UNITED STATES |

SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

|

SCHEDULE 14A |

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

Filed by the Registrant o |

|

Filed by a Party other than the Registrant o |

|

Check the appropriate box: |

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý | Definitive Proxy Statement |

o | Definitive Additional Materials |

o | Soliciting Material Pursuant to §240.14a-12 |

|

DATALINK CORPORATION |

(Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

ý | No fee required. |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| | |

| (2) | Aggregate number of securities to which transaction applies: |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4) | Proposed maximum aggregate value of transaction: |

| | |

| (5) | Total fee paid: |

| | |

o | Fee paid previously with preliminary materials. |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| | |

| (2) | Form, Schedule or Registration Statement No.: |

| | |

| (3) | Filing Party: |

| | |

| (4) | Date Filed: |

| | |

| | Persons who are to respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

| | | |

DATALINK CORPORATION

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 5, 2005

The Annual Meeting of Stockholders of Datalink Corporation will be held at the offices of the Company located at 8170 Upland Circle, Chanhassen, Minnesota, on Thursday, May 5, 2005, at 3:30 p.m. local time for the following purposes:

1. To elect five directors, each to serve until the next Annual Meeting of Stockholders or until their successors are elected and qualified;

2. To act upon any other business as may properly come before the Annual Meeting.

Holders of the Company’s common stock at the close of business on March 4, 2005 will be entitled to vote at the Annual Meeting.

By Order of the Board of Directors,

/s/ Jeffrey C. Robbins | |

|

Jeffrey C. Robbins, Secretary |

|

Minneapolis, Minnesota |

March 31, 2005 |

To assure your representation at the meeting, please sign, date and return your proxy on the enclosed proxy card whether or not you expect to attend in person. Stockholders who attend the meeting may revoke their proxies and vote in person if they so desire.

PROXY STATEMENT

OF

DATALINK CORPORATION

8170 Upland Circle

Chanhassen, Minnesota 55317-8589

Time, Date and Place of Annual Meeting

This Proxy Statement is furnished to the stockholders of Datalink Corporation in connection with the solicitation of proxies by the Board of Directors of the Company to be voted at the Annual Meeting of Stockholders or any adjournments or postponements of that meeting. The Annual Meeting will be held at the offices of the Company located at 8170 Upland Circle, Chanhassen, Minnesota, on Thursday, May 5, 2005, at 3:30 p.m. local time. The mailing of this Proxy Statement to the Company’s stockholders commenced on or about April 8, 2005.

Information Concerning the Proxy

We have enclosed a proxy card for your use. The Board of Directors solicits you to MARK, SIGN AND RETURN THE PROXY CARD IN THE ACCOMPANYING ENVELOPE. Any proxy given to this solicitation and received in time for the Annual Meeting will be voted in accordance with the instructions given in such proxy. However, if no direction is given by a stockholder, the shares will be voted as recommended by the Company’s Board of Directors. The giving of a proxy does not preclude the right to vote in person should a stockholder giving the proxy so desire. Any stockholder giving a proxy may revoke it any time prior to its use, either in person at the Annual Meeting or by giving the Company’s Secretary a written revocation or duly executed proxy bearing a later date; however, no such revocation will be effective until written notice of the revocation is received by the Company at or prior to the Annual Meeting.

The Company will bear the cost of soliciting proxies, including the preparation, assembly and mailing of the proxies, and the cost of forwarding the material to the beneficial owners of the common stock. Directors, officers and regular employees of the Company may solicit proxies by telephone or personal conversation. No additional compensation will be paid to directors, officers or other regular employees for such services. The Company may request banks, brokers and other custodians, nominees and fiduciaries to forward copies of the proxy material to their principals and to request authority for the execution of proxies. The Company may reimburse such persons for their expenses in doing so.

Under the Company’s Amended and Restated Articles of Incorporation, an action of the stockholders requires the affirmative vote of the holders of a majority of the voting power of all voting shares represented at a duly held meeting of the stockholders, except where a larger proportion is required by Minnesota law. If a stockholder abstains from voting on any matter, the abstention will be counted for purposes of determining whether a quorum is present at the Annual Meeting of Stockholders for the transaction of business as well as shares entitled to vote on that particular matter. Accordingly, an abstention on any matter will have the same effect as a vote against that matter. A non-vote occurs when a nominee holding shares for a beneficial owner votes on one proposal, but does not vote on another proposal because the nominee does not have discretionary voting power and has not received instructions from the beneficial owner. Broker non-votes on a matter are counted as present for purposes of establishing a quorum for the meeting, but are not considered entitled to vote on that particular matter. Consequently, non-votes do not have the same effect as a negative vote on the matter.

PROPOSAL NUMBER ONE

Election of Directors

Proxies solicited by the Board of Directors will, unless otherwise directed, be voted FOR the election of five nominees to serve as directors for one-year terms expiring at the next annual meeting of stockholders and until their successors are elected. The five nominees are Paul F. Lidsky, Margaret A. Loftus, Greg R. Meland, James E. Ousley and Robert M. Price. All of the nominees are now directors.

The Board of Directors believes that all of the nominees are available and will serve if elected. If for any reason any nominee becomes unavailable for election, the Board of Directors may designate substitute nominees. In

1

that event, the shares represented by the proxy cards returned to the Company will be voted for the substitute nominees, unless an instruction to the contrary is indicated on the proxy card.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE IN FAVOR OF EACH NAMED NOMINEE.

Director Biographical Information

Robert M. Price, age 74, was elected as our Chairman of the Board and a director in June 1998. Mr. Price has been President of PSV, Inc., a technology consulting business located in Burnsville, Minnesota, since 1990. Between 1961 and 1990, he served in various executive positions, including as Chairman and Chief Executive Officer, with Control Data Corporation. Mr. Price also serves on the Board of Directors of Public Service Company of New Mexico, Affinity Technology Group, Inc. and National Center for Social Entrepreneurs. Since May 1991, Mr. Price has been a Senior Advisor and Professor at the Fuqua School of Business at Duke University. Mr. Price is Mr. Meland’s father-in-law.

