may be required by applicable rules, such as financial literacy or financial expertise with respect to audit committee members. |

| | • | | With regard to candidates who are properly recommended by stockholders or by other means, the Committee will review the qualifications of any such candidate, which review may, in the Committee’s discretion, include interviewing references for the candidate, direct interviews with the candidate, or other actions that the Committee deems necessary or proper. |

9

| | • | | In evaluating and identifying candidates, the Committee has the authority to retain and terminate any third-party search firm that is used to identify director candidates, and has the authority to approve the fees and retention terms of any search firm. |

| | • | | The Committee will apply these same principles when evaluating candidates to the Board of Directors who may be elected initially by the full Board of Directors to fill vacancies or add additional directors prior to the annual meeting of stockholders at which directors are elected. |

| | • | | After completing its review and evaluation of director candidates, the Committee selects, or recommends to the full Board of Directors for selection, the director nominees. |

PROPOSAL TWO

APPROVAL OF THE ELIMINATION OF THE FLOOR PRICE LIMITATIONS FROM THE

ANTI-DILUTION PROVISIONS OF EACH OF THE COMPANY’S SENIOR SECURED CONVERTIBLE NOTES AND RELATED WARRANTS TO PURCHASE COMMON STOCK

Introduction

On May 19, 2005, the Company closed a private placement transaction in which it issued Senior Secured Convertible Notes in the aggregate principal amount of $35.0 million (the “Notes”) and related warrants (the “Warrants”) to purchase Common Stock of the Company (the “Transaction”).

The Notes accrue interest at a rate of 8% per annum, subject to adjustment, with accrued interest payable quarterly in arrears in cash. Interest for the first two years was pre-paid at closing. The term of the Notes is three years, and the Notes are convertible into shares of Common Stock at an initial conversion price of $1.21 (the “Conversion Price”). The Conversion Price is subject to broad-based anti-dilution provisions in connection with certain future issuances of securities of the Company, which contain a floor price equal to $1.1375 (the “Floor Price,” which would be eliminated if this Proposal Two is approved), as well as for adjustment for stock splits and the like. At the current Conversion Price, the Notes are convertible into 28,925,620 shares of Common Stock.

The Warrants are exercisable for a term of three years at an exercise price of $1.5125 per share (the “Exercise Price”), subject to broad-based anti-dilution provisions similar to the provisions set forth in the Notes, including a Floor Price equal to $1.1375 (which Floor Price would be eliminated if this Proposal Two is approved). The Warrants are currently exercisable for 8,677,689 shares of Common Stock. The terms of the Notes and Warrants are described in greater detail in the section entitled “Terms of the Transaction” below.

In connection with the Transaction, the Company made certain covenants with the holders of the Notes and the Warrants (the “Holders”), including (i) that the Company would seek stockholder approval pursuant to the Nasdaq Marketplace Rules described below to eliminate the Floor Price provisions contained in the Notes and the Warrants, and (ii) in the absence of such stockholder approval, that it would not issue or sell securities of the Company at a per share price less than the Floor Price.

Accordingly, the Company is seeking stockholder approval to eliminate the Floor Price provisions contained in the Notes and the Warrants such that if in the future the Company were to issue or sell, or be deemed to issue or sell, shares of Common Stock at a per share price less than the Conversion Price (in the case of the Notes) or the Exercise Price (in the case of the Warrants), the Conversion Price or the Exercise Price would be adjusted pursuant to the anti-dilution provisions of the Notes and the Warrants to a per share price that is less than the Floor Price. This would result in the Company issuing a greater number of shares of its Common Stock upon conversion of the Notes or exercise of the Warrants. In the event that this Proposal Two is not approved by the stockholders, the Company may be limited in its ability to obtain future financing in that it could not issue or sell securities of the Company at a per share price less than the Floor Price.

