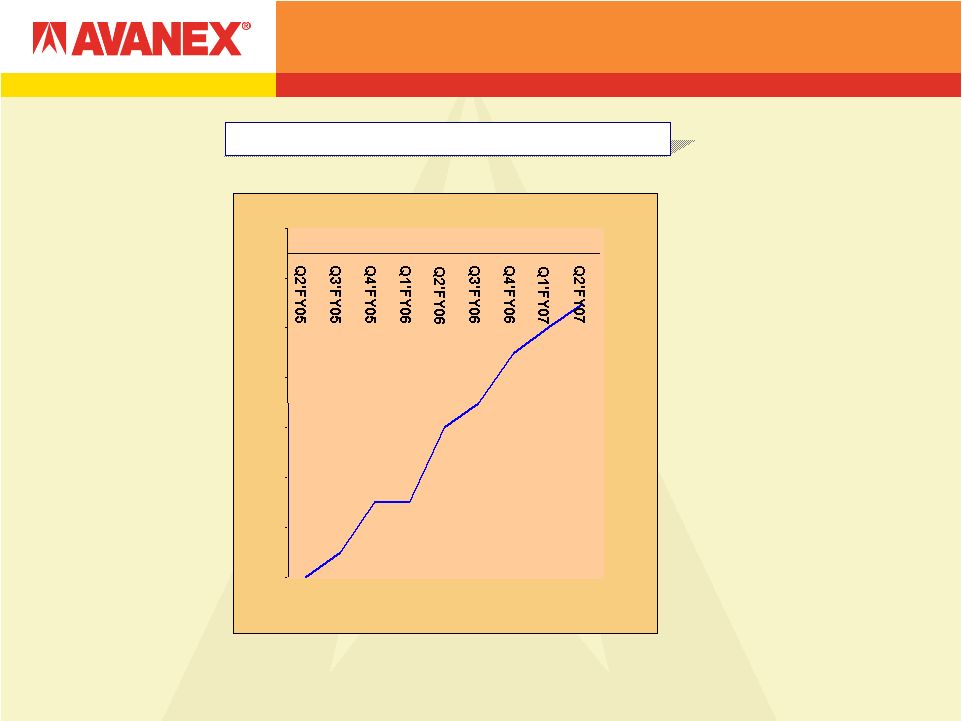

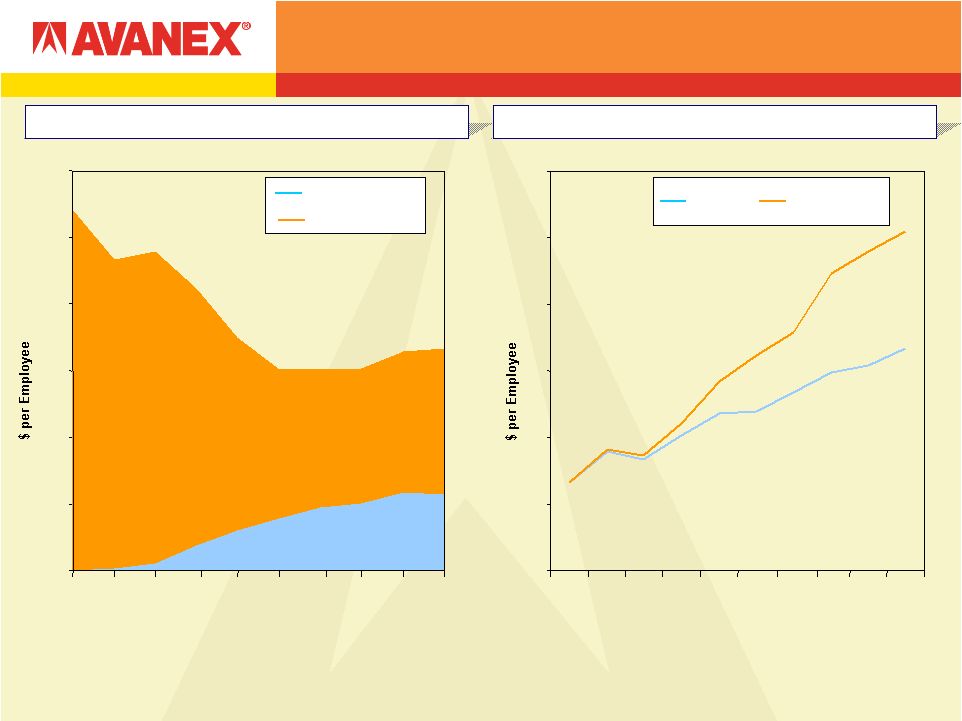

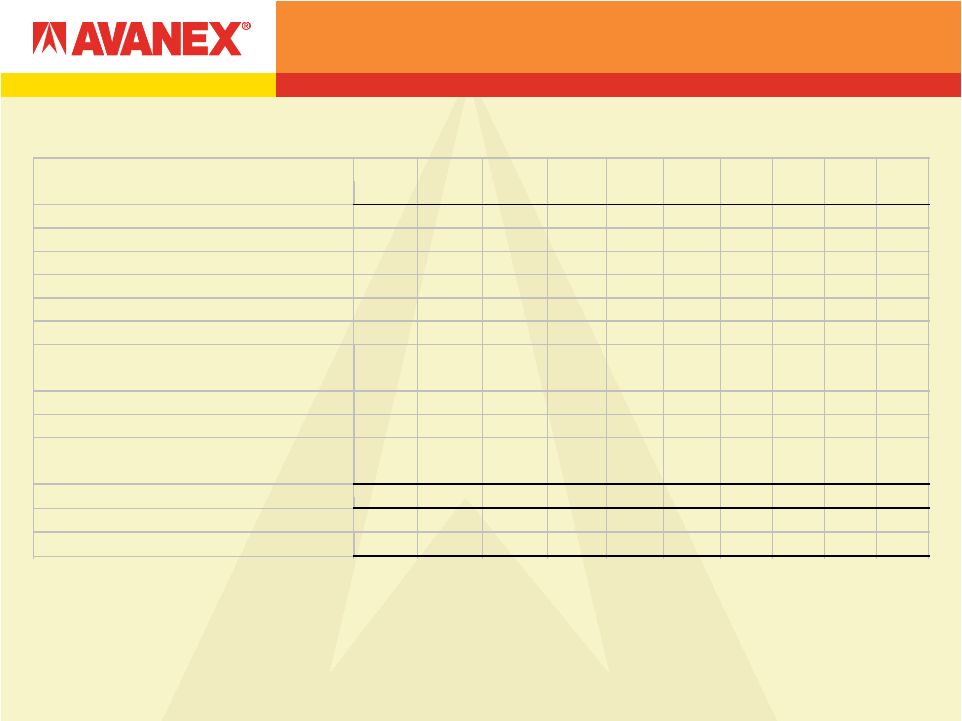

©2007 Avanex, Inc. All rights reserved. CONFIDENTIALITY NOTICE: The information contained in this presentation is Avanex confidential information. Any dissemination, distribution or copying of this presentation or disclosure of the information contained within by any unauthorized person is strictly prohibited. 25 Reconciliation Table Note: Fiscal Year ended 6/30. (a) Non-GAAP adjustments remove the effect of non-recurring events and stock-based compensation. NON-GAAP NET LOSS Q1/FY05 Q2/FY05 Q3/FY05 Q4/FY05 Q1/FY06 Q2/FY06 Q3/FY06 Q4/FY06 Q1/FY07 Q2/FY07 Net loss, GAAP (22,322) $ (24,351) $ (18,886) $ (42,812) $ (16,923) $ (18,543) $ (10,167) $ (9,059) $ (9,714) $ (8,553) $ Adjustments to measure non-GAAP: Amortization of intangibles 1,239 1,242 1,242 2,000 1,765 1,385 1,386 912 852 656 Share-based payments 83 157 53 73 442 618 1,242 2,150 1,888 1,813 Restructuring, without share-based payments 2,588 5,441 14 21,229 29 2,926 140 (1,252) (70) 433 (Gain) loss on disposal of property and equipment - (1,476) (410) 36 7 (775) (2,486) (1,810) (20) (28) Due diligence expenses related to abandoned acquisition activity - - - - - - - - - 2,146 Excess, obsolete RoHS - - - - - - 951 - - - Loss on debt refinancing - - - - - 4,525 - - - - Write-off of investment [in Gemfire, which was included in Other Expense in Q4/05] - - - 4,400 - - - - - - Non-GAAP Net Loss (18,412) $ (18,987) $ (17,987) $ (15,074) $ (14,680) $ (9,864) $ (8,934) $ (9,059) $ (7,064) $ (3,533) $ Non-GAAP net loss per share - basic and diluted (0.13) $ (0.13) $ (0.12) $ (0.10) $ (0.10) $ (0.07) $ (0.06) $ (0.04) $ (0.03) $ (0.02) $ |