Paul F. Lidsky, age 51, was elected as a director in June 1998. Between 2003 and 2004 Mr. Lidsky was President and Chief Executive Officer of Computer Telephony Solutions, a telecommunications software company specializing in call centers. From 2002 to 2003, Mr. Lidsky was President and Chief Executive Officer of VigiLanz Corporation, a medical software company. From 1997 until 2002, Mr. Lidsky was the President and Chief Executive Officer of OneLink Communications, Inc., a software company that provides business intelligence solutions to the telecommunications carriers. Between 1985 and 1997, Mr. Lidsky was employed by Norstan, Inc., a comprehensive technology services company, most recently as Executive Vice President of Strategy and Business Development. Mr. Lidsky also serves on the Board of Directors for VigiLanz Corporation.

Margaret A. Loftus, age 60, was elected as a director in June 1998. Ms. Loftus is an owner of Loftus Brown-Wescott, Inc., a business consulting firm, which she co-founded in 1989. Between 1976 and 1989, she was employed by Cray Research, Inc., most recently as Vice President of Software. Ms. Loftus also serves on the Board of Directors for Analysts International Corporation and several private technology companies.

Greg R. Meland, age 51, joined us in 1991 as our Vice President of Sales and Engineering. He became President and Chief Executive Officer in 1993 and is currently our Chief Executive Officer. Between 1979 and 1991, Mr. Meland served in various sales and marketing positions with the Imprimis disk drive subsidiary of Control Data Corporation (which was sold to Seagate in 1989), most recently as the North Central U.S. Director of Sales.

James E. Ousley, age 59, was elected as a director in June 1998. Between 2002 and 2004, Mr. Ousley was President and Chief Executive Officer of Vytek Wireless Inc., a mobile computing company. From 1999 to 2001, he served as President and Chairman of Syntegra (USA), a global e-Business solutions provider and a division of British Telecommunications plc. From 1991 to 1999, Mr. Ousley was President and Chief Executive Officer of Control Data Systems (CDS), which was acquired by British Telecommunications in August 1999. From 1968 to 1991, he held various sales and executive management positions with Control Data Corporation, a global computer systems, software/services and peripherals company. Mr. Ousley also serves on the Board of Directors for ActiveCard, Inc., Bell Microproducts Inc., CaLamp Corporation and Savvis Communications Corporation.

Board of Directors and Committees

During 2004, the Board of Directors met nine times. Each director attended more than 75% of the meetings of the Board of Directors and any committee on which the director served.

The Board of Directors has established a Compensation Committee and an Audit Committee. The following describes the current functions of each committee.

Audit Committee. The Audit Committee is a committee of the Board of Directors designed to monitor (1) the integrity of the financial statements of the Company, (2) the adequacy of the Company’s internal controls and (3) the independence and performance of the Company’s independent registered public accounting firm.

The Audit Committee is composed of Messrs. Ousley (Chairman) and Lidsky and Ms. Loftus. The Board of Directors has determined that each of the Audit Committee members meet the current independence and

2

experience requirements of the Nasdaq Stock Market and the applicable rules and regulations of the Securities and Exchange Commission. In their capacities serving other companies, none of the Audit Committee members has acted as an accounting or financial officer or independent public accountant or has actively supervised the direct activities of these functions. Accordingly, the Board of Directors has determined that none of the Audit Committee members satisfies the SEC requirements of an “audit committee financial expert.” Nevertheless, the Board of Directors believes that, together, the Audit Committee members have substantial experience as general managers and as directors of other companies, both public and private, in the review and analysis of financial statements presenting issues generally similar to those of the Company.

The Audit Committee is required to meet at least two times annually and held seven meetings during 2004.

The Committee is directly responsible for the appointment, compensation, retention and oversight of the work of any independent registered public accounting firm engaged (including resolution of disagreements between management and the auditors regarding financial reporting) for the purpose of preparing or issuing an audit report or performing other audit, review or attest services for the Company. Each such independent registered public accounting firm must report directly to the Committee. The Committee has primary responsibility for making recommendations to the Board of Directors with respect to the selection of the Company’s independent auditing firm. The Committee also has primary responsibility for reviewing the Company’s financial statements and making recommendations to the Board of Directors regarding the adequacy thereof and evaluating and reporting to the Board regarding the adequacy of the Company’s financial controls.

In furtherance of the foregoing, the Audit Committee also among other items (i) reviews the results of the annual audit with management and the Company’s independent auditing firm and reports the results of the annual audit to the Board of Directors, recommending whether or not the audited financial statements should be included in the Company’s annual report on Form 10-K, (ii) reviews with the Company’s management and independent auditing firm the Company’s interim financial results to be included in the Company’s quarterly reports to be filed with the SEC, (iii) reviews with financial management and the Company’s independent auditing firm significant financial reporting issues and practices, and any changes in accounting principles and disclosure practices, (iv) reviews the proposed scope of the annual audit and approves the fees to be paid in connection with the annual audit and related matters, (v) reviews the adequacy and effectiveness of the accounting and internal and financial controls of the Company with the independent auditors and the Company’s financial and accounting staff, (vi) inquires of management and the Company’s independent auditing firm about significant risks or exposures and assesses the steps management has taken to minimize such risks to the Company, (vii) reviews and approves transactions between the Company and its directors, officers and affiliates, (viii) establishes, reviews and revises procedures for the treatment of complaints regarding accounting issues, accounting controls and audit-related matters, (ix) reviews annually the adequacy of the Audit Committee Charter and the functions and independence of the Audit Committee, (x) reviews, approves and monitors the Company’s Code of Ethics and policy statements to determine the adequacy of such rules in connection with applicable laws, (xi) reviews the attestations by senior officers pursuant to the Sarbanes-Oxley Act of 2002 on full financial disclosure, internal controls and fraud, and discusses, as appropriate, with management the basis for such conclusions and (xii) reviews reports, if any, received from regulators and other legal and regulatory matters that may have a material effect on the Company’s financial statements and related Company compliance procedures.