10

Why the Company Needs Stockholder Approval

The Company is seeking stockholder approval to eliminate the Floor Price provisions contained in the Notes and the Warrants in order to comply with the Nasdaq Marketplace rules and to fulfill a covenant made as a condition to consummating the Transaction.

Nasdaq Marketplace Rules. Rule 4350(i) of the Nasdaq Marketplace Rules requires stockholder approval for the issuance of securities other than in a public offering at a price per share less than the greater of the book or market value of a company’s stock, where the amount of securities being issued represents 20% or more of an issuer’s outstanding listed securities or 20% or more of the voting power outstanding before the issuance.

Avanex is subject to the Nasdaq Marketplace Rules rules because its Common Stock is listed on the Nasdaq National Market. The issuance of the Notes and the Warrants in the Transaction did not require stockholder approval under Rule 4350(i). The Company is seeking stockholder approval pursuant to Rule 4350(i) so that, if stockholder approval is obtained, it may eliminate the Floor Price provisions contained in the Notes and the Warrants. Stockholder approval to eliminate the Floor Price is necessary because if, following a dilutive event, the Conversion Price of the Notes or the Exercise Price of the Warrants were adjusted below the Floor Price, then, as described in more detail below:

| | • | | the price at which such Common Stock would be issued upon conversion of the Notes or exercise of the Warrants would be below the market price of the Common Stock as of the closing of the Transaction; and |

| | • | | the number of shares of Common Stock issued upon conversion of the Notes or exercise of the Warrants could be in excess of 20% of the outstanding shares or in excess of 20% of the voting power as of the closing of the Transaction. |

Covenant of the Transaction. In addition, as a condition to consummating the Transaction, the Company agreed to seek stockholder approval to eliminate the Floor Price provisions contained in the Notes and the Warrants by October 29, 2005. If stockholder approval is not obtained on or prior to that deadline, the Company is obligated to seek stockholder approval during each twelve month period thereafter until such stockholder approval is obtained. If at any meeting of stockholders the Board of Directors of the Company does not recommend such stockholder approval and such stockholder approval is not obtained, the Company is obligated to seek stockholder approval during each calendar quarter thereafter until such stockholder approval is obtained.

Terms of the Transaction

General. On May 16, 2005, Avanex entered into a Securities Purchase Agreement (the “Purchase Agreement”) with the Holders for the private placement of the Notes in the principal amount of $35.0 million and the issuance of the related Warrants. In connection with the Transaction, Avanex entered into a Registration Rights Agreement with the Holders. The Transaction closed, and the Notes and Warrants were issued, on May 19, 2005. At the closing, Avanex and certain wholly owned subsidiaries of Avanex entered into a Pledge Agreement and a Security Agreement with a collateral agent, and certain wholly owned subsidiaries of Avanex executed a Guaranty in favor of the collateral agent. Pursuant to the Purchase Agreement, the Company made certain covenants with the Holders, including: (i) the Company would seek stockholder approval pursuant to the Nasdaq Marketplace Rules described below to eliminate the Floor Price provisions contained in the Notes and the Warrants, (ii) in the absence of such stockholder approval, that it would not issue or sell securities of the Company at a per share price less than the Floor Price and (iii) the Company would not amend the voting provisions of the Stockholders’ Agreement between Avanex Corporation, Alcatel and Corning Incorporated, dated as of July 31, 2003, without the prior express written consent of the Holders.

Notes. The Notes accrue interest at a rate of 8% per annum, subject to adjustment, with accrued interest payable quarterly in arrears in cash. Interest for the first two years was pre-paid on the closing date of the Transaction. The term of the Notes is three years, and the Notes are convertible into shares of common stock of

11

Avanex at the Conversion Price of $1.21, subject to broad-based anti-dilution provisions described below. At the current Conversion Price, the Notes are convertible into 28,925,620 shares of Common Stock.

Subject to certain conditions, at any time after May 19, 2007, Avanex may convert all of the outstanding Notes into Common Stock if the weighted average price of the Common Stock equals or exceeds 175% of the then current Conversion Price for a specified period.

Upon a change of control (as defined in the Notes), the Holders may require Avanex to repurchase some or all of their Notes at a price in cash equal to the greater of (i) the product of (x) the change of control premium, (y) the conversion amount being redeemed and (z) the quotient determined by dividing (a) the closing sale price of the Common Stock immediately following the public announcement of such proposed change of control by (b) the conversion price and (ii) the product of (x) the change of control premium and (y) the conversion amount being redeemed (as such terms are defined in the Notes).

An event of default will occur under the Notes for a number of reasons, including Avanex’s failure to pay when due any principal, interest or late charges on the Notes, certain defaults on Avanex’s indebtedness, certain events of bankruptcy and Avanex’s breach or failure to perform in respect of representations and obligations under the Notes.

Upon the occurrence of an event of default, Avanex’s obligations under the Notes may become due and payable in accordance with the terms thereof at a price equal to the greater of (i) the product of (x) the conversion amount to be redeemed and (y) the redemption premium and (ii) the product of (x) the conversion rate with respect to such conversion amount in effect at such time as the holder delivers an event of default redemption notice and (b) the closing sale price of the Common Stock on the date immediately preceding such event of default (as such terms are defined in the Notes).

Warrants. In connection with the issuance of the Notes, Avanex issued Warrants to the Holders that are currently exercisable for an aggregate of 8,677,689 shares of Common Stock. The Warrants are exercisable for a term of 3 years at an exercise price of $1.5125 per share, subject to broad-based anti-dilution provisions similar to the provisions set forth in the Notes and described below.

Registration Rights. In connection with the Transaction, Avanex entered into a Registration Rights Agreement with the Holders pursuant to which it agreed to file with the SEC a registration statement to register for resale a number of shares of Common Stock equal to 120% of the Common Stock initially issuable upon conversion of the Notes and 120% of the common stock initially issuable upon exercise of the Warrants. On June 17, 2005, Avanex filed with the SEC a registration statement on Form S-3 covering the resale of 45,123,971 shares. Avanex also agreed to bear the reasonable expenses of registration, except underwriting discounts and commissions (if any). Avanex agreed to keep the registration statement effective for specified periods. If Avanex fails to fulfill these and other obligations, it will pay certain penalties until it fulfills these obligations. Avanex has also authorized and reserved a sufficient number of shares of Common Stock for issuance in connection with the transaction.

Security Agreements. Avanex’s obligations under the Notes are secured by substantially all of the assets of Avanex, substantially all of the assets of the domestic subsidiaries of Avanex, and a pledge of 65% of the capital stock of the non-U.S. subsidiaries of Avanex. In addition, Avanex’s obligations under the Notes are guaranteed by its domestic subsidiaries.

Anti-dilution Provisions of the Notes and the Warrants. If the Company issues or sells, or pursuant to the Notes and Warrants is deemed to have issued or sold, any shares of Common Stock (excluding certain issuances or sales described below) for a price per share less than the Conversion Price (in the case of the Notes) or the Exercise Price (in the case of the Warrants) in effect immediately prior to such issue or sale (a “Dilutive Issuance”), then immediately after such Dilutive Issuance, the Conversion Price or the Exercise Price (or both)

12

then in effect shall be reduced to an amount equal to the product of (A) the Conversion Price or the Exercise Price, respectively, in effect immediately prior to such Dilutive Issuance and (B) the quotient determined by dividing (1) the sum of (I) the product derived by multiplying the Conversion Price or the Exercise Price, respectively, in effect immediately prior to such Dilutive Issuance and the number of shares of Common Stock deemed outstanding immediately prior to such Dilutive Issuance plus (II) the consideration, if any, received by the Company upon such Dilutive Issuance, by (2) the product derived by multiplying (I) the Conversion Price or the Exercise Price, respectively, in effect immediately prior to such Dilutive Issuance by (II) the number of shares of Common Stock deemed outstanding immediately after such Dilutive Issuance.