The Charter adopted by the Audit Committee originally during 2000 was revised in 2004 and appears as an exhibit to our Form 10-Q for the period ended September 30, 2004.

Compensation Committee. The Compensation Committee consists of Messrs. Ousley and Lidsky and Ms. Loftus, all of whom the Board of Directors has determined meet the independence requirements of the Nasdaq Stock Market. The Compensation Committee, which held three meetings during 2004, reviews and sets the compensation of the Company’s Chief Executive Officer and reviews and makes recommendations to the Board of Directors with respect to the compensation of other corporate officers and key employees. The Compensation Committee has primary responsibility for the administration of the Company’s 1999 Incentive Compensation Plan, including the granting of options thereunder.

3

Board Nominations. The Company does not have a formal nominating committee. The rules of Nasdaq Stock Market (specifically, NASD Rule 4350(c)(4)) requires director nominees of the Company to be either selected, or recommended for the Board’s selection, either by (i) a majority of the independent directors or (ii) a nominations committee comprised solely of independent directors. In accordance with these requirement, in April of 2004, the Board of Directors adopted the following requirements with respect to director nominations:

• all director nominees of the Company shall be selected, or recommended for the Board’s selection, by a majority of the directors of the Company who qualify as “independent” within the rules established by the Nasdaq Stock Market, and

• the director nominations selection process shall take place annually in connection with the Company’s annual meeting for the election of directors and prior to the filing of the Company’s annual proxy statement soliciting votes for the election of director nominees.

All director-nominees up for election at the May 2005 annual meeting have been recommended and selected by the entire Board, including the independent members of the Board as required by the Nasdaq rule.

If the Board determines to seek additional candidates in the future, it may create a nominating committee. The Board expects that it, or any nominating committee, would identify and qualify new candidates for directors based primarily on the following criteria:

• judgment, character, expertise, skills and knowledge useful to the oversight of the Company’s business,

• diversity of viewpoints, backgrounds, experiences and other demographics,

• business or other relevant experience, and

• the extent to which the interplay of the candidate’s expertise, skills, knowledge and experience with that of other directors will build a Board of Directors that is effective, collegial and responsive to the needs of the Company.

If the Board considers additional director candidates in the future, the Board intends to consider the entirety of each candidate’s credentials and does not have any specific minimum qualifications that must be met in order for a candidate to be recommended as a nominee. However, the Board does believe that all its members should have (i) the highest character and integrity, (ii) sound business judgment and an inquiring mind as well as expertise that adds to the composition of the Board of Directors, (iii) professional experience, education and interest in, and capacity for understanding the complexities of, the operation of the Company, (iv) a reputation for working constructively with others, (v) sufficient time to devote to Board of Directors’ matters and (vi) no conflict of interest that would interfere with performance as a director. The Board plans to consider any future candidates for the Board of Directors from any reasonable source, including stockholder recommendations. The Board may, but has no current plans to, hire and pay a fee to consultants or search firms to assist in the process of identifying and evaluating candidates. No such consultants or search firms have been used in connection with this year’s election and, accordingly, no fees have been paid to consultants or search firms in the past year.

Although there are no formal procedures for stockholders to nominate persons to serve as directors, stockholders wishing to submit nominations should notify the Company at its principal executive offices located at 8170 Upland Circle, Chanhassen, Minnesota 55317-8589. To be considered by the Board, nominations must be in writing and addressed to the Chairman of the Board of the Company and must be received by the Company on or before the deadline for the receipt of stockholder proposals. See “Information Concerning Stockholder Proposals.” Candidates, or the nominating person, must also submit a brief biographical sketch of the candidate, a document indicating the candidate’s willingness to serve if elected and evidence of the nominating person’s ownership of Company stock. The Board intends to evaluate each candidate, including incumbents, based on the same criteria.

4

Executive Sessions. Executive sessions of non-employee directors were held five times in 2004. The sessions are scheduled and chaired by Robert M. Price, the Chairman of the Board of Directors.

Code of Business Conduct and Ethics. The Company has adopted the Datalink Corporation Code of Conduct and Ethics Policy, a code of ethics that applies to all of the Company’s directors, officers and employees, including the Company’s Chief Executive Officer, Chief Financial Officer, Corporate Controller and other finance organization employees. The Code of Conduct and Ethics Policy is publicly available as an exhibit to our Annual Report on Form 10-K for the year ended December 31, 2003. We plan to disclose any substantive amendments to the Code of Conduct and Ethics Policy or grant of any waiver from a provision of it to the Chief Executive Officer, the Chief Financial Officer or the Corporate Controller in a report on Form 8-K.

Stockholder Communications with the Board of Directors. The Company does not have a formal policy by which stockholders may communicate directly with directors, but any stockholder who wishes to send communications to the Board of Directors should deliver such communications to the attention of the Chairman of the Board of Directors at the principal executive offices of the Company located at 8170 Upland Circle, Chanhassen, Minnesota 55317-8589. The Chairman is responsible for relaying to the full Board of Directors all stockholder communications he receives that are addressed to the Board of Directors.

Compensation Committee Interlocks and Insider Participation

None of the members of the Compensation Committee is now, or was during 2004, one of the Company’s officers or employees. During 2004, no executive officer of the Company served as a member of the Board of Directors or Compensation Committee of any entity that has one or more officers serving as a member of the Company’s Board of Directors or Compensation Committee.

Executive Compensation

Director Compensation

The Company’s 2000 Director Stock Option Plan was amended for 2004 and following years, and states that an annual grant of 9,000 common stock options to non-employee members of the Board of Directors will be at an exercise price of the common stock’s fair market value on the option grant date. These options vest ratably over the director’s year of service on the Board. These options expire ten years after the date of grant.