In addition, in the case of the Warrants, upon an adjustment of the Exercise Price as described above, the number of shares of Common Stock received upon exercise of the Warrants shall be adjusted to the number of shares of Common Stock determined by multiplying the Exercise Price in effect immediately prior to such adjustment by the number of number of shares of Common Stock acquirable upon exercise of the Warrant immediately prior to such adjustment and dividing the product thereof by the Exercise Price resulting from such adjustment.

The anti-dilution provisions above do not apply to certain “excluded securities,” including securities issued in connection with employee benefit plans, upon conversion of the Notes or the exercise of the Warrants, pursuant to certain underwritten public offerings, pursuant to certain acquisitions by the Company, or in respect of subdivisions, stock dividends or capital reorganizations affecting the Common Stock.

Currently, the anti-dilution adjustments described above are subject to the Floor Price such that if a Dilutive Issuance were to occur, the Conversion Price and Exercise Price could not be reduced to a price lower than the Floor Price. If the stockholders approve this Proposal Two, the Floor Price would be eliminated for both the Notes and the Warrants such that the Conversion Price and Exercise Price could be reduced to a price lower than the Floor Price.

Further Information. The terms of the Transaction and the Notes, Warrants and other Transaction documents are complex and only briefly summarized above. For further information on the Transaction and the rights of the Holders, please refer to the descriptions contained in the Current Reports on Form 8-K filed with the SEC on May 17, 2005 and May 25, 2005 and the transaction documents filed as exhibits to such reports. The terms of the Common Stock are set forth in Avanex’s Amended and Restated Certificate of Incorporation filed with the Quarterly Report on Form 10-Q filed with the SEC on May 16, 2000.

Effect of the Elimination of the Floor Price on Current Stockholders

The total number of shares of Common Stock currently issuable upon conversion of the Notes and exercise of the Warrants in full is 37,603,309, representing approximately 20.6% of the shares of Common Stock outstanding immediately following the Transaction (assuming such conversion and exercise). As discussed earlier, in the event that a future dilutive event were to occur, the Conversion Price of the Notes and the Exercise Price of the Warrants could be adjusted, but currently not below the Floor Price. This would result in some dilution to the stockholders of the Company upon a future conversion of the Notes or exercise of the Warrants by the Holders. If this Proposal Two is adopted, and a future dilutive event were to occur, the Conversion Price of the Notes and the Exercise Price of the Warrants could be adjusted below the Floor Price. As a result, the issuance of shares upon a future conversion of the Notes or exercise of the Warrants by the Holders could potentially result in significantly greater dilution to the stockholders.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THIS PROPOSAL.

13

Reasons for the Board of Directors’ Recommendation

The Board of Directors believes that approval of the proposal is in the best interests of the Company and its stockholders for the following reasons, among others:

| | • | | the Company will satisfy a covenant that it made with the Holders that was a condition to consummating the Transaction; |

| | • | | the Company would have increased flexibility with respect to future financing needs in that it would be able, if necessary, to issue or sell securities of the Company at a per share price less than the Floor Price; and |

| | • | | the Company would not be required to spend additional time and expense to seek such stockholder approval in the future. |

PROPOSAL THREE

APPROVAL OF THE 1998 STOCK PLAN

FOR PURPOSES OF SECTION 162(M)

Introduction

The Company is asking stockholders to approve the adoption of the Company’s amended and restated 1998 Stock Plan (the “1998 Plan”) so that it can use the 1998 Plan to achieve the Company’s goals and also receive a federal income tax deduction under Section 162(m) of the Internal Revenue Code for certain compensation paid under the 1998 Plan. The Board of Directors approved the amendment and restatement of the 1998 Plan in September 2005, subject to stockholder approval at the Annual Meeting. The primary purpose of the September 2005 amendment and restatement is to allow the 1998 Plan to qualify for purposes of Section 162(m); the Company is not proposing to amend the 1998 Plan in any other material respect. If stockholders approve the amended and restated 1998 Plan, it will replace the current version of the 1998 Plan. Otherwise, the current version of the 1998 Plan will remain in effect. In addition, in July 2005, prior to the adoption of the amended and restated 1998 Plan by the Board of Directors, the Board of Directors approved an amendment to the 1998 Plan to allow the Company to grant restricted stock units; this authority will remain in effect even if the stockholders do not approve the amended and restated 1998 Plan. Avanex’s named executive officers and directors have an interest in this Proposal Three by virtue of their being eligible to receive equity awards under the 1998 Plan. The full text of the amended and restated 1998 Plan is attached hereto asAppendix A.

This Proposal Three allows the Company the potential to take tax deductions associated with executive compensation, of which stock option gains are a significant component. Awards granted under the amended and restated 1998 Stock Plan may be designed to qualify as “performance-based” compensation within the meaning of Section 162(m) of the Internal Revenue Code. Pursuant to Section 162(m), the Company generally may not deduct for federal income tax purposes compensation paid to Avanex’s Chief Executive Officer or the four other highest paid executive officers to the extent that any of these persons receive more than $1 million in compensation in any single year. However, if the compensation qualifies as “performance-based” for Section 162(m) purposes, the Company may deduct for federal income tax purposes the compensation paid even if such compensation exceeds $1 million in a single year. For the awards granted under the amended and restated 1998 Stock Plan to qualify as “performance-based” compensation under Section 162(m), among other things, the stockholders must approve the material terms of the amended and restated 1998 Stock Plan at this Annual Meeting.

A favorable vote for this Proposal Three will allow Avanex to continue to have the ability to deduct executive compensation in excess of $1 million and provide Avanex with potentially significant future tax benefits and associated cash flows. An unfavorable vote for this Proposal Three would disallow any future tax deductions for executive compensation in excess of $1 million paid to the Chief Executive Officer and the four

14

other most highly compensated executive officers pursuant to the amended and restated 1998 Stock Plan. The Company is not proposing to amend the 1998 Plan in any other material respect.

Avanex strongly believes that the approval of the 1998 Plan is essential to its continued success. The Board of Directors and management believe that equity awards motivate high levels of performance, align the interests of employees and stockholders by giving employees the perspective of an owner with an equity stake in the Company, and provide an effective means of recognizing employee contributions to the success of the Company. The Board of Directors and management believe that equity awards are of great value in recruiting and retaining personnel who help the Company meet its goals, as well as rewarding and encouraging current employees. The Board of Directors and management believe that the ability to grant equity awards will be important to the future success of the Company.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THIS PROPOSAL.

Shares Available for Issuance Under the 1998 Plan

Shares under the 1998 Plan may be authorized but unissued, or reacquired shares. The maximum aggregate number of shares of Common Stock (“Shares”) that may be optioned and sold under the 1998 Plan is 29,550,000. In addition, the 1998 Plan provides for annual increases in the number of shares available for issuance thereunder on the first day of each Company fiscal year, beginning in 2000, equal to the least of:

| | • | | 4.9% of the outstanding shares of Common Stock on the first day of the fiscal year; and |

| | • | | such lesser amount as the Board of Directors may determine. |

If an award under the 1998 Plan expires or becomes unexercisable without having been exercised in full, surrendered pursuant to an option exchange program or, with respect to restricted stock or restricted stock units is forfeited back to or repurchased by the Company, the unpurchased shares subject to such awards generally will be returned to the available pool of shares reserved for issuance under the 1998 Plan. Shares that have actually been issued under the 1998 Plan will not be returned to the 1998 Plan and will not be available for future distribution under the 1998 Plan. However, shares of unvested restricted stock and restricted stock units that Avanex reacquires will become available for future grant under the 1998 Plan. Also, if the Company experiences any stock split, reverse stock split, stock dividend spin-off, combination or reclassification of the common stock other or other increase or decrease in the number of issued Shares effected without receipt of consideration, a proportional adjustment will be made to the number of Shares available for issuance under the 1998 Plan, the number and price of Shares subject to outstanding Awards and the per-person limits on Awards, as appropriate to reflect the stock dividend or other change.