Under the 2000 Director Stock Option Plan as amended, non-employee directors receive a grant of 700 common stock options for each board meeting attended. In addition, the Audit and Compensation Committee members receive a grant of 500 common stock options for each committee meeting attended. The directors can exercise these options starting immediately after the date they are granted, which is the last day of the calendar quarter during which the meetings take place. These options expire ten years after the date of grant. Under the plan, the Company grants the options for board or committee meeting attendance at an exercise price equal to the common stock’s fair market value on the option grant date. The following chart indicates the options granted during 2004 to directors under the 2000 Director Stock Option Plan:

Name of Directors | | Date of Grant | | No. of Options | | Exercise Price | |

| | | | | | | |

Lidsky, Loftus, Ousley and Price | | 4/04 | | 700 | | $ | 3.85 | |

| | 6/04 | | 9,500 | | $ | 3.32 | |

| | 9/04 | | 1,400 | | $ | 2.05 | |

| | 12/04 | | 2,800 | | $ | 2.89 | |

| | | | | | | |

Additional committee grants to Lidsky, Loftus and Ousley | | 4/04 | | 500 | | $ | 3.85 | |

| | 6/04 | | 1,400 | | $ | 3.32 | |

| | 9/04 | | 500 | | $ | 2.05 | |

| | 12/04 | | 2,000 | | $ | 2.89 | |

5

Annually, directors may elect to receive cash payments in lieu of grants of stock options under the 2000 Director Stock Option Plan, as amended, as follows: $10,000 in lieu of the annual stock option grant; $1,000 in lieu of board meeting stock option grants; and $500 in lieu of committee meeting stock option grants.

The Company also reimburses all directors for expenses incurred in connection with attendance at Board and committee meetings.

Indemnification Agreements

The Company has agreed to indemnify each director to the fullest extent permitted under Minnesota law against liability for damages and expenses, including attorneys’ fees, arising out of legal actions that occur because the person is or was the Company’s director, officer or employee. The indemnification agreement permits the director to demand advances against, or the creation of a trust for, expenses to be incurred in defending any covered claim. Insofar as the indemnification agreement may cover liabilities arising under the Securities Act of 1993, as amended, the Company has been informed that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is therefore unenforceable.

Executive Officer Compensation

Summary Compensation Table. The following table contains information regarding the annual compensation paid during each of 2004, 2003 and 2002 to the Chief Executive Officer and the other executive officers serving at the end of 2004 whose 2004 compensation exceeded $100,000.

ANNUAL COMPENSATION

NAME AND PRINCIPAL POSITION | | YEAR | | SALARY | | BONUS | | RESTRICTED

STOCK

AWARDS ($) (1) | | SECURITIES

UNDERLYING

OPTIONS/SARS (#) | | ALL OTHER

COMPENSATION

(2)(3) | |

| | | | | | | | | | | | | |

Greg R. Meland | | 2004 | | $ | 245,177 | | $ | — | | $ | — | | — | | $ | 6,550 | |

Chief Executive Officer | | 2003 | | 245,154 | | | — | | | — | | — | | 12,000 | |

| | 2002 | | 244,856 | | | — | | | — | | 5,000 | | 11,500 | |

| | | | | | | | | | | | | |

Charles B. Westling | | 2004 | | $ | 210,558 | | $ | 42,000 | | $ | 150,750 | (6) | 150,000 | | $ | 6,500 | |

President and Chief Operating Officer (4) (5) | | 2003 | | 181,043 | | 15,750 | | — | | 30,000 | | 10,200 | |

| 2002 | | 157,413 | | — | | — | | 100,000 | | 5,750 | |

| | | | | | | | | | | | | |

Daniel J. Kinsella | | 2004 | | $ | 185,744 | | $ | 27,750 | | $ | 150,750 | (7) | 50,000 | | $ | 6,463 | |

Vice President, Finance and Chief Financial Officer | | 2003 | | 166,953 | | 10,406 | | — | | 30,000 | | 10,891 | |

| 2002 | | 163,240 | | — | | — | | 2,500 | | 10,142 | |

| | | | | | | | | | | | | |

Mary E. West | | 2004 | | $ | 130,351 | | $ | 19,500 | | $ | 30,150 | (8) | — | | $ | 6,325 | |

Vice President, Human Resources | | 2003 | | 125,742 | | 7,313 | | — | | 30,000 | | 9,600 | |

| 2002 | | — | | — | | — | | 1,250 | | 9,300 | |

| | | | | | | | | | | | | | | | | | |

(1) Amounts set forth in the restricted stock awards column represent the unvested value of grants of restricted stock. The value is calculated by multiplying the closing price of the Company’s common stock on the date of grant by the number of shares or units granted. The aggregate number of the Company’s restricted stock holdings as of December 31, 2004, was 165,000 and the aggregate value at such date was $485,100.

(2) Represents matching and profit sharing contributions to each executive officer’s account under the Company’s 401(k) plan and car allowance for each executive officer. In 2004, the car allowance was $6,000.

(3) The Compensation Table does not reflect benefits available to the Company’s salaried employees as a group.

(4) For 2002, represents compensation beginning January 24, 2002.

(5) In October 2003, Mr. Westling was promoted to President and Chief Operating Officer. Prior to October 2003 Mr. Meland held the title of President and Chief Executive Officer.

6

(6) The amount shown reflects the value of an award of 75,000 restricted shares in August 2004. The restricted stock vests 1/3 upon the Company achieving (a) positive income from operation for two consecutive fiscal quarters, (b) a 5% return on investment capital, and (c) a 10% return on invested capital, all as more specifically set forth in the officer’s severance agreement. The restricted stock cliff vests 100% on August 13, 2009.

(7) The amount shown reflects the value of an award of 75,000 restricted shares in August 2004. The restricted stock vests 1/3 upon the Company achieving (a) positive income from operation for two consecutive fiscal quarters, (b) a 5% return on investment capital, and (c) a 10% return on invested capital, all as more specifically set forth in the officer’s severance agreement. The restricted stock cliff vests 100% on August 13, 2009.

(8) The amount shown reflects the value of an award of 15,000 restricted shares in August 2004. The restricted stock vests 1/3 upon the Company achieving (a) positive income from operation for two consecutive fiscal quarters, (b) a 5% return on investment capital, and (c) a 10% return on invested capital, all as more specifically set forth in the officer’s severance agreement. The restricted stock cliff vests 100% on August 13, 2009.