As of September 15, 2005, options to purchase 18,576,377 Shares were outstanding, and 15,366,079 Shares were available for future grant under the 1998 Plan. No stock purchase rights or restricted stock units were outstanding.

Summary of the Plan

The following paragraphs provide a summary of the principal features of the 1998 Plan and its operation. The Plan is set forth in its entirety asAppendix A to this Proxy Statement. The following summary is qualified in its entirety by reference to the 1998 Plan.

Background and Purpose of the 1998 Plan. The 1998 Plan permits the grant of stock options, stock purchase rights and restricted stock units (each individually, an “Award”). The 1998 Plan is intended to attract and retain the best available personnel for positions of substantial responsibility, including (1) employees of the

15

Company and any parent or subsidiary, (2) consultants who provide services to the Company and any parent or subsidiary, and (3) directors of the Company. The 1998 Plan also is designed to provide additional incentive to these services providers, to promote the success of the Company’s business and to permit the payment of compensation that qualifies as performance-based compensation under Section 162(m) of the Internal Revenue Code of 1986, as amended (“Section 162(m)”).

Administration of the 1998 Plan. A committee (the “Committee”) of the Board of Directors administers the 1998 Plan. The Committee generally will be the Compensation Committee, which consists of two or more directors who qualify as “non-employee directors” under Rule 16b-3 of the Securities Exchange Act of 1934, and as “outside directors” under Section 162(m) (so that the Company is entitled to a federal tax deduction for certain compensation paid under the 1998 Plan). Notwithstanding the foregoing, the Board of Directors may itself administer the 1998 Plan or appoint one or more committees to administer the 1998 Plan with respect to different groups of service providers. For instance, the Option Committee is responsible for granting options to purchase Common Stock, on behalf of the Board of Directors, to employees other than officers and directors, pursuant to guidelines established by the Compensation Committee. The Board of Directors, the Compensation Committee, the Option Committee or such other committee administering the 1998 Plan is referred to herein as the “Administrator.”

Subject to the terms of the 1998 Plan, the Administrator has the sole discretion to select the employees, consultants, and directors who will receive Awards, determine the terms and conditions of Awards (for example, the exercise price and vesting schedule), interpret the provisions of the 1998 Plan and outstanding Awards and reprice Awards or exchange stock options for other stock options.

Eligibility to Receive Awards. The Administrator selects the employees, consultants, and directors who will be granted Awards under the 1998 Plan. The actual number of individuals who will receive Awards cannot be determined in advance because the Administrator has the discretion to select the participants.

Stock Options. A stock option is the right to acquire Shares at a fixed exercise price for a fixed period of time. Under the 1998 Plan, the Administrator may grant nonstatutory stock options and/or incentive stock options (which entitle employees, but not the Company, to more favorable tax treatment). The Administrator will determine the number of Shares covered by each option, but during any fiscal year of the Company, no participant may be granted options covering more than 1,500,000 Shares, except that options covering an additional 4,500,000 Shares may be granted to a participant in connection with his or her initial service.

The exercise price of the Shares subject to each option is set by the Administrator but cannot be less than 100% of the fair market value (on the date of grant) of the Shares covered by the option. In addition, the exercise price of an incentive stock option must be at least 110% of fair market value if (on the grant date) the participant owns stock possessing more than 10% of the total combined voting power of all classes of stock of the Company or any of its subsidiaries. The aggregate fair market value of the Shares (determined on the grant date) covered by incentive stock options which first become exercisable by any participant during any calendar year also may not exceed $100,000.