Option Grants in 2004

| | | | Individual Grants | | | | | |

| | Number of

Securities

Underlying

Options

Granted | | Percent of

Total

Options

Granted to

Employees

in Fiscal

Year | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Name | | | | Exercise or

Base Price

($/share) | | Expiration

Date | | Potential Realizable Value At

Assumed Annual Rates of Stock

Price Appreciation for Option Term | |

| | | | | 5% ($) | | 10% ($) | |

Charles B. Westling | | 150,000 | | 47.8 | % | $ | 4.01/share | | 3/1/2014 | | $ | 979,780 | | $ | 1,560,136 | |

Daniel J. Kinsella | | 50,000 | | 15.9 | % | $ | 4.01/share | | 3/1/2014 | | $ | 326,593 | | $ | 520,045 | |

Aggregated Option Exercises and Fiscal Year-End Option Values

| | Shares

Acquired On

Exercise | | Number of Unexercised Options

at December 31, 2004 | | Value of Unexercised In-The-Money

Options at December 31, 2004 | |

Name | | | Value Realized | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable | |

Greg R. Meland | | — | | — | | 55,000 | | 5,000 | | $ | — | | $ | — | |

Charles B. Westling | | — | | — | | 127,500 | | 152,500 | | $ | — | | $ | — | |

Daniel J. Kinsella | | — | | — | | 151,620 | | 55,000 | | $ | — | | $ | — | |

Mary E. West | | — | | — | | 37,500 | | 22,500 | | $ | — | | $ | — | |

Employment Arrangements.

The Company does not have employment, non-competition or non-disclosure agreements with any of its executive officers except as discussed below.

Change of Control Severance Agreements.

In November 2004, the Company entered into change of control severance agreements with Messrs. Meland, Westling and Kinsella and Ms. West effective so long as they are employed by the Company. Under the agreements, each executive is entitled to a severance payment in the event the executive (a) is terminated without cause by the Company in anticipation of, in connection with, at the time of or within two years after a change of control, or (b) resigns for good reasons arising in anticipation of, in connection with, at the time of or within two years after a change of control (a “Covered Termination”).

7

If there is a “Covered Termination” of an executive’s employment, and provided the executive complies with certain confidentiality, non-competition and non-solicitation covenants, the Company will pay the executive (a) all cash compensation accrued but not paid as of the termination date, and (b) on the first day of the month following the termination date, a lump sum payment equal to two times the annual base salary for Messrs. Meland, Westling and Kinsella and one times the annual base salary for Ms. West, in effect immediately prior to the date of termination. Executives will also be entitled to COBRA health benefits at the Company’s expense.

Under the terms of the agreements, termination of employment for good reason generally means the occurrence of certain events without the employee’s consent, including, among other things, (1) the Company assigning him duties inconsistent in any material respect with his duties and responsibilities as in effect on the date of the agreement, (2) reduction in annual salary or targeted bonus opportunities, or (3) relocation of the Company’s offices at which the executive is employed to a location more than 50 miles from the prior location . Termination for cause means, among other things, (1) willfully or grossly negligent failure by the executive to perform his or her duties, or (2) conviction of the commission of a felony or a crime involving the Company or its business or involving or relating to moral turpitude.

Board Compensation Committee Report on Executive Compensation

Note: The material in this Compensation Committee report is not soliciting material, is not deemed filed with the Securities and Exchange Commission and is not to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language contained in such filing.

The Compensation Committee of the Board of Directors is responsible for establishing compensation policy and administering the compensation programs for the Company’s executive officers. The Committee is comprised of three independent, non-employee directors who are not eligible to participate in any of the executive compensation programs. All decisions by the Committee relating to the compensation of the Company’s executive officers are reviewed and approved by the Board of Directors.

Philosophy

The Committee has implemented compensation policies, plans and programs that seek to enhance stockholder value by aligning the financial interests of the executive officers with those of its stockholders. Annual base salaries are generally set at market-based competitive median levels. The Company relies on annual incentive compensation and stock options to attract, retain, motivate and reward executive officers and other key employees. Incentive compensation is variable and tied to corporate performance. The plans are designed to provide an incentive to management to grow revenues, enhance stockholder value and contribute to the long-term growth of the Company. All incentive compensation plans are reviewed at least annually to ensure they meet the current strategies and needs of the business.

Compensation Plans

The Company’s executive compensation is generally based on three components, each of which is intended to support the overall compensation philosophy.

Base Salary

The Company targets base salaries at the median level for similar data storage companies. The Committee reviews salaries for executive officers on an annual basis. The Committee may approve changes based on the individual’s performance or a change in competitive pay levels in the marketplace.

The Committee reviews with the Chief Executive Officer an annual salary plan for the Company’s executive officers (other than the Chief Executive Officer). The salary plan is modified as deemed appropriate and approved by the Committee. The annual salary plan is developed by the Company’s Chief Executive Officer based on publicly available information on organizations with similar characteristics and on performance judgments as to

8

the past and expected future contributions of the individual executive. The Committee reviews and establishes the base salary of the Chief Executive Officer based on similar competitive compensation data and the Committee’s assessment of his past performance and its expectation as to his future contributions in directing the long-term success of the Company.

The Committee set the Chief Executive Officer’s base salary in 2004 at $244,530 which is the same level as in 2003 and 2002. This reflects in part the financial results of the Company and the fact that Mr. Meland owns a significant percentage of the outstanding shares of the Company. The Committee believes that Mr. Meland’s compensation should be dependent on the Company’s financial performance. The Committee believes Mr. Meland’s salary to be at a competitive level for similar companies.

Annual Incentives

The Company’s short-term incentives are paid pursuant to bonus plans agreed to by the Committee and the executive at or near the beginning of the year and during certain interim periods. The Committee believes that the annual bonus of key employees, including executive officers, should be based on optimizing revenues while maintaining prudent management of gross margins and operating expenses. The Company achieved its financial objectives in the second half of 2004. The executive officers, excluding the Chief Executive Officer, received a bonus for attaining these objectives in the aggregate amount of approximately $90,000.

Equity Incentives

Long-term equity incentives are provided through grants of stock options and restricted stock to executive officers and other key employees pursuant to the Company’s 1999 Incentive Compensation Plan. The stock component of compensation is intended to retain and motivate employees to improve long-term stockholder value. Stock options for employees are granted at fair market value and have value only if the Company’s stock price increases. Restricted stock grants were granted in 2004 for the first time since the Company completed its initial public offering. Company personnel work with the Committee to evaluate the most effective equity incentive programs including the impact of equity incentives on operating results. In response to recent proposed changes in the accounting for stock options, the Company ceased issuing employee stock options as of July 2004. Company management and the Committee believe that the proposed changes in accounting for stock options make options a more costly compensation program. The Committee is working with Company personnel to modify its equity compensation plan to provide employees with equity incentives that are cost effective. Restricted stock grants were awarded to executive management (excluding the CEO) in 2004. These awards vest based on company performance and have a cliff vesting five years after grant date. The Committee believes this element of the total compensation program directly links the participant’s interests with those of the stockholders and the long-term performance of the Company.

The Committee establishes the number and terms of options and restricted stock granted under the Plan. The Committee encourages executives to build a substantial ownership investment in the Company’s common stock.

Out of 478,837 options and restricted stock granted to employees in 2004, executive officers of the Company received grants for 365,000, or approximately 76.2% of the total. The Company granted no stock options to the Chief Executive Officer in 2004.

The Committee believes that the programs described above provide compensation that is competitive with comparable companies, links executive and stockholder interests and provides the basis for the Company to attract and retain qualified executives. The Committee will continue to monitor the relationship among executive compensation, the Company’s performance and stockholder value.

| COMPENSATION COMMITTEE |

| |

| Paul F. Lidsky |

| Margaret A. Loftus |

| James E. Ousley |

9

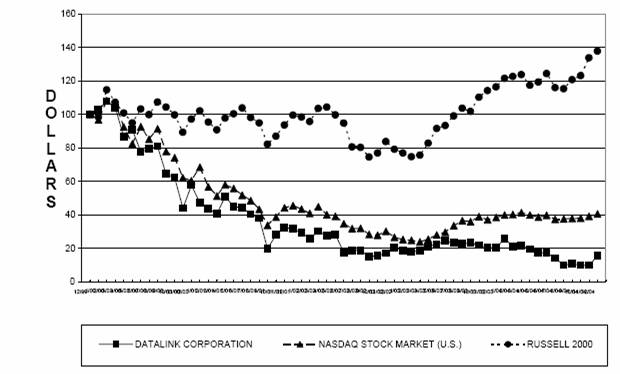

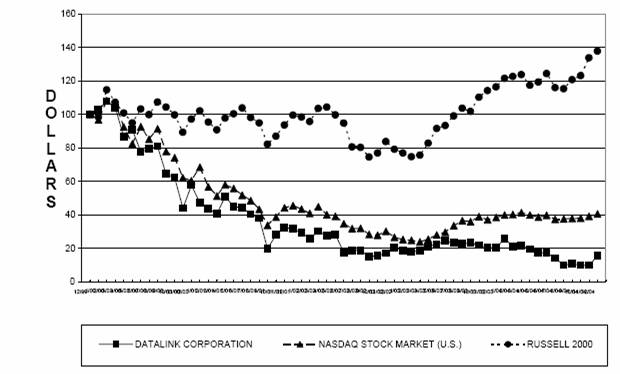

Stock Performance

The Securities and Exchange Commission requires that the Company include in this proxy statement a line-graph presentation comparing cumulative stockholder returns on an indexed basis with the Nasdaq Composite Index and either a nationally recognized industry standard or an index of peer companies selected by the Company. The Board of Directors previously approved the use of the Russell 2000 Index as its industry standard index. The table below compares the cumulative total return assuming $100 was invested as of August 6, 1999, the date of the Company’s initial public offering, in the common stock of the Company, the Russell 2000 Index and the Nasdaq Composite Index. The graph assumes the reinvestment of all dividends. The Indexes are weighted based on market capitalization at the time of each reported data point.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG DATALINK CORPORATION, THE NASDAQ STOCK MARKET (U.S.) INDEX

AND THE RUSSELL 2000 INDEX

* $100 invested on 12/31/99 in stock or index-including reinvestment of dividends.

Fiscal year ending December 31.

Note: The material in this graph is not soliciting material, is not deemed filed with the SEC and is not to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1924, as amended, whether made before or after the date hereof and irrespective of any general incorporation language contained in such filing.

Certain Transactions

The Company had no transactions to report.

10

Outstanding Voting Securities and Voting Rights

Only stockholders of record at the close of business on March 4, 2005 will be entitled to vote at the Annual Meeting and any adjournments of that meeting. At the close of business on the record date, the Company had outstanding 10,295,113 shares of $.001 par value common stock. Each share of common stock is entitled to one vote, and there is no cumulative voting. The presence, in person or by proxy, of holders of a majority of the shares of common stock entitled to vote at the Annual Meeting constitutes a quorum for the transaction of business.

The following table sets forth information regarding beneficial ownership of the Company’s common stock, as of March 4, 2005, by each person the Company knows who beneficially owns 5% or more of the common stock, each of the Company’s named executive officers and directors and all the Company’s executive officers and directors as a group.

Unless otherwise noted, each person or group identified has sole voting and investment power with respect to the shares shown. The address for each individual listed in the table is: c/o Datalink Corporation, 8170 Upland Circle, Chanhassen, Minnesota 55317-8589.