Options issued under the 1998 Plan become exercisable at the times and on the terms established by the Administrator. The Administrator also establishes the time at which options expire, but the expiration of an incentive stock option may not be later than ten years after the grant date (such term to be limited to 5 years in the case of an incentive stock option granted to a participant who owns stock possessing more than 10% of the total combined voting power of all classes of stock of the Company or any of parent or subsidiary of the Company).

The exercise price of each option must be paid in full at the time of exercise. The exercise price may be paid in any form as determined by the Administrator, including, but not limited to, cash, check, surrender of Shares that have a fair market value on the date of surrender equal to the aggregate exercise price of the shares as to

16

which the option is being exercise, consideration received pursuant to a cashless exercise program, promissory note, through a reduction in the amount of Company liability to the participant, or other legal methods of consideration.

If a participant’s service relationship terminates for any reason (excluding death or disability), then the participant may exercise the option within a period of time as determined by the Administrator and specified in the Award agreement to the extent that the Award is vested on the date of termination (but in no event later than the expiration of the term of such Award). In the absence of a specified time set forth in the Award agreement, the option will remain exercisable for three months following the termination of the participant’s service relationship. If a participant’s service relationship terminates due to the participant’s disability or death, the participant (or his or her estate or beneficiary) may exercise the option within a period of time as determined by the Administrator and specified in the Award agreement to the extent the Award was vested on the date of termination of the service relationship (but in no event later than the expiration of the term of such Award). In the absence of a specified time in the Award agreement, the option will remain exercisable for the twelve months following the termination of the participant’s service due to disability or death.

Stock Purchase Rights. Awards of stock purchase rights are rights to acquire or purchase Shares. Often, the Shares acquired or purchased will be considered restricted stock, which is Common Stock that vests in accordance with terms and conditions established by the Administrator. Stock purchase rights may be issued either alone, in addition to, or in tandem with other awards granted under the 1998 Plan and/or cash awards made outside of the 1998 Plan.

Unless the Administrator determines otherwise, the award agreement will grant the Company a repurchase option exercisable upon the termination of the participant’s service with the Company for any reason (including death or disability). The purchase price for shares repurchased pursuant to the restricted stock purchase agreement generally will be the original price paid by the purchaser and may be paid by cancellation of any indebtedness of the purchaser to the Company. The Administrator may impose whatever conditions to vesting it determines to be appropriate. The Administrator may set vesting criteria based upon the achievement of Company-wide, divisional or individual goals, which may include continued employment or service, applicable federal or state securities or any other basis determined by the Administrator. If the Administrator desires that the Award qualify as performance-based compensation under Section 162(m), any restrictions will be based on a specified list of performance goals (see “Performance Goals” below for more information). The Administrator will determine the number of Shares subject to stock purchase rights granted to any employee, consultant or director, but during any fiscal year of the Company, no participant may be granted stock purchase rights covering more than 750,000 Shares in the aggregate, except that the participant may receive stock purchase rights covering up to an additional 2,250,000 Shares in connection with his or her initial employment.

Restricted Stock Units. Restricted stock units are Awards that are paid in installments. The Administrator determines the terms and conditions of restricted stock units. Awards of restricted stock units are Shares that vest in accordance with terms and conditions established by the Administrator. The Administrator determines the number of restricted stock units granted to any employee, consultant or director, but during any fiscal year of the Company, no participant may be granted more than 750,000 Shares in the aggregate, except that the participant may receive such Awards covering up to an additional 2,250,000 Shares in connection with his or her initial employment.

In determining whether an Award of restricted stock units should be made, and/or the vesting schedule for any such Award, the Administrator may impose whatever conditions to vesting it determines to be appropriate. The number of restricted stock units paid out to the participant will depend on the extent to which the vesting criteria are met. The Administrator may set vesting criteria based upon the achievement of Company-wide, divisional or individual goals, which may include continued employment or service, applicable federal or state securities or any other basis determined by the Administrator. Notwithstanding the foregoing, if the Administrator desires that the Award qualify as performance-based compensation under Section 162(m), any

17

restrictions will be based on a specified list of performance goals (see “Performance Goals” below for more information).

Upon satisfying the applicable vesting criteria, the participant shall be entitled to the payout specified in the Award agreement. Notwithstanding the foregoing, at any time after the grant of restricted stock units, the Administrator may reduce or waive any vesting criteria that must be met to receive a payout. The Administrator, in its sole discretion, may pay earned restricted stock units in cash, Shares, or a combination thereof. Shares represented by restricted stock units that are fully paid in cash will again be available for grant under the Plan. On the date set forth in the Award agreement, all unearned restricted stock units will be forfeited to the Company.

Performance Goals. Under Section 162(m) of the Code, the annual compensation paid to Avanex’s Chief Executive Officer and to each of the other four most highly compensated executive officers may not be deductible to the extent it exceeds $1 million. However, Avanex is able to preserve the deductibility of compensation in excess of $1 million if the conditions of Section 162(m) are met. These conditions include stockholder approval of the amended and restated 1998 Plan, setting limits on the number of awards that any individual may receive and, for awards other than options, establishing performance criteria that must be met before the award actually will vest or be paid.

We have designed the amended and restated 1998 Plan so that it permits us to pay compensation that qualifies as performance-based under Section 162(m). Thus, the Administrator (in its discretion) may make performance goals applicable to a participant with respect to an award. At the Administrator’s discretion, one or more of the following performance goals may apply (all of which are defined in the Plan): (a) annual revenue, (b) cash position, (c) earnings per share, (d) individual performance objectives, (e) marketing and sales expenses as a percentage of sales, (f) net income as a percentage of sales, (g) net income, (h) operating cash flow, (i) operating income, (j) return on assets, (k) return on equity, (l) return on sales, and (m) total shareholder return. The Performance Goals may differ from Participant to Participant and from Award to Award.

Any criteria used may be measured, as applicable (1) in absolute terms, (2) in relative terms (including, but not limited to, passage of time and/or against another company or companies), (3) on a per-share basis, (4) against the performance of the Company as a whole or a business unit of the Company, and/or (5) on a pre-tax or after-tax basis. the Administrator shall determine whether any significant elements shall be included in or excluded from the calculation of any performance goal. The Administrator also will adjust any evaluation of performance under a performance goal to exclude (i) any extraordinary non-recurring items, or (ii) the effect of any changes in accounting principles affecting the Company’s or a business units’ reported results.

Merger or Change in Control. In the event of a merger “change in control” of the Company, the successor corporation will either assume or provide a substitute award for each outstanding Award. In the event the successor corporation refuses to assume or provide a substitute award, the Award will immediately vest and become exercisable as to all of the Shares subject to such Award, or, if applicable, the Award will be deemed fully earned and will be paid out prior to the merger or change in control. In addition, if an option or stock purchase right has become fully vested and exercisable in lieu of assumption or substitution, Avanex will provide at least 15 days’ notice that the option or stock purchase right will immediately vest and become exercisable as to all of the Shares subject to such Award and all outstanding options and stock purchase rights will terminate upon the expiration of such notice period.

Awards to be Granted to Certain Individuals and Groups. The number of Awards (if any) that an employee, consultant, or director may receive under the 1998 Plan is in the discretion of the Administrator and therefore cannot be determined in advance. Avanex’s executive officers and directors have an interest in this proposal because they are eligible to receive Awards under the 1998 Plan. To date, stock options and stock purchase rights have been granted under existing Company equity plans. The following table sets forth for each of the Company’s current executive officers and directors (a) the total number of Shares subject to options

18

granted during the last fiscal year and (b) the average per Share exercise price of such options. No stock purchase rights were granted during the last fiscal year.

| | | | | |