Name of Beneficial Owner | | Number (1) | | Percent | |

Greg R. Meland (2) | | 3,510,690 | | 33.9 | % |

Needham Investment Management, L.L.C.(3)(4) | | 834,000 | | 8.0 | % |

The Needham Funds, Inc. (3)(4) | | 834,000 | | 8.0 | % |

Needham Growth Fund(3)(5) | | 748,000 | | 7.2 | % |

Needham Management Partnership L.P. (3)(6) | | 1,271,100 | | 12.2 | % |

George A. Needham(3)(6) | | 1,271,100 | | 12.2 | % |

Needham Emerging Growth Partners, L.P.(3) | | 698,000 | | 6.7 | % |

Dimensional Fund Advisors (7) | | 635,800 | | 6.2 | % |

Daniel J. Kinsella (8) | | 177,994 | | 1.7 | % |

Charles B. Westling (9) | | 127,500 | | 1.2 | % |

Mary E. West (10) | | 37,951 | | | * |

Paul F. Lidsky (11) | | 65,050 | | | * |

Margaret A. Loftus (11) | | 64,800 | | | * |

James E. Ousley (11) | | 64,050 | | | * |

Robert M. Price (11) | | 53,900 | | | * |

| | | | | |

All executive officers and directors as a group (8 persons) (2)(8)(9)(10)(11) | | 4,101,935 | | 38.0 | % |

*less than 1%

(1) Beneficial ownership is determined in accordance with the rules of the U.S. Securities and Exchange Commission, and includes voting power and investment power with respect to shares. Shares issuable upon the exercise of outstanding stock options that are currently exercisable or become exercisable within 60 days from March 4, 2005 are considered outstanding for the purpose of calculating the percentage of common stock owned by a person and owned by a group, but not for the purpose of calculating the percentage of common stock owned by any other person.

(2) Includes 55,000 shares that Mr. Meland may acquire upon exercise of stock options within 60 days of March 4, 2005.

(3) The address for this beneficial owner is 445 Park Avenue, New York New York 10022. The amount represents the number of shares reported by the beneficial owner on Schedule 13G filed with the Securities and Exchange Commission. The number of shares and percent beneficially owned by Needham Investment Management, L.L.C., The Needham Funds, Inc., and Needham Growth Fund, represents shared voting and shared dispositive power regarding a portion of the same shares and warrants. The number of shares and percent beneficially owned Needham Management Partnership L.P., George A. Needham and Needham Emerging Growth Partners, L.P. represents sole voting and sole dispositive power with regarding a portion of the same shares and warrants. As required, each entity’s beneficial ownership is listed separately. The “Needham” entities together own 1,905,100 shares of the Company’s common stock and warrants to purchase 200,000 shares at an exercise price of $4.50 per share.

(4) Includes 680,000 shares and immediately exercisable warrants to purchase 68,000 shares held by Needham Growth Fund, a series of The Needham Funds, Inc., 25,000 shares and immediately exercisable warrants to purchase 4,000 shares held by Aggressive Growth Fund, a series of The Needham Funds, Inc., and 57,000 shares held by Small Cap Growth Fund, a series of The Needham Funds, Inc.

(5) Includes immediately exercisable warrants to purchase 68,000 shares.

11

(6) Includes (i) 630,000 shares beneficially owned by Needham Emerging Growth Partners, L.P., 98,999 shares beneficially owned by Needham Contrarian Fund, L.P., 254,751 shares beneficially owned by Needham Contrarian (QP) Fund, L.P. and 159,350 shares beneficially owned by Needham Emerging Growth Partners (Cayman), L.P. and (ii) immediately exercisable warrants to purchase 68,000 shares beneficially owned by Needham Emerging Growth Partners, L.P., 9,562 shares beneficially owned by Needham Contrarian Fund, L.P., 24,438 shares beneficially owned by Needham Contrarian (QP) Fund, L.P., and 26,000 shares beneficially owned by Needham Emerging Growth Partners (Cayman), L.P.

(7) The address for this beneficial owner is 1299 Ocean Avenue, 11th Floor, Santa Monica, CA 90401. The amount represents the number of shares reported on a Schedule 13G.

(8) Includes 151,620 shares that Mr. Kinsella may acquire upon exercise of stock options within 60 days of March 4, 2005.

(9) Includes 127,500 shares that Mr. Westling may acquire upon exercise of stock options within 60 days of March 4, 2005.

(10) Includes 37,500 shares that Ms. West may acquire upon exercise of stock options within 60 days of March 4, 2005.

(11) Includes 65,050 shares that Mr. Lidsky, 64,800 shares that Ms. Loftus, 64,050 shares that Mr. Ousley and 53,900 shares that Mr. Price may acquire upon exercise of stock options within 60 days of March 4, 2005.

AUDITING MATTERS

Audit Committee Report

Note: The material in this Audit Committee report is not soliciting material, is not deemed filed with the Securities and Exchange Commission and is not to be incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language contained in such filing.

The primary purpose of the Audit Committee is to assist the Board of Directors in fulfilling its oversight responsibilities relating to accounting, reporting practices and the quality and integrity of the financial reports and other publicly disseminated financial information of the Company. In this context, the Audit Committee has met with management (including the Chief Executive Officer and Chief Financial Officer) and McGladrey & Pullen, LLP, the Company’s independent public accountants (“Independent Auditors”).

The Audit Committee held meetings with the Company’s Independent Auditors, both in the presence of management and privately. The Audit Committee discussed the overall scope and plans for the Independent Auditors’ audit, the results of their examinations, their evaluations of the Company’s internal controls and the overall quality of the Company’s financial reports.

The Audit Committee has reviewed and discussed the audited consolidated financial statements with management and the Independent Auditors. The Audit Committee also discussed with the Independent Auditors the matters required by Statement on Auditing Standards No. 61 (Communication With Audit Committees).

With respect to independence, the Audit Committee has received the written disclosures from the Independent Auditors required by the Independence Standards Board Standard No. 1 (Independence Discussions With Audit Committees) and has discussed with the Independent Auditors their independence. The Audit Committee has also determined that all of its members are independent within the meaning of NASD Rule 4200(a)(15).

12

Based upon the reviews and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board has approved, the inclusion in the Company’s Annual Report on Form 10-K for the year ended December 31, 2004 of the Company’s financial statements as audited by the Independent Auditors for filing with the Securities and Exchange Commission.

| AUDIT COMMITTEE |

| |

| Paul F. Lidsky |

| Margaret A. Loftus |

| James E. Ousley |

13

Audit Fees

KPMG, LLP billed the Company an aggregate of $147,800 in fees for professional services rendered for the audit of the Company’s 2003 annual financial statements and the first, second and third quarter reviews of the Company’s financial statements included in the Company’s Form 10-Q filings made during 2004 with the Securities and Exchange Commission.

All Other Fees

Fees billed to the Company by KPMG, LLP for all other non-audit services, including tax-related, provided during 2004 totaled $48,100.

Additional Matters Regarding the Independent Auditors

In accordance with the requirements of the Sarbanes-Oxley Act of 2002, the Audit Committee expects to select and engage the Independent Auditors to audit the 2005 financial statements of the Company. However, the Audit Committee has not yet commenced this process. Accordingly, the Company does not seek stockholder ratification of the selection of independent auditors for 2005. A representative of McGladrey & Pullen, LLP will attend the Annual Meeting. This representative will be available to respond to appropriate questions and will have the opportunity to make a statement if the representative desires.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company’s directors, executive officers and persons who own more than ten percent of a registered class of the Company’s equity securities to file with the Securities and Exchange Commission reports of ownership and changes in ownership of the Company’s common stock. The Securities and Exchange Commission requires the Company to identify any of those persons who fail to file such reports on a timely basis. To the Company’s knowledge, all such filings were made on a timely basis in 2004.

Changes in Certifying Accountants

On November 19, 2004, we terminated KPMG, LLP as our principal accountants and engaged McGladrey & Pullen, LLP as our new principal accountants. Our audit committee approved the decision to change accountants. During 2003 and through the subsequent interim period through November 19, 2004, we had no disagreements with KPMG, LLP on any matter of accounting principles or practices, financial statement disclosure, or auditing scope of procedure, which disagreements, if not resolved to the satisfaction of KPMG, LLP, would have caused it to make reference to the subject matter of the disagreement in connection with its reports. The audit report of KPMG, LLP on our consolidated financial statements as of and for the year ended December 31, 2002 and December 31, 2003 did not contain any adverse opinion or disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope, or accounting principles. During 2002 and 2003 and through the subsequent interim period through November 19, 2004, we did not consult with McGladrey & Pullen, LLP regarding the application of accounting principles to a specific transaction, either completed or proposed, or the type of audit opinion that might be rendered on our consolidated financial statements.

Information Concerning Stockholder Proposals

A stockholder intending to present a proposal to be included in the Company’s proxy materials for the next Annual Meeting of Stockholders must deliver the proposal in writing to the Company’s principal executive offices at 8170 Upland Circle, Chanhassen, Minnesota 55317-8589 no later than December 1, 2005.

If the date of the 2006 Annual Meeting is moved more than 30 days before or after the anniversary date of the 2005 Annual Meeting, the deadline for inclusion of proposals in our proxy statement is instead a reasonable time before we begin to print and mail our proxy materials. Stockholder proposals also will need to comply with Securities and Exchange Commission regulations under Rule 14a-8 regarding the inclusion of stockholder proposals in company-sponsored proxy materials. Proposals should be addressed to the Company’s

14

principal executive offices at 8170 Upland Circle, Chanhassen, Minnesota 55317-8589, Attention Corporate Secretary.

If a shareholder of the Company wishes to present a proposal before the 2006 Annual Meeting, but does not wish to have the proposal considered for inclusion in the Company’s proxy statement and proxy card, such shareholder must also give written notice to the Company at the address noted above. The Company must receive such notice no later than February 26, 2006. If a shareholder fails to provide timely notice of a proposal to be presented at the 2006 Annual Meeting, the proxies designated by the Board of Directors of the Company will have discretionary authority to vote on any such proposal.

Other Matters

Other Business

The Board of Directors knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the meeting, it is the intention of the persons named in the accompanying proxy to vote on such matters in accordance with their best judgment.

Annual Report to Stockholders and Annual Report on Form 10-K

A copy of the 2004 Annual Report to Stockholders accompanies this Proxy Statement. The Company’s annual report on Form 10-K for the year ended December 31, 2004, as filed with the Securities and Exchange Commission, is available at no charge to stockholders upon written request to the Company at its business address. Copies may also be obtained without charge through the Securities and Exchange Commission’s web site at http://www.sec.gov/edgarhp.htm.

15

DATALINK CORPORATION

ANNUAL MEETING OF STOCKHOLDERS

Thursday, May 5, 2005

3:30 p.m.

8170 Upland Circle

Chanhassen, Minnesota 55317-8589

PROXY

This proxy is solicited by the Board of Directors.

The shares of stock you hold in your account will be voted as you specify below.

If no choice is specified, the Proxy will be voted “FOR” Proposal 1.

By signing the proxy, you revoke all prior proxies and appoint Daniel J. Kinsella and Greg R. Meland, and each of them, with full power of substitution, to vote your shares on the matters shown on the reverse side and any other matters which may come before the Annual Meeting and all adjournments.

See reverse for voting instructions.

16

The Board of Directors Recommends a Vote FOR Item 1.

(1) To elect five directors: | | PAUL F. LIDSKY, MARGARET A. LOFTUS, GREG R. MELAND, JAMES E. OUSLEY AND ROBERT M. PRICE. |

| | | | |

FOR all nominees listed (except as marked to the contrary) | | WITHHOLD authority to vote for all nominees listed | | (Instructions: To withhold authority to vote for any nominee, write that nominee’s name in the space provided below.) |

o | | o | | | |

| | | | | | | |

(2) The undersigned authorizes the Proxies to vote in their discretion upon such other business as may properly come before the meeting.

THIS PROXY WHEN PROPERLY EXECUTED WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED STOCKHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED FOR ITEM 1.

| | |

| | | |

| | |

| | | |

| | Signature of Stockholder(s) |

| | |

Date | | | | |

| | |

| | NOTE: Please sign your name exactly as it is shown at the left. When signing as attorney, executor, administrator, trustee, guardian or corporate officer, please give your full title as such. EACH joint owner is requested to sign. |

| | | | | |

PLEASE SIGN, DATE AND RETURN THIS PROXY PROMPTLY IN THE ENCLOSED

POSTAGE PAID ENVELOPE.

17